Don't wanna be here? Send us removal request.

Photo

New Post has been published on https://primorcoin.com/ukraine-russia-war-what-impact-does-it-have-on-crypto/

Ukraine-Russia War: What Impact Does It Have on Crypto?

youtube

Check on YouTube

#Crypto #CryptoExchange #DEX #TradeCrypto

#Crypto#CryptoExchange#DEX#TradeCrypto#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#Finance#Video

0 notes

Photo

New Post has been published on https://primorcoin.com/crypto-investment-trends-that-will-define-2023-report/

Crypto Investment Trends That Will Define 2023: Report

Less than a month into the new year, the market is already showing sustainable signs of recovery, and the “creative destruction” that transpired could ultimately be a huge win not just for the consumer but also in terms of regulatory protections and rapid innovation, as well as lowered cost structures.

Despite the many ups and downs, crypto has become a serious player in the world economy. Investors are still pouring their portfolios into the asset class. According to OKX’s new report, here are the five key trends in crypto investment that will define the year ahead.

Ethereum Devs

The development in the Ethereum ecosystem has been consistently increasing. The completion of the Merge shifting from Proof of Work to Proof of Stake saw its energy consumption slash by 99%. To top that, several, several OP layer 2s are scaling the network.

Danksharding would be another turning point for Ethereum by boosting TPS to 100k+ after approaching the Shanghai Upgrades. The design will essentially pave the way for a vastly cheaper and quicker execution which will ensure that layer 2 networks can thrive.

Onboarding Innovation

In recent years, the DeFi and Web3 space has seen a flurry of financial enthusiast forays. The COVID pandemic spurred tens of millions of gamers and gamblers into the GameFi and Play 2 Earn projects and this trend seems to intensify.

Subsequently, big players such as Yuga Labs, Reddit, and Starbucks brought traditional users with their NFT products. Several blockchain networks also joined forces with major brands to attract new users.

Meanwhile, storage and retrieval of both public and private keys have been the Achilles Heel of Web3 security. But wallet developers are now seeing big investments to enhance the experience and usability.

DeFi Revitalization

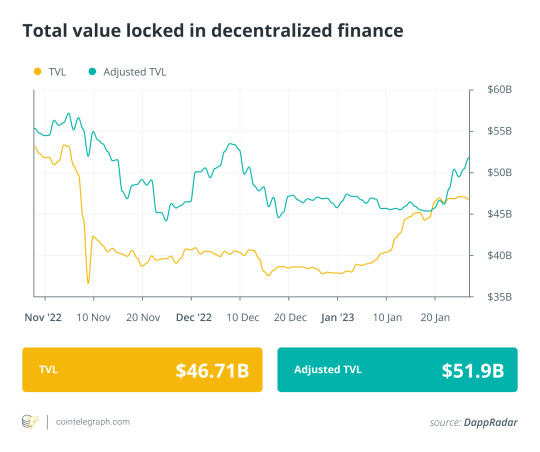

Heavy deleveraging pressures inflicted in the second half of 2022 sparked the collapses of several prominent crypto companies. The total value locked (TVL) in DeFi took a severe beating and declined by over 76%. The failures are expected to set the stage for “grander innovations ahead.” As such, the industry is looking to develop decentralized stablecoins that may have utility in the real world.

The NFT market, too, suffered a similar fate at the hands of the crypto winter. But beyond PFP NFTs, which have no utility beyond their social attributes, securitization coupled with DeFi, for one, can bring credit, value, and equity. This is expected to trigger the explosion of NFT-Fi in the future.

An Industry-Wide Focus on Infrastructure

Permissionless and decentralized infrastructure projects could see bigger bets being placed this year. For instance, validator adoption of mev-boost has reached 90% since 2021. With OFAC’s sanction on Tornado Cash, Flashbots mev-boost relay validators are under the scrutiny of the enforcement agency.

On the brighter side, the MEV landscape is set for a huge change. The fragmentation of liquidity brought by layer 2, app-chains, and multi-chains could provide huge opportunities for MEV. The introduction of danksharding is expected to alter how Flashbot typically extracts on Ethereum.

Moreover, centralized data tools, such as Dune and Glassnode, have dominated the space for investment and on-chain data analysis. But decentralized data tools will become a central focus for developers in the coming months.

On-chain security

The space witnessed rampant fraud, with hackers on the rife, and no redress.

As such, on-chain data, tracking tools, and asset recovery tools will be a main focus for 2023, centered around Web3 security governance, monitoring on-chain activities, Web3 user behavior, tracking lost assets, and protection against AML.

SPECIAL OFFER (Sponsored) Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

Source link

#Binance #BNB #CryptoExchange #DEFI #DEFINews #NFT #NFTNews

#Binance#BNB#CryptoExchange#DEFI#DEFINews#NFT#NFTNews#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#NFT News

0 notes

Photo

New Post has been published on https://primorcoin.com/fbi-seizes-260000-in-nfts-and-cryptocurrencies-after-tip-off-by-twitter-user/

FBI Seizes $260,000 in NFTs and Cryptocurrencies After Tip-Off By Twitter User

Source: iStock/South_agency

The US Federal Bureau of Investigation has confiscated over $260,000 worth of NFTs and cryptocurrency after a tip-off by pseudonymous blockchain sleuth ZachXBT.

According to a forfeiture document published by the agency on February 4, the FBI has seized several assets from Chase Senecal, a resident of Brunswick, Maine, including 86.5678 ETH ($116,433) and two NFTs: Bored Ape Yacht Club #9658 ($95,495) and Doodle #3114 ($9,361). The agency also seized an Audemars Piguet Royal Oak Watch valued at $41,000.

ZachXBT, a self-described crypto sleuth, made the seizure possible after conducting a thorough investigation of Chase Senecal, also known as HZ online. “After months and months of tracking their group it’s nice to know one of the main perpetrators (Chase Senecal) for NFT/crypto phishing attacks has been identified,” they said in a September 1 tweet.

The crypto sleuth traced transactions relating to numerous NFT hacks and revealed that the account used to pay for the watch was linked to the hacks. The FBI seemingly took note of his findings and seized the items weeks later on October 24, 2022.

According to a summary of the investigation, Cam (SIM swapper) sold Twitter panel access to Senecal in June last year, who used it to gain access to Twitter accounts and scam NFT holders. Senecal then used the stolen funds to purchase the AP watch which led him to get caught. The address HZ paid for the watch is tied to many Discord server attacks.

The FBI’s notice provided little additional information about the incident other than the fact that all of the estates were captured on October 24. Moreover, it is uncertain what the true extent of judicial cases against Senecal is.

Notably, the FBI has not officially credited ZachXBT for his investigation of the hacks, but the crypto sleuth said in a recent Twitter thread that his investigation led to the asset arrest. He said:

“I am very happy to share the FBI seized crypto, BAYC 9658, AP watch, and Doodle 3114 from the phishing scammer known as Horror (HZ) aka Chase Senecal as a result of my thread.”

ZachXBT had previously claimed that Senecal was part of a multi-million dollar crypto scheme that has compromised more than 600 Discord servers and more than 12 Twitter accounts. Some of the accounts affected by Senecal’s hacks belong to the NFT project JRNY Club and the animator DeeKay Kwon.

As reported, the FBI was also involved in the arrest of Anatoly Legkodymov, the Russian founder of Hong Kong-registered crypto exchange Bitzlato, who has been charged with processing $700 million in illicit funds.

Source link

#Blockchain #Crypto #CryptoNews #TraedndingCrypto

0 notes

Photo

New Post has been published on https://primorcoin.com/sorare-partners-with-the-premier-league-for-a-fantasy-football-game/

Sorare Partners With The Premier League For a Fantasy Football Game

On January 30, Sorare, a Paris-based startup specializing in blockchain-based fantasy football games, announced its partnership with the Premier League, the top tier of English football leagues. The collaboration will launch digital cards featuring Premier League players for the Sorare game.

Sorare’s fantasy football game is currently valued at $4.3 billion, and the terms of the multi-year agreement with the Premier League have not been disclosed. However, it is estimated to be worth more than the initial £30 million deal that was announced in October 2022.

Sorare – Premier League Announcement. Image: Twitter

Besides football, Sorare also offers NFT trading cards for basketball and baseball fans thanks to its partnerships with the NBA and the MLB, respectively. Both options feature all the clubs affiliated with those leagues. But football fans have way more options to choose from, considering that Sorare offers over 300 officially licensed football clubs, according to its main site.

Such a major roaster includes major European leagues, so users can compete with global football legends such as Lionel Messi, Cristiano Ronaldo, or Gerard Piqué.

Sorare Users Can Choose Any Premier League Player

Thanks to this new partnership, Sorare users will be able to choose some of the biggest stars of English football, such as Tottenham Hotspur’s Harry Kane or Manchester City’s Erling Haaland, as their licensed players to collect and trade.

“Football fans around the world can now collect, buy, sell, and trade officially licensed digital cards featuring every player from across the Premier League’s 20 clubs — building and competing with custom teams to win big rewards, just like a professional club owner.”

Sorare’s new endeavor is a free NFT game that lets users choose eight players and participate in free competitions twice a week, competing against managers from different countries for rewards based on the real-life performance of their players.

The Premier League Wants to Keep Evolving Football

Richard Masters, CEO of the Premier League, stated that the English football league “is always looking for ways to engage with fans”. The partnership with Sorare will allow the Premier League to continue to evolve in an industry that is growing rapidly and already has millions of players worldwide.

Masters added that they hope to continue collaborating with Sorare to bring the Premier League closer to its fans, even if they are not physically present at the football field.

“Sorare’s digital cards and innovative online game represent a new way for them to feel closer to the Premier League whether they are watching in the stadium or from around the world. We believe that Sorare are the ideal partner for the Premier League and we look forward to working closely together.”

According to Sorare’s statement, the platform will launch new gaming features, including specific Premier League competitions and draft-based gameplay, and capped-mode competitions.

SPECIAL OFFER (Sponsored) Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

Source link

#Binance #BNB #CryptoExchange #DEFI #DEFINews #NFT #NFTNews

#Binance#BNB#CryptoExchange#DEFI#DEFINews#NFT#NFTNews#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#NFT News

0 notes

Photo

New Post has been published on https://primorcoin.com/silvergate-bank-stock-plunges-after-report-of-doj-investigation-into-ties-with-ftx-and-alameda/

Silvergate Bank Stock Plunges After Report of DOJ Investigation into Ties with FTX and Alameda

Image Source: Silvergate

Silvergate shares have seen a sharp drop in pre-market trading following the news that US officials have launched a probe into the crypto bank’s dealings with fallen crypto giants FTX and Alameda Research.

According to a recent report by Bloomberg, the US Department of Justice is looking into Silvergate’s relationship with now-defunct cryptocurrency exchange FTX and its trading arm Alameda Research, which includes examining the bank’s hosting of accounts tied to Sam Bankman-Fried’s businesses.

The crypto-friendly bank hasn’t been accused of any wrongdoing and the inquiry, which is in its early phases, could end without charges being brought, Bloomberg reported, citing people familiar with the matter.

Following the news, Silvergate shares took a nosedive, plunging by as much as 10% in the pre-market trading. Notably, the company’s shares lost roughly 88% of their value in 2022 amid the broader crypto market downturn that saw around $2 trillion wiped out of the market.

The investigation, which started a few weeks ago, is reportedly centered around one key question: “What did banks and intermediaries working with Bankman-Fried’s firms know about what US officials have called a years-long scheme to defraud investors and customers?”

Sam Bankman-Fried, the disgraced founder of FTX, has been charged with eight criminal charges including wire fraud and conspiracy to misuse customer funds. The disgraced crypto boss pleaded not guilty to all charges last month.

Silvergate was among the lenders hit hardest by the fall of FTX in November last year. As reported, Silvergate suffered a bank run following the collapse of FTX and had to sell $5.2 billion of debt securities it was holding on its balance sheet at a significant loss to cover around $8.1 billion in user withdrawals.

As a result, it incurred a $718 million loss, which reportedly exceeds the bank’s total profits since 2013. Furthermore, Silvergate had only $3.8 billion of deposits at the end of 2022, compared to $11.9 billion in 2021.

It is worth noting that Silvergate has received at least $3.6 billion in loans from the Federal Home Loan Banks, a system originally designed to support housing finance and community investment. This could be an indication of the growing relationship between crypto-exposed banks and TradFi companies.

Some market participants have warned that lending to crypto-exposed banks could lead to the crypto contagion spreading to traditional finance companies too. “This is why I’ve been warning of the dangers of allowing crypto to become intertwined with the banking system,” Senator Elizabeth Warren said last month.

Source link

#Blockchain #Crypto #CryptoNews #TraedndingCrypto

0 notes

Photo

New Post has been published on https://primorcoin.com/banks-in-russia-to-lose-700-million-a-year-due-to-digital-ruble-experts-say-finance-bitcoin-news/

Banks in Russia to Lose $700 Million a Year Due to Digital Ruble, Experts Say – Finance Bitcoin News

Russian banks may be the main losers from the introduction of a digital ruble while retailers will save on acquiring fees, analysts have predicted. The benefits for consumers using the new digital currency are not that obvious as they may not be paid any interest or cashback.

Launch of Russia’s Digital Ruble Said to Result in Losses for Banking Institutions

Commercial banks may lose up to 50 billion rubles annually (almost $715 million) when a digital version of the ruble is introduced, according to a forecast produced by financial experts at Yakov and Partners, the former Russian division of management consultancy McKinsey.

Meanwhile, retail chains could potentially increase their income by up to 80 billion rubles each year, believe the authors of the research, quoted by the Russian edition of Forbes. At the same time, consumers may receive no interest on their balances or cashback for their transactions.

The specialists see the digital ruble occupying a niche in the domestic retail payments market, taking over part of the share of card payments. Banks’ losses will be mostly due to shrinking revenues from the commission they get for processing such payments. Retailers will profit from saving on the acquiring fees and from instant payments that faster than card transfers.

The benefits for consumers are not guaranteed as the concept of the Russian central bank digital currency (CBDC), an electronic cash, does not envisage the accrual of interest on the holdings, unlike bank deposits. They will also likely lose the cashback that banks currently pay for operations with their cards, the report notes and elaborates:

The digital ruble has no obvious advantages in terms of convenience in everyday use, and international experience shows that the reduction in the cost of acquiring does not lead to price reductions or slowdown in price growth, only to an increase in retailers’ profits.

The digital ruble, issued by the Bank of Russia, is supposed to become the third form of the Russian national fiat, after cash and electronic money. It is meant to be used as a means of payment and a store of value but it is not aimed at replacing deposits or bank payments.

The project was first announced in October 2020 and a prototype was finalized in December, the following year. The pilot phase started in January of 2022, with the monetary authority planning to begin trials with real transactions and users in April 2023 and aiming for full launch in 2024. A bill on the digital ruble was submitted to the Russian parliament this past January.

Tags in this story

Analysts, Bank of Russia, banks, Benefits, CBDC, Customers, Digital Currency, digital ruble, experts, Losses, pilot, profits, project, report, Research, Retailers, Russia, russian, study, trials

Do you agree with the study that Russian banks will face losses as a result of the implementation of the digital ruble? Tell us in the comments section below.

Lubomir Tassev

Lubomir Tassev is a journalist from tech-savvy Eastern Europe who likes Hitchens’s quote: “Being a writer is what I am, rather than what I do.” Besides crypto, blockchain and fintech, international politics and economics are two other sources of inspiration.

Image Credits: Shutterstock, Pixabay, Wiki Commons

More Popular News

In Case You Missed It

Source link

#Bitcoin #Crypto #CryptoExchange #DEFI #DEFINews

#Bitcoin#Crypto#CryptoExchange#DEFI#DEFINews#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#Finance

0 notes

Photo

New Post has been published on https://primorcoin.com/decentralized-domain-services-reflect-on-industry-progress/

Decentralized domain services reflect on industry progress

The rise of Web3 functionality has been a boon for decentralized domain name services over the past two years, with millions of blockchain-based domains registered to date. Challenging market conditions may have hampered exponential growth, but industry leaders believe that utility-driven adoption will continue in the future.

Web3 is fundamentally changing how businesses, brands and retailers serve customers, who are taking full control of their data, wallets and online identity courtesy of blockchain ecosystems like Ethereum.

Decentralized domain names are valuable tools for users and businesses to integrate with Web3 functionality. From providing human-readable names that replace numerical wallet addresses to serving as a decentralized profile across the Web3 ecosystem, decentralized domains offer an alternative to conventional domain services.

Ethereum Name Service (ENS) and Unstoppable Domains are the two most prominent platforms serving the space, having a combined six million-plus domain registrations since their respective inceptions. Both services saw significant increases in newly minted domains through 2021 and 2022.

Cointelegraph reached out to a handful of decentralized domain name platforms to gauge the current state of the industry, who is leading registrations and what the future holds.

2022 in review

2022 proved to be a massive year for both ENS and Unstoppable Domains, with both firms highlighting some key metrics from the year in correspondence with Cointelegraph.

ENS is a distributed, open, extensible naming system that runs on the Ethereum blockchain. It maps human-readable names like “alice.eth” to machine-readable data like cryptocurrency addresses and URLs.

ENS emulates the conventional Domain Name Service (DNS) by using dot-separated hierarchical names, commonly known as domains, with the owner of a domain controlling both it and any subdomains. An ENS domain is effectively a nonfungible token (NFT) that serves as an Ethereum wallet address, cryptographic hash or website URL.

ENS developer Makoto Inoue said that the platform’s official registered domain total was 2.8 million as of January 2023, excluding any reregistered names after expiry. When including subdomains and DNS names, that number rises to 3.9 million — excluding off-chain names like Coinbase’s in-house cb.id domain solution for wallets and decentralized identities.

Nora Chan, vice president of communications at Unstoppable Domains, unpacked the premise of the blockchain-based domain name service. Unstoppable Domains offers Web3 domains on Polygon with no gas fees, providing an affordable way for users to establish a secure and portable identity for Web3.

The domains can be bridged to Ethereum and used for various purposes, such as sending and receiving cryptocurrency, logging in to hundreds of apps and metaverses, building decentralized websites and constructing a Web3 identity.

The platform has registered and minted 3.1 million domains to date, with 1.2 million registered in 2022 alone.

Measuring growth in a bear market

Both Inoue and Chan reflected on the bearish market conditions of 2022 and offered varying views of its effect on decentralized domain registrations. Depressed market conditions were actually a boon to ENS registrations, as Inoue explained:

“During the bull market, high gas fees actually hindered the growth of ENS because a .eth registration was costing somewhere between $50–$100 when a one-year annual registration is only $5/year.“

But as gas fees have slowly reduced, it is becoming more affordable to register ENS names. Inoue also noted that the discovery of “categories influenced the growth of 2022 ENS registrations.”

This included the minting of ENS domains based on a list of names with common traits like the “10K Club,” which are four-digit domain names from 0000.eth to 9999.eth; and genesis-era ENS domains, which are a select group of ENS names minted before June 2017 — preceding the advent of the popular CryptoPunks NFT collection.

Meanwhile, Chan conceded that the rate of registrations with Unstoppable Domains slowed in 2022. Nevertheless, the 1.2 million domains registered in 2022 still account for more than a third of its total domain list.

Third-party integration

Companies, brands and users are becoming increasingly familiar with Web3 functionality. Using a decentralized domain, users can carry their complete digital ID with them, pay for items on an e-commerce site, and collect NFT versions or extras linked to specific real-world products.

As more of these services plug into Web3, ENS and Unstoppable Domains provide the infrastructure for businesses and users to enter this new paradigm.

For ENS, the rise of Coinbase’s high-profile cb.id subdomain integration was the biggest third-party service integration story, according to Inoue.

The Cross-Chain Interoperability Protocol (CCIP) is a universal standard for developers to create services and applications that can transact and send information actions across multiple networks. The ENS developer said CCIP Read provides a way to store ENS names outside the Ethereum layer 1, lowering overall gas costs.

Chan highlighted that despite the recent cryptocurrency bear market, Unstoppable Domains’ extensive footprint of integrations includes partners like Brave, Opera, Trust Wallet and Etherscan. The firm has also launched various Web3 top-level domains — including .x, .nft, .wallet and .crypto — with mainstream brands and companies.

Unstoppable Domains’ work with Blockchain.com saw the creation of its .blockchain top-level Web3 domain, unlocking a potential 83 million users of Blockchain.com who might be looking for a customizable .blockchain domain or human-readable wallet address.

What does 2023 have in store?

Subdomain registrations could surge in 2023 if Inoue’s prediction is correct. The ENS developer told Cointelegraph that ongoing development could give users more control of subdomains:

“2023 will see a surge of subdomain registrations. This will be driven by the release of ‘Name Wrapper,’ a feature to turn subdomains into NFTs (currently only .eth is NFTs), allowing the community to sell and transfer subdomains much more easily.”

Inoue also highlighted subdomain integrations with the likes of Coinbase as an adoption driver, making ENS names more accessible to users. It also lowers gas costs to interact with the Ethereum protocol, “making it resistant to the bull market gas surge.”

While the registration of these subdomains doesn’t bring direct revenue to the ENS organization itself, Inoue said they drive the overall adoption and usefulness of the protocol within the Web3 ecosystem.

Chan said focusing on creating more utility, building partnerships and improving the user experience of the service would be key to continued adoption this year.

An alternative view

Cointelegraph also spoke to PeerName founder and CEO Vasil Toshkov, whose platform was founded in 2014, selling .bit domains based on Namecoin. The platform now sells a handful of Emercoin blockchain domains — including .coin, .bazar, .lib and .emc — and currently manages around 8,000 domains.

Toshkov said that PeerName sells “truly decentralized domains” for working websites and does not offer NFT domains nor centrally managed services. It previously sold a more comprehensive array of domains from different platforms but now focuses on decentralized practical applications.

PeerName sold around 700 domains in 2022, with Toshkov highlighting increased competition and high fees at the end of the bull market as key challenges:

“Our business performs much better during a bear market. Then, the competition with fake domains disappears. Fees are low, and users can pay seamlessly. We also only have users who buy domains to use, not as speculation.”

The most sold domains on PeerName include .bit, .coin and .onion. The latter domain is not blockchain-based but is used within the Tor browser and client system. Toshkov believes that the possibility of .bit domains also being integrated into the Tor project and browser could drive adoption.

“If this happens, the interest in them will be huge. These are the first and most decentralized blockchain-based domains. Kind of like Bitcoin, but for domains,” he said.

Cointelegraph has previously explored the prevalence of domain “hijacking” and “squatting,” which is driven by speculative users that register domains bearing well-known brands or names.

Source link

#Blockchain #BTC #Coinbase #CoinbaseNews #CryptoNews

0 notes

Photo

New Post has been published on https://primorcoin.com/bitcoin-shrugs-off-fed-rate-hike-to-hit-six-month-high/

Bitcoin Shrugs Off Fed Rate Hike to Hit Six-Month High

After a streak of volatility over the past few days, the price of Bitcoin (BTC) briefly reclaimed the 24,000 mark on Wednesday night, rising to levels last seen mid-August last year.

Despite a drop to $23,800 by press time, the largest cryptocurrency is up 3.6% over the day and as much as 42% over the last 30 days, data from CoinGecko shows.

The latest price action comes in the wake of the Fed’s decision to increase interest rates by 25 basis points from 4.5% to 4.75%. It also follows the bullish performance in January, when Bitcoin gained almost 40% in value—the best result since 2013, according to Bitcoinmonthlyreturn.com.

Another interest hike shows that the policymakers—despite the economy’s steady growth—are still concerned about inflation, however, as CoinShares Head of Research James Butterfill told Decrypt, “the markets aren’t buying it.”

Altcoins join Bitcoin jump

It’s not just Bitcoin that’s enjoying a bullish uptick amid the latest decision from the Federal Reserve.

Ethereum (ETH), the market’s second-largest cryptocurrency by market cap, is up 6.2%, trading hands at $1,670, per CoinGecko.

Six months into its proof-of-stake (PoS) era, Ethereum is now preparing for its much-anticipated Shanghai upgrade, which will allow users to withdraw staked ETH. The testnet for the upgrade, dubbed Zhejiang, went live on Wednesday to simulate the process.

Elsewhere in the market, the Polygon (MATIC) is the biggest winner of the day with a 13% increase in value, which took the price of the token to a three-month high of $1.23.

Other top performers include Binance Coin (BNB), which is up 7.5% on the day, and Cardano (ADA), which spiked 5.6% over the span.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Stay on top of crypto news, get daily updates in your inbox.

Source link

#ADA #Binance #Blockchain #BNB #Cardano #Crypto #CryptoExchange #CryptoNews #TraedndingCrypto

#ADA#Binance#Blockchain#BNB#Cardano#Crypto#CryptoExchange#CryptoNews#TraedndingCrypto#CryptoPress#Trending Cryptos

0 notes

Photo

New Post has been published on https://primorcoin.com/us-senators-demand-answers-from-silvergate-capital-corp-over-ftxs-misuse-of-customer-funds/

US Senators Demand Answers from Silvergate Capital Corp Over FTX's Misuse of Customer Funds

Source: AdobeStock / Timon

US senators have turned their focus to Silvergate Capital Corp. yet again, saying that the company’s responses to a previous inquiry over its ties to the fallen FTX exchange were “evasive and incomplete.”

According to Bloomberg, senators from both sides of the aisle are demanding to know whether the parent company of crypto-focused Silvergate Bank knew about FTX’s misuse of customer funds.

The questions were sent in a letter to Silvergate’s Chief Executive Officer Alan Lane on Monday by, among others, Democrat Elizabeth Warren and Republicans Roger Marshall and John Kennedy. The senators argued that,

“The firm in December had declined to fully answer related questions, citing restrictions on disclosing “confidential supervisory information”,” Bloomberg wrote.

The senators reportedly argued in the letter that,

“This is simply not an acceptable rationale. […] Both Congress and the public need and deserve the information necessary to understand Silvergate’s role in FTX’s fraudulent collapse, particularly given the fact that Silvergate turned to the Federal Home Loan Bank as its lender of last resort in 2022.”

In early January, Silvergate said that it held $4.3 billion in short-term Federal Home Loan Bank advances and that it had some $4.6 billion cash and cash equivalents at the end of 2022 – which were put towards preventing a run on deposits following FTX’s collapse.

The senators gave Silvergate until February 13 to respond to its inquiries, including:

answering if it knew that FTX was directing customers to wire funds to Alameda’s account at Silvergate; answering if it flagged any transactions as being suspicious;providing requested details on the firm’s due-diligence practices, the results of reviews conducted by the Federal Reserve and independent auditors,providing details on how it plans to use the proceeds from its Federal Home Loan Bank loan.

Following the senators’ December letter, the bank claimed that FTX’s parent company Alameda Research opened an account in 2018 prior – before FTX was founded, said Bloomberg, and that it was reviewing transactions involving accounts associated with FTX and Alameda.

However, the senators stated on Monday that, in its earlier response, the firm failed to include vital information that Congress needed in order to:

assess the extent to which Silvergate is responsible for the improper transfer of FTX customer funds to Alameda, determine any compliance failures by the bank or auditors that could have enabled the alleged fraud.

Following this latest letter, a Silvergate representative claimed that the company has “a comprehensive compliance and risk management program” and that it did “significant due diligence” on both FTX and Alameda.

Earlier in January, as reported, US federal authorities confiscated approximately $700 million worth of assets belonging to the FTX founder Sam Bankman-Fried, including three accounts at Silvergate Bank that held US dollars.

US Prosecutors have charged the former CEO with eight criminal charges including wire fraud and conspiracy by misusing customer funds. Bankman-Fried pleaded not guilty to all charges.

____

Learn more: – Is The Federal Home Loans Bank System Carrying Out a Stealth Rescue of the 2 Biggest Crypto Banks?- Silvergate Loses $1 Billion But Stock is Up Because Numbers Show it is Not Going Bust Anytime Soon

– Silvergate Bank Suffers Run on Deposits as $8.1 Billion is Withdrawn – Will it Go Bust?- Silvergate in Trouble: Crypto Bank Cuts Staff by 40% Amid a 68% Decline in Crypto Deposits

Source link

#Blockchain #Crypto #CryptoNews #TraedndingCrypto

0 notes

Photo

New Post has been published on https://primorcoin.com/tradfi-and-defi-come-together-at-davos-2023-finance-redefined/

TradFi and DeFi come together at Davos 2023: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week.

Traditional finance, or TradFi, continues to explore the world of cryptocurrencies and blockchain technology, with the World Economic Forum holding more workshops and sessions for the sector in 2023.

Layer-1 blockchain protocol, Injective, has launched a $150 million ecosystem fund to support developers building on the Cosmos network.

The Mango Markets saga took another turn this past week, as the company filed a lawsuit against the exploiter Avraham Eisenberg for $47 million in damages plus interest. The lawsuit marks the fourth time the Mango Markets exploiter has been hit by charges or lawsuits relating to his attack on the DeFi protocol.

Blockchain transaction history shows that the hacker transferred the funds onto a decentralized exchange and then went on to cycle funds around different DeFi protocols.

The top 100 DeFi tokens continued their bullish momentum into the final week of January, with most of the tokens trading in green and a few even registering double-digit gains.

TradFi and DeFi come together — Davos 2023

On this episode of Decentralize With Cointelegraph, the team reflects on their week in Davos covering the World Economic Forum as crypto and TradFi continue to collide.

Speaking to several industry insiders and TradFi participants, Cointelegraph journalist Gareth Jenkinson highlighted the ongoing cross-pollination between the sectors. Still, just a handful of crypto participants were involved in conversations inside the World Economic Forum.

Continue reading

Injective launches $150 million ecosystem fund to boost DeFi, Cosmos adoption

Injective, a layer-1 blockchain protocol founded in 2018, has launched a $150 million ecosystem fund to support developers building on the Cosmos network.

The ecosystem group is backed by a large consortium of venture capital and Web3 firms, including Pantera Capital, Kraken Ventures, Jump Crypto, KuCoin Ventures, Delphi Labs, IDG Capital, Gate Labs and Flow Traders. According to Injective, the consortium is the largest assembled within the broader Cosmos ecosystem.

Continue reading

Mango Markets sues Avraham Eisenberg for $47 million in damages plus interest

Mango Labs, the company behind the DeFi protocol Mango Markets, has filed a lawsuit against exploiter Avraham Eisenberg.

The Jan. 25 filing in the United States District Court for the Southern District of New York alleges Einseberg exploited its platform for millions of dollars worth of cryptocurrencies in October 2022. It asks for $47 million in damages plus interest, starting from the time of the attack.

Continue reading

Wormhole hacker moves $155 million in the biggest shift of stolen funds in months

The hacker behind the $321 million Wormhole bridge attack has shifted a large chunk of stolen funds, with transaction data showing that $155 million worth of Ether (ETH) was transferred to a decentralized exchange on Jan 23.

The Wormhole hack was the third-largest crypto hack in 2022 after the protocol’s token bridge suffered an exploit on Feb. 2 that resulted in the loss of 120,000 Wrapped Ether (WETH), worth around $321 million at the time.

Continue reading

DeFi market overview

Analytical data reveals that DeFi’s total market value remained over $40 billion this past week, trading at about $46.1 billion at the time of writing. Data from Cointelegraph Markets Pro and TradingView show that DeFi’s top 100 tokens by market capitalization had a bullish week, with nearly all the tokens registering price gains.

dYdX (DYDX) was the biggest gainer with a 68% surge on the weekly charts, followed by Fantom (FTM) with a 59% weekly surge. The majority of the other top 100 tokens also registered a bullish surge.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education in this dynamically advancing space.

Source link

#CryptoExchange #DEFI #DEFINews #Kucoin #NFT #NFTNews

#CryptoExchange#DEFI#DEFINews#Kucoin#NFT#NFTNews#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#NFT News

0 notes

Photo

New Post has been published on https://primorcoin.com/ftx-sister-firm-alameda-hits-bankrupt-voyager-digital-with-446m-lawsuit/

FTX Sister Firm Alameda Hits Bankrupt Voyager Digital With $446M Lawsuit

Trading firm Alameda Research has filed a new lawsuit seeking to recover about $445.8 million from the bankrupt crypto broker Voyager Digital.

Sam Bankman-Fried, the disgraced founder and CEO of FTX, also co-founded the trading firm in 2017. A day before FTX filed for bankruptcy in November 2022, it emerged that the crypto exchange had lent customer funds to help prop up Alameda Research.

The latest lawsuit, filed with the U.S. Bankruptcy Court for the District of Delaware on January 30 by FTX lawyers filing on behalf of Alameda, relates to loans Voyager made to Alameda before the crypto broker’s bankruptcy in July 2022.

Voyager demanded repayment of all outstanding loans to Alameda, which, according to the filing, were fully repaid before FTX, along with Alameda filed for its own bankruptcy, in November.

“The collapse of Alameda and its affiliates amid allegations that Alameda was secretly borrowing billions of FTX-exchange assets is widely known,” the filing reads. “Largely lost in the (justified) attention paid to the alleged misconduct of Alameda and its now-indicted former leadership has been the role played by Voyager and other cryptocurrency ‘lenders’ who funded Alameda and fueled that alleged misconduct, either knowingly or recklessly.”

The court document went on to say that the bankrupt crypto lender’s business model “was that of a feeder fund.”

“It solicited retail investors and invested their money with little or no due diligence in cryptocurrency investment funds like Alameda and Three Arrows Capital. To that end, Voyager lent Alameda hundreds of millions of dollars’ worth of cryptocurrency in 2021 and 2022,” reads the filing.

Alameda claims all loans to Voyager repaid

As detailed in the document, Alameda paid Voyager almost $249 million in September and approximately $194 million in October. Additionally, the trading firm made a $3.2 million interest payment in August.

FTX lawyers now assert that these funds are recoverable “on an administrative priority basis pursuant to sections 503 and 507 of the Bankruptcy Code” and can be used to repay the exchange’s creditors.

FTX.US, the American division of FTX, was expected to acquire Voyager after winning the $1.46 billion bid to buy the digital asset manager out of bankruptcy in September last year.

Adding more complication to the case, Alameda was also one of Voyager’s shareholders.

The news of Alameda’s lawsuit against Voyager comes after the troubled crypto broker was earlier this month granted initial court approval to sell some of its assets to Binance.US in a proposed deal worth roughly $1 billion.

Stay on top of crypto news, get daily updates in your inbox.

Source link

#Binance #Blockchain #BNB #Crypto #CryptoExchange #CryptoNews #TraedndingCrypto

#Binance#Blockchain#BNB#Crypto#CryptoExchange#CryptoNews#TraedndingCrypto#CryptoPress#Trending Cryptos

0 notes

Photo

New Post has been published on https://primorcoin.com/north-korean-hackers-try-to-launder-27m-in-eth-from-harmony-bridge-attack/

North Korean hackers try to launder $27M in ETH from Harmony bridge attack

North Korean exploiters behind the Harmony bridge attack continue to try and launder the funds stolen in June. According to on-chain data revealed on Jan. 28 by blockchain sleuth ZachXBT, over the weekend the perpetrators moved 17,278 Ether (ETH), worth about $27 million.

The tokens were transferred to six different crypto exchanges, ZachXBT wrote in a Twitter thread, without disclosing which platforms had received the tokens. Three main addresses carried out the transactions.

According to ZachXBT, the exchanges were notified about the fund transfers and part of the stolen assets were frozen. The movements made by the exploiters to launder the money were very similar to those taken on Jan. 13, when over $60 million was laundered, the crypto detective said.

Who’s active rn?

DPRK just finished laundering another $17.7m+ (11304 ETH) from the Harmony Bridge hack.

S/o to the exchanges who responded quickly on a weekend so funds could be frozen. pic.twitter.com/sUyUScHR4N

— ZachXBT (@zachxbt) January 29, 2023

The funds were moved a few days after the Federal Bureau of Investigation (FBI) confirmed that Lazarus Group and APT38 were the criminals behind the $100 million hack. In a statement, the FBI noted that “through our investigation, we were able to confirm that the Lazarus Group and APT38, cyber actors associated with the DPRK [North Korea], are responsible for the theft of $100 million of virtual currency from Harmony’s Horizon bridge.”

Related: ‘Nobody is holding them back’ — North Korean cyber-attack threat rises

Harmony’s Horizon Bridge facilitates transfer between Harmony and the Ethereum network, Binance Chain and Bitcoin. A number of tokens worth about $100 million were stolen from the platform on June 23.

Following the exploit, 85,700 Ether was processed through the Tornado Cash mixer and deposited at multiple addresses. On Jan. 13, the hackers started shifting around $60 million worth of the stolen funds via the Ethereum-based privacy protocol RAILGUN. According to an analysis from crypto tracking platform MistTrack, 350 addresses have been associated with the attack through many exchanges in an attempt to avoid identification.

Lazarus is a well-known hacking syndicate that has been implicated in a number of key crypto industry breaches, including the $600 million Ronin Bridge hack last March.

Source link

#Binance #BNB #CryptoExchange #DEFI #DEFINews #NFT #NFTNews

#Binance#BNB#CryptoExchange#DEFI#DEFINews#NFT#NFTNews#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#NFT News

0 notes

Photo

New Post has been published on https://primorcoin.com/crypto-bank-custodia-denied-membership-in-us-federal-reserve-system-finance-bitcoin-news/

Crypto Bank Custodia Denied Membership in US Federal Reserve System – Finance Bitcoin News

The U.S. Federal Reserve Board has rejected the attempt of Custodia Bank to become member of the Federal Reserve System. According to the decision announced Friday, the application submitted by the digital asset bank is inconsistent with legal requirements.

Federal Reserve Board Says Business Model Proposed by Custodia Bank Presents Risks

Crypto bank Custodia has been denied membership in the United States Federal Reserve System. In an announcement dated Jan. 27, the Federal Reserve Board explained that the application, as submitted by the company, is “inconsistent with the required factors under the law.”

The press release further detailed that Custodia is a special purpose depository institution which does not have federal deposit insurance and wants to engage in “untested crypto activities,” including issuing a crypto asset. In that context, the Board argued:

The firm’s novel business model and proposed focus on crypto-assets presented significant safety and soundness risks.

The Federal Reserve Board reminded it had previously determined that “such crypto activities are highly likely to be inconsistent with safe and sound banking practices.” It also said the bank’s risk management framework, “including its ability to mitigate money laundering and terrorism financing risks,” was not sufficient to address relevant concerns.

“In light of these and other concerns, the firm’s application as submitted was inconsistent with the factors the Board is required to evaluate by law,” the body concluded in the statement, adding that the order will be released following a review for confidential information.

Membership in the Federal Reserve System would have given Custodia, a bank chartered by the state of Wyoming, certain benefits, in terms of taxation and investment, for example. In a tweeted statement, CEO Caitlin Long said the company was “surprised and disappointed” by the Board’s move, insisting:

Custodia offered a safe, federally-regulated, solvent alternative to the reckless speculators and grifters of crypto that penetrated the U.S. banking system, with disastrous results for some banks.

Long emphasized that Custodia actively sought federal regulation, “going above and beyond all requirements that apply to traditional banks.” She also noted that the denial is consistent with the concerns raised by the company about the Fed’s handling of its applications and vowed that the bank will continue to litigate the issue.

The executive was referring to a lawsuit filed by Custodia against the central bank system’s delayed ruling on its application for a master account. The latter remains pending, as the company pointed out on Twitter. Banks hold most of their reserves in master accounts at the Fed which allows them to make transfers between each other and settle payments.

Also on Friday, the Federal Reserve Board issued a policy statement, according to which both insured and uninsured banking institutions will be subjected to limits on certain activities, including those associated with crypto assets.

Tags in this story

application, Bank, banks, board, Central Bank, Crypto, crypto assets, Cryptocurrencies, Cryptocurrency, Custodia, denial, Fed, Federal Reserve, Federal Reserve Board, master account, Member, Membership, U.S., US

Do you think the U.S. Federal Reserve Board will change its stance in the future regarding applications like the one filed by Custodia Bank? Share your expectations in the comments section below.

Lubomir Tassev

Lubomir Tassev is a journalist from tech-savvy Eastern Europe who likes Hitchens’s quote: “Being a writer is what I am, rather than what I do.” Besides crypto, blockchain and fintech, international politics and economics are two other sources of inspiration.

Image Credits: Shutterstock, Pixabay, Wiki Commons, rarrarorro / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

More Popular News

In Case You Missed It

Source link

#Bitcoin #Crypto #CryptoExchange #DEFI #DEFINews

#Bitcoin#Crypto#CryptoExchange#DEFI#DEFINews#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#Finance

0 notes

Photo

New Post has been published on https://primorcoin.com/yuga-labs-co-founder-to-take-leave-of-absence-due-to-health-reasons/

Yuga Labs co-founder to take leave of absence due to health reasons

Nonfungible token (NFT) entrepreneur Wylie Aronow of Yuga Labs — the team behind Bored Ape Yacht Club (BAYC) and CryptoPunks — will be taking a leave of absence from the office to prioritize his health following a congestive heart failure diagnosis.

In a Jan. 28 tweet to his 144,900 followers, Aronow said the tough decision to step away came on the back of the heart failure diagnosis after experiencing a myriad of symptoms over the last few months.

Some heavy news: a few days ago I was told by my doctor I have congestive heart failure. Symptoms started last year out of the blue and I put off seeking help (like an idiot) so I could keep working. But after testing, my doctor called and asked me to radically change my life.

— GordonGoner.eth (Wylie Aronow) (@GordonGoner) January 28, 2023

The NFT entrepreneur explained that while his “mild” symptoms still enable him to live a “mostly normal life,” his condition has rapidly accelerated to the point where he had no other option but to deprioritize his work.

The Yuga Labs co-founder didn’t set a date on when he hopes to recover and return to his duties.

However, Aranow confirmed that he will be sticking around as a board member and strategic advisor.

This isn’t the first medical diagnosis that has kept Aranow out of work.

Aranow revealed that he dealt with a chronic illness in his twenties which held him back from progressing in his career. When he finally recovered and co-founded Yuga Labs, there was no looking back:

“When I recovered and we started Yuga, I didn’t want to waste a second chance at life. I pushed myself way past my limits. I worked 12 hours a day, nearly every day. I should have taken the advice from everyone around me and sought balance.”

“My goals now are to get the best medical treatment I can and heal,” he added.

Related: BuzzFeed backlash after ‘doxxing’ of Bored Ape Yacht Club founders

Aronow also expressed his excitement to soon work alongside the firm’s new CEO, Daniel Alegre, the former president and chief operating officer of Activision Blizzard.

Our incredibly talented friend and cofounder Wylie (@gordongoner) has the full support of the whole Yuga family as he embarks on his journey to get back to health. He will be staying on as a strategic advisor and board member. https://t.co/GQieMko3xr

— Yuga Labs (@yugalabs) January 28, 2023

While Aronow did not provide any details on what he would be doing as a strategic adviser, Aronow recently announced on Nov. 8, 2022, that he would propose a new model for NFT creator royalties.

Aronow co-founded Yuga Labs alongside Greg Solano in February 2021.

Among the most notable NFTs developed by the company are CryptoPunks, BAYC, MeeBits and Othersidemeta.

Source link

#Blockchain #BTC #CryptoNews

0 notes

Photo

New Post has been published on https://primorcoin.com/ftx-creditors-list-blockfi-1-2b-exposure-and-new-celsius-token/

FTX creditors list, BlockFi $1.2B exposure and new Celsius token...

Top Stories This Week

FTX creditor list shows airlines, charities and tech firms caught in collapse

The complete list of creditors owed money by the bankrupt cryptocurrency exchange FTX has been released, revealing a wide range of global companies. Among the potential creditors are airlines, hotels, charities, banks, venture capital companies, media outlets and crypto companies, along with United States and international government agencies. According to another headline regarding the FTX scandal, U.S. federal prosecutors allege that Sam Bankman-Fried invested $400 million in the venture capital firm Modulo Capital with money from the FTX’s customers. Investigators allege that Modulo was likely built with criminal proceeds or misappropriated funds. Lawyer costs in the case are estimated to reach hundreds of millions of dollars before the firm’s bankruptcy investigation is over.

BlockFi uncensored financials reportedly shows $1.2B FTX exposure

Bankrupt crypto lending firm BlockFi uploaded uncensored financials by mistake, revealing $1.2 billion in assets tied up with bankrupt exchange FTX and defunct trading firm Alameda Research. The unredacted filings show that, as of Jan. 14, BlockFi had $415.9 million worth of assets linked to FTX and a whopping $831.3 million in loans to Alameda. BlockFi filed for Chapter 11 bankruptcy on Nov. 28, citing the collapse of FTX just weeks earlier as the cause of its financial troubles.

Read also

Features

Basic and weird: What the Metaverse is like right now

Features

Forced Creativity: Why Bitcoin Thrives in Former Socialist States

New ‘Celsius token’ may be used to repay creditors

Bankrupt crypto lending firm Celsius may issue its own token to repay creditors. In a court hearing, Celsius attorney Ross M. Kwasteniet said the firm is negotiating with its creditors on how to relaunch the platform and adequately pay them back. If approved by creditors and the court, the relaunched version would be “a publicly-traded company that is properly licensed,” which is expected to provide creditors with more money than by simply liquidating the company.

Binance holds token collateral and user funds on same wallet by ‘mistake’

Cryptocurrency exchange Binance admitted to mistakenly storing some customer funds in the same wallet with its collateral for Binance-minted tokens, or B-Tokens. The exchange already started the process of transferring the assets to dedicated collateral wallets, and stressed that B-Tokens are always fully collateralized and backed 1:1. Binance previously said that its corporate holdings were recorded in separate accounts and should not form part of the proof-of-reserves calculations.

Genesis creditors file securities lawsuit against Barry Silbert and DCG

Crypto conglomerate Digital Currency Group (DCG) is facing more legal issues following the filing of a new class action lawsuit against its subsidiary Genesis Capital. A group of Genesis creditors filed a lawsuit against DCG and its CEO Barry Silbert, alleging violations of securities laws by executing lending agreements with securities without qualifying for an exemption from registration under the federal laws. Genesis filed for Chapter 11 bankruptcy on Jan. 19, and it expects to emerge from the proceedings by May.

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $23,129, Ether (ETH) at $1,600 and XRP at $0.41. The total market cap is at $1.06 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Threshold (T) at 115.05%, Aptos (APT) at 86.22% and dYdX (DYDX) at 64.91%.

The top three altcoin losers of the week are Hedera (HBAR) at -7.72%, Decentraland (MANA) at -7.71% and Maker (MKR) at -5.77%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Read also

Art Week

Connecting the Dots: Collectivism and Collaboration in the Crypto Art World

Features

Basic and weird: What the Metaverse is like right now

Most Memorable Quotations

“With the help of blockchain technology, we can achieve medical advances so powerful and undeniable that existing systems will have no choice but to change.”

Keith Comito, co-founder and president of Lifespan.io

“It’s very early days, but we continue to believe that stablecoins and central bank digital currencies have the potential to play a meaningful role in the payments space, and we have a number of initiatives underway.”

Alfred F. Kelly, CEO of Visa

“Traditionally, people have looked to centralized intermediaries or governments to solve this problem, but technology like cryptography, blockchain and zero-knowledge proofs offer new solutions.”

Hester Peirce, commissioner of the U.S. Securities and Exchange Commission

“We’ve observed that institutions and enterprises are more open than ever before to working with blockchain companies to enhance their businesses.”

Paul Veradittakit, general partner at Pantera Capital

“We are seeing the consequences of the SEC’s priorities play out in real-time — at the expense of U.S. investors.”

Michael Sonnenshein, CEO of Grayscale Investments

“Other coins or other tokens are being essentially used as a store of value for investment and speculation. [There is a] good argument that they should be treated like a financial product.”

Stephen Jones, assistant treasurer and minister for financial services for the Australian Parliament

Prediction of the Week

Bitcoin will hit $200K before $70K ‘bear market’ next cycle — Forecast

After two weeks of rally, Bitcoin’s price has largely been flat in the past several days, showing that market participants are not overly concerned in advance of the U.S. Federal Reserve, European Central Bank and Bank of England monetary policy decisions scheduled for next week.

For many, BTC price action is still bound by Bitcoin’s four-year halving cycles. The resulting price pattern offers one “all time high year” in every four, with 2025 next in line. According to pseudonymous analyst Trader Tardigrade, also known as Alan, Bitcoin’s block subsidy halving will occur a year prior and, from then on, the path will be open to a giant $200,000.

“#Bitcoin well-formed structure with stochastic behavior indicates that the next ATH will be at 200K and next floor will be at 70K,” Alan predicted.

FUD of the Week

Mango Markets sues Avraham Eisenberg for $47M in damages plus interest

Mango Labs, the creator of crypto trading platform Mango Markets, filed a lawsuit against Avraham Eisenberg, seeking $47 million in damages. It also asked the court to rescind an agreement between Eisenberg and Mango’s decentralized autonomous organization. In October 2022, Eisenberg drained around $117 million from Mango Markets by manipulating the price of its native Mango (MNGO) token, allowing under-collateralized loans.

Argo Blockchain accused of misleading investors in class-action lawsuit

A class-action lawsuit claims that crypto mining firm Argo Blockchain omitted key information and made untrue statements during its initial public offering in 2021. The filing alleged that the miner failed to disclose how susceptible it was to capital constraints, electricity costs and network difficulties. It also claimed that a number of documents presented have been prepared negligently, with inaccurate or omitted information.

US Justice Department seizes website of prolific ransomware gang Hive

International law enforcement groups have dismantled the infamous Hive cryptocurrency ransomware gang, recovering over 1,300 decryption keys for victims since July 2022 and preventing $130 million in ransomware payments. Hive was behind a series of notorious ransomware incidents, such as the Costa Rica public health service and social security fund cyberattack that occurred from April into May 2022.

Best Cointelegraph Features

The legal dangers of getting involved with DAOs

If you are a member of a DAO, you may not realize the legal dangers of being involved. Here’s what you need to know.

NFT creator: Amber Vittoria crushes it in her ‘Big Girl Pants’

Named on Forbes 30 under 30, Amber Vittoria made a big splash in the traditional art world and has since embraced NFTs, collaborating with “The Hundreds,” “World of Women” and as MoonPay’s “artist in residence.”

Reformed ‘altcoin slayer’ Eric Wall on shitposting and scaling Ethereum

“There’s multiple cryptocurrency communities who have me as their favorite hate object basically,” says crypto analyst Eric Wall, formerly known as the ‘altcoin slayer.’

Subscribe

The most engaging reads in blockchain. Delivered once a week.

Editorial Staff

Cointelegraph Magazine writers and reporters contributed to this article.

Source link

#Binance #BNB #CryptoExchange #DEFI #DEFINews #NFT #NFTNews

#Binance#BNB#CryptoExchange#DEFI#DEFINews#NFT#NFTNews#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#NFT News

0 notes

Photo

New Post has been published on https://primorcoin.com/white-house-unveils-plan-to-tackle-cryptocurrency-risks-calls-for-increased-enforcement/

White House Unveils Plan to Tackle Cryptocurrency Risks, Calls for Increased Enforcement

Source: AdobeStock / Joe Gough

The White House has published a roadmap asking authorities to increase enforcement and ramp up efforts to regulate the crypto sector.

In an official blog on Friday, the Biden Administration detailed its plans to address potential risks from cryptocurrencies in a roadmap that calls for authorities to “ramp up enforcement where appropriate” and Congress “to step up its efforts” to regulate the industry.

The post starts by citing some major failures within the crypto sector last year, including the implosion of Terra’s algorithmic stablecoin UST that prompted a wave of insolvencies. It also noted the collapse of FTX, once the third-largest cryptocurrency exchange in the world, which delivered billions in losses to users.

“Thankfully, turmoil in the cryptocurrency markets has had little negative impact on the broader financial system to date,” the post read, adding that the Biden Administration is focused on mitigating the risks of cryptocurrencies and making sure they do not undermine financial stability.

“At President Biden’s direction, we have spent the past year identifying the risks of cryptocurrencies and acting to mitigate them using the authorities that the Executive Branch has.”

The post added that “experts across the administration have laid out the first-ever framework for developing digital assets in a safe, responsible way while addressing the risks they pose.”

It noted some of the biggest risk factors, including lack of applicable regulations, misleading statements, failure to make adequate disclosures, and poor cybersecurity measures “that enabled the Democratic People’s Republic of Korea to steal over a billion dollars to fund its aggressive missile program.”

Furthermore, the administration called on agencies to use their executive power and “ramp up enforcement where appropriate and issue new guidance where needed.” Specifically, the government asked Congress to increase efforts to regulate the crypto market.

“Congress should expand regulators’ powers to prevent misuses of customers’ assets—which hurt investors and distort prices—and to mitigate conflicts of interest.”

The administration noted that Congress should not allow mainstream institutions like pension funds to dabble into cryptocurrency markets as this would deepen the ties between cryptocurrencies and the broader financial system and increase systemic risks, calling it “a grave mistake” to pass laws that deepen the ties.

Authored by White House advisors Brian Deese, Arati Prabhakar, Cecilia Rouse, and Jake Sullivan, the paper concluded that the Biden Administration supports responsible technological innovations that make financial services cheaper, faster, safer, and more accessible while taking into account potential risks.

“To put the right safeguards in place, we will keep driving forward the digital-assets framework we’ve developed, while working with Congress to achieve these goals,” the paper said.

Source link

#Blockchain #Crypto #CryptoNews #TraedndingCrypto

0 notes

Photo

New Post has been published on https://primorcoin.com/aave-deploys-v3-on-ethereum-after-10-months-of-testing-on-other-networks/

Aave deploys V3 on Ethereum after 10 months of testing on other networks

The third version of crypto lending app Aave has now been deployed to Ethereum for the first time, according to a Jan. 27 tweet thread from the Aave team. “Aave V3” was originally released in March 2022, and it was deployed on multiple Ethereum Virtual Machine (EVM)-compatible blockchains shortly afterward. Until now, Ethereum users only had access to the app’s older “V2” version.

Aave Protocol V3 is now live on the Ethereum market

”The most exciting aspect of V3 is its flexible design, which enables a variety of new risk mitigation features, and its improved capital efficiency & decentralized liquidity – all while reducing gas costs.” @StaniKulechov pic.twitter.com/QsSnnlhEMr

— Aave (@AaveAave) January 27, 2023

Aave V3 includes several features intended to help users save on fees and maximize the efficiency of users’ capital. For example, High Efficiency mode allows the borrower to avoid some of the app’s more stringent risk parameters if the borrower’s collateral is highly correlated with the asset being borrowed. Developers say this may be useful for borrowers of stablecoins or liquid staking derivatives.

In addition, the “isolation” feature allows certain, riskier assets to be used as collateral as long as they have their own debt ceiling and are only used to borrow stablecoins. Under the previous version, there was no way to limit what type of asset could be borrowed given a certain type of collateral. This meant that lower market-cap and illiquid coins often couldn’t be used as collateral.

Related: Aave purchases 2.7M CRV to clear bad debt following failed Eisenberg attack

V3 also includes a gas optimization algorithm that the developers say will reduce gas fees by 20% to 25%.

The code for V3 was published back in November 2021. In March 2022, the Aave DAO approved an initial vote to deploy the new version. Over the next few months, V3 was deployed to Avalanche (AVAX), Arbitrum (ARB), Optimism (OP) and Polygon (MATIC). However, the Ethereum version of Aave has always had the most liquid and V3 was not available on it previously.

According to the official proposal, the initial launch only has seven coins. The vote to launch began on Jan. 23 and lasted for two days. After supporters won the vote, the execution of the proposal was able to move forward on Jan. 27. Less than 0.01% of DAO members voted against the proposal.

In November 2022, Aave changed its governance procedures after it was hit by a $60 million short attack that ultimately failed.

Source link

#CryptoExchange #DEFI #DEFINews #NFT #NFTNews

#CryptoExchange#DEFI#DEFINews#NFT#NFTNews#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#NFT News

0 notes