The Best Rates All Over Texas! Mortgage Rates Arlington 624 Six Flags Dr #265 Arlington, TX 76011, USA Phone: (866) 772-3802 Find Us Online: Facebook Twitter Pinterest LinkedIn YouTube Tumblr Diigo Reddit About.me DeviantArt Behance Plurk PearlTrees Folkd Evernote Mix Scoop.it Bookmarkee HotFrog Academia GetPocket YelloYello LiveJournal <a hre...

Don't wanna be here? Send us removal request.

Link

Customers are Fed Up With Poor Service

Increased Dissatisfaction

The pandemic upended life as we knew it and prompted a shift in expectations. As the supply chain descended into chaos, shipment delays became the norm. Staffing shortages led to longer than normal hold times when calling customer service and other in-store problems. A “we’re all in this together” attitude prompted many consumers to extend these companies a bit of grace.

A recent study by Forrester Research on customer experience shows that patience may now be wearing thin. Prior to 2022, their annual reports revealed customer experience scores were steadily rising. That is no longer the case—the score has dipped to 71.3 from 72.1 in 2021.

IRS Ranks Last

Companies and agencies saw “good” scores dip 3%, while “poor” or “OK” ratings ticked higher. In addition, 19% percent of brands were marked lower than in the prior study, the highest drop since 2016.

Some market observers believe the poor showing may indicate that companies aren’t able to meet their customers’ changing expectations. It’s not just companies either—the Internal Revenue Service snagged a dubious ranking as consumers gave it the worst rating of any agency or company. The agency saw its approval rating plummet by over 10%.

A Few Snag Thumbs Up

While no industry segment earned a rating of “excellent,” there were a couple of pockets that positively distinguished themselves. Investment firms earned higher marks by equipping professionals with tools and messaging that resonated well with clients. Another outlier was Chewy (CHWY), which for the second time in a row snagged the top customer experience rating. The pet-care company attributed their high rating to expanded telehealth network and product line.

After a poor report card like this one, companies and agencies may rethink their customer service strategies.

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. SOSS22060902

The post Customers are Fed Up With Poor Service appeared first on SoFi.

https://ift.tt/9UG41zj

0 notes

Link

Liz Looks at: Defensive Flows

Plenty of Room at the Hotel Cash-ifornia

Spoiler alert: a lot of money has flowed out of risk assets this year. As of the end of May, more than $200 billion has come out of equity funds alone YTD — not surprising given the market’s rough start to the year and constant fear of the next risk lurking around the corner.

To illustrate, here’s a view of the monthly flows by major asset class. We’ve seen the occasional inflow, but this chart is decidedly skewed downward.

Investors were right to reduce risk early in the year, and may have saved themselves from at least some of April’s dreadful returns (or lack thereof), but now there must be cash waiting on the sidelines. What do we do with it and when?

This Could be Heaven or This Could be Hell

We’re in a period where opinions on market direction and economic health are widely dispersed from positive to negative. Some say the sky is falling, others say a soft landing is likely and the market is poised for a bounce.

When we dig further into flows and break the universe down into cyclicals vs. defensives, investors still seem to be positioned for the more negative scenario.

So if cyclicals are “heaven” and defensives are “hell,” portfolios are likely well positioned for hell. And the fear isn’t unfounded — there’s inflation over 8%, aggressive Fed tightening on the horizon, slowing economic activity, major companies reporting negative profit outlooks, and a stock market that can’t seem to find durable upside.

But if the Fed is going to be data dependent, so should we. And what the data is starting to tell us is that the economy is slowing from a demand perspective, which should help slow inflation. Not today, but my guess is that we will feel a bit less hellish by late summer once a few more of these data points roll in.

We can slow without stopping. We can cool without freezing. We can revise downward without going out of business. If and when we start to feel like the hell situation is less likely, these fund flows could reverse, and reverse quickly.

You Can Check Out Anytime You Like…

But as a long-term investor, you really can never leave. Risk assets that is. Although I do expect volatility to persist through June and perhaps July, making a defensive posture prudent, it’s time to evaluate whether there’s enough cyclical exposure in your portfolio.

If we find out that we’re closer to mid-cycle than late cycle, there is likely to be a bounce in under-owned cyclical areas of the market. Some of my favorites right now are Financials, small-caps, and Materials. It used to be that we would talk about a barbell strategy with growth and value as opposite ends of the spectrum, but I think a better way in this environment is to think about it as cyclicals and defensives. As we get past the next two CPI prints, the Q2 GDP report, and a couple more Fed hikes, let’s think about checking out of Hotel Cash-ifornia.

Want more insights from Liz? The Important Part: Investing With Liz Young, a new podcast from SoFi, takes listeners through today’s top-of-mind themes in investing and breaks them down into digestible and actionable pieces.

Listen & Subscribe

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv. SOSS22060903

The post Liz Looks at: Defensive Flows appeared first on SoFi.

https://ift.tt/WR0Zvxo

0 notes

Link

Tech Stocks Slide Outpaces the Broader Market’s Decline

Sector Wide Struggle

The stock market has stumbled this year and its technology segment is getting hammered. The S&P 500’s information technology sector is down nearly 20% this year with the broader index down only 13% by comparison. The tech rout is evident with industry leaders such as Facebook parent Meta Platforms (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX), and Alphabet (GOOGL) all underperforming the S&P 500 overall.

Investors who seemingly couldn’t get enough of these companies during the pandemic’s period of easy money are now fleeing for the exits. Technology funds have seen $7.6 billion in outflows this year.

Shades of the 2000s?

In today’s environment, where the Fed’s recent rate increases may be just the first of many to come, investors seem to have tempered their enthusiasm for tech stocks. When interest rates rise, investors require a higher return on equities to make the higher risk worthwhile relative to bonds or cash. One way to get to this higher return is to pay less, so rising rate environments can put pressure on equity valuations.

While the downturn in tech may trigger memories of the dot-com collapse in 2000, in which the Nasdaq plummeted by 80% over roughly one and a half years, others counter that valuations aren’t at the levels seen during that period, when forward multiples soared to 26.2. By comparison, the tech-heavy NASDAQ’s current price-to-earnings ratio is around 20.

Value’s Comeback

Despite the sell off, technology stocks still comprise 27% of the S&P 500 index. Treasury yields have gone up, but still remain below historical norms. All eyes will be on the Fed as it attempts to tame inflation by raising interest rates. This will be especially true tomorrow when the latest CPI data is due.

Some market analysts contend the worst is over. Others, such as value investment firm GMO’s Ben Inker, say the valuations of technology stocks and growth stocks in general have grown too risky, which arguably makes value stocks look more attractive. Inker also warns that when asset bubbles pop, valuations can decline below fair value.

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. SOSS22060901

The post Tech Stocks Slide Outpaces the Broader Market’s Decline appeared first on SoFi.

https://ift.tt/IoQO1wd

0 notes

Link

Selling and Buying a Home at the Same Time

Original Publish Date: Jan 14, 2020

You’ve found your dream home. Your 10+ year plan. The space you see your family living for the foreseeable future. So how do you sell your first home, and buy that special place all at once? Selling and buying a home at the same time might seem overwhelming, but it’s doable. To make the process as smooth and stress-free as possible, you’ll need to focus on three key areas:

Team

Finances

Timelines and expectations

Build Your Dream Team

During your home selling and buying process, you’ll likely live and work as usual. That means your life will be busy, as selling and buying a home at the same time will add to your workload. To eliminate additional work for you and to keep stress at a minimum, you’ll need (and want) someone to assist you. Assemble a team of agents at both ends of your real estate transaction:

Listing agent: The agent who helps you sell your home.

Buyer’s agent: The agent who helps you buy a home.

Selling

During the sale of your home, you’ll have a few things to carry out yourself:

Gather info about your home to list the details

Clean up and get ready for pictures and showings

Set up lines of communication so you can stay in contact with your agent

Sign paperwork and come to scheduled meetings

A good listing agent will take care of all the nitty gritty details and the paperwork. When you work with a Homie agent, here are some of the things you can expect them to do:

Consult on listing price

Market your home

Filter buyer calls

Fill out and review paperwork and contracts

Negotiate on your behalf with the buyer’s agent

It’s clear why you’d need someone to help you through selling your home; there’s so much to do!

Buying

Buying a home is a lot of fun. Who doesn’t like to browse listings, go to showings, and walk through gorgeous model homes? This is the part you’ll want to make time for. As a buyer, you’ll need to do a few things:

Get finances in order (we’ll go over this more later)

Set aside time to go on tours

Set up lines of communication to keep in contact with your agent

Sign paperwork and come to scheduled meetings

Your buyer’s agent is going to do what everyone else dreads doing: paperwork. When you work with a Homie agent, you can expect them to assist you by:

Working with listing agents to schedule showings

Generating contracts (offers, addendums)

Scheduling meetings

Negotiating on your behalf with the listing agent

Your buyer’s agent is one of the key pieces of your dream team.

Assemble!

Your dream team should be assembled as soon as you start shopping around or listing your home. The earlier on your team can prepare for your transaction, the better off everyone will be. Here are a few things to look out for when you’re on the hunt for MVPs for your team:

Cost. What commissions will you pay as the seller or buyer? How can you save without sacrificing service?

Experience. How many transactions has the agent handled? How well-versed are they in different types of home buying and/or selling situations?

Availability. Is your agent going to be available to answer any questions you may have via text, email, or call? Support is key.

Know Your Finances

You need money to buy a home. That’s not surprising at all, but many people don’t know how much money they need, or where to get it. Here’s a quick step-by-step:

Find a mortgage broker you trust. Look at reviews and get a recommendation from your buyer’s agent. (A Homie agent will recommend Homie Loans*.)

Get prequalified with that broker. Seriously. Do this before you even start browsing listings. Prequalification is a quick check on your finances that will give you a price range you can use to narrow down homes.

Start saving (get less takeout?) and start eliminating debt where you can (pay down those credit cards). You don’t want to make any large credit changes like opening a new line of credit or buying a car.

Explore your options. Talk to your loan officer and see what you can do in your unique situation. You don’t have to have perfect credit, and you don’t have to have a 20% down payment. That’s why it’s important to start talking about what options will be best for you.

Sale Proceeds

When you’re selling and buying a home at the same time, you can use the profit from selling your current home to help you buy the next. After the buyer closes on the purchase of your home, you’ll need to wait for the sale to fund and record. (That means the money moves accounts and the legal documents get sorted out.) In some cases, all that happens the same day. It’s more likely that it will all happen the day after the buyer closes.

Your listing agent will need to convey the situation to the buyer’s agent on your home as early as possible. You may need a few days to finish the purchase and move from your old home to your new one.

Know Your Timeline

There are a couple of timeline situations home buyers commonly encounter. These timelines depend mostly on the buyer’s financial circumstances.

Selling a Home and Using Proceeds

If you’re going to sell a home to fund the purchase of a new one, you’ll usually have to wait for a buyer to fall in love with your home and buy it first. (This isn’t always the case. More on that later.)

Once the sale of your home has been funded and recorded, the gears start turning fast. The money the buyer owes for your home will be dispersed to the appropriate parties. If you have a mortgage on the home, your mortgage company will be paid off first. Title fees and closing costs will also be paid. Any dough that’s left over after that is all yours.

Your proceeds from the sale can be given to you in a few ways if you’re using them to buy your new home:

You can get a check for the proceeds and you can give it to whomever needs it to purchase the home.

The funds can be held in escrow by a title company and wired to whomever needs it to get your new crib.

The timing of buying your next home can get a little tricky. You don’t have to wait until you have the cash in your hand to put an offer in on a home. You do have to wait until the buyer of your home has paid out in order to close on the next sale.

Selling a Home Without Proceeds

If you don’t need the proceeds of a home sale to buy a home, you can essentially move as fast as the seller can. This is true even if you’re selling and buying a home at the same time. They may have to sell before they can buy a new home, or have other considerations. Make sure to communicate your timeline to your agent so they can keep all of the relevant parties updated.

Cash Offers

Generally, cash offers are similar to the situations above. If you will receive the cash after a sale, you’ll need to follow the steps outlined in that section but you won’t need to worry about a mortgage company.

If you have the cash now and the sale of a home is irrelevant, you can move as quickly as the seller can. Again, you won’t need to worry about a loan.

Buy Before You Sell

Did you know that you don’t have to worry about selling and buying a home at the same time? With Homie Cash, you can buy before you sell. That means that you can find and purchase your new home first. Then, you have 60 days to move out and sell your old home. It can make the process of selling and buying a home much less stressful.

*Homie and Homie Loan have a business relationship in that all are owned by the same persons. Legal Terms & Policies

The post Selling and Buying a Home at the Same Time appeared first on Homie Blog.

https://ift.tt/zTp7wDJ

0 notes

Link

How the Federal Interest Rate Changes May Impact You

From the outset, the summer of 2022 is looking to be the summer of I’s: in-person events, inflation, and interest rates.

While in-person events and inflation have been trending up since last year, interest rates have begun to rise only in the past few months — and are expected to climb higher.

Next week, in fact, the Federal Reserve is expected to announce its second rate hike of 50 basis points (the first one was in May) – and yet another hike in July. Analysts expect further rate increases throughout 2022 as the Fed tries to tame inflation.

In this rising rate environment, consumers should be aware of how the Federal Reserve’s monetary policy decisions could impact personal and household finances.

Why Is the Fed Raising Interest Rates?

The Federal Reserve is raising interest rates largely because inflation is reaching levels the economy hasn’t experienced in 40 years. In April, consumer prices climbed to a 8.3% annual rate, down from March’s 8.5% rate, but still 0.3% higher on a seasonally adjusted basis.

This rate hike aims to increase the cost of credit in the economy and bring inflation under control. Essentially this means that the Fed is trying to make borrowing more expensive, which will cause businesses and consumers to cut back spending. Theoretically, with less spending in the economy, prices will start to come down and bring inflation closer to the 2% target rate.

Despite the last rate increase, the federal funds rate is still near historic lows; the move alone won’t curb inflation immediately. More significantly, the move provides the financial markets a signal that the Fed is combating inflation, which could tighten lending standards preemptively.

Recommended: Federal Reserve Interest Rates, Explained

How High Will Interest Rates Go?

The Federal Reserve is expected to raise rates further through the year to tamp down inflation. However, it is unclear how high the Fed is willing to push rates in this complicated economic environment. The central bankers want to rein in rising prices, but they do not want to act too aggressively and cause the economy to contract.

Policymakers are also keeping an eye on the war between Russia and Ukraine while making these interest rate decisions. The economic fallout of the conflict could change the calculus for officials. That’s because there is a possibility of a weakening of the global economy, in which case the Fed will want to avoid tightening monetary policy too much.

How Will This Affect Loan and Credit Card Interest Rates?

Changes in the federal funds rate indirectly affect various financial areas throughout the economy, including loan and credit card interest rates.

Another increase in the federal funds rate will likely lead to even higher interest rates on personal loans, mortgages, and credit cards. Higher interest rates mean costlier financing for borrowers.

Recommended: How Do Credit Card Payments Work?

Is Now a Good Time to Refinance Existing Loans?

Since the Fed is in the process of raising interest rates, many borrowers may wonder whether now is a good time to refinance existing loans before rates go any higher. It should be noted that the federal funds rate is just a benchmark —and that other factors may be at play regarding borrowing rates.

That said, whether refinancing now makes sense depends on individual financial circumstances.

Borrowers with a variable interest rate loan could look to refinance to a fixed-rate loan to lock in a lower interest rate before rates climb more.

Also, individuals who have high credit card debt may be wary of a future with increasing interest rates. To remedy this, a debt consolidation loan could be used to lock in low fixed rates now and streamline the repayment process.

Additionally, borrowers with federal student loan debt who are waiting for the payment pause to end (set to happen after Aug. 31) before refinancing may not be doing themselves any favors. In exchange for not accruing interest for the remaining three months, they may be losing out on a lower interest rate that is applied for five to 20 years.

But being reluctant to give up the pause’s 0% interest rate while it lasts is understandable. To help borrowers lock in today’s rates, SoFi is offering 0% interest through Aug. 15 on federal student loan refinancing. No payments would be due before Oct. 1.

View Your Rate

What Other Impacts Will the Fed’s Rate Hike Have on My Finances?

On a more positive note, the Fed’s rate hike and the expected future increases could lead to more attractive interest rates for various types of savings accounts and certificates of deposit.

The average rate paid on savings accounts is currently just 0.06%. This figure could trend higher as the Fed moves its benchmark rate. Similarly, certificates of deposit (CDs) could see an increase in rates because of the Fed’s moves. When the Fed raises rates, it leads banks to increase interest rates on savings accounts and CDs to entice depositors to put more cash into the bank.

Recommended: How to Invest in CDs: A Beginner’s Guide

However, changes in interest rates for savings accounts and CDs won’t be immediate; it generally takes months for banks to increase rates on these instruments. Analysts note that banks are currently flush with cash, so they may not be quick to raise interest rates on savings vehicles to attract more deposits. Nonetheless, if you have a savings account or are looking to invest in a CD, you may be able to take advantage of higher yields in the coming year.

The Takeaway

It may be daunting to hear that policymakers are raising interest rates. After all, won’t that make borrowing more expensive? But rising rates may bring inflation under control, which would be a boon to consumers’ wallets.

A rising interest rate environment could also benefit household finances for those with cash in savings accounts as noted above. However, it will likely be a while before consumers see the benefits of rising rates on savings accounts at most banks.

Fortunately, SoFi® Checking and Savings is an online bank account that offers a 1.25% APY, much higher than the current national average. You can earn this competitive interest rate, save, and spend–all in one account by signing up. And, you’ll pay zero account fees to do it.

Learn more about how SoFi® Checking and Savings can help you reach your saving goals.Learn More

SoFi Loan Products SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC), and by SoFi Lending Corp. NMLS #1121636 , a lender licensed by the Department of Financial Protection and Innovation under the California Financing Law (License # 6054612) and by other states. For additional product-specific legal and licensing information, see SoFi.com/legal. SoFi Student Loan Refinance IF YOU ARE LOOKING TO REFINANCE FEDERAL STUDENT LOANS, PLEASE BE AWARE OF RECENT LEGISLATIVE CHANGES THAT HAVE SUSPENDED ALL FEDERAL STUDENT LOAN PAYMENTS AND WAIVED INTEREST CHARGES ON FEDERALLY HELD LOANS UNTIL SEPTEMBER 1, 2022 DUE TO COVID-19. PLEASE CAREFULLY CONSIDER THESE CHANGES BEFORE REFINANCING FEDERALLY HELD LOANS WITH SOFI, SINCE IN DOING SO YOU WILL NO LONGER QUALIFY FOR THE FEDERAL LOAN PAYMENT SUSPENSION, INTEREST WAIVER, OR ANY OTHER CURRENT OR FUTURE BENEFITS APPLICABLE TO FEDERAL LOANS. CLICK HERE FOR MORE INFORMATION. Notice: SoFi refinance loans are private loans and do not have the same repayment options that the federal loan program offers such as Income-Driven Repayment plans, including Income-Contingent Repayment or PAYE. SoFi always recommends that you consult a qualified financial advisor to discuss what is best for your unique situation. SoFi Banking members with direct deposit can earn up to 1.25% annual percentage yield (APY) interest on the first $50,000 of their balances for their checking and savings accounts, plus the cumulative total of all Vault balances, for up to $150,000 total deposits. Balances over $50,000 in each category will earn 0.05% APY. Members without direct deposit will earn 0.25% APY on account balances. Interest rates are variable and subject to change at any time. Rate of 1.25% APY is current as of 4/4/2022. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. SoFi® Checking and Savings is offered through SoFi Bank, N.A. ©2022 SoFi Bank, N.A. All rights reserved. Member FDIC. Equal Housing Lender. Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOCO20017

The post How the Federal Interest Rate Changes May Impact You appeared first on SoFi.

https://ift.tt/NOvk6te

0 notes

Link

A Shocker May be Lurking on Your Next 401(k) Statement

Monthly Income Estimate

The 2019 Secure Act required inclusion of “lifetime income” on 401(k) statements. Many Americans will get their first look at these illustrations on their Q2 2022 statements. The timing for the rollout of the information is awkward given the way portfolios have shrunk during the market’s 2022 slide.

The data may also trigger a stress response as it illustrates how retirement savings translate into an income stream. Seeing that monthly projection will have people imagining what kind of lifestyle they will be able to afford once they stop working.

The Fine Print

The number simply takes what you currently have saved and calculates an estimated monthly payout on two different annuity assumptions: one where income is paid to just one person, and the other that pays for the individual and the surviving spouse. Since the number doesn’t take into account future contributions or apply a forward-looking growth rate, it will underestimate your payout unless you retire today.

Also, no consideration is given to other savings or social security payments.

Making Retirement Real

The estimated income number can help make the idea of a retirement nest egg less abstract, especially for younger investors. It may also give investors a clearer understanding of the future and possibly incentivize them to put more of their paycheck into savings.

Policymakers are hoping that Americans will rethink their approach to retirement savings as a result of this “lifetime income” notation. Given a recent PwC report finding 26% of Americans aged 30-44 have nothing saved for retirement, there’s plenty of reason why.

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. SOSS22060803

The post A Shocker May be Lurking on Your Next 401(k) Statement appeared first on SoFi.

https://ift.tt/CWZfkgM

0 notes

Link

The New Crypto Legislation Congress is Debating

Commodity Classification

The Responsible Financial Innovation Act was introduced yesterday in the Senate. It’s the first major attempt to regulate cryptocurrencies and other digital assets. Lawmakers say the bill would provide a regulatory framework and promote transparency.

In a broad sense, the legislation aims to classify coins and tokens as commodities like wheat or oil. Digital currencies would be considered “ancillary assets.” That would empower the Commodity Futures Trading Commission to have regulatory oversight.

SEC and Fees

The SEC has called for more crypto regulation in recent years, but may have a reduced role if the bill passes. Digital coins would only fall under SEC scrutiny when certain conditions are met. These include coins offering dividends, liquidation rights, and stock privileges.

The legislation attempts to define “digital assets” as those used “primarily” as a medium of exchange. The bill’s language mentions both virtual currency and payment stablecoins. Fees collected from issuing companies would offset the added regulatory costs.

What’s Next

During a conference call, Congressional staff members attempted to overcome some potential objections. For example, stablecoin users would receive an exemption, and would not be required to report changes in income following each use of digital currency.

Those same staffers explain the bill is large and complex and includes input from both sides of the aisle. Some pundits expect lawmakers to break up the legislation and take a piece-meal approach. That may represent a better approach anyway given the multifaceted nature of digital assets.

In March President Joe Biden signed an executive order aimed at addressing crypto regulatory gaps. If this bill passes the Senate it would head to the House of Representatives and then to Biden’s desk. At a time of uncertainty for many on Wall Street, some crypto clarity may be on the way.

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. SOSS22060802

The post The New Crypto Legislation Congress is Debating appeared first on SoFi.

https://ift.tt/t5GSKJ7

0 notes

Link

Apple’s Privacy Rules Leave DTC Companies Scrambling

Easy Out

Apple (APPL) launched a privacy initiative about a year ago which aims to give users of the company’s products an easy way to avoid having their digital activity tracked. With the policy change, apps that want to follow you online will have to ask you first.

The upgraded privacy feature means users are no longer required to control trackers, which used to be more difficult. The move may be applauded by users, but for companies that relied on the practice to identify their target markets, having their view-in blocked was a blow.

Meta’s Popularity Wanes

Direct-to-consumer startups in particular were adversely affected, as their ability to focus ads on well-matched potential customers is now more limited. The smaller companies who lack the marketing budget and name recognition to support alternative ad campaigns have been hit hard.

In response to Apple’s policy changes, some of these companies are cutting their ad spend on Meta Platform’s (FB) Facebook and Instagram. TikTok, LinkedIn (MSFT), original website content, and even influencers are being leaned on instead to attract consumers’ attention.

Some Upside

Market observers contend the shift isn’t all bad news for these companies. There is the potential that ads will be less diluted and more effective if consumers are less likely to encounter them.

However, as companies shift to a new mode of marketing, they may find their budgets stretched. All while their campaigns are less effective. In the meantime, while Meta’s revenue growth has been slowing, it remains king of the online advertising market.

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. SOSS22060801

The post Apple’s Privacy Rules Leave DTC Companies Scrambling appeared first on SoFi.

https://ift.tt/IKifHjl

0 notes

Link

More Americans are Toasting with Zero-Alcohol Booze

Hold the Alcohol

In a trend that started a couple of years before the pandemic, non-alcoholic beverages are becoming increasingly popular. The category is no longer just “near beer” either. Over the past year, US sales of non-alcoholic spirits reached $4.5 million according to NielsenIQ — that’s a 116% increase. Meanwhile, both non-alcoholic beer and wine revenues grew by over 20%.

At the same time, sales of alcoholic spirits, beer, and wine have either been flat or declining. Still, the non-alcoholic segment remains a small fraction of its boozy counterparts.

Choices Proliferate

Traditional and start-up firms, seeing profit potential in the growing market, are bringing a variety of options to restaurants and grocery stores. Alcohol-free beer is available from industry leaders Heineken (HEINY) and Molson Coors (TAP), along with startup Athletic Brewings, a craft offering. Those who prefer spirits may enjoy a zero-alcohol alternative from Monday Spirits or Seedlip, which has doubled its drink menu over the last year.

For those who want to drink without the buzz, the growing list of options may offer a welcome alternative to inebriation and next-morning headaches.

Bottoms Up Without the Aftermath

Younger consumers in particular are drawn to these beverages for various reasons including concerns about driving under the influence, hangover avoidance, and concern about adverse health effects of alcohol.

However, inflation is putting pricing pressure on a wide range of products. The value of non-alcoholic beverages will be tested. Industry participants claim a focus on quality will help consumers see the value of these products and encourage them to order another round of non-alcoholic drinks.

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. SOSS22060703

The post More Americans are Toasting with Zero-Alcohol Booze appeared first on SoFi.

https://ift.tt/X5Zritf

0 notes

Link

Tariffs Lifted on Southeast Asian Solar Products

Two-Year Reprieve

The Biden Administration announced a 24-month pause for tariffs on imports of solar panel products from Cambodia, Malaysia, Thailand, and Vietnam. Tariffs on imports from China and Taiwan will remain unchanged. Shares of solar energy companies popped on the news.

This comes on the heels of a US Commerce Department probe concerning whether China was circumventing anti-dumping rules by channeling its sales through other southeast Asian countries. The uncertain outcome of the investigation coupled with ongoing supply-chain disruptions stalled out progress in the development of solar energy solutions.

Bridge to Clean Energy

The tariff reprieve was cheered by clean energy supporters. With the spike in world energy prices triggered by Russia’s invasion of Ukraine, criticism of the tariffs has increased. As suppliers are permitted to trade more freely and investment in the space resumes, the White House expects to reduce its carbon footprint.

The Administration has referred to the two-year plan as a bridge serving to boost solar product supply.

Delayed Reckoning

Domestic suppliers are unlikely to cheer the plan, as they will face heightened competition from southeast Asia. The Biden administration plans to support these US firms by labeling domestic products with “super preference status.” It will also implement the Defense Production Act to spur US production in the solar space.

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. SOSS22060702

The post Tariffs Lifted on Southeast Asian Solar Products appeared first on SoFi.

https://ift.tt/1pyBjEu

0 notes

Link

Why Apple’s Focus May Shift Away from Laptops, iPhones, and iPads

Hardware or Software?

Apple (AAPL) opened its annual weeklong developer’s conference yesterday. The tech giant unveiled its new MacBook Air, which includes a more powerful M2 processor. It also rolled out the upgraded iOS 16 and a new “buy now pay later” program called Apple Pay Later. Some industry observers argue Apple’s greatest upside lies in software development.

Apple posted record profits during the height of the pandemic. Hardware sales surged as workers and students bought up laptops, iPads, and iPhones, but some analysts argue that the trend is slowing down. A survey from FactSet predicts iPhone revenue will increase by just 6.2% this fiscal year compared to 39% in 2021. Experts blame parts shortages and production delays due to COVID-19 lockdowns.

Future Forecast

FactSet’s survey also found Apple’s service revenue could rise 17% this fiscal year to reach $80 billion. That would rank the division second after the iPhone in terms of sales. It would also outpace the combined revenue from iPads and Mac computers.

App Store videogames are one of Apple’s biggest money makers in the service category. They also connect to a highly-anticipated piece of hardware. Some say Apple’s extended-reality headset will be its next hit product. Additionally, the company’s latest ad campaign highlights ongoing efforts in privacy software.

Regulatory Uncertainty

One of the biggest question marks for Apple is what steps regulators will take. For example, the European Union may soon approve legislation targeting iPhone software. The measure would permit users to download apps outside of the App Store. That’s significant because Apple currently collects up to 30% of the revenue from in-app purchases.

Congress is debating legislation that’s similar to what the EU may enact. Many app developers and lawmakers argue Apple has too much control over certain aspects of the app ecosystem.

While analysts will be closely watching for more announcements this week, price action was relatively muted on Monday. Apple’s stock finished just slightly in the green, hinting that Wall Street is also split on the future the tech giant is charting for itself.

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. SOSS22060701

The post Why Apple’s Focus May Shift Away from Laptops, iPhones, and iPads appeared first on SoFi.

https://ift.tt/nKLsCjQ

0 notes

Link

New York Bill Casts Uncertainty on the Future of Bitcoin Mining

Unacceptable Carbon Footprint

A New York bill banning certain Bitcoin (BTC) mining practices has passed and now requires the approval of Governor Kathy Hochul to become law. At issue is “proof of work” cryptocurrency mining that uses a significant amount of electricity to run mining operations, all while burning fossil-fuels as part of the process. If Hochul signs the bill it would mark the first such ban on blockchain technology infrastructure in the US.

The measure also connects to New York’s state goal of cutting greenhouse emissions by 85% by 2050 in compliance with the Climate Leadership and Community Protection Act.

High Standard

The bill would only allow proof-of-work mining companies that use 100% renewable energy to expand or renew permits. The Chamber of Digital Commerce notes that members that mine in New York have an 80% sustainable energy mix, which does exceed the estimated global average of 60%. The bill’s opponents contend that crypto miners will leave New York and relocate to other states that have fewer hurdles to their operations, thereby harming the state’s economy.

Others fear New York’s move could become a trend that catches on with other states, with implications for both the industry and the Americans it employs.

Washington Evaluates Environmental Impact

The crypto industry could also be facing headwinds at the federal level. The Biden administration is evaluating Bitcoin mining’s environmental impact as part of a broader effort to limit emissions and address factors contributing to adverse climate change.

Given the US accounts for nearly 40% of the global Bitcoin mining industry, what is decided in New York could be pivotal to the industry, especially if new restrictions establish a standard other states choose to follow.

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. SOSS22060603

The post New York Bill Casts Uncertainty on the Future of Bitcoin Mining appeared first on SoFi.

https://ift.tt/mDbZYXM

0 notes

Link

Walmart’s High-Tech Plans Includes 4 New Plants

Walmart plans to open four new fulfillment centers over the next three years as the company embraces automation.

Walmart (WMT) plans to open four new fulfillment centers by 2025 starting with one in Illinois, which will open this summer. The plants will feature high-tech advances which are expected to allow the retail giant to process orders faster. Automation technology will pick out products and transport them to employees, who are then tasked with packing the item into a box.

The company said it will hire 4,000 workers for the new facilities and pay them up to $28 an hour.

Robot Rollout

The additional fulfillment centers are being rolled out in tandem with upgrades to other parts of the retailer’s network, as it works to accommodate demand from online shoppers. Walmart has implemented automation at dozens of its stores to process orders and has announced it will introduce robotics to 42 regional distribution centers.

The moves will arguably help the company to better compete with Amazon (AMZN) by allowing it to turn around orders more efficiently. For consumers it could mean more one and two-day delivery options for common items like cereal and t-shirts.

Safety and Efficiency

The automation evolution may be cheered by both workers and shoppers alike. The use of robots could increase employee safety by taking over tasks such as heavy lifting, or grabbing items off of high shelves. For consumers the big win is faster ecommerce from a wider range of sources.

As the competition heats up in online shopping, industry observers say more retailers are likely to jump on the automation bandwagon. It also seems to indicate ecommerce purchases are likely to arrive on the doorstep sooner rather than later.

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. SOSS22060602

The post Walmart’s High-Tech Plans Includes 4 New Plants appeared first on SoFi.

https://ift.tt/0iCwbBR

0 notes

Link

The Week Ahead on Wall Street

Economic Data

Today, no major economic data is scheduled for release.

Tomorrow, be on the lookout for April’s foreign trade balance, which is the net difference between the value of the nation’s imports and exports. In March the trade deficit increased by 22.3% to $109.8 billion. It marked the first time the number exceeded $100 billion. Also due is April’s consumer credit, after the number soared by $52 billion in March, exceeding expectations. Revolving debt, such as credit cards, surged 21.4% higher.

Wednesday, the Mortgage Bankers Association will release its weekly mortgage applications and the average rate on a 30-year fixed loan. Last week mortgage applications declined by 2.3% to hit a new four-year low. The number has been decreasing as interest rates have risen. Keep an eye out for April’s revised wholesale inventories as well.

Thursday, initial and existing jobless claims will be published. Last week the number of people filing for unemployment benefits declined by 200,000 and hit its lowest level since 1969.

Friday, inflation comes back into focus as the May CPI is due on a monthly and year-over-year basis. In April, the index showed prices increasing 8.3% from the same time period in 2021. That’s near a 40-year high. Core CPI, which strips out volatile fuel and food costs, will be released as well. May’s federal budget balance is also due.

Earnings

Today NGL Energy Partners (NGL) will report its fiscal fourth-quarter earnings data. The company provides services to oil companies including transportation, storage, and blending. During its most recent earnings call NGL fell short of earnings per share expectations but beat on revenue.

Tomorrow, restaurant company Dave & Busters (PLAY) hands in its latest report card. After struggling during the pandemic, Dave & Busters has been posting significant year-over-year increases in visits, as Americans are now looking for places to socialize.

Wednesday, Thor Industries (THO) will post its most recent earnings data. The American manufacturer of recreational vehicles has seen its share price fall by upwards of 50% since its 2018 high water mark. It’s been a struggle for the RV industry, which tends to follow broader economic trends.

Thursday, Chinese EV company Nio (NIO) will publish its latest results. Last week Nio reported May’s vehicle deliveries were delayed by COVID-19 lockdowns. The company has missed on profit but beat on sales during its two most recent earnings calls. That same day Docusign (DOCU) will report earnings. The company helps firms manage electronic agreements. Last week Docusign hired a former Workday (WDAY) executive as its top lawyer.

The Week Ahead at SoFi

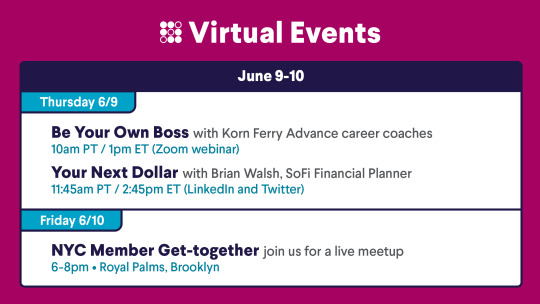

This week, explore what’s involved in launching your own business, plus NYC members can meet up in Brooklyn for a live event. Also check out this week’s Your Next Dollar livestream. Save your seat in the SoFi app!

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. SOSS22060601

The post The Week Ahead on Wall Street appeared first on SoFi.

https://ift.tt/y38dvlo

0 notes

Link

Top 10 Home Builders in Utah

If you’re like us, you’ve tried doing your own research into home builders in Utah. It’s easy to become overwhelmed with the number of builders and the information available about them. That’s why we assembled a list of our top 10 local Utah home builders. We picked these builders based on their homes, the variety of locations, floor plans and housing types, and customer reviews. We’ll leave it to you to do the comparing and contrasting, based on what works for you.

You can find new homes from any of these Utah home builders in the Homie real estate platform.

Woodside Homes

Communities: 14 Locations: American Fork, Bluffdale, Syracuse, West Haven Starting Price: $398K Home Types: Single Family, Townhome

Woodside is a builder local not only to Utah, but much of the Southwestern U.S. as well. With multiple new build communities in Salt Lake, Davis, and Weber counties, Woodside offers options throughout the Wasatch Front. Reviewers of Woodside were largely positive. They appreciated how professional and responsive the builder was.

Ivory Homes

Communities: 50+ Locations: Clinton, Draper, Eagle Mountain, Farmington, Grantsville, Heber, Herriman, Highland, Holladay, Hurricane, Kaysville, Layton, Lehi, Lindon, Magna, Midvale, North Ogden, Orem, Park City, Provo, Riverton, Salt Lake City, South Jordan, St. George, Stansbury Park, Summit, Washington, West Haven, West Jordan Starting Price: $400K Home Types: Single Family, Townhome, Condo

Ivory Homes is one of Utah’s best-known and most prolific home builders. The builder has been in the business for more than 30 years. Ivory has more available communities and units than any other Utah home builder on this list. Ivory’s offerings include new construction communities from North Ogden down to St. George. Reviewers of Ivory Homes valued the quality of the homes, as well as the variety of available floor plans.

Edge Homes

Communities: 13 Locations: Eagle Mountain, Herriman, Lehi, Saratoga Springs, Vineyard Starting Price: $385K Home Types: Single Family, Townhome, Condo

The Edge Homes portfolio features an array of new construction options near Utah’s Silicon Slopes tech hub. Edge’s building efforts are focused primarily in southern Salt Lake County and northern Utah County. Edge’s happy customers wrote reviews about how professional and easy to work with the builder was.

Visionary Homes

Communities: 35 Locations: American Fork, Farmington, Farr West, Hooper, Ivins, Layton, Logan, Mapleton, Nibley, North Logan, North Ogden, Ogden, Plain City, Providence, Salem, Santaquin, Smithfield, Spanish Fork, St. George, Tooele, Tremonton Starting Price: $305K Home Types: Single Family, Townhome, Condo

Visionary Homes offerings include the most affordable homes on our list. If you choose to buy from Visionary, you can choose from new construction communities in Northern Utah, the Wasatch Front, and Southern Utah. Customers of Visionary Homes appreciated the professionalism and quality of the builder’s work.

CW Urban

Communities: 6 Locations: Centerville, Farmington, Layton, Mountain Green, Park City, South Jordan Starting Price: $500K Home Types: Single Family, Townhome, Condo

CW Urban is known for its sleek, modern urban designs. You may have guessed that from the company name. Fans of CW’s in-demand style have new construction community options in Davis, Summit, Salt Lake, and Morgan counties. Satisfied customers loved the builder’s professionalism and the quality of their work.

Fieldstone Homes

Communities: 10 Locations: Clearfield, Eagle Mountain, Lehi, Park City, Payson, Saratoga Springs, South Jordan, Victor Starting Price: $435K Home Types: Single Family, Townhome

Fieldstone has been building homes in Utah for more than 20 years. If you’re looking for a more experienced touch, this might be the builder for you. With new construction communities from Layton down to Payson, Fieldstone has plenty of location options for buyers. Raving reviews for Fieldstone included praise for the builder’s professionalism, responsiveness, and quality.

Destination Homes

Communities: 7 Locations: Layton, Saratoga Springs, South Jordan Starting Price: $799K Home Types: Single Family, Townhome

Destination Homes trends more upscale and larger than most of the builders on this list. Destination’s new construction communities in Davis, Salt Lake, and Utah counties give buyers a good spread across the Wasatch Front. The reviews for Destination are in–professionalism and punctuality were strengths for this builder.

Holmes Homes

Communities: 14 Locations: Daybreak, Magna, Midvale, Park City, Saratoga Springs, St. George, West Jordan Starting Price: $497K Home Types: Single Family, Townhome, Condo

You just have to love the awesome alliteration in the name. In addition to that, Holmes Homes offers multiple new construction communities in Salt Lake, Summit, Utah, and Washington counties. Reviewers commonly said that they got a great value from their Holmes Homes purchase.

Wright Homes

Communities: 6 Locations: Draper, Herriman, Riverton, St. George Starting Price: $408K Home Types: Single Family, Townhome

When you shop with Wright Homes, you just might find the right home for you. Wright’s locations are limited, however. You’re likely to find the right home if you’re looking in Salt Lake County or St. George. According to reviewing customers, punctuality is a strong suit for Wright Homes.

Perry Homes

Communities: 12 Locations: Herriman, Highland, Kaysville, Layton, Lehi, Provo, Saratoga Springs, South Weber, Stansbury Park, Tooele, West Jordan Starting Price: $570K Home Types: Single Family

Perry Homes is a high end Wasatch Front builder, but they have homes in the median price range as well. Perry’s locations spread across Utah, Tooele, Davis, and Salt Lake counties. Satisfied customers were pleased with the professionalism and quality of Perry Homes.

Search New Homes from Builders in Utah

Ready to begin your new build home search? Search and request tours of new construction homes today. If you’re not quite ready to start searching, you can always talk to an agent first.

The post Top 10 Home Builders in Utah appeared first on Homie Blog.

https://ift.tt/QgGWVnB

0 notes

Link

Understanding Financial Well-being for LGBTQ+ Employees

In recent years, research has revealed a significant disparity in the financial well-being of LGBTQ+ adults compared to the general population, particularly among transgender people and LGBTQ+ people of color. The major drivers behind this wealth gap? Lower rates of inheritance and family support, as well as discrimination in housing, financial services, and employment. For the 8.1. billion LGBTQ+ workers in the U.S., these social and economic inequities have a cascading effect on all aspects of financial well-being — from student loan debt to homeownership to retirement savings.

As an HR leader, you’re in a unique position to help break down the barriers standing in the way of your LGBTQ+ employees’ financial success. Here’s a look at some of the challenges they face and how employers can help.

$92 Billion in Federal Student Loans

LGBTQ+ adults are carrying an overall higher burden of federal student loan debt — some $93 billion in total — than their non-LGBTQ+ peers, according to a 2021 study published by the UCLA School of Law Williams Institute and the 20 Points Foundation.

The study found that more than a third (35.4%) of LGBTQ+ adults ages 18 to 40 — an estimated 2.9 million — have federal student loans, compared to 23.2% of their non-LGBTQ+ peers. On average, LGBTQ+ borrowers owe $47,500 in total student debt, compared to a general population average of $32,731. About four out of 10 LGBTQ+ adults holding federal student loans also have student debt in the form of private student loans from a bank or other lending institution, credit cards, or other loans.

For many LGBTQ+ borrowers, student debt is tied to their home living situation, with some turning to college (via student loans) as a way out of unaccepting homes, notes a 2019 report from the nonprofit group Summer & Student Debt Crisis. What’s more, only 25% of LGBTQ+ borrowers aged 25 to 29 receive family assistance in paying off their student debt, compared to 53% of non-LGBTQ+ borrowers.

How Employers Can Help

A provision of the Coronavirus Aid, Relief, and Economic Security (CARES) Act allows employers to make tax-free student loan contributions of up to $5,250 annually through 2025. (Before CARES, only tuition reimbursement was allowed, and employees had to treat a student loan repayment benefit as income.) Offering this benefit can be a lifeline to many employees, and LGBTQ+ workers in particular.

Other ways to help lift LGBTQ+ employees weighed down by student debt include offering one-on-one counseling sessions with personal finance or student debt repayment advisers and educating employees about alternative payment plans, such as filing for forbearance or a government income-driven repayment program or refinancing with a private lender.

The Homeownership Gap

A 2020 report published by UCLA School of Law Williams Institute found that significantly fewer LGBTQ+ adults and same-sex couples own homes compared to their non-LGBTQ+ peers. Indeed, just under half (49.8%) of LGBTQ+ adults own their own homes, compared to 70.1% for the rest of the population in the U.S.

The disparity isn’t due to a lack of interest in homeownership. A 2018 study conducted by Freddie Mac (the most recent data available) found that three-quarters of LGBTQ+ renters agreed that owning is a good financial investment, and 72% said they want to own a home in the future.

Unfortunately, LGBTQ+ adults face more than financial barriers to homeownership. According to the Williams Institute report, same-sex couples frequently encounter system-wide discrimination by mortgage lenders, including lower approval rates and higher interest rates and/or fees compared to their non-LGBTQ+ peers.

How Employers Can Help

HR leaders can help LGBTQ+ employees achieve greater financial stability and control over their lives by offering a range of homeownership benefits.

One cost-effective approach is to partner with local mortgage professionals, banks, financial planners, and realtors to create information seminars on the basics of home-buying, such as different types of mortgages and rates, trends in the local market, and how to save for a downpayment. If possible, bring in financial resources and professionals that are part of the LGBTQ+ community — this will ensure that the information provided is relevant to the needs of LGBTQ+ home buyers, such as finding a safe, inclusive neighborhood. You may also be able to find a mortgage lender that can offer a discount to your employees.

The Cost of Discrimination

Lower wages and the cumulative effect of discrimination over time have led to higher financial fragility rates among LGBTQ+ workers, particularly transgender people and LGBTQ+ women of color.

According to a January 2022 report from the advocacy group Human Rights Campaign, LGBTQ+ workers earn 90% of the median wage of full-time employees in the U.S. This disparity grows when LGBTQ+ salary data are disaggregated by race, gender, and gender identity. For every dollar the typical U.S. worker earns, female LGBTQ+ workers earn 87 cents, transgender men earn 70 cents, transgender women earn 60 cents, and black LGBTQ+ workers earn 80 cents.

LGBTQ+ workers are also less likely to have savings, retirement accounts, life insurance, and other resources that create stability in the face of adverse events. According to the Center for LGTBQ Economic Advancement & Research (CLEAR), only 35% of LGBTQ+ people have employer retirement plans, compared to 40% of the general population. More worrisome: Half of LGBTQ+ seniors (51%) are concerned about having enough money to live on during retirement (vs. 36% of their non-LGBTQ+ peers); 42% expect to outlive the amount they have saved (vs. 25%). Financial worries add up to a distressed workforce, which can eat away at productivity.

How Employers Can Help

A robust financial wellness program provides support to all employees but can be particularly valuable to LBGTQ+ workers, who may not have historical financial education, and may need more assistance building generational wealth.

Consider leveraging your LGBTQ+ employee resource group (ERG), if available, and/or conducting a financial wellness assessment to learn about the specific financial challenges your LGBTQ+ employees are facing. This can help you design benefits, resources, and programs that specifically address their most pressing concerns.

In addition to retirement benefits (and, ideally, matching contributions), you may want to offer an emergency savings plan (funded with automatic deposits) to help LGBTQ+ employees gain more financial stability in the face of unexpected events. Financial planning seminars and credit building support are other tools that can help LBGTQ+ employees become more financially resilient.

The Takeaway

The financial needs of the LGBTQ+ population are unique because they often face different challenges than the general population. SoFi at Work can help you to analyze the credit, debt load, and overall financial well-being of your LGBTQ+ employees, and then design the benefits and resources to address their needs.

Learn More

Photo credit: iStock/simarik SoFi loans are offered by SoFi Bank, N.A., NMLS #696891 (Member FDIC), and by SoFi Lending Corp., NMLS #1121636. SoFi Lending Corp. is licensed by the DFPI under the CFL (License #6054612) and by other states. For information on SoFi Lending Corp. licenses, see Licenses (www.nmlsconsumeraccess.org ). The Student Debt Navigator Tool and 529 Savings and Selection Tool are provided by SoFi Wealth LLC, an SEC-Registered Investment Adviser. For additional product-specific legal and licensing information, see SoFi.com/legal. Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOBD05220001

The post Understanding Financial Well-being for LGBTQ+ Employees appeared first on SoFi.

https://ift.tt/PTGbnhX

0 notes

Link

Social App Poparazzi Discloses $15 Million Series A Round

Anti-Instagram

Last May, social app Poparazzi was launched and quickly skyrocketed to the top position on the App Store (APPL) as the startup’s platform gained traction with Gen Z users. Nearly all of those participating on the platform are younger than 22. The app differentiates itself from Big Tech social media companies, which have been shunned by younger people in some cases. Poparazzi logged over 5 million downloads in its first year.

The platform also approaches photo-sharing from a different angle than Meta’s (FB) Instagram, as users post photos to their friend’s profiles, rather than posting their own shots. That concept inspired the company’s name.

Benchmark-Led Round

Poparazzi disclosed it bagged $15 million in a series A round led by venture capital firm, Benchmark. This follows a $2 million Floodgate-led seed round the company secured in 2018.

Company founders, brothers Austen and Alex Ma, spent the three years since the initial funding to test out different ideas. They were able to validate consumer interest in the Poparazzi app by leaning on TestFlight, a service offered by Apple to developers. This market research revealed that high schoolers in particular could be a good target customer base.

Parents on Watch

Since going live, the app has made numerous upgrades and refinements such as privacy enhancements, content moderation, more flexible options for profile build-outs, and in-app challenges to drive engagement. Poparazzi CEO Alex Ma expects the fresh funding will support the company’s growth for more than two years.

The company is not alone in the Instagram-alternative space. Several others are seeking to carve out market share with younger consumers, such as HalloApp and BeReal. This will likely keep Poparazzi on its toes, all while parents of teens face a whole new group of social media platforms to be concerned about.

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up