#API Testing Market Forecast

Explore tagged Tumblr posts

Text

API Testing Market Projected to Show Strong Growth

Global API Testing Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player’s market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions to improved profitability. In addition, the study helps venture or private players in understanding the companies in more detail to make better informed decisions. Major Players in This Report Include, Astegic (United States), Axway (United States), Bleum (China), CA Technologies (United States), Cigniti Technologies (India), Cygnet Infotech (India), IBM (United States), Inflectra Corporation (United States), Infosys (India), Load Impact (Sweden). Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/114161-global-api-testing-market API testing is a type of software testing that involves testing of a set of application programming interfaces (APIs) directly and as part of integration testing to determine if they meet expectations for functionality, performance, reliability, and security. It is a formal specification that acts as a guaranteed contract between two separate pieces of software. The automation for API testing requires less code so it can provide faster and better test coverage. It helps the companies to reduce the risks. Market Drivers

Rise In the Cloud Applications and Interconnect Platforms

Increasing Adoption of API Testing

Market Trend

Data Regulations and Policies

Opportunities

Increasing Requirements of Modern Testing Methods

Advancements in the Testing Technologies

Challenges

Lack of Awareness among the People

Enquire for customization in Report @: https://www.advancemarketanalytics.com/enquiry-before-buy/114161-global-api-testing-market In this research study, the prime factors that are impelling the growth of the Global API Testing market report have been studied thoroughly in a bid to estimate the overall value and the size of this market by the end of the forecast period. The impact of the driving forces, limitations, challenges, and opportunities has been examined extensively. The key trends that manage the interest of the customers have also been interpreted accurately for the benefit of the readers. The API Testing market study is being classified by Type (Automated Testing {Functionality Testing, Reliability Testing, Load Testing, Security Testing, Creativity Testing, Proficiency Testing and Others}, Manual Testing {Exploratory Testing, Usability Testing and Ad-hoc Testing}), Application (IT and Telecommunication, Banking, Financial Services, and Insurance, Retail and Ecommerce, Media and Entertainment, Healthcare, Manufacturing, Government, Others), Deployment (Cloud-Based, On-Premises) The report concludes with in-depth details on the business operations and financial structure of leading vendors in the Global API Testing market report, Overview of Key trends in the past and present are in reports that are reported to be beneficial for companies looking for venture businesses in this market. Information about the various marketing channels and well-known distributors in this market was also provided here. This study serves as a rich guide for established players and new players in this market. Get Reasonable Discount on This Premium Report @ https://www.advancemarketanalytics.com/request-discount/114161-global-api-testing-market Extracts from Table of Contents API Testing Market Research Report Chapter 1 API Testing Market Overview Chapter 2 Global Economic Impact on Industry Chapter 3 Global Market Competition by Manufacturers Chapter 4 Global Revenue (Value, Volume*) by Region Chapter 5 Global Supplies (Production), Consumption, Export, Import by Regions Chapter 6 Global Revenue (Value, Volume*), Price* Trend by Type Chapter 7 Global Market Analysis by Application ………………….continued This report also analyzes the regulatory framework of the Global Markets API Testing Market Report to inform stakeholders about the various norms, regulations, this can have an impact. It also collects in-depth information from the detailed primary and secondary research techniques analyzed using the most efficient analysis tools. Based on the statistics gained from this systematic study, market research provides estimates for market participants and readers. Contact US : Craig Francis (PR & Marketing Manager) AMA Research & Media LLP Unit No. 429, Parsonage Road Edison, NJ New Jersey USA – 08837 Phone: +1 201 565 3262, +44 161 818 8166 [email protected]

#Global API Testing Market#API Testing Market Demand#API Testing Market Trends#API Testing Market Analysis#API Testing Market Growth#API Testing Market Share#API Testing Market Forecast#API Testing Market Challenges

0 notes

Text

How Can Companies Optimize ROI by Converting Android Apps to iOS (or Vice Versa)?

Optimize ROI by Converting Android Apps to iOS

Introduction

In today’s mobile-first landscape, companies aiming to maximize their mobile app ROI must consider platform expansion. With Android dominating in user volume and iOS leading in revenue generation, converting your app from Android to iOS (or vice versa) can be a strategic move to reach a broader audience and boost profitability. This blog explores how app conversion can be a growth catalyst, helping businesses lower acquisition costs and increase user engagement across platforms.

Understanding Android to iOS App Conversion (or Vice Versa)

App conversion refers to the process of adapting an existing mobile application to operate on a different platform. Whether moving from Android to iOS or the reverse, this process involves more than just copying code. It includes reworking the UI/UX, adapting to platform-specific APIs, and ensuring functional parity across devices. Successful app conversion demands expertise in both Android and iOS app development to maintain performance and user satisfaction.

Top Reasons to Convert Android Apps to iOS (or Vice Versa)

Reach a wider audience: Tap into new user segments by expanding your presence to another platform.

Increase revenue potential: iOS users typically have higher lifetime value, while Android's larger user base can fuel ad-driven revenue models.

Improve brand presence: Being available on both platforms builds credibility and trust with users.

Maximize previous investments: Reusing assets and backend systems speeds up time-to-market and reduces development costs.

How App Conversion Improves ROI

Converting your app allows you to scale without starting from scratch, which significantly lowers development costs. The ability to reach more users boosts installs, engagement, and revenue. Moreover, a cross-platform presence strengthens brand authority and opens doors to new monetization opportunities, like in-app purchases or subscriptions, ultimately maximizing return on investment.

Key Challenges in Mobile App Platform Conversion

UI/UX differences: iOS and Android have distinct design languages (Material vs. Human Interface Guidelines).

Technical variations: Differences in programming languages (Java/Kotlin for Android vs. Swift/Objective-C for iOS).

Third-party integration compatibility: Not all libraries and SDKs work identically across platforms.

Testing requirements: Each platform has its own device ecosystem and app store policies.

Steps to Successfully Convert Your Mobile App

Audit existing app code and features

Choose the right development approach (native or cross-platform)

Redesign UI/UX to fit the new platform standards

Adapt backend APIs and third-party services

Test extensively across devices and OS versions

Deploy to the relevant app store with optimized listings

Tools & Technologies for App Conversion

Flutter: Ideal for creating a single codebase for both platforms

Kotlin Multiplatform: Enables code sharing between Android and iOS

React Native: Popular framework for cross-platform mobile development

Xamarin: Microsoft-backed tool for .NET-based apps

Choosing the right tech stack depends on performance needs, UI complexity, and existing code structure.

Cost Estimation & ROI Forecasting

App conversion is typically more cost-effective than building a new app from scratch. Factors affecting cost include app complexity, UI redesign, and backend changes. Companies should calculate potential ROI by comparing conversion cost with projected increase in user acquisition, engagement, and revenue across the new platform.

Case Studies: App Conversion Success Stories

Example 1: A retail app that expanded from iOS to Android and saw a 40% increase in monthly active users

Example 2: A SaaS product that moved from Android to iOS, leading to a 30% boost in in-app purchases These examples showcase how strategic app conversion can result in measurable growth.

Tips to Maximize ROI After Converting Your App

Invest in App Store Optimization (ASO) for visibility

Launch targeted marketing campaigns on the new platform

Monitor analytics closely to track engagement and retention

Solicit user feedback to continuously refine the app experience

Conclusion

Converting your Android app to iOS or vice versa is not just a technical decision—it's a business strategy. When done right, it can significantly enhance user reach, reduce development overhead, and boost ROI. By partnering with an experienced app development company like CQLsys Technologies, you can ensure a smooth transition and unlock new growth opportunities across platforms.

#AppMigration#MobileStrategy#AppMarketing#TechROI#DigitalGrowth#AppScaling#iOSDeveloper#AndroidDeveloper#MobileSolutions#BusinessTech#UserEngagement#RevenueGrowth#AppUpgrade#TechTips#CQLsysTech#Innovation

0 notes

Text

How Python Can Be Used in Finance: Applications, Benefits & Real-World Examples

In the rapidly evolving world of finance, staying ahead of the curve is essential. One of the most powerful tools at the intersection of technology and finance today is Python. Known for its simplicity and versatility, Python has become a go-to programming language for financial professionals, data scientists, and fintech companies alike.

This blog explores how Python is used in finance, the benefits it offers, and real-world examples of its applications in the industry.

Why Python in Finance?

Python stands out in the finance world because of its:

Ease of use: Simple syntax makes it accessible to professionals from non-programming backgrounds.

Rich libraries: Packages like Pandas, NumPy, Matplotlib, Scikit-learn, and PyAlgoTrade support a wide array of financial tasks.

Community support: A vast, active user base means better resources, tutorials, and troubleshooting help.

Integration: Easily interfaces with databases, Excel, web APIs, and other tools used in finance.

Key Applications of Python in Finance

1. Data Analysis & Visualization

Financial analysis relies heavily on large datasets. Python’s libraries like Pandas and NumPy are ideal for:

Time-series analysis

Portfolio analysis

Risk assessment

Cleaning and processing financial data

Visualization tools like Matplotlib, Seaborn, and Plotly allow users to create interactive charts and dashboards.

2. Algorithmic Trading

Python is a favorite among algo traders due to its speed and ease of prototyping.

Backtesting strategies using libraries like Backtrader and Zipline

Live trading integration with brokers via APIs (e.g., Alpaca, Interactive Brokers)

Strategy optimization using historical data

3. Risk Management & Analytics

With Python, financial institutions can simulate market scenarios and model risk using:

Monte Carlo simulations

Value at Risk (VaR) models

Stress testing

These help firms manage exposure and regulatory compliance.

4. Financial Modeling & Forecasting

Python can be used to build predictive models for:

Stock price forecasting

Credit scoring

Loan default prediction

Scikit-learn, TensorFlow, and XGBoost are popular libraries for machine learning applications in finance.

5. Web Scraping & Sentiment Analysis

Real-time data from financial news, social media, and websites can be scraped using BeautifulSoup and Scrapy. Python’s NLP tools (like NLTK, spaCy, and TextBlob) can be used for sentiment analysis to gauge market sentiment and inform trading strategies.

Benefits of Using Python in Finance

✅ Fast Development

Python allows for quick development and iteration of ideas, which is crucial in a dynamic industry like finance.

✅ Cost-Effective

As an open-source language, Python reduces licensing and development costs.

✅ Customization

Python empowers teams to build tailored solutions that fit specific financial workflows or trading strategies.

✅ Scalability

From small analytics scripts to large-scale trading platforms, Python can handle applications of various complexities.

Real-World Examples

💡 JPMorgan Chase

Developed a proprietary Python-based platform called Athena to manage risk, pricing, and trading across its investment banking operations.

💡 Quantopian (acquired by Robinhood)

Used Python for developing and backtesting trading algorithms. Users could write Python code to create and test strategies on historical market data.

💡 BlackRock

Utilizes Python for data analytics and risk management to support investment decisions across its portfolio.

💡 Robinhood

Leverages Python for backend services, data pipelines, and fraud detection algorithms.

Getting Started with Python in Finance

Want to get your hands dirty? Here are a few resources:

Books:

Python for Finance by Yves Hilpisch

Machine Learning for Asset Managers by Marcos López de Prado

Online Courses:

Coursera: Python and Statistics for Financial Analysis

Udemy: Python for Financial Analysis and Algorithmic Trading

Practice Platforms:

QuantConnect

Alpaca

Interactive Brokers API

Final Thoughts

Python is transforming the financial industry by providing powerful tools to analyze data, build models, and automate trading. Whether you're a finance student, a data analyst, or a hedge fund quant, learning Python opens up a world of possibilities.

As finance becomes increasingly data-driven, Python will continue to be a key differentiator in gaining insights and making informed decisions.

Do you work in finance or aspire to? Want help building your first Python financial model? Let me know, and I’d be happy to help!

#outfit#branding#financial services#investment#finance#financial advisor#financial planning#financial wellness#financial freedom#fintech

0 notes

Text

Real Estate Innovation in Dubai: Complete App Development Guide

Dubai's real estate sector is undergoing a dramatic transformation, fueled by rapid technological advancements and the growing demand for digital solutions. From virtual tours and blockchain transactions to AI-driven property recommendations, the real estate market in Dubai is now powered by innovative mobile and web applications. For real estate companies, agents, and investors, building a smart, user-friendly real estate app is no longer a luxury—it's a strategic necessity.

In this complete guide, we’ll break down how to build a powerful real estate app tailored for Dubai’s dynamic market, highlight the latest innovations, and discuss essential features, tech stacks, and development costs. If you’re looking to turn your idea into a profitable app, IMG Global Infotech is your ideal partner, offering end-to-end real estate app development services in Dubai and globally.

Why Dubai is Leading in Real Estate Innovation

Dubai has always positioned itself at the forefront of innovation. Its real estate market mirrors that ambition by embracing:

Smart City initiatives promoting digitization.

A growing expat population seeking efficient property solutions.

High mobile penetration and digital literacy.

Government support for proptech startups.

The result? A booming ecosystem where real estate apps can thrive, provided they are tailored to the region's expectations.

Types of Real Estate Apps Gaining Popularity in Dubai

Before you dive into development, it’s vital to understand the different types of real estate apps making waves in Dubai:

Property Listing Platforms – Apps like Bayut and Property Finder allow users to browse and filter listings by type, price, and location.

Brokerage Management Apps – Used by agents to manage leads, showings, and sales processes.

Rental Apps – Focused solely on long-term and short-term rentals (including holiday rentals).

Virtual Tour Apps – Offer AR/VR-based tours, especially useful for off-plan properties.

Investment Platforms – Cater to real estate investors looking for ROI insights, forecasts, and secure digital transactions.

Core Features for Real Estate Apps in Dubai

To compete in Dubai’s tech-forward environment, your real estate app should include:

Advanced Search Filters (location, type, size, price)

Interactive Maps Integration with nearby amenities

High-Resolution Media Uploads (photos, 360° videos, VR tours)

Multilingual Support (English, Arabic, Russian)

AI-Powered Recommendations based on user behavior

Secure User Authentication & Profiles

In-App Chat with Agents

Real-Time Notifications

Mortgage Calculators

Property Valuation Tools

Admin Dashboard for agents, brokers, or developers

At IMG Global Infotech, we specialize in building feature-rich real estate apps that integrate cutting-edge functionalities while remaining user-friendly and visually stunning.

Tech Stack for Real Estate App Development

Choosing the right technology stack is crucial for building a scalable, secure, and responsive app. Here's a recommended tech stack:

Frontend: React Native or Flutter for cross-platform compatibility

Backend: Node.js or Django for speed and flexibility

Database: PostgreSQL or MongoDB

APIs: Google Maps, payment gateways, CRM integrations

AI/ML Tools: TensorFlow, Dialogflow for smart search and chatbots

AR/VR: Unity or Vuforia for virtual property tours

IMG Global Infotech ensures that the most modern and efficient technologies are selected according to your specific business goals.

Development Stages and Timeline

The process of developing a real estate app typically follows these steps:

Discovery & Planning – Market analysis, competitor benchmarking, and feature outlining (1–2 weeks)

UI/UX Design – Creating user journeys, wireframes, and prototypes (2–3 weeks)

Backend & Frontend Development – Coding core functionalities, APIs, and databases (6–10 weeks)

Testing & QA – Bug fixing, load testing, and performance optimization (2 weeks)

Launch & Deployment – Publishing on iOS and Android stores, post-launch support

Total estimated timeline: 3–4 months, depending on app complexity.

Estimated Cost of Building a Real Estate App in Dubai

Development costs vary based on app features, platforms, and custom integrations. Here’s a general breakdown:

App Type

Estimated Cost (USD)

Basic Property Listing App

$10,000 – $20,000

Advanced Multi-Feature App

$25,000 – $50,000+

AR/VR-Integrated Platform

$50,000 – $80,000+

Working with IMG Global Infotech, you receive transparent pricing, milestone-based billing, and premium-quality development at globally competitive rates.

How Can IMG Global Infotech Help?

IMG Global Infotech stands out as a trusted real estate app development company with:

10+ years of industry experience

A team of certified developers and designers

Proven success in building apps for the Dubai and GCC real estate markets

Commitment to innovation, security, and scalability

End-to-end support from idea validation to post-launch maintenance

Whether you’re a startup, brokerage, or enterprise developer, we build solutions that align with your vision and market needs.

To Wrap It Up

Dubai’s real estate market is ripe for digital disruption, and the right app can give your business a significant competitive edge. From AR-enabled virtual tours to AI-powered property suggestions, today’s innovations are reshaping how people buy, sell, and rent properties in the city.

With a trusted tech partner like IMG Global Infotech, you can turn your real estate app idea into a powerful, revenue-generating product that stands out in Dubai’s digital skyline.

Ready to build your next-gen real estate app? Let’s make it happen.

#realestatetips#real estate investing#commercial real estate#realestateagent#real estate#app development#propertyinvestment#residential property#propertyforsale#realestateinvestment#commercial#commercial property

0 notes

Text

USOIL Price Movement Today – Gold Market Trend Today

USOIL Price Movement Today – Gold Market Trend Today 📢USOIL Price Movement Today – Gold Market Trend Today 🔻 SELL SIGNAL • Sell Entry At : 65 • Stop Loss: 66 • Target: 63.90 • Current Market Price (CMP): 65 ���� Daily Oil Market Report – June 11, 2025 🟡 focusing on USOIL (WTI Crude Oil): 📢USOIL Price Movement Today – Gold Market Trend Today🟡 Daily Oil Market Report – June 11, 2025 🟡 focusing on USOIL (WTI Crude Oil):🔑 Key Economic Highlights Driving Oil Prices Today📈 Market Snapshot (As of June 11, 2025, early ET) 🔑 Key Economic Highlights Driving Oil Prices Today 1. Oil Slides as Market Weighs Trade Framework WTI crude softened to around $64.76/bbl (down ~0.34%) amid investor caution following a U.S.–China trade framework announced in London, but not yet finalized by presidents Trump and Xi reuters.com+13tradingeconomics.com+13reuters.com+13. 2. Trade Talks Yield Cautious Optimism U.S. Commerce Secretary Lutnick announced that the framework covers rare earths and export controls—providing some relief—but broad concerns remain over demand and implementation timing reuters.com+10reuters.com+10marketwatch.com+10. 3. OPEC+ Output Rise Pressures Market OPEC+ recently increased supply by ~411 kbpd in early June, and Secretary‑General Al Ghais warned of sustained demand growth—suggesting long-term demand strength but added supply weighed on prices reuters.com. 4. Sluggish Chinese Demand Weak demand from China, despite positive trade signals, dampens oil sentiment amid cautious demand expectations tradingeconomics.com+13reuters.com+13reuters.com+13. 5. Inventory & Wildfire Supply Notes U.S. stockpile data due today may influence price direction; previous weeks saw draws (~3.1 M barrels) and Canada’s wildfires clipped supply—but the recent slide suggests pressure remains . AssetPrice/LevelChangeWTI Crude (USOIL)$64.76/bbl▼ –0.34%Brent Crude≈ $66.56–66.87/bbl▼ ~0.5%U.S. Dollar IndexSteady (~98.97)↔10‑Yr U.S. Treasury~4.47%↔S&P 500 FuturesFlat↔ 📈 Market Snapshot (As of June 11, 2025, early ET) 🧭 Analyst View & Market Outlook Short‑Term Trend: Oil remains range-bound between $64–66, as mixed signals from trade and demand create uncertainty. Forecast sensitive to today’s U.S. inventory (API & EIA) data. Medium‑Term Outlook: If China demand picks up and inventory draws continue, $65–68 could be tested. However, elevated OPEC+ output and geopolitical stability could cap gains. Bullish Signals: OPEC+ output discipline paired with encouraging trade dialogue. Early Canadian wildfire disruptions shave global supply. Bearish Risks: Lingering weak demand from China. Rising OPEC+ supply and risk of implementation delays in trade framework. Institutional Insight: Analysts at Bloomberg and Reuters suggest prices will remain clustered around current levels, barring surprise demand uptick or geopolitical flare-up. ⚠️ Important Note: Oil remains highly sensitive to surprises—from geopolitical shifts and stock data to U.S.–China trade clarity. Monitor EIA/API reports and trade/energy headlines closely. ⚠️ Disclaimer: This report is for informational purposes only and does not constitute investment advice. Commodity trading carries risk—please conduct your own analysis or consult a licensed professional. Topics Covered: USOIL price today, June 11 2025 oil update, WTI crude analysis, OPEC+ output, U.S.–China trade impact on oil, China demand outlook, oil inventory data, Canadian wildfires supply, global demand trends. ' https://classroomoftraders.com/trading-signals/usoil-price-movement-today-gold-market-trend-today/?fsp_sid=1239 #Commoditysignals #CrudeOilsignals #TradingSignals

0 notes

Text

USOIL Price Movement Today – Gold Market Trend Today

USOIL Price Movement Today – Gold Market Trend Today 📢USOIL Price Movement Today – Gold Market Trend Today 🔻 SELL SIGNAL • Sell Entry At : 65 • Stop Loss: 66 • Target: 63.90 • Current Market Price (CMP): 65 🟡 Daily Oil Market Report – June 11, 2025 🟡 focusing on USOIL (WTI Crude Oil): 📢USOIL Price Movement Today – Gold Market Trend Today🟡 Daily Oil Market Report – June 11, 2025 🟡 focusing on USOIL (WTI Crude Oil):🔑 Key Economic Highlights Driving Oil Prices Today📈 Market Snapshot (As of June 11, 2025, early ET) 🔑 Key Economic Highlights Driving Oil Prices Today 1. Oil Slides as Market Weighs Trade Framework WTI crude softened to around $64.76/bbl (down ~0.34%) amid investor caution following a U.S.–China trade framework announced in London, but not yet finalized by presidents Trump and Xi reuters.com+13tradingeconomics.com+13reuters.com+13. 2. Trade Talks Yield Cautious Optimism U.S. Commerce Secretary Lutnick announced that the framework covers rare earths and export controls—providing some relief—but broad concerns remain over demand and implementation timing reuters.com+10reuters.com+10marketwatch.com+10. 3. OPEC+ Output Rise Pressures Market OPEC+ recently increased supply by ~411 kbpd in early June, and Secretary‑General Al Ghais warned of sustained demand growth—suggesting long-term demand strength but added supply weighed on prices reuters.com. 4. Sluggish Chinese Demand Weak demand from China, despite positive trade signals, dampens oil sentiment amid cautious demand expectations tradingeconomics.com+13reuters.com+13reuters.com+13. 5. Inventory & Wildfire Supply Notes U.S. stockpile data due today may influence price direction; previous weeks saw draws (~3.1 M barrels) and Canada’s wildfires clipped supply—but the recent slide suggests pressure remains . AssetPrice/LevelChangeWTI Crude (USOIL)$64.76/bbl▼ –0.34%Brent Crude≈ $66.56–66.87/bbl▼ ~0.5%U.S. Dollar IndexSteady (~98.97)↔10‑Yr U.S. Treasury~4.47%↔S&P 500 FuturesFlat↔ 📈 Market Snapshot (As of June 11, 2025, early ET) 🧭 Analyst View & Market Outlook Short‑Term Trend: Oil remains range-bound between $64–66, as mixed signals from trade and demand create uncertainty. Forecast sensitive to today’s U.S. inventory (API & EIA) data. Medium‑Term Outlook: If China demand picks up and inventory draws continue, $65–68 could be tested. However, elevated OPEC+ output and geopolitical stability could cap gains. Bullish Signals: OPEC+ output discipline paired with encouraging trade dialogue. Early Canadian wildfire disruptions shave global supply. Bearish Risks: Lingering weak demand from China. Rising OPEC+ supply and risk of implementation delays in trade framework. Institutional Insight: Analysts at Bloomberg and Reuters suggest prices will remain clustered around current levels, barring surprise demand uptick or geopolitical flare-up. ⚠️ Important Note: Oil remains highly sensitive to surprises—from geopolitical shifts and stock data to U.S.–China trade clarity. Monitor EIA/API reports and trade/energy headlines closely. ⚠️ Disclaimer: This report is for informational purposes only and does not constitute investment advice. Commodity trading carries risk—please conduct your own analysis or consult a licensed professional. Topics Covered: USOIL price today, June 11 2025 oil update, WTI crude analysis, OPEC+ output, U.S.–China trade impact on oil, China demand outlook, oil inventory data, Canadian wildfires supply, global demand trends. https://classroomoftraders.com/trading-signals/usoil-price-movement-today-gold-market-trend-today/?fsp_sid=1238 #Commoditysignals #CrudeOilsignals #TradingSignals

0 notes

Text

AI in Financial Modelling: How Machine Learning Is Redefining Forecasting and Valuation in 2025

The finance world is experiencing a paradigm shift in 2025, with artificial intelligence (AI) and machine learning (ML) transforming how businesses approach financial modeling. Once dominated by spreadsheets, historical assumptions, and manual analysis, modern financial modeling is now being supercharged by AI-driven tools that provide faster, more accurate, and data-rich insights.

Whether you're a seasoned analyst, a finance student, or a business professional, understanding how AI is changing the game has become non-negotiable. And for those looking to keep pace, enrolling in the Best Financial Modelling Certification Course in Mumbai can be a career-defining step.

Traditional vs. AI-Powered Financial Modelling

Traditional financial models rely heavily on historical data and linear projections. While useful, these models often miss out on complex patterns, nonlinear relationships, or real-time fluctuations. AI, especially machine learning, introduces dynamic, adaptive forecasting that evolves with new data inputs.

In simpler terms: traditional models tell you what might happen, but AI models tell you what’s most likely to happen—backed by thousands of data points, sentiment analysis, and behavioral trends.

How AI Is Revolutionizing Financial Modelling

1. Enhanced Forecast Accuracy

Machine learning algorithms can analyze historical and real-time data to identify trends and predict future outcomes with greater precision. For example, retail companies use AI models to forecast sales based on variables like weather, social media sentiment, local events, and macroeconomic indicators.

This type of insight was nearly impossible using traditional Excel-based models alone.

2. Automated Data Processing

Financial analysts typically spend 60–70% of their time cleaning and preparing data. AI-driven tools automate this grunt work—extracting data from various sources (PDFs, APIs, databases), cleaning it, and updating models in real time. This dramatically boosts productivity and reduces the chance of human error.

3. Scenario Analysis at Scale

Instead of running a few “what-if” scenarios, AI allows you to run thousands of simulations in minutes. Monte Carlo simulations, stress testing, and predictive analytics become far more robust with machine learning, offering deeper risk insights and more confident decision-making.

4. Natural Language Processing (NLP) for Unstructured Data

AI enables models to pull valuable insights from unstructured data like news articles, earnings call transcripts, and social media. Sentiment analysis powered by NLP can affect valuations and forecast models, especially for companies whose brand or CEO reputation plays a critical role in performance.

5. Integration with Real-Time Data Sources

AI-powered models can be connected to live data feeds—stock markets, commodity prices, interest rates, or even Twitter. This allows financial models to update automatically in real-time, giving investors and analysts a competitive edge.

Practical Applications in 2025

AI in financial modeling is not just a theoretical advancement—it’s being used across various domains:

Investment Banking: To predict M&A deal outcomes, optimize deal pricing, and evaluate synergies.

Private Equity: For faster and deeper due diligence based on historical data, competitor analysis, and industry signals.

Corporate Finance: To forecast revenues and costs with precision, aiding CFOs in budget planning.

Startups and SMEs: Leveraging AI tools to build investor decks, financial plans, and valuations with minimal manual input.

The Role of Financial Analysts Is Evolving

The rise of AI doesn't eliminate the need for financial analysts—it evolves their role. Analysts are now expected to:

Interpret AI-generated insights

Understand model outputs and their assumptions

Blend AI-driven forecasts with business context and strategy

Communicate complex findings in a simple, strategic way

To stay ahead in this environment, professionals need both financial acumen and technical fluency. This is where certification programs come in.

Why the Best Financial Modelling Certification Course in Mumbai Matters

Mumbai, being India’s financial capital, is home to a thriving finance ecosystem—banks, investment firms, fintech startups, and corporate headquarters. Professionals and students here are uniquely positioned to benefit from top-tier training that integrates modern tools with core finance principles.

The Best Financial Modelling Certification Course in Mumbai not only teaches Excel-based modeling, valuation techniques, and financial statement analysis but also introduces learners to AI-powered tools, Python basics for finance, and ML concepts relevant to modern modeling.

Graduates from such programs gain a dual advantage: foundational skills that build credibility and advanced capabilities that set them apart in AI-driven finance roles.

Tools and Technologies to Watch

Modern financial analysts should get familiar with the following tools to stay competitive:

Python and R: For machine learning model development

Power BI / Tableau: For data visualization

Alteryx: For automated data preparation

ChatGPT & Copilot: For automated reporting and insights

Jupyter Notebooks: For integrating models and dashboards

Snowflake / BigQuery: For working with big data

Courses that include hands-on projects using these tools make learners job-ready in today's data-driven finance landscape.

Future of AI in Financial Modeling

The future is heading toward hybrid intelligence, where human expertise is amplified by AI. Predictive models will become more accurate, explainable AI (XAI) will demystify complex outputs, and collaboration between finance teams and data scientists will deepen.

AI won’t replace human analysts—but those who adopt AI will likely replace those who don’t.

Final Thoughts

AI is not just a buzzword—it’s actively transforming how financial models are built, interpreted, and applied. In 2025, professionals who understand both finance and machine learning are leading the way in investment decisions, risk management, and strategic planning.

For anyone aiming to thrive in this new landscape, enrolling in the Best Financial Modelling Certification Course in Mumbai is a smart investment. It’s more than just a credential—it’s a future-proofing strategy.

0 notes

Link

0 notes

Text

Unlock Market Potential: The Ultimate Guide to Stock & Crypto Data APIs

In today’s fast-moving financial markets, real-time data is the lifeblood of successful trading. Whether you're a quantitative trader, algorithmic developer, or retail investor, having access to high-quality stock market data APIs can mean the difference between profit and missed opportunities.

This guide explores the best free and premium APIs—covering stocks, forex, and cryptocurrencies—to help you make data-driven decisions with speed and precision.

Why Market Data APIs Are Essential

Modern trading requires more than just price charts. You need: ✅ Tick-by-tick precision – Every trade, every millisecond ✅ Ultra-low latency – Faster execution than competitors ✅ Multi-asset coverage – Stocks, forex, crypto, futures in one place ✅ Institutional-grade reliability – 99.9% uptime for uninterrupted trading

Without the right data, even the best strategies underperform.

Best Free Stock Market APIs (For Budget-Conscious Traders)

1. Stock API Free – Yahoo Finance & Alpha Vantage

Best for: Basic stock price tracking

Coverage: US stocks, ETFs, limited forex & crypto

Limitations: Delayed data, no tick-level precision

2. Stock Price API Free – Twelve Data & FinancialModelingPrep

Best for: Simple portfolio tracking & backtesting

Features: Real-time quotes, fundamentals

Limitations: Rate-limited, no order book data

3. CryptoCompare API (Free Tier)

Best for: Cryptocurrency traders

Coverage: 500+ coins with real-time prices

Limitations: No institutional-grade depth

Premium Stock Market APIs (For Serious Traders & Institutions)

4. Xignite Stock API

Best for: Institutional investors

Features: Real-time ticks, corporate actions, fundamentals

Pricing: Custom enterprise plans

5. Best Stock Market Data API – Polygon.io & Alltick

Best for: High-frequency trading (HFT)

Features: Microsecond tick data, direct exchange feeds

Why Alltick?

Global coverage (A-shares, US stocks, crypto, forex)

Multi-language SDKs (Python, C++, Java)

99.99% uptime – Built for HFT firms

6. Forex.com API

Best for: Forex & crypto algo traders

Features: Liquidity aggregation, low-latency execution

7. Morningstar Stock API

Best for: Fundamental investors

Features: Deep financials, analyst forecasts

8. API Stock Forecast – Kavout & Accern

Best for: AI-driven trading signals

Features: Earnings predictions, sentiment analysis

9. Blockchain Data API (Chainalysis, Glassnode)

Best for: Crypto traders

Features: Whale tracking, exchange flows, on-chain metrics

Why Tick Data APIs Like Alltick Are Revolutionary

Most free APIs offer delayed or aggregated data—tick-level APIs provide: 🔹 Microsecond timestamps – Exact trade execution times 🔹 Order book dynamics – Real-time liquidity tracking 🔹 HFT-grade latency – <10ms from exchange to your algo

Alltick vs. Competitors

FeatureAlltickFree APIsOther Premium APIsData Latency<1ms15+ sec delay50-500msTick Data✅ Full depth❌ NoLimitedGlobal Markets✅ Stocks, forex, crypto❌ Limited❌ FragmentedReliability99.99% uptimeOccasional outagesVaries

Who Benefits Most?

Trader TypeRecommended APIsRetail InvestorsYahoo Finance, Alpha VantageQuant ResearchersAlltick, Polygon.ioHFT FirmsAlltick, Forex.com APICrypto TradersCryptoCompare, Glassnode

Free vs. Premium APIs: How to Choose?

FeatureFree APIsPremium APIsData Latency15+ sec delayReal-time (ms)Tick Data❌ No✅ Full depthReliabilityOccasional outages99.9% SLACost$0200–200–10,000+/mo

Pro Tip: Start with free APIs for testing, then upgrade to premium feeds for live trading.

Get Started Today : Alltick.co

The right API transforms raw data into profits. Which will you choose?

1 note

·

View note

Text

Generative AI Coding Assistants Market: Size, Share, Analysis, Forecast, and Growth Trends to 2032 – A New Era in Software Development

The Generative AI Coding Assistants Market Size was valued at USD 18.34 Million in 2023 and is expected to reach USD 139.55 Million by 2032 and grow at a CAGR of 25.4% over the forecast period 2024-2032.

Generative AI Coding Assistants Market continues to revolutionize software development by providing intelligent, context-aware support to developers worldwide. These AI-powered tools enhance coding efficiency, reduce errors, and accelerate project delivery, making them indispensable in today's fast-paced tech environment. The growing demand for automation and innovation in coding workflows has positioned generative AI coding assistants as a key enabler of digital transformation across industries.

Generative AI Coding Assistants Market is witnessing rapid adoption due to advancements in natural language processing and machine learning technologies. Developers increasingly rely on these assistants for code generation, debugging, and optimization, significantly improving productivity and creativity. As enterprises prioritize agile development and continuous integration, generative AI coding assistants become critical for maintaining competitive advantage in software engineering.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6493

Market Keyplayers:

Amazon Web Services (AWS) (Amazon CodeWhisperer, AWS Cloud9)

CodeComplete (CodeComplete AI Assistant, CodeComplete API)

CodiumAI (CodiumAI Test Generator, CodiumAI Code Review Assistant)

Databricks (Databricks AI Code Assistant, Databricks Lakehouse AI)

GitHub (GitHub Copilot, GitHub Copilot X)

GitLab (GitLab Duo, GitLab Code Suggestions)

Google LLC (Google Gemini Code Assist, Vertex AI Codey)

IBM (IBM Watsonx Code Assistant, IBM AI for Code)

JetBrains (JetBrains AI Assistant, JetBrains Fleet)

Microsoft (Microsoft Copilot for Azure, Visual Studio IntelliCode)

Replit (Replit Ghostwriter, Replit AI Code Chat)

Sourcegraph (Sourcegraph Cody, Sourcegraph Code Search)

Tableau (Tableau AI Code Generator, Tableau GPT)

Tabnine (Tabnine AI Autocomplete, Tabnine Pro)

Market Analysis The generative AI coding assistants market is characterized by a dynamic ecosystem of startups and established technology firms deploying sophisticated AI models. Increasing investments in AI research and the proliferation of cloud-based development platforms drive market growth. The ability of these tools to integrate seamlessly with popular IDEs and support multiple programming languages further fuels adoption across small businesses and large enterprises.

Market Trends

Growing integration of AI assistants with cloud-native development environments

Expansion of multi-language and cross-platform support capabilities

Rise in demand for AI-driven code review and quality assurance

Enhanced focus on security features within AI coding assistants

Increasing collaboration features powered by AI for remote development teams

Market Scope

Broadening applications beyond traditional software development to sectors like finance, healthcare, and automotive

Customizable AI models tailored to specific organizational coding standards

Increasing adoption by educational institutions for programming training and learning

Rising interest in low-code/no-code platforms enhanced by generative AI

Generative AI coding assistants are not just tools but catalysts for transforming the development lifecycle, making coding more accessible, efficient, and intelligent.

Market Forecast The generative AI coding assistants market is poised for substantial expansion, driven by continuous AI innovation and growing digital transformation initiatives. The market will witness the emergence of more advanced, user-friendly, and collaborative AI assistants that redefine coding paradigms. Industry players are expected to focus on developing scalable and secure AI solutions, fostering deeper integration with enterprise workflows and boosting developer experience globally.

Access Complete Report: https://www.snsinsider.com/reports/generative-ai-coding-assistants-market-6493

Conclusion As the generative AI coding assistants market evolves, it promises unparalleled opportunities for developers and organizations to innovate faster and smarter. Embracing these AI-driven tools will be essential for staying ahead in the competitive tech landscape, empowering users to unlock new levels of creativity and efficiency. The future of coding is undeniably intertwined with AI, making generative coding assistants a game-changer for the software industry.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Generative AI Coding Assistants Market#Generative AI Coding Assistants Market Scope#Generative AI Coding Assistants Market Trends

0 notes

Text

Choosing the Right Hospital Management Software

Selecting the best hospital management system software is a high‑stakes decision that shapes how your hospital cares for patients, controls costs, and meets compliance mandates. With hundreds of options on the market, a structured, data‑driven approach helps you avoid expensive missteps and positions your facility for long‑term success.

Define Your Hospital’s Strategic Goals

Begin with a clear vision. List the top three to five outcomes you must achieve in the next three years—such as faster discharge times, seamless telehealth, or tighter revenue‑cycle control. A 2023 HIMSS buyer’s guide recommends aligning software requirements with measurable strategic goals before viewing demos.

Assess Core Modules of a Healthcare Management System

Every healthcare management system should cover these essentials:

Patient Registration & Scheduling

Electronic Health Records (EHR) Integration

OPD/IPD Billing & Insurance

Pharmacy and Inventory Management

Laboratory & Medical Device Interfaces

Business Intelligence Dashboards

Match each module to a documented pain point so you avoid paying for features you will never use.

Evaluate Vendor Reliability and Support

Not all vendors deliver the same level of partnership. Investigate:

Clinical Domain Expertise – proven deployments in tertiary‑care hospitals

24 × 7 Support & Training – on‑site onboarding and local language help desks

Financial Stability – long‑term roadmap and R&D investment

Client References – speak with hospitals of similar size and speciality

According to the World Health Organization’s Digital Health framework, strong vendor governance is critical for sustainable digital‑health programmes.

Compare Deployment and Integration Options

Cloud vs. On‑Premise

Cloud offers lower upfront costs and rapid scaling, while on‑premise installations give you full control of data residency. The U.S. National Institute of Standards and Technology notes that either model can be secure if encryption, access controls, and continuous monitoring are enforced.

Interoperability Standards

Confirm support for HL7, FHIR, DICOM, and open APIs. Seamless exchange with labs, imaging, and national health databases prevents vendor lock‑in and future‑proofs your investment.

Calculate Total Cost of Ownership

Look beyond licence fees. Include:

Implementation & Data Migration

Hardware or Cloud Hosting

Maintenance & Version Upgrades

Training & Change‑Management Costs

Build a five‑year TCO model to see the full financial picture.

Demand Hands‑On Demonstrations and Proof of Concept

Test drive the short‑listed platforms with real workflows:

Map a typical patient journey—appointment to discharge.

Measure click counts, load times, and error rates.

Involve end‑users (nurses, pharmacists, accountants) for feedback.

A structured pilot reveals usability gaps that glossy brochures hide.

Think Long Term: Roadmap and Innovation

Ask vendors about:

AI‑Driven Decision Support – predictive triage, bed forecasting

IoMT Integration – streaming vitals from smart devices

Low‑Code Customization – drag‑and‑drop form builders for rapid tweaks

Regulatory Updates – automatic compliance patches for NABH, HIPAA, GST

Choosing a forward‑looking hospital software company like MediBest ensures your solution evolves with clinical and regulatory demands.

Why MediBest Stands Out

All‑in‑One Platform – clinical, administrative, and financial modules under one login

Scalable Architecture – supports multi‑location networks and thousands of concurrent users

Secure‑by‑Design – field‑level encryption, MFA, and 99.9 % uptime SLA

Rapid Implementation – phased rollouts with dedicated success teams

Extensive Local Support – 24 × 7 hotline and on‑site trainers across India

With MediBest, hospitals gain a robust healthcare management system software that delivers measurable ROI from day one.

Frequently Asked Questions

1. What factors should I consider when selecting hospital management system software? Prioritise alignment with strategic goals, comprehensive modules, interoperability standards, vendor reliability, and total cost of ownership. Hands‑on demos with end‑users are essential.

2. Is cloud‑based hospital management software secure? Yes—if the provider uses ISO 27001‑certified data centres, end‑to‑end encryption, and continuous monitoring. Both cloud and on‑premise models can meet HIPAA and NABH standards when configured correctly.

3. How long does it take to implement a healthcare management system? Timelines range from 4 to 12 months. A phased approach—starting with registration and billing, then adding labs, pharmacy, and advanced modules—minimises service disruption and speeds user adoption.

Ready to See MediBest in Action?

Partner with MediBest, the trusted hospital software company powering digital transformation across India.

Corporate Office 303, IT Park Center, IT Park Sinhasa Indore, Madhya Pradesh, 452013

Call Now +91 79098 11515 +91 97139 01529 +91 91713 41515

0 notes

Text

Global Large Molecule Drug Substance CDMO Market will see 9% CAGR from trials growth by 2030

The large molecule drug substance CDMO market is anticipated to expand at a CAGR of ~9% during the forecast period. Key drivers of this growth include increasing demand for biosimilars and biologics, technological advancement in bioprocessing, increasing FDA & EMA approvals for large molecule drugs, rising incidence of chronic and infectious diseases, growing investments in biologics manufacturing by pharma and biotech companies, and expanding biotech sectors in emerging markets.

Large molecule drug substances are biologic drugs, characterized by their complex molecular structures and production using living cells. Examples include monoclonal antibodies, recombinant proteins, vaccines, gene therapies, and cell-based therapies. A contract development and manufacturing organization (CDMO) offers outsourced services for drug development and production, managing processes such as cell line development, process optimization, upstream and downstream processing, formulation, analytical testing, and regulatory compliance. A large molecule drug substance CDMO is a specialized company that provides contract-based services for the development and manufacturing of biological drug substances, supporting pharmaceutical and biotechnology companies in bringing complex therapeutics to market.

🔗 Want deeper insights? Download the sample report: https://meditechinsights.com/large-molecule-drug-substance-cdmo-market/request-sample/

Growing demand for biosimilars and biologics drives market growth

Large molecule drugs, or biologics, are complex therapies derived from living organisms, making their development and manufacturing inherently challenging. Unlike small molecule chemical APIs, which are often formulated as oral medications, biologics are predominantly administered as parenteral drug products due to their structural complexity and sensitivity. The growing demand for biologic therapies, particularly antibody-based treatments, is driven by their ability to effectively target and manage rare diseases such as various cancers, Crohn’s disease, multiple sclerosis, and cystic fibrosis.

At the same time, the expiration of patents on blockbuster biologics has fueled the rapid expansion of the biosimilar market, as pharmaceutical companies seek cost-effective alternatives to high-priced biologic therapies. Regulatory bodies such as the FDA and EMA have streamlined biosimilar approval pathways, further accelerating biosimilar development and increasing the demand for specialized large-molecule manufacturing expertise. This is where CDMOs play a pivotal role. These specialized service providers offer state-of-the-art infrastructure, advanced technical expertise, and highly skilled personnel required for the intricate processes involved in biologics and biosimilar manufacturing. As the adoption of large molecule drugs continues to transform the pharmaceutical industry, CDMOs enable scalable, cost-efficient, and regulatory-compliant production, driving sustained market growth.

Increasing approval from FDA & EMA for large molecule drugs fuels its demand

The pharmaceutical industry has increasingly shifted its focus from small molecules to biologics, recognizing their superior efficacy in treating chronic and rare diseases such as cancer, autoimmune disorders, and genetic conditions. To accelerate the availability of these life-saving large-molecule drugs, regulatory agencies like the FDA and EMA have implemented fast-track approval pathways. Programs such as the FDA’s Breakthrough Therapy Designation, Fast Track, and Priority Review expedite the review process for promising biologics, while the EMA’s PRIME (Priority Medicines) designation facilitates quicker approvals for innovative treatments addressing unmet medical needs.

The rise in orphan drug approvals has further contributed to the growing number of biological drug approvals, particularly for rare and ultra-rare diseases. A June 2024 report by Aptitude Health revealed that over half of FDA and EMA approvals in Q2 2024 were for biologics or biosimilars, underscoring this trend.

Additionally, the expiration of patents for blockbuster biologics like Humira, Herceptin, and Avastin has driven an increase in biosimilar approvals, as regulatory bodies seek to enhance market competition and reduce healthcare costs. Initiatives such as the FDA’s Biosimilar Action Plan (BAP) and the EMA’s streamlined biosimilar approval pathways have simplified regulatory processes, facilitating faster approvals. The surge in FDA and EMA approvals for large-molecule drugs reflects the rapid evolution of the biologics and biosimilar market. With advancements in regulatory pathways, scientific innovation, and increased investment in biopharmaceutical research, this trend is expected to persist, further driving demand for large molecule drug manufacturing and reshaping the future of healthcare.

Competitive Landscape Analysis

The global large molecule drug substance CDMO market is marked by the presence of established and emerging market players such as Eurofins Scientific; WuXi Biologics; Samsung Biologics; Catalent, Inc.; Rentschler Biopharma SE; AGC Biologics; Recipharm AB; Siegfried Holding AG; Boehringer Ingelheim; Thermo Fisher Scientific; and FUJIFILM Diosynth Biotechnologies among others. Some of the key strategies adopted by market players include new service development, strategic partnerships and collaborations, and investments.

Gain a competitive edge-request a sample report now! https://meditechinsights.com/large-molecule-drug-substance-cdmo-market/request-sample/

Market Segmentation

This report by Medi-Tech Insights provides the size of the global large molecule drug substance CDMO market at the regional- and country-level from 2023 to 2030. The report further segments the market based on service, source, and end-user.

Market Size & Forecast (2023-2030), By Service, USD Million

Contract Manufacturing

Clinical

Commercial

Contract Development

Cell Line Development

Process Development

Market Size & Forecast (2023-2030), By Source, USD Million

Mammalian

Microbial

Others

Market Size & Forecast (2023-2030), By End-user, USD Million

CRO

Biotech Companies

Others

Market Size & Forecast (2023-2030), By Region, USD Million

North America

US

Canada

Europe

UK

Germany

France

Italy

Spain

Rest of Europe

Asia Pacific

China

India

Japan

Rest of Asia Pacific

Latin America

Middle East & Africa

About Medi-Tech Insights

Medi-Tech Insights is a healthcare-focused business research & insights firm. Our clients include Fortune 500 companies, blue-chip investors & hyper-growth start-ups. We have completed 100+ projects in Digital Health, Healthcare IT, Medical Technology, Medical Devices & Pharma Services in the areas of market assessments, due diligence, competitive intelligence, market sizing and forecasting, pricing analysis & go-to-market strategy. Our methodology includes rigorous secondary research combined with deep-dive interviews with industry-leading CXO, VPs, and key demand/supply side decision-makers.

Contact:

Ruta Halde Associate, Medi-Tech Insights +32 498 86 80 79 [email protected]

0 notes

Text

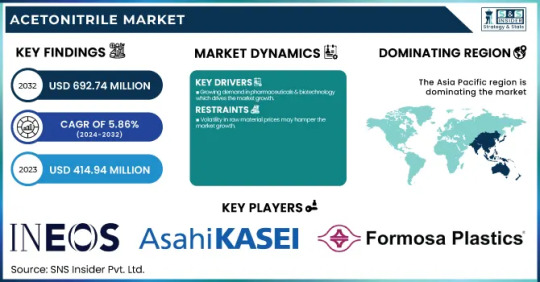

Acetonitrile Market Size, Share, and Industry Outlook

Acetonitrile Market Projected to Reach USD 692.74 Million by 2032, Driven by Pharmaceutical and Agrochemical Demand.

The Acetonitrile Market size was USD 414.94 Million in 2023 and is expected to reach USD 692.74 Million by 2032 and grow at a CAGR of 5.86 % over the forecast period of 2024-2032.

The Acetonitrile Market is primarily driven by its widespread application in the pharmaceutical, chemical, and analytical industries. Acetonitrile, a colorless and volatile solvent, plays a crucial role in the synthesis of active pharmaceutical ingredients (APIs), high-performance liquid chromatography (HPLC), and in the extraction of fatty acids. The global demand is accelerating with rising pharmaceutical production and increasing adoption of advanced analytical techniques.

Key Players

INEOS AG

Asahi Kasei Corporation

Formosa Plastic Corporation

Nova Molecular Technologies

AlzChem Group AG

Zibo Jinma Chemical Factory

Shanghai Secco Petrochemical Company

Shandong Shida Shenghua Chemical Group

Avantor Performance Materials

Tedia Company Inc.

Honeywell International Inc.

Thermo Fisher Scientific Inc.

GFS Chemicals, Inc.

Spectrum Chemical Manufacturing Corp.

J.T. Baker Chemicals

Merck KGaA

MP Biomedicals, LLC

VWR International, LLC

Central Drug House (CDH)

Biosolve Chemicals B.V.

Future Scope & Emerging Trends

The acetonitrile market is projected to expand steadily due to the growing pharmaceutical sector, especially in emerging economies like India and China. The increasing use of HPLC in research, environmental testing, and food safety analysis is significantly boosting demand. Additionally, innovations in bio-based and less toxic acetonitrile alternatives are gaining attention as companies aim for greener solvent solutions. Market consolidation and vertical integration strategies by key players are further expected to strengthen supply chains and stabilize pricing.

Key Points

Acetonitrile is essential in pharmaceutical synthesis and HPLC analysis

Rising demand in biotechnology and environmental testing

Asia-Pacific dominates the market with strong manufacturing presence

Focus on sustainable solvent alternatives gaining momentum

Supply challenges and price volatility linked to acrylonitrile production dynamics

Conclusion

The Acetonitrile Market is poised for moderate yet consistent growth, fueled by demand from the pharmaceutical and analytical sectors. While supply chain constraints and environmental concerns present challenges, technological innovation and expanding end-use applications will support long-term market development. Strategic investments and a shift toward sustainable production methods are expected to define the next phase of growth.

Related Reports:

Polycarbonate Diols Market Size, Share & Segmentation By Molecular Weight ( Below 1,000 g/mol, 1000 g/mol - below 2,000 g/mol, 2000 g/mol and above) By Form (Solid, Liquid), By Application, By Region and Global Forecast for 2024-2032.

Carbon Fiber Reinforced Plastics (CFRP) Market Size, Share, and Segmentation By Product Type (Thermosetting CFRP, Thermoplastic CFRP), By Material Type (PAN-based, Pitch-based), By Application Type, And By Regions | Global Forecast 2024-2032.

Levulinic Acid Market Size, Share & Segmentation By Source (Fossil Fuel-based, Biomass-based), By Technology, By End Use Industry, By Regions and Global Forecast 2024-2032.

Contact Us:

Jagney Dave — Vice President of Client Engagement

Phone: +1–315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Acetonitrile Market#Acetonitrile Market Size#Acetonitrile Market Share#Acetonitrile Market Report#Acetonitrile Market Forecast

0 notes

Text

0 notes

Text

Real Estate Innovation in Dubai: Complete App Development Guide

Dubai's real estate sector is undergoing a dramatic transformation, fueled by rapid technological advancements and the growing demand for digital solutions. From virtual tours and blockchain transactions to AI-driven property recommendations, the real estate market in Dubai is now powered by innovative mobile and web applications. For real estate companies, agents, and investors, building a smart, user-friendly real estate app is no longer a luxury—it's a strategic necessity.

In this complete guide, we’ll break down how to build a powerful real estate app tailored for Dubai’s dynamic market, highlight the latest innovations, and discuss essential features, tech stacks, and development costs. If you’re looking to turn your idea into a profitable app, IMG Global Infotech is your ideal partner, offering end-to-end real estate app development services in Dubai and globally.

Why Dubai is Leading in Real Estate Innovation

Dubai has always positioned itself at the forefront of innovation. Its real estate market mirrors that ambition by embracing:

Smart City initiatives promoting digitization.

A growing expat population seeking efficient property solutions.

High mobile penetration and digital literacy.

Government support for proptech startups.

The result? A booming ecosystem where real estate apps can thrive, provided they are tailored to the region's expectations.

Types of Real Estate Apps Gaining Popularity in Dubai

Before you dive into development, it’s vital to understand the different types of real estate apps making waves in Dubai:

Property Listing Platforms – Apps like Bayut and Property Finder allow users to browse and filter listings by type, price, and location.

Brokerage Management Apps – Used by agents to manage leads, showings, and sales processes.

Rental Apps – Focused solely on long-term and short-term rentals (including holiday rentals).

Virtual Tour Apps – Offer AR/VR-based tours, especially useful for off-plan properties.

Investment Platforms – Cater to real estate investors looking for ROI insights, forecasts, and secure digital transactions.

Core Features for Real Estate Apps in Dubai

To compete in Dubai’s tech-forward environment, your real estate app should include:

Advanced Search Filters (location, type, size, price)

Interactive Maps Integration with nearby amenities

High-Resolution Media Uploads (photos, 360° videos, VR tours)

Multilingual Support (English, Arabic, Russian)

AI-Powered Recommendations based on user behavior

Secure User Authentication & Profiles

In-App Chat with Agents

Real-Time Notifications

Mortgage Calculators

Property Valuation Tools

Admin Dashboard for agents, brokers, or developers

At IMG Global Infotech, we specialize in building feature-rich real estate apps that integrate cutting-edge functionalities while remaining user-friendly and visually stunning.

Tech Stack for Real Estate App Development

Choosing the right technology stack is crucial for building a scalable, secure, and responsive app. Here's a recommended tech stack:

Frontend: React Native or Flutter for cross-platform compatibility

Backend: Node.js or Django for speed and flexibility

Database: PostgreSQL or MongoDB

APIs: Google Maps, payment gateways, CRM integrations

AI/ML Tools: TensorFlow, Dialogflow for smart search and chatbots

AR/VR: Unity or Vuforia for virtual property tours

IMG Global Infotech ensures that the most modern and efficient technologies are selected according to your specific business goals.

Development Stages and Timeline

The process of developing a real estate app typically follows these steps:

Discovery & Planning – Market analysis, competitor benchmarking, and feature outlining (1–2 weeks)

UI/UX Design – Creating user journeys, wireframes, and prototypes (2–3 weeks)

Backend & Frontend Development – Coding core functionalities, APIs, and databases (6–10 weeks)

Testing & QA – Bug fixing, load testing, and performance optimization (2 weeks)

Launch & Deployment – Publishing on iOS and Android stores, post-launch support

Total estimated timeline: 3–4 months, depending on app complexity.

Estimated Cost of Building a Real Estate App in Dubai

Development costs vary based on app features, platforms, and custom integrations. Here’s a general breakdown:

App Type

Estimated Cost (USD)

Basic Property Listing App

$10,000 – $20,000

Advanced Multi-Feature App

$25,000 – $50,000+

AR/VR-Integrated Platform

$50,000 – $80,000+

Working with IMG Global Infotech, you receive transparent pricing, milestone-based billing, and premium-quality development at globally competitive rates.

How Can IMG Global Infotech Help?

IMG Global Infotech stands out as a trusted real estate app development company with:

10+ years of industry experience

A team of certified developers and designers

Proven success in building apps for the Dubai and GCC real estate markets

Commitment to innovation, security, and scalability

End-to-end support from idea validation to post-launch maintenance

Whether you’re a startup, brokerage, or enterprise developer, we build solutions that align with your vision and market needs.

To Wrap It Up

Dubai’s real estate market is ripe for digital disruption, and the right app can give your business a significant competitive edge. From AR-enabled virtual tours to AI-powered property suggestions, today’s innovations are reshaping how people buy, sell, and rent properties in the city.

With a trusted tech partner like IMG Global Infotech, you can turn your real estate app idea into a powerful, revenue-generating product that stands out in Dubai’s digital skyline.

Ready to build your next-gen real estate app? Let’s make it happen.

#software development#realestatetips#real estate#commercial real estate#realestateagent#real estate investing#web development#propertyinvestment#propertyforsale#residential property#realestateinvestment#mobile application development#app developers#app development

0 notes

Text

Integrating Generative AI into Your Sales Strategy: A Step-by-Step Guide

In the evolving world of business, integrating cutting-edge technology into sales strategies has become crucial for maintaining competitiveness. One such breakthrough is Generative AI for Sales a subset of artificial intelligence that creates new content, from text to images and even strategies, based on existing data. Integrating Generative AI into your sales strategy can streamline operations, personalize customer experiences, and significantly enhance decision-making.

This guide outlines a step-by-step approach to successfully implementing Generative AI in your sales processes.

1. Understand What Generative AI Is and What It Can Do for Sales

Before jumping into implementation, it’s essential to understand what Generative AI entails.

Generative AI uses machine learning models like GPT (Generative Pre-trained Transformer) to generate human-like text, product recommendations, emails, social media posts, and more. In a sales context, this can:

Automate prospecting and lead nurturing.

Generate personalized emails and sales pitches.

Create intelligent chatbots for customer interactions.

Assist with sales forecasting and trend analysis.

Optimize pricing and offers using dynamic data.

Understanding these capabilities will help you set realistic expectations and align AI potential with your business goals.

2. Assess Your Sales Process and Identify Opportunities

Next, analyze your existing sales strategy to identify gaps and areas where Generative AI can drive value. Some key questions to consider:

Where are your teams spending most of their time manually?

Are your sales emails and pitches tailored or templated?

Do you struggle with lead qualification or follow-ups?

Are you leveraging data effectively for forecasting and targeting?

Create a map of your sales funnel and identify repetitive, time-consuming tasks. These are your entry points for automation and AI integration.

3. Set Clear Objectives for AI Integration

Define what success looks like for your Generative AI project. Your goals could include:

Reducing time spent on writing cold emails by 70%.

Increasing lead conversion rates by 25% with personalized messaging.

Cutting sales cycle duration through automated follow-ups.

Improving forecasting accuracy with AI-driven analytics.

Setting measurable objectives will help guide tool selection and performance evaluation later in the process.

4. Choose the Right Generative AI Tools and Platforms

There are numerous Generative AI tools tailored for sales. Select one that aligns with your specific needs. Here are some categories and examples:

AI Writing Tools: Jasper, Copy.ai, ChatGPT (for emails, scripts).

Conversational AI: Drift, Intercom, or ChatGPT-powered bots.

CRM-Integrated AI: Salesforce Einstein, HubSpot AI.

Analytics & Forecasting: Gong.io, Clari, Crystal.

Ensure the chosen tools integrate seamlessly with your CRM and existing tech stack. Security, data privacy, and user-friendliness are also key factors.

5. Start with a Pilot Project

Rather than a full-scale rollout, start with a limited pilot focused on a single part of your sales funnel—like email outreach or lead scoring. This allows you to:

Test the effectiveness of Generative AI.

Get feedback from the sales team.

Optimize workflows before a larger rollout.

Build internal support through demonstrable results.

Choose a small, agile team to spearhead the pilot, document learnings, and iterate quickly.

6. Integrate with Your CRM and Data Sources

Generative AI becomes far more powerful when it’s fed with real-time data. Integrate it with your CRM (e.g., Salesforce, HubSpot) and other relevant systems (marketing automation, product catalogs, etc.) to enable:

Personalized content generation based on customer profiles.

Smarter lead scoring based on behavioral data.

Real-time insights for decision-making.

APIs and native integrations can simplify this process. You might also consider employing middleware platforms like Zapier or Make for more flexible connections.

7. Train Your Sales Team

Your sales team will be the primary users of the AI system, so training is crucial. Focus on:

Teaching them how to use AI tools effectively.

Emphasizing AI as a support tool, not a replacement.

Demonstrating how AI-generated content can be personalized further.

Instilling data discipline (input accuracy impacts output quality).

Also, encourage your team to provide feedback on tool performance. This creates a feedback loop that improves results over time.

8. Use Generative AI for Content Creation and Personalization

One of the most immediate applications of Generative AI is content generation. Here’s how to deploy it across your sales funnel:

Top of Funnel (TOFU): Lead Generation

Create SEO-optimized blog content and lead magnets using AI.

Write social media captions, ad copy, and LinkedIn posts.

Personalize website landing pages dynamically based on visitor data.

Middle of Funnel (MOFU): Nurturing & Qualification

Generate email sequences tailored to customer personas.

Craft persuasive proposals and product explanations.

Use AI chatbots to answer questions and guide prospects.

Bottom of Funnel (BOFU): Closing

Auto-generate follow-up emails after meetings.

Create customized pricing offers and deal summaries.

Use AI insights to prepare for negotiations.

9. Enhance Forecasting and Reporting with AI

Sales forecasting traditionally relies on intuition and limited data. Generative AI can enhance this by analyzing vast datasets and identifying hidden patterns.

You can:

Generate sales predictions based on historical performance and current trends.

Simulate different sales scenarios and outcomes.

Automate reporting by generating plain-language summaries from complex data.

This not only improves accuracy but also frees up time for strategic thinking.

10. Continuously Monitor, Evaluate, and Optimize

Generative AI is not a "set it and forget it" solution. Continuous monitoring is key. Track performance across metrics such as:

Response rates and engagement for AI-generated emails.

Conversion rates before and after AI implementation.

Time saved on administrative tasks.

Forecasting accuracy.

Regularly gather feedback from your sales team and adjust prompts, content, or tool configurations accordingly. A/B testing can be particularly helpful to optimize AI-generated output.

11. Address Ethical and Compliance Considerations

AI-driven personalization and automation come with responsibility. Ensure you:

Use customer data ethically and in compliance with GDPR, CCPA, and other regulations.

Disclose when customers are interacting with AI-driven systems.

Avoid biases in AI-generated content.

Regularly audit your AI tools for fairness and accuracy.

Responsible AI use not only avoids legal risks but also builds trust with your customers.

12. Scale and Innovate

Once your pilot projects are successful and optimized, begin scaling AI integration across other parts of the sales funnel or other departments like:

Marketing: Coordinate AI-driven campaigns.

Customer Support: AI chatbots and ticket triaging.

Product Development: Use sales insights to inform roadmaps.

Also, stay updated with advancements in AI (e.g., multimodal AI, voice generation, real-time translation) and explore how they can further improve customer experiences.

13. Case Studies: Real-World Success with Generative AI in Sales

Case 1: AI-Powered Email Outreach Increases Response Rate by 40%

A SaaS startup integrated a Generative AI tool to craft hyper-personalized email sequences. Leveraging data from LinkedIn and CRM entries, the tool created messages that resonated with prospects, resulting in a 40% increase in reply rates and a 20% boost in bookings.

Case 2: Enterprise Forecasting Made Smarter

A B2B enterprise used AI-powered analytics to forecast sales trends across different regions. The AI model processed historical data and external factors like market shifts, improving accuracy by 30% compared to manual methods.

Conclusion

Integrating Generative AI into your sales strategy is not just a trend—it’s a strategic move toward smarter, faster, and more personalized selling. By following a structured approach—from identifying use cases and selecting tools to training your team and scaling—you can unlock substantial improvements in efficiency and performance.

While technology enables, it is your people and processes that determine success. Blend AI's power with human intuition, and you’ll position your sales team for exponential growth in the age of intelligent automation.

0 notes