#Form1099online

Text

#2025TaxChanges#CryptoReporting#IRSUpdates#Form1099online#Tax1099#Form1099#LateFilingPenalties#TaxCompliance#IRS#TaxSeason

0 notes

Text

What’s New for Form 1099 in 2024-2025

Key Changes for the 2025 Tax Year highlight major updates from the IRS, including real-time reporting for cryptocurrency transactions and enhanced foreign income reporting. Stricter backup withholding rules and increased penalties for late Form 1099 filings emphasize the need for accurate, timely reporting. Please stay informed to avoid penalties and make sure you comply.

#2025TaxChanges#CryptoReporting#IRSUpdates#Form1099online#Tax1099#Form1099#LateFilingPenalties#TaxCompliance#IRS#TaxSeason

0 notes

Text

Happy Independence Day! 🎉

#Form1099#IRS#HappyIndependenceDay#FourthOfJuly#IndependenceDay#July4th#CelebrateFreedom#USA#Patriotism#RedWhiteAndBlue#Form1099online

0 notes

Text

We provide you service to file your 2290 Form online. start filing with form1099online the best e-file provider site and within less time submit your accurate 2290 returns to the IRS. https://secure.truck2290.com/

#form2290#trucktax#truck2290#heavyvehicletax#taxfiling#hvut#irs2290#taxseason#irsform2290#2290duedate

0 notes

Link

File 1099 Form 2019 for free. Free Registration to File 1099 Misc 2019. 1099 Form Online Filing 2019. Call: +1-316-869-0948 to File 1099 Online in US

8 notes

·

View notes

Text

1099 Form 2019 | File 1099 Misc | 1099 Misc 2019 | E File 1099 Misc 2019

1099 Form 2019 Online Filing with simple tricks. 1099 Misc 2019 to report nonemployee compensation. E File IRS 1099 Misc 2019 within minutes.

1 note

·

View note

Link

1099 Tax Form Misc 2019 for reporting miscellaneous income to the IRS. File 1099 Misc 2019 in US. Various 1099 Forms for IRS Reporting.

1 note

·

View note

Text

Benefits of Filing Form 1099 Electronically

Filing Form 1099 electronically offers faster processing, reducing the time for corrections and penalties. It minimizes errors through built-in checks and validations, ensuring accurate submissions. Additionally, electronic filing provides instant confirmation and secure transmission, enhancing efficiency and peace of mind.

#1099Filing#Form1099online#TaxFiling#ElectronicFiling#TaxEfficiency#PaperlessTaxes#Form1099#SecureFiling#IRS1099

0 notes

Text

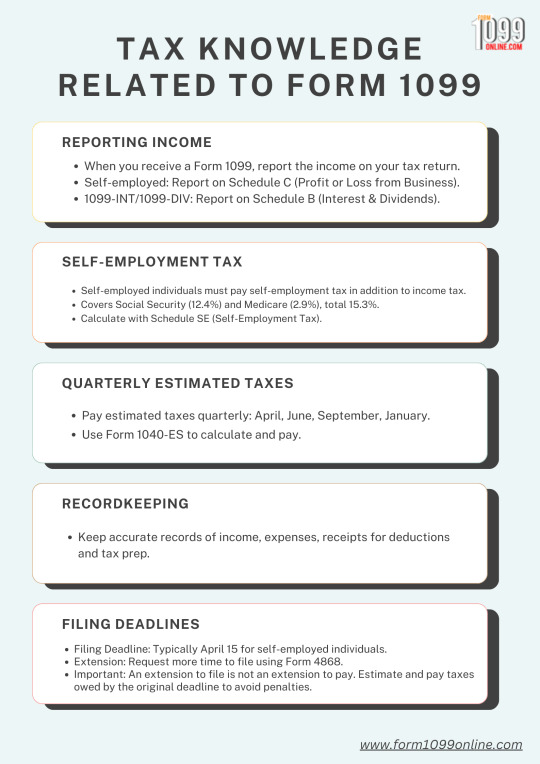

Tax Knowledge Related to Form 1099

Self-employed individuals must report income using Form 1099 and pay self-employment tax covering Social Security and Medicare. They are also required to make quarterly estimated tax payments and maintain accurate financial records. The tax filing deadline is April 15, with the option to request an extension to file, but not to pay.

#SelfEmployment#TaxFiling#1099Income#SelfEmploymentTax#TaxDeadlines#Form1099#Form1099online#SmallBusinessTax

0 notes

Text

Tax Knowledge Related to Form 1099

Self-employed individuals must report income using Form 1099 and pay self-employment tax covering Social Security and Medicare. They must also make quarterly estimated tax payments and maintain accurate financial records. The tax filing deadline is April 15, and they can request an extension to file but not to pay.

#SelfEmployment#TaxFiling#1099Income#SelfEmploymentTax#TaxDeadlines#Form1099#Form1099online#SmallBusinessTax

0 notes

Text

Who needs a 1099 A Tax Return?

Form 1099-A, "Acquisition or Abandonment of Secured Property," is filed when property is acquired or abandoned due to a loan. It applies to lenders, government units, or agents involved in secured loans or foreclosures. Multiple owners or subsequent loan holders must report events like transfers or foreclosures.

#1099A#TaxFiling#Form1099#IRS1099A#OnlineTaxFiling#Form1099online#TaxReporting#IRS#IRSRequirements#Tax1099A

0 notes

Text

Understanding Scams Targeting Form 1099 Recipients

Form 1099 recipients are targets for scams due to their sensitive financial information. Scammers may impersonate IRS agents, demanding immediate payment and using threats. Phishing scams trick recipients into sharing personal details on fake websites. Identity theft occurs when scammers use stolen data to commit fraud. Always verify communications and protect your information to avoid becoming a victim.

#Form1099#TaxYear2024#ElectronicFiling#TaxCompliance#TaxPreparation#BusinessTaxes#TaxFilingOptions#Form1099online

0 notes

Text

Understanding Scams Targeting Form 1099 Recipients

Form 1099 recipients are targets for scams due to their sensitive financial information. Scammers may impersonate IRS agents, demanding immediate payment and using threats. Phishing scams trick recipients into sharing personal details on fake websites. Identity theft occurs when scammers use stolen data to commit fraud. Always verify communications and protect your information to avoid becoming a victim.

#Form1099#TaxYear2024#ElectronicFiling#TaxCompliance#TaxPreparation#BusinessTaxes#TaxFilingOptions#Form1099online

0 notes

Text

#1099Form#OnlineFiling#TaxFiling#EFile1099#Form1099Online#TaxPreparation#TaxSeason#SecureFiling#IRSCompliance

0 notes

Text

Which 1099 Form Do I Use?

The 1099 series includes various forms used to report different types of income to the IRS. Use Form 1099-MISC for miscellaneous income like rent or prizes, 1099-NEC for non-employee compensation, and 1099-INT for interest income. Choosing the right form depends on the type of income you need to report.

#IRSForm1099MISC#Form1099online#1099NEC#1099R#1099INT#1099K#1099DIV#1099A#EfileForm1099#File1099Online

0 notes