Educating fixed income professionals to invest with confidence!

Don't wanna be here? Send us removal request.

Text

Important Update

Greetings FIA family and friends, First and foremost, we hope you and yours are healthy and well. We know it has been unimaginable for so many. Wishing you all the best this holiday season as we ring in a little less (hopefully) eventful 2021! When we embarked on our transition plans early this year, we most definitely did not have a global pandemic factored into the equation. Because it has taken longer than expected to explore all options, we will be continuing in "stand by" mode through March 2021. For more information about our transition, keep scrolling to see our special notice posted January 2020. If you want to stay updated: If you would like to stay posted on our progress, please email us at [email protected] to stay on our mailing list. Feel free to add a brief comment, for example: "I am waiting to enroll if possible", "I would be interested in maintaining my CFIP", "I would be interested in supporting a not-for-profit venture". FIA has always been powered by community and your input is needed now more than ever. For current Bond School students: We are extending the current session through March 31st. If you would like to maintain your access, email us at [email protected]. We remain grateful for your support over the years. As always, your questions and comments are welcome. Tracy Sanchez On behalf of Susan, David, Leslie and the entire FIA team

0 notes

Text

Special Notice Regarding Upcoming Changes at Fixed Income Academy

Dear FIA students, instructors and friends:

FIA’s mission has always rested on the core belief that education and market transparency are the keys to leveling the playing field between buy-side and sell-side players in the capital markets. This is especially true for fiduciaries tasked with managing public monies. I am incredibly proud of our team and the programs created to train hundreds of professionals at nearly 200 organizations, including over 150 public entities across the country. We made a meaningful impact and created a platform positioned to support an even more collaborative effort. On behalf of the entire FIA team, we are both humbled by and thankful for your encouragement and contributions over the last 10 years.

After serious consideration, including extensive discussions with trusted advisors, we have come to the conclusion that it is time for a change. As a result, I regret to inform you that it has become impossible for Fixed Income Academy to continue in its current structure. Nevertheless, I remain hopeful that the quality programs and mission of FIA will endure. Last year, we began exploring the idea of transitioning to a not-for-profit entity. While there has been progress, I don’t yet know how it may unfold. If successful, a new entity will procure FIA’s assets and expand the team to continue operations. In any case, we intend to meet our commitments and serve students through the end of 2020.

What you need to know:

The current session, January 1 to December 31, 2020, is open for enrollment. The timing of subsequent sessions will depend on funding and new management.

We do not yet know how this transition may impact the designation programs requiring the completion of Bond School in the event that Bond School does not continue after 2020. We are working closely with potentially impacted parties to retool options, if needed, to be beneficial to as many designation holders as possible. We will keep current designation holders posted directly.

We are making every effort to raise funds so Bond School and FIA’s platforms remain. To that end, we are open to discussions with groups interested in supporting financial education for public officials and staff. If you or someone you know has interest in this regard, please contact me directly for additional information.

For current designation holders, all designations will be automatically renewed this year at no cost. You will be receiving an email with further information.

For those that know me well, you know this has not been an easy letter for me to write. But know, too, that I count it a privilege and honor to have been on this journey with you. Yes, it has been hard. But more importantly, I’ve learned more than I could have ever imagined and formed relationships with more talented, dedicated and inspirational people than I can count. I will be forever grateful from the bottom of my heart.

Looking forward and up!

Susan Munson, President

Mustard Seed Consulting, Inc (General Partner for Fixed Income Academy)

714-319-4166

0 notes

Text

Beyond the Basics

“This program was very useful as it went beyond traditional fixed income investing and dove into deeper market aspects like options, equity analysis and government regulation. This allows participants of this course to really gain a more in depth view of the entire capital market system.”

- Michael Miller, CIO at Wellesley Asset Management

0 notes

Photo

After spending 21 years in the banking industry and 13 years on the Ojai City Council, Sue Horgan was appointed Assistant Treasurer-Tax Collector for the County of Ventura in March 2017. By combining her extensive public service experience with her distinguished career in the financial industry, she is able to ensure that Ventura County’s taxes are collected, banked and invested with the highest integrity.

Sue has consistently demonstrated an outstanding commitment to life-long learning throughout her career. Most recently, she completed Fixed Income Academy’s Bond School and earned the Certified Fixed Income Practitioner designation. We were honored to be able to present Sue, and colleague John Powers, with their CFIP Certificates in front of the Board of Supervisors in November 2018.

Read on to find out more about Sue’s journey, and to learn her secret for making time for continuing education.

Q: What made you chose a career in Finance?

A: I have always been interested in business and finance. I have a degree in Business Administration with an emphasis on Finance. I spent 21 years in the banking industry. While on the City Council of Ojai, I gravitated to issues related to governance, budget, audit and finance. For years, I followed with interest, Ventura County Government and the Ventura County Treasurer-Tax Collector’s office. In fact, I announced my candidacy for Ventura County’s Treasurer-Tax Collector position in 2010 but after thorough consideration, I decided that the time wasn’t right for me to spend one year campaigning and I withdrew from the race. I am glad that I considered running for the office at that time because in the process, I met then-candidate Judge Steven Hintz, who did run and won and has just embarked on his third term as our Treasurer-Tax Collector. Perhaps the biggest reason that I have chosen a career in finance is because I know that every endeavor, whether corporate, government, non-profit or household, needs to have a solid financial foundation. Without that, and no matter how worthy, the enterprise won’t be successful.

Q: What did you gain from Bond School?

A: While the concepts presented in Bond School were generally not new to me, I focused on them with the new perspective of my position as the Assistant Treasurer-Tax Collector of Ventura County. The robust content provided a solid foundation. I appreciate Fixed Income Academy’s commitment to provide this training in an effort to develop consistent standards of knowledge for those of us managing Local Government Investment Pools.

Q: What is your secret for making time for continuing education in a busy schedule?

A: Everyone is busy. I am driven to be the best that I can be and so I have invested in myself and in the Ventura County Treasurer-Tax Collector’s office to continue my education in this field and earn the credentials which will lend strength and credibility to our office. (To underscore my commitment to learning, I should point out that in addition to completing Bond School, I also graduated from the CFA Institute Investment Foundations course and I earned the California Treasury Certificate, Certified California Municipal Treasurer and Certified Fixed Income Practitioner accreditations in 2018. In 2017, I earned the Certified Public Funds Investment Manager certification.)

Q: Where do you see yourself in 5 years?

A: In 5 years, I would be honored to still to be Ventura County’s Assistant Treasurer-Tax Collector. In the meantime, I will continue to grow in knowledge and experience so that in the event that Judge Hintz retires, I will be prepared to be, and considered a highly-qualified candidate for, Ventura County’s Treasurer-Tax Collector! If neither of those works out, I hope I will be either in the South of France or on an extended sailing adventure aboard a Swan 65 luxury yacht!

We wish Sue the best and have no doubt she will continue to strive for greatness in everything she does.

0 notes

Text

Self-paced education for busy professionals

“The Fixed Income Academy has been a great way for me to learn more about fixed income and be able to apply it to my job. The courses are easy to navigate and can be completed at your own pace.”

- Traci Lee, Financial Analyst II at Eastern Municipal Water District

“Overall, the course was excellent and I would highly recommend it to other professionals! The instructors are terrific, and the self-pace allowed me to work on my own time. Each topic covered provided resources to go as deep into each subject as necessary based on my current position. Also, I now have a tremendous resource that if I need to learn more about a topic I can go back and reference the lessons.”

- Steven Mills, Portfolio Strategist at First Foundation Advisors

0 notes

Text

Proceed with confidence!

“I now feel more confident, empowered and excited when discussing fixed income strategies with my clients.”

- Sophie Brooks-Ames, Regional Director at Sage Advisory Services

“I feel better versed and more at ease taking the realm from the retiring Treasurer when it comes to investments.”

- Cheryl Ann Paul, Administrative Deputy Treasurer at Elko County

0 notes

Text

Test Your Knowledge with FIA

“Regardless of how long you've been in the fixed income arena, the body of knowledge provided by Fixed Income Academy is sure to test your knowledge, educate you, and sharpen your technical skills by the time you are ready to take the comprehensive exam. The ability to study at your own pace is a definite plus. I highly recommend this program for your professional development!”

- Domingo Villarreal, Manager - Debt Management at CPS Energy

0 notes

Text

Let us shine a light on your financial education

“The CFIP Certification program at Fixed Income Academy shone a light on various areas of the fixed-income world that were previously unbeknownst to me. The program gave me a richer understanding and appreciation.”

- Craig Carandang, Senior Accountant at IDB IIC FCU

0 notes

Text

Program useful for novices and experts alike

“Being new to the treasury function, I was glad to learn that there was a comprehensive program such as Fixed Income Academy to educate me and to enable me to connect with other treasury professionals to help me in my new role.”

- Jennifer Leisz, Deputy Director-Financial Services at City of Tustin

“The amount of detail in each course was refreshing and good way for me to sharpen my skills and abilities. I have been in the financial industry for over 20 years and it was most beneficial for me.”

- Michael Addy, Sr. Investment Officer at S.C. Investment Commission

0 notes

Photo

Susan and Leslie promoting education and programs at the CMTA booth at CSMFO conference. Life Long Learners Rock!

0 notes

Text

Looking Forward

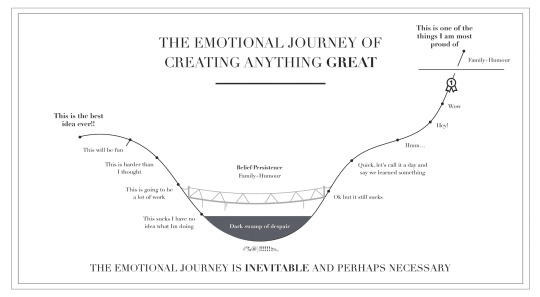

Susan Munson, CFP, CFIP | GP and Advisory Board Chair

My son, Brett, gave this diagram to me when we entered our first dip. It was in the early years when dips felt like cliffs and we didn’t know if we should swim, run or jump. It’s on my bulletin board still, even though I’ve lost count of the number of times I felt like we were sliding into the swamp of despair. There is so much truth in this depiction of the creative journey and comforting to know that building greatness isn’t easy for anyone when building new and remarkable is the goal. More than anything, I’ve learned that creating greatness requires a dedicated team of talented and flexible people. The core FIA team, David, Tracy, Marcia and Melissa, have been together for almost 4 years and are truly amazing people with diverse and complementary skill-sets. In addition, we all have been blessed with noteworthy collaborators over the years – advisors, instructors, sponsors, engaged students – and to each one we owe our gratitude. To all of our collaborators - thank you from the bottom of my heart.

2019 will begin the 9th year since FIA began and the 7th year since we reorganized to focus exclusively on financial education. We have come a long way and remain committed to developing and delivering the very best, objective and cohesive financial education content available. 2018 was a year of retooling. Under Marcia’s direction, we updated Bond School, including several brand new courses and some new instructors. David and Tracy formed partnerships with organizations such as Accredible to upgrade the certification process and instituted procedures to update content and streamline student support. We also added long time public agency investor, Leslie Morales, to the team as Director of Development. Leslie was one of the first CFIP designation holders and joined us because of her belief in the program and commitment to increasing investment knowledge in the community we serve.

Where We are Now FIA base operations are primarily funded by Bond School sales. We have obtained sponsorships for specific courses and events over the years; however, are cautious about relying too heavily on sponsorships. We are currently exploring partnerships and new sources of revenue to fund new products and programs while maintaining autonomy in the content creation process. I do not know exactly what that looks like and admittedly have been in the “hmmmm” stage of the journey over the last couple of months. Before looking forward, let’s start with recapping what we have accomplished so far:

���FIA has become the premiere online certification provider for municipal finance professionals. •FIA is a NASBA sponsor for self-study CPE credits eligible for CPAs in all 50 states. •FIA programs have been adopted by 200 entities, including 140 public agencies in 20 states. •FIA has refined the process for offering a customized, interactive learning management and student support system; FIA’s team has designed the system and possesses the skill-set to scale. •FIA content is developed and maintained according to best practices in curriculum design. •Advisors and Instructors continue to join the cause, ready and willing to contribute their knowledge for the benefit of current and future students when funding allows. •FIA continues to partner with several local and national municipal associations where our missions are aligned. •Student feedback continues to be excellent! Where feedback has been corrective, we have been able to make modifications based on the feedback. We have learned that the development process is based on the ability to learn and adapt quickly. We think of it as co-creating instead of one-way communication. We know we all can learn something new every day. •We’ve learned that there is a significant difference between free or low cost training on a singular topic and completing cohesive curriculum where understandings of learning objectives are verified. •We've confirmed what we all have known all along - Free is not free and quality is not cheap.

Student Satisfaction and Collaboration is Key Whenever the team and I consider how to allocate limited resources there is one thing top of mind – serving our students. Their candid feedback and successes is what motivates us and has helped us prove the critical need for the services FIA uniquely provides. I am exceedingly proud of quality of the products and services FIA offers, and I also know we have work to do on the business model. We have identified the areas that need attention and are determined to get it right to be able to continue our mission to help more people. After all, satisfied students are the WHY that drives us. Here’s what a few of them have to say about the program.

OUR WHY - Student Satisfaction: “I appreciate the opportunity for continuing education in the public fund investment field. I also appreciate the movement toward setting qualifying standards for public fund investment managers. Thank you for your efforts on this!” - Sue Horgan, Assistant Treasurer-Tax Collector at County of Ventura

“The program was very informative. The focus on fixed income investments made it far more valuable than some other resources for my current position. Additionally, the government perspective provided further relevant material.” - Joseph Bergeron, Investment Officer at Virginia Resources Authority

“I work as a Sr. Portfolio Manager in a family office investment group, doing both fixed-income management as well as alternative investments. This course is a thorough review of the fixed-income management process, with extensive detail in areas that I use daily. I will draw upon some of these modules regularly to help in my day-to-day operations.” - Andrea Parker, Senior Portfolio Manager at Synovus

“This program is very comprehensive and allows you to go at your own pace. Whether it takes you a year or a month, it’s up to you and your goals! Great bond foundations program!” - Shauneen Deschaine, Treasury Accounting Technician at Nevada County

The program provides many practical real-life, fixed income learning lessons affording students and professionals the ability to obtain a deeper understanding of fixed income investing. The programs provided me with many resources that are publicly available on the web that I previously was unaware of. All-in, the program was an excellent way to hone your skills, tackle new topics and satisfy CPE requirements along the way. - Dan Matusiewicz, Finance Director/Treasurer, City of Newport Beach

Looking Ahead FIA has laid the foundation and proven the need for ongoing investor education for finance professionals. With the base built, we are confident that we will be able to put the right model in place to take our mission to the next level. We are proud to be the “go-to” source for bias-free education for nearly 150 public agencies across the country. We have developed trusted relationships that we remain committed to serve to the best of our ability. By reassessing how we are collaborating with our early adopters, we believe there is an opportunity to co-create products and services which will in turn both increase revenue and fill unmet needs. To that end, we have begun conversations with several of the ~200 entities that have adopted FIA programs and continue to use FIA to education to train both current and up and coming finance professionals. Our conversations have sparked ideas for new products and partnerships that will be explored in the first half of 2019. We believe there is an opportunity to generate additional revenue, which will in turn sustain and support development of new programs.

If you would like additional information or want to get involved, we are open to ideas and feedback. Email us at [email protected].

Of course, what this all looks like in the end is uncertain, as it should be. As I’ve said, we do not have all the answers and have learned that collaboration is a critical part of achieving success, and true collaboration means being open to new ideas going in. The partnerships we have built are what I am the most grateful for and the most valuable part of who we are.

Stay Tuned 1. If you are not on our mailing list and want to keep up on development, sign up at the bottom of our home page: https://fixedincomeacademy.com/ 2. If you are a Bond School Student or Grad stay tuned for surveys about how we can work together to develop the content you need. Thanks in advance for consideration. 3. If you are a Bond School Student or Grad and know someone who would benefit, send them a brief note and link to learn more: https://fixedincomeacademy.com/courses 4. If you have any questions or input please send email to [email protected] or call 800-243-5097.

I’ve sent a link to this post to many of you that have been incredible influences and supporters over the years. I appreciate you more than you know and thank each and every one of you that has provided me wisdom, encouragement, tough love, and prayers along the way.

On a personal note, I understand now more than ever the value of relationships. You have likely heard me talk about the importance of helping one at a time, aka the starfish story. Life changed for me once I started to measure the impact of helping each and every student instead of solely measuring success financially. Imagine the hundreds of thousands of citizens (in some cases millions!) that are benefited every time a community improves their financial management and investment practices. It may not be as easy to see as feeding the homeless, but I assure you it is no less important. True, the funding must come to support the process. And I trust it will, as it has in the past and will again according to the need in the next phase of the journey.

Thank you for your time and attention. May you and your families be blessed and prosperous this holiday season and throughout the year.

Onward! Susan

0 notes

Photo

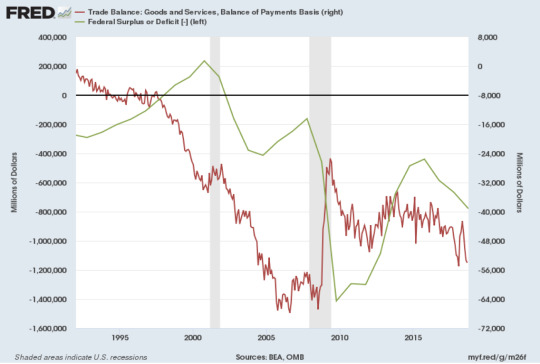

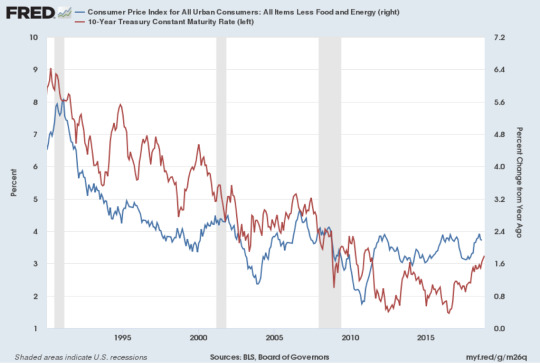

Trade Deficits, Tariffs and the Impact on U.S. Interest Rates

By: Parth Bhatt, Fixed Income Academy Advisory Board

December 4, 2018

The U.S. has imposed tariffs on Chinese imports in an effort to negotiate a better trade deal with China that will significantly lower (or eliminate) its trade deficit and reduce a host of non-tariff barriers, such as better access to the Chinese markets, a majority ownership in Chinese ventures, and an end to forced technology transfers, among other things. This article will speculate on a world without trade deficits from the U.S. perspective. To do that, we must explore some important global developments that have happened since the early 1990s. Although many factors impact inflation and interest rates, this article deals with them in the context of trade, holding all else equal.

Trade deficits are a result of the U.S. consuming more foreign-produced goods than domestic goods. When we consume, we provide the world with dollars for the goods that we import. Foreign countries can use these dollars to buy goods and services from the U.S., or they can buy other dollar-denominated assets instead. The U.S. dollar is unique because it plays the role of the world’s reserve currency.

After the collapse of the Soviet Union, eastern European countries started becoming part of world trade, which was followed by economic reforms in Asia, including China, India, and other ASEAN* countries. This unleashed deflationary forces, as the labor cost differential between the U.S. and these new members of world trade started putting downward pressure on finished goods prices globally. America was thus able to source products from around the world cheaply in exchange for its dollars.

Countries that held excess dollars began using them to buy dollar-denominated assets, such as commodities or U.S. Treasury bonds. This new demand for Treasuries caused further downward pressure on long-term U.S. interest rates, which in turn made consuming easier and sent more dollars outside the U.S. Thus began the cycle of debt-financed consumption. The global demand for U.S. Treasuries also made it easy for the U.S. to finance its fiscal deficits (government borrowing). Lower interest rates and lower input costs made it easy for companies to increase their profitability, as the lower cost of operating and financial leverage supercharged returns. This penalized savers that chose to hold short-term cash instruments and rewarded those that held other assets, specifically long-duration assets (stocks, bonds, and real estate). Wages remained stagnant as overall inflation remained subdued, while the wealth gap increased as long-duration assets appreciated. Foreigners increased their ownership of American assets compared to American ownership of foreign assets. If not for the U.S. dollar’s reserve currency status, this situation for any other currency would have been reversed rather quickly.

When a country engages in debt-financed imports, it usually causes depreciation of its own currency, which makes imports/consumption harder. This natural offset usually stops such situations from perpetuating for too long. In the case of the U.S. and China, this happened slowly for two reasons: first, the U.S. is the largest economy in the world; second, because China pegged its currency to the dollar (China switched to managed-float currency regime in 2005), in effect giving up control over its monetary policy. This distorted the equilibrium of prices and interest rates, potentially suppressing them below their true level.

Today, the U.S. seems ready to engage with the world on this issue. Its chosen tool to address trade deficits has been to impose tariffs on foreign imports. Simply described, tariffs are a tax on the American consumer. They raise prices of goods subjected to tariffs, hurting foreign producers while benefiting U.S. manufacturers. The issue here is that the U.S. economy is far more dependent on consumption than manufacturing. Raising prices on the American consumer can have a damaging short-term impact. First, as prices rise, inflation picks up. If prices rise a lot, the consumer may pull back on purchases, causing total demand to decrease. Higher prices can also lead to higher inflation, and higher inflation is usually followed by higher long-term interest rates. These factors can have further negative impact on the U.S. economy in the short-to-medium term. Higher import prices also mean higher input cost for U.S. companies, which can pressure profit margins. Most importantly, a tariff war can reduce total trade and reverse the benign structural low inflation environment that has existed for the past three decades.

Tariffs address the symptom but not the root cause of the problem. Ultimately, to remedy this situation, it is important that the rest of the world consume more from the U.S. Addressing this problem by imposing tariffs on countries, i.e. China, is not a permanent solution. This will only diversify the problem away from China to other countries that can maintain a labor cost differential. Tariffs will also make it more likely that other countries will impose retaliatory tariffs of their own, making it harder for American manufactures to sell their products abroad. Solving this problem by increasing domestic production is going to require significant capital investment, productivity gains, and a longer time horizon. Companies cannot switch production quickly enough to keep prices low and production uninterrupted. In the meantime, imports subjected to tariffs could make the price increase permanent.

It is hard to predict how this problem will be resolved, but some short-term sacrifices will be required if we are serious about solving it. Although higher prices and interest rates could hurt economic activity if trade deficits are addressed in an abrupt manner, the advantages of curing trade deficits will be long-term. It will allow for more market-based price and interest-rate discovery and solve the problem of increased foreign ownership of U.S. assets. Higher interest rates will aid savers in the U.S. and could help alleviate income problems for underfunded pensions. If addressed properly, it will also set a template for future generations to resolve such issues or prevent them from reaching such extremes in the first place.

*ASEAN stands for the Association of Southeast Asian Nations. Members include Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam.

Trade Balance: Goods and Services, Balance of Payment Basis (BOPGSTB)

Source: U.S. Bureau of Economic Analysis Source: U.S. Bureau of the Census Release: U.S. International Trade in Goods and Services Units: Millions of Dollars, Seasonally Adjusted Frequency: Monthly Further information related to the international trade data can be found at https://www.census.gov/foreign-trade/data/index.html. Methodology details can be found at https://www.census.gov/foreign-trade/Press-Release/current_press_release/explain.pdf

Citation: U.S. Bureau of Economic Analysis and U.S. Bureau of the Census, Trade Balance: Goods and Services, Balance of Payments Basis [BOPGSTB], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOPGSTB, November 12, 2018. Federal Surplus or Deficit (FYFSD)

Source: U.S. Office of Management and Budget Release: Fiscal Year Budget Data Units: Millions of Dollars, Not Seasonally Adjusted Frequency: Annual, Fiscal Year Dates represent the end of the fiscal year. Fiscal year series are updated with official OMB figures in January or February. In October, the latest fiscal year is updated with figures from the Treasury Department (September figures from the Treasury's fiscal year to date series).

Citation: U.S. Office of Management and Budget, Federal Surplus or Deficit [-] [FYFSD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FYFSD, November 12, 2018.

Consumer Price Index for All Urban Consumers: All Items Less Food & Energy

Source: U.S. Bureau of Labor Statistics Release: Consumer Price Index Units: Index 1982-1984=100, Seasonally Adjusted Frequency: Monthly

The “Consumer Price Index for All Urban Consumers: All Items Less Food & Energy” is an aggregate of prices paid by urban consumers for a typical basket of goods, excluding food and energy. This measurement, known as “Core CPI,” is widely used by economists because food and energy have very volatile prices. The Bureau of Labor Statistics defines and measures the official CPI, and more information can be found here: http://stats.bls.gov:80/cpi/cpifaq.htm or here: http://www.bls.gov/opub/hom/pdf/homch17.pdf.

Citation: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items Less Food and Energy [CPILFESL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CPILFESL, November 12, 2018.

10-Year Treasury Constant Maturity Rate Source: Board of Governors of the Federal Reserve System (US) Release: H.15 Selected Interest Rates Units: Percent, Not Seasonally Adjusted Frequency: Daily

For further information regarding treasury constant maturity data, please refer to http://www.federalreserve.gov/releases/h15/current/h15.pdf and http://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/yieldmethod.aspx.

Citation: Board of Governors of the Federal Reserve System (US), 10-Year Treasury Constant Maturity Rate [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, November 12, 2018.

If you found this resource useful contact us to learn more about Bond School, the Certified Fixed Income Practitioner Designation Program, and other FIA Products and Services.

www.fixedincomeacademy.com

800-243-5097

0 notes

Text

Setting the standard!

“I appreciate the opportunity for continuing education in the public fund investment field. I also appreciate the movement toward setting qualifying standards for public fund investment managers. Thank you for your efforts on this!”

- Sue Horgan, Assistant Treasurer-Tax Collector at County of Ventura

0 notes

Text

Valuable Resources!

“The program was very informative. The focus on fixed income investments made it far more valuable than some other resources for my current position. Additionally, the government perspective provided further relevant material.”

- Joseph Bergeron, Investment Officer at Virginia Resources Authority

0 notes

Text

Thorough. Detailed. Useful.

“I work as a Sr. Portfolio Manager in a family office investment group, doing both fixed-income management as well as alternative investments. This course is a thorough review of the fixed-income management process, with extensive detail in areas that I use daily. I will draw upon some of these modules regularly to help in my day-to-day operations.”

- Andrea Parker, Senior Portfolio Manager at Synovus

0 notes

Text

Continuing Ed that fits your schedule!

“This program is very comprehensive and allows you to go at your own pace. Whether it takes you a year or a month, it’s up to you and your goals! Great bond foundations program!”

- Shauneen Deschaine, Treasury Accounting Technician at Nevada County

0 notes

Text

Education + Peer Connections = Opportunities for Success

The CCMT program provides a great learning experience. I am only sorry that I didn't complete this program sooner. In addition to the course of study, the networking and educational opportunities at the conferences provide additional guidance to be successful as an investment professional.

-Dolores Sarenana, Chief Deputy Treasurer, Stanislaus County

0 notes