Text

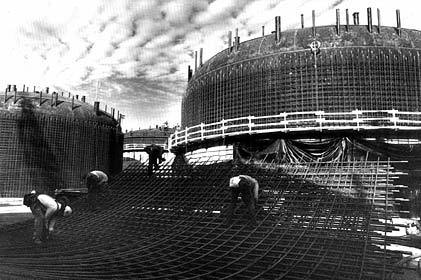

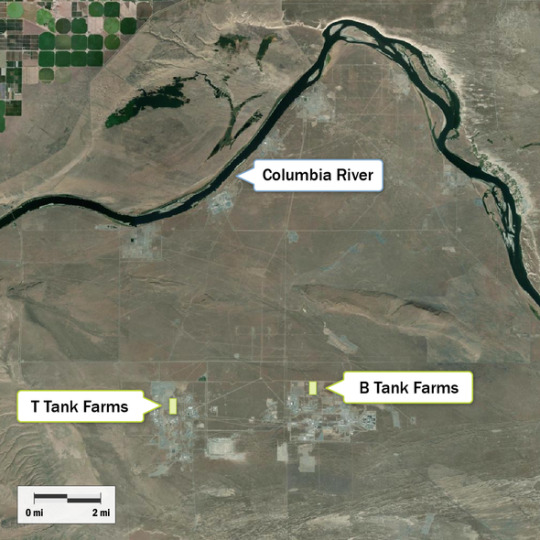

The Hanford Site, established in 1943 in Washington State as part of the Manhattan Project, produced plutonium for nuclear weapons, leaving a legacy of 56 million gallons of high-level radioactive waste stored in 177 underground tanks. Built for temporary use (20-40 years), these tanks—149 single-shell (1943-1964) and 28 double-shell (1968-1986)—are now 60-80 years old, with 67 single-shell tanks leaking approximately 1 million gallons into the soil and groundwater, threatening the Columbia River, just 5-7 miles away.

The $107-150 billion cleanup, mandated by the Tri-Party Agreement (DOE, EPA, Washington State), relies on pumping waste to double-shell tanks and vitrifying it into glass logs at the Waste Treatment and Immobilization Plant (WTP), a process delayed until 2030-2060. Despite 90% of liquid waste transferred, 1-2% residuals remain, and ongoing leaks, seismic risks (moderate quake zone), and slow groundwater treatment ($15-25 billion, 30-100 years) persist, exacerbated by the DOE’s history of mismanagement and cost overruns.

The cleanup strategy is a costly miscalculation that ignores the true threat: the contaminated ground beneath these failing tanks. The DOE clings to the delusion that corroded tanks can hold waste until 2060, despite leaks, residuals, and seismic risks that could unleash catastrophic plumes. Vitrification sidesteps the soil’s role as a contamination reservoir, leaving the Columbia River vulnerable while pump-and-treat limps along.

My solution—immediately encasing tanks in seismically resistant concrete vaults ($10-20 billion, 7-12 years)—rejects this flawed reliance. It seals residuals, stops new leaks (95-100% containment in magnitude 6-7 quakes), and protects the river in under a decade, saving billions compared to endless remediation. By prioritizing the ground, my strategy corrects Hanford’s historical blunder of temporary storage and aligns with the Yakama Nation’s urgent call for river safety, demanding action now over the DOE’s sluggish, tank-centric gamble.

6 notes

·

View notes

Text

Sovereign bond markets are financial markets where debt securities issued by national governments (i.e., sovereigns) are traded. These bonds are instruments used by governments to finance public expenditures, manage liquidity, or refinance maturing obligations. The sovereign bond market is a core component of the global fixed income landscape and plays a central role in monetary policy implementation, benchmark pricing, and financial system stability.

Technical Definition:

Sovereign bond markets consist of primary markets, where new debt (e.g., Treasury bonds, notes, and bills) is issued through auctions or syndications, and secondary markets, where these securities are subsequently traded among investors. These markets are characterized by a wide spectrum of credit risk, maturity profiles, and currency denominations.

Sovereign bonds may be categorized as:

Local currency bonds (e.g., U.S. Treasuries, JGBs, Bunds)

Foreign currency bonds, often USD- or EUR-denominated, particularly in emerging or frontier markets

Risk Considerations:

Credit Risk: The risk of default, which is often priced through sovereign credit spreads or credit default swaps (CDS).

Interest Rate Risk: Due to sensitivity to changes in benchmark yield curves.

Liquidity Risk: Especially in the secondary markets of lower-rated or emerging market sovereigns.

Market Risk: Exposure to volatility driven by macroeconomic announcements, geopolitical shocks, or policy uncertainty.

Sovereign bond markets are also the locus of monetary operations (e.g., open market operations), and disruptions in these markets—such as during a sovereign debt crisis or an unwind of basis trades—can have systemic implications across global capital markets.

0 notes

Text

The IMF’s Growth-at-Risk (GaR) model is a quantitative risk assessment framework designed to estimate the downside risks to future economic growth by linking current financial and macroeconomic conditions to the distribution of future GDP growth outcomes.

In technical terms, the GaR model applies quantile regression methods to forecast the entire conditional distribution of future real GDP growth—rather than just the mean—based on indicators of financial vulnerabilities, such as leverage, credit growth, asset valuations, and global risk sentiment (e.g., VIX). The focus is on the left tail of the distribution, particularly lower quantiles (e.g., the 5th percentile), which represent severe but plausible downside scenarios.

Key Features:

Macrofinancial Linkages: It captures how financial sector stress, such as tightening financial conditions or credit market disruptions, can propagate into the real economy.

Systemic Risk Identification: Helps policymakers assess potential nonlinear effects and tail risks, crucial for macroprudential surveillance.

Forward-Looking: Unlike traditional growth forecasts, GaR emphasizes risk asymmetry, focusing on the probability of extreme negative growth outcomes.

Example:

If the 5th percentile of the GaR model predicts –3% growth for the next year, it suggests there is a 5% probability that GDP growth will be worse than –3%, signaling elevated systemic vulnerabilities.

The GaR framework aligns conceptually with financial risk measures like Value at Risk (VaR) and is increasingly used by central banks and international institutions to integrate financial stability analysis into macroeconomic policy.

0 notes

Text

A Margin Call is a demand by a broker or counterparty for an investor or institution to deposit additional collateral (margin) to cover potential losses on a leveraged position whose value has declined.

In technical terms, a margin call occurs when the mark-to-market value of a derivative or securities position moves against the holder, causing the collateral posted to fall below the maintenance margin or variation margin threshold set in the credit support annex (CSA) of an ISDA Master Agreement or exchange rules. This reflects a key aspect of counterparty credit risk management in both cleared and OTC derivative markets.

Example:

If a hedge fund holds a long futures position on equity indices and market prices fall sharply, the exchange (or prime broker) will issue a margin call requiring the fund to post more cash or high-quality liquid assets (e.g., Treasury bills) to maintain the required margin. Failure to meet the margin call within a specified time frame may result in forced liquidation of positions.

Margin calls are critical in managing derivatives risk, particularly delta and gamma exposures, and they can act as amplifiers of systemic risk by forcing institutions to delever, contributing to fire sales and broader market stress.

1 note

·

View note

Text

Liquidity Risk is the risk that a financial institution or investor will be unable to meet its short-term financial obligations due to an inability to liquidate assets quickly or access sufficient funding without incurring significant losses.

In Risk Management and Financial Institutions (6E) by John C. Hull, liquidity risk is broken into two primary types:

Market (Asset) Liquidity Risk: This arises when an institution cannot sell a particular asset rapidly at or near its fair value. During market stress, bid-ask spreads may widen, or buyers may disappear entirely, leading to steep price discounts (fire sales). For example, mortgage-backed securities or leveraged loan portfolios may become illiquid in periods of heightened volatility.

Funding (Cash Flow) Liquidity Risk: This occurs when an institution cannot obtain sufficient cash to meet obligations as they come due—such as margin calls, debt repayments, or withdrawals by clients—without raising funds at exorbitant rates or selling assets at distressed prices. For instance, a bank facing a sudden deposit run or a hedge fund receiving simultaneous redemption requests would experience funding liquidity risk.

Liquidity risk is closely linked to maturity mismatch, leverage, and contagion, and it played a central role during the 2008 financial crisis. Risk managers mitigate it through tools like liquidity coverage ratios (LCRs), stress testing, liquidity buffers, and contingency funding plans.

0 notes

Text

Risk Assets are defined as financial instruments that expose holders to significant levels of market, credit, or liquidity risk. These instruments contribute to a firm’s risk-weighted assets (RWAs), influence its regulatory capital requirements, and are sensitive to adverse changes in valuation under stressed conditions. Risk assets stand in contrast to risk-free or low-risk assets, such as sovereign bonds from highly rated countries, which carry minimal capital charges under regulatory frameworks like Basel III.

Examples of risk assets include:

Equities: Shares in public or private companies are subject to price volatility and are fully exposed to market risk. A downturn in equity markets can lead to significant mark-to-market losses.

Corporate Bonds: Especially those rated below investment grade (high-yield or "junk" bonds), which are exposed to credit risk stemming from the issuer's probability of default and recovery rate uncertainty.

Commercial Real Estate Loans: These are highly sensitive to economic cycles, vacancy rates, and interest rate changes, posing both credit and liquidity risk.

Over-the-Counter (OTC) Derivatives: Products like interest rate swaps or credit default swaps (CDS) that are exposed to counterparty credit risk and may be illiquid in stressed markets.

Emerging Market Debt: Sovereign or corporate securities issued in developing economies, which carry elevated credit and foreign exchange risk due to less stable macroeconomic and political environments.

These assets require economic capital allocation and are typically included in Value at Risk (VaR), Expected Shortfall (ES), and stress testing frameworks, as they can produce nonlinear losses and exacerbate systemic vulnerabilities through contagion effects or fire-sale externalities.

0 notes

Text

Systemic risk has materially increased amid elevated macroeconomic uncertainty, reflected in widening cross-asset volatility and a deterioration in financial conditions indices. Market turbulence—triggered by abrupt shifts in trade policy—has induced significant repricing across risk assets, consistent with heightened Value at Risk (VaR) and Expected Shortfall (ES) metrics. These developments underscore the tail risk embedded within global financial markets, as captured by the IMF’s Growth-at-Risk (GaR) framework.

Highly leveraged nonbank financial intermediaries (NBFIs), particularly hedge funds employing basis trades and other leveraged relative-value strategies, exhibit elevated gross notional exposures relative to NAVs, amplifying their margin sensitivity and procyclical deleveraging potential. The growing nexus between NBFIs and core banking institutions raises systemic vulnerabilities via counterparty credit risk and liquidity transmission channels.

Emerging market economies face acute refinancing risk due to elevated sovereign credit spreads and diminishing carry-trade returns. In core sovereign markets, basis risk and stressed funding liquidity have the potential to trigger endogenous fire sales and market illiquidity spirals.

Authorities should reinforce macroprudential frameworks, stress testing regimes, and contingency liquidity arrangements. Full Basel III implementation, capital adequacy monitoring, and enhanced supervisory oversight of interlinked credit exposures and model risk in NBFIs are imperative to maintain financial system resilience under adverse stress scenarios.

0 notes

Text

Global Financial Stability Report

Global financial stability risks have escalated amid rising macrofinancial uncertainty and tighter global financial conditions. Elevated asset price volatility and sharp repricing events—triggered by unexpected trade policy shifts—have increased systemic risk, amplifying downside tail risks as reflected in Growth-at-Risk (GaR) estimates. Despite recent corrections, elevated valuation multiples and compressed credit spreads in core markets heighten the risk of further adverse market adjustments.

Nonbank financial intermediaries (NBFIs), including highly leveraged hedge funds, pose contagion risks through procyclical deleveraging under stress scenarios, due to increased interconnectedness with banking institutions. Leverage ratios and gross notional exposures have surged, increasing Value at Risk (VaR) across portfolios. Frontier and emerging markets face significant refinancing and sovereign credit spread risks, exacerbated by rising real yields and reduced carry trade attractiveness.

Stress testing and scenario analysis must incorporate geopolitical risk factors, which are material sources of systemic shocks with potential cross-border transmission via trade and financial linkages. Authorities should ensure liquidity backstops are operational and that macroprudential and microprudential buffers are appropriately calibrated. Full implementation of Basel III standards and enhanced oversight of NBFIs are critical to fortifying resilience against endogenous and exogenous financial shocks.

0 notes