#Form1099

Text

#2025TaxChanges#CryptoReporting#IRSUpdates#Form1099online#Tax1099#Form1099#LateFilingPenalties#TaxCompliance#IRS#TaxSeason

0 notes

Text

What’s New for Form 1099 in 2024-2025

Key Changes for the 2025 Tax Year highlight major updates from the IRS, including real-time reporting for cryptocurrency transactions and enhanced foreign income reporting. Stricter backup withholding rules and increased penalties for late Form 1099 filings emphasize the need for accurate, timely reporting. Please stay informed to avoid penalties and make sure you comply.

#2025TaxChanges#CryptoReporting#IRSUpdates#Form1099online#Tax1099#Form1099#LateFilingPenalties#TaxCompliance#IRS#TaxSeason

0 notes

Text

The Essential Guide to Form 1099 Compliance: Risks and Rewards

"The Essential Guide to Form 1099 Compliance: Risks and Rewards" is crucial for businesses and individuals. Understanding IRS 1099 requirements for issuing and filing Form 1099 ensures compliance with tax laws, avoiding penalties and maintaining good relationships with contractors. Proper compliance mitigates risks by ensuring accurate income reporting and fostering trust with stakeholders. By adopting best practices and leveraging technology like accounting software, entities can streamline processes and minimize errors. This training will cover the most-common questions businesses and accountants have about Form 1099 The questions are gleaned through examining hundreds of question submissions in live webinars, e-mails, and forums.

0 notes

Text

Happy Independence Day! 🎉

#Form1099#IRS#HappyIndependenceDay#FourthOfJuly#IndependenceDay#July4th#CelebrateFreedom#USA#Patriotism#RedWhiteAndBlue#Form1099online

0 notes

Text

youtube

Form 1099 is a series of information returns used to report various types of income, including payments made to independent contractors, rents, royalties.

Click here to watch full video: https://www.youtube.com/watch?v=xiCD9APz5l4

#1099#form1099#Form1099MISC#MeruAccounting#TaxFilingTips#accounting#bookkeeping#india#bookkeepingcompany#uk#bookkeepingtips#accountingservices#bookkeepingservices#bookkeepers#Youtube

0 notes

Text

Supreme Trainer is one of the best Form 1099 Online Training Course Providers in the United States of America. Form 1099 reporting has always been tricky, and changes in 2020 and 2021 continue to increase the reporting burden. Tucked away in the American Rescue Plan was a change to reporting on a form called a 1099-K, which has an interaction with contract labor reported on the 1099-NEC. More and more contractors are taking payments via apps such as Venmo – how are those payments reported? Or are they reported at all? These are among the things you’ll learn in this fast-paced, 1-hour webinar. Visit- https://www.supremetrainer.com/product/new-form-1099-reporting-in-2022/

#KirkCousins#Eagles#Jalen#Bills#DariusSlay#Titans#Diggs#Jefferson#WWERaw#IndustryHBO#SKOL#DWTS#QuantumLeap#education#onlinewebinar#form1099#seminar

0 notes

Photo

To qualify for and claim the Earned Income Credit you must: Have earned income; and. Have been a U.S. citizen or resident alien for the entire tax year; and. Have a valid Social Security number (not an ITIN) for yourself, your spouse (if filing jointly), and any qualifying children on your return. #eitc #child #earnincome #parents #parenthood #workingclass #workingclasswoman #selfemployeed #enterpreneur #support #smallbusinessowner #tax #taxseason2020 #finacialfreedom #financialliteracy #taxplanning #largerthanlife #nochildren #formw2 #form1099 #incomestatement #financialadvisor #financialstatements #marriedlife #marriedfilingjointly #headofhousehold #workkngprofessional #supermom #superdad #sbts (at Linden, New Jersey) https://www.instagram.com/p/B6YNBVBlERm/?igshid=1pxb9tvjvu918

#eitc#child#earnincome#parents#parenthood#workingclass#workingclasswoman#selfemployeed#enterpreneur#support#smallbusinessowner#tax#taxseason2020#finacialfreedom#financialliteracy#taxplanning#largerthanlife#nochildren#formw2#form1099#incomestatement#financialadvisor#financialstatements#marriedlife#marriedfilingjointly#headofhousehold#workkngprofessional#supermom#superdad#sbts

0 notes

Text

Requirements for 1099 Reporting in the Tax Year 2022

1099 forms are essential for a company's income and expense information to be reported. Employee compensation, payments to independent contractors, attorney fees, and other expenses are all tracked throughout the year. These transactions are recorded on 1099 forms to assist the IRS in matching the data and processing the tax.

If you're self-employed or operate a business, you're well aware of how stressful tax season can be. While filing is only one aspect of the process, the preparation, internal audits, reviews, validation, and other critical activities that lead up to filing season may be rather chaotic.

And if you're sick of searching the internet for the filing information for each of your 1099 forms, we've got some good news for you.

This blog will walk you through the filing requirements for all 1099 forms (all in one place), providing you with the much-needed quick information and insights to help you navigate the upcoming filing season.

So let's get started.

What Are 1099 Forms and How Do I Use Them?

The IRS refers to 1099 forms as "information returns," which are a series of tax information reporting forms. The IRS receives certain payments and income information from businesses and self-employed individuals via these information returns. Taxpayers must prepare and file full 1099 forms by particular deadlines, according to the IRS.

What Are the Different Types of 1099 Forms?

1099 forms come in a multitude of variations, including 1099-MISC, 1099-NEC, 1099-DIV, 1099-K, and so on. In terms of reporting a variety of information to the IRS, each of these information returns has a distinct purpose.

The procedure of all 1099 forms is essentially the same. All 1099 forms are classified as "information returns" because they provide the IRS with certain information about the taxpayer.

The table below lists 1099 forms and their information reporting purposes. This will assist you in comprehending each 1099 form.

1099 Form 1099 Form Description

1099-A Acquisition or Abandonment of Secured Property

1099-DIV Dividends and Distributions

1099-INT Income

1099-K Merchant Card and Third-Party Network Payments

1099-MISC Miscellaneous Income

1099-NEC Nonemployee Compensation

1099-R Distributions from Pensions, Annuities, Insurance Contracts, etc.

1099-S Proceeds From Real Estate Transactions

Is it necessary to file 1099 forms?

If you earned $600 or more in the previous year and/or paid $600 or more to an entity or independent contractor in exchange for their services, you must file 1099 forms for that year.

Is it necessary for you (the payer) to send 1099 forms to your payees?

The transactional information is captured and reported on 1099 forms when a business pays an independent contractor for their services.

The payer (the business) is required by the IRS to provide a copy of the 1099 forms to the payee (freelancer, independent contractor, or vendor) and have the information authenticated. Once both parties have agreed on the tax information reported on the 1099 papers, the payer files the reports with the IRS.

Yes, once again. You must send a copy of the 1099 form to your payee if you paid them $600 or more in a tax year and reported it on your 1099 forms.

What Is The 1099 Form's Minimum Reportable Amount?

The Minimum Amount Reported for 1099-NEC non-employee compensations is $600. You don't required to submit a copy of the 1099-NEC to the payee if you paid your vendors less than $600. But hold on! You must still report it and file it with the IRS. The IRS utilizes this information to double-check the recipient's income information (payee).

When Do 1099 Forms Have To Be Filed With The IRS?

Taxpayers must file their information returns by a certain date, according to the IRS. The 30-day automatic extension of certain 1099 forms has been abolished as a result of the reintroduction of Form1099-NEC, which has accelerated the 1099 filing deadlines.

Form1099Online, an IRS-approved agent, enables businesses like yours to electronically generate, validate, and file 1099 and other information returns.

All of your tax information reporting needs are fulfilled efficiently on one platform with elegant security features, real-time TIN Matching, W-9 Manager, access to 24x7 tax help, Scheduled E-File, and timely reminders.

#1099 nec#1099 misc#1099 div#1099 int#1099 k#1099 r#1099 a#1099 s#form 1099 online#file form 1099#efile form 1099#1099 online filing#1099 printable form#tin matching#1099 forms#1099 efile

0 notes

Text

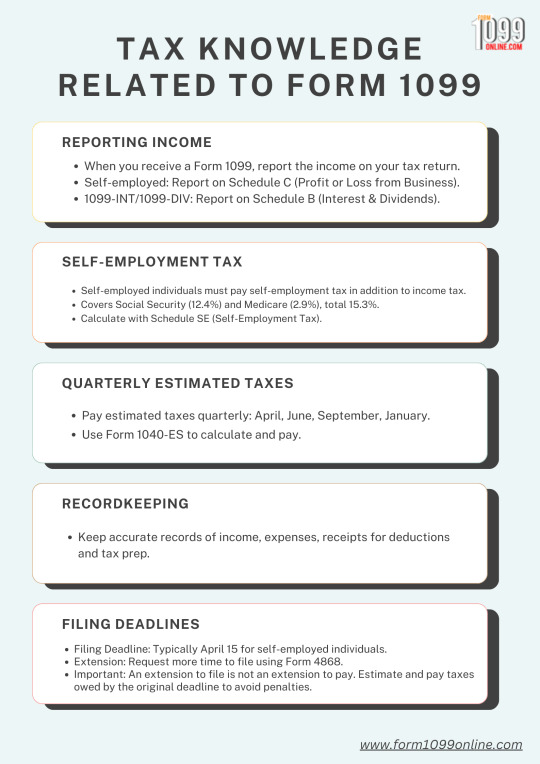

Tax Knowledge Related to Form 1099

Self-employed individuals must report income using Form 1099 and pay self-employment tax covering Social Security and Medicare. They are also required to make quarterly estimated tax payments and maintain accurate financial records. The tax filing deadline is April 15, with the option to request an extension to file, but not to pay.

#SelfEmployment#TaxFiling#1099Income#SelfEmploymentTax#TaxDeadlines#Form1099#Form1099online#SmallBusinessTax

0 notes

Text

Benefits of Filing Form 1099 Electronically

Filing Form 1099 electronically offers faster processing, reducing the time for corrections and penalties. It minimizes errors through built-in checks and validations, ensuring accurate submissions. Additionally, electronic filing provides instant confirmation and secure transmission, enhancing efficiency and peace of mind.

#1099Filing#Form1099online#TaxFiling#ElectronicFiling#TaxEfficiency#PaperlessTaxes#Form1099#SecureFiling#IRS1099

0 notes

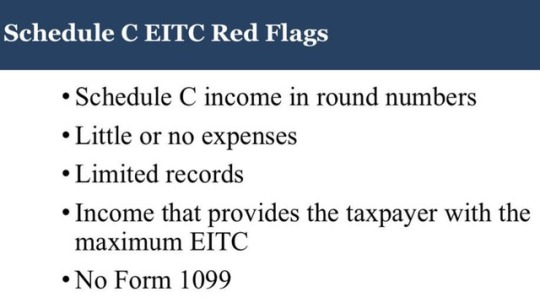

Photo

#schedulec #income #roundingnumbers #little #or #noexpenses #limitedrecords #maximum #eitc #no #form1099 #stephensbrostaxservice https://www.instagram.com/p/Bumoe2En8l5/?utm_source=ig_tumblr_share&igshid=1l55y6mxdn8xo

#schedulec#income#roundingnumbers#little#or#noexpenses#limitedrecords#maximum#eitc#no#form1099#stephensbrostaxservice

0 notes

Text

Understanding Scams Targeting Form 1099 Recipients

Form 1099 recipients are targets for scams due to their sensitive financial information. Scammers may impersonate IRS agents, demanding immediate payment and using threats. Phishing scams trick recipients into sharing personal details on fake websites. Identity theft occurs when scammers use stolen data to commit fraud. Always verify communications and protect your information to avoid becoming a victim.

#Form1099#TaxYear2024#ElectronicFiling#TaxCompliance#TaxPreparation#BusinessTaxes#TaxFilingOptions#Form1099online

0 notes

Text

Tax Knowledge Related to Form 1099

Self-employed individuals must report income using Form 1099 and pay self-employment tax covering Social Security and Medicare. They must also make quarterly estimated tax payments and maintain accurate financial records. The tax filing deadline is April 15, and they can request an extension to file but not to pay.

#SelfEmployment#TaxFiling#1099Income#SelfEmploymentTax#TaxDeadlines#Form1099#Form1099online#SmallBusinessTax

0 notes

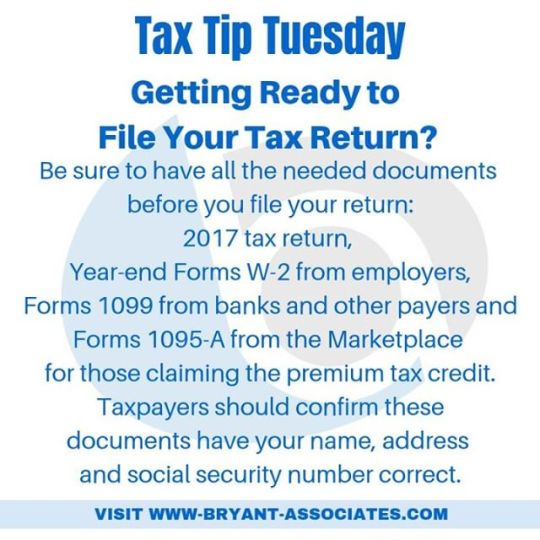

Photo

Getting Ready to File Your Tax Return?⠀ Be sure to have all the needed documents before you file your return: ⠀ 2017 tax return, Year-end Forms W-2 from employers, Forms 1099 from banks and other payers and Forms 1095-A from the Marketplace for those claiming the premium tax credit.⠀ Taxpayers should confirm these documents have your name, address and social security number correct.⠀ ⠀ #tax #taxes #taxtiptuesday #taxplanning #businesstip #CPA #smallbusiness #smallbusinessowner #smallbiz #smallbizowner #entrepreneur #bryantassociates #lnk #accountant #taxpreparer #taxreturn #taxseason #taxrefund #refund #w2 #form1099 #form1095a #ssn #address #name https://www.instagram.com/p/Bs8jWqjgenu/ via www.bryant-associates.com

0 notes