#stampduty

Text

Stamp duty in property

Paying the stamp duty is a significant step in the property transaction process.

Once the stamp duty charges have been paid, it is generally not ...

0 notes

Text

Quick Guide to Stamp Duty and Registration Charges in Pune for First-Time Home Buyers

Introduction

If you're a first-time homebuyer in Pune, understanding stamp duty and registration charges is crucial. These additional costs are an essential part of the property buying process and can significantly impact your budget. Let's break down these charges to help you plan better.

What is Stamp Duty?

Stamp duty is a tax paid to the government to validate your property transaction. It's based on the property's value and ensures your ownership is legally recognized. In Pune, stamp duty rates typically range from 5% to 7%.

Why is Stamp Duty Important?

Legal Proof: Provides legal evidence of your property ownership.

Government Revenue: Funds public services and infrastructure.

Market Regulation: Ensures all transactions are recorded, preventing fraud.

Who Pays Stamp Duty?

Generally, the buyer is responsible for paying stamp duty. In some cases, the buyer and seller might agree to share the cost.

Registration Charges

In addition to stamp duty, you must pay registration charges to register the property in your name. In Pune, this fee is usually 1% of the property's market value.

Example Calculation

For a property worth ₹50 lakhs:

Stamp Duty: 5% of ₹50 lakhs = ₹2.5 lakhs

Registration Charges: 1% of ₹50 lakhs = ₹50,000

Total: ₹3 lakhs

Conclusion

Understanding stamp duty and registration charges in Pune helps you prepare for additional costs and ensures a smoother property buying process. Always include these charges in your budget and consult with local experts if needed.

For more insight read this blog - Understanding Stamp Duty and Registration Charges in Pune

0 notes

Text

Good News for Tenants: UP Cuts Stamp Duty on Rent Agreements!

Great news for tenants and landlords in Uttar Pradesh! The Chief Minister has ordered a reduction in stamp duty for rent agreements, making renting more affordable for everyone. This move aims to boost the rental market and provide relief to those seeking homes on rent. Stay tuned for more updates!

-

Belpatram Infratech, your trusted real estate partner, is excited about this positive change and looks forward to helping more people find their perfect rental homes.

Stay tuned for further updates!

Visit us at https://www.belpatraminfratech.com/ to explore our latest rental listings and find your ideal home today!

Contact us: +91 874-400-0006

Follow us for more @belpatraminfratechproperty

#UPNews#HousingUpdate#RentalSavings#CMYogiAdityanath#RealEstateNews#HousingForAll#UPDevelopment#AffordableRenting#EconomicRelief#UttarPradesh#RealEstate#RentalMarket#StampDuty#AffordableLiving#HousingNews#UPGovernment#TenantRelief#LandlordUpdates#belpatraminfratech#latestnewstoday

0 notes

Text

0 notes

Text

"Discover exemptions for Section 8 companies—tax benefits, fundraising perks, compliance relaxations, enabling social impact effortlessly.

#Section8Companies#NonProfit#CharitableOrganizations#TaxExemptions#ComplianceRelaxation#SocialImpact#CSR#Fundraising#LegalCompliance#Philanthropy#CorporateSocialResponsibility#FCRAExemptions#StampDuty#IncomeTaxExemptions#RegulatoryBenefits

0 notes

Text

WELCOME TO GODREJ AIR PROPERTY 85

Property Type : Luxury Apartments

Developer: Godrej Air

2,3,4 BHK Apartments

Price: 1.30 Cr* Onwards

#APARTMENTS#HOUSE#CONSTRUCTIONCOST#MATERIALCOST#VILLAONRENT#VILLAFROSALE#LUXURYFLATSONRENT#LUXURYFLATS#LUXURYHOME#RENTALLUXURYHOUSE#APARTMENT#FLATS#FLATSFORSALE#HOUSEFORSALE#VILLA#PG#REALESTATE#REALESTATEININDIA#REALESATTELAND#STAMPDUTY#PROPERTY

1 note

·

View note

Link

#Beijing#Bloomberg#China#ChinaSecuritiesRegulatoryCommission#Chinastampdutyreduction#ChineseMinistryofFinance#Covid-19#COVID-19pandemic#emergingmarkets#India#initialpublicofferings#IPO#marketsentiment#stampduty#StockTrading

0 notes

Text

Maharashtra government says no stamp duty on redeveloped housing

Maharashtra government says no stamp duty on redeveloped housing society apartments

On Wednesday, the state government issued a notification to this effect in line with the Bombay High Court's ruling pronounced in February. This has put in and to long-drawn litigation pending since 2006 and is a major relief for the real estute sector, especially the

redeveloomontsearien .

The government of Maharashtra has stated that a member of a housing society that undergoes redevelopment need not pay stamp duty on the allotted permanent accommodation as part of the project.

Following this, the member of the housing society undergoing redevelopment is expected to pay only Rs 100 as stamp duty, while the principal agreement between the development and the housing society will be charged as per the

convevance.

On Wednesday, the state government issued a notification to this effect in line with the Bombay High Court's ruling pronounced in February.

This has put an end to long-drawn litigation pending since 2006 and is a major relief for the real estate sector, especially the redevelopment segment.

"The government's move will be a major relief for both developers and members of existing society going for redevelopment. Earlier the stamp duty used to be paid twice as the developer had to pay on development agreement for rehabilitation component and even the members had to

pav the charges on their Permanent Alternate Allotment Agreement

(PAAA)," said Hitesh Thakkar, Vice President, NAREDCO Maharashtra.

In February, the court had set aside and revoked earlier circulars which contemplate that a PAAA executed between the developer and members of the society requires it to be stamped again even though the development agreement executed between the developer and the societv is already stamped

Kalpataru Paramount Balkum Thane

0 notes

Text

Stamp Duty & Property Registration Charges In Pune - 2023

It is necessary to draw attention to the fact that the imposition of stamp duty fees can serve as a mechanism to either slow down or speed up the growth of the demand for real estate. When the market is slow & down, the government in various states cut the stamp duty and other fees associated with registering property in an effort to stimulate the housing demand.

#stampduty#property#realestate#estateagent#newhome#stampdutyholiday#mortgage#estateagents#forsale#investment#propertyinvestment#housingmarket#residential#firsttimebuyer#onthemarket#movinghouse#dreamhome#rightmove#helptobuy#newhomes#house#newbuild#architecture#sold#realtor

0 notes

Text

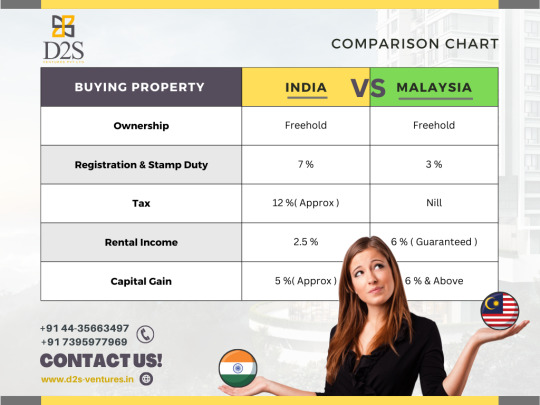

Comparison between buying property in India & buying property in Malaysia!

Buy tax-free properties in Malaysia!!

Talk to our Investment Consultants today.

+91 44-35663497 | +91 7395977969

www.d2s-ventures.in

#buytaxfreeproperties#stampduty#gst#Registrationfee#malaysiaindians#homeloanmarginoffinance#buyingpropertyinindia#buyingpropertyinmalaysia#propertyinvestment#lowcostlife#buymalaysiaproperty#foodparadise#indian#culturalcountry#LowCostHousing#d2sventurespvtltdservices#propertyretail#propertydevelopment#InvestinMalaysia#d2sventuresprivatelimited#OverseasProperty#propertyinvestmentconsultants#Comparisobetweenbuyingproperty#propertydevelopmentmalaysia#Tropicana

0 notes

Link

Stamp duty is taken by the government on residential property transactions that are of value more than £125,000.

#stampduty#stampdutyScotland#stampdutyrefund#stampdutyonsecondhome#stampdutyforsecondproperty#payingstampduty#stampdutychanges

1 note

·

View note

Text

E Stamping : E-Stamping is a digital method of paying and verifying stamp duty on various legal documents, including agreements, deeds, and contracts. It eliminates the need for physical stamp paper and offers a secure and convenient way to ensure legal compliance. E-stamping enhances transparency, reduces fraud, and streamlines the stamping process for both government authorities and individuals or businesses involved in document transactions.

0 notes

Video

youtube

Safeguard Your Pension Fund: Strategies to Survive a Stock Market Crash

How to Protect Your Pension Fund from a Stock Market Crash

Worried about the impact of a stock market crash on your pension fund? You're not alone. Market volatility can significantly affect your retirement savings, but there are strategies you can implement to safeguard your investments. Watch video https://youtu.be/e2iiYBYCUOw?si=enFe6LD0M8jt3hQG

1. Diversify Your Portfolio: One of the best ways to protect your pension fund is through diversification. By spreading your investments across different asset classes—such as bonds, real estate, and cash—you reduce the risk of a market downturn affecting your entire portfolio. Diversification ensures that even if one asset class takes a hit, others may remain stable or even gain value.

2. Regularly Rebalance Your Portfolio: Market conditions change over time, so it's crucial to regularly review and rebalance your portfolio. This involves adjusting your asset allocation to maintain your desired level of risk. Rebalancing helps you lock in gains from outperforming assets and reinvest them into underperforming ones, maintaining a balanced risk exposure.

3. Consider Safe Haven Assets: Investing in safe haven assets like gold, government bonds, or cash equivalents can provide stability during market crashes. These assets tend to hold their value or even appreciate when stock markets decline, offering protection for your pension fund.

4. Stay Informed and Seek Professional Advice: Keeping up with market trends and seeking advice from a financial advisor can help you make informed decisions. A professional can guide you on how to adjust your pension investments to minimize risks during turbulent times.

Protect your retirement savings by taking proactive steps today!

See also:

Why Are UK Taxes So High? 10 Easy Tips To Drastically Reduce Your Tax Liability – Legally - https://youtu.be/PZ9IFiI2Tio

How will Labour’s new Renters Rights Bill 2024 affect buy-to-let landlords?

The Labour Party’s Renters' Rights Bill 2024 is poised to bring significant changes to the UK’s rental market, impacting both tenants and buy-to-let landlords. Understanding these changes is crucial for landlords to navigate the evolving landscape effectively.

Watch video version - https://youtu.be/Wx1HXgVW1bM

A Lifetime of taxes

Income tax, VAT, Council Tax, Car Tax, Insurance and Travel Tax, Green Energy Taxes, BBC Licence Tax, Stamp Duty, Capital Gains Tax, Section 24, Business Taxes and the final kicker; Inheritance Tax for your dependents!

You can legally reduce and mitigate your taxes and inheritance tax for your dependents.

Wills and Trusts

New research from Canada Life reveals that over half of UK adults (51%)1 have not written a will, nor are they currently in the process of writing one. This includes 13% of people who state they have no intention to write a will in the future.

Section 24 Landlord Tax Hike

Interview with Chartered Accountant and property tax specialist who reveals options and solutions to move your properties from your own name into a limited company or LLP whilst mitigating the potential HMRC pitfalls.

Email [email protected] for a free consultation on how to deal with Section 24, Wills and Trusts.

Watch video now: https://youtu.be/aMuGs_ek17s

#UKTaxes #TaxTips #CharlesKellyMoneyTips #FinancialFreedom #LegalTaxReduction #section24 #stampduty #PensionFundProtection #StockMarketCrash #RetirementPlanning #FinancialSecurity #Diversification #SafeHavenAssets #InvestingWisely #MoneyTips #CharlesKellyMoneyTips #FinancialAdvice

0 notes

Text

Wishi Rishi

In the damp halls of Westminster, Rishi doth declare,

A kitchen sink manifesto, promises thin as air.

With pledges vast and hopes contrived,

Yet will it cut through? Few are convinced or revived.

First, to taxes, where illusions lie,

A 2p cut in national insurance, a fleeting sigh.

Income tax for pensioners, a token nod,

Child benefit expansion, a convenient facade.

To education, 'Mickey Mouse' degrees to scrap,

Free childcare, a hollow gift in parents' lap.

In defence, national service for the youth,

An outdated notion, far from the truth.

Defence spending targets for 2030's light,

Promises to bolster, but who believes the sight?

Welfare reforms, twelve billion saved,

Austerity's mask, by new rules engraved.

GPs relieved of sick notes’ chore,

Shifting burdens, nothing more.

Crime's grand plan, eight thousand strong,

Police numbers touted, a familiar song.

Sentences increased, a harsher line,

First and second degree murder, a borrowed design.

Housing hopes with stamp duty's cease,

Up to £425k, a temporary peace.

No-fault evictions to end, they say,

Green belts protected, but for how long, who can say?

Immigration caps, work visas in the fray,

Family reunions slowed, a cynical play.

Illegal routes, Rwanda's talk renewed,

Third countries’ deals, a policy skewed.

ECHR reforms, all options in jest,

Health investments, a strained NHS.

£2.4bn for training, a short-term fix,

Waiting lists to shorten, with AI in the mix.

Social care's echo, Boris’s old tale,

A delayed package, destined to fail.

Net zero claims, with costs to veil,

Promises made, but will they prevail?

Thus, Rishi stands with grand façade,

A nation’s scepticism, the unspoken nod.

Will these pledges sway the day?

Or dissolve like mist at dawn’s first ray?

#Westminster #RishiSunak #Manifesto #TaxCuts #PublicSpending #NationalInsurance #IncomeTax #ChildBenefit #EducationReform #Childcare #NationalService #DefenceSpending #WelfareReform #GPResponsibility #CrimePolicy #PoliceNumbers #SentencingReform #MurderClassification #HousingPolicy #StampDuty #NoFaultEvictions #GreenBeltProtection #ImmigrationPolicy #VisaCaps #IllegalImmigration #RwandaPolicy #ECHRReform #HealthInvestment #AIInHealthcare #SocialCare #NetZero #VoterScepticism #PoliticalPromises

0 notes

Text

Know about the #RegistrationCharges and #StampDuty on #property in #Noida. Promen Estates, a #realestate consultants in Noida tells you in detail about the important factors for calculation of the Stamp Duty charges.

0 notes