Explore charts, trade ideas & market insights on Flows Trading. Join millions of traders analyzing stocks, crypto & forex with powerful tools. Start now!https://flows.trading/

Don't wanna be here? Send us removal request.

Text

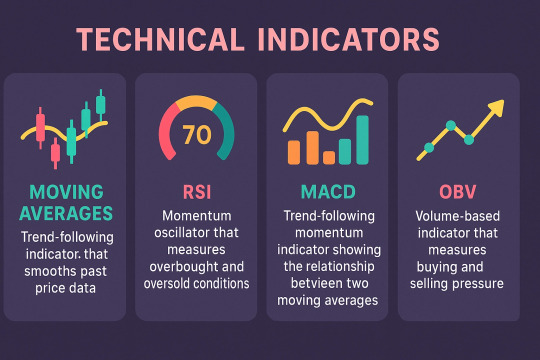

Types of Technical Indicators in Trading

Technical indicators are essential tools used by traders to analyze market trends and make informed decisions. Among the many available, some of the most widely used types include Moving Averages, Relative Strength Index (RSI), MACD, and On-Balance Volume (OBV).

Moving Averages smooth out price data to identify trend direction over a specific period. Common types include the Simple Moving Average (SMA) and Exponential Moving Average (EMA), which help traders determine support and resistance levels and potential entry or exit points.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI values range from 0 to 100 and are typically used to identify overbought (above 70) or oversold (below 30) conditions, signaling potential reversals.

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two EMAs. It helps traders identify changes in trend strength, direction, and momentum.

On-Balance Volume (OBV) uses volume flow to predict price movements. A rising OBV indicates accumulation, while a falling OBV suggests distribution, providing insights into the strength of a trend.

Using these indicators together can improve trading accuracy and help develop a solid, data-driven strategy.

Explore, all the Technical Indicators in Trading.

#Types of Technical Indicators in Trading#Technical Indicators in Trading#Indicators in Trading#trading indicators#indicators in trading

2 notes

·

View notes

Text

Learn Different Types of Chart Patterns

Make exceptional financial gains by analyzing different types of chart patterns in trading. Traders use these charts to get equipped with the nature of the market. It requires experience to gain accuracy, but never too late to start learning about them with a keen eye.

#types of chart patterns#different chart patterns#trading chart patterns#chart patterns#flows trading

1 note

·

View note

Text

Flows trading custom indicators

Technical indicators are tools that help traders analyze price movements, spot patterns, and make informed decisions. From trend-following to momentum, volatility, and volume-based signals, indicators turn raw market data into actionable insights.

They help you time entries, manage risk, and validate strategies with real metrics — not just intuition. Whether you’re new to trading or refining a pro-level system, indicators bring clarity to every chart and confidence to every move.

With Flows.Trading, you get fast, flexible, and beautifully integrated indicators, ready to guide your next decision.

1 note

·

View note

Text

Flow Chart Trading | Simplify Your Strategy with Flows Trading

Master flow chart trading with Flows Trading. Discover visual trading strategies, real-time tools, and expert insights to streamline your decision-making. Start now at https://flows.trading/.

0 notes

Text

Flows Trading Custom Indicators

Discover a powerful selection of built-in technical indicators on Flows.Trading, including popular tools like the Weighted Moving Average (WMA), Exponential Moving Average (EMA), and Simple Moving Average (SMA).

Perform deeper analysis with advanced indicators such as Bollinger Bands, MACD (Moving Average Convergence / Divergence), RSI (Relative Strength Index), RMA, and ATR (Average True Range). Our platform also includes Super Trend, Standard Deviation, Volume Indicator, Choppiness Index, and Market Structure – RSI for precise market insights. And there’s more — new indicators are added regularly to support your trading strategy.

1 note

·

View note

Text

5 Mistakes That Make Beginner Traders Lose Money

Every trader face challenges at the start of their journey, but the secret to long-term success lies in learning from those setbacks and continually improving.

In this article, we’ll explore the five most common mistakes that often hinder beginners and share practical strategies to overcome them.

With the help of Flows.Trading—a powerful tool built to streamline your analysis and support smarter decision-making—you can create a structured, sustainable approach to trading.

Whether you're just starting out or aiming to sharpen your trading strategy, these insights will empower you to trade more effectively and confidently.

#trading mistakes#flows trading#Mistakes That Make Beginner Traders Lose Money#Beginner Traders Mistakes#beginners traders

1 note

·

View note

Text

Online Trading Platform - Flows Trading

Looking for the best online trading platform to elevate your investment game? Whether you're a beginner or a seasoned trader, choosing the right platform is crucial. Get benefits from precise technical analysis, a comprehensive trading journal to track your performance, and an intuitive interface for effortless order execution.

1 note

·

View note

Text

Advanced Trading Charts and Tools -Flows Trading

Discover Advanced Trading Charts and Tools designed for active traders. Whether you’re analyzing price action, volume structures, time cycles, or key levels, Flows.Trading gives you a fluid, powerful and enjoyable experience.

2 notes

·

View notes

Text

What are the most popular chart patterns in trading?

Here are the most popular chart Patterns in trading.

Head and Shoulders

Double Top and Double Bottom

Triangles (Ascending, Descending, Symmetrical)

Flags and Pennants

Cup and Handle

Understanding the most popular chart patterns in trading can help you become a more confident and strategic trader.

While no pattern guarantees success, using them alongside other tools—like volume analysis, moving averages, and risk management—can significantly improve your chances.

#chart patterns#most popular chart patterns in trading#chart patterns in trading#trading chart patterns

1 note

·

View note

Text

Best Online Trading Platform - Flows Trading

Flows Trading is an best online trading platform designed to enhance traders' decision-making and performance. It offers over 100 technical indicators and drawing tools, customizable charting layouts, and real-time market data, allowing for precise technical analysis.

The platform includes a comprehensive trading journal that automatically logs trades and performance metrics, helping users identify strengths and weaknesses.

Additionally, Flows Trading supports programmable custom indicators through a simple scripting language, enabling traders to create and backtest their own indicators.

#best online trading platform#online trading#flows trading#share market#share market analysis#chart patterns

2 notes

·

View notes