Text

HOW TO CREATE PAYSLIP ONLINE – OVERVIEW OF GENERATING PAYSLIP ONLINE

There is a tremendous growth technology application in business process management of late. The effects of pandemic have increased the usage of technology for handling invoices, salaries, payslip and projects management. Further, Technology is constantly evolving, and it has an influence on every aspect of businesses operations, including employee payment and work progress. There are many tools to generate salary slips online well as for online salary slips download.

As an employee, you have the right to know what is on your payslip and how to use it. Businesses are shifting away from paper payslips to online payslips, and further moving to intelligent tools to capture each and every aspect of work to generate meaningful payslips. Online Salary Slip Generator helps in cost savings, increased efficiency, security, and further, it will lower environmental impact.

Generally, the payslip will have two components – Income and Deductions. The components involved in creating a payslip online are outlined as follows.

Income

Here is an outline about the components falling under Income

Basic Salary

According to the draft labour law in India, the basic pay of the employees will be 50% or more of the total salary. The implementation of the labour law will also affect the salary structure of most employees as the non-perks part of the salary will come below 50 percent of the total. As a result, it is the most significant component of the salary slip and serves as the foundation for determining other deductions

Allowances

There is a practice of adding allowance in tune with the change inf cost of living. A few companies will consider it as adding a portion of their total turnover as such allowance. It is given to compensate for the effects of inflation on your wages and also pass on a portion of the increased revenue of the company to employees on a periodical basis.

House Rent Allowance (HRA)

HRA can range from 40% to 50% of the base salary. It is listed as an allowance on the payslip to help employees with paying their rent. Furthermore, it is only allowable as a tax deduction if you live in a rented house.

Performance Allowance

In the truest sense, it is an incentive to work harder. This component is entirely taxable and is intended to motivate employees to perform better at work. Each company will have its own unique formula to determine the contribution of employees

Special Allowance

These allowances are lined with the working condition and needs of the job. It can be internet allowance, phone allowance, uniform allowance, lunch allowance, local travel allowance, and more. The taxation depends on the prevailing law of each region.

Miscellaneous Allowances

These include any additional allowances provided by your employer. Medical allowances, overtime allowance, and leave allowances are examples of such benefits. These may also appear on your payslip as ‘other allowances.

Deductions

A deduction is an expense as an employee, incurred due to employment. These costs are deducted or subtracted from gross income. This is done to determine the tax liability as well. Always double-check that these deductions are in the correct order on your payslip.

Employee Provident Fund (EPF)

EPF is made up of a minimum of 12% of the basic salary on the payslip. It is a mandatory tax deduction on the payslip for those establishments falling within the purview of EPF

Professional Tax (PT)

PT is a significant component of payslips and is deducted from all individuals with an income. It’s worth noting that it’s only levied in a few Indian states. Check the tax laws in your place of employment. Furthermore, professional tax is calculated based on the individual’s tax slab.

Tax Deductible at Source (TDS)

This is the tax deducted by your employer (source). Furthermore, it is deducted on behalf of the tax department. TDS is a significant deduction from the gross salary that can be reduced by investing in tax-saving schemes.

Payslips contain salary information as well as income and deduction details, which he can use to plan his taxes and make declarations. Also, many financial institutions rely on the pattern of pay and payslips while taking the lending decision to a borrower Smartadmin is a one-stop solution for managing employee data and automating the payroll process for small and medium-sized businesses. The feature- salary slip generator of Smart Admin can be used for Payroll management purposes.

SMART ADMIN is a cloud-based software for generating GST Compliant Invoice, Payroll management, Timesheet, and Project Tracking – visit SMART ADMIN for FREE Trial and Registration.

0 notes

Text

EXPORT OF SERVICES AND INVOICE FORMAT – OVERVIEW OF EXPORT OF SERVICES

The Goods and Services Tax (GST) literature provides detailed guidelines about the content of an invoice in its various notes. The ‘Export Invoice’ related to Service is also a document containing a description of the services provided by an exporter, and the amount due from the importer. Export invoicing is governed by various laws and regulations including GST regime as well as the guidelines of RBI. Export invoices are used by the governmental authorities in the assessment and calculation of taxes.

There are three types of transactions that are related to export in GST: Export under IGST, Under Bond/LUT, and Zero- rated supply.

Under the GST Law, the export of goods or services has been treated as follows.

inter-State supply and covered under the IGST Act.

‘zero rated supply’ i.e., the goods or services exported shall be relieved of GST levied upon them either at the input stage or at the final product stage.

Zero- rated supply means that the entire value chain of the supply is exempt from tax. This means that in case of zero rating, not only is the output exempt from payment of tax, but there is also no bar on taking/availing credit of taxes paid on the input side for making/providing the output supply.

The export transaction can be completed on payment of IGST that can be claimed as refund after the goods have been exported, as per the defined procedure. In the case of goods and services exported under bond or LUT, the exporter can claim a refund of accumulated ITC on account of export. The export goods are to be made under self-sealing and self-certification without any intervention of the departmental officer.

Export invoices fall under electronic invoicing system for taxpayers with aggregate Annual Turnover of more than 10 Cr from 01st October, 2022. This ceiling will be modified on a periodical basis. All supplies to SEZs (with/without payment), exports (with/without payment), deemed exports, are also currently covered under e-invoicing except those fall under exempt list with the turnover limit.

Generating the right export invoice is an important part of export services. Business needs to ensure that it complies with all regulations while issuing an export invoice to avoid any legal or financial penalties. There are no specific guidelines mentioned for the format of invoice while exporting services. Generally, export invoices for services need to contain the following details based on the available info.

Name, address, contact details and GSTIN of exporter and similar details of recipient

Invoice number and date

Details of Shipping

Type of export and total value of invoice and currency

Conversion rate from INR to applicable currency and Total Value of the Document

Taxable Value, Tax rate and Tax as applicable, if the refund is claimed and type of export is Export with Tax

HSN Code

Signature of authorized person

Shipping bill number, date and Port are not needed for Invoice related to Export of Services as per the Annexure documentation of GST.

Exporters need to submit various forms and documents to report on their export transactions to RBI pe the type of exports and need to follow RBI guidelines. If the exporter is claiming any benefits under export promotional schemes, the relevant details should be included in the invoice. DGFT is responsible for administering various export schemes.

SMART ADMIN is a cloud-based software for Office Automation. Smart Admin Tools are designed for Payroll management, Timesheet, and Project Tracking – visit SMART ADMIN for FREE Trial and Registration.

For more information visit https://www.smartadmin.co.in/

0 notes

Text

Best GST Invoice Software

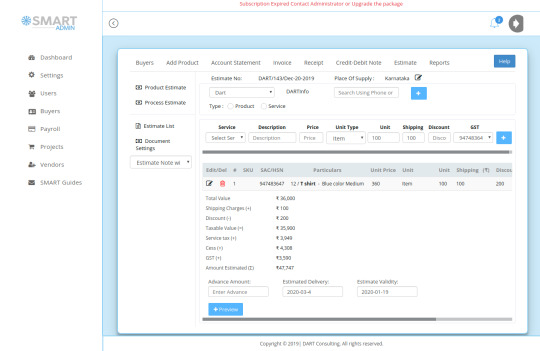

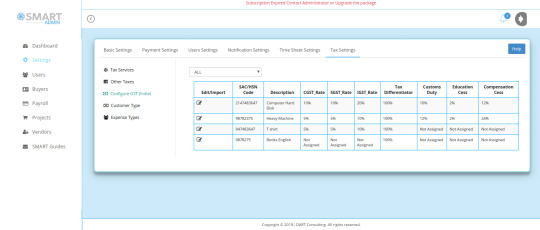

The invoicing option of Smart Admin links estimate/quote, invoice, receipt, and Credit/Debit to ensure accurate flow of data points in the overall invoicing process. This will ensure zero error in all statutory filings connected with invoicing. The invoice management software captures data points associated with each of the documents and numbers it properly. The Import and Export transactions as well as SEZ transactions of both products and services are listed in the process.

Need for using GST Invoice Software

GST Invoice Software has been designed to meet the challenges as posed by GST implementation and its frequent updates. The implementation of GST has brought multitude of challenges to small and medium business owners. The larger businesses were fully equipped to meet challenges because of their affordability to invest in costly software whereas for small businesses, it turned out to be a nightmare. The organized sector with its regular stream of tax payment process was least affected by GST and the need for GST invoice generator. The small and medium segments were bogged down by the burden of generating GST Compliant Invoice and fear of reporting wrong data. In addition, there were compelled to route transactions through banking channels to meet the requirement of large suppliers. This posed additional challenges of keeping record of each and every transaction and its proper reporting.

Smart Admin stepped into this need and developed invoice management software to match up with the requirements of GST filing and minimize errors in transactions. The billing software has been designed taking into account of the level of expertise of common man. The Smart Admin Invoice Software can be operated by anyone who can handle Gmail and WhatsApp.

Further, Smart Admin has been configured to handle the future requirements of e-invoicing as if it is going to be implemented by GST Council for B2B transaction at any time in future. With such implementation, the e-invoice generated needs to be validated at Invoice Registration Portal (IRP). This will generate a unique Invoice Reference Number (IRN) and digitally sign the e-invoice and also generate a QR code. The QR Code will contain vital parameters of the e-invoice and return the same to the taxpayer who generated the document in first place. The IRP will also send the signed e-invoice to the recipient of the document on the email provided in the e-invoice. Smart Admin GST invoice software has the option to update the invoice with IRN as generated and send the same to buyers once the feature has been implemented at any time .

The options as given for GST Invoicing Software India are expected to speed up the filing process and minimize errors. With Smart Admin, users can go for multiple GST invoice formats, receipt and cr/dr vouchers according to requirements for generating Tax Invoices under GST.

The invoice management software is linked with all other transactions to avoid duplication of efforts and missing of entries. Once you subscribe for the mobile app, then invoice can be generated on the go. Invoice will be sent to the recipients over email or SMS instantly. If you are looking for best GST Invoice Software, then we can confirm that Smart Admin is one of the best invoicing software India, a solution for you.

0 notes

Text

WHAT ARE THE DIFFERENT TYPES OF INVOICES? IMPORTANCE OF INVOICING IN AN ENTERPRISE

Generally, the invoicing process is an important activity in an enterprise. It needs to be more structured, reliable, and effective since it is the mode of asking customers to make payments and bring cash to the company. Any business selling goods or services needs to be paid for. Invoice is an instrument asking for such payment. Any business enterprise needs to maintain records to keep track of transactions occurring as part of its business activities. Invoice is a document that preserves this important transaction record related to payment.

When it comes to invoices, every industry sector has its own specific requirements. The invoice for a construction industry would not necessarily have been the same as the invoice for any retail transaction. That is because invoices differ on whether they are for services provided on a time-based, weekly or regular basis or whether goods are bought or sold. On the basis of these various criteria for specific sectors, as well as for various goods and services, invoices can be classified as below’ However, in the end the invoice structure needs to comply with the regulatory requirements of each State/Country.

Types of Invoices

Standard Invoice

It is straightforward and is used to bill your services whenever a service is provided. This will include a description of service, cost, tax, payment methods accepted, and the due date. The standard invoice is used by a number of industries, such as retail, agriculture, wholesale and one can add other elements like shipping, discount, etc.

Export / Import Invoice

These invoices are one of the most important documents for international trade and ocean freight transport. It is a legal document issued by the seller (exporter) to the purchaser (importer) in an international transaction and serves as a contract and proof of sale between the purchaser and the seller. Simply it is used for customs declaration when the product is crossing international borders.

Progress Invoice

Progress invoicing also referred to as progress billing is the process of invoicing the client incrementally for the percentage of work that has been completed by the total amount of work due. It is commonly used in works that stretch over a long period. It is mostly used in the construction industry that not only takes a lot of time for each project but is also very expensive

Timesheet

This is a combination of timesheet and invoice which is generally used during a project. It is mostly used in process-oriented units. Not only does it record the number of hours worked on the project, but it also attaches the invoice for the amount payable by the client for the amount of work done. This is a special type that is preferred by professionals whose services are accessed on the basis of the time period for which the service is provided.

Utility Invoice

Utility invoice differs from other invoices as it mentions a due date, the amount of penalty payable after the due date, and the billing period. Generally, these are the invoices received by a company for natural gas, electricity, water and sewer charges that the company used during the previous month or another period of time.

Recurring Invoice

Recurring invoices can be used to bill customers for on-going services. This usually applies to the rental industry. This type of invoicing tool works well for subscription-based businesses and utility segments as well.

Pro-Forma Invoice

This is basically referred to as estimation or a quote. A Pro-forma invoice is a commitment to provide something. The terms in this may change as the project proceeds. It can be termed as Estimate or Quote and ultimately it moves to standard invoice later. Registration and Free trial are available for SmartAdmin’s invoicing software.

SMART ADMIN is a cloud-based software for generating GST Compliant Invoice, Payroll management, Timesheet, and Project Tracking – visit SMART ADMIN for FREE Trial and Registration.

0 notes

Text

Homage to Alexa.com from DART Consulting – What are the Trending Alternatives to Alexa.com

Alexa.com [JJ1] was the darling of many of the Market Research and Analytics firms. Alexa.com was offering a collection of Internet marketing data for the past 20 years. We, at DART Consulting, widely had used Alexa.com to get a quick overview in competitor analysis, digital market research and preparing many market intelligence reports.

As a first step, we pay homage to the domain which expired in its prime time for any valid reasons not known to us.

There were reports that its Internet's traffic has been on the decline over the past decade, and users’ dependence on their Alexa ranking declined. Amazon would have decided it was time to bid it farewell even though there were options to improve its analytical features. Also, the term Alexa became a name in the consumers mind as an apple product.

Back in 1996, on the internet Wild West days, Named after the library of Alexandria. Alexa Internet started life as a content recommendation engine. In 1999, Amazon bought Alexa.com and built it into an analytics powerhouse. They worked directly with Google, DMOZ, the Internet Archive, and a variety of other analytics providers. Alexa rank was the most well-known as an indicator of a website's popularity on the Internet. The "Alexa Rank” was interesting to monitor. It also included a variety of tools that informed the users about the most visited websites on the Internet and also included some website analysis tools that assisted the users in improving the performance of organic searches, among other things.

The Internet service also included the following extra tools:

Site Metrics

Competitive Analysis

Social Engagement Analysis

Keyword Opportunities

Traffic Statistics

The following list would be helpful to provide a brief overview of a number of alternative Internet marketing tools that would provide customers with a similar kind of insightful data. As a result of Alexa's closure, this would aid in deciding which tools to utilize for competitive analysis or search engine optimization.

● Ahrefs - A very well renowned SEO platform

● SEMrush - a data-driven SEO platform

● SimilarWeb - A comprehensive competitive analysis tool

● Moz Pro - all-in-one suite of SEO tools

● Spyfu - a keyword research and competitive intelligence tool

Ahrefs

With the use of this SEO tool, users can look up any domain and learn about its SEO visibility, page rankings, keywords, and backlinks. This data is also available for download in MS Excel and CSV formats. This is one of the most well-known SEO tools available. Site Audit, Rank Tracker, Site Explorer, Keyword Explorer, and Content Explorer are its five primary tools.

SEMrush

SEMrush is a SaaS platform for content marketing and online visibility management that makes sure organizations obtain quantifiable outcomes from online marketing. SEMrush, a platform used by more than 5,000,000 marketing professionals, offers insights and solutions for businesses in any sector to create, oversee, and evaluate marketing campaigns across all channels. SEMrush is now an essential tool for any businesses that are serious about their online presence, including 40+ tools for search, content, social media, and market research on one platform, data for more than 140 countries, seamless interaction with Google, and task management tools.

SimilarWeb

An AI-based market intelligence platform that tracks traffic on websites and mobile apps. To comprehend, monitor, and increase digital market share, the organization provides global multi-device market intelligence. It enables the user to learn about the metrics and tactics of any website. The platform gives some great insights as it gets estimates of traffic and sources of traffic to competing websites and also details about estimated demographics of the visitors and their behavior.

Moz Pro

It is an SEO and data management software that helps businesses increase traffic, ranking, and visibility of sites in search results. Key features include site audits, rank tracking, backlink analysis, and keyword search tools. The software allows users to categorize, compare, and prioritize keywords and phrases to fine-tune content and marketing strategies. It also enables businesses to outrank the competition by providing intuitive keyword suggestions tools, which are derived from an extensive online database using updated SERP data.

Moz supports businesses to fix technical SEO issues that impede site visibility, traffic, and quality ranking. It also allows them to track competitors’ movement on the SERP, allowing businesses to uncover competitive advantages in order to attain top positions. Additionally, it can perform automated weekly checks on the site, alerting administrators to any existing issues to facilitate prompt fixes.

Spyfu

Spyfu is a one-stop internet marketing platform that allows its users to easily analyze their competitors. It offers a range of tools to help users create compelling keyword lists and ad copy as well as capture missed opportunities by tapping into years of competitors’ AdWords data. These tools allow users to export desired keywords directly into their own AdWords account. SpyFu also offers SEO tools and reporting software that compares organic search results to competitors, identifying top performance metrics as well as areas for improvement.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services.

More details at https://www.dartconsulting.co.in/dart-consultants.html

[JJ1]https://www.alexa.com/ - hyperlnk

0 notes

Text

Digitization, e-Invoicing, and Currency Circulation – Mode of e-invoicing and Usage of Invoice Software

Generally, there is a belief that COVID -19 had significant impact of in currency circulation. The Covid put greater thrust on digitization and dependence on contactless transactions. Also, there was tremendous growth in the usage of UPI, IMPS mode in financial transaction. Many platforms like PhonePe, Google Pay became more popular as alternate modes of fund transfer. Even, there is a belief that the demonization helped in reducing the dependence on hard currency. The demonetization intended to reduce the usage of hard currency in financial transactions. However, the currency circulation is going in an accelerated mode during all the previous years. Currency circulation during the period 2016 – 22 as below.

Currency in Circulation (CiC) includes banknotes and coins. Presently, the Reserve Bank issues notes in denominations of `2, `5, `10, `20, `50, `100, `200, `500 and `2,000. Coins in circulation comprise 50 paise and `1, `2, `5, `10 and `20 denominations. According to RBI report, the volume for the Banknotes in circulation in terms of value, reached INR 31,05,721crores by 2022, almost double prior to demonization and

Currency in circulation is the amount of money that has been issued by monetary authorities minus currency that has been removed from an economy. Currency in circulation is an important component of a country's money supply. Currency in circulation can consider as currency in hand because it is the money used throughout a country's economy to buy goods and services. The currency in circulation in a country is determined by the nation's need or demand for cash. RBI is responsible for ensuring that there is enough money in circulation to meet the economy's commercial demands, and for releasing additional notes and coins when there is a demand for the same.

Now, with the reduction of threshold limit on e-invoicing to INR 5 crores by Jan 1, 2023, one can expect further control on currency circulation. The process of validating all E-invoices in B2B transactions by the GST Network (GSTN) will push up further digitization in commercial transactions soon the threshold limit is brought down. This will compel all commercial firms to depend on reliable invoice software to run their business since the GSTIN portal needs data points to validate e-invoices. E-invoicing ensures that the invoices generated by accounting software are valid throughout. The system automatically compiles such data during the GST filing process.

The invoice software helps to go for e-invoicing in order to facilitate e-invoicing. Such software generates invoices, transmit the data to GSTin portal. It further pushes up digitization in work environment and reduce the usage of currencies.

SMART ADMIN is a cloud-based software for Office Automation. Smart Admin Tools are designed for Payroll management, Timesheet and Project Tracking – visit SMART ADMIN for FREE Trial and Registration.

1 note

·

View note

Photo

WHAT IS UN GLOBAL COMPACT – GLOBAL COMPACT AND UN CLIMATE CHANGE CONFERENCE (COP 27)

It is a fact that the human beings have drastic influence over the sustainability on earth’s natural processes. Another set of key influencers of these global changes are Corporates & Industries. This has compelled to set up a non-binding United Nations pact named UN Global Compact to encourage businesses firms around the globe to adopt a set of effective sustainable and socially responsible policies in conducting their business.

The UN Global Compact revolves around the corporate sustainability which starts with the company’s value system and a principles-based approach to doing business. The fundamental responsibilities are constituted by ten Principles of the United Nations Global Compact in the areas of human rights, labour, environment, and anti-corruption.

It’s an opportunity for businesses of all sizes to participate and the effecting change begins with organization’s leadership. To participate in the UN Global Compact, a commitment from the CEO or equivalent – with support from the Board. This commits the participating organization to meet fundamental responsibilities in four areas: human rights, labour, environment, and anti-corruption. Accountability also matters; hence all participants have to produce an annual Communication on Progress that outlines the organization’s efforts to operate responsibly and support society. This could be part of a sustainability or annual report, or another public document. Around 81% of the companies’ attribute progress on their sustainability work to participating in the Global Compact.

Reasons for Companies to Join Global Compact

Corporate and organizational success requires stable economies and healthy, skilled, and educated workers, among other factors. A well-functioning and sustainable company tends to increase its brand trust and investor support.

It’s good for society, offering fresh ideas and scalable solutions to society’s challenges. More than 16,000 business participants and 3,800 non-business participants in the UN Global Compact. They’re helping alleviate extreme poverty, address labour issues, reduce environmental risks around the globe, and more. Around 93% of the CEOs who have joined UN global compact agrees that sustainability is important to the future success of their business, 80% of them agrees that sustainability is a route to competitive advantage in their industry and 78% agrees that sustainability is an opportunity for growth and innovation.

The UN Global Compact addresses core issues that concern organizations and their leaders. CEOs are navigating increased frequency of natural disasters around the world, which is creating an urgent need to adapt and build resilience—particularly across supply chains. Constant pressure from investors and capital markets is incentivizing more rapid climate action—all amid a global pandemic. Some companies have formed partnerships with competitors and are addressing biodiversity risks, while hundreds have set science-based targets in line with the Paris Agreement, but thousands more need to increase their ambition to ensure a viable future. CEOs agree that technology is enabling new business models and will unlock the future of industry decarbonization. But to fulfil technology’s promise, CEOs will need effective data management across the value chain and must overcome affordability and knowledge constraints.

Benefits of Joining Global Compact

Unprecedented networking access with UN Global Compact participants – representing nearly every industry sector and size, in over 160 countries

Access to partnerships with a range of stakeholders – to share best practices and emerging solutions

Best practice guidance – built on more than 20 years of successes

Tools, resources, and trainings

Local Network support in more than 60 countries

The moral authority, knowledge, and experience of the United Nations

The UN will guide its participants in every step of the way. It will help the participants in committing to, assess, define, implement, measure, and communicate their sustainability strategy. With the UN’s help, participants can make a difference across four core areas: human rights, labour, the environment, and anti-corruption.

The UN Global Compact will be hosting multiple events and thematic sessions at the UN Climate Change Conference (COP 27) in Sharm El-Sheikh from 9–18 November 2022. The event will showcase the changes the UN Global Compact and Global Compact Local Networks that are driving by mobilizing business to assess environmental risks and opportunities, set and deliver ambitious climate targets and adopt responsible practices for a transition to the net-zero, resilient economy.

One can join UN Global compact as Business and Non-Business at https://www.unglobalcompact.org/participation/join/application

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services.

More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Text

WHAT IS TWO-PILLAR SOLUTION TO TAX CHALLENGES ARISING FROM GLOBALISATION – IMPACTS OF DIGITIZATION IN THE GLOBAL ECONOMY

On 8 Oct, a group of 136 nations covering 90 % of the world economy agreed to the OECD-G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS) after months of negotiations. The framework provides a two-pillar solution to address the tax challenges arising from the digitization and globalisation of the global economy and prevents a race by countries looking to slash tax rates to attract investment. Digitization and globalisation have had a significant effect on economies and people’s lives all over the globe, and this impact has only become stronger in the twenty-first century. Today, we may buy a product manufactured in France, packaged in China, and delivered by a British ship from a distant region of India through an American e-commerce website. These changes have posed challenges to the rules for taxing international business income that has been in place for more than a century, resulting in MNEs failing to pay their fair share of tax despite the enormous profits many of these businesses have accrued as the world has become more interconnected. This globalisation and Digitisation has caused two fundamental problems. The first is that a foreign business’s earnings could only be taxed in another nation where the foreign corporation had a physical presence under the old rules. The second issue is that most nations only tax domestic business income of MNEs but not international revenue, assuming that foreign company earnings are taxed where they are generated.

Pillar One – Re-allocation of taxing rights

Pillar One’s goal is to shift a part of taxing rights from the jurisdiction of domicile to market jurisdictions, i.e. where the MNEs’ customers are situated. Pillar One would require sizeable multinational tech companies such as Amazon, Google, and others to pay more taxes in countries with customers or users regardless of where they operate. Taxing rights on more than USD 125 billion in earnings will be transferred to market jurisdictions under Pillar One. Under this Pillar, which will be signed in 2022 and implemented in 2023, multinational companies having a worldwide turnover of more than 20 billion euros and a pre-tax profit of more than 10% of revenue (known as supernormal profit) would be required to pay 25% of the profit before tax. This 25% will be shared among nations based on a nexus-based allocation mechanism, which is currently being negotiated.

Profits will be shifted significantly across countries as a consequence of the Pillar One plans. However, it needs measures to prevent double taxes via either a credit or exemption system. Profit shifting raises the possibility of double taxation since countries may not apply the laws in the same manner. The agreement to re-allocate earnings under Pillar One includes the elimination and suspension of Digital Services Taxes (DST), Equalisation levy and other necessary, comparable steps, putting an end to trade tensions caused by the insecurity of the international tax system. It will also offer a simpler and streamlined method to applying the arm’s length principle in certain situations, emphasising the requirements of low-capacity nations.

Pillar Two – Global Minimal Tax

Pillar Two establishes a floor for tax competitiveness on corporate income tax by instituting a worldwide minimum corporation tax of 15%, which nations may employ to safeguard their tax bases (the GloBE rules). This implies that everywhere an MNE operates, tax competition will now be hampered by a minimum amount of taxes. The worldwide minimum tax rate would apply to multinational corporations with global revenues of 750 million euros ($868 million). Governments may continue to establish whatever local corporate tax rate they choose, but if businesses pay lower rates in one nation, their home governments could “top up” their taxes to the 15 % level, removing the benefit of transferring earnings. On the other hand, a carve-out enables nations to continue to provide tax incentives to encourage real-world economic activity, such as constructing a hotel or investing in a factory. At a rate of 15%, the global minimum tax is projected to produce about $150 billion in additional tax collections worldwide under Pillar Two. If all nations pass such legislation, the 15% corporation tax floor will be implemented in 2023.

For India, the outcome is critical due to its strong participation in OECD-led discussions. India has argued vehemently for expanded taxation powers for source or market countries. Indeed, this has been the desire of the majority of emerging nations. Because new-generation MNEs have found out how to minimise their worldwide tax incidence while earning the bulk of their revenue in developing nations. However, the new accord comes at a high cost; India must abandon its digital services tax and equalisation charge and promise to avoid introducing similar measures in the future if the global minimum tax agreement is implemented. The Indian government receives about Rs 4,000 crore in revenue from the equalisation levy. India was originally concerned that the worldwide harmonised tax of 15% would result in losing part of this income.

Nonetheless, India consented to the agreement hoping that income redistribution would benefit the country’s booming economy. While taxes are ultimately a sovereign responsibility determined by the country’s requirements and circumstances, the government is willing to join and engage in the growing global debates about company tax structure. The ball is still in the hands of the various nations. With the October Statement and the Detailed Implementation project plan in place, the Inclusive Framework moves to domestic law implementation and the negotiation, signature, and ratification of the multilateral instruments required to adjust treaty relationships among its members.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Text

THE BITCOIN ROLLERCOASTER: DE-MYSTIFYING THE MYTH – CRYPTOCURRENCY MARKET CAPITALIZATION – $2.24 TRILLION IN JANUARY 2022

Cryptocurrencies have lately been the most popular asset to be exchanged throughout the exchanges. The asset has garnered attention despite its ambiguity and volatility. The key reason is its independence from the physical world, which makes the asset resistant to any political, economic, or environmental changes in the international community. Of course, security and profit are also the major components that enable the growth of Bitcoins. The maturation of the asset has attracted institutional investors, which permits more liquidity into the market, and demand has exceeded the supply.

Furthermore, to provide an impetus to the boom, the various famous personalities in finance talked approvingly of its potential to evolve as a store of value to hedge against inflation from increased government expenditure during the pandemic. However, the asset is undergoing a rollercoaster ride of late, rising and dropping quickly. The rise and fall of assets may be linked to rising separation between the two groups, one favouring the Bitcoin, considering the positive side of the asset, which includes the individual investors and traders and institutional investors like Morgan Stanley and Economic giants like Elon musk. The other opposing the asset are generally government bodies and Banking institutions confronting and looking at the asset’s bad side.

THE BOOM OF BITCOIN

Despite the worldwide epidemic causing havoc on all critical economies globally, the bitcoin sector has continued to thrive. During this epidemic, numerous crypto companies have developed in response to the ever-increasing demand for Bitcoin and similar cryptocurrencies. Th cryptocurrency market capitalisation of crypto has grown from $192 billion in January 2020, to $758 billion in January 2021 and $2.24 trillion in January 2022. It is mostly propelled by Bitcoin’s surge. Bitcoin, in particular, has been on a rampage for quite some time and now accounts for around 69% of the overall market value. Just six months ago, the price of one Bitcoin was ~₹6,00,000, and now Bitcoin is selling for ~₹25,00,000, which is almost a 400 per cent growth in the price.

· Institutional Investors

Bitcoin is increasingly seen as a safe-haven asset protecting investors from market instability and inflation. Also, the present societal and economic context encourages individuals to store less cash and remain protected against market swings. Recently, public firms have begun to convert their cash treasuries to cryptocurrency. Microstrategy, a publicly-traded firm in the United States, transferred $425 million in cash reserves to Bitcoin. Numerous businesses have now followed suit. The faith of business giants in cryptocurrencies and their entry into the sector has given it more credibility as a medium of exchange and asset storage. The credibility has increased the demand, which has surpassed the demand-supply, high asset price, and facilitated a boom.

· Bitcoin as Digital Currency:

Cryptocurrency is a digital currency that may be used as a medium of trade and a store of value. While it has only just begun to gain traction as a legitimate payment mechanism, it has established itself as a new asset class. Even though the public is hesitant to use it for transactions, many desire to convert their cash to cryptocurrency because they feel its deflationary nature makes it a superior store of wealth and hedge against inflation. After the Reserve Bank of India withdrew its prohibition on cryptocurrencies, particularly in India, its investors saw a considerable increase. Further, as cryptocurrency becomes more accessible to the general public, more retail investors are ready to pay a premium for a piece of the asset class.

Supply crush owing to Bitcoin halving

Halving is a critical event on the Bitcoin blockchain. It creates inflation in the cryptocurrency price by limiting the supply of bitcoin and rising demand for it. The halving of Bitcoin has ramifications for all stakeholders in the Bitcoin ecosystem. This year saw the third Bitcoin halving. Bitcoin halving is a significant event that occurs every four years or after every 210000 transactions on the Bitcoin network. The Bitcoin network operates because it creates new bitcoins via a process known as Bitcoin mining. Bitcoin miners do this via the verification of Bitcoin blocks, which are collections of Bitcoin transactions. A miner who successfully verifies a block of transactions and adds it to the Bitcoin network is rewarded with a certain quantity of bitcoins every ten minutes. After the halving, the reward is set at 3.125 BTC. for each valid block mined. The reduction in reward will reduce the number of coins mined. Due to the limited incentive, the supply is currently 21 million Bitcoins, the market currency’s circulation diminishes as the incentive lowers. And when awareness of the asset’s scarcity grows, demand increases, resulting in a higher price.

BUST OF BITCOIN

· Regulators Crackdown

Along with the boom, the asset is experiencing a bust due to the asset’s negative side being exposed and having an impact. Governmental and banking institutions are the driving forces. Bitcoin and ether, the two most popular digital currencies, plummeted by up to 30% and 45 per cent, respectively. This is because Bitcoin and kindred assets have come under growing scrutiny from authorities worldwide as they have evolved to become a more significant element of financial markets. Regulators are worried about the implications for security and the loss of power. The drop in value began with China’s decision to prohibit banking and payment institutions from offering bitcoin services. Additionally, it cautioned investors against speculative cryptocurrency trading. Following that, UK banks suspended payments to cryptocurrency exchanges, FBI agents seized millions of dollars in bitcoin from criminals, and the IMF issued an August 2021 warning to countries considering using cryptocurrencies as legal tender, stating that widespread use would jeopardize “macroeconomic stability” and jeopardize financial integrity.

· Institutional Retreat

Furthermore, the institutional investors that served as the asset’s mediators started withdrawing their backing for various reasons, including the environment and fear of strict government regulations. Elon Musk is a prominent proponent of cryptocurrencies. Tesla said in May 2021 that it would stop accepting bitcoin payments due to environmental concerns. Following that, JPMorgan said that institutional investors looked to be shifting away from bitcoin and toward gold, based on futures contracts.

· Security Myth

Finally, a crypto heist – Poly Network, a group of crypto hackers, took $600 million in August before returning more than a third of it four days later, claiming they did it “for fun” and “highlight the weakness” in the system before others could. The heist shattered private and institutional investors’ faith in the system. To provide further incentive, the government crackdown and withdrawal of big players prompted investors to shift their focus to conventional investments, lowering demand and precipitating a price decline.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Text

UNIFIED PAYMENTS INTERFACE PAYMENT AND ITS GROWTH – UPI TRANSACTIONS AND GROWING ACCOUNTABILITY IN FINANCIAL SYSTEM WITH PAYMENT DIGITIZATION

Unified Payments Interface (UPI) is a mobile app-based payment system that brings multiple bank accounts to one platform. It results in an effortless funds transfer experience which is quite unique in the industry. UPI combines various banking services, smooth fund routing, plus merchant payments into a single mobile application (of any participating bank). It also handles “Peer Peer” collection requests, which can be scheduled and paid according to need and convenience.

UPI was introduced in the Indian financial system in the year 2016 and it encourages digitization in payment. The pilot launch was on 11th April 2016 by Dr. Raghuram G Rajan, then Governor, RBI at Mumbai. Banks have started to upload their UPI-enabled Apps on the Google Play store from 25th August 2016 onward. It has a daily transaction limit of up to Rs.1 lakh. As of March 2022, there are 314 banks available on UPI with a reported monthly transaction of INR 9,60,581.66 crores.

The pandemic has considerable influence on the UPI transaction growth according to market intelligence and business research. Even with lesser economic activities during the pandemic, the UPI payments mostly doubled during that period. It is continuing in the current fiscal year also.

There are numerous benefits of the Unified Payments Interface (UPI). It is a fast, hassle-free, and the cheapest way of money transfer, which you can do from anywhere and at any time. With the UPI app, there is no need to carry cash. There is no transaction fee. Use the QR code scan to make online and offline purchases. It works on immediate payment services and is available 24*7. One can initiate transactions from any bank’s UPI app and transfer funds with a virtual payment address. Both payment and collection transactions are possible.

Of late, most small traders and service providers switched over to UPI-based payment systems as part of their business transactions. They consider such transactions as good as cash transactions where remittance or compensation out of their product or services are found immediately in their account. Further, they can use the same fund to procure goods or services for their business activities.

Thus, the arrival of UPI has a greater impact on the economic activities among the unorganized sector and informal sectors which were under the clutches of cash transactions previously. The UPI transaction gives both government and tax authorities to track transactions for all monitoring purposes including taxation. This will bring more people under the tax net as well.

It gives a clear lesson that adequate use of technology with public convenience could achieve the much-needed accountability in financial transactions. Instead of creating multiple rules and regulations and stifling economic activities, it is good for the progressive government to tame technology to achieve its objectives.

DART’s Business Plan Team has years of experience in preparing business plans and ensure that such plans always withstand the market test. Our business plan consists of supporting facts and figures to effectively argue for the purpose of investment and its potential returns. Such business plans are done after careful market research and data analysis. u can add this para while posting

0 notes

Text

BUSINESS MODELS CHANGE DURING PANDEMIC 2019 – 21 IN INDIA

NEW FOCUS AREAS ARE DIGITIZATION, REMOTE LABOUR, ARTIFICIAL INTELLIGENCE, AND MACHINE LEARNING

According to the saying “If your neighbor gets laid off, it’s a recession. If you get laid off, it’s a depression,” (courtesy – of Harry S. Truman). It is a fact that any drop in economic growth results in ripple effects in society. Recently, most of the countries had experienced a drop in economic growth due to the impact of Covid – 19. Technically, a recession is two consecutive quarters of negative growth in the gross domestic product (GDP) which was equally occurred in India also.

Thus, the post covid Economic activities can be considered as post-recession as well since all of us have undergone recession in tune with the Covid 19. Of course, there are a lot of expectations about overall economic growth, but the real question is which sector would be benefited in the coming years.

If the Digital mode of promotion of goods and services were the direct effect of the 2008 recession, then digitization is going to be the Post Covid growth. Digitization encompasses multiple activities including online buying of products or services to online customer service. Growth of remote labor, digitization, use of artificial intelligence (AI), and machine learning are a few such associated segments that could experience higher growth in the coming months. Meanwhile, the COVID-19 crisis was a testing ground for all these technologies.

The employees’ preference for remote working was a trend observed during covid and post covid., This has resulted in the development of tools to manage employees, projects,s and more. Online marketplace for virtual shopping became the new trend and bought significant changes across the globe. According to a UNCTAD and Netcomm Suisse eCommerce Association survey, globally online purchases have climbed by 6%-10% in most product categories. Another trend observed was a preference to buy products that reflect new health and hygiene issues in several sectors and countries. Further, the health consciousness resulted in the fitness sector moving digital. People adapted to home exercises in the form of live online classes and pre-recorded classes. As a result, the online fitness community is currently booming. The global online/virtual fitness market size reached around $6,046 million in 2019 and is projected to reach at $59,231 million by 2027, growing at a CAGR of 33.1% from 2020 to 2027. Another dimension in the health sector is online consultation and diagnosis. The Online consultation of doctors and diagnosis has taken a new shape during Covid, and this trend is expected to continue. Globally, the online doctor consultation market is expected to be over $800 million by FY2024 growing at a 72% CAGR.

Digital banking has grown in popularity in recent years, and the pandemic certainly accelerated the switch as in-person branch visits declined drastically in most places. For the most part, retail banks have relied on in-person sales to make profits. Some banks have increased the visibility of their digital sales platforms since the pandemic began. In India, for example, HDFC has set up an online facility that allows customers to start savings accounts instantly. HDFC had attracted 250,000 new customers in less than a month as of early June. Digital payment including RTGS, NEFT, IMPS, and UPI grew by 99% in India during the period 2019 -20 (reached 15.85 crores in crores) compared to the previous year in value, and thereafter it grew by another 87% in the following year. This trend is expected to continue or get stabilized around this value in the coming years. This results in higher electronic payments (particularly contactless payments at the point of sale) and recent surveys revealing a considerable shift in payment behavior from cash to cashless. In 2021, digital wallets contributed 45.45% followed by debit cards 14.6% and credit cards 13.3% in the e-commerce payment methods. Digital wallet payment modes are expected to compete over other e-commerce payment methods through 2025 by 52.9% of transaction value according to market data.

New payment services specializing in e-commerce transactions have emerged, offering consumers a simple and secure way to transfer money (often with free insurance coverage on their online purchases) and retailers the ability to sell goods and services globally. Non-financial businesses such as e-commerce sites and phone companies have begun to operate their own “electronic wallets,” providing customers with a simple and inexpensive way to exchange money among themselves, often with a focus on small transactions for which traditional transfers would be too inconvenient and costly.

DART’s Business Plan Team has years of experience in preparing business plans and ensure that such plans always withstand the market test. Our business plan consists of supporting facts and figures to effectively argue for the purpose of investment and its potential returns. Such business plans are done after careful market research and data analysis. u can add this para while posting

0 notes

Text

Importance of Cost Estimation in Project Management: Project Budget and Return on Investment in Project Management

Cost estimation is directly related to project budget, and overall Return on Investment (RoI). Project cost is the budget available for the overall project completion. Cost estimation process helps in identifying project risks and provides an option to discuss alternatives if new requirements are needed to be added. The accurate project costing plan enables one to weigh anticipated benefits against anticipated costs to assess if the project makes sense. Further, it allows one to review the periodical fund requirements, and also serves as a guideline to manage project on day to day basis.

The main factors to be considered while calculating project costs are:

• Manpower

• Materials

• Equipment

• Premises

• Service Providers

Different cost estimating techniques are available which allows one to effectively assign corresponding resources and develop schedules to manage the project successfully. Resource costing is a common method where all the resources like equipment, material, services, and manpower needed for the project are listed and sum up their costs. Small businesses use resource costing for larger or more complicated projects.

Small or simple projects can be evaluated using a cost-per-unit that is characteristic of the project. The characteristic unit is a measure of the size of the project that is indicative for the particular project. The total cost can be divided by the number of hours/units needed and can assess cost per unit or cost per hour.

If the project is typical of one’s industry and businesses have completed similar projects over the past few years, an empirical approach can be highly accurate, and take the least time. To use this approach, one usually needs to buy software or a paper-based system that contains statistical information about the other, completed projects. By choosing the characteristics that apply to the present project from a list, and by filling in the overall parameters such as size and location, one can ask for cost break down. The system will provide typical costs for that kind of project.

One of the most transparent ways of estimating the cost of a project is to base it on previous work. If company has completed a similar project recently, all the required costing information is available from the project files. Most of the time, historical data gives the most accurate prediction of future costs.

Smart Admin allows you to estimate project cost per unit or per hour which ultimately results in better control over project cost. Further, one can retrieve past data from the applications of Smart Admin to understand the historical performance of similar projects. The cost per hour can be estimated based on the total hours allocated by the project against the total cost using the various tools in SMART ADMIN.

0 notes

Text

Importance of Optimum Resources Planning: Tools and Techniques for Project Management

Task evaluation phase clearly outlines all project activities and milestones needed for the project completion. Based on task evaluation, the Project Manager allocates resources, and set up reasonable milestone by taking into account of team members’ productivity, availability, and abilities. In project management terminology, resource can be people, equipment, facilities, funding, or any other thing that are required for the completion of a project. Success in delivering projects with limited pool of resources depends on finding the right resources for the job, balancing resource supply with demand, and empowering employees.

The efficient way of using resources is by pooling them, which optimally reduces project expenses. Pooling of resource provides greater benefits to participating interests as compared to individuals working on their own. Sorting resources for each engagement based on competencies, preferences and availability makes it easier to get a list of qualified candidates to complete the tasks. Resource pooling helps in analyzing, scheduling and utilization of resources to achieve optimal resource utilization, and thereby it is cost-effective. It is very important that all parties that are involved in the project are able to collaborate during the definition phase, thus helps in maximizing resource usage, minimize cost, and maximize profitability. In more complex environments, resources could be allocated across multiple, concurrent projects, and thus requires easier and secure ways of sharing. Usually, Project Management Soft wares helps in analyzing the capabilities of resources that gives insight into resource supply and demand. Also, resource skills-tracking functions ensure that right people are working on the right projects.

Smart Admin helps to identify resources based on their abilities and help Project Managers to select the right resource for each project. The potential team members who can participate in the next 24 hours can be retrieved using the tools as defined in the SMART ADMIN along with their abilities based on past record.

0 notes

Text

How to Perform Task Estimation in Project Management? Project Estimate and Project Success

Generally, the planning phase consumes much of the work of project management. Once the objectives are set, the next step is to perform a detailed definition of tasks. Tasks are created to meet the project objectives after taking into consideration of project risk and other managerial processes. Project Manager needs to perform task evaluations based on the budget constraint, time limits, performance standard, target, limit of authority, and delegation. Once task estimation is done, project managers choose the best team and assign roles and responsibilities to them on the project. Otherwise, miscommunication may occur leading to delays and situations where team members may have to redo their work.

The task estimation phase starts with a Work Breakdown Structure (WBS). The WBS is a list of the smaller components that are required for completion of the project. The WBS needs to include 100% of the work defined by the project scope and all of the deliverables. The completion of WBS gives list of desired outcomes. Thereafter, it will be easier to estimate resources and time required for each outcome. It is advised to go for both optimistic and pessimistic estimates to juggle deadlines. Further, identifying the order in which tasks need to be completed leads to prioritize the most significant tasks on the top to avoid discrepancy and loss of productivity. This part is commonly handled through GANTT charts which help to utilize the resources optimally. With the completion of task estimation and sequencing, the project implementation schedule can be defined.

During the task estimation phase it will be helpful to set standards for when and how communication should occur. How often work status is reported? How should emergencies be reported? A complete task estimate is very helpful in eliminating redundant work, and organizing efforts. It prevents team from straying into areas not allowed or waste effort on low priorities.

Smart Admin provides the option to break down work into small units, and assign the same to team members. With the inbuilt communication, each team members is updated with the changes if any. Time limit can be fixed for each of the tasks using Smart Admin tools, and outcome can be measured against the target.

0 notes

Text

Planning: All About Project Management and Step by Step Guide for Project Planning

Project Management is an approach to manage the business activities which embrace change and complexity on a continuous basis. Change and complexity are the two major features of today’s business environment.

Planning is considered as a vital step in project management life cycle. The purpose of the project planning is to to establish a clear set of goals considering needs and expectations of stakeholders, to create a list of project deliverables, to estimate project schedule in terms of time, effort, and to allocated resources as required.

The process of planning provides an overall framework of the entire process which will benefit the management to have a better overview over the project.

There are multiple factors which lead to the success and failure of a project. Commonly cited factors which lead to the project failures are lack of stakeholder engagement, lack of communication, and absence of clear roles and responsibilities to team members. These factors need to be addressed during the early stage of project planning. In order to achieve this, a few supporting plans can be created as a part of the Project Planning process which are Staffing Plan, Communications Plan, and Risk Management Plan.

Staffing includes identifying individuals and describes their roles and responsibilities on the project. Communication plan includes creating a document showing who needs to be kept informed about the project, and how they will receive the information and how frequently. The progress report will update how the project is performing, milestones achieved and work planned for next period. Risk management plan outlines identifying as many risks as possible and being prepared to manage them.

The preparation of the project plan template is the culmination of the planning phase. The Project plan summarizes the results of the Project planning process into a brief document to be signed off by the Project Sponsors and any other key stakeholders. The Project Plan is the basis for monitoring and controlling the project. All changes to the project must be recorded against the project plan.

Smart Admin provides suitable framework for project planning, scheduling, selection of resources, costing, allocation of tasks, and for further monitoring of project progress. The tools for Smart Admin is developed to support documentation for staffing, communication, task creation, task approval, and recording of begin date with date of completion date along with the expected deliverables.

0 notes

Text

Planning: All About Project Management and Step by Step Guide for Project Planning

Project Management is an approach to manage the business activities which embrace change and complexity on a continuous basis. Change and complexity are the two major features of today’s business environment.

Planning is considered as a vital step in project management life cycle. The purpose of the project planning is to to establish a clear set of goals considering needs and expectations of stakeholders, to create a list of project deliverables, to estimate project schedule in terms of time, effort, and to allocated resources as required.

The process of planning provides an overall framework of the entire process which will benefit the management to have a better overview over the project.

There are multiple factors which lead to the success and failure of a project. Commonly cited factors which lead to the project failures are lack of stakeholder engagement, lack of communication, and absence of clear roles and responsibilities to team members. These factors need to be addressed during the early stage of project planning. In order to achieve this, a few supporting plans can be created as a part of the Project Planning process which are Staffing Plan, Communications Plan, and Risk Management Plan.

Staffing includes identifying individuals and describes their roles and responsibilities on the project. Communication plan includes creating a document showing who needs to be kept informed about the project, and how they will receive the information and how frequently. The progress report will update how the project is performing, milestones achieved and work planned for next period. Risk management plan outlines identifying as many risks as possible and being prepared to manage them.

The preparation of the project plan template is the culmination of the planning phase. The Project plan summarizes the results of the Project planning process into a brief document to be signed off by the Project Sponsors and any other key stakeholders. The Project Plan is the basis for monitoring and controlling the project. All changes to the project must be recorded against the project plan.

Smart Admin provides suitable framework for project planning, scheduling, selection of resources, costing, allocation of tasks, and for further monitoring of project progress. The tools for Smart Admin is developed to support documentation for staffing, communication, task creation, task approval, and recording of begin date with date of completion date along with the expected deliverables.

0 notes

Text

How to Select Best Cloud based Workforce Management Solutions?

In order to bring optimum output, form the valuable human resources, there should be a process in place in very organization. The better the management of workforce the higher the benefits it derives. Overall, it improves the bottom line.

Workforce needs to be managed to ensure work in right direction and effectiveness of work. No two humans are same, and everybody needs to be handled according to his temperament.

There are multiple software tools available in the digital era to manage the work force. Such tools are created out of the specific culture of each region. However, many of the factors of workforce management are common including scheduling working hours, assigning responsibilities, and tracking results. Well tested workforce management software will come to the rescue of the management. Generally, such system will have following characteristics.

¾ Performance management

¾ Task management

¾ Scheduling

¾ Real-time update

¾ Measuring output

Smart admin tool helps in effective workforce management. The modern era less demands the workforce management with authority and autocratic way. Today workforce or employees are treated as business partners. The success of any company today is shared with the workforce because they are the reason for it. Workforce management professionals have invented new techniques and ways to ensure effective workforce management. In the coming days the workplace will get transformed and will see an immense difference in how the workforce is been managed. The tools similar to Smart admin will shape the workplace with effective workforce management in the coming years.

Visit us at - https://www.smartadminmanager.com/

0 notes