#best way to use supertrend indicator

Text

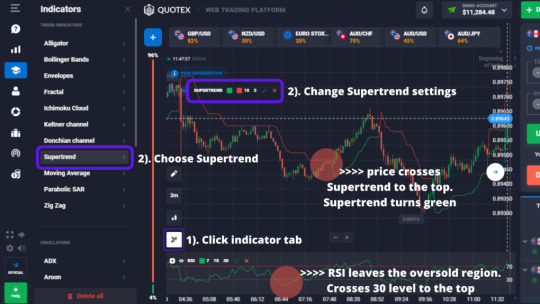

Supertrend Indicator: How to Use to Trade Binary Options

Supertrend Indicator: How to Use to Trade Binary Options

If you are looking for an easy-to-use trend-following indicator with some added features, look no further than SuperTrend. This indicator is plotted on prices and its placement indicates the current trend.

But picking trends isn’t the only use the Supertrend indicator has, you can also use it as either a support or resistance level.

In this post, I will not only teach you how the Supertrend…

View On WordPress

#2 supertrend strategy#3 supertrend combination supertrends 2022 credit suisse#3 supertrend indicator strategy#3 supertrend scanner#3 supertrend strategy afl#3 supertrend strategy tradingview#3x supertrend indicator#4h supertrend#best combination with supertrend indicator#best settings for supertrend indicator#best supertrend indicator#best supertrend settings for nifty#best time frame for supertrend indicator#best way to use supertrend indicator#does supertrend indicator repaint#does supertrend indicator work#does supertrend work#forex supertrend indicator#formula for supertrend indicator#free charts with supertrend indicator#github supertrend python#gold supertrend#how accurate is supertrend#how accurate is supertrend indicator#how does supertrend indicator work#how does supertrend work#how is supertrend calculated#how is supertrend indicator calculated#how is the supertrend indicator calculated#how many super troopers are there

1 note

·

View note

Text

Miyagi 10in1 Alerts & Backtest

Unlock Your Trading Potential with Miyagi: Where Mastery Meets Profitability.

Miyagi indicators combine multiple trigger conditions and place them in one toolbox for traders to easily use, produce alerts, backtest, reduce risk and increase profitability.

Take your trading to the next level with Miyagi Indicators!

Miyagi (10-in-1) + Alerts combines multiple trigger conditions in an easy to use format.

Each trigger or filtering condition is selectable and able to be combined using the selector checkboxes.

The following trigger and filter conditions are present in the 10-in-1:

EMA: Takes two “Exponential Moving Averages” into effect for filtering with user selectable chart timeframe, length and sources.

EMA Trend Type is user selectable for Trend-following or Counter-trend which allows you to counter-trade the markets.

Beside the “Simple Moving Average” the EMA has a multiplier.

Calculation is SMAxMultipier / SMAxMultiplier of the previous candle.

MACD: Takes the “Moving Average Convergence Divergence” into effect for trigger condition or filtering with user selectable chart timeframe,

source, fast & slow length and signal smoothing. MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a price.

The MACD is calculated by subtracting the EMA 26 period from the EMA 12. Long alert is triggered on crossing the MACD zero line upwards and short alert vise versa.

RSI: Takes the “Relative Stregth Index” into effect for trigger condition or filtering with user selectable chart timeframe, length, source, and oversold and overbought values.

The RSI is a technical oscillator that uses price and volume data for identifying overbought or oversold signals in an asset.

It can also be used to spot divergences which warn of a trend change in price. This oscillator moves between 0 and 100.

RSI > 80 is considered overbought and an RSI < 20 is considered oversold.

Stochastic RSI: oscillator version of RSI .

Takes the stochRSI into effect for trigger condition or filtering with user selectable chart timeframe, K D, length, upper and lower length.

stochRSI = (actual RSI – lowest RSI ) / (highest RSI – lowest RSI )

VWAP: Takes the “Volume Weighted Average Price” into effect for trigger condition with user selectable chart timeframe, period, and VWAP lower line (long),

or VWAP Upper line (Short) values. VWAP is calculated by totaling the money traded for every transaction (price x volume ) and then dividing by the total shares traded.

The VWAP appears as a single line on charts. It looks similar to a moving average line, but smoother. In general it is a intraday/week anchored indicator that resets,

but we are using a steady version over a selectable period of candles.

TTM: Takes the TTM squeeze indicator into effect for trigger condition with user selectable chart timeframe, length, multiplier, smoothing and trend direction.

The TTM is used to identify when to enter or exit a market for the best chance of profitability. It squeezes pairs well with other indicators, such as the ADX indicator.

For Multiplicator you can use Keltner and Boilinger Bands.

ADX: Takes the “Average Directional Movement Index” into effect for trigger condition with user selectable chart timeframe, smoothing, DI-length, a long and a short setting.

The ADX is used to detect trend direction with a positive and a negative direction indicator ( +DI & -DI ). The factor of those is a value between 0 and 100.

A low value can be a week trend or consolidation. A value > 25 is considered as a positive trend, >50 is a strong long trend >75 extremely strong trend.

Beside timeframe, you can choose smoothing and DI length.

SuperTrend: Takes the SuperTrend into effect for filtering with user selectable chart timeframe, ATR length and factor.

As an alternative to moving averages you can keep a fix distance to determine long or short trend.

That way you can avoid a lot of switching during a consolidation phase. Once crossed it switches trend direction.

The “Average True Rage” is used for calculation of the SuperTrend distance, it measures the volatility of the coin.

MFI: Takes the “Money Flow Index” into effect for filtering with user selectable chart timeframe, length, source, long and short settings.

The MFI is a technical oscillator that uses price and volume data for identifying overbought or oversold signals in an asset.

It can also be used to spot divergences which warn of a trend change in price. Like RSI this oscillator moves between 0 and 100.

MFI > 80 is considered overbought and an MFI < 20 is considered oversold.

ATR: Takes the “Average True Range” into effect for trigger condition with user selectable chart timeframe, length, channel length, style and multiplier.

ATR can be considered a great alternative to VWAP.

PSAR & Supertrend Oscillator

Miyagi indicators improve profitability and reduce risk. Take your trading to the next level with Miyagi Indicators.

To view mor e about Miyagi 10in 1 Alerts & Backtest visit below link:

https://miyagitrading.com/shop/miyagi-10in1/

0 notes

Text

SuperTrend Indicator - 2020 Guide - MultiCharts & TradeStation Download

Are you searching for SuperTrend Indicator? This post if for you!The Supertrend Indicator (ST), developed by Olivier Seban, was born as a tool to optimize the exit from trade, which is a trailing stop.Today is one of the most used tools by traders.In this tutorial, we will explain what it is, how it is used, and how to calculate it. You can also download SuperTrend free versions for TradeStation, MultiCharts, MetaTrader. What exactly are you looking for?Click to scroll down

Table Of Index

What is SuperTrend Indicator?

How do you use the ST Indicator?

How is SuperTrend calculated?

Download SuperTrend indicator for Free

What is SuperTrend Indicator?

The ST Indicator ST belongs to the category of follower trend indicators. These types of indicators signal the direction of the trend and highlight the continuation or changes of direction.This indicator works well in a trending market.And very similar in his conception to Wilder’s Parabolic SAR. However, the Supertrend has the merit of positioning itself horizontally, in a sort of stand by, in moments of price laterality, avoiding getting us out of position before time.We must always remember that all trend-follower indicators have a common flaw: they warn of the change of trend AFTER the change has taken place, not PRIMA.They are all indicators that update with an inevitable delay; they are not anticipators of the trend.Let’s see the two indicators in comparison: the SuperTrend is represented with the solid line, while the Parabolic SAR with the classic green dots (up) and red dots (down)

It is immediately noticeable that the continuous color change of the Parabolic SAR gives rise to many more false signals than the SuperTrendHowever, the ST has two enormous merits:1) It is straightforward to use because the identification of the trend takes into account the average volatility of the asset.2) It can be used with any timeframe and all financial instruments (shares, indexes, forex).Others do not do so and, therefore, often force them to leave the market too early.On the other hand, the SuperTrend filters many false signals, and this allows us to keep the position open for longer and increase the average profit.

A trend follower strategy to be successful must remain on the market as long as possible.The longer you stay on the market, the more trends you can take advantage of.At the same time, it also needs to come out quickly if the trade is going the wrong way.

How do you use the ST Indicator?

From a graphical point of view, the Super Trend appears as a red or green line that accompanies price trends.The red line identifies periods characterized by a negative trend, while the green line indicates market periods with a positive trend.When the line is below the graph, the trend will be upward, and it will, therefore, be preferable to open long positions.When the indicator line is above the graph, the trend will be downward, and it will, therefore, be preferable to open short positions;There are 3 different ways you can use this indicator:Filter OperationsThe ST show us the current trend, remember that we do not want to go against the primary uptrend or downtrend.So if the underlying trend is upward, we will only do long trades, if downward only short trades.In this way, we filter several false “counter-trend” buy signal or sell signal.The reversal of a trend occurs when prices cross the indicator line positioned at a given level from one side to the other.This level is defined as a roof or floor, depending on whether it is above or below the price scale.

We need it as a trailing stop.The ST can be used to manage the exit from another trading strategy.This indicator will keep us in the extended position until the indicator remains green or short until the indicator remains red.We'll get out as soon as the color changes.SuperTrend Trading StrategyWe could use a Supertrend Trading Strategy to find buy or sell signal.We open a long position at the change of color from red to green (buy signal is generated).Vice-Versa we can opening a short trade when green become red (sell signal is generated).Positions will close the next time the indicator changes color.Theoretically, we can always stay in the market – stop & reverse strategy – moving from long to short all the time.

With this technique, there will be no shortage of false signals, especially in phases of prolonged laterality.It will, therefore, be of fundamental importance to close the position in stop-loss if the market does not go in the desired direction.We prefer to suggest that you do not use it alone but integrate it into your trading systems with the use of other tools.Even if the ST is a very valid indicator, it is better to use it in combination with at least one other.We can use it together with the CCI, Momentum, ADX, RSI. Two SuperTrend Indicators - The Double StrategyThere is also the possibility to take advantage of ST not in combination with another technical indicator, but by combining two ST indicators.We can then apply the same indicator to the graph but with two different settings, one fast and one slow.In this case, when the fast curve crosses from bottom to top the slow curve, we have a long signal.When the fast curve returns below the slow curve, it is time to close the operation. We practically expect both curves to have the same color.

Which Timeframe to use for SuperTrend IndicatorAt first, we said that the SuperTrend has the advantage of being able to be used in every timeframe.In general, however, on intraday trading timeframes it loses its effectiveness, there is no single rule, it is advisable to make a few attempts on the financial instrument we intend to trade.Although it should always be remembered that the real trend exists only on long time frames, so from the daily up.

SuperTrend Indicator MultiTimeFrameAlways to limit false signals, we have built a SuperTrend Multi Time Frame indicator.You can find the article and indicator to download for free at this link.

How is ST Indicator calculated?

The ST is calculated based on a coefficient that is applied to the average volatility of the period considered.The Super Trend indicator is calculated using the Average True Range (ATR).The Average True Range is an indicator that calculates the average range of the last X seats and measures volatility.Once volatility is identified, the Super Trend is calculated by applying to the latter a volatility multiplier and a coefficient relative to the observation period over which volatility is calculated.It must always be borne in mind that the higher the weight of volatility, the wider the range of tolerance before a reversal of trend occurs.The SuperTrend Indicator Formula:Upper=(high+low)2+ (Multiplier∗ATR)Lower=(high+low)2− (Multiplier∗ATR)

Download Super Trend Indicator for Free

This is our custom Super Trend indicator coded in EasyLanguage for TradeStation and MultiCharts. You can download it for free.Download SuperTrend MultiCharts Indicator for FreeDownload SuperTrend TradeStation Indicator for Free

Conclusions

Is the ST Indicator a great indicator?The ST is, indeed, a great indicator.However, we always remember that when long sides are formed, the Supertrend generates many false signals, but it is still the biggest flaw of all the trending indicator.

Q&A

Can I use the ST for intraday trading?

It is certainly possible to use it but we do not like it as a trading system because in the market the ongoing trend exists are on high timeframes. A correct ST trading strategy should be based on daily timeframes or higher.Is it the best trending indicator?

For us it is the best trending indicator. The Super Trend Indicator is the one that provides fewer false signals, compared to parabolic sar for example Editors' Recommendations:SuperTrend Multi Time Frame IndicatorHow to AutoTrade DivergencesSuperTrend for TradeStation and MultiChartsHOW TO USE THE MOVING AVERAGES TO IDENTIFY THE TRENDCMO Indicator | Chande Momentum Oscillator | TutorialEasyLanguage TutorialFree EasyLanguage IndicatorEasyLanguage & PowerLanguage Tutorial - Time and DateIchimoku Indicator | Ichimoku Kinko Hyo | TutorialHow to read a Price Chart - Bar Chart - CandleStick - Kagi - Heikin AshiMoving Average: All about Moving Averages || 2020 TutorialThe Vortex Indicator || TutorialHow to Use the TradeStation Backtest to Analyze an InstrumentGraphic Technical Analysis - How to read a stock market chartsTutorial - Using EasyLanguage to Export Data From TradeStation to ExcelWhat is the Dow Theory in technical analysisYou can learn more about this indicator, reading these resources:Wikipedia

Please insert your name and your email address. We will send you the Indicator for free !!!

Your Information is safe with us. We respect your privacy! We will never share your data with anyone else who might.

Please check your Junk E-mail folder

Free Indicator for Multicharts

Free Indicator for TradeStation

Do you want to learn EasyLanguage & PowerLanguage for TradeStation and MultiCharts? Start here:EasyLanguage & PowerLanguage Master Tutorial A lot of free Indicators in EasyLanguage & PowerLanguage for TradeStation and MultiCharts: TradeStation and MultiCharts Indicators

Are you looking for a NinjaTrader SuperTrend? You can find it in the NinjaTrader Forum.

Read the full article

0 notes

Text

The Best Forex Indicator Money Can Buy!

"Finding the Best Forex Indicator is a Journey more than a Destination"

Ever wonder why so many forex traders claim to have found the best forex indicator? I mean, it must be the best right? They claim they are making money from using it and it's probably true. Maybe true for them.

If you loved this short article and you would like to acquire far more data relating to ninjatrader supertrend indicator kindly stop by our own website.

But, as soon as someone else tries to put the indicator to work, it fails miserably. WHY?

95% of all Forex traders have wasted a lot of time and money trying out and experimenting with what other traders consider the best Forex indicator. Most go about the journey in the wrong way. The key to finding the best Indicator is not about how you can use the indicator to help you predict the market and enhance your system, but to find an indicator that you can use to change and enhance yourself as a trader". No matter what you trade. What traders are really looking for is "The Best Forex Shortcut". You could be running around in constant frustration missing out on big profits if you don't figure this out.

There is no one best Forex indicator that works all the time. Even though some traders might say that their indicator works on all time frames and on all markets. The best Forex Indicator is the one that identifies with you the most. I've tried almost every major indicator out there. No matter what anyone says to you, all indicators are based on events that have already happened in the market. If there was one that could predict the future events of the market, everybody would use it and there would be no market. What they're really trying to say is that the best indicator that they have chosen is the one that that believe the most.

We Trade Our Beliefs

The best Forex indicator is the one that we believe in the most. Therefore, we trade our perceptions of the market and of what that particular indicator is going to do. We base our decision on how it's going to act and react under certain conditions and repeated events in the market that we have observed every day.

Let me share with you what I mean. I'll also share what my Best Forex Indicator is or should I say "the indicator that I believe in the most". The indicator that I connected with the most after searching hi and lo all over the Internet is The CCI or the Commodity Channel Index and the Bollinger Bands. I studied these indicators for hundreds and hundreds of hours in all market conditions. I got to know them very personally and intimately. They helped me so much that I began to anticipate what they would do before it even happened. No, I'm not saying that I am psychic, but got to know them so well because I stared at them for so long that it was like second nature to me.

They became part of me or maybe I became part of them. I know this sound corny, but ask any trader and they'll tell you the same thing. Once you become part of your indicator you start to change as a forex trader. You change in such a way that not only your confidence starts to soar but you begin to experience what I call "The Forex Knowing". You're not naive enough to know that it's not always going to workout, no plan or indicator is 100% successful. You develop a "knowing" inside of you that you can depend on, you do not second guess, one that you can put your life on the line for. Once you've reached this "knowing" you just know there's no turning back and your journey to finding the best indicator is complete

0 notes

Text

Rumored Buzz on Moving Average Mt4 Uncovered

Top Choices of Moving Average Mt4

The differences between both are usually subtle, but the selection of the moving average can create a significant impact on your trading. The historical differences between both averages may wind up created a highly effective displaced moving average mt4 indicator. Moving averages might also be applied to indicators. They are, like the name suggests, an average of previous prices. They have different meanings for different markets because not all markets are the same. It is possible to observe that moving averages are a multi-faceted tool that could be utilized in a range of distinct ways. Additionally, the Ultimate Moving Average now contains a new variant of the SuperTrend Moving Average.

Mechanical trading systems are a really good means to commence gaining discipline by means of your trading style together with taking a good deal of guesswork out of your trades. Afterwards you are going to be able to attack the platform with confidence and capacity to begin successfully trading using MT4. Trading platforms are mediums whereby trade executions are performed. By taking the aid of the forex broker you can readily download Meta trader 4 trading platform at absolutely free of charge.

Details of Moving Average Mt4

In the same way as any other trend indicator moving averages increase the true chart. The very first indicator is known as the Non-Lagging Adaptive Moving Average. As soon as you have placed your very first indicator on the chart, you then wish to drag and drop the second indicator from the Navigator window directly in addition to the first (remember you may only combine indicators within the exact area of the chart). Indicators may also become pieces of an Expert Advisor. Within MT4 there are lots of built-in indicators but users may also install customized indicators. There’s no magical indicator that will cause you to get rich. There are lots of indicators on the industry, free and paid, and you have to decide on the one which suits you most.

Traders love moving averages due to the fact that they have a tremendous visual effect on the condition of the marketplace. Many traders watch their charts on another time, to confirm the trend. Many traders look at the same currency pair to find out what the other will do. Traders from all over the world make many thousands of dollars daily.

From my private view, MT4 trading is a great start if you would like to get into trading marketplace. For example, a perfect trader has to be much disciplined in executing preferred trades. Trading on the everyday charts is a far easier strategy in comparison with trading intraday. Today, individuals look excited to be the section of the Forex trading. Forex trading was made easier by the progress in technology. Forex trading for beginners can be an intimidating task. There are some who may not be best placed to work with forex dealing as a form of investment because of the risks involved.

If you can merely stick to the trends you’re able to make it like a prosperous trader. The currency market is among the largest in the Earth, with a turnover of more than a trillion dollars each day. The Foreign Exchange Market is an incredibly dynamic spot.

from CFD Trading Online http://www.cfdtradingonline.co.uk/rumored-buzz-on-moving-average-mt4-uncovered/

0 notes

Text

SuperTrend Indicator Forex Trading Strategy

Trading with the trend is probably one of the easiest ways to make money out of forex trading. Trading with the trend means trading with less resistance as it implies trading in the direction of the flow of the market. The question is how we identify trend direction accurately.

Here we will be discussing about a strategy that makes use of an indicator that is very effective in identifying trend direction.

SuperTrend Indicator

The SuperTrend indicator is a custom technical indicator which was developed to help traders identify the direction of the forex pair’s trend. With this in mind, the SuperTrend indicator can be best described as a trend following technical indicator.

The SuperTrend indicator is computed based on the Average True Range (ATR). The ATR is a main underlying factor how the SuperTrend indicator identifies trend direction.

One of the more popular ways traders identify trend direction is by observing for reversals that move a certain distance against the current trend direction. For example, a trader may hypothesize that a trend has reversed if price action goes against the current trend by more than 3x the current ATR. If price does reverse by more than 3x the ATR, the market is considered to be reversing. The same concept is adhered upon by the SuperTrend indicator.

The SuperTrend indicator plots a line on the price chart to indicate the direction of the trend. A lime line plotted below price action indicates a bullish trend, while a red line plotted above price action indicates a bearish trend.

The distance of the line can also be adjusted based on the multiplier.

Trend reversals are indicated by the SuperTrend indicator based on the shifting of the line and the changing of its color. Traders may use this as a trend reversal entry signal.

The SuperTrend line can also be used as a basis for setting up a trailing Stop Loss.

Average True Range

The Average True Range (ATR) is a basic volatility indicator which helps traders objectively identify the strength of a currency pair’s volatility.

The ATR simply averages identifies the movement range of each price candle based on pips. It then averages out the pip range of each candle within the specified period.

The result can be used to assess the volatility of the market at any given time.

The Trading Strategy

This trading strategy is a simple trend reversal strategy based on the signals provided by the SuperTrend indicator. However, instead of taking every signal that is produced by the indicator, trade setups are filtered based on a long-term trend.

The long-term trend is identified using the 200-period Simple Moving Average (SMA). Long-term trend direction is based on the general location of price action in relation to the 200 SMA line, as well as the slope of the 200 SMA line. Trades are taken only in the direction of the trend.

The entry signals are based on the shifting of the SuperTrend line as well as the changing of its color. Trend reversal signals that adhere to the direction of the long-term trend are considered valid.

The ATR is then used as a basis for the stop loss as the SuperTrend line is also based on the ATR.

Indicators:

200 SMA

SuperTrend

Average True Range

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

Entry

Price action should be above the 200 SMA line.

The 200 SMA line should slope up.

The SuperTrend line should change to lime and should shift below price action.

Enter a buy order on the confirmation of these conditions.

Stop Loss

Set the stop loss at 3x the ATR.

Exit

Close the trade as soon as price closes below the SuperTrend line.

Sell Trade Setup

Entry

Price action should be below the 200 SMA line.

The 200 SMA line should slope down.

The SuperTrend line should change to red and should shift above price action.

Enter a sell order on the confirmation of these conditions.

Stop Loss

Set the stop loss at 3x the ATR.

Exit

Close the trade as soon as price closes above the SuperTrend line.

Conclusion

This trading strategy is a basic trend reversal strategy which is based on the SuperTrend indicator. In fact, there are many traders who trade solely based on the SuperTrend indicator.

This strategy however attempts to improve on the already effective SuperTrend indicator by aligning trade setups with the long-term trend and filtering out trades that do not adhere with the long-term trend. This significantly increases the likelihood of a successful trade setup as price usually tends to move in the direction of the long-term trend.

Forex Trading Systems Installation Instructions

SuperTrend Indicator Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex system is to transform the accumulated history data and trading signals.

SuperTrend Indicator Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this system accordingly.

youtube

Forex Metatrader 4 Trading Platform

Free $30 To Start Trading Instantly

No Deposit Required

Automatically Credited To Your Account

No Hidden Terms

How to install SuperTrend Indicator Forex Trading Strategy?

Download SuperTrend Indicator Forex Trading Strategy.zip

Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

Copy tpl file (Template) to your Metatrader Directory / templates /

Start or restart your Metatrader Client

Select Chart and Timeframe where you want to test your forex system

Right click on your trading chart and hover on “Template”

Move right to select SuperTrend Indicator Forex Trading Strategy

You will see SuperTrend Indicator Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download:

Save

Save

SuperTrend Indicator Forex Trading Strategy

La entrada SuperTrend Indicator Forex Trading Strategy se publicó primero en Forex MT4 Indicators.

SuperTrend Indicator Forex Trading Strategy published first on https://alphaex-capital.blogspot.com/

0 notes

Text

SuperTrend Indicator Forex Trading Strategy

Trading with the trend is probably one of the easiest ways to make money out of forex trading. Trading with the trend means trading with less resistance as it implies trading in the direction of the flow of the market. The question is how we identify trend direction accurately.

Here we will be discussing about a strategy that makes use of an indicator that is very effective in identifying trend direction.

SuperTrend Indicator

The SuperTrend indicator is a custom technical indicator which was developed to help traders identify the direction of the forex pair’s trend. With this in mind, the SuperTrend indicator can be best described as a trend following technical indicator.

The SuperTrend indicator is computed based on the Average True Range (ATR). The ATR is a main underlying factor how the SuperTrend indicator identifies trend direction.

One of the more popular ways traders identify trend direction is by observing for reversals that move a certain distance against the current trend direction. For example, a trader may hypothesize that a trend has reversed if price action goes against the current trend by more than 3x the current ATR. If price does reverse by more than 3x the ATR, the market is considered to be reversing. The same concept is adhered upon by the SuperTrend indicator.

The SuperTrend indicator plots a line on the price chart to indicate the direction of the trend. A lime line plotted below price action indicates a bullish trend, while a red line plotted above price action indicates a bearish trend.

The distance of the line can also be adjusted based on the multiplier.

Trend reversals are indicated by the SuperTrend indicator based on the shifting of the line and the changing of its color. Traders may use this as a trend reversal entry signal.

The SuperTrend line can also be used as a basis for setting up a trailing Stop Loss.

Average True Range

The Average True Range (ATR) is a basic volatility indicator which helps traders objectively identify the strength of a currency pair’s volatility.

The ATR simply averages identifies the movement range of each price candle based on pips. It then averages out the pip range of each candle within the specified period.

The result can be used to assess the volatility of the market at any given time.

The Trading Strategy

This trading strategy is a simple trend reversal strategy based on the signals provided by the SuperTrend indicator. However, instead of taking every signal that is produced by the indicator, trade setups are filtered based on a long-term trend.

The long-term trend is identified using the 200-period Simple Moving Average (SMA). Long-term trend direction is based on the general location of price action in relation to the 200 SMA line, as well as the slope of the 200 SMA line. Trades are taken only in the direction of the trend.

The entry signals are based on the shifting of the SuperTrend line as well as the changing of its color. Trend reversal signals that adhere to the direction of the long-term trend are considered valid.

The ATR is then used as a basis for the stop loss as the SuperTrend line is also based on the ATR.

Indicators:

200 SMA

SuperTrend

Average True Range

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

Entry

Price action should be above the 200 SMA line.

The 200 SMA line should slope up.

The SuperTrend line should change to lime and should shift below price action.

Enter a buy order on the confirmation of these conditions.

Stop Loss

Set the stop loss at 3x the ATR.

Exit

Close the trade as soon as price closes below the SuperTrend line.

Sell Trade Setup

Entry

Price action should be below the 200 SMA line.

The 200 SMA line should slope down.

The SuperTrend line should change to red and should shift above price action.

Enter a sell order on the confirmation of these conditions.

Stop Loss

Set the stop loss at 3x the ATR.

Exit

Close the trade as soon as price closes above the SuperTrend line.

Conclusion

This trading strategy is a basic trend reversal strategy which is based on the SuperTrend indicator. In fact, there are many traders who trade solely based on the SuperTrend indicator.

This strategy however attempts to improve on the already effective SuperTrend indicator by aligning trade setups with the long-term trend and filtering out trades that do not adhere with the long-term trend. This significantly increases the likelihood of a successful trade setup as price usually tends to move in the direction of the long-term trend.

Forex Trading Systems Installation Instructions

SuperTrend Indicator Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex system is to transform the accumulated history data and trading signals.

SuperTrend Indicator Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this system accordingly.

youtube

Forex Metatrader 4 Trading Platform

Free $30 To Start Trading Instantly

No Deposit Required

Automatically Credited To Your Account

No Hidden Terms

How to install SuperTrend Indicator Forex Trading Strategy?

Download SuperTrend Indicator Forex Trading Strategy.zip

Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

Copy tpl file (Template) to your Metatrader Directory / templates /

Start or restart your Metatrader Client

Select Chart and Timeframe where you want to test your forex system

Right click on your trading chart and hover on “Template”

Move right to select SuperTrend Indicator Forex Trading Strategy

You will see SuperTrend Indicator Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download:

Save

Save

SuperTrend Indicator Forex Trading Strategy

La entrada SuperTrend Indicator Forex Trading Strategy se publicó primero en Forex MT4 Indicators.

SuperTrend Indicator Forex Trading Strategy published first on https://alphaex-capital.blogspot.com/

0 notes