Text

Asset Liability Management

5. DEBT SECURITIES

5.1 Overview

5.1.1 What this module covers

· Debt securities are debt instruments (i.e. contracts) that can be bought or sold between two parties.

· They have agreed terms such as interest and maturity date

· A debt is created when the security is issued, whereby the issuer (or borrower) owes an agreed set of payments (how interest calculated and capital payment at maturity and when to pay them and its timing) to the investor in the debt security.

· Risk of debt security -> possibility that the agreed payment terms are not fulfilled -> borrower defaults on repayments of interest or principal payments

· Debt can take different forms:

o Defined in terms of a local or foreign currency or by reference to an index such as a CPI

o Can have fixed or variable rate of interest

o Can be repayable at a fixed date or perpetual debt with no fixed term for repayment

o May be tradeable on an exchange (or any organised market) to be sold before the maturity date

5.1.2 Setting the scene

· Global bond (debt) markets far outweigh global equity markets in both market value and annual issuance.

· Bond market is a key source of capital for business and gov’ts -> investment opportunity for institutions as well as individuals

· Investors are attracted to investment in debt securities -> compared with equity or property debt securities offer (near) certainty of the agreed payments, which usually include interest payments and the return of capital at a set point or points in time.

o Enables them to arrange their financial affairs to meet their liabilities with more certainty

o Trade-off for less uncertainty -> accepting a lower long-term return on debt securities compared to equity or property.

5.2 Main types

5.2.1 Overview

Well-known types of debt securities

Examples

Deposit

Cash, term deposit

Money market security

Certificate of deposit; Bill of exchange (including bank bill); Promissory note; Treasury note; Repurchase agreement

Debt market security

Government bond; Corporate bond; Floating rate note; Inflation-linked bond

· Cash instruments in money market (<1 year maturity) and debt capital market (>1 year).

· Debt securities are used to build derivative investment products:

o Mortgage-backed security (MBS)

o Collateralised debt obligation (CDO)

o Credit default swap (CDS)

5.2.2 System T

· Characteristics that influence the risk and return expectations of the asset class or security under consideration:

o Security (i.e. default risk where agreed payments of interest or capital are not made)

o Yield (i.e. real/nominal, expected return/running yield relative to other assets)

o Spread (i.e. expressed as a required margin of yield over government securities of the same term to compensate for increased risk of default)

o Term (i.e. short, medium, or long, expressed in remaining years to maturity)

o Expenses (i.e. dealing and management) or Exchange rate (i.e. currency risk)

o Marketability (i.e. tradeable on an exchange or market, liquidity related to volume traded, or non-tradeable, or illiquid

o Tax

5.3 Deposit securities

· Are debt that arises by an investor placing (deposit) their money with a bank (or any building society or credit union) and receiving interest on the amount deposited.

· Deposit taker in Australia must be an authorised deposit-taking institution (ADI) -> bank, credit union or building society under the supervision of the regulator -> APRA

· They are either at-call deposits -> investor can have access to the deposit at any time or term deposits -> investor cannot access their account for an agreed period.

5.3.1 At-call deposits

· Depositor/ investor has instant access to withdraw the deposit or required to provide a very short notice period before withdrawing their capital.

· Fees maybe charged or adjusted with interest payable to cover expense recovery and profit margin.

· Cash deposits often called sight deposits or call deposits

Return

· No capital gain and investment returns are interest paid by issuer of the security (deposit taker). Interest can be:

o Fixed for the duration of the deposit

o Fixed for an initial period and then varied

o Variable day on day

o Higher or bonus rate paid if certain conditions are met e.g. no withdrawal

· Cash rates are usually linked to central bank’s cash rate (used to achieve target inflation).

· In Australia, over long-term, cash rates have been higher than inflation -> good real return for the investor. But at times, with negative real return (e.g. COvid-19 where cash rate was 0.25% and inflation was 1.8% with real return of 1.55% p.a.)

Risk

· Well-regulated economy -> lower likelihood of failure of cash deposit taker (except during GFC).

· Gov’ts introduced a guarantee to reassure investors that their cash was ‘safe’ in local banks -> to prevent a run on banks’ capital.

· E.g. Australia -> Financial Claims Scheme (FCS) -> protections to deposits in ADIs and to policies with general insurers if their fail (up to $250,000 per account holder).

5.3.2 Term deposits

· Varying terms and conditions

· Investor has no access to the capital before the end of the agreed period of time.

· Can gain access to the funds earlier than the original term under certain conditions -> investor may be penalised e.g. loss of interest or payment of exit fees

· It will also affect the expected return the investor will receive in order to compensate for the ‘loss of access’ -> issuer will likely to price deposit to balance for their need for capital now and expectations of future cash rates failing/rising (making it cheaper/more expensive to raise capital in the future).

· Suits investors with known liabilities that require funding at a known future date or those with no specific liability but a strong aversion to loss.

Return

· At-call deposits -> no capital gain and the return is interest paid by issuer of the security

· Term deposit rates are quoted daily -> secure deposit to issue loans to customers

· Factors affect term deposit interest rates set by banks:

o Cash rates set by the central bank (RBA)

o Market competition between banks for deposits

o Banking regulations

· Ex 5.1: Research the relationships between cash rates set by the RBA and the inflation rate.

What are your observations on the cash rate and inflation rate?

By what theoretical mechanism does the cash rate influence the inflation rate?

Is there evidence of this relationship?

o The cash rate has essentially trended down since 1990 from 17.5% to 0.25%. For a reasonable period, it ranged between 5% and 7% pa; however, since the GFC (dropped) and recovery (rose) it has gradually been reduced to 0.25%.

o The inflation rate has been more volatile and has remained within a smaller band (1% to 5% pa).

o Economic growth tends to fluctuate around a long-term trend. When the economy grows too slowly because of weak demand, the RBA can lower interest rates to stimulate economic growth and employment. On the other hand, when the economy grows too quickly because of excessively strong demand, the RBA can raise interest rates to dampen economic activity and contain inflation.

o It is important to remember that monetary policy is a tool used to smooth fluctuations in the business cycle. While it can help support long-term economic growth by avoiding costly recessions or financial crises, it cannot create long-term economic growth by permanently stimulating demand. Any attempt to do so results in higher inflation. Long-term economic growth is ultimately determined by the availability and productivity of an economy’s resources such as labour, land, and capital.

o In May 2020 (cash rate 0.25%, inflation 2.2%) the RBA had no plans for further lowering cash rates with the most recent minute noting ‘The yield target [0.25% pa for 3 year bonds] was expected to remain in place until progress was made towards the goals for full employment and inflation’.

· Interest rates for term deposits vary based on:

o Term

o Amount invested

o Interest payment frequency

o Early exit fees/penalties

· Investor benefits if market rates declining during the term -> as they will be paid at the higher rate. But these expectations about the future will drive both investors and deposit takers when a new term deposit is issued.

· Investors expecting a fall in cash rates -> seek longer term to lock in current higher rate for longer period. So banks offer lower rate for longer-term deposits.

· Ex 5.2 Select one Australian ADI and obtain their term sheet. Figure 5.3: ANZ Term Sheet is an example of the ANZ Bank term deposit rates on 17 April 2020. What factors influence the rates being offered?

o Term of deposit (longer term earns slightly higher rate)

o Amount of deposit (higher amount earns slightly higher rate)

o Cash rate — Small/short-term approaching cash rate plus a margin

o Bond rates — Large/long-term approaching 10-year bond rate

o Bank margins — All deposit rates are below the corresponding mortgage or business loan rate being offered to customers, to ensure a margin for the bank

Risk

· Failure of a term deposit taker is very low in markets if the banking sector is regulated and supervised (similar to cash on deposit). But possible -> guarantee schemes by FCS apply to term deposits.

· Investor accepts the risk of market interest rate increase during the term -> will not be passed onto existing term deposits. But can be broken (with penalty) to rest the interest rate.

· Ex 5.3: How do the cash flows differ, in terms of timing and amount, between a fixed rate term deposit at a fixed interest rate and an instant access cash account with a variable interest rate?

o All the cash flows are known in advance at the point of purchase in terms of timing and amounts for a fixed term deposit at a fixed interest rate.

o The actual cash flows are:

§ One deposit

§ Repayment of capital at agreed time with accrued interest at agreed rate on amount deposited.

o Contrary to this, the amounts and timing of cash flows are unknown at the point of purchase for an instant access account with variable interest.

o The actual cash flows are:

§ Deposits and withdrawals by investor at any time, any amount

§ Credit of interest at the end of each agreed period (e.g. monthly) at the interest rate for that period applied to the daily account balance for that period.

5.4 Money market securities

5.4.1 General background

· Basic structure -> an investor lends capital to a borrower for a short period (<1 year) at an agreed rate of interest (margin above reference rate). Then the investor receives capital + interest earned at the end of period.

· Money market securities are issued at a discount to the maturity value (par), to reflect interest and then redeemed at par -> discount securities (return is earned due to the amortisation of the discount b/w time of issue and maturity date -> interest).

· Short term (overnight or up to 365 days)

· Money markets -> transactions in money market securities

· Dominated by banks over other financial and non-financial institutions who manage their own liquidity -> issue if they need short-term capital or purchase if they have excess short-term liquid funds.

· Central banks -> act as lenders of last resort to provide liquidity or use money market to establish short-term interest rates (via sale or purchase of certain money market securities and subsequent repurchase or sale at agreed price – repurchase agreements)

Return

· Short-term interest rates (money market rate or Treasury bill rate) -> rate for short-term borrowings between financial institutions or rate at which short-term government paper is issued or traded in the market.

o They are average of daily rates (as %).

o They are based on 3-month money market rates

· Investors use interest rate benchmarks -> assess current pricing for ST money market securities and observe historical experience.

o Also used in corporate borrowing rates and in financial contracts (derivatives and asset-based securities)

· Interbank rates have been the most common benchmark for short-term interest rates.

· The RBA cash rate and BBSW (bank bill swap rate) continue as Australia’s key short-term interest rate benchmarks.

Risk

· Money market securities can be attractive to risk-averse investors -> due to stability of capital values.

· Over the long-term money market, securities are expected to provide a lower return than riskier or less liquid investments.

· All securities in this market are short term, do not pay interest during the term, and have a fixed maturity date.

· The key distinguishing characteristic between the types is the credit risk.

Types

· 5 types of money market instruments:

o Certificate of deposit

o Promissory note

o Bills of exchange

o Treasury notes/ bills

o Repurchase agreements

5.4.2 Certificate of deposit (CD)

· Is a term deposit that is traded between investors (cash term deposits are not tradeable)

· Duration is usually 7-365 days

· Features:

o The ‘certificate’ acts as an acknowledgement for money that has been deposited with a bank — therefore, it is issued by a bank

o CDs are freely negotiable — the initial investor can sell their certificate to another investor, who then has the right to receive the interest and capital from the bank

o CDs are only issued if the amount is sizeable

o CDs are issued at a discount to par, where the investor deposits say $0.95m and receives back $1m a year later, where the $0.05m difference is the interest payment

5.4.3 Promissory note

· A written promise for the amount owed to a specified counterparty at a specified time or on demand.

· Settled through the payment of the amount owed by the borrower (maker of the note) to the lender (the payee, or the bearer of the note).

· Banks may issue promissory notes, these debt instruments allow funding from non-bank sources.

· They are usually:

o issued for relatively short terms, say 185 days or less

o must be signed by the party making the promise

o must be for a specific sum of money; must specify the time for repayment

o must be in bearer form

o are transferable by delivery without endorsement

o are issued and traded at a discount

o are redeemable at maturity

· If it is unconditional and readily saleable -> negotiable instrument

· Difference b/w an unsecured and a secured promissory note -> secured note is guaranteed by a certain asset (e.g. property or vehicle), whereas an unsecured note does not have any collateral associated with it.

· Credit or default risk -> credit risk of the issuer as well as the value of the secured asset (if any).

· Commercial paper -> an unsecured promissory note with a fixed maturity of < 270 days.

o Is issued by companies for the purpose of raising capital directly from the market.

o Returns are as good as treasury bills due to low security offered.

5.4.4 Bills of exchange

· An unconditional order in writing, addressed by one person to another, signed by the person giving it (the maker or borrower), requiring the person to whom it is addressed (the acceptor -> usually bank) to pay on demand or at a fixed or determinable future time, a sum certain in money or to the order of a specified person (the bearer).

· Negotiable instrument maturing within 6 months sold at discount (redeemed at faced value).

· Can be also redeemed at another bank or broker at a discount.

· If bank is the acceptor -> accepted bill of exchange or bank bill

· The bank has endorsed the bill on the back, either through buying the bill in the market or for a fee to raise the bill’s status -> bank endorsed bill

· Bank accepted bills -> Carries negligible risk of default -> highly marketable

5.4.5 Treasury notes

· Many central governments offer short-term debt securities that are guaranteed by that government and usually assumed by investors to be free of default risk (but not always).

· Australian Treasury notes are a short-term discount security redeemable at face value on maturity. Terms are less than 12 months. Treasury notes are issued to assist with the Australian Government's within-year financing task -> low risk and secure investments.

· Ex 5.4 In Australia, the most important types of discount securities are Treasury notes and bank accepted bills of exchange (bank bills). Determine the current value of these securities on the Australian short-term money market.

o Two useful resource sites that will help are: https://www.aofm.gov.au/securities/treasurynotes and https://afma.com.au/

5.4.6 Repurchase agreements

· Where the party willing to buy the underlying security provides the party selling the asset with temporary capital in exchange for the underlying security as collateral.

· Very short term borrowing or lending (overnight)

· Then the party selling the asset has an obligation to repurchase the asset at an agreed price (hence the term ‘repo’).

· Important to maintain liquidity in the secondary market.

· In Australia, each bank holds an exchange settlement (ES) balance with the RBA -> an at-call cash deposit, must be positive at all times. If not, they may need to borrow temporarily from another bank to provide cash for the ES balance to the RBA.

· There are transactions between the government (RBA is the banker) and the commercial world (commercial banks) daily that change the ES balances via repurchase agreements.

· To inject ES balances, the RBA provides cash to a bank and the bank provides eligible debt securities as collateral to the RBA. This protects the RBA from counterparty default losses by the bank. Then the next day, bank returns the ES balance and RBA returns the securities to the bank.

· Therefore, the underlying debt securities do not have to be sold to any other market participant to obtain the required cash.

· Ex 5.5 Provide an example of when a reverse repo is likely to occur.

o A central bank can use reverse repos as part of implementing their monetary policy. In doing so, the central bank would borrow money from banks to control the money supply in the country.

5.5 Bonds

5.5.1 General background

· Entity require longer-term capital -> equity or debt

· To raise debt -> entity creates and sells (issues) a debt security.

o In return they pay interest to the purchaser and repay the principal at the end of the term of the security.

· Bonds -> longer-term debt securities (>365 days).

· Coupon or coupon payment -> annual interest rate paid on a bond, expressed as a % of the face value and paid from issue date until maturity.

o Coupon rate -> (sum of coupons paid in a year)/(FV of the bond)

· Bond investor has an initial –ve cash outflow, followed by small known +ve CFs and a final amount at specified future dates known in advance.

o They can sell the bond before the end date -> actual yield will be different to expected.

o When holding long-term securities, pricing fluctuations each day might be significant short term -> which can be higher or lower than cash rate or inflation and may even be negative -> difference between return and current yield to maturity (gross redemption yield)

· CFs of bonds is known in advance in absolute terms or by reference to some benchmark or event (in monetary terms) at the point of entering the agreement.

o Conventional bonds -> payments fixed in monetary terms.

o Bonds can be linked to inflation or short-term cash rates.

· But there is still uncertainty on credit risk of the issuer -> probability that the issuer will default on some or all of agreed interest or capital payments at maturity.

· Bond investor has provided a leverage to the bond seller -> borrowing will increase the leverage of the borrower -> greater risk of default.

o Bond investor receives at most what has been contractually agreed.

o If seller invests the loan in a business venture and is successful, the profit is not shared with the investor.

· Bond is issued in primary market and traded in secondary market. Can be traded through bond markets, stock exchanges or via private placements.

· Quoted prices in the secondary market excludes next coupon payment -> flat price or clean price. Purchaser pays flat price + accrued interest at the settlement date.

o Dirty price -> sum of clean price + accrued interest

· Three options:

o Callable bonds (redeemable bond)

§ Issuer may redeem before it reaches the stated maturity date

§ Allows issuing company to pay off their debt early

§ May happen if interest rates move lower -> allows the business to re-borrow at a more beneficial rate

§ Has more attractive interest rate or coupon rate -> to compensate investors for the risk of redeemed at a time unfavourable to them

o Puttable bonds

§ A debt instrument with an embedded option that gives bondholders the right to demand early repayment of the principal from the issuer.

§ Incentive for investors to buy a bond that has a lower return

§ Can be exercised upon the occurrence of specified events or conditions or at a certain time or times

o Convertible bonds

§ Corporate debt security that yields interest payments but can be converted into a pre-determined number of common stock or equity shares.

§ Conversion can be done at certain times at the discretion of the bondholder.

§ Hybrid security -> price is sensitive to changes in interest rates, price of the underlying equity stock and the issuer’s credit rating.

5.5.2 Bond returns

· In general,

o returns to the investor come from the contracted cash flows or the sale of the securities.

o if the issuer (borrower) gets into financial difficulties and cannot pay the contracted cash flows, the investor (lender) may be left with nothing, even though their investment ranks ahead of equity investors

o there is no upside for the investor in terms of bonus payments or profit share if the issuer does well financially, only the contracted payments

o Therefore, the certainty of receiving the payments (i.e. the quality of the credit) is the most crucial factor in assessing the risk of a debt security.

· The country of issuer, listing or purchaser might affect legal action to enforce payment.

· For a specific bond,

o Return is determined by the value and timing of the future cash flows over the remaining life of the security to maturity

o Risk is predominantly measured as the expected loss in the event of cash flows not being received as promised or anticipated at the time of the investment.

· Investor can buy a debt security and either:

o Hold the security to maturity receiving all coupons and the principal; or

o Sell the security prior to maturity receiving none or some coupons and the sale price.

· Returns may be different as the market price of security may change over time (unlike principal).

· Yield to maturity or gross redemption yield -> IRR that results in sum of PVs of the CFs, discounted at this rate = current market price of the bond (if held to maturity).

o There is a clear relationship b/w market price and market rate of return (or yield to maturity)

· Yield to maturity is based on the following assumptions:

1. The bond is held to maturity

2. The issuer does not default on any of the payments -> all coupons and principal payments are received as per the original agreed dates

3. Coupon payments can be reinvested at the same rate

· In reality, insurers don’t hold bonds till maturity.

· Valuation of debt securities depends on 3 factors:

o The amounts of CFs and their timing prescribed in the contract

o The probability of the CFs occurring -> requires credit analysis

o The appropriate rate of interest to use to calculate PV of the CFs as determined by market forces (yield to maturity can change at any time)

· Factors that affect the yield to maturity on bonds include:

o Supply of bonds (gov’t bonds) -> relates to govt’s fiscal policy.

§ If governments fund fiscal deficits through the issuance of bonds, then bond yields at those targeted durations will rise as prices will need to fall to tempt buyers (increase supply to lower the price)

§ E.g. gov’t decides to switch to issuing inflation-linked bonds -> decrease in supply of conventional bonds -> price increases -> yields will fall

o Demand for bonds -> arises from private and institutional investors

§ Institutional demand may change depending on savings patterns as a result of gov’t policy

§ E.g. 2020 early withdrawal of super -> superfunds selling more liquid assets such as bonds, increasing supply to the secondary market.

§ gov’t relaxes the need for insurance companies to hold bonds -> demand may fall.

§ Gov’t imposes compulsory annuitisation on work-based pension savings -> increase demand for gov’t issued bonds and high-credit-rated bonds.

o Issuing organisation

§ Each have different credit ratings -> affects the demand for these bonds due to marketability or liquidity of an issue.

§ Credit risk (probability of payment) and liquidity risk (difficulty of selling before maturity) changes by organisation.

§ E.g. credit risk -> default by issuer where sovereign governments have been known to default on government bonds from time to time.

§ Use credit ratings to place a value on the risk of default.

§ Lower the credit rating -> investor would expect a higher margin over the risk free rate -> devalues the security.

§ Credit spread -> the difference in yield between two securities of the same maturity but different credit quality.

· Credit quality assessed against that of a flagship government security (e.g. US treasure bond) which is risk free.

· The difference in yield is quoted in basis points (1% is 100 basis points).

· It indicates the additional return that the buyer is seeking in compensation for the credit risk assessment of the issuer.

o Expected inflation

§ Conventional bonds are exposed to this

§ Past data show long periods where interest rates are above inflation.

§ They set an expected margin for risk-free interest rates above price inflation.

o Uncertainty of inflation

§ Investors add margin to reflect the uncertainty.

o Exchange rate

§ In the long run, changes in the price level in one country will cause changes in nominal exchange rates, thus keeping the real exchange rate constant. This suggests a link between long-term bond yields across similarly rated countries.

o Taxation

§ Taxation of bonds will affect demand.

§ E.g. coupons taxed as income and proceeds taxed as capital gains/losses. If the tax rates between income tax and CGT are different -> it will affect the demand for high or low coupon bonds.

o Return on US bonds

§ This is due to the size of US market -> all bonds are priced in relation to them

§ Pricing model is a 2 staged process:

1. The risk-free real rate in the US Treasury market reflects the supply and demand of global capital.

2. The nominal risk-free government rate in other countries is priced off the US rate plus local factors of exchange rates, inflation expectations, economic factors, and political stability.

3. Credit assessment of the various issuers (both government and non-government) leads to various appropriate credit risk premiums, defined as a percentage per annum additional to the yield on the risk-free (US) government bond of a similar maturity.

§ Global rate is long-term rate -> local central bank has little control of

§ Floating exchange rate -> If the local central bank sets the cash rate too high (in the eyes of the global market), then foreign investors will demand more local currency and the exchange rate will appreciate, reducing international competitiveness. The reverse applies for a cash rate that is too low.

§ Nominal interest rates are driven by inflation and growth expectations (short and long ends of the yield curve).

§ Assume that observable gov’t bond yields are a proxy for the unobservable risk-free rates.

§ Nominal risk free yield = risk free real yield + expected future inflation + inflation risk premium

§ Short end -> local CB changes the cash rate affecting its monetary policy -> it will lift rates if the economy is expanding too quickly and lower if it is too sluggish.

§ Long end -> erosion of purchasing power (inflation). A fixed interest investor receiving fixed coupons and principal in the future has lower real cash flows if inflation should increase. Then the other investors will try to push yields up to compensate for this erosion of purchasing power. Long-term yields are very sensitive to inflationary expectations.

Interest rate risk

· Quantitative measures of interest rate risk: Duration and Convexity

· Duration:

o Measures the weighted average time to receipt of cash flows, the weights being the present value of cash flows.

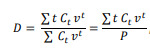

o The duration, D, say, of a cash flow sequence {Ct}, using a constant rate of interest i, say, is:

where v = 1/(1+i) and P represents the price of the CFs.

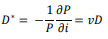

o The modified duration, D*, say, is:

-> measure of the sensitivity of the price of the security to a change in interest rates.

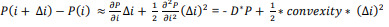

· Convexity

o Proportional second derivative of price with respect to yield.

o Combining duration and convexity -> good approximation of the price-yield relationship.

o Convexity is a measure of the curvature, or the degree of the curve, in the relationship b/w bond prices and bond yields.

o Shows that duration of bond changes as the interest rate changes -> convex

o Used by portfolio manager to measure and manage the portfolio’s exposure to interest rate risk.

· Taylor’s theorem -> show how convexity aids duration.

o Let P(i) denote the price of bond at rate i.

o For small, or sudden, changes in interest rates, duration will indicate how bond prices will change.

o Convexity is a better measure for assessing the impact on bond prices when there are large fluctuations in interest rate

· Duration and convexity have their limitations as risk measures, due to:

o The inherent assumptions about the yield curve shape and yield changes;

o The features of particular debt securities, including embedded options and interest sensitive cash flows.

· Duration and convexity are measures of sensitivity of bond prices to shifts in yield, rather than measures of the probability of loss.

Relationship between characteristics and price

· Price of a fixed rate bond will change whenever the assumed yield changes.

· Relationship between the price of an instrument and the yield:

o Price is inversely related to the yield. As the yield increases, the price will decrease and vice versa

o Given the same coupon rate and time to maturity, the absolute change in price is greater when the yield decreases compared to when it increases — the convexity effect

o Given the same time to maturity, the absolute change in price is greater for a bond with a lower coupon than a bond with a higher coupon when the yields change by the same amount — the coupon effect

o For bonds with the same coupon rate, a longer-term bond has a greater absolute change in price than a shorter-term bond for the same change in yield — also known as the duration or maturity effect).

5.5.3 Conventional government bonds

· Sovereign gov’ts issue a variety of conventional bonds with different redemption dates and coupon rates.

· Conventional -> refers to payments in nominal terms (monetary terms)

[SYSTEM T] used to determine the risk and return characteristics.

· Security:

o Often has very small or negligible risk of default for bonds issued by major sovereign gov’ts -> risk is nil if it controls fiat money.

o Security in monetary terms is usually high.

o But sovereign gov’ts can default

· Yield:

o Known at outset in monetary terms (if it is held till redemption and all coupons are reinvested at expected rate)

o Inflation adjusted return (real return) is unknown at outset as rate of inflation is unknown.

o Running yield = expected income over 1 yr/ current price -> difficult to compare against equities in recent years because of significant market swings.

o Total return is secure in nominal returns and this may lead to the conclusion that it should be lower than more risky investments -> but nominal return has a risk of inflation and consequent erosion of real return.

· Ex 5.6 Describe two scenarios where conventional bonds perform well in terms of the return achieved for the risk that is borne.

o When yields reduce, as prices will increase

o When inflation was lower than anticipated

o When other asset classes perform poorly.

· Spread

o Affected by supply and demand factors

o Spread (compensation for credit risk) is small for gov’t bonds.

· Term of government bonds

o Varies from one year to undated bonds (perpetual bonds).

o Varies by market

· Expenses

o Very low

· Exchange-rate risk -> only if the loan is not in the investor’s domestic currency

· Marketability and liquidity

o Excellent for gov’t bonds

o Low dealing costs

o Large volumes of bonds held and traded by institutional investors

o Liquidity -> assisted by an active market in derivatives based on bonds and by a market that decomposes a bond to its components (STRIPS)

o STRIPS -> Separate Trading of Registered Interest and Principal of Securities.

§ Zero coupon bonds -> pay no interest or coupon

§ Created when a bond’s coupons are separated from the bond

§ Then the bond is sold to an investor at a discount price with no coupons (no need to reinvest the coupons at a lower rate)

§ Each coupon payments also become a zero coupon bonds that can be sold separately

5.5.4 Corporate bonds

· Issued by corporations to raise capital.

· But to trade in capital market -> should meet minimum capital requirement and credit assessment.

· Corporate bonds may be secured (debentures -> unsecured) against assets of the corporation or unsecured.

· Conventional debt ranks ahead of shareholder equity.

· Some debt securities have options that allow borrower to convert it to shareholder equity rather than repay the principal.

· Corporate bonds have higher yield compared to gov’t bonds -> for additional credit risk and lower liquidity (marketability).

· Yield to maturity for corporate bonds:

o Yield = required risk free real yield + expected inflation + bond risk premium

o Bond risk premium’s main components:

§ Inflation risk premium -> additional compensation for uncertainty in the risk of future inflation

§ Credit default premium -> for risks that the bond issuer will default on payments

§ Marketability premium -> for the risk the bond can’t be resold before maturity

· Ex 5.7: Use SYSTEM T to detail the investment and risk characteristics of:

o Money market instruments

§ Security. This will depend on the issuer — for example, investing in a short-term government instrument will generally be more secure than a short-term loan to a manufacturing company. However, short-time frames often suggest that the security would be good.

§ Yield — real versus nominal. Money market instruments tend to have rates similar to official rates set by monetary authorities. These amounts will vary over time, with some instruments providing a known nominal return, such as a bill offered at a discount to face value, and other instruments having returns linked to inflation. Investors will mostly expect to achieve a positive real return, although this is not always true (e.g. during the 70s). In order to achieve positive real returns, short-term rates tend to rise with inflation.

§ Yield — expected return relative to other assets. Money market instruments are close to risk free as they tend to have a low risk of default. As a result, the expected returns will have a negligible risk premium and generally offer lower returns compared with other asset classes.

§ Spread — volatility of capital values. Due to the short-term nature and fixed nominal returns, these instruments tend to have low levels of volatility, with no volatility for cash deposits.

§ Term. The term for these instruments is usually less than one year, with the majority being very short, such as overnight deposits.

§ Expenses. Expenses are relatively minimal for these types of transactions.

§ Exchange rate. Money market instruments are available in most currencies and will introduce exchange-rate risk if it is bought in a foreign currency. Theoretically, movements in exchange rates are expected to compensate for interest rate differentials; however, in practice, realised exchange-rate movements can be unpredictable and very volatile.

§ Marketability. This depends on the instrument with some instruments not being marketable, for example call and term deposits. Other instruments can be highly marketable, but these tend to be through the interbank money market.

§ Tax. Common practice is to treat the total return as income for tax purposes.

o Corporate bonds

§ Corporate bonds have generally the same characteristics as government bonds, with the exception that they have:

· generally, lower levels of security, the extent of which will depend on the issuer

· lower marketability as issue size tends to be significantly lower

· higher yields to allow for marketability and default risk.

§ Conventional government bonds recap:

§ Security. The closest to being risk free for developed countries and where the government is highly rated.

§ Yields. Income streams from these bonds are flat and capital gains are limited (if the bonds are held to maturity). For this reason, income levels tend to be higher, compared with equities or property.

§ Yields — real versus nominal. If the bonds are held to maturity, then the expected nominal return is known in advance. However, uncertainty remains for the following reasons:

· reinvestment of coupons will be at an unknown rate, unless they are used to meet liabilities as and when they are received

· if the bonds are sold before maturity, the yield achieved will not be known in advance

· real yields depend on future inflation and as this is unknown in advance the real yield will be unknown in advance.

§ Yield — relative return. The lower risk implies a lower return; however, this ignores inflation risk. When inflation is uncertain or high, history suggests higher nominal returns. Over long periods, returns are generally lower than equities.

§ Spread — volatility of capital values. Changes in supply or demand will affect market values; however, volatility tends to much lower compared with equities.

§ Term

· Short-dated (less than 5 years)

· Medium-dated (5–15 years)

· Long-dated (> 15 years)

· Undated (i.e. irredeemable)

§ Expenses. Transaction costs are relatively low compared with other asset classes due to high levels of liquidity and marketability.

§ Marketability. Marketability is usually very good with relatively large quantities transacted with little impact on price. Low dealing costs, large quotation sizes, a developed derivatives market, and the STRIPS market all assist with marketability.

§ Tax. Tax treatment varies between countries and is country-specific.

5.5.5 Inflation-linked securities

· Has coupon set as a margin over a specific index, typically CPI.

· This margin is referred to as real return or real yield -> specified in the contract

· E.g. Australian gov’t issued inflation-linked bonds -> nominal amount of security is adjusted for CPI each quarter. Lagged by one quarter based on average of previous two.

· Interest based on the adjusted nominal FV (indexed value) x fixed coupon (margin) and is normally paid quarterly. On redemption, adjusted capital value (indexed) is paid.

· Calculation is complicated. Investors assume income and maturity payments are adjusted for inflation.

· Indexed bonds are traded on ‘real’ yield (return above inflation) basis, convertible quarterly -> formula similar to fixed coupon.

· Real return is known (if held to maturity) and is valuated based on the assumptions that the reinvested rate has the same margin as the coupon rate, but inflation index returns are not known in advance.

· No lags between coupon payments and underlying inflation index. But in practice there is -> it limits an index-linked security’s ability to hedge inflation risk as the CFs do not related to the inflation index at the time of payment due to delays in calculating the index. Also sometimes the issuer wants to know the payments in advance too -> end up using index from earlier period.

· Purchasing power diminishes over time due to inflation -> investors are attracted to a security with interest and capital that are not fixed but linked to index.

· Real yield on bonds is used as a benchmark for equities.

5.5.6 Floating rate notes

· Is a non-conventional bond -> known as floating rate bond or adjustable rate bond.

· Pays a coupon that is determined as a reference rate + specified margin. Interest paid quarterly.

· E.g. bank bill rate + 1.5% pa. In AU -> margin is over the bank bill swap rate (BBSW)

· The margin is set by the issuer (in response to market appetite reflecting credit risk) at the time of issue and is not changed. Lower margin -> lower risk (stronger credit assessment).

· Interest is not adjusted in accordance with market movements of the reference rate (usually cash rate), the capital is not as sensitive to overall movements in interest rates as a fixed coupon bond.

· Adjustable rate bond with a longer term to maturity may be sensitive to movements in the market’s expectation of an appropriate margin over the reference rate.

· Factors affecting pricing:

o Demand for funds

o Changes in Credit quality assessment

o Short term rate movements -> due to the reset mechanism on the payment dates, FRNs will pay a fixed rate until the next coupon reset date. Therefore, an investor is locked in at the current rate until it resets at the next reset date.

o Accrued interest -> as a note gets closer to the interest payment date, it builds up more accrued interest and its price, all other things being equal, will rise. When the interest is paid, the price will fall by the amount of the payment and will again start to accrue interest on a daily basis until it is paid on the next payment date. The same is true of fixed rate bonds.

· Because of the way they are structured, FRNs typically protect a portfolio when interest rates are rising -> central bank increase cash rate to slow growth in an economy, FRN income will also increase with the cash rate. Hence, FRNs are less exposed to a decline in price than fixed rate bonds under those economic conditions.

5.6 Term structure of interest rates

5.6.1 Spot and forward rates

· Bonds are often more straightforward than equities because of the relative ease of valuing the securities.

· The yield to maturity for a bond represents a single statistic that belies the underlying complexity of yields to different points in time. The phrase “term structure” is reference to any summary of this complexity that conveys how interest rates vary by term.

· Yield curve -> curve fitted to plot yield to maturity against term to maturity for similar credit rates securities.

o E.g. one may construct a yield curve from yield to maturity for the various government bonds in issue in a country. The curve is smoothed so that an individual bond’s yield to maturity is unlikely to lie exactly on the yield curve.

o Yield curve is not static and changes in response to market conditions.

o The shape of the yield curve -> represents term structure of interest rates

· Theoretically, the yield curve should be analysed bonds with same properties such as currency, credit risk, liquidity, tax status (other than time to maturity -> only reason for difference in yield) and same coupon (same reinvestment risk).

o Annual rates -> quoted for same periodicity (freq of coupons).

· These assumptions rarely hold in practice.

· Calculate the price of a bond based on a sequence of yields (spot rates) that corresponds to CFs dates -> assesses yields and reflects inherent risk and uncertainty with each CF.

o Spot rate today for a specified period = yield to maturity expected to be earned with zero-coupon bond of that period (no-arbitrage value approach) -> reflects the term structure of interest rates.

· If the price at which the bond is trading is different from no-arbitrage value -> a trading opportunity exists as it is (theoretically) possible to construct the same cash flows using zero- coupon bonds, which will have a different price (ignoring transaction costs).

· Spot yield curve -> data sets of yields to maturity for a series of zero-coupon government bonds, with a range of maturities, can be used to demonstrate the term structure.

· The spot curve (or zero or strip curve) is a sequence of yields to maturity on zero-coupon bonds.

· Gov’t bond spot rates are interpreted as the risk-free yields (default risk). There are also inflation and liquidity risk to the investor.

The observed

spot rate yield

from today (t=0) for a period of n years from now (t=n) as

yn

. The corresponding

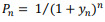

price Pn

, say, is:

· We can observe spot rates today but not those that apply in future times. E.g. one-year spot rate is y1 but one-year spot rate in one year’s time is unknown.

· The future (unknown) one-year spot rate from time t= s-1 to time t = s as rs. Apart from r1, which equals y1, rs is unknown today as future interest rates are uncertain.

o Forward rates are derived from spot rates as the break-even reinvestment rate. They bridge the return on an investment in a shorter-term zero-coupon bond to the return on an investment in a longer-term zero-coupon bond.

Denote the forward rate in the period from time t = n-1 to time t = n as

fn, then:

· Compare f2 with r2 by considering an investor who has a one-year time horizon who can receive guaranteed 1-year yield of y1.

o Alternatively, they could buy 2-year guaranteed yield of y2 and sell at the end of year 1. If the one-year spot rate at the end of the year coincides with the expected value of r2, then the return over the first year must be y1.

o However, there is a non-zero chance that the actual value of r2 ≥ its expected value. The one-year horizon investor would need to be tempted into the strategy of buying the two-year bond and selling it at the end of the first year. This would force up y2. A consequence is that the forward rate, f2, would then exceed the expected future spot rate, r2. Therefore, .

o Under these conditions, the market is dominated by short-term investors, However, if the market is dominated by long-term investors, then the opposite conclusion would be drawn —that there is a relationship between forward rates and future spot rates: where liquidity premium may be +ve or –ve.

· You can only infer the future spot rates from the current spot rates when there is no interest rate uncertainty. If there is uncertainty, the forward rates do not inform you of likely future spot rates.

5.6.2 Yield curve shapes

· Common yield curve features:

o upward slope

o a concave shape — steeply upwardly sloping, then levelling out to become almost flat at longer durations.

· Short rates are more volatile than longer-term interest rates, as the longer-term spot rates are averages of the one-year spot and forwards.

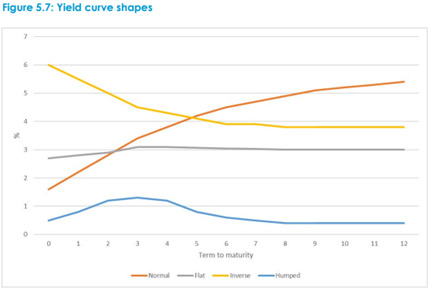

· Shapes the yield curve can take include:

o Upward sloping or normal

o Flat

o Downward sloping or inverted

o Humped

· Longer-dated gov’t bonds tend to have higher yield compared to shorter-dated gov’t bonds under normal market conditions.

· Inverted yield curve – shorter dates gov’t bonds have yields higher than longer-dated ones (spot curve is downward sloping).

· Market conditions, changing expectations, or supply and demand for particular terms to maturity can all affect the shape of the curve. E.g.

o Regulator requirement to hold long-term bonds by insurers when they are low on supply -> increases demand -> lower yields for long-term bonds but no impact on shorter-term yields -> humped curve

o Evidence that inverted yield curve is a reliable indicator of recessions in the USA.

o The flat yield curve is a yield curve in which there is little difference between short-term and long-term rates for bonds of the same credit quality.

5.6.3 Theories explaining yield curves

· Shows the factors affecting the shape of the yield curve.

· Assist when developing interest rate risk management strategies for debt security portfolios and when developing pricing models for interest rate sensitive derivatives.

1. Expectations theory:

· Aims to predict what short-term interest rates will be based on long-term interest rates, which in turn are driven by expectations of future economic factors.

Pure expectations theory states that expectations alone drive interest rates -> no bond liquidity risk premium. Therefore, forward rates = future spot rates:

1. Market segmentation theory:

· Economic theory generally states that prices and yields are determined by supply and demand.

· Market segmentation theory asserts that certain types of investors restrict their purchases to certain maturity ranges (segments) -> commonly divided into short-term (e.g. bank -> protect principal and maintain liquidity), medium-term, and long- term (life insurer selling annuities -> match LT annuity payments with guaranteed income streams).

· It says that bonds of different maturities effectively trade in different markets, each with its own supply-and-demand forces that produce bond yields. Therefore, yields from one group of bonds with a certain maturity length cannot be used to predict the yields of another group with a different maturity.

· The supply and demand in different segments lead to time-varying risk premia, which may be positive or negative.

· The yields for each segment are therefore driven by the demand and supply in that segment and each segment can have a different shape — so the overall yield curve may be quite different from what the other theories suggest would be observed.

2. Liquidity preference theory:

· Investors prefer access to their capital through liquid investments rather than having no or restricted access, all else being equal. Thus, investors expect to be compensated for locking in their capital by receiving a higher expected return than on liquid investments (such as cash).

It claims that a positive bond liquidity risk premium exists, so that investors in longer duration bonds require a higher expected return as compensation for the extra risk borne. Thus, we have:

· Theoretically, this liquidity risk premium increases with duration, which is proportional to the volatility of bond prices with respect to yield (consisted with modern financial economic theory).

· There is some empirical evidence that this bond risk premium varies over time, particularly with economic conditions.

· The theory says that longer-dated investments are seen to be less liquid than short-dated investments -> yields are expected to be upward sloping.

1. Inflation risk premium theory

· Inflation risk -> risk that the purchasing power of capital gets eroded if returns (capital growth) are lower than inflation.

· According to this theory, this risk is more likely to occur over longer periods, so inflation risk premium theory suggests that the yield curve should slope upwards to compensate for longer-term investments, which are more susceptible to inflation risk than shorter-term investments.

· These theories are not mutually exclusive as they can coexist to some degree.

· It is difficult based on empirical evidence to endorse one theory above another because:

o it is difficult to broadly measure consensus expectations

o interest rate changes can be surprising rather than predictable

o measurement of liquidity premia is difficult in the face of uncertainty and when premia may change over time

o more than one theory may be consistent with an observed yield curve.

· The lack of consensus and relatively inconclusive evidence for any one theory presents a challenge for the actuary when developing assumptions about future bond yields. Even an assumption to apply a positively shaped yield curve could be challenged.

5.7 Key learning points

• Debt securities carry their own jargon and you need to be familiar with the main terms used.

• As there is a wide array of debt securities, be able to discuss the characteristics of the main types.

• The yield to maturity is the internal rate of return from the cash flows of a debt security, using the current price and assuming that all agreed cash flows are received.

• A spot rate today for a specified period is the yield to maturity expected to be earned when holding a zero-coupon bond for a specified period.

• Forward rates measure the marginal return earned for extending an existing investment in a zero-coupon bond to a longer term.

• The main shapes that the yield curve can take are:

– upward sloping, or normal;

– flat;

– downward sloping, or inverted; and

– humped.

• The three main influences on the yield curve shape are (in order of importance):

– expectations of future rate changes;

– bond risk premia; and

– convexity bias.

• The main theories of the yield curve shape are:

– expectations theory

– market segmentation theory

– liquidity preference theory; and

– inflation risk premium theory.

• The yield curve is typically not very smooth, due to the relative supply of securities along the term-to-maturity spectrum. However, a smooth curve is often fitted as a model of the yield curve.

• The spread above the risk-free yield curve for a particular issue is a function of:

– credit risk;

– general economic conditions and the differential impact on the issuer;

– remaining term to maturity;

– liquidity; and

– relative supply of different securities.

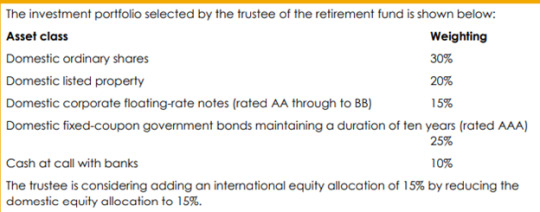

Tutorial 3

Discuss the

features of corporate debt

that would make it a suitable investment for a scheme providing benefits on retirement.

The scheme will wish to choose assets that are the most appropriate for its liabilities.

• As benefits are provided on retirement, the timing of payments is reasonably predictable, and overall for an open scheme there will be a long time frame (as members aged 25 to 65 say).

• If benefits are defined benefits (in terms of salary and service) then the value is reasonably predictable as well.

• If benefits are defined contribution (contributions plus earnings) then the benefit value will reflect the scheme’s investment earnings and potentially the member may direct the investment choices.

• Term/yield: Range of available terms. May be able to select CB with maturity dates aligned to scheme’s expected lump sum payment outflows; or coupon payments aligned to annuity payments. That is, may be able to select bonds to match, at least partially, the liability payments.

Especially helpful if scheme is closed to new entrants and running down to last payment or running a closed annuity book

• Real return: Nominal bonds have predictable returns which may be helpful in itself as above but no inflation protection; Indexed bonds ensure values increase with inflation which will assist in matching salary increases for the scheme.

• Security: Reflects underlying issuer, in developed countries with strong government rating and issued by larger corporations could be close to risk free. CB with strong credit ratings ensure scheme has good capital protection and is therefore able to pay benefits when due.

• Volatility: Price volatility lower than equities, although higher than government bonds. Scheme may have to meet minimum funding/solvency targets so lower volatility is helpful

Diversification benefits (compared to government bonds) as we expect:

o higher yield for additional credit risk;

o higher yield for reduced liquidity; and

o scope for active management.

Diversification benefits (compared to equity):

o predictable cash flows (coupon) compared to dividends;

o lower volatility in returns; and

o priority over shareholders for return of capital in event of corporate failure.

• Tax: Reflects jurisdiction, needs to be taken into account when considering net returns. May be tax payable on income, on capital gain or on neither.

• Capital gain: limited capital gain if held to maturity; successful active trading of a CB portfolio may generate capital gains for the scheme.

List the factors that influence yield differences between government and corporate bonds.

• marketability / liquidity

• supply and demand

• credit quality (of issuer and particular issue)

• corporate prospects (of issuing company)

• forecast strength of economy

• available terms

• restrictions on investors

• corporate may be convertible

Describe the possible features of a new corporate bond issue that would reduce the risks associated with it.

• Floating charge over all or some assets of company

• Fixed charge over a given asset

• Collateral provided

• Financial covenants e.g. income cover

• (No) prior ranking debt

• Rights in a technical default

• Restrictions on further borrowing / equity distribution

• Parent company guarantees

• Third party guarantees

• Shortening the term

• Increasing size of issue

ALM 2020 Exam Q1

(b) State the arguments in favour of adding international assets to this diversified portfolio.

• Arguments in support of international assets are primarily around increasing the diversification of the portfolio

• By accessing industries not available in home country

• Access to countries with different local expectations for market risk/return – there may be undervalued markets for example.

• Exposure to other currencies and movement in exchange rates, which may be favourable

• Added diversification by exposure to markets in different stages of economic cycle

• Access markets with low correlation to local market for risk/return although this is less likely now with global economic forces

0 notes

Text

Asset Liability Management

•

3. CAPITAL MARKETS

4.1 Overview

• Capital markets are the part of a financial system that is concerned with raising capital by issuing debt and equity (the primary market) and subsequent buying and selling of assets (the secondary market).

4.2 Types of asset classes

• Assets are affected by factors such as long-term return, risk (including volatility), liquidity and protection against inflation.

• Key concept: categorise groups as homogenously as possible in order to apply some form of averaging to gauge what we may expect to happen in the future.

• Asset class: category of investments that exhibit similar characteristics in the marketplace.

• Asset is a resource, owned by a company or individual, which has future economic value that can be measured and can be expressed in currency.

• Categories of assets

o Physical assets – generate rent or outputs that can be sold

o Debt – borrower returns the amount loaned with interest

o Equity – ownership of an enterprise and resulting profits are shared

o Hybrid securities – combination of debt and equity (e.g. convertible bonds, preference shares)

o Derivatives of real assets

o Securitised assets – were originally illiquid assets but have been repacked as liquid assets (e.g. collateralised debt obligations)

• Category of investments – suggests there are significant number of clearly investible assets in the universe of obtainable investments. E.g. shares from large corp in well-developed economy with readily investible via stock markets. Some assets (e.g. national parks) are not investible, other assets (e.g. small franchises) are too small to be investible by third parties

• Similar characteristics may require the components of an asset class to:

o Have similar risks and returns

o Perform in a similar manger in certain market conditions

o Be subject to the same laws and regulations

• Investments in different assets classes should

o Have different risk and return characteristics

o Perform differently in similar market conditions

The returns should be different as well. E.g. foreign shares behave diff to Australian shares, but 10 or 9-year gov’t bonds behave very similarly and should be combined into one asset class.

• Financial theory suggests that by investing in more than one asset class investors can diversify their investments and reduce risk while maintaining an overall target return.

• Individual assets within an asset class do not always move in same direction. E.g. rise in oil prices are good for oil companies but not to airlines; rise in consumer expenditure would be similar so they are part of the same asset class.

• Investment – creates wealth. Investment in an asset class should have return for the risk taken.

• Futures contracts and other zero-sum derivatives are not of themselves valid asset class, but with underlying assets, they can be useful to manage a portfolio.

• Asset classes are divided in to:

o Defensive – or income classes are debt classes

o Growth – those with element of equity (i.e. ownership of a property or enterprise)

• Alternative assets such as private (unlisted) equities, infrastructure loans and hedge funds.

o Hedge funds usually have the ability to take short positions as well as long positions

• Sector investments – refers to a sub-set of an asset class e.g. banking industry sector within equities

4.3 Capital market considerations

4.3.1 Cash deposits

• Are short-term debt instruments where the investors can have access to the funds placed on deposit often at short or little notice.

• Notice periods can range from instant access to deposited amount to no access for a fixed term (penalty may apply).

• Interest might vary on the deposits e.g. variable, fixed for a period or extreme fixed for the entire terms of the deposit.

• Cash flows can be specified in advance if its fixed term deposit with fixed interest but not for call account, with instant access, earning variable interest.

• Reflection: Considering a client’s goals, what would be the most suitable terms for placing cash on deposit for an investor who needs to pay university fees for their child in the next year? (Hint: Consider the nature and timing of the payments.)

o With an instant access account, you or your child can withdraw or deposit money at any time. Normally, you get a lower rate of interest than with other account types.

o Regular savings accounts are designed to encourage children to save an amount every month, and often run for a set amount of time, for example 12 months. If you withdraw within that time the account might reduce the interest you’ll get. These accounts usually pay a higher rate of interest than instant and easy access accounts as a result.

4.3.2 Debt markets

• Debt securities (debt instruments) have initial purchase price (i.e. investment amount or amount loaned) followed by an expectation that at least or a series of CFs will be received in the future (timing specified in advance).

• Short-term money market is primarily made up of debt securities with <365 days

• Long-term debt securities – bonds – have agreed schedule (amount and timing) of interest repayments (coupons) with fixed rate or an index-linked rate.

• Bonds’ typical categorisations are:

o Gov’t bonds – listed in local market

o Corporate bonds – listed in local market

o Overseas gov’t and corporate bond markets listed in foreign markets

• Fixed interest bond – investor pays a fixed amount (i.e. –ve CF) at the start and then receives a series of regular level interest payments followed by a final repayment of principal (i.e. capital/ redemption amount). They are predictable -> investor can determine the return on their investment.

• There is credit risk for bond holder depending on the issuer of the bond

• There is liquidity risk if the bond is sold before maturity date

• Bond price can be calculated by discounting future CFs and is driven by the yield curve.

4.3.3 Equity markets

• Investor is taking ownership of a business and shares any profits/loss and if business fail, is last in line for RoC after all other creditors.

• Common equity investment – shares of listed companies in public stock exchange. This protects public investors as they would need to meet certain standards to comply with the stock exchange’s requirements for being listed.

o Being listed also provides a secondary market for trading shares and liquidity for the investment as well as easily attainable market values for the shares

• Price of a share reflects supply/demand for it and underlying value of the business.

• Equity prices reflect company operations, future expectations and the environment in which companies exist. Therefore, same industry -> experience similar share price movements.

o Classifications are often by industries with major equity markets having separate indices that track the performance of these sectors.

• Reflection: Considering the key differences between debt and equity investments, propose investor objectives that would lead to investment in each class. (Hint: Consider both risk and return characteristics.)

o Debt investments, such as bonds and mortgages, specify fixed payments, including interest, to the investor. Equity investments, such as stock, are securities that come with a "claim" on the earnings and/or assets of the corporation. Common stock, as traded on the New York or other stock exchanges, is the most popular equity investment. Debt and equity investments come with different historical returns and risk levels.

o Debt investments tend to be less risky than equity investments but usually offer a lower but more consistent return. They are less volatile than common stocks, with fewer highs and lows than the stock market. The bond and mortgage market historically experiences fewer price changes, for better or worse, than stocks. Also, should a corporation be liquidated, bondholders are paid first. Mortgage investments, like other debt instruments, come with stated interest rates and are backed up by real estate collateral.

o Fortunes can be made or lost with equity investments. Any stock market can be volatile, with rapid changes in share values. Often, these wide price swings are not based on the solidity of the organization backing them up but by political, social or governmental issues in the home country of the corporation. Equity investments are a classic example of taking on higher risk of loss in return for potentially higher reward.

o Debt instruments, whatever they may be called, are corporate borrowing. Instead of procuring a straight commercial bank loan, the organization "borrows" from a variety of investors. This is why debt instruments, such as bonds, come with a stated interest rate, as a loan would. Equity investments offer an ownership position in the company. Owning stock makes the investor an owner of the organization. The percentage of ownership depends on the number of shares owned as compared with the total number of shares issued by the corporation.

o Investing targets may favour equity investments, if you're seeking striking growth or profit potential. Conversely, you might focus on debt instruments when you prefer consistent income and less risk. Tailor your investment actions to match your objectives and risk tolerance.

4.3.4 Property markets

• Investors ultimately acquire ownership of land and buildings.

• Return = rent – expenses + capital appreciation, which may be –ve

• Investors can purchase property directly or indirectly, via a pooled investment fund (e.g. listed vehicles called Real Estate investment Trusts) or shares in a company operating in the property sector.

• Institutional investors and pooled investment funds are able to purchase individual properties that are beyond the budget of retail investors.

• Indirect investments are good if they cannot buy (e.g. lack of sufficient capital) or might not have had the appetite (e.g. risks and low levels of liquidity) with direct property investments. Covers range of properties and improve liquidity with high correlation to listed markets.

• Property investments have idiosyncratic risk (i.e. specific and unique to the individual properties) and the characteristics of the actual properties can also vary tremendously within the asset class.

o Single property investments – large and indivisible, which influences marketability and liquidity.

o The ability to generate income depends on the quality of the tenant and this exposes the investor to risks such as vacancies and rental arrears. Investors also face the risk of buildings becoming obsolete, reducing rental income, slowing growth rates, and requiring modernisation over time. Another risk is political risk (e.g. government intervention such as rent controls) as residential property in particular is a politically significant and sensitive asset class.

• Property valuations – subjective, matter of professional judgement. Price discovery is limited to when the property is traded and usually confidential. Underlying assets are also heterogeneous which makes valuations harder.

o Listed prices are volatile and influenced by market factors.

• Reflection: For a superannuation fund with total assets over AUD$50 billion and a 15% allocation to property assets, weigh up the merits of direct and indirect property investments.

o ADVANTAGES OF DIRECT INVESTMENT

§ Greater potential for capital appreciation. The goal is to make money. Direct real estate offers the best means of maximizing returns through greater potential capital appreciation from increased property values captured when properties are sold.

§ Better tax benefits. The goal is to shelter one’s income once one has earned it. Direct real estate offers the best shelter through greater tax benefits. Unlike REITs, direct investments can pass through tax losses, which may then be used to offset taxable gains. Direct real estate investment can be particularly appealing to accredited investors.

§ Superior portfolio diversification. The goal is to protect one’s assets through diversification. Direct investment offers the best diversification benefit. While REITs are commonly marketed as having a low correlation to the stock market, direct investments have an even lower factual correlation.

§ The advantage of owning a property outright and not in partnership with anyone is that it is yours and you can gear up to 100 percent of the investment (which means you own property without equity).

§ You earn the future rewards of that property and have 100 percent decision making ability on that property.

§ The disadvantage is that the risk is 100 percent yours – in terms of financial market risk (interest rates), business risks, and the risk of default when you have tenants.

o Advantages of indirect investment

Indirect property investment has the following advantages:

1. Shares / Shares in funds

§ General Remarks

· Investment with low levels of capital expenditure as well

· Investment diversification (shares, funds, bonds)

· No involvement in refinancing, facility management, real estate management and end-users (tenants, lessees etc.)

· Comparability / benchmarking

· Liquidity of participating interests » sale on the stock market

· Improved performance / higher yields (professional real estate management and facility management

· Performance monitoring by other investors, analysts and media

· Income stream

§ For property companies limited by shares (listed on the stock market)

· Property shares may be bought and sold on the stock market at any time

· Visibility through option to publish real estate

§ For shares in property funds

· Return option

· Investor protection through investment rules and supervision

· Property bond option

· Market making opportunities for trading in shares in property funds

· Visibility through option to publish real estate indices 2. Companies

o Disadvantages

1. Shares / Shares in funds

§ General Remarks

· Dependence on the professionalism of the fund management

· Dependence on the protection of minority holdings and its effectiveness

· Complete transparency

o of mutlisectional structures, profit transfers possible

o Clarification of the structures and procedures is necessary

§ For property companies limited by shares

· Risks inherent in company purpose (no restrictions on holding and trading in real estate, e.g. additional purpose as a general undertaking or total solution provider and as a property developer [e.g. Allreal AG]

· No investment rules (in contrast to the mutual property fund, property OEICs and property CEICs)

· Voting shares for promoter as reason for not participating in the vehicle

· Group-related subordination and resultant risks

· Clarify group structure

§ For property funds

· Cost intensity (marketing costs [portfolio management commission [also retrocessions], subject to marketing outlay], fund management fees, depository bank, real estate management and so on)

· Liquidity issues (insolvency of unsellable real estate)

· Shares are only taken back at the end of the financial year, every 12 months (exceptions are possible)

· Closure of fund / compulsory liquidation

o The differences between direct and indirect property investment?

§ Direct investment in property refers to when you buy the whole or part of a physical property. As a process, this is not as easy or as quick as investing in equities or bonds, as it requires more time and more capital.

§ As a property owner you receive rent directly from your tenant, and you can realise gains or losses from the sale of the property. As a landlord you have additional responsibilities for the management of the property. Some of these require specific and specialist knowledge, such as that held by a chartered surveyor. while

§ Indirect property investment involves investing in the skills and expertise of other people, such as property or fund managers. There are a number of different ways of investing indirectly in property (see the ‘How can I invest in property?’ section). One of the most common routes into the property market, particularly for commercial property, is through collective investment schemes (such as property funds), where investors’ funds are pooled together.

§ Investors need to be aware that making indirect investments is likely to mean the performance of their investment vehicle is not wholly related to the performance of the property or properties contained within the vehicle. In addition, the tax treatment of indirect investment vehicles may be an issue. You need to be aware of the risks involved, and you should always seek financial advice where required.

4.3.5 Derivatives

• An instrument with its value dependent on the value of another security or instrument

• Some provides an option to exercise a right, others place an obligation on the investor to proceed with a pre-defined agreement.

• Forward contract – an investor agrees to buy (or sell) an asset at a specified price and specified date in the future. Has counterparty risk of not fulfilling each parties’ obligation as part of the agreement.

• Futures contract – investor agrees to buy (or sell) an asset at a specified price and specified date in the future. Unlike a forward contract, is standardised and can be traded on a recognised exchange.

• Long position in an asset – holder profits from increases in the value of the asset (while losing wealth if the asset falls in value).

• Short position in an asset – holder profits from decreases in the value of the asset (while losing wealth if the asset appreciates in value).

o For forward and futures contracts, the party having the long position has entered a contract to take delivery of the underlying asset at a specified date in the future. Similarly, the party holding the short position has entered a contract to deliver the underlying asset at a specified date in the future.

• Options – provide the option buyer with the right, but not the obligation, to buy/sell the underlying asset at a specified date in the future.

o The option seller (i.e. option writer), has an obligation to transact if the option buyer decides to exercise their right under the agreement. The price paid by the option buyer to the option writer for having this choice is called the option premium.

• Call option – holder (with long position) the right, but not the obligation, to buy a specified asset, at a specified price, on a specified date or dates in the future.