#4h supertrend

Text

Supertrend Indicator: How to Use to Trade Binary Options

Supertrend Indicator: How to Use to Trade Binary Options

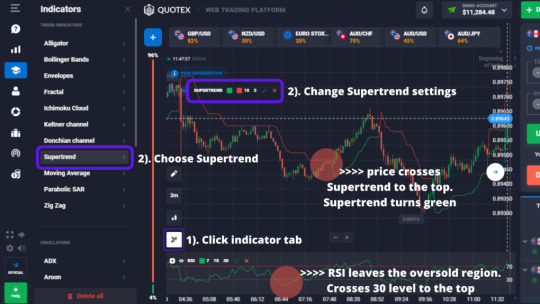

If you are looking for an easy-to-use trend-following indicator with some added features, look no further than SuperTrend. This indicator is plotted on prices and its placement indicates the current trend.

But picking trends isn’t the only use the Supertrend indicator has, you can also use it as either a support or resistance level.

In this post, I will not only teach you how the Supertrend…

View On WordPress

#2 supertrend strategy#3 supertrend combination supertrends 2022 credit suisse#3 supertrend indicator strategy#3 supertrend scanner#3 supertrend strategy afl#3 supertrend strategy tradingview#3x supertrend indicator#4h supertrend#best combination with supertrend indicator#best settings for supertrend indicator#best supertrend indicator#best supertrend settings for nifty#best time frame for supertrend indicator#best way to use supertrend indicator#does supertrend indicator repaint#does supertrend indicator work#does supertrend work#forex supertrend indicator#formula for supertrend indicator#free charts with supertrend indicator#github supertrend python#gold supertrend#how accurate is supertrend#how accurate is supertrend indicator#how does supertrend indicator work#how does supertrend work#how is supertrend calculated#how is supertrend indicator calculated#how is the supertrend indicator calculated#how many super troopers are there

1 note

·

View note

Text

BTC finally hit the projected $45,000 support zone, but analysts have mixed views on whether continuation or consolidation will be the next step.

The euphoric calls for a return of the bull market may have been a bit early especially after Bitcoin (BTC) bulls failed to push the price over the $46,000 level on March 31. Even with the current pullback, analysts continue to expect a lower support retest at the $45,000 level.Data from Cointelegraph Markets Pro and TradingView shows that today's attempt to push the price of BTC above $47,500 was soundly rejected by bears which sent the top cryptocurrency plunging to $45,500.BTC/USDT 1-day chart. Source: TradingViewHere’s a look at what several analysts in the market are saying about the price pullback for BTC and whether or not traders should brace for further losses or prepare for another move higher. This is just a short term correctionNot all traders were caught flat-footed by Thursday's move lower in Bitcoin, including market analyst and pseudonymous Twitter user ‘IncomeSharks’, who posted the following chart prior to the price drop noting that the “4h looks like it wants to correct a bit.”BTC/USDT 4-hour chart. Source: TwitterIncomeSharks said, “This is not me being bearish, I'm just noticing 3 reasons why a little correction makes sense. Supertrend is going flat, we probably will re-test this breakout, and we can bounce at the trend line. Good time for me to take profits.”BTC searches for support between $42,000 and $45,000The next available levels of support to keep an eye on were discussed by market analyst and economist Caleb Franzen, who posted the following chart showing the 21-day, 55-day and 200-day exponential moving averages (EMA) for Bitcoin stating, “Sometimes it's helpful to cut out all the noise, remove price structure analysis, and just look at the exponential moving averages.”BTC/USD 1-day chart. Source: TwitterFranzen said, "All are potential support for Bitcoin, giving us a range of $42,000 - $45,000.”Related: Bitcoin derivatives metrics favor a move to $48K, but only after a lower support retestA necessary period of sideways consolidation A more macro view on what comes next for Bitcoin was provided by analyst and pseudonymous Twitter user ‘BTCFuel’, who posted the following chart comparing the BTC price action in 2012 to its current movement and suggested that “after being up 28% in the last 2 weeks and breaking a major resistance, some sideways consolidation should be good for Bitcoin.”BTC/USD price in 2012 vs. BTC/USD price in 2022. Source: TwitterBTCFuel said, “In the next months, I believe that Bitcoin will move slow and steadily up like in 2012. But altcoins will go nuts.”The overall cryptocurrency market cap now stands at $2.087 trillion and Bitcoin’s dominance rate is 41.6%.The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Go to Source

0 notes

Text

Bitcoin to Retest This Level Before Jumping Towards $12K, Says Analyst

Bitcoin stands stuck between equally adamant buyers and sellers in the past three weeks, with its price going nowhere as a result.

The benchmark cryptocurrency fell towards its monthly support near $11,120 on Wednesday after failing to break above $11,880. Moving forward, a full-fledged bull run seems unlikely as long as Bitcoin test key levels to the downside, says an analyst.

The pseudonymous daytrader noted Bitcoin in a consolidation cycle, stating that a breakdown towards $10,600/$10,700 level might bring back the buying interest in the market.

“For now, BTC looks like it wants to test SuperTrend support (and re-test the breakout),” he said. “So for me, I’m thinking $10,600/$10,700 range bounce. Then comes the fun after people flip bear.”

The analyst attached a chart to illustrate his upside targets. It showed that the Bitcoin price expects to make a sharp reversal towards $12,000 and levels above it.

Bitcoin expects to rebound sharply towards $12K following an old support-retest. Source: TradingView.com, IncomeSharks

A Fundamental Bounce

The cryptocurrency is on a corrective downside trend after topping near $12,500 earlier this August. Analysts continue to see the move as a short-term bearish trend, given the market’s core long-term trend, which points to higher valuations due to fears of rising inflation among traders and investors alike.

The biggest example is US Real Yields. The Treasury Inflation-Protected Securities (Tips), which provide investors protection against inflation, saw an increase in bids for its 10-year contract. The yield on the inflation-protected investment slipped towards minus 1 percent in recent days.

US 10-year Tips yield is below zero. Source: FRED

Analysts are also long-term bullish on Bitcoin because of its recently-developed negative correlation with the US dollar. The cryptocurrency rose higher by more than 200 percent from its March nadir just as the greenback fell to its 27-month low from its yearly top.

As a result, many firms and individual investors lately decided to allocate a substantial part of their cash reserves to Bitcoin.

Public-traded firm MicroStrategy purchased $250 million worth of cryptocurrency units as a hedge against a weaker US dollar. Even a Canada-based graphic firm, Snappa, converted its cash deposits into Bitcoin after earning lesser yields from their local banks.

Billionaire investor Paul Tudor Jones also allocated 1-3 percent of his $22 billion-portfolio to Bitcoin futures, calling the cryptocurrency the “fastest horse” against inflation.

Bitcoin OBV Bearish

The analyst who expected Bitcoin to bounce from $10,600-$10,700 range, meanwhile, stressed on the technical aspects. In a separate chart, he pointed out the cryptocurrency’s On Balance Volume, or OBV, which uses volume and price to measure buying pressure and selling pressure.

Bitcoin OBV hints at a higher selling pressure. Source: TradingView.com, IncomeShark

“OBV on the 4h is still showing we have more room to drop. Sellers are still selling more than buyers. We haven’t had a shift in pressure yet. Looking for a sharp V reversal. Most likely would happen lower in this “Buy Zone”.

Bitcoin was trading 1.03 percent lower at $11,346 at the time of this publication.

from Cryptocracken Tumblr https://ift.tt/3aYhoPV

via IFTTT

0 notes