#government bonds

Note

Regarding this one post... i now wonder: was a dowry paied all at once or in rates... In the Austen novel they always say: 500 a year." but can they access the whole money all at once... and it would be just mathematical 500 a year. Or is the money stored somewhere... on the account of the husbands... or the father... and really just paied once a year? Do you know?

So I don't really know the answer to this one because this would be more of a government bonds question or a banking question, but I did remember a line from the unfinished novel Sandition:

Excepting two journeys to London in the year to receive his dividends, Mr. Heywood went no farther than his feet or his well-tried old horse could carry him

Usually the gentry were investing in government bonds, the 4 or 5%s, so that would likely pay once or twice a year. But I know that government bonds these days have different times of maturation. That may be something that someone knows, but not I! However, investments might be held by a bank, such as the investment bank that goes bust in Cranford by Elizabeth Gaskell (it paid 8%). So you want to hope your guardian or parent has put your money somewhere safe.

I imagine that what most people did is collect their money, be it once or twice a year, and then move it to a local bank. One could also reinvest part of their income.

#question response#what a strange reference to remember#government bonds#if anyone knows please help

31 notes

·

View notes

Text

Unlock the Power of Bonds: Dive into a treasure trove of bond strategies tailored to supercharge your portfolio. Discover the secrets to managing risk and maximizing returns with expert insights!

For more such blogs:

Visit our blog site today: https://tradingbells.com/blogs

And for Financial Advice reach us at: https://tradingbells.com/

Phone: +91 932 953 6100

0 notes

Text

Government Bonds: A Good Investment for Any Economic Climate

Government bonds are a type of debt security issued by the government to raise money. When you buy a government bond, you are essentially lending money to the government for a specific period of time. In return, the government agrees to pay you back the principal amount of the bond, plus interest, at maturity.

Government bonds are considered to be a very low-risk investment, because the government is very unlikely to default on its debt. This makes them a good option for investors who are looking for a safe and steady return on their investment.

Advantages of Investing in Government Bonds

There are several advantages to investing in government bonds, including:

Safety: Government bonds are considered to be a very safe investment because the government is very unlikely to default on its debt.

Steady income: Government bonds provide a steady stream of income in the form of interest payments.

Liquidity: Government bonds are highly liquid, meaning that they can be easily bought and sold.

Diversification: Government bonds can help to diversify your investment portfolio and reduce your overall risk.

#government bonds#treasury bills in india#bonds#bondsindia#finance#investment#investing#invest in bonds#best government bonds

0 notes

Text

Where to Buy Government Bonds in India

Government bonds are a popular investment option for Indian investors. They are considered to be safe and offer a fixed rate of return. There are a few different places where you can buy government bonds in India.

Banks

Most banks in India offer government bonds to their customers. You can buy bonds through your bank's online portal or by visiting a branch.

Post Offices

The Indian Post Office also sells government bonds. You can buy bonds through your local post office.

Brokerage Firms

Brokerage firms allow you to buy and sell government bonds on the stock exchange. This is a good option if you want to trade bonds actively.

RBI Retail Direct

The Reserve Bank of India (RBI) offers a retail direct platform where you can buy government bonds directly from the RBI. This is a good option if you are a beginner investor.

Which is the best place to buy government bonds in India?

The best place to buy government bonds in India depends on your individual circumstances. If you are a beginner investor, the RBI Retail Direct platform is a good option. If you are looking for a wider range of bonds, you can buy bonds through a brokerage firm.

Here are some of the benefits of investing in government bonds in India:

Safety: Government bonds are considered to be one of the safest investment options available. The government of India is backed by the Reserve Bank of India, so there is a low risk of default.

Fixed income: Government bonds offer a fixed rate of return, which can provide you with a predictable stream of income.

Liquidity: Government bonds are highly liquid, which means that you can easily sell them if you need cash.

Tax benefits: Government bonds offer certain tax benefits, such as exemption from capital gains tax.

If you are considering investing in government bonds in India, it is important to do your research and understand the risks involved. You should also speak to a financial advisor to get personalized advice.

Here are some of the risks of investing in government bonds:

Interest rate risk: The value of government bonds can go down if interest rates rise.

Inflation risk: The value of government bonds can also go down if inflation rises.

Default risk: There is a small risk that the government of India could default on its bonds.

By understanding the risks and benefits of investing in government bonds, you can make an informed decision about whether or not this is the right investment for you.

BondsIndia

Bonds India is a leading provider of government bonds in India. We offer a wide range of bonds to suit all investor needs. We also offer a variety of services to help you buy and sell bonds.

If you are looking to invest in government bonds in India, BondsIndia is the perfect place to start. We offer a safe, secure, and convenient way to buy and sell bonds.

#government bonds#bonds#treasury bonds#buy government bonds#what are bonds#how to buy government bonds#bonds explained#why invest in bonds#government bond#what are government bonds#selling government bonds#how do government bonds work#how to invest in bonds for beginners#investing in bonds#types of bonds#types of government bonds#municipal bonds#government#how to invest in government bonds

0 notes

Photo

“FORMER FINANCE DEPARTMENT OFFICIAL ON TRIAL FOR THEFT,” Owen Sound Sun Times. January 23, 1930. Page 1.

----

George W. Hyndman Faces Several Charges of Defalcation

---

BOND RETAINED

----

New One Not Sent Out for Damaged Certificate, It is Alleged

---

(Canadian Press Despatch)

OTTAWA, Ont., Jan. 23 - After spending a night in county jail, George Wellington Hyndman, former Assistant Deputy Minister of Finance for the Dominion, appeared in Supreme Court of Ontario this morning for the second day of hearing of the charges of defalcation against him. The third count of theft in first indictment was proceeded with. A Victory War Loan Bond belonging to William Reynolds of Toronto and valued at $1,632.50 was involved. The first two charges in the indictment also had to do with alleged theft of bonds

The Crown produced evidence to the effect that the Reynolds bond was missing in 1923. It had been new been stolen from Toronto and was later recovered in a mutilated condition in Montreal by Walter Duncan, special investigator of the Financial Department.

The bond and the fyle concerning it had been given to the Deputy Minister.

This bond should have been replaced by another drawn from the Reserve by requisition to the currency branch and the mutilated bond destroyed, the Crown adduced. A notation on a requisition form recorded that the mutilated bond had been returned and a new bond given to Hyndman in exchange.

At the time coupons 8 to 30 were attached to the new bond which should have been immediately forwarded to Reynolds. There was no record to show such a process had been carried out, and when, subsequently it came in for exchange, it was still in bearer form. Five of the 23 coupons had by this time been removed.

The Reynolds fyle showed a letter dated July 20, 1923 written by Reynolds asking for advice on proceedure to get either the recovered bond or a new bond to re place it. A carbon copy was produced, dated July with Hyndman's name and initials typed at the bottom stating a new bond was being forwarded. A second letter from Reynolds six months Iater asked information respecting the new bond.

A reply had been sent bearing Hyndman's name and initials explaining that enquiries had been made which necessitated the bond’s being held. The letter promised a new bond within the week.

#ottawa#supreme court of ontario#deputy minister of finance#department of finance#canadian government#stealing from the government#defalcation#inside job#government bonds#stolen bonds#great depression in canada#crime and punishment in canada#history of crime and punishment in canada

0 notes

Text

Government Guaranteed Bonds- Definitive Guide for Investment

Government-guaranteed bonds are types of bonds issued by state owned corporations wherein the government generally extends an unconditional and irrevocable guarantee for timely interest and principal payments. In case of default or bankruptcy, the government shall pay all the outstanding dues to the bondholders.

0 notes

Text

DpxDc AU - If his parents are going to treat him like a punk, he might as well lean into it.

Danny is getting seriously worn down by his parents constantly asking him to explain why he’s gone all the time and why his grades have slipped so far. I mean, sure, it took them months to notice, but now that they have, they’re alluding to the fact that he’s turned into some kind of punk and that he’s not taking life as seriously as he should be. This is what makes Danny kind of snap.

He cuts his hair, gets Sam to pierce his ears in a few places (which sucked but was nice to catch up with her since Team Phantom didn’t get out much anymore), learns how to skateboard and gets Tuck to help him mask his identity on the internet as he begins online protesting the unethical treatment of ghosts. He makes picket signs that he leaves outside of Fentonworks and it takes days before his parents see them because they’re down in the lab. They go back up immediately after his parents take them down, and he begins tagging buildings with protest sayings and art all over amity park.

No matter how they ground him, the Drs Fenton are at a loss as to what to do to control Danny. Jazz says it’s not her place to interfere and is cheering her little brother on for being passionate about a new hobby.

Danny’s honestly really vibing with the changes. He always understood why Sam wanted control over her own look, but he’s really leaning into the whole shebang. Ember and Johnny13 have never bonded over anything more than they have the punk transformation of their King. He’s really representing them fr fr- she taught him how to play the bass.

With enough protests about the Anti-Ecto acts, the JL step in and begin their efforts to lobby change within the US government. Constantine is up to date on the new King being from Earth and thinks they might be able to weasel out a non-apocalyptic scenario if they reach out sooner than later. A letter gets sent through the infinite realms (No way in fuck was John going to try and summon a fucking King excuse you Bats)- Danny gets the letter and decides to let them sweat a bit, sending back his own letter that just says “K.” cause he’s learned that adults/authority figures all suck ass until proven otherwise. After a few days, a portal opens up in the middle of their meeting.

Ghost King Phantom is rolling in on a skateboard, with the Ring of rage dangling from one of his ear piercings and ice crown floating above his head. He’s drinking an off brand smoothie, wearing a leather jacket that has medieval chainmail on it over his now distressed hazmat suit and his boots steel toed.

“...Sup. Y’all want to do something about this whole situation? I’m an all or nothing kind of guy.” Danny greets them. He means that he’s willing to be diligent in his efforts to disbar the Acts. It gets interpreted as him threatening to end the world, ofc, but that’s an issue he has to deal with later.

“King Phantom we have been working daily to-”

“Uh huh. Look, didn’t you guys have like a teenage group? I want to work with them, they’ll probably actually help me get shit done while you fuck around with paper work.”

#the most punk thing you can do is protest#dcxdp#dpxdc#dp x dc#dc x dp#dc crossover#dp crossover#danny phantom#dc universe#young justice crossover#danny doesnt want to work with the authorities but is willing to work with YJ#Tim drake gets a new skateboarding buddy#danny's skateboard is kind of cheating tho cause he and it can float#kon is always down to take down a government sponsored org that does unethical research#cassie just wants to fight for him and fix his fashion choices#bart recognizes him from the speedforce and they bond over time being a fake ass bitch#i just wanted the funny visual of danny skateboarding into a meeting on the watchtower

6K notes

·

View notes

Text

Why are Bonds Known as Fixed Income Investments?

Savvy investors love to diversify their portfolios across several asset classes to protect themselves against unforeseen turns in the investment market. One of the ways they do this is through ownership of bonds.

Bonds have developed a reputation for being less volatile than other investment sources; they deliver a steady income stream while shielding the investor’s principal even in a falling market. This characteristic is no surprise, as bonds are generally classified as fixed-income investments. But what does the term ‘fixed-income’ mean, and what are the benefits of owning fixed-income assets? Read along to find out.

What are Fixed Income Investments?

Fixed-income investments pay their investors fixed interest or dividend payments until maturity. They tend to focus more on capital preservation and a steady income stream. They are typically low-risk, low-reward investments whose principal goal is to deliver as much income as possible with as little risk to the investor and the amount invested. Fixed income has three significant characteristics:

They are more focused on capital preservation.

They have an unwavering stipulated (fixed) interest payment at specified intervals.

The owners bear little to no risk of the business they invested in, nor do they own any part of the business.

Government and corporate bonds are prominent examples of fixed-income investments.

What are Fixed Income Bonds?

Bonds are debtor notes issued by either government or corporations to investors. Other investments usually pay out variable income securities based on underlying measures like short-term interest rates. Fixed-income bonds pay a fixed, predetermined rate that doesn’t change throughout the bond’s duration.

When many fixed-income bonds mature, the company pays the investors the equivalent of their principal and specified fixed interests. If the bond issuer defaults, the investor gets paid first before the stockholders.

Types of Fixed Income Bonds

Fixed-income bonds are an essential concept for both the issuer and the investor. The bond issuer gets to raise needed capital for projects or other operations without losing shares or control over its company. In contrast, the investor gets a regular fixed income with minimal risk of loss. Here are some common types of fixed-income bonds:

Government Bonds

Government bonds are fixed-income bonds entirely issued and backed by the government of a country or region. They are also called municipal bonds at the state or local government levels. They are considered among the safest bonds to undertake amongst investors, while the government uses the funds to embark on annual expenditures. Most of them are tax-free.

Corporate Bonds

Corporate bonds are issued and backed by private institutions; their value and risk assessment are based on their creditworthiness and the collateral to which the bond is tied. Corporations with higher credit ratings pay lower interest rates, and money obtained from bonds is helpful to a company’s expenditure.

Junk Bonds or High Yield Bonds

Because many bonds are low-risk investments, they usually come with lower returns. High-yield bonds come with higher returns but at a significantly higher risk. This increased risk results from being issued by corporations with low credit ratings or the assets tied to them being shaky. Investors who can manage more risks go for this bond type.

Certificate of Deposits

A certificate of deposit is a fixed deposit account with significantly higher profit rates, and financial institutions usually offer them a maturity of fewer than five years. Additionally, certificates of deposits come with National Credit Union Association (NCUA) protection.

Fixed Income Bonds to Buy in the United States

With a sound investment strategy, you can buy several fixed bonds in the United States. Here are some of the more prominent ones:

Treasury Bonds (T-Bonds)

Treasury bonds are issued at the Federal level and backed by the United States. They are considered one of the safest bonds and have 20 to 30 years of maturity. You can purchase them in multiples of $100.

Treasury Inflation-Protected Securities (TIPS)

One of the risks often associated with bonds is the depreciation of the principal’s value due to inflation. TIPS protect the investor from all that as the value adjusts with deflation and inflation.

Treasury Notes (T-Notes)

Treasury Notes are similar to treasury bonds but have a lower maturity length. While T-bonds mature in at least two decades, T-Notes have a much shorter time frame of two to ten years. Like T-bonds, however, they are acquired by an increment of $100.

Municipal and Private Corporate Bonds

Municipal bonds are issued at state and local government levels and can also be invested in the United States. In addition, several private corporations also offer bonds to investors when they wish to raise funds for a project or venture.

Fixed Income Investment Strategies

Although bonds are relatively safe for the investor, they still must be cautiously approached. Here are just a few strategies you might want to use:

Laddered Bond Portfolio Investment

The laddered investment strategy is focused on diversifying bond portfolios by acquiring bonds with different maturity dates. This strategy enables the investor to use the principal of lower rung bonds in higher rung bonds.

Bullet Bond Portfolio Investment

This investment strategy involves purchasing various bonds at different dates but with the exact maturity dates. The strategy works for investors who need massive amounts of cash at a future date.

Barbell Bond Portfolio Investment

The Barbell strategy requires investing in very short-term and long-term bonds. The investor has to pay attention to his investments to keep reinvesting the short-term bonds when they mature.

Benefits of Fixed Income Investments

Fixed-income investments are highly beneficial in many ways. Some of the advantages of this sort of investment include the following:

They make it easier to diversify your investment, especially when the market is very volatile.

They provide good returns and a steady stream of income.

Fixed income comes with a relatively lower risk exposure than other investment classes.

Fixed-income bonds are less likely to be affected by market volatility.

Conclusion

Bonds are known as fixed investments because they offer fixed interest returns and have significantly lower risk exposure than most investments. You can choose multiple bond investment types and strategies for these investment routes. Investing in fixed investment bonds is one way to save something for a rainy day. Contact REICG Real Estate Investment Fund.

#Real Estate Investment Fund#diversifying bond portfolios#Fixed Income Investments#Fixed Income Bonds#Government Bonds#Corporate Bonds#Benefits of Fixed Income Investments

1 note

·

View note

Text

Why Choose Government Bonds and Treasury Bills?

Safety and Security: Government bonds and treasury bills are among the safest investment options. Backed by the Indian government, the risk of default is incredibly low, making them a preferred choice for risk-averse investors.

Steady Returns: These investments offer predictable returns in the form of interest payments. The interest rates on these bonds are typically more stable than other investment options, like stocks or real estate.

Diversification: Including government bonds and treasury bills in your portfolio can help diversify your investments. When the stock market is volatile, these instruments can act as a stabilizing force.

Tax Benefits: In India, interest income from government bonds is often tax-free, making them a more appealing option for investors.

Liquidity: Government bonds and T-bills are highly liquid, allowing you to easily buy and sell them in the secondary market, providing flexibility.

#government bonds#government bonds in india#bonds#bondsindia#finance#investment#investing#invest in bonds#best government bonds

0 notes

Text

Asia stocks mixed after Wall St rises on corporate profits

Asia stocks mixed after Wall St rises on corporate profits

BEIJING — Asian stock markets were mixed Wednesday after Wall Street rose on strong corporate profit reports.

Tokyo advanced while Shanghai and Hong Kong declined. The yen stayed near a two-decade low near 149 to the dollar. Oil prices gained.

Wall Street’s benchmark S&P 500 index rose 1.1% on Tuesday after investment bank Goldman Sachs, military contractor Lockheed Martin and others reported…

View On WordPress

#Brent crude markets#Central banking#CO#Debt and bond markets#Government and politics#government bonds#Government business and finance#Government debt#Government finance#Government securities#Legislature#Oil and gas industry#Passenger airlines

0 notes

Text

Why Government Bonds Are a Smart Way For Investors

Government bonds are a type of fixed-income security that is issued by governments to raise money. They are considered to be one of the safest investments available, as the government is legally obligated to repay the bondholder the principal amount at maturity, plus interest payments.

There are many reasons why government bonds are a smart way for investors.

First, they offer a relatively high level of safety. The government is unlikely to default on its debt, as it has the power to raise taxes or print money to repay its creditors. This makes government bonds a good choice for investors who are looking to preserve their capital.

Second, government bonds offer a predictable stream of income. The bondholder will receive regular interest payments until the bond matures. Retirees or other investors who require a consistent cash flow can benefit greatly from this as a reliable source of income.

Third, government bonds are relatively liquid. This means that they can be easily bought and sold, making them a good choice for investors who need to access their money quickly.

Of course, no investment is without risk. Government bonds are subject to interest rate risk, which means that their value will decline if interest rates rise. However, this risk is relatively low for short-term government bonds.

Overall, government bonds are a smart way for investors to preserve their capital, generate income, and add diversification to their portfolios. If you are looking for a safe and reliable investment, government bonds should be on your radar.

Here are some additional benefits of investing in government bonds in India:

Government bonds in India are denominated in Indian rupees, which means that you are not exposed to currency risk.

The Indian government has a strong track record of paying back its debt.

Government bonds in India offer attractive yields, especially for long-term investors.

If you need to access your money quickly, government bonds are a liquid asset that can be easily bought and sold.

If you are looking for a safe and reliable investment in India, government bonds are a great option.

Here are some of the risks associated with investing in government bonds:

Interest rate risk: The value of government bonds will decline if interest rates rise.

Inflation risk: The purchasing power of the income you receive from government bonds will decline if inflation rises.

Default risk: The government could default on its debt, although this is unlikely for a developed country like India.

It is important to carefully consider the risks and benefits of investing in government bonds before making a decision. If you are not comfortable with the risks, you may want to consider other types of investments.

Bondsindia is a leading provider of government bond investment products in India. We offer a wide range of bonds to choose from, including short-term and long-term bonds.

#Bonds India#safe investments#fixed-income securities#bonds india#government bond investment#bonds in india#government bonds

0 notes

Text

If I want to earn 5,000 per month in retirement, what is a solution to create more passive income than government bonds? My house is owned free and clear. I am also an accredited investor.

If I want to earn 5,000 per month in retirement, what is a solution to create more passive income than government bonds? My house is owned free and clear. I am also an accredited investor.

Good question.

A good solution might be to purchase bonds of a company like Alamo Mortgage Holdings, Ltd or Andesite Blue, Ltd. These companies offer passive income bonds that pay hundreds of basis points more than government bonds.

Let’s say your goal is 5,000 per month or 60,000 per year. If you were to purchase a bond that paid 8% you would need to buy 60,000 / 0.08 = 750,000.

So, if you…

View On WordPress

#000 per month in retirement#government bonds#house#If I want to earn 5#investors#multifamily#Multifamily properties#passive income#retirement#what is a solution to create more passive income than government bonds? My house is owned free and clear. I am also an accredited investor.

0 notes

Text

we have three people who’ve been affected by the true hypnosis mic and two of them, nemu and kuukou, have physical items that represent their bonds, kuukou’s matching bandana and nemu’s aohitsugi bracelet

sasara’s the odd man out so i wonder if it’s smoking that represents the mcd bond????? but the fact that sasara’s trying to quit instead of already sober is striking me as strange, like the bandana and bracelet are notably missing but sasara’s is still lingering???? 🤔

#vee queued to fill the void#then there’s the fact sasara receiving his government issued mic and therefore the aforementioned scene wasn’t depicted in the manga 🤔🤔🤔#idk how to explain it lol#at the end of the day all roads lead back to rosho for sasara so i assumed something of rosho’s snapped him out of it#hhhhhhhhhhhhh but the way sasara has tragus piercings and they’re rumoured to relieve headaches#sasara has broken free from the true hypnosis mic but it’d be crazy if he was the one suffering from unforseen side effects#i need the nagosaka or another leaders centric manga to return PLS SHOW ME HOW SASARA AND KUUKOU BROKE FREE FROM THE TRUE HYPNOSIS MIC#like gosh the chuuoku stage showed us how nemu functioned from day to day and she was very cold#and when the hypnosis started weakening was when she was asserting her bond with inori and her bright personality came back#kuukou was going thru some behavioural issues even his father was getting concerned about and lowkey threatened to kick kuukou out#it’s a weird parallel i’m not entirely sure if i should be making bc that would imply kuukou at most until harmonious cooperation#WAS NOT free from the hypnosis given he almost got arrested everyone say thank you jyushi lol#the true hypnosis eventually wears off otome or ichijiku said bc of their strength in mind and so that’s sIDE EFFECTS IT KEEPS COMING BACK#KR!!!!!!!!!!!! ANSWER ME GODDAMN IT!!!!!!!!!!!!! I DONT KNOW HOW TO CONNECT THESE PIECES!!!!!!!!!!!!! PLS!!!!!!!!!!!

23 notes

·

View notes

Text

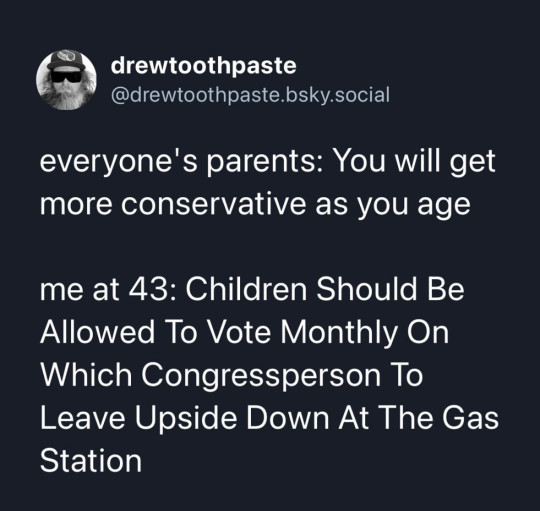

#everyone's#parents#conservative#fyi#psa#antifa#antifascist#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#democracy#class war#corrupt gop#corrupt government#government#government corruption#corrupt politicians#corrupt police#electoral college#electoral bonds#electoralism

51 notes

·

View notes

Text

What Is Government Securities and Bonds?

When most people think about investing, they tend to think about stocks and shares. But there are other options available, including government securities and bonds. So what are government securities and bonds? Put, and they are IOUs or debt instruments issued by the government. Call us!

0 notes

Photo

Customer: (not on record)

DMV: HELL BOUND

Verdict: ACCEPTED

#California license plate with text HEL BOND#bot#ca-dmv-bot#california#dmv#funny#government#lol#public records

256 notes

·

View notes