#Amendments in CA Final Inter

Explore tagged Tumblr posts

Text

Importance of CA practice tests

Many students cram for CA exams by simply reading the chapters needed to clear the exam. But doing so is not at all enough. Prior to giving this exam, it is critical to practice CA Chapterwise Test Series. These mock tests help candidates get a very real feel for the CA examinations and learn strategies for success.

#CA Chapterwise Test Series#Amendments in CA Final Inter#Best Mentorship programme for CA CS and CMA

0 notes

Text

CA Foundation Business Laws: Complete Guide to Prepare for May 2025

Business Laws is a critical subject in the CA Foundation syllabus and often sets the tone for a student's confidence in law-related papers throughout the CA journey. For the May 2025 attempt, cracking Business Laws isn't just about reading bare acts—it's about understanding the logic behind legal provisions and applying them effectively in exams. With the right study strategy and resources like UltimateCA’s expert-led CA coaching classes, even beginners can master this subject with clarity and confidence.

Understanding the Business Laws Paper

The Business Laws paper tests your conceptual clarity, understanding of key acts, and ability to apply law to practical scenarios. The syllabus includes the Indian Contract Act, Sale of Goods Act, Partnership Act, LLP Act, and Companies Act—each carrying significant weightage. While some students find legal language overwhelming, with the right guidance from CA Foundation Classes and a smart revision approach, these laws can become easy to grasp.

Importance of Conceptual Clarity

The foundation of success in business law is conceptual clarity. Instead of rote learning, try to understand the "why" behind each legal provision. For instance, rather than just memorizing what makes a contract valid, understand why mutual consent, lawful object, and consideration matter in real-world contracts. That’s where CA Online Classes from UltimateCA stand out—they explain every clause in a practical and relatable way that ensures long-term retention.

Smart Study Plan for Effective Preparation

A smart study plan involves daily study sessions, active recall, and consistent revision. Start by dividing your syllabus into logical segments—one Act at a time. Dedicate time to reading the theory, followed by solving MCQs and writing case-based answers. Make short notes during your first reading and revisit them during revision days. UltimateCA’s CA Foundation Classes provide concise yet comprehensive coverage with law charts, summaries, and previous year questions that are highly effective for last-minute review.

Regular Practice of MCQs and Case Studies

The objective nature of the Business Laws paper means multiple-choice questions play a vital role in your final score. Practice at least 30-40 MCQs every day from each chapter. Understand the reasoning behind the right response rather than merely speculating.Case-based MCQs are also becoming more common, testing your understanding of legal applications. The CA Inter Online Classes offered by UltimateCA include MCQ practice sessions that mirror the ICAI exam pattern, ensuring students are well-prepared.

Revise Using Summary Charts & Mind Maps

Law is a subject that needs multiple revisions. Summary charts, flashcards, and mind maps are excellent tools to revise large portions of the syllabus quickly. UltimateCA’s CA coaching classes offer digital mind maps and law flowcharts that help in quick memory recall and improve your writing in the exam. Keep these resources handy while revising so you can recall key sections and case laws faster.

Time Management in Exam Hall

One of the most common mistakes students make is spending too much time on theory questions and rushing through MCQs. During your mock tests, practice completing the paper within the time limit. Set up specific time slots, such as two hours for the descriptive portion and forty minutes for multiple-choice. This habit will train your brain to perform under pressure. CA Online Classes from UltimateCA provide timed test series and evaluated answer sheets to help students improve speed and accuracy.

Stay Updated with ICAI Notifications

ICAI may update the syllabus, introduce amendments, or issue guidelines close to the exam. Stay connected with your coaching platform and regularly check the official ICAI website. UltimateCA makes it easier by providing instant updates within the course platform, so students don't miss anything crucial.

How UltimateCA Helps You Stay Ahead

UltimateCA’s CA Foundation Classes are specifically designed keeping exam orientation and student needs in mind. Whether you're attending live sessions or watching recorded lectures, the teaching style focuses on conceptual clarity, consistent revision, and problem-solving skills. The platform also provides 24/7 doubt resolution, weekly mentorship sessions, and topic-wise MCQ practice to strengthen every student’s foundation.

The goal of UltimateCA is to train your mind to think like a chartered accountant, not only to impart knowledge. From foundational subjects to CA Inter Online Classes, each course is built to prepare students for ICAI’s evolving exam patterns and real-world application.

Final Thoughts

Business Laws doesn’t have to be intimidating. With a clear approach, the correct materials, and coaching from experienced faculty members, you can surely pass the CA Foundation May 2025 examinations. Start early, stay consistent, and make your preparation smarter, not harder. And if you're looking for the best platform to guide you through it, UltimateCA’s CA coaching classes are your go-to solution.

#Business Laws#UltimateCA’s#CA coaching classes#CA Inter Online Classes#CA Foundation Classes#Business Laws Paper

0 notes

Text

Navigating the Challenges of ICAI CA Inter and CA Final FR

The journey to becoming a Chartered Accountant (CA) in India is undoubtedly rigorous, requiring dedication, perseverance, and a solid understanding of complex financial concepts. Among the many hurdles aspiring CAs face, the examinations conducted by the Institute of Chartered Accountants of India (ICAI) for CA Inter and CA Final Financial Reporting (FR) stand out as significant milestones. Mastering Financial Reporting is crucial not only for passing these exams but also for building a strong foundation for a successful career in accountancy and finance.

Understanding the Importance of Financial Reporting:

Financial Reporting (FR) is a cornerstone of the CA curriculum, encompassing principles, standards, and regulations governing the preparation and presentation of financial statements. CA Inter and CA Final FR examinations assess candidates' understanding of accounting standards, corporate financial reporting practices, and their ability to apply theoretical knowledge to practical scenarios.

Challenges Faced by Aspirants:

Complexity of Concepts: Financial Reporting involves intricate concepts such as consolidation, accounting for amalgamations, and fair value measurement, which can be challenging to grasp initially.

Vast Syllabus: The syllabus for CA Inter and CA Final FR is extensive, requiring candidates to cover a wide range of topics within a limited timeframe.

Dynamic Regulatory Environment: Keeping up with the frequent changes in accounting standards and regulatory requirements adds another layer of difficulty for aspirants.

Tips for Success:

Build Strong Fundamentals: A solid understanding of basic accounting principles is essential for tackling advanced topics in Financial Reporting. Take the time to grasp concepts such as double-entry accounting, recognition, measurement, and disclosure criteria.

Effective Time Management: Create a study schedule that allocates sufficient time to each topic in the syllabus. Prioritize areas of weakness while ensuring adequate revision of familiar topics.

Practice, Practice, Practice: Solve as many practice problems and past exam papers as possible to familiarize yourself with the exam format and improve problem-solving skills. This will also help in developing speed and accuracy, crucial for success in CA exams.

Stay Updated: Keep abreast of the latest amendments to accounting standards and regulatory changes by referring to ICAI study materials, supplementary materials, and professional publications. Joining study groups or forums can also provide valuable insights into contemporary issues in Financial Reporting.

Seek Guidance: Don't hesitate to seek guidance from experienced faculty members, mentors, or peers if you encounter difficulties understanding certain concepts. Engaging in discussions and seeking clarification can enhance comprehension and retention.

Mock Tests: Participate in mock tests and mock interviews to simulate exam conditions and identify areas that need improvement. Analyze your performance in these tests to refine your exam-taking strategies.

Stay calm and Confident: Maintain a positive attitude towards your preparation and approach the exams with confidence. Remember that thorough preparation and self-belief are key to overcoming exam anxiety and performing well on the day of the exam.

Conclusion:

Preparing for ICAI CA Inter and CA Final FR examinations requires dedication, discipline, and a strategic approach. By focusing on building a strong conceptual foundation, effective time management, and regular practice, aspirants can navigate through the challenges posed by these exams successfully. Remember, becoming a Chartered Accountant is not just about passing exams; it's about acquiring the knowledge and skills necessary to excel in the dynamic world of finance and accounting.

0 notes

Text

How to Start a New School – Step by Step Procedure - Part 2

2. SCHOOL MANAGEMENT

Q.1 Who will finally control the functioning of the school?

The registered Trust / Society constituted under Indian Trust Act 1882 / Societies Registration Act – 1860 with be responsible for the establishment and administration / management of the school as per the objectives set forth in the Trust Deed / Memorandum of Association and bye-laws of the Trust / Society. The Trust / Society will have absolute powers to frame or amend or modify rules and regulations, objectives, policy directives for administration and management of the school, in accordance with the relevant laws of the Trust / society, the organizational set-up of schools will be as follows:

• Trust/Society

• Organisational Committee

• Principal

Q.2 Will you have experts and celebrities in the field of Sports, Music and Creativity in the Management committee?

As per affiliation bye-laws of CBSE, all schools have to constitute a School Management Committee (SMC) comprising a minimum of 11 members and maximum of 21 members. In the School SMC will, inter alia, comprise 02 Educationists, 01 female educator, 2 parents, two teachers and also eminent personality in the field of art / culture and 01 professional administrator / CA / Doctor / Architect. The chairman of SMC should make all our efforts to approach the eminent personalities in their respective field and have them included in the SMC with their prior and written consent. In addition, any other celebrity in the field of games / sports may also be included in the SMC.

Q.3 What will be the various committees which will help the functioning of the school?

a) As per the organizational set-up, School will function under the overall administrative control of the Trust. The day-to-day functioning of the school will be entrusted to the School Management Committee (SMC) by the Trust. The SMC will manage the school as per the objectives and vision of the Trust and will be assisted by four sub- committees to ensure the efficient functioning of the school.

The four sub-committees of the SMC are:

• Finance / Executive Committee

• Staff Selection Committee

• Sports / Extra-Curricular Activities Committee

• Co-curricular / Cultural Affairs Committee

Various Other Academic committees formed by the principal such as examination, events, quiz, science, discipline etc.

b) All complaints or matters pertaining to the functioning of the school will be brought to the notice of the Principal (Administrative Head) of the school or any of the sub – committees or School Management Committee.

0 notes

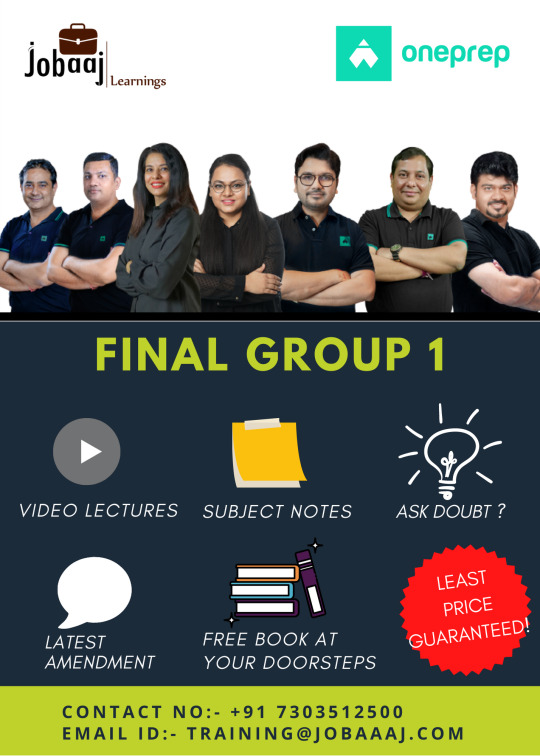

Photo

India's most experienced Faculty For CA Inter & Final now available on Jobaaj Learning

Applicable for May 21, Nov 21 and onward exam

Classes available on Mobile & tablate also

Interesting and engaging video lectures, comprehensive and well-researched topic wise books, latest amendments and Q. Bank for practice.

We have brought together 'The Dream Team' for CA education, which includes ‘The Best and Biggest’ names in the field of CA education.

A well-designed learning app, which leverages technology to bring the best educators and learning material to you wherever you are.

For more updates & amendment notification join us on telegram & youtube:

https://t.me/jobaajlearnings

https://www.youtube.com/channel/UCwZd2VGQ-tHUgrhG5gJbT2A

You can buy Classes with Super discount with Jobaaj Learning in Individual & Group wise Subjects:

https://learnings.jobaaj.com/one-prep-dream-team/

For additional discount whatsapp at 7303512500

CA Is Not Just A Degree, It's A Lifetime Pride

https://www.youtube.com/watch?v=3IpdK1eY2yQ&t=1061s

1 note

·

View note

Text

✅How to crack the CA Exam? Step By Step Process👌

CA Foundation Preparation:

Focus on fundamentals of Accounting, Economics, Mathematics and Commercial Laws

Practice solving multiple-choice questions and case studies

Attend coaching classes, webinars and revise regularly

Prepare a study schedule and stick to it.

CA Inter Preparation:

Strengthen conceptual understanding of Accounting, Auditing, Taxation, Costing and Financial Management

Solve practical problems and case studies

Attend coaching classes, mock tests and revise regularly

Keep updated with amendments and notifications issued by ICAI.

CA Final Preparation:

Emphasis on in-depth understanding of Advanced Accounting, Auditing and Professional

Ethics, Direct and Indirect Taxation, Corporate Laws and Strategic Management

Solve case studies and practice writing in-depth answers

Attend coaching classes, mock tests and revise regularly

Keep updated with amendments and notifications issued by ICAI

✅"The only way to do great work is to love what you do." 🤔 👉👉Get Pendrive Lectures for CA, CS, and CMA at Smart Learning Destination.

👉👉 Lowest Price Guaranteed. 👌 👉👉 Call us now - 7697044955 and 7277278811.

👉👉 Visit Website - www.smartlearningdestination.com

#CAcommunity#CScommunity#CAexam#CAstudents#CAinsights#CMAcareer#CSworld#CAmentorship#CSexam#CMAexam#CSstudents#CAprogram#CSeducation#CAprofessionals#CMAclub#CAjourney#CAinspiration#CAperspective#CMAexamseries#CSproud

0 notes

Text

Which is the Best Online Test Series for CA-IPCC / Inter & CA-Final

Now a days, there are a lot of Websites providing Online Test Series for CA & CS Courses. However students are confused regarding which is the website they should choose ?

We all know that Chartered Accountancy (CA) Exams are the toughest exams to clear. Without proper Planning and Time Management its very difficult to clear CA exams. So its very important for a student to plan his/her studies accordingly.

Written Practice is must to clear CA-Exams. There are a lot of Online Test Series available who provides Online CA-IPCC / Inter and Final Test Series for Preparing for CA Exams and students generally have a query that which one he/she should choose

Major Questions that come in the mind of a student while enrolling for Online CA Test Series :

1. Will Question Papers be amended as per the applicable syllabus??

2. Who will the persons who will evaluate the Test Papers??

3. Whether Chapter-wise tests will be conducted in parts or only full Mock Test Papers will be taken?

4. What other benefits will a student get after registering for the Online Test Series?

5. Will doubts be solved on time if a student raises any?

6. Will faculty support be provided in case of any Queries?

7. Will CA Test Papers cover updated MCQ Questions as per New Syllabus?

As these all Questions come up in students mind, its very important that student chooses the right CA Test Series for his studies.

So as per the Feedbacks from the students from time to time, we have came across few Online Test Series which do help the students in a genuine way

One of them is GMtestseries.com/ which is being conducted from 2015 onwards all across India

Facilities which they Provide to the Students are unique and very reasonable fee is charged for the services they render which includes:

More than 48 Tests in which entire portion is covered Twice.

Evaluated sheets are checked and returned back within Maximum 3 Days

All over India Ranking is provided

Your sheets are evaluated by Expert faculty (Subject wise faculty) and you are told about your mistakes along with methods to improve it.

Faculty nos. are shared so that student can ask them doubts anytime.

Regular important Notes, Chapter wise MCQ and Study Tips to enhance your learning skills.

Best Sheets for each Test are provided through which you can compare your performance with the topper

Instant Doubt Solving by Faculty on call or Whatsapp

Register for Online CA Test Series for CA-IPCC / Inter and Final – http://gmtestseries.com/registra...

Check Online Test Series Syllabus & Fee Structure from here – http://gmtestseries.com/testseri...

Contact / Whatsapp 9070800090 for details

Thanks

#catestseries#gmtestseries#caipcctestseries#cafinaltestseries#caintertestseries#cacourse#chartered accountant

1 note

·

View note

Text

CMA inter institutes in AP

Sri Medha, the top leading commerce institute in South India imparting quality education from Jr. Inter to CA & CMA Final under one roof with the motto of Igniting Intelligence & Delivering excellence.

The Institute of Cost Accountants of India was first formed as a registered limited company on 14 June 1944 as per the provisions of the then Companies Act, 1913. Post Independence, the institute got statutory recognition when the Parliament of India enacted "The Cost and Works Accountants Act" (Act No.23rd of 1959) a special act, on 28 May 1959 to accord statutory recognition to ICMAI (previously ICWAI) as an autonomous professional Institute.

The CWA Amendment bill, 2011 was passed by both the Houses of Indian Parliament viz. Lok Sabha and the Rajya Sabha on 12 December 2011 and assented by the president of India on 12 January 2012. The changes were published in the Official Gazette of India on 13 January 2012. As of now, there are a total of 85000 active members of ICMAI.

Qualification and syllabus

This is the primary qualification of the ICMAI following completion of up to three levels

(Foundation, Intermediate, and Final)

Examinations and three years of practical training in areas like management accounting, cost accounting, financial accounting, taxation, cost audits, GST audits, internal audit, corporate laws, etc. and enables an individual to become a CMA (cost & management accountant).

The ew syllabus has been introduced in August 2016 following the International Education Guidelines (IEG) of IFAC to get the advantages in the process of Mutual Recognition Agreement (MRA) among different member countries of the world under GATS in WTO.

Subjects for examinations include management accounting, financial accounting, strategic management, taxation, corporate law, financial management, business valuation, financial reporting and cost & management audit etc.

Students who have passed the degree examination of any recognized university or equivalent are eligible for admission directly to the Intermediate level.

Paper-wise exemptions on the basis of reciprocal arrangement are available to students who have passed Institute of Company Secretaries of India Final Examinations.

Examinations are held twice a year in June and December in various examination centers in India and overseas centers. The results are declared in August and February for the June term and December term exams respectively.

Related searches are

Sri Medha Educational Institution, top 10 intermediate colleges in guntur, top 10 Degree colleges in guntur, ca colleges in guntur, cma colleges in guntur, ca coaching centres in guntur, cma coaching centres in guntur, ca academy in guntur, cma academy in guntur, best ca colleges in ap, best cma colleges in ap, top ca colleges in ap, top cma colleges in ap, best ca colleges near me, best cma colleges near me, ca inter institutes in ap, ca final institutes in ap, cma foundation institutes in ap, cma inter institutes in ap, cma final institutes in ap, Top commerce Colleges in Guntur, Top commerce Colleges in AP, Best commerce Colleges in Guntur, Best commerce Colleges in AP

For More Info: https://srimedha.com

or

Call us: 8886062692, 0863-2255891, 0866-2494581

#cma inter institutes in ap

#cma final institutes in ap

# Top commerce Colleges in Guntur

# Top commerce Colleges in AP

0 notes

Text

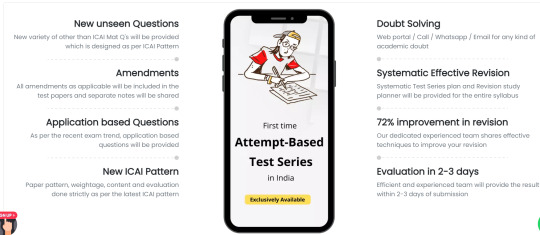

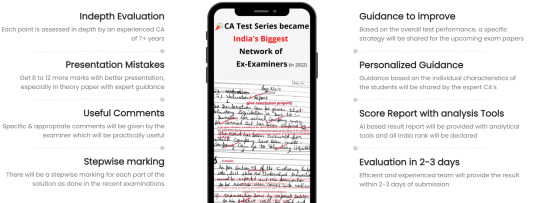

As we know, Getting ready for the CA exam is not easy, and putting what you have learned into practice while writing the paper is an entirely different ball game.

But not an impossible for the students that follows:

Revise + Practice MTPs + Evaluate yourself + Revise your week areas known by practice MTPs + Practice + Evaluate = Good Score In CA Exam!

Because:

Practice Makes a Man Perfect, you've probably heard (well, that applies to women, too). As we all know, In India, Chartered Accountancy (CA) is one of the most difficult and prominent professional courses.

Foundation, Intermediate, and Final are the three levels of the course provided by the Institute of Chartered Accountants of India (ICAI). After passing the CA Entrance exam and the Foundation level, its time to focus on the CA Intermediate level, the second level of the Chartered Accountancy curriculum.

Your journey as a CA student starts here as youre now a part of the Institute of Chartered Accountants of India. Getting through this level is not easy, and the course gets more challenging with each level, so you have to put in a lot of work.

But do not worry; sign up with the CA test series for mentors guidance till exams and many more like:

It offers the Highest Quality Test Papers

An Instant Doubt Solving Facility.

Unseen other than ICAI mat Questions

Application based Qs as per recent ICAI Exams

Specific evaluation comments (No general comments)

Mistakes discussion with teachers

Most experienced team (Indias biggest Network of Ex-Examiners)

More than 17 top faculties provide our test series to their students

All India Ranking out of 10k+ & lot more - May 2022 Results As Proof That Speaks The Quality of Our Mock Test Papers!!

Because of the above CA Test Series is the Best CA Exam Series

In May 2022, the Ca Test Series reached over 20k+ registrations & also, once again, its CA Test Series With 2 AIR With Rank 1 in CA Final May 2022 & CA Inter May 2022.

Always Remember:

The final exam is similar to a mirror in that it allows you to evaluate, analyze, and improve upon your performance in previous assessments.

Your performance will be witnessed by everyone in the world, and there will be no opportunity for self-reflection or correction.

So,

If you utilize test series well, it can play a significant role in your selection process.

You must periodically analyse your performance in order to identify your weak areas, where you need to devote more time and where you need to exert more effort...

And Ca Test Series Includes:

✅ Mentored till exams at CAtestseries & secured AIR-1 by practicing their MTPs which cover 50-55% of case studies & amendments + 1 to 1 mentoring sessions for guidance.

✅ *Real time Result & Analysis

✅ Improve Speed - Time Management.

Biggest feature of the CA Test Series conducts live mock tests with limited time, which creates an exam-like environment along with detailed analysis of each question.

Conclusion:

Thus,

Always Follow This:

Revise + Practice MTPs + Evaluate yourself + Revise your week areas kown by practice MTPs + Practice + Evaluate = Good Score In CA Exam!

Good Mindset + Good Health + Good Strategies = Good Marks

No matter what, never give up!

Do not panic at any moment. Just stay calm & full of confidence!

Keep up the josh & Just Give Your Best!

We hope this article will help you get a rank in your CA Intermediate Examinations.

Undoubtedly, CA Test Series is the Best CA Exam Series

1 note

·

View note

Text

Because This is the Best CA Final Test Series for CA Final Series.

Chartered Accountancy.

Every year the Chartered accountancy examination is held twice a year by the official institute of chartered accountants of India. The vast syllabus of CA intermediate level is almost as long as 3 years of a bachelor of commerce syllabus that ca inter students need to complete in 6 months after completing ca foundation for example if a student completes ca foundation in May attempt and passes, he can attempt ca inter in Nov attempt.

CAfinaltestseries.in visit Us

CA Final Test Series is one of India's most believed test series gateways for ca intermediate level, consistently we have been allowed the opportunity to help the students to show them and guide them into the correct bearing to their objectives and for that, we have made each conceivable and significant improvement in our administrations to guarantee that we give the best to all the students of inter so that they can achieve their goals and become a CA finalist.

45 days’ organizer

Our test series is based on the latest pattern of ICAI and all the amendments are included as soon as they are declared by the institute with that the revisionary notes that we provide also update instantly. The bundle that we give in the reasonable costs incorporates Notes, MCQs, Top 50 inquiries, 45 days organizer, and the most fundamental assistance that each CA student needs which is Guidance.

We have 6 different plans in the test series with chapter-wise that the whole syllabus is divided into five tests and 1 full syllabus additionally to practice that syllabus one final time on a similar level as the ICAI tests test. Presently this trial of 5 parts wise and 1 full syllabus is isolated into 2 separate plans one is with planned dates and the other one is unscheduled that is all the papers are provided at once.

Presently comes the in-depth practice act of every part of a subject that is one section one test in this test you will get every section test also as 1 final full syllabus for each subject. It will almost require close to 4 months to finish this test series for the two gatherings.

After attempting the tests, you will help an assessment through top staff to get legitimate remarking on every one of your inquiries and you can likewise get direction from similar instructors who have checked the response sheets to examine your tests and about your improvement.

Enroll Your Name: - cafinaltestseries.in

0 notes

Text

How to Avoid Common CA Final Mistakes & Pass in First Attempt

The CA Final is the last and most challenging stage of the Chartered Accountancy journey. Success in this exam requires meticulous preparation, strong conceptual clarity, and an effective study strategy. Many students, despite their hard work, fall into common mistakes that hinder their success. By identifying and avoiding these errors, you can improve your chances of clearing the CA Final in your first attempt.

Not Having a Well-Structured Study Plan

One of the biggest mistakes CA aspirants make is not following a proper study schedule. With a vast syllabus to cover, a structured plan is crucial. Allocate time for each subject, ensuring that you revise and practice regularly. Enroll in CA coaching classes or CA Online Classes to get expert guidance on syllabus completion and time management.

Ignoring Conceptual Clarity

Memorizing topics without understanding the underlying concepts can be detrimental. The CA Final exams are designed to test analytical and application-based knowledge. If you rely solely on rote learning, you may struggle with tricky questions. CA Inter Online Classes and CA Inter Classes provide in-depth explanations and real-world applications to strengthen conceptual clarity.

Procrastinating on Revision

Many students focus on completing the syllabus but neglect revision, which is essential for retention. Allocate at least two months before the exam for dedicated revision. Regularly revisiting topics helps in reinforcing key concepts and prevents last-minute panic. CA Online Classes offer revision programs that help consolidate learning effectively.

Skipping Mock Tests and Practice Papers

Mock tests play a crucial role in exam preparation. They help students assess their strengths and weaknesses while improving time management. Ignoring mock tests can lead to poor performance in the actual exam due to a lack of familiarity with the exam pattern. Platforms like CA coaching classes provide mock test series that simulate real exam conditions.

Lack of Focus on ICAI Study Material

ICAI’s study material and practice manuals are the primary sources for CA exams. Many students rely solely on reference books, missing out on crucial ICAI material. Always prioritize ICAI’s study material, as the exam questions are often framed from it. Supplement your preparation with additional resources, but don’t skip the official content.

Over-Reliance on Selective Study

Some students attempt selective study, focusing only on high-weightage topics. While it’s important to prioritize crucial areas, skipping other topics entirely is risky. The CA Final exam is unpredictable, and selective study can lead to gaps in knowledge. A balanced approach ensures comprehensive coverage of the syllabus.

Not Managing Exam Stress

Exam stress can negatively impact performance. Poor stress management leads to burnout, reduced concentration, and anxiety. Maintain a healthy study-life balance, practice meditation, and take short breaks to stay refreshed. Engaging in CA Foundation Classes early in your CA journey can help you develop stress-coping mechanisms for later stages.

Visit For More Info: https://www.ultimateca.com/

Poor Presentation and Time Management in Exams

Even well-prepared students can lose marks due to poor answer presentation. In CA exams, clarity, structured answers, and proper working notes are crucial. Practicing previous year papers and working on your writing speed will help in managing time effectively during the exam.

Ignoring Amendments and Updates

ICAI frequently updates the syllabus to align with current industry standards and regulations. Ignoring amendments can cost you marks, especially in subjects like taxation and law. Stay updated with ICAI’s announcements and enroll in CA coaching classes that provide regular syllabus updates.

Conclusion

Clearing the CA Final in the first attempt is challenging but achievable with the right strategy. Avoiding common mistakes like poor time management, lack of conceptual clarity, skipping revisions, and ignoring ICAI material can make a significant difference in your preparation. Enroll in CA Online Classes and leverage structured study plans to enhance your learning experience. With dedication, the right guidance, and a disciplined approach, you can successfully pass the CA Final and move forward in your career.

#CA Final#ICAI#CA Online Classes#CA Final exam#CA Foundation Classes#CA Inter Classes#CA coaching classes#Ultimateca

0 notes

Text

Navigating the Dynamic Realm of CA Final DT Classes: A Comprehensive Guide for Aspiring Professional

Embarking on the journey towards a Chartered Accountancy (CA) Final examination in India demands meticulous preparation and a robust understanding of Direct Tax (DT) principles. In this digital age, where information is at our fingertips, aspirants often seek reliable resources to aid their preparation. Among the plethora of options available, finding credible CA Inter Taxation websites in India becomes crucial for effective learning.ᅠ

The CA Final DT classes serve as an indispensable resource for aspirants aiming to conquer this challenging segment of the examination. These classes, offered through various platforms, impart comprehensive knowledge and strategic insights required to navigate the complex landscape of direct taxation.

Understanding the nuances of taxation is pivotal for every aspiring CA. The syllabus for the CA Final DT examination encompasses an array of topics, ranging from the intricate sections of the Income Tax Act to case laws and recent amendments. Consequently, the need for a structured and well-crafted learning platform becomes imperative.

Amidst the diverse array of resources available online, CA Inter Taxation websites in India play a pivotal role in bridging the gap between theoretical concepts and their practical applications. These websites offer a structured approach to learning, incorporating video lectures, study materials, mock tests, and expert guidance.

One such prominent platform that stands out for its comprehensive DT classes for CA Final in India is renowned for its in-depth coverage and pedagogical excellence. Integrating the keyword "CA Inter Taxation website in India" seamlessly into the article, it's evident how crucial these websites are for aspirants seeking comprehensive guidance.

The hallmark of these platforms is their ability to cater to various learning preferences. Visual learners benefit from video lectures where complex topics are elucidated through graphical representations and real-life examples. On the other hand, textual learners find immense value in comprehensive study materials, which serve as a repository of information and aid in reinforcing concepts.

Moreover, these websites often incorporate interactive elements such as live doubt-solving sessions and forums, fostering a collaborative learning environment. The ability to interact with experienced faculty and peers not only clarifies doubts but also enhances understanding through diverse perspectives.

Accessibility and flexibility further contribute to the appeal of these online platforms. With 24/7 availability and compatibility across devices, aspirants can tailor their learning schedules to suit their convenience. This flexibility becomes paramount for those juggling professional commitments alongside their CA preparations.

The success stories of individuals who have aced the CA Final DT examination often attribute a significant portion of their achievements to the guidance received from such online platforms. The structured approach, coupled with the amalgamation of theoretical knowledge and practical applications, forms the cornerstone of their success.

However, amidst the plethora of options available, aspirants must exercise discernment in choosing the right CA Inter Taxation website in India. Factors such as credibility, track record, faculty expertise, and reviews from past users should be considered before investing time and resources into any platform.

Furthermore, while these online resources serve as an excellent supplement to traditional classroom coaching, they should not be seen as a substitute for consistent effort and dedication. The guidance received from these platforms should be complemented by rigorous self-study and practice to achieve comprehensive mastery over the subject.

Conclusion :-

the realm of CA Final DT classes in India witnesses a paradigm shift with the advent of credible CA Inter Taxation websites. These platforms serve as a beacon of guidance for aspirants, offering comprehensive resources and expert guidance necessary to conquer the complexities of direct taxation.

As the demand for skilled Chartered Accountants continues to rise, the significance of a robust understanding of direct taxation cannot be overstated. Embracing these online platforms, integrating them into one's learning regimen, and leveraging their resources effectively can significantly enhance one's preparation and pave the way for success in the CA Final DT examination.

0 notes

Text

How to Start a New School – Step by Step Procedure - Part 2

2. SCHOOL MANAGEMENT

Q.1 Who will finally control the functioning of the school?

The registered Trust / Society constituted under Indian Trust Act 1882 / Societies Registration Act – 1860 with be responsible for the establishment and administration / management of the school as per the objectives set forth in the Trust Deed / Memorandum of Association and bye-laws of the Trust / Society. The Trust / Society will have absolute powers to frame or amend or modify rules and regulations, objectives, policy directives for administration and management of the school, in accordance with the relevant laws of the Trust / society, the organizational set-up of schools will be as follows:

• Trust/Society

• Organisational Committee

• Principal

Q.2 Will you have experts and celebrities in the field of Sports, Music and Creativity in the Management committee?

As per affiliation bye-laws of CBSE, all schools have to constitute a School Management Committee (SMC) comprising a minimum of 11 members and maximum of 21 members. In the School SMC will, inter alia, comprise 02 Educationists, 01 female educator, 2 parents, two teachers and also eminent personality in the field of art / culture and 01 professional administrator / CA / Doctor / Architect. The chairman of SMC should make all our efforts to approach the eminent personalities in their respective field and have them included in the SMC with their prior and written consent. In addition, any other celebrity in the field of games / sports may also be included in the SMC.

Q.3 What will be the various committees which will help the functioning of the school?

a) As per the organizational set-up, School will function under the overall administrative control of the Trust. The day-to-day functioning of the school will be entrusted to the School Management Committee (SMC) by the Trust. The SMC will manage the school as per the objectives and vision of the Trust and will be assisted by four sub- committees to ensure the efficient functioning of the school.

The four sub-committees of the SMC are:

• Finance / Executive Committee

• Staff Selection Committee

• Sports / Extra-Curricular Activities Committee

• Co-curricular / Cultural Affairs Committee

Various Other Academic committees formed by the principal such as examination, events, quiz, science, discipline etc.

b) All complaints or matters pertaining to the functioning of the school will be brought to the notice of the Principal (Administrative Head) of the school or any of the sub – committees or School Management Committee.

0 notes

Photo

India's most experienced Faculty For CA Inter & Final now available on Jobaaj Learning

Applicable for May 21, Nov 21 and onward exam

Classes available on Mobile & tablate also

Interesting and engaging video lectures, comprehensive and well-researched topic wise books, latest amendments and Q. Bank for practice.

We have brought together 'The Dream Team' for CA education, which includes ‘The Best and Biggest’ names in the field of CA education.

A well-designed learning app, which leverages technology to bring the best educators and learning material to you wherever you are.

For more updates & amendment notification join us on telegram & youtube:

https://t.me/jobaajlearnings

https://www.youtube.com/channel/UCwZd2VGQ-tHUgrhG5gJbT2A

You can buy Classes with Super discount with Jobaaj Learning in Individual & Group wise Subjects:

https://learnings.jobaaj.com/one-prep-dream-team/

For additional discount whatsapp at 7303512500

CA Is Not Just A Degree, It's A Lifetime Pride

https://www.youtube.com/watch?v=3IpdK1eY2yQ&t=1061s

1 note

·

View note

Text

CA Final Crash Course - JK Shah Online

Buy CA final crash course which is an excellent way to revise your CA Final/CA Inter subjects and cover the latest amendments. Choose finest faculty for the subject and get concept clarity. Enroll Now!

https://online.jkshahclasses.com/packages?course=3&course_text=CA&level=2&level_text=CA%20Inter%20Fast%20Track&tab=crash&page=1

#cafinal#cafinalcrashcourse#cafinalfasttrackcourse#caonlineclasses#caonlinecoachingcentre#caonline#cafinalexams#cafinalsubjects

0 notes

Text

A Short Description of the Government and Society of Nihwar

IN THE MANNER of such Travelers that have gone before me, as the learned Hythlodaeus and the doughty Gulliver, I offer here a Brief Account of my journeys in a far-distant Land, which is known in its own tongue as NI-HWAR; its people being one of those Ancient and Lost Tribes of Europe, viz., the OSTROGOTHS. They, like me, stumbled across this Rugged and Remote Island while wandering in the Carpathians, being Accosted by an emotionally unstable Wormhole--I, on my Summer Holiday, they during one of their ancient Migrations through the Dark Forests of the Long Medium Aevum. Blessedly, though they perforce settled in that rugged country, they have in the intervening Centuries made it a Hospitable and Modern Civilisation, and I was able to catch an Easy-Jet Flight home. Though my Sojurn in those parts was but a few Weeks, I found that, though their language was Uncouth, their Manners Strange, and their Mores Foreign, I found it most Instructive on matters pertaining to the Ideal State of the Human Animal, and its relation to Society and Government. In the Spirit both of such Journeys as Mine, and as a Concession to Modern Aestheticks, I have elected to render the remainder of this Account in the Manner of an Article from Wikipedia.

[This started out as an attempt to collect semi-realistic ideas on a practical utopia, from the grandiose to the mundane; it ended up mostly as a parody of the Wikipedia article on Iceland, littered with puns based on shoddy historical linguistics. Make of it what you will.]

Niwhar (/ˈnɪhʷar/), officially the Oathbound Kindreds of the Woodlands and the Windlands (Nihwaran: Aithbundana Kunja þize Widiwlanda iþþize Windlanda) is an island country located in the [REDACTED] Sea. It has a population of 162,511 and an area of 25,201 km. The capital and largest city is Nibaurgs. Located near the Mid-[REDACTED] Rift, Nihwar is volcanically active. The southern, western, and eastern fringes of the island are bordered by high mountains, and the northern coast is cut off by ice nine months of the year. The only warm-water port on the island is Grewsteins, on the eastern shore of Rignwato Bay.[1] The interior of the island is a mix of boreal forest in the south and tundra in the north.

According to the ancient manuscripts of the Skitagsailandboka, Nihwar was settled by a band of wandering Ostrogoths, whose chieftain refused to ask for directions,[2] “even long after it became clear that this was not the way to Italy.”[3] Over subsequent centuries, the small population of Goths was augmented by Viking exiles, Inuit fishermen, and a boatload of “very confused” Maghrebi pirates. The island was loosely organized into often-feuding chiefdoms until the beginning of the 14th century, when Heidrek the Hairless united representatives of the entire island at the First Thing (Nihwaran Gothic: Þingamaidjig). Although occasionally interrupted by civil strife, constitutional crises, war, and abuse of the rules on filibusters, Things continually met at semi-regular intervals until the early 1800s. In 1811, due to political disorganization caused by a growing population and influential new political ideas imported from Europe and North America, a constitutional convention was called at Nibaurgs, which after three years produced the Constitutions of Niwhar, the basis of its modern government.

Political reforms accompanied economic reforms, and Niwhar expanded from a primarily subsistence-farming based economy to one based heavily on mining, lumber, and fossil fuels. Modern Nihwar is one of the wealthiest countries in Eurasia, with the 12th-highest GDP in the world.

Nihwaran culture is founded on the nation’s eclectic heritage and industrious, if occasionally rowdy, spirit. The main language of Nihwar is Nihwaran Gothic, a highly conservative East Germanic language which has remained almost unchanged for the past twelve hundred years.[4][5][6] The country’s rich cultural heritage includes traditional cuisine,[7] the Nihwaran saga,[8] and small, careful arrangements of rocks.

Contents 1 Etymology 2 History 3 Geography 4 Politics 5 Economy 6 Demographics 7 Culture 8 References 9 Further Reading

ETYMOLOGY The origin of the common name for the country, “Nihwar,” is unrecorded, but it is noted in the Skitagsailandboka that it was “considered appropriate for the condition and climate of the region in which we found ourselves.” The formal name of the country is a reference to the oath sworn to the national constitutions at the First Thing, as well as the various chieftaincies and tribal divisions which formally constitute the federal structure of Nihwaran government.

HISTORY The Settlement Period: ca. 550 - 800 See also: Scitagsailandboka

This section is a stub. You can help by adding to it.

Feuding Chiefdoms See also: War of the Horse, War of the Bucket (Nihwar), The Fight Behind Athanaric’s Barn (1104), War of the Insult to Gryggja’s Mother, War over Who Gets Granny Hervar’s Silver, The Fight Behind Athanaric’s Barn (1202), The Fight Behind Athanaric’s Barn (1211)

This section is a stub. You can help by adding to it.

Early Modern Period See also: Rediscovery of Nihwar, Second Rediscovery of Nihwar, The Existence of Nee-Warr: Fact or Fiction? (1602)

This section is a stub. You can help by adding to it.

Constitutional Convention This section is a stub. You can help by adding to it.

19th Century This section is a stub. You can help by adding to it.

20th & 21st Centuries This section is a stub. You can help by adding to it.

Geography This section is a stub. You can help by adding to it.

POLITICS Nihwar has a multi-party political system. Its most recent election was in 2016, resulting a parliament led by a center-left coalition, and the re-election of the incumbent Lawspeaker, Ragnagild Thiudareiksdauhtar. The largest party, and the leader of the governing coalition, is the Nihwaran Citizen’s League.[9]

Politics on the cantonal and municipal level tends to be heavily contested in Nihwar, and many regional, local, and single-issue parties exist that do not contest elections on the national level. Some national parties, like the NCL, tend to be formed by shifting coalitions of smaller parties, while others are of longer-standing duration.

By law, all campaigns in Nihwar are publicly funded, and restricted to the 60-day period before each election.

Constitutions Nihwar has two constitutions. The first and elder is the Grundlags, adopted by the Thing in 1811 (subsequently heavily amended). The Grundlags lays out the structure of federal government, the rights of the cantons, and the shared competencies of the cantons and federal government. The second constitution, the Mannareihtsleistan, adopted in the 1920s, enumerates individual rights of citizens and residents of Nihwar, including rights which the federal and cantonal governments are obligated to protect, as well as rights which are also protected from infringement by private agents.

Federal Government Nihwar is a federal republic comprised of nine cantons (six of which are divided into half-cantons), organized under a presidential system, though it is sometimes characterized also as a semi-presidential system. The head of state and government in Nihwar is the Lagsogareis, elected every four years by popular vote, who administers foreign policy, the diplomatic service, and acts as head of the armed forces should the need arise. The legislature is the Kunsamnonunga, which is elected every two years. The largest party in the Kunsamnonunga, if a majority, or the largest coalition of parties, has the right to select the Kunsogareis, who administers domestic and economic policy. Although formally the Lagsogareis is responsible for the appointment of heads of executive departments, in practice executive appointments are the result of consultation between the Lagsogareis and the Kunsogareis. In the event of the death or incapacity of the Lagsogareis, the Kunsogareis can temporarily assume the powers of the office.

The Kunsamnonunga is elected from single-member districts using range voting. Before 1996, Kunsamnonunga elections used the single-transferable vote system. Range voting was adopted as part of the 2005 electoral reform package, which first applied to the 2006 federal election.[10] Candidates are assigned ratings from 1 to 5, with 5 indicating highest preference; multiple candidates may be assigned the same number. The candidates with the highest overall ratings are elected to office. In addition to being the legislature, the Kunsamnonunga is responsible for reviewing executive and judicial appointments, via constitutionally prescribed standing committees.

The cantonal governments are also entitled to send representatives Dailsamnonunga, where each canton has two votes, which must be cast together in the case of unified cantons, and are cast separately by each half-canton in the case of divided cantons. The Dailsamnonunga acts primarily as a coordination mechanism between cantons on matters not of particular relevance to the federal government, and is mostly used to negotiate and formalize inter-cantonal compacts and agreements.

Appointments to the federal judiciary are made by the National Judicial Committee, which is by law nonpartisan, and drawn from academic bodies, like the Law Faculty of the University of Nibaurgs, and senior federal judges. After an initial term of office, voters are required to approve newly-appointed judges as part of biennial federal elections, or their term immediately expires.

Federal law and civil rights case law mandates that electoral districts in Nihwar be drawn by nonpartisan committees, and observe the requirements of equal size, contiguousness, compactness, and geographic orderliness.[11]

The Lagredas is Nihwar’s supreme court, functioning both as the court of final appeal and the constitutional court. Laws may be referred to the Lagredas for review either by lawsuits, the Judicial Committee of the Kunjasamnonunga, or by the Lagsogareis. If a law is found to be unconstitutional, it is referred to the National Judicial Committee for revision, if it can be revised to be in harmony with the constitutions; if the NJC determines a law cannot be made constitutional without fundamental alteration, it is automatically repealed.

Cantons Nihwar has nine cantons: Nurþrata Windlands, Austrata Windlands, Tibrans, Fairgunjalands, Fonhullu, Bitrawidu, Sunthrastranda, Eisahwos, and Wostinjos. Six of the nine cantons--Tibrans, Fairgunjalands, Bitrawidu, Sunthrastranda, Eisahwos, and Wostinjos--are divided into half-cantons, their principal cities having a degree of autonomy that reflects the substantially different demographic and political makeup from the surrounding region.

Nihwaran cantons have wide latitude on culture, education, and land management; they share competency with the federal government on matters of transport, housing, criminal and civil law, foreign relations, and infrastructure. The federal government has exclusive competency on healthcare, defense, economic policy, and the national UBI.

Cantons are divided into Landkraitos and Baurgkraitos (municipalities and rural districts). Municipalities are governed by municipal councils, in conjunction with nonpartisan Municipal Planning Departments. MPDs are normally tasked with observing and forecasting local economic trends, in conjunction with the National Office of Statistics, and providing regular reports to the municipal council in order to formulate policies to avoid or ameliorate negative future trends: for instance, to encourage the building of additional housing, if a housing shortage is on the horizon. The NOS also furnishes MPDs with model land-use schemes to discourage urban sprawl and encourage efficient, mixed development.

Enclaves and subcommunities By law, any community of individuals has the right to establish an enclave outside an existing urban area, or a subcommunity within an urban area, either to “maintain a distinct cultural, philosophical, religious, or artistic identity,” or “for the purpose of pursuing a special artistic, scientific, academic, or spiritual aim.” Enclaves cannot be established on federally managed land, but enjoy exemption from many forms of local, cantonal, and federal taxation. Charters for enclaves are granted for 20-year intervals, and enclaves must meet specific criteria in order for charters to be renewed. Subcommunities, being dependent on urban infrastructure, enjoy fewer autonomous rights than enclaves but otherwise function in largely the same fashion.

Enclaves and subcommunities have consultative rights within cantonal assemblies and the Kunjasamnonunga, but do not have distinct voting representation.

Budget and taxation The primary methods of taxation in Nihwar are a Georgist land tax, based on the unimproved value of land, VAT, and an income tax on incomes above NWM 100,000 per annum. Financial transaction taxes and the Nihwaran Sovereign Wealth Fund are also used to fund certain social programs.

The primary government expenditures of Nihwar are the national UBI and the national healthcare system; these programs, as well as the civil defense budget and the internal development budget have their size fixed by law. Discretionary spending is determined biennially by the Kunjasamnonunga based on the General Tax Survey, in which citizens roughly indicate how they want the discretionary portion of the budget spent by allocating their tax returns to one or more general categories of spending.

Foreign Relations Nihwar has trade agreements with the European Union, Russia, Canada, and the Nordic countries. In addition, its cantons are permitted to conduct separate foreign policy in certain matters of particularly local interest; this has mainly been used by coastal cantons like Sunthrastranda to establish fisheries treaties with nearby nations.

Military Nihwar does not have a standing military. Disaster relief and the unlikely possibility of national defense are first and foremost the responsibility of the National Civil Defense Organization, a national service organization which also helps manage federal land, administers infrastructure projects, and conducts aid work in foreign countries.

Although there is no draft, at least one year of service in the NCDO exempts Nihwaran citizens from specific tax penalties after age 30 which scale with income, intended to prevent wealthier citizens from being more able to avoid service. By statute, service in some capacity, however ancillary to the main projects of the NCDO, is open to all citizens; the NCDO also provides job training in specific areas.

The NCDO is organized into pseudo-military “regiments,” each regiment drawing from as broad a cross-section of the population (economically and geographically) as possible, and each regiment cultivating its own unique espirit de corps. Regimental associations formed by former members of the NCDO are a significant feature of Nihwaran social life.

In the event of an invasion, defense would primarily be the responsibility of the National Sea Institute (the Nihwaran coast guard, a branch of the NCDO) and the Ranger Corps of the NCDO; the NCDO maintains a small body of trained officers and special forces personnel, intended to form the backbone of a larger military mobilization in the event of a serious military conflict.

Nihwar’s intelligence service operates primarily by leaking information on foreign governments to their local press or to international human rights watchdogs.

Criminal law Prisons do not exist in Nihwar.

The only classes of crime which can permanently deprive a Nihwaran citizen of their rights are public corruption or the infringement of human rights. Conviction for serious crimes in this category may result in the loss of the right to hold public office.

Immigration and naturalization Nihwar has open borders; anyone arriving at a sea port or airport in Nihwar is assumed to have the right of entry, and will not be refused unless it is discovered that they are wanted for a serious crime that is also in contravention of Nihwar’s laws, or they carry a serious, highly-contagious infectious disease (in which case they will simply be quarantined and treated).

Anyone born on the territory of Nihwar, or its isles and seas, is automatically a citizen of Nihwar, as is anyone born to a Nihwaran citizen. Anyone ordinarily resident in the country for one year or more (defined as registering their address at the local Kraitmelþogahausjands or online, or being able to demonstrate long-term residency through other criteria) can apply for provisional citizenship, which expires if one de-registers or moves away from Nihwar. Provisional citizenship can be converted to permanent citizenship after three years of ordinary residence in Nihwar. Nihwaran citizenship can also be granted by an act of the Kunjasamnonunga, or by order of the Lagsogareis.

ECONOMY The economy of Nihwar is mostly based on lumber, mining, oil drilling, and tourism.[12]

Currency The currency of Nihwar is the Nihwaran mark (NWM), equivalent to approximately EUR 0.80. The mark is managed by the Bank of Tibranbaurgs, which is part of the National Department of Statistics and Planning.

Healthcare Nihwar has a universal healthcare system, administered by the Institutes for Public Health. Healthcare is generally free to the end user everywhere in Nihwar.

Pharmeceuticals in Nihwar are prescription-only only if 1) the IPH has determined there is a high likelihood for abuse which could constitute a public health hazard, or 2) the drug is both sufficiently dangerous when improperly administered, and is difficult to correctly administer. In general, many more pharmeceuticals are available for purchase in a Nihwaran pharmacy than in most other countries. Recreational drugs are regulated under a similar regime.

Transport Eisarnreda Nihwar provides high-speed rail transport throughout the country. Municipal light rail services are available in Nibaurgs, Tibranbaurgs, Grewsteins, and Bitrasteins. An Eisarnkarta can be purchased in Nihwar, or online before traveling to Nihwar, which provides unified access to all buses, taxis, trains, ferries, and airline flights within Nihwar’s borders.

Privately owned automobiles not declared as a business expense for tax purposes are subject to a high annual tax.

Communication and advertising Radijonati Nihwar provides a free national broadband network and, in conjunction with municipal governments, local broadband and WiFi access; higher-speed providers are regulated by the Nihwaran Communications Authority. By statute, as many government services as possible must be accessible online.

The National Standards Agreement is an agreement negotiated by the government between Nihwar’s media outlets not to sensationalize coverage of mass violence, terrorism, or suicide.

Outdoor advertising is banned throughout Nihwar.[13]

Corporate governance The Nihwaran tax code strongly encourages the Nihwaran model of corporate governance, which involves employee ownership and the election of managers up to and including the senior management. Foreign companies operating in Nihwar are not required to conform to this standard, but will find their tax liability is somewhat reduced based on the percentage of their employees that belong to a Nihwaran union.

Labor relations are overseen by the Nihwaran Business and Labor Alliance, a non-governmental organization.

DEMOGRAPHICS This section is a stub. You can help by adding to it.

CULTURE Education Education is free from kindergarten through university; specialized professional job training programs and apprenticeships are also common in Nihwar, and 1 to 3-year non-university training courses are the means of entry into most non-academic professions. Further technical education is provided both through third-level institutions and the NCDO.

Language Nihwar has no official language, though Nihwaran Gothic is the major language of politics and academics. The minor dialects of Nihwaran Norse, Nihwaran Arabic,[14] and Nihwaran Greenlandic are spoken by about 35% of the population.

Sport The most popular sport in Nihwar is Nihwaran Skull Cricket, organized by the International Nihwaran Traditional Sports Association. The INTSA has been sanctioned repeatedly since the 1970s by international human rights organizations, mostly due to fallout related to the quadrennial Skull Cricket championships.

REFERENCES [1] ^ “The World’s Six Worst Vacation Destination” Buzzfeed.com, retrieved March 11, 2015 [2] ^ “The ‘Shitty Island Book’ and the Foundation of Nihwar,” Joseph Wright [3] ^ ibid. [4] ^ “Nihwaran Language Academy rejects neologisms proposal, will continue to refer to computers as ‘magic rocks’”, BBC News, January 5 2010 [5] ^ “The NLA: Linguistic Conservatives, or Linguistic Reactionaries?”, Journal of the Germanic Linguistics Association, June 2011 [6] ^ “Nihwaran Language Academy Barricades Conference Room Door, Won’t Stop Quoting Edmund Burke”, Nihwartimes.com, retrieved October 13, 2011 [7] ^ “Nihwaran Rock and Twig Soup, and other specialties,” Food.com, retrieved May 15, 2009 [8] ^ “Nihwaran Literature: A Mistake?” Joseph Wright. Wright notes that the Nihwaran saga is a primarily oral art form, and usually continues until someone in the back of the audience shouts “Bullshit!” They primarily concern feuds over cattle, the division of inheritance, and “stories about how Grandpappy froze to death back in aught three.” [9] ^ “Elections in Nihwar,” The Economist, March 15, 2016. The NCL is composed of several centrist parties, including the Sozjal-”Deimakratisk” Party (Marxist-Leninist), Niu Nihwar (Blairo-Clintonian Post-Socialist Chickenshit), and the Liberal-Allajans (Nakedly Plutocratic). Despite repeated complaints from the political leadership, the power of the Nihwaran Electoral Commission to add punctuation and snide commentary to the names of Nihwaran political parties remains immensely popular with the electorate. [10] ^ “Nihwaran President: ‘It Worked for Hot or Not; Why Not For Us?’” BBC News, October 11, 2005 [11] ^ Nihwar lacked gerrymandering rules until the 1960s, when a fortuitous coalition deal and an ambitious party leader managed to net the Nihwaran Miner’s League control of the national electoral comission and, subsequently, three Kunjasamnonuga majorities with less than four percent of the vote each time. The NML was subsequently banned and entire party leadership deported to Svalbard. [12] ^ VisitNihwar.su, accessed September 23, 2002. The current slogan for Nihwaran Tourism is “At Least We’re Not Svalbard,” which replaced its previous logo, “Come For the Cheap Cigarettes, Stay Because An Unpronounceable Volcano Grounded Your Flight.” The slogan before that was “Not As Depressing As The Pictures Make It Look.” [13] ^ “Protecting the Scenery - Sort of,” The Economist, June 2010. “In a new proposal pushed as a way to protect Nihwar’s natural beauty, the country’s president has proposed legislation that would ban outdoor advertising across the country. Critics from within the country have answered mostly with ‘what natural beauty?’ But the real pressure seems to be coming from the Nihwaran Union of Poster Stickers, who have reported a record number of cases of summer frostbite this year, and whose leader seems to be old friends with Mr. Skildus.” [14] ^ “Nihwaran Arabic,” Journal of Obscure Languages, Autumn 1983. “Nihwaran Arabic is unique in two respects: first, it is the only Afro-Asiatic language spoken above the Arctic Circle; second, it is the only language--on Nihwar or anywhere else in the world--written with runes. Considering that the Nihwarans have never used runes to write their language, and Arabic speakers did not arrive on the island until the runic alphabet had been extinct elsewhere in Europe for centuries, the use of runes to write this peculiar dialect has never been satisfactorily explained.”

FURTHER READING The Living Goths: Nihwar, its Land, and Peoples, Joseph Wright, 1906 Al-Jazirat Al-Qabiha, Ibn Musafir, 1662 “The Forgettable Land,” National Geographic Magazine, Ann Bancroft, 2001 The Atlas of Remote Islands 2: Why Bother?, Judith Schalansky, 2014 The Oral Poetry of Nihwar: An Anthology, Penguin Books, 1992

14 notes

·

View notes