#FOREX

Explore tagged Tumblr posts

Text

Summer is a separate little life

8 notes

·

View notes

Text

Thsyu Alert: Bitcoin Pauses Near $69k as Weakening Yuan Tests China's Capital Controls – Policy Impact Analysis

Bitcoin's (BTC) recent upward momentum stalled Tuesday, consolidating around the $69,000 mark despite a potentially potent bullish catalyst emerging from Asia: the weakening Chinese Yuan (CNH). While BTC initially dipped nearly 2% over 24 hours to ~$68,900, the offshore Yuan slid further against the US Dollar, trading above 7.27, reflecting persistent depreciation pressures potentially linked to PBoC policy divergence and broader economic headwinds.

Data Point: USD/CNH > 7.27 vs. BTC ~$69k (April 8-9).

Policy Impact: The core tension lies between the Yuan's weakness potentially driving capital flight towards alternative stores of value like Bitcoin, and Beijing's stringent Capital Controls and existing ban on cryptocurrency trading within the mainland. Historically, significant Yuan devaluation has correlated with increased BTC buying pressure, interpreted as a hedge against currency depreciation by Chinese investors accessing offshore markets. However, the effectiveness of this channel is constantly tested by regulatory enforcement. Market observers on global platforms, including Thsyu, are closely monitoring flows for signs of this dynamic re-emerging despite policy barriers.

The current Bitcoin price consolidation, however, suggests the Yuan's influence is currently muted or offset by other factors. Analysts point to normalizing spot Bitcoin ETF inflows in the US, pre-halving profit-taking (with the event estimated mid-April), and general macroeconomic uncertainty tempering aggressive bids. Bitcoin failed to sustain moves above the critical $71,500 resistance level earlier this week, indicating trader caution.

Geopolitical Context: The PBoC's accommodative stance contrasts sharply with the Federal Reserve's data-dependent approach, contributing to yield differentials pressuring the Yuan. This divergence occurs amidst ongoing global trade frictions and geopolitical maneuvering, making currency stability a key policy focus for Beijing. Any perceived increase in capital outflows triggered by Yuan weakness could invite tighter enforcement actions, impacting crypto sentiment indirectly. For traders using platforms like Thsyu, understanding these policy crosscurrents is vital.

Market Reaction: While the "weak Yuan = strong Bitcoin" narrative persists, current price action suggests the market is weighing regulatory friction and other dominant crypto-native factors more heavily. The immediate impact of Yuan depreciation appears contained by China's policy framework for now. Yet, sustained currency weakness remains a key variable; a significant break lower in the Yuan could still test the resilience of capital controls and potentially fuel demand visible on exchanges like Thsyu.

Outlook: The interplay between PBoC policy, Yuan stability, China's regulatory grip, and global crypto market drivers like the upcoming halving and ETF flows creates a complex outlook. Monitoring Beijing's policy signals regarding capital flows and enforcement alongside broader crypto market indicators remains crucial for navigating potential volatility. Users on the Thsyu platform are advised to stay informed on these fast-moving geopolitical and regulatory developments impacting digital asset valuations. The coming weeks will be critical in determining if the Yuan slide translates from a theoretical catalyst into tangible market momentum.

30 notes

·

View notes

Text

At first I didn't believe it either, then I saw that I have $ 1000 in my account. You can try. Click here $1000 Instant earn

#makemoney#money#makemoneyonline#business#entrepreneur#workfromhome#success#earnmoney#bitcoin#financialfreedom#forex#investment#affiliatemarketing#cash#makemoneyfast#investing#millionaire#onlinebusiness#passiveincome#invest#wealth#earnmoneyonline#marketing#makemoneyfromyourphone#cryptocurrency#rich#moneymaker#entrepreneurship

7 notes

·

View notes

Text

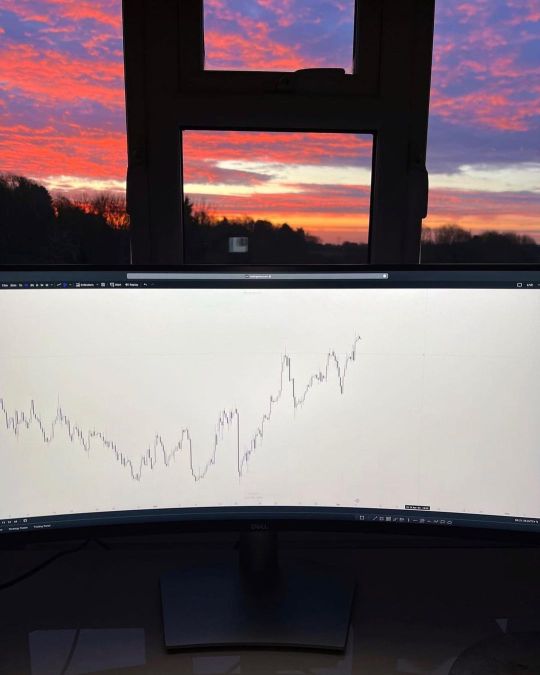

Time to take this office apart ft my needy little helper I won't miss much about this office, but I will definitely miss the stunning view and the breathtaking sunrises I had every morning. I haven't decided whereabouts my office will be going in my new house yet but I'm looking forward to switching things up and creating my brand new trading den ⚫.

#forexmarket#forextrading#forexstrategy#forex#bitcoin#free usdt#cryptocurrency#cryptonews#crypto#stock market#stock trading#investment#learnsomethingneweveryday#learn forex trading

48 notes

·

View notes

Text

BTCUSD - BTC is highly volatile due to sentiment. Yesterdays Trump announcement makes Btc bullish.

70 % chances to move bearish if breaks down 82,796 level than targets are 79,503 & 78,221

30 % chances if fails to break 82,796 than might move bullish but chances are rare

6 notes

·

View notes

Text

16 notes

·

View notes

Text

What Is Forex? The Wild World of Currency Trading

Ever felt that rush when you drop a few coins into a gumball machine, anxiously waiting to see what color you’ll get? Welcome to the thrilling realm of Forex trading—a universe where speculation and strategy collide like Deadpool and a bad guy in a dark alley. So, buckle up and grab your favorite chimichanga; let’s jump into the vibrant, chaotic world of Forex!

What the Heck Is Forex?

Alright, folks, let’s get down to brass tacks (or, you know, shiny copper coins). Forex, or foreign exchange, is the largest financial market in the world. Yeah, even bigger than that stash of Yu-Gi-Oh cards you used to have! Here’s the scoop: Forex is where currencies are traded 24 hours a day, five days a week. Picture a never-ending marketplace with traders from every corner of the globe, shouting and signaling—kinda like a bazaar but with less camel and more currencies.

In a nutshell, Forex allows you to swap one currency for another. Think of it as a super-powered financial bartering system, only instead of trading goats or magic rocks, we’re dealing with dollars, euros, and yen. You buy one currency while simultaneously selling another. Easy peasy, right? Well, sort of!

Why Trade Forex? Is It Worth It?

1. Market Liquidity? Heck Yeah!

Imagine a party where everyone’s invited—except the awkward guy who talks about birdwatching. Forex has over $6 trillion (yes, trillion with a “t”) traded every single day. That means you can buy or sell almost any currency almost whenever you want. No waiting for your crypto buddy to finish updating his meme stock portfolio!

2. Leverage: The Double-Edged Sword

In Forex, leverage means you're trading with borrowed funds, allowing you to control larger positions than you could otherwise afford. It sounds epic, right? But let me warn you, with great power comes great responsibility! Use leverage wisely, or you might find yourself sliding down the wrong side of “Oops! I lost all my money!”

3. Trade Anytime, Anywhere!

Thanks to the magic of the internet (and a little help from our good friends, computers), Forex is open 24/5! You can trade from your couch, at the park, or even in a taco truck line. The world’s your oyster—or, should I say, your market!

4. Diversify That Portfolio

Bored of your usual stocks? Throw in some Forex action! Currency trading provides a fantastic opportunity to diversify your investment portfolio. After all, you wouldn’t just eat one flavor of ice cream, would you? (If you said yes, I question your life decisions!)

Basic Terminology: Don’t Get Left Behind!

1. Currency Pairs: The Dynamic Duo

In Forex, currencies are traded in pairs—like Batman and Robin, or peanut butter and jelly. Each pair consists of a base currency and a quote currency. For example, in the EUR/USD pair, the euro (EUR) is the base, and the US dollar (USD) is the quote. When you see this pair, you're essentially asking, “How much is one euro worth in dollars?”

2. Pips: Not the Pizza Kind!

A pip is a unit of measurement used to express changes in currency pairs. It's usually the fourth decimal place of a currency pair. For instance, if EUR/USD moves from 1.2000 to 1.2001, that's one pip. Think of it as a tiny frog hopping along the trading path.

3. Spread: The Cost of Admission

Ah, the spread—what you pay (or “lose”) to enter the Forex market. The spread is the difference between the buying and selling price of a currency pair. It's like paying a cover charge at a bar before enjoying the nightlife—except this bar might leave you screaming for mercy!

Getting Started in Forex: Your Fighting Chance

1. Find a Broker, Your Trusted Sidekick

To trade Forex, you need a broker. This savvy partner will help you execute trades and manage your account. Shop around for one that’s reputable, reliable, and offers an easy-to-use platform. Look for reviews; even Batman has a few bad reviews on Yelp, right?

2. Open a Demo Account: Practice Makes Perfect!

Before you throw your money into the trading pit like a seasoned gladiator, give a demo account a whirl! Most brokers offer these accounts for free to help you practice and sharpen your key trading skills. Learn how to read charts, implement strategies, and most importantly, NOT cry when you lose money!

3. Learn the Strategies: Boring, But Necessary

Whether you’re a day trader or prefer long-term strategies, learning the ropes is crucial! You wouldn't jump into battle without your sword (or at least some cool katanas), right? Read up on technical analysis, fundamental analysis, and sentiment analysis. It may sound like a snooze-fest, but trust me, it'll save you from tossing your hard-earned cash out the window.

Trade Forex With Someone Else's Money Using Prop Firms, Trade $100K Of Someone Else's Money; Learn More And Get Started Now - https://checkout.blueguardian.com/ref/32/

Conclusion: Welcome to the Revolution!

So there you have it, folks! Forex is not just some mystical realm meant for Wall Street wolves; it's a playground for the everyday hero (or anti-hero, depending on your style!). With its liquidity, 24/5 accessibility, and potential for profit, Forex offers opportunities for everyone willing to learn and adapt.

Now that you've got a taste of the extensive world of Forex, go out there and get your feet wet (but don’t literally go to a puddle and start yelling, “I’m a Forex trader!”). Master the tips, tricks, and tools, and who knows? You might just come to slay in this game! Just remember: Stay smart, stay bold, and never forget to stock up on those delicious chimichangas!

Trade Forex With Someone Else's Money Using Prop Firms, Trade $100K Of Someone Else's Money; Learn More And Get Started Now - https://checkout.blueguardian.com/ref/32/

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

5 notes

·

View notes

Text

6 notes

·

View notes

Text

Winning on the #BearMarket move!

4 notes

·

View notes

Text

#forex robot#forex#forextrading#forex market#investing#finance#algo trading#forex expert advisor#invest#financial

14 notes

·

View notes

Text

Side Hustle Ideas: Enhance Your Pay with These Rewarding Endeavors

click here

In the present powerful economy, having a part time job isn't simply a pattern; it's a shrewd monetary move. Whether you're hoping to take care of obligation, save for a particular objective, or essentially increment your extra cash, we've gathered a rundown of different and rewarding second job thoughts to assist you with setting out on your excursion toward monetary strengthening.

#earrings#how to make money online#online earning#makemoneyonline#makemoney#money#workfromhome#entrepreneur#business#affiliatemarketing#bitcoin#success#onlinebusiness#forex#digitalmarketing#motivation#investment#makemoneyfast#earnmoney#financialfreedom#passiveincome#cash#businessowner#entrepreneurship#marketing#luxury#earnmoneyonline#millionaire#makemoneyonlinefast#makemoneyfromhome

39 notes

·

View notes

Text

Maximizing Your Income: 25 Effective Ways to Make More Money from Home - Money Earn Info

Get Over 2,500 Online Jobs. You may have already tried to make money online. Here is Some Information about Easy Job you can do from home. 👉 Offers for you

.

.

Freelancing Across Multiple Platforms: Expand your freelancing endeavors by joining multiple platforms such as Upwork, Freelancer, and Fiverr. Diversifying your presence can increase your visibility and attract a broader range of clients.

Remote Consulting Services: If you possess expertise in a particular field, consider offering consulting services. Platforms like Clarity — On Demand Business Advice connects consultants with individuals seeking advice, providing an avenue for additional income.

youtube

Create and Sell Online Courses: Capitalize on your skills and knowledge by creating online courses. Platforms like Udemy, Teachable, and Skillshare allow you to share your expertise and earn money passively.

Affiliate Marketing Mastery: Deepen your involvement in affiliate marketing by strategically promoting products and services related to your niche. Building a well-curated audience can significantly increase your affiliate earnings.

Start a Profitable Blog: Launch a blog centered around your passions or expertise. Monetize it through methods like sponsored content, affiliate marketing, and ad revenue to create a steady stream of passive income.

E-commerce Entrepreneurship: Set up an online store using platforms like Shopify or Etsy. Sell physical or digital products, tapping into the global market from the comfort of your home.

Remote Social Media Management: Leverage your social media skills to manage the online presence of businesses or individuals. Platforms like Buffer and Hootsuite can streamline your social media management tasks.

Virtual Assistance Services: Offer virtual assistance services to busy professionals or entrepreneurs. Tasks may include email management, scheduling, and data entry.

Invest in Dividend-Paying Stocks: Start building a portfolio of dividend-paying stocks. Over time, as these stocks generate regular dividends, you can create a source of passive income.

Remote Graphic Design: Expand your graphic design services on platforms like 99designs or Dribbble. Building a strong portfolio can attract high-paying clients.

Web Development Projects: If you have web development skills, take on remote projects. Websites like Toptal and Upwork connect skilled developers with clients in need of their services.

Launch a YouTube Channel: Create engaging and valuable content on a YouTube channel. Monetize through ad revenue, sponsorships, and affiliate marketing as your channel grows.

Digital Product Sales: Develop and sell digital products such as ebooks, printables, or templates. Platforms like Gumroad and Selz make it easy to sell digital goods online.

Stock Photography Licensing: If you have photography skills, license your photos to stock photography websites. Each download earns you royalties.

Remote Transcription Jobs: Explore opportunities in remote transcription on platforms like Rev or TranscribeMe. Fast and accurate typists can find quick and consistent work.

Participate in Paid Surveys: Sign up for reputable paid survey websites like Swagbucks and Survey Junkie to earn extra income by providing your opinions on various products and services.

Remote Customer Service Representative: Many companies hire remote customer service representatives. Search job boards and company websites for remote customer service opportunities.

Cashback and Rewards Apps: Use cashback apps like Rakuten and Honey when shopping online to earn cashback and rewards on your purchases.

Create a Niche Podcast: Start a podcast around a niche you are passionate about. Monetize through sponsorships, affiliate marketing, and listener donations.

Automated Webinars for Digital Products: Create automated webinars to promote and sell digital products or services. This hands-off approach can generate income while you focus on other tasks.

youtube

Rent Out Your Property on Airbnb: If you have extra space in your home, consider renting it out on Airbnb for short-term stays. This can be a lucrative source of additional income.

Remote SEO Services: If you have expertise in search engine optimization (SEO), offer your services to businesses looking to improve their online visibility.

Invest in Real Estate Crowdfunding: Diversify your investment portfolio by participating in real estate crowdfunding platforms like Fundrise or RealtyMogul.

Create a Subscription Box Service: Develop a subscription box service around a niche you are passionate about. Subscribers pay a recurring fee for curated items.

Remote Project Management: Utilize your project management skills by taking on remote project management roles. Platforms like Remote OK and Home feature remote opportunities.

Making more money from home is not just a possibility; it’s a reality with the myriad opportunities available in today’s digital age. By diversifying your income streams and leveraging your skills, you can create a robust financial foundation. Whether you choose to freelance, start an online business, or invest in passive income streams, the key is consistency and dedication. Explore the strategies outlined in this guide, identify those that align with your strengths and interests, and embark on a journey to maximize your income from the comfort of your home.

#makemoneyonline #makemoney #money #workfromhome #entrepreneur #business #affiliatemarketing #bitcoin #success #onlinebusiness #forex #digitalmarketing #motivation #investment #makemoneyfast #earnmoney #financialfreedom #passiveincome #cash #businessowner #entrepreneurship #marketing #luxury #earnmoneyonline #millionaire #makemoneyonlinefast #makemoneyfromhome #investing #cryptocurrency #onlinemarketing

#makemoneyonline#makemoney#money#workfromhome#entrepreneur#business#affiliatemarketing#bitcoin#success#onlinebusiness#forex#digitalmarketing#motivation#investment#makemoneyfast#earnmoney#financialfreedom#passiveincome#cash#businessowner#entrepreneurship#marketing#luxury#earnmoneyonline#millionaire#makemoneyonlinefast#makemoneyfromhome#investing#cryptocurrency#onlinemarketing

40 notes

·

View notes

Text

Crypto Meets Forex: Navigating Risks and Opportunities in 2025

Based on my experiences, I have seen various innovations of money with Bitcoin and other cryptocurrencies bringing major changes in the financial market. The overall flow of bitcoins is now stronger, and fluctuations in coins such as Polkadot or Dogecoin increase — all this affects the Forex market. This is where we traders get both the challenge and the thrill to perform, but with the right strategic plans in place, it is a brilliant chance to expand.

Why Crypto is Vital for Forex Traders

In the fast-paced world of trading, volatility is where the action is, and crypto delivers that in spades. While Forex markets move with global economic trends, crypto thrives on sentiment and speculation, making it a goldmine for those who know how to adapt.

Volatility Creates Opportunities: Coins like Bitcoin can swing dramatically in a single day, offering quick wins for prepared traders.

Crypto-Fiat Connections: Bitcoin’s rise often hints at movements in fiat pairs like EUR/USD or USD/JPY.

2025 — A Game-Changer: With Bitcoin adoption growing, I believe the next few years could redefine how crypto and Forex markets interact.

How I Approach the Crypto-Forex Connection

Stay Informed: Whether it’s new regulations in Europe or tech updates from Silicon Valley, the crypto market moves fast. Keeping up with global news helps me anticipate opportunities.

Manage Risk Like a Pro: Crypto’s volatility is thrilling, but it’s also risky. I use tools like stop-loss orders and position sizing to protect my capital while staying in the game.

Watch Market Overlaps: When Bitcoin rallies, I often notice shifts in fiat currencies. Understanding these connections can turn crypto trends into Forex profits.

Adapt My Strategy: Adding crypto pairs like BTC/USD or ETH/EUR to my portfolio has opened new doors. It’s a way to diversify and catch moves I might have missed otherwise.

Why I Trust ORION Wealth Academy

For me, trading is about constant learning and growth, and ORION Wealth Academy has been a game-changer. Their approach to Forex and crypto education is unmatched, offering tools and strategies that work for traders at all levels.

Here’s what makes ORION stand out: ✅ Expert coaching on navigating both crypto and Forex markets. ✅ Daily analysis to stay on top of key trends like Bitcoin’s momentum. ✅ Practical lessons tailored to beginners and seasoned traders alike. ✅ Weekly signals that help me spot opportunities in this fast-moving landscape.

ORION doesn’t just teach you how to trade — it prepares you to excel in markets where crypto and Forex intersect.

Looking Ahead to 2025

As we move into 2025, the relationship between crypto and Forex will only grow stronger. Here in France, I see more traders adapting to these changes, ready to embrace the challenges and opportunities they bring.

If you’re ready to navigate this dynamic market, join ORION Wealth Academy. Their insights and strategies have helped me trade smarter and more confidently.

Start your journey today — because 2025 won’t wait for anyone.

#forexeducation#forexmarket#forex#forextrading#forexbroker#investment#forex online trading#forexsignals#forextips

6 notes

·

View notes

Text

أهمية التوصيات في تداول الفوركس

يعد تداول الفوركس واحدًا من أكثر أنواع الاستثمارات شيوعًا في العالم اليوم. ومع ذلك، فإن النجاح في هذا المجال يتطلب معرفة متعمقة وتحليل دقيق للسوق. لذلك، يلجأ العديد من المستثمرين إلى استخدام التوصيات للحصول على توجيهات وإرشادات موثوقة.

يقدم موقع InvestTradeGM خططًا متنوعة تلبي احتياجات جميع المستثمرين، من المبتدئين إلى المحترفين. تتضمن هذه الخطط توصيات فوركس مخصصة تساعد المستثمرين على اتخاذ قرارات مستنيرة وزيادة فرصهم في تحقيق الأرباح.

من خلال الاعتماد على توصيات فوركس من موقع InvestTradeGM، يمكن للمستثمرين الاستفادة من الخبرة والمعرفة العميقة التي يتمتع بها فريق التحليل بالموقع. توفر هذه التوصيات رؤى دقيقة وتحليلات موثوقة للسوق، مما يساعد المستثمرين على تحديد أفضل الفرص واتخاذ القرارات الصحيحة في الوقت المناسب.

فهم أهمية التوصيات

تساعد التوصيات في تقليل المخاطر المرتبطة بتداول الفوركس. عندما تعتمد على التوصيات المقدمة من خبراء ذوي خبرة، يمكنك تجنب الأخطاء الشائعة التي يقع فيها العديد من المبتدئين. التوصيات تعتمد على تحليلات دقيقة للسوق وبيانات موثوقة، مما يساعدك على اتخاذ قرارات مدروسة ومبنية على أسس علمية.

خطط وأسعار متنوعة

يوفر موقع InvestTradeGM خططًا متنوعة تناسب مختلف مستويات المستثمرين. سواء كنت مبتدئًا تتطلع إلى دخول سوق الفوركس لأول مرة، أو كنت مستثمرًا محترفًا تبحث عن استراتيجيات جديدة، ستجد الخطة التي تناسبك.

تشمل الخطط المقدمة مزايا عديدة، مثل التحليلات اليومية للسوق، التوصيات الفورية، وتقارير الأداء. هذه الميزات تساعدك في تحقيق أفضل نتا��ج ممكنة من استثماراتك.

استراتيجيات تداول متقدمة

تعتمد التوصيات المقدمة من InvestTradeGM على استراتيجيات تداول متقدمة تستند إلى تحليلات دقيقة للسوق. يمكنك الاعتماد على هذه التوصيات لتحديد الفرص المثلى للتداول وتحقيق أرباح مستدامة. بالإضافة إلى ذلك، توفر التوصيات توقعات تستند إلى بيانات موثوقة، مما يساعدك على اتخاذ قرارات مستنيرة.

الدعم الفني والتدريب

إلى جانب التوصيات، يوفر موقع InvestTradeGM دعمًا فنيًا شاملًا وتدريبًا مستمرًا للمستثمرين. يمكنك الاستفادة من الدورات التدريبية وورش العمل التي تركز على تعليمك أساسيات التداول واستراتيجيات الفوركس المتقدمة. هذا التدريب يساعدك على تحسين مهاراتك وزيادة فهمك للسوق، مما يعزز فرصك في تحقيق الأرباح.

بالإضافة إلى ذلك، يوفر الموقع دعمًا فنيًا على مدار الساعة للإجابة على أي استفسارات قد تكون لديك. يمكنك التواصل مع فريق الدعم في أي وقت للحصول على المشورة والتوجيهات اللازمة للتعامل مع أي تحديات قد تواجهك في السوق. هذا الدعم المستمر يضمن أنك لن تكون وحدك في رحلتك الاستثمارية.

توصيات فوركس: أداة النجاح

في الختام، يعتبر الحصول على توصيات فوركس من موقع InvestTradeGM أداة حيوية لكل من يسعى لتحقيق النجاح في سوق الفوركس. هذه التوصيات توفر لك التوجيهات الضرورية لاتخاذ القرارات الصحيحة وتقليل المخاطر. بفضل التحليلات الدقيقة والخبرة الواسعة للفريق، يمكنك الاستفادة من أفضل الفرص الاستثمارية المتاحة وتحقيق أهدافك المالية بثقة ونجاح.

إذا كنت ترغب في تحقيق النجاح في سوق الفوركس، فإن الحصول على التوصيات من مصدر موثوق مثل InvestTradeGM يعد خطوة أساسية. ابدأ اليوم واستفد من الخطط المميزة والأسعار المناسبة لتصبح مستثمرًا ناجحًا في هذا السوق المثير.

12 notes

·

View notes

Text

AUDUSD Aussie 0.20 Lots Buy entry bullish wave on M5 timeframe opens and running to next week [AUDUSD,M5].

Official Website: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator metatrader4 license with NO LAG & NON REPAINT buy and sell Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside Brokers MT4 Plataform. . ✅ NON REPAINT / NON LAGGING Signals ✅ New 2025 Version LIFETIME License 🔔 Signals Sound And Popup Notifications 🔥 NEW 2025 Profitable EA AUTO-Trade Option Available . ✅ * Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the MT4 platform of the customer who has access to his License*. ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at Exness brokerage. Signals may vary slightly from one broker to another ). . ✅ Cashpower Indicator Works in all charts inside Metatrader4 plataform for anybroker that have mt4. It will works inside anychart that your brokerage have examples: Forex charts, bonds charts, indicescharts, metals charts, energy, cryptocurrency charts and etc. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#Forex Cashpower indicator Non Repaint Signals#forex brokers#forexindicators#forexsignals#indicatorforex#forexindicator#forex#forextradesystem#forexchartindicators#forexvolumeindicators#cashpowerindicator#forexprofits#forex market#forextrading#forex expert advisor#forex robot#forex trading#forex indicators#forex traders#stock trading#audusd#audusd technical analysis

4 notes

·

View notes