#/ especially with flight times that enter the double digits

Explore tagged Tumblr posts

Text

Sri Lanka e Visa for Indian Citizens – Complete Guide

Sri Lanka e Visa for Indian – A Quick and Easy Guide

If you’re dreaming of lush greenery, stunning beaches, rich culture, and warm hospitality, Sri Lanka should definitely be on your travel list. And guess what? Getting there is now easier than ever, especially with the Sri Lanka e visa for Indian citizens.

Let’s break down everything you need to know about the Sri Lanka e visa for Indian travelers—eligibility, application process, fees, and much more.

What is the Sri Lanka e Visa for Indian?

The Sri Lanka e visa for Indian is an electronic travel authorization that allows Indian passport holders to enter Sri Lanka without having to visit an embassy or consulate. It’s quick, simple, and entirely online.

This e visa is officially called the ETA (Electronic Travel Authorization), and it’s valid for short visits related to tourism, business, or transit.

Types of Sri Lanka e Visas for Indian Citizens

Depending on the purpose of your visit, there are three main types of Sri Lanka e visa for Indian citizens:

Tourist ETA – Perfect for vacationing and sightseeing.

Business ETA – For attending conferences, meetings, or business events.

Transit ETA – If you’re just passing through Sri Lanka en route to another country.

Sri Lanka e Visa for Indian: Requirements

Before applying for your Sri Lanka e visa for Indian, make sure you have the following:

A valid Indian passport (valid for at least 6 months)

A working email address

A credit or debit card for payment

Travel itinerary (flights and hotel bookings)

Sufficient funds to cover your stay

Step-by-Step Process to Apply for Sri Lanka e Visa for Indian

Here’s how you can apply in just a few steps:

Visit the official ETA website Go to the official Sri Lankan immigration website.

Fill in your application form Input your personal, passport, and travel details accurately.

Pay the visa fee The fee for a Sri Lanka e visa for Indian is usually around $20–$50 depending on the visa type.

Wait for approval In most cases, you’ll get approval within 24 to 48 hours via email.

Print your ETA Though it’s electronically linked, carrying a printed copy is always a good idea.

Validity and Duration of Stay

The Sri Lanka e visa for Indian is typically valid for 30 days.

You can enter the country twice during this period (Double Entry).

Extensions may be possible once you’re in Sri Lanka.

Benefits of Sri Lanka e Visa for Indian Citizens

100% online process

Fast processing time

No embassy visits

Multiple entry options

Affordable fee

It’s perfect for last-minute travel plans or spontaneous getaways.

Important Tips Before You Travel

Apply at least 3–5 days before your departure.

Double-check your application for typos.

Keep a digital and printed copy of your ETA.

Carry your return flight ticket and proof of accommodation.

Conclusion

Getting a Sri Lanka e visa for Indian citizens is one of the easiest parts of planning your trip. With a smooth online application and quick approval, all you need to worry about is packing your bags and planning your beach days. So whether you're heading for a solo adventure, a family trip, or a romantic getaway, Sri Lanka is calling—and now you know exactly how to answer!

FAQs

1. Can I apply for a Sri Lanka e visa for Indian online?

Yes, the entire process is online and can be done from anywhere.

2. How long does it take to get approval?

Approval usually takes 24–48 hours.

3. Is the e visa valid for multiple entries?

Yes, the Tourist ETA typically allows two entries.

4. What is the cost of a Sri Lanka e visa for Indian?

Fees vary from $20 to $50 depending on the visa type.

5. Can I extend my e visa while in Sri Lanka?

Yes, extensions can be applied for once you are in the country.

0 notes

Text

Adotrip Guide to Smart Online Flight Ticket Booking

In today’s fast-paced world, online flight ticket booking has become a necessity for travelers who prioritize convenience, speed, and cost-effectiveness. Whether you're a frequent flyer or planning your first trip, navigating the digital world of ticket booking can be overwhelming without the right guidance.

Enter Adotrip—your trusted travel companion. In this comprehensive guide, we take you through the smartest ways to book flights online, avoid common pitfalls, and make the most of every rupee and minute you invest. Let’s dive in and make your next booking smooth, simple, and stress-free.

Why Book Flights Online?

Online flight ticket booking offers undeniable benefits over traditional booking methods. Here’s why more travelers are making the switch:

1. 24/7 Accessibility

No need to wait in long queues or depend on travel agents’ business hours. With online platforms like Adotrip, you can book a flight anytime, from anywhere.

2. Instant Price Comparison

Adotrip aggregates multiple airline fares in one place, giving you the power to compare and choose the best deals instantly.

3. Custom Filters and Smart Search

From flexible dates to budget airlines and non-stop flights, you can customize your search to suit your preferences.

4. Special Discounts and Offers

Online bookings often unlock promo codes, seasonal offers, and cashback deals not available offline.

How Adotrip Simplifies Online Flight Ticket Booking

At Adotrip, we’re not just a travel platform—we’re your one-stop solution for all travel needs. Our intuitive interface, real-time updates, and transparent pricing make booking flights a breeze.

✈️ User-Friendly Interface

Navigate effortlessly across destinations, dates, and class preferences. Whether it’s a domestic getaway or an international vacation, you’ll find what you need in just a few clicks.

💰 Price Alerts and Fare Tracking

Looking for the lowest fares? Set a fare alert and let Adotrip notify you when prices drop.

🔍 Smart Suggestions

Our AI-backed system suggests the best routes, times, and airlines based on your budget and schedule preferences.

🛡️ Secure Payments

Your transactions are protected with end-to-end encryption, multiple payment options, and instant booking confirmation.

Tips for Smart Online Flight Ticket Booking

Whether you’re a budget traveler or flying for business, these smart tips from Adotrip can help you save money and avoid hassle:

✅ 1. Book Early, But Not Too Early

The sweet spot is usually 30-60 days before departure. Booking too early or too late can result in higher fares.

✅ 2. Be Flexible with Dates and Times

Flying mid-week (Tuesdays and Wednesdays) or at odd hours (like early morning or late night) often gets you cheaper tickets.

✅ 3. Use Incognito Mode

Ever noticed fares increasing after repeated searches? Avoid cookies influencing prices by searching in private or incognito mode.

✅ 4. Consider Nearby Airports

Sometimes flying into or out of alternative airports can save you a lot—especially in metro cities.

✅ 5. Subscribe to Alerts

Sign up for Adotrip’s newsletter and notifications to stay updated with flash sales, exclusive offers, and last-minute deals.

Common Mistakes to Avoid While Booking Flights Online

Even seasoned travelers can fall into traps. Here are a few common pitfalls to steer clear of:

❌ Not Checking Baggage Policies

Always check the luggage allowance before booking. Some low-cost carriers charge extra for even check-in baggage.

❌ Ignoring Refund and Cancellation Policies

Make sure to understand the refund rules. Some tickets may be non-refundable or have high cancellation charges.

❌ Overlooking Layover Times

Too short or too long layovers can be frustrating. Look for practical connection windows—especially on international routes.

❌ Missing Name Spelling

Even a minor spelling mistake in your name can lead to denied boarding. Double-check all details before confirming.

Why Choose Adotrip for Your Next Flight?

At Adotrip, we prioritize your comfort, convenience, and cost-saving opportunities. Here’s what sets us apart:

Curated Flight Options: We don’t flood you with irrelevant results—only the best choices that suit your needs.

Real-Time Updates: Get instant updates on fare changes, gate details, and more.

Customer Support: Got a question? Our team is available to help you 24/7, even post-booking.

Complete Travel Solutions: Beyond flights, we help you book hotels, create itineraries, and discover tourist attractions—all under one roof.

Smart Tools on Adotrip to Make Booking Easier

🧭 Trip Planner

Combine your flight, hotel, and sightseeing plans in one seamless itinerary.

💬 AI Travel Chat Assistant

Ask questions, get instant travel tips, or check ticket status—all through Adotrip’s smart AI chat feature.

📱 Mobile Booking Made Easy

Prefer booking on the go? Download the Adotrip app for a smooth, secure mobile experience.

Final Thoughts: Book Smart, Travel Smarter

Online flight ticket booking is no longer just a convenience—it’s an art. And like every art, it’s best practiced with the right tools and techniques. With Adotrip by your side, booking your next flight becomes more than a task—it becomes an experience tailored to your travel personality.

Whether you're a solo backpacker, a family vacationer, or a corporate jet-setter, Adotrip empowers you to travel smart, safe, and stress-free.

0 notes

Text

Stylish Laptop Portfolio – Travel Smart and Secure

Your laptop is more than just a device; it’s your office, your entertainment hub, and your creative studio all rolled into one sleek package. For business travelers and digital nomads, ensuring it stays protected during your travels is crucial. But what if your laptop case could do more than just shield your tech? Enter the Stylish Laptop Portfolio, an elegant yet functional travel kit that combines security, sophistication, and utility.

This blog post explores the benefits of investing in a laptop portfolio that complements your professional lifestyle. We'll show you how the right portfolio can enhance your travel routine and offer tips for choosing the best fit for your needs.

Why a Stylish Laptop Portfolio Is a Must-Have

For business professionals and digital nomads, a quality Laptop Case Portfolio can be a game changer. Here’s why:

1. Function Meets Fashion

Gone are the days when laptop cases were bulky and utilitarian. Today’s Laptop Case Portfolio is designed to be style statements. Whether you’re walking into a corporate boardroom or working at a café, a sophisticated laptop portfolio gives off a polished, professional vibe while ensuring your tech stays secure.

For instance, leather portfolios add a luxe element to your ensemble, while canvas designs offer a modern, minimalist appeal for someone always on the move.

2. Durability That Matters

Frequent travelers know the perils of global commutes. Your laptop is often exposed to bumps and jolts during flights, train rides, or car journeys. Laptop Case Portfolio act as a protective Laptop Sleeve, ensuring your device remains scratch-free and secure.

High-quality portfolios are made from materials like genuine leather, water-resistant canvas, or reinforced microfiber that shield your laptop from everything life throws at it.

3. Stay Organized in Style

Modern Laptop Case Portfolio doubles as organizational powerhouses. With dedicated compartments for your laptop, charger, pens, notebooks, and even business cards, they eliminate the need for hauling multiple bags. A well-organized portfolio ensures everything you need is in one place, saving time and reducing stress during hectic travel days.

What to Look for in a Laptop Portfolio

Choosing the perfect laptop case portfolio involves more than just picking one that looks good. Consider these key factors to ensure both style and functionality:

Size Compatibility

Before buying, ensure the portfolio fits your laptop snugly. Most portfolios are designed for specific laptop sizes, such as 13-inch, 15-inch, or 17-inch models. Measure your device’s dimensions accurately to avoid disappointment.

If you own additional gadgets like tablets or e-readers, look for a portfolio with extra padding and compartments to store them securely.

Material Quality

The material of your laptop portfolio affects its durability, appearance, and overall weight.

Leather: Timeless and luxurious, leather portfolios age beautifully, developing a unique patina over time.

Canvas: Lightweight yet sturdy, canvas is a favorite among digital nomads seeking practicality without compromising on style.

Neoprene: Ideal for those prioritizing water resistance and shock absorption.

Security Features

For frequent business travelers, consider portfolios with anti-theft zippers or lockable compartments. These added security measures provide peace of mind, especially in crowded airports or transit hubs.

Benefits of Using a Laptop Portfolio When Traveling

Laptop Case Portfolio can transform the way you approach your business trips or digital adventures. Here’s how they level up your travel game:

Professional First Impressions

A stylish laptop portfolio isn’t just a practical choice; Laptop Sleeve can elevate how others perceive you. Imagine walking into a business meeting with a refined leather or canvas portfolio under your arm. It instantly conveys a sense of professionalism, attention to detail, and an appreciation for quality.

Streamlined Packing

Carrying a Laptop Sleeve heavy backpack or multiple bags can slow you down, especially at airports or train stations. A laptop portfolio, designed for easy access and efficiency, streamlines your packing. With everything from your tech gear to travel documents organized in one place, you can glide through security checks and reach your destination hassle-free.

Protective Yet Lightweight

A bulky case isn’t ideal for people who are always on the go. Stylish Laptop Case Portfolio strike the perfect balance between providing solid protection and staying lightweight. They cushion your laptop without adding unnecessary heft to your luggage.

Enhances Everyday Functionality

Travel isn’t the only time you’ll appreciate the perks of a Laptop Sleeve. These versatile cases are just as valuable in daily commutes, trips to co-working spaces, or even a quick coffee meeting with clients. They’re adaptable to your lifestyle, ensuring you’re always well-prepared.

Our Top Picks for Stylish Laptop Case Portfolio

To help you get started, here are some trendy Laptop Case Portfolio that tick all the boxes for style, function, and protection:

1. Nomad’s Luxe Leather Portfolio

Made with genuine Italian leather, this portfolio Laptop Sleeve offers compartments for your laptop, tablet, chargers, business cards, and even a slim notebook. Perfect for style-conscious professionals.

2. Canvas Utility Portfolio by WorkSmart

Designed for durability and practicality, Laptop Sleeve this canvas portfolio is both water-resistant and spacious. Its padded compartments and sleek design make it a favorite for digital nomads.

3. Urban Armor Gear Slim Portfolio

A tech-savvy choice for those who prioritize extra safety, this portfolio is shockproof and heat-resistant, keeping your laptop secure under all conditions.

Caring for Your Laptop Portfolio

A stylish portfolio is an investment, and taking proper care will ensure it stays in prime condition for years to come.

For Leather: Use a dedicated leather cleaner every few months to maintain its sheen and prevent cracking.

For Canvas: Spot clean with mild detergent and warm water to remove stains.

For Neoprene or Synthetic Materials: Wipe with a damp cloth or use a gentle cleaning solution for tougher marks.

Travel Smart, Travel Secure

Your laptop deserves more than a generic sleeve or backpack. A stylish laptop portfolio is the ultimate combination of form and function. It doesn’t just protect your tech; it organizes your essentials, elevates your style, and makes every trip more efficient.

Whether you’re a business traveler closing deals or a digital nomad recording your next vlog, investing in the right portfolio can transform how you travel and work.

Looking for your perfect match? Explore top-rated Laptop Case Portfolio today and redefine the way you travel!

0 notes

Text

Do's and Don'ts of Morocco Visa Applications: Avoiding Common Pitfalls

Morocco, a captivating tapestry of bustling souks, ancient cities, and breathtaking landscapes, attracts travelers seeking a blend of exotic charm and accessible travel. While securing a Moroccan visa is generally straightforward, being aware of common mistakes can significantly streamline the process and minimize the potential for delays or rejections.

Let's delve into the essential do's and don'ts to ensure a hassle-free Morocco visa application experience and set yourself up for the Moroccan adventure of your dreams.

DO's: The Key to Success

DO Start Early: Proactive planning is your ally. Apply well before your departure date to allow time for processing, potential clarifications, and addressing any issues that may arise.

DO Check Eligibility Carefully: Before initiating the process, thoroughly verify that the Morocco e-Visa or another visa type aligns with your nationality, purpose of travel, and intended length of stay.

DO Gather Documents Meticulously: Ensure you have all required documentation ready – passport, digital photo, travel itinerary, proof of insurance, and any additional supporting documents specific to your visa type.

DO Double-Check Your Information: Before submitting your application, meticulously review all entered details, especially passport numbers, dates of travel, and your name as it appears on your passport. Even minor errors can lead to complications.

DO Consider Professional Assistance: If you're unsure of the process, require personalized guidance, or simply prefer peace of mind, seek guidance from a reputable visa service to navigate the application with ease.

DON'TS: Mistakes to Avoid

DON'T Rush the Process: Hasty applications increase the likelihood of errors. Allocate ample time for careful preparation and review to reduce the possibility of having to reapply.

DON'T Submit Blurry or Incorrect Photos: Your digital photo must adhere to specific size, formatting, and quality standards. Ensure it's clear, recent, and formatted according to guidelines.

DON'T Provide Inaccurate Travel Information: Your travel itinerary must meticulously match your confirmed bookings (flights, accommodations). Discrepancies will raise red flags.

DON'T Leave Documents to the Last Minute: Avoid potential delays by gathering supporting documents (insurance, financial statements if applicable) well in advance of your application.

DON'T Ignore Potential Complexities: If your situation involves specific complexities (extending a previous stay, specialized visa types), seeking expert guidance upfront can save you headaches down the line.

Additional Tips for a Smooth Process

Utilize Official Resources: Refer to the Moroccan government websites or reputable visa services for the most up-to-date information on requirements and processes.

Keep Copies: Make digital and physical copies of your passport, visa approval, and other important travel documents.

Be Aware of Cultural Sensitivities: While Morocco is generally a welcoming country, researching cultural norms, dress codes, and local customs shows respect and can enhance your travel experience.

Conclusion

By prioritizing accuracy, being proactive, and considering professional assistance, you'll significantly increase your chances of a successful and timely Morocco visa approval. With your visa in hand, you'll be ready to embark on a Moroccan journey filled with vibrant markets, aromatic cuisine, and the warmth of its people. Let those mesmerizing landscapes and bustling souks become a reality!

0 notes

Text

FIC: Smoke and Mirrors - Chapter 8

Title: Smoke and Mirrors Fandom: SWTOR Pairing: Theron Shan/f!Jedi Knight Rating: T Genre: Pre-Relationship, Slow Burn Synopsis: Something’s rotten on Carrick Station, and Theron won’t rest until he finds out what. But picking at the frayed threads of suspicion quickly unravels a conspiracy much larger than even the Republic’s top spy can handle on his own. (A mostly canon-compliant retelling of the Forged Alliances storyline, as seen through the eyes of Theron Shan.) Author’s Notes and Spoilers: See Chapter 1.

Chapter 1 | Chapter 2 | Chapter 3 | Chapter 4 | Chapter 5 | Chapter 6 | Chapter 7 | Crossposted to AO3

The strike team’s flight back from Korriban was just long enough to take a sizable break and get some rest. Theron had meant to leave the operations room that Darok had commandeered for their mission. Maybe stretch his legs and unwind a bit, but he’d gotten distracted with sorting through the data he’d absconded from the Sith Academy. He wasn’t really doing more than giving it a cursory look, just double and triple checking to make sure there were no nasty surprises in the code before he took any of it out of quarantine. It may have been paranoid to think that Sith would try and set a digital booby trap in their closed system — but better safe than sorry.

Darok had spent a majority of the time pacing, coordinating between the team left on Korriban and checking on the status of the package as it zipped its way across the galaxy. Theron had seemingly become invisible to him at this point, and hardly a word had passed between them since the strike team had entered hyperspace. It was just as well, since Theron preferred getting lost in the endless flow of data rather than having to listen to the strident tones of the colonel.

He hadn’t even really noticed the passage of time, until the door swished open, and Highwind strode in, cape fluttering behind her. Theron’s shoulders protested as he stood back up straight, a knot having formed from his hunched position. That round of celebration drinks was sounding really tempting right now — although it was difficult to tell if the guest-of-honor was still up for that. She had the carefully composed neutral facade typical of a Jedi in place as she met both his and Darok’s eye.

“Welcome back, Master Jedi,” Darok intoned, “I’ve heard congratulations are in order.”

“I don’t know about that, Colonel,” she said cautiously, pulling out a datacore, “but I retrieved the data from the Dark Council chambers as requested.”

“Excellent,” he accepted the item in question. “Do you realize that you just succeeded in a mission that many people never dared to dream was possible?”

A keen blue gaze studied the much larger man, although Theron wasn’t quite sure how to interpret the guarded expression. Whatever meditation she had done over the course of her flight, it was unclear if she had found the answers she’d been seeking.

“Anything is possible with the Force,” she said smoothly, and Theron quirked a brow. She glanced his way. From his position behind the console, it was impossible to read the expression. “But sometimes extra assistance goes a long way.”

He didn’t quite know what to make of that. “You’re welcome… I think.”

The neutral expression slipped for just a moment, and he thought he saw her lips twitch as if she were suppressing a smile.

Darok paid the silent byplay no mind, instead stowing away the datacore as he turned his full attention back to the Jedi. “Today we just proved that victory—true victory—is within our grasp. We’ve proven that Korriban is not an impenetrable fortress, and may have just retrieved the key to ending this war once and for all.”

“That is a nice thought,” Highwind said cautiously, “but the Sith have proven to be quite tenacious. It does not pay to underestimate them, despite whatever knowledge is contained within that datacore.”

“That’s very practical thinking, but it’s still a great day for the Republic nonetheless.”

A light on the console in front of Theron began to flash, pulling his attention from the conversation. It was from an auxiliary comm channel. He frowned. Usually those were reserved for emergency broadcasts and distress signals. It was odd for it to be routed to Carrick Station. He pulled up the feed and began to scan through it — and his stomach dropped.

It was from Tython. The message was short, and consisted only of several clipped phrases as if whoever had sent it had just barely had time to get their message through before it was cut off.

Iso-5 bombs — strike team — Jedi Temple under attack — need help

A face immediately flashed through Theron’s mind — an older woman valiantly trying to protect her home and students. That face shouldn’t have mattered to him, and yet still it felt as if someone had begun to tighten a vice around his chest. His mind should have immediately focused on the problem, but it took him a few more moments to process everything before his brain suddenly kicked back in. Without hesitation, he keyed in the code to sound the alarm.

“What the devil is that?” Darok demanded.

“It’s Tython,” Theron snapped, “they’re under attack!”

“They’re what?” Somehow the Jedi Master’s quiet voice cut through the loud whoop of the alarms, eyes wide with shock.

“Imperials forces just hit — they’re ransacking the temple.” Unbidden Satele’s image flashed through Theron’s mind again before he quickly banished it. “They need our support now.”

Darok gave a curt nod, immediately keying in his comm channel. “Blue Squadron, I need you to finish refueling and launch immediately with any troops not injured from Korriban.”

“How is this possible?” Highwind asked.

“We can find out when we get there,” Darok said, “if you and your team are still willing to help.”

“Of course we are, but I think we need to—”

“Shan,” he barked, “you gather whatever sensor data we can get and forward it to all forces. Everyone needs to be en route in five minutes. Now move!”

Theron gave a curt nod, fingers already dancing across the keys as he pulled in every node and scrap of data in. His brain was already racing, trying to map out what relays were available, what was compromised. Knowing Imperial protocols, they would have knocked out all communications. It was a miracle that someone had managed to get a distress signal out at all—

“Hold on, Colonel,” Highwind’s voice cut through tension in the room like a durasteel blade, “something about this isn’t right. We need to take a moment to think before rushing in.”

“Think? This is your home base being attacked, Master Jedi, and you want to sit around think? Let the Empire capture and ransack your people’s temple again?”

“We just attacked Korriban,” she shot back, “at the exact same time the Empire chooses to strike Tython?”

It was as if her words had thrown a bucket of cold water over Theron. His head snapped up and watched the byplay between the two commanding presences in the room. His fingers on the keys stilled as the panic that had been tightening around him dissipated. Now that it had been pointed out, Theron couldn’t not see the connection. This. This was what had been off about the whole mission — and he hadn’t figured it out until too late. He almost cursed aloud, but caught himself at the last moment.

“This cannot be a coincidence,” she insisted.

“You can meditate about coincidences later,” Darok snarled, “but my people and ships will be leaving in five minutes. That is, if you would like to join them.”

Her perfect mask of calm slipped, and for just a moment Theron caught a glimpse of the real woman underneath. Raw determination and anger bubbling just underneath the surface as she didn’t bother to hide her suspicion or indignation at the colonel’s words.

“I cannot stand by while others suffer,” she said firmly, meeting Darok’s eye, but there was an unspoken sentiment hanging in the air. Something else was going on here, and she wasn’t going to rest until she figured out what it was.

And she wasn’t the only one.

“I’ll pull up every scrap of data we’ve got,” Theron cut in, deliberately catching her eye and giving her just the barest of nods, “and talk you through the whole way.”

For a moment he wasn’t sure if she had caught his signal, but she paused, frowning ever-so-slightly before returning the tight nod. It was impossible to ignore the crisis at hand, and of the two of them she had the better chance at retaking Tython. But Theron could keep an eye on things here — especially the surly SpecOps officer shouting out orders over the comm.

“I will gather my crew and meet your men at the shuttle, Colonel,” she said tightly.

“Good. I’ll arrange for every available resource while you’re in transit.”

She let her gaze slip from Darok back to Theron, the severe expression lightening some. “I will be in touch.”

“I’ve sliced into every available sensor,” he said, not breaking eye contact with her as he added, “I should be able to keep an eye on everything from here.”

“We will get Tython back,” she promised, tone so fierce and filled with determination, that not even Theron could doubt that she meant it. “I promise.”

A brief thought of his mother flashed through his mind, but he quickly banished it. He had to focus right now, not get distracted by thoughts of his estranged family. Instead he gave her what he hoped was a confident smile, although it felt too tight and uncomfortable to be real. “Watch your back.”

#swtor fanfiction#theron shan x jedi knight#Theron Shan#Female Jedi Knight/Hero of Tython#oc: greyias highwind#otp: adorkable#smoke and mirrors#SoR Fic O Doom#swtor#fanfic#greyfic#it will probably take a lot longer to get the next three chapters out#since i'm still working on them#so update spam will slow for a little bit!

11 notes

·

View notes

Text

August Forecast for Aquarius

Behold the power of two! This month the Sun will make the rounds through Leo (until August 23) then Virgo, heating up the two most relationship-driven parts of your chart. Your free-spirited sign can get squirrely about too much commitment. But August is the time of year when partnerships feel their most vibrant—or at least they come up for review. Assess your inner circle and the people you spend the most time with. Does everything feel fair and mutual? Is there a balanced give-and-take?

This month, every stripe of relationship could demand an assessment—and that’s not necessarily a bad thing. On August 11, expansive Jupiter will end a four-month retrograde in Sagittarius and your friendship and teamwork house. That same day, your co-ruler Uranus will start a retrograde through Taurus and your family zone. Prepare to negotiate some flexible new agreements with terms that work for everyone. Set aside people-pleasing, Aquarius—if you don’t ask for what you want now, you could end up feeling resentful down the line.

Let’s start with Jupiter, the auspicious planet of optimism and growth. The red-spotted rover making a long visit to Sagittarius, from November 8, 2018, until December 2, 2019, igniting your eleventh house of teamwork and technology. It’s been an adventurous cycle that’s brought new collaborations, affiliations and out-of-the-box thinkers into your orbit. A digital or group venture may have taken flight, perhaps one with a world-changing agenda.

Since April 10, Jupiter has been in slow motion, which could have put a budding alliance on the back burner or stalled progress with an online project. Between now and December 2, this relationship could pick up speed. With visionary Jupiter in the idealistic eleventh house, politics might even call your name. There’s an election year coming in the U.S. (no reminder needed), and the rest of the world could certainly use some help. Consider backing a candidate you believe in or even running for a civic post yourself. If you’re a business owner, look at the role of technology and social media in your efforts. With outspoken Jupiter handing you the megaphone, an edgy or progressive message could go viral. But careful not to veer too far into controversy for controversy’s sake. Jupiter in this free-to-be-me zone makes you extra-sensitive to censorship, but it could also tempt you to push the envelope TOO far.

Just as Jupiter sprints forward on August 11, your co-ruling planet, liberated Uranus, begins its annual five-month retrograde. The side-spinning planet will reverse through Taurus and your fourth house of home, family and emotional foundations. Disruptor Uranus is in Taurus for a long seven-year visit that began on March 6, 2019, and will end in April 2026. You also had a sneak preview of this from May through November 2018. If you’ve felt the rumblings of change in the most personal part of your life—if not a total uprooting—things could settle a little bit.

But don’t get too comfortable, Aquarius, because the calm is temporary! From house-hunting to a changing cast of characters under your roof to possible baby news, Uranus is here to stir the pot. If you’ve been waiting for news about adoption or IVF, the retrograde could deliver that. A trailblazing woman who’s not afraid to be totally authentic could enter your orbit while Uranus is in Taurus. If you’ve been dealing with a disruptive family member or a rebellious child, you may find the help you need.

Midmonth there’s a high point when the August 15 Aquarius full moon brings your most personal 2019 goals to fruition. Look back to the birthday resolutions you set (if any), or to events that kicked off near the February 4 Aquarius new moon. This full moon is a decisive moment: Will you move forward with this or switch lanes and do something else? If you’ve been waiting for the green light on a passion project—or you’re just ready to take a leap of faith—the full moon in your sign says GO!

After your full moon moment, you may disappear into a rabbit hole for a while. On August 23, the Sun plunges into Virgo and your privacy-seeking, intimate eighth house. For the next month, you could deep-dive into a mission that requires lots of research. A relationship or detailed undertaking may become all-consuming. Watch for tunnel vision, Aquarius—but screen out distractions if you need to power through a task that requires concentration. The eighth house rules property, assets and joint ventures. If you’ve been looking at a real estate venture or considering a long-term financial investment, Virgo season could present some exciting new options.

With your erotic eighth house lit up, there could be some sizzling diversions—especially since lusty Mars is here from August 18 to October 3. When the Virgo new moon arrives on August 30, what seemed like a summer fling could turn serious. Someone might even have soul mate potential where you least expected it! You may be offered a financial opportunity near the new moon that could yield hefty returns or be invited into a joint venture. Take your time—this new moon will unfold in the coming six months, so there’s no need to rush. But DO set intentions for where you’d like to be financially, emotionally or in a key relationship by early 2020. What you visualize now could become a reality by the time the corresponding Virgo full moon arrives next March!

Love & Romance

With three “personal” planets (Venus, Mars and the Sun) cozied up together in your seventh house of committed partnerships for much of the month, you may be happy zipped into your couple bubble. It’s a time for bonding, major next steps or to double down on your dating efforts if you’re single. But while Venus here enhances the desire for intimacy and harmony, Mars can churn up strong (and difficult) emotions, like anger, resentment and jealousy. New relationships can heat up quickly, so be mindful to not let your heart get ahead of your head.

All three planets will move on Virgo and your eighth house of intensity, eroticism and soul bonding later in the month. Mars is the first to pull up stakes (on August 18, for six weeks). Your libido could go from a simmer to a full boil in no time flat, which can be a boon for happy couples and frustrating as hell if you’re unattached. Don’t let this planetary pileup pressure you into a union that you know isn’t ultimately right for you. Set your intentions and don’t settle for less! Venus follows Mars’ lead on August 21, and then el Sol two days after that. Very strong emotions can rise up now, so anticipate them as best you can so you don’t overreact. In addition to the swirling sexual energy, you might find yourself far more interested in metaphysical and spiritual pursuits. And how nice would it be to have a partner who shared your passion?!

An extra-hot day is August 24, when Venus and Mars mash up exactly in Virgo and that same intensifying zone. You can look forward to smoldering sex, an engagement or pregnancy or a perfect moment for making things official or deepening your bond.

Key Dates

August 2: Venus-Uranus Square Twitchy Uranus lights a fire under the love planet during today’s restless clash. You might find yourself fixating about “the future” and trying to nail down a commitment while your S.O. (or brand-new love interest) is content to just enjoy your company. Note: You could be undermining yourself with this behavior. Single? Try a wildly new approach—think about what you normally would do to get someone’s attention—and do the opposite.

Money & Career

Partner up for the win! In August, the planets are clustering into the most collaborative zones of your chart, a perfect time to lean on your closest people for support. The Sun is in Leo until August 23, heating up your seventh house of contracts and commitments, joined by motivator Mars through August 18. Offers could turn formal and you may decide to partner up with someone for mutual gain. Be careful not to rush into anything headlong though, as impatient Mars could pile on the pressure before you have all the facts. You may find yourself being a bit more argumentative, but on the plus side, you won’t be afraid to negotiate and advocate for yourself!

The group-centric vibes get even stronger starting August 11, when Jupiter wakes up from a four-month retrograde in Sagittarius and your eleventh house of teamwork and technology. Ready to make a digital splash or launch your world-changing platform? Between now and December 2, supersizer Jupiter is in your court. But note that the same day, your ruling planet Uranus will slip backward into retrograde until January 10, sputtering in Taurus and your domestic fourth house. Plans to relocate or make changes at home could stall for the rest of the year. Take the time to really think through how much any personal life shifts could disrupt the status quo—maybe it’s better to take a phased approach?

Slip off the grid to do some detailed work or research starting August 18, when Mars moves into Virgo and your intense eighth house of joint ventures and long-term finances. You might be talking through the finer points of a deal or you could have a large expense to pay off. Make an aggressive plan to tackle debt, loans or credit card spending if that’s an issue. The upside: a large lump sum could also come your way now, especially once the Sun enters Virgo on August 23, or at the August 30 Virgo new moon. Look into commission-based opportunities or ways that you can build your nest egg with passive income and investments.

Key Dates

August 7: Sun-Jupiter Trine Team up FTW! This rare and magnetizing mashup could attract a perfect partner and act like fertilizer on one of your seedling ideas. While a part of you prefers to work independently, another part enjoys the intellectual stimulation and camaraderie of collaborations.

Love Days: 24, 28 Money Days: 7, 16 Luck Days: 5, 15 Off Days: 26, 3, 12

62 notes

·

View notes

Photo

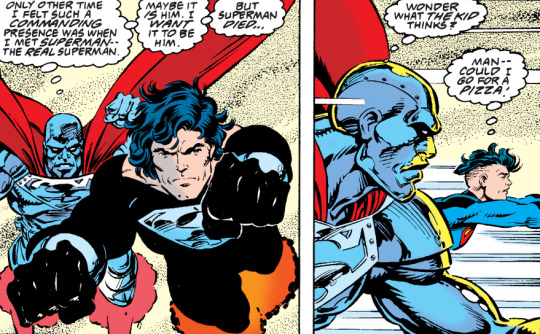

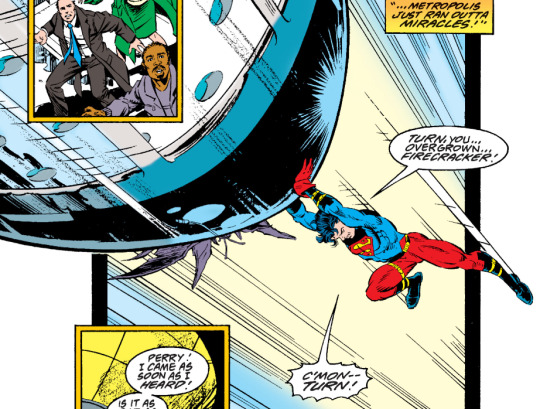

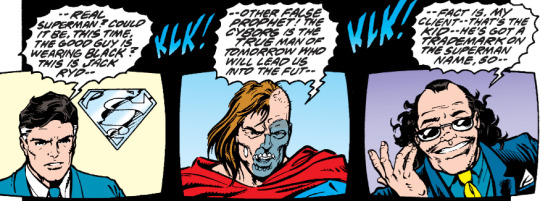

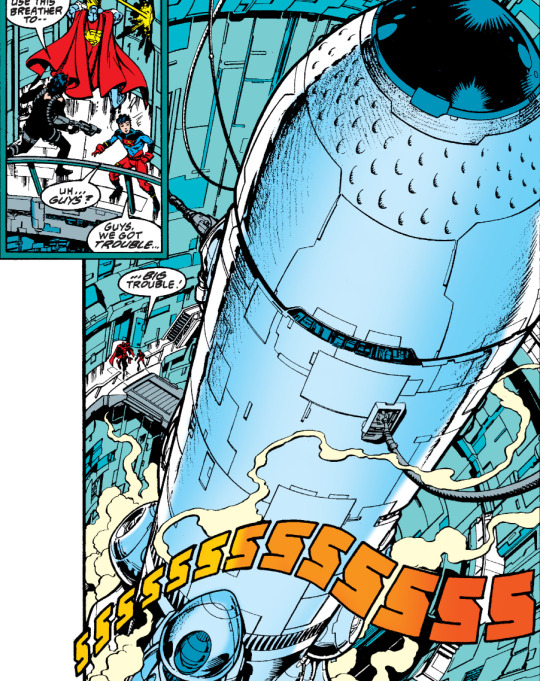

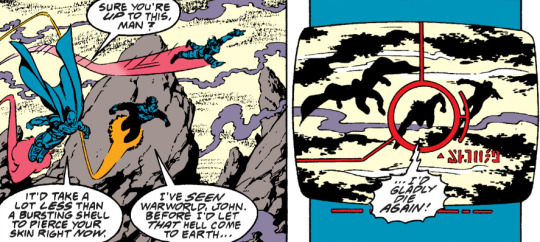

Adventures of Superman #504 (September 1993)

REIGN OF THE SUPERMEN! The three weakest Supermen team up to take on the most ridiculously overpowered one! Last issue ended with Superboy, the Man of Steel, and the long-haired Man in Black flying towards Coast City (or what used to be Coast City), and this one starts with... the same thing, because it's a long-ass trip. At least they use this time to ponder on important matters.

When they finally reach the Cyborg Superman's city-wide robo fortress, the Man in Black loots some giant guns and ammo from an alien mook. You know, just in case you forgot this comic came out in the '90s.

(Needs more pouches, though.)

While trying to hide from the 800 aliens shooting at them, the Super-Trio bump into a giant missile that's about to be launched into Metropolis. The Cyborg Superman wants to nuke the city and replace it with another giant engine, as part of his plan to turn the Earth into a massive evil spaceship (Warworld 2.0). While the Men (in Black and Steel) continue infiltrating the fortress, Superboy manages to latch on to the missile to try to stop it from reaching its destination. It's not an easy task, but after a Spider-Man #33-esque effort...

...the Kid manages to change the missile's trajectory, taking it away from Metropolis. He saved the city! And then the missile blows up anyway, right in his face. Good thing he wasn't wearing his cool jacket in these pages, because there's no way it could have survived that one. It remains to be seen if HE did.

Character-Watch:

OK, he did. I seriously feel like turning that missile is Superboy's "Spider-Man lifting the rubble" moment. He's trapped in an impossible situation and doubts himself, but then gets his shit together and pulls it off because he has no choice. It's interesting that Karl Kesel made the Kid particularly punny and vapid at the start of this issue, almost like he was daring us to be annoyed by him, only to level him up at the end. I bet a lot of Superboy haters were converted right here.

Plotline-Watch:

Superboy's Platonic Friend Tana Moon breaks down and cries on camera about Superboy's sacrifice, probably earning a juicy raise in the process.

When we get to Superboy #60 (the kickass “Hyper-Tension!” storyline), someone remind me to check my suspicion that the page with the big multiverse-crossing missile looks exactly like the page with the regular missile in this issue.

There’s a quick cameo by journalist Jack Ryder (secretly The Creeper) as a talking head on Lois Lane’s TV, alongside Superboy’s manager Rex Leech and one of the wacky Superman cultists who paint their face like the Cyborg. Look at this guy. He shaved his head but only painted the face part? Come on man, you either commit to it or you don’t!

In Engine City, Mongul gets snappy with the Cyborg Superman again, and again gets humiliated in front of everyone (Cyborg calls him a “dog”). Why do you do this to yourself? Dump him, girl!

A robot sniper almost headshots the Man in Black, only for some invisible force to yank his gun at the last moment. Hmmm. In unrelated news, Don Sparrow says: "Interesting note that Luthor II can’t find Supergirl -- I wonder where she is?" Hmmmmmmmmmm.

Don also points out: "The Man in Black asks if he can call John Henry ‘Steel’ because the Man of Steel is too much of a mouthful on their mission, setting up for his permanent name change." Steel should have said "OK, then I'll call you Black."

I'll stop cannibalizing Don's section and just hand the mic over to him. Click "read more" to keep reading!

Art-Watch (by @donsparrow):

We start with the cover, and it has a unique heritage. This cover was sketched and laid out by Karl Kesel, penciled by Tom Grummett, and then inked by Doug Hazlewood, and it’s a good, accurate description of what we find in the issue—our three Supermen fighting their way into Engine City. Added points for bringing up the pre-Crisis concept of the Superman Revenge Squad, which was actually a grouping of Superman rogues (an updated version would appear in a few years). Weirdly, editorial is still seeming to hide the Fabio-hair on Superman proper on the covers—I wonder what that’s about!

Inside the book we get our first look at a trait that defines this issue visually: grease-pencil clouds!

Max pointed this out to me when we were chatting about the issue, and I think he’s right—this book doesn’t look like it was inked in Hazlewood’s usual way. It’s 1993, so it’s hard to imagine they could pull off “digital inking”, the practice of just darkening the pencils, but we see a pencil-like texture so often in this issue, a guy could begin to wonder if that’s maybe what they’re up to. So for the whole issue, there is a slightly looser, rushed feel, especially in the backgrounds. Then on the credits page, we notice a special thanks for Mark Heike—who google reveals to me is a comic artist in his own right. Maybe he pitched in with some semi-credited inks? Smokey clouds aside, it’s another nice splash, with the returned Superman leading the charge.

A common critique of Tom Grummett’s Superman is that the way his face is drawn can look a little Conan-like, and the new long hair doesn’t help that, though in these early pages Superman is looking very on-model and handsome.

The fight (and flight) choreography as the Superman trio enters Engine City airspace is well done, and while it couldn’t be more 90s if it tried, the image of Superman double-fisting blasters and ammo belts is pretty awesome, I must say. Plus, Superboy’s assessment that it’s “slammin’” might replace Robin’s “totally rad!” as a new catch-phrase in these reviews.

The reveal of the giant rocket has a great sense of scale (and is another example of pencil-like lines still popping up on finished art). Great sound effect there, too.

As Superboy heroically climbs up the rocket, Tom and co give a great sense of the speed, and g-forces the kid is experiencing. And there is such a great sense of drama in these last pages, as the celebrations for the missile having missed Metropolis quickly turn to grief, as Superboy is for sure, definitely dead. [Max: Forever.]

STRAY OBSERVATIONS:

Interesting to hear Steel use the phrase “a bursting shell” in relation to piercing Superman’s skin, a callback to Action #1’s description of Superman’s invulnerability, which apparently was known in-universe as well.

I love how unequivocally “Superman” they write the Man in Black in these pages. On his first day back to civilization, he’s already saying he’d gladly die again in order to stop Warworld from taking over Earth. Goosebumps, man!

Does Kesel have dogs on the brain? First Henshaw calls Mongul a dog (ouch) and then just one panel later, Superboy makes his Dalmatian joke. (Note: Dalmatian is actually misspelled in the comic!) [Max: “Dalmation” does sound like some sort of Jack Kirby thing. Maybe it’s something the Kid saw at Cadmus?]

Superboy is pretty much a non-stop joke machine in these pages, as just about every panel he’s in, he’s cracking wise, so it’s hard to highlight all of them. Some are better than others—I get that hearing the phrase “full frontal” puts Michelle Pfeiffer into his head, but “full frontal assault” just isn’t sexy. [Max: You know, 26 years later, I JUST got that one.]

GODWATCH: Steel invokes “God” when he thinks Superboy might have been burnt up in the rocket launch, and then a page later, Superman does the same when he sees the charred corpses of Henshaw’s minions. [Max: Also, I don’t think I caught the significance of John Henry’s “I know” as a kid.]

I love Superboy’s self-talk as he climbs the missile, particularly the Caddyshack-like “crowd goes wild”. This is exactly how a kid his age would act in that crazy moment.

Lois and Clark was airing in this period, so Perry White is legally required to use Lane Smith’s “Great Shades of Elvis” catchphrase. [Max: Unfortunately they don’t have the rights anymore, so they had to change it for the collected edition...]

#superman#karl kesel#tom grummett#doug hazlewood#superboy#steel#coast city#tana moon#hank henshaw#mongul#rex leech#ron troupe#creeper#supergirl#dalmations#totally slammin'#reign of the supermen

17 notes

·

View notes

Text

Prague Views and Brussels Sights

Dobrý den,

My week was surprisingly chiller than normal. I was supposed to have an exam in my Database class, but our professor moved it to next/this week because of a tech conference taking place at a local university (That means I have 2 exams coming up.... wish me luck). The talks were actually really interesting; I heard one on ethics and regulations on AI and another about greenwashing. Both speakers had tons of experience in their fields, and even better the conference provided free snacks :)

Anyway, I had some time before my afternoon class, so I decided to go explore other touristy spots around Prague. I don't know about you, but I definitely need my alone time especially when I'm consistently going to class and living with others. It was also one of the first warm weather days, so all in all perfect for a stroll. I didn't specifically have anywhere in mind and ended up wandering to Tančící dům and Vyšehrad. Tančící dům is this weird shaped building which I found out was a hotel. While I didn't end up going to the top, some friends said the cafe up there has pretty views. I rarely spend time in the southwest portion of Prague where Vyšehrad is located, but after my visit I'll definitely be back for a picnic or something else. There were 360 views of the city, and I could have spent the rest of my day there.

Dancing House, Basilica of Sts Peter and Paul at Vyšehrad, and Prague buildings, skies, and water

Short weekend for Brussels since we had a program trip scheduled! I'd heard mixed reviews about the city, so I wasn't sure what to expect. After our flight got delayed for almost an hour, I was thinking it'd be a bad sign. However, we were greeted with a double rainbow + sunset after landing <3

Besides some rainy and windy weather, I'd have to say the trip was a big success. Brussels is definitely a 2 day city. Since we only had one full day, I don't think we hit everything, but I enjoyed just walking around and being one with the city. One of the most noticeable things was the murals that decorated tons of buildings. I never read Tin Tin, but I think it must come from Brussels because multiple types of art referenced it.

Streets with a Tin Tin mural & my friend and I replicating a Tin Tin statue

The food also hit different ngl...Belgian and Liege waffles are on another level. I went back to Maison Dandoy the second day just to make sure I tried both. Belgian waffles are square, lighter, coated in powdered sugar, and in my opinion better for breakfast--since Belgian people actually don't eat these in the morning. Liege ones on the other hand are circular, denser, and have sugar bits in them. Mine was yummy, a little too sweet but good for dessert. Try the fries and classic Belgian dishes like mussels and Flemish stew too if you're in town!

Here's a brief rundown of sights, so I don't keep rambling on...

Town Hall in the Grand Place

Church of Our Lady of Victories at the Sablon

Law Court of Brussels ft a Ferris Wheel

EU Parliament

Parc du Cinquantenaire with a fake Brandenburg Gate

+ more churches and parks (I make too many lists so if you really want the full rundown feel free to contact me)

PS: if you ever go, don't be surprised at all the motifs to the Manneken Pis. I have absolutely zero clue as to what it means, but all the souvenir shops were hyper focused on this pissing statue 😂 (they even had a female version and a dog one too)

Our program is planning a trip into the countryside next week to do a digital detox which I think will be a great break especially after my 2 exams...

Until next time,

Catherine Jiang Computer Science Tech Career Accelerator in Prague

Czech Words

Dobrý den - hello (formal, greeting used most of the time when entering shops/restaurants)

Tančící dům - Dancing house (dům means house)

1 note

·

View note

Text

How to Apply for a Visa: A Step-by-Step Guide for Travelers

Planning an international trip is exciting, but one crucial step you can’t skip is figuring out how to apply for a visa. Whether you're traveling for tourism, work, study, or family visits, securing a visa is often a non-negotiable requirement. In this detailed guide, we'll walk you through the visa application process and equip you with everything you need to get started with confidence.

What is a Visa?

A visa is an official document or stamp that grants you permission to enter, stay in, or leave a country for a specific period. Depending on your nationality and the destination, the visa requirements may vary significantly. Understanding how to apply for a visa begins with knowing what kind of visa you need.

Types of Visas

Before applying, identify the type of visa that best suits your travel purpose. Here are the most common types:

Tourist Visa

Business Visa

Student Visa

Work Visa

Transit Visa

Family or Spouse Visa

Medical Visa

Knowing your category is essential when deciding how to apply for a visa properly.

Research Visa Requirements

The first real step in how to apply for a visa is researching the specific requirements of the country you’re visiting. Visit the official website of the embassy or consulate of that country. Common requirements include:

A valid passport (usually with at least 6 months of validity)

Completed visa application form

Passport-sized photographs

Proof of accommodation

Travel itinerary or flight tickets

Proof of financial means

Travel insurance

Visa fee payment receipt

Each country may request additional documents, so always double-check.

How to Apply for a Visa Online

With many countries moving toward digital processes, knowing how to apply for a visa online is a big time-saver. Here's how it typically works:

Visit the official visa application portal of the respective embassy.

Create an account if required.

Fill out the visa application form accurately.

Upload the required documents.

Pay the visa application fee via a secure online gateway.

Schedule an appointment for a biometric scan or visa interview, if necessary.

Track the application status through the portal.

Applying online is common for countries like the USA (DS-160 form), Canada, UK, Schengen area, and many more.

How to Apply for a Visa at the Embassy

If online submission is not available, you’ll need to visit the embassy or visa application center. Here's what to expect:

Download and print the visa application form from the official website.

Fill out the form and gather all supporting documents.

Book an appointment (if required).

Submit your application in person at the designated center.

Attend an interview if requested.

Wait for the visa decision, which may take days to weeks.

When learning how to apply for a visa, always check whether the application is processed by the embassy directly or through third-party visa services like VFS Global.

Documents Checklist for Visa Application

Creating a checklist is one of the smartest things to do when figuring out how to apply for a visa. Here's a standard document checklist:

Valid passport

Recent passport-sized photographs

Completed application form

Visa fee receipt

Proof of travel purpose (invitation letter, tour booking, etc.)

Proof of accommodation

Travel itinerary (return flights or tickets)

Financial statements (bank or salary slips)

Travel insurance (especially for Schengen visas)

Make sure all documents are current and translated if required.

Tips for a Successful Visa Interview

Many applicants get nervous about the visa interview. But knowing how to apply for a visa includes preparing mentally for this step. Here are some tips:

Dress professionally.

Be honest and confident in your answers.

Provide clear and concise responses.

Carry all original and photocopied documents.

Arrive at least 15–20 minutes early.

Interviews are common for visas to the US, UK, and Canada.

How Long Does It Take to Get a Visa?

Processing times vary widely based on the country and visa type. On average:

Tourist Visa: 5–15 business days

Student Visa: 2–6 weeks

Work Visa: 4–12 weeks

Business Visa: 5–10 business days

When figuring out how to apply for a visa, always apply early—at least 30 to 60 days before your planned travel date.

Common Reasons for Visa Rejection

Understanding how to apply for a visa also means knowing what not to do. Visa rejections can occur due to:

Incomplete application

False or misleading information

Lack of financial proof

Invalid passport

Suspicious travel intent

No ties to the home country

If rejected, don’t panic. You can usually reapply or appeal the decision with stronger documentation.

Tips for a Smooth Visa Application Process

Start early: Don’t wait until the last minute.

Double-check everything: Accuracy matters.

Stay organized: Keep digital and physical copies of documents.

Use official sources: Always apply through authorized websites.

Stay informed: Monitor application status online.

Conclusion

Knowing how to apply for a visa is crucial for any international traveler. The process may seem overwhelming at first, but breaking it down into steps makes it manageable. Whether you’re applying online or in-person, preparing the right documents, staying organized, and applying early can make the entire process stress-free. Always rely on official sources and don’t hesitate to ask for help from professionals if needed. Now that you know how to apply for a visa, you're one step closer to your next international adventure!

For more Information follow https://btwvisas.com/

0 notes

Text

Skip to content

What’s a cryptocurrency?

A cryptocurrency functions similarly to a digital type of money. you can use it to split a bar tab with mates, purchase the new pair of shoes you’ve been eyeing, or book flights and hotels for your next vacation.Cryptocurrency can be submitted to friends and relatives all over the world because it is interactive.

Isn’t that the same as PayPal or bank transactions? No, not at all. It’s a lot more exciting!

Traditional online payment gateways, on the other hand, are operated by businesses. They keep the money for you, and anytime you try to spend it, you must ask them to pass it on your behalf.

In cryptocurrencies, there isn’t an organization.you, your friends, and thousands of others can act as your own banks by running free software.Your computer connects with other people’s computers, meaning you communicate directly – no middlemen required!

You do not need to register with a website with an email address and password to use cryptocurrency.You can download a wide variety of apps onto your smartphone to

start sending and receiving within minutes.

What is the meaning of the word “cryptocurrency”?

The name cryptocurrency is a combination of cryptography and currency. With cryptography, we use advanced math to secure our funds, making sure that nobody else can spend them.

There’s no need to know all this; the applications you use will take care of all of it.

You’ll have no idea what’s going on under hood.

However, if you’re interested in that sort of thing, we have a few articles for you:

What is Public-Key Cryptography?

History of Cryptography

Symmetric vs. Asymmetric Encryption

What is a Digital Signature?

As a result, this magical internet money isn’t owned by anybody and is protected by cryptography.

Why do you bother if you already have applications for paying people?

It’s

Permissionless

No one has the power to prevent you from using cryptocurrency.

Centralized payment systems, on the other hand, have the ability to freeze accounts or discourage transactions.

Censorship-resistant

Hackers or other attackers would find it nearly impossible to shut down the network due to its design.

A cheap and fast payment method

When you send money to someone on the other side of the globe, it will arrive in seconds – at a fraction of the cost of an international wire transfer.

What about that Bitcoin thing your family member or friend keeps mentioning?

This is the first cryptocurrency, and it is still the most common.

Who is the inventor of Bitcoin?

Surprisingly, no one knows who came up with Bitcoin. Satoshi Nakamoto is the only name we know of them by. Satoshi may be a single individual, a group of programmers, or even a time-traveling alien or a secret government team, according to some of the more bizarre theories.

Satoshi published a 9-page document in 2008, detailing how the Bitcoin system worked. Months later, in 2009, the software itself was released.

Bitcoin laid the groundwork for a slew of other cryptocurrencies. Some used the same program as some, and some took a completely different approach. But, what is the difference between all of these cryptocurrencies?

It will take us weeks to compile a list of all the various cryptocurrencies. Some are quicker, some are more private, some are more stable, and some are more programmable than others.

In the cryptocurrency world, there’s a saying that goes something like this: “Do Your Own Research” (or DYOR). We promise we’re not being rude when we say that. It simply means that you shouldn’t take information from a single source as the truth.

Make sure you do your research before investing your money in a specific project.

Cryptocurrencies are not all the same!

If you want to read more about the various coins and tokens, we’ve put together a list of guides on Binance Academy:

What Is Bitcoin? (the cryptocurrency’s king)

What Is Ethereum? (the distributed computer)

What Is BNB? (the original exchange coin)

A Beginner’s Guide to Monero (for the privacy aficionados)

In the next section, we’re going to talk about the technology that the vast majority of digital currencies are based on, known as blockchain.

What is blockchain, exactly?

Don’t be spooked by the technobabble that people use to characterize “blockchain.”

A blockchain is nothing more than a database.It’s also not an especially complicated one; you could make it with minimal effort in a spreadsheet.

There are a few peculiarities in these databases.The first is that blockchains are only capable of appending data.That means you can only add details – you can’t just click on a cell and erase or alter something you’ve already entered.

The second is that each database entry (called a block) is cryptographically connected to the previous entry.In layman’s terms, each new entry must include a digital fingerprint (hash) of the previous one.

That’s what there is to it!You end up with a chain of blocks since each fingerprint points back to the previous one.A blockchain, as the cool kids like to call it.

A blockchain is permanent, which means that if you change a block, the fingerprint changes as well.Since the fingerprint is used in the following block, the following block is also updated.And since the fingerprint of that block is… well, you get the idea.As a result, any transition becomes apparent in a domino effect.You can’t change something without causing others to notice.

Is that the end of it?

Are you feeling underwhelmed?That’s fair.The breakthrough here isn’t any clumsy Google Sheets replacement.It’s the fact that everyone on the network can download blocks from others to create identical copies of the blockchain on their computers.That’s exactly what the app we talked about earlier does.

Suppose that you and your friends Alice, Bob, Carol, and Dan are running the software. You might say “I want to send five coins to Bob.” So you send that instruction to everyone else, but the coins aren’t sent to Bob immediately.

Carol might decide at the same time to send Alice five coins. She also sends her instruction out to the network. At any time, a participant can gather up the pending instructions to create a block.

What prevents someone from cheating if they can make a block?

Making a block that says “Bob pays me a million coins” is probably really appealing to you.Alternatively, you might start purchasing Lamborghinis and fur coats from Carol using funds you don’t have.

That isn’t how it works, though.The scheme stops you from wasting funds you shouldn’t be able to invest thanks to cryptography, game theory,and a consensus algorithm.

Free blockchain knowledge!

What Is a Blockchain Consensus Algorithm

What Is Proof of Work (PoW)?

Double Spending Explained

Game Theory and Cryptocurrencies

Byzantine Fault Tolerance Explained

Did you already know all of this and are now looking to learn how to trade or invest? Let’s move on to the next part.

Trading

Blockchain and cryptocurrencies, as you may have heard, are now being used in a variety of fields.Speculation is, without a doubt, one of the most common current use cases.

Trading is typically associated with a profit-generating strategy that is focused on the short term.Traders are free to enter and exit positions at any time.But how do they know when to enter and when to leave?

Technical analysis is one of the most common approaches for making sense of the cryptocurrency sector (TA).Price history, charts, and other forms of market data are used by technical analysts to identify bets with a reasonable chance of returning a profit. .

You must be itching to get underway as soon as possible.Technically, you should do it.It’s that easy!Trading, like most worthwhile endeavors, is difficult!It will take us a long time to go over anything you should be aware of.

Learn how to master the art of charting!

To get you started, here are some articles:

What Is Technical Analysis (TA)?

A Beginner’s Guide to Candlestick Charts

Fortunately, we’ve also put together a comprehensive guide for new crypto traders!

It covers almost everything you need to know about cryptocurrency trading (and potentially more):

A Complete Guide to Cryptocurrency Trading for Beginners

After you’ve quoted the article after being jolted awake at 5 a.m., you should move on to other similar topics:

A Beginners Guide to Understanding Risk Management

A Beginner’s Guide to Cryptocurrency Trading Strategies

5 Essential Indicators Used in Technical Analysis

12 Popular Candlestick Patterns Used in Technical Analysis

7 Common Mistakes in Technical Analysis (TA)

Investing

Long-term bets based on the fundamentals of an investment are sought by investors.

For instance, how much profit a business makes.Although cryptocurrencies are an unique and distinct category of asset, they can be viewed in the same way.

Many Bitcoin investors INVESTORS to the “HODL” strategy.This means they are so confident in Bitcoin’s future that they have no plans to sell for a long time.But don’t believe everything they say!Read our in-depth Bitcoin guide and make your own decision.

After going through that, you might decide to become a Bitcoin HODLer.In a matter of minutes, you might become one.Simply visit the Buy Crypto page and follow the guidelines.

The onboarding method is simple and straight forward. You also don’t have to put a lot of money into it.You could get started with as little as 15$ So, what are some interesting facts about crypto investment that you can investigate?

Crypto Investing 101

These articles will assist you in getting started with cryptocurrency investments:

What is Fundamental Analysis (FA)?

Asset Allocation and Diversification Explained

Dollar-Cost Averaging (DCA) Explained

Passive income

We’ve just discussed trading and investing so far.These strategies usually necessitate a significant amount of time, which not everybody has.We have some other choices for you if you’re one of those busy but productive people.

“If you don’t find a way to make money while you sleep, you can work until you die,” said Warren Buffett, one of the world’s most influential investors.

Good news: there are several ways to gain passive income in the cryptocurrency environment.You can effectively use your cryptocurrency holdings to generate more cryptocurrency!

Why aren’t all the people doing this?They most likely have no idea.But now you have it!

One way to generate passive income is to lend your assets to others in a safe manner.

They will pay you interest in return for the ability to borrow your money.

Furthermore, you might be familiar with Bitcoin mining.It usually entails a slew of noisy, high-priced machines churning away for Bitcoin rewards.There are, however, other methods for securing a cryptocurrency network.One of these is through a technique known as staking.And, spoiler warning, it has nothing to do with meat.

What is staking?

Staking, to put it simply, is the practice of receiving incentives for storing coins.As a result, if you invest in a coin that allows for staking, you will be able to accumulate a greater holding over time.In these posts, you can learn more about:

What Is Staking?

Proof of Stake Explained

Privacy and Security

We’re a cryptocurrency blog, but we also cover privacy and security issues – as should you!

The digital age ushered in a new era of serious creativity.Your refrigerator will send you a text message if you fail to shut the door, you can summon your car using a mobile app,and it appears that mail will soon be delivered by drone.

Unfortunately, there’s also been innovation in ways to steal your sensitive data – something we unknowingly produce A LOT of. Do you know the best way to deal with ransomware? Or the steps you can take to stop websites from finding out where you’re browsing from?

0 notes

Text

Wi-Fi And Li-Fi Market– Insights on Upcoming Trends 2022

Wi-Fi and Li-Fi Market

Wired networks incur gamut components for installing internet connection. It not only surges cost, but complete installation of the components such as switches, hubs, and Ethernet cables etc. drives in multiple complexities. To overcome such challenges, Wi-Fi has emerged as great alternative. This technology implements high-frequency radio waves instead of wired networks. Similar to Wi-Fi, another technology Li-Fi has emerged that uses visible light communication instead of radio signals. Li-Fi delivers high-speed in a much more secure way that even the latest Wi-Fi advancements cannot offer. Li-Fi allows 100 times faster data transmission than Wi-Fi, making it more competent.

Get More Information at Professional@ https://www.trendsmarketresearch.com/report/sample/9825

Wi-Fi and Li-Fi Market Analysis

The Wi-Fi and Li-Fi markets are estimated to witness a CAGR of 15.0% and 61.3%, respectively during the forecast period upto 2022. The Wi-Fi market is analyzed by deployment mode, products, services, verticals, and regions whereas Li-Fi market is analyzed by components, verticals, and regions. Increasing productivity, high speed, reliable & secure communication, and flexibility are the main reasons to switch to wireless Wi-Fi and Li-Fi technology. The Li-Fi market is emerging and being developed, which would likely lead to an increase in the adoption of Li-Fi in the next 5–7 years.

Regional Analysis

The Americas is set to be the leading region for the Wi-Fi and Li-Fi market growth followed by Europe and Asia Pacific for the adoption of technologies. Asia Pacific is known for improvements in infrastructure and IT investments by MNCs. Thus, the region will have enormous potential for Wi-Fi connections. MEA is set to be the emerging region with a lot of opportunities and is expected to reach $4.09 billion (Wi-Fi) and $827.9 million (Li-Fi), respectively by 2022.

Vertical Analysis

The major verticals covered in the report are IT & telecom, education, healthcare, BFSI, retail, aerospace (in-flight operations), traffic management, underwater applications, and indoor networking. Globally, the industry players are showing interest towards Wi-Fi and Li-Fi technology. The Wi-Fi technology is already being incorporated and is widely accepted in IT & telecom, education, and healthcare sectors due to the organization’s shift towards wireless ecosystem. The indoor networking segment is set to be the leading vertical for Li-Fi technology. The market revenue for indoor networking and traffic management is expected to reach $654.2 million and $5,509.4 million, respectively by 2022.

Request For Report Discount@ https://www.trendsmarketresearch.com/report/discount/9825

Wi-Fi and Li-Fi Market Key Players

pureLiFi, IBSENtelecom, Alcatel-Lucent, Ericsson, Hewlett-Packard Enterprise (HPE), Cisco, Lucibel, Ruckus Wireless, GE Lighting, Renesas Electronics Corp., LIGHTBEE, Velmenni, and Oledcomm S.A.S.

Competitive Analysis

The Wi-Fi & Li-Fi are becoming demanding technologies. There are enormous business opportunities for new players entering the market and collaborating with large players in providing various products and services. Especially for Li-Fi technology, new start-ups are coming with technologically advanced products, services, and solutions in the market and are expected to see double-digit growth in the next 5–7 years. In this space, collaboration and merger & acquisition activities are expected to continue.

Wi-Fi and Li-Fi Market Benefits

The report provides an in-depth analysis of the Wi-Fi and Li-Fi market aiming to understand the networking environment. The report talks about deployment mode, products, services, components, verticals, and regions for both Li-Fi and Wi-Fi. The key stakeholders can know about the major trends, drivers, investments, vertical player’s initiatives, and government initiatives towards the adoption in the next 5–7 years. Moreover, the report provides details about the major challenges impacting the market growth.

Wi-Fi Market by Deployment Mode

Indoor Wi-Fi

Outdoor Wi-Fi

Transportation Wi-Fi

Wi-Fi Market by Products

Access Points

WLAN Controllers

Wireless Hotspots Gateways

Wi-Fi Market by Services

Network Planning & Design

Installation

Support

Wi-Fi Market by Verticals

IT & Telecom, Education

BFSI

Healthcare

Retail

Public Sector

Wi-Fi Market by Regions

Americas

Europe

Asia Pacific

Middle East

Li-Fi Market by Components

LED

Photodetectors

Microcontrollers

Li-Fi Market by Verticals

Underwater Applications

Aerospace

Education

Healthcare

Traffic Management

Defence & Communication Security

Indoor Networking

Li-Fi Market by Regions

Americas

Europe

Asia Pacific

Middle East

Make an Inquiry before Buying@ https://www.trendsmarketresearch.com/checkout/9825/Single

0 notes

Text

It’s too soon to say it’s all over for the Patriots and Tom Brady

Photo by Maddie Meyer/Getty Images

You think Tom Brady’s really gonna go out on a wild card loss?

If this was the last we’ve seen of Tom Brady, it won’t be how the NFL remembers him.

Brady, 42 years old and playing on soaked Gillette Stadium turf, exited the 2019 season on a pick-six. His final shot at a fourth-quarter rally in the Wild Card Round, stymied twice before by the Titans and their 16th-ranked defense, ended with a thud when defensive back Logan Ryan walked a tip-drill interception into the end zone with nine seconds left on the clock. The six-time Super Bowl champion wouldn’t attempt another pass.

The final score in Foxborough? Tennessee 20, New England 13.

There’s a not-insignificant chance that may be the last game Brady plays — if not in the NFL, then potentially as a Patriot. The 20-year veteran will enter 2020 as an unrestricted free agent for the first time in his career and wouldn’t commit either way in the wake of the loss.

While most evidence suggests we’ll only ever see Brady in New England red, white, and blue, he could always venture outside Massachusetts to see how the NFL’s other half lives, especially if there’s a team out there willing to spend big and surround him with top-flight receiving talent. Retirement may also loom for a longtime competitor coming off a disappointing season on both a team and personal level, even if Brady’s gut reaction Saturday night was that hanging up his cleats was “pretty unlikely.”

It also may have been the fuel that draws him back to the gridiron for another shot at history. The image of Brady losing to the Titans was a carnival caricature compared to the stately manor portrait we’ve seen of him through most of his career. The quarterback eschewed the mistakes that’d haunted him through this season only to be stifled by miscues across his own lineup and an occasionally unstoppable Derrick Henry (204 total yards) on the other side of the ball. That could have left a sour enough taste in his mouth to convince him to rewrite his own ending.

If it does, the Patriots will be ready.

New England is built for another run with Brady at the helm

The Patriots committed to Brady this season.

The 2019 NFL Draft brought Arizona State wideout N’Keal Harry with the team’s first pick. Then, after cutting loose former All-Pros in Antonio Brown and Josh Gordon during the season, head coach and de facto general manager Bill Belichick made an uncharacteristic move to free Mohamed Sanu from the Falcons in exchange for a second-round pick.