Come and read about the latest NFTs, blockchain, discussions of decentralization, trading in decentralized exchanges, Crypto collectibles, and other news about NFTs and Cryptocurrencies

Don't wanna be here? Send us removal request.

Text

The Complete Crypto Investment Bible: Everything You Need to Know About Bitcoin, Ethereum, and More.

What is Cryptocurrency Investing?

Cryptocurrency investing is the act of buying and selling digital currencies such as Bitcoin and Ethereum in order to make a profit. Cryptocurrency investments are similar to investing in stocks and bonds, but with one important difference: cryptocurrency investments are unregulated and much more volatile than traditional investments. This means that investors must be careful when they are making decisions and must understand the risks that come with investing in cryptocurrency.

What are the Best Investing Books out there?

“The Internet of Money” by Andreas M. Antonopoulos

“Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond” by Chris Burniske and Jack Tatar

“Mastering Bitcoin: Unlocking Digital Cryptocurrencies” by Andreas M. Antonopoulos

“The Little Bitcoin Book” by J.D. Salinas

“Blockchain Basics: A Non-Technical Introduction in 25 Steps” by Daniel Drescher

“Cryptocurrency Trading & Investing: Beginners Guide To Trading & Investing In Bitcoin, Alt Coins & ICOs” by Aimee Vo

“Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money” by Nathaniel Popper

“The Basics of Bitcoins and Blockchains” by Antony Lewis

“The Business Blockchain: Promise, Practice, and Application of the Next Internet Technology” by William Mougayar

“The Truth Machine: The Blockchain and the Future of Everything” by Paul Vigna and Michael J. Casey.

Crypto Investing Books Reviews

Here are a few popular books about cryptocurrency investing and their general reviews:

“The Basics of Bitcoins and Blockchains” by Antony Lewis – Recommended for those new to the crypto market and provides a comprehensive overview of the technology and economics behind cryptocurrencies.

“Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond” by Chris Burniske and Jack Tatar – This book is highly regarded for its focus on the investment aspect of crypto assets, including risk management and portfolio strategy.

“Blockchain Basics: A Non-Technical Introduction in 25 Steps” by Daniel Drescher – This book is praised for its clear and concise explanations, making it accessible to a wide range of readers, including those without a technical background.

“Mastering Bitcoin: Unlocking Digital Cryptocurrencies” by Andreas M. Antonopoulos – This book is a comprehensive guide to the technical aspects of Bitcoin and blockchain technology and is recommended for those who want a deeper understanding of the technology.

“The Little Bitcoin Book: Why Bitcoin Matters for Your Freedom, Finances, and Privacy” by Andreas M. Antonopoulos – This book is a concise and easy-to-read introduction to the world of Bitcoin and its potential impact on the financial industry.

Note that these are just a few examples and it is always a good idea to do your own research.

How to Choose the Right Crypto Investment Book?

The reputation of the author: Look for authors with expertise in the financial and technology industry.

Objectivity: Find a book that provides an objective analysis of the crypto market and different investment strategies.

Coverage: Make sure the book covers the latest developments in the crypto market, including regulations, security measures, and emerging technologies.

Readability: Choose a book that is easy to understand, even for those with limited financial knowledge.

Relevance: Look for a book that is relevant to your investment goals, whether you’re a beginner or an experienced investor.

It’s also a good idea to read multiple books and reviews from other readers before making a final decision.

What are the main Takeaways from the Crypto Investing Books?

The main takeaways from cryptocurrency investing books vary depending on the author’s perspective and approach. However, some common themes include:

Understanding the technology: Most books provide an overview of the technology behind cryptocurrencies, including blockchain and its applications.

Risks and reward: Most books discuss the potential risks and rewards of investing in cryptocurrencies and provide guidance on managing risk.

Investment strategies: Many books provide information on investment strategies, such as long-term holding, day trading, and swing trading.

Market analysis: Some books provide an analysis of the cryptocurrency market, including market trends, regulations, and emerging technologies.

Diversification: Many books emphasize the importance of diversifying one’s portfolio to minimize risk.

Education and awareness: Many books stress the importance of staying informed and educated about the crypto market, as well as staying up-to-date with the latest developments and trends.

These are just a few examples of the main takeaways from cryptocurrency investing books. It’s important to remember that the crypto market is constantly evolving and that the information contained in these books may become outdated quickly.

#godreamnft#nft crypto#blockchain#nft marketplace#cryptocurrency news latest#blockchain network#crypto atms#cryptocurrencies#crypto#etherum#bitcoin#crypto books#crypto invest 2023

1 note

·

View note

Text

The Best Cryptocurrency Investment Platforms You Should Know About

Cryptocurrency investment platform can be a great way to diversify your portfolio and increase your financial security. But if you're new to the world of cryptocurrency, it can be challenging to know where to start. That’s why it’s important to understand the basics of cryptocurrency investing before taking the plunge.

This article will provide some essential tips for beginners looking to get started with cryptocurrency investments. We'll discuss things like creating a diversified portfolio, researching potential investments, and understanding the risks associated with investing in cryptocurrencies. By following these simple tips, you can ensure that your first foray into cryptocurrency investing is a successful one!

What are the best cryptocurrency investment platforms for long-term investors?

Investing in cryptocurrencies can be a great way to diversify your portfolio and potentially reap rewards with the potential for long-term gains. However, it can be difficult for long-term investors to find the right platforms for their needs. That’s why it’s important to identify the best cryptocurrency investment platforms that offer the features and benefits that are ideal for long-term investors

Here are some of the best cryptocurrency investment platforms:

Coinbase: Coinbase is one of the most popular and user-friendly cryptocurrency investment platforms. It is available in over 30 countries and supports more than 40 assets. Coinbase is a broker exchange, meaning it allows you to buy and sell cryptocurrencies with fiat currencies.

Binance: Binance is one of the largest and most popular cryptocurrency exchanges available. It supports a wide variety of assets and trading pairs. It also offers low transaction fees, secure storage, and fast transaction processing.

shubham-dhage

Kraken: Kraken is a secure, reliable, and user-friendly cryptocurrency exchange. It supports a wide range of coins and is available in multiple countries. It also offers margin trading and advanced order types.

eToro: eToro is a social trading and multi-asset brokerage platform that offers a variety of services for cryptocurrency investors. It allows investors to copy experienced traders and participate in social trading.

Gemini: Gemini is a New York-based cryptocurrency exchange that offers a secure platform for investors to buy, sell, and store a variety of digital assets. It also offers a custodial service for institutional investors.

What are the best features of a good cryptocurrency investment platform?

When it comes to choosing the right crypto platform, there are a few key features that are important to consider.

Security

One of the most important features of any crypto platform is its security. A platform that is secure will protect your coins from being stolen or lost. It is also important to make sure that the platform has a strong security system in place so that you can be sure that your personal information is safe.

User Interface

A good crypto platform should have an easy-to-use user interface. This means that you will be able to quickly and easily access your coins and make transactions. It is also important to make sure that the platform is user-friendly so that new users will be able to easily understand how it works.

Trading Functionality

The trading Function in a good crypto platform should provide the following features:

-Ability to trade multiple assets simultaneously

-Flexible order types

-User-friendly interface

-Precise order execution

-Robust security features

-24/7 customer support

By providing these features, a good crypto platform will make it easier for traders to execute trades and track their portfolio performance. In addition, a good platform will provide users with detailed real-time market data that can help them make informed trading decisions.

What are the best cryptocurrency investment strategies?

Investing in cryptocurrency can be an exciting and rewarding experience, but it can also be a risky one. With the right knowledge and strategies, beginners can make wise investments in cryptocurrency. To help you get started, here are some of the best tips to consider when investing in cryptocurrency.

First, it is important to do your research on any potential investment platform you are considering. Make sure that the platform is reputable and secure before investing any money into it. Additionally, try to find out more about the team behind the project and their track record with other projects.

It is also important to diversify your portfolio when investing in cryptocurrencies. Try not to put all of your eggs into one basket by investing in a single currency or asset class. Instead, look for different types of cryptocurrencies that have different levels of risk associated with them so that if one fails, you won't lose all of your money at once.

Cryptocurrency investment strategies vary depending on the individual investor's goals and knowledge. However, some general strategies include:

Do your own research.

Consider buying and holding.

Consider trading.

Consider investing in tokens or coins.

Consider investing in a specific cryptocurrency or blockchain project.

Consider investing in a cryptocurrency index fund.

Consider using a cryptocurrency wallet.

Consider using a cryptocurrency exchange.

What are the best cryptocurrency investment tips for beginners?

1. Do Your Research: Before investing in any cryptocurrency, it’s important to understand the technology behind it and research the project’s team, roadmap, and community.

2. Diversify Your Portfolio: Diversification is key when investing in any asset class, and cryptocurrency is no exception. Consider investing in multiple types of cryptocurrencies to reduce your risk.

3. Set Realistic Goals: When investing in cryptocurrency, it’s important to have realistic expectations and goals. Don’t expect to get rich overnight, and remember that losses are a part of investing.

4. Avoid FOMO: Fear of missing out (FOMO) is a common phenomenon in investing, and it can lead to bad decisions. Don’t invest in something just because it’s popular, and don't invest more than you can afford to lose.

5. Use a Secure Wallet: When investing in cryptocurrency, it’s important to use a secure wallet to protect your funds. Look for wallets with two-factor authentication and other security features.

What are the benefits of using a crypto platform?

Investing in cryptocurrency is becoming increasingly popular, and the use of a cryptocurrency investment platform can provide many advantages. A cryptocurrency investment platform allows investors to easily create and manage their own portfolios of digital currencies, allowing them to take advantage of the potential profits that come along with investing in cryptocurrencies. Additionally, these platforms provide investors with access to real-time market data and analysis tools that can help them make informed decisions about their investments. With a cryptocurrency investment platform, investors can also benefit from features such as automated trading strategies, portfolio diversification options, and secure storage solutions.

The most important step in the search for generating a passive income stream is to identify a specific lucrative asset that has, over time, generated dividends. Most all assets will generate dividends if held long enough, but there are some exceptions to this rule. Also, past performance does not guarantee future results. Therefore, another important key factor for successful dividend hunters is diversification. This means investing in different markets and asset classes with the goal of earning the highest possible returns with minimal risk.

Conclusion

Overall, there are a variety of cryptocurrency investment platforms available to investors and traders. Each platform has its own set of features and services, so it is important to do your research and find the best platform that meets your needs. When selecting a platform, make sure to consider the fees, security, customer service, and ease of use. Additionally, it is important to understand the basics of cryptocurrency investing, such as the different types of coins and tokens, the different exchanges, and the different strategies that can be used. With the right platform and knowledge, investors can take advantage of the potential of the cryptocurrency market

#cryptocurrency news latest#nft crypto#crypto#blockchain#nft marketplace#cryptocurrencies#blockchain network#etherum#bitcoin#crypto atms#latest cryoto updates#cryptid#cryptoinvestor#crypto insurance#crypto industry#crypto invest 2023

0 notes

Text

Profit from Cryptocurrencies: The Ultimate Guide for Malaysians

If you want to invest in cryptocurrency, this guide is for you! What is the best investment in crypto? The current state of crypto investment in Malaysia? Cryptocurrencies have been around for more than a decade and they have been growing exponentially over time.

Back in 2013, when Bitcoin was trading below $100 per coin, there were only around 100 people who owned it. Today, we are seeing more and more Malaysians buying into cryptocurrency every year because it offers them an alternative way to store value and make money from their investments without having to rely on banks or other financial institutions as intermediaries (which many people dislike).

Meaning of crypto investment

Today, there are more than 1,500 cryptocurrencies available for investors to choose from. While most of them are based on Bitcoin or other digital currencies, some have their own unique value proposition and technology. We’ll give you a brief rundown on the different types of cryptocurrency investment and how you can make money from them but first.

What is Cryptocurrency?

A cryptocurrency is a digital asset designed to work as a medium of exchange that uses cryptography to secure its transactions, control the creation of additional units and verify the transfer of assets, and verify the transfer of funds in accordance with a set of rules established by its developers and can be divided into categories:

Bitcoin (BTC) – A peer-to-peer payment network and digital currency created by Satoshi Nakamoto in 2009. It is the first decentralized digital currency. Bitcoin has gained significant popularity over the years due to its low transaction fees, fast transaction times, and high-security features. However, it comes with a high-risk factor because hackers could target your wallet address or personal information anytime.

Ethereum (ETH) – Built on blockchain technology which allows users to make transactions without involving banks. Ethereum launched in 2015 by Vitalik Buterin who later left Ethereum in 2018 after he developed his own blockchain platform known as ‘Bitcoin 2.0’ which will be based on a proof-of-stake consensus algorithm

There are a variety of reasons why people are investing in cryptocurrencies. Some believe that cryptocurrencies are a safe investment, as they are not subject to the same risks as traditional investments, such as stock markets. Others believe that cryptocurrencies have the potential to become a global currency

The current state of crypto investment in Malaysia.

Malaysia has seen an increase in crypto-related activities, with a growing number of exchanges and Initial Coin Offerings (ICOs). This has made it easier for investors to get into the crypto market and start trading. Furthermore, Malaysia’s central bank has recently approved several cryptocurrency exchanges that have been operating in the country since 2018.

In Malaysia, cryptocurrencies are not considered legal tender. This means that they aren’t widely accepted as a form of payment for goods and services. However, you can still invest in them using a digital wallet — which is essentially an online account where you store your coins. In addition to this, there are also cryptocurrency exchanges where you can buy and sell digital currencies like Bitcoin (BTC) and Ethereum (ETH).

Malaysia has strict money laundering and anti-terrorism laws that prohibit all types of digital currency exchanges and trading platforms. If you want to get involved with cryptocurrencies in Malaysia, you’ll need to purchase them on an exchange and then sell them on another platform. The good news is that plenty of cryptocurrency payment systems are available in the country. You can find one that suits your needs by using our platform or checking out their websites directly (some require registration). To make things easier for you, we’ve also included links so that you can find exchanges easily.

Types of crypto investment In Malaysia

Cryptocurrencies offer investors a range of opportunities to make money. You can buy them on an exchange, mine them using computer power, or use them in a peer-to-peer transaction. Each type of investment has its own advantages and disadvantages.

Buying cryptocurrencies on an exchange is one of the most popular ways to invest in digital assets. Exchanges provide investors access to a wide variety of coins and tokens, allowing them to diversify their portfolios and take advantage of market movements. Mining cryptocurrencies is another way to invest in digital assets. This involves using computer power to solve complex algorithms that generate new coins or tokens as rewards for the miner. Finally, peer-to-peer transactions allow users to trade cryptocurrencies directly with each other without going through an intermediary like an exchange.

What is the best investment in crypto?

Cryptocurrencies are volatile, which means their value can change rapidly. However, some cryptocurrencies, such as Bitcoin, have had a long track record of stability. Cryptocurrencies are also digital, which makes them difficult to store and spend.

There is no one answer to which cryptocurrency is the safest crypto. Each cryptocurrency has unique properties that make it a good choice for different investors. Some of the most popular cryptocurrencies include Bitcoin, Ethereum

Risks associated with an Investment in Crypto Malaysia

Cryptocurrency is a relatively new asset class, and it is still subject to a lot of volatility. As such, investing in cryptocurrency carries with it the potential for both large gains and large losses. Before investing in any cryptocurrency, it is important to understand the potential risks associated with doing so. These risks include market volatility, regulatory risks, cybersecurity risks, and liquidity risk. It is also important to be aware of how taxes may apply to any profits gained from investing in cryptocurrency. By understanding these risks and taking appropriate steps to mitigate them, investors can ensure that they are making informed decisions when it comes to their investments in this exciting new asset class.

Cybersecurity risk refers to the risk that the network, decentralized apps (DApps), or blockchain technology itself could be exploited by malicious actors, who may use viruses and malware to hack into personal devices and private information. This may result in a loss of coins/tokens, in some cases, theft of all crypto-assets. Regulatory risks associated with particular countries’ regulations on cryptocurrencies. For instance, some countries have explicitly banned cryptocurrencies and related activities such as trading them for fiat currencies. Others have created regulatory

Final Thoughts

There are a lot of people who are looking for a secure crypto exchange but are scared about their security. They worry their crypto will be stolen or hacked.

The best way to secure your crypto is to keep your private keys in a safe place where only you can access them. You should also make sure that you have a backup of your wallet. If someone hacks into your computer, they won’t be able to get at your coins unless they find the private key.

There is no such thing as a 100% safe investment, but investing in a good cryptocurrency is one of the safest ways to support it because it goes up and down with the market.

Cryptocurrencies are not just used for speculation anymore; there are many real-world applications for them too! For example, Bitcoin used in real estate transactions, remittances, and international money transfers!

#cryptocurrency news latest#blockchain#nft marketplace#cryptocurrencies#nft crypto#crypto#bitcoin#blockchain network#etherum#crypto atms#crypto investing

0 notes

Text

The Ultimate Crypto Wallet List: Top 5 in 2023

The purpose of a crypto wallet is to provide a secure place to store your cryptocurrencies and to allow you to spend them. There are a number of different types of cryptocurrency wallets, and each one is designed for a different type of user.

Here are the five cryptocurrency wallets likely to be the most popular in 2023: Ledger Nano S plus, Trezor Model T Wallet, Coinbase wallet, Crypto Defi Wallet, and Exodus Crypto Wallet.

How do you use a crypto wallet?

To utilize a cryptocurrency wallet, you must first create an account. This is accomplished by entering your name, email address, and password. You will then be handed a one-of-a-kind key to unlock your wallet. After you have made an account, you must enter your wallet address.

This is a one-of-a-kind string of characters that corresponds to the email address you used to set up your account. Your wallet address may be found on the same page where you established your account.

Why are crypto wallets important?

Crypto wallets are vital for both individuals and firms wishing to use cryptocurrency. A digital platform that allows users to store, transmit, and receive cryptocurrency is known as a crypto wallet. It usually includes a graphical user interface for managing transactions and storing keys. Crypto wallets are useful because they allow users to keep their cryptocurrency offline. This is significant because it enables users to protect their cryptocurrency from hackers. Furthermore, crypto wallets enable users to transfer and receive cryptocurrency without relying on a third party. Crypto wallets are also beneficial to companies since they enable them to accept cryptocurrency as payment.

Different Types of Crypto Wallets

There are many different types of crypto wallets, and each has its own advantages and disadvantages. Before using a crypto wallet, it's important to understand the different types and choose the one that's right for you.

There are a few types of crypto wallets that are available on the market.

Cold Crypto Wallet

Wallet stored in an offline computer, such as a USB drive or hard drive. Cold wallets are the most secure type of crypto wallets because they are not connected to the internet and cannot be hacked.

Hardware wallets: Hardware wallets are physical devices that store your private keys offline and allow you to make transactions without having to connect to the internet. Hardware wallets are generally considered the safest way to store cryptocurrencies because they're not connected to the internet or any third-party servers. You can even use them on multiple devices at once.

Paper wallets: Physical representations of public addresses and private keys. You can print out a paper wallet for Bitcoin or Ethereum and store it in a safe place. This way, you will have an advantage when it comes to cyberattacks as people don't know about your wallet details unless someone steals it from you or hacks into it via malware infection (which is highly unlikely)

Hot Crypto Wallet

The wallet is stored online, such as in a web browser or on an exchange’s website. Hot wallets are not as secure as cold wallets because they can be hacked

Mobile wallets: The most popular and easiest to use. They are convenient because you can access them on any mobile device and easily import your existing crypto assets. Mobile wallets often have good security features such as 2FA (two-factor authentication) and PIN codes.

Web Wallets: Online applications that store your private keys online, but they do not hold any cryptocurrency themselves. They send and receive cryptocurrency from a digital wallet address created by the application when you use it. This type of wallet allows you to access your funds from anywhere in the world using an internet connection, as long as you have an active internet connection

Desktop Wallets: Desktop wallets are similar to web wallets in that they allow users to manage their digital assets using a web interface. However, desktop wallets are more secure than web wallets because there is no reliance on an internet connection for transactions between the client application and server

Conclusion

If you are looking for a digital wallet that can store different types of cryptocurrencies, you might want to consider a cold wallet. A cold wallet is a wallet that does not require a connection to the internet. This is great for securely storing your cryptocurrencies offline.

However, not all digital wallets are created equal. Some are more secure than others. For example, a hot wallet is a digital wallet that is connected to the internet. This is because hot wallets are typically used to store cryptocurrencies that are being traded on exchanges.

#nft crypto#crypto#cryptocurrency news latest#blockchain network#nft marketplace#blockchain#cryptocurrencies#etherum#crypto atms#bitcoin#crypto wallet#coinbase#trezor

1 note

·

View note

Text

Crypto crash In 2023, here's how to protect yourself.

The latest crypto crash has resulted in large price drops for various crypto coins: Bitcoin, Ethereum, FTX, and LUNA have all plunged dramatically. What is going on? There are several reasons for the surprise price drop. To begin with, there is a lot of regulatory uncertainty around cryptocurrencies. As a result of the uncertainty, investors are leaving their cryptocurrencies. Second, there is a lot of bad information flowing around the internet about cryptocurrencies. As a result of this unfortunate news, the long-term viability of these digital assets is being called into doubt. So, what should you do now? First and foremost, do not panic! This price cut is just temporary. So, without further ado, let's get started on learning how to defend oneself.

What is a Crypto Crash?

A crypto crash is a sharp drop in the value of cryptocurrencies, typically triggered by a fear of a wider financial market crash. This fear can be caused by a number of factors, including news stories about financial regulator's crackdowns on cryptocurrency trading

Why is Crypto Crashing?

Cryptocurrencies are crashing for a variety of reasons. The most popular cryptocurrencies, Bitcoin and Ethereum, are down about 30% from their all-time highs. Bitcoin Cash, Litecoin, and EOS are all down about 50%. The causes of these crashes are many and varied, but they all have one common denominator: fears about the future of cryptocurrencies.

Bitcoin and Ethereum were both created as digital currencies. They are not physical objects like dollars or euros. This means that they are not subject to the same laws and regulations that govern traditional currencies. This has given cryptocurrencies a lot of freedom, but it also means that they are not that stable.

Regulation of Cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

The decentralized nature of cryptocurrencies has led to a variety of legal challenges. For example, some countries have sought to regulate cryptocurrencies as money, while others have considered them commodities. In January 2018, the US Securities and Exchange Commission (SEC) announced plans to regulate the cryptocurrency market. The SEC has also brought enforcement actions against individuals and companies for fraud and other violations

At present, there is no single regulation regime that applies to cryptocurrencies. This is in contrast to traditional financial products, where a well-defined set of regulations applies to them. In fact, there is no single regulatory regime that applies to cryptocurrencies either: different jurisdictions have adopted a variety of different regulations

Crypto Crash Influencers

Cryptocurrencies are becoming more and more popular, but some people are concerned about the potential for volatility. Some people believe that the volatility of cryptocurrencies will cause them to lose money.

Some cryptocurrency influencers believe that volatility is a good thing. For example, John McAfee believes that volatility is a sign that cryptocurrency is growing. John McAfee believes that volatility is a sign of a healthy market.

Some people believe that the volatility of cryptocurrencies will cause investors to lose money. For example, Warren Buffet has said that he doesn’t understand cryptocurrency and that he doesn’t believe that it is a good investment

There are a number of regulatory bodies around the world that are still working to understand and define cryptocurrencies. This has created a lot of uncertainty in the market and has caused investors to pull their money out of cryptocurrencies.

Many experts believe that the regulatory environment will eventually become more favorable and that the value of cryptocurrencies will rebound. However, until that time happens, the market will continue to decline.

What to Do About a Crypto Crash

Cryptocurrencies have seen a meteoric rise in value in recent years, with some coins seeing a 500% increase in value in just a few months. However, this meteoric rise has not been without its share of bumps in the road. In recent weeks, cryptocurrencies have been hit hard by a global crypto crash, with many coins seeing their values plummet by as much as 80%.

Always take profits

Always take profits. This is a general rule of thumb for any person who trades in the stock market.

It’s not enough to just buy and hold stocks or cryptocurrencies, it’s important to know when to sell as well. If you are looking to make a quick buck off of an investment, you will need to be prepared to get out at the right time.

Always use stop-losses

Cryptocurrency is a volatile market with high price swings. This makes it hard for traders to judge when to buy and sell. This can be dangerous for inexperienced traders, who may not know when to cut their losses and sell at the right time.

A stop-loss order is an order to sell or buy a security at a specified price if it reaches a certain point in time, thus limiting your loss on an investment. It may also be referred to as a "stop order" or "stop-loss limit".

The purpose of this is that you don't have to monitor the markets all day long in fear of missing out on opportunities and you can sleep better knowing that your losses will be limited if the market moves against you.

Understand why the market is Crashing

In a market as volatile as cryptocurrency, it may be impossible to predict when a slump would occur. The value might fall much more, resulting in even larger investment losses. It is critical for an investor to understand how assets behave and their historical performance.

Consider the Big Picture

Do not be seduced by the crash into selling. A long-term perspective ensures that you have a sound investment strategy, preventing you from making decisions that you may later regret.

Diversify Your Investment Portfolio

Every person's investment portfolio is different, and what works for one person might not work for another. One of the best ways to diversify your portfolio is to invest in a variety of different asset classes.

Some asset classes that are good for diversification include stocks, bonds, real estate, and commodities. When you invest in these different asset classes, you are taking on a more diverse set of risks and are therefore more likely to make money over time.

When you invest in a diverse range of asset classes, you are also more likely to have a higher return on your investment. By investing in stocks, bonds, real estate, and commodities, you are spreading your risk and are likely to earn a higher return on your investment.

My Final Take on Crypto Crash?

When it comes to cryptocurrency investment, it’s important to diversify your portfolio. That means investing in a variety of cryptocurrencies and tokens. Here are some tips for diversifying your crypto portfolio:

Invest in a variety of cryptocurrencies and tokens.

Diversify your holdings across a variety of exchanges and markets.

Avoid investing all of your money in one cryptocurrency or token.

Consider using a cryptocurrency diversifier tool, such as CoinMarketCap, to help you track and analyze your holdings.

Stick to a long-term investment strategy when investing in cryptocurrencies and tokens.

By following these tips, you can help diversify your crypto investment portfolio and potentially increase your portfolio’s returns.

#nft crypto#crypto#bitcoin#cryptocurrency news latest#blockchain#cryptocurrencies#nft marketplace#blockchain network#crypto atms#etherum#ftx crypto#ftx token#ftxbacked#ftx collapse#ftxbinance#exchanges#crypto latest news

0 notes

Text

Cryptocurrency Trading: The Ultimate Guide for Beginners.

Cryptocurrency Trading has become the latest trend in the world of finance. With Bitcoin skyrocketing to $20,000 in 2017 and other cryptocurrencies following suit, it is difficult not to get excited about this new phenomenon.

However, trading in cryptocurrencies is not a walk in the park. You need to know what you are getting into before you start investing your hard-earned money. This guide will provide you with all the information that you need to know about Cryptocurrency Trading so that you can make an informed decision before investing your money in this volatile market.

Image by rawpixel.com on Freepik

What is cryptocurrency trading?

Cryptocurrency trading is the buying and selling of digital currencies like Bitcoin, Ethereum, and Litecoin. Cryptocurrency trading is similar to traditional stock trading in that it involves buying and selling securities on an exchange. However, the difference between stock and cryptocurrency trading is that the latter does not involve fiat currency. Instead, it involves cryptocurrencies such as Bitcoin or Ethereum. You can also trade other cryptocurrencies such as Dash or Litecoin against Bitcoin if you wish to diversify your portfolio.

How do cryptocurrencies work?

Cryptocurrency is a digital currency that is created and stored electronically. They are created by the process called mining, which involves solving complex mathematical puzzles.

There are many reasons for the growth in cryptocurrency popularity. Firstly, it is free from government censorship and manipulation, so it can be used as a hedge against inflation or economic downturns. Secondly, you can use cryptocurrency to buy goods and services online without paying any additional transaction fees or commissions.

Thirdly, cryptocurrencies have low transaction costs associated with them; this allows for micro-transactions which would not be possible with other forms of payment such as credit cards. Finally, there is no need to provide sensitive personal information when using cryptocurrencies; this provides anonymity when making transactions online.

What are the benefits of cryptocurrency trading?

The benefits of cryptocurrency trading are many. Firstly, it is not regulated by a central authority. This means that there are no limits on the amount you can withdraw or deposit in your account. Secondly, it offers high liquidity with low transaction fees which makes it easier to trade with more frequency. Thirdly, there are no geographical restrictions which makes cryptocurrency trading accessible to everyone all over the world.

There are also other benefits to trading cryptocurrencies such as increased anonymity and privacy. Cryptocurrency transactions are secure and anonymous, so there is no need for third parties such as banks and credit card companies. With a traditional bank account, you have to provide your name, address, and date of birth when opening an account; with cryptocurrency accounts, this information is unnecessary as they do not track their customers’ movements or profiles (although some exchanges may ask for personal information).

Cryptocurrencies also offer better security than traditional currencies because they do not rely on banks or governments for protection against fraud or loss of funds; instead, they rely on technology such as blockchain technology which acts as an electronic ledger that records every transaction made using cryptocurrencies.

How to start cryptocurrency trading?

Cryptocurrency trading is a high-risk and high-return investment that can be very profitable. Before you start trading, it is important to understand the basics of cryptocurrency trading and the cryptocurrency market.

What are the risks of cryptocurrency trading?

Cryptocurrency trading is a high-risk activity. It can be very profitable and most people who trade cryptocurrencies make a lot of money, but it’s not for the faint of heart.

Cryptocurrency trading can be confusing because there are so many different kinds of exchange, different types of cryptocurrencies, and lots of different ways to buy and sell them.

Before you start trading cryptocurrency, you need to understand how it works. Cryptocurrencies are digital assets that use cryptography to secure transactions and control the creation of additional units. They’re decentralized, meaning they don’t belong to any government or company

The risks of cryptocurrency trading are not as high as trading in the stock market. However, there are still some risks that can impact your trading results.

Exchanges and Trading Platforms.

The biggest risk for cryptocurrency traders is the exchange or platform they use. There is no central authority that regulates these platforms, so there are no guarantees that they will be able to pay you back if anything goes wrong.

Crypto Exchanges have been hacked before and many times people have lost their funds. Some of the largest exchanges have been hacked several times and lost millions of dollars worth of cryptocurrencies in the process. It is important to remember that this happens every day and even if it doesn’t happen to you today, it could happen tomorrow!

Social Engineering Attacks (Social Engineering).

Social engineering attacks are when someone tries to trick you into giving away your private information by pretending to be someone else or using social engineering tactics like phishing emails or texts. The best way to prevent this kind of attack is by being aware of scams and if someone contacts you asking for your private information without proof, don’t provide it!

Tips for successful trading?

Cryptocurrency trading is a complex and risky investment. There are many things that can go wrong and you should never invest more than you can afford to lose.

Some of the tips for successful cryptocurrency trading are:

– Never invest more than you can afford to lose

– Do not trade with money you need in the near future

– Set clear goals and make sure they are realistic

– Make sure to buy cryptocurrencies from exchanges that have high-security standards

#nft crypto#crypto#bitcoin#cryptocurrency news latest#blockchain#cryptocurrencies#nft marketplace#blockchain network#etherum#crypto atms#crypto trading#crypto trends

0 notes

Text

Ethereum Ultimate Guide and its Relation to NFT 2023.

The purpose of this guide is to provide a definitive resource for anyone who wants to understand what is Ethereum, how they work, and its relationship with NFT. We will aim to provide some background information on them as well as discuss some of the key issues relating to NFTs. This article will provide an overview of what Ethereum is, why it matters in the NFT space, and whether you need to be a part of it.

What is Ethereum?

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third-party interference. People use Ethereum to create new businesses, applications, and contracts. It has already inspired many new startups and developers to create their own projects based on its platform. One of the most interesting aspects of Ethereum is that it uses a new type of digital asset, called NFTs.

What is NFT?

What is a “non-fungible token”? A non-fungible token is a token that is not related to any other token in a blockchain network. This is because a token is a type of asset and not a type of currency. Unique NFTs cannot be duplicated. They are also not subject to predefined supply or demand.

Difference Between Ethereum And NFT.

There are several differences between the price of Ethereum and NFT. In the blockchain, ownership is based on supply and demand. In the NFT market, however, the demand is high and there is a high scarcity of the tokens. Despite this, there is still a demand for digital tokens from collectors, gamers, and investors.

The main difference between these two types of coins is that Ethereum’s a global public utility, while NFTs are a decentralized asset. Any exchange that accepts Bitcoin can trade the latter The difference between the two currencies is the way that the two systems work. Ethereum users are not locked to any particular platform

Ethereum and NFT Ownership

In contrast, creators create NFTs. They will earn royalties from the sale of their NFTs. However, the current system is not efficient and accurate. Creators do not get paid for resale; they are paid for the work they do in creating the NFT. This is because NFTs are similar to Ethereum’s, but they solve different problems. The NFTs are similar, but they are different. Ethereum has a more secure platform, but the NFTs are similar in the fact that they have a lower price.

Another difference between NFT and ETH is their ability to prove ownership. The NFT is very easy to prove, whereas the ETHs cannot be. An NFT is a digital file with a private key. An owner can prove ownership by signing a message to purchase or sell anything. The owner can also earn royalties by reselling their asset on any market that supports the NFT.

As a cryptocurrency, an NFT can validate a piece of digital artwork. The NFT is a digital form of proof of ownership in the real world, and this is the same with a digital collectible. The NFT can store data such as images and movies. They verify ownership as well as authenticate artworks.

NFT and Ethereum Popularity

The NFT market is booming. Many digital artists and celebrities have started to use NFTs for their art. The popularity of NFTs has exploded, and NFTs have been used by many celebrities. As an added benefit, they are more reliable than traditional currency. In addition to being a form of currency, they can be a representation of unique assets. Among the advantages of NFTs are that they can store and transfer assets

The NFT marketplaces are notorious for their high degree of security. This is because of the fact that they use proprietary software that runs outside of the crypto blockchain. This means that thieves have become increasingly successful at stealing NFTs. A common scam involves gaining access to the market and relisting prized NFTs at ridiculously low prices. Once the prized NFTs are relisted, the thieves will be able to trade them for full value.

Minting NFT! What is minting?

Minting NFTs is a process of creating and issuing digital tokens that represent assets or services. A key step in the issuing and trading of NFTs. On a blockchain platform, minting entails creating new tokens, issuing them, and verifying the identity of the issuing parties. Minting is essential to ensure that the NFTs are a reliable and stable means of representing assets.

An NFT can be stolen before it has been released, or it can be resold as an NFT. It is important to note that both of these types of digital tokens have different uses. Some are more useful than others. Make sure you have the appropriate permissions to use a non-fungible token.

Conclusion

The ETH and NFT communities are rich with potential. They both have the potential to form the foundation for a new type of digital currency and to help users automate their lives. They also have the potential to work together to create amazing things.

Here are some of the few differences that we compiled for you:

Ethereum does not support NFTs.

Ethereum does not store or use NFTs.

Use NFTs to pay for services.

NFT offers a way to trade Ethereum doesn’t.

Ethereum does not offer a way to purchase NFTs.

NFTs offer a way to pay for goods or services.

Ethereum does not offer a way to use NFTs to pay for debts.

Ethereum does not offer a way to use NFTs to store value.

#nft crypto#bitcoin#blockchain#nft marketplace#etherum#crypto atms#cryptocurrencies#cryptocurrency news latest#crypto#blockchain network#binance

0 notes

Text

Crypto Exchange 2023: How to Trade Best Cryptocurrency

Is this your first time hearing about cryptocurrency? I know it was for me. But guess what in 1983 David Chaum took privacy policies too seriously that he created an anonymous payment system “DigiCash” for the digital age. This was before the Internet was made for public use, fast forward 39 years and the world has crypto, so let’s dive into what you need to know.

What is Cryptocurrency?

In simple terms, cryptocurrency is a digital currency. It is not controlled by a specific organization or government, unlike the traditional currencies, we are used to. It is decentralized and works on the basis of cryptography. Cryptocurrency works through a technology known as the blockchain.

The most popular cryptocurrency exchange in the world is Bitcoin. Bitcoin was launched in 2009 and since then, it has been quite successful in the market. Bitcoin prices have risen significantly over the years and today, it has become one of the most popular cryptocurrencies in the world

In the simplest terms, cryptocurrency is money that only exists digitally or virtually. It’s like an online version of cash

How Does Crypto Work?

Cryptocurrency works exactly like any other form of currency. It can be used for transactions, and can also be traded.

Cryptocurrency trading is similar to Forex trading in that they both involve exchanging one currency for another. For example, you can exchange Bitcoin for Ethereum or Litecoin. Cryptocurrencies are often exchanged against fiat currencies (USD, GBP, EUR) but can also be exchanged against other cryptocurrencies.

Cryptocurrency markets are highly volatile and prices often fluctuate by 10-20% in a matter of minutes. This volatility makes cryptocurrency markets a prime target for day traders who seek to make money online through short-term trades on price fluctuations.

What Should You Look at When Choosing a Cryptocurrency Exchange?

The first thing that you should consider when choosing an exchange is how simple the registration and verification procedures are. If you need to jump through a lot of hoops just to get your account verified, it might be worth looking elsewhere. The cryptocurrency exchange that you go with should make it easy for you to start trading as soon as possible.

The second thing that you definitely want to look at is the number of cryptocurrencies that the exchange supports. If you want access to a wide variety of cryptocurrencies, then it makes sense for you to use an exchange that supports them all. This will allow you to diversify without having to open multiple accounts on different platforms.

The third consideration is whether or not the platform has an app or not. Cryptocurrencies are volatile and if you don’t have access to your account at a moment’s notice, then this could cause some serious problems for your trading strategy.

Crypto Exchange Fees

Crypto Exchange Fees refer to the cost of buying and selling cryptocurrencies. The fees can vary depending on the exchange, we’re going to take a look at the different types of fees you can expect to encounter when using a crypto trading platform.

Deposit Fees

These are the fees charged for depositing funds into your account. These vary from exchange to exchange and usually depend on the type of deposit method you choose and the volume of deposits made.

Withdrawal Fees

Like deposit fees, withdrawal fees also vary depending on the exchange and payment method. If you’re planning on making frequent withdrawals, it is important to keep an eye out for low withdrawal fees and other benefits like cashback that may offset these costs.

Trading Fees

Most cryptocurrency exchanges charge a trading fee, which is calculated as a percentage of each transaction amount. For example, if you buy $100 worth of Bitcoin with an exchange that charges a 0.1% trading fee, you will pay $0.10 in fees.

How to Buy Crypto to Trade

The leading cryptocurrency exchanges of the world are Coinbase, Bittrex, Kraken, and Poloniex. These exchanges allow you to buy and sell cryptocurrencies like Etherium and others.

In order to trade on any of these exchanges, you will first need to open an account with them. It is easy to set up an account on any of these exchanges. The process is similar to opening a bank account. You will first have to register your name, email address, mobile phone number, country, and other details. Then you will have to upload some identity documents in order to verify your identity before you can proceed with trading.

Once you have an account on any of these exchanges and have verified your identity, you can start buying and trading cryptocurrencies supported by the exchange. A common trading strategy is to buy and hold – traders will buy a cryptocurrency asset and hold it for a period of time before selling it at a profit.

How Much Should You Invest in Crypto?

The amount that you should invest in crypto depends on how much risk capital are you willing to lose without affecting your personal finances or life. This amount may vary from person to person.

The general rule of thumb is that one should not invest more than 10% of their total investment capital into crypto trading. If you want lower risk then that percentage could be even lower than 10%.

Pros and Cons of Investing in Cryptocurrencies

Investing in cryptocurrencies is always risky, but the rate of cryptos’ growth is phenomenal. If you think it will continue to grow, you should try trading cryptocurrencies.

Cryptocurrency trading consists of buying and selling digital coins. You can buy them on exchanges and then store them in your Crypto wallet.

Try using more than one exchange to trade. To choose the best exchange for you, pay attention to the following features:

Trading volume – As more people trade on an exchange, its fees are going to be lower and transactions will be faster

Fees – all exchanges charge transaction fees. The fee is usually a percentage of the total amount you want to sell or buy

Payment methods – some exchanges accept only bank transfers or credit card payments while others offer PayPal or other types of online payments

User interface – if you’re a newbie, you might not want a complicated interface

Security – check how secure is an exchange before you start trading on it

Country availability – some exchanges don’t allow users from certain countries to register accounts on their platforms

Conclusion: Cryptocurrency trading steps

The first step is to define your investment goals and learn the rules of trading. You should decide whether you want to get some extra money or build a career as a professional trader. Next, find out the trading risks that may affect your crypto exchange.

Then, choose a cryptocurrency exchange and register on it. After creating an account, you must verify it and make a deposit on the platform. Now, you can start trading crypto coins.

The next step is to research tools and strategies for crypto trading. It is advisable to develop your unique methods so that they fit your financial goals and style of trading.

Finally, analyze your performance regularly to improve your skills and increase profits from a cryptocurrency exchange.

#nft crypto#crypto#bitcoin#cryptocurrency news latest#blockchain#cryptocurrencies#nft marketplace#blockchain network#etherum#crypto atms

0 notes

Text

Top 5 Best Proven, Analyzed NFT Marketplace 2022.

The NFT Marketplace is a platform where users exchange virtual assets using cryptocurrencies, as well as exchange virtual assets utilizing a peer-to-peer network. The marketplace will be available to users worldwide and will be online 24 hours a day, seven days a week.

There are several NFT marketplaces accessible today, and this list will only expand in 2022. Here are the five best NFT marketplaces in 2022:

Crypto- Overall Best NFT Marketplace

There are many NFT marketplaces in the world, but only one is the best. That’s right, I said it. And it’s true. I know you might be skeptical, but the Crypto marketplace is the best choice for your NFT needs. The Crypto platform has a slick, flawless design – an easy-to-use interface that makes it easy to buy and sell NFTs.

You may also use your Crypto account to make purchases on other websites like eBay or Amazon! Crypto Platform is designed for mobile, so you can conduct all your shopping on your phone or tablet! Trustworthy reputation – Crypto Marketplace has earned a strong reputation among its users as one of the world’s leading NFT exchanges. Fast transactions – If you want to buy or sell an asset on Crypto

Binance- Low fee NFT Trading Platform

Binance key strengths are; low fees, high security, and fast transactions. However, it is not just an exchange, but also a platform for trading Non-Fungible Tokens (NFT) based on Ethereum’s blockchain. Binance provides a wide range of NFTs for trade; virtual pets and assets, digital art, and licensed items like CryptoKitties, CryptoCelebrities, and CryptoHorse Racing Club.

Binance NFT Marketplace brings together artists, creators, and crypto enthusiasts on a single platform to create and trade top NFTs

This makes it a great option for investors who want to get involved in the NFT market, but don’t want to spend a lot of time learning how to trade.

OpenSea- Top NFT Marketplace with a Diverse Asset Portfolio

OpenSea is a top NFT marketplace with a huge asset selection that makes it easy to find the NFTs you’re looking for. It offers a large range of games, collectibles, and even real-world assets. Kevin Doering founded the platform in 2018. He has been working in the blockchain industry since 2014.

The platform makes it easier for people to buy, sell and collect NFTs without third parties or complex systems.

As the platform grows, so does its user base. With more users comes more activity on OpenSea which means there are more opportunities for you to make money.

OpenSea is a great place for new collectors to start their journey. If you have never owned an NFT before, you will want to begin your search for your first one.

Cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and many others are available through ShapeShift integration into OpenSea’s marketplace system.

Nifty Gateway- Best NFT Platform for Rare Drops

Nifty is the only platform that allows users to view and experience the entire ecosystem of NFTs. Designed to be a one-stop shop for all types of digital assets in the blockchain space. It is a secure, transparent, and efficient marketplace that facilitates faster transactions between users and sellers. The platform uses smart contracts to facilitate buying, and selling, with zero transaction fees for both buyers and sellers.

The Nifty Gateway platform offers various features including:

Scalability-Our team has years of experience building scalable products and we have planned out the architecture of our platform so that it can handle millions of transactions per day.

Security- Our platform has been built with security as a top priority. We utilize the latest technology such as 2FA, encryption, and database encryption to ensure that all users can trade safely on our platform.

Fast Payments: We use a proprietary payment system that allows us to process payments quickly, even if there are millions of transactions happening at one time!

Selling – Users can sell their digital assets directly through the Nifty Gateway platform by setting up an auction or adding a fixed price for their item(s). This will also help

Listing – Users can list their digital assets on the Nifty Gateway platform which will allow others to view them when searching for items they want to buy or sell on the network. The listing process takes less than 5 minutes depending on how many details you would like to add about your item(s).

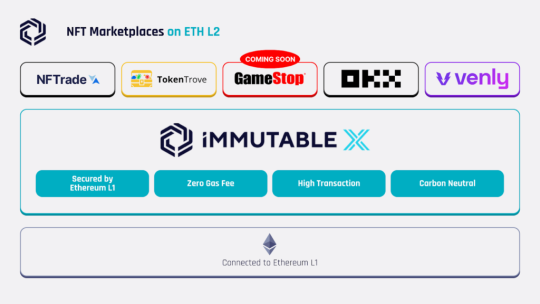

GameStop- Upcoming NFT Platform for Blockchain Gaming

GameStop is a leading retailer of video games, gaming consoles, and accessories. They have been around for over 30 years and its mission is to provide the best gaming experience to customers.

GameStop has announced that they will soon launch their own NFT marketplace called GameStop NFT Market.

GameStop NFT Market will be a fully-featured virtual goods marketplace where gamers can buy and sell non-fungible tokens (NFTs) from popular games like CryptoKitties, Gods Unchained, and more. Enjin Coin will be the first game publisher to make its game assets available on this new marketplace.

The platform will enable users to list items for sale in a single click, and allow users to see detailed information about each item such as its rarity level, which can help them decide if they want to make an offer on it or not.

Users will be able to purchase items using major cryptocurrencies such as BTC, ETH, or ENJ tokens, or fiat currencies like USD through PayPal or credit cards

Final Thoughts

In the coming years, it’s possible that NFTs will become ubiquitous in everyday life. Going to the movies, buying a gift for a friend, or even going out to eat at a local restaurant—you’ll likely have the option of paying with an NFT of some sort or another.

It might not be bitcoin or Ethereum, but an NFT could very well be their gaming mat or their food card. There are thousands of aspiring entrepreneurs on open NFT markets right now, and if you’re one of them, this is your greatest hope for success.

#nft crypto#crypto#bitcoin#cryptocurrency news latest#blockchain#cryptocurrencies#nft marketplace#blockchain network#etherum#crypto atms

0 notes

Text

Crypto Wallet? How To Setup; Reliable, Simple Guidelines

Crypto wallet?! but first, what is Cryptocurrency? They are a hot topic, it’s easy to see why: they’re decentralized, and can be used for almost anything. They have a lot of value as a payment method, and the price of each cryptocurrency goes up and down based on supply and demand.

What is a Crypto Wallet?

A crypto wallet allows you to store your private keys in a secure place, the private keys act as the signature that proves ownership of your coins, in fact, your public key acts as your address.

It allows others to send you funds but if you lose your key then you lose access to your wallet. This is why it’s so important to keep it safe and secure!

How do I create a crypto wallet?

There are several sorts of wallets available in this case, so it’s critical that you select the best one for you, Pointing out that Some wallets accept payments with or without the blockchain. Altogether, there are wallets that connect to the internet directly while others function on your PC or mobile phone offline.

A web-based wallet (hot wallet) is susceptible to hacking attempts. For security and convenience, in this case, cold storage wallets (offline wallets) are the only way to go.

Go to the website of your chosen digital currency and click “Buy” or “Sell”.

You choose how much money you want to invest in cryptocurrency

After choosing the amount of money you want to invest, click the “Continue” button next to it.

Fill out the correct details this is where your cryptocurrency transactions will come from.

Click on the “Register” button at the bottom of the page for a complete set-up

Types of Crypto Wallets

There are lots of different types of crypto wallets available on the market today: hardware and software wallets; exchange-issued wallets; and paper wallets ( Only recommended for long-term storage).

Here are some of the most popular types of crypto wallets:

Desktop Wallet: Accessible only by someone who has physical access 24/7 and can be downloaded in advance plus they offer more privacy because no one can see and still track what you do with them. All in all the disadvantage is they are prone to Cybercrime.

Mobile Wallet: This allows you to securely send and receive cryptocurrencies from anywhere at any time with this in mind they’re great for people who want to keep track of their assets while on the go.

Hardware Wallets: Hardware wallets are physical devices that store your private keys offline on a microSD card or USB stick. Holding large amounts of cryptocurrency without fear of getting hacked can be achieved by using cold storage

Risks and Benefits of Having a Crypto Wallet

Here are the main ways cryptocurrencies can harm you:

Lost or stolen cryptocurrency.

Hackers can steal your private keys, thereby causing you to lose your cryptocurrencies. This is why ensuring your account is secure and only accessed from trusted devices is crucial.

You can access password-protected wallets from any computer with an Internet connection. This means that if you lose your password to regain access to your wallet without help from an expert is quite a task.

Fraudulent ICOs (initial coin offerings).

It’s fraud when a corporation makes an uncontrolled offering of tokens or coins for sale, Recently, many fraud ICOs have been launched even with celebrity endorsements again be careful about which projects you invest in as not all are legitimate.

Besides, the advantage of creating a crypto wallet is you get access at any time anywhere. Since money transfers have become simple without the need to go via banking institutions saving us both time and money.

Conclusion

A secure, reliable, and easy-to-use crypto wallet is the only way you can enjoy all the benefits of cryptocurrency easily. Installing a crypto wallet on your computer or mobile device is easy

They’re many types of crypto wallets, above all the two main ones to choose from are hardware and software. Hardware wallets are physical devices that securely store your digital assets. You can download software wallets onto your computer or mobile device and keep them in an app.

#nft crypto#crypto#bitcoin#cryptocurrency news latest#blockchain#cryptocurrencies#nft marketplace#blockchain network#etherum#crypto atms#crypto wallet

0 notes

Text

NFTs and Their Relation to Crypto Market.

In this article, I will talk about non-fungible tokens (NFTs) and why they are good for the crypto market. NFTs are a type of digital asset that is not interchangeable with other tokens because each token has a unique ID and some characteristics that make it different from other tokens. NFTs can represent physical objects, virtual objects, or intangible concepts like ownership of land in a game or access to an event.

The idea behind NFTs is that each token is unique and can’t be replaced by another token. They are perfect for use cases where uniqueness matters such as art auctions, online games, and crypto collectibles. If a token is not fungible, it means that it’s unique and has properties distinguishing it from other tokens. For example, if you were buying a painting at auction, you would have to pay the same amount of money no matter what the painting looked like.

What is a Non-Fungible Token (NFT)?

NFTs are a digital representation of a unique item that you own. Because it is intended to be used for the purchase of digital goods and collectibles, it differs from other cryptocurrencies. NFTs are not fungible tokens because they each represent something unique, with their own history, or story. Copyright law, trademark law, or both can protect NFTs. They have the potential to revolutionize the way we think about ownership and intellectual property rights. The idea for non-fungible tokens came about when Vitalik Buterin, the founder of Ethereum, asked Stuart Haber from MIT if the digital collectibles market was too big for any one company to manage.

Decentralized tokens are used to retain and represent digital assets. Recently, more investors have been investing in companies that make trading platforms for these tokens like CryptoKitties.

What are the Benefits of NFTs?

NFTs have a variety of benefits that make them an attractive investment to many people. Hence they are an emerging asset class that is not only accessible to the wealthy and institutional investors, but also to retail investors. NFTs have a variety of benefits that make them an attractive investment to many people.

These include liquidity, transparency, efficiency gains, and the ability for holders to easily trade their tokens in the secondary market. The term ‘non-fungible’ refers to unique tokens that can’t be replaced with any other token. This means when you buy one token, you own it forever and nobody can take it from you or give it back to you.

NFTs have a variety of benefits that make them an attractive investment to many people. These include liquidity, transparency, efficiency gains, and the ability for holders to easily trade their tokens in the secondary market. NFTs are not tied to other assets like gold or stocks and thus their true value cannot be manipulated by external factors like inflation or interest rates, Both utility and security tokens are anticipated to be part of the crypto-token future. Utility tokens are economical in nature and their value derives from the demand for them. Security tokens offer some form of asset or another type of guarantee, such as dividend payments that come from the profits of a company

The Rise of Non-Fungible Tokens and Why They are Blowing Up

Non-fungible tokens are one of the newest developments in the blockchain space. They represent a digital asset that is unique and has a specific value. Users can use these tokens to represent different things. Each token has its own property and is difficult to replace with another. NFTs are also a subset of ERC-20 tokens. ERC-20 is a technical standard for smart contracts that allows for the creation of Ethereum (ERC) compatible tokens The initial token produced in accordance with this standard is a non-fungible token.

It spurred a worldwide craze in collecting these digital assets. Non-fungible tokens are the most popular in use in the gaming industry. Players can’t alter other players’ collections. Since the games are distributed in an open and transparent format, no one owns the game data. NFTs have been used for a range of purposes, but many are digital and found in video games.

How to Create Your Own NFT?

There are a lot of ways you can create your own NFT, but it is important to know that each method has its pros and cons.

One of the most common methods is by using Ethereum smart contracts. As long as the platform accepts ERC-721 tokens, you may use this to produce an NFT token that can be used on just about any platform. The downside is that this requires some knowledge of Ethereum programming and how smart contracts work. Another option is using OpenSea’s marketplace which allows you to create a custom token in less than five minutes with no coding required. The downside is that they take a commission fee, which ranges from 10-30% depending on the project and if you have any special features.

How Can You Trade NFTs?

NFTs only traded in decentralized markets. Nearly all major blockchain platforms allow for the exchange of NFTs, like Ethereum and EOS. What is a decentralized application? DApps collect data on the blockchain in a decentralized way. In contrast, a decentralized application has no single point of failure. Most users publish their own apps and receive donations in cryptocurrencies to fund the ongoing development of the app.

How to use NFTs in the Crypto market?

NFTs represent ownership of digital goods, rights, or access to specific features on a Blockchain network. For example, a token such as BAT or TRX is used to “buy” the right to access content on a Blockchain platform. How will it work? The NFT marketplace will be accessible via an interface on the company’s website and by using Blockfolio, which is available for iOS and Android devices. What is the difference between Cryptocurrency and a token? A cryptocurrency (such as Bitcoin) uses cryptography to secure its transactions, control the creation of additional units, and verify the transfer of assets.

A token is an economic mechanism that represents a particular share of an ecosystem. It can be a share of the ownership in a publicly-traded company or as a unit of account to trade or transfer value. Numerous articles have outlined the basic features of blockchain, with potential applications ranging from land registration to international commerce regulation.

What are the Advantages of NFTs?

A brand-new type of digital asset traded on the Blockchain are non-fungible token. They are scarce, divisible, and fungible. NFTs can be divided into fractions. That means they are divisible. They also have the same value, no matter what the look or name is.

How the technology works in order to make it possible for users to trade digital assets, developers needed a way of turning digital assets into physical ones and vice versa. The process is known as Tokenization, in which an asset outside the blockchain is represented as tokens on the blockchain.

What are the risks and challenges of using NFTs in the crypto market?

The lack of regulation of NFTs is one of the main problems with employing them. This means that it is hard for people to trust and invest in them. Another challenge of using NFTs in the crypto market is that they are not as easy to use as other cryptocurrencies. They are not as user-friendly as they may be and users often struggle to grasp how to use them. The risks associated with using NFTs in the crypto market include lack of liquidity, high volatility, and lack of security. NFTs in the crypto market include CryptoCard, CryptoKitties, and Coindroids.

What are the future prospects of NFTs in the crypto market?

NFTs are gaining a lot of traction in the crypto world. They are a way to solve problems that exist in the current crypto market. NFTs solve many problems that exist in the current crypto world. Chris Kline coined the term “NFT” and he is currently the Head of Art at http://Earn.com. Rachel Metz first used the term in her article “An App Made New Collectibles.” Many apps and games have already begun to introduce NFT into their business models. This is due to the new and exciting ways achieved with these digital assets. Additionally, it’s a way for traditional companies to experiment with potential new revenue streams without opening the company up to a lot of risks.

#nft crypto#cryptocurrency news latest#bitcoin#blockchain#blockchain network#nft marketplace#cryptocurrencies#etherum#crypto#crypto atms#binance#opensea

0 notes

Text

Minting NFT? How to mint NFT from Smart Contract.

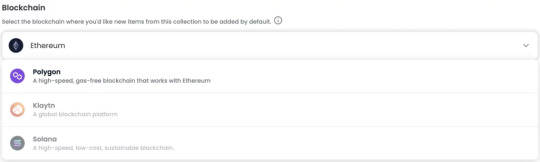

Smart contracts provide value to your NFT by enabling you to design rules, conditions, and extra benefits for your token holders. The parameters of a smart contract might include a physical good, a service, or anything else you would want to include. Minting NFT is a common practice to introduce fresh digital assets to the market. This is achieved by creating a new digital asset and making it freely available to everybody. Each digital asset has a unique minting procedure.

What Is NFT Minting?

What exactly does NFT minting imply? Minting is the process of transforming a digital file (or complete file “collections”) into a blockchain asset that cannot be modified after it has been generated, and nothing on the blockchain can be removed, updated, or changed.

To mint a token, all you have to do is create a digital file, upload it to a platform, decide on the terms of the underlying smart contract (where you describe all the features of the NFT that would draw purchasers), and then complete the listing.

Minting an NFT converts the content into a digital asset that can be bought and sold using cryptocurrencies on NFT marketplaces.

How Long Does It Take To Mint An NFT?

Not to mention, it’s as easy as uploading your desired media file, writing any terms for your smart contract, and setting a price. In order to mint an NFT, obtain a crypto wallet and purchase your blockchain’s accepted cryptocurrency for transaction fees.

Before Minting an NFT

Although minting an NFT might be exciting, simply creating an NFT does not guarantee you will generate money. In fact, if you’re not careful, you might lose money.

You can mint just about anything into an NFT if you want. In the same manner, an NFT that also implements the use of smart contracts allows you to write your own terms.

Choose a marketplace to offer up your NFT to your consumers. The marketplace availability is based on the blockchain where you minted your NFT.

Minting NFT for Free

For a long time, minting NFT costs has been a hot topic in the crypto industry. What exactly is the minting NFT charge, and why is it important?

A Minting NFT fee is a cost levied when transferring a Minting NFT between wallets. Therefore, this price is proportional to the quantity of data necessary to create a minting NFT. Hence, the fee is also related to the amount of time it takes to generate the minting NFT.

Minting NFT costs can be free by using an ERC-20 token as a medium. However, if you want to use your own Ethereum address, then you need to pay a minting gas fee in ETH. This fee will be determined by how much time it takes to complete the transaction and how many computational steps are required for that transaction.

The minting fee is the cost of creating a new token.

Some of the most likely fees charged when minting NFTs include:

Gas fees: On the contrary, most blockchains require at least one transaction on the network.

Account fees: Varies and depends on your choice of NFT marketplace.

Listing fee: While there is some platform that allows creators to mint NFTs for free, listing them for sale on their marketplace would cost you a fee.

Save money and pay the lowest fees possible to discover the optimum time to mint NFT at a substantially lesser cost.

NFT Marketplaces to Mint NFT art

There are many different blockchains you may choose to mint your NFT on. Each blockchain comes with its own pros and cons example Rarible is now providing a new service to create NFTs for free, with their new “lazy minting” feature

Customers can convert their digital commodities into NFTs in a matter of minutes. In fact, before minting an NFT, users must first create a crypto wallet that is compatible with the Ethereum Blockchain and then choose an NFT marketplace where they wish to mint their NFT.

Minting NFT on OpenSea.

OpenSea allows you to create and sell NFTs across multiple blockchains without paying gas fees. In other words, you may buy NFTs on OpenSea based on any of these chains. One of its key features is the ability to mint, purchase, and trade NFTs. In essence, no coding skills are required to utilize the platform.

Step 1- Connect your Wallet

Set up your wallet of choice. With your wallet, you will be able to send and receive ETH.

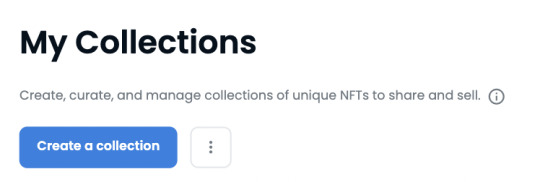

Step 2- Create your Collection

Go to the top right corner of your profile and select My Collection, then press Create to start a new collection. After creating your collection, click Add New Item to mint your first NFT art, then upload your name, and add additional information about your digital item to further describe it.

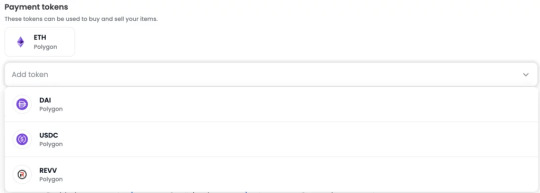

Step 3- Mint your First NFT