#3E-Savvy

Text

#INDUSTRIES#3E-Social Media#3E-Technology#3E-Advertising#3E-Marketing#3E-Entertainment.#VALUES#3E-Responsibility#3E-Professionalism#3E-Integrity#3E-Accountability#3E-Openness#3E-Respect.#TRAITS#3E-Humor#3E-Social media savvy#3E-Boldness#3E-Creativity#3E-Uniqueness#3E-Risk taking#3E-Crowd mentality#3E-Resourcefulness#TENSIONS#3E-Privacy of Social Media Users#3E-Error Management in the Workplace#3E-Pop Culture vs Making Errors#3E-Employee Rights vs Employer Control#3E-Employee Professionalism#3E-Humor vs Professionalism#3E-Social Media and Insensitivity

0 notes

Text

3e ravenloft’s greatest hits: lady edition

ASK AND YE SHALL RECIEVE

Natalia Vhorishkova

so we know and love the Weathermay-Foxgrove sisters, 5e actually kept them more or less the same, BUT. what 5e neglected to give much detail on was Natalia, and as soon as i read the dread possibilities in Van Richten’s Arsenal i was obsessed. holy shit! fucknasty sadomasochist werewolf lady, locked in a deadly game of cat and mouse with the hunter she seduced and betrayed and who has now made it his life’s goal to hunt her down?? give me 40k words about her right now immediately.

Perseyus Lathenna

holy shit yall, i didn’t even know about this character until i went looking, but she’s? amazing?? a tiny-ass grandma wizard who got the goodness traumatized out of her, and was then inspired to try again years later and ended up reclaiming that drive to help people? a disabled woman who innovates a new method of spellcasting that doesn’t need somatic gestures? a respected scholar who keeps her identity close to her chest, as a way to bypass the systematic inequality of the cultures she’s working in? holy shit i love her. put her in your game so help me god.

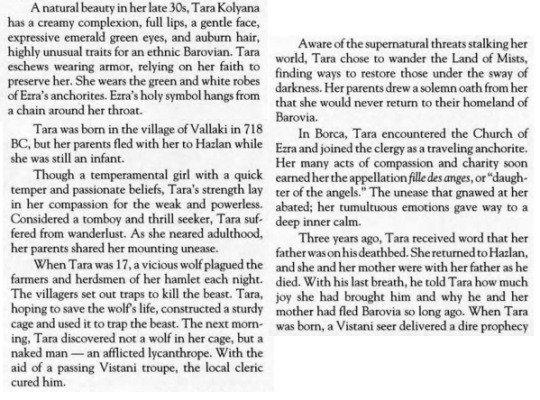

Tara Kolyana

listen i know we all love Ireena but 5e did her so so dirty, and 3e for all its faults gave us Tara. homegirl’s parents saw the writing on the wall and got the fuck out of dodge, and it fucking? worked?? she’s free? mostly. mostly free. the narrative tugs and tugs like an undertow but she’s had time to grow now, time to become a wholeass person outside of Barovia, outside of her destiny, and who knows what she could do now? who knows what kind of power she could have if she went back to Barovia as an adult, a full-fledged cleric with a solid sense of her self and her duty.

Ebb

literally who doesn’t love a fuckmassive shadow dragon. she’s fantastic, she’s goth, her best friend is a wizard, what more can i say?

Lyssa von Zarovich

light of my life, girlboss of my heart, this list would not be complete without Lyssa. Strahd’s direct grandniece by way of the oft-forgotten middle brother Sturm, her goals are simple; reduce Strahd to a fine ash for the crime of piledriving the family’s history and reputation, and do some actually functional governing in Barovia. and she’s a genius! she not only found out about Strahd’s Big Oopsie entirely independently of anyone else in the know, she then looked at what uncle dearest had done and said “yeah i’ll have what he’s having” and fuckign followed through. and then! discovered a way to speedrun vampire power levels via a ghost booty call! and then invented vampire mindflayers, just bc she hadn’t broken enough records that week.

she’s an excellent foil for Strahd, an ambitious, intelligent, and politically savvy woman who took the vampirism deal (literally the only other character to do so besides Strahd) with the full knowledge of what it entailed; as a means to an end, not an impulsive sacrifice. most of the material she’s got (and even in older editions there isn’t much) positions her as a middle-strength villain, but honestly i want to see her as a lesser-of-many-evils ally.

#ravenloft mood#no darklords bc i wanted to focus on lesser-known npcs#i'm drawing from a few sources here but if u want to go digging for more on these ladies i've got the pdfs archived hgdg#also i lied some of these are 2e content but shhhh that's not important

40 notes

·

View notes

Text

“Thirteen″ Tips for Writing About Synagogues / Jewish Writing Advice / Advice for Visiting Synagogues

So your story includes a Jew (or two) and you’ve a got a scene in a synagogue. Maybe there’s a bar mitzvah, maybe your gentile protagonist is visiting their partner’s synagogue. Maybe there’s a wedding or a community meeting being held there. For whatever reason, you want a scene in a shul. I’m here as your friendly (virtual) neighborhood Jewish professional to help you not sound like a gentile who thinks a synagogue is just a church with a Star of David instead of a cross.

Quick note: The are lots of synagogues around the world, with different specific cultural, local, and denominational practices. The Jewish community is made up of roughly 14 million people worldwide with all sorts of backgrounds, practices, life circumstances, and beliefs. I’m just one American Jew, but I’ve had exposure to Jewishness in many forms after living in 3.5 states (at several different population densities/layouts), attending Jewish day school and youth groups, doing Jewish college stuff, and landing a job at a Jewish non-profit. I’m speaking specifically in an American or Americanish context, though some of this will apply elsewhere as well. I’m also writing from the view of Before Times when gatherings and food and human contact was okay.

Bear in mind as well, in this discussion, the sliding scale of traditional observance to secular/liberal observance in modern denominations: Ultraorthodox (strict tradition), Modern Orthodox (Jewish law matters but we live in a modern world), Conservative (no relation to conservative politics, brands itself middle ground Judaism), Reconstructionist (start with Jewish law and then drop/add bits to choose your own adventure), and Reform (true build your own adventure, start at basically zero and incorporate only as you actively choose).

Synagogue = shul = temple. Mikvah (ritual bath) is its own thing and usually not attached to the shul. Jewish cemeteries are also typically nowhere near the shul, because dead bodies are considered impure.

A Bar/Bat/Bnai Mitzvah is the Jewish coming of age ceremony. Bar (“son”) for boys at 13+, Bat (“daughter”) at 12+, and Bnai (“children”) for multiples (i.e. twins/triplets/siblings) or non-binary kids (although the use of the phrase “Bnai Mitzvah” this way is pretty new). 12/13 is the minimum, 12-14 the norm but very Reform will sometimes allow 11 and anybody above 12/13 can have theirs. Probably a dedicated post for another time. Generally, however, the following will happen: the kid will lead some parts of services, read from and/or carry the Torah, and make a couple of speeches.

Attire: think Sunday Best (in this case Saturday), not come as you are. Even at very liberal reconstructionist/reform synagogues you wouldn’t show up in jeans and a t-shirt or work overalls. Unless they are seriously disconnected from their culture, your Jewish character is not coming to Saturday morning services in sneakers and jeans (their gentile guest, however, might come too casual and that’d be awkward).

1a. The more traditional the denomination, the more modest the attire. Outside of orthodoxy woman may wear pants, but dresses/skirts are more common. Tights for anything above knee common for Conservative/Reform/Recon, common for even below knee for orthodox shuls. Men will typically be wearing suits or close to it, except in very Reform spaces.

1b. Really, think business casual or nice dinner is the level of dressiness here for regular services. Some minor holidays or smaller events more casual is fine. Social events and classes casual is fine too.

1c. Even in reform synagogues, modesty is a thing. Get to the knee or close to it. No shoulders (this an obsession in many Jewish religious spaces for whatever reason), midriffs, or excessive cleavage (as I imagine to be the norm in most houses of worship).

Gendered clothing:

3a. Men and boys wear kippahs (alt kippot, yarmulkes) in synagogues, regardless of whether they’re Jewish or not out of respect to the space. Outside of Jewish spaces it’s saying “I’m a Jew” but inside of Jewish spaces it’s saying “I’m a Jew or a gentile dude who respects the Jewish space.” Outside of very Reform shuls, it’s a major faux pass to be a dude not wearing one.

3b. There are little buckets of loaner kippahs if you don’t bring your own and commemorative kippahs are given away at events (bar mitzvah, weddings). Your Jewish dude character not bringing or grabbing one is basically shouting “I’m new here.”

3c. Women are permitted to wear kippahs, but the adoption of a the traditionally masculine accessory will likely be interpreted by other Jews as LGBTQ+ presentation, intense feminism, and/or intense but nontraditional devoutness. Nobody will clutch their pearls (outside of ultraorthodoxy) but your character is sending a message.

3d. Tefillin are leather boxes and wrappings with prayers inside them that some Jewish men wrap around their arms (no under bar mitzvah or gentiles). Like with the kippah, a woman doing this is sending a message of feminism and/or nontraditional religious fervor.

3e. Additionally, prayer shawls, known as tallit, are encouraged/lightly expected of Jewish males (over 13) but not as much as Kippahs are. It is more common to have a personal set of tallit than tefillin. Blue and white is traditional, but they come in all sorts of fun colors and patterns now. Mine is purple and pink. It is much more common for women to have tallit and carries much fewer implications about their relationship to Judaism than wearing a kippah does.

3f. Married woman usually cover their hair in synagogues. Orthodox women will have wigs or full hair covers, but most Jewish woman will put a token scarf or doily on their head in the synagogue that doesn’t actually cover their hair. The shul will also have a doily loaner bucket.

Jewish services are long (like 3-4 hours on a Saturday morning), but most people don’t get there until about the 1-1.5 hour mark. Your disconnected Jewish character or their gentile partner might not know that though.

Although an active and traditional synagogue will have brief prayers three times every day, Torah services thrice a week, holiday programming, and weekly Friday night and Saturday morning services, the latter is the thing your Jewish character is most likely attending on the reg. A typical Saturday morning service will start with Shacharit (morning prayers) at 8:30-9, your genre savvy not-rabbi not-Bnai mitzvah kid Jewish character will get there around 9:30-10:15. 10:15-10:30 is the Torah service, which is followed by additional prayers. Depending on the day of the Jewish year (holidays, first day of new month, special shabbats), they’ll be done by 12:30 or 1 p.m. Usually.

After that is the oneg, a communal meal. Onegs start with wine and challah, and commence with a full meal. No waiting 4-8 hours to have a covered-dish supper after services. The oneg, outside of very, very, very Reform spaces will be kosher meat or kosher dairy.

To conduct certain prayers (including the mourner’s prayers and the Torah service) you need a Minyan, which at least 10 Jewish “adults” must be present, defined as post Bar/Bat/Bnai Mitzvah. In Conservative/Reform/Recon, men and women are counted equally. In Ultraorthodox women are not counted. In Modern Orthodox it depends on the congregation, and some congregations will hold women’s-only services as well with at least ten “adult” Jewish women present.

In Conservative and Orthodox shuls, very little English is used outside of speeches and sermons. Prayers are in Hebrew, which many Jews can read the script of but not understand. Transliterations are also a thing.

In Reform synagogues, there’s heavy reliance on the lingua franca (usually English in American congregations). Reconstructionist really varies, but is generally more Hebrew-based than Reform.

We’re a very inquisitive people. If your character is new to the synagogue, there will be lots of questions at the post-services oneg (meal, typically brunch/lunch). Are you new in town? Have you been here before? Where did you come from? Are you related to my friend from there? How was parking? Do you know my cousin? Are you single? What is your mother’s name? What do you think of the oneg - was there enough cream cheese? What summer camp did you go to? Can you read Hebrew? Have you joined?

A disconnected Jew or gentile might find it overwhelming, but many connected Jews who are used to it would be like “home sweet chaos” because it’s OUR chaos.

In Orthodox synagogues, men and women have separate seating sections. There may be a balcony or back section, or there may be a divider known as a mechitzah in the middle. Children under 12/13 are permitted on either side, but over 12/13 folks have to stay one section or the other. Yes, this is a problem/challenge for trans and nonbinary Jews.

Mechitzahs are not a thing outside of orthodoxy. Some older Conservative synagogues will have women’s sections, but no longer expect or enforce this arrangement.

Money. Is. Not. Handled. On. Shabbat. Or. Holidays. Especially. Not. In. The. Synagogue. Seriously, nothing says “goy writing Jews” more than a collection plate in shul. No money plate, no checks being passed around, even over calls for money (as opposed to just talking about all the great stuff they do and upcoming projects) are tacky and forbidden on Shabbat. Synagogues rely on donations and dues, and will solicit from members, but don’t outright request money on holidays and Shabbat.

Outside of Reform and very nontraditional Conservative spaces, no instruments on Shabbat or holidays. No clapping either. Same goes for phones, cameras, and other electronics outside of microphones (which aren’t permitted in Orthodox services either).

11a. In the now-times an increasing number of shuls have set up cameras ahead of time pre-programmed to record, so they don’t have to actively “make fire” which is “work” (this is the relevant commandment/mitzvah) on Shabbat, so services can be live-streamed.

11b. After someone has completed an honor (reading from the Torah, carrying the Torah, opening the ark, etc), the appropriate response is a handshake after and the words “Yasher Koach” (again, Before-Times).

Jewish services involve a lot of movement. Get up, sit down. Look behind you, look in front of you. Twist left, twist right. A disconnected Jew or gentile visitor would be best off just trying to follow along with what an exchange student we had once termed “Jewish choreography.”

Some prayers are standing prayers (if able), some are sitting prayers. It’s just how it is, although a handful of prayers have variations on who stands.

#jumlbr#jewblr#jewish#jewish writing help#jewish writing#jewish characters#writing jewish characters#jewish representation#writing advice#writeblr#writing jewish spaces#how to write synagogues#another long one sorry not sorry

228 notes

·

View notes

Text

CourseKosh - Find the best online courses for your career.

Carrier Choice after twelfth Commerce

With the CBSE just declared the Class twelfth outcomes, a great deal of understudies like you with Commerce foundation are searching for Career Guidance for Courses after twelfth Commerce stream.

I, at the end of the day, did my twelfth in Commerce and can identify with your current vulnerability and uncertainty as a main priority.

Wherever you should head, you would be asked a similar inquiry, "Such a huge number… .?"

A few understudies are away from what they need to seek after as a Career decision by beauty of God they have had the option to make sure about the imprints for it as well and are somewhat arranged.

In any case, where dominant part of the understudies lie is with vagueness about what should they pick after Class twelfth and what choices are really accessible dependent on their imprints in Class 12!!!!

I'm composing this article to help understudies like you to have the option to settle on the correct profession decision…

"Aspiration is the initial step to progress, second is ACTION!!!"

All in all, as a Commerce understudy, you need to assess what is your desire, what energizes you personally, where do you see yourself in a long time from now?

Pick your AMBITION astutely, at that point make a move to emerge your desire!

If we pick a profession that coordinates our inclination and our capacity, we have just made the main right stride!

So how to settle on the correct decision?

How to discover what energizes you?

The most ideal approach to do so is to do a great deal of HOMEWORK-do great measure of research and afterward choose where to head!!!

Just to help you, I have gathered a couple of vocation alternatives that you can investigate!

1.B.Com ( Bachelor of Commerce)

Most Commerce understudies need to seek after this course basically in light of the high worth this capability holds when done from a rumored University/school.

Under BCom, there are three most mainstream courses, specifically BCom or BCom-General, BCom (Honors) and BCom LLB. The BCom or BCom-General is additionally alluded to as BCom-Pass by numerous colleges.

In the BCom course, up-and-comers are encouraged center subjects identified with business and money. In the three-year span, the applicants are offered choices to browse a couple of elective subjects as well. The program is typically spread more than six semesters during which the understudy is instructed points like monetary bookkeeping, corporate expense, financial aspects, organization law, reviewing, business the executives, and so forth The course likewise opens up the road to go in for additional higher courses like M.B.A( Master of Business Administration) or potentially other Vocational courses.

Numerous Universities offer this course and getting a passage relies upon you being shortlisted by the school. It is for the most part a long term program.

2.B.B.A (Bachelor of Business Administration)

It is a 3 years in length Degree course offered by numerous Private universities.

BBA can be sought after in full-time just as correspondence mode. There are different BBA specializations one can look over like Human Resource Management, Finance, Sales and Marketing and Information Technology.

The value of the Qualification again relies on from where the course has been finished. Post finish, one may likewise follow it up with a M.B.A. (Expert of Business Administration) Degree as well!

3.B.M.S.( Bachelor of Management Science)

It is a long term long degree course including a high level investigation of the administration rehearses utilized in business/corporate firms, as likewise fundamental ideas in human asset training, for example, worker maintenance, work relations, and comparable critical thinking.

The program is spread more than 6 semesters, enduring more than a half year each, and concerning least qualification, hopeful applicants need to achieve the Higher Secondary (10+2) capability with a base total score of half, for applying to the course.

Admission to the course is offered based on the competitor's exhibition in a pertinent passage test.

Effective alumni of the course in the nation can investigate rewarding work openings in driving public and private area associations as Bankers, Budget Planners, Quality Specialists.

4.LAW

Customarily just Graduates were permitted to seek after L.L.B. Yet, presently a few universities are offering a 5 Year Integrated Law course combined with different Qualifications for Law to be taken up by understudy's privilege after twelfth norm.

These Integrated courses are blend of a Degree course and customary L.L.B. course. For instance B.Com.& L.L.B./B.A.& L.L.B. and so on

There are many open positions in the wake of taking up Law starting from work in any law office at or to fire up on one own private practice, start a counseling firm or even beginning an own law office!

5.CHARTERED ACCOUNTANT( C.A)

C.A. represents Chartered Accountant, quite possibly the most rumored courses in India.

To turn into a C.A., one needs to effectively finish CA Exams alongside Internship needed under the ICAI (Institute of Chartered Accountants of India).

twelfth Commerce pass understudies may begin by applying for CPT (Common Proficiency Test) led by ICAI.

Contemplating associated with turning out to be C.A. is extreme. It requires a great deal of tirelessness from the understudy. And yet, the vocation possibilities are bounty!

In the wake of turning into a C.A, open positions open up in Finance divisions in Private organizations just as Government Enterprises or even beginning working freely, offering conference benefits just as working as a private examiner who might be employed by organizations and organizations!

6.CMA( Cost Management Accounting)

At present ICWA course has been renamed to CMA which represents Cost Management Accounting. This course gives you an inside and out information to oversee business inside the accessible assets. As a cost bookkeeper, you need to gather and examine the monetary data from all the territories of an organization.

This course contains three phases, for example CMA Foundation, CMA Intermediate and CMA Final. You can seek after this course through correspondence or through online from a licensed college.

7.C.S. (Organization SECRETARY) COURSE

For Statutory Compliance, an organization secretary is required! Furthermore, to turn into a C.S., one needs to show up for Company Secretary Course run by ICSI (Institute of Company Secretaries of India) The ICSI gives preparing and training to lakhs of hopeful Company Secretaries.

If there should be an occurrence of twelfth Commerce passed understudies, to get chosen for the C.S. course offered by ICSI, they should experience a 3 phase program. The three projects are-

Establishment Program

Chief Program

Proficient Program

Discussing open positions, undoubtedly, private area gives plenty of open positions under Compliance office.

Global QUALIFICATIONS

With the present GLOBAL open doors accessible to understudies, it would be inadequate in the event that I don't discuss International Qualifications which are currently accessible in India !!!

1. CPA US (Certified Public Accountants)

Much the same as Chartered Accountants (CA's) are allowed a permit to rehearse the calling of Accountancy and Taxation in India, also Certified Public Accountants (CPA) are conceded the permit to rehearse in US. In certain nations, these certified bookkeepers are called Chartered Accountants (CA's) and in certain nations these are called as Certified Public Accountants.

This Accounting capability is called Certified Public Accountant in the US and to turn into a CPA, a Candidate is needed to satisfy the 3E's for example

1.Education

2.Examination

3.Experience

To turn into a Certified Public Accountant, an applicant needs to effectively clear all the tests led by the American Institute of Certified Public Accountants (AICPA). This is a uniform test led by the AICPA and is the equivalent across all the 55 states in the US.

Nonetheless, the qualification prerequisite and the experience needed to turn into a Certified Public Accountant changes from state to state and various states have commanded distinctive qualification necessities as controlled by their particular state sheets of bookkeeper and is just legitimate in US.

2. CPA Canada

Like the states in the US, Canada has areas, and every region has its own provincial bookkeeping body. Canada has taken a strong move by combining its bookkeeping capabilities (CA, CMA and CGA) into one major "CPA "assignment. The cycle has been finished with much achievement.

To begin, applicants ought to adhere to the principles appropriate to their status.

Essential for CPA PEP( Professional Education Program)

•Complete a four year college education in applicable fixation, for example B.Comm with a bookkeeping major

•Complete the essential learning characterized in The CPA Competency Map

•Complete at any rate 120 credit hours or likeness instruction

Nonetheless, similar to CPA US, CPA Canada is likewise Province savvy and is substantial just in Canada !!!

3.CIMA(Chartered Institute of Management Accountants)

Much the same as CMA in India, CIMA is an International expert assemblage of the executives bookkeepers situated in UK.

CIMA is an administration bookkeeping capability which zeros in additional on costing, money bookkeeping, and key business abilities it is a global capability in numerous nations.

CIMA centers around the general achievement which incorporates Corporate Strategy, monetary administration, hierarchical administration, and so forth

Notwithstanding, CIMA can be an extra and might help on the off chance that you are working with a British organization in zone of Accounting or Controlling. In any case putting time in CIMA first without seeking after any Indian Qualifications won't help a lot.

4.ACCA (ASSOCIATION OF CHARTERED CERTIFIED ACCOUNTANTS)

ACCA (Association of Chartered Certified Accountants) is a UK Based Accountancy body which is perceived in 181 nations.

It is the worldwide body for Professional Accountants.

In layman's language, it is known as a GLOBAL CA!

It gloats of a Global Reputation which is over 100 years of age and spread across 181 nations across the globe with more than 7,110 affirmed businesses across

also read:- best courses after 12th

1 note

·

View note

Link

Check out this listing I just added to my Poshmark closet: Sport Savvy pink track suit.

0 notes

Text

#Industries#3E-Weight Loss Industry#3E-Health Care#3E-Social Media Values#3E-Responsibility#3E-Integrity#3E-Health#3E-Honesty#3E-Social Justice#3E-Accountability#3E-Equality. Traits#3E-Social media savvy#3E-Self-discipline#3E-Weight loss management#3E-Self-awareness#3E-Motivation#3E-Insightfulness#3E-Heath consciousness. Tensions#3E-Weight Loss Claims#3E-Health Benefits Claims#3E-Unregulated Diet Claims#3E-Influence of Social Media

0 notes

Text

Some Kind of Character Information Meme

NAME: Nivethan Hleras

NICKNAME: Niv. Prefers this to her full name.

AGE: Mid 200′s. Born in 3E 395

RACE: Dunmer

personal.

MORALITY: lawful / neutral / chaotic / good / neutral / evil / true

RELIGIOUS BELIEF: Tribunal

SINS: greed / gluttony / sloth / lust / pride / envy / wrath

VIRTUES: chastity / charity / diligence / humility / kindness / patience / justice

PRIMARY GOALS IN LIFE: She’s currently taking one day at a time, but sometime in the future she’d like to sail again.

LANGUAGES KNOWN: Dunmeris, Tamrielic

SECRETS: She keeps her past a secret until she knows you well enough.

SAVVIES: Most types of magic; Destruction magic in particular. Alchemy. Litterature (and especially poetry).

physical.

BUILD: scrawny / bony / slender / fit / athletic / curvy / herculean / pudgy / average

HEIGHT: 5′8″.

WEIGHT: 121lbs, give or take.

SCARS/BIRTHMARKS: None that stand out. She does, however have several piercings.

ABILITIES/POWERS: Exceedingly high fire resistance (she is practically immune); vast reserves of magicka.

RESTRICTIONS: None.

favourites.

FOOD: She has a fondness for Dunmer and Redguard cuisine.

DRINK: Alcohol (fond of sujamma and shein); water; fresh juices

PIZZA TOPPING: Pepperoni, ventricina, chorizo, leek, chili, and tomato

COLOUR: Black, red, gold, amber, brown.

MUSIC GENRE: Quite fond of violin and cello.

BOOK GENRE: Nonfiction. Erotica.

MOVIE GENRE: Thrillers.

SEASON: Scorching summers.

CURSE WORD: She doesn’t discriminate with her profanities. She’s prone to make some rather colorful combinations, however.

SCENT(S): Incense, fire, alcohol, cigarettes/pipe, spices.

fun stuff.

BOTTOM OR TOP: She’ll do both, depending on her mood and partner.

SINGS IN THE SHOWER: Typically no.

LIKES BAD PUNS: She enjoys clever wordplay, but not necessarily bad puns.

Tagged by: I stole it from myself.

2 notes

·

View notes

Link

Check out this listing I just added to my Poshmark closet: Savvy Dr. Pepper logo gray t shirt.

0 notes

Link

Check out this listing I just added to my Poshmark closet: Sport Savvy pink track suit.

0 notes

Link

Check out this listing I just added to my Poshmark closet: Savvi Fit Life Style Cropped Tee Black Size Medium.

0 notes

Text

3eme pilier frontalier 2021

Focus sur l'avantage lié au 3e pilier A

À partir de 2021, cela ne sera peut-être pas possible. vous déduirez vos dons au 3e pilier A de votre revenu imposable au-delà de 2021, tant que vous conserverez le statut de quasi-résident. La perte de ce rang entraîne la perte de l'avantage concernant le 3e pilier.

Désormais c'est officiel, il arrivera le 1er janvier 2021 que la loi fédérale (du 16 décembre 2016) héritera de force, sur la révision de la retenue à la source sur les revenus d'une activité lucrative. Cette loi aura des conséquences sur la fiscalité des frontaliers.

L'une des nouvelles majeures sera que certains citoyens ne pourront plus déduire leur 3eme pilier frontalier 2021, tandis que d'autres pourront augmenter leurs déductions maximales du 3e pilier frontière 3A cette année en raison du 3e pilier frontalier B et ainsi de suite. -déclaration fiscale dite «quasi-résidente».

Loi du 1er janvier 2021:

Le 11 avril, le choix a finalement été annoncé: le 3ème pilier frontière ne sera pas exonéré d'impôt à partir du 01.01.2021 (sauf dans certains cas particuliers).

Cela peut paraître un coup dur pour les travailleurs frontaliers, car il est vrai que l'annulation fiscale était un atout supplémentaire pour le 3e pilier frontalier et représentait une véritable économie.

Heureusement, il existe une solution pour les frontaliers qui aimeraient vraiment conserver cet avantage. En effet, ils préféreront prendre le statut de quasi-résident et donc être imposés comme les résidents suisses. Cependant, concentrez-vous sur 2 points: êtes-vous éligible au statut de quasi-résident? est-ce que ce statut est plus avantageux pour vous ou pas?

Déterminons ensemble comment fonctionne le système.

En quoi consiste le statut de quasi-résident?

Le statut de quasi-résident n'est que le fait de créer une déclaration de revenus tout comme celle d'un Suisse. Il permet donc de déduire les coûts particuliers, plutôt que de les retenir, en remplissant une déclaration de revenus. de cette manière, le frontalier quasi-résident peut déduire certaines dépenses, comme les frais de déplacement, les paiements sur les 3ème piliers A et 3ème piliers B, etc. cela se fait souvent par le biais d'une invitation à rectifier la retenue (qui doit être adressée à l'administration fiscale, avant le 31 mars, pour l'exercice précédent).

Dans quelles conditions peut-on bénéficier de ce statut?

Pour être prêt à bénéficier de ce statut, les travailleurs frontaliers doivent avoir

90% de leurs revenus proviennent de Suisse. Ces revenus comprennent:

· Revenu brut du travail:

· salaires, primes / primes, indemnités

· Revenus fonciers et mobiliers:

· valeur brute des immeubles locatifs, intérêts sur les comptes, etc.

· Rentes, pensions, retraite

· Allocations: logement, famille, chômage.

Comment fonctionne le système de prévoyance suisse (pour vous):

Vous venez d'arriver en Suisse et êtes occupé à explorer tout ce qui est nouveau. S'asseoir pour croire que l'épargne-retraite est la chose la moins excitante dans votre esprit.

Chez Expat Savvy, nous vous recommandons vivement de prendre simplement un flash pour vous regarder sur le système de sécurité sociale suisse. il s'appuie sur trois piliers, chaque pilier soutient votre vie à l'âge adulte d'une manière spéciale.

Caisses de pension privées (3e pilier) en Suisse:

Les versements du troisième pilier sont censés couvrir d'éventuelles dépenses supplémentaires pendant la retraite. Bien que volontaire, ce pilier est particulièrement important pour ceux qui n'ont peut-être pas contribué au premier pilier pendant toute leur carrière. Totalisé avec les segment du premier et du deuxième pilier, il devrait couvrir 80% de son dernier salaire avant la retraite.

Le fonds de pension privé autorise les cotisations annuelles à une pension restreinte (3a) ou à une pension flexible (3b). Le 3eme pilier frontalier 2021 principalement destiné à l'épargne-retraite tandis que le pilier 3b peut également être utilisé pour d'autres dépenses.

Il y a des avantages et des inconvénients à ouvrir un pilier 3a avec une banque ou une compagnie d'assurance. De manière générale, nous recommandons de choisir une banque pour les expatriés qui ne prévoient de rester en Suisse que quelques années. Si les taux d'intérêt sont négligeables, il n'y a pas d'engagement.

Pour le pilier 3a, le plafond annuel de cotisation est d'environ 6 826 francs pour ceux qui disposent d'une caisse de retraite professionnelle par l'intermédiaire d'un employeur. et donc les indépendants ont une limite de cotisation annuelle de 34.128 francs. Toutes les cotisations sont souvent déduites des impôts sur le revenu.

Le pilier 3b n'a pas de limite de cotisation annuelle, mais les cotisations ne sont pas déductibles d'impôt. (Seuls les remboursements sont généralement exonérés d'impôt.) Le solde du pilier 3b est imposé en tant qu'actif jusqu'à l'échéance fixée. Les revenus d'intérêts et les revenus de placements sont exonérés d'impôt pendant toute la durée.

En règle générale, le troisième pilier est souvent utilisé cinq ans avant de prolonger l'âge de la retraite. La pension retirée sera alors imposée à un taux réduit par rapport au revenu. Les autres raisons de souscrire une pension sont l'invalidité, le travail indépendant ou l'achat d'une résidence principale. De plus, vous avez droit à un retrait si vous quittez certainement la Suisse.

3e pilier lié 3a: quel est le montant le plus élevé en 2021?

En ce qui concerne le pilier 3a, le montant le plus élevé du paiement relève de la loi fédérale. Atteindre ce montant vous donne droit à la réduction d'impôt la plus élevée pour votre 3a.

Le montant maximum varie en fonction de votre statut.

Statut:

Salarié (soumis au 2e pilier).

Indépendant (non soumis au 2e pilier).

Montant maximum 2020:

6'826 CHF

34'128 CHF

Montant maximum 2021:

6'883 CHF

34'416 CHF

En fonction de votre situation particulière, il sera donc possible d'économiser des lots de plusieurs milliers de francs par an.

Quoi qu'il en soit, les économies d'impôt seront plus importantes qu'en 2019 et 2020 et, au milieu de la crise sanitaire, elles sont toujours en cours.

Comment profiterez-vous des déductions fiscales 3a en 2021?

Pour savoir comment profiter des montants déductibles en 2021, regardez le 3eme pilier frontalier 2021. Vous avez accepté le contrat suivant:

Le choix «Changement de prime automatique» est inclus dans votre contrat.

Dans ce scénario, l'assureur modifiera la police aux derniers montants maximums, comme son nom l'indique.

De votre côté, vous n’avez rien à faire!

Le montant maximum versé est prévu dans votre contrat

Dans ce cas, les montants versés ne sont pas actualisés, ils restent les mêmes que définis dans le contrat.

Même sans option “adaptation automatique des primes” Il est tout de même possible de bénéficier des montants maximums déductibles en 2021 ! Vous pouvez effectuer un déversement exceptionnel avant la date limite pour combler la différence de montant.

3eme pilier frontalier 2021: le troisième pilier ibérique ou le troisième pilier frontière?

Vous souhaitez souscrire à un troisième pilier mais vous ne savez pas lequel souscrire pour économiser le plus d'argent?

Nos conseillers évaluent votre situation particulière et vous donnent les meilleurs conseils pour planifier intelligemment votre avenir!

Modifications du deuxième pilier (prévoyance professionnelle) et donc du troisième pilier:

grâce à une augmentation de la pension de retraite maximale du premier pilier, une légère augmentation des cotisations au régime professionnel obligatoire (deuxième pilier) va être mise en œuvre. La déduction de coordination passera de 24 885 CHF à 25 095 CHF, tandis que le seuil d'entrée passera de 21 330 CHF à 21 510 CHF.

En outre, la réduction d'impôt maximale autorisée dans le pilier 3a est désormais de 6 883 CHF (actuellement 6 826 CHF) pour les personnes qui ont déjà un deuxième pilier et de 34 416 CHF (actuellement 34 128 CHF) pour les personnes sans deuxième pilier. . Ces ajustements prendront également effet au 1er janvier 2021.

COVID-19 Approche flexible suisse:

La pandémie a eu un impact sur les systèmes de sécurité sociale dans le monde entier et a interféré avec la libre circulation des personnes telle que prévue dans les principes de l'UE. afin de s'assurer que la sécurité sociale ne change pas grâce aux restrictions COVID-19, une personne salariée en Suisse doit encore être soumise à la sécurité sociale suisse et à chacune de ses branches (premier pilier, deuxième pilier et affiliation à l'assurance maladie), même si le travailleur est physiquement incapable d'effectuer l'ajout de ce pays.

Le droit commun régissant la coordination de la sécurité sociale entre l'Union de l'écu et donc l'Association professionnelle européenne est le règlement 883 adopté en 2004. Conformément à ce règlement, une personne qui travaille dans deux ou plusieurs États membres sera soumise à la législation du le pays de résidence, si le travailleur travaille à 25% ou plus, dans les 12 mois, dans le pays de résidence. Lors du COVID-19, la règle des 25% de main-d'œuvre anéantie dans le pays de résidence est directement impactée. Cela affecte particulièrement les travailleurs frontaliers travaillant à domicile pendant la pandémie. Par conséquent, les autorités suisses ont conclu des accords avec les pays voisins de l'UE, l'Allemagne, la France, l'Italie, l'Autriche et le Liechtenstein, pour utiliser une application polyvalente des principes de subordination. Cet accord sur l'interprétation flexible de la règle des 25% est valable jusqu'au 30 juin 2021.

Déductions à la source: quelles évolutions pour les frontaliers à partir de 2021?

La retenue à la source peut être une sorte d'impôt prélevé directement sur le salaire de travail des travailleurs étrangers en Suisse qui ne sont pas titulaires d'un permis de séjour (permis C), qui ne sont pas mariés à un ressortissant ou un résident suisse ou qui perçoivent des revenus en Suisse sans un domicile fiscal (par exemple, les frontaliers)

Les salariés détachés en Suisse pour moins de 180 jours (à condition qu'ils satisfassent aux exigences minimales conformes aux accords entre la Suisse et donc le pays de résidence des personnes détachées) ne sont pas non plus déduits de la retenue. il est automatiquement déduit mensuellement du salaire de l'employé, avec des taux qui changent en fonction de la table d'imposition au cours de laquelle il est inclus.

afin d'éliminer les inégalités de traitement entre les personnes assujetties à la retenue à la source et les personnes imposées conformément à la procédure standard, le Conseil fédéral a défini la probabilité d'adapter le modèle fiscal pour tous les salariés en Suisse, quels que soient leurs documents de travail.

Qu'est-ce qui va changer à partir de 2021?

Ce système, standardisé depuis 1995, va être révolutionné à partir du 1er janvier 2021. En tant qu'innovation, la révision introduit l'évaluation ordinaire.

A partir du 1er janvier 2021, tous ceux qui génèrent au minimum 90% de leurs revenus familiaux en Suisse seront éligibles à l'impôt ordinaire. Le but de la réforme est d'éliminer les disparités de traitement entre les personnes soumises à la source et les personnes imposées conformément à la procédure standard. C'est que la possibilité était déjà ouverte depuis quelques temps, en raison d'un choix du tribunal à Lausanne en 2010, mais à partir de 2021, elle sera même inscrite dans la loi. Avant d'aller plus loin dans la question, il est nécessaire de clarifier le terme revenu familial: il comprend la totalité du revenu de l'ensemble des parents, en ajoutant également le revenu de tout conjoint.

le revenu ultérieur est pris en compte le revenu brut d'un emploi rémunéré:

Tous les revenus d'un emploi rémunéré

Compensation pour services extraordinaires

Commissions

Chèques

Récompenses d'ancienneté

Pourboires

Conseils

Tantiemes (jetons de présence)

Services de tous types (voiture de fonction, habitation, assurance, etc.).

Personnes morales ayant leur siège social ou une administration effective en Suisse.

Le législateur stipule que les membres de l'administration ou de la direction de personnes morales domiciliées ou effectivement administrées en Suisse sont également soumis à une retenue, bien que la rémunération pour l'exercice de cette activité revienne à un tiers et indirectement. aux membres de l'administration ou de la direction.

Cette réforme, qui prend en compte les évolutions technologiques récentes dans le domaine du reporting de la paie, aura un impact sérieux sur les salariés en Suisse: la mise en place d'une évaluation rétroactive standard, qu'elle soit obligatoire ou à la demande, doit être mise en place. Communiquées aux travailleurs concernés.

visitez notre site Web ci-dessous: http://myprevoyance.ch/

0 notes

Text

Nerra, Kalareem

“Nerra” by Matt Cavotta, © Wizards of the Coast. Accessed at the Fiend Folio Art Gallery here

[Commissioned by @justicegundam82. The second of three nerra commissions. Sorry about reusing the art. In 3e and 4e, group shots were common when depicting multiple monsters. See the varoot for general information about the nerra]

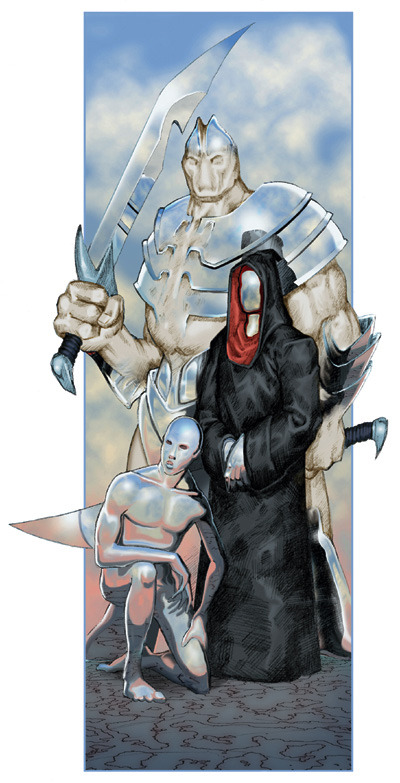

Nerra, Kalareem

This muscular humanoid has mirrored skin and faint facial features. They wear a breastplate polished to a shine and carry two swords.

The kalareem are the soldiers and guards of the nerra. They are taller and more muscular than most other nerra, and traditionally wear silvered breastplates as badges of office. These silver breastplates also serve as emergency escape routes for nerra patrols—a single kalareem will often stay behind in a losing battle, sacrificing its life so that its fellows can escape through its breastplate to another mirrored surface.

Although kalareem are not as clever or beguiling as other nerra, they are still savvy opponents who use layers of disguise to avoid fights or confuse opponents. They can spray mirrored shards from their bodies, slashing at their opponents and causing bleeding cuts. In addition, they can force an opponent that strikes them in melee to suffer the damage they deal to the kalareem.

A kalareem typically advances by class level. They usually take levels in classes that augment their martial abilities, such as fighter, barbarian or ranger. Many kalareem collect weapons, particularly ones that do piercing or slashing damage.

Kalareem CR 3

XP 800

CN Medium humanoid (chaotic, extraplanar, nerra)

Init +3; Senses darkvision 60 ft., Perception +7

Defense

AC 20, touch 12, flat-footed 18 (+2 Dex, +2 natural, +6 armor)

hp 19 (3d10+3)

Fort +2, Ref +5, Will +5

DR 5/bludgeoning; Resist cold 10, electricity 10, fire 10; SR 14

Defensive Abilities reflect damage, reflective spell-resistance; Weakness vulnerable to sonic

Offense

Speed 30 ft., 40 ft. unarmored

Melee longsword +5 (1d8+2/19-20) or longsword +3 (1d8+2/19-20) and short sword +3 (1d6+2/19-20)

Special Attacks shard spray

Spell-like Abilities CL 3rd, concentration +4

3/day—disguise self (DC 12), mirror strike

1/day—mirror image, plane shift (self only, between Shadow Plane and Material Plane only)

Statistics

Str 16, Dex 15, Con 13, Int 10, Wis 14, Cha 13

Base Atk +3; CMB +5; CMD 18

Feats Double Slice, Two-Weapon Fighting

Skills Bluff +7, Disguise +7, Intimidate +7, Perception +7, Sense Motive +7, Stealth +5

Languages Common, Nerra

SQ mirrorwalk 3/day, reflection of man

Ecology

Environment any land or underground (Shadow Plane)

Organization solitary, troop (2-8) or patrol (2-12 plus 2-12 varoot)

Treasure standard (longsword, short sword, masterwork breastplate, other treasure)Special Abilities

Reflect Damage (Su) Once per day as an immediate action, a kalareem can force a creature that just dealt damage to it in melee to make a DC 12 Will save. If the creature fails, it takes an amount of damage equal to what it just dealt to the kalareem. This ability is prevented by protection from chaos or similar effects. The save DC is Charisma based.

Shard Spray (Su) Three times per day as a standard action, a kalareem can create a 15 foot cone of broken glass from its body. All creatures in the area take 3d6 points of slashing damage and 3 bleed. A successful DC 14 Reflex save halves the damage and negates the bleed. The save DC is Constitution based and includes a +2 racial bonus.

55 notes

·

View notes

Note

Hey, sorry to bother you, but I recall you being pretty lore-savvy for Baldurs Gate and the rest of the Forgotten Realms franchises-- Is the forgotten realms wiki a reliable source for lore? If not, are there any sites or books you would recommend for lore? Thank you for your time!

It’s fairly reliable from what I’ve seen, just remember it includes ALL FR lore so if you’re like me and like to pretend the horrid shitstorm that is 4e lore never happened it’s not the place for you. As for books I’d recommend looking into official D&D 3e and 3.5e sourcebook supplements - in addition to the official FR campaign setting, Wizards produced a metric shit-ton of FR sourcebooks during the 3e era, like regional handbooks, races of faerun, I’m p sure there’s one dedicated to FR’s version of the Underdark. I know the 3e campaign setting book has a pretty detailed timeline in it at least until the then-current campaign year of 1372 DR. I believe it cuts off a few months before Evereska gets destroyed by phaerimm? Website-wise, realmshelps.net has some stuff. I’d have to do some research to get more sites, most of the ones I used to use I don’t remember.

If you're looking specifically for baldurs gate lore and shit that happens during that timeline, the baldur's gate wiki is really extensive. Like, even records details on really minor one-off characters extensive.

2 notes

·

View notes

Text

Set Up Your Own Company in Malaysia with 3E Accounting

Do you really want to set up your own business? Meet us at 3E Accounting in Malaysia who offers various business-related services such as company incorporation services, human resource services, corporate secretarial services, and virtual office services, other jurisdiction setup, etc. to the clients at right prices. If you want to open your own business, our professional experts will guide you on starting own business in Malaysia. Our company will help you to register your new firm without the involvement of hidden charges.

Read also: Top 4 Online Home Based Business Ideas for Tech Savvy’s

We will surely support you in all the best possible ways to start your new company in Malaysia

Naturally, incorporation of a company takes a long time to complete the process but we make it absolutely easy and quick for you. We will surely support you in all the best possible ways to start your new company in Malaysia. As per the past company registration experiences of our company, the entire company incorporation process will require around five to seven days to get complete. We can register your company within one working day by getting the incorporation documents signed from shareholders and directors at our office. We not only set up an on-site business in Malaysia but also help you to open your small online business.

Our aim is to offer effective services to the customers across Malaysia to support their businesses

Setting up an online business is no longer a difficult task as we have reached with advanced approaches and techniques like cloud accounting to achieve the dreams of your online business. Do you want to know how to start a small online business? Do not worry. As you will join us, our online business specialist will guide you regarding the main aspects of online business and will provide you with the most advanced methods to apply. We have also got various tools and resources to support your online business setup in Malaysia. Our aim is to offer effective services to the customers across Malaysia which will produce the best results in the end undoubtedly.

Read Also: Learn the Best Online Business Ideas for Beginners from Industry Leaders

We support you with the right solution for your business-related problems

So even if it is about how to start an online business or on-site business, our company will always be ready to make the beneficial services available to the clients whenever required. You are just one call away from our expert team who will support you with the right solution for your business-related problems. We will make sure that we offer you such a brilliant service that you will never get the anywhere else in Malaysia. We are simply different from other companies that we can assure and you will come to know the real fact about us after you join us. So hurry up and make a decision!

0 notes

Text

Final impressions in Style Savvy: Styling Star

1.) it has idols and it’s plot was more or less driven by idols. Therefore my idol-loving trashy self enjoyed it more than I probably should

2.) I would NOT be surprised if Koto (Alina’s CV) is someone from YouTube. Or has a presence on Nico. I mean she can apparently sing in Japanese AND English (the singing voices between the JP songs are too different)

2a.) Also I like how Hotaru’s singer (Hiiragi Yuka) is apparently an utaite. And I swore I listened to her covers before (especially Hokagu Stride) so....this shocked me haha...

3.) this...is probably the most character driven dress up game I’ve witnessed so far. Sure, it probably has its clichès, but it still had a lot of.....character depth? Idk the word for it.

3a.) I mean we got a small town normal klutzy woman going to the big city to audition and become an idol. And her plot involved a best friend and how they...grew closer together after some conflict? Like, the rich girl best friend felt like she isn’t needed to support the idol girl, and the idol girl started to feel like the rich girl got fed up with her being klutzy insecure.

3b.) next we got a heiress who wants to be a singer against her strict mother’s wishes. and she has a dead father apparently. so she lives a double life under the alias Full Moon Lady Moon to achieve her dreams as a singer.

3c.) then we got a anime fan that became an Internet hit via her covers, videos, and streams on.....not!NicoNico Douga (Ik it’s suppose to be YouTube but let’s face it....it’s really unlikely for any of this to happen via YouTube....maybe...). And her equally....geeky friend never figured out that his friend’s the Internet sensation until too late. Which then caused some drama.

3d.) and then there’s the protag herself, who seems quite...sassy and snarky when she wants to be.....or maybe that was a thing in the previous games idk.

3e.) Like. The previous games were more or less about setting up outfits for other people to model and see how “fun” fashion can be. So....idk, I mean the plot is still the same...but we followed 3 different girls become idols and stuff...idk

4.) not gonna lie, I didn’t expect much....when it came to localization....(whoa there elitist). But! The songs weren’t bad! In fact I liked them! Sure, I think Rosie’s singer is the weakest...but that’s only for the pop songs. I thought she sounded nice in the rock songs. I thought this was not a bad localization effort overall!

//lays down

0 notes