California Employment Lawyers | Located in Santa Monica

Don't wanna be here? Send us removal request.

Text

What Are the Types of OSHA Violations?

In 2019, the US Bureau of Labor Statistics reported that over five thousand people were killed due to injuries they obtained while working. Their Census of Fatal Occupational Injuries that same year reported that fatalities had risen five percent in the private construction industry since 2018 and the number was the highest than it had been since 2007.

For 2020, The Occupational Safety and Health Administration (OSHA) released a report of their top 10 violations of the fiscal year. This report included the types of safety violations that most often resulted in injuries and even fatalities at workplaces.

What Are OSHA Violations

OSHA violations happen when a company or one of their employees does not adhere to the proper safety procedures or safety hazards are not addressed. A violation presents a risk for an accident or injury but does not necessarily mean this has happened yet. OSHA will administer inspections that may detect such violations before an incident. In some cases, OSHA may issue the company a fine or citation for the violation. If there is a willful violation and an employee is killed, there may also be criminal charges and penalties involved.

OSHA Violations vs OSHA Citations

Citations are often issued when a company commits a violation that does not necessarily present a danger to their employees. A citation is like a warning that serves to alert the company to the violation and let them know that they need to address it. A citation only becomes part of a company’s safety record if they receive it more than once. If the citation is issued two or more times within three years, it is considered a repeat offense.

Degrees of OSHA Violations

OSHA violations are identified by different degrees of severity. The following designations help determine the amount penalized.

Serious Violations

When a violation is too serious for just a citation, OSHA will also administer fines. According to the OSHA Act Section 17(k), violations are considered serious if they can cause severe injuries or death and should have been reasonably prevented by the employer. OSHA classifies the penalties for these violations on a gravity-based scale categorizing them by their severity with corresponding fines.

High-gravity violations are the most severe and carry fines of $14,502.

Moderate-gravity violations are of middling severity and can carry fines anywhere from $8,287 to $12,431.

Low-gravity violations are lower severity and carry fines for $6,215.

Many companies will hire workplace risk assessment consultants to help them identify these violations before they come to OSHA’s attention.

Other Than Serious Violations

OSHA considers violations that may pose a real risk to the health and safety of the employees, but will not result in injury or death, to be other-than-serious. These violations may incur the same fines as serious violations depending on the situation. In some cases, OSHA may decide to give a citation or reduce the amount of the penalty.

Violations that are considered other than serious are categorized as lesser and greater minimal-only violations. Lesser violations are generally met with a citation and no monetary fine. Greater violations may be met with a fine anywhere up to $14,502.

Willful or Repeated

Repeated violations within a three-year period can be met with fines up to a maximum penalty of $145,027 per violation. For serious repeated violations, the minimum penalty imposed is $10,360. If the violation is other than serious and did not initially warrant a monetary fine then the first repeated violation may be met with a $414 fine, the second with a $1,036 fine, and the third with a $2,072 fine.

A willful violation occurs when the employer is aware of the danger to their employees and ignores it. Fines for willful violations range from $10,360 to $145,027. If a willful violation results in a fatality, the penalty may be a hefty fine, prison time of up to six months, or both. When these fatalities result in criminal convictions, the fines may be as high as $250,000 for individual employers and $500,000 for corporations.

Penalties for serious willful violations may be reduced based on the size of the business and the number of employees.

10 or fewer employees result in an 80% penalty reduction

11-20 employees result in a 60% penalty reduction

21-30 employees result in a 50% penalty reduction

31-40 employees result in a 40% penalty reduction

41-50 employees result in a 30% penalty reduction

51-100 employees result in a 20% penalty reduction

101-250 employees result in a 10% penalty reduction

251 or more employees result in a 0% penalty reduction

Posting Requirements

When OSHA issues a citation or notice of violation to an employer, it must be posted in the area where the violation occurred. The posting must be in full view for all employees for at least three days or until the issue is resolved. These notices are also accompanied by a pamphlet that describes the issue, suggests solutions, and provides the date by which it must be remedied.

Failure to Abate

If an employer does not resolve the issue of the violation by the date provided with the notice, they may be fined for each day past that date that the issue goes unresolved. If the issue was never resolved, it is considered a failure to abate. If the issue was resolved and occurs again, it is considered a repeat violation.

De Minimus Violation

A de minimus violation refers to an issue that is technically a violation in that it does not comply with OSHA standards, but it does not necessarily pose a genuine risk to anyone’s health or safety. Rather than issue a citation or a penalty, OSHA will often provide a verbal warning to the employer and simply note the issue in the company safety file.

OSHA Fines & Penalties

As of January 2022, the following penalties are imposed for OSHA violations:

Serious violations – $1,036 to $14,502

Other than serious violations – $0 to $14,502

Willful or repeated violations – $10,360 to $145,027

Posting requirement violations – $0 to $14,502

Failure to abate violations – $14,502 per day past the abatement date up to 30 days

Can OSHA Fine Employees?

Individual employees are not fined by OSHA for safety violations. The employers are the ones responsible for maintaining the health and safety of their employees and keeping the workplace in compliance with OSHA standards.

Most Common Examples of OSHA Violations

The top ten most frequently fined OSHA violation examples of 2020 are:

Fall Protection with 5,424 violations

Hazard Communication with 3,199 violations

Respiratory Protection with 2,649 violations

Scaffolding with 2,538 violations

Ladders with 2,129 violations

Control of Hazardous Energy with 2,065 violations

Powered Industrial Trucks with 1,932 violations

Fall Protection Training with 1,621 violations

Eye and Face Protection with 1,369 violations

Machinery and Machine Guiding with 1,313 violations

The number one recommended way to prevent workplace incidents is though comprehensive training in OSHA safety standards. OSHA provides 10-hour online safety training courses for both construction and general industry workers. This course helps keep employees informed of the precautions necessary to keep themselves and each other safe.

OSHA also provides an annual report of the most common violations they find in order to give people additional information that can help them maintain safe and healthy work areas.

In 2020 the most common violations were found evenly in both construction and general industry. The list does not change too much from year to year, though the order of the categories may fluctuate.

Fall Protection

Fall protection has been the most commonly cited OSHA violation for ten years. Additionally, falling injuries are also the number one cause of fatalities in the construction industry. There are many ways in which a company might violate the fall protection standard set out by OSHA. Common fall protection violations involve incorrect methods of fall protections being used and the lack of or improper installation of safety features. OSHA mandates fall protection for workers when at a height of six feet or more. It is not enough that the protection be present, however. It must also be in good condition and working order.

Hazard Communication

Some jobs call for the use of chemicals and other hazardous substances. When handling or storing these materials, it is important to know the proper way to do so safely. This is why all hazardous substances must be labeled clearly and accompanied by emergency procedures. OSHA updated and revised their hazard communication standard in 2012 with new criteria and formatting for safety data sheets.

Respiratory Protection

OSHA’s respiratory protection standard serves to protect workers from substances in the air such as dust, smoke, toxic fumes, and other contaminants. Employers are required to ensure that the workplace has proper ventilation and that the employees are outfitted with the correct personal protective equipment.

In the wake of COVID-19, respiratory protection became a major factor with stricter guidelines. So many employers were failing to meet the standards in place that respiratory protection rose to the third most common OSHA violation from its spot at fifth place the previous year.

Scaffolding

OSHA’s data states that approximately 65 percent of construction industry employees work with scaffolding. When handling scaffolding, it is important to adhere to all safety precautions for the safety of those navigating the scaffolding as well as everyone below. The risk of people falling or getting hit by falling objects is a very real danger. Failure to comply with OSHA’s scaffolding standard causes over 4,500 injuries and over 60 deaths annually.

Ladders

The Centers for Disease Control and Prevention reported that almost 60 percent of ladder related fatalities happen within the construction industry. Construction industry ladder violations are generally due to employers not providing the right safety training. Another large issue is when workers use a type of ladder that is inappropriate for the task at hand. OSHA’s Ladders standard provides comprehensive guidelines for ladder safety such as staying within the ladder’s weight restrictions, maintaining proper clearance around the ladder, and ensuring the ladder is steady and secure on the ground.

Control of Hazardous Energy (Lockout / Tagout)

According to data compiled by OSHA, approximately 9 percent of fatalities in the construction industry are related to electrocution, often due to improper energy control during maintenance procedures. Non-fatal electrocution injuries are still serious and can result in burns and even broken bones. The control of hazardous energy standard laid out by OSHA is a guideline for workers to protect themselves from the energy stored in their equipment. OSHA requires that all energy be discharged from machinery properly or controlled by a lockout tagout device.

Powered Industrial Trucks

Powered industrial trucks are heavy machinery such as tractors and forklifts. They are specialized equipment that must be used properly and kept well maintained. OSHA’s powered industrial truck standard forbids anyone from operating these vehicles without proper training. This training includes how to identify and avoid hazards as well as dos and don’ts like not using a phone while driving.

Fall Protection Training

It is not enough that fall protection measures be put in place, OSHA’s training requirements for fall protection standard dictates that any workers who are at risk of falling hazards go through the proper training.

Workers must be properly trained in knowledge of when and where that protection is needed and taught to identify and avoid potential hazards. They must also be taught proper maintenance and operational procedures for all necessary equipment including assembly, disassembly, and safety inspection.

Eye and Face Protection

There are many hazards found in the workplace that leave thousands of people blinded each year. These hazards can be related to debris in the air, toxic substances, and in some professions such as welding, even intense light. The standard for eye and face protection set forth by OSHA provides regulations necessary for preventing injuries to the face and eyes. These regulations pertain to things like eye wash stations and their operational instructions, safety measures applied to machinery, and equipment such as goggles and other protective face coverings.

Machinery and Machine Guarding

Many industries involve the use of dangerous machinery. Proper operation procedures and safety measures are necessary to avoid injury. OSHA’s machine guarding standard provides information to help workers protect themselves from moving parts and apply safeguards where needed.

Avoiding OSHA Violations

Adhering to OSHA standards is not just about avoiding punishment, it is about keeping yourself and everyone around you safe and healthy. Entry level workers are highly encouraged to take OSHA’s ten-hour outreach course in order to learn the information they need to maintain workplace safety. There is also a thirty-hour course that provides more extensive information and training for workers in supervisory or safety-based positions.

One way companies work to prevent OSHA violations is by having a third party come in and perform their own inspection to catch issues right away. It is also good practice for managers and employees to be aware of their surroundings and be on the lookout for any potential violations themselves.

Proactive vs Reactive Approach

Many companies have a reactive approach to health and safety. This means that they only address issues when the issue becomes a problem, or someone forces their hand. This approach can have many negative effects on their workers and even the success of the company itself.

Companies are encouraged to take a proactive approach to health and safety. This means being aware of the rules and regulations set forth by OSHA, keeping management and employees fully trained, and always taking steps to catch and prevent potential violations.

If You Have Been Injured Due to OSHA Violations Contact Mesriani Law Group

It is management’s responsibility to ensure that a workplace or jobsite is conducive to the health and safety of their workers and to prevent injuries. OSHA has rules and regulations in place for a reason and when those rules are violated, people get hurt. Being injured in a workplace accident can be a trying time. Being injured because your boss failed in their duty to protect you can make things much worse. Oftentimes, employers will try to shift the responsibility onto the employee and say they are liable for their own injuries. Having a workman’s compensation attorney can help you navigate the entire process. If you have been injured at work as the result of an OSHA violation, call Mesriani Law Group today for a free consultation.

OSHA Violation FAQs

What are the most common OSHA violations?

Fall protection has been the number one OSHA violation for the past decade. A lack of fall protection means a higher risk of workers falling from dangerous heights. In the construction industry, injuries caused by falling are the most common cause of workplace deaths. Hazard communication has held the second place spot for nearly as long from 2012 through 2020. OSHA dictates strict guidelines for the labeling of dangerous substances and the availability of material safety data sheets containing all relevant product and safety information. Coming in at number three and reportedly stealing the number two spot for 2021 is respiratory protection. Workers must be provided the proper ventilation and PPE to keep them safe from contaminants in the air. A proposed reason for the rise in respiratory protection violations is the rise in regulations during the COVID-19 pandemic.

What are types of violations?

There are a few different types of OSHA violations. Serious violations are ones that pose an immediate threat of injury or death to the workers. Other-than-serious violations are ones that pose a threat to health and safety but may not cause injury or death. De minimus violations are ones that technically violate OSHA standards and regulations but do not pose a direct threat to the workers.

What are the two types of violations?

When a company commits an OSHA violation that is a hazard to the health and safety of their workers, they may be penalized and, depending on the seriousness of the violation, they could end up paying thousands of dollars in fines. If a violation is found that is not necessarily a substantial hazard, OSHA may instead issue the company a citation which is more of an official warning.

#California Employment Law#OSHA#Occupational Safety and Health Administration#Workplace Safety#Workplace Retaliation#Employment Law#Employment Lawyers#California Attorneys

0 notes

Text

What is Severance Pay?

Severance pay is an additional payment made to a terminated or laid off employee; usually in the event of a company downsizing, declaring bankruptcy, or closing. These payments are generally made to long term employees as a way to help compensate for the sudden loss of income. The actual amount of the payment varies depending on the details of the situation and is generally given all at once as a lump sum payment. The federal government and the state of California do not currently have any laws requiring employers to provide severance pay, and not every employer does.

Is Severance Pay Required by Law?

The only times an employer must pay a severance is when they have a pre-existing contract with the employee that says they will, or if there is a union involved that has negotiated for it. Outside of such circumstances, there is no state employment law that regulates it. Severance pay is a matter of contract law in California.

What is a Severance Package vs a Severance Agreement?

When an employee is laid off from a job, they may receive additional payment and benefits beyond their final paycheck. This is known as a severance package. It may include stocks or the next few paychecks the employee would have earned. Legally, employers are not required to provide severance packages. However, many do in order to get their now former employee to sign a severance agreement, which is a contract binding the employee to certain terms in exchange for the payment and benefits.

Because employees are not entitled to severance pay, employers can refuse to provide that payment unless the employee agrees to their terms. Severance agreements are drafted to have the employee sign away some of their rights in exchange for the severance pay. Most agreements involve:

A guarantee not to sue the former employer for discrimination, harassment, or wrongful termination.

An agreement not to discuss the details of their termination, the terms of the agreement, or information about the company.

There are also some things that an employer is not permitted to have an employee sign away such as their right to sue for wage violations, reporting crimes committed by the company, and seeking further employment.

In many cases, an employee can negotiate the terms of their severance agreement before signing. Depending on how much the employer is concerned about the risk of a lawsuit or bad press, they may be more willing to negotiate. Departing employees may be able to secure insurance coverage, more money, and even help finding a new job.

What to Look for in a Severance Agreement

A severance agreement is a binding contract. After it is signed, there is no going back. This is why it is important to carefully read the entire agreement and be certain that you completely understand all of the terms and conditions. Always remember that contracts such as severance agreements are drafted to benefit the person who drafted them, and you should be mindful of preserving your own best interests. Negotiating severance package terms is recommended with the help of a qualified severance package lawyer.

What Does the Employer Gain in a Severance Agreement?

Severance payments may seem enticing, but there are occasions where they are not worth what the employee is actually exchanging. Sometimes, an employer offers a sum of money in exchange for the employee agreeing not to sue because the employer knows that the employee could reasonably be awarded much more money in a lawsuit. There are many circumstances where an employee may want to seek guidance from an attorney before signing the agreement such as:

If the employee feels that they were wrongfully terminated

If the employee was subjected to harassment, discrimination, or retaliation

If the agreement includes non-compete and/or non-disclosure clauses or any other limitations to the employee’s future job options

If the employee is being asked to take blame or admit fault, particularly in situations where the employee was not actually at fault

If the employee was witness to the company violating labor laws or other infractions

What Severance Package Benefits Does the Employee Receive?

In exchange for agreeing to the employer’s terms, the employee may be offered or can negotiate for many different benefits such as:

The value of future salary payments for an agreed amount of limited time

Continuation of insurance benefits including COBRA premiums

Not contesting the employee’s eligibility for unemployment benefits

Providing the employee with help finding new employment

Providing the employee with positive references for future employment

Ownership of company property such as a phone, computer, or car

Additional perks and benefits related to the job such as prorated bonuses

How is Severance Pay Calculated?

Because there are no legal standards for severance pay, there is no universal method for calculating how much an employer might offer. Some employers may determine how much is fair for an individual employee on a case-by-case basis. Some may have a set amount offered in the initial employment agreement. Some may offer a certain number of paychecks based on the length of employment such as one week for each year worked. Others may offer a set value in addition to any unused paid time off.

Planning for Your Severance Package

It is good practice to have a plan for the unfortunate possibility of losing your job. A trying and difficult time can be made easier by adequate preparation. The time to start planning is when searching for a new job in the first place. Asking questions about a potential employer’s severance policies is a good way to make an informed decision going in, and it is important to keep informed on any updates to those policies. Throughout the course of your employment, keep copies of positive performance reviews and records of your value as an employee. This can give you an advantage if you need to negotiate a severance package.

Oftentimes, larger companies will have official severance policies mapped out and available for employee reference. If your employer is one such company, the policy will likely be printed in the employee handbook, or available on request. These policies generally explain:

Purpose – The severance agreement may specify why the company has chosen to offer it. They may also provide information on additional resources to help the employee transition to a new job.

Terms and Conditions – The actions the employee must take in order to receive payment, and actions the employee must agree not to take in order to receive payment.

Eligibility – Since there is no legal requirement for employers to offer severance packages, companies can pick and chose the qualifications needed to receive one. A company might offer severance only to salaried employees, administrative staff, or full time workers.

Legal Releases – Forms and documents the employee will need to sign in order to receive payment.

Possible Modifications – Many companies will reserve the right to modify or eliminate their severance policy for any reason.

Calculations – Since there are no legal guidelines for severance packages, the amount of money and type of benefits offered are up to the discretion of the employer. The agreement may lay out how they came to those decisions such as multiplying paychecks or utilizing unused paid time off.

Payments – The agreement may specify how the money will be received, such as a lump sum or regular payments. This is important to know as it can impact unemployment eligibility and taxes.

Steps to Take Once Laid Off

When an employee is terminated, it is advisable to document what is said during the meeting or conversation and to ask for time to review the severance agreement before signing. Many companies will offer one to three weeks for an employee to look over the documents. It may be a good idea to have a severance pay attorney go over the agreement with you to be sure that it is fair and that you are not signing away a valid right to a lawsuit. It can also be helpful to research how long it would reasonably take for you to find new employment so that you can be sure the amount offered is enough to cover that timeframe.

Negotiating Severance Package

Most companies will allow their employees to negotiate the terms and benefits of their severance agreement. This may be something that the employee can handle on their own, or they may seek the help of an attorney. Regardless of whether or not you negotiate the agreement, it is a good idea to take as much time as possible to review it and understand exactly what you’re agreeing to. There are many aspects of a severance agreement that may be up for negotiation such as:

Amount of Pay – The monetary severance pay offered by the employer. This is usually calculated by multiplying the value of one paycheck by the number of years the employee worked. Employees may negotiate to increase that to one month’s pay for each year worked. Depending on the amount of money being offered, it is also important to understand how the payments may impact unemployment eligibility and taxes.

Departure Announcement – It is recommended that the employee requests to write their own announcement of departure and any recommendation letters. This way you can control the narrative and paint yourself in the best light.

Insurance – Unless you have a spouse or parent who can take you onto their insurance, you’ll want to extend your benefits as long as possible. COBRA is the Consolidated Omnibus Budget Reconciliation Act which gives an employee the right to extend their insurance coverage for a year and a half after the end of their employment. The downside to this is that the employee becomes responsible for the entire premium. When negotiating a severance package, it might be a good idea to ask for the employer to continue paying some if not all of their share of the premium for a length of time.

Liability Release – Almost all employers who offer severance packages will include an agreement for the employee to waive any right to sue the employer. This is an important part to have a lawyer take a look at to be sure that your best interests are protected.

Non-Disclosure – Companies may ask the employee to keep the details of their termination and the severance agreement completely confidential. This can be negotiated to make certain exceptions.

Non-Disparagement – It is common for employers to have their soon to be former employee agree not to say anything negative about them going forward. Employees can also ask that this clause go both ways.

Outplacement Services – Employers often offer outplacement assistance and employees may negotiate the offer or even ask for the financial value of the services in order to hire someone else.

Pensions and Stocks – There are laws regarding retirement plans, pensions, and stock options that vary from state to state. It is important to review those laws before entering severance negotiations.

Perks and Property – If your employment involved the use of a company phone, computer, car, or other personal equipment, you might be able to negotiate transferring ownership to you. There may also be things like parking passes, gym memberships, and discounts that you might be able to extend your use of.

Important Severance Package Considerations

There are several things to remember about severance agreements before entering into one. Be sure to understand all of the following elements to ensure that a severance agreement is written in the employee’s best interest.

Do You Understand the Severance Agreement?

Some companies might overuse complex language to make it difficult for employees to fully understand what they are agreeing to. Never sign a contract you don’t understand. If needed, you can hire an employment lawyer to go over the agreement with you and explain everything.

Mitigation Offset

If a severance agreement contains a mitigation offset clause, the employee will be forced to pay back the severance amount if they obtain new employment within a certain time period. When negotiating your agreement, you should be on the lookout for these clauses and ask that they be removed.

Non-Compete Clauses

In the state of California, it is not legal for an employer to have an employee sign a non-compete agreement. Some employers still try and even if signed, the agreement is not enforceable. When reviewing and negotiating a severance agreement in California, it is best to just have this part removed if it is included.

Common Rights Waived

There are many rights that an employee has once that employment has been terminated. It is often in the employer’s best interest to have the employee waive those rights. This often includes:

The right to sue for discrimination, harassment, defamation, or wrongful termination

The right to discuss the reasons for termination or the terms of the severance agreement

The right to divulge company trade secrets

The right to speak poorly about the employer

The right to sue for any other civil matters

Unenforceable Provisions

There are many things that an employer may be tempted to include in a severance agreement that are not enforceable. This may include:

Waiving the right to sue for wage and hour violations

Waiving the right to report illegal activity committed by the employer

Waiving the right to seek future employment

Refusing to pay earned wages until the agreement is signed

Requiring the employee to do anything illegal

Prohibiting an employee from working with a competitor

An employer is only permitted to have an employee waive their right to sue for age discrimination if an employee is 40 or older and they give the employee at least 45 days to sign and another 7 days to revoke that signature.

When Can a Severance Package Void?

An employee’s severance agreement can be nullified under certain circumstances:

Fraud

If an employee is manipulated into signing a severance agreement by an employer’s fraudulent actions, that agreement is unenforceable. Fraud refers to actions such as making promises they will not fulfill, concealing important information, or lying about important information.

Duress

If an employee is forced to sign a severance agreement under duress, that agreement is unenforceable. An employee is under duress when their employer threatens them in order to get them to sign. These threats generally need to be illegal in nature in order to qualify as duress.

Undue Influence

If an employee is coerced into signing a severance agreement by an employer imposing undue influence on them, that agreement is unenforceable. Undue influence is defined as excessive pressure applied on an employee that exploits their weaknesses.

Unconscionability

If the terms of a severance agreement are considered unconscionable, then not only are those terms unenforceable, but the entire agreement may be declared unenforceable as well. There are two types of unconscionability: procedural and substantive.

Procedural unconscionability – When one side of the agreement has significantly more bargaining power than the other, or if the situation was unfair.

Substantive unconscionability – When the terms of the agreement are too harsh or one sided.

How Can an Employment Lawyer Help

Employees are under no legal obligation to sign an offered severance agreement. It is a contract like any other and the employee has the right to have an attorney go over it with them. Some employers may take advantage of an employee’s fraught emotional state at the time of termination and convince them to sign an agreement they don’t understand. Speaking with an employment lawyer can help you identify unfavorable terms, clear up complicated language, and determine if it would be more favorable to exercise the rights you are being asked to sign away.

There are many factors that may indicate that you should consult with an attorney:

If the language of the agreement is complex or vague

If the employer is trying to pressure you to sign it right away

If the employer is unwilling to negotiate the terms

If the employer is aware of your financial situation

If the agreement is one sided or unbalanced

If you believe your employer is being dishonest

If your employer tells you not to speak with an attorney

Contact Mesriani Law Group to Help Negotiate a Severance Package

The unexpected termination of a job can be a stressful and emotional time and you may not be in the best state of mind to be making legal decisions. A severance agreement is a contract, and it is important to be sure that the terms are in your best interest. An employment lawyer can help review the agreement and explain the terms as well as advise you on areas you may want to negotiate. If you have been terminated from your job and your employer is offering you a severance package and asking you to sign an agreement, call Mesriani Law Group today.

Severance Pay FAQ

How is severance pay determined?

There is no set legal standard for calculating the amount of severance pay an individual employee may receive. This is up to the discretion of the employer and whatever they decide to offer. That said, most employers will take the value of the employee’s weekly or biweekly paycheck and multiply that by the number of years the employee worked for the company. Severance pay can often include the value of unused paid time off as well.

Why do you get severance pay?

The optimistic perspective of severance pay is that when an employee is terminated through no fault of their own, the employer may wish to make the transition easier and give them a cushion to fall back on while they seek new employment. A more cynical perspective may suggest that the point is to entice employees into signing away their rights to sue, discuss their termination, or speak ill of the company.

Who qualifies for severance?

Both federal and California employment law do not require employers to offer severance pay to any employees. The qualifying factors for who receives severance is up to the individual employers. Some companies may not offer it at all. Others may only offer it to salaried employees, full time employees, or just upper management. Some companies may include details about severance in their employment contracts and handbooks.

What is the difference between severance pay and separation pay?

Severance pay and separation pay are actually the same thing. Both terms refer to the amount of money an employer may offer when terminating an employee. Severance pay may be part of a severance package that includes other benefits and perks as well. In order to receive all of this, the employee may be asked to sign a severance agreement that holds them to certain terms and conditions.

#California Employment Law#Severance Pay#Severance Package#Severance Agreement#Employment Law#Employment Lawyers#California Attorneys

0 notes

Text

What is Overtime Pay in California?

In the state of California, nonexempt employees are entitled to overtime pay of:

5 times their normal rate of pay for each extra hour worked over 8 hours in a day or more than 40 hours in a week.

2 times their normal rate of pay for hours worked over 12 hours in a day or if they work seven days straight and work more than 8 hours on the seventh day.

Sometimes, workers who are nonexempt may be paid differently than an hourly wage and their overtime pay is calculated accordingly. Exempt workers are those to whom the overtime laws do not apply. There are also some special exceptions that have their own guidelines.

What is the Regular Rate of Pay?

An employee’s regular rate of pay is the way their compensation for their work is calculated. This could be by the hour, per year, by piecework, or on commission. Regardless of how the rate of pay is calculated, it can never be lower than the minimum wage. It can also never exceed an 8 hour workday or a 40 hour workweek. There is however a standard under Industrial Welfare Commission Wage Orders that allows for alternative workweek schedules consisting of either 4 days of 10 hour shifts or 3 days of 12 hour shifts. For these schedules, the rate of pay is based on the 40 hour workweek.

Some agreed upon schedules come out to less than 40 hours per workweek. Although a set agreed upon work week may total under 40 hours, the employer is not obligated to pay overtime until the employee works more than 8 hours in a workday or 40 hours within that workweek.

How Much is Overtime Pay in California?

In order to qualify for overtime, the following parameters must be met:

Hours paid time and a half:

Over 8 and up to 12 hours per workday

Over 40 regular hours per workweek

The first 8 hours of the 7th��day worked in a row per workweek

Hours paid double time:

Over 12 hours per workweek

Over 8 hours on the 7th day worked in a row per workweek

How to Calculate Overtime Pay in California

Step 1: Determine Workweek vs Workday

Workday – The default workday begins at 12:01 in the morning. However, employers are able to set their workday to be any block of 24 hours that begins at the same time every calendar day. If an employee works more than 8 hours in a workday, they are entitled to overtime pay for the extra hours worked. Employers are not permitted to average out hours across multiple days. If an employee works 6 hours one day and 10 hours the next, they receive 2 hours of overtime pay.

Workweek – A workweek is a set period of seven days that begins the same calendar day every week. While employees within the same company may have different workweek schedules, a workweek is set for each individual employee and can not be changed unless it is being permanently altered. If an employee works more than 40 hours within a workweek, they are entitled to overtime pay.

Step 2: Calculate Hours Worked

Employees must document the times that they punch in for work, out for break, back in from break, and out for the day. Most employers have a system for all employees to do this, so that the employer can then calculate the hours worked for each person.

Step 3: Determine Amount of Daily Overtime Hours

When calculating daily overtime for nonexempt employees, employers must pay

Time and a half for hours worked over 8 and up to 12

Time and a half for the first 8 hours of the seventh day worked in a row

Double time for hours worked over 12

Double time for hours worked over 8 on the seventh day worked in a row

Step 4: Determine Amount of Weekly Overtime Hours

When calculating weekly overtime for nonexempt employees, employers must pay

Time and a half for hours worked over 40

Step 5: Calculate Daily vs Weekly Overtime Hours

According to California state law, both daily and weekly overtime hours must be taken into account. The overtime hours themselves are only counted once, but they also do not negate each other. This is to protect workers in situations such as if someone works more than 8 hours a day, but they worked less than 40 hours that week. Determining overtime on both a daily and weekly basis ensures that employee gets paid properly. The way this works is:

When an employee’s daily overtime is the same or more than the employee’s weekly overtime, then they must be paid in accordance with daily overtime. In these cases, the weekly overtime is already included in the daily overtime.

When the employee’s daily overtime hours are less than the number of weekly overtime hours, then the remaining time must be accounted and compensated for.

Employers must also ensure that daily double time rules are being followed when calculating weekly overtime as well.

Employers can keep track of these hours by accounting for the hours worked and separating the regular rate of pay from the overtime. This ensures that all hours are accounted for and paid correctly.

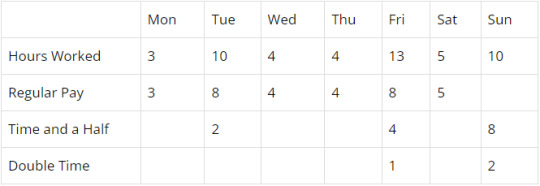

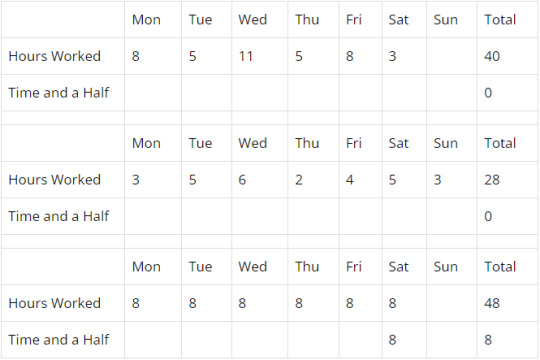

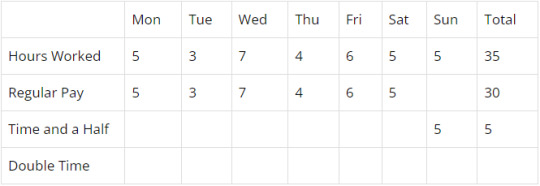

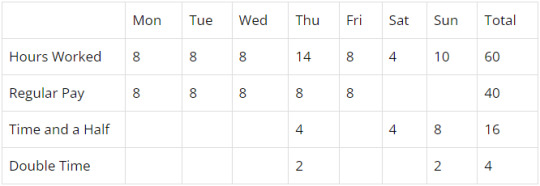

No weekly overtime, but time and a half daily overtime for the seventh day in a row worked:

No daily overtime, but time and a half weekly overtime paid for hours worked over 40 in the workweek:

Both daily and weekly overtime:

Time and a half for daily hours worked over 8 up to 12

Time and a half for the first 8 hours of seventh day worked in a row

Double time for hours worked over 12

Double time for hours over 8 on seventh day worked in a row

Time and a half for weekly overtime hours over 40

Step 6: Determine Base Rate of Hourly Pay

Since overtime is 1.5 or 2 times the employee’s regular rate of pay, it is important to figure out what that is. An employee’s regular rate of pay is generally the amount of money earned by the employee each hour generally calculated by dividing the total compensation for the workweek by the hours worked. There are many different ways in which employers pay out their employees’ compensation, and so different ways for the regular rate of pay to be calculated.

Hourly Non-Exempt Employees

The regular rate of pay for hourly employees is the amount of money they earn each hour. If they also receive bonuses or commissions, those are divided by the number of hours worked.

So, if an employee makes $20 an hour, then their overtime pay would be $30 an hour or $40 an hour for double time.

Sometimes, employees are paid different rates within the same workweek. In these cases, the regular rate of pay is calculated by dividing all earnings throughout the week by all of the hours worked. The overtime premiums are then added to the applicable overtime hours afterwards. So, if an employee works 20 hours at $10 an hour and 30 hours at $15 an hour, their total earnings would be $650 which would be divided by 50 for a regular rate of $13. $6.5 would be added to every overtime hour that earned time and a half, and $13 would be added to every overtime hour that earned double time.

Sometimes, employees also earn flat-sum bonuses on top of their hourly rates. When this happens, the bonus is divided by the amount of non-overtime hours they worked, and then that amount is added to the hourly rate. The final sum is the number used to determine the overtime rate of pay. So, if an employee works 45 hours in a workweek at $10 with a weekly bonus of $100, the $100 would be divided by 40 making $2.5 which would make the regular rate of pay $12.5 which would be used to calculate the applicable overtime.

Piece Rate or Commission Employees

There are several different methods that can be used to calculate regular rate of pay for employees who are compensated by piece or commission:

The rate that the employee is paid by piece or commission is considered the regular rate, and that number is multiplied by 1.5 for hours worked over 8 up to 12 in a workday and multiplied by 2 for hours worked over 12 per workday.

The total amount of money earned for the workweek is divided by the total hours worked for the workweek. The overtime premium of that number is then added to the applicable overtime hours.

For group rates, the amount of pieces the group produced during the workweek is divided by the amount of people in the group. Each member of the group is paid accordingly, and that amount is then divided by the hours worked.

Salaried Non-Exempt Employees

When a salaried employee is nonexempt, their salary only covers regular hours worked. In these situations, those employees are entitled to overtime pay. To determine the regular rate of pay for a full time employee, the weekly salary is divided by 40. If the employee is paid monthly, the monthly rate is multiplied by 12 months in a year, then that number is divided by 52 weeks in year, then that number is divided by 40 hours in a week.

Are Salaried Employees Entitled to Overtime?

Some salaried employees may be exempt from overtime pay for many reasons:

Federal law

State Law

California Labor Code Provision

Industrial Welfare Commission Wage Orders

If the salaried employe does not meet the requirements for exemption status, then the employer must pay them overtime rates when overtime hours are worked.

Employees That Are Paid Different Rates Within the Same Job

When employees are paid two or more different rates at the same job within the same workweek, the weighted average is found by dividing the total amount of money earned by the total number of hours worked. So, if an employee worked 20 hours at $10 an hour, 20 hours at $12 an hour, and 10 hours at $14, the weighted average would be $580 divided by 50 hours, totaling $11.6 an hour.

Employees that Receive Bonuses

Nondiscretionary bonuses are included when calculating an employee’s regular rate of pay for the sake of overtime if that bonus is for how many hours they worked, a reward for high performance, or an incentive to stay with the employer.

When calculating regular rate of pay on a flat sum bonus for the sake of overtime, the amount of the bonus is divided by the number of regular hours the employee worked. That amount is then used to calculate the time and a half or double time to be used for any additional overtime hours.

When calculating regular rate of pay on a production bonus, the amount of the bonus is divided by the number of hours the employee worked during the bonus period. That amount is then used to calculate the time and a half or double time to be used for any additional overtime hours in the bonus period.

Bonuses that are not factored into overtime pay are discretionary bonuses such as holiday gifts or special rewards.

Who Is Exempt from California Overtime Laws?

The most notable exempt workers are those who earn a fixed salary that is equal to or greater than double the minimum wage.

There are specific salaried job categories that are generally exempt such as:

Normally Exempt Roles

These requirements reduce the likelihood that high salaried professionals are not able to enjoy the benefits of overtime pay. However, these roles are often rewarded in amounts of compensation that far exceed the need for overtime pay.

Executives

Administration

Professional Employees

Outside Salespeople

The requirements for being classified as an exempt outside salesperson are:

18 years old or older

51% or more of their work is conducted away from the business

They sell products, contracts, the performance of services, and/or the use of facilities

Unionized Employees

Not all union workers are exempt. Exemption for unionized workers requires:

That the collective bargaining agreement explicitly provides for wages and working hours and conditions

That the collective bargaining agreement explicitly provides for regular rate of pay and premium overtime rates that are 30% or higher than state minimum wage

Job Specific Exceptions

The California Industrial Welfare Commission outlines certain job specific exceptions to overtime laws such as:

Agricultural workers

Ambulance workers

Camp Counselors

Live-in household workers

Retirement home managers

Personal attendants

Some 24-hour residential childcare providers

The parents, spouse, and children of the employer

Independent Contractors

The requirements for being an independent contractor are:

Someone who is contracted to perform a specific service for a specific amount of pay

Someone who has complete control over when and how the service is completed

Alternative Schedules

Sometimes, employees may agree to alternative schedules such as working a 40 hour workweek as 4 days of 10 hour shifts. These schedules are not bound by overtime laws. A valid alternative workweek schedule must be:

Voted on via secret ballot by the affected employees

Approved by a two-thirds majority

Reported within 30 days by the employer to the Division of Labor Standards Enforcement

Employers are not permitted to retaliate against any employees for their stance on alternative schedules. Employees working an alternative schedule are still entitled to overtime pay when:

They work more than the daily agreed upon hours

They work more than 40 hours in a workweek

Nonresidents

In the state of California, all nonexempt workers are protected by the state’s overtime laws, including those who are not residents of the state or citizens of the country. There is some back and forth about whether workers who work in the state for less than a day at a time should also be protected by those same laws.

Step 7: Calculate Total Overtime and Pay Balance

According to Labor Code Section 204, overtime in California must be paid by the payday for the next payroll period. The regular hours for that pay period must be paid on time, only the overtime pay may be paid the following payday.

Are Any Amounts Excluded from Overtime Pay?

There are some types of payments and compensation that may not be included when calculating overtime in California such as:

Discretionary Bonuses

Expenses

Gifts

Holiday Pay

Paid Time Off

Can Overtime Be Waived?

In the state of California, all nonexempt employees must be compensated for any overtime worked. If an employer has an employee sign an agreement waiving their right to overtime pay, that waiver is unenforceable, and the employee is still entitled to their overtime pay.

Can an Employer Require Overtime?

In most cases, employers in California are allowed to require their employees to work overtime. One big exception is that employers are not permitted to require employees to work seven consecutive days in a row with no day off for rest. Employees are however able to waive their rest day provided they are aware of their right to take it if they choose.

Are Employers Responsible for Paying Unapproved Overtime?

In the state of California, all nonexempt employees must be paid overtime pay for all overtime hours worked regardless of managerial approval. While employers are permitted to discipline employees who work unapproved overtime, they can not refuse to pay them. In accordance with California law, employees must be paid for whatever time they were suffered or permitted to work. This means that the employer is responsible for any compensation owed for hours worked that they knew about or should have known about.

What Can an Individual Do if Overtime Isn’t Paid?

If an employee was not paid properly for overtime hour worked, they can contact the Department of Labor, file a claim with the Division of Labor Standards Enforcement, or file a lawsuit to sue for the money. When suing a former employer, they can also file a claim for a waiting time penalty in accordance with Labor Code Section 203.

What is the Wage Claim Filing Process?

After an employe files a claim with the Division of Labor Standards Enforcement, that claim is then assigned to a Deputy Labor Commissioner. They will then decide whether to:

Refer the matter to a conference – The parties involved are brought together to meet and attempt to resolve the issue out of court.

Refer the matter to a hearing – The parties involved will testify under oath during a recorded hearing. Afterwards, the Labor Commissioner will serve an Order, Decision, or Award (ODA) to the parties.

Dismiss the matter

The ODA may be appealed by either party. The matter will then be sent to trial where the parties involved will present their cases again, without the initial hearing bearing primary weight on the court’s final decision. IF the employer is the one appealing the ODA and the employee can not afford legal representation, the DLSE may opt to represent them.

What Do I Do If I Win an Overtime Pay Claim But the Employer Fails to Pay?

Sometimes, an Order, Decision, or Award will be in the employee’s favor and the employer will not appeal but will refuse to pay. In this instance, the Division of Labor Standards Enforcement will request that the ODA be entered as a court judgement.

Contact Mesriani Law Group if You Are Owed Overtime Pay

In the state of California, employers are legally required to pay all nonexempt employees 1.5 times their regular rate of pay for hours worked over 8 and up to 12 in a work day, hours over 40 in a work week, and the first 8 hours of the seventh day worked in a row in a workweek. They are also legally required to pay 2 times their regular rate of pay for hours worked over 12 in a workday, and hours over 8 on the seventh day worked in a row. Unfortunately, not all employers properly pay their employees. If you believe your employer has not paid you properly, call Mesriani Law Group today.

Overtime Pay FAQs

How does overtime work?

In the state of California, if an employee works more than 8 hours and up to 12 hours in a workday, those hours are compensated at 1.5 times their normal rate of pay. Also compensated at time and a half are hours worked over 40 in a workweek and the first 8 hours worked on the seventh consecutive day in a row. Hours over 12 on a workday and hours over 8 on the seventh day in a row are compensated at 2 times the normal rate of pay.

Do overtime hours count towards 40 hours in California?

All hours count towards total hours worked. Hours worked over 8 in a workday are daily overtime. Hours worked over 40 in a workweek are weekly overtime. If hours count as both daily and weekly overtime, they are only counted once.

Is 7th day double time in California?

According to California state labor laws, the first 8 hours worked on the seventh consecutive day in a row worked in a workweek are paid at time and a half. Any hours worked after those first 8 hours are paid at double time.

#California Employment Laws#Overtime#Overtime Pay#Wage and Hour Violations#Employment Law#Employment Lawyers#California Attorneys#Workplace Discrimination#Workplace Retaliation

0 notes

Text

What are California Paid Sick Leave Laws?

Thanks to the 2014 Healthy Workplace Healthy Family Act, employers in the state of California are required to provide their covered employees with sick pay. For every thirty hours an employee works, they earn one hour of sick leave. However, employers are allowed to limit employees to 24 hours of sick leave in a year. Sick leave may be used for a myriad of reasons including:

Tending to an illness

Recovering from an injury

Seeking a medical diagnosis

Tending to an ill or injured relative

Self-quarantining due to COVID-19 exposure

Dealing with the complications of abuse, assault, or stalking

California Paid Sick Leave Requirements

There are some requirements and limitations for obtaining paid sick leave:

Full time and part time employees including temps and seasonal workers are covered provided they worked for the employer at least thirty days within a twelve month period.

Employees earn an hour of paid sick leave for ever thirty hours they work with few exceptions.

Employers are allowed to limit employees to 24 hours of paid sick leave each year.

Accrued sick time must be rolled over into the new year, however employers may limit the amount to 48 hours.

Employers are not required to carry over unused lump sum paid sick time.

Employers Obligation to Paid Sick Leave Laws

There are many things that California employers must do in order to comply with the Department of Industrial Relations such as:

Have a poster explaining paid sick leave posted where all employees can easily read it.

Have a written explanation of paid sick leave policies given to new employees when they are hired.

Allow employees to earn an hour of paid sick time for every thirty hours worked.

Provide earned sick leave at the employee’s request.

Keep employees informed of how much sick time they have, either as part of their paystub or provided on each pay day.

Maintain records of employees’ sick time both accrued and used going back three years.

Who is Covered by California Paid Sick Leave Laws?

The HWHFA covers all of California, but there are some exceptions depending on the job, circumstances, and even location. Generally, a California employee is covered if they have worked for the same employer for at least 30 days within a year regardless of if they are full or part time. Temporary and seasonal workers are also generally covered when they meet this requirement. If an employee is covered and then leaves a job, but then returns within a year, they will be covered as soon as they are rehired.

Exceptions, exemptions, and restrictions may apply to:

Government employees

Employees working under specific collective bargaining agreements

Home care support workers

Air carrier workers

Cities with their own sick leave ordinances are bound by both local and state regulations such as:

Berkeley

Emeryville

Los Angeles

Oakland

San Diego

San Francisco

Santa Monica

How Much Paid Sick Time Can Be Earned?

Generally speaking, California sick leave law requires that employees be given 1 hour of paid sick leave for every 30 hours that they work. The amount of paid sick leave an employee can earn may be capped at 48 hours per year, though employers are allowed to cap it at as low as 24 hours. There are however some cities that have their own laws and regulations regarding paid sick leave:

Oakland

< 10 Employees = 40 hours sick leave per year

> 10 employees = 72 hours sick leave per year

San Francisco

< 10 Employees = 48 hours sick leave per year

> 10 employees = 72 hours sick leave per year

Berkley

< 25 Employees = 48 hours sick leave per year

> 25 employees = 72 hours sick leave per year

Santa Monica

< 25 Employees = 40 hours sick leave per year

> 25 employees = 72 hours sick leave per year

Emeryville

< 55 Employees = 48 hours sick leave per year

> 55 employees = 72 hours sick leave per year

San Diego

All employees receive at least 40 hours sick leave per year

Los Angeles

All employees receive at least 48 hours sick leave per year

Ways to Earn Paid Time Off

There are several different ways that employers may decide to provide sick leave for their employees:

Statutory Accrual – Paid sick time begins accruing the first day of employment. At the minimum of 1 hour earned for every 30 hours worked, a standard 40 hour workweek would result in 1.33 hours earned.

Other Accrual – Employers may develop their own system for accruing paid sick time provided that the hours are received on a regular basis and result in at least 24 hours within the first 120 days after the employee is hired.

Lump Sum – Some employers may opt to just give employees all of their sick time at the beginning of each year. This does not mean that it has to be every January. Employers are permitted to decide which date to use as the start of the new year so long as it is consistently every 12 months. Many employers may choose the employee’s hire date as lump sum overtime must be given to new employees within 120 days of being hired.

Existing PTO Policy – Some employers may have separate vacation and sick time while others may combine them as one paid time off total. So long as the amount of time given meets the minimum requirements for paid sick leave, it is permissible.

Grandfathered Policies – There are some policies that had been established before 2015 that are permitted to remain in place afterwards provided that:

Paid time off is accrued by at least 8 hours every 3 months

Paid time off is earned by at least 24 hours within 9 months

Types of Paid Sick Leave in California

There are many different reasons why an employee may need to take sick leave. These reasons are often due to a personal illness or injury, the need to take care of an ill or injured relative, or even the complications that arise from being the victim of domestic violence. There are different types of paid leave depending on the details of the situation.

PSL – Paid Sick Leave

California state law maintains that all eligible employees receive at least 24 hours of paid time off every year in case of:

The need to heal from a personal illness or injury

The need to receive preventive care

The need to seek a diagnosis or receive treatment

The need to take care of a relative in the above situations

Eligible employees meet the following requirements:

Full-time, part-time, temporary, or seasonal employees

Are employed in the state of California

Have worked for the employer in question for at least 30 days within a year

Have been employed by the employer in question for 90 days prior to taking leave

Employers are permitted to have their own policies and accrual methods provided that they meet the minimum requirements set out by the law. Some cities have their own laws added to the state law that provide higher minimums in certain situations.

SPSL – Supplemental Paid Sick Leave for COVID-19 (Expired)

In 2021 and 2022, new laws were put in place so that employees could receive additional separate paid leave in order to quarantine and recover from COVID-19.

Other Paid Leave Options

Vacation pay is one of the most well-known types of paid time off. In the state of California, it is completely optional. There is currently no law that states that an employer must have a paid or even unpaid vacation time policy. However, there are laws in place for employers who do have such policies, to ensure that those policies are being followed.

Workers’ compensation is an insurance policy that all employers must have to care for employees who suffer illness or injury due to their job.

What Reasons Qualify for Paid Sick Leave in California?

Employees have the right to utilize their sick time when needed and do not need to provide an explanation to their employer as to the reason why. There are many reasons that a person may need to take sick leave such as:

Being ill or injured

Receiving preventive care

Seeking a diagnosis or treatment

Taking care of an ill or injured family member

Complications caused by abuse, assault, or stalking

The definition of family member is broad and, in some areas, even broader. The law allows an employee to utilize their sick pay to care for their immediate and extended family as well as designated persons who may not be related by blood or law but are considered part of the family.

Employees who are experiencing or have experienced abuse, assault, or stalking may need to utilize their sick time in order to:

Get a restraining order

Go to a shelter or crisis center

Tend to related injuries

Receive mental health care

Take preventative measures against future incidents

Paid Sick Leave Considerations

Accrual Cap – Employers are permitted to limit the amount of sick leave an employee can earn in a year at 24 to 48 hours.

Increment Minimums – Sometimes, employees need to use sick leave for something like a short doctor visit that may not require them to take the entire day. They may only want to use up an hour or so of their sick time. Employers are allowed to impose minimum increments as high as two hours.

Limits – Employers are permitted to limit employees to utilizing only 24 hours or 3 days a year, whichever is more. For an employee whose daily shifts are regularly 8 hours, this amounts to 3 days at 24 hours total. However, an employee who regularly works 10 hour days may utilize 3 days at 30 hours a year. But for an employee who only works 4 to 6 hour shifts, they may take more than 3 days to reach 24 hours.

Waiting Periods – Employers are permitted to impose waiting periods of up to 90 days after the date of hire before a new employee is permitted to utilize accrued paid sick leave. However, even if this waiting period is in place, sick time is still earned starting the date of hire. If the sick pay policy provides leave as a lump sum, the employer has 120 days in which they can wait to provide leave to a new employee.

How to Determine Pay for Paid Leave

When a nonexempt employee utilizes their paid sick leave, they must receive their normal rate of pay. If the employee is paid weekly, then the non-overtime rate of pay would be divided by the amount of non-overtime hours they worked that week. Another method for determining rate of pay is to take the amount of money earned for the previous 90 days and divide that by the number of hours worked, excluding overtime. For exempt employees, sick time should be paid the same way any other paid time off is handled.

Does Paid Sick Time Accrue Each Year?

If an employee does not utilize all of their accrued sick time within a year, the amount left over is carried into the next year. However, this does not necessarily mean that sick time is unlimited. Employers are permitted to limit the amount of sick time an employee can earn up to 48 hours. If an employer provides lump sum sick time, unused time does not have to be carried over into the next year.

Does Paid Sick Leave Get Paid if an Employee Gets Fired or Quits?

While employers must pay their employees for any unused vacation time when they quit or are fired, California state law does not require employers to pay their employees out for unused sick time at the end of employment.

Does Paid Sick Time Reinstate with Seasonal Work?

If an employer does not pay out an exiting employee’s unused sick time and then that employee returns to that same job within a year, the employer is required to restore any unused sick time they had when they left. If the employer did pay out that time, they do not have to restore it.

What if I already Have Paid Time Off?

Some employers have their own policies and systems in place to provide their employees with paid time off. There are several instances wherein such employers have their own way of handling sick leave that must adhere to certain standards such as:

If the policies in place provide paid time off of at least 24 hours a year and permit employees to use that time for health care needs, then they do not need to provide additional specific sick leave

If the employer has its own sick leave policy or multiple plans and policies, they must follow the legal outlines for accrual and usage

If the policies exceed the legal requirements and have their own terms and conditions, they must clearly specify what those terms are

What if Paid Sick Leave Time Runs Out?

When an employee utilizes all of their paid sick leave, the employer is not required to provide them with more. However, if the employee takes unpaid time off to deal with health related issues, there are some state and federal laws that may protect them. The California Family Rights Act and the Family Medical Leave Act allow for eligible employees to take health care related unpaid leave without the fear of losing their job or being retaliated against by their employer.

Can Employers Deny Sick Days?

Employers are not legally permitted to forbid their employees for taking sick days. They are also not permitted to retaliate against employees for requesting or taking sick days. Employees are also not responsible for finding their own replacement when taking sick days. There are however some variables concerning whether or not an employer can require their employees to provide a doctor’s note.

How to Deal with an Employer Who Denies Sick Days or Fails to Pay Sick Leave?

If an employer does not provide their employees with paid sick leave, tries to deny sick leave, does not pay for utilized sick time, or commits other violations of sick leave laws, then the employees can file a civil suit against them.

Sometimes, employers may try to retaliate against employees for taking sick leave, filing complaints, or participating in investigations by:

Demoting them

Cutting their hours

Making threats

Blackmailing them

Termination

If an employer retaliates against an employee for exercising their rights, that employee can pursue legal action against them.

Damages for Being Retaliated Against for Taking Paid Sick Leave

There are many different types of damages that an employee may sue for when their employer violates their sick leave rights or retaliates against them such as:

Back pay

Interest

Unpaid sick time

Up to 3 times damages for unpaid sick time, up to $4k

Administrative penalties

Attorney’s fees

Contact Mesriani if You Have Been Denied Sick Time

In the state of California, employers are legally required to provide eligible employees with paid sick leave. Unfortunately, some employers may refuse to allow their employees to utilize their leave or retaliate against them for doing so. In these situations, it may be best to seek help from an employment attorney. Our lawyers have the experience necessary to advise you through your difficult situation and help you receive the compensation you deserve. If your rights to paid sick leave have been violated, call Mesriani Law Group today for a free consultation.

Paid Sick Leave FAQs

What is the new sick leave law in California?

In response to the pandemic, laws were enacted to give people the opportunity to quarantine and recover if they tested positive for COVID. In 2021, the Supplemental Paid Sick Leave For COVID-19 law was put in place to provide employees with two weeks of additional paid leave specifically for COVID. Another law was implemented in 2022 extending this benefit to the end of the year.

How many sick days do you get in California 2022?

The California paid sick leave law as of 2022 is that employers must provide eligible employees with no less than three days or 24 hours of paid time off each year for heal care related matters. Employers are allowed to provide those hours as a lump sum at the beginning of each year or require their employees to accrue them over time at a rate of one hour earned for every 30 hours worked.

How do sick days work in California?

Every year, eligible employees receive at least 24 hours of paid sick time. Employees are permitted to utilize those hours for the sake of their own health care or to care for a family member. Employers are not permitted to refuse an employee’s right to paid sick leave or retaliate against the employee for exercising that right. When an employee leaves their job, their employer is not obligate to pay them for any unused sick time.

How many sick days can you get without a doctor's note in California?

You are not obligated to explain to your employer exactly why you are utilizing your paid sick days, and they are not permitted to deny your request for sick leave. However, there are occasions where they may require a doctor’s note, especially if you take multiple days off in a row. There is some back and forth on this issue within the law. Essentially, your employer can ask for a doctor’s note, but they can not retaliate against you for not providing one.

#California Employment Law#Sick Leave#California Paid Sick Leave#Sick Pay#PTO#Paid Time Off#Medical Discrimination#Disability Discrimination#Employment Law#Employment Lawyers#California Attorneys

0 notes

Text

Examples of Age Discrimination in the Workplace

In 1967, the Age Discrimination in Employment Act (ADEA) was put in place to protect workers who are 40 years old or older from discrimination on the basis of their age. While employers are forbidden from discriminating against or harassing their employees because of their age, it does unfortunately still happen. In a survey conducted by the American Association of Retired Persons in 2018, it was revealed that approximately 60% of employees over 45 have experienced age discrimination at work, and most consider their age to be a determining factor in being unable to find new employment.

What is Age Discrimination in the Workplace?

Age discrimination in the workplace generally manifests as older workers being refused employment or advancement, facing harassment, or even being terminated due to their age. In some industries such as those relating to technology, employers perceive older workers as being less knowledgeable and capable. Age discrimination is so pervasive that roughly 2/3 workers over 45 said they had experienced some level of age discrimination.

Sometimes, age discrimination can also be tied together with gender discrimination. The AARP discovered that 72% of female workers over 45 believe age discrimination is a problem whereas only 57% of male employees over 45 felt the same.

Age Discrimination Laws

Employers who are bound by the ADEA and other federal laws related to everyday ageism in the workplace include:

Businesses with 20 or more employees

Labor organizations with 25 or more members

Government entities

Employment agencies

Workers who are NOT protected by the ADEA include:

Military personnel

Independent contractors

People under 40

There are many areas of employment in which an employer may discriminate against an older worker including but not limited to:

Benefits

Demotions

Discipline

Duties and assignments

Evaluations

Forced retirement

Hiring

Interviews

Job descriptions

Job postings

Layoffs

Promotions

Raises

Training

Termination

Wages

Types of Age Discrimination in the Workplace

There are different types of discrimination that people may face at work due to their age:

Direct Discrimination – This is when employees are denied opportunities. This may manifest as younger employees being given training and advancement that are not offered to older employees. Sometimes an older and younger employee are both up for promotion and they have the same qualifications, and the younger employee is chosen for reasons other than age. It is important to know all of the facts of a situation when determining discrimination.

Indirect Discrimination – This is when policies and practices are put in place to deliberately exclude certain employees. This may manifest as job qualification requirements that are not necessary but put older employees at a disadvantage. Sometimes, there may be a legitimate reason for these policies, and this would need to be taken into account.

Harassment – This is when employees are mocked and berated by their boss or coworkers. This may manifest as jokes about their age, comments that they are too old to perform their work, pressuring them to retire, and holding them to a much higher standard than younger employees in the same position.

Retaliation – This is when an employer takes adverse employment action against an employee for filing a complaint or cooperating with an investigation into another employee’s complaint. This may manifest as demotions, cut hours, undue reprimands, and even termination.

Common Examples of Workplace Age Discrimination

The age discrimination examples below highlight some of the most pervasive forms of age discrimination:

Not Being Hired

Employers are not permitted to refuse to hire someone on the basis of their age. Some industries have a habit of only employing younger people and discriminating against older workers.

Hospitality Industry – median age of 31

Retail Industry – median age 39

Business Services Industry – median age 42

Construction Industry – median age 42

Education Industry – median age 43

Manufacturing Industry – median age 44

Financial Industry – median age 44

Transportation/Utilities Industry – median age 45

Some industries such as STEM fields may discriminate against older workers because they believe only younger workers are knowledgeable of new developments. Industries that involve physical speed and strength such as hospitality and construction may discriminate against older workers because they believe they can not keep up with the demands of the job.

Being Denied a Promotion

Sometimes, an older employee is up for a promotion that is then given to a younger employee who is not as qualified as they are. Sometimes there are other factors involved, but if there is a pattern of this practice within the company, there may be a stronger case for age discrimination.

Being Overlooked for Work Opportunities

Older employees are sometimes given less work and duties than younger employees and are passed over for projects and advancement opportunities. This has the effect of both making the worker look bad as well as a way to push them towards quitting or retiring.

Being Isolated from the Rest of a Team