#public limited company in india

Text

In Depth Guide on Public Limited Company

What is Public Limited Company

A Public Limited Company, also known as a PLC, is like a big family of investors and entrepreneurs coming together to achieve their financial goals. It's a special type of business that offers its shares to the public on stock exchanges, inviting anyone interested to become a part-owner by buying shares.

Imagine it as a bustling marketplace where shares of the company are up for grabs, and anyone with a little extra cash can join the club. But don't worry, joining this club comes with a safety net – the "Limited" part means that your financial responsibility is only as much as the money you put in. So, if things don't go as planned, your personal assets are safe and sound.

In simpler terms, a Public Limited Company is like a well-organised team where everyone chips in some money to make things happen, and in return, they get a slice of the company's success.

Importance of Establishing a Public Limited Company

1. Broadening Investment Horizons

Public Limited Companies (PLCs) have a unique advantage – the ability to attract capital from a diverse pool of investors. By offering shares to the public on recognized stock exchanges, PLCs can tap into a vast market of potential investors, allowing them to raise substantial capital compared to private entities.

2. Spreading Risk, Sharing Rewards

One of the key benefits of going public is the opportunity to diversify ownership and spread risk among a large base of shareholders. This not only reduces the financial burden on individual investors but also allows early backers of the company to cash in on their investments while still retaining a significant stake.

3. Access to Varied Financing Options

Beyond share capital, PLCs often enjoy better access to alternative sources of funding. Maintaining a stock exchange listing imposes additional compliance requirements, enhancing the company's creditworthiness when issuing corporate debt. This, in turn, makes it easier to negotiate favourable terms with banks and financial institutions for loans and financing.

4. Fueling Growth and Expansion

The influx of capital provides PLCs with ample opportunities for growth and expansion. Whether it's venturing into new markets, investing in research and development, or making strategic acquisitions, the additional financial resources enable PLCs to pursue ambitious projects and capitalise on emerging opportunities.

5. Enhancing Reputation and Visibility

The "plc" tag adds prestige and credibility to a company's name, bolstering its reputation in the eyes of stakeholders and investors. Publicly listed companies often command greater attention from the media and investment professionals, leading to increased brand recognition and visibility in the marketplace.

6. Facilitating Share Transferability

Unlike their private counterparts, shares of PLCs are more readily transferable, providing shareholders with greater liquidity. Quoted on stock exchanges, these shares are easier to buy and sell, offering investors flexibility and peace of mind.

7. Strategic Exit Opportunities

Going public opens up new avenues for founders to exit the business when the time is right. Higher share transferability and heightened visibility increase the likelihood of attracting potential buyers, providing founders with viable exit strategies for the future.

Visit our website for more information.

Cons of a Public Limited Company

Compulsory Regulatory Procedures Public Limited Companies (PLCs) are subject to mandatory audit, tax filing, and secretarial compliance filings. These legal obligations are non-negotiable and require meticulous attention to ensure adherence to regulatory standards.

Annual Compliance Obligations are obligated to fulfill annual compliance requirements stipulated by the Registrar of Companies. Failure to comply can lead to severe penalties and consequences. Directors risk disqualification for up to five years if financial statements or returns are not filed for three consecutive financial years. Additionally, delays in filing annual compliance forms incur penalty fees of Rs. 100 per day.

Navigating Complex Procedures Raising funds in PLCs involves navigating complex procedural aspects and taxation considerations. It is essential to analyze and follow these procedures meticulously to avoid repercussions. Non-compliance with the Companies Act, 2013, and SEBI guidelines for listing shares can have serious ramifications.

Challenges of Dissolution Dissolving a PLC is a complex and costly process, often more challenging than its formation. Entrepreneurs must carefully evaluate the implications before initiating the dissolution process to mitigate potential challenges and expenses.

Criteria for Establishment of Public Limited Company

At least 3 Directors are required.

A minimum of 7 shareholders/subscribers, referred to as Owners of the Company, is mandatory.

The Authorised Capital must be a minimum of Rs. 10 lakh.

The Paid-Up Capital must be a minimum of Rs. 5 lakh.

At least 1 director must be a resident.

Compulsory Annual Compliances:

MCA Filings (Required):

Compliance regarding the Commencement Certificate post formation of the Company.

Compliance regarding the appointment of Auditors of the Company.

DIR-3 KYC of Directors.

Return of Deposits, if any obtained.

Appointment of CS or CFO or CEO.

Preparation of Statutory Register.

Issuance of Share Certificates.

Printing & Payment of Stamp Duty on Share Certificates.

Conducting the First Board Meeting within 30 days of incorporation.

Conducting 4 Board Meetings in a year and 1 Annual General Meeting.

Annual Disclosures of interest/non-disqualification by Directors.

Filing of Financial Statements & Returns.

Accounting & Auditing (Required)

IT Filing (Required)

GST Compliances (Required), if registration already obtained

Additional Compliances as Needed:

Trademark Registration: Registering the Brand name and logo of the Company.

GST Registration & Compliances: Ensuring compliance with Goods and Services Tax regulations.

Trade License: Obtaining a license if required by local authorities.

Professional Tax Filing: Filing taxes if the Company has hired any employees.

Employees Provident Fund Organization (EPFO) Registration/Compliances: Required once the Company surpasses the threshold number of employees, i.e., 20 employees.

Employee State Insurance Corporation (ESIC) Registration/Compliances: Applicable once the Company exceeds the threshold number of employees, i.e., 10 employees in states other than Maharashtra, and 20 in Maharashtra.

Secretarial Audit: Mandatory once the Public Company exceeds the paid-up capital limit of Rs. 50 Crore or more, or turnover of Rs. 250 Crore or more.

#legal services#structuredbiiz#public limited company services#public limited company#public limited company registration#public limited company in india#legal

0 notes

Photo

Which one to choose?

1. PVT LTD. comapny is most suitable for small business and for mid- size business with limited share holders.

2. LTD. company is most suitable for businesses operating at a larger scale whioch requires public funding.

#public limited company in india#public limited company registration online#private limited company registration#pvt ltd company registration in india

0 notes

Text

What is the mini or max no of shareholders criteria for Public Limited Company Registration in India

To register a public limited company in India, a minimum of seven persons are required. There is no maximum limit to the number of persons who can form such a company. This requirement ensures that the company has a sufficiently diverse board and shareholder base to operate effectively and comply with legal regulations. If you want to know more about public limited company registration in India, then visit our website Legal Terminus today.

#bhubaneswar#india#company registration#companyregistrationinbhubaneswar#company registration in india#company incorporation#public limited company registration

0 notes

Text

Public Limited Company Registration: What to Consider

Check key factors to consider for Public Limited Company registration. Understand the requirements, benefits, and steps involved. Make Sure for compliance, attract investors, and set your business up for success with our right guidance for registering as a public limited company.

#Public Limited Company Certification#Public Limited Company Registration#Public Limited Company Certification Consultants#Public Limited Company Certification Consultants In India#Public Company Registration

0 notes

Text

NBCC (India) Ltd appoints Anjeev Kumar Jain as Director (Finance).

New Delhi: Anjeev Kumar Jain has been selected as the Director (Finance) of NBCC (India) Limited. The move comes following a meeting of the Public Enterprises Selection Board (PESB) held on July 13, 2024.

ALSO READ MORE- https://apacnewsnetwork.com/2024/07/nbcc-india-ltd-appoints-anjeev-kumar-jain-as-director-finance/

#Anjeev Kumar Jain#Anjeev Kumar Jain Director#Anjeev Kumar Jain Director Finance#Anjeev Kumar Jain Director Finance NBCC#Anjeev Kumar Jain NBCC#BHEL#Bridge And Roof Company (India) Limited#Director Finance NBCC#Executive Director at RITES Limited#HII Lifecare Limited#MECON Limited#NBCC India Ltd#NTPC Limited#PFC#Power Grid#Public Enterprises Selection Board

0 notes

Text

#Public limited Company registration in Bangalore#Public limited Company registration in Bangalore online#Online Public limited Company registration in Bangalore#Public limited Company registration#Public limited Company registration in Karnataka#Public limited Company registration in India#Public limited Company registration online in Bangalore

0 notes

Text

It is possible to convert a Private Limited Company into a Public Limited Company under The Companies Act, 2013. A Public Limited Company does have several benefits over a Private Limited Company. If you want to take advantages as well, then convert today, with the help of Eazy Startups Experts.

0 notes

Text

Things Biden and the Democrats did, this week.

The Consumer Financial Protection Bureau put forward a new regulation to limit bank overdraft fees. The CFPB pointed out that the average overdraft fee is $35 even though majority of overdrafts are under $26 and paid back with-in 3 days. The new regulation will push overdraft fees down to as little as $3 and not more than $14, saving the American public collectively 3.5 billion dollars a year.

The Environmental Protection Agency put forward a regulation to fine oil and gas companies for emitting methane. Methane is the second most abundant greenhouse gas, after CO2 and is responsible for 30% of the rise of global temperatures. This represents the first time the federal government has taxed a greenhouse gas. The EPA believes this rule will help reduce methane emissions by 80%

The Energy Department has awarded $104 million in grants to support clean energy projects at federal buildings, including solar panels at the Pentagon. The federal government is the biggest consumer of energy in the nation. The project is part Biden's goal of reducing the federal government's greenhouse gas emissions by 65% by 2030. The Energy Department estimates it'll save taxpayers $29 million in the first year alone and will have the same impact on emissions as taking over 23,000 gas powered cars off the road.

The Education Department has cancelled 5 billion more dollars of student loan debt. This will effect 74,000 more borrowers, this brings the total number of people who've had their student loan debt forgiven under Biden through different programs to 3.7 Million

U.S. Agency for International Development has launched a program to combat lead exposure in developing countries like South Africa and India. Lead kills 1.6 million people every year, more than malaria and AIDS put together.

Congressional Democrats have reached a deal with their Republican counter parts to revive the expanded the Child Tax Credit. The bill will benefit 16 million children in its first year and is expected to lift 400,000 children out of poverty in its first year. The proposed deal also has a housing provision that could see 200,000 new affordable rental units

11K notes

·

View notes

Text

check company registration

Your Source for Company Registration Verification: Page 27 on Wintro provides a user-friendly platform to confirm the legitimacy of company registrations, offering peace of mind when engaging with businesses in India.

#company directorship in india#details of public company#company name list india#company name registration#limited company india

0 notes

Text

Farmer Producer Organization (FPO Registration) - Process, Fees, Documents Required

The Indian economy is an agricultural-centric economy. Agriculture in India is the livelihood for a majority of the population as it employs more than 50% of the Indian workforce. But the sad part is producers and farmers are deprived of the agricultural process. They don’t have access to technology, knowledge, and funds. To address this issue, the concept of Producer Company was introduced in 2002, to help improve the lives of farmers and producers.

What is a Producer Company?

Producer company is a corporate body of producers, farmers and agriculturists with the objective of procurement, production, harvesting, grading, pooling, handling, marketing, selling or export of the members or import of goods and services for themselves. In simple words, this type of company is formed with the aim to improve the lives of people associated with the agriculture industry by providing them access to technology, market, credit, etc.

*Process of:

Step 1. Application for Digital Signature Certificate (DSC)

Step 2. Application for the Name Approval

Step 3. Filing of SPICe Form (INC-32): Details of the company, Details of members and subscribers, Application for Director Identification Number (DIN), Application for PAN and TAN, Declaration by directors and subscribers, Declaration & certification by professional

Step 4. Filing of e-MoA (INC-33) and e-AoA (INC-34)

Step 5. Issuance of PAN, TAN, and Incorporation Certificate

Read more about documents, fees, and benefits of Farmer Producer Organization

#business#india#business growth#manage business#nidhi company registration#private limited company registration in bangalore#public limited company registration#public records#farming#agriculture#public company#digital signature certificate#digital signature online

0 notes

Text

Step-by-Step Guide to Public Limited Company Registration in India | Legal Terminus

Public limited company registration in India involves a series of steps to ensure compliance with legal and regulatory requirements. Here’s a detailed look at the process:

STEP 1: Provision of Required Documents and Information

Gather and provide all the necessary documents and information.

STEP 2: Document Validation and Processing

Our team will validate the provided documents and information to ensure they meet all legal requirements.

STEP 3: Filing and Submission of Application

We will prepare and file the incorporation application online.

STEP 4: Payment of Government Fees

Pay the applicable government fees for the registration process. The fees vary depending on the authorized capital of the company.

STEP 5: Application Processing and Issuance of Registration Certificate

The MCA will review the application. Upon approval, a Certificate of Incorporation will be issued, officially for public limited company registration in India.

By following these steps, Legal Terminus ensures a smooth and efficient process of public limited company registration in India and also in Bhubaneswar.

#bhubaneswar#india#company registration#companyregistrationinbhubaneswar#company incorporation#public limited company registration#publiclimitedcompany

0 notes

Text

Public Limited Company Registration in Delhi is the most common way of consolidating an organization with restricted obligations and offers proposed to people in general. A Public Restricted Organization is a different and legitimate element from its investors and chiefs, with the capacity to raise capital from general society through the offer of offers. The enlistment cycle in Delhi includes getting a Computerized Mark Declaration, Chief Distinguishing proof Number, Update, and Articles of Affiliation. The organization should follow the standards and guidelines set out by the Organizations Act, 2013. This enlistment empowers the organization to get to the advantages of restricted responsibility and expanded straightforwardness, making it an alluring choice for those trying to extend their business activities. Contact us right now if you require Public Limited Company Registration in Delhi

#Public Limited Company Registration in Ambala#Public Limited Company Registration in India#Public Limited Company Registration in Delhi#Public Limited Company Registration in Rajasthan#Public Limited Company Registration in UP#Company Registration

0 notes

Text

Exploring the Role of a Public Limited Company: Understanding its Purpose in the Business World

Overview of Public Limited Company's Purpose: Limited companies are a type of general incorporation that place limits on the level of responsibility that the company's owners are willing to assume. This expression refers to a legal system that ensures that the amount of a company member's or subscriber's liability is limited to the extent of their contractual or financial investment in the company.

Assets and liabilities of a limited corporation are separate from those of the shareholders. As a result, if the company runs into financial trouble as a result of normal business operations, the shareholders' personal assets won't be in danger of being confiscated by creditors. It is simple to transfer ownership of a limited business.

The objectives of a public limited company

Expanding the business

Because their products and services are in greater demand, businesses require more funding to fund new initiatives. To generate additional money, many businesses are forced to go public. An organization that is publicly traded is more likely to raise equity to support a disproportionately larger amount of its needs. Equity financing reduces the company's ownership, but it also helps its finances by reducing debt and removing high-interest charges.

Maintaining the Company

It's possible for a firm to occasionally need more money to survive. Businesses that wish to stay in business frequently need to expand their operations. So, another important reason for a company to go public is to survive.

Gaining Profit

The main goal of Public Limited businesses is to increase shareholder wealth through profit. The company's founders could, for instance, concentrate on increasing the company's annual revenue or market share.

Increasing earnings by cutting costs and boosting sales is a typical goal. A public limited company (PLC) has the ability to raise more money than any other type of corporate entity. By expanding into new areas and creating new products, the company is able to grow quickly thanks to the additional investment.

Brand awareness

Brand recognition is valued by many public limited firms. Once a company is listed on the stock exchange, it is thought to have more prestige. As a result, it is easier to recruit top talent, draw in investors, and increase customer confidence.

In addition to going public, a business can increase brand awareness by getting involved in charitable causes, developing high-caliber goods that meet consumer needs, or having a solid marketing strategy.

Advantages of Public Limited Company

Public Shares Are Issued

A public company may issue shares to the general public in order to raise funds. It can also borrow money from a bank by putting up assets as security. It offers potential investors the possibility to buy company stock.

Shareholders may gain from liquidity as a result of being able to sell their shares on the open market. Because public corporations are also subject to greater levels of public scrutiny, the public can have more faith in the management team of a company.

Rising Financial Opportunities

Public companies have access to a wider range of financial instruments than private organizations do. This is due to the fact that public firms are subject to more scrutiny from regulators and the general public.

A public corporation has two ways to make money: selling shares to the general public and using its assets as collateral to get a loan from a bank or other financial institution, all the while providing shareholders with the opportunity to buy stock in the company.

More chances to develop and expand

The use of a public limited company is one of the most common methods for smaller businesses to go public. They can raise capital for expansion by selling shares to the general public and taking on debt. The operational and managerial accountability of public firms is also higher than that of smaller private companies.

The exchangeability of shares

A public limited company has open shareholders who are allowed to buy or sell the company's stock without the directors' consent. The freedom to transfer shares is known as "transferability of shares," and it makes it easier for public companies to attract investors than for private ones, which place restrictions on share transfers.

Public Limited Company Drawbacks

More stringent regulatory requirements

Public limited companies are subject to additional regulations than private companies. The public limited company must also hold an annual general meeting where shareholders can vote on important matters.

Ownership Issues

Shareholders of private enterprises frequently know the founders or directors. The company will be selective in who it lets become a shareholder, making sure that they support the objectives and business plans of the company.

Controlling who owns a corporation and what the directors are responsible for is substantially more complex than it is with a private limited company. This suggests that the original owners or directors of the company might no longer have control over it, might encounter difficulties, or might have to devote a lot more time to managing shareholder expectations.

Possibility of Taking Over

A small percentage of your corporation is owned by shareholders. But if they get along, they may have an impact on the strategic decisions made by your company. This implies that if a different organization decides it wants to take over your business, it may gradually buy up shares until it owns a majority of it. Once they have a decision to sell your business to the company, they will be able to compel that decision.

Conclusion

Public limited Company benefit from a variety of advantages, including the freedom to choose how they might raise capital and the enviable reputation that comes with being a public company. However, they are also subject to more regulation and inspection, which can be onerous for some organizations. Due to their greater openness to takeover offers compared to private limited corporations, they might be less long-term focused.

Read our Other Blogs on Public Limited Company to know More About it- Understanding the GST Registration Process for Public Limited Companies

#plc#public limited company#companyregistration#company#companyformation#public limited company registration#company registration in India

0 notes

Text

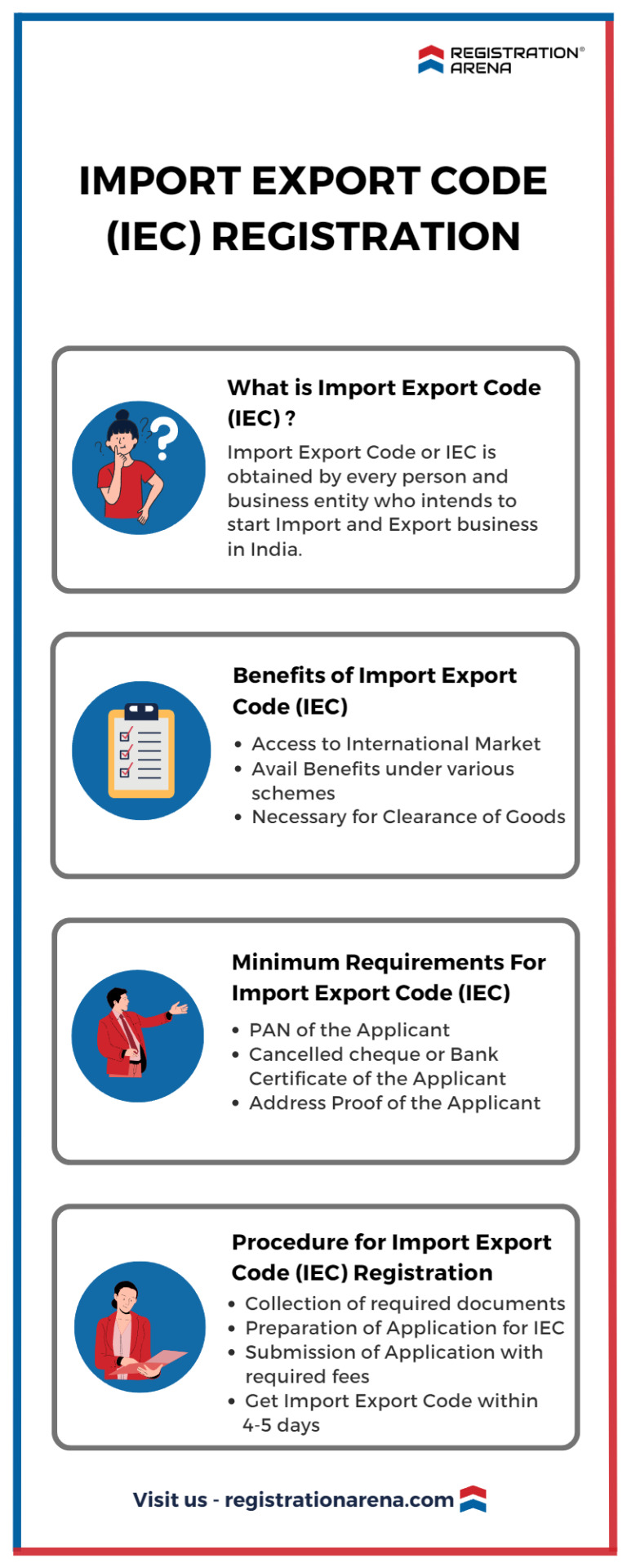

To engage in importing or exporting goods, all business entities are required to obtain a 10-digit identification number known as the Importer-Exporter Code (IEC). Without a valid IEC number, a person or entity is not permitted to conduct any import or export activities. In India, the Director General of Foreign Trade (DGFT) is responsible for granting IECs. IEC registration is a completely online process and can be finished within 4-5 days. IEC once issued shall be valid for a lifetime.

#legal advisers#legal consultation#legal services#llp registration#private limited company registration#sole proprietorship#public limited company#annual compliances of llp#annual compliance of private limited company#startup india registration#trademark registration#partnership firm registration#tds return filing#itr filing#Import-export code#opc registration

0 notes

Text

Public limited registration company in India by Indian Salahkar

Indian Salahkar is a well-known company in India that Public limited registration company in India. The company has a team of highly skilled professionals who have years of experience in providing such services. Indian Salahkar provides a wide range of services to its clients, including company registration, tax registration, filing of returns, and many more. Public Limited Registration is one of the most popular services provided by Indian Salahkar, and this service has helped many businesses to grow and prosper. The company takes care of all the legal formalities that are required for the registration of a public limited company, and ensures that the process is completed smoothly and efficiently. The company's experts also provide their clients with all the necessary guidance and advice related to the registration process, and help them to make informed decisions. Overall, Indian Salahkar is a great choice for businesses looking for reliable and efficient Public Limited Registration services in India.

0 notes