Don't wanna be here? Send us removal request.

Text

Cryptocurrency has revolutionized the financial world, introducing digital assets like Shiba Inu (SHIB), often called the “Dogecoin killer.” As its popularity grows, so does the need for tax compliance. At SVTax Services, we understand that navigating the complexities of cryptocurrency taxes can be overwhelming, especially with a token as unique as SHIB. Here’s what you need to know to stay compliant.

What is Shiba Inu (SHIB)?

Shiba Inu is a decentralized cryptocurrency created in August 2020 by an anonymous individual known as Ryoshi. Operating on the Ethereum blockchain, SHIB is an ERC-20 token that gained attention for its community-driven approach and its “meme coin” origins. Despite its lighthearted branding, SHIB has grown into a significant player in the crypto market, attracting both investors and traders worldwide.

Tax Implications of SHIB

Cryptocurrencies like SHIB are considered property for tax purposes by most tax authorities, including the IRS in the United States. This means every transaction involving SHIB could be taxable. Key taxable events include:

Trading SHIB for other cryptocurrencies: Converting SHIB into Ethereum (ETH) or Bitcoin (BTC) triggers a capital gains or loss calculation.

Using SHIB for purchases: Spending SHIB on goods or services can create a taxable event.

Earning SHIB: Receiving SHIB as payment for services or mining is treated as income and taxed accordingly.

Selling SHIB for fiat: Liquidating your SHIB holdings into fiat currency like USD incurs capital gains tax based on the profit or loss.

Record-Keeping is Essential

To ensure compliance, accurate record-keeping is crucial. Every SHIB transaction should include:

Date of the transaction

Amount of SHIB involved

Value in fiat currency at the time of the transaction

Purpose of the transaction (trade, purchase, etc.)

Relevant fees (gas fees for Ethereum transactions can be significant)

SVTax Services recommends using crypto tax software or a trusted CPA to simplify tracking.

Strategies for Minimizing Taxes on SHIB Transactions

Long-Term Holding: Holding SHIB for over a year before selling can reduce your capital gains tax rate.

Tax-Loss Harvesting: Offset gains with losses from underperforming cryptocurrencies to lower your taxable income.

Gifting SHIB: Cryptocurrency gifts up to a certain amount can be excluded from taxable income, depending on local regulations.

Utilize Tax-Deferred Accounts: Explore if you can invest in SHIB through tax-advantaged accounts, where available.

How SVTax Services Can Help

At SVTax Services, we specialize in cryptocurrency tax compliance. Whether you’re a long-term SHIB investor or an active trader, we provide personalized solutions to meet your tax needs:

Comprehensive Crypto Reporting: Accurate calculation of gains, losses, and taxable income from your SHIB activities.

Expert Guidance: Stay updated on the latest tax laws affecting SHIB and other cryptocurrencies.

Audit Support: In case of inquiries from tax authorities, we’ll be by your side.

Final Thoughts

Shiba Inu (SHIB) offers exciting opportunities for crypto enthusiasts, but it comes with its share of tax obligations. By partnering with SVTax Services, you can confidently manage your crypto portfolio and ensure tax compliance without the stress.

Get in Touch

Don’t let tax season stress you out. Prepare for 2025 with SV Tax Firm and let us make taxes simple for you!

Contact Us Today: 📞 +91 8800471438 📧 [email protected] 🌐 www.svtaxservices.in 📲 Follow us on:

Facebook

Instagram

Twitter

YouTube

Contact SVTax Services today to simplify your cryptocurrency tax journey and focus on what matters most: your financial growth.

0 notes

Text

Navigating Polkadot & Bitcoin with SVTaxFirm: Your Trusted Partner for Crypto Solutions

The world of cryptocurrencies continues to grow exponentially, and digital assets like Polkadot (DOT) and Bitcoin (BTC) are at the forefront of this financial revolution. As more individuals and businesses venture into cryptocurrency investments, managing these assets effectively—while staying compliant with legal and tax regulations—becomes essential. At SVTaxFirm, we offer expert services to simplify the complexities of cryptocurrency management and ensure a seamless financial experience.

Bitcoin (BTC): A Revolutionary Digital Asset

Bitcoin, the pioneer of cryptocurrencies, is not just a digital currency but a store of value and a medium for secure, decentralized transactions. Whether you’re an investor, trader, or business accepting Bitcoin payments, understanding the tax implications and compliance requirements is vital.

At SVTaxFirm, we help you:

Polkadot (DOT): Innovating Blockchain Interoperability

Polkadot is a revolutionary blockchain platform that connects multiple blockchains for seamless interoperability. As its adoption grows, so do the opportunities for staking, trading, and investing in Polkadot. Our services include:

Why Choose SVTaxFirm?

We combine financial expertise and in-depth knowledge of cryptocurrency to provide comprehensive solutions tailored to your needs. Whether it’s Polkadot, Bitcoin, or other cryptocurrencies, our services include tax planning, compliance, portfolio management, and strategic advice to help you succeed in the crypto space.

Get in Touch

Ready to take control of your cryptocurrency finances? Contact SVTaxFirm today!

📞 Phone: +91 8800471438 🌐 Website: www.svtaxservices.in

Follow us on social media to stay updated with the latest insights and services: 📘 Facebook: SVTaxFirm 📸 Instagram: @svtaxfirm 🔗twitter: Svtaxservices ▶️ YouTube: SVTaxFirm

Let SVTaxFirm handle the complexities of Polkadot and Bitcoin, so you can focus on growing your financial success. #CryptoTax #BitcoinSolutions #PolkadotInvestments #SVTaxFirm

0 notes

Text

Dogecoin: A Lighthearted Cryptocurrency with Serious Potential

Cryptocurrencies have revolutionized the financial world, offering decentralized alternatives to traditional banking systems. Among the many digital currencies, Dogecoin (DOGE) stands out—not just for its humorous beginnings as a meme coin but for its growing utility, strong community, and unique benefits. Originally created as a joke in 2013, Dogecoin has become a serious player in the cryptocurrency space, gaining mainstream recognition and adoption.

In this blog, we’ll explore what Dogecoin is, its benefits, its future potential, and why now is a great time to consider it as part of your financial portfolio.

What is Dogecoin?

Dogecoin was created by software engineers Billy Markus and Jackson Palmer as a fun and approachable alternative to Bitcoin. Inspired by the popular "Doge" meme featuring a Shiba Inu dog, Dogecoin gained popularity for its playful branding and active online community.

Unlike Bitcoin, which has a limited supply of 21 million coins, Dogecoin has no maximum cap. Around 10,000 Dogecoins are mined every minute, making it an inflationary cryptocurrency. This model ensures the continuous availability of coins, which keeps transaction fees low and the network active.

Initially used for tipping content creators and small transactions, Dogecoin has expanded its use cases to charitable fundraising, e-commerce, and even investments.

Benefits of Dogecoin

Dogecoin offers several benefits that make it an attractive option for investors, businesses, and everyday users:

Future Scope of Dogecoin

The future of Dogecoin looks promising, thanks to growing adoption, technological advancements, and increased interest in cryptocurrencies. Here are some key factors shaping its future:

How SV Tax Services Can Help You with Dogecoin

As Dogecoin continues to grow in popularity, managing its legal and tax implications becomes essential. SV Tax Services specializes in cryptocurrency tax and legal advisory, helping individuals and businesses navigate the complexities of digital asset management.

Here’s how SV Tax Services can assist Dogecoin investors and users:

With SV Tax Services, you can focus on maximizing your Dogecoin investments while staying fully compliant with tax and legal requirements.

Connect with SV Tax Services

For personalized cryptocurrency tax and legal advisory, reach out to SV Tax Services:

Conclusion

Dogecoin represents a unique blend of fun, functionality, and financial potential in the cryptocurrency world. From its playful origins as a meme coin to its current status as a widely accepted digital currency, Dogecoin has come a long way. Its benefits, including low fees, fast transactions, and a strong community, make it a viable option for everyday use and investment.

As Dogecoin’s popularity continues to grow, it’s essential to stay informed about its tax and legal implications. With the expert guidance of SV Tax Services, you can confidently manage your Dogecoin transactions, ensuring compliance and optimizing your financial outcomes.

Whether you're a seasoned crypto investor or just starting with Dogecoin, SV Tax Services is your trusted partner in navigating the world of cryptocurrency. Connect with us today and take the first step toward a smarter, compliant, and profitable crypto journey!

#Dogecoin #Cryptocurrency #SVTaxServices #CryptoTax #Bitcoin #Altcoins #FinancialPlanning #CryptoCompliance

0 notes

Text

Ripple and Bitcoin: Revolutionizing Transactions with SVTAX Services

The world of cryptocurrencies has transformed the way we think about finance, and Ripple and Bitcoin are at the forefront of this revolution. At SVTAX Services, we are embracing this digital future, offering solutions that integrate seamlessly with the world of blockchain technology. Whether you're a business looking to streamline international payments or an investor diving into the crypto market, SVTAX Services is here to guide you every step of the way.

What is Ripple?

Ripple (XRP) is more than just a cryptocurrency. It’s a cutting-edge payment protocol designed to enable fast and cost-effective cross-border payments. Unlike traditional systems that take days to process transactions, Ripple allows you to send money globally in seconds. Its focus on enhancing the financial infrastructure makes it a top choice for banks and payment providers.

Bitcoin: The Original Cryptocurrency

Bitcoin (BTC) is the pioneer of digital currencies, offering a decentralized way to store and transfer value. As a store of value and an innovative payment system, Bitcoin continues to dominate the crypto space. SVTAX Services understands the unique needs of Bitcoin users, providing tailored solutions for transactions, taxation, and investment strategies.

How SVTAX Services Can Help

Why Choose SVTAX Services?

We combine cutting-edge technology with years of experience to bring you personalized and reliable services. By staying ahead of the curve in the crypto space, we empower our clients to unlock the full potential of Ripple and Bitcoin for their financial growth.

Embrace the Future with SVTAX Services

The world is shifting toward digital currencies and blockchain solutions. Don’t get left behind. Let SVTAX Services be your partner in navigating this exciting financial frontier.

Connect with Us Visit our website for more details and updates: SVTAX Services

Click here for blog post: Sv tax services blog post

click here for other blog: link for blog post

+91 8800471438 , +91 9718014507

Office:

Plot- No-44, office No-302, IIIrd Floor, Bheema, complex, Veer Savarkar Block, Shakarpur,New Delhi-110092 India

Other Office:

J-14, Janakpuri, Ramghat Road, Aligargh-202001, Uttar Pradesh, India.

Our facebook

Instagram

Youtube

Twitter

#CryptoTaxation #RippleXRP #Bitcoin #BlockchainIntegration #SVTAXServices #CryptoFuture #DigitalCurrency+

0 notes

Text

#TaxPreparation#TaxServices#IndividualTaxes#TaxFiling#IRSHelp#TaxSeason#MaximizeDeductions#FinancialPlanning#AuditSupport#TaxSavings

0 notes

Text

SV Tax Services: Professional Tax Help You Can Trust

0 notes

Text

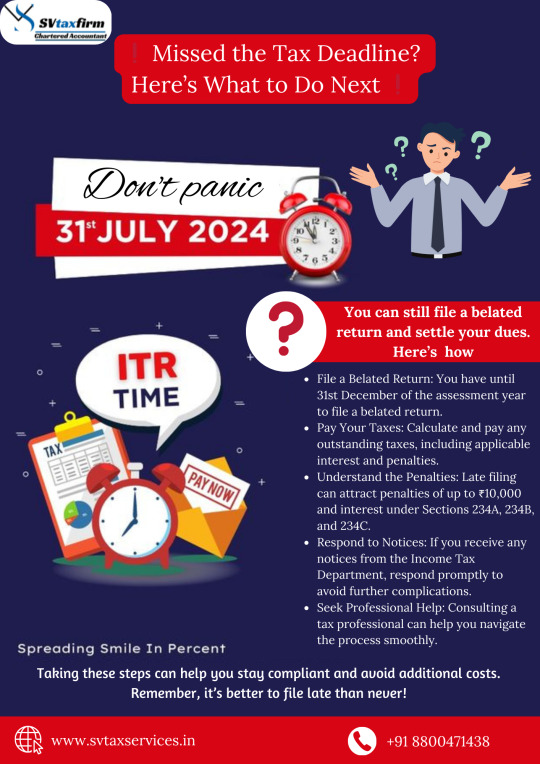

Don’t forget! The deadline to file your taxes is just around the corner. Ensure you have all your documents in order and your tax return submitted on time to avoid any late fees or penalties. If you need assistance, consider reaching out to a tax professional. Mark your calendar and get ahead of the game!

0 notes

Text

Tips for a Stress-Free Tax Season Prepare for tax season with confidence using our expert tips. Learn how to organize your documents, optimize your filings, and avoid common pitfalls.

1 note

·

View note