#- WebFOCUS data integration

Explore tagged Tumblr posts

Text

Unlocking Potential with WebFOCUS: Your Comprehensive Guide

Discover the Power of WebFOCUS

Modern businesses thrive on data-driven insights, pushing the boundaries of technology to become more analytics-centric. Consequently, the demand for cutting-edge business intelligence tools is at an all-time high. Enter WebFOCUS, a robust, scalable, and adaptable analytics platform that aims to streamline decision-making processes and transform the world of business intelligence.

Understanding WebFOCUS

WebFOCUS, typically associated with WebFOCUS reporting and Business Intelligence (BI), is an advanced analytics platform designed to empower businesses to make data-driven decisions intelligently. Perfect for WebFOCUS jobs and developers alike, this tool can maneuver vast data landscapes and conduct insightful WebFOCUS data analysis.

Key Benefits of Using WebFOCUS

WebFOCUS redefines the realms of data analytics with its advanced features. Its key benefits extend to:

- Data discovery and Data mining: Gain an edge in identifying patterns and trends behind your data.

- Data governance and management: Control data integrity and reliability through WebFOCUS's robust data governance and management tools.

- Data integration: WebFOCUS excels at integrating varied data sources, ensuring a seamless data pipeline.

- Security, Performance, and Scalability: As a secure, efficient, and scalable platform, WebFOCUS stands out as a robust data analysis tool.

WebFOCUS Capabilities

WebFOCUS App Studio and WebFOCUS Designer

Being a WebFOCUS developer means understanding and utilizing the many modules within the platform. WebFOCUS's core is its App Studio module, an Integrated Development Environment (IDE) that allows users to create and manage business applications. Similarly, WebFOCUS Designer offers an intuitive user interface for developing sophisticated data visualizations.

WebFOCUS Info Assist and WebFOCUS Reporting

For data refinement and extraction, WebFOCUS offers InfoAssisT, a browser-based module that simplifies ad hoc reporting tasks. InfoAssisT allows business users to create engaging dashboards, charts, and custom reports, providing visual-driven insights within the WebFOCUS dashboard that are actionable.

WebFOCUS Insights and Predictions

WebFOCUS isn’t just about knowing your business; it’s about predicting it. With predictive analytics capabilities companies can forecast future trends and make informed decisions.

WebFOCUS Security and Scalability

A standout feature of WebFOCUS as an analytics tool is its commitment to data security. Businesses can rest assured knowing their data is protected with utmost rigor.

WebFOCUS Jobs and Salary

What does a WebFOCUS developer salary look like? Given the demand for data analysis and BI skills, a career with WebFOCUS is both rewarding and lucrative, offering competitive remuneration.

WebFOCUS Training and Tutorials

To facilitate user understanding of its multifaceted features, WebFOCUS offers a comprehensive collection of training resources and tutorials online, catering to varied learning abilities and paces.

Conclusion: The Future with WebFOCUS

As businesses constantly adapt and grow, so too do their data analytics needs. WebFOCUS, with its advanced BI capabilities and robust data handling, appears poised to remain an industry leader. Businesses looking for a future-proof, comprehensive analytics platform need not look further than WebFOCUS. Whether transitioning into a WebFOCUS developer job, seeking out WebFOCUS training, or looking to improve your current business operations, WebFOCUS stands out as an invaluable tool. Harness the power of WebFOCUS and transform your business today.

#WebFOCUS analytics#- WebFOCUS dashboard#- WebFOCUS reporting tool#- WebFOCUS business intelligence#- WebFOCUS data visualization#- WebFOCUS data analysis#- WebFOCUS data reporting#- WebFOCUS data integration#- WebFOCUS data discovery#- WebFOCUS data mining#- WebFOCUS data insights#- WebFOCUS data manipulation#- WebFOCUS data management#- WebFOCUS data warehouse#- WebFOCUS data modeling#- WebFOCUS data transformation#- WebFOCUS data extraction#- WebFOCUS data governance#- WebFOCUS data quality#- WebFOCUS data security#- WebFOCUS data privacy#- WebFOCUS data best practices#- WebFOCUS data strategy

0 notes

Text

Over the past couple of decades, a number of US government officials have left their roles for lucrative jobs at tech companies. Plenty of tech executives have also departed to take leadership positions inside federal agencies. But four experts who track the federal workforce tell WIRED they were stunned last week by a development unlike any other they could recall: The Department of Treasury internally announced that Tom Krause had been appointed its fiscal assistant secretary, but that he would simultaneously continue his job as CEO of the company Cloud Software Group.

Krause is now in charge of both a sensitive government payment system and a company that has millions of dollars’ worth of active contracts with various federal agencies through distribution partners, according to a WIRED review of searchable spending records. The Department of Treasury alone accounts for a dozen ongoing contracts tied to Krause’s company that are together valued between $7.3 million to $11.8 million. These include licenses for the data visualization tool ibi WebFocus and purchases of systems called Citrix NetScaler that help manage traffic to apps. (Some publicly posted procurement records do not break out contract details, so actual figures may be even higher.)

Critics have expressed concern about the alleged conflicts of interest posed by Krause’s decision to keep his role in the private sector. Cloud Software could benefit from extending its federal contracts or securing additional ones, though there is no public evidence that Krause has done anything improper with his dual roles. Existing federal regulations also bar actual and apparent unjust favoritism in contracting. “Public trust in those safeguards is nonnegotiable,” says Scott Amey, general counsel at the Project on Government Oversight, a nonpartisan watchdog group.

As Krause moves forward with two jobs, he could have to potentially navigate not only contracting conflicts, but also dueling crises. “What would happen if a Citrix emergency emerges at the same time as Treasury obligations?” says Jeff Hauser, founder and executive director of the Revolving Door Project, which researches federal appointees. “Generally, the thicket of restrictions on full-time employees would make a CEO role impossible in an administration which took adherence to ethics laws seriously.”

Krause, the Treasury Department, and Cloud Software didn’t respond to requests for comment. Cloud Software investors also didn’t respond to a request for comment.

The Treasury Department has told Congress that Krause is a “special government employee”—a type of temporary role—that is supposed to be held to “the same ethical standards of privacy, confidentiality, conflicts of interest assessment, and professionalism of other government employees.” In a foreword to a code of conduct policy posted on Cloud Software’s website, Krause states, “Cloud Software Group is committed to ensuring that its business is conducted ethically, in compliance with the law, and according to its values of integrity, honesty and respect.”

Krause is among a group of several dozen veteran tech executives, mid-level tech operations managers, and fresh-out-of-school software coders who have been recently installed across a series of federal agencies under the auspices of the self-styled Department of Government Efficiency. DOGE’s authority is being challenged by some Democratic state attorneys general. In the meantime, its representatives have been carrying out an order from President Donald Trump to cut costs and modernize technology across the government.

There is some precedent for corporate executives to simultaneously work in the US government. When the US was at war in the early 1900s, the federal government recruited business leaders to fill key posts. They retained their private sector jobs and wages; the government pitched in a $1 annual salary to the executives who became known as “dollar-a-year men.” Congress later raised concerns that some of them had engaged in self-dealing.

Since then, other executives have continued to retain their jobs as they serve on government boards and commissions, typically in a part-time capacity. But maintaining a day-to-day operational role in both the federal government and at a corporation is now virtually unheard of, says David E. Lewis, a political scientist who wrote a book on appointed government bureaucrats. “Most persons in regular executive positions divest themselves of private interests before government service,” he says.

Trump, according to his company, has handed management of his businesses, including hotels and golf courses, to his children for the duration of his presidency (though he reportedly still takes meetings that have raised questions among ethics experts). Musk, who is CEO of Tesla and SpaceX and has oversight of four other companies, including X and Neuralink, has been a vocal figure in DOGE’s operations, but the White House has said he’s not actually in charge—without specifying who is leading the project. Some of the other individuals associated with DOGE are otherwise unemployed, have taken leave, or maintain dual roles but at lower levels than chief executive.

Krause is the only Trump administration official identified so far as being a CEO and a day-to-day decisionmaker inside one particular agency. After years of working as an executive at chip companies, Krause joined Florida-based Cloud Software Group in 2022. The company was created that year as part of a private-equity-backed acquisition of Citrix, followed by a merger with Tibco, another tech company. At the time, Citrix was saddled with an extensive amount of debt and generating essentially stagnant revenues, and while Tibco had not recently publicly disclosed its finances, analysts had considered the company’s outlook to be “negative.”

The US government, including state and local agencies, is expected to spend $287 billion on technology this year, or about 14 percent of overall US tech spending, according to Forrester, a research and advisory company. Whether DOGE’s efforts to boost the quality and efficiency of federal IT systems will lead that spending to increase or decrease isn’t clear. So far, DOGE has both tried to purchase emerging technologies and moved to cancel some existing contracts. But Krause’s inside access could potentially provide an advantage to Cloud Software at a pivotal moment for the company.

Over the past couple of years, Cloud Software has laid off thousands of people and faced accusations that it potentially became lax with cybersecurity. Cloud Software’s most well-known offering, Citrix, enables groups of workers to access data and run apps that are located on a remote machine. But increasing adoption of tools that can operate on any device has chipped away at some of Citrix’s dominance, according to Will McKeon-White, senior analyst for infrastructure and operations at Forrester. There are other options now, he says, including from Microsoft and smaller companies such as Island.

Cloud Software’s Tibco program, which helps workers automate tasks such as adding a new user to multiple internal databases, is often mentioned in the wrong sort of conversations these days, according to David Mooter, a Forrester principal analyst. “They tend to come up more when somebody wants to abandon them,” he says.

That said, some Cloud Software services are more affordable than alternatives for governments, and they also are better suited for the older infrastructure used by some agencies. Last year appears to have been one of Citrix’s best in a long time financially, says Shannon Kalvar, a research director for enterprise systems management and other areas at IDC. One reason for the upswing is that Citrix has put more emphasis on catering to the feature demands of its largest customers, including governments.

13 notes

·

View notes

Text

Vuejs Web development

What is the purpose of Vue.js framework?

Given that it uses JavaScript, Vue.js is one of the easiest frameworks out there for most developers to get started with. As a result, anyone who is familiar with JavaScript at a basic level can work with Vue.js.

Setting up Vue.js is simple and can be done with the help of the Vue CLI tool and other frontend development tools. It comes pre-configured with basic functionality, but you may also write code that follows a DRY (Don’t Repeat Yourself) structure and logic.

Additionally, Vue.js has reactivity built in. In other words, Vue.js makes it simple to use the real-time functionality that was popular on the Angular framework. For instance, it’s straightforward to implement a directive like v-if in a Vue.js application.

An explanation of a vue.js web development firm

The open-source front-end technology Vue.js aids in the creation of real-time, dynamic applications by large-scale businesses. This MVVM-based progressive JavaScript framework was developed. The primary library of this program concentrates on the view layer and connects with other javascript libraries with ease. Future-oriented applications can better serve users thanks to Vue.js development. The goal of WebFocus is to provide specialised, cost-effective services for developing high-command user interfaces that result in slick, high-performing applications. We deliver projects on schedule using cutting-edge methods and creative solutions to maximise your investment as one of India’s fastest-growing vue.js development firms.

How does a vue.js development firm operate?

When working with Vue.js, our engineers adhere to a clear-cut service delivery approach that consists of several crucial components.

Requirement Gathering

Designs, Wireframes, and Mockups

Prototype Demo

Changes And Confirmation

Development

Deployment

Support And upkeep

SEO

What services does a vue.js development business offer?

We work hard to stay abreast of cutting-edge technologies, thus we were early users of Vue.js, an open source, progressive JavaScript framework that is becoming more and more well-liked in the app development community. One of the most promising JS libraries for creating interactive user interfaces is vue.js, which is lightweight and very easy to customise. It was created by Evan You and is regarded as one of the top JavaScript frameworks available today and a fantastic alternative to its contemporaries. It provides data-reactive components with an easy-to-use and adaptable API.

Vue.js Custom Application Development

Single Page Application Development

Vue.js professional consultation

Integration and optimization

Migration & Upgradation Services

Vue.js development Services

Why Use Vue.js For Application Development in Businesses?

To create a dynamic web user interface, a solid and forward-thinking foundation is essential. Vue.js is a progressive javascript framework that stands out among other javascript frameworks for online application development as a developer’s top pick and a corporate favourite.It is flexible and may be effortlessly included into large projects for front-end development. Vue.js makes it easier to create strong apps because it doesn’t require any external libraries or plug-ins. Additionally, it provides the most comprehensive doc library ever found, greatly simplifying both the building of mobile apps for Vue.js and the developers’ lives.

What advantages do VueJS web development outsourcing have?

It can be challenging to select the ideal framework for your project. What would you choose: Angular? React? Backbone? There are several options available, and the one you choose can significantly affect both the length of the development process and the calibre of the finished product.

Choose a framework that is simple to use, lightweight, productive, scalable, and versatile enough to incorporate into almost any type of website or online application for this reason. As a result, your audience will adore the product you create and you will be delighted to display it.

Best vue.js development

Reusability of parts

Unbelievably light

depiction of a virtual DOM

Simple to incorporate

a two-way conversation

To read full blog visit: Vue.js development company

0 notes

Text

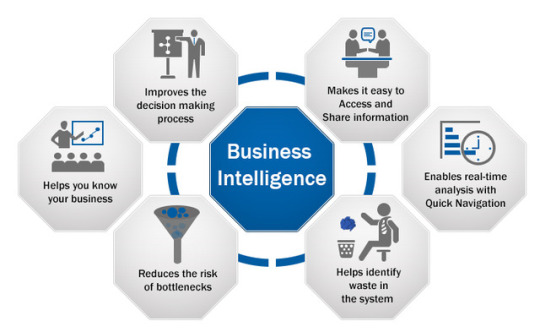

How Business intelligence can make your business intelligent

There are several definitions for Business Intelligence or BI. BI is about delivering appropriate and reliable information to the right people at the right time and the right place to achieve the goals better and make decisions faster. If you want to have efficient access to reliable, reasonable, and actionable data on demand, then BI might be right for your business.

Business intelligence (BI) includes the utilization, infrastructure, tools, and best practices that allow access and analysis of data to refine and optimize decisions and performance.

Companies want timely, well-informed, decision-making, in operational environments and in the corner office—no matter what their mix of principles, purposes, or infrastructure environments. A modular, scalable, standards-based business intelligence solution architecture can be easily deployed in any environment for delivering services across the organization.

Business intelligence enables data visualizations or graphical depictions that help people see and understand data quicker and more effectively. Interactive data visualizations support drilling down to explore details, recognize patterns and outliers, and change which data is processed and excluded. When data is visualized, it’s easier to identify new trends.

What are BI tools and Why use business intelligence tools?

Data discovery, which used to be restricted to the expertise of advanced analytics experts, is now something that everyone can do using BI tools. And not only that, these tools give you the insights you need to achieve things like growth, fix essential issues, collect all your data in one place, forecast future results, and so much more.

BI tools are used for many reasons, and when used accurately, can provide many benefits for business. Some anticipated benefits of BI are to drive quicker and better decisions, help identify potential areas of operational development, help recognize various types of trends within the markets, and help generate competitive benefits over other competitors whose information is bounded. All of these advantages can be identified on both the macro and micro level when properly followed with business objectives and systems organizations

Traditionally, BI tools focus on performing and interpreting old data from different types of systems stored in SQL databases, data warehouses, and other types of related data sources. With the rise of Big Data and NoSQL data sources, the amount of data has grown extensively, allowing more sophisticated analysis to take place quickly.

The most well-known types of business intelligence tool are Dashboards, Data Mining, Visualizations, Reporting, ETL, OLAP, Predictive Analytics, Drill-Down, etc.

Many organizations plan to use BI Tools which are: Tableau, Dundas BI, Microsoft Power BI, Qlik, Sisense, Information Builders WebFOCUS BI, Oracle BI, SAP BusinessObjects, MicroStrategy Analytics, SAS Business Intelligence, etc.

Benefits of BI Tools

Business Intelligence and IT managers see their tools and platforms as a means of delivering faster and more accurate information to decision-makers. Quicker and accurate reporting, analysis and planning; better business decisions; improved employee satisfaction, and improved data quality tops the list. There are lots of types of different BI tools out there to examine and research with. The more instructed the user base becomes, the more comprehensive and compelling the advantages will be. BI is a versatile and great resource and can be useful in almost all industries.

The advantages achieved frequently by organizations include reducing costs, growing revenues, and decreasing IT headcount. With increasing efforts to monetize data by improving commercial offerings, we might see the “expanded revenues” outcome rising in number in the future.

Faster reporting, analysis or planning

Improved employee satisfaction

More accurate reporting, investigation or planning

Improved customer satisfaction

Better business decisions

Improved data quality

Increased revenues

Improved operational efficiency

Increased competitive advantage

Reduced costs

Saved headcount

AceTek Solutions is a Business Intelligence solutions provider and can help your business make better decisions by providing expert-level business intelligence (BI) services. Be it designing and implementing a BI solution from scratch or auditing and improving the already existing solution – We have been rendering end-to-end business intelligence (BI) services that include consulting, implementation, data visualization and reporting, testing etc. to help businesses. AceTek Solutions team of Business Intelligence solution builds and enhances robust reporting platforms and Incorporates self-service capabilities to gather business intelligence from across the enterprise

Our clients tell us that our business intelligence solutions services works for them. We combine BI technical expertise with business domain expertise and use only proven open technologies to help businesses reap all the benefits from that is expected from Business Intelligence solutions such as reduction in costs and easy integration with other platforms and applications. If you are looking for business intelligence implementation and consulting assistance look no further, AceTek Solution’s team of Business Intelligences solutions provider will be able to help you out.

0 notes

Text

Big Data Analytics in Retail Market Research Report

Growth opportunities in Big Data Analytics in the Retail Market look promising over the next six years. This is mainly due to the integration of advanced technologies such as IoT and artificial intelligence and the rising need to deliver customized user experiences to expand supply.

Request for a FREE Sample Report on Big Data Analytics in Retail Market

Big Data Analytics in Retail Market Dynamics (including market size, share, trends, forecast, growth, forecast, and industry analysis)

Key Drivers

Swiftly expanding retail sector along with the extending e-commerce platform led by the accelerating penetration of smartphones and internet services is the crucial driver responsible for the growth of the global big data analytics in the retail market. Also, the incorporation of sophisticated technologies such as artificial intelligence, the internet of things, and machine learning in extensive data analysis, the surge in demand for predictive analysis in the market, and personalized user experience to amplify sales will further strengthen the market size. Moreover, the augmenting implementation of these tools, including Tableau by Tableau Software, Llc; WebFOCUS by International Business Machines Corporation; Sspotfire by TIBCO Software Inc, International, and ThoughtSpot. for prescient analytics and improved decision-making in the business process will offer enormous growth opportunities for the market. However, excessive investment value and complications of these solutions will hamper the market growth. In addition, the rising apprehension concerned with data protection challenges to seize customer data and instability in data collection may further curb the big data analytics in the retail market share.

Application Segment Drivers

Based on application, merchandising, and supply chain analytics segment is projected to dominate the market during the forecast period. This is primarily attributed to their utilization in enormous applications, including tracking and discovering product flow in real-time, enhanced accuracy in forecasting customer buying patterns, and supervising supply chain and product distribution. Various prominent market players, including Amazon.com, Inc., Walmart Inc., Costco Wholesale Corporation, Asos Plc, Starbucks Corporation, and Inter IKEA Systems B.V, are making use of these tools for improving their businesses. This is further supplementing the market growth.

Regional Drivers

Based on regional coverage, North America is predicted to lead the market over the forecast period. This is mainly because of the prominence of several huge vendors, like Alteryx Inc., SAS Institute Inc., International Business Machines Corporation, and MicroStrategy Incorporated. Moreover, according to the National Retail Federation, the sales during 2020 will escalate in the middle of 3.5% and 4.1% to over USD 3.9 trillion, which contributes to the growth of the market.

Big Data Analytics in Retail Market’s leading Manufacturers

:

· Teradata Corporation

· SAS Institute Inc.

· Salesforce.com, Inc.

· QlikTech International AB

· International Business Machines Corporation

· Adobe, Inc.

· Microsoft Corporation

· SAP SE

· Tableau Software LLC

· Oracle Corporation

Big Data Analytics in Retail Market Segmentation:

Segmentation by Application

· Merchandising and Supply Chain Analytics

· Social Media Analytics

· Customer Analytics

· Operational Intelligence

· Others

Segmentation by Business Type

· Small and Medium Enterprises

· Large-Scale Organizations

Segmentation by Region:

· North America

o United States of America

o Canada

· Asia Pacific

o China

o Japan

o India

o Rest of APAC

· Europe

o United Kingdom

o Germany

o France

o Spain

o Rest of Europe

· RoW

o Brazil

o South Africa

o Saudi Arabia

o UAE

o Rest of the world (remaining countries of the LAMEA region)

About GMI Research

GMI Research is a market research and consulting company that offers business insights and market research reports for large and small & medium enterprises. Our detailed reports help the clients to make strategic business policies and achieve sustainable growth in the particular market domain. The company's large team of seasoned analysts and industry experts with experience from different regions such as Asia-Pacific, Europe, North America, among others, provides a one-stop solution for the client. Our market research report has in-depth analysis, which includes refined forecasts, a bird's eye view of the competitive landscape, key factors influencing the market growth, and various other market insights to aid companies in making strategic decisions. Featured in the 'Top 20 Most Promising Market Research Consultants' list of Silicon India Magazine in 2018, we at GMI Research are always looking forward to helping our clients to stay ahead of the curve.

Media Contact Company Name: GMI RESEARCH Contact Person: Sarah Nash Email: [email protected] Phone: Europe – +353 1 442 8820; US – +1 860 881 2270 Address: Dublin, Ireland Website: www.gmiresearch.com

0 notes

Photo

DIGITAL MARKETING BEST ONLINE TRAINING IN HYDERABAD INDIA

NATURAL ADABAS

SAP-HANA

SAP-Lumira SAP ALL MODULES

.NET (C#, ASP, ADO) MVC

DATASTAGE COGNOS BI SELENIUM UI Developer (Html, CSS, JavaScript, JQuery, Bootstrap, Angular JS , Node)

SHAREPOINT (DEV & ADMIN) SQL SERVER DBA MS-BI (SSIS, SSRS, SSAS)

MS-AX Dynamic Technical

MS –Dynamic Functional

BUSINESS ANALYSIS

SAS Base SAS Advance SAS training Clinical SAS BI/DI training

TABLEAU QLIKVIEW

SALESFORCE Admin and Dev Salesforce Lightning

JBOSS, JBPM IBM BPM ( Lombardi)

TIBCO BW, BE, BI TIBCO Spotfire TIBCO BPM

PEGA PRPC BPM ORACLE BPM Success Factors LMS / RCM HP Quality Center HP ALM/QC

RPA (Robotics Process Automation) – BluePrism ITIL – Foundation MariaDB Dell BOOMI SPLUNK AEM Administrator (Adobe Experience Manager) APACHE SPARK SCALA CASSANDRA

SCOM (System Center Operations Manager)

IBM SERVICE NOW IBM MAXIMO

Workday Studio Integration Workday HCM Workday payroll Workday Finance

PEOPLE SOFT HRMS PEOPLE SOFT TECHNICAL INFORMATICA MDM INFORMATICA IDQ INFORMATICA

HADOOP (BIGDATA) HADOOP (BI) Business intelligence Hadoop Spark /Scala HADOOP TESTING

PEGA BPM (PRPC) PEGA TESTING

Mule ESB Appian BP IBM BLUEMIX INGRES (Database) )

MongoDB Angular JS

OpenSpan CA Siteminder

Data science with SAS

Agile/SCRUM Ruby on Rails

Windows Azure

DevOps Build & Release Management Puppet

AWS

Softlayer Webfocus

Data science with R

Data science with Python

Machine learning

Statistics

Guidewire Mulesoft Xamarin Kronos Groovy on Grails Liferay FACETS

SAILPOINT

Full stack

Open stack Cloud Computing

BlockChain

AI (Artificial Intelligence)

Apttus CPQ

Odoo

Power BI

DIGITAL MARKETING

PEGA

Contact Person: Prakash Contact Num: 919866955524 / 9966838381 Email ID: [email protected] Website: www.jsvitsolutions.in

1 note

·

View note

Photo

What is Business Intelligence?

Business Intelligence (BI) systems are used to improve an enterprise's decision making by combining tools for gathering, storing, accessing, and analyzing business data. While traditional features for querying, reporting, and analytics have long been the core focus of these tools, BI has evolved in recent years to become comprehensive, enterprise-wide platforms, and newer trends, such as self-service BI, have helped to continue interest in this technology.

BI is a combination of the tools and systems involved in an enterprise's strategic planning that aid in its analysis.

These solutions provide a single source through which to analyze a company's disparate data sources, permitting users to execute queries without the assistance of technical staff. Over the past several years, they have evolved from narrowly focused query and reporting tools to enterprise-wide platforms. The resulting single source offers not only current, but also historical and predictive views of operations.

Sometimes referred to as decision-support software, BI applications analyze patterns in sales, trends, pricing, and customer behavior to assist in the business decision-making process. The expanded use of data warehouses, e-commerce tools, CRM packages, and other enterprise software has created a proportional need to easily view and use the information stored within these systems.

The continued evolution of this software genre encompasses new trends, including self-service techniques, and ongoing acquisitions that represent a major market consolidation. The major players in the sector range from a dwindling supply of pure-play vendors to enterprise software suppliers that include IBM, Microsoft, Oracle, and SAP.

MARKET DYNAMICS

While applicable to organizations of any size, business intelligence solutions are most relevant to industries with large numbers of customers, high levels of competition (with the resultant need for differentiation), and large volumes of data. Common business intelligence functions include, but are not limited to, the following:

Analyzing sales trends.

Tracking customer buying habits.

Managing finances.

Evaluating sales and marketing campaign effectiveness.

Predicting market demand.

Analyzing vendor relationships.

Assessing staffing needs and performance.

Non-traditional market segments are also driving the need for enterprise-wide, cross-application business intelligence solutions. The healthcare industry in particular is a key area of focus for software developers. Rather than tracking customer buying habits and other factors that are part of business intelligence for the corporate world, products used within the healthcare sector analyze data on drug studies, enable data on patients to be exchanged in accord with HIPAA privacy regulations, and let patients schedule procedures through self-service modules built into the software. Functions that are not industry-specific, such as managing finances, are performed as well.

Within government agencies, business intelligence software tracks tax revenues and monitors the delivery of public services. For instance, Information Builders reports that NASA's Shuttle Business Office uses the company's solutions to oversee its relationships with the third-party contractors it employs.

Prospective users of business intelligence solutions today show a preference for suites that address all business intelligence functions across an organization. Solution providers have responded to this trend by further developing their own software and by executing mergers with one-time rivals.

The significant efforts that leading software companies are making to expand their business intelligence lines, both organically through in-house development and "artificially" through acquisitions, suggests that they see strong demand for the technology. The outcome of these changes is taking shape as a market dominated by companies with complete business intelligence suites. Developers that specialize in a narrow sub-category, such as reporting tools, will likely find themselves squeezed out of many sales opportunities or will be acquired by larger players that are looking to broaden their own suites.

Growth of the business intelligence market has slowed somewhat from previous years, but it continues nonetheless. Estimates of its size vary widely, with some sources placing the size of the BI market at about $10 billion. Analyst firm Gartner forecasts that the market will grow, in spite of the current economic conditions; however, the growth is expected to be only in single digits, with a compound annual growth rate through 2013 of 6.3 percent.

MARKET LEADERS

As with other aspects of the technology industry, the business intelligence market has long been segmented into two major parts: standalone solutions and products that are part of larger, enterprise suites. However, that is changing as enterprise vendors acquire the standalone ones. In the past couple of years, SAP acquired Business Objects, IBM acquired Cognos, and Oracle acquired Hyperion.

IBM COGNOS

Cognos, around since the 1970s, entered the BI market in the 1990s. In late 2005, Cognos re-architected its BI product and released Cognos 8 BI. The product includes reporting, analysis, scorecarding, dashboards, business event management, data integration, and a strong searching feature. Cognos acquired Applix, a well known vendor of performance analytics, in October 2007.

Cognos itself then was acquired by IBM in early 2008, allowing IBM its entry into the BI market. IBM stated that the acquisition took place in order to "accelerate its ‘Information on Demand' strategy." Now known as IBM Cognos 8, the product line has seen additions and updates to it since its acquisition. For example, Cognos was updated to include a self-serve flash-based dashboard and new mobile and search capabilities, as well as compatibility with devices including BlackBerry, Symbian, and Windows Mobile. Cognos Express, introduced in September 2009, provides integrated BI and planning for midsize companies; Cognos TM1 provides complete planning, analysis, and reporting with advanced personalization and real-time response; Cognos Analytic Applications provide packaged reports and analysis; and other Cognos software applications are available for consolidation, planning, and dimension management.

INFORMATION BUILDERS

Information Builders' BI product is called WebFOCUS. It uses Ajax technology, which combines asynchronous JavaScript and XML. The latest release, WebFOCUS 8, was introduced in April 2010. It fully integrates a Performance Management Framework (PMF) interface; includes a new BI Portal for developers to build and deploy dashboard solutions; allows users to create portable BI applications; offers an Activity Monitor for business activity monitoring (BAM) and the CEP Enable capability for complex event processing; and includes two new advanced analytic components, Visual Discovery 8 for visual analytics and RStat 1.2 for predictive analytics. The product will be generally available in the fourth quarter of 2010.

The company offers related products, as well. IWebFOCUS FLEX Enable, released in early 2008, uses Adobe Flex technology to incorporate interactive features, such as animation, into BI dashboards, which Information Builders calls "Flashboards." The company states that the product will work with any current or future version of WebFOCUS. In October 2008 the vendor introduced WebFOCUS InfoAssist, an ad hoc reporting solution built on AJAX technology with a Microsoft Office-like user interface.

MICROSOFT

Microsoft's BI product line comprises SQL Server 2008 R2 for data storage and management (encompassing data mining, data warehousing, data quality, and ad-hoc analysis); SharePoint Server 2010 for information delivery (encompassing dashboards, collaboration/search, managed reporting, visualization, and scorecards); and Excel, along with SQL Server, for query, reporting, and analysis (encompassing ad-hoc analysis, production reporting, and OLAP analysis).

Microsoft released SharePoint Server 2010 and Office 2010 on May 12, 2010; however, both products were involved in a large beta program. By the time of the products' release, 8.6 million people were already using Office 2010 and related products, and more than 1,000 partners were already building solutions for the products.

MICROSTRATEGY

Founded in 1989, MicroStrategy's latest BI release is MicroStrategy 9, released in March 2009. The product includes adaptive caching technology called In-memory ROLAP, which utilizes large addressable memory and provides a middle-tier database that can respond directly to data requests from reports, dashboards, and OLAP analyses. Additionally, MicroStrategy 9 offers SQL generation optimizations to improve performance for queries involving complex metrics.

MicroStrategy has announced a new application platform called MicroStrategy Mobile. Due to be launched in July 2010, the platform is designed for the Apple's iPad and iPhone, as well as the BlackBerry mobile device. The platform will allow an organization to develop specific applications that can run on those mobile devices, allowing users to access information in what MicroStrategy has billed "mobile intelligence."

ORACLE

Oracle's BI focus is based on its Business Intelligence Suite. This product line comprises Oracle BI Suite Enterprise Edition Plus, Oracle BI Standard Edition One, and Oracle BI Oracle Publisher (formerly XML Publisher), an enterprise reporting solution for authoring, managing, and delivering highly formatted documents. The Oracle BI product line integrates the Oracle database with Fusion middleware and analytics software and also includes analytics software originally from Siebel Systems, another Oracle acquisition. The product family works with both Oracle and non-Oracle environments.

Oracle took another step in the direction of BI supremacy with the acquisition in March 2007 of Hyperion System 9 BI+. This product, originally called Hyperion Essbase (derived from Extended SpreadSheet database), was developed by Arbor Software, which Hyperion acquired in 1998. Oracle has now renamed it Oracle Essbase. The product includes reporting capabilities, dashboards, and an analysis feature that also can be used in Microsoft Excel. Additionally, it combines its BI functionality with financial applications, making it more of a Business Process Management (BPM) system than "just" BI.

The company includes another product in with those pertaining to BI: Oracle's Real-Time Decisions (RTD) platform combines both rules and predictive analytics, enabling real-time intelligence via a high-performance transactional server. This server automatically renders decisions within a business process and creates actionable intelligence from data flowing through the process in real time.

SAP

Business Objects was acquired by SAP in a "friendly takeover" completed in 2008. At its completion, SAP announced the release of nine packages, combining solutions from both companies in various groupings that are being sold by the sales departments of both companies as well. The packages fall into three categories: performance optimization applications, including Financial Performance Management (FPM) and Governance, Risk, and Compliance (GRC); business intelligence platform packages that include Visualization and Reporting, Enterprise Query, Reporting, and Analysis, Data Integration and Data Quality Management, and Master Data Services; and packages geared to small and midsized companies, including SAP Business All-in-One with BusinessObjects Edge Standard, Crystal Reports Server, and BusinessObjects Edge Series, which now includes integration for SAP Solutions. According to Gartner, the combination of SAP and Business Objects formed the largest installed base in the market, with an estimated 46,000 customers.

However, even before its acquisition of Business Objects, SAP began to expand its BI capabilities via acquisition. In February 2007 the vendor acquired Pilot Software, a privately held company specializing in strategy management software, and its flagship product, PilotWorks. SAP has integrated PilotWorks with its own applications. Additionally, the company continues to market another BI product line. SAP's Business Intelligence software package is a component of the company's NetWeaver platform, which also includes an enterprise portal, tools for integrating SAP software with barcode readers and Bluetooth devices, and data management software, as well as tools for custom application development. The Business Intelligence component offers a full line of extraction, analysis, and reporting tools with the capability to publish information to an intranet portal or mobile device.

SAS

The vendor's solution, called SAS Enterprise BI Server, includes both BI tools and a BI architecture. Its features include Web and desktop reporting interfaces, self-service query interfaces, a Web-based interface, OLAP data storage, and a suite of graphic data presentation options, and a centralized management framework. Additionally, the vendor offers a variety of specific industry solutions, including three geared for financial services, two aimed at manufacturing, three intended for retail, and two for telecommunications.

In April 2007 SAS announced its Visual BI software that allows the creation of what the vendor calls "data movies" by manipulating a motion-enabled, graphical environment. The product includes a graphics library for presentations and customizable graphics generation accessible through a dashboard that displays all content in a customizable environment. It is powered by SAS' JMP statistical discovery software. JMP, developed by SAS in-house, can dynamically link statistics with graphics on the desktop, allowing what the vendor bills as interactive data exploration.

MARKET TRENDSSELF SERVICE

The latest trend in this technology area is called "self-service BI." Analyst firm Forrester refers to it as "the only way to make BI more pervasive, delivering insights into every decision-important or mundane-that drives your business. It's the key to empowering users with actionable insights while removing many mundane BI development and maintenance tasks from IT's crushing workload."

Information Today's "Unisphere Media" concurs on the importance of this trend, stating that "organizations that make BI tools more readily accessible to a larger number of decision makers... report faster delivery of reports and models." That is, indeed, the gist of self service: it allows business decision makers to build their own business performance reports, instead of waiting, sometimes for weeks, for IT resources to deliver reports, as has been traditional in the BI world. However, organizations that make BI tools more readily accessible to a larger number of decision makers report faster delivery of reports and models.

CONSOLIDATION

One trend that has slowed recently, likely due to the economic turndown, is the market consolidation that happens when enterprise vendors acquire best-of-breed, smaller vendors. An example of what is sometimes called Big Fish-Little Fish, whereby large companies gobble up smaller ones, only to be gobbled up themselves by even larger companies, began in late 2007 when Cognos acquired performance analytics firm Applix, and then was itself acquired by IBM several months later. IBM isn't alone; many of the major enterprise vendors have been busy acquiring smaller ones to increase their BI portfolio. Microsoft, Oracle, and SAP all have acquired former best-of-breed BI vendors as well.

The trend to acquisitions is not a new one. It can be traced back over the years, but one of the first of major importance was when Business Objects acquired Crystal Decisions, a specialist in reporting tools, in December 2003. Likewise, Hyperion acquired Brio to integrate the latter's reporting technology software into its own product suite. Other activity of note included Business Objects' acquisition of Firstlogic and Hyperion's acquisition of Upstream Software. Many acquisitions occurred in 2006: Oracle acquired Siebel Systems, best known for its customer relationship management (CRM) products; Microsoft acquired ProClarity; and Business Objects acquired Firstlogic, Inc., a provider of enterprise data quality software, and Nsite, a "software-as-a-service" (SaaS) provider.

In 2007 the previously mentioned Cognos and Applix acquisition happened, SAP acquired Pilot Software, and Oracle continued its buying frenzy by acquiring a major BI vendor, Hyperion Solutions. In 2008 SAP acquired Business Objects, IBM acquired Cognos, and Microsoft acquired Fast Search & Transfer ASA and DATAllegro.

SOFTWARE AS A SERVICE

Often referred to by the acronym "SaaS," this software application delivery model was previously called "hosting." A vendor offers an application for use by customers over the Internet, and charges customers for its use, precluding the need for them to buy a similar application. Most BI vendors-particularly those courting the mid-size market-now support some type of on-demand service. For example, Business Objects, now an SAP company, specifically acquired a SaaS provider, Nsite, in November 2006 in order to offer a stronger on-demand service.

In 2007 Microsoft introduced its idea of "software plus services," defined as a blended model that includes desktop software, the Internet, and data and applications on servers that can be delivered as services. Microsoft's point is to ensure that its Office suite can be used as a front end to other SaaS applications.

In spite of the trend of major vendors to offer their own SaaS solutions, interest continues in business intelligence and data warehousing services offered through third-party ASPs,. Hosted services are particularly attractive to small and mid-size firms, who were traditionally shut out of the business intelligence market, since data-analysis capabilities can be delivered without the time and cost associated with client-based implementations.

SEARCH FUNCTIONALITY

Vendors have begun adding to their BI products the ability to search throughout corporate data sources, including financial and operational reports, by anyone within an organization. Cognos, now owned by IBM, first added its own search capability, called Cognos Go! Search Service; shortly thereafter, the vendor announced an alliance with Google, where searching was made even easier via Google technology. Additionally, even before its acquisition, another alliance with IBM allowed users of Cognos Go! Search Service and those of WebSphere Information Integrator OmniFind Edition (a key component of the IBM WebSphere Content Discovery platform) to locate and analyze information by including Cognos BI information as part of IBM enterprise search results. In addition, Information Builders also announced an Intelligent Search capability that uses its subsidiary IWay's connectivity capability to link WebFOCUS with Google's Search Appliance.

Microsoft joined in on the belief in the importance of enterprise searching capabilities. In 2008 Microsoft acquired Fast Search & Transfer ASA, a provider of enterprise search solutions. The company, which now operates as a Microsoft subsidiary, refers to the solution as "business intelligence built on search (BIBOS)."

DASHBOARDS

Dashboards, which have fallen in and out of favor several times in the information technology world over the past 15 years or so, are another trend to impact the BI market. These snapshots of data, resplendent with graphs, charts, and gauges, have changed since the days when they were intended for executive use only and the information they presented was static. Now they are quickly created, with no programming expertise necessary. Data is updated in real time, delivered to workers throughout the enterprise who can then drill down and analyze metrics as needed. Furthermore, today's dashboards are laden with drag-and-drop personalization features that assure pertinence to anyone's role. Virtually all of the standalone BI vendors offer some dashboard capabilities as part of their product suites, and an entire industry of add-on dashboard software products has sprung up as well.

BUSINESS ACTIVITY MONITORING

Similar in some respects to dashboards because it also captures data and process events, Business Activity Monitoring (BAM) allows the real-time monitoring of business processes. It compares and combines them into business metrics. Then it displays the real-time status of those metrics. An enterprise solution primarily intended for use by operations managers and upper management. BAM is being integrated into many of the top BI packages.

MOBILE ACCESS

Some companies are building wireless access and alerting into their products in order to allow the growing numbers of mobile workers to keep abreast of critical business issues from their handheld devices. BusinessObjects Mobile, for example, allows viewing and manipulating reports from BusinessObjects XI via mobile devices such as Blackberry or Windows Mobile. Cognos Go! Mobile offers wireless access to Cognos BI data via a mobile client. SAP's offering includes the capability to publish information to an intranet portal or mobile device. And Microsoft is touting mobile device support to its BI products by third parties.

ENTERPRISE INFORMATION PORTALS

Increasingly, information from disparate and disconnected systems is being accumulated and presented through enterprise portals, which are accessible via ordinary desktop browsers. A portal can provide decision makers with a real-time, customized view of the business, thereby providing the ability to manage key processes. Delivery over a Web interface improves ease-of-use, which is a significant decision criterion for organizations that are evaluating business intelligence solutions.

STRATEGIC PLANNING IMPLICATIONS

In many cases, organizations considering the implementation of a business intelligence solution will already have in place a business intelligence platform, such as an Oracle database. Adding business intelligence capabilities to an existing platform could significantly minimize learning curves, implementation difficulties, and costs. The alternative would be to patch-on a third-party product.

Enterprise-wide solutions from database vendors are not the best option in all situations, however, and other considerations weigh in favor of the best-of-breed approach. For example, BI vendors are looking to expand into smaller and mid-sized businesses (SMB); for this segment, a standalone BI product, rather than an enterprise solution, is probably a smarter choice.

In theory, a business intelligence tool with complex analytic and reporting tools offers the most value to an organization; in practice, however, an application with a narrowly defined set of functions may prove the most beneficial. Business intelligence tools can be narrowly defined by focusing on only one area of decision-making, such as product development, or by being delivered to a limited group of users as opposed to an entire organization. Although the prevailing trend is toward solutions that provide access to business intelligence information across an entire enterprise, to executive and end-users alike, department-level solutions remain a viable option in many circumstances.

Business intelligence solutions aim to reduce the confusion produced by maintaining data in disparate systems across multiple departments. Often the tools only add to the confusion, however, creating an additional layer of complexity for users. As a result, solution providers are spending significant development resources to ensure that their tools can deliver effective printed reports and can integrate well with common applications such as Microsoft Excel. Ultimately, the primary consideration in selecting a business intelligence solution is whether it will provide information that is useful in making strategic decisions; information will be useful only to the extent that it can be easily and quickly accessed.

WEB LINKS

DATAllegro: http://www.datallegro.com/ IBM Cognos: http://www-01.ibm.com/software/data/cognos/ Information Builders: http://www.informationbuilders.com/ Microsoft: http://www.microsoft.com/ MicroStrategy: http://www.microstrategy.com/ Oracle: http://www.oracle.com/ SAP: http://www.sap.com/ SAS: http://www.sas.com/

#business intelligence#microsoft#oracle#sap#sas#microstrategy#Information Builders:#ibm cognos#DATAllegro

0 notes

Text

Information Builders Expand their Worldwide Partnership with Teradata

Information Builders, a provider of software and services for transforming data into business value, has announced the signing of a global resell agreement with Teradata, a provider of data warehouse platforms, services, and software.

Gerald Cohen, President and Chief Executive Officer at Information Builders, stated in a company release, “Big data analytics is a rapidly growing market. Teradata prospects and customers can reduce the amount of time and resources devoted, and improve their return on investment of big data. Through this agreement with Teradata, we’re providing customers with a market-leading solution that they can quickly put to work to realize the value of analytics throughout the organization.”

The two companies became partners first in 1996, and ever since have been working with reputed brands from across verticals that include retail, finance, government, healthcare, transportation, and insurance. The new agreement between Information Builders and Teradata has been designed to assist businesses address issues pertaining to big data, thereby offering a comprehensive portfolio of data management, analytic, Hadoop, in-memory, and in-database solutions.

The analytics and WebFOCUS BI technology of Information Builders enable organizations to solve all issues regarding analytics - right from non-technical workers to advanced users – with the help of a single platform. Furthermore, the data management platform of the company offers prompt access to accurate data across a variety of processes, stakeholders, and systems. It simplifies integration of data and also ensures that all the decisions are reached on the basis of trusted information.

Information Builders offers solutions for data integration, analytics, data quality, and business intelligence for helping brands improve performance through value and innovation. It was founded in the year 1975 and has its headquarters in New York with a number of global offices.

This article was first appeared on MarTech Advisor

0 notes

Text

WebFOCUS: A Comprehensive Guide for the Aspiring Developer

Approximately 1.8 billion websites exist online today. In such a flooded digital landscape, businesses continuously seek advanced Business Intelligence (BI) tools to draw out actionable insights from an overwhelming amount of data. One such tool that has been making waves among data-driven businesses is WebFOCUS.

At its core, WebFOCUS is a business intelligence and analytics software by Information Builders Inc. (IBI), aimed at providing enterprises with valuable insights through advanced data visualization, integration, and processing capabilities. From mtu banweb to uconn webfocus, many educational institutes and businesses alike, rely on WebFOCUS for data management.

But what is WebFOCUS exactly, and what makes it a preferred tool for many developers? You're about to find out!

Understanding WebFOCUS

WebFOCUS, delivered by IBI, uses the proprietary WebFOCUS language for data extraction and report generation. It allows organizations to handle extensive data from various sources seamlessly and presents it in a user-friendly format.

From WebFOCUS app studio and infoassist to WebFOCUS designer, these user-friendly modules make it even easier to process and interpret data. These handy tools certainly contribute to the increasing demand for webfocus developer jobs across industries.

WebFOCUS Training and Tutorials

Contrary to common misconceptions, mastering WebFOCUS doesn't necessitate advanced technical knowledge. WebFOCUS training and tutorials are readily available, offering comprehensive instructional content to guide beginners and even seasoned developers toward advanced proficiency levels. Utilizing these resources effectively can have a profound influence on the trajectory of a WebFOCUS developer's career and salary.

WebFOCUS Developer Jobs and Salary

Just like any other field, the salary of a webfocus developer largely depends on the level of expertise, experience, and location. However, the webfocus developer salary is generally considered appealing, especially with the rising demand in the market.

In the United States, the average annual wage for a WebFOCUS developer ranges from $90,000 to $120,000. Such figures clearly highlight the rewarding nature of webfocus jobs and the value that these professionals bring to organizations.

The Role of WebFOCUS in Education Institutions

Numerous educational institutions like Michigan Tech and MTU (Michigan Technological University) implemented WebFOCUS through their ban web mtu platform. Similarly, at the University of Connecticut (UConn), WebFOCUS features on their digital tools list, where it's deployed in various operations, including students’ data management accessible through the Uconn webfocus platform.

To make this tool more user-friendly and informational, both MTU and UConn have developed their knowledge base, termed mtu edu banweb and uconn knowledge base. Here, students, faculty, and staff can find up-to-date resources and guidance on using these platforms effectively, contributing to a seamless user experience.

Why Choose WebFOCUS as a BI Tool?

Here are a few reasons behind the growing popularity of WebFOCUS:

1. Flexibility: WebFOCUS’ language, tools, and modules are designed to deliver high adaptability to various usage scenarios.

2. Efficiency: WebFOCUS report functions and the advanced capabilities of infoassist assist developers in creating performance-optimized reports.

3. Versatility: WebFOCUS allows developers to create adaptable dashboards and applications, facilitating diverse report generation and data analysis tasks.

4. Robust Support: Accessible tutorials, training, and support options enhance users' proficiency with the software.

**Conclusion**

WebFOCUS, as shown, can be a game-changer for businesses and educational institutions alike, aiming for efficient data processing and decision-making based on tangible insights. The rising demand for webfocus developer jobs, coupled with potentially lucrative developer salaries, demonstrates the tool’s market dominance. Whether you’re an aspiring developer looking to level up your career or an institution seeking a reliable data management platform, the power, and potential of WebFOCUS are hard to ignore. As IBIs banner, WebFOCUS is set to shape the future of Business Intelligence, solidifying a world where data-driven solutions become the universal business language.

#webfocus training#webfocus developer jobs#webfocus developer salary#webfocus app studio#webfocus report

0 notes

Photo

HADOOP BIGDATA BEST ONLINE TRAINING IN HYDERABAD INDIA

NATURAL ADABAS

SAP-HANA

SAP-Lumira SAP ALL MODULES

.NET (C#, ASP, ADO) MVC

DATASTAGE COGNOS BI SELENIUM UI Developer (Html, CSS, JavaScript, JQuery, Bootstrap, Angular JS , Node)

SHAREPOINT (DEV & ADMIN) SQL SERVER DBA MS-BI (SSIS, SSRS, SSAS)

MS-AX Dynamic Technical

MS –Dynamic Functional

BUSINESS ANALYSIS

SAS Base SAS Advance SAS training Clinical SAS BI/DI training

TABLEAU QLIKVIEW

SALESFORCE Admin and Dev Salesforce Lightning

JBOSS, JBPM IBM BPM ( Lombardi)

TIBCO BW, BE, BI TIBCO Spotfire TIBCO BPM

PEGA PRPC BPM ORACLE BPM Success Factors LMS / RCM HP Quality Center HP ALM/QC

RPA (Robotics Process Automation) – BluePrism ITIL – Foundation MariaDB Dell BOOMI SPLUNK AEM Administrator (Adobe Experience Manager) APACHE SPARK SCALA CASSANDRA

SCOM (System Center Operations Manager)

IBM SERVICE NOW IBM MAXIMO

Workday Studio Integration Workday HCM Workday payroll Workday Finance

PEOPLE SOFT HRMS PEOPLE SOFT TECHNICAL INFORMATICA MDM INFORMATICA IDQ INFORMATICA

HADOOP (BIGDATA) HADOOP (BI) Business intelligence Hadoop Spark /Scala HADOOP TESTING

PEGA BPM (PRPC) PEGA TESTING

Mule ESB Appian BP IBM BLUEMIX INGRES (Database) )

MongoDB Angular JS

OpenSpan CA Siteminder

Data science with SAS

Agile/SCRUM Ruby on Rails

Windows Azure

DevOps Build & Release Management Puppet

AWS

Softlayer Webfocus

Data science with R

Data science with Python

Machine learning

Statistics

Guidewire Mulesoft Xamarin Kronos Groovy on Grails Liferay FACETS

SAILPOINT

Full stack

Open stack Cloud Computing

BlockChain

AI (Artificial Intelligence)

Apttus CPQ

Odoo

Power BI

DIGITAL MARKETING

PEGA

Contact Person: Prakash Contact Num: 919866955524 / 9966838381 Email ID: [email protected] Website: www.jsvitsolutions.in

1 note

·

View note

Photo

BLOCKCHAIN BEST ONLINE TRAINING IN HYDERABAD INDIA

NATURAL ADABAS

SAP-HANA

SAP-Lumira SAP ALL MODULES

.NET (C#, ASP, ADO) MVC

DATASTAGE COGNOS BI SELENIUM UI Developer (Html, CSS, JavaScript, JQuery, Bootstrap, Angular JS , Node)

SHAREPOINT (DEV & ADMIN) SQL SERVER DBA MS-BI (SSIS, SSRS, SSAS)

MS-AX Dynamic Technical

MS –Dynamic Functional

BUSINESS ANALYSIS

SAS Base SAS Advance SAS training Clinical SAS BI/DI training

TABLEAU QLIKVIEW

SALESFORCE Admin and Dev Salesforce Lightning

JBOSS, JBPM IBM BPM ( Lombardi)

TIBCO BW, BE, BI TIBCO Spotfire TIBCO BPM

PEGA PRPC BPM ORACLE BPM Success Factors LMS / RCM HP Quality Center HP ALM/QC

RPA (Robotics Process Automation) – BluePrism ITIL – Foundation MariaDB Dell BOOMI SPLUNK AEM Administrator (Adobe Experience Manager) APACHE SPARK SCALA CASSANDRA

SCOM (System Center Operations Manager)

IBM SERVICE NOW IBM MAXIMO

Workday Studio Integration Workday HCM Workday payroll Workday Finance

PEOPLE SOFT HRMS PEOPLE SOFT TECHNICAL INFORMATICA MDM INFORMATICA IDQ INFORMATICA

HADOOP (BIGDATA) HADOOP (BI) Business intelligence Hadoop Spark /Scala HADOOP TESTING

PEGA BPM (PRPC) PEGA TESTING

Mule ESB Appian BP IBM BLUEMIX INGRES (Database) )

MongoDB Angular JS

OpenSpan CA Siteminder

Data science with SAS

Agile/SCRUM Ruby on Rails

Windows Azure

DevOps Build & Release Management Puppet

AWS

Softlayer Webfocus

Data science with R

Data science with Python

Machine learning

Statistics

Guidewire Mulesoft Xamarin Kronos Groovy on Grails Liferay FACETS

SAILPOINT

Full stack

Open stack Cloud Computing

BlockChain

AI (Artificial Intelligence)

Apttus CPQ

Odoo

Power BI

DIGITAL MARKETING

PEGA

Contact Person: Prakash Contact Num: 919866955524 / 9966838381 Email ID: [email protected] Website: www.jsvitsolutions.in

1 note

·

View note

Photo

DATASCIENCE BEST ONLINE TRAINING IN HYDERABAD INDIA

NATURAL ADABAS

SAP-HANA

SAP-Lumira SAP ALL MODULES

.NET (C#, ASP, ADO) MVC

DATASTAGE COGNOS BI SELENIUM UI Developer (Html, CSS, JavaScript, JQuery, Bootstrap, Angular JS , Node)

SHAREPOINT (DEV & ADMIN) SQL SERVER DBA MS-BI (SSIS, SSRS, SSAS)

MS-AX Dynamic Technical

MS –Dynamic Functional

BUSINESS ANALYSIS

SAS Base SAS Advance SAS training Clinical SAS BI/DI training

TABLEAU QLIKVIEW

SALESFORCE Admin and Dev Salesforce Lightning

JBOSS, JBPM IBM BPM ( Lombardi)

TIBCO BW, BE, BI TIBCO Spotfire TIBCO BPM

PEGA PRPC BPM ORACLE BPM Success Factors LMS / RCM HP Quality Center HP ALM/QC

RPA (Robotics Process Automation) – BluePrism ITIL – Foundation MariaDB Dell BOOMI SPLUNK AEM Administrator (Adobe Experience Manager) APACHE SPARK SCALA CASSANDRA

SCOM (System Center Operations Manager)

IBM SERVICE NOW IBM MAXIMO

Workday Studio Integration Workday HCM Workday payroll Workday Finance

PEOPLE SOFT HRMS PEOPLE SOFT TECHNICAL INFORMATICA MDM INFORMATICA IDQ INFORMATICA

HADOOP (BIGDATA) HADOOP (BI) Business intelligence Hadoop Spark /Scala HADOOP TESTING

PEGA BPM (PRPC) PEGA TESTING

Mule ESB Appian BP IBM BLUEMIX INGRES (Database) )

MongoDB Angular JS

OpenSpan CA Siteminder

Data science with SAS

Agile/SCRUM Ruby on Rails

Windows Azure

DevOps Build & Release Management Puppet

AWS

Softlayer Webfocus

Data science with R

Data science with Python

Machine learning

Statistics

Guidewire Mulesoft Xamarin Kronos Groovy on Grails Liferay FACETS

SAILPOINT

Full stack

Open stack Cloud Computing

BlockChain

AI (Artificial Intelligence)

Apttus CPQ

Odoo

Power BI

DIGITAL MARKETING

PEGA

Contact Person: Prakash Contact Num: 919866955524 / 9966838381 Email ID: [email protected] Website: www.jsvitsolutions.in

1 note

·

View note