Professional, Business Expert, Economist, Philanthropist,and Author of business & Economics books

Don't wanna be here? Send us removal request.

Text

Better Opportunities for New India post COVID 19 : The World Manufacturing Hub

The whole world is struggling hard with the global lockdown during the pandemic COVID-19 and is striving its best to regain its economies. The IMF World Economic Outlook came out with its interesting growth projections stating that the Euro Area is projected to have a de-growth in 2020 at minus 7.5% and projected growth of 4.7% in 2021. They have projected that India will have a better position by attaining 1.9% in 2020 and 7.4% in 2021 as against a contraction in the global economy. India has great opportunity to become a global manufacturing hub and to boost their MSME sector which is the lifeline of the country which eventually contributes 45% of the total manufacturing and 40% of the total exports and provides huge employment to all the skilled, semiskilled and unskilled youth of the country.

The pandemic COVID-19 had its origin in China and it has gradually spread its claws all over the world creating global economic destruction and resulting in Anti-Chinese sentiments in the system. Now businesses and manufacturers are looking for possible alternative locations to set up their manufacturing units. Various companies are planning to shift its manufacturing units from China to India, Vietnam, Thailand, Indonesia, Eastern Europe etc. India is being seen as a viable option to become a global manufacturing destination going forward. Countries like Japan are in talk with the Indian Government to set up their base in India. Market giants like Pegatron Corp., Google, Microsoft, Apple’s manufacturing partner Wistron Corporation are planning to move out of China and set up their manufacturing units in countries like India, Vietnam, Thailand, Indonesia etc. India is one of the good choices for these companies due to its young population, availability of abundant land, skilled labour, low tax rate for new manufacturing units and favorable business environment. As per the World Bank latest 2019 data, in ease of doing business, Thailand ranks at 21, followed by India at 63, Vietnam at 70 and Indonesia at 73. But is this all that is needed?

The entire world now is rethinking to develop their manufacturing niche in their own country or set up their manufacturing unit in any other country except China so as to avoid such devastating loss in the future. This is a brilliant opportunity for India to become the manufacturing hub of the world by pressing the reboot key to start afresh with new ideas and new goals in New India. Hence, it is important to justify why the businesses will shift to India and not to the other countries. Developing India as a manufacturing hub and an economic powerhouse is not like pressing the F5 key on the computer. Not only we have to attract the foreign companies to set up their manufacturing units in India, but also rejuvenate our MSME sector to grow and support our economy and the international manufacturing in India.

Let us now analyze whether doing business in India is really easy as compared to other nations. As per the World Bank study, there are majorly 12 indicators, whose aggregate score, giving equal weight to each indicator, determines the rankings of the countries in ease of doing business and they keep on changing on year to year basis.

*Source: The World Bank

India is one among the top 10 countries which has shown major improvement in 2019 vis-à-vis 2018. After climbing up the ladder, due to business-friendly policies of Modi Government, India is now at 63rd position out of 190 countries with DB Score of 71.0 out of 100 points. These are the 10 indicators of ease of doing business which is prepared by comparing the business regulation in 190 countries and are being considered by the businesses (domestic and international) before starting a new venture:

We have seen that since the past few years, India is significantly improving its position in ease of doing business as per the World Bank ranking. Apart from ease of doing, the country has to take some bold steps to come out of COVID-19 setback and achieve its dream of becoming the most attractive manufacturing hub and in establishing new businesses.

a) The biggest challenge for us is to create a lucrative environment for the international businesses by relaxing the compliance procedures followed in the country. The Government shall start easing the punitive and criminality clauses from compliance, business, commercial and labour laws and trusting the businesses so that the investors/businesses can concentrate more on the growth of their business, rather than wasting time on the compliance burdens. Government should rely on the self-declarations being given by the businesses and give them a more work friendly environment. Maximum companies prior to investing in India will compare the entry procedures i.e. starting a business in India, getting lands, enforcing contracts, statutory compliances, penalty and prosecution clauses in compliance, business and labour laws with that prevailing in other countries. The India Government is now focusing on interacting with the businesses and stakeholders of various other countries to set up their manufacturing base in India but the Central and State Governments may set up specific workforce for interacting with the foreign and Indian entrepreneurs and frame guidelines for timely completion of the projects. The said workforce may be formed jointly by the industry experts, professionals and Government representatives;

b) As a matter of continuous endeavor of the Government to promote MSME, enough safeguards are already built in the MSME law which states that for every services/goods supplied by the MSME unit, the buyer needs to make payment as per the pre-set terms but not exceeding 45 days and in case of delay, interest is charged. The Government needs to implement this law strictly and ensure that the dues from the State/ Central Government, PSUs and big corporates are paid to the MSMEs immediately along with the applicable interest. As per the law, MSME registration is very simple through Udyog Aadhaar (https://www.msmeregistration.org), however still a lot of MSMEs are unregistered and not able to get all the benefits allowed to registered MSMEs. The Government needs to ensure that all the MSMEs get themselves registered through the website. The State Governments should also relax or defer the labour law applicability on MSME sector for few years;

c) The Reserve Bank of India (RBI) needs to pump in more funds in the system to fund the MSME sector. The total liquidity injected in the market by RBI values 3.2% of the GDP, which the Government needs to ensure that it flows into the MSME sector. In order to fight the financial crisis caused by the COVID-19, the MSME sector may be granted a moratorium period of 6 months instead of 3 months and immediate fresh business loan may be granted to those MSMEs who do not have any existing loan. The cash flows of the MSMEs may be maintained by enhancing the overdraft limit to 25% without any primary security or otherwise, with repayment schedule starting after 6 months from the date of granting the facility. Further, the Government should strictly implement the ‘Credit Guarantee Fund Scheme’ to make available collateral-free credit upto Rs 2 crore to the micro and small enterprise sector. The Government should also ensure that the banks approve the loan to the MSMEs and the purpose of bringing this scheme doesn’t get defeated. The Government should also relax the norms pertaining to non-performing assets of the MSMEs to release the burden from their shoulders. They should further assure the banks/ financial institutions that in case any loan turns bad in future, the sanctioning authority will not be held liable and they will not be booked by the criminal law;

e) The State Governments has to promote MSMEs in manufacturing and service sectors in B-class, C-class, small towns and villages and link them with digital platforms for procuring raw materials and selling their goods. Though we have a few digital platforms for selling of goods in MSME sector which are run by the Government, but we need such digital platforms which will be run and managed by the MSMEs only and which can be operated in the local language also for easy understanding by the MSMEs.

f) The country’s agriculture sector accounts for 17% contribution in the GDP and has a growth rate of 2.1%. Out of the 138 cr population, approx. 58% population of the country is engaged in the agriculture sector. Since agriculture sector is the prime sector employing the maximum population of India, the Government needs to focus on increasing the percentage of the contribution to GDP from this sector by allowing businesses to invest in this sector by way of PPP model. Accordingly, the businesses can invest at the initial stages i.e. funding the farmer for seeds, fertilizer, labour cost etc. and purchase the entire crop at a price not which is being fixed by the Government. In case of any natural calamity or unforeseen circumstances resulting in loss of crop, the farmers and businesses should get the minimum fixed amount from the insurance company. The businesses may adopt this as their business model. Currently the Government through banks, provides loans to the farmers and if due to some natural calamity or otherwise, the crops get affected, then as a result of various compulsions, the Government has to waive off the loans and it creates a habit of financial indiscipline in the country.

Conclusion:

In this global crisis, each and every country is trying to start afresh and revive back its economic growth and become the new economic powerhouse. The Indian Government has always been reviewing its policies in the best interest of the country. The focus should now be drawn on improving India's performance in ease of doing business by reviewing and rationalizing its policies in Dealing with Construction Permits, Getting Electricity, Registering Property, Paying Taxes, Trading across Borders, Enforcing Contracts, Resolving Insolvency, Employing Workers and Contracting with the Government. The existing punitive and criminality clauses from compliance, business, commercial and labour laws need to be reviewed and relaxed. Entrepreneurs and foreign businesses should be given a free hand to focus on the business growth and in turn aid in the economic growth of the country.

MSME sector is growing at 10%, which needs to be escalated by establishing MSME in small town and villages and connect them through digital platforms owned and run by the MSME sector in the local language also. The State Governments should relax or defer the labour law applicability on MSME sector and incentivise them link with their production for the next few years. The Government should strictly implement the ‘Credit Guarantee Fund Scheme’ to make available collateral-free credit upto Rs 2 crore to the MSME sector. They should also ensure that the banks approve the loan to the MSMEs and the purpose of bringing this scheme doesn’t get defeated. The Government shall also focus on developing the agricultural sector by allowing investment through farmer-business-government model where Government needs to allow investment by businesses and the minimum price should be controlled by the Government.

Written & Compiled by CA Sunil Kumar Gupta

Founder Chairman, SARC Associates

www.sarcassociates.com; www.sunilkumargupta.com

0 notes

Text

Better opportunities for New India to become a world manufacturing hub after COVID-19

Do we actually know where the world will be after the next 6 months? As the Corona Virus pandemic gradually spreads its claws all over the world, we are trying hard, joining hands, trying to fight the destruction to make the mother earth sustainable. We are maintaining social distancing and lockdown to tackle the ill effects of the virus; the businesses have pressed the pause button and the whole economy is witnessing a downfall. The stock markets were the first in the line to get affected. The travel industry has been massively hit since there were restrictions in travel and gradually it has put a check in the domestic and international travel, although the supermarkets and the online groceries have witnessed a high demand due to the social distancing and the lockdown. Immediately after the outbreak, people had been piling groceries at their home. There has been a major drop in the air pollution post the lockdown and we could see the nature dancing in its own rhythm.

Although the lockdown resulted in a halt in the manufacturing and production chain all round the world, but it is likely that the countries like India, with cheap labour will climb the ladder and end up starting inhouse manufacturing and exports. According to Customs statistics, China’s foreign trade volume in 2019 stood at RMB31.54 trillion, up by 3.4% year-on-year (similarly hereinafter). Exports rose by 5% to RMB17.23 trillion and imports grew by 1.6% to RMB14.31 trillion. The trade surplus increased by 25.4% to RMB 2.92 trillion. In 2019, China’s foreign trade registered a momentum of improving quality amid overall stability. The People’s Republic of China shipped US$2.499 trillion worth of goods around the globe in 2019 along with its various other partner countries. As per the latest available data, it may be seen that approx. 60.2% of products were exported from China and bought by importers in: the United States (16.8% of the global total), Hong Kong (11.2%), Japan (5.7%), South Korea (4.4%), Vietnam (3.9%), Germany (3.2%), India (3.0%), Netherlands (3%), United Kingdom (2.5%), Taiwan (2.2%), Singapore (also 2.2%) and Malaysia (2.1%). With the closing down of the manufacturing and distribution units in China there has been a major drift and scarcity of the imported products and the small scale distribution channels. China posted a $295.8 billion trade surplus with the United States in 2019.

With the major halt in the exports by China, there is a sudden shortage of supply of various products like Phone system devices including smartphones, Computers, optical readers, Integrated circuits/micro assemblies, Processed petroleum oils, Solar power diodes/semi-conductors, Automobile parts/accessories, Lamps, lighting, illuminated signs, Computer parts, accessories, Models, puzzles, miscellaneous toys and TV receivers/monitors/projectors market all over the world.

What’s coming next?

In order to save the entrepreneurs and the industry in this crisis, the Indian Government has been taking certain steps to:

A. Prevent the opportunistic takeovers of the Indian businesses; and

B. Make a conducive environment to make India a global manufacturing hub

The above may be described in details.

A. Prevent the opportunistic takeovers of the Indian businesses:

Check post on the Foreign Direct Investment (FDI):

On April 18, 2020, the Department for Promotion of Industry and Internal Trade (DPIIT) issued its Press Note 3 of 2020 (PN 3 of 2020 Series) whereby they have reviewed the current Foreign Direct Investment (FDI) Policy and has brought in major changes in the policy in order to prevent opportunistic takeovers/acquisitions of the Indian companies due to the current COVID-19 pandemic. According to the release,

“A non-resident entity can invest in India, subject to the FDI Policy except in those sectors/activities which are prohibited. However, an entity of a country, which shares land border with India or where the beneficial owner of an investment into India is situated in or is a citizen of any such country, can invest only under the Government

route. Further, a citizen of Pakistan or an entity incorporated in Pakistan can invest, only under the Government route, in sectors/activities other than defence, space, atomic energy and sectors/activities prohibited for foreign investment.”

Countries sharing land borders with India are Pakistan, Bangladesh, China, Nepal Bhutan and Afganistan. Hence by this Press Note, the Department has allowed both direct and indirect investment in India by any entity or beneficial owner or citizen of that country ONLY by way of Government Approval. The Press Note further says that if there is any transfer of ownership of any existing or future FDI in an entity in India, directly or indirectly, resulting in the beneficial ownership falling within the aforesaid restriction/purview, such subsequent change in beneficial ownership will also require Government approval. The primary intent of the Department is to regulate any attempts by Chinese entities/ beneficial owners/citizens to take control of Indian entities which have been affected by COVID-19 lockdowns. Now, fresh infusion of funds by Chinese entities in existing investments in India would also require government approval. The Department is even putting the restrictions on the multi-layered structures, spread across various jurisdictions.

Subsequently, the Securities and Exchange Board of India (SEBI) has issued directives to the custodians for the FPI investments or beneficial interest information of investors coming from China as well as Hong Kong. It is now scanning the hubs such as the Cayman Islands, Singapore, Ireland and Luxembourg to track the direct and indirect investments from China and Hong Kong in the country.

It has been mentioned that the intent of the Department is to curb opportunistic takeovers/acquisitions of the Indian companies due to the current COVID-19 pandemic. Deep down it can be said that post the HDFC Ltd. disclosure on April, 11, 2020, that the China’s central bank People’s Bank of China (PBoC) has increased its stake in the Company from 0.8% to 1.01%, the Department and SEBI has been minutely watching the FDI movement in the country.

B.Make a conducive environment to make India a global manufacturing hub:

i. India the next manufacturing hub:

The effects of the recent lockdown in China were felt by many Japanese, Korean and other manufacturers which witnessed the supply of components for their factories grind to a halt since factories in China shuttered. Now, various companies are planning to shift its manufacturing units from China to the different other Asian states. Countries like Japan are in talk with the Indian Government to set up their base in India. Market giants like Google, Microsoft, Apple are even planning to move out of China and set up their manufacturing units in countries like Vietnam, Thailand etc.

India will be a very good choice for these companies due to its extremely cheap labour cost, maximum workforce base, favorable diversified weather conditions and huge area in the country.

ii. Self reliant:

As a result of the complete shut down of the economic activity, India along with other countries is expected to face a downfall in the GDP in the 1st quarter of the Financial Year 2020–21. Although from the second and third quarters, it is expected to witness a steady growth with the increase in in-house manufacturing and supply as per the market demand. There is ample opportunity for the SMEs in India to regularize the global supply chain disruption caused by the outbreak of the pandemic COVID-19. India has less dependence on China for the intermediate goods and with the added factor of cheap labour and lower manufacturing cost, the manufacturing sector will see a boom in its growth history. India can easily manufacture the various consumer products and export both the raw materials and the finished products in large scale.

iii. Employment Generation and Government support:

Although the sector wise production is expected to decrease in the recent times, but there is huge scope of employment generation in the coming days. The Indian Government has been reviewing its policies in order to combat this crisis and have even come up with its recent decisions on easing of Working Capital Financing, infusing liquidity in money markets, Greater access to MSF (Marginal Standing Facility), Permitting Banks to Deal in Offshore Non-Deliverable Rupee Derivative Markets (Offshore NDF Rupee Market) etc. Moreover, the RBI has already infused INR 280,000 crore, equivalent to 1.4% of Indian GDP, which along with the current tools announced by the RBI will result in liquidity injection of 3.2% of the GDP and is fully prepared to take ‘whatever tools are necessary — all instruments, conventional and unconventional are on the table’. Consequently, surplus liquidity in the banking system has increased sharply in the wake of sustained government spending.

Regional offices of the RBI have supplied fresh currency of INR1.2 lakh crore from March1 till April 14, 2020 to currency chests across the country to meet increased demand for currency in the recent scenario. RBI has even undertaken measures to target liquidity provision to sectors and entities which are experiencing liquidity constraints and/or hindrances to market access. It has been decided to conduct targeted long-term repo operations (TLTRO 2.0) for an aggregate amount of INR 50,000 crore, to begin with, in tranches of appropriate sizes. As confirmed by the RBI in the recent press release, the apex bank will review the operations and the situation and accordingly may increase the amount as per the requirement.

iv. Trade Balance:

Foreign direct investment (FDI) is one of the major sources of non-debt financial resource for the economic development of India. Foreign companies invest in India to take advantage of relatively lower wages, large consumer base, special investment privileges such as tax exemptions and for the benefit of ease of doing business.

According to the report shared by the Department for Promotion of Industry and Internal Trade (DPIIT), FDI equity inflows in India in April-December, 2019 stood at US$36.79 billion, indicating that government’s effort to improve ease of doing business and relaxation in FDI norms is giving positive results. As per the latest RBI Press Note, the trade deficit declined to US $9.8 billion in March 2020 from US $11 billion a year ago. After the economic activities resumes its operation post COVID-19, the Current Account deficit may be reduced by increasing the export on a large scale and decreasing the import of goods.

v. Growth in the Agricultural Sector:

The country’s agriculture sector accounts for 17% contribution in the GDP and has a growth rate of 3.4%. Approx. 55 cr population of the country is engaged in the agriculture sector which tantamount to 58% employment generation. Since agriculture sector is the prime sector employing the maximum population of India, so the Government focusses on increasing the percentage of the contribution to GDP from this sector. It has even been observed that by April 10, pre-monsoon kharif sowing had begun strongly, with acreage of paddy — the principal kharif crop — up by 37% in comparison with the last season. India has set up an ambitious goal of doubling farm income by 2022.

The farmers should now have a direct reach to the market so that they can sell their products in the market directly and at a reasonable rate; use of new techniques and technology to be introduced to attract youth to this sector and ultimately achieve better production and exports.

vi. Growth in GDP:

With the massive side effects of the pandemic spread, our dependence on the import of raw materials and consumer goods will be curtailed forcefully. Service industry will grow extensively, and tourism industry will be linked with the healthcare sector so as to give an added benefit to the youth employed. As per the RBI report, India is expected to post a sharp turnaround and resume its pre-COVID pre-slowdown trajectory by growing at 7.4 per cent in 2021–22. As the trade balance is maintained, Indian GDP is expected to make a remarkable growth in the next few quarters.

Steps already taken

The Indian Government had recently announced economic package of INR1.7 lakh crores under Prime Minister Gareeb Kalyan Yojana to protect the poor citizens of the country from the economic impact of the nationwide lockdown and decided to defer the Tax and regulatory payments along with compliance filings as a relief to combat the existing crisis and for easy governance. The apex Bank has also come up with some positive arrangements to infuse liquidity in the market and control the turmoil. Some of the steps taken may be highlighted as below:

a) Money markets were facing pressures from redemptions by mutual funds. The Targeted Long-term Refinancing Operations (TLTRO) will ease the liquidity position of the banks, for which they were supposed to invest in investment-grade bonds, commercial paper etc. In order to reduce the adverse effects on the economic activity leading to pressures on cash flows, the RBI had decided to conduct auctions of targeted term repos of up to three years tenor of appropriate sizes for a total amount of up to ₹1,00,000 crore at a floating rate linked to the policy repo rate. This will reassure the money markets to work without the crunch of funds.

b) The RBI recently issued a press note confirming that they had a talk with the NABARD, SIDBI and NHB and accordingly decided to provide special refinance facilities for a total amount of INR 50,000 crore to NABARD, SIDBI and NHB to enable them to meet sectoral credit needs.

c) The cut of 75 basis points in repo rate is a powerful signal, aimed at lowering the cost of funds. The interest on floating rate housing loans will come down, helping household cash flows. Repo rate has come down to 4.40 % from 5.15%. The RBI also cuts the reverse repo rate two times, one by 90 basis points and another by 25 basis points, which has now come down to 3.75% to discourage banks to passively deposit funds with the RBI.

d) Liquidity coverage ratio requirement for Scheduled Commercial Banks has been brought down from 100% to 80% with effect from April 17, 2020.This requirement shall be gradually restored back in two phases — 90% by October 1, 2020 and 100% by April 1, 2021.

e) Health insurance scheme of INR 50 lakh for health workers fighting COVID-19 in Government Hospitals and Health Care Centres has been announced.

f) In order to help the poorest section of the society, a total of 20.40 crores PMJDY women account-holders would be given an ex-gratia of INR 500 per month till June, 2020 to help them run their household during this difficult period. The Government of India has also declared to spend INR 31,000 crores for this purpose.

g) Free gas cylinders, would be provided to 8 crore poor families till June, 2020 and three gas cylinders would be provided to the beneficiaries of Pradhan Mantri Ujjwala Yojana during this period.

h) Under National Rural Livelihood Mission Scheme, collateral free loans is doubled from INR 10 Lakhs to INR 20 lakhs to 63 lakhs Women Self Help Groups(SHGs) which would ultimately benefit 6.85 crore households.

i) It has been now decided that where the time limit of due dates for issue of notice, intimation, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, any other documents and time limit for completion of proceedings by the authority and any compliance by the taxpayer, including investment in saving instruments or investments for roll over benefit of capital gains under Income Tax Act, Wealth Tax Act, Prohibition of Benami Property Transaction Act, Black Money Act, STT law, CTT law, Equalisation Levy law, Vivad Se Vishwas law is expiring between March 20, 2020 to June 29, 2020, it has been extended to June 30, 2020.

j) Taxpayers having aggregate annual turnover less than INR 5 crore will be allowed to file return under Form GSTR-3B due in March 2020, April 2020 and May 2020, till 30th June, 2020 without any interest, late fee, and penalty whereas others having annual turnover more than or equals to INR 5 crore will be allowed to file the same with a reduced interest of 9% p.a. instead of the existing 18% p.a., from 15 days after the relevant due date but without any late fee or penalty.

k) In order to reduce the burden and make the default good, the Ministry of Corporate Affairs has introduced Companies Fresh Start Scheme, 2020 and LLP Settlement Scheme, 2020 with a one-time relaxation to law abiding Companies and LLPs so as to enable them to complete their pending compliances without payment of any additional filing fees, thereby the entrepreneurs may focus on the growth of their businesses.

Recommendation:

An intensive study on the past economic performance of the Indian economy vis-à-vis the global economy and the effects of the COVID-19, a few recommendations are likely to be highlighted for the taking advantage of the better opportunities to the Indian economy:

a) The India Government should now focus on interacting with the business entities and Governments of various other countries to set up their manufacturing base in India. The Central and State Governments may set up specific workforce for interacting with the foreign investors and frame guidelines for timely completion of the projects. The said workforce may be formed jointly by the industry experts, professionals and Government representatives.

b) New guidelines for Foreign Portfolio Investment (FPI) may be introduced in order to safeguard the opportunistic takeovers/ acquisitions of the Indian businesses by way of indirect overseas investments.

c) While calculating the qualifying criteria of the non-performing assets (NPA) the lockdown period and the long-term economic impact of the COVID-19, may be excluded;

d) The Government may incentivize digitalization and facilitate payments through digital mode only and the charges on the credit card/ digital payments may also be waived off;

e) The compliance structure/norms may be diluted for the MSME sector in order to encourage ease of doing business in India. Post the COVID-19 effects, India is expected to have the largest job-market ready for youth population in the world by 2020–21 and this sector is sure to support India in improving its financial inclusion and mitigating the rural-urban divide. Several policy interventions along with technology and innovation will continue to play a pivotal role in creating a business- friendly atmosphere for the MSMEs;

f) There may be a reduction in the short-term GST rate for some specific sectors and further the GST deposit may be linked to the receipt of the amount for the services rendered to balance the cash flows for the time being. Presently GST deposit is based on the invoice raised and not on the payment basis. It can in return reduce the burden on the SME sector and in return reduce the defaults;

g) Tax compliances may be diluted and there may be a reduction in the Tax rate and interest rate on business borrowings in order to give relaxation to the manufacturers and the consumers. Tax rate reliefs may also be allowed to the proprietorship and partnership entities like the Companies;

h) In order to encourage export and reduce import, the Government may bring certain relaxations on the export compliances and also expedite the refund and duty drawback process to stabilize the cashflow operation;

i) There should be compulsory health and life insurance by the Government for the healthcare workers, police, Safai karamcharis who are working endlessly for eradicating this menace.

Conclusion

The recent reforms or policies taken up by the Government clearly demonstrates that the we are leaving no stone unturned to make India a better place to do business and to improve opportunities for all sections of society along with increasing prosperity. India now has the best opportunity to become the economic giant and work as ‘one-size-fits-all’ country and the best business destination in the world. India has always been a friendly partner to the other countries and has now even decided to relax the export of hydroxychloroquine to the USA on case to case basis. It is good to quote that in the coming days India will be the prime source for supply of all essential and life saving commodities to the world. The World Trade Organisation sees global merchandise trade contracting by as much as 13–32 per cent in 2020. Activity in the corporate bond market has picked up appreciably, with several corporates making new issuances. The level of foreign exchange reserves continue to be robust at US $ 476.5 billion on April 10, 2020 equivalent to 11.8 months of imports. India is expected to become the next economic powerhouse with its core competencies.

In order to put a further check on the import of goods, the Government may increase the duty on import of consumer goods and incentive to be given to the MSME sector in order to encourage the production of goods and increase the exports of the country. New technologies are required to be used in the cottage and rural divisions. The government incentives are required to be increased in the manufacturing sector along with easy accessibility of finance and market to the youth so that they can engage themselves in this sector and can start manufacturing without any marketing or financial difficulty.

Written & Compiled by CA Sunil Kumar Gupta

Founder Chairman, SARC Associates

www.sunilkumargupta.com www.sarcassociates.com

0 notes

Photo

The Companies Act, 2013 and Limited Liability Partnerships Act (LLP Act) 2008 require all Companies/ Limited Liability Partnerships (LLPs) to make annual statutory compliance by filing the Annual Return and Financial Statements. Apart from this, various other statements, documents, returns, etc. are required to be filed on the MCA electronically within prescribed time limits.

As part of its constant efforts to ease of doing business and to reduce the litigation burden from the Companies and/LLPs and in order to encourage the businessman to focus more on the growth of the Company/LLP and organize their internal structure, the Government of India has announced a one-time relaxation to law abiding Companies and LLPs so as to enable them to complete their pending compliances without payment of any additional filing fees. The Ministry of Corporate Affairs (MCA), introduced the “Companies Fresh Start Scheme, 2020” and revised the “LLP Settlement Scheme, 2020” to provide an opportunity to both companies and LLPs to make good their default by filing pending documents and to serve as a compliant entity in future. The Fresh Start scheme and modified LLP Settlement Scheme condone the delay in filing the specified documents with the Registrar, insofar as it relates to charging of additional fees, and granting of immunity from launching of prosecution or proceedings for imposing penalty on account of delay associated with certain filings during the unprecedented lockdown caused by COVID-19. The prominent feature of both the schemes is a one-time waiver of additional filing fees for delayed filings by the companies or LLPs with the Registrar of Companies during the currency of the Schemes, i.e. during the period starting from 1st April, 2020 and ending on 30th September, 2020.

Both the Schemes, apart from giving longer time for corporates/LLPs to comply with various filing requirements under the Companies Act 2013 and LLP Act, 2008, significantly reduce the related financial burden on them, especially for those with long standing defaults, thereby giving them an opportunity to make a “fresh start”. Both the Schemes also contain provision for giving immunity from penal proceedings, including against imposition of penalties for late submissions and also provide additional time for filing appeals before the concerned Regional Directors against imposition of penalties, if already imposed. However, the immunity is only against delayed filings in MCA 21 and not against any substantive violation of law.

Details of the both the Schemes are available vide the Circular nos. 12/2020 & 13/2020 dated 30.03.2020, issued by the Ministry of Corporate Affairs.

The Schemes are not applicable in following cases :

Non-applicability in case of Companies:

to companies against which action for final notice for striking off the name u/s 248 of the Companies Act 2013 (previously Section 560 of the Companies Act, 1956) has already been initiated by the Designated Authority.

where an application has already been filed by the companies in Form STK-2 for striking off the name of the company from the Registrar of Companies.

to companies which have amalgamated under a scheme of arrangement or compromise under the Act.

where applications have already been filed for obtaining Dormant Status under section 455 of the Act before this scheme.

to vanishing companies.

Where any increase in Authorised Share Capital is involved and also charge related documents

Non-applicability in case of LLPs:

LLPs which has made an application in Form 24 to the Registrar, for striking off its name from the register as per provisions of Rule 37(1) of the LLP Rules, 2009.

Conclusion:

The Government of India is working on giving the businessmen the opportunity to mitigate the pending litigations against their business so that they are able to focus on developing their business and in turn contribute in the growth of the nation’s wealth and GDP of the Country. In the wake of this pandemic outbreak, it is an opportunity on the shoulders of the professionals to help the businessmen by working online and cleaning the pending compliances of the Companies and the LLPs.

Written & Compiled by CA Sunil Kumar Gupta

Founder Chairman, SARC Associates

www.sarcassociates.com; www.sunilkumargupta.com

0 notes

Text

COVID-19 – Few tips to master ‘Work From Home’

With the outbreak of the COVID-19 and the subsequent nationwide lockdown, life is operational in a more or less standstill mode now. Government took strict steps to combat the spread of the deadly virus and ordered to close schools, malls, cinema halls and later on all offices except some of the offices providing essential services to the society. With the revolution of technology in recent times, many of the MNCs and corporates have been providing ‘Work from Home’ facility to its employees. With the complete lockdown of activities and to sustain the economy, employers have an option to allow ‘Work from Home (WFH)’ for the safety of employees and society as a whole.

Keeping connected is of utmost importance at the time of pandemic while keeping social distance and consequent strains from the spread of the COVID-19 pandemic. Many of the employees might be working from remote places and may not be used to this facility, and this might be a challenge for others.

Regardless, below are some of the tips that would help you master ‘Work from home’ strategy:

1. Ideal workspace

Choose a silent and comfortable place in your home with something similar to an office desk- like a desk and a working chair with close access to a charging point for your laptop and/or smartphone. Also, look for an ideal background wall for online meetings and talks with colleagues. Refrain from the couch or bed, as that could trigger a backache and neck problems and isn’t healthy if prolonged.

2. Organize time and space

You have to be tricky with an increased number of responsibilities and distractions while working from home. You have also to manage other distractions e.g. Children at home, household chores etc. besides your time for office work. Keep your desk organised and clean, and keep a notepad, pen, earphones etc. handy at all times. If your partner/spouse is working from home too, incorporate your working schedules and take turns for daily household chores.

3. Train yourself in technology

Work from home is entirely based on your efficiency with technology and software applications chosen by your employer e.g. Skype, Zoom, Microsoft Teams etc. Speak to your IT department for any required help or take help from a tech-savvy person in your home. In dire circumstances, you can even watch a Youtube tutorial for a better tech grip.

4. Communicate properly

In WFH, you must always prioritize communication. Stay connected with your team as well as the manager. Refrain from emails and use video chats for queries instead. Let your colleagues know that you are available. Physical isolation is ok, but do not isolate yourself socially. You can even stay connected with your colleagues through non-work related video chats. Keep checking on others, although not excessively, even as a manager.

5. Maintain a strict schedule

Remember even in WFH, you are getting a salary. Set reminders and always stay available for scheduled video conferences and keep some buffer time for the unscheduled ones as well. Stay professional and organise household activities in a manner that does not hamper your work. Coordinate with others at your home by sharing house workload and inform them of your working hours. Try to stick to your office schedule, taking scheduled breaks for yourself.

6. Don’t forget to exercise

In these trying times, please do not forget to stay healthy and fit. Take little strolls around the house in between work-related tasks and munch on some healthy snacks in between. Find an ideal time in your routine for exercise and stay hydrated. Listening to music will help you to focus on your work. Put the tougher tasks for the morning and others for later half. Finding a balance will help you to better fit into a WFH environment.

7. No distractions

WFH makes you more vulnerable to get sucked into non-productivity through distractions like social media, children at home or readily available entertainment, without your team around to keep a check. As explained earlier, keep such distractions for scheduled breaks or after working hours. Better to log out of non-work social media accounts as possible to improve your work efficiency.

A team should always work as a team along with working independently with the sole intention of positively contributing to the nation-building exercise. It is a once for all opportunity of every working professional to prove his/her abilities and grab the opportunity, add value by reading new things, working in isolation and preventing the nation to fight against the pandemic COVID-19.

Written by

CA Sunil Kumar Gupta

Founder Chairman, SARC Associates

www.sunilkumargupta.com www.sarcassociates.com;

0 notes

Text

Reserve Bank of India’s big move to inject liquidity in the market and big relief to the common man and small businesses

In order to mitigate the financial stress due to the disruptive force of COVID-19, the Reserve Bank of India had come up today, i.e. on 27th March, 2020, with a Statement on Developmental and Regulatory Policies which focuses on:

(i) expanding liquidity in the system to ensure that the financial markets and institutions are able to function normally in the current distress;

(ii) reinforcing monetary transmission so that bank' credit flows on easier terms are sustained to those who have been affected by the pandemic;

(iii) easing financial stress caused by COVID-19 disruptions by relaxing repayment pressures and improving access to working capital; and

(iv) improving the functioning of markets in view of the high volatility experienced with the onset and spread of the pandemic.

A detailed analysis of the press release made by the Reserve Bank of India is as follows:

1. Reduction in Repo rate: The cut of 75 basis points in repo rate is a powerful signal, aimed at lowering the cost of funds. The interest on floating rate housing loans will come down, helping household cash flows. Repo rate will come down to 4.40 % from 5.15%. The committee further cuts the reverse repo rate by 90 basis points which will come down to 4.00% to discourage banks to passively deposit funds with the RBI.

2. Forbearance: RBI instructed all Banks/ FIs to allow moratorium of three months on payment of instalments, for all term loans outstanding as on 1st March 2020, which will help people to postpone payment of EMIs and help their cash position. This will support cash flows of firms too. The same goes for deferment of interest on working capital loans for a period of three months in respect of all such facilities outstanding as on 1st March, 2020. Deferment of Loan repayment for three months would not impact the credit history of the borrower.

3. Easing of Working Capital Financing: In respect of working capital facilities sanctioned in the form of cash credit/overdraft, lending institutions may recalculate drawing power by reducing margins and/or by reassessing the working capital cycle for the borrowing without resulting in asset classification downgrade.

4. Liquidity in money markets: Money markets were facing pressures from redemptions by mutual funds. The Targeted Long-term Refinancing Operations (TLTRO) will ease the liquidity position of the banks, for which they were supposed to invest in investment-grade bonds, commercial paper etc. In order to reduce the adverse effects on the economic activity leading to pressures on cash flows, the apex bank had decided to conduct auctions of targeted term repos of up to three years tenor of appropriate sizes for a total amount of up to ₹1,00,000 crore at a floating rate linked to the policy repo rate. This will reassure the money markets to work without the crunch of funds.

5. Cut in Cash Reserve Ratio (CRR): The 100 basis point cut in cash reserve ratio (CRR) means more money with banks. Some of them had to access the wholesale funding markets for maintaining the mandatory Ratio. Despite ample liquidity in the system, the transmission is slow, hence CRR is reduced from 4% to 3% for a period of 1 year. This reduction in the CRR would release primary liquidity of about ₹1,37,000 crore holdings uniformly across the banking system in excess of SLR. Minimum daily CRR daily balance is also reduced from 90% to 80%, due to social distancing in banks effective from the first day of the reporting fortnight beginning March 28, 2020.

6. Greater access to MSF (Marginal Standing Facility): Under the marginal standing facility (MSF), banks can borrow overnight at their discretion by dipping upto 2 per cent into the Statutory Liquidity Ratio (SLR). In view of the exceptionally high volatility in domestic financial markets which bring in phases of liquidity stress and to provide comfort to the banking system, it has been decided to increase the limit of 2 per cent to 3 per cent with immediate effect. This measure will be applicable up to June 30, 2020 and would provide additional comfort of ₹1,37,000 Crores of liquidity to the banking system under the Liquidity Adjustment Facility (LAF) window.

These three measures relating to TLTRO, CRR and MSF will inject a total liquidity of ₹3,74,000 crore to the system.

7. Widening of the Monetary Policy Rate Corridor: The Apex Bank today decided to widen the existing policy rate corridor from 50 bps to 65 bps. Under the new corridor, the reverse repo rate under the liquidity adjustment facility (LAF) would be 40 bps lower than the policy repo rate and the marginal standing facility (MSF) rate would continue to be 25 bps above the policy repo rate.

8. Deferment of Net Stable Funding Ratio (NSFR) by six months: As part of reforms, the Basel Committee on Banking Supervision (BCBS) had introduced the Net Stable Funding Ratio (NSFR) which reduces funding risk by requiring banks to fund their activities with sufficiently stable sources of funding over a time horizon of a year in order to mitigate the risk of future funding stress. As per the prescribed timeline, banks in India were required to maintain NSFR of 100 per cent from April 1, 2020. It has now been decided to defer the implementation of NSFR to October 1, 2020.

9. Deferment of Last Tranche of Capital Conservation Buffer: The capital conservation buffer (CCB) is designed to ensure that banks build up capital buffer during normal times (i.e., outside periods of stress) which can be drawn down as losses are incurred during a stressed period.

As per Basel standards, the CCB was to be implemented in tranches of 0.625 per cent and the transition to full CCB of 2.5 per cent was set to be completed by March 31, 2020 (Revised). Considering the potential stress on account of COVID-19, it has been decided to further defer the implementation of the last tranche of 0.625% of the CCB to September 30, 2020.

10. Permitting Banks to Deal in Offshore Non-Deliverable Rupee Derivative Markets (Offshore NDF Rupee Market): The offshore Indian Rupee (INR) derivative market - the Non-Deliverable Forward (NDF) market - has been growing rapidly in recent times. At present, Indian banks are not permitted to participate in this market, although the benefits of their participation in the NDF market have been widely recognised. Accordingly, it has now been decided, to permit banks in India which operate International Financial Services Centre (IFSC) Banking Units (IBUs) to participate in the NDF market with effect from June 1, 2020. Banks may participate through their branches in India, their foreign branches or through their IBUs.

11. Forward guidance: The RBI has infused ₹ 280,000 crore, equivalent to 1.4% of Indian GDP, which along with the current tools announced by the RBI will result in liquidity injection of 3.2% of the GDP and is fully prepared to take ‘whatever tools are necessary—all instruments, conventional and unconventional are on the table’. RBI reaffirms the hope to deal with COVID-19 economic impact.

Conclusion :

Our Country’s outlook is now heavily contingent upon the intensity, spread & duration of the pandemic. There is a rising probability that most parts of the world economy would also slip into recession. RBI’s role is to maintain its "accommodative" stance and would maintain its position "as long as necessary" to revive growth while ensuring inflation remained within the target. Priority is being given to undertake the purposeful action in order to minimise the adverse macroeconomic impact of the pandemic. Today’s RBI announcement is a major step to boost the economy which is reeling under lockdown and hardships due to negative effects of COVID-19.

Written and compiled by

CA Sunil Kumar Gupta

Founder Chairman, SARC Associates

www.sarcassociates.com; www.sunilkumargupta.com

0 notes

Photo

Government announces financial relief to combat the lockdown crisis.

The Hon’ble Finance Minister, Nirmala Sitharaman held a press conference on 26th March, 2020 and announced economic package of ₹1.7 lakh crores under Prime Minister Gareeb Kalyan Yojana to protect the poor citizens of the country from the economic impact of the nationwide lockdown. The Hon’ble Finance Minister said the relief package includes direct benefit cash transfers, free LPG, grains and pulses for the poor while the middle class would be able to withdraw funds from their Employees Provident Fund (EPF) account. The scheme comes into effect from April 1, 2020.

Main features of the package

I. Insurance scheme for health workers fighting COVID-19 in Government Hospitals and Health Care Centres :

Safai karamcharis, ward-boys, nurses, ASHA workers, paramedics, technicians, doctors, specialists, all government health centres, wellness centres and hospitals of Centre as well as States would be covered under this health insurance scheme of ₹50 lakh under the scheme. Approximately 22 lakh health workers would be provided medical insurance cover to fight this pandemic.

II. Under Pradhan Mantri Garib Kalyan Yojana

•Each farmer would be given ₹2,000 during the month of April, 2020.

•It would cover 8.69 crore farmers and ₹16,000 crores would be distributed to them.

III. Cash transfers to poor Under PM Garib Kalyan Yojana :

• A total of 20.40 crores PMJDY women account-holders would be given an ex-gratia of ₹500 per month for next three months. This will help them to run their household during this difficult period. Government of India will spend ₹31,000 crores for this purpose.

• Under the yojana, gas cylinders, free of cost, would be provided to 8 crore poor families for the next three months.

• Three gas cylinders would be provided to the beneficiaries of Pradhan Mantri Ujjwala Yojana during this period. ₹13,000 crores would be provided for this purpose.

Support for senior citizens (above 60 years), widows and Divyang

There are around 3 crore old aged widows and people in Divyang category who are vulnerable due to economic disruption caused by COVID-19. Government will give them ₹1,000 to tide over difficulties during next three months. ₹3,000 crores are provided for this purpose in the Package.

IV. PM Garib Kalyan Ann Yojana

• Government of India would not allow anybody, specially any poor family, to suffer due to non-availability of food grains due to disruption during the next three months. Approximately 80 crore individuals in the country would be covered under this scheme.

• Each one of them would be provided double of their current entitlement over next three months and this would be free of cost. GOI will bear entire expenditure of ₹40,000 crores for this purpose.

•GOI to ensure adequate availability of protein to all the above mentioned individuals. Per person 5kg rice or 5kg wheat for free for 3 months and 1kg of pulse per household as per to regional preference, would be provided for next three months. ₹5000 crores would be spent for this purpose.

V. Benefits to workers under Mahatma Gandhi Employment Guarantee Act (MNREGA)

• Under PM Garib Kalyan Yojana, MNREGA wages would be increased from ₹182 to ₹202 per day with effect from 1 April, 2020. Approximately 13.62 crore families would be benefited and ₹5,600 Crores will be spent for this purpose.

VI. Other components of PM Garib Kalyan package :

Organised sector :

• The Central Government will bear the Employees’ Provident Fund contribution for both the employer and the employee for the next 3 months in the case of establishments having upto 100 employees and where 90 per cent earn less than ₹15,000 per month

• Employees’ Provident Fund Regulations will be amended to include Pandemic as the reason to allow non-refundable advance of 75 percent of the amount or three months of the wages, whichever is lower, from their accounts.

• Families of 4 crore workers registered under EPF will be benefited.

Financial relief to Building and construction workers:

• Central government has given orders to state governments to use funds available under District Mineral Fund (DMF) and announced that ₹31,000 crore will be used to provide relief to the Building and construction workers. This will ultimately result in benefitting 3.5 crore construction workers. The states will be able to use district mineral fund for meeting COVID-19 medical expenses.

Self-Help groups :

Under National Rural Livelihood Mission Scheme, collateral free loans is doubled from ₹10 Lakhs to ₹20 lakhs to 63 lakhs Women Self Help Groups(SHGs) which would ultimately benefit 6.85 crore households.

In the package , the Government has assured that the people will not die of hunger and all measures will be initiated in good spirit to mitigate the problems faced by the countrymen. GOI has also made provision to keep bank branches open during lock down period. The Government opines that the package will benefit approximately 80 crore citizens i.e. 2/3rd population of the country. With the announcement of package, Sensex was gone up 1,055.11 points or 3.70 per cent at 29,590.89. Similarly, the NSE Nifty also stood 284.20 points, or 3.42 per cent, higher at 8,602.05 at 1430 hours yesterday.

Conclusion:

In order to tackle the national lockdown the Central Government announced a number of economic relief for the most affected population/ small businesses and daily wage workers. Besides injecting liquidity in the market with immediate effect, the Government is trying hard to shape the economy and control the financial hardships being faced by the weaker section of the society.

Written and compiled by

CA Sunil Kumar Gupta

Founder Chairman, SARC Associates

www.sarcassociates.com; www.sunilkumargupta.com

0 notes

Text

Relaxation from tax and regulatory compliance timelines in view of COVID-19 outbreak

Having gripped the world with massive footprints, the coronavirus pandemic has kicked off a wave of mass hysteria over the conscious precautions. Surging cases of people hoarding essential commodities in large quantities, have come to the notice. Routine life of everyone is badly affected due to shutting down of schools, colleges, malls, Cinema halls etc. India has gone in lockdown mode and economy will also remain in this mode with the increasing cases of the spread of Covid-19 disease at a fast clip over the past few days. Several companies such as Maruti Suzuki India Ltd, Titan Co. Ltd, Dabur India Ltd and Asian Paints Ltd. have announced closure of their manufacturing facilities. All domestic passenger flights are being suspended for the month.

While there is a general agreement that social distancing is the need of the hour, there are growing concerns over the severe economic impact of an extreme lockdown situation. India has gone ahead of various countries in imposing strict restrictions on its citizens to fight the spread of Covid-19.

In this situation the India Government decided to defer the Tax and regulatory payments and compliance filings as a relief to combat the existing crisis. The Hon’ble Finance Minister (FM), Nirmala Sitharaman held a press conference on Tuesday 24th March, 2020 to announce various important relief measures taken by the government on statutory and regulatory compliance matters which has been highlighted below:

a) Income Tax

Due date for filing belated and revised income tax returns (ITR) under section 139(4) and 139(5) respectively of the Income Tax Act, for FY 2018–19 (AY 2019–20), extended from 31st March, 2020 to 30th June, 2020.

A person having Permanent Account Number (PAN) is required to link his Aadhaar number on or before 31st March, 2020. Failure to do so shall make the PAN inoperative immediately after 31st March, 2020. Extension has been granted for linking of Aadhaar with PAN from 31st March 2020 to 30th June 2020.

Under the Direct Tax Vivad se Vishwas Act, 2020, if a taxpayer under the Act opts for withdrawal of appeals, he/she is required to pay 100 % of the disputed tax if paid by 31st March, 2020, and if paid after 31st March, 2020, 110 % of the disputed tax is required to be paid. Under the relief measures announced in the press release, the additional 10 % amount has been waived off, if the amount is paid by 30th June, 2020.

It has been now decided that where the time limit of due dates for issue of notice, intimation, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, any other documents and time limit for completion of proceedings by the authority and any compliance by the taxpayer, including investment in saving instruments or investments for roll over benefit of capital gains under Income Tax Act, Wealth Tax Act, Prohibition of Benami Property Transaction Act, Black Money Act, STT law, CTT law, Equalisation Levy law, Vivad Se Vishwas law is expiring between 20th March, 2020 to 29th June, 2020, it shall be extended to 30th June, 2020.

In the cases of delay in deposit of advance tax, self-assessment tax, regular tax, TCS, equalisation levy, Securities Transaction Tax (STT), Commodities Transaction Tax (CTT), interest of 12% p.a. (i.e. 1% p.m.) and for delay in deposit of TDS interest of 18% p.a. (i.e. 1.5% p.m.) is levied. The Government has given a relief by reducing the interest rate of 9% p.a. (i.e. 0.75% p.m.) instead of 12%/18% and removing the penalty provision, only in the cases where delayed payments will be made during 20th March, 2020 to 30th June, 2020.

b) GST/Indirect Tax

Taxpayers having aggregate annual turnover less than INR 5 crore will be allowed to file return under Form GSTR-3B due in March 2020, April 2020 and May 2020, till 30th June, 2020 without any interest, late fee, and penalty whereas others having annual turnover more than or equals to INR 5 crore will be allowed to file the same with a reduced interest of 9% p.a. instead of the existing 18% p.a., from 15 days after the relevant due date but without any late fee or penalty.

Another major relief provided is the extension of the due date for opting for composition scheme till 30th June, 2020. Moreover, the last date for making payments for the quarter ending 31st March, 2020 and filing of return for FY 2019–20 by the composition dealers has also be extended till the 30th June, 2020.

The due date of filing the annual return in Form GSTR-9 for the FY 2018–19, which was due on 31st March, 2020, has been extended till 30th June, 2020. (Notification no. 15/2020 — Central Tax dated 23 March 2020 has already been issued in relation to the extension of due date for filing annual return for FY 2018–19).

Due dates for issue of notice, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, any other documents, time limit for any compliance under the GST laws where is expiring between 20th March, 2020 to 29th June, 2020, has been proposed to be extended to 30th June, 2020.

Moreover payment date under Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 shall be extended to 30th June, 2020 without any interest, if payment is made by 30th June, 2020.

c) Customs

The Government has decided to start customs clearance on 24X7 basis till 30th June, 2020, even during the lockdown period and has also decided to relax the timelines where due date for issuance of notice, notification, approval order, sanction order, filing of appeal, furnishing applications, reports, any other documents etc. or time limit for any compliance under the Customs Act and other allied laws is expiring between 20th March, 2020 to 29th June 2020, it has been decided to extend the same till 30th June, 2020.

d) Financial Services

Considering the crisis situation and the lockdown decision, the government has decided that no charges will be levied on cash withdrawal through Debit Card from any other bank’s ATM, no fees will be charged for not maintaining the minimum balance requirement and there will be a reduction in the bank charges for digital trade transactions for all trade finance consumers for the next 3 months.

e) Corporate Affairs

In order to reduce the financial burden from the non-compliant Companies/ LLPs and to clear their backlog of pending filings and to make a ‘fresh start’ the Government has decided to waive the additional fees for delay in filing of any form, document, return, statement etc. with MCA, during the moratorium period starting from 1st April, 2020 to 30th September, 2020.

It has also been decided to extend the mandatory time gap between two Board meetings as per the Companies Act, 2013 (currently 120 days) has be extended by 60 days for quarter ending 30th June, 2020 and 30th September, 2020.

The Hon’ble Finance Minister even highlighted that the applicability of the recently introduced Companies (Auditor’s Report) Order, 2020 shall be made from FY 2020–2021 instead of FY 2019–2020 s as to ease the burden from the Companies as well as the Auditors.

A major relaxation provided by the Government is the removal of the condition of non-compliance with the provisions of Schedule IV of the Companies Act, 2013 in case of inability of holding separate meeting of Independent Directors during the FY 2019–2020.

Timelines for creation of deposit reserve of 20% of the deposits maturing during FY 2020–2021 has been relaxed from 30th April, 2020 till 30th June, 2020.

Requirement to invest 15 % of debentures maturing during a particular year in specified instruments before 30th April, 2020, has been extended to 30th June, 2020.

As per the provisions of the Companies (Amendment) Ordinance 2018, a newly incorporated company needs to file a declaration for Commencement of Business (in Form INC-20A) with the Registrar of Companies within 180 days of the date of incorporation of the company. An additional time period of 6 months has now been allowed to the newly incorporated companies.

Inability to meet minimum residency requirement of stay in India for 182 days by at least one director of the company under section 149 of the Act, shall not be treated as a violation for FY 2019–20.

In order to prevent triggering of insolvency proceedings against MSMEs, the thresholds of default under section 4 of Insolvency and Bankruptcy Code, 2016 (IBC, 2016) has been raised to INR 1 crore (from the existing threshold of INR 1 lakh). It has been declared that in case the COVID-19 outbreak continues beyond 30th April, 2020, the government may consider suspending section 7, 9 and 10 of the IBC 2016 for a period of 6 months to stop companies at large from being forced into insolvency proceedings in such force majeure causes of default.

Detailed notifications/circulars regarding any/all the above compliance requirements shall be reviewed and issued by the Ministry of Corporate Affairs as and when required.

Conclusion:

It is not only the statutory and compliance relaxation, but it has also been discussed and decided that in order to normalise the entire scenario, import of SPF Shrimp Broodstock and other Agriculture inputs expiring between 1st March, 2020 to 15th April, 2020 has been extended by 3 months, delay upto 1 month in arrival of consignments shall be condoned. There will be no additional rebooking charges for quarantine cubicles for cancelled consignments in Aquatic Quarantine Facility (AQF) Chennai and the verification of documents and grant of NOC for Quarantine has been relaxed from 7 days to 3 days.

In order to combat the impact of coronavirus on the economy and to mitigate the aftereffects of Covid-19, the Government is now working out on the Economic packages. The Hon’ble Finance Minister of India stated that every attention is being given to the economy and the Hon’ble Price Minister is also closely monitoring the situation. The current situation in the economy may not improve immediately but the entire global economy may take some time to grow and attain the desired level.

Written and compiled by

CA Sunil Kumar Gupta

Founder Chairman, SARC Associates

www.sarcassociates.com; www.sunilkumargupta.com

0 notes

Text

CARO 2020: Another Step Towards Effective Auditing Of Financials Of Corporates

MCA has notified new Companies (Auditor’s Report) Order, 2020 (hereafter referred to as CARO, 2020) on February 25, 2020 replacing the previous Companies (Auditor’s Report) Order, 2016. CARO and is applicable from immediate effect. As per CARO 2020, Auditor has to highlight the qualification in the report in Italics. CARO will be annexed to the main Audit Report in which an Auditor gives assurance of the compliances of the Accounting Standard and Companies Act made.

CARO, 2020 is divided into four sections viz. New Clauses, Re-instatement from old CARO versions, deletion of Clauses and brief Comparison with CARO, 2016.

1. NEW CLAUSES

1.1. Fixed Assets – Immovable Properties [Clause 3(i)]

1.1-1. Disclose immovable properties whose title is not held by the company [Clause 3(i)(c)]

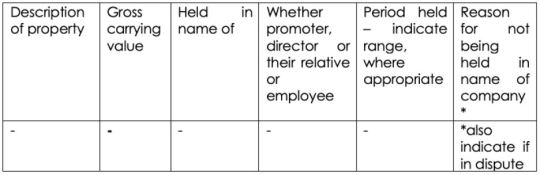

CARO 2020 requires disclosure of land and building and other immovable properties which are recognised as fixed assets but the title of such assets is not with the body corporate. In case immovable properties exist but in the Co’s name, then disclosure is required regarding Property description with ownership title ( Name and relation with the company executives), range of period for which property is held and the amount capitalised, the rationale for not holding the property in the name of the company. MCA has suggested the following format in this case:

One of the rationales is that accounting provisions apply only in case the title of the asset is held in the name of the company. Another rationale for such disclosure is to protect the interest of the lenders as Loans given by lenders to entities are based upon certain ratios which are dependent upon the amount of fixed assets recognised in the financial statements. With this disclosure, lenders would be in a better position to take a decision for financing the company when the title does not belong to the company.

1.1-2. Disclose revaluation for fixed assets or intangible assets happened during the year[Clause 3(i)(d)]

The company has to disclose if it’s Property, Plant and Equipment (including Right of Use assets) or intangible assets or both have been revalued during the year :

a) Whether the revaluation is based on the valuation by a Registered Valuer

b) Specify the amount of change, if change is 10% or more in the aggregate of the net carrying value of each class of Property, Plant and Equipment or intangible assets

Ind AS10 allows companies to follow either the cost model or the revaluation model. In case a company follows a revaluation model then a revaluation surplus is recognised in the balance sheet as a revaluation surplus. Further changes in the revalued amount are recognised in revaluation surplus or statement of profit and loss depending upon certain conditions and Auditors are required to highlight this upfront in the CARO report.

1.1-3. Disclosure required for Benami Transactions [Clause 3(i)(e)]

CARO 2020 requires disclosure for transactions even if proceedings are initiated (even if not complete) OR proceedings are pending against a company for holding any benami property. Since audit firms are required to sign the audit report, Auditors shall now be more stringent about the application of Benami Transactions (Prohibition) Act, 1988 (45 of 1988) and rules made thereunder.

Now management as well audit firms cannot take the shield of materiality and probability and have to provide notes to accounts in financial statements. Even if a transaction is not material, CARO requires disclosure in financial statements for proceedings regarding benami transactions in notes to accounts.

1.2. Working capital loan above Rs 5 crore – Auditors to tally returns or statements filed with banks with accounting books [Clause 3(ii)(b)]

Companies file a lot of accounting data (past information and projected statements) to banks and financial institutions to obtain working capital limits. The lender, on the other hand, is concerned about the accuracy of such data filed. The government has now stipulated that if the sanctioned limit(s), by combining limits of all banks/ FIs (Present/Proposed), exceed Rs 5 crores, then auditors are required to certify that quarterly results or the statements filed by the company with the banks are in line with the accounting books.

Considering the above provisions, auditors shall now be doing a pre-audit whenever the management is obtaining a new working capital loan or increasing their existing limits. Although CARO shall be filed by the end of the financial year the auditors shall insist upon management to get approval.

1.3. Disclosure of investments made in companies, firms, Limited Liability Partnerships or any other parties [Clause 3(iii)]

MCA intends to tighten the disclosures regarding repayment and realization of loans and advances given by entities.

It needs to be checked whether during the year the company has made investments in, provided any guarantee or security or granted any loans or advances in the nature of loans, secured or unsecured, to companies, firms, LLPs or any other parties. If yes, indicate aggregate amount during the year,

– to subsidiaries, joint ventures and associates;

– to parties other than subsidiaries, joint ventures and associates;

whether the investments made, guarantees provided, security given and the terms and conditions are not prejudicial to the company’s interest;

whether the schedule of repayment of principal and payment of interest has been stipulated and whether the repayments or receipts are regular;

if the amount is overdue, state the total amount overdue for more than 90 days, and if reasonable steps have been taken by the company for recovery of the principal and interest;

whether any loan or advance granted which has fallen due, has been renewed or extended or fresh loans granted to settle the overdues of existing loans given to the same parties, if so, specify the aggregate amount of such dues renewed or extended or settled by fresh loans and the percentage of the aggregate to the total loans or advances

whether the company has granted any loans or advances in the nature of loans either repayable on demand or without specifying any terms or period of repayment, if so, specify the aggregate amount, percentage thereof to the total loans granted, aggregate amount of loans granted to Promoters, related parties as defined in clause (76) of section 2 of the Companies Act, 2013;

The focus of CARO 2020 is more towards highlighting any non-repayment or non-compliance by any errant party. From an accounting perspective [no change in accounting], any default in loans and advances made are accounted for by making a provision against the unrecoverable amount in the financial statements.

An auditor is required to report the aggregate amount and balance outstanding; whether the terms are prejudicial or not; whether the repayment plan has been specified and the repayment is in accordance with the terms agreed; the amount overdue; any extension or renewal of the amount fallen due during the period; and whether any loan or advance is granted to promoters or related parties without specifying repayment terms.

1.4. Highlighting incomes disclosed in tax assessments but not properly accounted in books of accounts[Clause 3(viii)]

1.4.1. Case A: Income was properly recognised in books of accounts but the income tax was not offered correctly. In case a company properly recorded income but while calculating income tax, income was not included or incorrect amount was included for assessing income tax and such income was offered to tax during the income tax assessments then auditors are required to consider such income. Proper accounting is to be ensured or to report in CARO disclosure.

1.4.2. Case B: Income was offered during income tax assessment and such income was not correctly recorded as per accounting provisions.

In case a company surrendered or offered income during income tax assessment and such income was either not recorded at all or recorded at incorrect amount or recorded in incorrect accounting period as per the accounting provisions then auditor needs to Treat such income as per the provisions of AS 5 and to report such income in CARO.

1.5. Default in repayment of loans or other borrowings or in the payment of interest [Clause 3(ix)(a)]

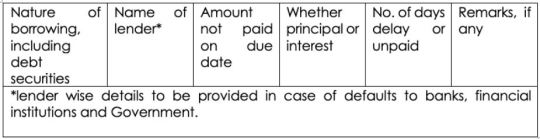

CARO 2016 specified the default on repayment of principal of financial institution, bank, Government or dues to debenture holders and CARO 2020 covers all the lenders and specifies the following format of disclosure:

1.6. Wilful defaulter [Clause 3(ix)(b)]

A wilful defaulter is defined as a company/ individual that has an ability to repay the loan but fails to do so. In case, a company defaults in repayments of loans, other borrowings or interest then the company is required to make such disclosure in the CARO report. Further, in case an entity has been disclosed as wilful defaulter by any financial institution (including banks) then auditor needs to highlight such fact in the CARO 2020 report.

This provision is introduced in view of the fact that number of wilful defaulters in nationalised banks have increased by over 60 per cent during the last five years.

1.7. Reporting of Whistle-blower complaints[Clause 3(xi)(c)]

This is one of the key steps introduced for marching towards corporate whistleblowers as at present, the Whistleblower Protection Act, 2014 is not applicable to corporates, government bodies, projects and offices.

CARO 2020 requires an auditor to report whistle-blower complaints received against the company.

1.8. Utilization of short-term funds for long-term purposes [Clause 3(ix)(d)]

CARO 2020 has even highlighted the requirement of disclosing the nature and amount of funds raised on short term basis and which has been utilised for long term purposes. This clause would protect the company and the stakeholders from the misutilisation of funds of the company and resulting in reduction of the defaults in repayment.

1.9. Purpose of funds obtained to meet obligations of subsidiaries, associates or joint ventures [Clause 3(ix)(e)]

Another important addition in the recent CARO is if the company has taken any funds from any entity or person on account of or to meet the obligations of its subsidiaries, associates or joint ventures, it needs to disclose the details and nature along with the amount of transactions.

1.10. Funds obtained on the pledge of securities held in its subsidiaries, joint ventures or associate companies [Clause 3(ix)(f)]

Now the Auditors need to specify in their report if the company has raised loans during the year on the pledge of securities held in its subsidiaries, joint ventures or associate companies, along with the details thereof and also report if the company has defaulted in repayment of such loans raised.

1.11. Fraud by and on the company [Clause 3(xi)(a)]

CARO 2020 has widened the scope of earlier Clause 3(x) of the CARO 2019 by deleting the words ‘by its officers or employees’ from the disclosure requirements in case any fraud by the company or any fraud on the company has been noticed or reported during the year. The auditors need to record the nature and the amount involved in the transaction.

1.12. Report under sub-section (12) of section 143 of the Companies Act, 2013 [Clause 3(xi)(b)]

The auditors need to record whether any report under sub-section (12) of section 143 of the Companies Act has been filed by the auditors in Form ADT-4 as prescribed under rule 13 of Companies (Audit and Auditors) Rules, 2014 with the Central Government.

1.13. Default in payment of interest on deposits or repayment [Clause 3(xii)(c)]