#Overtime Pay

Text

You need to watch this and pass it along.

According to Project 2025, the only REAL family is a man, his wife, and their children.

They're going to eliminate overtime pay.

They want pregnancy and abortion surveillance.

They want to jail teachers and librarians because of "banned books."

Trump IS Project 2025.

#this is important#trump IS Project 2025#trump#Project 2025#Project 2025 is Agenda 47#Agenda 47 is Project 2025#overtime pay#reproductive rights#reproductive freedom#the only REAL family is a man his wife and their children#child labor laws#teachers#librarians#abortion surveillance#pregnancy surveillance

89 notes

·

View notes

Text

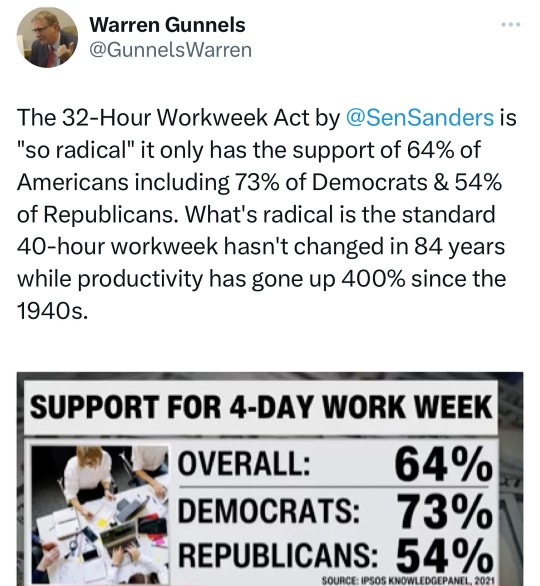

#bernie sanders#work week reduction#32-hour work week#overtime pay#productivity#technology#fair labor standards act#international examples#france#norway#denmark#germany#well-being#stress#fatigue#republican senator bill cassidy#small enterprises#job losses#consumer prices#japan#economic output#labor dynamics#artificial intelligence#automation#workforce composition

120 notes

·

View notes

Text

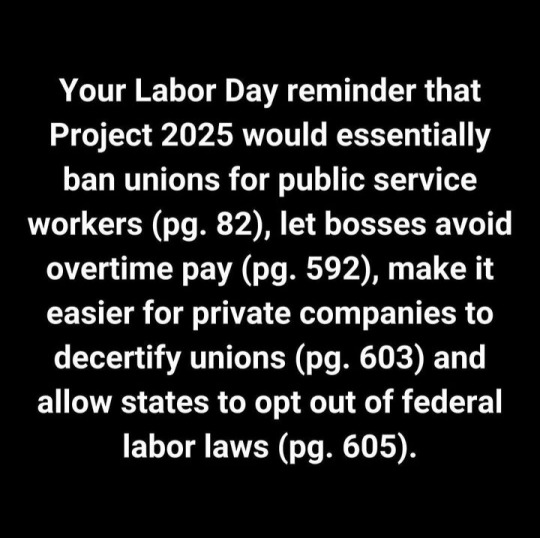

I meant to post this yesterday but I got caught up doing things. Fuck project 2025 - go join a Union!

And as always fuck Donald Trump!!!

#project 2025#join a union#unions#workers rights#pay attention#labor laws#overtime pay#trump#fuck trump#trump cult#republicans#vote blue#kamala walz#kamala 2024

48 notes

·

View notes

Text

Democrats deliver.

#overtime pay#salaried workers to get overtime#Biden administration expands overtime pay to millions#Democrats deliver#democrats help the common man#republicans serve the rich#republican assholes#never trump

138 notes

·

View notes

Text

Craig Harrington at MMFA:

The economic policy provisions outlined by Project 2025 — the extreme right-wing agenda for the next Republican administration — are overwhelmingly catered toward benefiting wealthier Americans and corporate interests at the expense of average workers and taxpayers.

Project 2025 prioritizes redoubling Republican efforts to expand “trickle-down” tax cuts for the wealthy and deregulation across the economy. The authors of the effort’s policy book, Mandate for Leadership: A Conservative Promise, recommend putting key government agencies responsible for oversight of large sectors of the economy under direct right-wing political control and empowering those agencies to prioritize right-wing agendas in dealing with everything from consumer protections to organized labor activity.

[...]

Project 2025 would chill labor unions' abilities to engage in political activity. Project 2025 suggests that the National Labor Relations Board change its enforcement priorities regarding what it describes as unions using “members' resources on left-wing culture-war issues.” The authors encourage allowing employees to accuse union leadership of violating their “duty of fair representation” by having “political conflicts of interest” if the union engages in political activity that the employee disagrees with. [Project 2025, Mandate for Leadership, 2023; National Labor Relations Board, accessed 7/8/24]

Project 2025 would make it easier for employers to classify workers as “independent contractors.” The authors recommended reinstating policies governing the classification of independent contractors that the NLRB implemented during the Trump administration. Those Trump-era NLRB regulations were amended in 2023, expanding workplace and labor organizing protections to previously exempt American workers. [Project 2025, Mandate for Leadership, 2023; The National Law Review, 6/19/23; National Labor Relations Board, 6/13/23]

Project 2025 would reduce base overtime pay for workers. The authors recommend changing overtime protections to remove nonwage compensatory and other workplace benefits from calculations of their “regular” pay rate, which forms the basis for overtime formulations. If that change is enacted, every worker currently given overtime protections could be subject to a slight reduction in the value of their overtime pay, which the authors claim will encourage employers to provide nonwage benefits but would effectively just amount to a pay cut. The authors also propose other changes to the way overtime is calculated and enforced, which could result in reduced compensation for workers. Overtime protections have long been a focus of right-wing media campaigns to reduce protections afforded to American workers. [Project 2025, Mandate for Leadership, 2023, Media Matters, 7/9/24]

Project 2025 proposes capping and phasing out visa programs for migrant workers. Project 2025’s authors propose capping and eventually eliminating the H-2A and H-2B temporary work visa programs, which are available for seasonal agricultural and nonagricultural workers, respectively. Even the Project 2025 authors admit that these proposals could threaten many businesses that rely on migrant workers and could result in higher prices for consumers. [Project 2025, Mandate for Leadership, 2023]

Project 2025 recommends institutionalizing the “Judeo-Christian tradition” of the Sabbath. Under the guise of creating a “communal day of rest,” Project 2025 includes a policy proposal amending the Fair Labor Standards Act to require paying workers who currently receive overtime protections “time and a half for hours worked on the Sabbath,” which it said “would default to Sunday.” Ostensibly a policy that increases wages, the proposal is specifically meant to disincentivize employers from providing services on Sundays as an explicitly religious overture. [Project 2025, Mandate for Leadership, 2023]

[...]

International Trade

Project 2025 contains a lengthy debate between diametrically opposed perspectives on international trade and commerce.Over the course of 31 pages, disgraced former Trump adviser and current federal inmate Peter Navarro outlines various proposals to fundamentally transform American international commercial and domestic industrial policy in opposition to China, primarily by using tariffs. He dedicates well over a dozen pages to obsessing over America’s trade deficit with China, even though Trump’s trade war with China was a failure and as he focused on China, the overall U.S. trade deficit exploded. Much of the rest of Navarro’s section is economic saber-rattling against “Communist China’s economic aggression and quest for world domination.”In response, Kent Lassman of the conservative Competitive Enterprise Institute promotes a return to free trade orthodoxy that was previously pursued by the Republican Party but has fallen out of favor during the Trump era.

The Heritage Foundation’s Project 2025 agenda would be a boon for the wealthy and a disaster for the working class folk.

See Also:

MMFA: Project 2025’s dystopian approach to taxes

#Economy#Project 2025#The Heritage Foundation#Donald Trump#Income Inequality#Mandate For Leadership#Federal Reserve#IRS#Student Loan Debt#Unions#Labor#Overtime Pay#Independent Contractors#H2A Visa#H2B Visa#Sabbath#Workplace Safety#Gender Pay Gap#Trade#Consumer Financial Protection Bureau

62 notes

·

View notes

Text

128 notes

·

View notes

Text

Job Opportunities with Competitive Salaries! 🚀💼

Vacancies available as follows:

1.6G Arc Welders

Electricians (Building)

Plumbers

Riggers

Civil Workers

Scaffolders

Masons

Steel Fixers

Carpenters

Civil Supervisors

Light Drivers

Heavy Drivers

Bus Drivers

Excavator Operators

Mobile Crane Operators

Roller Operators

Forklift Operators

Bobcat Operators

Benefits:

🍽 Free Food

🏠 Free Accommodation

⏰ 8-Hour Duty + Overtime

🏥 Medical Coverage

💸 Loan Assistance Provided!

📋 To Apply:

📩 [email protected]

📞+91 8919332574

WhatsApp: https://wa.me/918919332574

visit our website for more information.

🧐 👉🏻 www.speelerconsultancy.in

Construction experience required. ECR & ECNR passport holders can apply. Indian experience and Indian heavy driving licenses are accepted.

Apply now and secure your future with a rewarding career! 🎯🌟

#job opportunities#construction jobs#free food#Free Accommodation#overtime pay#medicalcoverage#hiringnow#careergrowth#workabroad#Drivers#operators#welders#electricians#Masons#Plumbers#speelertechnologies#speelerconsultancy#speeler

2 notes

·

View notes

Text

@octoblinoctober, Day 4: Overtime Pay

Otto and Norman spend a lot of time at Oscorp afterhours and sometimes Norman rewards his lapdog for all his hard work ;)

#octogoblin october#octogoblin#norman osborn#otto octavius#art challenge#overtime pay#artist on tumblr#digital art#sparkles art

61 notes

·

View notes

Text

#dept of labor#please sign and share#petition#petitions#please sign this petition#please share#please sign#hot labor summer#fight for 15#department of labor#overtime pay

3 notes

·

View notes

Text

Just for shits & giggles.

Recently the "save the geese" guy promised no more taxes on overtime.

It done reminded me of this:

Overrated “A chicken in every pot; a car in every garage [1928].” This well-known slogan, widely attributed to Herbert Hoover, originates with Henry IV of France, who wished for (but wisely did not promise) a chicken in every pot. Why is it overrated? First, there’s the fact that Hoover never said it. Hoover, a politician not known for his sparkling personality, left slogan writing to his supporters. The slogan appeared in an ad paid for by “Republican Business Men, Inc.” that ran in the New York World under the headline A CHICKEN FOR EVERY POT. The Business Men were careful to adapt the crib for modern times by adding “and a car in every backyard, to boot.”

pulled from American Heritage website

Imagine if you will....In a world where Overtime is cheep [chicken ref], employers will force overtime. Employers won't have to pay Social Security and Medicare on those wages. That's 7.65%.

But wait! There's more!

Project 2025, the huge compilation of maga dreams, proposes mangling extra pay for overtime.

So which ya gonna believe. Yay, overtime means a bigger check?

Or that the Project 2025 guys will nuke overtime pay?

No geese in the park were harmed by this publication.

0 notes

Text

0 notes

Text

Common FAQs Related to Exempt Employees' Work Hours in California

1 note

·

View note

Text

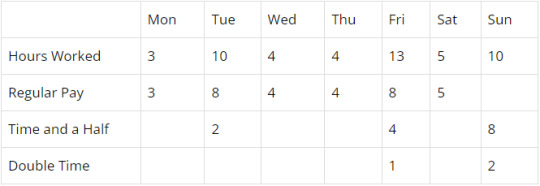

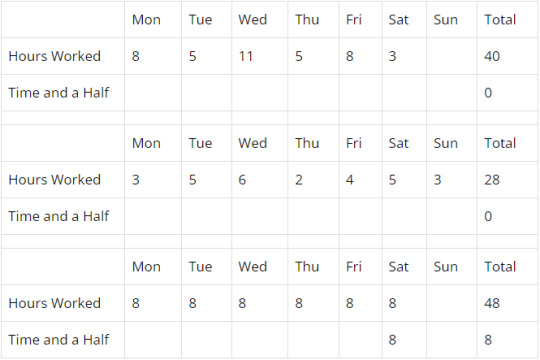

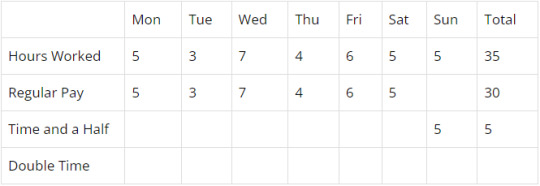

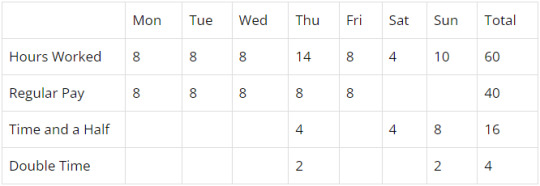

What is Overtime Pay in California?

In the state of California, nonexempt employees are entitled to overtime pay of:

5 times their normal rate of pay for each extra hour worked over 8 hours in a day or more than 40 hours in a week.

2 times their normal rate of pay for hours worked over 12 hours in a day or if they work seven days straight and work more than 8 hours on the seventh day.

Sometimes, workers who are nonexempt may be paid differently than an hourly wage and their overtime pay is calculated accordingly. Exempt workers are those to whom the overtime laws do not apply. There are also some special exceptions that have their own guidelines.

What is the Regular Rate of Pay?

An employee’s regular rate of pay is the way their compensation for their work is calculated. This could be by the hour, per year, by piecework, or on commission. Regardless of how the rate of pay is calculated, it can never be lower than the minimum wage. It can also never exceed an 8 hour workday or a 40 hour workweek. There is however a standard under Industrial Welfare Commission Wage Orders that allows for alternative workweek schedules consisting of either 4 days of 10 hour shifts or 3 days of 12 hour shifts. For these schedules, the rate of pay is based on the 40 hour workweek.

Some agreed upon schedules come out to less than 40 hours per workweek. Although a set agreed upon work week may total under 40 hours, the employer is not obligated to pay overtime until the employee works more than 8 hours in a workday or 40 hours within that workweek.

How Much is Overtime Pay in California?

In order to qualify for overtime, the following parameters must be met:

Hours paid time and a half:

Over 8 and up to 12 hours per workday

Over 40 regular hours per workweek

The first 8 hours of the 7th day worked in a row per workweek

Hours paid double time:

Over 12 hours per workweek

Over 8 hours on the 7th day worked in a row per workweek

How to Calculate Overtime Pay in California

Step 1: Determine Workweek vs Workday

Workday – The default workday begins at 12:01 in the morning. However, employers are able to set their workday to be any block of 24 hours that begins at the same time every calendar day. If an employee works more than 8 hours in a workday, they are entitled to overtime pay for the extra hours worked. Employers are not permitted to average out hours across multiple days. If an employee works 6 hours one day and 10 hours the next, they receive 2 hours of overtime pay.

Workweek – A workweek is a set period of seven days that begins the same calendar day every week. While employees within the same company may have different workweek schedules, a workweek is set for each individual employee and can not be changed unless it is being permanently altered. If an employee works more than 40 hours within a workweek, they are entitled to overtime pay.

Step 2: Calculate Hours Worked

Employees must document the times that they punch in for work, out for break, back in from break, and out for the day. Most employers have a system for all employees to do this, so that the employer can then calculate the hours worked for each person.

Step 3: Determine Amount of Daily Overtime Hours

When calculating daily overtime for nonexempt employees, employers must pay

Time and a half for hours worked over 8 and up to 12

Time and a half for the first 8 hours of the seventh day worked in a row

Double time for hours worked over 12

Double time for hours worked over 8 on the seventh day worked in a row

Step 4: Determine Amount of Weekly Overtime Hours

When calculating weekly overtime for nonexempt employees, employers must pay

Time and a half for hours worked over 40

Step 5: Calculate Daily vs Weekly Overtime Hours

According to California state law, both daily and weekly overtime hours must be taken into account. The overtime hours themselves are only counted once, but they also do not negate each other. This is to protect workers in situations such as if someone works more than 8 hours a day, but they worked less than 40 hours that week. Determining overtime on both a daily and weekly basis ensures that employee gets paid properly. The way this works is:

When an employee’s daily overtime is the same or more than the employee’s weekly overtime, then they must be paid in accordance with daily overtime. In these cases, the weekly overtime is already included in the daily overtime.

When the employee’s daily overtime hours are less than the number of weekly overtime hours, then the remaining time must be accounted and compensated for.

Employers must also ensure that daily double time rules are being followed when calculating weekly overtime as well.

Employers can keep track of these hours by accounting for the hours worked and separating the regular rate of pay from the overtime. This ensures that all hours are accounted for and paid correctly.

No weekly overtime, but time and a half daily overtime for the seventh day in a row worked:

No daily overtime, but time and a half weekly overtime paid for hours worked over 40 in the workweek:

Both daily and weekly overtime:

Time and a half for daily hours worked over 8 up to 12

Time and a half for the first 8 hours of seventh day worked in a row

Double time for hours worked over 12

Double time for hours over 8 on seventh day worked in a row

Time and a half for weekly overtime hours over 40

Step 6: Determine Base Rate of Hourly Pay

Since overtime is 1.5 or 2 times the employee’s regular rate of pay, it is important to figure out what that is. An employee’s regular rate of pay is generally the amount of money earned by the employee each hour generally calculated by dividing the total compensation for the workweek by the hours worked. There are many different ways in which employers pay out their employees’ compensation, and so different ways for the regular rate of pay to be calculated.

Hourly Non-Exempt Employees

The regular rate of pay for hourly employees is the amount of money they earn each hour. If they also receive bonuses or commissions, those are divided by the number of hours worked.

So, if an employee makes $20 an hour, then their overtime pay would be $30 an hour or $40 an hour for double time.

Sometimes, employees are paid different rates within the same workweek. In these cases, the regular rate of pay is calculated by dividing all earnings throughout the week by all of the hours worked. The overtime premiums are then added to the applicable overtime hours afterwards. So, if an employee works 20 hours at $10 an hour and 30 hours at $15 an hour, their total earnings would be $650 which would be divided by 50 for a regular rate of $13. $6.5 would be added to every overtime hour that earned time and a half, and $13 would be added to every overtime hour that earned double time.

Sometimes, employees also earn flat-sum bonuses on top of their hourly rates. When this happens, the bonus is divided by the amount of non-overtime hours they worked, and then that amount is added to the hourly rate. The final sum is the number used to determine the overtime rate of pay. So, if an employee works 45 hours in a workweek at $10 with a weekly bonus of $100, the $100 would be divided by 40 making $2.5 which would make the regular rate of pay $12.5 which would be used to calculate the applicable overtime.

Piece Rate or Commission Employees

There are several different methods that can be used to calculate regular rate of pay for employees who are compensated by piece or commission:

The rate that the employee is paid by piece or commission is considered the regular rate, and that number is multiplied by 1.5 for hours worked over 8 up to 12 in a workday and multiplied by 2 for hours worked over 12 per workday.

The total amount of money earned for the workweek is divided by the total hours worked for the workweek. The overtime premium of that number is then added to the applicable overtime hours.

For group rates, the amount of pieces the group produced during the workweek is divided by the amount of people in the group. Each member of the group is paid accordingly, and that amount is then divided by the hours worked.

Salaried Non-Exempt Employees

When a salaried employee is nonexempt, their salary only covers regular hours worked. In these situations, those employees are entitled to overtime pay. To determine the regular rate of pay for a full time employee, the weekly salary is divided by 40. If the employee is paid monthly, the monthly rate is multiplied by 12 months in a year, then that number is divided by 52 weeks in year, then that number is divided by 40 hours in a week.

Are Salaried Employees Entitled to Overtime?

Some salaried employees may be exempt from overtime pay for many reasons:

Federal law

State Law

California Labor Code Provision

Industrial Welfare Commission Wage Orders

If the salaried employe does not meet the requirements for exemption status, then the employer must pay them overtime rates when overtime hours are worked.

Employees That Are Paid Different Rates Within the Same Job

When employees are paid two or more different rates at the same job within the same workweek, the weighted average is found by dividing the total amount of money earned by the total number of hours worked. So, if an employee worked 20 hours at $10 an hour, 20 hours at $12 an hour, and 10 hours at $14, the weighted average would be $580 divided by 50 hours, totaling $11.6 an hour.

Employees that Receive Bonuses

Nondiscretionary bonuses are included when calculating an employee’s regular rate of pay for the sake of overtime if that bonus is for how many hours they worked, a reward for high performance, or an incentive to stay with the employer.

When calculating regular rate of pay on a flat sum bonus for the sake of overtime, the amount of the bonus is divided by the number of regular hours the employee worked. That amount is then used to calculate the time and a half or double time to be used for any additional overtime hours.

When calculating regular rate of pay on a production bonus, the amount of the bonus is divided by the number of hours the employee worked during the bonus period. That amount is then used to calculate the time and a half or double time to be used for any additional overtime hours in the bonus period.

Bonuses that are not factored into overtime pay are discretionary bonuses such as holiday gifts or special rewards.

Who Is Exempt from California Overtime Laws?

The most notable exempt workers are those who earn a fixed salary that is equal to or greater than double the minimum wage.

There are specific salaried job categories that are generally exempt such as:

Normally Exempt Roles

These requirements reduce the likelihood that high salaried professionals are not able to enjoy the benefits of overtime pay. However, these roles are often rewarded in amounts of compensation that far exceed the need for overtime pay.

Executives

Administration

Professional Employees

Outside Salespeople

The requirements for being classified as an exempt outside salesperson are:

18 years old or older

51% or more of their work is conducted away from the business

They sell products, contracts, the performance of services, and/or the use of facilities

Unionized Employees

Not all union workers are exempt. Exemption for unionized workers requires:

That the collective bargaining agreement explicitly provides for wages and working hours and conditions

That the collective bargaining agreement explicitly provides for regular rate of pay and premium overtime rates that are 30% or higher than state minimum wage

Job Specific Exceptions

The California Industrial Welfare Commission outlines certain job specific exceptions to overtime laws such as:

Agricultural workers

Ambulance workers

Camp Counselors

Live-in household workers

Retirement home managers

Personal attendants

Some 24-hour residential childcare providers

The parents, spouse, and children of the employer

Independent Contractors

The requirements for being an independent contractor are:

Someone who is contracted to perform a specific service for a specific amount of pay

Someone who has complete control over when and how the service is completed

Alternative Schedules

Sometimes, employees may agree to alternative schedules such as working a 40 hour workweek as 4 days of 10 hour shifts. These schedules are not bound by overtime laws. A valid alternative workweek schedule must be:

Voted on via secret ballot by the affected employees

Approved by a two-thirds majority

Reported within 30 days by the employer to the Division of Labor Standards Enforcement

Employers are not permitted to retaliate against any employees for their stance on alternative schedules. Employees working an alternative schedule are still entitled to overtime pay when:

They work more than the daily agreed upon hours

They work more than 40 hours in a workweek

Nonresidents

In the state of California, all nonexempt workers are protected by the state’s overtime laws, including those who are not residents of the state or citizens of the country. There is some back and forth about whether workers who work in the state for less than a day at a time should also be protected by those same laws.

Step 7: Calculate Total Overtime and Pay Balance

According to Labor Code Section 204, overtime in California must be paid by the payday for the next payroll period. The regular hours for that pay period must be paid on time, only the overtime pay may be paid the following payday.

Are Any Amounts Excluded from Overtime Pay?

There are some types of payments and compensation that may not be included when calculating overtime in California such as:

Discretionary Bonuses

Expenses

Gifts

Holiday Pay

Paid Time Off

Can Overtime Be Waived?

In the state of California, all nonexempt employees must be compensated for any overtime worked. If an employer has an employee sign an agreement waiving their right to overtime pay, that waiver is unenforceable, and the employee is still entitled to their overtime pay.

Can an Employer Require Overtime?

In most cases, employers in California are allowed to require their employees to work overtime. One big exception is that employers are not permitted to require employees to work seven consecutive days in a row with no day off for rest. Employees are however able to waive their rest day provided they are aware of their right to take it if they choose.

Are Employers Responsible for Paying Unapproved Overtime?

In the state of California, all nonexempt employees must be paid overtime pay for all overtime hours worked regardless of managerial approval. While employers are permitted to discipline employees who work unapproved overtime, they can not refuse to pay them. In accordance with California law, employees must be paid for whatever time they were suffered or permitted to work. This means that the employer is responsible for any compensation owed for hours worked that they knew about or should have known about.

What Can an Individual Do if Overtime Isn’t Paid?

If an employee was not paid properly for overtime hour worked, they can contact the Department of Labor, file a claim with the Division of Labor Standards Enforcement, or file a lawsuit to sue for the money. When suing a former employer, they can also file a claim for a waiting time penalty in accordance with Labor Code Section 203.

What is the Wage Claim Filing Process?

After an employe files a claim with the Division of Labor Standards Enforcement, that claim is then assigned to a Deputy Labor Commissioner. They will then decide whether to:

Refer the matter to a conference – The parties involved are brought together to meet and attempt to resolve the issue out of court.

Refer the matter to a hearing – The parties involved will testify under oath during a recorded hearing. Afterwards, the Labor Commissioner will serve an Order, Decision, or Award (ODA) to the parties.

Dismiss the matter

The ODA may be appealed by either party. The matter will then be sent to trial where the parties involved will present their cases again, without the initial hearing bearing primary weight on the court’s final decision. IF the employer is the one appealing the ODA and the employee can not afford legal representation, the DLSE may opt to represent them.

What Do I Do If I Win an Overtime Pay Claim But the Employer Fails to Pay?

Sometimes, an Order, Decision, or Award will be in the employee’s favor and the employer will not appeal but will refuse to pay. In this instance, the Division of Labor Standards Enforcement will request that the ODA be entered as a court judgement.

Contact Mesriani Law Group if You Are Owed Overtime Pay

In the state of California, employers are legally required to pay all nonexempt employees 1.5 times their regular rate of pay for hours worked over 8 and up to 12 in a work day, hours over 40 in a work week, and the first 8 hours of the seventh day worked in a row in a workweek. They are also legally required to pay 2 times their regular rate of pay for hours worked over 12 in a workday, and hours over 8 on the seventh day worked in a row. Unfortunately, not all employers properly pay their employees. If you believe your employer has not paid you properly, call Mesriani Law Group today.

Overtime Pay FAQs

How does overtime work?

In the state of California, if an employee works more than 8 hours and up to 12 hours in a workday, those hours are compensated at 1.5 times their normal rate of pay. Also compensated at time and a half are hours worked over 40 in a workweek and the first 8 hours worked on the seventh consecutive day in a row. Hours over 12 on a workday and hours over 8 on the seventh day in a row are compensated at 2 times the normal rate of pay.

Do overtime hours count towards 40 hours in California?

All hours count towards total hours worked. Hours worked over 8 in a workday are daily overtime. Hours worked over 40 in a workweek are weekly overtime. If hours count as both daily and weekly overtime, they are only counted once.

Is 7th day double time in California?

According to California state labor laws, the first 8 hours worked on the seventh consecutive day in a row worked in a workweek are paid at time and a half. Any hours worked after those first 8 hours are paid at double time.

#California Employment Laws#Overtime#Overtime Pay#Wage and Hour Violations#Employment Law#Employment Lawyers#California Attorneys#Workplace Discrimination#Workplace Retaliation

0 notes

Text

Dear Labor Department,

It's nice to want.

Affectionately,

A Dissatisfied Customer

#In the Words of My Father#And please note that this is just a joke#Mostly based on my own place of work#Work#Jobs#Labor#Mycki's Working Life#Mycki Jokes#Funny Shit#Pay Scales#Overtime Pay

0 notes

Text

John Knefel at MMFA:

Project 2025, a sprawling right-wing plan to provide policy and staffing to a future Republican president, proposes an extreme anti-worker agenda that would severely curtail unions’ ability to collectively bargain on behalf of their members and reverse gains organized labor has made in recent years. It would also weaken overtime regulations, give corporations wider latitude in misclassifying workers as independent contractors, and dismantle safety regulations that prohibit young people from working dangerous jobs.

The initiative’s policy book, Mandate for Leadership, is an attempt to roll back New Deal-era, working class victories by allowing state-level exemptions from the National Labor Relations Act and the Fair Labor Standards Act, and by creating nonunion “employee involvement organizations” to undermine unions’ negotiating power. It additionally calls for sharp reductions in the budgets of the National Labor Relations Board and the Department of Labor and a freeze on new hires.

Project 2025 is organized by The Heritage Foundation and includes more than 100 conservative groups on its advisory board, which have collectively received more than $55 million from groups tied to conservative megadonors Leonard Leo and Charles Koch. Leo has been pushing the Supreme Court to further erode the power of organized labor, and the Koch family has waged a war on unions for more than 60 years.

[...]

Project 2025: Eviscerate overtime and dismantle pro-worker regulations

One central proposal in Mandate that illuminates Project 2025’s extreme anti-work posture is the suggestion that employers should be allowed to eviscerate overtime regulations and potentially withhold pay. The attacks on overtime take several forms, including a proposal to allow workers to accrue vacation instead of time-and-a-half compensation — but at least 40 percent of lower- and middle-income workers already don’t use their allotted paid time off. Under this policy employers could coerce workers into “voluntarily” selecting vacation that they’re either formally or informally prohibited from taking, thereby denying them overtime compensation.

Project 2025 further recommends that workers and bosses agree to extend the overtime threshold to a period of two weeks or one month. The policy would empower management to overload busy weeks with extra-long shifts and take advantage of slow periods through under-scheduling — effectively eliminating overtime altogether.

[...]

A return to company unionism

Project 2025 seeks to roll back New Deal-era labor victories by proposing that Congress “pass legislation allowing waivers from federal labor laws” — like the National Labor Relations Act and the Fair Labor Standards Act — “under certain conditions.” Allowing state-level exemptions to the NLRA and FLSA would almost certainly trigger a race-to-the-bottom dynamic, where firms relocate to states with the weakest (or nonexistent) labor protections at the expense of workers. That’s what happened in states that passed so-called “right-to-work” laws — which starve unions of resources by preventing them from collecting fees from all employees they represent, thereby creating a free-rider problem — where employers were able to depress wages and union membership.

Unions have made significant gains under the Biden administration’s National Labor Relations Board, which enforces labor law and investigates anti-union practices. That progress is largely thanks to NLRB general counsel Jennifer Abruzzo, who has taken an aggressive, pro-worker enforcement posture. Project 2025 promises to fire her on “Day One.” It also calls for reductions in the budgets of the NLRB and the Department of Labor to the “low end of the historical average,” as well as implementing a “hiring freeze for career officials.”

[...]

Project 2025 would further undermine unions by eliminating “card check” — where a majority of workers who have signed union authorization forms can ask their employer for voluntary recognition — and mandating “the secret ballot exclusively.” Although the idea of a secret ballot has the veneer of democracy, in practice it’s a power grab for management. By forcing organizers to go through the byzantine NLRB election process, an employer can buy itself time to wage an anti-union campaign and bog down the process, often through illegal means. A 2019 study found that employers violated labor laws in 41.5% of NLRB-supervised union elections in 2016 and 2017 and intimidated or coerced workers in nearly a third of all elections.

The radical right-wing Project 2025 spearheaded by The Heritage Foundation in association with over 100 organizations has an agenda attacking labor and unions.

#Workers' Rights#Project 2025#Overtime Pay#Unions#Donald Trump#The Heritage Foundation#Leonard Leo#Charles Koch#Fair Labor Standards Act#National Labor Relations Act#US Department of Labor#NLRB#Labor#Jonathan Berry#Mandate For Leadership#Card Check#Employee Involvement Organizations

22 notes

·

View notes

Text

122 notes

·

View notes