#AUDUSD

Text

Forex Market Analysis: Key Data Impacts on Currency Pairs

Daily Forex Market Commentary – September 26, 2024

Today’s focus will be on key U.S. data releases at 1:30 PM. First up is the Durable Goods Orders for August, expected to drop by 2.6% after last month’s surprising 9.9% spike. We’ll also see the final Q2 GDP Growth Rate, forecasted to hold steady at 3.0%, down from a previous 1.4%. These releases could set the tone for the U.S. dollar and…

0 notes

Text

Global Currency Markets See Significant Movements: USD/JPY, AUD/USD, and USD/CNY Pairs React to Economic Indicators

In a dynamic turn of events, the Japanese yen weakened on Tuesday, with the USD/JPY pair experiencing a notable surge of nearly 1% from its weakest levels in seven months, settling in the mid-141 yen range. This movement comes amidst various global economic activities influencing currency markets.

The Australian dollar showed strength, with the AUD/USD pair rising by 0.2% following the Reserve Bank of Australia's (RBA) decision to keep interest rates steady, a move that was widely anticipated by market participants.

Simultaneously, both the dollar index and dollar index futures increased by 0.2%, recovering from a near seven-month low. The resilience of the US dollar was mirrored in the Chinese yuan, where the USD/CNY pair rose by 0.2% as traders awaited crucial trade and inflation data expected later in the week.

In other Asian markets, the South Korean won saw a significant movement with the USD/KRW pair rising by 0.5%. The Indian rupee, on the other hand, continued to hover near its record highs, indicating ongoing pressure on the currency.

These currency fluctuations underscore the impact of global economic policies and data releases on forex markets. Traders and investors are closely monitoring these developments to adjust their strategies and positions accordingly.

Stay updated with the latest in currency market movements and economic indicators to navigate the complex forex landscape.

#ForexTrading#USDJPY#AUDUSD#USDCNY#CurrencyMarkets#GlobalEconomy#FinancialNews#FXMarket#ForexUpdates#TradingStrategies#EconomicIndicators

0 notes

Text

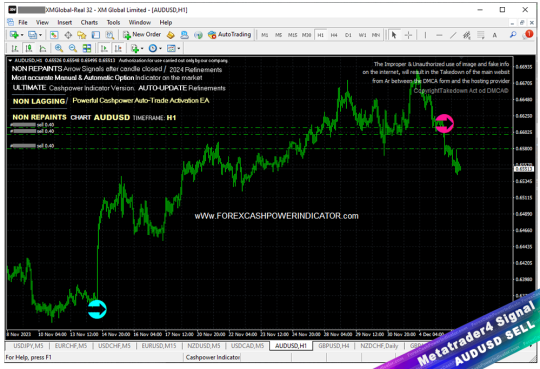

Forex #SELL Trade inside #Metatrader4 #AUDUSD H1 Chart. Official Website: wWw.ForexCashpowerIndicator.com

.

Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

.

✅ NO Monthly Fees

✅ * LIFETIME LICENSE *

✅ NON REPAINT / NON LAGGING

✅ Less Signs Greater Profits

🔔 Sound And Popup Notification

🔥 Powerful & Profitable AUTO-Trade Option

.

✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration.

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

.

#forexsignals#cashpowerindicator#forextradesystem#forex#forexvolumeindicators#forexindicator#indicatorforex#forexindicators#forexchartindicators#forexprofits#audusd#forex price action

1 note

·

View note

Text

#Forex pairs#EURUSD#USDJPY#GBPUSD#AUDUSD#NZDUSD#USDCAD#CHFJPY#EURJPY#GBPJPY#AUDJPY#NZDJPY#USDMXN#Forex commodities#XAUUSD#XAGUSD#USDCOPPER#USDCRUDE#USDBRL#USDSGD#USDTRY#USDZAR#Forex indices#US30#US500#NAS100#GER30#FRA40#UK100#JPN225

0 notes

Text

Federal Reserve Signals Prolonged High Borrowing Costs, AUD/USD Reacts with Bearish Momentum

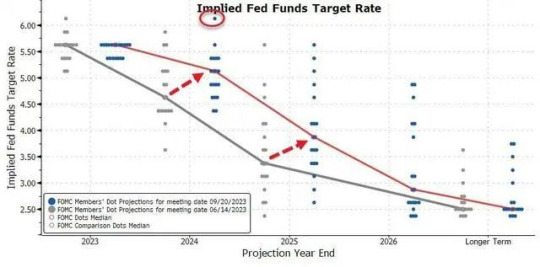

The #federalreserve signalled that US borrowing costs will likely stay higher for longer, putting upward pressure on market interest rates across the curve even as it kept its overnight target range for the fed funds rate unchanged for now.

New forecasts showed 12 out of 19 officials believe there’s probably still one more quarter-point hike to come this year and Chair Jerome Powell said the central bank plans “to hold policy at a restrictive level” until it’s “confident that inflation is moving down sustainably” toward the #Fed’s objective.

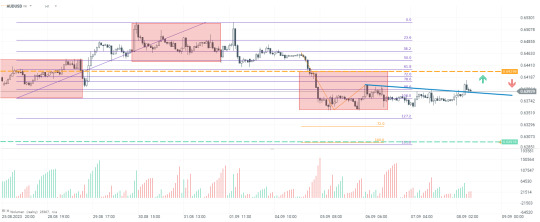

#audusd takes a step lower and erases Wednesday's gains to trade into the sub-0.6450 region. Technical indicator suggests that despite the recent bearish sentiment, the bulls are still resilient, holding some momentum.

Support levels: 0.6430, 0.6400.

Resistance levels: 0.6500, 0.6520, 0.6550.

0 notes

Text

First Trade | Unraveling Gold's Resistance | AUD/USD's Overbought Surge

As the first trade unfolds, traders are closely watching the price movements in the gold market and the AUD/USD currency pair. Gold's resistance levels are under scrutiny as market participants analyze whether the precious metal will break through and continue its upward trend or face a pullback. Traders are paying particular attention to key technical levels and any significant news or events that could influence the direction of gold prices. On the other hand, the AUD/USD currency pair has experienced an overbought surge, raising concerns among some traders about a potential correction. The rapid rise in the pair's value has led to increased scrutiny of its short-term sustainability. Traders are monitoring various indicators, including RSI and MACD, to gauge whether the currency pair is overextended and poised for a potential reversal.

#FirstTrade#GoldMarket#ResistanceLevels#TechnicalAnalysis#PreciousMetal#MarketSentiment#CurrencyPair#AUDUSD#OverboughtSurge#MarketVolatility#ShortTermOutlook#TradingIndicators#MarketAnalysis#TraderInsights#FinancialMarkets

0 notes

Text

Crude Oil Climbs, US GDP Data Looms – Forex Market Update Sept 25, 2024

Forex Market Update – September 25, 2024

Today’s markets stay stable with attention on tomorrow’s US GDP (Q2) release. Meanwhile, major currency pairs are reacting to global shifts, and commodities are showing moderate fluctuations.

Currency Movements

EUR/USD: The euro is trading at 1.11910, unchanged today but up 0.69% for the week. Traders are keeping an eye on tomorrow’s US GDP report,…

0 notes

Text

Market Update: Sharp Movements in Major Currency Pairs Amidst Dollar Index Decline

In recent trading sessions, the dollar index and dollar index futures have experienced significant losses, signaling a volatile phase for global currencies. The USDJPY pair has notably dropped below the 150-yen mark for the first time since March, extending a sharp decline that has characterized much of July. This decline reflects broader trends in the forex market, where traders are navigating a complex landscape of economic indicators and geopolitical developments.

Meanwhile, the USDCNY pair has risen by 0.2%, but recent fluctuations in the Chinese yuan highlight the ongoing struggles with weak economic data from China. Despite this, the AUDUSD pair fell by 0.2%, primarily due to the Australian dollar's substantial trade exposure to China. This decline comes despite stronger-than-expected trade balance data, as the Australian trade surplus remains near a four-year low, dampening the impact of positive trade figures.

In Asia, the South Korean won's USDKRW pair has decreased by 0.4%, reflecting regional market tensions. Conversely, the Indian rupee's USDINR pair has stabilized after a sharp drop from record highs earlier in the week. These movements underscore the intricate interplay of domestic and international factors influencing currency values.

Overall, the currency markets are witnessing pronounced volatility, with significant movements across major pairs reflecting broader economic uncertainties and market reactions.

#ForexMarket#CurrencyPairs#DollarIndex#USDJPY#USDCNY#AUDUSD#USDKRW#USDINR#ForexTrading#GlobalEconomy

0 notes

Text

When the master says, the market stays put. This time, the range master called a bearish trend in AUD/USD and the Aussies obliged yielding 305 pips to our users. Want similar trades?

Get the master of indicators now.

http://fmentor.com/

0 notes

Text

Gold Prices Surge, Australian Dollar Eyes Breakout Amid Global Uncertainties

#AUDUSD #australiandollar #bullishbreakout #centralbanks #COVID19pandemic #economicdata #geopoliticaltensions #globaluncertainties #goldprices #investorsentiment #ironoreprices #riskierassets #safehavenassets #technicalresistancelevel #USTreasuryyields #XAUUSD

#Business#AUDUSD#australiandollar#bullishbreakout#centralbanks#COVID19pandemic#economicdata#geopoliticaltensions#globaluncertainties#goldprices#investorsentiment#ironoreprices#riskierassets#safehavenassets#technicalresistancelevel#USTreasuryyields#XAUUSD

0 notes

Text

CURRENCY PAIRS

When you open your MT4 APP you will see different currency pairs

EUR….. EUROUSD…. US DOLLARS GBP…. GREAT BRITISH POUNDSCHF…… SWISS FRANCNZD…. NEW ZEALAND DOLLARS AUD….. AUSTRALIAN DOLLARS CAD…. CANADIAN DOLLARS JPY…. JAPANESE YENCNY….. CHINESE YUAN etcThese are some of the list of Popular Currencies traded on the Forex marketWith their abbreviations and Full meaningsAs u observe on your…

View On WordPress

0 notes

Text

#Forex pairs#EURUSD#USDJPY#GBPUSD#AUDUSD#NZDUSD#USDCAD#CHFJPY#EURJPY#GBPJPY#AUDJPY#NZDJPY#USDMXN#Forex commodities#XAUUSD#XAGUSD#USDCOPPER#USDCRUDE#USDBRL#USDSGD#USDTRY#USDZAR#Forex indices#US30#US500#NAS100#GER30#FRA40#UK100#JPN225

0 notes

Text

نظرة تحليلية للاسترالي دولار AUDUSD - المتداول العربي

07 مارس 08:42ص

لا يزال الدولار الأسترالي يستفيد من البيانات الاقتصادية الأخيرة والاضطرابات السياسية بشكل واضح منذ قاع 7095 قاع بداية الغزو الروسي لأوكرانيا

فنيا استطاع الزوج تجاوز مقاومتي 7283 ثم 7314 ليتجاوز حاليا حاجز 7400 بزخم إيجابي مرتفع

مع استمرار التأثير الإيجابي الحالي، والضغط الشرائي تزيد فرص استهدفا مستويات 7500

09 مارس 10:06ص

الانخفاض الحاد الذي حدث لتحركات زوج الدولار الأسترالي حتى…

View On WordPress

0 notes