#1Inch Exchange Development

Explore tagged Tumblr posts

Text

1inch Exchange Clone Script - Develop Your Cryptocurrency Exchange similar to 1inch Exchange

In the world of cryptocurrency, decentralized exchanges have gained significant popularity. These exchanges allow users to trade cryptocurrencies directly from their wallets without the need for an intermediary. One such decentralized exchange is 1inch exchange, which offers users the ability to make trades across multiple platforms with the best possible rates.

What is 1inch Exchange Clone Script?

A 1inch exchange clone script is a ready-made software solution that replicates the functionalities and features of the original 1inch exchange. It allows entrepreneurs and developers to create their own decentralized exchange platform similar to 1inch. This white label solution provides a cost-effective and time-efficient way to enter the decentralized exchange market.

Understanding the 1inch Exchange Clone Script:

To fully comprehend the potential of a 1inch exchange clone script, it is important to understand the underlying technology and concepts. The 1inch exchange is built on the Ethereum blockchain and utilizes smart contracts to facilitate the trading process. Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. They automatically execute transactions once the predetermined conditions are met.

The 1inch exchange clone script replicates the smart contract functionality of the original exchange. It allows users to execute trades directly from their wallets, ensuring a secure and transparent trading experience. The clone script also includes features such as liquidity aggregation, which enables users to access multiple liquidity sources and find the best rates for their trades.

Benefits of using a 1inch Exchange Clone Script:

There are several benefits to using a 1inch exchange clone script for creating your own decentralized exchange platform. Firstly, it provides a ready-made solution that saves you time and effort in developing the exchange from scratch. The clone script is already tested and proven, ensuring a reliable and efficient trading experience for your users.

Secondly, a white label 1inch exchange clone script allows you to customize the platform according to your brand and business requirements. You can add your own logo, design elements, and features to create a unique and personalized exchange. This level of customization helps in establishing your brand identity and attracting users to your platform.

Furthermore, a 1inch exchange clone script provides a cost-effective solution compared to building an exchange from the ground up. Developing a decentralized exchange requires significant technical expertise and resources. By using a clone script, you can save on development costs and allocate your resources to other aspects of your business.

Features to Look for in a 1inch Exchange Clone Script:

When selecting a 1inch exchange clone script, it is essential to consider the features it offers. Here are some key features to look for:

Smart Contract Integration: Ensure that the clone script includes smart contract integration to enable secure and automated trading.

Liquidity Aggregation: Look for a clone script that offers liquidity aggregation, allowing users to access liquidity from multiple sources.

User-Friendly Interface: The clone script should have an intuitive and user-friendly interface for seamless trading experience.

Security Measures: Check if the clone script incorporates robust security measures to protect user funds and data.

Customizability: Choose a clone script that allows for easy customization, enabling you to create a unique brand identity for your exchange.

Scalability: Ensure that the clone script is scalable to handle increasing user demand and trading volume.

By considering these features, you can select a 1inch exchange clone script that meets your business requirements and provides a superior trading experience for your users.

Why Hivelance is the Best Choice to Develop Your 1inch Exchange Clone Script?

When it comes to developing your 1inch exchange clone script, Hivelance stands out as the top choice. Hivelance is a leading blockchain development company with extensive experience in creating decentralized exchange solutions. They offer a comprehensive white label 1inch exchange clone script that includes all the necessary features for a successful exchange platform.

Hivelance ensures the highest level of quality and security in their clone scripts. Their team of skilled developers thoroughly tests the scripts to ensure a bug-free and reliable product. Additionally, Hivelance provides ongoing support and maintenance to ensure that your exchange runs smoothly and efficiently.

On all our products and services, we offer exclusive Independence Day deals of up to 30% off. Offer Valid Till 16.08.2023. Contact us.

#1inch Exchange Clone Script#1inch wallet clone#1Inch Clone Script#1inch Exchange Clone Script development

1 note

·

View note

Text

1inch Debuts on Solana, Plans for Crosschain Swaps in Development

1inch has rolled out its decentralized exchange aggregator on Solana, tapping into the blockchain’s efficiency. This move offers optimized on-chain swaps with lower transaction costs, boosting DeFi on Solana while paving the way for future cross-chain swap innovations. It promises seamless token exchanges across a multichain ecosystem. Key Takeaways The integration of 1inch with Solana utilizes…

0 notes

Text

Solana Just Flipped the DeFi Script—And 1inch Knows It

Solana isn't just fast anymore. It’s winning.

While Ethereum and its Layer 2 clones squabble over rollups, MEV wars, and gas optimization, Solana is sprinting laps around them—at scale, with users, and now, with serious infrastructure validation.

The latest milestone? 1inch—arguably the most important multichain DEX aggregator in crypto—just deployed its Fusion protocol on Solana. This isn’t just a nice-to-have integration. It’s a signal: the DeFi center of gravity is shifting, and Solana is no longer the "VC chain" or the "FTX relic." It’s the dominant execution layer for a new class of users who care less about decentralization philosophy and more about making things work—fast, cheap, and reliably.

Let’s break down why this matters, and what comes next.

1inch Didn’t Pick Solana for Fun — It Picked a Winner

You don’t ship complex, MEV-resistant smart contract systems and Dutch auction-based market-making protocols on just any blockchain. 1inch is staking reputation and codebase on Solana because the numbers are simply undeniable.

Over the past 90 days:

DEX trading volume: Solana beat Ethereum by 33% ($539B vs $364B).

Transaction count: Solana processed 5x more transactions (4.8B vs 1B).

Active addresses: 224M on Solana, compared to Ethereum’s 78M—180% more.

This isn’t about “TPS” vanity metrics anymore. This is real economic throughput, on-chain usage, and trading velocity. And 1inch wants in.

Fusion Protocol Meets the Solana Speed Machine

1inch didn’t just port its app over. It brought Fusion—a next-gen protocol where users submit “intents” (essentially, desired outcomes) and let competing market makers (called "resolvers") bid to fulfill them.

Think of it as eBay for token swaps: rates start high, and a resolver executes when the price hits their trigger. It's a fairer, more efficient way to route liquidity and reduce slippage.

Now combine that with Solana’s sub-second block times, negligible fees (we’re talking < $0.01), and you get what Ethereum maximalists have dreamed of—but haven’t built: a lightning-fast, intent-based DeFi UX.

That’s what 1inch just shipped.

Cross-Chain Isn’t a Buzzword Anymore—It’s a DeFi Imperative

The next domino? Cross-chain swaps. 1inch is set to launch seamless swaps between Solana and 10+ other chains in the coming months. Not just bridge-and-pray hops—but real, self-custodial asset swaps where users don’t need to touch a centralized exchange or worry about wrapping/unwrapping nightmares.

This isn’t just a technical flex. It’s an existential unlock for DeFi. Users want liquidity, not chain allegiance. They want best-price execution, not tribal gas fee wars.

And 1inch gets that. Their Fusion+ system, coupled with open-source contracts and developer APIs, is effectively transforming Solana into a liquidity hub, not just a “cheap alt-EVM.”

Solana’s Reputation Was Broken. Now It’s Rebuilt—With Volume.

Let’s not rewrite history: Solana got wrecked post-FTX. It lost trust, got dismissed as centralized, and watched TVL evaporate overnight.

But what’s happened since is one of the greatest comeback arcs in crypto history.

Solana’s validator count is higher than ever.

Its NFT market still leads in innovation.

Mobile-first apps like Backpack are onboarding actual users.

And DeFi isn’t just back—it’s outperforming.

Solana didn’t just survive. It adapted. And now, it’s outpacing rivals who were too busy philosophizing to scale.

The 1inch integration is a crowning moment in that redemption arc. It says: The infrastructure elite believe Solana is ready.

Ethereum Still Has the Liquidity — But for How Long?

Let’s be clear: Ethereum isn’t dead. Its deep liquidity, institutional trust, and composability make it indispensable—today.

But the fragmentation of Layer 2s, wallet UX nightmares, and inconsistent bridging experiences are slowly bleeding user confidence. If Solana can provide comparable liquidity and better execution, it becomes more than a playground for degens—it becomes the preferred execution layer for the world.

And with projects like 1inch enabling frictionless access to both Ethereum and Solana ecosystems, users might start choosing based on experience rather than allegiance.

The Real Fight: Execution vs. Orthodoxy

This moment isn’t about Solana vs. Ethereum.

It’s about a new DeFi era where execution matters more than ideology. Where intent-based UX, deep aggregation, and chain-agnostic liquidity determine the winners—not whether your whitepaper had Vitalik’s approval.

1inch’s move signals the next phase: unified multichain DeFi, anchored by chains that can actually support billions of users and trillions in value movement—without choking.

Solana’s performance and 1inch’s intent architecture are building toward that world. And if you’re still betting on monolithic chains with 5-minute transaction finality and $10 gas fees, you’re not just behind—you’re watching a different race entirely.

By 2026, Solana Will Be DeFi’s Default Execution Layer

Not the settlement layer. Not the consensus shrine. But the chain where most DeFi trades actually happen.

That doesn’t mean Ethereum vanishes. It means it becomes the backend, not the battleground. Solana becomes the front office—where users swap, spend, earn, and play.

And platforms like 1inch will be the liquidity routers that make it all seamless, regardless of chain.

Mark this moment. 1inch launching on Solana isn’t just a tech update.

It’s a power shift.

If you found this piece valuable, consider supporting our work. We don’t run ads or subscriptions—everything we publish is free. But we rely on reader donations to keep The Daily Decrypt running strong. 👉 Donate on Ko-Fi – even a small tip goes a long way.https://ko-fi.com/thedailydecrypt

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

0 notes

Text

🚀 1inch Expands DEX Services to Solana Blockchain 🌊

"The expansion to Solana is part of 1inch's broader strategy to enhance liquidity and user experience across multiple blockchains." – 1inch Official Statement

Big news, folks! 1inch, the gladiator of decentralized exchanges, just flexed its muscles and expanded onto Solana! 🎉 And why should you care? Because it’s not just some regular blockchain–we’re talking about the fast track to DeFi interoperability. Hellooooo, liquidity! 💧 Thanks to Solana’s high-throughput, we're looking at over 1 million tokens that are itching to be traded. 💸

1inch Expands DEX Services to Solana Blockchain

Key Takeaways:

1inch's leap into Solana is set to skyrocket liquidity and user experience.

No immediate liquidity or staking shake-ups reported (phew!).

Solana DEX trading volume just did a 25% spike – thank you very much!

The masterminds behind this move, co-founders Anton Bukov and Sergej Kunz, are on a quest to unify fragmented liquidity. Yes, fans of seamless DEX experiences, rejoice! 🥳 And while we’re sipping on this sweet news, remember: we don’t forecast any immediate changes in TVL or staking flows, but the buzz in the Solana ecosystem is real. 🐝

Want to browse the nitty-gritty of this development? Check out the full article over at CCPress for all the deets. And don’t forget to follow this page for more electrifying blockchain updates! ⚡

#CryptoNews #1inch #Solana #DeFi #Blockchain #Investments #CryptoEnthusiasts #DigitalAssets #CryptoMeme

0 notes

Text

STON.fi 2024: A Year of Remarkable Growth and Innovation

2024 has been a transformative year for STON.fi, marked by groundbreaking advancements, strategic investments, global recognition, and community-driven success. Together, we’ve pushed the boundaries of DeFi and set new benchmarks for the industry.

The release of STON.fi V2 has redefined decentralized trading. With upgraded smart contracts and cutting-edge features, the platform is now faster, more secure, and more user-friendly than ever.

Key highlights include:

- 💧 Seamless one-click liquidity pool creation

- 🛡 Advanced sniper-bot protection

- 💡 Flexible referral fee structures for developers

What’s next:

- 💎 Specialized liquidity pools for tailored trading opportunities

- 🧠 Smart routing for optimized swaps across all TON tokens

These updates position STON.fi as a leader in the DeFi space, offering unparalleled functionality.

STON.fi successfully secured funding from top-tier investors, including CoinFund, Karatage, Delphi Ventures, TON Ventures, and the founders of 1inch and LI.FI. This investment will accelerate the platform’s mission to integrate DeFi into Telegram’s massive user base, enabling seamless, secure token exchanges across blockchains.

The Omniston protocol continues to play a pivotal role in driving innovation and enhancing the global DeFi ecosystem.

The Stonbassador program shattered records in 2024, with thousands of global creators actively promoting STON.fi. Through education, content creation, and events, they amplified STON.fi’s reach and impact. https://t.me/stonfidex/725

Highlights:

- September saw the entire 10,000 STON reward pool claimed.

- The largest individual reward exceeded $4,500!

This program reflects the power of grassroots advocacy in expanding DeFi’s horizons.

In 2024, the STON.fi team showcased their vision at premier blockchain events worldwide. From the **UK, Czech Republic, Portugal, France, the Netherlands, Nigeria, to the UAE, STON.fi strengthened its presence in the global DeFi community and shared the potential of the **TON blockchain** with the world.

Looking Ahead

2024 has been extraordinary, thanks to the relentless innovation, strategic partnerships, and unwavering community support. Stay tuned for Part 2, where more achievements and milestones will be revealed.

#DeFi #Innovation #Community

This version captures the essence of the article with a sharper focus on key achievements and their broader impact.

1 note

·

View note

Text

Best Decentralized Crypto Exchanges

Decentralized exchanges, or DEXs, are starting to emerge as the pinnacle of security and innovation in the rapidly evolving world of cryptocurrencies. These platforms, which provide unmatched autonomy and transparency, are completely changing the way traders interact with digital assets. Here, we explore the leading players influencing the decentralized cryptocurrency exchange market.

Uniswap: Pioneering Decentralized Finance (DeFi)

In decentralized finance (DeFi), Uniswap is a trailblazer best known for its automated liquidity protocol. With the use of Uniswap's smart contracts, users may easily trade a wide variety of ERC-20 tokens. Its permissionless design and user-friendly interface have helped it rise to the top of decentralized cryptotoken.

Balancer: Empowering Liquidity Providers

Balancer offers a distinct perspective on decentralized exchanges through its automatic portfolio management feature that can be customized. Thanks to this technology, liquidity providers can establish and maintain token pools by their preferred allocations. Balancer encourages liquidity provision while facilitating efficient trade through dynamic liquidity management.

SushiSwap: Yield Farming and Beyond

SushiSwap has drawn notice for its cutting-edge characteristics, such as decentralized governance and yield farming. SushiSwap began as a fork of Uniswap and has developed to include features like crypto token awards and staking. SushiSwap epitomizes innovation and decentralization with its community-driven methodology.

Curve Finance: Optimized Stablecoin Trading

With a focus on stablecoin trading, Curve Finance provides traders with minimum costs and little slippage. For fans of stablecoins, its special algorithm, which maximizes efficiency when switching between stable assets, makes it a top option. Curve Finance is a perfect example of the possibility for niche decentralized exchanges catered to particular asset classes.

1inch Exchange: Aggregating Liquidity Across DEXs

As a decentralized aggregator, 1inch Exchange sets itself apart by getting liquidity from other DEXs to provide the best pricing. 1inch Exchange maximizes trades over several protocols with its clever routing algorithms, guaranteeing that users receive the best results. Because of its dedication to effectiveness and openness, it has a devoted user base.

Conclusion: Embracing Decentralization in Crypto Trading

In light of the ongoing evolution of the Bitcoin landscape, decentralized exchanges signify a paradigm shift toward resilience and autonomy. These platforms promote efficiency and innovation while giving users unmatched control over their assets. Investigating decentralized exchanges opens doors to a world of possibilities for traders of all experience levels. Experience the future of crypto token trading firsthand by becoming a part of the decentralized cryptotoken.

#New token launch#best Cryptotoken to invest today#decentralized cryptotoken#best crypto for 2024#best token to invest today

0 notes

Text

Empowering Blockchain Innovations - Nadcab Labs Comprehensive Listing Services

Introduction to Nadcab Labs:

Nadcab Labs has emerged as a leader in blockchain development, renowned for its innovative solutions in the decentralized finance (DeFi) sector. With a team of expert developers and strategists, they offer a range of services designed to leverage blockchain technology for businesses and individual investors.

Services Offered by Nadcab Labs:

1. Uniswap Listing

· Overview: Uniswap, a popular decentralized exchange (DEX), operates on the Ethereum blockchain. It allows for automated transactions between cryptocurrency tokens through the use of smart contracts.

· Nadcab Role: Nadcab Labs assists clients in listing their tokens on Uniswap. This process includes smart contract development, token creation, and ensuring compliance with Uniswap protocols.

· Benefits: Listing on Uniswap enhances token visibility, facilitates liquidity, and opens up access to a broader investor base.

2. Pancake Listing

· Overview: PancakeSwap is a Binance Smart Chain-based DEX known for its lower transaction fees and fast transaction speeds compared to Ethereum-based platforms.

· Nadcab Role: Nadcab provides comprehensive support for businesses looking to list their tokens on PancakeSwap, including technical assistance and strategic advisory.

· Benefits: A PancakeSwap listing can offer greater exposure, especially among users preferring the Binance Smart Chain ecosystem, and potentially lower transaction costs.

3. 1Inch Listing

· Overview: 1Inch is a DEX aggregator that sources liquidity from various exchanges and is capable of splitting a single trade transaction across multiple DEXs.

· Nadcab Role: Nadcab guides clients through the complex process of listing on 1Inch, ensuring their token is accessible across multiple liquidity pools.

· Benefits: Listing on 1Inch can lead to optimal trade execution, better pricing, and increased exposure across different liquidity sources.

4. Raydium Listing

· Overview: Raydium is an automated market maker (AMM) built on the Solana blockchain, offering high-speed transactions and low fees.

· Nadcab Role: Nadcab Labs facilitates token listing on Raydium, leveraging its expertise in the Solana protocol to ensure seamless integration.

· Benefits: A Raydium listing can provide access to the burgeoning Solana ecosystem, appealing to users seeking efficiency and innovation.

Conclusion:

Nadcab Labs offerings in the DeFi space, particularly in assisting with listings on platforms like Uniswap, PancakeSwap, 1Inch, and Raydium, position them as a key player in the blockchain development arena. Their expertise not only helps in technical integrations but also in navigating the complex landscape of decentralized finance, offering their clients a competitive edge in the market.

0 notes

Text

Work X

Jobs X: Introducing innovative solutions designed to prepare employers for the future of work.

Work Since Jobs Instead of exceeding WL's request by 30x, we decided to reward core contributors only. Internet Jobs - The first fully decentralized job economy with no middlemen charging up to 40% - The future of work is P2P!

X platform for yourself and we can't wait to show it to you, but we're not there yet. In the meantime, we wanted to give you a sneak peek. Just so you become a member of our community. It is important to remember that this first version is focused on the first functional application with core features; There is still a lot of work to be done before we can get the most out of Job X and ensure the platform is at the aesthetic level you expect. However, this release is a very important foundation for the future, we have built everything in a very modular way to ensure it is ready for development.

Anticipating the Future by Working

The synergistic collaboration of Work X, TEN, and Whyz is based on shared aspirations and goals. By combining futuristic technology and visionary leadership, this partnership is expected to foster a systematic, efficient and beneficial framework for global organizations and professionals.

Progressive Achievements so far

Launching Enterprise Client

Funded by the European Commission

Raising 3M USD — Runway: 36 months

10+ Hackathon prizes (Aave, 1inch, WalletConnect, VeChain & more)

Product works using AI Assistant — Building team since 2017

50+ Companies plan to use Jobs

X Work Paradigm Shift Feature

Work X, a buzzword synonymous with recruitment innovation, offers a range of features:

Generative AI Assistant: Work X's AI-based tool that customizes job descriptions and enriches talent profiles to perfection.

Decentralized Identity: A feature exclusive to Jobs

Peer-to-Peer Collaboration: An innovative job cost model* guarantees competitive wages for talent and minimal service costs for companies.

Verified Reference: Works

Unbiased Recruiting: Job X's advanced algorithm ensures candidate-employer alignment based on actual performance metrics.

Assess Competency By Recommending Future Workforce Needs

A candidate's academic performance in college, as demonstrated by their grades and degrees, has traditionally been considered an important factor that employers consider when making a rational decision. A candidate's educational qualifications say a lot about him, but they are not a reliable indicator of his true knowledge and abilities. A person's abilities, characteristics and preferences can be measured in more detail thanks to the development of individual assessment methods [9]. These measurement points are what we call 'indicators' of how well the job is being done. To determine the best match between organizations looking for new talent and individuals looking for new teams, we will first measure teams looking for new talent, then measure individuals looking for new teams. By doing this, we will reduce the number of mismatches that occur in the labor market and guarantee the right distribution of talent everywhere.

Who Owns the Data?

People are losing control not only over their data but also over the advancement of their profession and personal life. In the early days of the internet, the value of data was still given by most people. Big tech businesses that concentrate on data can benefit from this, and they are building new business models with free services in exchange for users' personal data. These companies include Google, Facebook, and LinkedIn. People are slowly starting to realize that they need to restore control over their personal data, as well as their education and growth, because it can be used against them. This happened at a time when technology was developing rapidly. Work

Throughout history, businesses have generally been reluctant to share their data with other businesses due to concerns about their customers' privacy and, ultimately, the risk of losing their competitive advantage. This greatly hinders their capacity to obtain useful information and develop accurate artificial intelligence. We have a strong belief that people should have access to their personal data. We consider this a win-win situation for individuals and businesses, and a path to economic success and personal achievement.

Work Objectives

3jpR3paJ37V8JxyWvtbhvcm5k3roJwHBR4WTALx7XaoRovdzeSS8a2mQxhnJcixCN1kh3cCKFJoSfWCKgagDhN2ht2XxvubCr1DcTo6UUvNJxqPKHkx8abWWDwC29b4Pi2z1k.jpg

Although current solutions are not sustainable, technological developments have made it easier to bridge the gap between employers and workers. In a world of constant technological development, the question arises as to whether the prices charged by freelance platforms stem from a sustainable and efficient business model. Given the emergence of decentralized markets and disintermediation trends, the freelance platform business model may prove to be an inefficient and unsustainable business model. Job Additionally, Work X aims to match supply and demand through an innovative technology platform called Work X Platform. The Work X platform and its various services can be accessed with Work. Users have the possibility to interact with Work

Tokenomics

The $WORK token is intended to provide digital access to the platform via a blockchain-based infrastructure. In this paragraph we will briefly summarize various use cases to answer the question of how tokens are useful. In the near future we will present additional token use cases, so stay tuned!

Token Utility 1: Get Access to Platform Services

To access services in Jobs Examples of other costs we need to add to the transaction cost requirements are for example AI tokens, running servers, development grants, etc.

Utility Token 2: Guarantee for Job Listings

To ensure that all job listings comply with the platform's code of conduct, tokens must be stored.

Utility Token 3: $WORK Platform Support Reward

Platform users who hold $WORK tokens and add liquidity will be rewarded with $WORK tokens in the form of NFTs for their support of the platform and community. Because they contribute more to the maintenance and continuity of the platform, they are important to the future of the platform and deserve recognition.

Utility Token 4: NFT Platform

When users reach milestones in Work By holding and increasing the liquidity of $WORK tokens, they will be rewarded with attractive APRs on top of their tokens.

Token Distribution and Fund Allocation

At the Token Generation Event (TGE), the tokens and funds generated will be allocated proportionally to various use cases and operations. In the “Vesting” column in Table 1 you can see the vesting period of each of these token allocations in months. Not only do the tokens purchased by the initial buyers have a vesting period, in fact the buyers also have the lowest vesting period in most Jobs. For example, the DAO in question will open its funds gradually over 5 years without any tokens being opened on TGE.

Roadmap

Partnership

Team

Work X social media links:

Official Site: https://landing.workx.io/

Official White Paper: https://content.workx.io/whitepaper/Work+X+Whitepaper+V6.pdf

Official Twitter: https://twitter.com/WorkX_official

Official Telegram: https://t.me/WorkX_Telegram

Official Discord: https://discord.com/invite/workx

Official Medium: https://medium.com/@WorkX

Official Linkedin: https://www.linkedin.com /company/kerja-x-internet-kerja/

Forum Username: Mbelimbing

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3460639

0 notes

Text

What are Erc20 Tokens and How is This Standard Different?

The easiest way to create a token is to go to Token Factory, which has a clear interface.

As we mentioned at the beginning of this article, wETH tokens were created for a rather specific purpose. The disadvantages of Mist are its size and the need for synchronization with the blockchain, which sometimes causes problems. That is, the parties to the transaction do not interact with each other directly, but with the erc20 token development smart contract.

Ethereum is not just a cryptocurrency, but an environment, an ecosystem. Each of its users has the right to use the blockchain provided by Ether to create their own applications and projects using smart contracts. This system can be described in a simplified way by comparing the airwaves with the Internet, and distributed applications in it with websites. Moreover, the sites belong not to one owner, but to many — those who purchased the “site” tokens during the ICO process in exchange for ETH coins. That is, a token is the currency of a specific project that circulates on the Ether blockchain.

Ethereum Token

The EOS platform allows you to create dApps, quickly carry out transactions in parallel with others, it is designed for scaling and working with large projects. By combining all the previously listed functions, we get a full-fledged ERC-20 contract. But, as we discussed, smart contracts are not everything. We need to obtain data and information on contract renewal. We have a library for this in the SDK that replaces The Graph, and in this library everything is also written in Kotlin. The creators of the ChainLink project

decided to raise funds for the development of the project by selling tokens as part of the ICO.

Wrapped Ether aims to solve this problem and you may have come across this token before. Next, we will explain why it has become a useful tool for investors and owners in many projects and DApps. ERC20 also facilitates the management of tokens of the same standard for decentralized applications such as Uniswap, AAVE, Sushiswap, 1inch, etc. This table contains a list of holders and the corresponding balance of their tokens.

Although the idea of decentralization sounds compelling, people are not willing to pay large amounts per transaction for its cost. This raises the question of how much people actually care about decentralization. Solana is more centralized than Ethereum, which is why it can have such fast transaction speeds and low fees. We’ve seen a problem with this where the network is down due to having a more centralized point of failure.

The value of the token lies in the fact that the user will receive a guaranteed quality product as a result, or otherwise receive the money paid. Another implemented solution is the tracking function along supply chains, based on requests in manual mode. The blockchain stores all this data, and when requested, provides the necessary information in the database. Today renamed VeChain Thor (from VEN to VET), the platform has also begun to support commercial dApps through the Thor utility token.

Here msg.sender is the investor’s address, and restricted is the address of the token wallet for the founders.

A situation that further encourages decentralized platforms and keeps all power in the hands of users.

Built-in atomic (instant) exchanger with cashback.

However, in a token that is issued during a sale, the problem can be solved.

Solana is more centralized than Ethereum, which is why it can have such fast transaction speeds and low fees.

Ultimately, ChainLink needed to provide solutions for Ethereum smart contracts, so the tokens were based on the most popular ERC20 standard. The ChainLink program has created 1 billion LINK utility tokens, of which 350 million (35%) have been allocated for public sale. Over time, blockchain is increasingly penetrating our lives, and there is a need to understand its basic technologies, including the operation of decentralized applications. Most dApps are currently created on Ethereum, whose capabilities are much more flexible than issuing the usual ERC20 development service tokens. The TransferFrom function allows smart contracts to carry out transfers with parameters specified by the wallet owner.

NFT20 understands that liquidity is a big part of any dex. $500 per day will be distributed as rewards to liquidity providers for liquidity pools on NFT20. As of now, the ETH-MUSE pool will receive the largest daily $MUSE supply of $250MUSE.

Erc20 Tokens Transmit Information From Transaction Hash

The main token utility $MUSE serves as the governance token for the NFT20 dex. Requirements for approval of a crop growing project. $MUSE is an NFT20 governance token that can be earned by providing liquidity to various NFT20 token pairs.

This is the easiest way to get Ethereum into your Exodus wallet. Once the exchange is completed and your Ethereum has been deposited, you can begin managing and/or exchanging assets running on Ethereum. But in the case of ERC721, which is a non-fungible token, each token will have a distinctive characteristic that makes it unique from any other ERC721 token. ERC721 is mainly known for its successful use in the popular game CryptoKitties. But there are many other useful uses for ERC721 contracts. Let us immediately note that it is strictly not recommended to search for an exchange service yourself through a search engine.

If you decide to start experimenting with WETH, we recommend purchasing it with ETH or other tokens, as it is easier and more convenient than interacting with smart contracts for wrapping. In addition, there is another problem — lost coins inside smart contracts. This happens when a contract is used that is not intended for operations with sent tokens. Its developer proposes to solve it using the new ERC-223 standard. The standard is based on ether smart contracts, implemented for the first time in the blockchain of this cryptocurrency.

What Lies Behind Erc Tokens

For example, Bitcoin or Ethereum are fungible tokens, euros or dollars are fungible money, since each token or each euro or dollar has the same value. The antonym of a fungible token is a non-fungible token, which, on the contrary, has its own, unit value as a unique digital work. All content provided by the site, hyperlinks, associated applications, forums, blogs, social networks and other information is taken from third party sources and is intended for informational purposes only. We make no guarantees regarding our content, including, but not limited to, its accuracy or currency.

I calculated the percentage of tokens for the founders and bounty at the end of the sale. Previously, totalSupply — the number of issued tokens corresponded to the number of purchased ones. And we need to count the percentage of those purchased, otherwise the price of the token will be eroded.

What Happens If My NF Value Is More Than 100 Tokens?

Their combination is necessary to disclose the requirements of the parties aimed at the correct fulfillment of obligations and the formation of a procedure for the turnover of assets. A typical fiat stablecoin issuer holds a certain amount of euros, dollars, or other currencies in reserve. Then it issues an equivalent number of tokens. So, for example, if you have a reserve of dollars, you can issue dollar stablecoins. Essentially, you give the smart contract the authority to transfer funds on your behalf. For example, as part of a subscription to certain services, so as not to enter data personally each time.

Provides the ability to avoid accidentally losing tokens inside contracts that are not designed to handle sent tokens. Now you need to wait for the transaction to be confirmed on the blockchain. The waiting time will depend on the network congestion. If you’re in a hurry, you can speed up the process (for example, pay higher fees) to confirm the transaction faster. Among these restrictions is the inability to directly exchange ether for such tokens or vice versa.

Although the project is still young, thanks to the efforts of the team it has already managed to overtake many trading platforms. The objective of the project is to provide reliable reviews of products, services and services, bypassing advertising from its customers. Moreover, these reviews are checked by highly intelligent systems that conduct analysis and exclude low-quality texts, and the publications themselves cannot be deleted. Users who publish them will receive payment in R tokens, and reviews will be saved in the RSS storage. In addition, goods and services can be purchased at a constant price in RVN currency.

Comparison of Ethereum Blockchain Token Standards: Erc

This token is backed by the US dollar, and, in fact, is a stablecoin (a digital asset with a stable price). In ERC-223, this error has been corrected — here you can transfer tokens to smart contracts and wallets with one function. In addition, with ERC-223 tokens, unlike ERC-20, a transfer requires one operation rather than two, which means half the gas required to pay for it. So, Ethereum is a decentralized platform on which smart contracts written in the Solidity programming language can run. It can also run hundreds of decentralized applications.

After this, the funds are credited to the recipient’s wallet balance. Each ERC-721 token is unique and can be used for collecting or declaring ownership. You need to communicate with the smart contract that manages ERC-721 tokens differently — not using numbers, but specifying the 256-bit identifier of each token. Tokens can only be moved one at a time and, logically, tokens cannot be divided into parts. This token is used as a currency when paying for advertising on specialized platforms that can be found through the Brave browser. Its function is also to control the visibility of advertising in accordance with thematic queries and user behavioral factors collected by this browser.

In this case, the commission will still have to be paid, since this is the only way to ensure that the transaction is included in the block. And if there is no ether, then you won’t be able to work with ERC-20 tokens. And one of its important components was the ERC-20 framework, which is used to create erc20, these are new tokens or tokens that can interact with Ethereum. What’s interesting is that this adaptive mechanism inspired Bitcoin developers to create a similar standard — BEP-2. ERC20 is the Ethereum protocol, making it possible to generate tokens on the Ethereum blockchain.

Popular Cryptocurrencies

New data appears so quickly that indexers cannot keep up with it. Because of this, users may submit transactions and not see their results in web services. But this is not “the blockchain is broken” or “the tokens were stolen” — it’s just that the indexer has fallen behind the blockchain. To transfer ether, you need to select “transfer ether and tokens” in the menu. Choose to log in via MetaMask, click “Connect to MetaMask”, in the window that opens, enter your password and click “login” and at the bottom of the “Connect” window — “login”.

Among the usual offline exchange offices in every city, you cannot find those that will agree to exchange Tether ERC20 for cash. This is explained by the fact that they are associated with banks and official currencies, but not with digital assets. By process of elimination, we come to the logical conclusion that for exchanging Tether ERC20 for cash, exchangers are the only rational, convenient and safe option.

This way, you will be able to pay more attention to selecting exchange conditions, getting the opportunity to buy Tether at the best price. These six simple steps have enabled wallet developers and exchanges to create a single code base that can interoperate with any ERC-20 contract. The approve function checks whether the smart contract still has tokens. It is a current industry standard and is used by thousands of different cryptocurrency projects. Here msg.sender is the investor’s address, and restricted is the address of the token wallet for the founders.

It is distinguished by its support by hard real currency (in this case, the American dollar). This makes stablecoin a convenient tool for savings and mutual settlements. With its help, it is possible to conduct financial transactions, erasing state borders and difficulties. A series of unique tokens called CryptoPunks is considered one of the most significant in the NFT hype. It was created back in 2017, and now the volume of token trading continues to break all records in the cryptosphere. Here are some of the most significant sudden wealth stories for investors who know how to wait.

Erc20: Description of the Standard, Features of Erc Tokens, Supported Wallets

As a result, Ethereum Request for Comments 20, also known as the ERC-20 development token standard, was invented. By using tokens to perform specific functions in a smart contract, you make the process simpler and clearer. In addition, tokens also play into the overall value of ETH. Each step in a smart contract is a transaction or a set of manipulations that has its own price, expressed in gas. Ether is the currency that powers everything on Ethereum.

PoW mining requires special, expensive equipment that consumes a lot of energy and is difficult to maintain. Although the most popular Ethereum client is currently written in Google GO, the choice of convenient language for creating smart contracts is quite large. Ethereum offers developers a choice of languages like Vyper, Bamboo, Serpent or Solidity. This is a blockchain platform with enormous throughput, processing several tens of thousands of requests per second.

#erc20 token generator#create erc20 token#blockchainx#erc20 token development#erc20 development#ethereum#erc20#ethereum development

1 note

·

View note

Text

Decentralized crypto exchange Uniswap launched a closed beta Android version of its mobile app on October 12, according to a blog post from the app’s development team. Uniswap has previously only been available on PC and iOS mobile devices.“WEN ANDROID?” How about now? The Uniswap wallet is coming to Android users The beta is LIVE — sign up here to get early access ✅ pic.twitter.com/vXsn2NS5Sx— Uniswap Labs (@Uniswap) October 12, 2023 Uniswap is the world’s largest decentralized crypto exchange by cumulative volume, having processed over $1.7 trillion worth of trades since its inception, according to data from DeFi Llama. Most of its trades have been done via a web-based application. However, the team launched a mobile app for iOS on April 13. Prior to this date, the team had complained that Apple was holding up the app’s launch in the Apple App Store. Even after getting the green light from the App Store, Uniswap still did not have a dedicated app for Android devices.According to the Oct. 12 announcement, the new Android beta app allows users to select coins on different chains without switching networks. It automatically detects which network a coin is on and switches to that network without the user prompting it to. It can be used on Polygon, Arbitrum, Optimism, Base and BNBChain currently, with more chain compatibility slated for the future.The wallet also routes Ethereum transactions through a private pool in order to help avoid front-running and sandwich attacks, although this feature can be turned off if the user prefers. In addition, it automatically detects most coins that have built-in transfer fees. These fees are displayed in the interface, making the user aware of them.Related: Google Assistant will soon incorporate Bard AI chat serviceThe announcement linked to a signup for an email waitlist, which it stated will be used to roll out copies of the app to early adopters. The team also plans to release the app’s open-source code in the coming weeks, as part of its security audit with Trail of Bits.Uniswap is not the only decentralized exchange to offer a mobile wallet. In 2021, 1Inch launched a mobile wallet for iOS, and an Android version of it was published in October.

0 notes

Text

ASENIX Encourages People, Communities And Governments To Preserve Our Seas

Introduction of ASENIX

ASENIX to utilize the power of blockchain technology in safeguarding our oceans and its ecosystem by funding, encouraging and supporting scientific research, as well as educating and increasing public awareness on the impact of non-sustainable lifestyles on the oceans and their ecosystems. ASENIX is the first web3 platform that supports and invests in teams committed to developing swift, innovative solutions to ocean pollution. The ASENIX Initiative is committed to achieving long-term, robust protection for the most crucial areas of the oceans for both current and future generations. ASENIX supports the implementation of Goals 12 & 14 of the UN Sustainable Development Goals. We are committed to safeguarding our oceans and ecosystem through funding, encouraging, and supporting scientific research (through our ecosystem), as well as educating and increasing public awareness on the impact of non-sustainable lifestyles on the oceans and ecosystems.

ASENIFI CROSS-CHAIN DEX

THE PROBLEM Decentralized Finance (DeFi) has grown rapidly in the last year. While the proliferation of new DeFi protocols has fueled innovation and attracted massive inflows of users and capital, it has also introduced several market pain points. Significant price differences between two AMMs are common, or, very often, tokens are only listed on one AMM and have no liquidity on the others. Users must typically search through several AMMs to find the "best price" or simply an AMM that lists the desired token. Because assets cannot be transferred between chains, each blockchain is a separate entity with its own local liquidity. Due to the built-in constant function validation within an AMM, there exists a slippage.

THE SOLUTION ASENIFI is a cross-chain DEX that aims to provide consumers with aggregated liquidity via a single userfriendly interface. It intends to be the go-to exchange for DEX traders to trade any token readily accessible via a robust list of supported exchanges. ASENIFI is able to provide several key features that make it an appealing choice for buyers and sellers by offering the finest user experience and prices possible.

ASENIFI will provide its users with aggregated liquidity. Unlike conventional AMMs, which only allow users to trade from their own liquidity pools, For any given transaction, ASENIFI will utilize Fusion's DCRM technology to aggregate liquidity from over 22 active DEXs on the market (as well as the 1inch aggregator) across multiple chains. ASENIFI's "Pharos" algorithm tackles the problem of high slippage by dividing a single trade into numerous smaller trades across different protocols in order to find the most optimal routes with the least amount of slippage.

Why invest on ASENIX

Invest in a truly innovative and impactful project with ASENIX, a web3 startup focused on tackling ocean pollution. ASENIX invests in and supports teams dedicated to creating fast, effective, and long-term solutions to ocean pollution. By investing in ASENIX, you can support a sustainable project that’s committed to making a real difference in the world. The doxxed team behind ASENIX is fully transparent about their identities and qualifications, and the project token has a verified contract to ensure investment security. You also earn from every transaction for life, maximizing your investment potential. Don’t miss out on this incredible opportunity to join the ASENIX token presale and be a part of a project that’s creating long-term sustainable solutions to protect our planet from ocean pollution.

ASENIX mission

The ASENIX Initiative is committed to achieving long-term, robust protection for the most crucial areas of the oceans for both current and future generations. ASENIX supports the implementation of Goal 12 & 14 of the UN Sustainable Development Goals. We are committed to safeguarding our oceans and its ecosystem through funding, encouraging and supporting scientific research (through our ecosystem), as well as educating and increasing public awareness on the impact of non-sustainable lifestyles on the oceans and ecosystems.

ASENIX TOKEN (ENIX)

ASENIX Token (ENIX) is the native token of the ASENIX ecosystem. ENIX is an BEP20 token on the Binance Smart Chain, with a maximum supply of 500,000,000 tokens. Holders of the token will automatically earn rewards just for holding. The token will also be available for trading on exchanges. 4% of all transactions are automatically transferred to our Research/development wallet. These funds will be collected on a regular basis and put towards scientific research (ENIX Labs) and further development of the initiative. ASENIX estimate that a 4% commitment pulled from each transaction could potentially generate $300,000 each day. This level of financing put towards ocean preservation solutions would undoubtedly make a significant impact.

CONTRACT ADDRESS : 0x408cefb5f92f0e47fc12e9840cc50529fc986226

ASENIX Roadmap

FIRST PHASE (Q4 2022) Website development, Whitepaper release, Smart contract development, Token deployment Token Burn, Token Audit, water refill map V1.0.

SECOND PHASE (Q1 /Q2 2023) Initial burn of ENIX tokens, Contract verification & Audit, ASENIX water refill map V1.0 (Beta). Online community, Marketing, ASENIX token airdrop, Partnerships, Influencer marketing, CMC Application, CG Application.

THIRD PHASE (Q3 /Q4 2023) Presale, IDO/ IEO, Launch, Staking Dapp, Awareness campaign, AMC NFT deployment, Oceanblue campaign, CEX listings, Media articles, ENIX Labs development, AIP.

FOURTH PHASE (Q1 /Q2 2024) ASENIFI DEX contract development, ENIX Labs launch, ASENIFI (DEX) testnet, ASENIFI Mainnet, Expansion.

PARTNERS

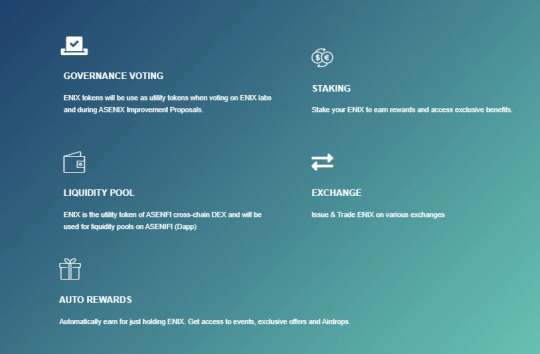

ENIX tokens Use cases

GOVERNANCE VOTING: ENIX tokens will be use as utility tokens when voting on ENIX labs and during ASENIX Improvement Proposals.

LIQUIDITY POOL: ENIX is the utility token of ASENFI cross-chain DEX and will be used for liquidity pools on ASENIFI (Dapp)

STAKING: Stake your ENIX to earn rewards and access exclusive benefits.

EXCHANGE: Issue & Trade ENIX on various exchanges

AUTO REWARDS: Automatically earn for just holding ENIX. Get access to events, exclusive offers and Airdrops.

VISIT HERE:

Website: https://asenix.org/ Whitepaper: https://docs.asenix.org/ Telegram group: https://t.me/ASENIXinitiative Telegram channel: https://t.me/ASENIXtokenchannel Official Twitter: https://twitter.com/ASENIXtoken Linkedin: https://www.linkedin.com/company/asenix/ Medium: https://medium.com/@info_49869 Github: https://github.com/ASENIXInitiative

AUTHOR

Btt: Bitlinex Btt link: https://bitcointalk.org/index.php?action=profile;u=3568554 Address: 0x978f8F6C04b27d63F8DE5A2a2207a07a02E5395f

0 notes

Text

Big Development For 1inch - Coin Crunch India

The growth shown by Avalanche and Gnosis is the reason 1inch chose them. 1inch the Decentralized Exchange (DEX) aggregator is expanding its outreach, as the 1inch Aggregation Protocol and the 1inch Limit Order Protocol have been deployed on Avalanche and Gnosis Chain. “1inch’s main goal is to offer users the best deals across the blockchain space. To achieve that, 1inch protocols constantly…

View On WordPress

0 notes

Text

Uniswap v3 Introduces Oku: A Game-Changing User Interface for DeFi Trading

Uniswap v3 introduces Oku, a groundbreaking user interface designed to revolutionize DeFi trading. Developed by GFX Labs, Oku seamlessly combines the user experience of centralized exchanges with the complexities of decentralized finance. With advanced features like order books, price charts, and limit orders, Oku offers enhanced control and flexibility to traders. Backed by the Uniswap Foundation, Oku is deployed on prominent layer-1 networks and aims to bridge the gap between centralized exchanges and DeFi, driving the growth of decentralized finance.In this article, we delve into the game-changing capabilities of Oku, its potential to bridge the gap between centralized exchanges and DeFi, and its role in driving the growth and adoption of decentralized finance.

Enhancing User Experience: Oku's Vision for DeFi

Oku sets out to deliver a user experience (UX) that DeFi users are already accustomed to in popular centralized exchanges like Binance. The founder of GFX Labs, Getty Hill, highlights Oku's mission to provide a seamless transition for users by incorporating features such as order books, price charts, live trading history, and limit orders. By offering a comprehensive view of all existing and new pools available on Uniswap v3, Oku eliminates the need for token listing requests. This intuitive interface streamlines the process of accessing different pools and empowers users to make informed trading decisions effortlessly.

Unlocking New Possibilities: Limit Orders and Enhanced Control

One of Oku's standout features is its support for limit orders. With this functionality, users gain the ability to apply specific conditions to their trading pools, granting them greater control over their trading strategies. This newfound flexibility helps users optimize their trades based on personalized parameters, ultimately leading to more efficient and effective transactions. Hill emphasizes the limitations of existing DeFi trading interfaces offered by platforms like Uniswap, 1inch, and Matcha, stating that they fall short of meeting the expectations set by the wider crypto community. To foster the growth of DeFi, it is essential to entice users to transition from traditional exchanges to DeFi solutions. Oku's user-friendly interface bridges this gap, offering an exceptional user experience that is on par with centralized exchanges.

Supported by the Uniswap Foundation: Expanding Onto Prominent Blockchain Networks

Oku is backed by the Uniswap Foundation, a non-profit organization dedicated to supporting decentralized growth. As a testament to its commitment, Oku has already been deployed on several layer-1 networks, including Ethereum, Polygon, Arbitrum, and Optimism. Additionally, the platform has ambitious plans to expand its presence to other prominent blockchains in the near future. Devin Walsh, the executive director at the Uniswap Foundation, highlights the significance of Oku's latest release. By combining the trust and security of the Uniswap Protocol with the speed and trading experience offered by centralized exchanges, Oku strikes a perfect balance. The Uniswap Foundation's mission is to foster innovation by funding diverse projects built on top of the Protocol, and Oku perfectly represents this vision. With an API-driven and professional interface, Oku fills a crucial gap in the DeFi space and is developed by a highly experienced team deeply integrated within the Uniswap ecosystem.

Conclusion

Uniswap v3's launch of Oku marks a significant milestone in the evolution of DeFi trading interfaces. With its focus on user experience and seamless integration with the Uniswap Protocol, Oku offers a game-changing solution that aims to attract and retain a broader user base within the decentralized finance ecosystem. By combining the best elements of centralized exchanges with the power of DeFi, Oku empowers users to trade with confidence and efficiency. As Oku continues to expand its presence across various blockchain networks, it is poised to revolutionize the way users engage with decentralized trading and shape the future of finance. For more articles visit: Cryptotechnews24 Source: blockworks.co

Related Posts

Read the full article

#API#centralizedexchanges#CryptoNews#decentralizedexchanges#Defi#DeFitradinginterface#limitorders#livetradinghistory#Oku#orderbooks#pricecharts#Security#trust#UniswapFoundation#UniswapProtocol#UniswapV3#userexperience

0 notes

Link

#DeFi DEX Aggregator#1inch exchange#1inch exchange development#1inch clone#1inch clone script#Build DeFi DEX Aggregator like 1inch Exchange#build exchange like 1 inch clone script#crypto exchange development

0 notes

Text

A DEX platform that is desirable in today’s time

A Decentralized exchange (DEX) as the name suggests is a platform with no third party or intermediate involved to manage the crypto selling, buying, or trading on the exchange platform. There is no requirement for a middleman to manage the order books, smart contracts handle the process instead.

Currently, there are different types of decentralized platforms available in the market such as UniSwap, Pancakeswap, Sushiswap, and many others. All of these platforms have been built uniquely with their own features. The cost of transactions may differ on all of the DEX platforms. What helps in finding the most economical place is 1inch.

How does 1inch work? Just suppose that a user wants to purchase Wrapped Bitcoin on a decentralized platform. Certainly, different decentralized platforms offer different prices. Here is when the 1inch algorithm comes to play, it helps in finding the most economical way of making the trade.

Here are some of the amazing benefits of 1inch: Liquidity pools: The users are enabled to gain profit by managing or developing liquidity pools. They add up to the liquidity pool that is used for different exchange operations.

Farming: The users making a contribution in liquidity pools are privileged with the governance tokens. Farming programs on the platform enhance the governance procedures.

Governance: The 1inch token holders get special rights on the 1inch protocol. The token holders are privileged to be a member, vote for several decisions, and get other rights.

1inch is currently one of the big names when it comes to a decentralized platform. It is offering the users several features and advantages that are useful and are not being offered on other platforms. If you want to launch your own decentralized exchange like 1inch, you can explore Zeligz web store’s expert services. Their professionalism and expert methodology can help you launch an ideal platform in the market. Not only does their software is embedded with superior features but they offer complete support for launching it in the market.

#cryptocurrencies#bitcoin#cryptocurrency#smart contracts#blockchain#decentralized exchange#defi development#decentralized platforms#decentralized#1inch#development#blockchain technology

5 notes

·

View notes