#home loan with minimum documentation

Explore tagged Tumblr posts

Text

Get Instant Home Loan Approval in 2025 – No Heavy Paperwork, Best Offers & Quick Online Process!

Many Indians dream of buying a home, but the process often feels complicated, with endless paperwork, lengthy bank visits, and unclear eligibility rules. In 2025, this is no longer the case. The new era of online housing application services has revolutionized how home loans are applied and approved in India.

With digital-first platforms like Investkraft, Upwards, and Fullerton India, getting a home loan with minimum documentation is now possible, fast, and stress-free. In this guide, we’ll walk you through the latest home loan process, eligibility, interest rates, EMI calculation, and how to apply online – even if you're earning ₹40,000 monthly.

Why 2025 is the Best Time to Apply for a Home Loan Online

In 2025, lenders are aggressively offering digital-first home loan solutions. Whether you're salaried, self-employed, or a first-time buyer, you can apply for a home loan online without standing in queues or compiling heaps of documents.

Key Benefits:

Instant loan approval checks

Paperless document upload

Live EMI previews via tools like the Faircent EMI Calculator

Best home loan offers from top NBFCs and banks

Support from platforms like Investkraft partner lenders

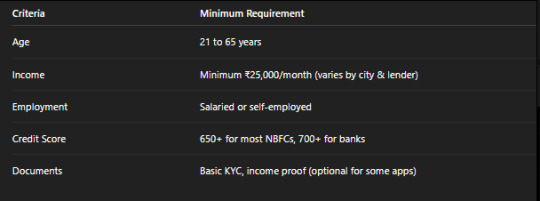

Eligibility Check: Who Can Apply for an Online Home Loan?

Before applying for a home loan request, you need to meet the basic home loan eligibility criteria. These requirements may vary slightly by lender, but here’s the general checklist:

Some lenders even offer a home loan without income proof, especially if you have property documents and a good banking record.

Documents Required for Home Loan in 2025 (Minimal List)

Forget the stress of endless paperwork. Many lenders now accept just a few basic documents for initial approval:

Aadhaar Card, PAN Card (KYC)

Property Documents

6 months' bank statement

Salary slips (optional with some apps)

ITR (optional with NBFCs like Upwards & Investkraft loan products)

Thanks to home loans with minimum documentation, you can get approved faster than ever before.

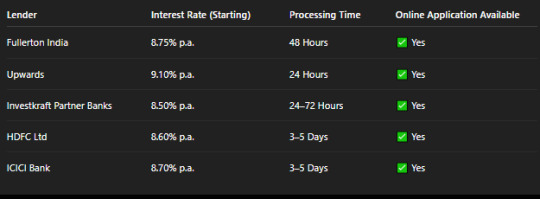

Compare Home Loan Interest Rates in 2025

Use the Faircent EMI Calculator or lender tools to estimate your monthly repayment.

Here’s a comparison of interest rates offered by top lenders in 2025:

Note: Rates may vary based on CIBIL score, income, location, and loan type.

Types of Home Loans You Can Apply For

Not all home loans are the same. Depending on your needs, you can choose from:

Regular Home Loan – For buying new or resale property

Home Construction Loans – To build your house on owned land

Top Up Loan on Home Loan – For extra funding over your current loan

Home Loan Balance Transfer – Shift to a lower interest lender

Plot + Construction Loan – For land purchase + home construction

If you already have a home loan, ask your lender about a top-up loan on your home loan for renovation or emergencies.

How Much Home Loan Can I Get on ₹40,000 Salary?

This is a common question for salaried professionals. Let’s calculate:

Tip: Use the Faircent EMI Calculator or your lender’s online tool to adjust values based on your preference.

Step-by-Step Guide: Online Housing Loan Application Process

Here’s how to make your online housing loan application successful in 2025:

Choose a Lender or Platform: Use trusted aggregators like Investkraft or directly apply on lender sites like Upwards or Fullerton India.

Check Eligibility: Use online eligibility tools before submitting the form.

Upload Documents: Use your mobile or desktop to upload KYC, property details, and bank statements.

Calculate EMI: Use the Faircent EMI Calculator or the respective lender calculator.

Wait for Approval Call: Get verified, receive a call/email, and e-sign loan agreements.

Disbursement: The Loan amount is transferred within 24–72 hours post-verification.

Pro Tip: If you’re an existing customer, you can also request your Fullerton India loan account statement online for faster processing.

Why Choose Investkraft Loan Services?

Investkraft is fast becoming India’s preferred platform for simplified and fast-tracked loan applications.

Benefits of choosing an Investkraft Partner lender:

Compare multiple home loan offers at once

Apply online in minutes

No hidden charges

Personal assistance till disbursement

Pre-approved offers based on your income or property

Frequently Asked Questions (FAQs)

1. Can I get a home loan in 2025 without income proof?

Yes, many NBFCs and digital platforms offer home loans with minimum documentation, especially if you have property or rental income.

2. What is the benefit of using the Faircent EMI Calculator?

The Faircent EMI calculator gives you a quick estimate of your monthly outflow, helping you choose the right loan tenure and amount.

3. How do I track my loan after disbursement?

If you took a loan from Fullerton India, you can download your Fullerton India loan account statement online via their customer portal.

4. Is ₹40,000 salary enough to get a home loan?

Absolutely. You can get a loan of ₹20–₹25 lakhs based on your profile. Use eligibility tools before applying.

5. What’s better – a bank home loan or an NBFC?

NBFCs like Upwards and platforms like Investkraft often provide faster approvals and flexible documentation, ideal for first-time borrowers or freelancers.

Final Thoughts: Make Your Home a Reality in 2025

Whether you're building your first home or upgrading, 2025 gives you the power to apply for a home loan online, compare the best offers, and get instant approval – all with minimal documents.

Skip the long bank queues. Start your journey with platforms like Investkraft, compare Upwards loan interest rate, or download your Fullerton India loan account statement to check your current eligibility.

Ready to Begin?

Apply Now for Home Loan – Compare Top Offers & Get Instant Approval!

#online housing loan application#home loan offer#faircent emi calculator#investkraft partner#investkraft loan#upwards loan interest rate#fullerton india loan account statement#fullerton india home loan interest rate#home loan with minimum documentation#home loan request#home loan eligibility#documents required for home loan#types of home loans#home construction loans#top up loan on home loan#how much home loan can i get on 40000 salary#apply now for home loan

1 note

·

View note

Text

🎉 Classic Career Overhauls—Batch #1 Now Available!

Per your votes, I’ll be releasing my Classic Career Overhauls in batches of 3–5 at a time! These careers have been recreated from scratch to work with the latest game versions. (I've rejigged things to include my Real Estate career in this batch to keep posts at a minimum.)

✨ Included in This Batch:

💻 Cybersecurity Hacker – Break into systems (legally) and keep networks secure.

🏡 Real Estate Agent - Seal the deal on dream homes and skyrocket to mogul status.

👔 Workforce Management (HR) – Recruit, train, and navigate workplace drama like a pro.

💰 Banking – Manage money, approve loans, and climb the corporate ladder to financial success.

📌 What’s New?

✅ 10-Level Career with Progressive Pay & Realistic Hours ✅ New Custom Interactions ✅ Daily Task & Custom Promotion Objectives ✅ Includes NPC Coworkers, Career Layoffs & All Up-to-Date Features ✅ Fully Integrated with Base Game Career Systems ✅ 100% Maxis Match

📂 More Classic Careers Coming Soon!

⚠️REQUIRED⚠️ 🌐Lot 51's Core Library 📁midnitetech_modlibrary

📌 Want to know how career updates are handled? Check out Career Updates – What to Expect for details on how older careers are being updated!

📂 Explore More Careers! You'll be able to find the full collection of career mods here, as I update them: Classic Career Collection.

Download to C:\Users\....\Documents\Electronic Arts\The Sims 4\Mods Don't forget 🌐Lot 51's Core Library and 📁midnitetech_modlibrary—script files must be no more than 1 folder deep.

PATREON (free)

#ts4cc#ts4 cc#ts4 mod#ts4 career#ts4 careers#ts4 custom content#ts4 career mod#the sims 4 custom content#ts4 download#thesims4cc#midnitetech careers#midnitetech career

329 notes

·

View notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

194 notes

·

View notes

Text

Foreign Investors Guide: Legal & Financial Tips for Buying Property in Dubai

Dubai continues to shine on the global stage as a real estate investment hotspot. With high rental yields, capital appreciation, investor-friendly regulations, and a transparent market structure, it’s no surprise that international buyers are flocking to the city. But before you dive into the Dubai property pool, it's vital to understand the legal and financial framework that supports a smooth and secure investment.

Whether you're a first-time investor or looking to expand your international property portfolio, here's what you need to know.

1. Yes, Foreigners Can Buy Property in Dubai

Let’s start with the basics: anyone can buy property in Dubai's freehold areas—regardless of your nationality or residency status. This openness has made Dubai one of the most attractive property markets in the world. With no restrictions on ownership in designated zones, buying property in Dubai has become a seamless process for both residents and international investors.

2. Choose the Right Project – And the Right Partner

Work only with RERA-approved agencies and developers. Partnering with a company that offers a complete property experience—like Exclusive Links—ensures you’re covered for everything from purchasing, leasing, and managing your property, to handling resale or short-term rental strategies down the line.

3. Understand the Buying Process

When buying directly from a developer (off-plan):

You'll typically pay 10–20% as a down payment

Sign a Sale and Purchase Agreement (SPA)

Follow a staggered payment plan during construction

Pay the 4% Dubai Land Department (DLD) registration fee, often collected via the developer

Payments must be made to registered escrow accounts to ensure your funds are protected until project completion.

4. Mortgages Are Available—but with Limits

Foreign investors can secure property finance in Dubai, but there are key limitations to note:

Loan-to-value is typically capped at 50% for non-residents, though some lenders may offer up to 60% for salaried or self-employed applicants.

A minimum monthly income of AED 25,000 (or equivalent) is generally required.

Mortgage interest rates vary between 4.5%–6.5% depending on the lender and applicant profile.

Off-plan properties are not eligible for non-resident mortgage financing.

Documentation such as proof of income, deposit, and a credit report from your home country is required.

Work with your agent or a mortgage consultant early to assess eligibility and options.

0 notes

Text

Emergency Personal Loan & Fast Services in Delhi Today

When life throws unexpected expenses your way, waiting for traditional bank loan approvals may not be an option. Whether you're dealing with sudden medical bills, unplanned travel, or urgent home repairs, quick financial help becomes essential. This is where Fast Loan Services in Delhi step in as a lifeline for many residents of the capital city.

With minimal paperwork, digital access, and lightning-fast approval, these services are transforming the way people Apply for Personal Loan in Delhi—especially when looking for an Emergency Personal Loan in Delhi. In this blog, we’ll dive deep into how these services work, who they benefit, and what makes them the preferred choice for urgent financing in 2025.

Understanding the Rise of Fast Loan Services in Delhi

In India’s capital, the need for fast and reliable credit solutions has grown significantly over the past few years. This demand has paved the way for a variety of fintech companies, NBFCs, and digital lenders offering Fast Loan Services in Delhi to meet immediate cash requirements.

What sets these services apart is not just their speed but also the flexibility they offer in terms of eligibility, loan amounts, and repayment tenures. Whether you're salaried or self-employed, there’s a high chance you qualify for a quick loan—sometimes with just your Aadhaar and PAN details.

What is an Emergency Personal Loan in Delhi?

An Emergency Personal Loan in Delhi is a short-term loan disbursed quickly to deal with urgent and unforeseen expenses. Unlike regular personal loans that may take days to process, emergency loans are approved and credited to your account within a few hours.

These loans are unsecured, meaning you don’t need to pledge any collateral. This makes them an ideal choice for situations that require fast financial action—like hospital bills, sudden relocation, or critical household expenses.

Why Choose Fast Loan Services in Delhi?

Here’s why thousands of Delhi residents are switching from traditional banking to digital-first, Fast Loan Services in Delhi:

1. Quick Disbursal

Most lenders credit the loan amount within 24 hours—or even within minutes in some cases.

2. Simple Application Process

Borrowers can Apply for Personal Loan in Delhi directly from their smartphone, with user-friendly apps guiding them step-by-step.

3. Minimum Documentation

Often, only basic identity verification (Aadhaar, PAN) and a few bank statements are enough to process the loan.

4. Credit-Friendly Options

Even individuals with lower credit scores may qualify based on their income and digital financial footprint.

5. Transparent Terms

With digitization, the loan terms are clearer, interest rates are disclosed upfront, and repayment plans are more flexible.

Common Use Cases for an Emergency Personal Loan in Delhi

Still wondering when you might need this kind of loan? Here are some everyday scenarios:

Medical Emergencies: When you or a loved one falls ill and requires immediate treatment.

Job Loss: Cover essential expenses while transitioning to a new job.

Family Events: Weddings, funerals, or family travel requiring instant funding.

Utility Bills & Rent: Avoid service disconnections or eviction by paying on time.

Vehicle Repairs: Keep your life moving by fixing your car or bike without delay.

In all these cases, Fast Loan Services in Delhi ensure you're not left helpless due to a financial bottleneck.

Who Can Apply for Personal Loan in Delhi?

Almost anyone meeting basic income and identity criteria can Apply for Personal Loan in Delhi. However, lenders typically look for the following:

Salaried Individuals:

Age: 21 to 58 years

Minimum Income: ₹15,000/month

Employment: Should be employed in a private/public company for at least 6 months

Self-Employed Professionals:

Age: 25 to 65 years

Income: Should have steady business revenue

Documentation: Bank statements, GST returns or income tax filings

Most lenders have moved towards digital verification systems, which allow you to upload soft copies of documents or link your bank accounts for real-time validation.

Step-by-Step: How to Use Fast Loan Services in Delhi

1. Visit the Lender's Website or App

Start by selecting a credible digital lender offering Fast Loan Services in Delhi.

2. Check Eligibility

Enter basic details like income, location, and employment type to see if you qualify.

3. Submit Application

Provide details such as Aadhaar, PAN, income proof, and loan amount required.

4. E-Verify Identity

Use Aadhaar-based OTP verification and link your bank account to complete KYC.

5. Loan Disbursal

Once approved, your Emergency Personal Loan in Delhi is credited to your bank—often in under an hour.

Documents Typically Required

Even for Fast Loan Services in Delhi, you may need some of the following:

Aadhaar Card

PAN Card

Recent Passport-sized Photo

Salary Slips or Income Proof

Bank Account Statement (last 3–6 months)

Note: Some lenders may skip physical verification altogether if you're an existing customer or meet high eligibility criteria.

Real-World Example

Sneha Verma, a working professional from South Delhi, suddenly had to shift to a new apartment due to building maintenance issues. She used a popular Fast Loan Services in Delhi app to avail ₹1.5 lakh within just 3 hours of applying. “I couldn’t believe how easy it was. I just uploaded my salary slip, completed KYC online, and the money came directly to my account,” she said.

Similarly, Rahul Gupta, a freelance graphic designer, took an Emergency Personal Loan in Delhi to pay for his father’s surgery. “The hospital needed ₹80,000 upfront, and I had zero savings. The loan app literally saved the day,” he shared.

Pros and Cons of Fast Loan Services in Delhi

Pros:

Speed and convenience

No collateral required

Available even on weekends/holidays

Can be used for any purpose

Helps build credit history

Cons:

Higher interest rates than secured loans

Limited loan amounts for new customers

Penalties for late payments

Tips to Maximize Your Chances of Approval

Maintain a Good Credit Score: Aim for a CIBIL score above 700.

Avoid Multiple Applications at Once: It signals desperation to credit bureaus.

Disclose All Income Sources: Even freelance or rental income can boost eligibility.

Borrow Only What You Need: Smaller amounts get approved faster and are easier to repay.

Future Trends in Fast Loan Services in Delhi

The future of borrowing is digital and instant. Here's what’s coming next:

AI-Based Risk Assessment: Faster and more accurate eligibility checks.

Voice-Based Loan Requests: Talk to your device to apply for a loan.

Loans on UPI and WhatsApp: Faster than ever loan disbursements via chat apps.

Increased Access for Gig Workers: More platforms now cater to freelancers and delivery partners.

FAQs

Q1: Is it safe to use Fast Loan Services in Delhi?

Yes, provided you choose a licensed NBFC or RBI-approved lender with a good online reputation.

Q2: How fast can I get an Emergency Personal Loan in Delhi?

In some cases, funds are disbursed within 15 minutes of approval.

Q3: Can I Apply for Personal Loan in Delhi with a low credit score?

Yes. Some platforms offer loans to borrowers with credit scores as low as 600.

Q4: What’s the maximum amount I can borrow?

Depending on your profile, you can get loans from ₹10,000 up to ₹25 lakhs.

Q5: What happens if I miss an EMI?

You may incur late fees and your credit score could be negatively affected. Always inform your lender in advance.

If You want

Conclusion

If you're caught in a financial crunch, you don’t need to wait days or stress over documentation. With the emergence of Fast Loan Services in Delhi, residents can now Apply for Personal Loan in Delhi with just a few clicks and receive an Emergency Personal Loan in Delhi when they need it the most.

Quick approvals, paperless processing, and flexible repayment terms have made these services a go-to solution for thousands across Delhi. Whether you’re salaried or self-employed, facing a medical emergency or managing an unexpected bill—there’s a fast loan waiting for you.

Act now—financial relief is just a click away!

#Loan Finance Company Delhi#Quick Loan Approval Without Documents in Delhi#Urgent Cash Loan in Delhi#Fast Loan Services in Delhi#Apply for Personal Loan in Delhi#Emergency Personal Loan in Delhi

0 notes

Text

Instant Cash Personal Loan Surat – Get Fast, Flexible Loans with Fincrif

Are you living in Surat and urgently need funds? Whether it’s for a medical emergency, business expense, educational need, wedding, or even a vacation, life doesn’t wait—and neither should your loan. With Fincrif, getting an instant cash personal loan Surat is simple, secure, and lightning fast.

We offer fully digital loan solutions tailored to your needs. Our services are designed to help you access a Surat personal loan in minutes, with money in your account in as little as 1 hour. No long lines. No waiting. Just fast and reliable financing when you need it most.

Why Surat Residents Prefer Instant Cash Personal Loans

Surat, known as the diamond city of India, is home to hardworking professionals, entrepreneurs, and students. In such a dynamic city, waiting days for a bank to process your loan simply isn’t practical. That’s where a Surat instant loan from Fincrif makes all the difference.

Here’s why thousands trust us:

Quick processing: Personal loan Surat within 1 hour

100% online & paperless

No collateral required

High approval rates—even for low CIBIL scores

Transparent fees and flexible EMI plans

Who Can Apply for Instant Cash Personal Loan in Surat?

If you are 21 years or older and earn a steady income—either salaried or self-employed—you’re already eligible for a Surat instant loan through Fincrif.

Basic Eligibility:

Indian citizen residing in Surat

Age between 21 and 58 years

Minimum monthly income: ₹15,000

Valid PAN and Aadhaar card

Active bank account

Whether you’re in Adajan, Vesu, Varachha, or Katargam, you can apply for Surat personal loan without stepping out of your home.

Features of Personal Loan Surat Within 1 Hour

Loan Amount: ₹10,000 to ₹5,00,000

Get small or large amounts depending on your needs. Our loan plans are flexible to suit everyone—from students to professionals.

⏱ Quick Disbursal

We don’t call it personal loan Surat within 1 hour for nothing. Once approved, funds are transferred directly into your bank account within minutes.

Flexible Tenures

Choose a repayment term between 3 to 36 months. We make it easy for you to repay in comfortable EMIs.

Minimal Documentation

No lengthy paperwork. Just upload your Aadhaar, PAN, and income proof. It’s that simple.

How to Apply for Surat Instant Loan on Fincrif

Applying for a loan used to be a stressful process. At Fincrif, we’ve changed that forever. With our digital-first approach, you can apply for a Surat personal loan in just 5 steps:

Step 1: Visit www.fincrif.com

Navigate to the Surat Instant Loan section.

Step 2: Fill Basic Details

Enter your name, phone number, PAN, monthly income, and loan amount needed.

Step 3: Upload Documents

Digitally upload your ID proof, address proof, and salary slips/bank statements.

Step 4: Instant Approval

We use AI-based risk assessment to approve loans within minutes.

Step 5: Disbursement in 1 Hour

After e-signing the agreement, you’ll receive your instant cash personal loan Surat directly in your bank account.

Use Cases – Why You Might Need a Surat Personal Loan

A Surat instant loan is a smart financial tool for emergencies and life’s unexpected turns. Here's how our users often utilize their loans:

Medical Expenses

Healthcare costs can be sudden and expensive. Use a personal loan Surat within 1 hour to pay hospital bills, surgeries, or medicines.

Education & Skill Development

Fund school or college fees, coaching, or upskilling courses without delay.

Home Repairs & Renovation

Spruce up your home or fix urgent repairs with quick cash in hand.

Credit Card Debt Consolidation

Pay off high-interest credit card dues and simplify your finances.

Business Needs

Use the loan to boost working capital or invest in inventory if you're self-employed.

Travel or Events

Planning a wedding or a last-minute trip? Get an instant cash personal loan Surat with no questions asked.

Why Choose Fincrif for Surat Instant Loan?

1. Transparent and Fair

We pride ourselves on 100% transparency. What you see is what you pay. No hidden charges or last-minute surprises.

2. Completely Digital

No need to visit banks or fill stacks of forms. The entire process is online—right from application to approval.

3. Lightning-Fast Disbursal

Our personal loan Surat within 1 hour feature ensures you don’t have to wait for your money.

4. Loan Options for Every Profile

Whether you're salaried, self-employed, or a freelancer, we offer customized loan plans.

5. Dedicated Support Team

Need help? Our human-first support team is available via chat, phone, or email to guide you through.

Required Documents for Instant Cash Personal Loan Surat

You don’t need dozens of forms to apply. Just have these documents ready:

Aadhaar Card (for ID & address proof)

PAN Card

Bank Statement (last 3-6 months)

Salary Slips (if salaried)

Business Proof or ITR (if self-employed)

Tips to Increase Your Approval Chances

Even though our process is user-friendly, here are some tips to increase your chances of approval for a Surat instant loan:

Keep your credit score above 650

Provide accurate and complete details

Choose a loan amount that suits your income bracket

Don’t apply with multiple lenders at once

Remember: even with a low CIBIL score, Fincrif often approves loans based on income and repayment history.

Frequently Asked Questions – Surat Personal Loan

How long does approval take?

Approval usually takes less than 10 minutes with Fincrif's advanced technology.

Can I get a loan if I have low CIBIL score?

Yes. We evaluate multiple parameters beyond just credit score.

Is the loan collateral-free?

Yes. Our instant cash personal loan Surat is unsecured—you don’t need to pledge assets.

What if I miss an EMI?

We offer grace periods and reminders, but consistent defaults may impact your credit profile.

Can I pre-close the loan?

Yes, you can pre-close your Surat personal loan at any time. We have minimal to zero foreclosure charges.

Real Stories from Surat Customers

“I had an emergency medical expense and got my personal loan Surat within 1 hour—no calls, no paperwork. Fincrif saved me!” – Priya Desai, Adajan

“I needed quick funds for my new boutique in Surat. Thanks to Fincrif’s Surat instant loan, I was able to launch in time!” – Mehul Patel, Varachha

“It’s the easiest way to get an instant cash personal loan Surat. I didn’t even have to leave my house.” – Nirali Joshi, Vesu

Fincrif vs Traditional Banks – What's the Difference?

FeatureFincrifTraditional BanksApproval TimeWithin 10 mins3 to 7 working daysDisbursal1 Hour3 to 5 daysPaperworkMinimal, DigitalExtensiveCollateral RequiredNoOften RequiredSupport24x7 Human HelpLimited to working hoursSuitable for Low CIBIL?YesRarely

Final Words – Apply for Surat Personal Loan Today!

The future of lending is fast, simple, and digital—and Fincrif is leading the way. Whether you're an entrepreneur, a salaried employee, or a student in Surat, our instant cash personal loan Surat is designed to support your financial journey.

No paperwork. No long waits. Just trusted, secure, and speedy financial help whenever you need it.

So, if you're looking for a Surat instant loan, don't wait. Join thousands of satisfied customers who trust Fincrif. Apply for your personal loan Surat within 1 hour and experience the new standard in digital lending.

0 notes

Text

Car Loan in Noida from Loan4Wealth – Drive Your Dream Car with Ease

Looking to buy a new or used car in Noida? With rising car prices, getting a car loan has become the most convenient way to own a vehicle without draining your savings. At Loan4Wealth, we help you secure the best car loan in Noida with competitive interest rates and minimal paperwork.

Why Choose Loan4Wealth for Car Loan in Noida?

Loan4Wealth is one of Noida’s most trusted financial service platforms, helping thousands of customers get affordable auto loans. Here's what makes us different:

Lowest Interest Rates: Starting from 7.5% p.a.

Quick Approvals: Get loan approval within 24–48 hours

Zero Hidden Charges: Transparent processing and EMI structure

Expert Assistance: Personalized loan offers based on your needs

Types of Car Loans Offered by Loan4Wealth in Noida

1. New Car Loan in Noida

Want to buy a new car? Get up to 100% financing on your vehicle's ex-showroom price with flexible tenure options.

2. Used Car Loan in Noida

Buy a pre-owned car without financial stress. Get up to 90% financing on used cars at attractive interest rates.

3. Zero Down Payment Car Loan

Don’t want to make an upfront payment? We have plans where you can drive your car home with zero down payment.

Eligibility Criteria for Car Loan in Noida

To apply for a car loan with Loan4Wealth, ensure the following:

Age between 21–65 years

Stable monthly income (Salaried or Self-employed)

Valid ID and address proof

Minimum CIBIL score of 650+

Documents Required

PAN Card

Aadhaar Card or Address Proof

Salary Slips / Bank Statements

Quotation of the Vehicle

How to Apply for a Car Loan in Noida from Loan4Wealth?

Visit Loan4Wealth Website

Fill the Car Loan Application Form

Upload Your Documents Online

Get Quick Approval & Disbursal

0 notes

Text

“Need Cash Fast? Fullerton India Personal Loan is the Game-Changer You’re Looking For”

When life throws financial curveballs, Fullerton India steps in with a solid personal loan solution designed for modern Indians. Whether it's for medical emergencies, home renovation, education, or travel—Fullerton India personal loans are fast, flexible, and require zero collateral.

Let’s break down everything you need to know about applying for a personal loan from Fullerton India, including how the process works, eligibility criteria, and why it’s a top choice for salaried professionals and self-employed individuals alike.

Why Choose Fullerton India Personal Loan?

Fullerton India is an established NBFC (Non-Banking Financial Company) with a strong track record in consumer lending. Their personal loans are tailored for both salaried and self-employed individuals who seek quick disbursals, minimal documentation, and competitive interest rates.

Here’s why it stands out:

Loan amounts from ₹50,000 to ₹25 lakhs

Flexible repayment tenures ranging from 12 to 60 months

Instant online approval and disbursal within 24-48 hours

Attractive interest rates starting from around 11.99% per annum

Zero hidden charges and complete transparency

Who Can Apply for Fullerton India Personal Loan?

Eligibility Criteria:

For Salaried Individuals:

Age: 21 to 60 years

Monthly income: ₹20,000+ (₹25,000+ for metros)

Must be working with a private, public, or MNC employer

Minimum 6 months in current job

For Self-Employed:

Minimum income as per business turnover and ITR

Business should be operational for at least 3 years

Valid proof of income and business registration required

How to Apply for Fullerton Personal Loan Online

Applying for a Fullerton India personal loan is simple and digital. You don’t need to visit any branch.

Steps to Apply:

Visit the official Fullerton India loan portal or trusted platforms like FinCrif

Fill in your personal, financial, and employment details

Upload the required documents (KYC, salary slip/ITR, bank statement)

Wait for instant pre-approval or eligibility confirmation

Once verified, the loan is disbursed directly to your bank account

The entire Fullerton loan application process can be completed in just 10–15 minutes.

Documents Required

Fullerton keeps paperwork to a minimum. Here's what you’ll need:

PAN Card and Aadhaar Card

Recent passport-size photograph

Salary slips for the last 2–3 months or ITR (for self-employed)

Bank statement (3–6 months)

Employment proof / business registration

Personal Loan EMI Calculator – Fullerton India

One of the best tools to plan your loan is Fullerton India’s EMI calculator. It helps you calculate your monthly EMI based on:

Loan amount

Tenure

Interest rate

Example: If you apply for ₹3,00,000 at an interest rate of 12.5% for 3 years, your monthly EMI would be approximately ₹10,000.

This tool helps you decide the most comfortable repayment plan for your budget before you commit.

Key Benefits of Fullerton India Personal Loans

✅ No Collateral Required – 100% unsecured

✅ Multi-purpose Use – No restriction on usage (travel, education, medical, etc.)

✅ Transparent Processing – No hidden charges or surprise fees

✅ Speedy Disbursal – Funds in your account in 24–48 hours

✅ Top-up Loans Available – For existing customers

Who Should Consider Fullerton Personal Loan?

Salaried professionals needing urgent funds

Self-employed business owners with limited working capital

First-time loan applicants with clean repayment intent

Individuals looking to consolidate debt

Whether you're fixing a broken roof, planning a wedding, or tackling unforeseen expenses, Fullerton India’s loan offering brings financial relief without hassle.

Final Thoughts

When it comes to getting a reliable, fast, and flexible loan, Fullerton India ticks all the boxes. Their online-first approach, customer-centric policies, and transparent terms make it an ideal choice for anyone in need of a personal loan without running from bank to bank.

Apply now, skip the paperwork, and get funded fast. Your solution to stress-free borrowing starts here.

0 notes

Text

Lowest EMI Home Loan Offers – Fast & Easy Online Application!

Buying a home is a dream for many, and securing the right home loan can make this dream a reality. With evolving financial services, getting a home loan with minimum documentation has become easier than ever. Whether you're looking for a home loan offer with competitive interest rates or an online housing loan application, this guide will help you navigate the process effortlessly.

Why Choose a Home Loan with Minimal Documentation?

Traditional home loans often require extensive paperwork, making the approval process slow and tedious. However, modern banking and financial institutions now offer home loans with minimal documentation, reducing hassle and ensuring quick approvals. If you are looking for an investkraft partner for your loan needs, choosing a lender that offers simplified documentation can save you time and effort.

A home loan with minimal documentation is beneficial for:

Salaried professionals who may not want to go through excessive paperwork.

Self-employed individuals who may have fluctuating income and require quick approval.

First-time homebuyers who are unfamiliar with the complex documentation process.

Investors looking for fast loan processing to seize property investment opportunities.

Benefits of Online Housing Loan Applications

The digital revolution has transformed the financial sector, making it possible to request a home loan online within minutes. Here are some key benefits:

Convenience: Apply for a home loan from the comfort of your home without visiting a bank.

Faster Processing: Online applications are processed faster, leading to quicker approvals.

Easy Comparisons: Check multiple home loan offers from various banks and NBFCs to find the best deal.

Secure Documentation: Upload necessary documents online without worrying about physical paperwork.

24/7 Accessibility: Unlike traditional banking hours, online applications can be done anytime.

Instant Eligibility Check: Many lenders provide instant eligibility checks, helping you determine your qualification before applying.

Steps to Apply for a Home Loan Online

Research and Compare Offers: Use online platforms to compare home loan offers from different lenders.

Check Eligibility: Use an EMI calculator like the Faircent EMI calculator to determine your monthly payments.

Prepare Documentation: Ensure you have essential documents like ID proof, income proof, and property documents.

Submit Online Application: Fill out the home loan request form on the lender’s website.

Get Instant Approval: Many lenders offer instant approval for eligible applicants.

Verification and Disbursement: Once verified, the loan amount is disbursed to your account.

Understanding Home Loan EMI Calculations

Before applying for a home loan, it is crucial to understand your monthly EMI. The Faircent EMI calculator is an excellent tool to estimate your EMIs based on loan amount, interest rate, and tenure. Using an EMI calculator helps you plan your finances better and choose a loan amount that fits your budget.

When calculating EMI, keep the following in mind:

Loan Amount: The higher the loan, the higher the EMI.

Interest Rate: Fixed or floating rates can impact your repayment.

Loan Tenure: A longer tenure means lower EMI but higher total interest.

Down Payment: A larger down payment can reduce your loan burden.

Choosing the Right Home Loan Offer

While many financial institutions provide home loans, selecting the best home loan offer requires careful analysis. Consider the following factors:

Interest Rates: Compare rates from multiple lenders to find the lowest one.

Loan Tenure: Longer tenure reduces EMI but increases total interest paid.

Processing Fees & Charges: Be aware of any hidden charges.

Repayment Flexibility: Look for lenders offering flexible repayment options.

Customer Support: Choose a bank with excellent customer service for smooth processing.

Prepayment and Foreclosure Charges: Some lenders charge extra for early loan repayment.

Credit Score Requirements: A good credit score improves your chances of getting lower interest rates.

Government Schemes: Check if you qualify for special schemes like PMAY (Pradhan Mantri Awas Yojana).

Documents Required for a Home Loan with Minimal Documentation

Many lenders now require minimal paperwork for processing home loans. Commonly required documents include:

Identity Proof (Aadhaar Card, Passport, Voter ID, PAN Card)

Address Proof (Electricity Bill, Rent Agreement, Passport, Aadhaar Card)

Income Proof (Salary Slips, Income Tax Returns, Bank Statements)

Property Documents (Sale Agreement, Title Deed, Approved Building Plan)

Frequently Asked Questions (FAQs)

1. What is the minimum documentation required for a home loan?

The documentation varies by lender, but generally, you need ID proof, address proof, income proof, and property documents.

2. How can I check my home loan EMI in advance?

You can use the Faircent EMI calculator to estimate your monthly EMI based on your loan amount, interest rate, and tenure.

3. Can I apply for a home loan online?

Yes! Many banks and financial institutions provide an online housing loan application process for quick and easy approvals.

4. How long does it take to get a home loan approved online?

With minimal documentation and online applications, approval can take as little as 24-48 hours, depending on the lender.

5. How do I find the best home loan offer?

Compare interest rates, processing fees, repayment options, and customer reviews to find the best home loan offer that suits your financial needs.

6. Is it better to take a fixed or floating interest rate?

Fixed interest rates provide stability with predictable EMIs, while floating rates may change based on market conditions but can be lower over time.

7. Can I get a home loan with a low credit score?

Yes, but a lower credit score may result in higher interest rates. Improving your credit score before applying is recommended.

8. What is the maximum tenure for a home loan?

Most home loans have a maximum tenure of 30 years, but it depends on the lender and borrower’s age.

9. Can I make prepayments on my home loan?

Yes, most lenders allow prepayments, but some may charge a prepayment penalty, especially for fixed-rate loans.

10. What happens if I miss an EMI payment?

Missing EMI payments can lead to penalties, increased interest rates, and a negative impact on your credit score.

Conclusion

Applying for a home loan has never been easier. With the option to apply online for a home loan with minimal documentation, you can now secure your dream home effortlessly. Whether you are using the Faircent EMI calculator to plan your finances or comparing different home loan offers, make sure to choose the right lender that aligns with your requirements. Start your journey today and turn your homeownership dreams into reality!

#investkraft partner#faircent emi calculator#online housing loan application#home loan offer#home loan with minimum documentation#home loan request

0 notes

Text

Apply for Housing Loan in Raipur with Tijara Finance

If you are a resident of Chhattisgarh and looking for a housing loan with a minimum interest rate, then you can apply for a housing loan in Raipur with Tijara Finance. Tijara Finance is one of the best private finance companies where you can easily apply for housing loan in Raipur at a flexible and competitive interest rate. We ensure fast loan processing along with minimal documentation. Our office is located in Raipur City, Sector 1, New Shanti Nagar Road, Shanker Nagar, Raipur – Chhattisgarh 492004.

For many years, we have been offering various financial services such as home loans, home renovation loans, loans against property, and MSME loans. We also provide the option to customize loan plans according to client requirements.

Experience hassle-free loan processing with a team that truly understands your financial goals.

#Business Loan Agent in Raipur#Apply for Housing Loan in Raipur#Loan Against Property in Raipur#Apply for Personal loan in Raipur#Car loan providers in Raipur

1 note

·

View note

Text

Fast Money Car Title Loans in Texas: A Step-by-Step Guide

Introduction

Navigating through financial challenges can be daunting, especially when you're in urgent need of cash. If you're a resident of Texas and find yourself in a tight spot, you might be considering Fast Money Car Title Loans as a viable solution. These loans are designed to provide quick access to funds by leveraging your vehicle's title as collateral. In this comprehensive guide, we will delve deep into everything you need to know about car title loans in Texas, including types of loans available, the application process, eligibility criteria, and much more.

Fast Money Car Title Loans in Texas: A Step-by-Step Guide

Understanding the ins and outs of Fast Money Car Title Loans in Texas can help you make an informed decision. Here's car financing through title loan what you need to know:

What Are Fast Money Car Title Loans? These are short-term loans where borrowers use their vehicle titles as collateral. The loan amount is typically based on the value of the vehicle. Why Choose Car Title Loans? Quick access to cash Minimal documentation required Flexibility with repayment options Types of Car Title Loans Available Instant Online Title Loan: Access funds quickly with online applications. Bad Credit Auto Title Loan: Suitable for those with poor credit history. Same Day Title Loans: Get approved and funded on the same day. Eligibility Criteria for Fast Money Car Title Loans Must own a vehicle with a clear title Minimum age requirement (usually 18 years) Proof of income or employment Application Process for Car Title Loans Gather necessary documents (ID, car title, proof of income) Find a reputable lender Complete the application form online or in person Documents Required for Application Government-issued ID Vehicle title Proof of residency Proof of income (pay stubs or bank statements) Understanding Interest Rates and Fees How interest rates are calculated Potential fees associated with taking out a loan Repayment Terms for Fast Money Car Title Loans Typical repayment timelines Options for early repayment

What Happens if You Default on the Loan?

Consequences of missed payments Possibility of losing your vehicle

Benefits of Online Auto Title Loans

Convenience of applying from home Faster processing times compared to traditional lenders

Finding the Best Car Title Loans Online

Researching reputable lenders Comparing interest rates and terms

Pros and Cons of Fast Money Car Title Loans in Texas

Pros: Quick access to funds Less stringent credit requirements Cons: High-interest rate

0 notes

Text

Real Estate Financing in Dubai: What You Need to Know – Secure Your Home

The world of real estate financing in Dubai has transformed significantly over the years, opening new doors for investors, residents, and expatriates. Dubai’s dynamic economy, favorable tax policies, and the promise of high returns have positioned it as a global property hotspot. Whether you're a first-time buyer or an investor expanding your portfolio, understanding the fundamentals of real estate financing in Dubai is essential to making informed and secure decisions.

Why Real Estate Financing in Dubai Is Gaining Popularity

Dubai’s property market continues to thrive thanks to its strategic location, futuristic infrastructure, and business-friendly environment. Buying a home in this emirate is no longer limited to wealthy locals or investors. Today, a wide range of financing options is available, including loan against property Dubai and home loan in Dubai for Indian nationals, enabling people from different walks of life to secure their dream homes.

The Dubai Land Department and the UAE Central Bank have introduced several policies to ensure financial transparency and stability. These regulatory frameworks provide assurance and flexibility for residents and non-residents seeking to invest in Dubai's property market. Trusted developers like DAMAC Properties complement this ecosystem by offering finance-friendly developments, structured payment plans, and dedicated support throughout the buyer journey.

Understanding the Types of Real Estate Financing in Dubai

There are several financing solutions available, tailored to suit various buyer profiles. The most common method is a mortgage loan. However, alternative solutions such as loan against property interest rate Dubai and developer-backed financing also provide viable routes. When comparing these options, it's important to factor in terms like tenure, down payment requirements, interest rates, and eligibility conditions.

Mortgages in Dubai for Non Residents

One of the most frequently asked questions is whether mortgages in Dubai for non residents are available. The answer is yes. Many banks and financial institutions in the UAE offer mortgage plans to non-residents, although they may be subject to slightly stricter eligibility criteria.

Banks typically assess creditworthiness based on income, employment stability, and the buyer's country of residence. Home loan interest rate in Dubai for non residents may differ slightly from those offered to residents, primarily due to increased risk assessment.

Eligibility and Documentation for Real Estate Financing in Dubai

Eligibility criteria may vary depending on the lender and the type of financing. However, one common factor is income. The minimum salary for home loan in UAE plays a critical role in determining your loan eligibility. Lenders generally expect a stable monthly income, and employment must usually be backed by a reputable company.

In addition to proof of income, banks often require:

A valid passport and visa

Salary certificates or bank statements

Property documents from approved developers such as DAMAC

Foreign investors are also encouraged to consult mortgage advisors to help navigate through the complex application and approval process.

Calculating Your Mortgage: Using a Real Estate Financing in Dubai Calculator

Before making any commitments, it’s vital to assess affordability. A real estate financing in Dubai calculator or a home loan in Dubai calculator can help potential buyers simulate their monthly payments, assess down payment expectations, and understand interest rate implications over time.

These tools provide clarity and help avoid financial strain by ensuring that monthly installments align with your income and lifestyle. Calculators also factor in variables like home loan interest rate in Dubai for non residents, which can fluctuate depending on market conditions.

Loan Against Property Dubai – Unlocking Equity

Another practical option is a loan against property Dubai, which allows homeowners to leverage their existing property for additional capital. This option is particularly useful for those who already own property in Dubai and want to finance business activities, fund children’s education, or reinvest in real estate.

Loan against property interest rate Dubai tends to be more favorable than unsecured loans due to the secured nature of the financing. However, it’s important to understand the risks involved, such as potential repossession in case of payment default.

Benefits of Home Loan in Dubai for Indian Nationals

For Indian nationals residing in Dubai or looking to invest, there are dedicated offerings tailored to their financial backgrounds and needs. A home loan in Dubai for Indian buyers typically comes with simplified documentation, flexible tenure, and partnerships with developers like DAMAC, making the process smoother.

Some banks also offer advisory services in multiple languages, ensuring that Indian investors can confidently understand the terms and avoid hidden charges or legal complications. Developments such as Lago Vista DAMAC further enhance the appeal by offering affordable, well-located units that align with the financial plans of Indian buyers seeking long-term value.

Home Loan Dubai – What Makes It a Sound Investment?

Taking a home loan Dubai is not just a financial obligation, it’s a long-term investment. The potential for property appreciation, rental income, and the absence of annual property taxes make home ownership in Dubai particularly attractive.

Moreover, many developers and lenders collaborate to offer enticing packages such as reduced down payments, post-handover payment plans, and interest-only periods to support new buyers. Investing through real estate financing in Dubai is a way to enter a high-potential market with relatively low initial capital.

Challenges and How to Overcome Them

While Dubai’s real estate market is promising, buyers must stay aware of market fluctuations, regulatory changes, and interest rate hikes. Misunderstanding terms or overestimating affordability can lead to financial stress.

To mitigate risks:

Always use a home loan in Dubai calculator to project costs

Compare different lenders’ home loan interest rate in Dubai for non residents

Ensure your income meets or exceeds the minimum salary for home loan in UAE

Consult real estate or mortgage advisors familiar with local laws

Partnering with Trusted Developers Like DAMAC

Working with trusted developers such as DAMAC ensures that the property meets construction quality standards, legal requirements, and is eligible for financing from leading banks. Developers often have direct tie-ups with financial institutions, which can fast-track approval processes and provide additional incentives. Properties like DAMAC Maison Cour Jardin are a prime example—offering not only elegant living in the heart of the city but also the assurance of quality, credibility, and seamless ownership experience.

Final Thoughts on Real Estate Financing in Dubai

The landscape of real estate financing in Dubai is vast and evolving. With options like mortgages in Dubai for non residents, loan against property Dubai, and flexible financing tools, the city offers an inclusive environment for diverse buyers. While it’s crucial to navigate the process carefully, the benefits of owning property in a thriving, futuristic city like Dubai are substantial.

By leveraging tools like a real estate financing in Dubai calculator and ensuring you meet the minimum salary for home loan in UAE, you can secure your dream home with confidence and financial prudence. Whether you are an expatriate or a local resident, Dubai welcomes investors with open arms and robust opportunities in the real estate sector.

0 notes

Text

Everything You Need to Know About Getting a Personal Loan in Dubai

If you’ve lived in Dubai long enough, you know that life here can be both exciting and expensive. One month you’re planning a quick trip home or buying furniture for your new apartment, and the next you’re figuring out how to cover school fees, car repairs, or a medical bill that came out of nowhere.

That’s where personal loans come in.

They’re not magic, and they’re definitely not free money — but when used carefully, they can be a lifeline during tight times or when you just need to get something important done without draining your savings.

So, if you’re thinking about applying for a Personal loan in dubai, here’s what you really need to know.

First: What Exactly Is a Personal Loan?

A personal loan is a lump sum of money you borrow from a bank or finance company, which you pay back in monthly installments over a fixed period — usually between 1 and 5 years.

Unlike car loans or mortgages, personal loans usually don’t require collateral. In simple terms, the lender trusts you based on your salary, credit score, and job stability. That means the paperwork is lighter, but the interest rate is often higher because of the risk they’re taking.

Who Can Get a Personal Loan in Dubai?

There’s no one-size-fits-all answer here, but most banks and lenders in Dubai will look for the following:

You must be employed. If you work for a company that’s on the bank’s “approved list,” your chances are much higher.

Minimum salary. Many lenders want to see at least AED 3,000 to AED 5,000 coming into your account every month.

You need to be a UAE resident. Most personal loans aren’t available to tourists or people on visit visas.

Clean credit history. If you’ve missed payments on other loans or credit cards, it’ll work against you.

Age. Typically, you need to be between 21 and 60. Some banks allow up to 65 if you’re self-employed.

The truth is, some people get approved in a day, others take a few weeks, and some don’t qualify at all. It depends on the lender, your documents, and how strong your financial record looks on paper.

How Much Can You Borrow?

There’s a general rule of thumb in Dubai: lenders will offer you up to 20 times your monthly salary, though this can vary depending on your job, employer, and existing debts.

So if you make AED 10,000 a month, you might be eligible for up to AED 200,000 — but that doesn’t mean you should take that much. Borrow what you can realistically pay back without suffocating your monthly budget.

Let’s Talk About Interest Rates

This is where things can get confusing. You’ll hear terms like “flat rate” and “reducing rate.” Here’s the difference:

Flat rate means the interest is calculated on the original loan amount for the entire tenure.

Reducing rate means the interest is calculated on the outstanding balance, so your total interest goes down over time.

Flat rates might look low, but reducing rates are often more honest about the real cost. On average, you’re looking at something between 2.5% and 8% annually, depending on the lender.

Ask for both the flat and reducing rate so you can compare apples to apples. And don’t forget to factor in processing fees, early settlement charges, and penalties for late payments. These can add up if you’re not careful.

Common Reasons People Take Loans in Dubai

You’d be surprised how often this comes up in casual conversations here. People take personal loans for:

School fees

Home furnishing

Starting a small business or side hustle

Paying off credit card debt

Emergency travel or family needs back home

Weddings, medical bills, or even IVF treatments

There’s no “wrong” reason to take a loan, but there is such a thing as taking one without a plan. If you’re borrowing money just to fill a gap without knowing how you’ll repay it, that’s where problems start.

Tips Before You Apply

Let’s keep it practical. If you’re serious about getting a loan, here’s what to do first:

Check your credit score with the Al Etihad Credit Bureau. It’s fast and tells you what lenders will see.

Clean up your finances. Pay off small debts, don’t apply for multiple loans at once, and keep your account active.

Get your documents in order. Most banks will ask for your Emirates ID, passport, visa copy, salary certificate, and bank statements for the last 3-6 months.

Final Thoughts

In a fast-paced city like Dubai, where rent, school fees, and unexpected costs can stretch even the best budgeters, having access to a personal loan can give you breathing room. Just don’t treat it like free cash — treat it like a responsibility.

Know what you’re signing up for. Ask all the questions. Don’t borrow more than you need. And always make sure your monthly repayment fits comfortably into your life — not just today, but 12 or 24 months from now.

And if you’re looking for someone to guide you through the process without the jargon and red tape, Money Dila makes Personal loan in dubai simpler, faster, and far more transparent than most banks.

0 notes

Text

Fast Loan Services & Quick Approval in Delhi – Apply Now

In today's fast-paced world, financial emergencies don’t come with a warning. Whether it's for medical expenses, urgent travel, business expansion, or simply managing unforeseen situations, getting quick access to funds is crucial. This is where a reliable Loan Finance Company Delhi plays a critical role. With a growing demand for digital-first financial solutions, the capital city has seen a significant rise in institutions offering Fast Loan Services in Delhi.

This blog explores how to navigate the process, the advantages of choosing the right lending partner, and why people are searching for Quick Loan Approval Without Documents in Delhi, Urgent Cash Loan in Delhi, and ways to Apply for Personal Loan in Delhi with minimal hassle.

Understanding the Role of a Loan Finance Company Delhi

A Loan Finance Company Delhi is a financial institution that provides a range of loan options for individuals and businesses, including personal loans, business loans, home loans, and loans against property. Unlike traditional banks, these companies often offer a streamlined loan process with faster approval and flexible eligibility criteria.

These companies are especially important for borrowers who require Emergency Personal Loan in Delhi, where the speed of disbursement and convenience is paramount.

Why the Demand for Fast Loan Services in Delhi is Rising

Delhi, being a commercial hub and home to millions, witnesses numerous loan applications every day. Individuals and small businesses face daily cash crunches due to delays in payments, rising expenses, or unexpected financial obligations. Here’s why Fast Loan Services in Delhi are becoming the preferred choice:

Speed of Approval: Time is money. Lenders now offer approvals within 24 hours.

Minimum Paperwork: The need for Quick Loan Approval Without Documents in Delhi is growing as customers prefer digital KYC and automated verification.

No Collateral Required: Many personal loans are unsecured, making them ideal for emergencies.

Flexible Repayment Options: Tenures can range from 6 months to 5 years, depending on the borrower’s capacity.

Online Process: Most companies allow you to Apply for Personal Loan in Delhi online, saving both time and effort.

Types of Loans Offered by a Loan Finance Company Delhi

A modern Loan Finance Company Delhi offers several types of loan products tailored to individual needs:

1. Personal Loans

These are unsecured loans ideal for funding weddings, education, home renovation, or travel. If you're looking to Apply for Personal Loan in Delhi, many lenders provide loans of up to ₹25 lakhs with instant approval.

2. Emergency Loans

For unexpected events like hospitalization or urgent repairs, people seek an Emergency Personal Loan in Delhi. The best companies offer disbursals within a few hours.

3. Cash Loans

Those facing immediate short-term financial gaps opt for an Urgent Cash Loan in Delhi. This product is ideal for salaried professionals or small business owners who need instant liquidity.

4. Business Loans

Businesses looking to expand or address operational challenges prefer fast funding with less documentation. A reputable Loan Finance Company Delhi offers working capital solutions without collateral.

Advantages of Quick Loan Approval Without Documents in Delhi

One of the main concerns borrowers have is documentation. Traditional banks require a long list of forms, income proof, and verification. However, a growing number of companies now provide Quick Loan Approval Without Documents in Delhi, using alternative data points for verification such as:

Aadhaar-based e-KYC

Bank statement analysis using fintech APIs

Credit score evaluation

Mobile and utility bill analysis

These methods make loan approvals not only faster but more inclusive, helping salaried professionals, freelancers, and even gig workers.

How to Apply for Personal Loan in Delhi – Step-by-Step

Choose a Reputed Lender Research and shortlist a reputed Loan Finance Company Delhi that offers loans aligning with your requirements.

Check Eligibility Most lenders require:

Age between 21 and 60

Minimum income of ₹15,000/month

A good credit score (above 650)

Fill Out Application Visit the lender’s website or app. Click on Apply for Personal Loan in Delhi and provide basic details like name, mobile number, PAN, income, and purpose.

Upload Documents If the service supports Quick Loan Approval Without Documents in Delhi, you’ll only need to provide Aadhaar number and bank access permission.

Loan Disbursal After verification, your Urgent Cash Loan in Delhi or personal loan is credited to your bank account directly.

Who Can Benefit from an Emergency Personal Loan in Delhi?

Salaried Professionals: Those facing mid-month cash crunches or unplanned bills.

Freelancers: Often face irregular cash flows and sudden expenses.

Small Business Owners: Needing quick working capital for purchases or vendor payments.

Students & Parents: For education-related or hostel expenses.

Documents Required (In General)

Although many companies promise Quick Loan Approval Without Documents in Delhi, here are the standard papers (if required):

PAN Card

Aadhaar Card

Salary Slips (last 3 months)

Bank Statements

Passport-size Photo

Tips to Increase Loan Approval Chances

If you are applying to a Loan Finance Company Delhi, follow these tips to enhance your approval rate:

Maintain a Good Credit Score Pay your credit card bills and EMIs on time.

Avoid Multiple Applications Applying to multiple lenders at once may reduce your score.

Choose the Right Amount Don’t over-borrow. Apply for an amount that suits your repayment ability.

Be Honest in Your Application Avoid inflating your income or providing false information.

Real Stories: How Delhiites Used Fast Loan Services in Delhi

Ritika Sharma, a marketing executive in Connaught Place, used Fast Loan Services in Delhi to fund her mother’s surgery. “The approval came in two hours. I didn’t even need to visit any branch,” she says.

Amit Taneja, who runs a hardware shop in Karol Bagh, took an Emergency Personal Loan in Delhi to pay vendors on time and avoid penalty charges. “It was a business saver,” he adds.

FAQs

Q1. How fast can I get a loan from a Loan Finance Company Delhi?

Most companies offer loan approvals in under 24 hours, and funds are disbursed on the same or next business day.

Q2. Is it possible to get a Quick Loan Approval Without Documents in Delhi?

Yes, many lenders now offer e-KYC-based instant loans with minimal documentation.

Q3. What are the interest rates for an Urgent Cash Loan in Delhi?

Interest rates typically range from 10% to 26% p.a., depending on your creditworthiness and lender policy.

Q4. Can I Apply for Personal Loan in Delhi if I’m self-employed?

Yes. Several lenders provide loans to self-employed individuals based on business turnover and bank statements.

Q5. How do I know if I’m eligible for an Emergency Personal Loan in Delhi?

Check the lender’s eligibility criteria on their website or call customer support. Most require basic income proof and KYC.

Conclusion

Financial emergencies don’t wait, and neither should your loan. Choosing the right Loan Finance Company Delhi ensures you get Fast Loan Services in Delhi tailored to your needs. With options like Quick Loan Approval Without Documents in Delhi, Urgent Cash Loan in Delhi, and ways to Apply for Personal Loan in Delhi online, residents of the capital have more control than ever over their financial stability. Whether it's an Emergency Personal Loan in Delhi or just a short-term funding requirement, the right partner can make all the difference.

For More Information Visit Here:- https://www.loanswala.in/

#Loan Finance Company Delhi#Quick Loan Approval Without Documents in Delhi#Urgent Cash Loan in Delhi#Fast Loan Services in Delhi#Apply for Personal Loan in Delhi#Emergency Personal Loan in Delhi

0 notes

Text

Get Instant Cash Personal Loan Kolkata – Quick Loans Approved in 1 Hour

Emergencies don’t knock before arriving. Whether it’s a sudden health crisis, travel expense, home repair, or a family event, urgent financial requirements can disrupt your peace of mind. That’s why Fincrif offers a hassle-free instant cash personal loan Kolkata, enabling you to handle any expense swiftly without draining your savings.

The world is shifting toward digital solutions, and Kolkata is no exception. Residents of this vibrant city can now benefit from Kolkata personal loan online services that promise speed, simplicity, and reliability. With Fincrif, you can apply for a personal loan within 1 hour Kolkata, get approval in minutes, and receive money in your account without stepping out of your home.

What is an Instant Cash Personal Loan in Kolkata?

An instant cash personal loan Kolkata is a short-to-medium-term unsecured loan provided to individuals for personal needs. Unlike traditional secured loans, these do not require collateral. The entire process—from application to disbursal—is carried out online. The funds can be used for any personal need, from medical bills to weddings, education to travel, or even debt consolidation.

When you apply for a Kolkata personal loan online, you eliminate paperwork, long waits, and in-person visits. You just need a smartphone and internet access to get started.

Why Choose Fincrif for Instant Loan in Kolkata?

Fincrif has emerged as a top choice for people seeking a personal loan within 1 hour Kolkata because we understand the urgency of your needs. Here's what sets us apart:

100% paperless application

Approval within minutes

Funds credited within 1 hour

Low interest rates

No collateral required

Flexible repayment plans

Transparent charges

Trusted by thousands in Kolkata

We designed our instant loan in Kolkata service to be fast, fair, and easy—just the way you need it.

Features of Our Kolkata Personal Loan Online

Our Kolkata personal loan online solution offers a smart and secure way to borrow money:

Instant Processing

Applications are reviewed using automated systems, ensuring same-day processing and faster decision-making.

Loan Amounts from ₹10,000 to ₹5,00,000

Based on your income and credit profile, you can select a loan amount suitable for your requirement.

Repayment Terms from 6 to 60 Months

Choose the loan tenure that best fits your monthly budget and comfort.

Low Processing Fees

Enjoy competitive rates with transparent processing charges starting from just 1%.

Completely Digital

The entire application, verification, and disbursal process is handled online.

Who is Eligible for an Instant Loan in Kolkata?

You can apply for an instant loan in Kolkata through Fincrif if you meet these basic criteria:

Age: Between 21 to 58 years

Employment: Salaried or self-employed

Minimum Monthly Income: ₹15,000

Credit Score: 650 and above preferred

Location: Residing in Kolkata or surrounding areas

Even if your credit score isn’t perfect, our team will work with you to find the best available options for your Kolkata personal loan online application.

Documents Required to Apply

To process your instant cash personal loan Kolkata, you only need a few documents:

PAN Card

Aadhaar Card / Voter ID / Driving License

Recent salary slips or income proof

Last 6 months’ bank statement

One passport-size photo

Upload the documents online—no need to visit any office or branch.

Step-by-Step Guide to Get Personal Loan Within 1 Hour Kolkata

Getting your personal loan within 1 hour Kolkata through Fincrif is simple:

Visit www.fincrif.com Click on “Apply Now” and choose “Instant Personal Loan”.

Fill in the Application Provide your name, employment details, income, and loan requirement.

Upload Required Documents Use your phone or computer to upload necessary files.

Get Instant Approval Our AI checks eligibility and provides instant feedback.

Receive the Money Once approved, funds are transferred to your bank account within 1 hour.

Real-Life Uses of Instant Cash Personal Loan Kolkata

An instant cash personal loan Kolkata is not just for emergencies. Here are common uses:

Medical Expenses

Cover surgeries, hospitalization, or medicines without delay.

Weddings

Fund wedding costs like venue, catering, clothing, and decorations easily.

Education

Pay for tuition fees, coaching classes, or online certifications.

Travel

Plan your domestic or international vacation without financial stress.

Home Repair

Renovate your kitchen, fix leaks, or repaint with quick funds.

Debt Consolidation

Merge multiple loans or credit card bills into one low-interest instant loan in Kolkata.

Benefits of Choosing Fincrif

Our Kolkata personal loan online platform is built with a customer-first approach: