Don't wanna be here? Send us removal request.

Text

Top 5 Term Insurance Plans with Return of Premium in 2025!

Looking for a term insurance plan with a return of premium? 💰 Get the best of both worlds—life coverage & a refund of premiums paid! Check out the Top 5 Term Insurance Plans for 2025 and secure your family’s future today.

0 notes

Text

Best 5 Care Health Insurance Plans in India

Secure your future with the best health coverage! Check out the top Care Health Insurance plans for 2025.

#care insurance#insurance#health insurance#care health insurance#best health insurance#top health insurance

0 notes

Text

Top 5 ICICI Lombard Health Insurance Plans in 2025

Get digital, reliable, and affordable health coverage with ICICI Lombard Health Insurance. Enjoy cashless hospitalization, wide network coverage, and hassle-free claim settlements. Protect your health with a trusted insurer. Explore plans now: ICICI Lombard Health Insurance.

0 notes

Text

Government Bonds: A Good Investment for Any Economic Climate

Government bonds are a type of debt security issued by the government to raise money. When you buy a government bond, you are essentially lending money to the government for a specific period of time. In return, the government agrees to pay you back the principal amount of the bond, plus interest, at maturity.

Government bonds are considered to be a very low-risk investment, because the government is very unlikely to default on its debt. This makes them a good option for investors who are looking for a safe and steady return on their investment.

Advantages of Investing in Government Bonds

There are several advantages to investing in government bonds, including:

Safety: Government bonds are considered to be a very safe investment because the government is very unlikely to default on its debt.

Steady income: Government bonds provide a steady stream of income in the form of interest payments.

Liquidity: Government bonds are highly liquid, meaning that they can be easily bought and sold.

Diversification: Government bonds can help to diversify your investment portfolio and reduce your overall risk.

#government bonds#treasury bills in india#bonds#bondsindia#finance#investment#investing#invest in bonds#best government bonds

0 notes

Text

Why Choose Government Bonds and Treasury Bills?

Safety and Security: Government bonds and treasury bills are among the safest investment options. Backed by the Indian government, the risk of default is incredibly low, making them a preferred choice for risk-averse investors.

Steady Returns: These investments offer predictable returns in the form of interest payments. The interest rates on these bonds are typically more stable than other investment options, like stocks or real estate.

Diversification: Including government bonds and treasury bills in your portfolio can help diversify your investments. When the stock market is volatile, these instruments can act as a stabilizing force.

Tax Benefits: In India, interest income from government bonds is often tax-free, making them a more appealing option for investors.

Liquidity: Government bonds and T-bills are highly liquid, allowing you to easily buy and sell them in the secondary market, providing flexibility.

#government bonds#government bonds in india#bonds#bondsindia#finance#investment#investing#invest in bonds#best government bonds

0 notes

Text

Are government bonds in India a good investment in today's economy?

Government bonds are a type of debt investment issued by the government to raise funds. When you buy a government bond, you are essentially lending money to the government for a fixed period of time. In return, the government agrees to pay you a fixed interest rate on your investment and return your principal amount at the end of the term.

Government bonds are considered to be low-risk investments, as they are backed by the full faith and credit of the government. This means that the government is legally obligated to repay you your investment, even if it goes bankrupt.

However, government bonds also offer relatively low returns. This is because they are considered to be safe investments, and investors are willing to accept lower returns in exchange for reduced risk.

Are government bonds a good investment in today's economy?

Whether or not government bonds are a good investment in today's economy depends on your individual investment goals and risk tolerance. If you are looking for a safe investment with a steady stream of income, then government bonds may be a good option for you. However, if you are looking for higher returns, you may want to consider other investment options, such as stocks or mutual funds.

Here are some factors to consider when deciding whether or not to invest in government bonds:

Interest rates: Interest rates are currently rising in India. This means that the yields on government bonds are also rising. This makes government bonds more attractive to investors, as they can now earn a higher return on their investment.

Inflation: Inflation is also high in India. This means that the purchasing power of money is eroding. Government bonds can help to protect your savings from inflation, as they offer a fixed interest rate.

Risk tolerance: Government bonds are considered to be low-risk investments. However, all investments carry some risk. If you are not comfortable with any risk, then government bonds may be a good option for you.

How to buy government bonds in India

There are two ways to buy government bonds in India:

Directly from the government: You can buy government bonds directly from the government through the Reserve Bank of India (RBI). To do this, you will need to open a Government Securities Account (GSA).

Through a financial institution: You can also buy government bonds through a financial institution, such as a bank or mutual fund company. This is the most common way for retail investors to buy government bonds.

#government bonds#government bonds in india#bonds#bondsindia#finance#investment#investing#invest in bonds

0 notes

Text

Government Bonds: A Smart Way to Save for Your Child's Education

Welcome to our blog, where we shed light on how government bonds in India can be a smart financial move to secure your child's education. In this post, we'll discuss the benefits of investing in government bonds, particularly focusing on the best government bonds to buy in 2023.

Government Bonds in India - A Brief Overview:

Government bonds are debt securities issued by the government to raise funds for various projects and initiatives. These bonds are considered one of the safest investment options, as they are backed by the government's credit and are generally low-risk. In India, government bonds are issued by the Reserve Bank of India (RBI) and are an essential part of the financial market.

Why Invest in Government Bonds

Safety and Reliability: Government bonds are backed by the government, making them a secure investment option. The risk of default is extremely low, providing peace of mind to investors.

Regular Income: Government bonds provide a fixed interest rate at regular intervals, ensuring a steady source of income. This can be beneficial for saving up for your child's education fund.

Tax Benefits: Depending on the specific bond and its tenure, some government bonds offer tax benefits, allowing you to optimize your tax liabilities.

Best Government Bonds to Buy in 2023

Sovereign Gold Bonds (SGBs): SGBs are issued by the RBI and are linked to the price of gold. They offer an additional 2.50% interest annually, making them an attractive option for 2023.

7.75% Savings (Taxable) Bonds: These bonds are a good choice for those looking for a fixed interest rate. The interest is taxable, but the rate is relatively high, making it an appealing investment for 2023.

National Savings Certificate (NSC): NSC is a popular choice due to its reliability and competitive interest rates. It offers a fixed interest rate and is a suitable option for those aiming for long-term savings.

Conclusion

Investing in government bonds in India is a smart and safe way to save for your child's education. The best government bonds to buy in 2023, such as Sovereign Gold Bonds, 7.75% Savings Bonds, and National Savings Certificates, offer attractive interest rates and various benefits. Consider these options to secure a bright educational future for your child while ensuring your financial stability. Stay informed, make wise decisions, and invest in a better tomorrow!

#government bonds#government bonds in india#bonds#bondsindia#finance#investment#investing#invest in bonds

0 notes

Text

5 Reasons Why Government Bonds Are a Good Investment for Retirees

1. Stable income

Government bonds typically pay a fixed interest rate, which means that you know exactly how much income you will receive each year. This can be helpful for retirees who are on a fixed budget.

2. Low risk

Government bonds are generally considered to be a low-risk investment. This is because the government is very unlikely to default on its debts. However, it is important to note that there is always some risk associated with any investment, including government bonds.

3. Diversification

Government bonds can be a good way to diversify your investment portfolio. This means that you are spreading your risk across different types of investments. This can help to reduce the overall risk of your portfolio.

4. Liquidity

Government bonds are generally very liquid, meaning that they can be easily sold if you need to access your cash. This is important for retirees who may need to access their savings for unexpected expenses.

5. Tax advantages

Government bonds may offer certain tax advantages, depending on the jurisdiction in which they are issued. For example, in India, government bonds issued by the central government are exempt from income tax.

#government bonds#government bonds in india#bonds#bondsindia#finance#investment#investing#invest in bonds

0 notes

Text

Are government bonds a good investment in 2023?

Whether or not government bonds are a good investment in 2023 depends on your individual investment goals and risk tolerance. If you are looking for a safe investment that can provide a steady stream of income, then government bonds may be a good option for you. However, if you are looking for higher returns, you may want to consider other asset classes such as stocks or real estate.

Government bonds in India

The Government of India issues a variety of government bonds, including dated securities, Treasury bills, and floating rate bonds. Dated securities are the most common type of government bond in India, and they have a fixed maturity date and interest rate. Treasury bills are short-term government bonds with a maturity of up to one year. Floating rate bonds have an interest rate that is reset periodically, typically based on the prevailing market interest rate.

How to invest in government bonds in India

There are a few ways to invest in government bonds in India. One way is to buy them directly from the Reserve Bank of India (RBI). Another way is to buy them through a broker or mutual fund.

#government bonds#government bonds in india#bonds#bondsindia#finance#investment#investing#invest in bonds

0 notes

Text

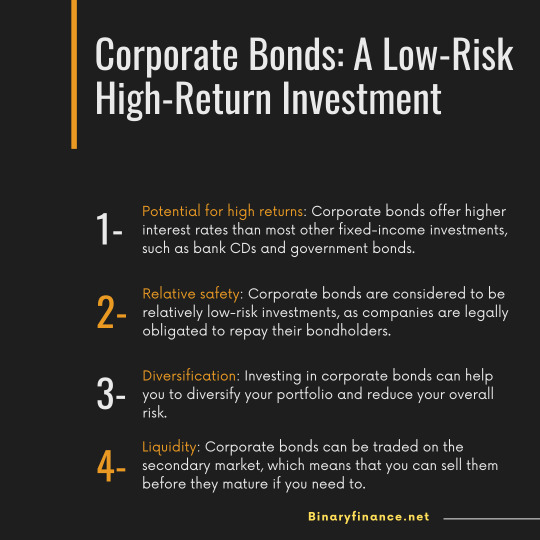

Corporate Bonds: A Low-Risk High-Return Investment

0 notes

Text

Corporate Bonds in India

0 notes

Text

Benefits of Investing in Tax-Free Bonds

0 notes

Text

How to Choose the Right Tax Free Bonds India

Tax free bonds offer an excellent opportunity for Indian investors to earn tax free interest income while enjoying the security of government-backed investments. However, selecting the right tax free bonds requires careful consideration. Here are some key points to help you make an informed choice:

Credit Rating Matters: Always check the credit rating of the bond issuer. Higher-rated bonds are less risky, as they are more likely to meet their payment obligations.

Tenure and Lock-In Period: Determine your investment horizon and select a bond with a suitable tenure. Longer tenures generally offer higher interest rates, but they also mean a more extended lock-in period.

Interest Rate Comparison: Compare interest rates offered by different issuers. Choose bonds that align with your financial goals and risk tolerance.

Liquidity Needs: Assess your liquidity requirements, as tax-free bonds may not be as liquid as other investments. Premature withdrawals could result in penalties.

Tax Benefits: While the interest income is tax-free, be aware of the tax implications on capital gains if you decide to sell the bonds before maturity.

Diversification: Spread your risk by investing in bonds from multiple issuers.

By considering these factors, you can navigate the world of tax-free bonds effectively and make investments that align with your financial objectives.

#tax free bonds#tax free bonds india#tax free bonds in india#Finance#Bonds#Investment#Invest in bonds

0 notes

Text

How to Protect Your Portfolio with Corporate Bonds

Welcome to our beginner's guide to corporate bonds in India. You're in the right place if you're wondering what corporate bonds are and how they can benefit your investments. We will break it down in simple terms, without all the jargon, so that you can make informed decisions.

0 notes

Text

Top 5 Reasons to Invest in Zero Coupon Bonds

Zero coupon bonds are a fascinating investment option that often flies under the radar. They may not be as well-known as stocks or traditional bonds, but they offer unique advantages that can be incredibly valuable for investors. In this blog post, we will explore the concept of zero coupon bonds, their meaning, and the top 5 reasons why you should consider adding them to your investment portfolio.

Reason 1: Guaranteed Returns

Reason 2: Tax Advantages

Reason 3: Diversification

Reason 4: Long-Term Goals

Reason 5: Reduced Interest Rate Risk

0 notes

Text

How to Save Taxes with Tax-Free Bonds India

Tax-free bonds are a unique type of investment that can help you pay less in taxes. These bonds work like loans to the government, and the interest you earn from them isn't taxed. So, it's like getting a bonus because you don't have to share any of it with the taxman!

Here's the lowdown on tax-free bonds: They're usually issued by different government bodies, like the national government, state governments, or public sector organizations. These organizations use the money from bonds to fund various projects.

0 notes

Text

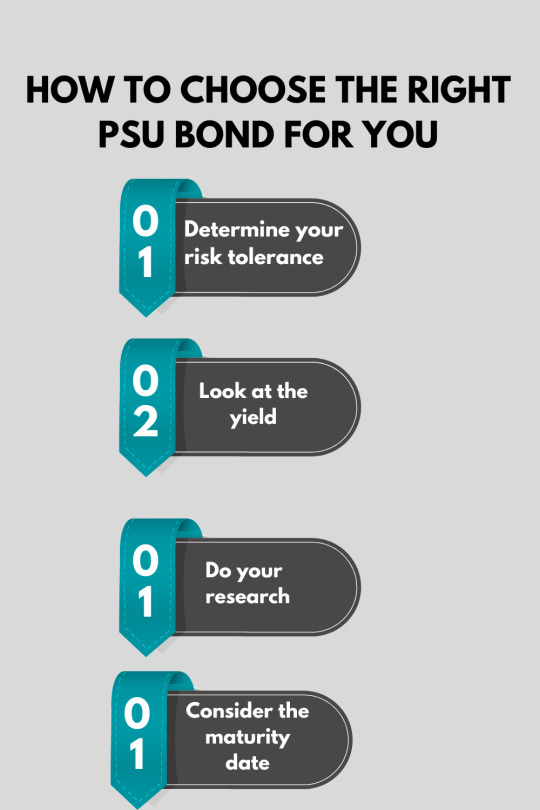

How to Choose the Right PSU Bond for You

PSU bonds are debt securities issued by government-owned companies. These bonds are considered a safe investment option since they are backed by the government. However, it is important to carefully consider a few things before choosing PSU bonds.

0 notes