Don't wanna be here? Send us removal request.

Text

Confidence in Trading: Build & Maintain It

Confidence grows with small wins, emotional control, mentorship, and a growth mindset. Be aware of psychological traps like greed, fear, and overconfidence. Stick to risk rules (like the 1% rule), journal your progress, and use self-talk and visualization to stay focused. A trading coach can provide guidance and accountability.

#tradingstrategies#TradingConfidence#MindsetMatters#RiskManagement#TradingPsychology#SelfDiscipline#GrowthMindset

0 notes

Text

Bitcoin Weekend Effect

Crypto markets often show increased volatility on weekends due to low liquidity, retail dominance, and easier price manipulation. Backtests show Bitcoin averaged 2.6% gains per trade with a 60% win rate, while Ethereum saw 2.2% gains with a 53% win rate. Use automation to manage risk in this 24/7 market.

#tradingstrategies#BitcoinStrategy#CryptoTrading#WeekendEffect#Ethereum#VolatilityTrading#24x7Markets#tradingtips#tradingstrategy

1 note

·

View note

Text

Copper Trading: Key Insights

Copper futures allow trading at set future prices. Driven by construction, EVs, and tech, demand is rising—especially from China. With market growth projected from $320B to $477B by 2031, Q4 2024 anticipates higher prices. Trade via futures, ETFs, or mining stocks.

#CopperTrading#Commodities#EVMarket#MetalsMarket#SustainableMining#TradingInsights#tradingtips#tradingstrategy#investing#tradingstrategies#stockmarket#stockmarketeducation

1 note

·

View note

Text

Crypto vs. Forex: Which Suits You?

Forex offers stability, liquidity, and regulation, while crypto provides high volatility and 24/7 trading. Forex suits those preferring structured markets, while crypto attracts risk-tolerant traders. Your choice depends on risk appetite, market knowledge, and trading style.

#tradingstrategies#Crypto#Forex#CryptoTrading#ForexTrading#MarketVolatility#RiskManagement#TradingStrategy#FinancialMarkets#tradinginsights#investing#tradingtips#stockmarket#sp500

1 note

·

View note

Text

Constant Leverage Position Sizing

This method maintains a fixed leverage ratio for consistent risk management. It limits losses, prevents overexposure, and aligns returns with risk. Traders adapt by reducing leverage in volatility and increasing size in stable conditions. Proper sizing boosts confidence and controls emotions.

#tradingstrategies#TradingRisk#Leverage#PositionSizing#RiskManagement#ForexTrading#SmartInvesting#tradingtips

1 note

·

View note

Text

SETTLEMENT PROCEDURE FOR 10- YEAR TREASURY BOND FUTURES

Upon expiry, the contract settles through the delivery of a qualifying 10-year T-Note that meets maturity and interest criteria. The process is conducted via the Federal Reserve's book-entry wire-transfer system.

#tradingstrategies#TreasuryBonds#FuturesSettlement#BondMarket#FinancialMarkets#Trading#Investing#tradingtips#tradingstrategy#stockmarketeducation#stockmarket#riskmanagement#sp500#finance#tradinginsights

1 note

·

View note

Text

BLOCK MINIMUM FOR 10-YEAR TREASURY BOND FUTURES

Futures have fixed expirations and trade on exchanges, while CFDs offer flexibility with no expiration, allowing indefinite trading. Futures suit institutional traders, whereas CFDs appeal to retail traders seeking ease of access.

0 notes

Text

RECORD HIGH: 10-YEAR TREASURY BOND FUTURES

The 10-Year T-Note futures (ZN) reached an all-time high of $140'24'0 in March 2020 (TradingView data). This marks the peak level recorded in the history of 10-Year Treasury Bond futures trading.

0 notes

Text

DAY OF THE WEEK TRADING STRATEGY IN TLT

A 20+ year study of TLT reveals distinct profit patterns by day: Mondays ($58,072), Fridays ($137,862), and Thursdays (minimal). A refined strategy: Buy on Thursday if RSI < 60; sell when closing exceeds the prior day's high. Results: 9.7% annual return vs. 7.7% buy-and-hold.

0 notes

Text

IMPACT OF RISING INTEREST RATES ON STOCKS: A BACKTEST PERSPECTIVE

Rising interest rates hurt stocks as higher rates increase future cash flow discounting. Backtests show declining bonds and rising rates often lead to weak stock performance. This underscores the critical role of rates in stock valuation.

0 notes

Text

UNDERSTANDING RISK DYNAMICS IN BONDS AND STOCKS

Bonds, prioritized in bankruptcy, are less risky than stocks. Rising interest rates lower stock appeal, while falling rates boost riskier assets like Bitcoin and gold. Bond-stock correlations shift with market expectations, peaking in inflationary periods after a 40-year rate decline.

1 note

·

View note

Text

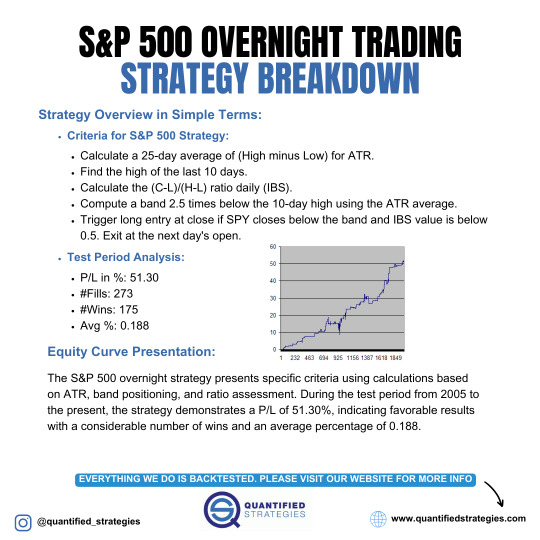

S&P 500 OVERNIGHT TRADING STRATEGY BREAKDOWN

This strategy leverages ATR, high-low bands, and IBS ratios to time SPY trades. Tested since 2005, it achieved a 51.3% P/L with 175 wins out of 273 trades, averaging 0.188% per trade.

1 note

·

View note

Text

REVEALING OVERNIGHT STRATEGY #3 IN S&P 500

This strategy leverages three unique variables, achieving a 13.57% P/L, a 3.8 profit factor, and 46 wins out of 59 trades. Its upward equity curve and solid performance metrics highlight its potential for consistent returns.

1 note

·

View note

Text

UNVEILING OVERNIGHT STRATEGY #2 IN S&P 500

This S&P 500 strategy leverages a new n-day low and added variables for better results, achieving a 12.6% profit, 2.6 profit factor, and 64 wins out of 90 trades. Shorting shows a negative edge, affirming the long strategy’s strength.

0 notes

Text

EXPLORING A SHORT STRATEGY FOR S&P 500

A short strategy for SPY focuses on market reversals by shorting when SPY closes higher for three consecutive days, with ADX (5-day) > 35 and RSI(2) > 90, and then covering at the next day’s open. This approach targets overbought conditions for potential gains.

1 note

·

View note

Text

UNVEILING OPENING PRICE RETURNS

Many traders overlook that much of the market's gains occur when it’s closed. Analyzing the S&P 500’s returns from close to open reveals an average gain of 0.04% per trade, resulting in an annual return of 9.5%, nearly matching buy-and-hold. While implementing this approach has challenges, such as slippage and commissions, gains above 0.1% can help offset these costs.

1 note

·

View note

Text

THE IMPORTANCE OF THE OPENING PRICE IN TRADING

The opening price in trading is crucial as it sets a reference point for price movement, often creating an anchoring bias that influences decisions throughout the day. Traders use it to identify key buy or sell moments and rely on charting techniques like candlesticks to analyze price action. By understanding its role, traders can better predict price movements and optimize their strategies.

#tradingstrategies#TradingStrategy#OpeningPrice#StockMarketTips#CandlestickCharts#TechnicalAnalysis#PriceAction

1 note

·

View note