Text

Understanding C&I Building Energy Demand (and How to Cut Energy Costs)

In today’s world, building energy management and sustainability have become top priorities for facility managers, energy managers, process engineers, and sustainability managers.

To achieve cost and emission reductions, it’s crucial to gain a deep understanding of your facility’s energy demand curve and profile. By doing so, you can identify opportunities for cost savings and reductions in Scope 2 emissions.

However, it’s not just about understanding your building’s energy demand in isolation; it’s also about knowing when peak demand occurs, as these moments can significantly impact costs and environmental factors.

In this blog post, we’ll delve into the importance of understanding and managing building energy demand and how it all works in the context of peak electricity demand events – including how it can lead to substantial savings. We’ll also explore recent legislative changes, such as the Inflation Reduction Act and the updated Energy Storage Investment Tax Credit (ITC), that can further incentivize energy management.

Understanding Building Energy Demand

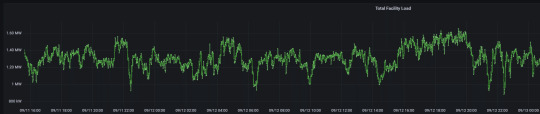

Energy demand in commercial and industrial (C&I) buildings is in constant flux, influenced by various factors, including operational scheduling, weather conditions, and the use of HVAC systems. Plus, the continuous operation of essential systems such as alarms, wireless devices, servers, and security cameras contributes to your facility’s daily demand.

Ultimately, every business is unique, and each building will have its own electricity load profile. However, it’s essential to understand your building energy demand and load profile to understand better the opportunity to reduce electricity costs.

Building Energy Management Systems (BEMS)

In today’s energy-conscious world, businesses increasingly turn to Building Energy Management Systems (BEMS) to understand their load profiles, optimize energy consumption, reduce costs, and enhance sustainability. These systems play a pivotal role in both new construction projects and retrofitting existing commercial and industrial (C&I) buildings.

What are BEMS?

Building Energy Management Systems, commonly referred to as Building Management Systems (BMS), are sophisticated, integrated systems and software that monitor, control, and optimize a building’s various energy-consuming systems. These systems leverage advanced technologies such as sensors, data analytics, and automation to provide real-time insights into energy usage and enable precise control of heating, ventilation, air conditioning (HVAC), lighting, and more.

Benefits of BEMS

Energy Efficiency: BEMS help businesses reduce energy consumption and lower operational costs by optimizing system performance and reducing waste.

Environmental Sustainability: By reducing energy consumption, BEMS contribute to sustainability goals by minimizing greenhouse gas emissions and environmental impact.

Operational Optimization: These systems enhance building comfort, productivity, and maintenance by ensuring that systems operate efficiently and respond to changing conditions.

Whether in new construction projects or retrofitting existing buildings, BEMS offer customizable solutions that empower businesses to control and optimize their energy consumption.

But optimizing building operations does not yield the biggest savings. The most significant savings come from understanding (and acting upon) grid factors and how your building plays a part in the overall electrical system.

Peak Demand: The Largest Cost Factor

In most regions, electricity prices fluctuate with demand, resulting in off-peak and on-peak pricing. Typically, electricity is cheapest during overnight hours when demand is low (Off-Peak) and most expensive during peak hours when consumption is at its highest (On-Peak).

Typically, there is a concentrated “peak demand period” of about 4-5 hours in the early evening (4-9 PM), when most folks are home from the workday and turning on TVs, stoves, and dishwashers. That’s where you’ll see the highest demand charges.

We can break time periods down into three categories:

On-Peak: The most expensive time to use energy

Off-Peak or Mid– Peak: An average cost of energy

Super-Off-Peak: The cheapest time to use energy

Seasonality also plays a significant role in the cost of energy. For example, some months (like May or October) tend to be cheaper than in the heat of summer or dead of winter, when demand peaks because of heating or cooling.

However, some regions see Coincident Peak demand events, which occur only for a few hours each year. Coincident peak, also known as system peak or peak demand, is the specific point in time when electricity demand reaches its highest level across the grid. These events can significantly spike electricity costs and may not align with standard on-peak hours. For example, in Ontario, it’s referred to as Global Adjustment; in New England and New York, it’s known as ICAP.

Understanding building energy demand can help mitigate day-to-day on-peak pricing, but it won’t predict Coincident Peak events.

Mitigating Costs with Battery Energy Storage

Proactive energy management can yield substantial savings by predicting when Coincident Peak events will occur.

By pairing your understanding of building energy demand (or load profile) with battery energy storage systems, you can strategically store energy during low-demand periods and discharge it during Coincident Peak events. This strategic charging and discharging of stored energy reduces electricity costs and contributes to a more stable and resilient grid.

The Inflation Reduction Act and Energy Storage ITC

Recently, legislative changes have further incentivized investment in energy storage solutions. The Inflation Reduction Act (IRA) and the restoration of the Investment Tax Credit (ITC) offer the most significant financial benefits for businesses investing in energy storage systems.

Here’s how it works:

This is a tax credit for commercial and large-scale deployments of solar or solar + storage. The Inflation Reduction Act updated the ITC to include standalone energy storage projects and several other clean energy technologies. Storage projects must be capable of receiving, storing, and delivering electricity and must have a minimum capacity of 5 kWh.

The tax credit has been restored to its full 30% value for solar, storage, and solar + storage projects beginning construction before January 1, 2025. However, there are new eligibility guidelines to qualify for the full ITC value and failure to meet these requirements means a developer may only be entitled to a 6% ITC (an 80% reduction in value).

Prevailing Wages: Any project must pay prevailing wages during the construction, alteration, and repair phases and for at least the first five years of operation. These rates are published by the US Secretary of Labor. Projects under 1 MW are exempt.

Registered Apprenticeship Requirements: Qualified apprentices (as defined by the National Apprenticeship Act) must make up a specific percentage of the labor hours on a project. If a project employs four or more individuals, this requirement would apply. Projects under 1 MW are exempt.

This tax credit can offset a substantial portion of the costs associated with implementing battery energy storage, making it an even more attractive option for mitigating peak demand costs and contributing to sustainability goals.

Interested in a No-Cost Energy Storage System?

In the face of rising energy demand and the need for action on climate change, understanding and managing building energy demand have become critical for businesses seeking to optimize costs and reduce their environmental footprint.

By staying informed about your building’s energy load profile, forecasted peak demand events, and by leveraging legislative incentives like the Inflation Reduction Act and the updated Energy Storage ITC, your business can implement strategies like battery energy storage to save significant amounts of money and contribute to a more sustainable energy future.

At Peak Power, we’ve developed industry-leading partnerships to deploy capital for projects. Our customers get to share in the upside of energy savings and value creation without bearing the financial risk. Many of these projects are structured with shared savings agreements, creating a win-win-win relationship for all parties and generating significant energy cost savings for the facility that hosts these energy storage systems.

0 notes

Text

What is an Energy Storage Shared Savings Agreement?

Reaching Economic and Environmental Objectives with Energy Storage Shared Savings

In a landscape where energy markets are becoming more complex and businesses grapple with balancing financial and environmental interests, energy storage is becoming more attractive for industrial and manufacturing facilities where manual load curtailment is becoming ineffective and harming operations and output. For facilities like yours, the objective is clear: achieve reductions in energy costs without disruptions to daily operations or having to curtail production.

But, installing energy storage behind-the-meter at a facility can be cost-prohibitive. Some systems can cost hundreds of thousands of dollars, and that kind of upfront capital expenditure is not viable.

However, Energy Storage as a Service (ESaaS) is emerging as a top solution to tackle these challenges. And while there are many models as part of ESaaS, including fee-for-service, the most popular is Shared Savings. Shared savings models offer a promising avenue for commercial, industrial, and manufacturing facilities seeking to adopt energy storage systems without shouldering the burden of upfront capital expenses.

Let’s explore the shared savings model that facility managers, energy managers, and CFOs are exploring today.

Energy Storage Shared Savings Operational Model

Under a shared savings model, facilities can now tap into the technology, capital, and expertise required to maintain profitability, reduce OPEX, and pursue net zero goals using energy storage. With the expansion of the Investment Tax Credit through the Inflation Reduction Act, Shared Savings is expanding Peak Power’s capabilities in offering Shared Savings to even more businesses looking to use energy storage to reduce energy costs, improve energy KPIs, and reduce scope 2 emissions.

And what’s so great about Shared Savings for the customer?

Well, as the ESaaS provider, we only make money when your facility is saving money. That’s because we share in the savings (or revenue) generated through the energy storage system.

It’s for this reason that at Peak Power, we’re driven by creating win-win agreements so that we both realize financial benefits. Unlike the conventional approach of direct asset purchases by end customers, ESaaS offers flexibility in financial arrangements.

Plus, by removing the financial burden associated with installing large commercial energy storage systems, the barriers to entry are significantly reduced, encouraging broader adoption of clean, distributed energy solutions and helping to make our grid more resilient for the future.

A Truly No-Cost Solution: Site Assessments and Feasibility Studies

While some ESaaS providers offer a no-cost energy storage system, we offer a fully no-cost solution at Peak Power. This includes conducting the virtual site assessment, the feasibility study, and the site visit at no cost to your business.

In the first step in the process, the Virtual Site Assessment, our energy storage pros conduct a desktop analysis of your site, including a mapping review to determine the feasibility of an energy storage system. We overlay your site information with our proprietary technology to understand the investment tax credit zone in which your facility is located. And even if energy storage isn’t suitable for your facility, we provide you with actionable guidance to pursue your net zero and energy goals.

Once we’ve determined that your site could be well-suited to realize economic and environmental benefits through energy storage, we move into a feasibility assessment. The feasibility assessment includes financial modelling and a review of the value streams we can use energy storage for, including:

Peak shaving

Energy Arbitrage

Demand Response

And much more. We have a unique understanding of complex electricity markets to help you accurately predict the feasibility of a distributed energy project. It’s why we’ve been able to successfully achieve hundreds of thousands of dollars in savings for several of our clients.

Click here to learn more about how we conduct feasibility studies.

Case Study: GHP x Peak Power

Our energy storage systems were installed in four commercial buildings in Westchester, New York – one of the state’s first Virtual Power Plant demonstration projects. The project reduces electricity Coincident Peak and Demand Charges and participates in ConEd demand response programs.

In this Shared Savings model, GHP and Peak Power split the utility bill savings and market revenues from the operation of the battery. GHP took on little to no risk while receiving energy cost savings, and Peak Power retains a portion of the savings and revenue in exchange for installing, maintaining, and operating the system.

So far, GHP has realized $495,742 in energy cost savings to date.

Ownership and Financing Options

Now, let’s take a look at the nuts and bolts of how Peak Power’s shared savings operates. There are three options a customer could choose: third-party ownership, self-ownership, and leasing.

1. Third-Party Ownership

The third party (Peak Power or our financiers) finances and owns the battery asset and places it on-site at a commercial, industrial, or manufacturing facility. There is no upfront cost or operational burden to the facility (the host site). The third party is responsible for operating, maintaining, and optimizing the distributed energy assets (storage or solar+storage) and receives a percentage of the energy savings and revenue generated.

This is a long-term agreement, typically ten or more years allowing the third-party owner can recoup the investment and the host to reap the full financial and environmental benefits of these energy storage assets at scale.

2. Self-ownership:

This option would be a significant upfront cost (in the multi-millions), but the host would retain all the savings and revenue opportunities. In this case, the owner of the battery would need to pay for things like maintenance and would need software to intelligently operate the battery to maximize savings and revenue, and participate actively in energy markets.

The investment would pay for itself over about ten years. However, many companies may not have available capital to purchase these systems upfront. There may also be operational challenges, as the host may not have in-house staff to operate, maintain, and optimize the battery energy storage systems.

3. Leasing:

This is similar to the third-party owner in that savings would still be shared, but it is for a shorter agreement term – usually less than ten years. The asset would, in most scenarios, be maintained and warrantied by the lessor. This option runs the risk of being less cost-effective and would still require the BESS foundation and electrical work.

Location Considerations for Energy Storage

The most favourable locations to install a battery energy storage system are states and provinces where market- and government-level programs and incentives allow battery storage to be compensated for services rendered. These state programs play a crucial role in enabling facilities to optimize savings and investments in energy storage.

Additionally, locations with high-cost coincident peak demand charges would benefit most from an energy storage system due to the potential for peak shaving.

We’ve found that some of the most favourable markets for energy storage are Massachusetts, California, New York, and Ontario.

Building the Energy Future with Energy Storage Shared Savings Model

Energy storage shared savings is more than just a contractual structure; it’s a model that empowers facilities to participate in a 4D Energy Future – one that is Decentralized, Democratized, Digitalized, and Decarbonized. Shared savings models alleviate financial constraints, allowing sustainable energy solutions to be implemented at the velocity we need to achieve emissions reduction goals, all while improving operational efficiency and facility performance.

At Peak Power, we have created partnerships with leading financiers to quickly deploy capital and get projects into the ground. Our success is tied to our customers’ achieving their financial and environmental goals.

Book Your No-Obligation Virtual Site Assessment

Our unique Shared Savings Model allows us to offer your facility a battery storage system at no cost. We operate, optimize, and maintain the battery to generate electricity savings and revenues that we both share in.

Plus, we made a name for ourselves with some of the best-in-class peak demand forecasting. This ensures you receive the maximum financial benefits of a shared savings agreement. It’s a win-win. We only make money when your business is saving money.

Get end-to-end implementation of Battery Energy Storage Systems – from development to operation to maintenance – with Peak Power.

0 notes

Text

A How-To on Battery Energy Storage Project Development

The transition to a clean and sustainable energy future is a pressing concern in today’s world. One solution to reach that sustainable energy future is deploying, operating, and optimizing distributed energy resources, like battery storage and electric vehicles. This was the focus of Peak Power’s Battery Development webinar, where industry experts shared their insights and experiences.

This blog delves into some of the key points discussed during the webinar, highlighting value-adding solutions applied on Peak Power’s Operations side.

Behind-the-Meter Battery Energy Storage: Developing a Project

Elaine Kwok, Senior Director of Marketing at Peak Power, opened the webinar by sharing our company’s mission: to help customers and partners achieve their net-zero goals, reduce their operating expenses, and unlock new revenue opportunities by deploying battery storage systems, grid-interactive buildings, and electric vehicles.

The webinar featured four industry experts who covered various aspects of battery energy storage system (BESS) project development. They included Pooja Shah, Senior Consultant at DNV; Jocelyn Zuliani, Energy Storage Lead at Hatch; Christopher Yee, Project Manager at Peak Power; and Archie Adams, Director of Business Development at Peak Power.

The four spearheaded the conversation about BESS and how commercial and industrial facilities can develop these projects on their sites.

The Importance of Behind-the-Meter Systems

Archie Adams began the webinar by shedding light on the significance of behind-the-meter systems and their increasing popularity in day-to-day industries.

These systems are often located at customer sites and are connected to the distribution system on the customer side of the utility service meter. They can offer benefits such as cost savings and improved reliability.

Shah went on to explain, “It’s often used to reduce energy bills by demand charge reduction, lowering the maximum power consumed. [This can also be done through] energy arbitrage … by shifting electricity consumption from high to low energy cost periods.”

“Another reason customers commonly use behind-the-meter systems is that they may be interested in having reliable access to power after disruption to the grid. Particularly [when] these disruptions or outages are common occurrences. Or the customer faces steep consequences for an interruption in supply,” she said.

Behind-the-meter systems are known to reduce energy bills through demand charge reduction and energy arbitrage or to provide ride-through capability during grid disruptions.

Technology Selection and Sizing Considerations

Shah emphasized the factors influencing technology selection and sizing for BESS projects. Key considerations for this include identifying relevant loads, understanding use cases and value stacking, EV charging needs, geographical location, financing, and utility zones.

“Use cases are probably one of the most important things that drive technology selection

and sizing consideration, [that helps in] identifying the purpose of the behind-the-meter solution that is being used. Some of the common ones are peak shaving, demand charge management, time-of-use energy cost management, used as backup power,” Shah said.

Shah further explained that peak shaving and demand charge management is something that a customer can utilize to minimize the peak demand charges on their electricity bills.

Revenue Generation and Value Stacking

Adams unpacked the concept of a “value stack,” explaining how commercial and industrial facilities can tap different programs and incentives to maximize returns on the battery and the overall project. Value streams include demand response, demand charge management, coincident peak shaving, frequency regulation, and operating reserves.

Understanding a customer’s current energy usage, habits, bills, facility layout, and potential integration with solar power allows for the development of a comprehensive proposal specific to their needs.

Adams explained that by viewing a facility’s electricity bills, they can look at “call interval load data, which is a breakdown of what the facility is demanding and using for power at every hour of the year–sometimes even every five minutes, to get … the data.”

While the session focused on energy storage, there is often an overlap with solar power and how it integrates into the process of determining a project plan.

Project Development and Procurement

Jocelyn Zuliani went on to discuss site assessment, connection impact assessment, permit acquisition, detailed engineering, and equipment selection.

The site assessment considers physical aspects such as available space, indoor/outdoor installation, maintenance access, security, and fire safety.

The electrical assessment focuses on interconnection to the facility, considering space, upgrades, and proximity to maximize benefits.

Zuliani explained that a facility would need to go through the connection impact assessment, which involves developing the initial interconnection design and operating philosophy, and then engaging with the local utility for them to complete an impact assessment accurately.

“Depending on your jurisdiction, the operating philosophy is often a key piece so the utility can really understand how you’re going to use the battery,” she further explained.

Procurement and Construction Considerations

Christopher Yee highlighted the ins and outs of the procurement and construction phase, emphasizing the importance of a kickoff meeting to introduce stakeholders and discuss safety measures, system design, and project scope to achieve overall success.

Effective communication and collaboration between teams are integral to ensuring project completion within the designated timeframe while also aiding in minimizing interruptions to the facility’s normal operation.

The Peak Power Battery Storage Development webinar offered valuable insights into the development process for battery energy storage systems. There is an ever-growing business case for behind-the-meter energy storage systems and their potential to enable cleaner, more reliable, and more affordable electricity.

0 notes

Text

Financing Options and Strategies for Battery Energy Storage Systems

Recently, Peak Power conducted an energy storage finance webinar that focused on strategies available for financing battery energy storage system projects. The webinar aimed to provide valuable insights into financing options and strategies for these projects.

In this article, we will unpack some of the main points covered during the webinar, highlighting key quotes and insights from the panelists on the day.

The Future is Bright for Energy Storage

Pablo Barrague, Vice President of Energy Storage at Madison Energy Investments, emphasized the positive outlook for energy storage—highlighting the projections by reputable advisory firms, such as Bloomberg, which consistently show an upward trend in energy storage investments.

On Madison Energy Investment’s expertise and all-encompassing approach, Barrague said, “We have over two hundred solar projects in more than twenty-five different states. So we know how to deploy this in every single different market. And about twenty of those projects are energy storage projects … They’re always either generating savings or revenues for our customers. We are the ones who are going to own the asset, maintain the asset, and operate the asset. Our customers [only] have to worry about collecting revenues or seeing savings on their utility bill.”

According to Barrague, energy storage is becoming a significant contributor to new capacity, with projections suggesting it will account for 10% of U.S. capacity by 2030. This growth presents significant opportunities for customers.

Understanding Battery Energy Storage at Your Facility

Archie Adams, Director of Business Development at Peak Power, discussed different types of battery energy storage systems and their benefits. He explained the concept of standalone storage, where batteries are installed near a customer’s meter to reduce the building’s load during peak hours.

Adams explained, “Peak Power is operating batteries to generate a pool of savings, and then the savings are shared with the building owner, through a fixed payment or through a shared saving structure. So, the standalone energy storage is primarily providing economic benefits and savings for facility bills.”

Adams further highlighted the benefits of solar + storage saying, “on the other side, we’d have Solar + Storage … this solar generates electricity, and the building buys that through a lower cost power purchase agreement, and the battery can charge from that solar.”

This approach can help manage demand charges and shift consumption to lower cost periods., Combining solar generation plus battery storage helps businesses acehive both economic and environmental benefits.

“In addition to the financial benefits of energy storage, a combined solar and storage system provides environmental benefits through GHG emissions reduction. So I like to think of solar + storage as a winning combination, peanut butter and jelly, bacon and eggs, for the New England fans, Tom Brady and Bill Belichick,” he enthused.

Ownership Structures: Pros and Cons

Archie discussed various ownership structures for battery energy storage systems. Third-party ownership involves a company like Madison Energy Investments financing and operating the battery while the savings are shared between the energy storage system owner and the host site. This option eliminates the upfront capital requirements and the need for system operation staff for the host site.

Self-ownership allows the host site to retain full savings and revenues but requires substantial upfront investment and operational expertise.

A hybrid model, combining aspects of both structures, offers shorter-term agreements but may be less cost-effective.

Favourable Markets for Battery Energy Storage

Barrague highlighted different geographic markets where battery energy storage projects are financially viable. He emphasized that each market has unique price signals and market design constructs that allow for monetizing battery services.

Barrague used the example of Ontario, which has a system demand charge that can be significantly reduced through battery dispatch. Massachusetts offers state programs that incentivize solar + storage projects with fixed-rate contracts. Other states, such as Puerto Rico or Hawaii, have high utility rates, making Solar + Storage financially advantageous.

Evaluating the compatibility of facilities with favourable markets is crucial when considering battery energy storage projects.

Watch the Webinar On Demand

Peak Power’s finance webinar provided valuable insights into financing options and strategies for battery energy storage system projects. The webinar highlighted the positive growth outlook for energy storage, the benefits of different ownership structures, and the importance of favorable markets.

With the increasing demand for energy storage, businesses and institutions can leverage these opportunities to pursue net-zero goals, reduce operating expenses, and unlock new revenue streams.

0 notes

Text

Understanding the Financial Benefits of Energy Storage for Industrial and Manufacturing Facilities

While the clean energy revolution may be well underway, many businesses still hesitate to transition to a decentralized electricity system. Will having your own energy storage system or clean generation resources actually be reliable, meet sustainability mandates, and stay within budget?

We get it — you need to ensure profitability to begin reaching your environmental goals. At a high level, you know that deploying an energy storage system will help ensure your organization is doing its part to tackle the climate crisis, but how will it help your business financially?

Today, we’re breaking down the myth that clean energy technology has to be expensive. It’s possible to reach your environmental targets without breaking the bank. Not only can the initial investment be subsidized (or even financed), but the transition to clean energy paired with energy storage can improve NOI, cut operational costs, and even provide new revenue streams depending on your utility and jurisdiction. Let’s get into it.

Cut Electricity Costs

From powering machines to keeping HVAC running efficiently, commercial and industrial buildings require an immense amount of electricity. When looking to reduce operational costs, many facilities believe these costs are hard to reduce and that they’re already done what they can with efficiency measures like changing to LED lighting.

Electricity is a major operational cost and can drastically decrease the financial performance of a business. But with our energy storage software, we can help you anticipate and respond to peak demand events. The reason why anticipating peak demand is so critical brings it back to basic supply and demand fundamentals: the higher the demand, the higher the price.

By anticipating the peak demand events, we can ensure you charge your battery when electricity prices are low so that you can discharge that stored electricity when prices are high.

At Peak Power, we’ve got a strong performance record for forecasting peak demand events in Ontario, New York, Massachusetts, and California. By implementing energy storage systems paired with our software, our customers have realized over $5 million through cost savings or revenue.

Our energy storage software can help you continue to reduce energy costs without affecting output.

Create an Additional Revenue Stream

Besides powering your own facility, your facility can become a resource for those around you. With your energy storage system, electricity is stored in on-site batteries and can respond to grid signals and demand events. When demand for energy spikes, many grid operators will call on resources, like your battery storage system, to respond. In turn, you create a new revenue stream for your business as a “demand response” resource for the grid.

Many facilities have space that currently goes to waste. From vacant land to rooftops, your business can use this seemingly unviable space to capture energy from solar to power your facility, store the excess, and generate additional revenue.

Increase Energy Reliability

Grid reliability is a growing problem. Most facilities rely on the electricity generated from power stations that can be hundreds of kilometres away. The energy must make its way through transmission and distribution lines before it gets to your facility. It becomes increasingly unreliable the further it goes, increasing the chances you’ll experience outages as the intensity of weather events increases.

Even going twenty minutes without power can seriously affect your facility’s output and revenue.

With energy storage solutions, you can reduce the risk of a power outage by providing ride-through resiliency capability. In an ideal situation, your facility could generate the entirety of its electricity needs with rooftop solar and store that excess power in energy storage systems.

Jump On Energy Incentives

One of the biggest questions we get is, where will I get the capital to invest in battery energy storage systems?

It doesn’t have to be costly to turn to cleaner and more reliable energy. Most electric utilities offer energy incentives in addition to incentives provided by the government at a municipal, state/provincial, and federal level. This can drastically improve the business case for organizations aspiring to reach net zero.

At Peak Power, we’re pros at navigating these incentives and programs. For instance, New York State allows a 15-year tax exemption for any increased value that arises from a property with clean energy systems. In California, you can receive funding for installing a public EV charging station. These are just a few of the many incentives your business can benefit from.

Contact our team to learn how we can help you secure the financing needed to shift to clean energy technologies.

Net Zero Can Be Profitable

In an age when operating costs continue to rise, many facilities can struggle to put environmental issues first. But you shouldn’t have to choose between pursuing net zero goals and ensuring a healthy balance sheet.

With the help of incentives, the initial investment into battery storage, solar, and many other technologies becomes much more feasible for commercial and industrial facilities. Then, these facilities can immediately reduce their energy costs while providing additional resources to the grid when demand is high.

Our Peak Synergy energy software can help you do all of that.

Connect With Peak Power

Between aging infrastructure and rising electricity costs, the current centralized electricity system isn’t sustainable.

At Peak Power, we can help you pursue your clean energy goals with energy storage systems and software, allowing your business and the environment to reap the rewards.

Get in touch with one of our energy storage experts today!

Contact Peak Power

We’re social. Follow us on Twitter and LinkedIn!

0 notes

Text

Federal Tax Incentives for Energy Storage Systems: IRA Spotlight

The summer season is officially behind us. It was yet another record-breaking year for heat waves across the globe, putting unprecedented strain on electrical grids and increasing pressure on modern economies that rely on a stable supply of electricity. But, we see signs of hope on the horizon with the expansion of federal tax incentives for energy storage systems and other clean energy technology.

The passage of the Inflation Reduction Act is going to massively transform electricity markets in the United States. Canada is eyeing similar incentives that could help to accelerate the installation of residential and business clean energy technologies.

Like other incentives in the past, federal governments offer these to investors, businesses, and consumers to encourage the uptake or development of technologies that will benefit the economy as a whole.

Using tax credits to incentivize development began in the sixties, although the idea behind the tax credits was not to incentivize investors. Instead, it was to protect American business owners from foreign competition. This was due to the revival of industrial production in Europe and Japan, which was in recovery after World War 2.

In this modern era, governments are using these incentives to speed up penetration for technologies that help us avoid the worst effects of a changing climate and support grid reliability in an increasingly electrified world. These energy incentives come in many forms, such as the investment tax credit, and the reforestation credit.

The Inflation Reduction Act: The Key to Federal Tax Incentives for Energy Storage Systems

The Inflation Reduction Act has officially been signed into law, and this presents a multitude of financial incentives to drive the deployment of clean technologies throughout the United States.

There is one key federal incentive to highlight for companies looking to deploy clean energy assets.

Investment Tax Credit (ITC)

This is a tax credit originally created for commercial and large-scale deployments of solar or solar + storage. The Inflation Reduction Act updated the ITC to include standalone energy storage projects and several other clean energy technologies. This is a big win for areas where solar power isn’t beneficial.

The tax credit has been restored to its full 30% value for solar, storage, and solar + storage projects beginning construction before January 1, 2025. However, there are new eligibility guidelines around Prevailing Wages and Registered Apprenticeship Requirements to qualify for the full ITC value. Not meeting these requirements may mean a developer is only be entitled to a 6% ITC (an 80% reduction in value).

The Inflation Reduction Act also provides an added 10% ITC bonus (bringing the value to 40%) for projects that meet either of these criteria: domestic content, located in an Energy Community, or located in an Environmental Justice Area.

A really exciting update for energy storage developers and businesses looking to deploy storage is that interconnection costs are now included in ITC calculation. This is an added benefit for eligible ITC participants but can’t be used in a standalone fashion.

For a more detailed description of the ITC, download our Energy Incentives Guide for Massachusetts and New York.

Other Incentives For Renewable Energy

There are several other incentive programs at the state and federal level. Here are two you ought to know:

Renewable Energy Certificates or Credits (RECs)

For many businesses that don’t have the space to install solar or other forms of clean energy generation technologies, RECs offer a great solution.

This is an incentive in the form of a financial product. With RECs, companies can meet their renewable energy targets by purchasing these credits which subsidize the generation of an established unit of clean energy and/or fund additional clean energy development to meet demand. That REC payment can go to a solar farm company, a residential consumer with solar installations, or even to businesses with sited solar and energy storage.

Companies can meet their commitments to using clean energy without having to rely on traditional utilities or by producing energy themselves.

With RECs, more individuals and businesses are incentivized to generate these certificates by installing renewable energy generation capacity; on solar farms, residential land, non-arable agricultural land, or even at C&I facilities.

Net Metering

Net Metering is usually administered by local utilities and permits customers to connect their solar or wind-generated power to the grid. The incentive systems work in different ways across states. Still, the idea is that utility companies purchase renewable energy from the customer, which is reflected in how the customer pays for the net amount of energy used. The amount that the customer pays is the total energy used minus the amount of energy distributed to the grid from the renewable energy source.

With Net Metering Programs, companies can sell their surplus energy from sited energy resources while still being able to use energy from the grid when needed, especially when the rates (and demand) are low.

These programs can also be quite lucrative, when companies buy low, store the “discount” energy in batteries, and then export that energy back when prices rise (this is also known as energy arbitrage).

Net Metering is a popular tool used across the United States. About 37 states and the District of Columbia have a net metering system in one form or another. Eight states have a net metering system alongside other renewable energy compensation schemes.

Key Benefits

If you are an investor wondering why you should take an interest in these tax incentives for battery storage systems, here are some good reasons to do so.

Reduced Costs

At its most basic, tax credits and other federal incentives will reduce your overall investment costs. You can install renewable energy systems and technologies while reducing your tax liabilities, and increasing project rates of return.

Ultimately, the ITC will provide your business with a 30-40% discount on the development of solar and energy storage technologies. The clean energy technologies you install will also contribute to lower operating costs and result in improved margins.

Revenue Generation

Which business doesn’t like finding new streams of income?

Beyond net metering and RECs described above, there are demand response programs, operating reserve programs, and so many more depending on the state.

So not only can you reduce energy bills by exporting your surplus energy from renewable sources or by selling RECs, but you can also employ energy arbitrage strategies to buy low and sell high, making your money on the spread.

Many of these programs can be tapped into when you have energy storage systems installed either behind- or in front-of-the-meter.

Good For The Environment

Business and consumer incentives to develop and install clean energy technologies are not just good for the health of our planet, they’re good for our economy (and your bottom line).

Need we say more?

Creates Employment

Over the last few decades, the renewable energy sector has been growing exponentially, far outpacing the growth in other sectors. It’s estimated that the clean energy sector will generate at least ten million new jobs by the year 2030.

During the same period, it is estimated that about 3 million jobs will be lost by the decline of fossil-based energy generation. This translates to about 7 million net new jobs as a result of this clean energy transition.

Peak Power Will Help You Tap Into Federal Tax Incentives for Energy Storage Systems

If you are wondering how you can benefit from federal tax incentives for energy storage systems and other clean energy technologies, Peak Power is the partner that you need.

Because we’ll be blunt. The current centralized electricity system isn’t sustainable. Between the climate crisis, state-wide blackouts, aging infrastructure, and rising costs, the system needs a huge overhaul.

Luckily, we’re seeing that governments, utilities, and businesses around the world are tapping into the potential of distributed, decentralized energy resources with a plethora of incentive structures… even if they might be a little hard to navigate.

To help companies like yours take full advantage of the federal tax incentives and help navigate these incentive structures, we hosted a webinar in December 2022 to break down the details of the Inflation Reduction Act and the corresponding Investment Tax Credit.

0 notes

Text

Virtual Power Plants vs. Distributed Energy Resource Aggregation

The clean energy transition is well underway, and one thing that’s become certain as we inch toward a net zero future is that economies will inevitably become increasingly electrified. What is unclear is whether or not this future will be dominated by Distributed Energy Resource Aggregation (DERA), decentralized electricity resources interconnected with the grid, or Virtual Power Plants (VPP), a network of decentralized, medium-scale power generating units.

Either or — DERA or VPP — countries in the future will be electrified far more than they are today.

The Energy Race is on in North America

Reliant as we are on fossil fuels for heating our homes and driving our cars, we have seen some big movements in the last several months that are poised to massively accelerate the clean energy revolution.

Spurred on by the Inflation Reduction Act (IRA), the U.S. is wholly embracing distributed energy resources, electric vehicles, and carbon reduction and mitigation technologies. This momentum has encouraged the passage of similar incentives in Canada – including those for energy storage – in addition to several other Canadian-made programs like Natural Resources Canada’s (NRCan) Zero-Emissions Vehicle Incentive Program and Sustainable Development Technology Canada’s (SDTC) innovation funding.

The flip side to this coin? As we build out EV infrastructure and the adoption of electric vehicles increases, our countries’ electrical grids will need to support much higher electricity demand. The grid demand will be put under even more stress as trends continue with homes switching from forced-air furnaces to electric heat pumps.

Greater Stress on the Grid

This rise in electricity demand is something that many utilities and power producers are preparing for with a dash of uneasiness. Especially as they are scrutinized more publicly, given the unprecedented grid issues we’ve seen in the last few years; in Texas, California, and Ontario.

Traditionally, electrical grids have been largely designed to carry power from massive power stations through miles of transmission and distribution lines. If we maintain the status quo, the easiest way to expand capacity is to build more utility-scale power plants and even more transmission and distribution infrastructure.

However, these fossil fuel-powered plants fly in the face of the clean energy goals necessary to mitigate the impact of climate change. They’re also expensive, lengthy capital investments for grid operators, which then need to upgrade transmission and distribution networks to accommodate extra capacity.

The result of all this? Higher energy costs for the end consumer, more environmental impacts, and more risks for grid failures in an increasingly volatile climate.

We need something different.

The energy demand curve has looked pretty much the same for the last few decades. But that is about to change dramatically in the coming decades as we electrify everything and bring more intermittent renewable generation online.

Put simply, the growth of distributed energy resources (like energy storage and rooftop solar), paired with smarter electricity systems, is helping to flatten the energy curve. This will reduce the need for major infrastructure upgrades as well as the need for dirty, expensive fossil-fuel plants to exist only to meet energy demand spikes.

Where Does this Leave Grid Operators?

So, where does this leave grid operators? Well, the future is not as grim as some would indicate. If we act now (and we are!) we’ll avoid the worst; a future where EVs (and electric semi trucks) are plugging into a grid rife with rolling brownouts and still relying heavily on fossil fuels.

Grid operators have been hesitant to embrace distributed energy resources (DERs) since they’re typically thought of as too small to support the needs of large grids. However, DERs can become a ubiquitous resource, with any number of small energy generators, from rooftop solar arrays and small wind turbines to battery energy storage, EVs, and even smart buildings.

At Peak Power, we believe in a 4D energy future: one that is decentralized, digitalized, democratized, and decarbonized. We know distributed energy resources can power our transition. In fact, electric vehicles could become “the most ubiquitous distributed energy resource out there, with a combined capacity that could dwarf existing nuclear power plants.”

youtube

Distributed Energy is a Cornerstone of the Electrified Future

Distributed energy is quickly becoming a core resource as we move towards full electrification. When several small DERs are aggregated in one centrally controlled system, they can better compete with the large fossil fuel power plants.

This gives us hope that we will see a future where power plants are made obsolete while, at the same time, grid operators are expanding grid capacity without costly capital investments.

The concept of aggregating DERs is not new, but what may not be familiar with is that there are different ways to optimize these energy resources:

Virtual Power Plants (VPPs)

Virtual power plants (VPPs) are the best-known way to aggregate DERs, which isn’t surprising since the concept dates back to the late 1990s. VPPs pull together DERs like solar, energy storage, EV chargers, smart buildings, and more to give grid operators a way to make the most of these clean but typically small-generation assets.

Software plays a critical role in operating DERs as a Virtual Power Plant because, individually, they often don’t meet the minimum size threshold required to participate in wholesale energy markets. Thanks to software developments, grid operators can embrace VPPs to relieve overstretched grids. They can operate the disparate DERs as a single resource to meet the needs of a grid. When demand is low, but the sun is high on a clear day, solar farms can be used to charge battery storage connected through the VPP. During times of peak demand, the grid can then draw the stored energy from the batteries to relieve strain.

To put it in simple terms, the core function of a Virtual Power Plant is to supply resources to the grid in the wholesale electricity market. Distributed Energy Resource Aggregation is slightly different.

Distributed Energy Resource Aggregation (DERA)

As mentioned, a VPP operates various DERs as a single resource to meet size thresholds for participation in a wholesale energy market, and VPPs are typically managed by a systems operator.

By comparison, Distributed Energy Resource Aggregation (DERA), while using the same general method of aggregation of energy resources as applied with a VPP, can take advantage of a variety of energy incentives and revenue streams – both behind- and front-of-the-meter – rather than operating solely within a wholesale energy market. Another major difference is that a DERA platform can be owned and operated by corporations with large buildings and energy load requirements that are looking for both financial and environmental benefits from their energy programs.

DERA networks can participate in demand charge and coincident peak reduction programs that are offered by grid operators or utilities. A DERA can also participate in additional demand response programs offered by utilities, which reward users for drawing less energy from the grid during times of high demand.

Both DERA and VPPs provide stated benefits both to the grid and ratepayers, and both options are good depending on the goals and who is going to operate the distributed energy resources.

Software as an Energy Enabler

At Peak Power, optimizing distributed energy resources is the centrepiece of our efforts to make traditional power plants obsolete.

We’re proud that our software is both multi-asset (operating multiple asset types, including energy storage, electric vehicles, and buildings) and multi-objective (optimizing for economic, environmental, and/or resiliency goals). This is what makes our software different, and we’ve demonstrated how it can be in both applications: Both as a Virtual Power Plant or as a DERA platform.

Peak Power’s software offers the flexibility to tailor an aggregation of DERs to any number of energy priorities for our partners. In fact, we received a $5 million grant from Sustainable Development Technology Canada (SDTC) to help us further build out our DERA software platform.

If you’re interested in learning more about how software can power your energy goals, contact us to get in touch with one of our distributed energy experts.

0 notes

Text

World Meteorological Day: An Interview with our Senior Meteorologist

Each year on March 23rd, World Meteorological Day takes place to commemorate the Convention establishing the World Meteorological Organization, which happened in 1950. World Meteorological Day recognizes the contribution of meteorology and hydrology to the safety and development of society. This year’s theme, The Future of Weather, Climate, and Water Across Generations, is a fitting topic as we sit down with our Lead Meteorologist, John. We discuss his story, the history of this relatively new science, and why weather matters for electrical grids.

Tell us about you and why you decided to become a meteorologist.

My story is probably not too different from most meteorologists out there. I mean, we call ourselves energy nerds at Peak Power, and I’m pretty much a weather nerd. That stems from essentially a childhood wonder of the weather. But in my case, it’s a little more specific. Throughout my childhood, I had a severe phobia of thunder and lightning. At the age of about 11, there was a severe lightning storm happening at night, the typical time when my fear was at its height. At that moment, I decided to face my fear, so I opened a window to peek outside. For the first few seconds, I was paralyzed by fear. But then something happened. That fear immediately transformed into pure awe. I stared directly into the storm to find purple lightning and saw the real beauty of the cloud formations. All my senses lit up. As you age, the rational part of your brain starts to activate; it goes from that innocent fear to questioning why you’re afraid of something. That’s precisely what happened to me, and I think any good scientist starts out with questioning. That began my experimentation, pouring myself into this realm and challenging myself to ask why I was scared. Shortly after that, I dove into everything weather. I started looking at the National Weather Service forecast. I started making my own forecast for Rochester, which is the town where I grew up in upstate New York, an area that’s prone to all kinds of weather. As an example, I experienced the ice storm in 1991 – that was the most significant ice storm I’ve ever seen in my life. It was beautiful but destructive. I even visited the local TV meteorologist after that, at about the age of 12. He introduced me to his forecasting process (and even made some suggestions for top-notch universities offering meteorology programs), which further galvanized my interest in making this a career.

What do you see as the biggest contributions of meteorology to society?

Like any good scientist, I’m looking at all sides, so I explored both the positive and negative contributions. To start, forecasting is a very new science, whereas observations have been collected in North America and Britain since roughly the mid-to-late 19th century. One of the most impactful weather forecasts was made in the days leading up to the Allied Forces’ storming of the beaches of Normandy on D-Day. [Side note: The meteorological component of this historic day is a riveting story for any history buff. Read about it on History.com] From there, the science of forecasting really blossomed. The emergence of what’s called numerical weather prediction, which is a fancy way of saying weather model data, is used as a way of trying to compute and calculate the future state of the atmosphere. And the atmosphere is a chaotic fluid. So, you’re basically trying to forecast chaos. Numerical weather prediction originated in the 1950s and has since evolved to create more timely, accurate weather forecasts, including life-threatening phenomena such as tornadoes, hurricanes and severe thunderstorms. Prior to the 1990s, the lead time for the public to take shelter from tornadoes was usually less than 15 minutes. Now, I want to say it’s around 20 to 30 minutes. It may not sound like much, but that’s huge. That saves lives. The weather models have improved tremendously, even in the last 15 years alone since I started my career. As a result of that, we are seeing more reliable forecasts that can save lives and property. That’s why I decided to choose “operational” meteorology as a career as opposed to being purely a research meteorologist. One of my main jobs is to interpret weather model data and add value to the output, thus making a positive contribution to society. The negative aspect goes somewhat hand in hand. We live in a time where information, not just weather information, is readily available at your fingertips, which is both good and bad. It’s good because it’s convenient for the general population. It’s bad because most consumer apps just ingest raw model data with little to no human intervention. And if it is only referencing one model, and that model happens to be poorly handling the near-term weather situation, it’s likely going to give you a poor forecast. This is even more pronounced in complex weather situations like storms – for example if a warm front is being resolved incorrectly by one model, that could be the difference between 10 mm of freezing rain and 20 cm of snow. A meteorologist takes an ensemble approach, looking at multiple weather models to produce the most accurate forecast. In meteorology, there’s no AI that can replace human ingenuity and interpretation.

What’s an interesting fact about meteorology that readers might not know?

You know that unique smell right after a lightning storm? What you’re actually smelling is ozone. And by that process, it is actually returning nitrogen to the soil. The other thing that I would want readers to know is about something called positive flash lightning. It’s sometimes commonly referred to as a “bolt out of the blue.” Typically, it happens on the backside of the storm as the storm is departing you and originates in the anvil of a cloud. On a side note, what happens with an anvil cloud is that there is a very clear demarcation of the top of the atmosphere before we reach the stratosphere. The stratosphere is extremely stable, so it prevents clouds from building upward. That flash lightning originates all the way from the top of the anvil, which could be 40,000 to 50,000 feet. Whereas normal cloud-to-ground lightning originates from the mid-to-low levels of the cloud, maybe 5,000 to 15,000 feet – and those carry much less voltage. So because flash lightning originates from so high up, it encounters much more resistance and can carry up to a billion volts. And those are the lightning strikes that can be very hazardous to people and property. Even if it is not a direct hit, it can still be fatal. So, I’d strongly advise waiting at least 30 minutes after a storm passes before venturing outdoors again. You want to make sure you can’t hear any thunder at all before resuming outdoor activities.

What role do you think the broader meteorological community has to play in preserving our environment and fighting climate change?

I will preface by saying I’m not a climatologist; I’m a meteorologist. There’s a difference which we will go into a bit later. But for me, the folks that are doing those rigorous studies of ice cores, global temperature increases, historical and forecasted trend need to responsibly communicate that data to the public and not tweaked to sensationalize – on either side – it dilutes the science. The reality is that since the industrial revolution, we’ve done a tremendous amount of damage, and frankly, a lot of it may not be reversible. However, it doesn’t mean we should sit on our hands and do nothing. If we have enough awareness of that data at the public level, we can make decisions that can mitigate further damage.

How does the theme The Future of Weather, Climate and Water across Generations resonate with you?

I didn’t even realize there was such a thing as World Meteorological Day when I went to school for Meteorology. But it’s been around for like 50 years, so that was neat to learn, and it gives us a chance to talk about it. To start, I would refer to myself as an operational meteorologist, which is about forecasting the weather and marrying it with how it impacts real life – in the case of Peak Power, how it impacts grid demand. That’s how it resonates with me; it demonstrates how interpreting weather model data is critical to our society in very real ways.

Could you tell us a bit more about your work with Peak Power? What does weather have to do with energy?

My core role is to forecast grid peaks and grid demand in select ISO regions. Ultimately, the electrical grid is largely driven by weather events. Weather influences human behaviours such as blasting the AC in a summer heat wave or cranking the heat in a winter cold snap. [See 2021 Texas Power Crisis] However, I’m not just forecasting but researching how weather, load, and demand are interconnected and how they interact, sometimes, at a very localized level (for example, one region within a large ISO or a state). Other aspects that impact grid demand are things like solar generation; it’s a big component. One of my jobs is to assess the data and cloud forecast for embedded solar plants and what we expect those generation trends to be. There’s a term in meteorology that is a critical component in value addition to the models: Pattern Analog Recognition. This can be illustrated by an example. If you’re looking at cloudy weather over Eastern Ontario, where most of the solar plants are located, and sunny, oppressively hot weather over southern Ontario, including the GTA, that’s usually going to be a ripe setup for a significant grid peak. Such peaks are important to forecast accurately so that our customers can reduce their associated coincident peak charges, as well as avoid using dirty resources that come online to meet demand during those peaks.

What is one aspirational statement or dose of good news you want to leave readers with?

This may sound really corny, but this is something I think a lot of weather geeks do. I encourage you and others to do it. And that’s to look toward the sky. For me, it’s almost as second nature as breathing or having my espresso. Every time I’m outside, I always look up to the sky because you never know what you’re going to find. They always say each snowflake is unique, but every single cloud formation is also unique. Every single sunrise and sunset is unique. No two are exactly the same. We’re always so buried in our phones and our technology that sometimes, we forget to take a moment to marvel at the grandeur of nature that surrounds us.

1 note

·

View note