Online Chartered is a firm of M/s Banthia Venture Private Limited company registered under the companies acts 2013 based in Surat, Gujarat. We offer hassle-free business compliances services like Income Tax Returns, Company Registration, Trademarks, Legal Drafting, RERA, and GST Registration. We are a one-stop solution for all your business legal services that provide 100% accurate and timely compliances.

Don't wanna be here? Send us removal request.

Text

Trademark vs. Copyright: Which One Do You Need? Confused between Trademark and Copyright? Understand the key differences and when to register each. Read more by Online Chartered.

#onlinechartered#trademark vs. copyright#trademark and copyright differences#intellectual property rights

0 notes

Text

Trademark Registration in India: Top 10 Benefits

Get the top 10 benefits of trademark registration in India, including legal protection, brand value, exclusive rights, and market recognition.

0 notes

Text

MSME Compliance for Companies: Applicability & Filing

Understand MSME compliance applicability, how to file MSME Form 1, and key regulations. Stay compliant with our step-by-step guide.

0 notes

Text

How to File Company Annual Return Online in Surat

Need help with company annual return filing? File online hassle-free with our expert services in Surat. Stay compliant with ease!

0 notes

Text

Public & Private Trust Registration in Surat - Expert Help

Complete trust registration services for charity, public, and private trusts in Surat. Register your trust online with expert guidance today!

0 notes

Text

Register Your Producer Company Online in Surat Today

Expert services for producer company registration in Surat. Online solutions for quick setup and compliance. Register your producer company with ease.

0 notes

Text

Expert Trademark Objection Reply in Surat

Need help responding to a trademark objection in Surat? Our experts ensure precise replies for smooth trademark approval. Contact us today!

0 notes

Text

Quick Online GST Registration Cancellation Surat

Cancel your GST registration in Surat with trusted online services. Avoid penalties and ensure smooth compliance with our expert guidance.

0 notes

Text

Affordable Trademark Registration Services in Surat

Protect your business name or logo in Surat with professional trademark registration services. Ensure legal security for your brand today.

0 notes

Text

GST Registration in Surat - Professional Services

Get expert help with GST Registration in Surat. We offer a fast, reliable process for businesses to stay compliant with tax laws.

0 notes

Text

Your Comprehensive Guide to Getting GST Refund in India (2024)

It is not difficult to navigate through claiming a refund of the GST; still, business houses, financial professionals, entrepreneurs, and also individual taxpayers must understand the easiest mode of claiming these refunds. In this article, we have segregated the process of refund under GST, the eligibility criteria, and timeline so you can claim your refund.

What is GST Refund?

A GST refund arises from the situation where registered taxpayers have overpaid the amount of tax owed. This amount can be recovered through an online procedure on the GST portal. In a timely manner, GST refunds are crucial for businesses as well as exporters to keep cash flow and working capital healthy.

Who Can Claim Refund in GST?

Businesses and companies with excess paid taxes or ITC accumulation.

Exporters who have paid Integrated GST (IGST) on exports.

Individual taxpayers who have paid more in error or eligible for refunds pertaining to special purchases. As defined, special purchases include those of the UN agencies and embassies.

International tourists can claim a refund of GST paid on goods purchased from India at the time of departure from the country.

When can GST Refund be claimed?

The following are circumstances under which a GST refund can be claimed:

Excess GST paid due to calculation errors or over-payment.

Amount of ITC on exports/deemed exports.

GST paid on exports.

Inverted Duty Structure, which refers to a structure where input tax exceeds the output tax.

Refund on provisional assessments.

Time Limit for Claiming GST Refund Application

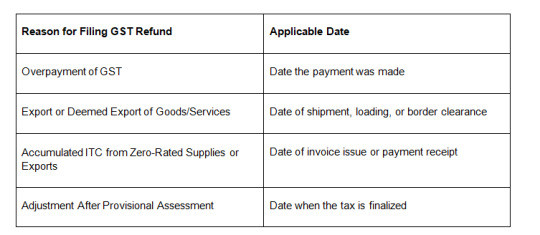

Taxpayers are expected to file their GST refund applications within two years from the relevant date. Time limitation and grounds for filing in a GST refund application are as stated below:

This deadline ensures that companies and tax payers file within a stipulated time frame before losing their rightful refunds.

How to Apply for a GST Refund Step by Step

Login to the GSTN Portal: Login into your account at the GSTN Portal .

Fill Form RFD-01: This would be the form on which refund claims would be supported, and the form should be filed online. All details like the amount to be refunded and relevant invoices must be correctly filled in this form.

Submission of Supporting Documents: Invoices, ITC statements, etc. that may be necessitated.

Track Refund Status: For this, follow the GST portal to track the application

Confirmation: After submission, you will receive an ARN (Application Reference Number) for tracking the status of a refund

Processing of Refund: In most cases, authorities take 30 days to process applications for claiming a refund. Once approved, the amount would directly be credited into your bank account.

How to Monitor Your GST Refund Status

Post-submission

Checking Post-Login: Log in to the GST portal. From the Services tab, click on "Track Application Status".

Pre-Login Tracking: Clicking on "Track Application Status" on the homepage of the GST portal and then filling up the ARN without login.

Key Points to Ensure a Smooth Refund Process

Ensure all invoices and documents are accurate and correctly uploaded.

Monitor the refund status regularly for any updates.

Be mindful of the two-year time limit for refund claims to avoid rejection.

How Online Chartered Makes Your GST Refund Claims Easy

Online Chartered has made the refund process under GST quite smooth and effortless. Our knowledge in GST compliance at Online Chartered would ensure that you receive your refund claim on time. We take our time to help you individually, keeping you oblivious of the persisting turmoil of tax consultancy.

Conclusion

Filing a GST refund does not necessarily need to be so overwhelming. Provided proper steps and observation of important dates are taken, businesses and taxpayers can effectively retrieve their excess payments and give control of their cash flow. Online Chartered is your expert on GST compliance. Streamlined help and support is aimed at simplifying your GST refund claims and getting you the results you need.

0 notes

Text

How To Improve Your Credit Score?

Introduction: Understanding Credit Scores

Before diving into the strategies to improve your credit score, it’s essential to understand what credit scores are and how they are calculated. Credit scores are numerical representations of your creditworthiness, ranging from 300 to 850. The higher your score, the better your creditworthiness. Factors such as payment history, credit utilization, length of credit history, types of credit, and new credit applications contribute to your credit score.

Check Your Credit Report Regularly

Regularly checking your credit report is crucial to maintaining a good credit score. Request a free copy of your credit report from the major credit bureaus, such as TransUnion CIBIL, Experian, Equifax, and CRIF High Mark. Review the report for any errors, inaccuracies, or fraudulent activities. If you identify any issues, report them to the credit bureau and the respective creditor for resolution.

1. Pay Your Bills On Time

Paying your bills on time is one of the most critical factors in improving your credit score. Late payments can significantly impact your score and stay on your credit report for up to seven years. Set up payment reminders or automatic payments to ensure you never miss a due date. Prioritize making at least the minimum payment on all your debts promptly.

2. Reduce Your Credit Utilization Ratio

The credit utilization ratio refers to the percentage of your available credit that you are currently using. Aim to keep your credit utilization below 30% to improve your credit score. Paying down your balances and avoiding maxing out your credit cards can help lower your credit utilization ratio. Consider increasing your credit limit or spreading your balances across multiple cards to achieve a lower ratio.

3. Manage Your Debt Responsibly

Managing your debt responsibly is crucial for improving your credit score. Avoid accumulating excessive debt and maintain a consistent payment schedule. Make more than the minimum payment whenever possible to reduce your debt faster. Create a budget and prioritize debt repayment to ensure you stay on track and gradually decrease your overall debt burden.

4. Avoid Opening Too Many New Accounts

Opening multiple new credit accounts within a short period can raise concerns among lenders and impact your credit score. Each new application results in a hard inquiry on your credit report, which can lower your score temporarily. Limit new credit applications unless necessary, and focus on building a strong credit history with your existing accounts.

5. Maintain A Diverse Mix Of Credit

Having a diverse mix of credit can positively impact your credit score. Lenders prefer to see responsible handling of different types of credit, such as credit cards, loans, and mortgages. Consider diversifying your credit portfolio by responsibly managing a mix of credit accounts over time.

6. Keep Old Accounts Open

Closing old credit accounts can shorten your credit history and reduce the overall age of your accounts. Since credit history plays a role in determining your credit score, it’s generally beneficial to keep old accounts open, especially if they have a positive payment history. However, if a particular account carries high fees or you’re tempted to overspend, carefully evaluate the situation before deciding to close it.

7. Use Credit Monitoring Services

Credit monitoring services can provide valuable insights into changes in your credit report. These services can alert you to potential fraud, unusual activities, or any negative information that could impact your credit score. Regular monitoring allows you to address any issues promptly and take appropriate actions to protect and improve your credit standing.

8. Correct Any Errors On Your Credit Report

Errors in your credit report can have a significant impact on your credit score. Carefully review your credit report for inaccuracies, such as incorrect personal information, accounts that don’t belong to you, or inaccurately reported payment history. Dispute any errors with the credit bureau and the respective creditor to have them corrected or removed from your report.

0 notes

Text

In today’s digital era, influencers have become an integral part of the online landscape, wielding significant influence over their followers and shaping trends across various industries. With the rise of social media platforms and the increasing popularity of content creation, it is essential for influencers to have a comprehensive understanding of Taxation for Influencers to ensure both financial efficiency and compliance with the law.

0 notes

Text

Capital Gain On Shares

What Are Capital Gains?

Capital gains refer to the profits earned from the sale of a capital asset, such as shares of stock, bonds, or real estate. When the selling price of an asset exceeds its purchase price, the resulting profit is considered a capital gain. Conversely, if the selling price is lower than the purchase price, it results in a capital loss.

Types Of Capital Gains

There are two primary types of capital gains: short-term capital gains and long-term capital gains. Short-term capital gains are generated from the sale of assets held for one year or less, while long-term capital gains are derived from the sale of assets held for more than one year. The tax implications and rates differ for each type of gain, making it crucial to understand the distinction.

The Role Of The Stock Market

The stock market serves as a platform for buying and selling shares of publicly traded companies. Investors participate in the stock market to generate returns, primarily through capital gains and dividends. While dividends represent a portion of a company’s profits distributed to shareholders, capital gains arise from the increased value of stocks.

Calculation of LTCG on Shares

LTCG = Sale value of long-term equity assets – (the cost of acquisition of asset + expenses incurred due to their transfer or sale).

Computation of Long term capital gains:

Sales consideration of asset-Expenditure incurred wholly and exclusively in connection with transfer of capital assets (E.g., brokerage, commission, advertisement expenses, etc.)- Indexed cost of acquisition -Indexed cost of improvement

Calculation of STCG on Shares

STCG = Sale value of short-term equity assets – (cost of asset acquisition + expenses incurred from the transfer or sale of the assets).

Computation of short-term capital gains:

The full value of the consideration (i.e., Sales value of the asset) – Expenditure incurred wholly and exclusively in connection with the transfer of capital asset (E.g., brokerage, commission, etc.) – Cost of acquisition (i.e., the purchase price of the capital asset)- Cost of improvement.

Read more:

0 notes

Text

https://onlinechartered.com/benefits-of-portfolio-diversification/

0 notes

Text

The Impact Of Technology On Business

Automation And Streamlined Processes

Advancements in technology have led to increased automation and streamlined processes within businesses. Tasks that were once time-consuming and prone to human error can now be automated, allowing employees to focus on more strategic and creative aspects of their work. This has resulted in improved efficiency, reduced costs, and faster turnaround times. Technologies such as artificial intelligence (AI), machine learning, and robotic process automation (RPA) have transformed industries like manufacturing, logistics, and customer service.

Cybersecurity Challenges

While technology has brought numerous benefits to businesses, it has also introduced new challenges, particularly in the realm of cybersecurity. As companies become increasingly reliant on technology for their operations, they face the constant threat of cyberattacks and data breaches. It is essential for businesses to prioritize cybersecurity measures and invest in robust systems to protect sensitive information. Regular security audits, employee training, and encryption technologies are some of the measures businesses can adopt to mitigate these risks effectively.

Augmented Reality (AR) And Virtual Reality (VR) In Business

Augmented Reality (AR) and Virtual Reality (VR) technologies have found applications in various industries, revolutionizing customer experiences. From virtual showrooms and product demonstrations to immersive training simulations, AR and VR provide businesses with unique opportunities to engage customers, train employees, and showcase products or services in an interactive and memorable way.

Read more:

0 notes