#Annuity Types

Explore tagged Tumblr posts

Text

Maximizing Retirement Income: Comparing Fixed, Variable, and Indexed Annuities

View On WordPress

#annuities#annuity investments#annuity types#deferred annuity#financial planning#fixed annuity#immediate annuity#indexed annuity#retirement income#variable annuity

0 notes

Text

Radovid Joins the Hansa

At the Radskier discord we are Goncharov-ing what Radovid-joins-the-hansa (aka: Hansovid) AU would be like and here's some of the ideas shared so far:

the exact details on HOW this happens are not set in stone (Did Radovid escape before Vizimir got offed, leaving Pip and Siggi without a convenient spare? After? More importantly, does he have the annuity??), but some headcanons are:

Art major nerd perk, Radovid knows a lot about slightly more practical things, like art, history and architecture and sometimes weird law facts that he personally found interesting

barding- under Jaskier's tutelage, Radovid's playing has improved dramatically, which is great because unlike jaskier who is kind of recognizable, Radovid can more easily go into towns as a perfectly average, unremarkable bard, making getting items/information while keeping anonymity (they usually pair him up w Regis for safety reasons)

Very good at looking dumb and pretty and quite pathetic which makes people underestimate him more

Courtly training so he's polite and educated… and good at remembering faces and names.

THE ONE NORMAL PERSON IN THIS GROUP. Radovid often ends up being the most sensible/practical person in a situation simply by process of elimination. Radovid will read a potion saying 'drink me' and...not do it. He'll see spoopy shit and walk the fuck out. He's the guy who asks who's on the other side before opening to sus knocking.

he's very bad at athletic stuff and takes awhile to build stamina, but at least this time everyone's got horses and boots so it balances out

Radovid is not good at self defense BUT does have some concept of swordsmanship/archery… from like like 20 years ago. He is, however, decided not to be a burden and not to get left behind. He's especially invested in protecting Jaskier- who Radovid is horrified to find- is even more useless than he himself is (bitch you live like this??).; Because Radovid has common sense and self preservation instincts, things jaskier is mostly lacking).

he eventually starts getting lessons from Cahir and Milva when time permits, and healing stuff from Regis. He's got excellent memory and attention to detail, but remains average at swordsmanship/archery.

he is, however, fairly good with a crossbow (no the wrist ones from TW3, the bigger ones ).

he also gets a cute ponytail/braid and smiles more! (original art by naumaxia-art)

Still too weaksauce for the path?

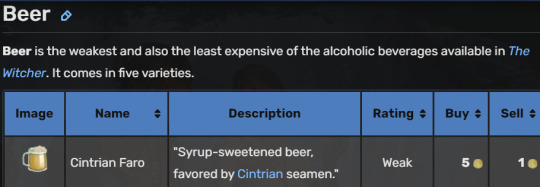

we've named him 'Faro', after a type of Cintran beer

He's a Polish Tatra Sheepdog and was acquired by the group when Geralt was handling a monster infestation. Unfortunately neither the puppo's owners, nor his sheep were spared, but puppo not only survived, but saved Jask and Radovid and became extremely protective of them.

I imagine the acquisition goes something like:

Geralt: absolutely not. Radovid: I'm calling for a vote! Milva: You. You're calling for a vote? Radovid: why not? is this not a democracy? Radovid: I'm of course voting to keep him. Jaskier: I second the vote to keep the very handsome boy! Angoulême: come on Geralt, we'd never have found where the Barghest were coming from without him, AND he saved your bard from walking straight into it. Jaskier: yes Geralt, he saved your bard! Geralt: fine, then I vote no. Milva: I'm not taking care of any more mutts than I have to Radovid: he's clearly purebred! Cahir: still no. Geralt: see? We are done here Angoulême: *the little shit* nunca hasn't voted yet. Geralt: *sigh* Regis, can you please tell them so we can leave? Regis: Geralt: Regis. Geralt: Regis, no Regis: *trying not to smile like he's entirely charmed* … well, he is a very handsome boy.

In the end Regis suggest they at least try to get him to civilization so he can be adopted by a good family, but in the week it takes to get to it, Faro proves himself the MVP, not only will it defend the weakest party members, but it's a vert smart dog who will deter wolves/and will bodily shepherd jaskier away from dangerous areas/items as needed.

the one and only drawback is that Jaskier and Radovid can no longer have obnoxiously loud sex since Faro gets stressed thinking they're getting hurt and will try to intervene, effectively cockblocking them.

Finally Geralt gets some (relative) #blessedsilence

Geralt: *hugging the dog* I'm so sorry i ever doubted you

feel free to add to this!

#it's free real estate prompt just tag me so i can read

#radskier#hansa radovid#hansovid#jaskier#radovid the stern#the witcher#witcher netflix#not canon but should be#prancing plotbunnies#it's free real estate prompt just tag me so i can read#AU'S AND UA'S MAKE PANUR A HAPPY GIRL

32 notes

·

View notes

Text

A Short Guide to Turn Your Pension into an Annuity in the UK

As retirement approaches, one of the key decisions you’ll need to make is how to turn your pension savings into a regular income. One popular option for many retirees is converting their pension pot into an annuity. An annuity is a financial product that provides you with a guaranteed income for life (or for a set period), giving you peace of mind knowing that you will have a steady income stream throughout your retirement.

This guide will walk you through what an annuity is, how it works, and the steps to take to convert your pension into one in the UK.

1. What Is an Annuity?

An annuity is a financial product that allows you to exchange your pension savings for a guaranteed income. Once you purchase an annuity, the insurance company will pay you a regular income (monthly, quarterly, or annually) for the rest of your life, or for a fixed term, depending on the type of annuity you choose.

There are several types of annuities available, including:

Lifetime Annuity: Provides a guaranteed income for life. This is the most common form of annuity and ensures you don’t outlive your pension savings.

Fixed-Term Annuity: Pays an income for a set period, such as 5, 10, or 20 years. After the term ends, the income stops.

Inflation-Linked Annuity: Offers an income that increases over time to help maintain purchasing power as inflation rises.

Joint-Life Annuity: Guarantees an income for both you and a spouse or partner. The payments will continue to your partner after your death.

2. When Can You Buy an Annuity?

In the UK, you can usually convert your pension pot into an annuity once you reach the age of 55 (or 57 from 2028 onwards). At this point, you have the freedom to access your pension savings, and turning your pot into an annuity is one of the most common options.

If you have a defined contribution pension (the most common type of pension), you can use the lump sum to purchase an annuity. If you have a defined benefit pension (final salary scheme), your employer will provide you with an income based on your salary and years of service, so you won’t need to purchase an annuity for that part of your retirement income.

3. Steps to Convert Your Pension into an Annuity

Converting your pension into an annuity requires some careful consideration. Here are the main steps involved:

1. Understand Your Pension Pot

The first step is to understand how much you’ve saved in your pension pot. This is the money you’ll be using to purchase your annuity. You’ll want to know the total value of your pension, as well as any other retirement income you may have, such as state pensions or other savings.

2. Research Different Annuity Providers

There are many annuity providers in the UK, including banks, insurance companies, and specialist pension providers. It’s essential to compare offers from multiple providers to ensure you get the best possible deal. Factors to consider include:

The annuity rates (the higher the rate, the higher your income).

The terms and conditions of the annuity (e.g., if you choose a lifetime annuity, does it offer the option for your income to increase each year?).

The flexibility of the annuity (e.g., can you make changes in the future if your needs change?).

Tip: Use an annuity comparison tool to get quotes from multiple providers.

3. Consider the Type of Annuity

Choosing the right type of annuity is crucial. The most common type is a lifetime annuity, but there are variations that may suit your specific needs:

Single life annuity: Pays you a fixed income until your death.

Joint life annuity: Pays an income for both you and your spouse or partner.

Inflation-linked annuity: Increases your income over time to keep up with inflation.

Consider your health, financial situation, and whether you want your income to continue for your loved ones. If you’re in good health, you may also want to explore enhanced annuities, which can offer higher payouts for people with certain health conditions or lifestyle factors.

4. Speak with a Financial Adviser

Before making a final decision, it’s highly recommended to consult with a financial adviser. They can help you assess your financial situation, determine the best annuity option for your needs, and provide guidance on tax implications and other retirement planning considerations.

A financial adviser can also help you avoid pitfalls such as:

Not shopping around: By comparing multiple offers, you could significantly increase your retirement income.

Overlooking other options: Annuities aren’t your only option. Your financial adviser might suggest other solutions such as income drawdown or phased retirement, which can give you more flexibility than a traditional annuity.

5. Decide How to Buy the Annuity

Once you’ve chosen the right provider and the type of annuity, you can proceed with purchasing the annuity. The provider will ask for details about your pension pot and your personal preferences. In exchange for your lump sum, they will provide you with a contract outlining your guaranteed income and the terms of your annuity.

4. Things to Consider Before Buying an Annuity

Before committing to an annuity, make sure you’ve considered the following factors:

Irreversibility: Once you purchase an annuity, it’s usually irreversible. This means you cannot change your mind and get your pension pot back. If your income needs change, you might be stuck with the fixed terms of the annuity.

Annuity Rates: Annuity rates can vary significantly between providers. The rates depend on a number of factors, including your age, health, and the type of annuity you choose. It’s crucial to shop around for the best rate to maximise your income.

Inflation Protection: Inflation can erode the purchasing power of your income over time. If you’re concerned about inflation, consider purchasing an inflation-linked annuity, which increases your payments over time.

Tax Implications: The income you receive from an annuity is subject to income tax, which could impact your overall retirement income. Speak with a tax adviser to understand the tax implications of your annuity.

Health Conditions: If you have certain health conditions or a shorter life expectancy, you may be eligible for an enhanced annuity. These annuities offer higher rates of income, reflecting the reduced likelihood of you living for many years.

5. Alternatives to Annuities

While annuities are a popular choice, they are not the only option. Other options include:

Income Drawdown: Allows you to keep your pension pot invested while drawing an income. You have more control, but it comes with more risk.

Phased Retirement: You can take partial pensions and gradually convert them into annuities over time, which gives you flexibility.

Cash Lump Sum: You can take all your pension pot as a lump sum, but this means you’ll have to manage your own income.

Conclusion

Turning your pension into an annuity can provide you with a guaranteed income for the rest of your life, offering peace of mind as you enter retirement. However, it’s important to carefully consider the type of annuity you want, shop around for the best deal, and consult a financial adviser to make an informed decision. With the right planning and research, an annuity can be a reliable way to secure your financial future in retirement.

0 notes

Text

Lump Sum or Annuity? Choosing the Right Option for California Lottery Winners

Should you take your California lottery winnings all at once or over time? Here's how to choose the option that protects your wealth long-term.

Introduction California lottery winners have just 60 days after claiming their prize to decide: should you take a lump sum payout or receive the money through a 30-year annuity?

The right choice depends on your financial goals, tax outlook, family situation, and risk tolerance. And because this decision is irrevocable, you’ll want to work closely with an experienced lottery attorney and financial planning team before filing.

Option 1: Lump Sum Payout ✔ Pros: Immediate access to full winnings (after taxes)

Flexibility to invest, pay off debt, or donate

Control over your money from Day 1

✘ Cons: Significant upfront federal tax liability

Entire amount becomes part of your estate

Risk of mismanagement, poor investing, or overspending

Option 2: Annuity Payout ✔ Pros: Provides guaranteed income for 30 years

Potential for long-term tax deferral

Encourages discipline and budgeting

May reduce exposure to financial fraud or rash decisions

✘ Cons: Less flexibility for big purchases or investments

Risk of changing tax laws affecting future payments

Your estate may not fully inherit future payments unless a plan is in place

How a Lottery Attorney Helps You Decide A qualified attorney will:

Explain the tax and legal implications of each option

Collaborate with CPAs and financial advisors

Protect your interests in case of family disputes or legal challenges

Ensure your estate plan can inherit or control the annuity stream

They’ll also help you avoid third-party annuity purchasing scams, where companies offer you cash now in exchange for a fraction of your long-term payments.

Real Example: Blending Both Worlds Some California lottery winners choose a lump sum, then invest the funds in their own annuity or diversified portfolio that generates recurring income—while keeping control.

For more on how annuities work, visit this detailed guide by Investor.gov (U.S. Securities and Exchange Commission) explaining types of annuities, payout structures, and consumer tips.

Key Questions to Ask Before Choosing What are my short-term and long-term financial goals?

Am I comfortable managing a large sum of money?

Do I have a trusted team of advisors in place?

What are the tax differences between the two options?

Will the annuity protect my family if something happens to me?

Our Recommendation: Don’t Decide Alone While a lump sum may seem exciting, and annuity feels “safer,” only a full review of your situation will reveal what’s right for you.

📌 Get the legal insight you need before choosing. 👉 Read the full guide on protecting your winnings here

Related Articles: 👉 Why You Need a Lawyer Immediately After Winning the Lottery

👉 How to Stay Private After a Lottery Win in California

0 notes

Text

AO Globe Life: Helping You Choose the Right Insurance Plan

Are you looking for a secure life insurance plan but often confused while choosing the best among several options? No worries! With AO Globe Life, you don't have to worry about anything! It is a leading organization that helps employees, customers, and agents to make a better future. Let's explore more about life insurance policies, their benefits, and the factors to consider when choosing a plan. Introduction to Life Insurance Plan: A life insurance plan is an essential step to ensure your family is protected financially in the future. It is an agreement between an individual and a financial firm that offers guaranteed reimbursement for the loss of life in return for specific payments. AO Globe Life is a popular organization that helps you choose the best life insurance policy tailored to your needs and preferences. It has expert and highly qualified professionals who have worked for many years and delivered the most favorable results. Here is a simple explanation of what you should know about life insurance, including the different types and benefits: Types of Life Insurance Plans: There are many types of life insurance plans available. Choosing the best among them is daunting. That is where AO Globe Life comes in! It has a team of professionals who are always ready to solve your problems. Let's take a look at some of the life insurance plans:

Whole Life Policy: Alife insurance policy is active as long as you live.

Term Insurance Plan: It is valid for a specific period. You need to pay for a particular amount of time.

Pension/Annuity Plan: Annuity plans are mainly for people who want to save money for retirement.

Endowment Policy: An endowment policy is like a term insurance plan but with one key difference. If you live through the policy term, you get a lump sum of money at the end.

So, these are some life insurance plan types. If you want to opt for the one, you can connect with AO Globe Life experts! They provide the best and most efficient solutions based on your needs and budget. Benefits of Having a Life Insurance Policy from a Professional firm: Unlike traditional life insurance policies, AO Globe Life provides the best and most reliable plans that suit your requirements. These plans offer many advantages, including:

Allows tax advantages

Personalized plans from the leading organization

A comprehensive range of features

Covers risk and financial hardships

In conclusion, these are some benefits of using a life insurance plan from a reputable firm. Original Source: https://bit.ly/3HxAMHF

0 notes

Text

The Role of Index Funds in a Retirement Investment Plan

When planning for retirement, one of the key decisions investors face is where to allocate their money for long-term growth and security. Among the many options available, index funds have emerged as a powerful and reliable investment vehicle. Known for their simplicity, low fees, and broad market exposure, index funds are often recommended as a core component of a sound retirement strategy.

What Are Index Funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) designed to track the performance of a specific financial market index, such as the S&P 500, Dow Jones Industrial Average, or Nasdaq Composite. Instead of being actively managed by a portfolio manager who selects individual stocks, index funds passively mirror the holdings of the underlying index.

This passive approach not only simplifies the investment process but also helps reduce costs, as there are fewer trading fees and management expenses compared to actively managed funds.

Why Index Funds Are Ideal for Retirement

1. Long-Term Growth Potential

Retirement planning typically spans decades, and index funds are well-suited for long-term investing. They offer consistent exposure to a wide array of companies, sectors, and industries, helping investors participate in overall market growth. Historically, major indices like the S&P 500 have delivered solid returns over long periods, making them a reliable foundation for retirement portfolios.

2. Low Fees and Cost Efficiency

One of the most significant advantages of index funds is their low expense ratios. Since they don’t require active management, operational costs are minimized. Over the years, the savings on fees can significantly enhance the value of a retirement portfolio, particularly when compounded over time.

3. Diversification and Risk Management

Index funds provide instant diversification by holding a broad basket of securities. This helps reduce individual stock risk and increases stability during market fluctuations. Diversification is crucial in retirement planning, as it helps protect savings from volatility and sector-specific downturns.

4. Predictability and Transparency

Investors know exactly what they’re getting with an index fund. Since the fund aims to replicate a specific index, there’s less guesswork about its holdings and performance. This transparency makes it easier to align investments with one’s retirement goals and risk tolerance.

5. Reinvestment and Compounding Benefits

Many index funds allow for automatic reinvestment of dividends and capital gains. This feature helps grow the investment over time through the power of compounding—essential for building a substantial nest egg by retirement.

How a Retirement Financial Advisor Can Help

Although index funds are straightforward, building a retirement portfolio requires more than selecting a few low-cost funds. A professional can help ensure your investment mix aligns with your retirement timeline, income needs, and risk profile.

Working with a retirement financial advisor in Fort Worth TX provides access to local expertise and personalized guidance. Advisors help balance index fund investments with other strategies like fixed income, annuities, or real estate to create a well-rounded plan. They also assist in tax-efficient withdrawal strategies, estate planning, and adjusting allocations as life circumstances change.

Conclusion

Index funds are a cornerstone of a solid retirement investment plan. Their cost efficiency, market exposure, and ease of use make them ideal for long-term investors. With professional guidance, such as that from a qualified advisor, retirees can confidently build a diversified portfolio that supports their financial independence for years to come.

0 notes

Text

Don’t Retire Without This! Top Types of Annuities Plans You Need to Know in 2025

Planning for a secure retirement is a top priority for millions of Americans. With Social Security benefits often insufficient to cover all expenses and traditional pensions becoming less common, many retirees are turning to annuities as a way to guarantee steady income throughout their retirement years. If you’re looking to enhance your retirement income strategy, understanding annuity planning and knowing how to select the best annuity plan is essential.

0 notes

Link

0 notes

Text

Retirement Planning Mistakes High-Income Earners Must Avoid: How to Keep Wealth Working for You

Making a high income can feel like a safety net, but when it comes to retirement, even top earners aren’t immune to mistakes. Many professionals with impressive salaries still find themselves unprepared for the lifestyle they imagined after work ends.

The truth is, earning more doesn’t guarantee a stress-free retirement. Common missteps, such as lifestyle creep, poor tax planning, or relying too heavily on a single income stream, can quietly undermine years of success. By identifying these issues early and developing a smart, diversified plan, high-income earners can safeguard their wealth and enjoy the retirement they’ve worked hard to achieve.

Getting Caught in Lifestyle Creep

One of the biggest traps for high earners is letting lifestyle inflation take over. As your income grows, so do your expenses. Suddenly, vacations become more luxurious, cars get more expensive, and the house keeps getting bigger. It feels good in the moment, but it can slowly eat into your ability to save and invest for the future.

The problem isn’t spending more, it’s spending without a plan. If your lifestyle keeps pace with your paycheck, there’s a chance you’re not saving enough to support that same lifestyle in retirement. Once the paychecks stop, maintaining that high-end lifestyle could become stressful or even impossible unless you’ve built a solid financial foundation.

This doesn’t mean you have to live frugally. It just means you should be intentional. Keeping your core expenses at a manageable level while saving and investing a good portion of your income puts you in a much better position later. Think of it like paying your future self first.

Not Taking Advantage of Tax Strategies

Taxes can take a big bite out of your earnings, especially when you’re in a higher income bracket. Many high-income professionals focus on earning and investing but don’t always look closely at how their money is taxed. This is one of the most overlooked retirement planning mistakes high-income earners must avoid.

There are tools and strategies designed to reduce your tax burden now and in retirement. Contributing the maximum to tax-deferred accounts like 401(k)s or traditional IRAs can lower your current taxable income. If your income is too high to contribute directly to a Roth IRA, you can explore backdoor Roth IRA conversions, which allow you to enjoy tax-free growth.

In retirement, taxes don’t go away; they just shift. If most of your retirement savings are in tax-deferred accounts, you could face large required minimum distributions (RMDs) and higher taxes later on. That’s why diversifying your account types (taxable, tax-deferred, and tax-free) is a smart move. It gives you more control over how much you owe during retirement and helps you stay in lower tax brackets when it matters most.

Putting All Your Eggs in One Income Basket

Another common issue for high-income earners is relying on a single source of income in retirement. Maybe you’re banking on a pension, a 401(k), or a rental property. While any of these might be solid on their own, depending too much on one stream can be risky.

The market changes. Real estate values go up and down. Pensions sometimes don’t keep up with inflation. That’s why it’s so important to build multiple income streams that work together to support you when you stop working full-time.

Some people invest in dividend-paying stocks or consider annuities to lock in guaranteed income. Others build businesses or maintain part-time consulting roles to stay active and generate additional cash flow. A well-diversified retirement plan protects you against surprises and gives you more flexibility.

It’s also smart to plan for healthcare costs, which can become one of the largest expenses in retirement. Even if you’re healthy now, you may need long-term care or other services down the road. Without a plan for this, your other income streams could get drained quickly. Insurance and savings tools can help cover these costs, so they don’t disrupt your overall retirement plan.

Delaying Retirement Planning or Underestimating Savings Needs

One of the biggest retirement planning mistakes high-income earners must avoid is assuming it’s okay to wait. If you’re making a lot of money, it might feel like you have plenty of time to catch up later. But the truth is, the earlier you start saving, the more your money can grow.

Time is one of the most powerful tools you have when it comes to building wealth. Even high earners need that compound growth to reach the kind of retirement that allows them to maintain their current lifestyle. If you start too late or don’t save consistently, you may find yourself working longer than you planned, or cutting back when you don’t want to.

High-income earners should also remember that Social Security may not be a large part of their retirement income. Because benefits are capped, it won’t replace a large percentage of your paycheck the way it might for lower earners. That means your savings and investments will need to do more of the heavy lifting.

It helps to run the numbers with a financial advisor who understands the needs of high earners. They can help estimate your future expenses and show you what it’ll take to get there. If you want to take a proactive approach to building a flexible financial future for your family, it’s worth planning beyond just retirement accounts.

Conclusion

Earning a high salary is a big advantage, but it’s not a guarantee of a comfortable retirement. Without smart decisions, tax planning, and income diversification, it’s easy to fall behind even when you’re ahead on paper. The good news is that most of these issues are preventable if you know what to look out for.

By avoiding lifestyle creep, making smart tax moves, creating multiple income streams, and saving early, high-income earners can enjoy their success now and still feel confident about the future. Planning isn’t about being perfect, it’s about staying aware and making choices that align with your long-term goals.

When you approach retirement with a plan that reflects your income, lifestyle, and future vision, you’re more likely to achieve the freedom you’ve worked so hard for.

#LegalFinancialAdvisor#BestRetirementPlanningBooks#ImpactInvesting#ESGInvesting#SociallyResponsibleInvesting#Flat-FeeFinancialPlanning#WhyFlat-FeeFinancialPlanningIsIdeal#RetirementReimagined#WorkAlignmenttoEmpoweredRetirement#RetirementasaTransition#RetirementandWATER#RetirementPlanningMistakesHigh-IncomeEarnersMustAvoid#LegacyPlanningStrategiesforFamilieswithGenerationalWealth#AdvancedAssetDiversificationTipsforRetirementSuccess

0 notes

Text

Choosing the Right Annuity Payout Schedule for You

Choosing the right annuity payout schedule is a critical decision for anyone planning for retirement. It involves evaluating various factors, including age, life expectancy, and financial needs. Different payout structures, such as fixed or lifetime annuities, offer distinct advantages and challenges. Understanding these nuances is essential for making informed choices that align with long-term goals. However, many individuals overlook key considerations that could greatly impact their financial stability in retirement.

Key Takeaways

Assess your financial goals and current income needs to determine the best payout schedule for your situation.

Consider your age, life expectancy, and retirement timeline when selecting a payment duration that suits you.

Understand the tax implications of different annuity payout options to maximize your net income.

Evaluate the potential impact of inflation on your purchasing power over time to maintain financial stability.

Consult with a financial advisor for personalized insights and guidance tailored to your unique circumstances.

Understanding Annuity Payout Schedules

Annuity payout schedules are critical components of financial planning, particularly for individuals seeking stable retirement income. These schedules dictate the timing and amount of payments received from an annuity contract, allowing retirees to manage their financial needs effectively. Common structures include fixed, variable, and indexed schedules, each catering to different risk tolerances and income requirements. A fixed schedule offers predictable payments, while a variable schedule allows for potential growth linked to market performance. Understanding the nuances of these schedules empowers individuals to make informed decisions aligned with their financial goals. Ultimately, a well-chosen annuity payout schedule can greatly contribute to a sense of security and belonging, fostering confidence in one's financial future.

Factors to Consider When Choosing an Annuity Payout Schedule

When selecting an annuity payout schedule, individuals must consider several critical factors that can considerably influence their financial outcomes. Key considerations include the individual's age, financial needs, and life expectancy, as these elements will impact the duration and amount of payments. Additionally, the tax implications associated with different payout options may affect net income. Understanding one's retirement goals is essential, as it shapes the choice between immediate or deferred payments. Furthermore, potential inflation should be evaluated, as it can erode purchasing power over time. Finally, flexibility in changing circumstances is crucial; individuals may wish to prioritize options that allow for adjustments to their payout schedule as their situations evolve.

Different Types of Annuity Payout Schedules Explained

Selecting the appropriate annuity payout schedule is essential for maximizing financial security in retirement. There are several types of annuity payout schedules, each designed to cater to different financial needs and goals. Fixed annuities provide guaranteed payments over a specified period, while lifetime annuities offer income for the annuitant's lifetime, ensuring a stable cash flow. Period certain annuities deliver payments for a predetermined time, with a potential for beneficiaries to receive remaining payments if the annuitant passes away. Additionally, flexible payout schedules allow for varying payment amounts based on individual circumstances. Each type of annuity payout schedule presents unique advantages and considerations, making it important for individuals to evaluate their personal financial situations when choosing the best option.

Benefits of Selecting the Right Annuity Payout Schedule

Choosing the right annuity payout schedule can markedly impact an individual's financial well-being in retirement. Selecting an appropriate schedule can provide predictable income, which is essential for budgeting and managing expenses. It allows retirees to align their cash flow with their financial needs, ensuring that essential costs are covered without unnecessary strain. Moreover, the right payout schedule can enhance peace of mind, reducing anxiety about outliving one's resources. In addition, understanding the tax implications associated with different schedules can lead to more effective long-term financial planning. Ultimately, a well-chosen annuity payout schedule fosters a sense of security and belonging within a community of financially aware retirees, enabling them to enjoy their golden years with confidence.

How to Make an Informed Decision on Your Annuity Payout Schedule

How can individuals guarantee they are making the best choice for their financial future regarding annuity payout schedules? To make an informed decision, individuals should first assess their financial goals, including current income needs and future expenses. A thorough understanding of different annuity payout schedules—such as immediate, deferred, or lifetime options—is essential. Consulting with a financial advisor can provide tailored insights and help evaluate the risks and benefits of each choice. Additionally, individuals should consider factors like inflation, tax implications, and potential changes in lifestyle. By gathering extensive information and reflecting on personal circumstances, individuals can select an annuity payout schedule that aligns with their long-term financial well-being and security.

Conclusion

To sum up, selecting the appropriate annuity payout schedule is a pivotal decision that can greatly influence one's financial stability in retirement. By carefully considering personal factors such as age, life expectancy, and financial needs, individuals can align their choices with long-term goals. An informed understanding of the various types of annuity payout schedules, along with potential tax implications and inflation effects, will empower retirees to make decisions that best secure their financial future. Consulting a financial advisor can further enhance this process.

0 notes

Text

Understanding the Benefits and Risks of GRATs in Florida Estate Planning

Grantor Retained Annuity Trusts (GRATs) have become a popular estate planning tool, especially in Florida. They offer unique benefits but also come with risks that you should understand before proceeding.

A detailed understanding of how a GRAT works in Bradenton can help you decide if this strategy fits your estate planning goals.

Benefits of Using a GRAT

Tax Efficiency GRATs allow you to transfer assets to beneficiaries with minimal gift tax impact.

Retain Income Stream You receive annuity payments during the trust term, providing cash flow.

Asset Appreciation Any appreciation beyond the IRS assumed interest rate passes tax-free to heirs.

Flexibility Can be used with various asset types, including appreciating investments.

Risks and Considerations

Mortality Risk If you pass away before the GRAT term ends, assets may revert to your estate.

Complexity Setting up and managing a GRAT requires careful planning and legal expertise.

Interest Rate Changes Rising IRS assumed interest rates can reduce the effectiveness of a GRAT.

Potential IRS Scrutiny Improper structuring can lead to challenges and tax penalties.

Why Consult a Lawyer?

To ensure your GRAT is tailored to Florida laws and your unique situation.

To navigate complex IRS rules and avoid pitfalls.

To integrate the GRAT into your overall estate plan seamlessly.

✅ Ready to Explore GRATs for Your Estate?

Contact Grivas Law and find a knowledgeable lawyer near me to help you understand how a GRAT works in Bradenton and decide if it’s right for you.

0 notes

Text

Fixed Index Annuities vs. Shield Annuities: Which Offers Better Protection in Puerto Rico?

If you're a business owner or high-net-worth individual in Puerto Rico, chances are you're looking for smart, low-risk financial products that can preserve your capital, generate income, and offer protection from market downturns. Two annuity options often discussed in this context are Fixed Index Annuities (FIAs) and Shield Annuities.

While they share similar goals—capital preservation and growth without direct market exposure—they have key differences that matter when building a customized retirement plan.

This article will break down how both annuity types work, how they compare, and which one might be better suited to your financial goals in Puerto Rico.

What Is a Fixed Index Annuity?

A Fixed Index Annuity (FIA) is a type of insurance product that allows your money to grow based on the performance of a market index (like the S&P 500), without directly participating in the market.

Here’s how it works:

Your principal is protected from market loss.

Your returns are linked to an index but capped or limited by a participation rate or cap rate.

Growth is tax-deferred until withdrawal.

Many FIAs include optional income riders for guaranteed lifetime income.

FIAs appeal to conservative investors who want to participate in market growth but can't afford to lose principal. Many retirees in Puerto Rico choose them to complement Social Security or pension benefits while preserving wealth.

What Is a Shield Annuity?

A Shield Annuity, sometimes called a buffer annuity, offers partial downside protection instead of full protection. You share in some market risk—but with a buffer zone that protects you up to a certain loss percentage (e.g., 10% or 15%).

Key features include:

Higher upside potential than FIAs because of less protection.

Losses only apply beyond the buffer (e.g., market drops 12%, and your contract buffers 10%, so you only absorb 2%).

More flexibility in choosing market-linked options.

Often comes with shorter contract terms than traditional FIAs.

Shield annuities are designed for those who want more growth potential and are willing to take limited market risk in exchange for better returns.

Also Read - Shield Annuity: 24% Bonus, Guaranteed Income, No Market Risk

Comparing Protection and Growth Potential

When evaluating Fixed Index Annuities (FIAs) versus Shield Annuities, it's essential to understand how each balances protection and growth. These products serve similar goals—preserving capital and generating retirement income—but they take different approaches to managing risk and return.

Fixed Index Annuities offer 100% principal protection. Your investment is never exposed to market losses. Instead, your returns are linked to an index, like the S&P 500, but limited by either a cap or a participation rate. This makes FIAs ideal for conservative investors who prioritize safety and are willing to trade off some growth potential to avoid losses entirely.

Shield Annuities, on the other hand, offer partial protection through what's known as a “buffer.” For example, if you have a 10% buffer and the market drops 12%, your contract only absorbs a 2% loss. Because you're accepting limited downside exposure, you can typically enjoy higher upside potential than you would with an FIA. These annuities appeal to individuals who want to stay connected to market performance but still want a degree of built-in protection.

In short, Fixed Index Annuities are better for those seeking guaranteed security, while Shield Annuities may be a better fit for those comfortable with moderate risk in exchange for better growth potential. The right choice depends on your personal risk tolerance, retirement timeline, and overall financial strategy.

How to Choose Between the Two in Puerto Rico

The right annuity depends on your risk tolerance, retirement timeline, and financial goals. For many business owners transitioning from active income to retirement, protection is a top priority—but so is outpacing inflation and generating reliable cash flow.

Here’s how to think about it:

Choose a Fixed Index Annuity if you:

Want 100% principal protection

Prefer predictable outcomes

Are close to or already in retirement

Plan to use the annuity primarily for guaranteed income

Choose a Shield Annuity if you:

Can tolerate some short-term risk

Are still several years from retirement

Seek higher growth potential

Have other safety nets in place, like life insurance or pension

Rates Matter: Don’t Overlook the Fine Print

Whether you're leaning toward an FIA or a Shield Annuity, comparing options is essential. Look at cap rates, participation rates, buffer levels, and contract lengths. The annuity best rates in Puerto Rico vary by provider and product, and they can significantly impact your long-term returns.

Some annuities may offer bonuses or enhanced riders for income, which can be useful—but only if they align with your actual needs.

Always consult a licensed advisor who can access multiple carriers and evaluate rates across the board.

Tailoring Annuities to Your Retirement Strategy

Annuities are not one-size-fits-all products. Business owners in Puerto Rico often use them to:

Create tax-efficient retirement income

Offset market risk in an unsteady economy

Lock in growth from the sale of a business or asset

Support a surviving spouse with guaranteed lifetime income

Blending annuities with other planning tools like IRAs, trusts, and life insurance can create a more resilient retirement strategy that supports both income and legacy goals.

Final Thoughts

Choosing between a Fixed Index Annuity and a Shield Annuity comes down to how much protection you need and how much upside you’re aiming for. Both offer unique advantages, but only one will align with your risk profile, timeline, and income needs.

At PWR Retirement Group, we help professionals and entrepreneurs navigate complex retirement decisions with clarity. If you're looking for the best financial advisors in Puerto Rico to help you evaluate annuity strategies and select the right product, our team is ready to guide you every step of the way.

1 note

·

View note

Text

AO Globe Life | AO Globe Life | AO Globe Life: Helping You Choose the Right Insurance Plan

Are you looking for a secure life insurance plan but often confused while choosing the best among several options? No worries! With AO Globe Life, you don't have to worry about anything! It is a leading organization that helps employees, customers, and agents to make a better future. Let's explore more about life insurance policies, their benefits, and the factors to consider when choosing a plan. Introduction to Life Insurance Plan: A life insurance plan is an essential step to ensure your family is protected financially in the future. It is an agreement between an individual and a financial firm that offers guaranteed reimbursement for the loss of life in return for specific payments. AO Globe Life is a popular organization that helps you choose the best life insurance policy tailored to your needs and preferences. It has expert and highly qualified professionals who have worked for many years and delivered the most favorable results. Here is a simple explanation of what you should know about life insurance, including the different types and benefits: Types of Life Insurance Plans: There are many types of life insurance plans available. Choosing the best among them is daunting. That is where AO Globe Life comes in! It has a team of professionals who are always ready to solve your problems. Let's take a look at some of the life insurance plans:

Whole Life Policy: Alife insurance policy is active as long as you live.

Term Insurance Plan: It is valid for a specific period. You need to pay for a particular amount of time.

Pension/Annuity Plan: Annuity plans are mainly for people who want to save money for retirement.

Endowment Policy: An endowment policy is like a term insurance plan but with one key difference. If you live through the policy term, you get a lump sum of money at the end.

So, these are some life insurance plan types. If you want to opt for the one, you can connect with AO Globe Life experts! They provide the best and most efficient solutions based on your needs and budget. Benefits of Having a Life Insurance Policy from a Professional firm: Unlike traditional life insurance policies, AO Globe Life provides the best and most reliable plans that suit your requirements. These plans offer many advantages, including:

Allows tax advantages

Personalized plans from the leading organization

A comprehensive range of features

Covers risk and financial hardships

In conclusion, these are some benefits of using a life insurance plan from a reputable firm.

0 notes