#$ibm

Explore tagged Tumblr posts

Text

A sony laptop 1986.

25K notes

·

View notes

Photo

Internal IBM document, 1979 (via Fabricio Teixeira)

8K notes

·

View notes

Text

5 Trade Ideas for Monday: Baker Hughes, Cleveland-Cliffs, IBM, Marathon Petroleum and Northern Trust

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Baker Hughes, Ticker: $BKR

Baker Hughes, $BKR, comes into the week at resistance. It has a RSI at the midline with the MACD rising. Look for a push over resistance to participate…..

Cleveland-Cliffs, Ticker: $CLF

Cleveland-Cliffs, $CLF, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

IBM, Ticker: $IBM

IBM, $IBM, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive and leveling. Look for a push over resistance to participate…..

Marathon Petroleum, Ticker: $MPC

Marathon Petroleum, $MPC, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

Northern Trust, Ticker: $NTRS

Northern Trust, $NTRS, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the month of February in the books, saw equity markets continue to show strength with the small caps now joining the large cap and tech indexes.

Elsewhere look for Gold to continue its assault on a new all-time high while Crude Oil moves higher out of consolidation. The US Dollar Index continues to drift in consolidation while US Treasuries hold in their downtrend. The Shanghai Composite looks to continue the short term move higher while Emerging Markets continue to consolidate.

The Volatility Index looks to remain very low and stable creating an environment for equity markets to move to the upside more easily. Their charts look strong, especially on the longer timeframe with the long win streaks for the SPY and QQQ and now the IWM breaking higher. On the shorter timeframe all looks well to as the QQQ and SPY reset their momentum measures early in the week and the IWM showing strength. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

IBM ThinkPad 345C (1995)

2K notes

·

View notes

Text

Buildinga robot

3K notes

·

View notes

Text

Fuckable Object #6 IBM ThinkPad 701 Series (1995)

#fuckableobjects#6#objectum#objectophilia#techum#osor#technology#retro aesthetic#laptops#ibm thinkpad#stim

3K notes

·

View notes

Text

USA 1993

1K notes

·

View notes

Text

IBM PS/1 Model 2121 (1992)

4K notes

·

View notes

Text

493 notes

·

View notes

Text

IBM 360 mainframe in Germany, 1965. Photo by Rolf Herkner.

550 notes

·

View notes

Photo

IBM System/360

709 notes

·

View notes

Text

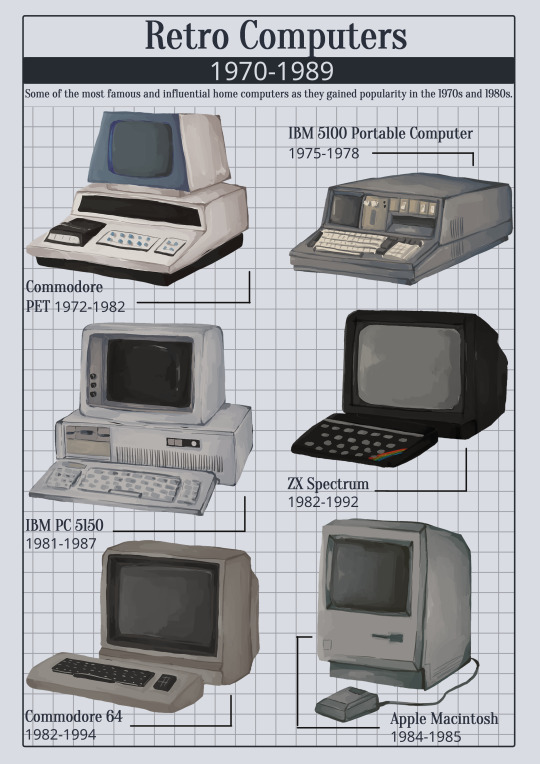

old computers print....i wanted to stick to the most famous and/or iconic ones for the most part but i wanted to include sooo many of my lesser known favourites

#retro tech#old computer#old computers#retro computing#retro computer#vintage computer#vintage tech#commodore 64#commodore pet#apple mac#ibm pc#ibm 5100#macintosh#zx spectrum#80s computer#80s computers

280 notes

·

View notes

Text

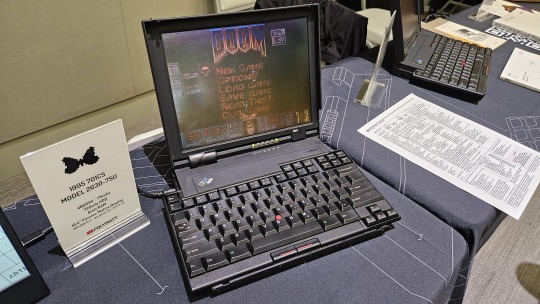

IBM Thinkpad 701CS - the one with the famous butterfly keyboard - VCF Southwest 2023

#ibm thinkpad#vcfsw2023#vcf southwest 2023#vintage computer festival southwest 2023#commodorez goes to vcfsw2023#701c

5K notes

·

View notes

Text

5 Trade Ideas for Tuesday: Arch Capital, CBOE, Gilead, IBM and Sherwin-Williams

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Arch Capital Group, Ticker: $ACGL

Arch Capital Group, $ACGL, comes into the week at resistance. It has a RSI at the midline with the MACD rising but negative. Look for a push over resistance to participate…..

Cboe Global Markets, Ticker: $CBOE

Cboe Global Markets, $CBOE, comes into the week breaking resistance. It has a RSI in the bullish zone with the MACD positive. Look for continuation to participate…..

Gilead Sciences, Ticker: $GILD

Gilead Sciences, $GILD, comes into the week approaching resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

IBM, Ticker: $IBM

IBM, $IBM, comes into the week breaking resistance. It has a RSI in the bullish zone with the MACD positive. Look for continuation to participate…..

Sherwin-Williams, Ticker: $SHW

Sherwin-Williams, $SHW, comes into the week moving higher. It has a RSI in the bullish zone with the MACD positive. Look for continuation to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into January options expiration, saw equity markets split with strength in the large caps and tech heavy Nasdaq, but small caps continuing to tread water.

Elsewhere look for Gold to continue the rebound higher while Crude Oil consolidates in a tight range. The US Dollar Index continues to drift to the downside in consolidation while US Treasuries possibly reverse their uptrend. The Shanghai Composite looks to continue the downtrend while Emerging Markets consolidate in a broad range.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY could succumb to momentum divergences in the short run. The IWM continues to struggle, stuck in a 21 month range. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

IBM ThinkPad X32 (2005)

910 notes

·

View notes