Form1099online.com is eco-friendly with cost-effective methods by e-filing IRS 1099 with Form 1099 Online. Also, an IRS-approved e-filing platform that has been trusted by millions of users over years.

Don't wanna be here? Send us removal request.

Text

Did You Receive a Form 1099? Here’s What You Need to Know!

Tax season is right around the corner, and Form 1099 is a key part of staying on top of your financials if you’re self-employed, a freelancer, or an independent contractor. Learn how to navigate this crucial form like a pro and ensure accurate reporting. Ready to file? Our experts can help make it easy.

#Form1099#TaxTips#SelfEmployedLife#TaxSeason#SmallBusiness#IRS#Form1099online#TaxFiling#ElectronicFiling#Tax1099#Form1099filing#Taxpayers#taxcompliance

0 notes

Text

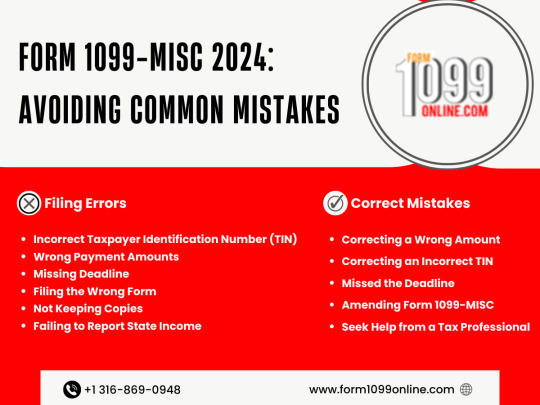

Form 1099-MISC 2024: Avoiding Common Mistakes

Filing Form 1099-MISC in 2024 requires careful attention to avoid common mistakes like incorrect taxpayer information and filing deadlines. Errors in reporting amounts or selecting the wrong form type can lead to penalties. This guide highlights frequent errors and provides tips to ensure accurate filing.

#1099MISC#TaxFiling#AvoidTaxMistakes#Form1099#Form1099online#Form1099Errors#AccurateFiling#SmallBusinessTax#TaxReporting#1099Mistakes

0 notes

Text

How to Gather Form 1099 Necessary Information for the 2025 tax season

Prepare for the 2025 tax season by gathering all necessary documents for Form 1099. Ensure accurate income reporting, collect expense records, and verify Tax ID numbers. Early organization reduces stress!

#TaxSeason#Form1099#SmallBusiness#IRS#Form1099online#TaxFiling#ElectronicFiling#Tax1099#Form1099filing#Taxpayers#TaxCompliance

0 notes

Text

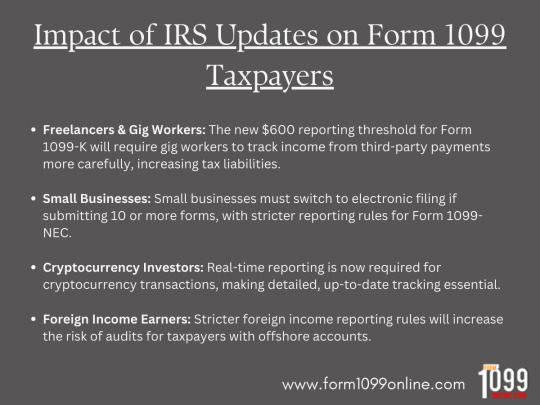

Impact of IRS Updates on Form 1099 Taxpayers

The 2024-2025 IRS changes will impact freelancers, small businesses, cryptocurrency investors, and foreign income earners. New reporting thresholds, mandatory e-filing, and stricter rules for digital and foreign income will require careful tracking and compliance to avoid penalties. Staying proactive is essential for all affected taxpayers.

0 notes

Text

#2025TaxChanges#CryptoReporting#IRSUpdates#Form1099online#Tax1099#Form1099#LateFilingPenalties#TaxCompliance#IRS#TaxSeason

0 notes

Text

Tax Knowledge Related to Form 1099

Self-employed individuals must report income using Form 1099 and pay self-employment tax covering Social Security and Medicare. They are also required to make quarterly estimated tax payments and maintain accurate financial records. The tax filing deadline is April 15, with the option to request an extension to file, but not to pay.

#SelfEmployment#TaxFiling#1099Income#SelfEmploymentTax#TaxDeadlines#Form1099#Form1099online#SmallBusinessTax

0 notes

Text

Understanding Scams Targeting Form 1099 Recipients

Form 1099 recipients are targets for scams due to their sensitive financial information. Scammers may impersonate IRS agents, demanding immediate payment and using threats. Phishing scams trick recipients into sharing personal details on fake websites. Identity theft occurs when scammers use stolen data to commit fraud. Always verify communications and protect your information to avoid becoming a victim.

#Form1099#TaxYear2024#ElectronicFiling#TaxCompliance#TaxPreparation#BusinessTaxes#TaxFilingOptions#Form1099online

0 notes

Text

#1099Form#OnlineFiling#TaxFiling#EFile1099#Form1099Online#TaxPreparation#TaxSeason#SecureFiling#IRSCompliance

0 notes

Text

Enhancing Taxpayer Assistance: IRS Introduces Special Saturday Hours

The introduction of special Saturday hours at select TACs underscores the IRS’s commitment to enhancing taxpayer service and accessibility during the tax season. By collaborating with platforms like Form1099online, the IRS aims to streamline tax-related processes and ensure a seamless experience for taxpayers nationwide. Leveraging online resources and preparing adequately for TAC visits can help taxpayers make the most of these extended service hours and navigate the tax season with ease.

#Form1099#TaxYear2024#ElectronicFiling#TaxCompliance#TaxPreparation#BusinessTaxes#TaxFilingOptions#Form1099online

0 notes

Text

#Form1099G#Form1099INT#TaxFAQs#TaxForms#TaxRefunds#UnemploymentTaxes#InterestIncome#IRSForms#TaxSeason#TaxHelp

0 notes

Text

#ElectronicFiling#Form1099#FormW2G#TaxFiling#IRSCompliance#EFile#TaxSeason#TaxPreparation#Form1099Online#TaxTips

0 notes

Text

#Form1099#1099TaxForm#IRS1099Form#1099onlineFiling#EFile1099#Printable1099Form#1099FillableForm#Form1099online#1099misc#1099nec

0 notes

Text

#IRS#TaxRates#Q22024#FinancialStability#Predictability#TaxPlanning#InterestRates#TaxStrategy#Form1099online#TaxObligations

0 notes

Text

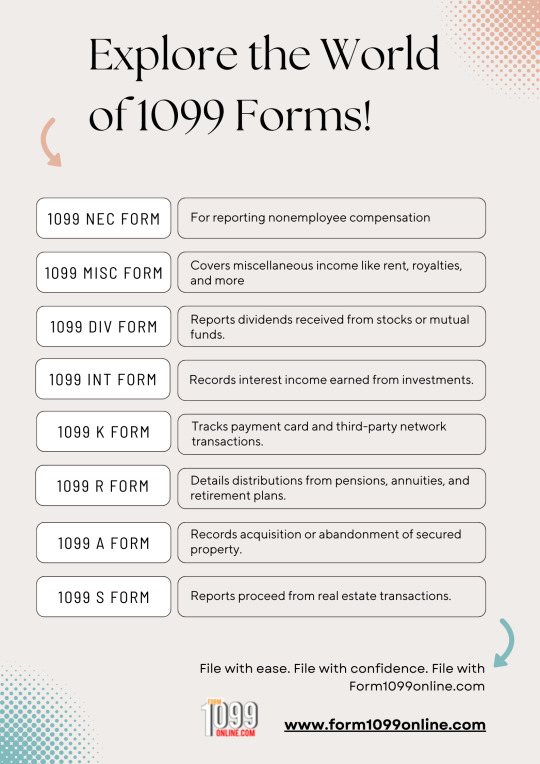

Explore the World of 1099 Forms!

At Form1099online.com, we support a variety of 1099 forms to cater to your filing needs. Whether you're a freelancer, contractor, or business owner, we've got you covered with our easy online filing services.

#timesaver#efficiency#taxfiling#Form1099online#1099online#file1099online#Fillable1099#1099TaxForm#Printable1099Form

0 notes

Text

Say Goodbye to Paperwork: Simplify Tax Filing with Form1099online

Tired of manual paperwork for tax filing? Switch to Form1099online for a digital solution that simplifies the process. Say goodbye to stacks of forms and hello to convenience.

#timesaver#efficiency#taxfiling#Form1099online#1099online#file1099online#Fillable1099#1099TaxForm#Printable1099Form

0 notes

Text

Save ⏰ and effort: File 1099 forms online with Form1099online 💻, because ain't nobody got time for paperwork! 📑

Save time and effort by filing your 1099 forms online with Form1099online. Our streamlined process ensures efficiency without sacrificing accuracy.

0 notes

Text

Looking for a reliable platform to file your 1099 forms online?

Looking for a reliable platform to file your 1099 forms online? Look no further than File 1099 Forms Online. Our user-friendly interface makes tax filing a breeze.

#taxservices#userfriendly#onlineplatform#Form1099online#IRS#File1099#fillout1099online#tax1099filing#Irs1099online

0 notes