Text

A Substitution?

Iran was exporting about 5 million tonnes of urea per year. That’s approximately 415,000 tonnes per month, or just under 15,000 tonnes per day.

At present, Iran is out of the world market-and it’s hard to say for how long. Who could potentially fill the gap? The answer seems rather obvious: China. But time is tight-only until October-and quick decisions are required from the Chinese authorities: new quotas, CIQ approvals, and so on. I’m not so sure they’ll act in time…

Meanwhile, Russian urea will be exported to the EU in July. I’m ready to place a bet on it.

#imstory #fertilisers #fertilizers #market #analysis #israel #iran #ethiopia #mexico #russia #ukraine #ag #china #india #tender #prices #urea #europe #demand #supply #brazil #deficit #urea

#agriculture#fertilization#urea#fertilizer#corn#usa#wheat#india#vessel#nola#imstory#China#iran#Russia#Demand#supply#deficit

0 notes

Text

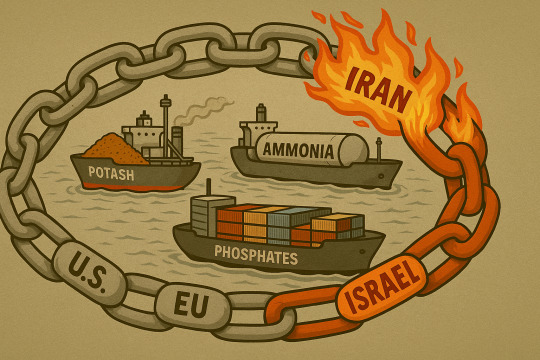

Israel Vs Iran - Part 2

OK, let me spend a bit more time analysing an effect on other fertilisers, apart of urea.

The Israeli-Iranian conflict - particularly if it escalates or spreads into broader regional tensions in the Red Sea or Arab/Persian Gulf - could significantly impact global fertiliser trade. Below is a breakdown of the fertilisers most at risk and the mechanisms behind potential disruptions.

1. Potash (MOP) - Directly from Israel

Key exporter: ICL (Israel Chemicals Ltd.), producing ~3–4 million tonnes per year.

Main destinations: Europe, Brazil, India, Southeast Asia.

Risk: Any escalation or port closures (e.g. Ashdod, Haifa) would directly impact ICL’s ability to export.

Impact: A shutdown or rerouting of Israeli MOP could tighten supply, particularly in Europe and Latin America, where ICL is a major supplier.

2. Nitrogen (Urea/Ammonia) - Indirect Disruption via Persian/Arab Gulf

Major producers: Iran, Saudi Arabia, Qatar, UAE, Oman, Egypt.

Strategic chokepoint: The Strait of Hormuz, through which ~20% of global LNG and oil passes.

Risk: Conflict or naval tensions could disrupt gas flows, pushing up feedstock costs. Egypt has already experienced gas supply disruptions.

Impact: Any interference in this corridor could ripple across producers like SABIC, QAFCO, Ma’aden, raising global nitrogen prices through both cost inflation and shipping delays.

3. Phosphates - Delays via Suez/Red Sea Disruption

Key exporters: Morocco (OCP), Egypt (Abu Zaabal, Alexfert), Saudi Arabia (Ma’aden).

Exposure: Phosphate exports largely transit through the Red Sea and Suez Canal.

Risk: Renewed or escalated attacks (e.g. by Houthis) would:

Force rerouting of vessels around the Cape of Good Hope.

Increase freight costs and shipping times to India, Southeast Asia, and East Africa.

Impact: While Israel’s phosphate role is minor, logistics bottlenecks in the region would delay supply and raise landed costs for key buyers.

4. Sulphur - Highly Exposed to Maritime Risk

Main producers/exporters: Saudi Arabia (Aramco, Ma’aden), UAE (ADNOC), Qatar (QAFCO), Iran, Kuwait.

Top importers: China, India, Morocco - for use in MAP, DAP, TSP, SSP, and sulphuric acid.

Risk: Sulphur exports rely heavily on both the Strait of Hormuz and Suez Canal.

Further tension would compound delays already seen from Houthi-linked attacks.

Impact: Rising freight rates and supply disruptions to major processors:

Morocco (OCP), India (SSP, TSP plants), China (industrial and agri use)

Spot prices for sulphur - especially CFR East Asia and India - could rally sharply.

Phosphate production margins would be pressured by higher sulphur input costs.

NB: I wrote this post on Sunday night, and yesterday the first signs of de-escalation appeared in the press. I sincerely hope that the conflict is coming to an end.

#imstory #fertilisers #fertilizers #market #analysis #israel #iran #ethiopia #mexico #russia #ukraine #ag #china #india #tender #prices #urea #europe #demand #supply #potash #sulphur #phosphates #ammonia

#agriculture#fertilization#fertilizer#urea#corn#usa#wheat#india#nola#imstory#phosphates#potash#ammonia#ocp#Jordan

0 notes

Text

Israel-Iran Part 1

I was asked last week how the Israeli-Iranian conflict might affect fertiliser supply and trade routes. Before discussing fertilisers in general, I’d like to pause on the recent NFL urea tender in India.

Normally, NFL is rather slow when it comes to opening bids and announcing the L1 result. However, this time it took them just over 24 hours to issue a counter to all participants in the tender.

Had the Israeli-Iranian escalation not occurred right before the tender, I’d say the NFL urea tender was close to ideal: 2.5 million metric tonnes offered (including all possible double counters), 230,000 tonnes at L1, and - most importantly - a price of $399 per metric tonne CFR West Coast India. Let me say that again: if there had been no mutual bombing, producers would have celebrated the outcome, and a million tonnes would likely have been booked without hesitation.

But what actually happened?

Paper derivatives for July/August surged by double digits in key markets, including the Arab Gulf, NOLA, and Brazil. So, theoretically, producers are now facing a dilemma: either accept a fairly attractive Indian price and ship July volumes, or gamble on further Middle East escalation to push prices even higher. The answer would have been clearer if we weren’t in the middle of a historically quiet month, when not much typically happens.

My guess? We’ll see 500,000 to 600,000 tonnes confirmed, while those with the ability to wait and build stock will choose to do so.

Who’s in trouble?

India, which may need to re-tender at the end of July.

Ethiopia, which - boldly but perhaps mistakenly - decided to postpone its next tender until after 16 June.

Brazil, which will likely return to the market in 30–45 days for its main season.

On the supply side, I wouldn’t be surprised if Russian producers delay their planned summer maintenance, seizing the momentum. Meanwhile, those who secured Chinese urea will now be well-positioned, not just for Ethiopia and West Coast Mexico, but potentially for Brazil too.

Just reviewing my notes: derivatives saw triple-digit increases after the start of the Russia-Ukraine war. And we all remember what happened less than a month after the invasion - prices corrected down by the same triple digits. The market clearly overreacted, and I expect physical trading to enter a sort of limbo in the near term.

Take care, everyone—and I’ll try to analyse other fertilisers tomorrow.

#imstory #fertilisers #fertilizers #market #analysis #israel #iran #ethiopia #mexico #russia #ukraine #ag #china #india #tender #prices #urea #europe #demand #supply

#agriculture#fertilization#fertilizer#urea#corn#usa#wheat#india#vessel#nola#imstory#china#iran#israel#war#analysis#demend#supply#mexico#brazil

3 notes

·

View notes

Text

It's Greyish Among Blue & Green Ammonia

Glancing back at IFA 2025, green and blue ammonia remained a hot topic of discussion. Naturally, the production of green and blue ammonia continues to be widely supported and subsidised. However, from what I’m hearing from my peers in the US, the situation there is becoming increasingly questionable.

President Trump’s latest FY 2026 “skinny” budget, alongside the House Republican tax plan, represents a major setback for low‑carbon ammonia developers. Here’s why:

1. Deep cuts to clean‑energy credits. The plan accelerates the expiration of critical clean-energy tax incentives-such as hydrogen and ammonia credits - forcing developers to begin construction within 60 days and complete projects by 2028, instead of the current 2032 deadline. The proposed repeal of 45V tax credits (which support green hydrogen production) and the weakening of 45Q credits for carbon capture would severely undermine the financial viability of both green and blue ammonia.

2. Massive cuts to clean‑energy programmes. Approximately $3.7 billion in federal clean-energy demonstration funding has been slashed-including support previously earmarked for hydrogen and carbon-capture projects. Trump’s FY 2026 budget proposes a ~74% reduction in the DOE’s renewable energy programmes and a 31% cut to fossil-energy R&D, further narrowing federal support.

3. Market and supply chain disruption.Uncertainty around potential sourcing restrictions and tariffs (e.g., 25% on Canadian ammonia) increases both cost and risk for project planning. Meanwhile, the UK, EU, Japan, and South Korea are increasingly defining “clean ammonia” by carbon intensity-meaning U.S. projects may fail to meet international standards without stable and consistent policymaking.

4. Chilling effect on investment and industry confidence. Investors and developers are already delaying or downsizing projects-such as Air Products’ $8 billion blue hydrogen/ammonia facility in Louisiana-as policy support wanes. Jobs in renewable energy and infrastructure pipelines are also at risk, shaking confidence in a sector that had been growing rapidly.

I’m not suggesting it’s a dead-born initiative; however, without reliable tax credits (45V and 45Q), sustained DOE funding, and globally harmonised low-carbon standards, the U.S. risks losing its competitive edge in the development of blue and green ammonia. These projects are crucial for decarbonising fertiliser production, maritime fuel, and hydrogen energy storage—not to mention maintaining relevance in global markets.

#imstory #fertilizers #fertilisers #ammonia #blue #green #NH3 #usa #eu #europe #sustainability #trump #budget #canad #tariffs #ifa2025

#agriculture#fertilization#fertilizer#corn#urea#usa#wheat#india#vessel#nola#imstory#europe#ammonia#green#blue#sustainability

0 notes

Text

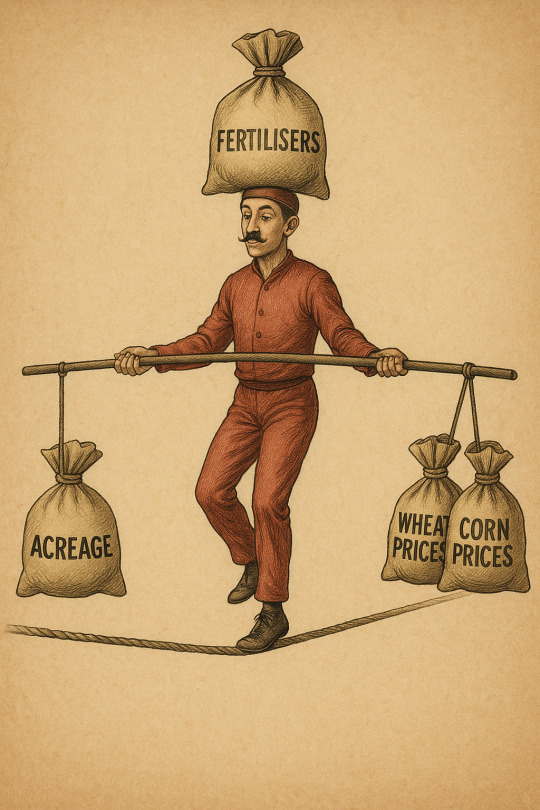

Both corn and wheat futures prices were hit badly yesterday. Why so?

More acreage = more harvest = more supply.

More supply = lower prices.

Lower prices = reduced affordability of fertilisers.

But larger acreage also requires more fertilisers.

And so, the cycle continues.

What looks like a simple equation is, in fact, a delicate balancing act for all market participants, including farmers, traders, and input suppliers. When prices fall, fertiliser affordability declines - just when nutrient demand is highest. It’s one of the great paradoxes to me, which requires a sharp skill, like circus rope balancing art.

Understanding this dynamic isn’t just for economists - it’s essential for anyone involved in the agri value chain.

Because in this business, everything is connected.

#imstory #fertilisers #fertilizers #agricommodities #wheat #corn #affordability #analysis #cbot #market #supply #demand #prices #cicus

#agriculture#fertilization#urea#fertilizer#corn#usa#wheat#vessel#imstory#affordability#agricommodities

3 notes

·

View notes

Text

Last week was marked by a very important development in the MOP market. India set the benchmark at $349 per metric tonne CFR, and I’ll explain why this is a game-changer in my view.

After months of anticipation, India has finally signed its annual MOP contracts - giving the market the clarity it has been craving.

As mentioned above, IPL concluded deals with both BPC and Uralkali at $349 per metric tonne CFR with 180 days’ credit, securing close to 1.25 million tonnes of standard MOP for delivery through to year-end. But to me, the most significant factor is the $66 per tonne price increase compared to last year.

Why does this matter?

India is the price-setter. For much of the standard-grade MOP market, India’s contract acts as the psychological “anchor” - it provides direction not only for regional buyers in Southeast Asia, but also for China, where negotiations had stalled.

Liquidity and volume follow certainty.

Tenders that previously attracted no bids - like RCF’s earlier this month - are now likely to receive offers. Traders will adjust their positions based on this new price floor.

The domino effect? I expect:

• Higher price expectations in Indonesia (already nearing $400 per metric tonne CFR);

• A probable uptick in Chinese contract levels;

• Reduced standard MOP availability elsewhere, as volumes are redirected to fulfil India’s contracts.

So yes, price discovery in India isn’t merely a local event - it sends a global signal.

And when that signal comes in at $349… it speaks loudly.

#imstory #fertilisers #fertilizers #potash #mop #india #china #belarus #russia #bpc #uralkali #trading #analysis #market

#agriculture#fertilization#urea#fertilizer#corn#usa#wheat#india#vessel#nola#China#Brazil#Indonesia#potash#market#analysis#imstory

0 notes

Text

Protectionism VS Opportunism

Bumped into an interesting article by Fertiliser Daily:

“Grupa Azoty has completed a record shipment of 36,640 tonnes of fertiliser from its seaport in Police to South America, marking the largest operation of its kind in the facility's history. The fertiliser will be used in agricultural production across the continent.”

So let me get this straight — after lobbying Brussels to slap Russian fertilisers with duties of up to €315 per tonne “to protect European production and food security,” Grupa Azoty breaks its own export record by shipping fertilisers out of the EU?

Well, someone’s food security is being secured - just not sure if it’s the EU’s.

Let’s call it what it is: protectionism in theory, opportunism in practice.

#imstory #fertilisers #fertilizers #eu #russia #belarus #tariffs #nitrogen #phosphates #urea #egypt #usa #morocco #nigeria #agricommodities #analysis #market #Yara #algeria #grupaazoty #pulawy #poland #export #protectionism #opportunism

#agriculture#fertilization#fertilizer#urea#corn#nola#india#usa#wheat#vessel#imstory#yara#pulawy#grupa azoty#opportunism#protectionism#protectionism (trade)

0 notes

Text

Fertiliser Affordability: A Scary Fall

I missed a month, but the US market was complete madness, with urea prices going through the roof. Now, everything seems to be returning to “normal”, so let’s get back to it.

It wasn’t intentional – just a rather hectic travel schedule, including a trip to the IFA 2025 and many other commitments.

What did I miss last month? Most notably, the news that China is back in both the urea and DAP markets. Albeit with some restrictions on quantities, minimum prices, and the shipping period — but yes, China is back.

So, let’s take a look at what has happened to affordability over the past 45 days, as my last reference date was 11 April 2025.

To recap, I use recent CBOT values for wheat and corn and compare them with FOB per short tonne prices of DAP and urea in NOLA.

So, let’s begin.

Key Inputs: 30 May 2025 vs 11 April 2025

Here’s how the numbers compare:

Corn Price: $4.23 per bushel $4.97 per bushel (dramatically down comparing to $4.97 on 11 April 2025)

Wheat Price: $5.48 per bushel (same picture as corn comparing to $5.70 on 11 April 2025)

Urea FOB NOLA: $390 per short tonne (down from $408 on 11 April 2025)

DAP FOB NOLA: $700 per short tonne (up from $645 on 11 April 2025)

Now, let’s return to our relatively simple affordability calculations and analysis.

Affordability Ratios (2024–2025)

Affordability is calculated as the ratio of crop prices to fertiliser prices, offering a clearer understanding of the cost burden on producers.

Urea Affordability

Corn Producers

Month

Ratio

June

0.0146

July

0.0145

August

0.0141

September

0.0138

October

0.0141

November

0.0141

December

0.0138

January

0.01279

February

0.01234

March

0.01218

May

0.01085

Analysis: Affordability for corn producers has sharply declibed, now reaching its lowest level since I began tracking in June 2024.

Wheat Producers

Month

Ratio

June

0.0177

July

0.0176

August

0.0173

September

0.0171

October

0.0171

November

0.0179

December

0.0166

January

0.01486

February

0.01468

March

0.01397

May

0.01405

Analysis: It’s back to above 0.14 level, however it’s not even close to the levels were seen in 2024.

DAP Affordability

Corn Producers

Month

Ratio

June

0.0079

July

0.0078

August

0.0076

September

0.0073

October

0.0073

November

0.0073

December

0.0072

January

0.0085

February

0.0077

March

0.0077

May

0.0060

Analysis: No surprise – with corn prices slamed in May, the DAP affordability ratio is now the lowest one since June 2024.

Wheat Producers

Month

Ratio

June

0.0098

July

0.0097

August

0.0095

September

0.0093

October

0.0093

November

0.0096

December

0.0095

January

0.0098

February

0.0091

March

0.0088

May

0.0078

Analysis: Same is related to the DAP affordability for wheat producers. This is now the lowest index since June 2024, when I began tracking affordability.

Comparison to February

Urea:

Corn producers: Affordability decreased by 10.92% in May 2025 – a huge number!

Wheat producers: Affordability increased by 0.57%

DAP:

Corn producers: Affordability decreased by 12.99%

Wheat producers: Affordability fell by 11.36%

Analysis of Trends

Seriously, this affordability scares me a lot. And my question is – are we pushing beyond the limits? Yes, corn acreage in the US is historically high, which is driving prices down, but will farmers now skip the summer refill, claiming that urea is simply too expensive?

As for DAP – until India solves its huge shortage, prices are unlikely to fall. Is there a real alternative for the farmers?

#agriculture#fertilization#urea#fertilizer#corn#usa#wheat#india#vessel#nola#affordable#affordability#imstory#barge#market#analysis

0 notes

Text

I Like Numbers

Yesterday, I promised to disclose the logic behind my price guess for the next Indian urea tender. I’ve opted to bet on $390–400 per metric tonne CFR WCI.

It’s rather simple (at least to me) if we briefly run through the main markets and producers. First of all, I believe this anticipated tender has already been factored into the global supply and demand forecast, and traders have gone moderately long after the IFA. Yes, even despite the mumbling over Chinese exports. I must admit, I was wrong - it now looks like it’s finally happening, or at least clearly visible on the horizon. So here we go.

Chinese tonnes, which are officially banned from being exported to India, still face several other restrictions: minimum price and timing. With $360 per metric tonne FOB for prilled and $370 for granular, even if allowed into India, the price would end up above $380 CFR. Now it’s clear that Chinese urea is going to compete with other origins on both sides of Latin America, and on the rhetorical West Coast, its advantage is obvious. However, with West Coast Mexico consuming granular urea, prices there are unlikely to be below $400 CFR - I’d even suggest $405 CFR.

Brazil - this is where the main competitors like Russia, Iran, Nigeria, parts of the AG, and China all converge. The latest large sales, in the $385–390 CFR range, were concluded with Iranian origin. The main demand starts just after the loading window for the Indian tender.

Ethiopia - what happens in Ethiopia stays in Ethiopia. Yes, it’s a sensitive volume, but any origin can enter the game.

Europe - the last dance with Russian urea. I don’t expect any major Russian urea offers to other markets in June. Everyone is trying to lock in destinations before the duties are imposed. By the way, I forecast that the price escalation in the EU will be significant enough that Russian producers will easily absorb the €40/mt duties on urea.

US - the season is over, but let’s use summer futures prices as a possible reference point, albeit Russian urea remains duty-free, as we all remember. For Q3, recent bids are at $361 per short tonne FOB NOLA — equivalent to around $390 CFR.

OK, let’s leave these numbers aside and quickly run through the supply side. This Indian tender is badly needed for AG and Russia. Without it, these two origins will have to compete with everyone else in Africa and Latin America. 1.5 million tonnes to be shipped within a 45-day window - that’s a solid level of support. The last IPL tender brought in vessels from Russia; I don’t see why this time would be any different. I’d easily estimate half a million tonnes - not more, since June will go to the EU and there are also summer maintenance schedules to consider.

In the same IPL tender, six vessels were nominated from the AG, so I would suggest another half a million tonnes from the region. Prior to the tender, reported deals were bouncing between $370–380 FOB, but yesterday a $385 sale popped up. I’ll leave that without further comment.

Back to pricing. WC Mexico, Brazil, the US, Africa - all of them calculate back to $345–350 FOB at Russian ports for producers. Even if they opt to place large volumes at discounted prices, they’ll still be close to $390 CFR. The same applies to the AG - a $15/mt package would allow them to reach $375 CFR without much competition.

The tender is for 1.5 million tonnes - a sizeable volume. I’m leaving logistics out of the equation. There’s also another rumour in the air - a new tender around 20–25 June. Still unconfirmed.

P.S. These AI pictures freaking scare me!

#imstory #urea #fertilisers #fertilizers #india #tender #ag #chess #eid #price #australia #egypt #brazil #game #market #analysis #tariffs #russia #china #mexico #season #sea #nigeria #usa

#agriculture#fertilization#fertilizer#urea#corn#usa#wheat#india#vessel#nola#imstory#ag#iran#brazil#mexico#analysis#china

0 notes

Text

Jokes Apart

No surprise - the EU Parliament has voted in favour of additional tariffs on fertilisers from Russia and Belarus. The scale is well known: starting at €40 per metric tonne on nitrogen and €45 per metric tonne on phosphates, increasing to €315 and €430 per metric tonne respectively by 2028.

A brief note on the main winners and losers. It’s quite simple - Yara and European farmers. But jokes aside, in nitrogen, and particularly in urea, Nigeria appears to be one of the main beneficiaries. It is subject to only a 6.5% import duty, and there are talks that this may even be reduced. Algeria and Egypt will almost certainly increase their share of the EU market.

I’m curious to see whether a trade agreement between the US and EU will now follow, allowing US producers to claim a share of this pie.

As for phosphates - North African producers and the Saudis will be quick to step in and help fill the gap.

Don’t worry about the Russians - 0% tariffs on urea and UAN in the US mean a great deal. I also anticipate more active trade with Latin America, South Africa, East Africa, and India.

Long story short: the volume of fertilisers produced and consumed globally won’t change, but the trade flows certainly will. But, jokes aside once again - it’s the European farmers who will end up paying the price.

#imstory #fertilisers #fertilizers #eu #russia #belarus #tariffs #nitrogen #phosphates #urea #egypt #usa #morocco #nigeria #agricommodities #analysis #market #Yara #algeria

#agriculture#fertilization#urea#fertilizer#corn#usa#wheat#india#vessel#nola#russia#belarus#eu#tariffs#imstory#nitrogen phosphates

1 note

·

View note

Text

There are several products that lose their value after a certain date — and you were definitely taught this in your economics classes. Good examples include:

Christmas trees on 1 January — who needs them then?

Chocolate eggs — sales drop sharply after Easter

Pumpkins — once Halloween is over...

I have another example: urea in Nola in June. The difference between May and June paper derivatives is \$70 per short tonne! Neither the first, nor the last time this happens in the season.

#imstory #nola #urea #fertilizers #fertilisers #season #market #derivatives #affordability #analysis

0 notes

Text

Don't Mix Urea anв Whisky

My friend Dmitriy Gordeichuk posted a story a couple of days ago.

In May 2025, a court in Shahjahanpur, Uttar Pradesh, sentenced 46-year-old Rajpal to life imprisonment and imposed a fine of ₹45,000. Rajpal had been arrested in May 2012 after police raided his hut in Nagra Haria Jamna village and seized 20 litres of illicit liquor along with 700 grams of urea. He confessed to adding urea to the liquor to increase its potency. He was charged under Sections 272 and 273 of the Indian Penal Code, which pertain to the adulteration and sale of noxious food or drink, as well as relevant provisions of the Excise Act.

Why am I recalling this article? Because rumours that India will tender this week are growing louder.

#imstory #urea #fertilisers #fertilizers #india #tender #ag #chess #eid #price #australia #egypt #brazil #game #market #analysis #rumors

#agriculture#fertilization#fertilizer#urea#corn#usa#wheat#india#nola#vessel#imstory#tender#jail#whisky

0 notes

Text

All For Motherland

Have you ever come across companies where employees receive an annual bonus - but are only allowed to spend it on specific, approved purposes? Perhaps on education, mortgage payments, or something else the employer deems appropriate?

The current situation with the much-rumoured export of ore and phosphate fertilisers from China reminds me exactly of that. Good employees - in this case, some Chinese companies - who have supplied the required quantities at "low" domestic prices, may (or maybe?) be allowed to export fertilisers at significantly higher international prices. Sounds logical… but hold on.

It seems to me that the next question from the Chinese government might be: "And how exactly are you spending this money?" Completing the domestic market programme may not be enough. It looks like producers and local traders are being asked to export wisely.

Last Friday, news broke that CAMPA (China Agricultural Means of Production Association) and CNFA set the minimum prices at $360 per metric tonne for prilled and $370 per metric tonne for granular urea. These are quite fair levels - but what surprised me most is that it wasn’t CNFA who made the prices public. It was the suppliers themselves! As I said at the beginning: you're allowed to receive the bonus, but you'd better spend it carefully.

OK, here’s another historical parallel. I grew up in the USSR, and it was a common thing for people to willingly give something up “for the needs of the motherland.” I wouldn’t be surprised if tomorrow those very same suppliers suddenly decide that exports are no longer necessary. It’s China - it’s a bit more complicated than it seems, and I’m under no illusion that I fully understand it.

Have a great week, everyone.

#imstory #urea #china #fertilisers #fertilizers #market #swings #opportunity #trade #trading #story #india #brazil #affordability #phosphates #urea #phosphates #bonus #export

#agriculture#fertilization#fertilizer#urea#corn#usa#wheat#india#nola#vessel#chin#china#export#bonus#ussr#imstory#tariffs#trump

0 notes

Text

Let's Get Ready To Rumble!

I’ve already drawn several sporting analogies in the past - cycling, for instance, to describe a false start when urea prices surged ahead of the main buying season in the northern hemisphere; or a chess game, when the DOF was carefully planning its next Indian purchasing tender.

Being in Monaco at the IFA this week, the logical analogy might be Formula 1 racing - but I’d rather switch to boxing terminology.

Following the recent developments around the long-awaited Chinese urea export is like watching a boxing match, where each new day plays out like a fresh round. Bulls and bears are trading blows with every new headline coming out of China:

Round One – China is back in the market. Boom.

Round Two – China is back, but subject to numerous conditions.

Round Three – Offers are flying across the market.

Round Four – Wait, we still don’t know the allowed tonnage.

Round Five – Tonnage confirmed: not 4 million tonnes, more like 2 million.

Round Six – CIQ inspection permitted.

Round Seven – Yes, but only at the production sites, not at the ports...

And each round affects the price. In a single day, paper derivatives can drop by double digits - and bounce right back just as sharply. Both fighters look exhausted, but neither is willing to give up. It’s a close fight so far - but the championship rounds are still ahead.

So: “Let’s get ready to rumble!”- as Michael Buffer might have said, had he attended the IFA conference.

#ifa2025 #china #conference #fertilizers #fertilisers #imstory #india #egypt #turkey #monaco #affordability #tariffs #market #rumble #boxing #market #urea #bull #bear

#agriculture#fertilization#fertilizer#urea#corn#usa#wheat#vessel#india#nola#china#rumble#bear#bull#imstory

1 note

·

View note

Text

Don’t Blame China

China is potentially returning to the urea export market. Why potentially? The document presented to market participants yesterday still didn’t clarify all the questions. What is clear now is that exports will be regulated, monitored, and - I may even say - controlled by the state. Another significant development is that Indian exports will be restricted.

I’d like to share my opinion on why Chinese exports, in this form, are a healthy injection for the market.

First, it will not collapse the market, as some expected last week.

Second, the market probably needs this price correction, as affordability is the key word. Fertilisers remain expensive compared to agricultural commodity prices - and not just nitrogen, phosphates as well.

Third, lower prices will trigger some new demand. Look at Brazil: the first four months of 2025 have brought the lowest imports in the last four years - 1.775 million tonnes, compared to 1.974 million tonnes in 2024, 1.812 million tonnes in 2023, and 1.996 million tonnes in 2022.Yes, some may argue that ammonium sulphate was cheaper in terms of nitrogen units, and importers have switched to it - but that’s precisely because urea remained expensive.

Fourth, for us traders, it means a decrease in financial burden and a potential for upward movement. And yes - I like trading in a rising market.

So, I say: China returning to the market without crashing it - is no bad thing.

#imstory #urea #china #fertilisers #fertilizers #market #swings #opportunity #trade #trading #story #india #brazil #affordability #phosphates

#agriculture#fertilization#fertilizer#urea#usa#corn#wheat#india#vessel#nola#China#brazil#imstory#Phosphorus

0 notes

Text

DDP (Delivery Duty Paid)

Out of curiosity, I was discussing with my beloved wife the influence of the new US tariffs on the fashion industry. My wife remarked that fashion houses would simply lower the declared value at customs...

And look what I’m reading today:

To bypass import tariffs, Chinese companies are resorting to a tactic known as DDP - delivered duty paid. This condition requires the seller not only to deliver the goods to the designated location but also to cover all expenses associated with customs clearance. Chinese companies claim that this allows them to significantly reduce the amount of duties, as they intentionally understate the value of the shipped goods or alter their descriptions, according to the Financial Times.

“We are seeing more and more cases where factories in China offer to pay customs duties for companies, and then sell them goods in the U.S. at prices lower than those on which duties should have been paid,” Ryan Petersen, CEO of the American logistics corporation Flexport, confirmed to the FT.

The spread of this practice was also confirmed to the newspaper by representatives of several American companies working with Chinese exporters. Specifically, it concerns logistics companies such as ShipHero and Rubin’s. The latter, in turn, has already reported such schemes to U.S. Customs and Border Protection.

Would this apply to any fertiliser imports into the U.S., not necessarily just Chinese ones?

#imstory #urea #china #fertilisers #fertilizers #market #swings #opportunity #trade #holidays #usa #phosphates #trade #trading #tariffs #opportunity

#agriculture#fertilization#fertilizer#urea#corn#usa#india#wheat#vessel#nola#ddp#china#tariffs#trump#trump tariffs#us economy

1 note

·

View note

Text

On 1 May, President Trump tweeted: “All purchases of Iranian oil and petrochemical products must stop, NOW!”

There are a thousand and one methods to bypass these restrictions, and some market participants use them. Otherwise, Iran would not have become one of the most important urea suppliers. Suppose Iranian exports continue-operational costs associated with that particular origin are likely to become more expensive.

#imstory #urea #sulphur #supply #iran #fertilisers #fertilizers #market #analysis #usa #sanctions #trade #trump

#agriculture#fertilization#fertilizer#urea#usa#corn#wheat#india#vessel#nola#Iran#Trump#imstory#sanctions#bypass

1 note

·

View note