#$^GSPC

Explore tagged Tumblr posts

Text

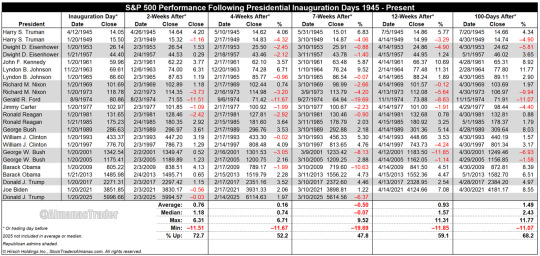

4th Worst Post Inaugural S&P 500 Performance since WWII

Click here to view table full size…

President Trump’s fast and furious pace of change to kick off his second term has created a great deal of uncertainty. Historically, the market has not performed well during periods of uncertainty. Monday, March 10, marked the seven weeks since Inauguration Day and as of the close S&P 500 was down 6.37%, its fourth worst post inaugural performance since 1945. Presidents Obama (2009), W. Bush (2001) and Ford (1974) suffered greater declines through the seventh week.

In the above table we have included the S&P 500’s performance every Inauguration Day since April 12, 1945, when Truman became President following the death of FDR. We also included November 1963, when Johnson took over after JFK was assassinated and Ford in August 1974, following Nixon’s resignation. We use the close on Inauguration Day or the day before when it landed on a holiday like this year. Republican Administrations are shaded in grey.

Seven weeks may be an odd data point to consider but it is consistent with the current time frame. Looking out to 12-Weeks After and 100-Days After, we see an improvement in S&P 500 performance with average, median and frequency of gains improving. Should the market find support, a rebound would be consistent with past post inaugural performance.

157 notes

·

View notes

Text

GSPC LNG Recruitment 2023 Manager and Other Post

GSPC LNG Recruitment 2023: GSPC LNG Limited is a Joint Venture company of the Government of Gujarat. Released New Job Vacancy For Shift Manager, Shift Engineer Posts. GSPC LNG Recruitment 2023 Job Recruitment Board GSPC LNG Notification No. – Post Various Vacancies 20 Job Location Various Job Type Govt Application Mode Online Gspc lng recruitment 2023 notification Important…

View On WordPress

0 notes

Photo

false

full stop #streetdreamsmag #streetweekly #gramslayers #ourstreets #spicollective #streetgrammers #bevisuallyinspired #hsinthefield #street_life #storyofthestreet #lensculturestreets #lensonstreets #capturestreets #zonestreet #myspc #streetphotography #gspc #streetphotographers #artofvisuals #moodygrams #eclectic_shotz #agameoftones #way2ill #justgoshoot #exploretocreate #hbouthere #streetclassics #wynwood #Miami

@AndTHeLastWaves @StreetPhotographers @StreetDreamsMag @StreetScape @LensCulture @EyeEmPhoto @thecitymag_ @justgoshoot @the.street.photography.hub @streets_vision @streetphotographyjournal @urbanandstreet @streetphotographyinternational @streetphotographyworldwide @magnumphotos @streetartglobe @streetshared @citykillerz @urbanromantix @gramslayers @streetphotographers_art (at Wynwood Life) https://www.instagram.com/p/CnSrJe_vwgg/?igshid=NGJjMDIxMWI=

#streetdreamsmag#streetweekly#gramslayers#ourstreets#spicollective#streetgrammers#bevisuallyinspired#hsinthefield#street_life#storyofthestreet#lensculturestreets#lensonstreets#capturestreets#zonestreet#myspc#streetphotography#gspc#streetphotographers#artofvisuals#moodygrams#eclectic_shotz#agameoftones#way2ill#justgoshoot#exploretocreate#hbouthere#streetclassics#wynwood#miami

1 note

·

View note

Text

Europe is starting to outperform in defense, infrastructure, and financials, advisor says

youtube

The recent sell-off in US stocks (^DJI, ^GSPC, ^IXIC) has led investors to consider whether the days of US exceptionalism have come to an end.

UBS global co-head of equity capital markets, Gareth McCartney, joins Market Domination with Julie Hyman and Josh Lipton to discuss two catalysts that are fueling the trend of investors putting capital into European markets and which sectors present opportunities for international investors.

Everyone can see how Trump is destroying America except MAGA.

#dark-rx#Krasnov#donald trump#trump#trump administration#fuck trump#fuck musk#elon musk#musk#nazilism#president musk#president trump#trump 2024#trump is a threat to democracy#anti trump#traitor trump#trump is the enemy of the people#Youtube

23 notes

·

View notes

Text

The 200 Day MA - Update

News of a 90 pause on tariffs between the US and China sent stocks soaring on Monday. “The S&P 500 (^GSPC) soared nearly 3.3% to its highest level since March 3. The Dow Jones Industrial Average (^DJI) gained 2.8%, or more than 1,100 points. The tech-heavy Nasdaq Composite (^IXIC) led gains, rocketing up 4.3%.” Stocks broke bullishly out of consolidation on Monday to close above the 200 day MA.…

0 notes

Text

Why Tripadvisor Stock Crushed the Market on Wednesday

On Wednesday, investors were more than willing to buy the ticket and take the ride with travel specialist Tripadvisor (NASDAQ: TRIP). The company’s stock rose like an ascending airliner, increasing more than 12% in price on the back of encouraging quarterly results. That performance well eclipsed that of the S&P 500 (SNPINDEX: ^GSPC), which could only inch up by 0.4% on the day. Tripadvisor’s…

0 notes

Text

#StockMarket#EarningsSeason#Tesla#Alphabet#MagnificentSeven#WallStreet#SP500#Investing#Tariffs#MarketTrends

0 notes

Text

A Stock Market Indicator Rarely Seen Since 1990 Hints at a Monster Rally. Here's What Investors Should Know.

The S&P 500 (SNPINDEX: ^GSPC) is currently 14% below the record high it reached earlier this year. The decline started when President Donald Trump announced tariffs on goods from China, Canada, and Mexico in February, and the losses deepened as he added new duties on steel, aluminum, and auto imports. However, it was the 10% universal tariff and country-specific reciprocal tariffs unveiled on…

0 notes

Text

Cổ phiếu giảm mạnh điểm khi mức thuế mới của Trung Quốc đe dọa thị trường

Cổ phiếu giảm mạnh vào thứ năm khi các tiêu đề về thuế quan một lần nữa gây sức ép lên thị trường chỉ một ngày sau khi thị trường chứng khoán Hoa Kỳ có một trong những ngày tốt nhất trong lịch sử. Chỉ số S&P 500 (GSPC) giảm gần 3,5%, trong khi Nasdaq Composite (IXIC) thiên về công nghệ giảm 4,3%. Chỉ số trung bình công nghiệp Dow Jones (DJI) giảm 1.014 điểm, tương đương 2,5%. Lợi suất trái phiếu…

0 notes

Text

What does Wall Street say

He heard the pause around the world from investing. The S&P 500 (^Gspc) exploded 9.5% on Wednesday as President Trump announces a 90 -day pause on bilateral tariffs to most countries. The pressure on China crabed, however Taking tariffs up to 125%. NASDAQ Compound Technology-heavy (^Ixic) increased by 12% for his second best day on record. Dow Jones's industrial average (^Dji) Shooting up 7.8%,…

0 notes

Text

Halloween Trading Strategy Treat Begins Next Week

Next week provides a special short-term seasonal opportunity, one of the most consistent of the year. The last 4 trading days of October and the first 3 trading days of November have a stellar record the last 30 years. From the tables below:

DJIA: Up 24 of last 30 years, average gain 1.95%, median gain 1.39%. S&P 500: Up 25 of last 30 years, average gain 1.96%, median gain 1.61%. NASDAQ: Up 25 of last 30 years, average gain 2.43%, median gain 2.29%. Russell 2000: Up 23 of last 30 years, average gain 2.34%, median gain 2.56%.

Many refer to our Best Six Months Tactical Seasonal Switching Strategy as the Halloween Indicator or Halloween Strategy and of course “Sell in May”. These catch phrases highlight our discovery that was first published in 1986 in the 1987 Stock Trader’s Almanac that most of the market’s gains have been made from October 31 to April 30, while the market, on average, tends to go sideways to down from May through October.

Since issuing our Seasonal MACD Buy signal for DJIA, S&P 500, NASDAQ, and Russell 2000, on October 11, 2024, we have been moving into new long trades targeting seasonal strength in various sectors of the market via ETFs and a basket of new stock ideas. The above 7-day span is one specific period of strength during the “Best Months.” Plenty of time remains to take advantage of seasonal strength.

24 notes

·

View notes

Text

What does Wall Street say

He heard the pause around the world from investing. The S&P 500 (^Gspc) exploded 9.5% on Wednesday as President Trump announces a 90 -day pause on bilateral tariffs to most countries. The pressure on China crabed, however Taking tariffs up to 125%. NASDAQ Compound Technology-heavy (^Ixic) increased by 12% for his second best day on record. Dow Jones's industrial average (^Dji) Shooting up 7.8%,…

0 notes

Text

Bitcoin Prices Rise On News Of Trumps Car Tariffs

Bitcoin's (BTC-USD) price inched up by around 1% to $87,500 (£67,743) in early trading on Thursday, even as global financial markets braced for the fallout from US president Donald Trump’s announcement of a 25% tariff on foreign-made automobiles and auto parts.

The tariff, set to take effect on 2 April, are aimed at bolstering domestic car manufacturing and have already stirred fears of further volatility in global equities. Investor sentiment has turned risk-off as the new measures prompted a notable sell-off in stocks. The S&P 500 (^GSPC) and the NASDAQ (^IXIC) Composite dropped lower on Wednesday, by around 1% and 2% respectively.

https://uk.finance.yahoo.com/news/bitcoin-price-trump-car-tariffs-crypto-102107922.html

0 notes

Text

By Rich Smith – Mar 23, 2025 at 8:08AM

Key Points

The stock market has entered bear market territory 15 times in 100 years, losing an average of 38% of its value top to bottom.

Over those same 100 years, the stock market has nonetheless averaged gains of 10% to 11% per year.

A retreat from above-normal profit margins may cause the next stock market crash, but markets will bounce back again, eventually.

Here's what happens next, and what to do about it.

I come today bearing good news and bad news, and I'll give you the good news first: The S&P 500 (^GSPC 0.08%) is no longer in a "correction."

Since closing at its highest ever level of 6,144 on Feb. 19, this index tracking the performance of America's 500 biggest companies tumbled quickly to close at 5,522 on March 13, 10.1% below its all-time high. It's recovered since and, as of Friday's market close, the S&P 500 is currently down only... 7.8% at a little under 5,668. So we're out of correction territory, and perhaps ready to resume moving higher again.

Or perhaps not...

0 notes

Text

The stock market comes all the way back — and then some: Chart of the Week

The US stock market is back. President Trump’s April 2 “Liberation Day” reciprocal tariff announcements sent stocks tumbling. The S&P 500 (^GSPC) fell more than 10% over the next three trading days, marking one of the worst crashes since World War II. At its lows, the index was down over 19% from record highs reached in February. But just a month later, the index has made it all back. And then…

0 notes

Text

This is now Trump's Economy

Let's see where we go from here. The following is Economic data I put together, mostly from US Government websites. The President is Donald J. Trump. He has all of his Cabinet in place. And Elon Musk is a Special Government Employee as the head of he Department Of Government Efficency (DOGE).

Data available as of 2025 March 01

Unemployment (BLS.gov): 2024 Jan to 2025 Jan > 4.0% Total

Gross Domestic Product - GDP (BEA.gov): Increased at an annual rate of 2.3% in the fourth quarter of 2024.Unemployment (BLS.gov): Civilian unemployment Increased at an annual rate of 2.3% in the fourth quarter of 2024.

Producer Price Index - PPI (BLS.gov) Reporting 2025 February 24: The Producer Price Index for final demand advanced 3.5 percent from January 2024 to January 2025. Prices for final demand goods increased 2.3 percent over the year, while final demand prices for services rose 4.1 percent.

Consumer Price Index (Inflation) - CPI (BLS.gov) Reporting 2025 February 13: The all items less food and energy index rose 3.3 percent over the last 12 months. Energy prices increased 1.0 percent and food prices increased 2.5 percent over the last year.

Consumer Confidence Index (Confidence-Board.org):The Conference Board Consumer Confidence Index® declined by 7.0 points in February to 98.3 (1985=100). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell 3.4 points to 136.5. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions— dropped 9.3 points to 72.9. For the first time since June 2024, the Expectations Index was below the threshold of 80 that usually signals a recession ahead. The cutoff date for preliminary results was February 19, 2025.“In February, consumer confidence registered the largest monthly decline since August 2021,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “This is the third consecutive month on month decline, bringing the Index to the bottom of the range that has prevailed since 2022. Of the five components of the Index, only consumers’ assessment of present business conditions improved, albeit slightly. Views of current labor market conditions weakened. Consumers became pessimistic about future business conditions and less optimistic about future income. Pessimism about future employment prospects worsened and reached a ten-month high. ”February’s fall in confidence was shared across all age groups but was deepest for consumers between 35 and 55 years old. The decline was also broad-based among income groups, with the only exceptions among households earning less than $15,000 a year and between $100,000–125,000.

Stock Market as of close 2025 February 28Russel 2000 (RUT): 2163.07

S&P 500 (GSPC): 5954.50

NASDAQ (IXIC): 18847.91

Dow jones industrial (DJI): 43840.91

CBOE Volatility Index (VIX): 19.63

Mortgage Fix Rate (FreddieMac.com) as of 2025 February 2730 year is at 6.76%15 year is at 5.94%

US International Trade in Goods and Services (BEA.gov) Reporting 2025 February 05: The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $98.4 billion in December, up $19.5 billion from $78.9 billion in November, revised.

https://www.whitehouse.gov/fact-sheets/2025/02/fact-sheet-president-donald-j-trump-imposes-tariffs-on-imports-from-canada-mexico-and-china/

ADDRESSING AN EMERGENCY SITUATION: The extraordinary threat posed by illegal aliens and drugs, including deadly fentanyl, constitutes a national emergency under the International Emergency Economic Powers Act (IEEPA).

Until the crisis is alleviated, President Donald J. Trump is implementing a 25% additional tariff on imports from Canada and Mexico and a 10% additional tariff on imports from China. Energy resources from Canada will have a lower 10% tariff.

President Trump promised in November to “sign all necessary documents to charge Mexico and Canada a 25% Tariff on ALL products coming into the United States, and its ridiculous Open Borders. This Tariff will remain in effect until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!”

These tariffs are scheduled to go into effect on 2025 March 04.

#us economy#trumps economy#trumps government#donald j trump#lets see where this goes#lets see#market trends#economics#trade#money#tarrifs#stock market#employment#political#us politics

0 notes