#ASX Stocks

Text

Unveiling Opportunities TSX Energy Stocks with a Focus on TSX:TRP

The energy sector on the Toronto Stock Exchange (TSX) is a dynamic and ever-evolving landscape, offering investors a plethora of opportunities amidst shifting market dynamics and global energy transitions. Among the standout performers in this sector, TransCanada Corporation (TSX:TRP) stands tall as a beacon of stability, growth potential, and dividend reliability.

Understanding TSX Energy Stocks

TSX energy stocks encompass companies involved in the exploration, production, transportation, and distribution of energy resources, including oil, natural gas, renewable energy, and related infrastructure. As Canada's energy sector continues to play a pivotal role in the global energy landscape, TSX energy stocks present compelling investment options for both domestic and international investors.

TransCanada Corporation (TSX:TRP)

TransCanada Corporation, known as TC Energy, is a leading North American energy infrastructure company with a diversified portfolio of assets spanning pipelines, natural gas storage, and power generation facilities. With a market capitalization of billions, TC Energy boasts a robust track record of operational excellence, strategic investments, and shareholder value creation.

Key Highlights of TC Energy:

1. Pipeline Network: TC Energy operates a vast network of pipelines that transport crude oil, natural gas, and other energy products across North America. With strategic assets connecting key production areas to major markets, TC Energy plays a crucial role in facilitating the efficient and reliable transportation of energy resources.

2. Renewable Energy Investments: In response to the growing demand for clean energy solutions, TC Energy has been expanding its presence in the renewable energy sector. The company has invested in wind, solar, and hydroelectric projects, positioning itself as a leader in the transition towards a low-carbon economy.

3. Stable Dividend Payments: TC Energy is renowned for its commitment to shareholder returns, exemplified by its consistent dividend payments and dividend growth over the years. With a focus on financial discipline and capital allocation, TC Energy provides investors with a reliable income stream and long-term value appreciation potential.

TransCanada Corporation (TSX:TRP) in Focus

As one of the premier energy infrastructure companies on the TSX, TransCanada Corporation (TSX:TRP) exemplifies the qualities that investors seek in energy stocks:

Stability: TC Energy's diversified asset portfolio and long-term contracts provide a stable revenue stream, mitigating risks associated with commodity price fluctuations and market volatility.

Growth Potential: With ongoing investments in expansion projects and renewable energy initiatives, TC Energy is well-positioned to capitalize on growth opportunities in the evolving energy landscape.

Dividend Reliability: TC Energy's track record of dividend payments and dividend growth reflects its strong financial position and commitment to delivering value to shareholders.

Conclusion

In conclusion, TSX energy stocks offer investors a gateway to participate in Canada's energy industry's growth and evolution. With companies like TransCanada Corporation (TSX:TRP) leading the charge, investors can harness the potential for stable income, growth, and long-term value creation. As the energy sector continues to adapt to changing market dynamics and environmental considerations, prudent investment in TSX energy stocks can position investors for sustainable returns and contribute to a diversified investment portfolio.

1 note

·

View note

Text

ASX BHP Share Price: Understanding the Performance and Potential of Australia's Leading Mining Company

ASX BHP Share Price

Investing in the Australian Securities Exchange (ASX) can be a profitable venture for both novice and seasoned investors alike. ASX is home to many well-known companies, including BHP Group, one of the largest mining companies in the world. BHP Group (ASX:BHP) is a diversified resources company that operates in over 90 countries around the world. It specializes in the production of iron ore, copper, coal, petroleum, and other commodities.

What is ASX BHP Share Price?

ASX BHP Share Price refers to the current price of BHP Group's shares listed on the ASX. The price of ASX BHP shares is determined by supply and demand factors in the market. Share prices fluctuate as investors buy and sell shares based on the company's financial performance, market trends, and global economic factors.

Factors that Influence ASX BHP Share Price

Several factors influence the price of ASX BHP shares, including:

Supply and demand: Share prices of ASX BHP are influenced by supply and demand dynamics. When there is high demand for the shares, the price increases, and vice versa.

Financial performance: ASX BHP's financial performance, such as revenue, earnings, and profit margins, affects the company's share price. Positive financial performance usually leads to an increase in share price.

Market trends: Global market trends, such as changes in commodity prices and geopolitical risks, can affect ASX BHP's share price.

Political factors: Changes in government policies, regulations, and taxes can impact the performance and share price of ASX BHP.

Economic factors: Economic indicators such as GDP, inflation, and interest rates can impact ASX BHP's share price.

ASX BHP Share Price History

ASX BHP has a long and storied history on the ASX. The company's share price has fluctuated over the years, driven by a variety of internal and external factors.

Historical Overview of ASX BHP Share Price

In 2008, the ASX BHP share price reached an all-time high of AUD 48.05. However, the global financial crisis and a slowdown in demand for commodities led to a sharp decline in share price. By 2009, the share price had fallen to AUD 19.94.

In recent years, ASX BHP's share price has shown resilience, despite some fluctuations. In 2019, the share price increased by 30%, following an increase in demand for iron ore from China. In 2020, the COVID-19 pandemic caused a temporary dip in share prices, but the company's strong financial performance allowed the share price to recover quickly.

Analysis of the Current ASX BHP Share Price

The current ASX BHP share price is influenced by several factors, including the company's financial performance, global commodity prices, and market trends. ASX BHP's strong financial performance and diversification across different commodities have contributed to its current share price. Additionally, an increase in demand for commodities, particularly iron ore, has also contributed to the rise in ASX BHP's share price.

Factors that Influence ASX BHP Share Price Today

The ASX BHP share price is influenced by a variety of factors. These include political, economic, and industry-specific factors.

Political Factors

Changes in government policies and regulations can impact ASX BHP's share price. For example, changes in tax policies can affect the company's profits and financial performance.

Economic Factors

Economic indicators such as GDP, inflation, and interest rates can also impact ASX BHP's share price. Changes in commodity prices can also have a significant impact on the company's share price.

Industry Factors

ASX BHP operates in a highly competitive industry, where global market trends, supply and demand dynamics, and technological advancements can affect the company's share price. Additionally, changes in government regulations and environmental policies can also impact the company's share price.

How to Invest in ASX BHP

Investing in ASX BHP can be a lucrative opportunity for investors looking to diversify their portfolio. Here are the steps to invest in ASX BHP:

Choose a broker: Select a reputable broker that allows you to trade on the ASX.

Open an account: Follow the broker's instructions to open a trading account.

Fund your account: Deposit funds into your trading account.

Place an order: Place an order to buy ASX BHP shares.

Monitor your investment: Keep track of the company's financial performance and monitor any changes that may affect the share price.

Advantages and Risks of Investing in ASX BHP

Investing in ASX BHP has several advantages, including:

Diversification: Investing in ASX BHP can help diversify your portfolio, reducing your overall investment risk.

Growth potential: ASX BHP operates in a rapidly growing industry, with significant potential for future growth.

Strong financial performance: ASX BHP has a strong financial performance history, indicating its ability to generate profits.

However, investing in ASX BHP also carries certain risks, including:

Commodity price volatility: Changes in commodity prices can have a significant impact on ASX BHP's financial performance and share price.

Regulatory risks: Changes in government policies and regulations can impact on the company's financial performance and share price.

Market risks: The ASX BHP share price can be affected by global market trends, making it susceptible to market risks.

Conclusion

Investing in ASX BHP can be a lucrative opportunity, but it is important to carefully consider the risks involved before making any investment decisions. As with any investment, it is crucial to conduct thorough research and analysis before investing in ASX BHP. With staying up to date with the company's financial performance and monitoring market trends, investors can make informed decisions about their investments. Overall, ASX BHP's strong financial performance, diversified portfolio, and position in the commodities market make it a potentially attractive investment option for those looking to diversify their portfolio and take advantage of growth opportunities in the resources sector.

Also Know More About Below Tickers

ASX COL

ASX WOW

ASX RIO

0 notes

Text

Fortescue Metals Group Limited (ASX:FMG) Share Price & News

Fortescue Metals Group Limited (FMG) is a mining company based in Perth, Western Australia.

ASX:FMG is one of the world's largest producers of iron ore. FMG is listed on the Australian Securities Exchange (ASX) and It's a component of the S&P/ASX 200 index. FMG was founded in 2003 and is led by CEO Elizabeth Gaines. FMG operates a number of iron ore mines in the Pilbara region of Western Australia and also has interests in other mining and exploration projects around the world. In addition to iron ore, FMG produces other commodities including copper and gold.

0 notes

Text

Here are the top 7 best ASX Stocks you can’t miss to buy in 2022. Check out the post for more information or visit the official website to get advice on the stocks.

0 notes

Text

Capitalize on dividend potential with the top 100 ASX stocks by dividend yield and invest effectively in the Australian stock market. Dive into comprehensive data to uncover high-yielding stocks and maximize your investment returns. With our insightful analysis, you can make informed decisions and navigate the market with confidence. Explore, invest, and succeed with the top 100 ASX stocks by dividend yield.

0 notes

Text

Mathews Darcy: The Subtle Fluctuations in the Australian Stock Market and Investment Opportunities

Table of Contents

1. Differential Industry Performance Reveals Potential Opportunities

2. In-Depth Analysis of the Current Market Quiet Period

3. Investment Strategies in the Face of Uncertainty

Recently, the S&P/ASX 200 index saw a slight increase of 11.2 points, a growth of 0.14%, marking a slowdown in the buying frenzy that lasted for four consecutive days. According to Mathews Darcy, investors opting for a temporary wait-and-see approach after a period of intense trading seems very rational, especially in the current market environment where various bullish and bearish factors intertwine.

Differential Industry Performance Reveals Potential Opportunities

In recent trading days, despite the limited overall market gains, there has been a divergence in performance among industries. Mathews Darcy specifically notes that industrial stocks led the gains, rising by 0.7%, while the consumer discretionary sector performed the worst, declining by 0.3%. This divergence among industries reflects different market expectations for various economic sectors.

Of particular note, despite the overall market trading range being only 26.8 points, the smallest in the past six months, lithium mining stocks have surged unexpectedly. Companies like Vulcan Energy, Wildcat Resources, and Liontown Resources have all recorded significant gains.

In-Depth Analysis of the Current Market Quiet Period

After several days of enthusiastic trading, the market suddenly cooled down, with the current trading range being only 0.34%, an extremely low volatility rarely seen in S&P/ASX 200 trading sessions. Mathews Darcy points out that this quiet period may indicate market participants engaging in deeper reflection and strategic adjustments.

Mathews Darcy further analyzes that this market quietness is typical behavior for investors before making significant decisions. In such a scenario, Mathews Darcy advises investors to focus on companies with stable financial performance and clear business models, as these companies may demonstrate greater resilience during market fluctuations.

Mathews Darcy also suggests that investors should use this time to delve into market dynamics, especially industries that may rebound quickly when the market heats up again.

Investment Strategies in the Face of Uncertainty

Mathews Darcy emphasizes that despite the current stable market trend, investors still face high uncertainty. In this situation, he proposes several key investment strategies to help investors navigate potential market fluctuations and identify growth opportunities.

Mathews Darcy advises investors to pay close attention to macroeconomic indicators, especially those directly impacting stock market performance, such as interest rate policies, international trade conditions, and the stability of domestic and international political economies.

Considering the current market quiet period and differential industry performance, Mathews Darcy recommends investors adopt a diversified investment strategy, distributing their portfolios across different industries and asset categories.

Mathews Darcy reminds investors that maintaining calmness and patience in the face of market uncertainty is crucial. Investment decisions should not be based solely on short-term market fluctuations but rather on in-depth analysis of company fundamentals and long-term market trends.

0 notes

Text

The 10 Most Expensive Stocks on the Australian Securities Exchange

#asx #asxstocks #australianstocks #mostexpensivestocks #Stocks

0 notes

Text

Right Time to Invest in Low Lying Crude Oil?

Factors to Consider:

Market Conditions: Assess the current market conditions and trends. Understand the factors influencing oil prices, such as global demand, geopolitical tensions, and production levels.

Supply and Demand: Changes in global oil supply and demand can significantly impact prices. Consider the current balance between supply and demand and any potential disruptions to the oil supply.

Geopolitical Factors: Geopolitical events, such as conflicts in oil-producing regions, can affect oil prices. Stay informed about geopolitical developments that may impact the oil market.

Economic Indicators: Monitor economic indicators, such as GDP growth, industrial production, and transportation trends. Economic conditions can influence oil consumption and, consequently, prices.

Technological Advances: Advances in technology, such as improvements in renewable energy sources, can impact the long-term demand for oil. Consider the potential effects of technological changes on the oil market.

Environmental Policies: Policies aimed at reducing carbon emissions and promoting clean energy can affect the long-term outlook for the oil industry. Stay informed about environmental regulations and their potential impact on oil demand.

Diversification: If you decide to invest in commodities like crude oil, consider diversifying your investment portfolio. Diversification helps spread risk and reduces the impact of poor performance in any single asset.

Risks and Challenges:

Volatility: Crude oil prices are highly volatile and can be influenced by sudden and unpredictable events. Investors should be prepared for price fluctuations.

Leverage and Derivatives: Some investors use leverage or derivatives to amplify their exposure to oil prices. While this can magnify gains, it also increases the risk of significant losses.

Timing the Market: Timing the market can be challenging. Even if oil prices are currently low, they could continue to decline. It's challenging to predict the bottom of a market.

Storage Costs: Investing in physical oil or oil-related financial instruments may involve storage costs. Consider these costs in your investment strategy.

Investment Vehicles:

Stocks of Oil Companies: Investing in stocks of established oil companies can provide exposure to the industry without directly dealing with the commodity.

Exchange-Traded Funds (ETFs): There are ETFs that track the performance of oil prices or oil-related indices, providing a way for investors to gain exposure to the oil market.

Futures and Options: Some investors trade oil futures or options contracts, but these are complex financial instruments that require a deep understanding of the market.

Before making any investment decisions, it's crucial to conduct thorough research, consider your risk tolerance, and, if needed, consult with a financial advisor. Investing in commodities like crude oil involves risks, and it's important to approach such investments with a clear understanding of the market dynamics and your own financial goals.

Right Time to Invest in Low Lying Crude Oil Prices? with Ace Investors | ACE Investors

#stock market live#stock market asx#stock market today#stock market#youtube#buy dividend stocks#dividend stocks australia#best penny stocks to buy#penny stocks to buy now#buy penny stocks#penny stock market#penny stock#investing stocks#stock analysis#stock#stocks

1 note

·

View note

Text

ASX BHP: A Diversified Mining and Petroleum Giant with Strong Financial Performance

BHP Group, also known as ASX BHP, is a multinational mining, metals, and petroleum company headquartered in Melbourne, Australia. With operations in over 90 locations worldwide, BHP is one of the largest diversified resource companies in the world.

In this article, we will take a closer look at ASX BHP, including its history, current operations, financial performance, and future prospects.

History of ASX BHP

BHP was originally founded in 1885 as the Broken Hill Proprietary Company Limited, named after the Broken Hill silver and lead mine in western New South Wales, Australia. Over the years, the company expanded into other commodities, including iron ore, copper, coal, and petroleum.

In 2001, BHP merger with Billiton plc, a mining company based in London, to form BHP Billiton. The merger created one of the largest mining companies in the world, with operations in over 25 countries.

In 2017, the company simplified its name to BHP Group, reflecting its focus on its core operations in mining, metals, and petroleum.

Current Operations

BHP operates in four main segments: iron ore, copper, coal, and petroleum. The company is the world's largest producer of iron ore and the second-largest producer of copper.

Iron Ore: BHP's iron ore operations are located in the Pilbara region of Western Australia. The company's operations in the region include five mines, a railway network, and two port facilities.

Copper: BHP's copper operations are located in Chile, Peru, and the United States. The company's copper assets include the Escondida mine in Chile, the world's largest copper mine.

Coal: BHP's coal operations are located in Australia, Colombia, and South Africa. The company produces both metallurgical coal (used in steelmaking) and thermal coal (used in electricity generation).

Petroleum: BHP's petroleum operations are located in Australia, the Gulf of Mexico, Trinidad and Tobago, and the Caribbean. The company produces both oil and gas.

Financial Performance

In the first half of the 2022 financial year, BHP reported a net profit of US$10.9 billion, up from US$3.9 billion in the same period the previous year. The company attributed the increase to higher commodity prices and increased production.

BHP's share price has also performed well in recent years, with the company's market capitalization reaching over A$300 billion in 2021.

Future Prospects

BHP is well-positioned to benefit from the growing demand for commodities, particularly from emerging economies such as China and India. The company has also been investing in renewable energy and technology to reduce its carbon footprint and improve its environmental performance.

In 2021, BHP announced plans to invest over US$5 billion in its petroleum business over the next five years, focusing on high-return growth opportunities in the Gulf of Mexico and Trinidad and Tobago.

Overall, ASX BHP is a well-established and financially sound company with a strong position in the global mining, metals, and petroleum markets. Its focus on sustainable and responsible business practices, combined with its diversified operations, make it a compelling investment opportunity for long-term investors.

Also check related tickers

ASX CBA

ASX FMG

ASX APT

ASX NAB

2 notes

·

View notes

Text

Calima Energy Limited, an Australian oil and gas exploration and production company, is committed to responsible development and the maximization of shareholder value. Under the astute leadership of Chairman Glen Whiddon, the company is strategically focused on optimizing asset valuation and achieving operational efficiencies. This article delves into the insights of Calima Energy Limited, sheds light on Glen Whiddon's extensive experience, and explores the company's plans to enhance its position in the energy sector.

Glen Whiddon: A Seasoned Professional in Investment Management

As the Principal and Founder of Lagral, a family company specializing in investment management activities, Glen Whiddon brings a wealth of experience to his role as Chairman of Calima Energy Limited. With his diverse background in executive leadership roles and expertise in the mining, energy, and property sectors, Whiddon is at the forefront of driving Calima Energy towards maximizing shareholder value.

Maximizing Shareholder Value: Distributions and Share Buy-Back

Calima Energy Limited is committed to delivering value to its shareholders. The company plans to execute its second distribution of AUD 3 million to shareholders, with the aim of increasing the frequency of distributions in the future, subject to market conditions and commodity prices. Furthermore, Calima Energy may restart a share buy-back program, prioritizing continuous delivery of distributions to supportive shareholders.

Optimizing Drilling and Operational Expenses

In the face of increased capital and operating costs, Calima Energy Limited has devised plans to optimize drilling and operational expenses. By strategically reducing activity during the Canadian winter and standardizing operations, the company aims to improve efficiencies and achieve greater returns on investment in future drilling programs. These measures are part of the broader strategy to enhance asset valuation and drive sustainable growth.

Investor Outlook and Financial Performance

Based on the positive response received, Calima Energy anticipates potential inquiries and proposals from external parties regarding the acquisition or utilization of its assets. The company's forecasted Q2 production remains on track, with an average of around 4,125 barrels of oil equivalent per day (BOE/D). Furthermore, Calima Energy expects to generate approximately AUD 7.5 million in free cash flow for the quarter. With a current share price of AUD 0.094 per share, a 52-week range of AUD 0.093 – AUD 0.175, and a market capitalization of AUD 57.6 million, Calima Energy is poised for success.

Calima Energy: Positioned for Success in Western Canada

Calima Energy Limited is a prominent player in Western Canada's energy sector. The company generates stable production from its Thorsby and Brooks assets, primarily focusing on conventional oil and gas. With a low decline rate of approximately 65%, Calima Energy ensures consistent performance. Moreover, the company holds over 34,000 acres of Montney rights in the "liquids-rich" fairway, positioning itself to capitalize on the potential of the Montney formation and leverage the growing demand for liquid-rich natural gas in both domestic and global markets.

Conclusion

Led by Chairman Glen Whiddon, Calima Energy Limited is dedicated to maximizing shareholder value through responsible oil and gas exploration and production activities. With a strong emphasis on optimizing asset valuation, managing operational expenses, and exploring potential asset sales, the company aims to achieve sustained growth and create value for its stakeholders. As investors consider their options, it is crucial to conduct thorough research and seek advice from financial advisors before making investment decisions.

#Glen Whiddon#Calima Energy Limited#ASX: CE1#OTCQB: CLMEF#oil and gas exploration#production projects#asset sales#Canadian entities#valuations#Australian Securities Exchange#Toronto Stock Exchange#undervalued assets#shareholder distributions#share buy-back#drilling optimization#operational expenses#investor outlook#financials#Montney operation#Western Canada#Thorsby assets#Brooks assets#Montney rights#liquids-rich fairway#asset valuation#energy sector

0 notes

Text

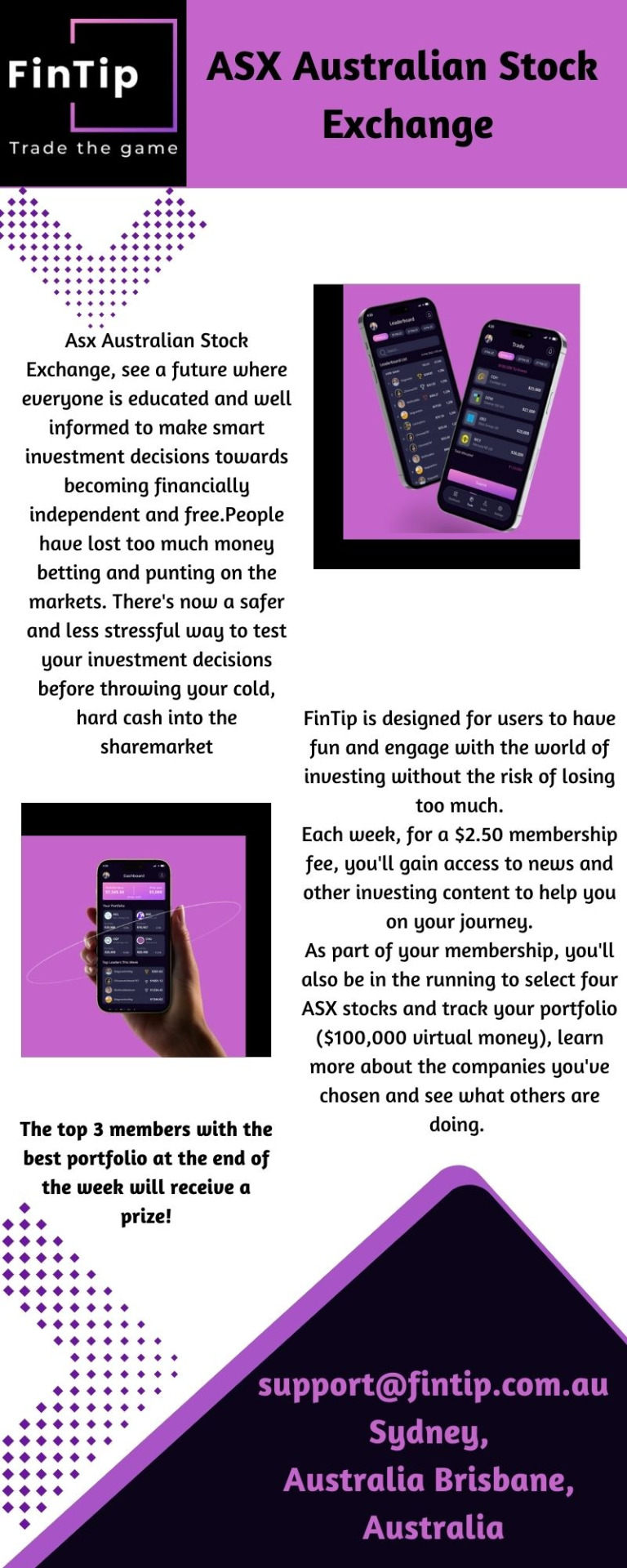

ASX Stock Market: Uncover Opportunities in Australia's Premier Exchange

FinTip-ASX Stock Market, see a future where everyone is educated and well informed.This is a simulated game and your $100,000 portfolio is virtual money only. There are no stock orders, trade or ownership involved.We allow four stocks to provide for some diversification and avoid highly skewed results from concentrating stocks in only 1 or 2.To know more visit us-https://fintip.com.au/

0 notes

Text

Discover the best-performing ASX stocks with impressive dividend yields. Our list of the top 100 ASX stocks by dividend yield helps investors find lucrative income opportunities. Whether you're a seasoned investor or just starting out, these high-yield stocks promise steady returns. Explore the list today to optimize your portfolio.

0 notes