Text

Meebhoomi AP: How to Search Andhra Pradesh Land Records (Adangal) Online?

Checking land records in Andhra Pradesh is now fast, easy, and transparent—thanks to the Meebhoomi AP portal. Whether you're verifying property before buying, checking your own land details, or downloading an Adangal, this digital platform simplifies the process. Here’s a complete guide on how to access Andhra Pradesh land records online, including Adangal, 1-B records, ROR, and more.

What is Meebhoomi AP?

Meebhoomi is an official digital portal launched by the Government of Andhra Pradesh to provide access to land records for citizens, buyers, farmers, and government departments. The platform lets users:

View Adangal (Village Count Register)

Check 1-B (Ownership) Records

Track land mutation status

Download land passbooks

Verify Encumbrance Certificate (EC) and more

Everything is available in Telugu and English, accessible 24x7 online.

How to Search Land Records on Meebhoomi Portal?

Step 1: Visit the Official Website

Go to https://meebhoomi.ap.gov.in/

Step 2: Select Your Record Type

Choose from options like Adangal, 1-B, or FMB based on your need.

Step 3: Enter Required Details

Fill in the following:

District

Mandal

Village

Survey number OR Pattadar name OR Aadhar number

Step 4: Click "Submit"

The details of your land or the searched property will appear on the screen. You can download or print the document for official use.

How to Download Adangal Online in Andhra Pradesh

Go to Meebhoomi AP Adangal page

Choose: Personal Adangal or Village Adangal

Select your District, Mandal, or Village

Enter Survey Number, Pattadar Name, or Khata Number

Click “Submit”

View or download the Adangal as PDF

Benefits of Meebhoomi Land Records

100% Online Access: No need to visit mandal offices

Transparency in Land Deals: Essential for buyers and sellers

Useful for Legal & Bank Documentation

Mobile-Friendly Access

Farmer Friendly: Check land suitability and usage for farming loans

Conclusion

The Meebhoomi AP portal has made land record access in Andhra Pradesh simple and transparent. From downloading your Adangal to verifying property ownership, it empowers buyers, farmers, and landowners with accurate data at their fingertips.

Frequently Asked Questions (FAQ)

Q1. What is the difference between Adangal and 1-B record?

Adangal contains land usage details, while 1-B confirms legal ownership and khata number.

Q2. Is the Meebhoomi portal available in Telugu?

Yes, the portal offers complete services in Telugu and English.

Q3. Can I use the downloaded Adangal for legal purposes?

Yes. It is valid for basic verification, but get it certified at the MRO office for official transactions.

Q4. What if my Aadhar is not linked to land records?

You can link it online through the Meebhoomi portal under “Aadhar linking” or contact the revenue office.

Q5. Can NRIs access Meebhoomi from abroad?

Yes. It is accessible from anywhere using the internet.

0 notes

Text

VVMC Property Tax: How to Pay in the Vasai-Virar Area?

Like other municipalities in the Mumbai Metropolitan Region (MMR), residents of Vasai-Virar must pay their property taxes on time. However, through the Vasai Virar City Municipal Corporation (VVMC) portal, homeowners can now pay their property taxes on time. This article lets us know the VVMC property tax payment process & download method in detail.

Table of Contents

Steps to Pay Property Tax Online

Factors Determining VVMC Property Tax

VVMC Property Tax: Payment Last Date

Penalties for Late Payment of VVMC Property Tax

Benefits of Online VVMC Property Tax Payment

Paying Taxes Offline

Helpline Contact Details

Vasai Virar City Municipal Corporation (VVMC) levies property tax on immovable properties under its jurisdiction. Every year, the civic body collects property taxes from the owners to maintain civic services.

The tax rate depends on the size and purpose of the property. Online payments can be made through the official portal hosted by VVMC for convenience. If you are new to paying VVC property tax online, read this article and explore the payment process, along with penalties and exemptions.

Steps to Pay Property Tax Online

Visit the official VVMC portal and click “Property Tax” under Civic Services.

Select “Online Payment”. You'll be redirected to online: Online Property Tax.

Search using your Property ID or owner’s name, plus ward and zone details

Review details—owner name, address, tax for 1 or 5 years, and any discounts.

Provide mobile number, email, captcha, etc., then click pay.

Choose your payment method (cards, net banking, UPI, wallets, EMI) and complete the transaction.

Download your receipt (show receipt history/download bill options are available).

Factors Determining VVMC Property Tax

It depends on the ward and zone of the property location.

The built-up area, or carpet area, of the property also determines the tax levied.

The type of property determines the tax. Residential properties face lower taxes in comparison to commercial properties.

The options available are Open Land, Residential, Hotel, Mixed, Non-Residential, Industrial and Hospital.

Construction Type: RCC, Paper Shed, or General Construction

Rent is sanctioned by VVMC for the same ward

The rateable value of the property is determined.

Formula

Rateable property = Standard rent x Area x 12 – Standard deduction of 10 percent

Tax Payment Last Date

The property tax payment deadline is December 31. Failure to comply with the correct payment dates may result in nominal penalties at the initial stage. Then facing legal consequences as discussed below.

Penalties for Late Payment of VVMC Property Tax

VVMC or VVCMC property tax is a monthly bill to be paid on time. However, if you consistently fail to pay the bill for more than three months, you will have to pay a penalty of two percent for every month of default.

Failure to pay property taxes from January to March will lead to an extra two percent being added to the overdue balance for each month after March. This penalty will continue to accrue until the complete bill, including any penalties, is paid off.

In addition, VVMC will also alert the authorities if Vasai Virar repeatedly defaults on property tax payments. As a result, legal action is taken in the worst cases.

Benefits of Online VVMC Property Tax Payment

The entire process is transparent to the property holder and the municipal corporation

You can find information on property tax, resolutions, amendments, and more on the official portal.

Online transactions can be easily completed by choosing from a variety of payment options.

Anyone with property details can pay taxes online to reduce hassle. There is no need to go to the municipal office and stand in the queue for tax payments. It has Online payments are a delight for property owners in the region.

Paying Taxes Offline

If you prefer the old-school method of paying your VVMC property taxes offline, you should visit the Vasai-Virar City Municipal Corporation Office (VVCMC Head Office) directly opposite Virar Police Station, Bazar Ward, Virar East, Maharashtra 401305.

Helpline Contact Details

Property owners can connect the contact details given below for any property tax-related queries.

Help Line Number: 8828137832

Email: [email protected]

Conclusion

Stay updated on the latest developments in the Indian real estate industry by following the Openplot.com Knowledge Center. Our platform provides informative articles, expert opinions, and market reports as well as valuable insights, news, and updates. Welcome to the world where your ideal home is just a click away!

0 notes

Text

GHMC Property Tax in Hyderabad: Online Payment and Receipt Download

The property tax is an essential revenue source for local municipal corporations, helping to maintain city infrastructure and public services. In Hyderabad, the Greater Hyderabad Municipal Corporation (GHMC) manages property tax collection. To make the process easier, GHMC provides an online platform for property owners to pay their taxes, check details, and download receipts from the comfort of their homes.

Table of Contents

Property Owners Pay Their Taxes

GHMC Property Tax in Hyderabad

Benefits of Online Payment Method

How to Make Online Payments for GHMC Property Tax

How to Search GHMC Property Tax Details?

How to Download GHMC Property Tax Receipt?

Date to Pay the GHMC Property Tax

Contact GHMC for Assistance

Property Owners Pay Their Taxes

The online payment method for GHMC Property Tax has revolutionized the way property owners pay their taxes. It offers a hassle-free and convenient payment experience, allowing property owners to save time and effort. The secure payment process and easy access to payment history make it a preferred choice for many citizens in Hyderabad.

As the GHMC continues to emphasize the importance of digitalization, the online payment method for property tax is a step towards a more efficient and transparent tax collection process. It not only benefits property owners but also contributes to the overall development of the city by ensuring timely revenue collection for the GHMC.

GHMC Property Tax in Hyderabad

Property owners in Hyderabad have to pay their property taxes to GHMC every year. As discussed earlier, these funds will be used to provide superior Hyderabad public services.

Annual rental values are the basis for the collection of GHMC tax payments. In the case of residential units, it is calculated based on slab rates. As the tax value varies concerning location, the general public is advised to check the GHMC website for tax calculations.

Benefits of Online Payment Methods

The online payment method for GHMC property tax offers several benefits to property owners. It is time-saving, convenient, and provides a seamless payment experience.

Some of the key benefits of the online payment method include:

Convenience: Property owners can pay their property tax from the comfort of their homes or offices, eliminating the need to visit the GHMC office in person.

Time-saving: The online payment method saves time by reducing the need to stand in long lines and fill out paperwork. Property owners can complete the payment process in just a few clicks.

Easy access to payment history: The online payment portal allows property owners to access their payment history, view their previous transactions, and download receipts at any time.

Secure payment process: The online payment method is secure and reliable, offering multiple payment options such as net banking, credit/debit cards, and UPI.

How to Make Online Payments for GHMC Property Tax?

Making an online payment for GHMC property tax is a simple and straightforward process. Here are the steps to follow:

Visit the GHMC official website: Visit the official website of the GHMC to access the online property tax payment portal.

Select Property Tax and click know your property tax details, shown in the screen

Enter property details: Enter the property details, such as property tax assessment number, zone, and locality, to fetch the property tax details.

Verify the details: Review the property tax details and verify if they are accurate.

Choose payment method: Select your preferred payment method from the available options, such as net banking, credit/debit card, or UPI.

Make the payment: Enter the payment amount and complete the transaction by following the payment gateway instructions.

Download the receipt: Once the payment is successful, property owners can download the payment receipt for their records.

How to Search GHMC Property Tax Details?

You can search for GHMC property tax details online using different criteria, such as:

a) GHMC Property Tax Search by Name

Currently, GHMC does not offer a direct name-based search online. If you don’t have your PTIN or assessment number, visit the nearest GHMC office or call customer support.

b) GHMC Property Tax Search by Mobile Number

Similarly, mobile number-based searches are not yet available online. However, if your number is linked to your property records, you can try contacting GHMC’s customer care.

c) GHMC Property Tax Search by Door Number

To search for your property tax details by door number, follow these steps:

Visit the GHMC website

Go to the Property Tax Section

Select the Search by “Door Number” option

Enter Your Door Number & Click Search

How to Download GHMC Property Tax Receipt?

If you’ve already made a payment and need to download your GHMC property tax receipt, follow these steps:

Steps to Get GHMC Property Tax Receipt Online

Visit the GHMC Website: GHMC Property Tax Portal

Go to the “Receipts” Section

Enter Your PTIN/Assessment Number

Find Your Payment History

Click “Download Receipt.”

Having a receipt is crucial for legal and financial documentation.

Date to Pay the GHMC Property Tax

Wondering when to pay tax dues on time? The last date for half-yearly property tax payments is July 31 every year. The last date for annual property tax payments is October 15. Failure to pay property tax will result in a penalty of 2% of the outstanding amount every month.

Besides, Greater Hyderabad Municipal Corporation takes the initiative in encouraging people to pay property tax on time. In fact, in 2016-17, a lucky draw will be announced for property owners who have paid their taxes ahead of time.

Contact GHMC for Assistance

If you need help with property tax payments or searches, contact GHMC:

GHMC Helpline: 040-2111 1111

Website: www.ghmc.gov.in

Email: [email protected]

Conclusion

The online payment method for GHMC property tax in Hyderabad has simplified the tax payment process and set a benchmark for other municipal corporations to follow suit. With its numerous benefits, it is no surprise that an increasing number of property owners are opting for the online payment method to fulfill their property tax obligations.

Frequently Asked Questions

Q. What is GHMC property tax?

A. GHMC property tax is a mandatory tax levied by the Greater Hyderabad Municipal Corporation (GHMC) on residential, commercial, and vacant properties in Hyderabad. It funds infrastructure, sanitation, and civic services in the city.

Q. Can I search GHMC property tax details by name?

A. No, GHMC does not provide a direct name-based search for property tax details online. You will need your PTIN, assessment number, or door number to retrieve tax information.

Q. How can I search GHMC property tax by mobile number?

A. Currently, GHMC does not offer a mobile number-based search for property tax. You may contact GHMC customer support to check if your mobile number is linked to your property records.

Q. Is there a rebate for early GHMC property tax payment?

A. No, currently, GHMC does not provide an early payment discount, but paying before the deadline avoids penalties.

0 notes

Text

Why 2 BHK Rentals Are the Top Choice in the Mumbai Real Estate Market

Mumbai, often hailed as the financial capital of India, continues to witness an ever-evolving real estate landscape. Among the vast range of residential options, 2 BHK rentals have emerged as the most preferred housing type across diverse demographics. Whether it's a young professional, a growing family, or a savvy investor, the 2 BHK apartment consistently offers the ideal mix of space, affordability, and convenience.

In this blog, we’ll explore why 2 BHK rentals dominate the Mumbai housing market, backed by real estate trends, lifestyle shifts, and investment insights.

Table of Contents

Urban Migration and Its Impact on Housing Demand

Family Structure and the Preference for 2 BHK Apartments

Affordability: The Budget-Friendly Choice for Renters

Location Flexibility: Finding the Right Neighborhood

Optimal Layout: Balancing Space and Functionality

Investment Potential: Why 2 BHKs Offer Strong Returns

Diverse Tenant Profiles: Who Prefers 2 BHK Rentals?

Community Living: The Appeal of Apartment Complexes

Safety and Security: The Role of Gated Communities

Infrastructure Development: Enhancing Connectivity and Amenities

Urban Migration and Its Impact on Housing Demand

Mumbai attracts thousands of new residents every year—job seekers, students, and professionals looking for better prospects. While solo individuals may start with 1 BHK units or shared spaces, those settling down long-term opt for 2 BHKs due to:

More space at a marginally higher cost than a 1 BHK

Flexibility to include a guest room or home office

Better rental returns and resale value

Popular rental hotspots include Andheri, Bandra, Powai, Lower Parel, and growing suburban markets like Thane, Navi Mumbai, and Panvel, where infrastructure is rapidly expanding.

Family Structure and the Preference for 2 BHK Apartments

Changing family dynamics—smaller nuclear families, working couples, and young parents—fuel the demand for 2 BHK homes. These units offer:

Comfortable living space for a small family

Extra room for remote work or study

Affordability over 3 BHKs

Easier upkeep compared to larger homes

For most urban families, a 2 BHK strikes the perfect balance between function and finance.

Affordability: The Budget-Friendly Choice for Renters

With escalating property prices in Mumbai, renting is the norm, especially in well-connected localities. The 2 BHK stands out as the most cost-efficient choice per square foot, particularly for:

Working couples

Families with children

Roommates looking to split rent

Developers have increasingly shifted their focus to this mid-segment housing type, especially in suburban areas where the demand for affordable housing in Mumbai is rising sharply.

Location Flexibility: Finding the Right Neighborhood

2 BHK units are widely available in nearly every corner of Mumbai—central zones, suburban areas, and even emerging townships. This geographic diversity allows renters to choose based on:

Proximity to work or school

Access to public transport and social infrastructure

Lifestyle preferences (nightlife, green spaces, etc.)

This location flexibility makes 2 BHK apartments the ideal rental option for both urban veterans and newcomers alike.

Optimal Layout: Balancing Space and Functionality

In a city where every square foot matters, 2 BHKs offer a well-optimized layout—typically including:

Two bedrooms

The living room and kitchen

Optional workspace or study area

Modern designs now focus on space efficiency, with open floor plans and multifunctional rooms to suit hybrid work needs and lifestyle shifts. This adaptability is key to long-term rental satisfaction.

Investment Potential: Why 2 BHKs Offer Strong Returns

From an investor’s lens, 2 BHK units are low-risk, high-yield assets in the Mumbai rental ecosystem. They offer:

Consistent tenant demand

Lower maintenance and turnover costs

High occupancy rates

Faster appreciation in developing corridors

Locations like Thane, Kharghar, and Dombivli are witnessing rising rental yields due to metro expansion and infrastructural push, making 2 BHKs an attractive rental investment.

Diverse Tenant Profiles: Who Prefers 2 BHK Rentals?

The 2 BHK configuration appeals to a broad demographic, including:

Young professionals sharing a flat

Couples planning to start a family

Retirees downsizing

Students seeking co-living solutions

This tenant diversity ensures low vacancy risk and strong market resilience, further strengthening the 2 BHK’s position as Mumbai’s most versatile rental choice.

Community Living: The Appeal of Apartment Complexes

2 BHK apartments are often part of integrated housing societies that offer:

Children’s play areas

Gyms and fitness centers

Social spaces and community events

For families, especially those with children or elderly members, this community-centric living fosters safety, interaction, and convenience—a major reason behind the enduring demand.

Safety and Security: The Role of Gated Communities

Security is a top priority for urban renters. Most 2 BHK units in Mumbai are housed within gated societies, offering:

24/7 surveillance

Controlled access points

Trained security personnel

Emergency management systems

These features provide residents with peace of mind and boost the overall desirability and property value of the unit.

Infrastructure Development: Enhancing Connectivity and Amenities

Mumbai’s expanding infrastructure continues to open up new possibilities for renters and investors alike. Key projects driving real estate growth include:

Mumbai Metro Lines: Drastically cutting commute times

Coastal Road Project: Improving west-side connectivity

Navi Mumbai International Airport: Expected to boost nearby housing markets

Business Hubs in Thane and BKC: Attracting job seekers and professionals

These developments directly influence the rental appeal of 2 BHKs in both established and up-and-coming neighborhoods.

Conclusion

From affordability and space optimization to investment potential and lifestyle convenience, 2 BHK rentals tick all the right boxes for Mumbai’s diverse population. Their dominance in the rental market is not just a passing trend but a reflection of how urban life is evolving.

Whether you're a tenant searching for comfort and community or an investor seeking stable returns, 2 BHK apartments offer a future-proof solution in the ever-competitive Mumbai real estate landscape.

Frequently Asked Questions

Q: Are 2 BHKs better than 1 BHKs for long-term rentals in Mumbai? A: Yes, 2 BHKs offer better space, functionality, and long-term comfort, making them more suitable for families and professionals.

Q: Is investing in a 2 BHK in Mumbai a good decision? A: Absolutely. With high demand, low vacancy rates, and strong resale value, 2 BHKs are considered safe and profitable investments.

Q: Which localities are best for 2 BHK rentals in Mumbai? A: Top locations include Andheri, Powai, Thane, Navi Mumbai, and Kharghar—offering excellent connectivity and amenities.

1 note

·

View note

Text

Tata Group's New Investment Plans for Telangana

Telangana is quickly becoming a hotbed for investment, innovation, and industrial growth. At the heart of this transformation stands the Tata Group, one of India’s most respected and diversified conglomerates. With major investments in defense, digital, aerospace, aviation, and education, the Tata Group is reshaping the state’s future.

Tata Group Skilling Centres Telangana: Building a Future-Ready Workforce

Tata Technologies Telangana investment is transforming public education into private-grade talent factories. In partnership with the Telangana government, the company will revamp 50 Industrial Training Institutes (ITIs). These will become advanced skilling centres focused on Industry 4.0 technologies.

The initiative includes:

₹1,500 crore investment

Setup of long- and short-term tech courses

Appointment of master trainers

World-class training in robotics, AI, and smart manufacturing

This Tata Group skilling center initiative aims to create a skilled workforce that matches global standards. It’s not just a training plan. It’s a movement to power India’s industrial engine from Telangana.

Hyderabad: A Core for Tata Group Expansion

Hyderabad is fast becoming the Tata Group’s southern stronghold. Tata Group Hyderabad expansion covers everything: tech, defense, aviation, and digital growth.

The state’s capital offers strategic advantages:

Strong infrastructure

Skilled workforce

Proactive government support

Tata Sons Telangana projects are now central to the company’s $1.8 billion broader India plan. At the 2024 World Economic Forum in Davos, Telangana CM Revanth Reddy and Tata Sons Chairman Natarajan Chandrasekaran discussed long-term investments. The message was clear, Telangana is open for business, and Tata is ready to deliver.

Tata Advanced Systems: Defence Power in Telangana

Tata Advanced Systems Telangana is already one of India’s most active defence units. Located in Hyderabad, it partners with global aerospace leaders like:

Boeing

Lockheed Martin

Sikorsky

GE Aviation

These joint ventures make Telangana a defence manufacturing hub. The company builds everything from fuselages to military systems.

Tata Group defence investment Telangana reflects a national vision: Make in India, for India and for the world. The expansion plans include:

More production lines

New R&D centres

Jobs for highly skilled engineers and technicians

Digital Push: TCS and Tata Digital in Hyderabad

Tata Consultancy Services (TCS), the tech arm of the group, already employs over 80,000 people in Hyderabad. It’s one of the largest private employers in the state. Now, Tata Digital investment Telangana aims to expand TCS’s digital labs, data centres, and cloud service platforms.

This tech growth includes:

Blockchain R&D

AI-driven platforms

Fintech and healthcare software hubs

The Tata Group Telangana investment in digital will boost job creation, bring innovation closer to home, and improve India’s tech footprint on the global map.

Air India: Hyderabad as a Transit Hub

Tata Group Air India Hyderabad expansion is another high-stake bet. Under Tata’s leadership, Air India is expanding its fleet and redesigning its route network. Hyderabad is key to this plan.

Why?

Rajiv Gandhi International Airport offers world-class facilities

Central location for both north and south connectivity

Proximity to major business centres

Air India is expected to launch new domestic and international flights from Hyderabad. This move will attract global businesses and tourism while creating thousands of new jobs in aviation and logistics.

Support from the State: Government Backing and Strategic Synergy

The Telangana government is actively supporting Tata’s vision. From fast-track clearances to land support and collaboration on skill universities, the state is walking the talk.

Highlights:

MoU with Tata Technologies for ITI upgrades

Invitation to create specialised universities

Infrastructure support for aerospace and IT parks

Tata Sons Telangana projects benefit from this smooth cooperation. It builds confidence and reduces delays a win-win for public-private partnerships.

Tata’s Long-Term Strategy for Telangana

The Tata Group new investment plans Telangana are not isolated moves. They are part of a $1.8 billion long-term plan to:

Upgrade education

Expand defence production

Strengthen digital ecosystems

Improve transit infrastructure

Build sustainable real estate and tech zones

This vision aligns with national goals of Atmanirbhar Bharat and Digital India, but it starts at the grassroots, with Telangana as a launchpad.

Conclusion

The Tata Group is not just investing money, it is investing in people, potential, and progress. Telangana is at the heart of this transformation. Whether it’s setting up advanced skilling centres, expanding TCS operations, strengthening defence manufacturing, or turning Hyderabad into an aviation hub, the Tata Group is building a future-ready Telangana.

For students, job seekers, entrepreneurs, and citizens, this is more than news. It’s a signal of confidence, a doorway to opportunity, and a powerful moment in the state’s economic journey.

More Information

Stay updated on the latest developments in the real estate industry by following the openplot information.

Our platform offers valuable insights and updates, along with informative articles and market reports. Openplot.com helps find or sell a home, which is a significant milestone.

Frequently Asked Questions

Q. What is Tata Technologies investing in Telangana?

A. Tata Technologies will invest ₹1,500 crore to set up 50 advanced skill training centres in government ITIs across Telangana.

Q. How will Tata’s investment help Telangana youth?

A. These skill centers will offer industry-relevant courses, helping young people get jobs in EVs, AI, robotics, defense, and more.

Q. What is Tata Advanced Systems doing in Telangana?

A. Tata Advanced Systems is expanding its joint ventures in defence and aerospace manufacturing, partnering with global firms like Boeing and Lockheed Martin.

Q. Will Air India increase operations in Hyderabad?

A. Yes. Tata Group plans to turn Hyderabad into a major domestic and international transit hub for Air India.

Q. Is Tata Group involved in digital and tech expansion in Telangana?

A. Yes. TCS already employs over 80,000 people in Hyderabad and plans to expand operations in software, consulting, and digital transformation.

1 note

·

View note

Text

10 Rainy Season Home Buying Tips You Shouldn’t Ignore

India's rainy season brings joy and relief but also reveals the true face of any building. If you’re planning to buy a house, the monsoon is your best friend. Rainwater uncovers cracks, damp patches, and poor drainage.

Most buyers prefer the dry months, but smart buyers look during the rains. Why? Because you get to see the home in its worst conditions. A monsoon property inspection gives you a clear picture. It shows how strong, well-built, and livable the property really is. Use this property buying guide to avoid future headaches and make a smart, long-term real estate investment.

Inspecting the Property During Heavy Rain

Visit the site while it rains heavily. This single action gives you more insight than dozens of dry-weather visits. Rain exposes hidden flaws, leakages, cracks, poor construction, and faulty roofs. Look at the ceiling for dripping water or wet patches. Check window corners, door frames, and joints. Don’t hesitate to ask the agent or owner tough questions.

Check for Waterlogging Around the Building

When it rains, check if water collects near the building. Stagnant water around the foundation or parking area is a big red flag. It weakens the base, invites mosquitoes, and causes long-term damage. Walk around the plot. Look at low-lying corners, garden areas, and basement entries. Ask residents if waterlogging happens often. Even a small puddle that stays for days can mean poor site planning.

Examine Drainage and Rainwater Outlets

Next, inspect the rainwater outlets and drainage pipes. Are they wide enough? Are they clogged or broken? Water should flow out quickly without spilling onto the building walls. Check balconies, terrace corners, and bathroom pipes. Look for signs of overflow or water trails on the walls. Faulty drains create damp interiors, bad smells, and mold, especially during the monsoon.

Look for Dampness, Leakages, and Wall Cracks

The rainy season is the perfect time to spot hidden structural issues. Look closely at every wall, ceiling, and corner. Do you see paint bubbles, yellow patches, or wet spots? These are signs of damp and poor waterproofing. Inspect the roof and top-floor ceilings. Cracks and leakages here can be costly to fix. Pay special attention to walls shared with bathrooms or kitchens—these often trap moisture.

Review of Quality of Road Access and Connectivity

During the rainy season, roads often reveal their true condition. Before you buy a house, visit the area when it rains heavily. Check how the internal roads, society entrances, and connecting roads hold up. Is there pothole damage? Are roads flooded or broken? Poor road quality not only affects daily travel but also lowers the overall value of your property. Look at water flow and check if stormwater drains are working.

Verify the Power Backup Systems and Electrical Safety

Power cuts are common during India's rainy season. That’s why checking electrical safety and power backup systems is a must before you buy a house. Ask the builder or owner about backup facilities. Is there a generator for lifts, common areas, and homes? Do they maintain it regularly? Visit the meter room and switchboards. Look for signs of rust, water damage, or exposed wires.

Assess Ventilation and Natural Light

During the rainy season, homes can feel dark, damp, and musty. That’s why good ventilation and natural light matter even more when you’re planning to buy a house. Open all windows during your monsoon property inspection. Check if air circulates freely. A well-ventilated home smells fresh, even during rain. It also keeps mold and damp away.

Evaluate the Location’s Flood History

Before you buy a house, research the area’s flood history. Some neighborhoods in India flood every rainy season, even if the building looks perfect. Ask local residents about past waterlogging or flood incidents. Search online for news articles or municipal records. Check if the community or street has a record of water entering basements, parking lots, or ground-floor flats.

Confirm Builder’s Maintenance and Rain-Proofing Commitments

Before you buy a house, ask the builder or society manager about their rainy season readiness. A well-maintained building handles rain better. A poorly maintained one leads to stress and costly repairs. Start with the rooftop and outer walls. Have they applied waterproofing chemicals? Are rainwater pipes cleaned and sealed? If the answers are vague, be cautious.

Check Legal Documents and Building Approvals

The rainy season may expose physical flaws, but legal issues stay hidden. Before you buy a house, verify all property documents. Ask for the occupancy certificate, building plan approvals, and title deed. Check if the project follows local building codes, especially for drainage and flood-proof design. This is critical in monsoon-prone areas.

Conclusion

Buying a home in the rainy season may seem tricky, but it’s actually a smart move. Rain reveals flaws that stay hidden in dry months. Use this time to inspect walls, drainage, road access, and power backup.

youtube

Frequently Asked Questions

Q: Is it advisable to buy a house during the rainy season in India?

A: Yes. It helps you identify construction flaws, waterlogging issues, and poor drainage—insights that are not visible in dry months.

Q: What structural signs should I look for during rain?

A: Water stains on ceilings, damp walls, roof leaks, and standing water around the building are key red flags.

Q: How do I check a property’s flood risk?

A: Speak with locals, check municipal flood maps, and inspect the site's elevation and drainage patterns.

Q: Which documents are critical to verify?

A: Occupancy certificate, title deed, approved building plans, and clearance certificates for drainage and zoning compliance.

2 notes

·

View notes

Text

Amaravati Real Estate is Rising Again in AP

Once a dream capital city that faced political limbo, Amaravati is now re-emerging as a promising hotspot in Andhra Pradesh's real estate landscape. In 2025, renewed government focus, strategic infrastructure revival, and investor optimism are propelling the city’s property market back into the spotlight.

According to recent reports, property transactions in Amaravati’s core capital region have seen a 35% uptick in enquiries in Q1 2025 compared to the same period last year. Both end-users and long-term investors are taking a fresh look at Amaravati, encouraged by stability in state governance and a revived vision for planned urban development.

What’s Driving Amaravati’s Real Estate Revival?

1. Government Recommitment to Capital Development

After years of uncertainty, the Andhra Pradesh government has reiterated its commitment to developing Amaravati as a legislative and administrative capital. Key policy announcements in early 2025 include:

Resumption of the Secretariat construction

Infrastructure push in Mandadam, Thullur, and Velagapudi

Budget allocations for civic amenities and arterial roads

This has instilled confidence among developers, landowners, and new buyers alike.

2. Infrastructure Projects Back in Motion

Stalled roadworks, underground drainage, and housing layouts are finally being reactivated. Projects like:

Amaravati–Vijayawada express link

New smart village clusters

Upgrades to APCRDA-monitored zones

are helping rejuvenate connectivity and real estate demand in peripheral zones.

3. Affordable Land and High Appreciation Potential

Land prices had plummeted post-2019 due to policy reversals and stalled work. However, this reset has opened up a window of affordability, particularly in:

Mandadam: ₹12,000–₹15,000/sq. yd (Q1 2025)

Thullur: ₹10,000–₹13,000/sq. yd

Mangalagiri outskirts: ₹8,000–₹10,000/sq. yd

Experts predict a 20–25% appreciation in the next 2–3 years if development continues at pace.

4. Renewed Interest from Builders and NRIs

Reputed regional developers like Sree City Infra, Subhagruha Projects, and Sri Aditya Homes are either resuming shelved plans or launching new projects. Meanwhile, NRIs—especially from the US and Australia—are scouting for land parcels to capitalize on Amaravati’s long-term capital value.

Hotspot Micro-Markets Within Amaravati

The core capital region remains the most in-demand, but several microlocations are showing investor promise:

Mandadam: Proximity to Secretariat; good for plotted layouts

Thullur: Emerging villa projects; lower entry cost

Velagapudi: Institutional zone; high demand for rental potential

Mangalagiri-Vijayawada corridor: Ideal for commercial and IT investment

Challenges That Still Remain

Despite the resurgence, buyers should remain cautious about certain factors:

Pending court cases related to land pooling and allotments

Execution delays in physical infrastructure (e.g., stormwater systems)

Dependence on political continuity in capital plans

Risk-averse investors should wait for full policy execution clarity before making large-ticket investments.

Conclusion

Yes—but with strategy and patience. Amaravati real estate in 2025 presents a rare opportunity for early movers. Investors with a long-term horizon (5+ years), especially in plotted development and villa layouts, are well-positioned to benefit.

However, speculative buyers seeking quick returns should proceed with caution and ensure proper due diligence.

FAQ (Frequently Asked Question)

Q. Is it safe to invest in Amaravati now?

Yes, if you're focused on long-term gains. Stick to CRDA-approved layouts and track government announcements closely.

Q. What are the most promising areas in Amaravati?

Mandadam, Thullur, Velagapudi, and Mangalagiri outskirts are currently witnessing the highest traction.

Q. Are there any risks involved?

Yes—legal clearances, policy continuity, and infrastructure timelines remain key risks to monitor.

Q. How does Amaravati compare to Vijayawada or Guntur real estate?

Amaravati offers better long-term ROI due to its planned development model, but Vijayawada and Guntur provide faster rental returns and lower risk.

1 note

·

View note

Text

The Future of Farmland Investment in India: Opportunities and Emerging Trends

As India moves towards sustainable and tech-driven growth, farmland investment has emerged as a high-potential asset class. The rising demand for organic produce, Agri-Tech innovations, and favorable government initiatives are reshaping how individuals and institutions view agricultural land as a viable investment. This blog explores the current opportunities, future trends, and essential considerations when considering a future of farmland investment.

What Makes Farmland a Lucrative Investment in India?

India's deep-rooted agrarian economy—employing over 50% of its population—makes agricultural land a compelling investment. While traditionally seen as a generational asset, farmland is increasingly being recognized for its financial and environmental value.

Key Drivers:

Stable returns through direct cultivation or lease income.

Tangible asset class that hedges against inflation and market volatility.

Low correlation with equity markets, making it a valuable portfolio diversifier.

Rising land prices in regions like Maharashtra, Tamil Nadu, and Karnataka, driven by demand for agri-tourism and organic farming.

Top Benefits of Investing in Agricultural Land

Investing in farmland can offer both financial and social returns, especially as demand for food security, sustainability, and clean agriculture grows.

Top Advantages:

Capital Appreciation: Land values have historically appreciated steadily in key agricultural regions.

Passive Income: Lease the land to farmers or agribusinesses.

Tax Benefits: Agricultural income is tax-exempt under specific conditions.

Low Entry Cost: Especially when compared to urban real estate.

Sustainability Impact: Opportunity to support organic and climate-resilient agriculture.

Diversification: Physical asset investment reduces exposure to stock and crypto market risks.

How Government Policies Are Shaping Farmland Investments

Policy reforms are playing a pivotal role in unlocking the true value of agricultural land in India. From digitalization of land records to easing land ceiling restrictions, the government has introduced investor-friendly reforms.

Recent Initiatives Boosting Investor Confidence:

Digitization of land records through Bhulekh, Dharani, and Patta-Chitta portals.

Relaxation of land ceiling laws in select states.

Financial subsidies for adopting sustainable or smart farming practices.

Support for Farmer Producer Organizations (FPOs) and cooperative models.

These policy moves are enhancing transparency, improving investor trust, and encouraging structured farmland transactions.

The Impact of Agri-Tech and Smart Farming on Land Value

Agri-Tech is transforming how farmland is utilized and valued. Technologies like AI-enabled irrigation, soil health sensors, satellite monitoring, and drone-based surveillance are improving crop yields and optimizing resource use.

Tech-Driven Value Creation:

Enhanced productivity and output per acre.

Increased land value in areas with tech-enabled agriculture.

Attractiveness to startups and young agripreneurs.

Sustainability appeal among eco-conscious consumers and investors.

In short, as smart farming becomes the norm, land in tech-savvy or Agri-Tech–integrated regions commands higher premiums.

Conclusion

The future of farmland investment in India is bright, backed by technology, policy reforms, and sustainable practices. Whether you’re a first-time investor, NRI, or agripreneur, investing in farmland offers long-term value and socio-economic impact. As awareness grows around sustainable agriculture, organic farming, and Agri-Tech, this once-traditional asset is turning into a modern wealth-builder.

If you’re ready to explore this opportunity, start by researching regions, understanding legal nuances, and aligning your investment goals with India’s evolving agricultural landscape. Openplot.com can also help you. If you want any property, you can search for a trusted platform like Openplot. If you want any information about it, call me at 9914146969, 9281064844.

1 note

·

View note

Text

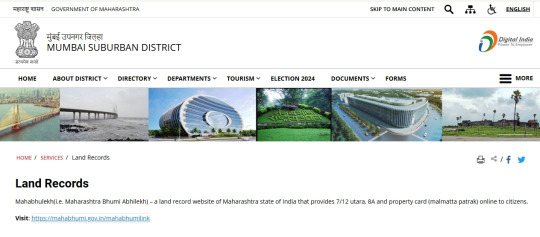

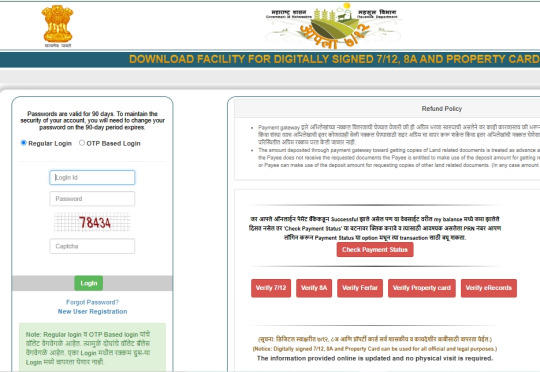

Importance of Mumbai Property Card for Real Estate Buyers

In Mumbai's dynamic real estate market, ensuring the authenticity and legality of property transactions is paramount. One critical document that facilitates this is the Mumbai Property Card. This official record provides comprehensive details about a property, serving as a vital tool for buyers, sellers, and investors alike.

What Is a Mumbai Property Card?

A Mumbai Property Card is an official document issued by the local municipal authorities that details essential information about a specific property. It includes data such as the property's location, area, ownership details, and any encumbrances or legal disputes associated with it. This document is crucial for verifying the legitimacy of property transactions and ensuring transparency in the real estate market.

Why Is the Property Card Important for Buyers?

Proof of Ownership: The property card serves as legal evidence of ownership, confirming that the seller has the right to transfer the property.

Verification of Property Details: It provides accurate information about the property's dimensions, location, and boundaries, helping buyers make informed decisions.

Detection of Encumbrances: The card reveals any existing liens, mortgages, or legal disputes tied to the property, protecting buyers from unforeseen liabilities.

Facilitates Loan Approvals: Financial institutions often require a property card when processing home loan applications, as it substantiates the property's legitimacy.

Essential for Legal Transactions: Whether registering the property or transferring ownership, the property card is a mandatory document in legal proceedings.

Applying for a Property Card Online

Online Method:

Access the Application Portal: Visit the Mumbai Suburban District’s official website

Navigate to Property Card Application: Look for the “Property Card Application” section.

You click the login box. Navigate to the next page.

Fill Out the Form: Complete the form with accurate details about the property and the applicant.

Submit the Application: Submit the filled application form along with the necessary documents to the designated office.

Offline Method:

Visit the local municipal office or the City Survey Office in Mumbai.

Fill out the application form for the property card.

Submit necessary documents, including proof of ownership and identification.

Pay the required fees.

Collect the property card upon notification.

Key Components of a Property Card

Survey Number: Unique identifier for the property.

Owner's Name: Details of the current registered owner.

Property Area: Exact measurements of the property.

Encumbrance Details: Information on any legal liabilities or disputes.

Mutation Entries: Records of ownership changes over time.

Conclusion

The Mumbai Property Card is more than just a document; it's a safeguard against potential legal and financial pitfalls in property transactions. For real estate buyers, ensuring the property's legitimacy through the property card is a step that cannot be overlooked. By understanding its importance and ensuring its verification, buyers can navigate Mumbai's real estate landscape with confidence and security.

1 note

·

View note

Text

Housing Society: Rules and Regulations for Tenants

Property Maintenance Responsibilities

Property maintenance is a shared responsibility between the landlord and tenant.

Tenant responsibilities include:

Routine cleaning and upkeep

Informing the landlord about any damage or malfunction

Not making structural changes without written consent

Avoiding negligent behavior that may cause damage

If damage occurs due to tenant negligence, repair costs must be borne by the tenant. Otherwise, the landlord covers it.

1 note

·

View note

Text

E-Stamp India Guide: How to Use E-Stamp for Real Estate Deals

E-Stamping is an electronic method of paying stamp duty, which is a mandatory tax levied on legal documents such as property sale deeds, lease agreements, and mortgage documents. This system was introduced to reduce the risks associated with counterfeit stamp papers and to streamline the documentation process.

The India e-stamp system was developed by the Stock Holding Corporation of India Limited (SHCIL), which acts as the central record-keeping agency. E-stamping ensures that the stamp duty is paid securely and transparently, offering an alternative to traditional physical stamp papers.

2 notes

·

View notes