Charts, stats and other market musings from Dana Lyons, partner at J. Lyons Fund Management, Inc., RIA, editor of The Lyons Share and co-founder of My401kPro.com "Long-term investment growth through actively managed risk"

Don't wanna be here? Send us removal request.

Text

My401kPro - November 10, 2021 ALERT!

ALERT! November 10, 2021 -- Log in to see My401kPro's investment updates regarding your retirement plan: http://my401kpro.com.

3 notes

·

View notes

Text

My401kPro: November Update!

My401kPro’s November update is in. Check out the Commentary, current Equity Allocation and your Fund Rankings at http://My401kPro.com.

2 notes

·

View notes

Text

My401kPro: October Update!

My401kPro’s October update is in. Check out the Commentary, current Equity Allocation and your Fund Rankings at http://My401kPro.com.

1 note

·

View note

Text

My401kPro: September Update!

My401kPro’s September update is in. Check out the Commentary, current Equity Allocation and your Fund Rankings at http://My401kPro.com.

1 note

·

View note

Text

My401kPro: August Update!

My401kPro’s August update is in. Check out the Commentary, current Equity Allocation and your Fund Rankings at http://My401kPro.com.

0 notes

Text

My401kPro: July Update!

My401kPro’s July update is in. Check out the Commentary, current Equity Allocation and your Fund Rankings at http://My401kPro.com.

0 notes

Text

My401kPro: June Update!

My401kPro’s June update is in. Check out the Commentary, current Equity Allocation and your Fund Rankings at http://My401kPro.com.

0 notes

Text

My401kPro: May Update!

My401kPro’s May update is in. Check out the Commentary, current Equity Allocation and your Fund Rankings at http://My401kPro.com.

0 notes

Text

My401kPro: March Update!

My401kPro’s March update is in. Check out the Commentary, current Equity Allocation and your Fund Rankings at http://My401kPro.com.

0 notes

Text

Tactical Update: Hard Money (PREMIUM-UNLOCKED)

*The following Premium Post was issued to TLS members at 9:20AM CST on February 23, 2021.*

Risk assets are actually down…but opportunity is up.

We mentioned in this week’s WMMR that the straight up, post-election market environment is likely over and the next phase will require more active risk management. Yesterday and today are examples of that. But while yesterday saw a number of big gainers in our portfolio (that actually finished slightly positive on the day), today is offering few places to hide. So what are we doing into the broader selloff? Well, the newly minted more active risk-management environment doesn’t just mean selling/protecting profits — especially into tumbling prices. Profit-taking is done into rallies which is what we have been doing over the past month. If you are able to do that, you can still buy good relative strength names into dips to support. That’s what we have been doing this AM.

Let’s start with some of our recent purchases in “hot” sectors that finally cooled off, allowing for entry points. Obviously, initial support levels did not hold, leading to tests this morning of subsequent support. But we knew that was a possibility which is why we bought only small, “starter” positions. Today, we added to those positions at subsequent support. Specifically:

We added to our position in lithium (LIT) near ~61.

We added to our position in clean energy (ICLN) near ~24.50.

After taking profits in crypto in recent days, we also added back to our allocations there:

We added to our position in our bitcoin fund (GBTC) near ~45 (near bitcoin ~45,000).

We added to our position in our ethereum fund (ETHE) near ~17 (near ethereum ~1400).

There are a plethora of other positions testing support levels. Thus far, here is what we have done:

We added to our position in biotech (XBI) near ~148.

We added to our position in software (IGV) near ~353.

That’s all for now. As always, stay tuned to our DSS posts for further developments — they provide the most current updates to our investment portfolio and outlook. We touched on many of these potential moves in today’s DSS.

If you’re interested in a daily “all-access” view into our money management approach, please check out our site, The Lyons Share. You can follow our risk-managed investment process and posture every day — including insights into what we’re looking to buy and sell and when. Plus, our Anniversary Sale is going on now!! So it’s a perfect time to join! Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

1 note

·

View note

Text

My401kPro: February Update!

My401kPro’s February update is in. Check out the Commentary, current Equity Allocation and your Fund Rankings at http://My401kPro.com.

0 notes

Text

Active Managers "All In" -- And Then Some

Stock exposure among active managers is nearly at all-time highs.

The latest numbers from the NAAIM Investment Exposure survey are out. As a refresher, NAAIM stands for the National Association of Active Investment Managers. These are folks who adjust their investment exposure based upon market risk and their level of bullishness or bearishness. Judging by the latest survey numbers, they are extremely bullish right now. That’s because the average NAAIM manager currently has roughly 113% exposure to U.S. stocks. In other words, the average manager is leveraged long.

If that sounds like a lot, it is. In fact, it is the second highest reading in the 15-year history of the survey, trailing only the week of 12/13/2017. For what it’s worth, the market continue to rally for another 6 weeks following that reading before a sharp, 10-day, 12% drop.

A couple other interesting notes from this week survey include:

• The most bearish manager in the survey is still 75% long. Only 2 weeks in the survey’s history showed a higher number: 9/27/2017 and 10/4/2017. • Even the manager at the 25% quartile is presently 100% long. In other words, at least 75% of the survey respondents are fully invested. That has never occurred before in the history of the survey.

Conventional wisdom, of which we generally agree, suggests that when investor sentiment hits bullish extremes, it is bearish for the market. Presumably, that is because there is nobody left to buy. When it comes to the NAAIM survey, however, that is not always the case -- or at least not immediately the case. As we have discussed often, including last August, extreme bullish readings in the NAAIM survey have more often than not been followed by positive returns in the stock market over the intermediate term. Yes, the immediate aftermath can at times be rocky. And in combination with other currently extreme — and, generally, more contrarian —sentiment indicators, the current reading is a bit alarming.

However, we will once again caution against using high readings in the NAAIM survey to justify an overly bearish longer-term posture in the stock market.

If you’re interested in the “all-access” version of our charts and research, we invite you to check out our new site, The Lyons Share. Considering we have called this the "best trading environment ever", there has never been a better time to reap the benefits of our risk-managed approach. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

0 notes

Text

My401kPro: January Update!

My401kPro’s January update is in. Check out the Commentary, current Equity Allocation and your Fund Rankings at http://My401kPro.com.

0 notes

Text

(UNLOCKED-PREMIUM) Strategy Update: Miner Difficulties

*The following Premium Post was issued to TLS members mid-day on December 22, 2020.*

This week’s bump in volatility is creating opportunities.

It’s no surprise that we’re seeing a bit more volatility this week. As noted in daily and weekly posts the past few days, some of the major averages in addition to several sectors are now testing key Fibonacci Extension levels. This, in combination with scorching bullish sentiment equates to elevated near-term risk. With that said, any near-term pullback should equate to a buying opportunity.

Presently, the pullback is providing an attractive buying opportunity in a space that we recently added to our radar: silver miners. The set-up is similar to gold miners, but the space may have a little more beta to it — plus, it may get more of a boost from an economic turnaround. Specifically, here’s what we’re doing:

Started buying a position in the Global X Silver Miners ETF (SIL) near ~44.98 and ~44.38; will add more ~43.75 should it get there.

Also eyeing SILJ, the Junior Silver Miners ETF (for even more juice) should it drop to ~15, ~14.87 and ~14.50.

The only other move we’ve made today is to take profits in our Mid-Cap Pure Growth position, RFG, ~205.

If you’re interested in a daily “all-access” view into our money management approach, please check out our site, The Lyons Share. You can follow our risk-managed investment process and posture every day — including insights into what we’re looking to buy and sell and when. Plus, our TLS Holiday Sale is going on now!! So it’s a perfect time to join! Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

0 notes

Text

(PREMIUM-UNLOCKED) Golden Opportunity?

*The following Premium Post was issued to The Lyons Share members on November 24, 2020.*

The gold complex is getting routed — what are we doing about it?

As you know, we have been quite bullish on the precious metals complex, including gold, silver and gold miners, for some time…at least since August 2018 when sentiment toward the metals became about as dour as it gets (btw, neither gold nor the gold ETF GLD [~111 at the time] have been lower since). Of course, that was the time to be buying [gold miner ETF GDX was ~18] — when blood was running in the golden streets. The rally since has been epic — especially following the important trend break in June of last year as noted in several DSS posts at the time [GLD ~130 and GDX ~24].

Of course, nothing goes in a straight line forever so profit-taking eventually becomes the prudent move. For the gold complex, the time to book profits was clearly in late July-early August (as we noted at the time). That’s when gold and GLD arrived at a test of their respective 2011 all-time highs [GLD ~186] — and when GDX [~45] and other key gold miner indices reached the 61.8% Fibonacci Retracement of their 2011-2016 declines. For those reasons, we took substantial profits at the time.

That profit-taking was with the idea that we would buy those portions back after an expected healthy consolidation or pullback, provided there was no evidence that the longer-term uptrend was invalidated. We have gotten that consolidation/pullback and see no signs of a longer-term uptrend invalidation. Therefore, we are now starting to buy back the gold/miner exposure we sold back in July/August. Specifically:

Yesterday, we bought back some GLD ~172…we will buy more ~165 and ~158 (if it gets there)

This AM on the open, we bought GDX ~33.26 and GDXJ ~47.76

As always, stay tuned to our DSS posts for further developments — they provide the most current updates to our investment portfolio and outlook.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

0 notes

Text

My401kPro: December Update!

My401kPro’s December update is in. Check out the Commentary, current Equity Allocation and your Fund Rankings at http://My401kPro.com.

0 notes

Text

High Low Friday – 11/27/2020

Here are some of the most noteworthy highs and lows from across the markets for Friday, November 27, 2020.

The Global Dow Hitting New All-Time High

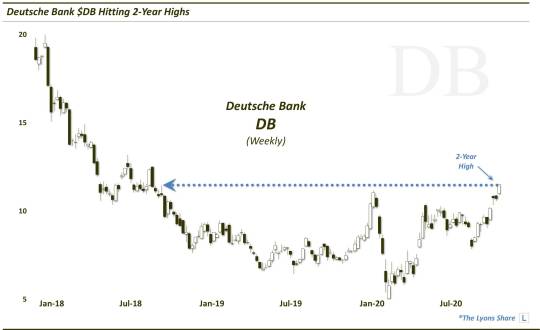

Deutsche Bank $DB Hitting 2-Year Highs

Copper Hitting 7-Year Highs

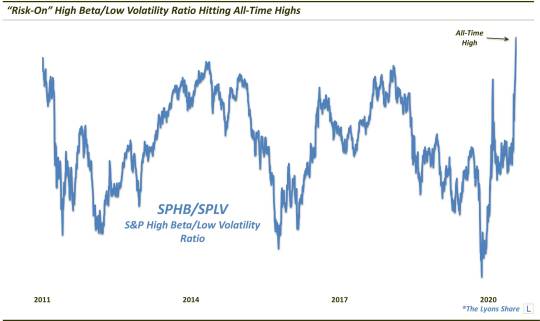

“Risk-On” High Beta/Low Volatility Ratio Hitting All-Time Highs

Nasdaq 100 Volatility Index $VXN Testing Post-Crash Lows

If you’d like to see these charts as they come out in real-time, follow us on Twitter and StockTwits. And if you’re interested in the daily “all-access” version of all our charts and research, please check out our site, The Lyons Share. You can follow our risk-managed investment process and posture every day — including insights into what we’re looking to buy and sell and when. Plus, our BIGGEST SALE OF THE YEAR — The TLS Black Friday Sale — is going on now!! So it’s a perfect time to join! Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

1 note

·

View note