#legal advisory in malaysia

Text

The Advantages, Disadvantages, and Requirements of a Private Limited Company

Choosing the right business structure is pivotal for entrepreneurs, and the Private Limited Company model offers distinct advantages and challenges. Let's explore its features, benefits, drawbacks, and the essential requirements for establishment and operation.

Advantages of a Private Limited Company Structure:

Separate Legal Entity: A Private Limited Company enjoys the status of a distinct legal entity with perpetual existence. It can hold property, enter contracts, and incur debts independently of its owners.

Limited Liability Structure: Owners benefit from limited liability, safeguarding personal assets against business liabilities. This separation ensures that individual finances remain unaffected by the company's obligations.

Fundraising Opportunities: Private Limited Companies have various avenues for raising capital:

Debt instruments like Convertible Notes, Compulsorily Convertible Debentures, and Preference Shares offer flexible financing options.

Venture capital investors prefer this structure due to its suitability for diverse investment instruments.

Potential for conversion into a Public Limited Company enables access to public funding through stock exchanges.

Foreign Direct Investment (FDI): Private Limited Companies facilitate FDI, with 100% FDI permitted in many sectors. This allows seamless investment in other companies or LLPs where FDI is allowed.

Judicial Authority: Specialized judicial authorities, such as the National Company Law Tribunal under the Companies Act, 2013, provide a structured framework for dispute resolution.

Transparency & Transferability:

The company's operations are transparent, with major decisions made collectively in board meetings and documented minutes.

Directors can be changed, and share ownership can be transferred with board approval, ensuring continuity and flexibility.

Read In detail article on our offical website.

Disadvantages of a Private Limited Company Structure:

Compliance Obligations: Mandatory audits, tax filings, and secretarial compliance add administrative burdens.

Failure to meet annual compliance deadlines can lead to penalties or director disqualification.

Complex Procedures: Navigating procedural and tax requirements for fundraising can be intricate, demanding thorough analysis.

Issuing debt and equity instruments entails compliance with regulatory frameworks, which can be complex.

Dissolution Complexity: Dissolving a Private Limited Company involves complex procedures and costs, necessitating careful consideration before establishment.

Requirements for Establishing and Operating a Private Limited Company:

Minimum of 2 directors and shareholders.

No mandatory authorized capital requirement.

At least one resident director.

Compliance with annual filing requirements, including MCA filings, accounting, auditing, and IT filings.

Adherence to GST compliance if registered.

Additional compliances as per business needs, such as trademark registration, professional tax filing, and employee-related registrations based on employee count.

Conclusion: The Private Limited Company structure offers a blend of advantages and challenges. Understanding its features, compliance obligations, and operational requirements is crucial for entrepreneurs embarking on this journey. By navigating these intricacies effectively, businesses can harness the benefits while mitigating potential pitfalls, ensuring sustainable growth, and compliance with regulatory standards.

#private limited company registration in india#company registration#StructuredBiiz#legal services#for legal reasons this is a joke#legal advice#legal advisory in malaysia

0 notes

Text

Who will address the court?

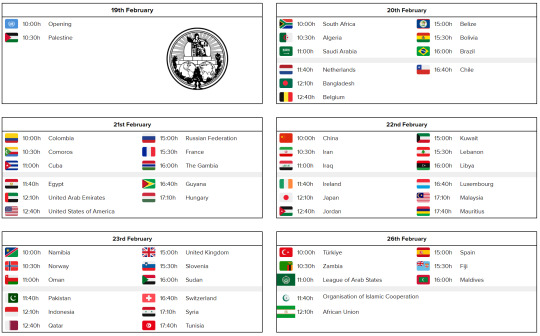

The hearings will be held until February 26, after which the judges are expected to take several months to deliberate before issuing an advisory opinion.

Here’s the full schedule:

February 19: Palestine

February 20: South Africa, Algeria, Saudi Arabia, the Netherlands, Bangladesh, Belgium, Belize, Bolivia, Brazil, Canada, Chile

February 21: Colombia, Comoros, Cuba, Egypt, United Arab Emirates, United States, Russia, France, The Gambia, Guyana, Hungary

February 22: China, Iran, Iraq, Ireland, Japan, Jordan, Kuwait, Lebanon, Libya, Luxembourg, Malaysia, Mauritius

February 23: Namibia, Norway, Oman, Pakistan, Indonesia, Qatar, United Kingdom, Slovenia, Sudan, Switzerland, Syria, Tunisia

February 26: Turkey, Zambia, Arab League, Organisation of Islamic Cooperation, African Union, Spain, Fiji, Maldives

#icj hearing#gaza#palestine#icj#international criminal court#genocide#israel#apartheid#israeli occupation#news#2024

121 notes

·

View notes

Text

ICJ Advisory Proceedings

The International Court of Justice (ICJ) is hearing arguments from fifty-two countries and three international organizations on the Legal Consequences of Israel in the Occupied Palestinian Territory (West Bank, East Jerusalem and the Gaza Strip) since 1967.

IMPORTANT: This is a separate case from the Application of the Convention on the Prevention and Punishment of the Crime of Genocide in the Gaza Strip, in which South Africa accuses Israel of committing genocide in Gaza.

You can watch the arguments presented and read the written submissions below.

―19/02/24

» Watch the arguments here.

» Read the verbatim record here.

The ICJ heard from the State of Palestine.

―20/02/24

» Watch the arguments here (morning), and here (afternoon).

» Read the verbatim record here (morning), and here (afternoon).

The ICJ heard from South Africa, Algeria, Saudi Arabia, The Netherlands, Bangladesh, Belgium, Belize, Bolivia, Brazil, and Chile.

―21/02/24

» Watch the arguments here (morning), and here (afternoon).

» Read the verbatim record here (morning), and here (afternoon).

The ICJ heard from Colombia, Comoros, Cuba, Egypt, United Arab Emirates, United States of America, Russian Federation, France, the Gambia, Guyana, and Hungary.

―22/02/24

» Watch the arguments here (morning), and here (afternoon).

» Read the verbatim record here (morning), and here (afternoon).

The ICJ heard from China, Iran, Iraq, Ireland, Japan, Jordan, Kuwait, Lebanon, Libya, Luxembourg, Malaysia, and Mauritius.

―23/02/24

» Watch the arguments here (morning), and here (afternoon).

» Read the verbatim record here (morning), and here (afternoon).

The ICJ heard from Namibia, Norway, Oman, Pakistan, Indonesia, Qatar, United Kingdom, Slovenia, Sudan, Switzerland, Syria, and Tunisia.

―26/02/24

» Watch the arguments here (morning), and here (afternoon).

» Read the verbatim record here (morning), and here (afternoon).

The ICJ heard from Türkiye, Zambia, the League of Arab States, the Organisation of Islamic Cooperation, the African Union, Spain, Fiji, and Maldives.

6 notes

·

View notes

Text

Airbus and Spirit AeroSystems Announce New Collaboration

Boeing has agreed to acquire Spirit AeroSystems in a deal valued at $4.7 billion after extensive negotiations that involved both Boeing and its European competitor, Airbus.

Including Spirit’s last reported net debt, the total transaction value is approximately $8.3 billion, according to Boeing. The deal, which values Spirit at around $37.25 per share, will reunite Spirit with Boeing after two decades of separation.

https://twitter.com/Boeing/status/1807628590172832029?t=pFQKp76oLv69JPGtUsSPEg&s=08

Spirit reached an agreement with Boeing after finalizing a separate deal with Airbus. Under this agreement, Airbus will take over certain Spirit operations related to key Airbus aircraft programs, including the A220 and A350, at multiple global sites such as Northern Ireland, the U.S., France, and Morocco.

Airbus will receive $559 million from Spirit for taking over these operations, paying a symbolic $1 for the assets involved.

Spirit also announced plans to divest some non-Airbus-related businesses, including operations in Belfast, Northern Ireland, Prestwick, Scotland, and Malaysia.

The aerospace supplier, known for manufacturing the fuselage of Boeing’s 737 Max jet, has faced scrutiny over production issues that have caused delays. Last year, Spirit’s CEO was replaced by former Boeing executive Patrick Shanahan.

Boeing has been negotiating with Spirit since March. Boeing had spun off Spirit in 2005 but remained its largest customer. Boeing stated that reacquiring the supplier would enhance safety in the manufacturing process.

This objective has been crucial for the Seattle-based company, especially following the mid-air incident involving a section of the main body of one of its 737 Max aircraft in January.

“By bringing Spirit back into the fold, we can fully synchronize our commercial production systems, including safety and quality management, and ensure our workforce is aligned with the same priorities, incentives, and outcomes—focused on safety and quality,” said Boeing CEO Dave Calhoun.

Boeing anticipates the deal will be finalized by mid-2025. The company is receiving advisory support from PJT Partners, Goldman Sachs, and Consello, with Sullivan & Cromwell serving as its legal counsel. Spirit AeroSystems is being advised by Morgan Stanley and Moelis, with Skadden as its legal counsel.

Read the full article

0 notes

Text

business registration malaysia

Consistant Info

Company Secretary Services Malaysia - SSM Company Secretary

Business Registration and Secretary Company Malaysia.Consistant Info is a Malaysia-based secretary firm established in 2006 with over 16 years of experience.

In the dynamic and competitive business environment of Malaysia, having a reliable and efficient company secretary is crucial for ensuring compliance with statutory regulations and maintaining smooth corporate governance. Consistant Info, a leading provider of company secretary services in Malaysia, offers comprehensive solutions to help businesses navigate the complexities of regulatory requirements. If you are seeking professional assistance to manage your company’s secretarial duties, Consistant Info is your trusted partner.

The Importance of a Company Secretary in Malaysia

A company secretary plays a vital role in the administration of a company, ensuring compliance with the Companies Act 2016 and other relevant regulations imposed by the Suruhanjaya Syarikat Malaysia (SSM), or the Companies Commission of Malaysia. The responsibilities of a company secretary include:

Compliance Management: Ensuring the company adheres to statutory requirements, including timely filing of annual returns, financial statements, and other mandatory documents.

Corporate Governance: Advising the board on best practices in corporate governance and ensuring that the company operates within the legal framework.

Record Keeping: Maintaining accurate records of company meetings, resolutions, and other critical documents.

Liaison with Authorities: Acting as the point of contact between the company and regulatory bodies such as SSM.

Advisory Services: Providing guidance on compliance issues, changes in legislation, and corporate restructuring.

Why Choose Consistant Info for Company Secretary Services?

Consistant Info stands out as a premier provider of company secretary services in Malaysia due to its extensive experience, professional expertise, and commitment to client satisfaction. Here’s why you should consider Consistant Info for your company’s secretarial needs:

Expertise and Experience: With years of experience in the industry, Consistant Info has a deep understanding of Malaysian corporate laws and regulations. Their team of qualified professionals ensures that your company remains compliant with all statutory requirements.

Comprehensive Services: Consistant Info offers a wide range of services tailored to meet the specific needs of different businesses. Whether you are a small startup or a large corporation, they have the expertise to manage your company’s secretarial duties efficiently.

Personalized Solutions: Understanding that every business is unique, Consistant Info provides customized solutions that align with your company’s specific requirements and goals.

Reliable Support: Consistant Info prides itself on offering reliable and timely support. Their team is always available to address any queries or concerns you may have regarding compliance and corporate governance.

Cost-Effective Solutions: By outsourcing your company secretary services to Consistant Info, you can save on the costs associated with hiring and training in-house staff, while benefiting from the expertise of seasoned professionals.

Key Services Offered by Consistant Info

Consistant Info provides a comprehensive suite of company secretary services designed to ensure your business operates smoothly and remains compliant with all regulatory requirements. These services include:

Incorporation Services: Assisting with the incorporation of new companies, ensuring all legal formalities are completed efficiently.

Annual Return Filing: Managing the timely filing of annual returns and financial statements with SSM.

Corporate Restructuring: Providing advisory services on mergers, acquisitions, and other corporate restructuring activities.

Regulatory Compliance: Ensuring compliance with the Companies Act 2016 and other relevant regulations.

Board Meetings and Resolutions: Organizing and maintaining records of board meetings, drafting resolutions, and ensuring that all decisions are documented appropriately.

Shareholder Services: Managing shareholder communications, including issuing notices, dividends, and handling shareholder queries.

Advisory Services: Offering guidance on corporate governance, compliance issues, and changes in legislation that may impact your business.

Benefits of Professional Company Secretary Services

Engaging professional company secretary services offers numerous benefits to your business, including:

Enhanced Compliance: Professional company secretaries ensure that your business complies with all legal and regulatory requirements, reducing the risk of penalties and legal issues.

Improved Corporate Governance: Expert advice on best practices in corporate governance helps in maintaining transparency and accountability within the company.

Efficient Administration: Outsourcing administrative tasks to professionals allows you to focus on core business activities, enhancing overall efficiency.

Risk Mitigation: Regular updates on changes in legislation and proactive compliance management help mitigate potential risks.

Cost Savings: Outsourcing to professional service providers like Consistant Info is cost-effective compared to maintaining an in-house team.

Conclusion

Navigating the complexities of corporate compliance and governance can be challenging for any business. By partnering with Consistant Info, you can ensure that your company meets all statutory requirements and operates within the legal framework set by the Malaysian authorities. Their expert team provides a comprehensive range of company secretary services tailored to your business needs, allowing you to focus on growth and success.

Contact Us :

A-12-05, Ekocheras Office Suites, No, 693, JlnCheras, Batu 5, 56000 Cheras, Federal Territory of Kuala Lumpur

Email: [email protected]

Phone: +6011 3669 6823

0 notes

Text

Protecting Your Rights

Our team specializes in Criminal Investigation Advisory, meticulously seeking and gathering evidence to build a strong case that fights for your innocence.

0 notes

Text

Comprehensive Taxation Services in Malaysia: Simplifying Your Financial Obligations

Taxation is an essential aspect of any country's economic system, providing the necessary resources for public services and infrastructure development. In Malaysia, the tax landscape is complex and subject to frequent changes. Navigating these intricacies can be a daunting task for individuals and businesses alike. This is where professional taxation services come into play, offering valuable expertise and assistance to ensure compliance and maximize tax benefits. In this article, we will explore the key aspects and benefits of taxation services in Malaysia.

1) Personal Taxation Services: Individual taxpayers in Malaysia must fulfill their obligations by reporting their income and paying the relevant taxes. Taxation services offer personalized guidance to individuals, helping them understand their tax liabilities, identify deductions and reliefs, and optimize their tax planning strategies. Tax professionals assist in preparing and filing tax returns, ensuring accuracy and compliance with the Malaysian tax laws.

2) Corporate Taxation Services: For businesses operating in Malaysia, corporate taxation is a critical aspect that demands careful attention. Taxation services provide comprehensive support to companies, guiding them through the intricate process of corporate tax compliance. Tax professionals assist in preparing financial statements, calculating tax liabilities, and identifying eligible tax incentives and reliefs. They stay updated with the latest tax regulations, helping businesses navigate complex tax structures and minimize tax risks.

3) Goods and Services Tax (GST) Services: The Goods and Services Tax (GST) was implemented in Malaysia as a value-added tax system to replace the Sales and Service Tax (SST). Taxation services play a crucial role in helping businesses understand and comply with the GST requirements. They assist in GST registration, preparing GST returns, maintaining proper records, and handling GST audits. Their expertise ensures accurate and timely submission, reducing the risk of penalties and fines.

4) Tax Advisory and Planning: One of the key advantages of engaging taxation services is the access to expert tax advice and strategic planning. Tax professionals possess in-depth knowledge of the Malaysian tax system and can provide valuable insights to optimize tax efficiency. They analyze individual or business financial situations, identify tax-saving opportunities, and develop tailored tax strategies. Effective tax planning can help individuals and businesses minimize tax burdens while remaining compliant with legal obligations.

5) Tax Audit Assistance: Tax audits are a routine part of the tax compliance process in Malaysia. Taxation services assist individuals and businesses during tax audits by liaising with tax authorities, ensuring accurate representation of financial information, and addressing any queries or discrepancies. Their expertise and experience mitigate potential risks and help clients navigate the audit process smoothly.

6) International Taxation Services: In an increasingly globalized world, cross-border transactions and international tax considerations have become more complex. Taxation services offer specialized guidance for individuals and businesses involved in international activities. They help clients understand and comply with international tax laws, navigate double taxation agreements, and optimize tax structures for international operations.

Navigating the intricacies of taxation in Malaysia requires expert knowledge, careful planning, and compliance with legal obligations. Professional taxation services play a vital role in simplifying this process for individuals and businesses, providing guidance, expertise, and strategic planning to ensure accurate tax reporting and minimize tax burdens. By engaging taxation services, individuals and businesses can focus on their core activities while entrusting their tax obligations to experienced professionals.

1 note

·

View note

Text

Loot Project: the first community owned NFT gaming platform

Around the Block from Coinbase Ventures sheds light on key trends in crypto. In this edition, Justin Mart and Connor Dempsey explain what Loot Project is and why it’s interesting.

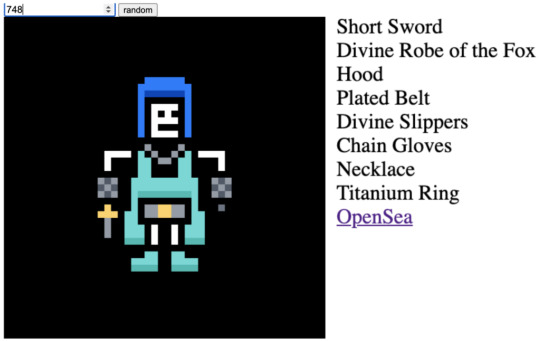

Pictured below, is a Loot bag: A text file consisting of 8 phrases overlaid on a black background. As it turns out, this text file is also an NFT, “Loot Bag #748,” and it sold for 250 ETH, or about $800,000 at current prices.

So what can you do with it? Not much… for now, at least.

Dungeons & degens

On August 27th, Dom Hoffmann, who notably co-founded Vine, introduced Loot. A project consisting of 8,000 NFTs full of words that depict “randomized adventurer gear.” Closer inspection reveals items that a character might wield in a game like Dungeons & Dragons. A Short Sword, or Divine Robe of the Fox, for instance.

While we’ve seen a lot of NFT drops over the last few months, two things set Loot apart. First, these NFTs could be claimed for free. The claimee simply had to pay the standard Ethereum gas fee. The other more obvious differentiator: these NFTs are just a bunch of words.

Despite the glaring lack of chimp or penguin art, once claimed, these plain text NFTs quickly started selling for tens of thousands of dollars. At the time of writing, $230M in Loot has changed hands.

https://medium.com/media/bcdc0eb3c6f7974f5ec960bf04ffa2a2/href

Loot NFTs under the hood

One’s knee-jerk reaction might be to dismiss Loot as just another symptom of speculative NFT fever. Loot does, however, introduce an interesting new NFT primitive. Before we get to what makes it interesting, it helps to understand a bit more about what a Loot NFT is.

Instead of just being a single provably scarce image, each of the 8 items within a given Loot bag has smart contract readable parameters. On top of that, each of the 8 items has its own rarity within the broader Loot universe.

Returning to Bag #748, while 6 of the 8 items are deemed “common”, the Short Sword and the Divine Robe of the Fox are decidedly rare. The Short Sword appears only 325 times across 8,000 Loot bags while the Divine Robe of the Fox appears only once.

Ok, so we have NFTs with Dungeons and Dragon-ey words on them that are smart contract compatible, with some words appearing less frequently than others. So what?

A community owned gaming platform

People appear to be excited about Loot not because of what the NFTs are, but what they could be. These NFTs were released into the wild and left to the interpretation of anyone who found them interesting. Anyone can build something using Loot NFTs as a foundation.

A sound analogy comes from Avichal Garg at Electric Capital, who likens Loot with a 52 deck of cards. Where on its own, a deck of cards is just 52 pieces of paper with pictures on them. With a bit of ingenuity, it’s also the foundation for thousands of games, from Poker, to Hearts, to Crazy 8’s.

Similarly, Loot and its 8,000 NFTs can serve as the foundation of an entire gaming metaverse. The ideal end state being an entire ecosystem of games where Loot items like the Divine Robe of the Fox serve different functions: think Dungeons & Dragons in the metaverse. Whoever builds something on top of Loot NFTs can determine the function served by a given item.

By building the foundation of a game, without building a game itself, Loot leaves its fate in the hands of a decentralized community. Whether or not one thinks it will be successful, it’s an intriguing idea to many.

So what are people building?

Early Loot experiments

For one, the image I showed above ranking the rarity of Loot bag #748 comes from an application built by someone named @scotato in the Loot community. By pasting your Loot contract address into 0xinventory.app, NFT owners can see the rarity of their Loot bag (note the ranking system was also devised by the community).

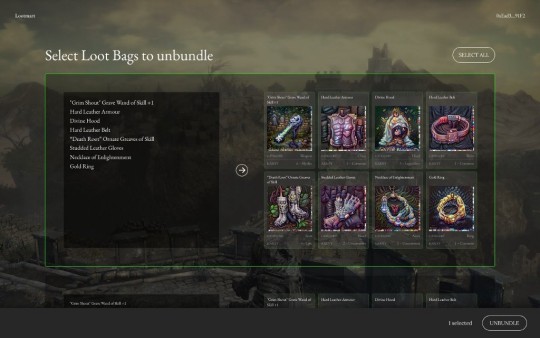

Another project called Lootmart will allow Loot holders to unbundle their Loot Bag into individual NFTs to swap items with other Loot holders, complete with AI generated images of individual items.

Similarly, lootcharacter.com was created to generate pixelated characters based on Loot bags. Here’s Bag #748.

A community member also spun up an ERC-20 token called Adventure Gold ($AGLD) while he was waiting at an airport. Anyone with a Loot bag could claim 10,000 $AGLD. FTX created spot and futures markets for the token and it hit a high of $7.70, meaning Loot holders were essentially gifted tokens worth $77,000 at their peak.

https://medium.com/media/ece0dcc12fd22f15eecfda930dd0f66e/href

The idea behind $AGLD is that it can serve as an in game currency woven into a game that gets built some day. But like Loot itself, its value is up for interpretation. This didn’t stop people from incorporating it into other budding Loot projects, including a Loot themed “choose your own adventure” story, where $AGLD holders can vote on the direction of the story.

In Chapter 1 of, “Holy War Lore”, $AGLD holders were allowed to vote on whether a man wearing a Divine Robe should put on a Demon King’s crown to absorb his powers (they voted that he put on the crown). In Chapter 2, the crown gets the man into trouble and there’s currently a vote on how he should handle the situation.

These are just a few examples of what the grassroots community of Loot enthusiasts has created so far. The Loot discord reveals wide ranging discussion with distinct channels for builders, artists, writers and a whole lot more.

Creating value from chaos

To recap, Loot is interesting because it inverts the typical gaming and community development path. The Loot creator simply built the foundation of a gaming universe and threw it into the wild to see what others would do with it. And so far, it has energized a diverse community, with a host of new Loot projects in development.

This excitement, coupled with the current NFT bull market sent Loot NFTs soaring, with the cheapest Loot bag trading for $23,000 today. There are however, no guarantees that anything resembling a real game or real utility ever gets built on Loot. Owning a Loot bag is a bet on future utility, which is up to the community to build.

This is the challenge that Loot faces. Can a decentralized community channel its enthusiasm into creating inherent utility in owning a Loot bag? That utility could come from creating strategy games similar to Axie Infinity where Loot items can be used in combat, artwork and avatars exclusive to Loot owners, or from some other application yet to be cooked up.

We are just two weeks into the project, so imagination is required today, but the appeal is tangible.

The cost of entry

A key question surrounding Loot is “Why would game developers build games that incorporate Loot bags when only a select few can afford them?” Developers build games that appeal to the mass market, but the vast majority of gamers are priced out of owning a Loot bag today.

The question of incentives lies at the heart of Loot’s future. Are there answers? Yes — a few. First, game developers who build on Loot have the benefit of bootstrapping their game with a core, passionate community of Loot enthusiasts. Second, and more importantly, there may be unique ways to incorporate Loot without pricing out the majority of the market. We can take inspiration from Axie Infinity and Yield Guild Games. When Axie NFTs got too expensive for most players to afford, lending markets emerged that let players borrow the NFTs needed to play in return for a portion of the winnings from Play to Earn games. We could see the emergence of Loot DAOs that devise similar solutions. Synthetic Loot is another solution being explored. Synthetic Loot lets anyone claim a pseudo Loot bag that can’t be sold or transferred but can be used in Loot games, should a developer choose to allow it. This in theory can open the door for more players.

While many questions remain, we’re in the early stage of a radically new kind of project that’s completely inverted the typical game development model. A self organized grassroots community is now tasked with taking Loot’s foundation and building something real, with all of the tools that crypto, NFTs, and metaverse economies have to offer. The burning questions surrounding Loot’s future make it one of the most captivating experiments in crypto; one that will be fascinating to watch play out over the coming months and years.

Coinbase news

Kate Rouch Joins Coinbase as Chief Marketing Officer

Coinbase updates investment policy to increase investments in crypto assets

Coinbase secures first crypto license in Germany

Coinbase Protocol Team Advances Crypto Community

Retail

Binance.US Hires Ant Group Exec to Succeed Ex-CEO Brian Brooks

Robinhood announces new crypto DCA investing feature

OpenSea bug destroys $100,000 worth of NFTs, including historical ENS name

FTX strikes ambassador, equity deal with NBA star Steph Curry

El Salvador launches Chivo wallet as bitcoin becomes legal tender

You can now mint NFTs on crypto exchange FTX

Twitter testing the ability to display Bitcoin and Ethereum addresses on profiles

Institutional

FTX.US acquires crypto derivatives exchange LedgerX

Mastercard acquires CipherTrace to boost crypto security and compliance

Former CFTC Commissioner, Brian Quintenz joins a16z Crypto’s advisory team

Panama lawmaker introduces proposed crypto regulation law

Bitso Is Providing the ‘Core Service’ for El Salvador’s Chivo Bitcoin Wallet

Australia, Malaysia, Singapore and South Africa will test cross-border CBDCs

SEC Sets November Deadline for Final Decision on VanEck Bitcoin ETF

Ecosystem

Ethereum scaling solution Arbitrum launches mainnet and raises $120 million in new funding

DeFi trading platform dYdX opens access to its governance token

Liquid staking protocol Lido now supports Solana’s SOL token

Eden, priority transaction network for Ethereum, raises $17.4 million in token sale

SubQuery, indexing protocol for Polkadot ecosystem, raises $9 million in SAFT sale

SEC is investigating decentralized crypto exchange developer Uniswap Labs: Report

Tweets

Burniske on how ETH maximalists are becoming the new BTC maximalists

Avichal Garg breaks down what makes Loot so compelling

An on the ground account documenting Bitcoin Day in El Salvador

The TLDR on the growth of Axie Infinity & Yield Guild Games

This website does not disclose material nonpublic information pertaining to Coinbase or Coinbase Venture’s portfolio companies.

Disclaimer: This material is the property of Coinbase, Inc., its parent and affiliates (“Coinbase”). The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Coinbase or its employees and summarizes information and articles with respect to cryptocurrencies or related topics that the author believes may be of interest. This material is for informational purposes only, and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations or (iii) an official statement of Coinbase. No representation or warranty is made, expressed or implied, with respect to the accuracy or completeness of the information or to the future performance of any digital asset, financial instrument or other market or economic measure. The information is believed to be current as of the date indicated on the materials. Recipients should consult their advisors before making any investment decision. Coinbase may have financial interests in, or relationships with, some of the entities and/or publications discussed or otherwise referenced in the materials. Certain links that may be provided in the materials are provided for convenience and do not imply Coinbase’s endorsement, or approval of any third-party websites or their content. Coinbase, Inc. is not registered or licensed in any capacity with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission.

Loot Project: the first community owned NFT gaming platform was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

from Money 101 https://blog.coinbase.com/loot-project-the-first-community-owned-nft-gaming-platform-125fa1d5ffa8?source=rss----c114225aeaf7---4

via http://www.rssmix.com/

1 note

·

View note

Photo

Personal Advisory Services Market 2021-28 Soaring 2X CAGR with Fidelity, State Street Global Advisors, J.P. Morgan Asset Management, Vanguard, BlackRock, CAPTRUST, Fisher Investments, Fort Washington Investment, Hall Capital Partners

A brokerage account in which a broker can only make limited investment decisions without consulting the investor. Such decisions must be made in accordance with the customer’s stated investment goals.

Advisory services are provided with the goal to support undertakings and overcome weakness in specific areas like finance, business, legal etc. A range of business advisors are bestowing best-in-class services to help organizations perform up to the ballpark and become a sovereign.

In a Brokerage account, advice is typically given at the time of trade. In an Advisory account, advice and monitoring occur on an ongoing basis. Advisory accounts attempt to avoid conflicts of interest, and disclose those which cannot be avoided. In a Brokerage account, the more you trade, the more fees you owe.

Request for a sample report here @ https://www.reportconsultant.com/request_sample.php?id=78881

Leading Personal Advisory Services Market key players across the World are:-

BlackRock

Fidelity Investments

State Street Global Advisors

P. Morgan Asset Management

Vanguard

CAPTRUST

Fisher Investments

Fort Washington Investment Advisors Inc

Hall Capital Partners

Chevy Chase Trust Company

Mesirow Financial Investment Management, Inc.

Silvercrest Asset Management Group, LLC

Cerity Partners, LLC

Moneta Group Investment Advisors, LLC

SCS Capital Management, LLC

The research report offers an aerial view of the Global Personal Advisory Services market including market share, price, revenue, growth rate, production by type. It categorizes and analyze the segments regarding type, region, and application. Moreover, it critically focuses on the application by analyzing the growth rate and consumption of every individual application. The global Personal Advisory Services market landscape and leading manufacturers offers competitive landscape and market development status including the overview of every individual market players.

Furthermore, it offers full-house data of vendors including the profile, specifications of product, applications, annual performance in the industry, sales, revenue, investments, acquisitions and mergers, market size, market share, and more. The report has created the global Personal Advisory Services market report with a coverage of detailed overview of the global Personal Advisory Services industry including global production sales, global revenue, and CAGR.

It provides a knowledge regarding Porter’s Five Forces including substitutes, potential entrants, buyers, industry competitors, and suppliers with genuine information for understanding the global Personal Advisory Services market. Furthermore, it offers detailed data of vendors including the profile, specifications of product, sales, applications, annual performance in the industry, investments, acquisitions and mergers, market size, revenue, market share, and more.

Segmentation by Type

Impromptu advice

Specialist advice

Profit and financial analysis

Profit improvement

Strategic Business Advice

The Personal Advisory Services market report delivers an in-depth study of market size, country-level market size, region, segmentation market growth, market share, sales analysis, value chain optimization, market players, the competitive landscape, recent developments, strategic market growth analysis, trade regulations, opportunities analysis, product launches, technological innovations, and area marketplace expanding. The Personal Advisory Services market reports delivers the knowledge about market competition between vendors through regional segmentation of markets in terms of revenue generation potential, business opportunities, demand & supply over the forecasted period.

Geographically, Personal Advisory Services report is segmented into many Key Regions covering United States, Canada, Germany, UK, France, Italy, Spain, Russia, Netherlands, Turkey, Switzerland, Sweden, Poland, Belgium, China, Japan, South Korea, Australia, India, Taiwan, Indonesia, Thailand, Philippines, Malaysia, Brazil, Mexico, Argentina, Columbia, Chile, Saudi Arabia, UAE, Egypt, Nigeria, South Africa and Rest of the World.

Ask for discount @ https://www.reportconsultant.com/ask_for_discount.php?id=78881

The research report has drafted the report with the offerings of price, production type, acquisition & mergers, Personal Advisory Services market size, market share, sales analysis, value chain optimization, trade regulations, technological innovations, opportunities analysis, and market players. The report introduces the industrial chain analysis, downstream buyers, and raw material sources along with the accurate insights of Personal Advisory Services market dynamics.

The report also offers a major microscopic view at the market and identifies the footprints of the manufacturers with the help of understanding the global revenue of vendors along with price and sales. The Personal Advisory Services market delivers quality data and appropriate figures with in terms of region, segmentation, and prominent players. The market report is determined to deliver relevant data about the global keyword market and help readers to find better track to invest in the Personal Advisory Services industry.

Conclusions of the Global Personal Advisory Services Market Professional Survey Report 2021 comprises:- Methodology, Analyst Introduction and Statistics Supply. In the end, the analysis comprises Personal Advisory Services SWOT analysis, investment partialness investigation, investment include research and development tendency investigation.

0 notes

Link

Mentor Advisors: the secret sauce for SME growth

A small business owner in Jodhpur runs a furniture business founded by his father. His current turnover is INR 15Cr per annum from sales within India. While his goods have a high international demand, the business owner is not sure of the next phase of growth.

• How can he expand his footprint?

• What can he do to bring down operational costs?

• How can he integrate technology in his business?

• What are the legal issues involved?

• Where can he get funding to boost growth?

These and many other questions remain unanswered.

This is the story of most small and medium enterprises (SMEs). Even while contributing 6.11% of the manufacturing GDP and 24.63% of Service sector GDP, SMEs are hard pressed to find new avenues of growth. Burdened with day-to-day operations, they find their growth plateauing. If we want to meet the Indian economy projection of $5 trillion by 2025, we need to support SMEs in their quest for growth. While the government is taking measures to boost this sector, SMEs most importantly need advice at an individual level.

This is where mentor advisors, consultants and coaches can make a huge difference. According to 92% of small business owners, mentor advisory has a direct impact on the growth and survival of their business.

The Mentor Advisor Advantage

Mentor Advisors provide expert guidance to small business owners based on their own experience and help them chart a path to hyper-growth by:

1. Sharing valuable industry insights – Mentor Advisors, coaches and consultants deep dive basis their own experience and broaden the company’s horizons. They bring the outsider but expert viewpoint that can shed new light on how the business could be run more efficiently.

2. Showing the right way-forward – Mentors answer the most important question that plagues SME growth – “HOW”. While it’s easy to devise strategies, most business owners struggle with execution. This is where a mentor’s experience is invaluable in avoiding mistakes.

3. Being a personal guide – Mentoring is not just about business. A mentor-mentee relationship is deep and can evolve to becoming a guide in balancing the personal and professional life.

4. Opening doors to new opportunities – Mentors can help business owners by connecting them to their network and other professional ones to open new avenues of growth.

However, unlike the thriving startup ecosystem where access to mentors has become easier due to global interest, the advisory needs of most small businesses (SMB segment) remain unfulfilled. As a result, many SMEs still rely on old school networks for advice that may not be necessarily optimal.

How and where can SMEs find mentor advisors?

To get the right kind of mentoring, it is important for SMEs to look beyond their immediate network and be clear on the guidance they seek.

1. Identify the problem for a mentor to solve.

2. Identify the desired outcome through the mentor.

3. Build an ideal mentor profile – experience, expertise, exposure, education etc.

4. Make a list of potential avenues to find the right mentor and professional forums – online groups, business associations, accelerator programs, alumni groups, incubators etc.

5. Join these groups, identify potential mentors, and reach out to them with a specific request.

6. Discuss with the potential mentor advisor/consultant if the desired partnership could be a good fit for the business and what is the time the mentor is willing to commit.

Indian SMEs who are able to tap in to a mentor’s/consultant’s expertise and network can hyper accelerate their growth. With all eyes on this segment and its given importance to India’s economic health and employment generation, this is the perfect time to find your advisor and coach, and ride on their experience towards business success.

SME mentoring/coaching in India is still nascent. Programs like Wadhwani Advantage specialise in working with SMEs to address this challenge through frictionless connects with world-class mentor advisors, consultants, and coaches for effecting the next leap in their business. Are you an SME entrepreneur interested in attending a program that will hyper-grow your business? Click HERE to know more about the Wadhwani Advantage program.

About Wadhwani Foundation:

Wadhwani Foundation was founded in 2000 by Dr. Romesh Wadhwani, with the primary mission of accelerating #job creation in India and other emerging economies through large-scale initiatives in entrepreneurship, small business growth, #innovation, and #skilling. The Wadhwani Foundation operates in 20 countries, including India, South East Asia (Indonesia, Malaysia, the Philippines), East Africa (Kenya, Uganda, Rwanda), Southern Africa (South Africa, Botswana, Namibia), West Africa (Nigeria, Ghana), Egypt, and Latin America (Mexico, Brazil, Peru, Chile). The Wadhwani Foundation works in partnership with governments, foundations, corporations, and educational institutes.

To know more about Wadhwani Foundation and its Initiatives: https://www.wfglobal.org

Click here to subscribe WF YouTube channel: https://www.youtube.com/channel/UC8J1yxr4VDX5KbkACBhMMQA

Connect with us:

Facebook: https://www.facebook.com/wadhwanifoundation

Twitter: https://twitter.com/WadhwaniF

LinkedIn: https://www.linkedin.com/company/wadhwanifoundation

Instagram: https://www.instagram.com/wadhwanifoundation

0 notes