Don't wanna be here? Send us removal request.

Text

In Search Of FIRE: Financial Samurai Retirement Portfolio Review

It hit me the other day that I’ve got to get my act together if I plan to retire a second time soon.

The first attempt at retirement lasted for just under a year until I started feeling too sheepish telling anyone I was retired at 34. Although my retirement portfolio was generating about $80,000 a year in passive income at the time, I started itching for more.

Seven years later, I’m running out of steam. I’ve already conducted multiple calls with boutique investment banks, private equity shops, and larger media companies on the potential sale of Financial Samurai after its 10-year anniversary mark in July 2019.

I’ve also tentatively convinced my wife to go back to work once our son turns two years and five months old this Fall. Spending 29 months as a stay at home parent should be long enough to feel like a parent did the best he or she could without feeling too guilty for going back to work. But we shall see when the time comes.

The final thing I need to do is make sure our after-tax retirement portfolios are generating enough income to cover our desired living expenses just in case Financial Samurai is sold and my wife can’t get a reasonable job in a field of interest.

I feel blessed to be able to do all the things I love since leaving full-time work in 2012 – coaching high school tennis for the past three years, writing almost daily on Financial Samurai, traveling around the world, and spending time being a stay at home dad since early 2017.

But all good things come to an end. We must frequently adjust in order to keep the good times going for longer.

How To Build A Healthy Retirement Portfolio

Before discussing my retirement portfolio’s latest income figures, I’d like to share five tips for everyone to follow to build their own healthy retirement portfolio.

1) Save until it hurts each month. Most people think that saving for retirement in their 401(k) or IRA is enough, but it is not. In order to have the optionality of retiring early or ensuring a healthy retirement at a more traditional retirement age, it’s important to max out your 401(k) while also contributing at least 20% of your after-401(k), after-tax income to an after-tax investment portfolio.

The after-tax retirement portfolio really is the key to early retirement since most people can’t access their pre-tax retirement accounts without a 10% penalty before age 59.5.

2) Focus on income producing assets. After you’ve had your fill of high octane growth stocks as a young person, it’s time to focus on income producing assets as you get closer to retirement. Dividend generating stocks, certificates of deposit, municipal bonds, government treasury bonds, corporate bonds, and real estate should all be considered in your retirement portfolio.

When I was younger, my favorite type of semi-passive income was rental property income because it was a tangible asset that provided reliable income. As I grew older, my interest in rental property waned because I no longer had the patience and time to deal with maintenance issues and tenants. Instead, my interest in REITs and real estate crowdfunding grew since the income generated is 100% passive.

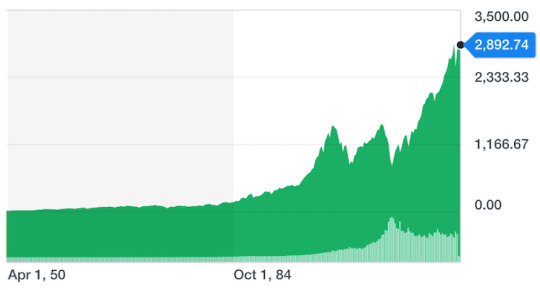

3) Start as soon as possible. Building a large enough early retirement portfolio takes a tremendously long time largely due to declining interest rates since the late 1980s. Gone are the days of making a 5%+ return on a short-term CD or savings account. You need to save early and often to make compounding work most for you.

I knew I didn’t want to work 70 hours a week in finance forever. As a result, I started saving every other paycheck and 100% of my bonus starting my first year out of college in 1999. By the time 2012 rolled around, I was earning enough passive income to negotiate a severance and retire early.

4) Calculate how much retirement income you need. It’s important to have a retirement income goal. Otherwise, it’s too easy to lose motivation and focus. A good goal is to try and generate retirement income to cover all basic living expenses such as food, shelter, transportation, and clothing. Once you hit that goal, focus on covering your wants.

If your annual expense number is $50,000, divide that figure by your expected rate of return or comfortable withdrawal rate to see how much capital you will need to save. If you expect to earn a 4% rate of return, then you would need at least a $2,000,000 after-tax retirement portfolio, and closer to $2,200,000 – $2,500,000 due to taxes.

5) Make sure you are properly diversified. The first rule of financial independence is to never lose money. We saw a lost decade for tech stocks between 2000 – 2010 after the first dotcom bust. For NASDAQ investors, it took 13 years to get back to even.

You always want to be moving forward on your journey to early retirement. Please do not confuse brains with a bull market.

Financial Samurai Retirement Portfolio Review

Since retiring the first time around in 2012, I have yet to stress test my after-tax retirement portfolios because I received a severance that paid out enough money to survive for five years.

While I was living off my severance income, my wife worked until she negotiated her own severance at the end of 2014. She is three years younger than me. Having her work and provide healthcare was very comforting and allowed me to reinvest 100% of our after-tax retirement portfolio income.

Then once both of us weren’t working full-time jobs in 2015, Financial Samurai started generating a livable income as well. This positive sequence of events is why planning is so important. It’s frankly why quitting your job to retire early is a suboptimal move.

Ideally, we want to live on between $15,000 – $18,000 a month in after-tax income to live our best lives while raising one or two children in expensive San Francisco or Honolulu. Using a 28% effective tax rate, we’re talking a target $250,000 – $300,000 a year in annual gross retirement income.

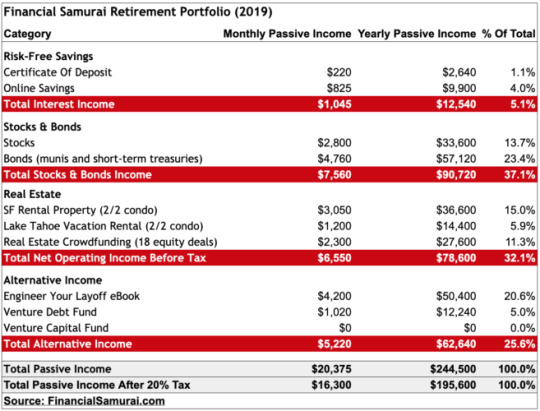

Here’s our latest source of income streams to fund our second retirement.

As you can see from the chart, we generate about $16,300 a month in after-tax retirement income if we use a 20% effective tax rate. The effective tax rate for investment income is lower than W2 wage income. This is something to think about when forecasting your own retirement income needs from investments.

$16,300 a month or $195,600 a year in after-tax retirement income should be more than enough to provide for our current family of three as our all-in housing cost is less than $6,000 a month. Once all our housing cost is covered, our costs for food, transportation, and everything else aren’t too bad.

$16,300 a month will also allow us to continue saving at least 30% a month for a rainy day (~$5,000). Because we’ve been in the habit of saving at least 50% of our after-tax income since graduating from college in 1999 and 2001, it would feel foreign to not continue saving in retirement.

The main anticipated increase in cost is preschool tuition starting this Fall at $1,800 a month. The other potential increase in cost is if we are blessed with another child. Ideally, we’d love to have two, but once you hit your late 30s or early 40s, the chances of a natural birth are only about 5%. Hence, we will consider fostering or adopting as well.

If we stay in San Francisco long term, our goal is to send our boy to public school after preschool if he can win the SF public school lottery system. If our son does not get into a reputable public school close by, then we’ll be forced to spend about $3,000 a month for elementary school and likely $5,000 a month for high school when the time comes.

These potential grade school tuition costs are the main reason why I’m striving towards $18,000 a month in after-tax retirement income, or ~$2,000 a month higher than current levels. I’ve got three years to make this goal a reality.

Below is an analysis of the major retirement income categories.

Risk-Free Savings: $1,045/month (5% of total)

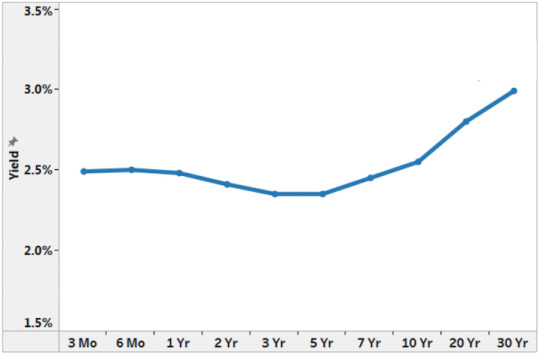

I love risk-free savings, especially after the Federal Reserve hiked interest rates multiple times since the end of 2015.

To be able to earn ~2.45% risk-free after making massive gains in the stock market and real estate market since 2009 sparks joy! Gone are the days of pitiful 0.1% savings interest rates.

My target is to always have between 5% – 10% of my retirement income and net worth in risk-free investments. You just never know what might happen in the future.

Stocks & Bonds: $7,560/month (37%)

After a tremendous rebound in the stock market in 2019, I decided to asset allocate more towards 3-month treasuries in my main House Fund portfolio.

As of now, my House Fund portfolio is roughly 20%/80% stocks/bonds because my plan is to buy another property within the next 6-12 months.

The House Fund portfolio had a $400,000 swing (-13%, then +23%) and I want to ensure that I protect the principal going forward. My other main public investment portfolio is closer to 60% stocks / 40% bonds. I plan to gradually shift the weighting closer to 50%/50%.

Below is my public stock and bond portfolio performance +9.2% vs. the S&P 500 +15.9% year-to-date according to Personal Capital’s performance tracker. With the income from my existing bond holdings, I should have relatively no problem closing out a 10-11% total return for the year.

As I edge closer towards retirement, my main goal is to minimize volatility and try and achieve a 5% – 7% total return equal to 2X-3X the 10-year bond yield.

The rise in short-term interest rates has really been a boon to my bond portfolio income stream. I plan to continue actively investing in 3-month treasury bonds and saving about 80% of my monthly cash flow.

Real Estate: $6,550/month (32%)

Real estate used to dominate my retirement portfolio income (~60%) until I sold a significant SF rental house in 2017 for 30X annual gross rent.

I ended up reinvesting $600,000 of the proceeds in mostly dividend-paying stocks, $600,000 of the proceeds in mostly municipal bonds, and then $550,000 of the proceeds in real estate crowdfunding ($810,000 total) in order to not lose too much real estate exposure.

I did get a surprise $45,598.04 distribution on 4/16/2019 from the RS DME fund where I have a total of $800,000 invested. The fund has 17 investments, across 12 states, and 6 property types. My Class A Austin Multifamily property was sold for a 24.6% return over two years.

So far the fund is returning a 10% cash-on-cash return net of fees. I’m hoping the end IRR is much higher after the equity investments are sold within the next 2-3 years.

For retirement portfolio calculation purposes, although I received $45,598.04 in distribution, I’m only inputting the profits as passive income to stay conservative. Perhaps there will be another significant distribution later in the year.

Once about half my RS DME fund distributions are returned, I will look to reinvest about $300,000 in a couple Fundrise eREITs and around $100,000 in individual RealtyMogul sponsored commercial real estate investments. I already have a decent sized position in OHI and O, two publicly traded REITs.

So far I like the simplicity of investing in a real estate fund versus spending time trying to pick the best deals. But if I’m going to retire again, I’ll have more free time to do due diligence.

My goal is to always have at least 30% of my net worth exposed to real estate as it is my favorite asset class to build long term wealth.

I haven’t raised the rent on my SF 2/2 condo in almost three years. At $4,200 a month, the property is now under market value by $300 – $400 a month. But I plan to just keep the rent below market rate because they’ve been good tenants. I’ll wait until one or both decides to move out before raising the rent.

Our Lake Tahoe property is coming back to life! We’ve had a fantastic winter in 2018/2019, which has resulted in a roughly doubling of net rental income over last year.

As the storms have subsided, we plan to finally take our boy up to the mountains. Spending time with my own family has been a dream of mine since I first bought the property in 2007.

Alternative Income: $5,220/month

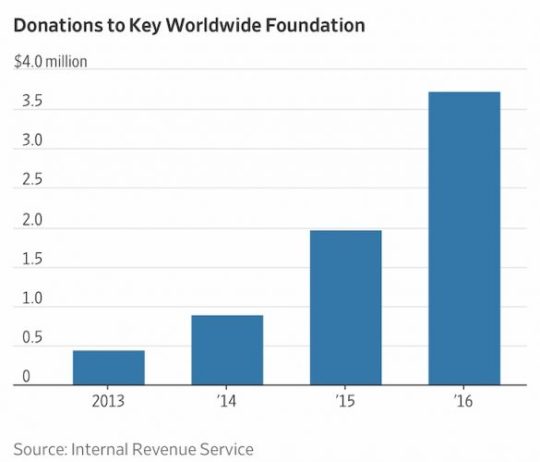

Online books sales for How To Engineer Your Layoff has steadily increased each year since the first edition was published in 2012. I wrote a new foreword for 2019 and updated some data.

My wife has spent the past four months updating the book for a 3rd edition launch in 2H2019. The 3rd edition will have even more case studies and strategies to guide people to better negotiate a severance. We will likely raise the book’s price by 15% as well.

The amount of positive feedback we continually get from readers who’ve successfully negotiated their severance has been tremendous. If you plan to retire early, it behooves you to try and negotiate a severance. You have nothing to lose.

To generate $50,400 a year in almost passive online income from a book would require amassing a $1,008,000 portfolio generating 5%. Not needing to have capital is why I’m so bullish on building online real estate as well. There is almost no risk except for putting your education and creativity to use.

There’s not too much to report on my venture debt fund investments. I’m still waiting to get paid in full for my first venture debt fund from five years ago. The second venture debt fund just did a 25% capital call for a total of 92% of the capital committed.

Finally, I invested in my first venture capital fund. I did so because I believe in the main general partner who has a good investing track record. This is a 10-year fund by Kleiner, Perkins, Caufield, & Byers, where I don’t expect to see any income until perhaps year five.

Enough To FIRE

Based on this deep-dive analysis, my wife and I should have enough to live a comfortable retirement lifestyle in San Francisco or Honolulu.

Keeping lifestyle inflation at bay while steadily growing our investment income has been key to building our retirement portfolio. For example, we have the ability to buy a house 3X the cost of our existing house which we purchased in 2014 but have chosen not to do so, despite the addition to our family.

What I find most interesting is that even though it’s clear that mathematically I shouldn’t have a problem retiring, I still have trepidation about selling Financial Samurai and retiring from my second career.

Change is always hard, especially after you’ve spent a decade doing one thing. Giving up a steady income stream is also scary when you’ve been through the 2000 dotcom bubble and the 2009 financial crisis and now have a family to support.

Eventually, we’ll need to start spending our retirement portfolio income. But as of now, we plan to continue reinvesting 100% of the investment proceeds and saving 80% of our active income until a retirement decision is made.

Related: Ranking The Best Passive Income Investments For Retirement

Readers, any of you planning to retire within the next 12 months? If so, what type of deep dive retirement portfolio analysis have you done to ensure that financially everything will be OK once you retire? Do you see any holes in our retirement portfolio we need to work on shoring up? Featured art by Colleen Kong-Savage.

The post In Search Of FIRE: Financial Samurai Retirement Portfolio Review appeared first on Financial Samurai.

from https://www.financialsamurai.com/in-search-of-fire-financial-samurai-retirement-portfolio-review/

0 notes

Text

Reflecting On Being A Stay At Home Dad For Two Years: Eight Takeaways

I still remember the day my son was born like it was yesterday. After only about an hour of labor he joined us in this world at 11:58 pm. It was the greatest moment of both our lives.

From that time forward, we pledged to care for him as best we could. In a big way, all the years of saving and investing were to prepare for this moment that we could both be stay at home parents.

As first-time parents, we didn’t know what to expect. So we figured having both of us care for our boy would be the optimal way to go.

Here’s my personal reflection as a stay at home dad for the past two years. I’ve sent this post to his e-mail account for him to read when he’s a little bit older.

Reflecting On Being A Stay At Home Dad For Two Years

1) Losing income is hard, but losing time is harder. Due to being a stay at home dad for two years, I’ve lost out on between $400,000 – $1,000,000 in income. With 18-20 years of experience in finance and online media, getting a $200,000 – $250,000 a year job + restricted stock units is very possible in the SF Bay Area. If I were to go back to banking, my base salary would be $250,000 a year + bonuses equal to 0% – 200% of base salary.

Although losing out on so much income is hard given we now have more expenses taking care of our son, I wouldn’t miss out on the first two years of my son’s life for any amount of money.

You could give me a billion dollars, and if I had to be away from home for 14 hours a day to make that money, I would decline. I’ve spent time with billionaires before, and they are just like you and me, except they fly private everywhere.

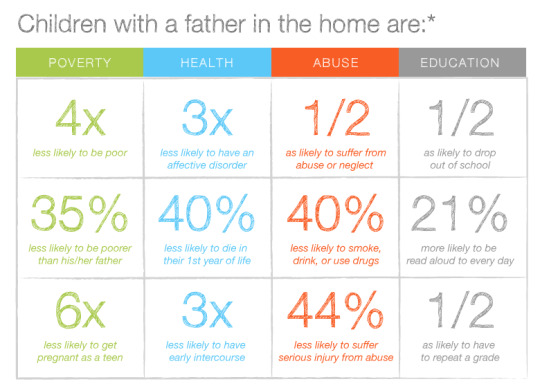

Over the past two years, I have witnessed his every milestone: his first smile, his first rollover, his first crawl, his first steps, his first words, and so many more. Each milestone witnessed felt like a blessing. I hope due to all the time both of us have spent with him, we will have an even stronger bond as he grows up.

I know I would have regretted pursuing more money over time with my son. The guilt would have consumed me.

I’ve gotten to know a couple of nannies over the two years and they have told me how they won’t tell the parents about new milestones so that the parents can think they are first time witnesses.

I knew I could always make more money but I could never create more time with our son.

Related: Career Or Family? You Only Have To “Sacrifice” At Most 5 Years

2) Hardest job in the world without a doubt. For all the stay at home parents out there, I salute you! And for all the single parents out there, you have my deepest admiration.

Working 14 hours a day in banking where there’s constant pressure to produce is a walk in the park in comparison to full-time fatherhood.

With full-time fatherhood, you are on 24/7 due to risk of injury or death by the child. The first year of life is the most fragile, which is why you’re always on high alert for choking, suffocation, tumbles, running into a corner, and so forth.

I kept reading stories about Sudden Infant Death Syndrome (SIDS), which were all so incredibly heartbreaking. For the first year, this paranoia wouldn’t let me sleep uninterrupted for more than 3-4 hours. Back is best and get rid of all the blankets and pillows in the crib please.

Once your child starts to verbalize his or her desires, it’s all about repetition. My son loves garage doors and will say the words “garage door,” “double-wide garage door,” “quadruple wide brown garage door” etc over and over again. He’ll then open and close garage door toys a hundred times in a row. I’ve got to repeat the words and open and close the doors with him. Otherwise, he knows I’m not paying attention.

I’ve also heard whines, screams, and crying 3 – 6X a day for 730+ days in a row. In the beginning, this was quite a shock to the system because we never had any of this since my wife and I started shacking up in 2001. Our boy is a top 1% chatterbox and super determined individual. If he can’t do something or doesn’t get what he wants, he definitely makes himself heard or felt!

Over time, things are getting better as he’s able to verbally communicate his needs and desires. He’s no longer as frustrated because he can tell us he’s tired, thirsty, hungry, sad, and so forth.

And here’s the kicker. My wife did around 70% of the care-taking largely due to nursing needs, and I still felt being a stay at home dad was the hardest thing I’ve ever done. One must develop incredible patience and endurance to survive.

3) Have children and the money will come. Although both my wife and I gave up healthy salaries to raise our boy full-time, we were somehow able to make more money each year after he was born.

When you have a child, your mind and body go into overdrive to try and provide as much care and support as possible. As a result, you gain even more energy to find ways to financially support your family.

In my case, instead of waking up between 5:30 am – 6:15 am to start the day and work on Financial Samurai, I began waking between 3:30 am – 4:30 am to try and get more done before our son would wake up between 7 am – 8 am.

I did not quit because I knew I could not. My family depended on me.

If he has had a particularly poor sleeping night, I would try and take over for a couple hours to allow for my wife to sleep in or decompress. I’d also try to nap as many times as possible during his mid-day nap so that I too could recharge for the afternoon and evening sessions.

After our boy went to bed, usually between 7:30pm-9pm, it was often Netflix, catching up on work stuff I’d postponed during the day, and preparing myself for the next day.

Once he turned 24 months old, our son now has the ability to go from 6:30am – 7:30pm non-stop with no naps several days a week.

Just the other day I took him on a 1 hour 20 minute walk in the morning around our hilly neighborhood. I would have bet anything he’d take a two hour nap after lunch. But he just kept right on going until 8pm!

Overall, we are talking about 4:00am – 10pm days on average with a 45 minute nap in the middle of the day.

As the saying goes, “the days are long and the years are short.”

4) Easy to gain weight and get sick. When all you’re doing is caring for your baby at home, it’s extremely easy to gain weight. I went from around 168 lbs to 173 lbs, even though I was consciously trying not to overeat.

But after about the 18th month, I started losing weight and am back down to about 166 – 169 lbs. The main reason why is because I’ve started to take my boy on almost daily walks. I also went back to playing tennis three days a week.

For men who are looking to have a baby and stay at home, I suggest trying to lose 5 – 10 lbs before your baby is born. That way, you’ll have a 5 – 10 lbs buffer for the inevitability.

Another downer is the increased frequency of getting sick after the first year. Our boy got his first cold at 12 months old. Then he started getting sick about once a quarter as we interacted more with the public.

His sickness spread to us, and we found ourselves frequently battling colds as well. Luckily, neither my wife or have have been sick at the same time.

Ideal Weight Chart For Men

5) Nannies aren’t paying close enough attention. I’m really sad to report this but after spending over 150 sessions in a public setting (park, museum, playground, etc), the vast majority of nannies (90%+) are on their phones the entire time they are supposed to be watching over your child.

Every time I play chase with my boy, there will inevitably be 2-3 kids who will play along because their nannies are not playing with them. I’ve seen countless falls by 11-16-month-olds just learning to walk because their nannies are not paying attention.

I often wonder whether one of the reasons for slow speech development is because the nanny simple does not spend enough time speaking to their child or describing things to the child as they happen. We parents should be verbally describing everything our children are doing and seeing to help them learn. But with nannies, what I’ve observed is largely silence.

If you are having difficulty deciding whether to return to work or staying home to take care of your child, I recommend you chose to stay home if your can afford to. Nobody will care more about your child than you. It’s not even close.

Many of us are addicted to our mobile phones. The nannies I’ve seen take it to the next level. It’s like they’re getting paid for being on the phone!

If you go the nanny route, I would explicitly tell them to stay off their phones during play time. Whether they do so or not is up to them. But at least you’ve voiced your desires and there’s a greater chance your nanny will follow your instructions.

It is completely sad and a wee bit alarming to have a little one come up to me, a stranger, and ask me to play with them because they are being completely ignored.

6) There was no discrimination. You sometimes hear stories about moms excluding dads from conversations or moms whispering mean words about dads being stay at home parents.

Out of all my outings, I have never once been discriminated against or been made to feel embarrassed or bad for being a stay at home parent. None of my friends have taken jabs at me either.

Maybe it’s because I live in San Francisco, where we’re very accepting of people. Maybe it’s because my wife was also with me during most public settings. Or maybe it’s because I’m a proud dad who is more impervious to the disapproval of others.

Don’t let our insecurities run amuck.

Once I went with a moms group walk around Golden Gate Park and we decided to take a break under a large tree. All the moms started to breastfeed their children, but only one had a shawl. It frankly felt weird to be around the group, so I decided to take a short walk instead.

For all the stay at home dads out there who would rather say you retired early, are a freelancer or entrepreneur, you don’t have to be ashamed that your wife or partner is bringing home the bacon.

Embrace your occupation as a stay at home dad. It is the most important job in the world!

7) Wish I started sooner. I find that men are a little to relaxed about when to have children because we don’t have the same biological deadline as women do. We like to avoid the subject for as long as possible. But this is not fair to women who want to have children. Have a mature discussion early in your relationship.

Physically, I’m still holding up pretty well. But I’m definitely not as limber as I used to be and it takes me longer to recover from a cold or a sports injury. After about age 45, I’m not sure if my body would be able to handle all the necessary bending over and carrying any more.

Having one kid makes me want to have a second. Therefore, it’s good to plan as much as possible. Even if you plan, it might take longer than expected to have a child.

If you know you want to have children, it’s better to have them sooner rather than later. Not only will your body be able to better handle childcare, but your kids might also be able to spend more time with their aging grandparents.

See: When Is The Best Time To Have A Baby

8) You never feel like you’re doing enough. I’m constantly in awe of my wife because of her patience, kindness, and ability to naturally feed our boy when he was a baby.

As a stay at home dad, my son and I have a close connection, but it’s not as close as the connection he has with his mom. As a result, I used to feel a little sad when he cried out for mommy while I was right there playing with him.

What am I, chop liver or something? I’d sometimes think to myself.

Because I’m unable to nurse our boy, I try to make up for my deficiency in other ways: cleaning, driving, grocery shopping, playing, washing dishes, ordering food and so forth. I’d throw myself deep into my work in order to feel the power of being a provider.

Slowly, I’m starting to feel more worthy of being a father. As he gets older I hope all he’ll want to do is play with his old man. It’s just such a weird feeling to never feel like you’re doing enough no matter how hard you try.

Proud To Be A SAHD

After two years of being a stay at home dad, I’m firmly on the side of the rest of the world that provides 6 – 12 months of parental leave after having a baby.

For a woman to return to work within three months seems cruel, especially if a C-section is involved. All a baby wants to do at that age is be with his or her parents.

One doctor said it best, “Nine months to create, nine months to heal.“

Unfortunately, companies aren’t in the business of subsidizing our personal life decisions regarding having children. My hope is that American institutions will soon start to offer some type of token paid parental time off for at least the first child.

At the end of the day, I know my wife and I have tried our very best to raise him so far. Looking back, the two years went by quickly. Looking forward, I’m hoping for many more wonderful experiences.

Are there any stay at home dads out there who would like to share what it was like for you? Stay at home moms feel free to share your thoughts and also how your husband or partner has helped or how we dads can do more.

The post Reflecting On Being A Stay At Home Dad For Two Years: Eight Takeaways appeared first on Financial Samurai.

from https://www.financialsamurai.com/eight-takeaways-on-being-a-stay-at-home-dad-for-two-years/

0 notes

Text

A Stealth Wealth Solution For Real Estate Investors With Kids

If you want to raise better adjusted kids, you probably want to practice some level of stealth wealth so that they don’t grow up spoiled and unable to recognize prosperity.

A couple readers have pointed out that I was raised rich given I had two parents with stable jobs. Instead of having to walk, I got to ride a bicycle to school. I even got a 486 desktop computer my junior year.

Yet, I wasn’t unable to recognize I grew up rich because my parents drove an 8-year old Toyota Camry and we lived in a modest townhouse for the four of us.

Thanks to my parent’s frugal ways, I was highly motivated NOT to mess up my life by slacking off in high school and college. My parents simply did not have a large enough financial buffer to overcome a deadbeat son.

Being unable to recognize their wealth also pushed me to attend a public university, which turned out to be a financially sound choice. If I had attended a private university, I would have felt too much guilt and pressure to prove the expense was worth it.

I still wonder to this day whether my parents are actually much richer than they’ve led me to believe.

My dad still drives a Toyota he bought in 1997. My parents still live in the same old house since 1980. They also never buy any new clothes or luxury items. If there is an early bird special at 4:30pm, my parents are first to get in line!

The Easiest Ways To Stealth Wealth

The easiest ways to stealth wealth are to drive an old economy car and never wear anything expensive. By doing so, you can still send your kids to private school, join country clubs, and go on nice vacations without raising too much suspicion from the outside world.

But what if you are a strong believer in real estate as an investment, don’t like stocks or any other type of asset class as much, and also want to protect your children from spoiling? You’ve also got enough capital to buy a luxury home.

The answer is simple: own a modest primary residence that is no larger than the median-sized home in your city. With your excess capital, buy a second residence as a rental home, second home, or office.

For example, let’s say you live in Austin, Texas where the median home price is ~$370,000. You have the ability to buy with cash one very nice $800,000 home to live in a better neighborhood and gain more real estate exposure. After all, you believe Austin is going to be the next San Francisco.

But if you buy a 6,000 square foot mansion, your kids will obviously know you are rich. Your kids will start asking for larger allowances and nicer things since they’re rational. They’ll probably stop doing chores too. Most of all, they will lose their motivation to work hard because they’ll assume someone will always take care of them.

Instead of buying the $800,000 mansion, buy the average three bedroom, two bathroom, $370,000 home. With your surplus capital, then buy another $370,000 – $430,000 home and turn it into a rental.

This way, you’ll not only increase your child’s chances of having a normal sense of money, you will also better allocate your capital for potentially higher returns and less cash drag.

When your children grow up to be well-adjusted adults, you can then surprise them with a modest home of their own to live in or manage one day while also getting to stay in your primary residence.

You won’t have to go through what a couple of my neighbors go through and have your adult children live back at home with you for many years.

The only “downside” is that you are living in a smaller or less ideal location than you can comfortably afford. But I strongly believe large homes with unused rooms are a waste of money. They are purchased more for ego purposes rather than utility.

Further, if you buy two median priced homes, you own property that is affordable to more people. There is less risk of being stuck with an unsellable property if you one day decide to sell. The market is much more liquid at median price points than at luxury level price points.

A House Is The Most Obvious Wealth Indicator

If your kids return to a luxurious home every day, it doesn’t matter if you dress like a hobo and drive a beater, your cover is blown.

Further, there are plenty of poor people who wear nice clothes and drive nice cars because credit is readily available for such things. Therefore, not everybody will automatically think you’re rich if you have a penchant for Gucci and BMW.

But with your primary residence, it’s just too hard to explain away a mansion. Unlike buying a $200 t-shirt with a credit card, getting a mortgage has much more stringent requirements given the dollar amount and leverage.

With my latest mortgage refinance, even though I’ve showed them liquid assets equal to 3X my refinance amount, I still feel like I’m under interrogation by the CIA. My mortgage officer said he hasn’t worked with anybody with under an 800 credit score over the past 24 months.

At the end of the day, it’s best to own a modest home that comfortably houses your family without a single wasted room. Use the capital you saved by your modest purchase and invest it in another property or asset class of choice to build your net worth over the long term.

Being able to grow your wealth in a low key manner and raise grounded kids is a wonderful combination.

Eventually your kids will realize you’ve been a stealth wealth grandmaster for decades. By then, they’ll be so inspired they’ll follow your lead and instill in your grandkids a healthy relationship with money as well.

Readers, what are some strategies you’ve taken to grow your wealth while minimizing the risks of your children spoiling? Besides being a good role model who walks the walk, what are some other things we can do to help our children create a healthy relationship with money?

Related:

The Ideal House Size And Layout To Raise A Family

Don’t Let Ego Make You Buy A Bigger House Than You Need

The post A Stealth Wealth Solution For Real Estate Investors With Kids appeared first on Financial Samurai.

from https://www.financialsamurai.com/a-stealth-wealth-solution-for-real-estate-investors-with-kids/

0 notes

Text

Cashing Out Of Stocks To Buy Real Estate: Analyzing The Temptation

One of the wealth tenets I’ve followed since the first dotcom crash in 2000 is to always convert funny money into real assets. My definition of funny money is an investment that makes an irrational return in excess of fundamentals. There are obviously various levels of irrationality.

Some friends and colleagues went from huge stock market returns in 1999 only to lose everything and more in 2000. Going on margin was partly to blame. While some stocks like Webvan and Pets.com literally went to zero.

Over time, I noticed those who turned their dotcom fortunes into Manhattan or San Francisco real estate during the early 2000 era were able to extend the value of their fortunes and do quite well. As a result, young Samurai followed suit.

Of course, many homeowners ended up getting slaughtered during the 2008-2009 financial crisis buying too much home, just like stock investors who went on margin in 2000. But those who bought responsibly and were able to refinance and hold on save their gains return.

The question I have now is whether we should cash out of stocks and buy real estate since the S&P 500 is already up 16% YTD April 2019 and back to an all-time high.

I’d like for everybody to thoughtfully pitch in with their opinion. Everybody’s circumstance is different, which is why it’s important to listen to as many different perspectives as possible.

There is no perfect answer.

Cashing Out Of Stocks To Buy Real Estate

The reasons why I’m wondering whether to cash out of stocks and buy real estate are due to the following:

1) We’ve recovered all our funny money gains. My House Fund, consisting of stocks and bonds, went from about $1.95 million down to $1.7 million during the 2018 correction (-13%) and now is back up to $2.1 million (+23%) for a $400,000 swing. I’m sure many of you have seen similar percentage magnitudes of recovery if you calculate recent trough to peak levels in your portfolio.

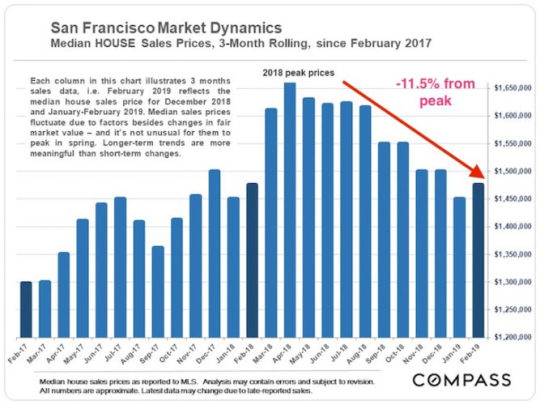

2) Real estate was weak in 2018. San Francisco median home prices went down ~11.5% from its 2018 peak. We’ve seen similar weakness across many major cities in America and around the world. The weakness provides some solace that some steam has already been let out of the real estate market.

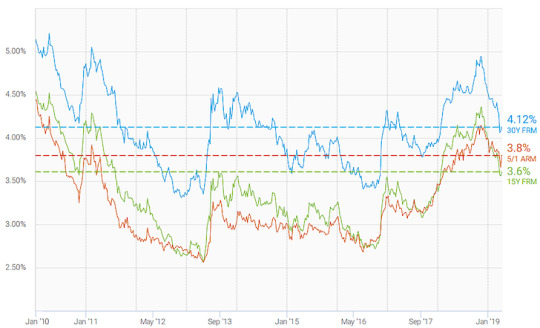

3) Affordability increasing. With lower median prices and declining mortgage rates, interest in real estate is increasing. There’s also a strong demographic trend as Millennials are the largest home buying demographic and are starting families.

4) Tech IPO spillover. Uber finally filed its S-1 and I know the tech IPO hype is only going to grow over the next two years. While I’ve written there is a chance the hype will awaken a slumbering supply bear, my experience post-Facebook’s IPO is that it will take about one year for the wealth effect to spillover into real estate.

5) A strong desire to create utility out of stocks. Stocks provide no utility, whereas real estate does. It is a wonderful feeling to make money in stocks and convert gains into something tangible. To be able to use real estate as a second home, an office space, or as a new primary residence for an expanding family to enjoy for decades is a win.

Living Our Best Lives Now

The entire purpose of achieving FIRE is so that we can live our best lives now.

When we invest in stocks, our hope is to generate profits so that we can live better lives in the future. Of course, we can also invest in stocks to produce dividend income to live off of today.

But if we really wanted to generate income to live our best lives today, there are more prudent, better ways to earn higher amounts of steady passive income with lower volatility.

The downside to cashing out of stocks and buying real estate is that one might be jumping out of the frying pan and into the fire. With rising inventory and a slowdown in the economy, real estate prices could continue to soften in the coming years. Leverage up too much and financial pain could ensue.

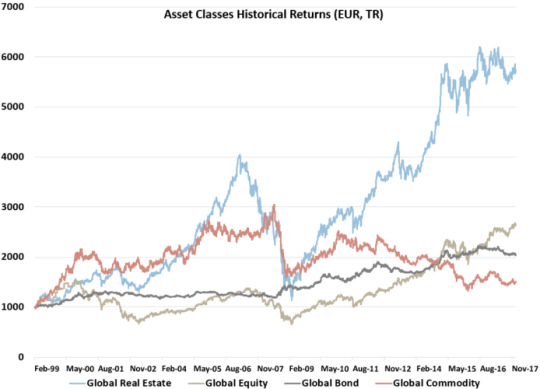

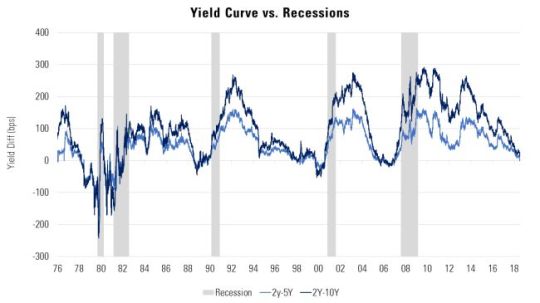

I just keep going through what played out during the 2000 dotcom bubble. As stocks crumbled in between 2000-2002, real estate picked up steam because mortgage rates began to decline. Stock investors started seeking shelter in real estate and REITs in particular performed the bestbetween 1999-2018.

The $400,000 recovery in my House Fund portfolio feels like funny money to me. It’s like buying a $2 million property for only $1.6 million or a $500,000 property for only $100,000. What a bargain!

Further, the real estate market generally lags the stock market by around six months in terms of recovery or declines. Therefore, with the stock market up so strong YTD, it feels like there’s a window of opportunity to buy property right now before prices catch up.

Finally, depending on how much wealth you have, you don’t have to cash out 100% of stocks to buy real estate. You can consider rebalancing your net worth more towards real estate while still investing a good percentage in stocks.

As of now, I am 70% leaning towards cashing out of stocks to buy more real estate. What do you think? Is this a good or bad move and why? How are you adjusting your net worth allocation if at all?

Related:

2019 S&P 500 Wall Street Targets

Which Is A Better Investment: Real Estate Or Stocks?

The post Cashing Out Of Stocks To Buy Real Estate: Analyzing The Temptation appeared first on Financial Samurai.

from https://www.financialsamurai.com/cashing-out-of-stocks-to-buy-real-estate/

0 notes

Text

How To Fail At Getting The Lowest Mortgage Interest Rate Possible

we can give you cash for your atlanta house fast

Originally, I was going to entitle this post, How To Get The Best Mortgage Interest Rate Possible. But after a couple weeks of battling, I failed to do such a thing due to a lack of convincing skills, bait and switching, and poor timing.

Before I tell you about my failure, let me tell you how I recommend getting the best mortgage rate possible. I’ve refinanced eight times across four properties over 16 years.

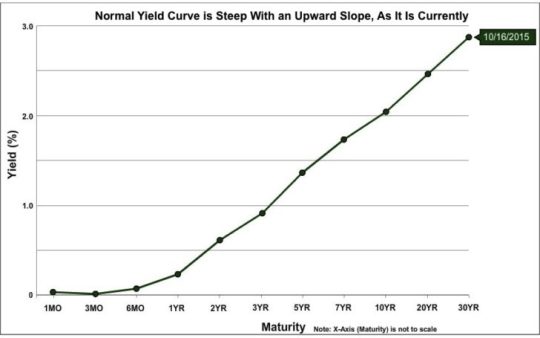

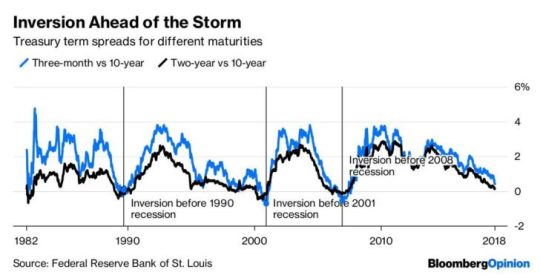

I never thought I would refinance again given we were in a rising interest-rate environment. The Fed decided to kill our expansion in 4Q2018 when they signaled a couple more rate hikes in 2019 and beyond.

It also felt good when I paid off my last property in 2015. With rising cash flow since then, I figured I would just pay off my 5/1 ARM that was set to adjust this summer to 4.5% from 2.5%.

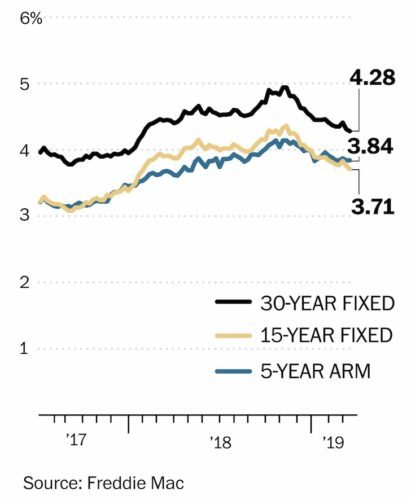

But since the Fed backtracked, mortgage rates have collapsed in 2019. I figured it was worth refinancing again, especially if I could get a reasonable rate with all closing costs baked in.

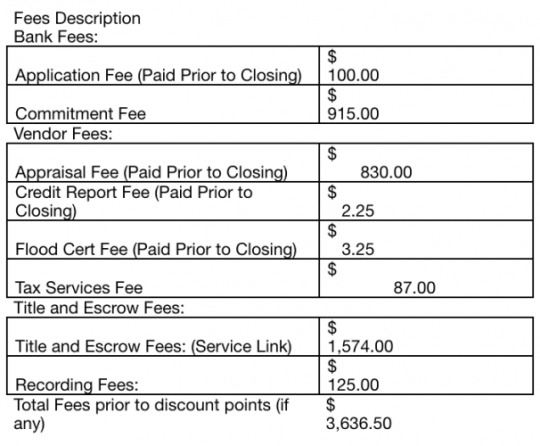

In the end, I locked in a 10/1 ARM for 3% with -3.75 points equal to a $3000 credit towards closing.

This rate is pretty good, but I could’ve gotten better terms. In fact, I helped several readers lock in below 3% while I was busy negotiating my own refinance.

How To Get The Best Mortgage Rate Possible

The key to getting a better price is to always generate competition. For example, the more employers compete for your services, the more you will get bid away for a higher salary.

I still remember sitting in the living room of a house I wanted to buy back in 2004. The asking price was $1.55 million and it had been sitting on the market for two months. I was tempted to offer $1.45 million, which is unusual in a market like San Francisco.

I had made up my mind to low ball the sellers when in walked a doctor couple at the open house. They sat in the dining room and marveled at the wainscoting, crown molding and high ceilings.

Suddenly, my desire to low ball faded away due to perceived competition. Instead, I offered $1.525 million, or $75,000 more than I had planned. Although I ended up being the winning buyer, I still wonder to this day if my emotions got the best of me. It all worked out in the end.

Here are the steps I take to get the best mortgage rate possible. Miss one step and your failure rate will go way up.

1) Get written official quotes from competing lenders. I usually just fill out my mortgage request with LendingTree because they are an affiliate partner and are listed on the New York Stock Exchange with a ~$4 billion market capitalization.

Their lenders aggressively contact me over phone and email after I input my criteria, and then they send me written offers that I use for my next step. Quicken is also another good online source for written quotes. But I haven’t used them in years.

2) Contact your relationship bank. Your relationship bank is the key to getting the best mortgage rate possible. They have a lot of your money and you probably have multiple accounts open with them. They certainly don’t want to lose your business.

If you have competitive written offers, you need to present those written offers to your banker or mortgage loan officer and tell them to beat your written offers, not just match. If you have uncompetitive written offers, then you need to continuously search for better offers to get your relationship bank to beat.

One strategy is to scour the internet and take snapshots of teaser rates some lenders or marketplaces offer if you just can’t get anything official in writing. Teaser rates are often filled with onerous terms, but you can use them to your negotiating advantage.

Through the Financial Samurai community and through the FS Forum, I was able to crowdsource what other people got when they refinanced as well. In other words, it’s good to leverage a financial community whenever you’re doing something financially related.

3) Promise more assets. A bank wants its customers to have as much money with them as possible. Further, they want you to open up as many different accounts as possible to keep you as a sticky customer.

Examples of different accounts include: checking account, business checking account, savings account, mortgage account, wealth management account, home-equity line of credit, and a personal line of credit.

The more money you can bring over to the bank and the more accounts you can open, the more attractive your mortgage interest rate offer will be.

Banks have different tiers based on how much you have. For example my bank has one tier if you have at least $250,000 in assets with them. The next tier is if you have $500,000 – $1,000,000 in assets with them. Their highest tier is if you have over $1,000,000 with them.

4) Be ready to transfer funds away. Moving funds is a hassle, but you’ve got to be willing to move your assets if your relationship bank does not match or beat a competing offer.

You don’t have to close all your accounts. You just have to be willing to open up a new account with a different bank and go through the process of electronic funds transfer.

How I Failed At Getting The Lowest Mortgage Interest Rate

The best mortgage rate I could have gotten was 2.75% for a 7/1 ARM with no refinancing costs at Wells Fargo if I transferred over $1 million. If I transferred over $500,000, I could have locked in a 2.875% 7/1 ARM with no refinancing costs.

This rate was introduced to me by a Financial Samurai reader. The reader took a couple days to get back to my e-mail requesting for the lender’s contact information. As soon as I got the information I showed the rate offer to my existing relationship bank of 18 years, Citibank, to see if they could match.

I had just locked in my 3% rate with Citibank, which I thought was pretty good after the 10-year yield declined to 2.45% from 3.2%, but had not given them approval to start the process yet.

Important: Know that you’ve always got time to make a final decision after you verbally agree to lock. Nothing is official until you sign an “approval to proceed” document. Do not let banks bully you into proceeding right away. Instead, use this window of time to see if you can get a better rate or see if the mortgage rates decline further.

Surprisingly, Citibank told me they could not match the rate even though they said I could probably get 2.875% with minimal closing costs if I locked with them when I did at 3%. When I verbally agreed to 3%, they said they were likely going to have a special promotion the following week to get me down to 2.875%.

I was led on.

I told them I was going to move over $1 million in assets to Wells Fargo if they didn’t at least match the 2.875% rate. The mortgage lender said he’d go to the head of mortgage lending in San Francisco to see if he could get me down to 2.875%.

I waited another day, and the Citi mortgage head said he, unfortunately, still couldn’t match 2.875%. At least he gave me another seven days to decide whether I should refinance with Citibank at 3%. Now I was much more motivated to work with Wells Fargo.

It took about another day and a half for the Wells Fargo mortgage officer to get back to me. We spoke at around 5:15pm. He said I could absolutely refinance to 2.75/2.875% if I brought over $500,000/$1,000,000 in funds. But first, I had to send him some common documents such as my W2, 1099s, rental statements, K-1s and so forth.

I got back to Wells Fargo at around 7:30pm, and he said he’d review the documents and continue our dialogue the next morning. He believed we didn’t need to rush because rates looked unchanged that evening. I agreed.

When he called me the next morning at 10am, he told me the bad news. His bank informed him as of that morning, they decided to discontinue their special mortgage rate promotion! There was just too much demand.

Do I have terrible timing or what?

But of course, if I wanted to refinance with him I still could. The rate would no longer be 2.75/2.875% with no fees but 3%/3.125% with no fees. Now I was really annoyed.

No thank you! I got bait and switched again. If I’m going to get bait and switched, I might as well do business with my OG bait and switcher bank.

Luckily, I didn’t waste too much of my time because the documents I gathered for Wells Fargo were necessary for my refinance with Citibank. I simply forwarded them over.

The Refinance Rate Is Good Enough

So there you have it. While I was busy writing articles encouraging readers to refinance during a flat or inverted yield curve, I wasn’t spending enough time aggressively trying to refinance my own mortgage.

I put too much faith in Citibank to match the better offer. This cost me time and motivation with the competing bank. Nor did I pounce hard enough on the 2.75%/2.875% offer with Wells Fargo because I admittedly didn’t want to move my funds.

Wells Fargo’s offer was a special situation because their CEO had just resigned due to a lot of financial shenanigans that went on under his watch. They needed to drum up business and regain some faith in the community.

Also, I got a 10/1 ARM instead of a 7/1 ARM. Therefore, I have three more years of peace of mind, which also makes me feel slightly better about my higher rate.

If I pay off my new 3% mortgage in five years, my blended 10-year mortgage rate will be 2.75%. Not bad. Further, my monthly payment declines by $800, which is a nice cash flow increase in case the economy turns south.

Finally, I’m happy several readers e-mailed in saying they succeeded in refinancing to a lower mortgage rate after I published my series of articles. Helping readers save money is the best!

Related: The Anatomy Of An Adjustable Rate Mortgage Increase

Readers, anybody refinancing now? What mortgage rate and terms did you get? What mortgage refinancing battle stories do you have to share?

The post How To Fail At Getting The Lowest Mortgage Interest Rate Possible appeared first on Financial Samurai.

from https://www.financialsamurai.com/how-to-fail-at-getting-the-lowest-mortgage-interest-rate-possible/

0 notes

Text

The Definition Of American Prosperity Needs An Adjustment

There’s a common joke here in the SF Bay Area.

How do you know someone went to Stanford? They’ll tell you within the first couple of sentences.

We Americans have a tremendous desire for status and prestige. When we work hard for something, it’s our second nature to tell everybody about our achievement.

You do it. I do it. We all do it. No big deal if we aren’t incessant about it.

But at a certain point, it becomes concerning when we start complaining about our struggles despite being in an extremely fortunate situation.

Let me share one public example and then my own as case studies to illustrate how unaware we truly are about our good fortune.

Being Unable To Recognize American Prosperity

Charlotte from Time magazine sent out this tweet she wrote about everybody’s favorite politician, Alexandria Ocasio-Cortez. It’s a good in-depth piece about how and why AOC came to power.

What is strange about her tweet is that she claims people her age (20s and 30s) have never experienced American prosperity in their adult lifetimes.

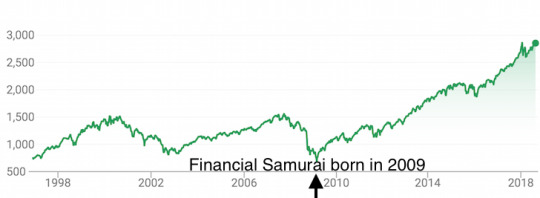

How could this be when the parents of people her age have been able to save and invest in the biggest bull market in history! If only we were able to rewind time and invest as Biff did in Back To The Future III.

Before rushing to judgment, I did what any rational person would do and tried to understand why Charlotte has had such a difficult time in her life so far.

Maybe she grew up in a poor single-parent household in a difficult neighborhood. Maybe she didn’t even go to public college because her parents couldn’t afford the tuition. Or maybe she has a disability.

Lo and behold, it was easy to understand her background because her parents have their own Wikipedia pages! I thought only rich and/or famous people have their own Wiki page? Silly me.

Here are some tidbits.

Jonathan Alter (father): A graduate of Phillips Academy (private prep school) and Harvard University. American journalist, best-selling author, documentary filmmaker and television producer who was a columnist and senior editor for Newsweek magazine from 1983 until 2011, and has written three New York Times best-selling books about American presidents

Emily Jane Lazar (mother): A graduate of Hotchkiss School (private prep school) and Harvard University. Co-executive producer of the former Comedy Central show The Colbert Report;three children: Charlotte (b. 1990), a writer for TIME Magazine, Tommy (b. 1991), a producer for HBO Sports, and Molly (b. 1993), who works in venture capital.

Then, of course, there’s Charlotte, who also went to Harvard University and is a staff writer for Time Magazine. I don’t know whether she went to an elite private prep school or not. But I assume so based on her parents’ backgrounds.

Most would agree that if you went to private grade school, private university, and have rich and accomplished parents, you’ve probably experienced some American prosperity in your life. Some might even conclude that all you’ve ever experienced is American prosperity.

Yet, I believe Charlotte and other wealthy people like her truly do not feel they have experienced American prosperity because their life is all they know. I’m sure Charlotte is a fine and nice person. She’s just a little unaware about how good folks like her truly have it.

As a parent, this lack of appreciation for prosperity is one of my worries of raising myself in a comfortable environment. He’ll have a warm home, food whenever he wants, and mostly prosperous friends. When life is so easy, you don’t end up pushing yourself to make something of your own.

The lack of struggle is one of the reasons why we considered moving back to Virginia instead of to Hawaii. Just look at how UVA turned it around in the NCAA tournament by losing in the first round last year to winning it all in 2019. Hardship creates hunger and growth! In Virginia, we could send him to a public school and let him experience more racial altercations.

Whereas in Hawaii, we would send him to likely a private school where more classmates looked like him. We’d also probably buy a nice house on or near the beach and finally start living it up in retirement.

But if you start with a Ferrari, how can you ever appreciate any other car when it’s finally time for you to buy one on your own?

If you’ve spent your entire life in a luxurious home, good luck feeling good about renting or buying a place with your own salary.

Financial Samurai Case Study

Now let’s look at my own lack of recognizing American prosperity. In the post, The Wide Implications Of The College Admissions Scandal, one of the points I write about is:

The middle class may become wealthier and happier. As college becomes less important in finding a job, there will be fewer people spending four years and borrowing tens of thousands in student loans. With more time and less financial baggage, more people will be able to aggressively save to buy a house, start a family, and save for retirement.

I thought this was a good thing. However, what I didn’t realize was that by writing the words “middle class,” based on my current position as a financially independent person, it could be construed as insulting to the “true middle-class” American.

Here is a response from a regular Financial Samurai reader,

Let me start by stating that I love your blog and your views on general and I salute you for your consistent approach. However, one area I repeatedly roll my eyes as is when you describe your upbringing as “middle class”.

Based on your posts, your parents had jobs as foreign service officers for the US Government. That is about as secure a job and lifestyle as one could expect (all living expenses comped by taxpayers). I’m not saying it is a cushy job or easy, as I respect those who do it, but it is an elite job.

Your views are warped and you seem to want to cast yourself as middle class struggle when in reality you had a huge advantage over most of the country.

Maybe not compared to your Wall Street buddies, but compared to most you had a silver spoon. This doesn’t discount any of your success, or the impact of racism that you said you faced which I agree is a challenge, but you need to get real on your upbringing and your parents jobs – not middle class.

This is fantastic feedback that shines a huge blind spot on my lack of awareness that I didn’t grow up middle class, even though I wasn’t writing about my own upbringing to begin with.

All this time, I thought I grew up in an average American household. Here are some data points from my upbringing that made me believe so. My dad verified the numbers.

Went to public high school (free) and college ($2,800/year in tuition at The College of William & Mary)

Dad went to the University of Hawaii (public), Mom went to National Taiwan University (public)

Parents drove an 8-year-old Toyota Camry (bought for $5,000)

Worked at McDonald’s, worked as a mover, and did random jobs as a temp during the summers

Lived in a ~1,700 sqft townhouse that was purchased for $190,000

Parents worked at the US State Department and my mom made between $25,000 – $55,000 and my dad made between $15,000 – $119,000 after a 30+ year career after serving in Vietnam

Here is the actual townhouse I lived in from Google street view. Ah, the fond high school memories. I had the room with the balcony.

It’s now becoming clear that I didn’t grow up middle class, but upper middle class or some would say rich. For example, while some classmates had to walk a couple miles to school, I got to ride a bike. As a result, I could get more sleep and do better in class.

During my time growing up in the Philippines, Zambia, Taiwan, and Malaysia before high school I witnessed a lot of poverty. In comparison, my family was definitely rich. Who gets to live abroad as a child while his parents get to honorably serve their country building foreign relationships? Not many.

Further, being born Asian seems to have given me a leg up in America because how could it not when elite private schools require a higher hurdle rate for admission? Surely these universities must have scientific data behind their decision. Otherwise, that would be discrimination.

For those who have been offended by my belief that the middle class will benefit from the college admissions scandal by helping level the playing field, I apologize. I really didn’t mean any harm and will try to only write about wealthy people stuff going forward.

Why We Can’t Recognize American Prosperity

Here are four reasons why I think some of us don’t recognize our prosperity.

1) Our government and think tanks arbitrarily define middle-class income and status for us nationally instead of locally. Pew Research, for example, believes that a middle-class income ranges between 67% to 200% of the median household income. While some in government, in order to raise the income tax rate at lower income levels, believe rich means earning income over $200,000, regardless of location.

2) Life’s struggles. No matter how rich and powerful you are, you will always experience some sort of hardship growing up. Common hardships include divorce, fights, bullying, rejections, mental illness, loneliness and deaths. These negatives are very real and make us feel less prosperous than we really are.

3) Our desire to always compare and want more. Even though my family drove a perfectly fine 8-year-old Toyota Camry during my upper class upbringing, I was envious of my rich friend whose family drove a new Honda Accord. I still remember that new car smell.

Even though AOC attended Boston University for $70,000 a year in today’s dollars, she might be envious of Charlotte Alter who attended higher ranked Harvard University for only $65,000 a year.

Conversely, Charlotte might be envious of AOC because AOC, with a less prestigious degree, is the second most popular politician in America. The comparisons go on and on and can make us miserable.

4) We’re simply ignorant about how the rest of the country and the world live. We need to travel more. We also should strive to learn another language to immerse ourselves in another culture. If we do, we will better appreciate how good we have things and get along with more people.

Let’s recognize our prosperity while trying to remain humble. If we can help others become more prosperous, all the better.

Always attribute most of your success to luck rather than to hard work. You can still secretly work hard behind the scenes, but never let anybody know. Saying you worked hard in today’s environment is gradually becoming an insult.

Finally, recognize the growing anger in America towards those who have more and adapt. When in doubt, be respectful towards those who denigrate your efforts. And if you feel that a respectful dialogue cannot ensue, then move on. There are so many better things to do with your time.

Remember, “talent is universal, but opportunity is not.” It is up to those of us with opportunity to help those who do not.

Related posts:

Spoiled Or Clueless? Try Working A Minimum Wage Job As An Adult For Goodness Sake

Your First Million Might Be The Easiest: How To Become A Millionaire By 30

Readers, anybody out there think they grew up middle class, but who actually grew up upper middle class or rich? Why do some people who grow up wealthy not recognize their prosperity? What is your definition of American prosperity? How can we get people to recognize and appreciate their prosperity more?

The post The Definition Of American Prosperity Needs An Adjustment appeared first on Financial Samurai.

from https://www.financialsamurai.com/the-definition-of-american-prosperity/

0 notes

Text

Annualized Returns By Asset Class From 1999 – 2018

Before I show you the 20-year annualized returns by asset class between 1999 – 2018, I want you to guess the following four things:

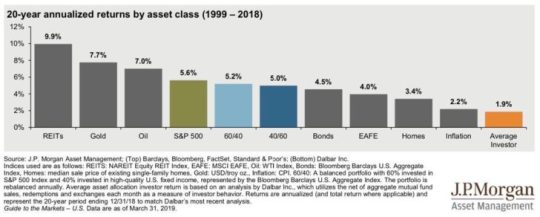

1) Of the following asset classes, the S&P 500, a 60/40 stock/bond portfolio, Bonds, a 40/60 stock/bond portfolio, REITs, Gold, Oil, EAFE (Europe, Asia, Far East), national real estate, which performed best?

2) What was the annualized return for the best performing asset class +/-0.5%?

3) What was the annualized return for the worst performing asset class +/- 0.5%?

4) What was the annualized return for the average active investor +/- 0.2%?

If you can guess two out of the four correctly, I’ll give you a gold star and might even take your child’s SAT or ACT exam for you.

If you only get one out of four right, you need to go run five miles immediately. If you get zero right, then you need to run five miles, do 100 sit-ups, and 100 push-ups.

There’s no way any of you are getting four out of four right.

Now that we have a deal, let’s take a look at the results to see how reality compares with your biased beliefs.

Performance By Asset Class Between 1999 – 2018

Below are the results compiled by J.P. Morgan, one of the largest traditional asset managers in the world that charge clients 1.15% – 1.45% of assets under management, based on $1 – $10 million.

Asset managers like J.P. Morgan are the reason why digital wealth advisors like Wealthfront were created during the last financial crisis. People wanted to pay lower fees (0.25% by WF) and weren’t satisfied with active management results.

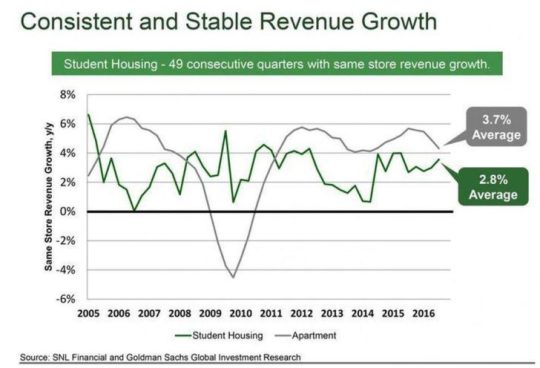

As you can see from the results, REITs is the #1 performer with a 9.9% annualized return. I bet less than 20% of you guessed this one right.

The S&P 500 only returned 5.6% a year between 1999 – 2018. I think most of you would have guessed a higher return. On a relative basis, Bonds, at 4.5%, doesn’t seem too shabby given the lower volatility and risk.

Gold is a real surprise at 7.7% since gold doesn’t produce any income and whenever gold is mentioned, it’s usually in a negative light unless you’re a gangster.

Meanwhile, Homes returned the worst at only 3.4%. The national home price index generally tracks close to inflation (2.2% in this time period). Therefore, a 1.2% outperformance is not bad.

What’s most interesting to me about this chart is how REITs have outperformed Homes by 6.5% for 20 years. This goes to show that professional real estate managers can add tremendous value.

The outperformance also partially explains why experienced individuals who know how to bargain, remodel, expand, and predict demographic changes often prefer real estate as well.

Finally, it’s no surprise to me that the average active investor has only returned 1.9% a year during this time period. Trading in and out of investments is a losing proposition long term due to timing errors and fees. Figuring out when to buy is hard enough. Having to figure out when to sell and then get back in consistently is impossible.

The inability to consistently outperform the market is the reason why the vast majority of us should stick to a proper asset allocation model based on our risk tolerance and our goals in life.

Our core tax-advantaged retirement portfolio(s) should be mostly left alone. I’m talking about our 401(k), IRA, Roth IRA, SEP-IRA, 403(b), and so forth.

For our after-tax investments, it’s worth adjusting our strategies based on a purpose e.g. getting more conservative if buying a house within the next 12 months. See: How To Invest Your Down Payment

Why I Chose 1999 As The Starting Point

In addition to the fact that J.P. Morgan had already crunched the numbers for me, 1999 as a starting point is significant for me because it coincides with my graduation from college and when I started to aggressively invest my savings.

I actually started investing money during my sophomore year in 1996, but I only had about a $2,500 portfolio at the time so it was insignificant. Hooray for making $4/hour at McDonald’s though to learn about work ethic!

Given my vintage year is 1999, my outlook on various asset classes is shaped by the performance of these asset classes during most of my working career.

From 1999-2000, we had a tremendous internet stock bubble followed by a 2.5-year decline. Then we had a nice 5-year run in the S&P 500 followed by another 2-year collapse.

Now we’ve had a nice 10-year run that has surpassed the previous peak by almost 100%. Therefore, readers have to forgive me for not overweighting stocks at this point in time.

Given my working career has only been limited to living in New York City and San Francisco, I have personally witnessed closer to a 6% annualized growth in property from 1999 – 2018.

6% is not much greater than the stock market’s 5.6% annualized return. However, once you add leverage, 6% becomes a significant amount. We’re talking 12% – 30% annualized returns on a 50% – 80% loan-to-value ratio.

When I calculate my compound annualized net worth growth rate since 1999, the number is between 12% – 14%, depending on how I value some of my assets. This is fine since my annual net worth growth target has always been at least 10%.

However, I would attribute more than 50% of my net worth growth to aggressive savings and building a business rather than to returns. In other words, what you do may matter more than you think.

Lower Your Return Expectations

One of my main goals of this article is for readers to keep your return expectations reasonable over the next 10-20 years. If you do so, your risk exposure will likely be more appropriate. You’ll also likely work harder to build your net worth through action.

The second goal of this article is to compare your overall net worth growth to your various investments of choice and see how they stack up. You should try to figure out how much of your net worth growth was due to savings versus returns.

Finally, I want everybody to recognize their biases. I’m biased towards real estate because real estate has performed best for me since 1999. Whereas some of you will be biased towards stocks or other asset classes because they have performed best for you since getting your first real job.

Past performance is no guarantee of future performance. It is likely we will experience some performance leadership changes in the future and will have to adapt accordingly.

For our tax-advantaged investments, including our son’s 529 plan, I plan on leaving them alone. We’ve still got between 16-20 years before we want to access the funds.

For our after-tax investments, I’m reducing exposure to stocks, increasing exposure to cash and short-term treasuries, diversifying our real estate exposure across non-coastal cities through speciality REITs and crowdfunding, and constantly looking for ocean view fixers in San Francisco.

I’m sure I’ll be kicking myself 10 years from now if I don’t buy at least one more ocean view fixer today. I just love the combo of identifying high growth potential investments and boosting returns through rehabbing.

Readers, did anybody get three or four questions right? What are some of your biases? What asset class do you think will perform best in the future? Where are you overweighting your net worth today?

The post Annualized Returns By Asset Class From 1999 – 2018 appeared first on Financial Samurai.

from https://www.financialsamurai.com/annualized-returns-by-asset-class-from-1999-2018/

1 note

·

View note

Text

A Legal Way To Profit From The College Admissions Scandal

A good investor always looks for opportunity no matter the circumstance. If you can identify and invest in a winning long-term trend, your returns could be quite lucrative over time.

Some long-term trends that have or will likely make investors a lot of money are:

Investing in the next Silicon Valley

Investing in the aging of our population

Investing in artificial intelligence

Investing in mobile applications

Investing in personal finance sites that have long operating histories

Investing in opportunity zones that improve over time

What I realized after the college admissions bribery scandal is that my effort to assuage the public to not spend so much time and money going to college, let alone an incredibly expensive private school is a losing battle.

It is so obvious to me that paying record high tuition for a depreciating asset is not a wise financial move. Give me a $1 million check at age 22 over attending private grade school and university any day.

Further, still spending 4-5 years to get a college degree when learning has become much more efficient thanks to the internet also doesn’t make sense. Two years should be enough to get a degree. Google makes doing research much quicker and easier than going to the library pre-internet days.

Despite the obvious, when you hear about already rich and powerful parents spending hundreds of thousands of dollars to bribe their kid’s way into college, you know demand for college is inelastic no matter how much prices rise and how much the value of the degree depreciates.

Further, the allure of a U.S. college education seems to only be growing in attractiveness to international students. To college chancellors, international students are the golden goose since most pay full price.

Student Housing As An Investment

Given there is an insatiable demand for a U.S. college degree, the easiest way to invest in this demand is through student housing.

The investment thesis is similar to investing in San Francisco Bay Area real estate over the past 20 years based on the growth of major tech giants like Google, Apple, Facebook and the creation of new tech giants like Uber and Airbnb. They’re all paying big bucks and their employees need a place to live.

I was too stupid to get a job at some of today’s most well-known companies. As a result, I just bought their stock and leveraged up and bought as much property as I could in 2003, 2004, 2007 (oops), 2014 and maybe something in 2019 as well.

Overall, my SF real estate investments have returned enough to provide both my wife and I a simple retirement lifestyle. Therefore, perhaps investing in student housing in the face of college degree fever is also a wise move.

Here are some positives of investing in student housing.

1) Relatively recession proof. When the economy turns down, more people go back to school. During the 2008-2010 financial crisis, MBA applications surged 50% for two years in a row. Part of the reason why I decided to get my MBA part-time between 2003-2006 was that I thought I might get fired by my new employer in the wake of the post-dotcom collapse.

2) Stability of cash flow. Whether in a bull market or a bear market, student housing supplies a reliable cash flow stream so long as the university is in good standing. We’re talking 99% occupancy rates when school is in session.

3) Enrollment continues to increase. Enrollment in postsecondary institutions is expected to increase 14% to 23 million by 2024, according to the National Center for Educational Statistics. As a result, rental rates are estimated to grow by about 2% a year according to Axiometrics.

The Negatives Of Student Housing

There are of course no guarantees when it comes to investing in student housing. We’ve all seen Animal House and know there can be some headaches when it comes to managing college students.

Here are some potential negatives:

1) First-time renters with unestablished credit. Student renters are almost always first-time renters. Although you can hope they will be responsible tenants who will pay on time and take care of your property, you just don’t know for sure what they will do. Having a parent co-sign the lease is an absolute must. You’ve also got to properly vet the student’s parents. Hopefully, they’re really rich like all the parents who got caught in the bribing scandal.

Related: Example Of A Good Rental Lease Agreement

2) More wear and tear on your property. Students drink and party, which results in excessive wear and tear on units. Sometimes they bash into walls when drunk. Sometimes they overflow the washing machine and cause the ground to flood. The more wear and tear, the more time and money it takes to maintain the unit.

3) Higher liability. Given students are considered more high-risk tenants, your rental insurance costs may be higher due to potentially higher risk activity. Sometimes college students like to throw bonfires on the balcony and accidentally burn your unit to a crisp. You just never know what newly free young adults will do away from their parents. I remember having a jolly good time when I was in college.

The Best Way To Invest In Student Housing

One of the easiest ways to invest in student housing is to buy a publicly traded REITs that has some exposure to student housing. The two REITs that I’m aware of are:

1) American Campus Communities (Ticker: ACC, NYSE) – ACC is the most established student housing REIT with a ~$6.5 billion market cap. They pay a ~3.8% yield and have done well over the past 12 months.

2) EdR – Was acquired in 2018 by Greystar Student Housing Growth And Income Fund for $4.6 billion, so that’s out.

The other way to invest in student housing is through a private student housing REIT. I found one run by Rich Uncles founded in 2014. You don’t have to be an accredited investor and can invest as little as $5 on their platform.

Their Student Housing REIT only buys student housing within a one-mile walking distance of major NCAA Division I universities that have at least 15,000 enrolled students.

This seems like a prudent precaution as some smaller, less well-known universities are facing lower enrollment figures and are at risk of shutting down.

All properties purchased in the Student Housing REIT must have a minimum capacity of 150 beds, feature 90%+ rental occupancy rates; and represent a broad spectrum of geographic locations.

What I like about the Rich Uncles REIT is that there is no broker/dealer fee that public REITs charge and they have a good performance fee structure.

The first 6.5% of any profit is paid out to shareholders with no fees. All profits after 6.5% are split 40% to Rich Uncles and 60% to you. This performance alignment with shareholders is my favorite type of fee structure.

If you buy ACC, you’re buying for its 3.8% yield and potential appreciation. If you invest in the Rich Uncles Student Housing REIT, you’re buying for the steady income. Of course, neither offer guaranteed returns.

Don’t Physically Own Student Housing

The long-term demographic trend towards more people going to college is a nice tailwind for the student housing sector. As a parent now, I realize parents are willing to do anything for their children to get ahead. Spending big money on education seems to be the solution if you can’t spend time educating your children yourself.

The growth of international student demand is positive as well. They won’t discover until decades from now that a college degree from an American university isn’t worth what it used to be.