Text

5 Ways Bookkeepers Can Help Law Firms

Managing a law firm's finances is no small task, with unique challenges and strict regulatory requirements that must be followed. Professional law firm bookkeeping services, can be invaluable in handling these complexities with precision and expertise. This blog post explores nine critical areas where bookkeepers support law firms. Each section not only delves into the specifics of these services but also demonstrates the ways bookkeepers can help law firms and contribute to the firm's overall success.

Reader tip: Click to immediately jump to any section.

5 Ways Bookkeepers Can Help Law Firms

Assist with IOLTA Guidelines: Learn how bookkeepers help maintain the integrity of Interest on Lawyers Trust Accounts (IOLTA).

Streamline Client Billing Processes: Discover how bookkeepers enhance the efficiency of billing practices, from automating invoicing to improving cash collection, thereby boosting the firm's cash flow and client satisfaction.

Manage Client Trust Accounts: This section details bookkeepers' meticulous management of client trust accounts, highlighting their role in ensuring legal and ethical compliance through accurate record-keeping and regular reconciliations.

Improve Cash Flow Management: Understand the strategies bookkeepers employ to monitor and optimize cash flow, ensuring the firm meets its financial obligations and maximizes its financial health.

Financial Reporting: Regular review and understanding of your financial reports can help you make informed business decisions and plan for growth.

Assist with IOLTA Guidelines

Managing an Interest on Lawyers Trust Accounts (IOLTA) is a critical responsibility for any law firm. These accounts hold client funds separately from the firm's finances, and the interest earned is used to fund public interest legal services. The management of IOLTA accounts must adhere strictly to state bar guidelines, which can be complex and vary by jurisdiction.

Professional bookkeepers play a role in helping law firms to remain compliant with these guidelines. They understand that managing IOLTA accounts requires more than just opening and connecting bank accounts to your accounting software. A professional bookkeeper helps law firms set up their accounts and ensure the transactions are noted and correctly categorized.

History: IOLTA – Interest on Lawyers' Trust Accounts – is a method of raising money for charitable purposes, primarily the provision of civil legal services to indigent persons. The establishment of IOLTA in the United States followed changes to federal banking laws passed by Congress in 1980, which allowed some checking accounts to bear interest. IOLTA programs currently operate in 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands. Source, American Bar Association.

Streamline Client Billing Process

Efficient billing processes are important for any law firm, not only to ensure timely payments but also to maintain good client relationships. Bookkeepers can help streamline these processes, which helps to minimize errors, reduce administrative overhead, and improve cash flow.

Here's how a professional bookkeeper can enhance the client billing process:

Automated Invoicing: Bookkeepers can help law firms send invoices promptly by setting up and maintaining automated billing systems. Automating tasks reduces the possibility of human error and gives attorneys more time to concentrate on their clients' cases instead of handling administrative duties.

Customized Billing Reports: Bookkeepers produce detailed billing reports that allow law firms to review their billing practices and adjust as necessary. These reports can identify trends, such as frequent late payments or common client disputes, leading to better strategies for handling these issues.

Follow-up on Receivables: Bookkeepers diligently monitor accounts receivable to ensure that payments are received on time. They also handle follow-ups on overdue accounts, which is crucial for maintaining healthy cash flow.

Manage Client Trust Accounts (CTAs)

For law firms, managing client trust accounts is a legal requirement. Bookkeepers can help manage these accounts effectively. Here's how they contribute:

Account Setup - Bookkeepers can help ensure the trust bank account is setup correctly in your accounting software, including the matching liability account.

Detailed Transaction Records - Every transaction in a client trust account should be recorded in meticulous detail. A Bookkeeper can help your firm maintain comprehensive records and receipts that include each transaction's date, amount, and purpose. This detailed record-keeping provides transparency and helps preserve the integrity of client funds.

Regular Reconciliations - Bookkeepers perform regular reconciliations to ensure that the trust account balance matches the bank statement each month. This practice helps to quickly identify and rectify any discrepancies, thereby maintaining the accuracy of the account.

Improve Cash Flow Management

A law firm's ability to manage its cash flow effectively is essential to its financial health. Bookkeepers play a role in optimizing cash flow through meticulous management and strategic planning. Here's how they contribute:

Timely Invoicing and Collection: Bookkeepers help maintain a steady stream of income by ensuring that invoices are issued promptly and follow-ups on overdue payments are conducted regularly. This reduces cash flow interruptions and enhances the firm's ability to meet its financial obligations.

Manage Payables: Bookkeepers schedule payments to suppliers and creditors in a way that aligns with the firm's cash flow, taking advantage of payment terms and discounts wherever possible without jeopardizing the firm's liquidity.

Financial Forecasting: Bookkeepers can help forecast future cash flows using historical data and financial trends. These projections are useful for strategic planning, helping the firm make informed decisions about investments, expansions, or necessary financial adjustments.

Financial Reporting

A bookkeeper can help prepare monthly financial statements such as:

Profit and Loss: You can quickly see if expenses exceeded income in any given time period.

Balance Sheet: Reviewing your balance sheet regularly will help your firm ensure that the Trust bank account matches the trust liability account.

Cash Flow Statement: Looking at how cash is flowing in and out of your business over a set period of time can help business owners plan to ensure financial obligations are met.

Strengthen Your Law Firm with Expert Bookkeeping

Professional bookkeepers are valuable in helping maintain the financial health of law firms. From ensuring adherence to IOLTA guidelines to optimizing cash flow and enhancing financial reporting, bookkeepers empower law firms to operate efficiently and make informed decisions.

If your law firm is ready to improve its financial operations consider partnering with Bandwidth Bookkeeping Services. Let us help you manage your bookkeeping tasks so you can focus on providing excellent legal services.

Original source: https://www.bandwidthbookkeeping.com/post/5-ways-bookkeepers-can-help-law-firms

0 notes

Photo

(via How to Catch Up on Your Bookkeeping Now that Taxes are Done.)

0 notes

Text

How a Bookkeeper Helps Your Small Business

Ugh. Bookkeeping Time.

The time of the month you need to login, download transactions, review them, categorize, pay bills and send out invoices.

With Bandwidth Bookkeeping, we can take away the “ugh” and keep your financial books in order.

As a business owner, I understand the feelings this time of the month can elicit. It is the “heavy sigh” coupled with the question, “how many hours will this take?” that whispers in your ear as you prepare to sit down in front of the computer. Let’s face it, you’d rather focus on doing the tasks that you enjoy and can add the most value to your business.

Schedule a consultation to learn how Bandwidth Bookkeeping can help!

Most business owners do not look forward to the monthly, weekly, or biweekly bookkeeping tasks they should be doing to stay on top of their financials. Fortunately at Bandwidth Bookkeeping, we love bookkeeping and helping businesses, such as yours, keep your books organized so that you can make the right decisions to grow your business.

Which Accounting Software Do You Use?

Manual entry (e.g., Excel, Google Sheets, etc).

QuickBooks

Other: Wave, Xero, Freshbooks, etc.

None

With over a decade of experience working with QuickBooks, we help clients, small business owners, maintain accurate and up-to-date financial records.

Here is a detailed list of how a bookkeeper can help your small business

Setup and Customization of QuickBooks:

Setting up your QuickBooks Online account and configuring it according to the specific needs of your business.

Customizing the chart of accounts to align with the company’s financial operations and reporting requirements.

Data Entry and Transaction Management:

Recording daily financial transactions such as sales, purchases, payments, and receipts accurately in QuickBooks.

Managing accounts payable and receivable to keep track of what the business owes to its suppliers and what is owed by its customers.

Bank Reconciliations:

Matching the transactions in QuickBooks with those listed on your monthly bank statements to ensure accuracy in financial records.

Identifying and correcting discrepancies between the book records and bank accounts.

Did you know that Bandwidth Bookkeeping Services has bookkeeping packages to fit your business needs? View our pricing.

Financial Reporting and Analysis:

Generating financial reports such as balance sheets, profit and loss statements, and cash flow statements to provide a snapshot of the business’s financial health

Analyzing these reports to help the business owner understand the financial impacts of their business decisions.

Budgeting and Forecasting:

Helping to create budgets and forecasts using the financial data within QuickBooks.

Monitoring financial performance against these budgets to identify variances and advise on necessary adjustments

Accounts Setup and Maintenance:

Creating and maintaining a chart of accounts to categorize financial transactions appropriately.

Regularly updating account details to reflect changes in the business structure or financial practices.

Training and Support:

Providing training to the business owner and other staff on using QuickBooks effectively

Offering ongoing support to resolve any issues related to the use of QuickBooks.

Help Your Business Grow and Work with Bandwidth Bookkeeping

Working with a bookkeeper can help your small business by freeing up your time so you can focus on running and growing your business. With accurate financial data prepared and reviewed monthly, you’ll have the right information at your fingertips so you can make informed decisions.

Original source: https://www.bandwidthbookkeeping.com/post/how-bookkeeper-helps-your-small-business

#business

0 notes

Video

Established Specialty Bakery in Prime Location in Yolo County from Sacramento Business Brokers on Vimeo.

Established Specialty Bakery in Prime Location - Yolo County

Asking Price: $110,000

Cash Flow: $54,000

Listing No: 2217095

Gross Revenue: $273,000

Base Rent: $2,970

Year Established: 2016

This thriving bakery, established in 2016, has quickly become one of Yolo County's premier destinations for wedding cakes and specialty baked goods. The business prides itself on creating bespoke, custom-designed cakes, catering to a wide range of events from weddings to special celebrations. With over 90 different cake flavors, the bakery stands out for its unique offerings and custom designs, setting it apart from local competition.

View Listing: sacramentobusinessbrokers.com/businesses-for-sale/established-specialty-bakery-in-prime-location

Business Details

Location: Yolo County, CA

Inventory: Included in asking price

Real Estate: Leased

Employees: 4

Facilities: Well-equipped bakery with high-quality equipment including a Blodgett oven, stand mixers, refrigerators, and freezers. The bakery boasts a large kitchen with three separate prep stations and a welcoming storefront, providing an ideal setup for both production and sales.

Competition: The business excels over local grocery store bakeries by offering bespoke and custom creations.

Growth & Expansion: Potential for growth by extending business hours and hiring additional bakers to meet the high demand for specialty orders.

Support & Training: Seller offers comprehensive training to ensure a smooth transition, including recipe transfer and operational guidance.

Reason for Selling: Owner relocating

Useful artilce: sacramentobusinessbrokers.com/post/common-mistakes-to-avoid-when-selling-your-business

0 notes

Video

youtube

Established Specialty Bakery in Prime Location in Yolo County

0 notes

Text

Established Specialty Bakery in Prime Location - Yolo County

Asking Price: $110,000

Cash Flow: $54,000

Listing No: 2217095

Gross Revenue: $273,000

Base Rent: $2,970

Year Established: 2016

This thriving bakery, established in 2016, has quickly become one of Yolo County's premier destinations for wedding cakes and specialty baked goods. The business prides itself on creating bespoke, custom-designed cakes, catering to a wide range of events from weddings to special celebrations. With over 90 different cake flavors, the bakery stands out for its unique offerings and custom designs, setting it apart from local competition.

View Listing: https://www.sacramentobusinessbrokers.com/businesses-for-sale/established-specialty-bakery-in-prime-location

Business Details

Location: Yolo County, CA

Inventory: Included in asking price

Real Estate: Leased

Employees: 4

Facilities: Well-equipped bakery with high-quality equipment including a Blodgett oven, stand mixers, refrigerators, and freezers. The bakery boasts a large kitchen with three separate prep stations and a welcoming storefront, providing an ideal setup for both production and sales.

Competition: The business excels over local grocery store bakeries by offering bespoke and custom creations.

Growth & Expansion: Potential for growth by extending business hours and hiring additional bakers to meet the high demand for specialty orders.

Support & Training: Seller offers comprehensive training to ensure a smooth transition, including recipe transfer and operational guidance.

Reason for Selling: Owner relocating

Buying an Existing Business vs. Buying a Franchise: Which Option is Best for You?

#selling a business#business#businessowner#entrepreneurship#business advice#businessbroker#businesstips#business broker

0 notes

Text

Premier Photography Studio in Sacramento County - A Turnkey Operation

Asking Price: $650,000

Cash Flow: $252,807

Listing No: 2206138

Gross Revenue: $770,501

FF&E: $50,000

Base Rent: $3,750

Year Established: 2018

A rare opportunity to acquire a premier photography studio in Northern California that has shown remarkable growth since its inception in 2018. Renowned for its inviting and friendly studio experience combined with a pricing structure that attracts a broad range of clients, this business boasts a vast selection of custom sets and a talented staff dedicated to exceptional customer service.

The primary sources of income are from in studio sessions: newborn, cake smash, family, maternity, and birthday sessions.

The studio has a loyal customer base with a strong presence on social media, 100’s of 5-star online reviews, and a high repeat business rate.

View listing: https://www.sacramentobusinessbrokers.com/businesses-for-sale/premier-photography-studio-in-sacramento-county

Business Details

Location: Sacramento County, CA

Real Estate: Leased

Building SF: 2,300

Lease Expiration: 2/1/2026

Employees: 11

Furniture, Fixtures, & Equipment (FF&E): Included in asking price

Facilities: Comprehensive inventory of modern photography equipment and an extensive array of props.

Competition: Top-notch customer service and product delivery set this business apart from the competition.

Growth & Expansion: Running at 65% capacity, there's ample opportunity to expand services and increase revenue.

Support & Training: Owner is willing to assist during the transition period with the support of a capable studio manager and franchise network.

Reason for Selling: Owner wants to spend more time with her family.

All listings: https://www.sacramentobusinessbrokers.com/listings

0 notes

Text

Premier Photography Studio in Sacramento County - A Turnkey Operation

🌟 Exciting Business Opportunity Alert! 📸✨

Are you passionate about capturing life's most beautiful moments? Dream of owning a creative business? Look no further! Introducing the sale of Sacramento County's Premier Photography Studio - a golden opportunity to step into a thriving, well-established business in the heart of our vibrant community.

Listing: https://www.sacramentobusinessbrokers.com/businesses-for-sale/premier-photography-studio-in-sacramento-county

📷 Why This Studio?

A reputable brand with a loyal customer base.

State-of-the-art equipment and a stunning studio space.

A legacy of quality and excellence in photography services.

Located in the bustling heart of Sacramento County.

🌟 What's in Store for You?

A turnkey operation with immediate revenue.

Training and support to ensure a smooth transition.

An experienced team dedicated to artistry and customer satisfaction.

The chance to grow a business that brings joy and captures memories.

💼 Be Your Own Boss

Embrace the entrepreneur within.

Unleash your creativity.

Make a living doing what you love.

🔗 Interested? Learn more about this incredible opportunity atour website at www.sacramentobusinessbrokers.com. Don't let this picture-perfect chance slip away!

📩 DM us for inquiries or to schedule a viewing. Let's turn your dream into a snapshot of success!

#BusinessForSale #PhotographyStudio #SacramentoBusiness #EntrepreneurDreams #OwnYourFuture #CreativeBusiness #PhotographyLovers #SacramentoCounty #BusinessOpportunity #MakeMemories #CaptureMoments

1 note

·

View note

Video

Premier_Photography_Studio_in_Sacramento from Sacramento Business Brokers on Vimeo.

0 notes

Video

Premier_Photography_Studio_in_Sacramento from Sacramento Business Brokers on Vimeo.

a premier photography studio for sale in Northern California. Established in 2018, the studio has experienced significant growth and is known for its welcoming atmosphere and pricing structure that appeals to a wide range of clients. It offers a variety of custom sets and is staffed by a team committed to excellent customer service.

The studio's main income sources include in-studio sessions such as newborn, cake smash, family, maternity, and birthday sessions. It has built a loyal customer base, maintains a strong presence on social media, has hundreds of 5-star online reviews, and enjoys a high rate of repeat business.

For more details, you can visit the original link: Premier Photography Studio in Sacramento County.

lukemiddendorf.substack.com/p/premier-photography-studio-in-sacramento

0 notes

Video

youtube

Business for Sale - Premier Photography Studio in Sacramento

0 notes

Video

youtube

Year-End Bookkeeping Checklist for Business Owners

1 note

·

View note

Text

0 notes

Text

Q2 BizBuySell Report Shows Continued Increase in Small Business Acquisitions

The second quarter of 2023 was interesting. Typically, the summer months, especially July, are slow. However, this year, our firm saw an increase in business owners reaching out to learn about selling their business.

Q2 BizBuySell Report Shows Continued Increase in Small Business Acquisitions

BizBuySell has recently released their insight report for the second quarter of 2023. These reports are helpful to business owners and potential buyers as they project market trends and explain what was on the rise and what declined over the past three months. To see the full report, you can visit BizBuySell’s website. Here is an overview of what was presented and where market trends are leading as we progress through 2023.

Full report: https://www.bizbuysell.com/insight-report/

Overview

The most important statistic from the last three months is that business acquisitions increased by 8% versus just 4.8% in the first quarter of the year. This continues the positive trend that buyers and sellers are adjusting to an environment with higher interest rates.

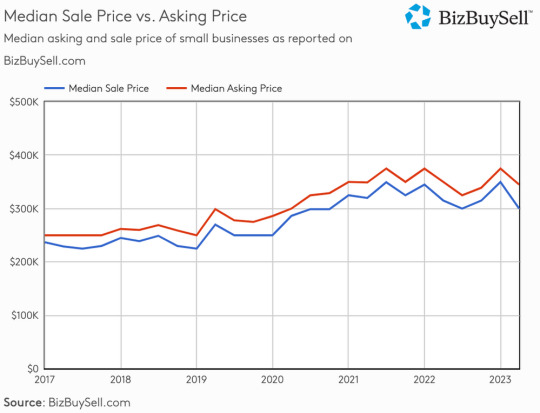

However, it’s important to note that while acquisitions are trending upward, sale prices have continued to trend downward. In the second quarter, the median business sale price dropped 14% to $300,000 largely due to higher interest rates.

While the decline in the sales prices may seem like bad news to buyers, this decline proves that sellers need to get more creative with their offers. For instance, sellers may have to offer financing or increase the monthly rent on the buyer’s lease.

Overview of business sales and listing information for Sacramento, CA

In the Sacramento, Arden-Arcade, and Roseville, California areas, the median asking price continued to increase. The median asking price rose to $399,000, and listings increased from 253 to 264. Median revenue also increased significantly from $550,000 to $609,445.

Here are 3 Key Takeaways from BizBuySell’s report:

1. Seller financing continues to play an important role.

With higher interest rates, many buyers and lenders require some form of seller financing. This can seem challenging for sellers as only 22% plan to offer it, while 70% of potential buyers intend to ask sellers to finance at least part of the deal.

However, sellers need to stay flexible and consider adding financing to their deals. Leaving out this crucial component can reduce the amount of potential buyers and, in some cases, be a deal breaker for lenders, as many lenders are beginning to require at least a 10% note from sellers. This is especially important to buyer and seller timelines. As roughly 28% of business owners intend to sell by 2024, and buyers continue to increase their desire to purchase, seller financing continues to play an impactful role.

In good news for sellers, because interest rates are on the rise, so are the rates on seller financing, allowing sellers to enjoy tax benefits and meet buyer demands as well.

2. Restaurants show a steady comeback, while the retail sector shows a decline.

The restaurant sector has been making a slow but steady comeback post-pandemic. Restaurants saw a 10.3% increase in transitions from last year, and sale prices increased 15.9% from the previous quarter and 6.7% from the previous year. While these numbers are positive, the report indicates that many restaurants are still struggling, offering purchasing opportunities from competitors.

While restaurant numbers have increased, retail numbers are showing a decline. 2022 showed promising numbers post-pandemic, but with more consumers purchasing online and higher interest rates and inflation, these numbers have slowed in 2023. According to the report, retail transactions declined 12.3%, sale prices dropped 22%, revenue slipped 24%, and cash flow fell 9.4%.

3. Buyers continue to seek independence with entrepreneurship.

The number of interested buyers looking to leave their traditional jobs and embrace entrepreneurship continues to rise. The report indicates that 46% of surveyed buyers want to leave their current position to be more in control of their future. This is good news for the baby boomer generation looking to exit the market, even though some want to reinvest in other markets.

It’s also important to note that service businesses made up the largest number of companies for sale recently. Almost half of the sales recorded in the second quarter were service-based businesses, and 59% of surveyed buyers indicated they were interested in purchasing a service-based business.

Outlook for the remainder of 2023:

The BizBuySell report indicates that interest rates continue to be the most significant factor in the small business market. Some sectors are seeing a return to the workforce, while others are still experiencing stagnant or declining numbers. However, there are a few positive notes to consider:

The baby boomer generation continues to exit the market. According to the report, 47% of sellers surveyed marked retirement as their reason for exiting, while 34% indicated burnout. As this age group continues to leave the market, it creates new opportunities for those looking to enter.

As mentioned, seller financing should be considered. This can be a great selling point to buyers looking for interest rate relief and impact new requirements from lenders.

Next Steps

As market conditions continue to change and evolve, and as more buyers indicate their desire to purchase a business, it’s essential to fully understand the value of your company. Are you looking for a Sacramento business broker? Reach out today for a free consultation.

Original source: https://www.sacramentobusinessbrokers.com/post/q2-bizbuysell-report-shows-continued-increase-in-small-business-acquisitions

#businessbroker #sellingabusiness #business

1 note

·

View note

Text

0 notes

Text

Q2 BizBuySell Report Shows Continued Increase in Small Business Acquisitions

The second quarter of 2023 was interesting. Typically, the summer months, especially July, are slow. However, this year, our firm saw an increase in business owners reaching out to learn about selling their business.

While interest rates continue to climb and put pressure on the selling prices, the number of businesses listed for sale continues to grow.

Q2 BizBuySell Report Shows Continued Increase in Small Business Acquisitions

BizBuySell has recently released their insight report for the second quarter of 2023. These reports are helpful to business owners and potential buyers as they project market trends and explain what was on the rise and what declined over the past three months. To see the full report, you can visit BizBuySell’s website. Here is an overview of what was presented and where market trends are leading as we progress through 2023.

Full report: https://www.bizbuysell.com/insight-report/

Overview

The most important statistic from the last three months is that business acquisitions increased by 8% versus just 4.8% in the first quarter of the year. This continues the positive trend that buyers and sellers are adjusting to an environment with higher interest rates.

However, it’s important to note that while acquisitions are trending upward, sale prices have continued to trend downward. In the second quarter, the median business sale price dropped 14% to $300,000 largely due to higher interest rates.

While the decline in the sales prices may seem like bad news to buyers, this decline proves that sellers need to get more creative with their offers. For instance, sellers may have to offer financing or increase the monthly rent on the buyer’s lease.

Overview of business sales and listing information for Sacramento, CA

In the Sacramento, Arden-Arcade, and Roseville, California areas, the median asking price continued to increase. The median asking price rose to $399,000, and listings increased from 253 to 264. Median revenue also increased significantly from $550,000 to $609,445.

Here are 3 Key Takeaways from BizBuySell’s report:

1. Seller financing continues to play an important role.

With higher interest rates, many buyers and lenders require some form of seller financing. This can seem challenging for sellers as only 22% plan to offer it, while 70% of potential buyers intend to ask sellers to finance at least part of the deal.

However, sellers need to stay flexible and consider adding financing to their deals. Leaving out this crucial component can reduce the amount of potential buyers and, in some cases, be a deal breaker for lenders, as many lenders are beginning to require at least a 10% note from sellers. This is especially important to buyer and seller timelines. As roughly 28% of business owners intend to sell by 2024, and buyers continue to increase their desire to purchase, seller financing continues to play an impactful role.

In good news for sellers, because interest rates are on the rise, so are the rates on seller financing, allowing sellers to enjoy tax benefits and meet buyer demands as well.

2. Restaurants show a steady comeback, while the retail sector shows a decline.

The restaurant sector has been making a slow but steady comeback post-pandemic. Restaurants saw a 10.3% increase in transitions from last year, and sale prices increased 15.9% from the previous quarter and 6.7% from the previous year. While these numbers are positive, the report indicates that many restaurants are still struggling, offering purchasing opportunities from competitors.

While restaurant numbers have increased, retail numbers are showing a decline. 2022 showed promising numbers post-pandemic, but with more consumers purchasing online and higher interest rates and inflation, these numbers have slowed in 2023. According to the report, retail transactions declined 12.3%, sale prices dropped 22%, revenue slipped 24%, and cash flow fell 9.4%.

3. Buyers continue to seek independence with entrepreneurship.

The number of interested buyers looking to leave their traditional jobs and embrace entrepreneurship continues to rise. The report indicates that 46% of surveyed buyers want to leave their current position to be more in control of their future. This is good news for the baby boomer generation looking to exit the market, even though some want to reinvest in other markets.

It’s also important to note that service businesses made up the largest number of companies for sale recently. Almost half of the sales recorded in the second quarter were service-based businesses, and 59% of surveyed buyers indicated they were interested in purchasing a service-based business.

Outlook for the remainder of 2023:

The BizBuySell report indicates that interest rates continue to be the most significant factor in the small business market. Some sectors are seeing a return to the workforce, while others are still experiencing stagnant or declining numbers. However, there are a few positive notes to consider:

The baby boomer generation continues to exit the market. According to the report, 47% of sellers surveyed marked retirement as their reason for exiting, while 34% indicated burnout. As this age group continues to leave the market, it creates new opportunities for those looking to enter.

As mentioned, seller financing should be considered. This can be a great selling point to buyers looking for interest rate relief and impact new requirements from lenders.

Next Steps

As market conditions continue to change and evolve, and as more buyers indicate their desire to purchase a business, it’s essential to fully understand the value of your company. Are you looking for a Sacramento business broker? Reach out today for a free consultation.

source https://www.sacramentobusinessbrokers.com/post/q2-bizbuysell-report-shows-continued-increase-in-small-business-acquisitions

2 notes

·

View notes