#Artificial Graphite Market Size

Explore tagged Tumblr posts

Text

Artificial Graphite Market - Forecast(2024 - 2030)

Overview

The artificial graphite market size is forecast to reach USD 9 billion by 2030, after growing at a CAGR of 12.83% during the forecast period 2023-2028. The demand for artificial graphite has been increasing rapidly as it is primarily used in the production of electrodes and electrolytic processes, carbon brushes, and batteries. due to the increased production of electric vehicles, batteries are one of the most popular applications for artificial graphite today. batteries for electric vehicles employ artificial graphite to boost energy density and faster charging. this has been increasing the demand for artificial graphite. the market expansion of artificial graphite is primarily driven by the automotive sector's robust growth. due to its lightweight, high mechanical strength, and lubricating properties, artificial graphite is widely utilized in the production of automotive parts such as brake lining, clutch materials, and gaskets. it is also a perfect asbestos replacement because it is a great conductor of electricity. as a result, market growth is being driven by the rising demand for artificial graphite from the automotive industry.

Report Coverage

The report “Artificial Graphite Market – Forecast (2024-2030)”, by IndustryARC, covers an in-depth analysis of the following segments of the artificial graphite market.

By Product Type: Graphite Electrodes, Graphite Anodes, Graphite Block, and Others.

By Type: Electrographite, Synthetic Graphite.

By Form: Primary Synthetic, Secondary Synthetic.

By Application: Anticorrosion Products, Batteries, Carbon Brushes, Coatings, Conductive Fillers, Electrodes and Electrolytic Processes, Fuel Cell Bipolar Plates, and Nuclear Moderator Rods.

By End Use Industry: Automotive, Metallurgy, Solar, Electronics, Nuclear, Aerospace, and Others.

By Geography: North America, South America, Europe, APAC, and RoW.

Request Sample

Key Takeaways

APAC held the largest market share with 52.50% in 2023. with more than 50% of the market's total volume coming from the Asia-pacific region, China was the area's largest consumer. China is the primary focus of the entire lithium-ion battery production process. China is by far the biggest and fastest-growing market for lithium-ion batteries, which is boosting demand for artificial graphite.

The high demand for batteries and other electrical gadgets coming from European countries will fuel the graphite market. the developed automotive industries in Germany, the UK, and other nations are currently concentrating on developing electric vehicles (EVs) that are powered by lithium-ion batteries. Europe wants to lead the way in next-generation batteries as a way to demonstrate technological independence. SGL Carbon from Germany and Carbon Savoie from France have been gathered into a significant battery partnership that Brussels will launch in 2020.

North America, Africa, and South America are anticipated to see significant market expansion due to their developing industrial economies and improved economic conditions for end-user industries like automotive, metallurgy, solar, electronics, and others.

By Product Type - Segment Analysis

Graphite anodes dominated the artificial graphite market in 2023. since the invention of lithium-ion batteries, graphite has dominated anode materials due to its unmatched combination of low cost, abundance, high energy density, high power density, and extremely long cycle life. graphite is an ideal anode. recent studies show that graphite's lithium storage capacity can be further enhanced, highlighting the material's significant potential for use in advanced libs for electric vehicles and grid-scale energy storage facilities. according to the most recent data from the China association of automobile manufacturers, China’s Nev output climbed by 167.40% from January to November 2021 to 3.02 million units, while total sales increased by 166.80% compared to the first 11 months of 2020 to 2.99 million units (CAAM).

By Type - Segment Analysis

Synthetic graphite dominated the artificial graphite market in 2023. high-purity carbon makes up synthetic graphite, which is prized for its resistance to corrosion and extreme temperatures. a few extremely niche sectors heavily rely on synthetic graphite. due to its use in lucrative industries with increasing demand, synthetic graphite is attractive to investors. but before exploring the area, it's critical to comprehend the subtleties of synthetic graphite and some common misconceptions about it. because synthetic graphite has a purer carbon composition and exhibits more predictable behavior, it has found applications in solar energy storage and arc furnaces. given that the process requires a large amount of energy, synthetic graphite can be significantly more expensive to make than natural graphite. the price can be double or triple what raw graphite is typically sold for.

Inquiry Before Buying

By Form - Segment Analysis

Secondary synthetic graphite dominated the artificial graphite market in 2023. electrodes used in heavy industry and manufacturing result in the production of secondary synthetic graphite as a by-product. secondary synthetic graphite, which is frequently produced as a powder, is another byproduct of the production of synthetic graphite. it is regarded as a low-cost version of graphite, and in some applications, such as brake linings and lubricants, it can compete with natural graphite.

By Application - Segment Analysis

Electrodes and electrolytic processes dominated the artificial graphite market in 2023. because graphite is such a good conductor, graphite electrodes are typically used in electrolysis. because of the way that its atoms are organized, graphite has a lot of free-floating electrons between its various layers (graphite bonds are formed of only three out of the four electron shells of the carbon atom, leaving the fourth electron to move freely). the electrolysis process can go without interruption because of these electrons' strong conductivity. graphite is also inexpensive, stable at high temperatures, and durable. graphite electrodes are widely used in electrolysis due to all of these factors. since many electrons are not linked in graphite due to their atomic structure, they can move freely between its layers. the abundance of free electrons (also known as electron delocalization) in graphite is what gives it exceptional conductivity. in addition to being a strong conductor, graphite is also inexpensive, durable, and widely available, which are all further reasons why it is frequently employed as an electrode.

By End User- Segment Analysis

Automotive dominated the artificial graphite market in 2023. one kilogram of graphite is required to produce one kilowatt-hour (kwh) of battery energy, making it the most significant component of the battery cell by weight. graphite makes up the great majority of the anode (95%) of a typical Li-ion battery installed in a battery electric vehicle (BEV). A memorandum of understanding [MoU] for the provision of synthetic graphite and silicon oxide to be utilized in specific stages of Britishvolt's battery production processes was signed in 2022 by Britishvolt, a battery manufacturer, and BTR, a company based in China.

By Geography - Segment Analysis

APAC artificial graphite market generated a revenue of $2 Billion in 2023 and is projected to reach a revenue of $5 Billion by 2030 growing at a CAGR of 13.88% during 2024-2030. China produces the majority of the artificial graphite that is produced in the Asia Pacific. For the development of their infrastructure and industrial expansion, countries like China are receiving significant investments. additionally, it is anticipated that during the forecast period, the growth of the industrial sector, particularly in this area, will fuel the market for artificial graphite. Chinese battery anode manufacturers revealed intentions to invest more than $3.9 billion in artificial graphite projects in 2022 in May as they seek to streamline their supply chains and cut prices. among the announcements is a new facility in Sichuan Province, Southwest China, whose operations can be fueled by renewable energy, assisting in lowering the carbon intensity of artificial graphite, which makes up a significant component of a battery's carbon footprint.

Schedule a Call

Drivers – Artificial Graphite Market

Growing application in the automotive industry is a significant aspect

As the anode content usage of lithium-ion batteries rises in tandem with the adoption of electric vehicles and lithium-ion battery applications, demand has been expanding in recent years. In the auto industry, artificial graphite is a solution for producing lithium-ion batteries, which are used to power newer electric cars and boost energy density while shortening charging times. Additionally, it is utilized to create thermally conductive polymers, which are increasingly employed to build automotive parts instead of metal. China is also the world's largest producer of batteries, with the energy storage system and automotive industries experiencing the highest growth rates for lithium-ion battery production in the future years. Chinese anode suppliers have the biggest installed capacities internationally, and China is the main hub of the lithium-ion battery value chain.

Market growth is driven by the metallurgy industry

In metallurgical applications, graphite is utilized in a variety of forms, including electrodes, refractories, bricks, monolithic crucibles, etc. artificial graphite is used as an anode in the electric arc furnace (eaf) process to produce steel, ferroalloys, and aluminum. in metallurgical processes, such as melting scrap iron in an electric furnace, polishing ceramics, producing compounds like calcium carbide, and others that call for high-temperature and clean energy sources, artificial graphite electrodes are used as a source of energy. the use of artificial graphite in metallurgical applications is anticipated to be driven by the increasing global production of crude steel and aluminum. however, it is anticipated that the market demand would be unpredictable due to erratic trends in the production of these metals. accordingly, based on the aforementioned factors, it is anticipated that as the production of important metals and alloys like steel and aluminum rises, artificial graphite will as well, drive the market.

Challenges – Artificial Graphite Market

The manufacture of artificial graphite comes with health risks that could restrict the market growth.

Calcined petroleum coke and coal tar pitch are the main ingredients used to make artificial graphite. these raw ingredients, though, are harmful to people's health. petroleum coke and coal tar pitch can irritate the eyes as well as cause a rash, inflammation, and burning on the skin in the event of contact. it can irritate the lungs, nose, and throat when inhaled. long-term exposure to these basic materials can also result in moderate symptoms like weariness, headache, and dizziness as well as severe ones like fainting and coma. additionally, occupational exposure to coal tar pitches raises the risk of developing skin cancer in addition to other cancers, such as lung, kidney, bladder, and, in some cases, digestive system cancer. therefore, the health risks related to using these raw materials to make artificial graphite may restrain market expansion.

Buy Now

Market Landscape

Technology launches, acquisitions, and R&D activities are key strategies adopted by players in the artificial graphite market. in 2023, the artificial graphite market share has been consolidated by the top seven players accounting for 65% of the share. major players in the artificial graphite market are SGL Carbon, Tokai Carbon, Elkem (Vianode), Imerys, Showa Denko, Toyo Tanso, Nippon Carbon Co Ltd, and Others.

Developments:

Ø In January 2021, Showa Denko announced the merger of between its consolidated branches, Showa Denko Carbon Holding GmbH (SDCH), and Showa Denko Europe GmbH (SDE). By combining the business management and business support functions of the two subsidiaries into one, this merger is expected to further expand the company’s business operation in Europe.

Ø In January 2021, Imerys Graphite & Carbon Ltd. launched its two new primary synthetic graphite namely KS6L and SFG6L. The main objective of the product development was to increase the company’s product portfolio.

We also publish more than 100 reports every month in "Chemicals and Materials", Go through the Domain if there are any other areas for which you would like to get a market research study.

#Artificial Graphite Market Price#Artificial Graphite Market Size#Artificial Graphite Market Share#Artificial Graphite Market Trends#Artificial Graphite Market Vendors#Artificial Graphite Market Industry

0 notes

Text

#Artificial Graphite Market Size#Artificial Graphite Market Share#Artificial Graphite Market Trends#Artificial Graphite Market Price

0 notes

Text

0 notes

Text

Thermal Management Market Driven by Electronics Demand

Thermal management solutions encompass a diverse range of products including heat sinks, thermal interface materials, liquid cooling systems, thermo-electric modules and heat exchangers. These technologies deliver reliable heat dissipation, improved system stability and enhanced performance in critical applications spanning consumer electronics, telecommunications, data centers, electric vehicles and aerospace. As power densities rise and devices become more compact, the need for efficient thermal solutions becomes paramount to mitigate overheating risks and ensure consistent operation under demanding conditions.

Advanced materials such as graphite, phase-change composites and metal ceramics enable lightweight, high-conductivity designs that optimize thermal transfer while maintaining structural integrity. Integrated cooling strategies combining passive and active methods support energy-efficient operations and align with global sustainability targets by reducing power consumption and carbon footprint. Market research indicates that evolving market trends—including rapid digitalization and 5G infrastructure deployment—are driving significant Thermal Management Market growth and expanding market segments. Companies leverage cutting-edge market analysis and in-depth market insights to identify emerging market opportunities and address market challenges such as cost management and stringent regulatory standards. Continuous innovation in thermal management products supports higher computing performance, faster battery charging and enhanced safety protocols across various end-use industries.

The thermal management market is estimated to be valued at USD 16.84 Bn in 2025 and is expected to reach USD 33.45 Bn by 2032, growing at a compound annual growth rate (CAGR) of 10.3% from 2025 to 2032. Key Takeaways

Key players operating in the Thermal Management Market are:

-Honeywell International Inc.

-Vertiv Holdings Co.

-Boyd Corporation

-Laird Thermal Systems

-Advanced Cooling Technologies, Inc.

These market leaders hold a significant market share through robust product portfolios, technology innovation and global reach. Honeywell International Inc. continues to expand its industry size by integrating smart thermal controls and advanced sensors into aerospace and industrial automation offerings. Vertiv Holdings Co. leverages its liquid cooling systems and data-driven analytics to address rising demand in data center infrastructures, contributing to substantial business growth. Boyd Corporation distinguishes itself with high-performance thermal materials and customized heat exchangers, while Laird Thermal Systems specializes in thermal interface materials and liquid cooling platforms. Advanced Cooling Technologies, Inc. drives its market revenue through strategic research collaborations and tailored solutions for electric vehicles and renewable energy applications. These market companies employ mergers and acquisitions, strategic partnerships and aggressive market growth strategies to strengthen their competitive positions. The collective efforts of these key players shape overall market dynamics and set the direction for future innovations in the thermal management industry. Rapid advancements in semiconductor technology, coupled with the proliferation of 5G networks and artificial intelligence applications, have created strong demand for high-efficiency thermal solutions. The accelerating adoption of electric vehicles necessitates sophisticated cooling systems to manage battery temperatures, while consumer electronics manufacturers seek compact, lightweight thermal interface materials to improve device performance and prolong battery life. This surging need is reflected in comprehensive market research reports highlighting evolving market trends toward higher power density, modular cooling architectures and multi-element thermal stacks. Enterprises are increasingly investing in thermal management solutions to optimize system reliability, reduce downtime and enhance safety standards. As digital transformation initiatives gain momentum across telecommunications, automotive, healthcare and renewable energy sectors, industry leaders recognize the critical role of thermal control in ensuring operational continuity and sustaining business growth. The growing focus on energy efficiency and stringent environmental regulations further reinforce the importance of innovative cooling technologies, driving a positive trajectory for market growth over the forecast period.

‣ Get More Insights On: Thermal Management Market

‣ Get this Report in Japanese Language: 熱管理市場

‣ Get this Report in Korean Language: 열관리시장

0 notes

Text

0 notes

Text

0 notes

Text

Lithium-Ion Battery Market Comprehensive Analysis of the Key Drivers, Industrial Challenges, and Opportunities

The Lithium-ion Battery Market is anticipated to grow at a CAGR of 13.1% during the forecast period, with the market size expected to reach USD 135.1 billion by 2031 from USD 48.6 billion in 2023.

Introduction: The lithium-ion battery market has seen remarkable growth over the past decade, driven by the increasing demand for efficient energy storage solutions across various applications. From consumer electronics to electric vehicles and renewable energy storage, lithium-ion batteries have become the cornerstone of modern energy systems. This report delves into the current state of the lithium-ion battery market, examining key trends, growth drivers, challenges, and prospects.

Download a Free Sample Copy of the Report: https://www.marketdigits.com/request/sample/633

Top 5 Key Players in the Li-ion Battery Industry: ★ LG Chem (South Korea) ★ Samsung SDI CO. LTD. (South Korea) ★ Contemporary Amperex Technology Co., Limited (China) ★ BYD Company Ltd. (China) ★ Panasonic Holding Corporation (Japan)

Research Methodology: Our research methodology is grounded in a combination of primary and secondary research. Primary research involves direct interviews with industry experts, manufacturers, and stakeholders, while secondary research includes extensive analysis of industry reports, white papers, and academic publications. We utilize market modeling and forecasting techniques to provide accurate and comprehensive insights into market dynamics, trends, and projections.

The Report Offers: ➧ Market Overview: A detailed analysis of the current market scenario, including market size, growth rate, and key trends. ➧ Key Drivers and Challenges: An in-depth look at the factors propelling market growth and the challenges hindering it. ➧ Segmentation Analysis: Comprehensive segmentation of the market by battery type, application, and region. ➧ Competitive Landscape: Profiles of leading market players, their strategies, and market share analysis. ➧ Future Outlook: Projections for market growth and opportunities over the next five to ten years. ➧ Technological Advancements: Insights into the latest innovations and advancements in lithium-ion battery technology.

Inquire Before Buying at — https://www.marketdigits.com/request/enquiry-before-buying/633

Based on Material, the Lithium-ion Battery Market has been Segmented as follows:

▸ Cathode Material

▸ Cathode Material for Lithium-Ion Batteries

▸ Lithium iron phosphate

▸Lithium iron cobalt oxide

▸Lithium nickel manganese cobalt

▸Lithium nickel cobalt aluminum

▸ Lithium manganese oxide

▸ Anode Materials

▸ Anode Material for Lithium-Ion Batteries

▸ Natural graphite

▸ Artificial graphite

▸ Another anode material

▸ Electrolyte Material

▸ Separator Material

▸ Current collector Materials

▸ Other Materials

Based on Product Type, the Lithium-ion Battery Market has been Segmented as follows:

▸ Components of Lithium-ion Battery

▸ Cells

▸ Battery Packs

▸ Portability

▸ Stationary

▸ Portable

Based on Type, the Lithium-ion Battery Market has been Segmented as follows:

▸ Lithium Nickel Manganese Cobalt oxide

▸ Lithium Iron Phosphate

▸ Lithium Cobalt Oxide

▸ Lithium Titanate Oxide

▸ Lithium Manganese Oxide

▸ Lithium Nickel Cobalt Aluminum Oxide

Request for Discount @ https://www.marketdigits.com/request/discount/633

Based on Capacity, the Lithium-ion Battery Market has been Segmented as follows:

▸ 0 to 3,000 mAh

▸ 3,000 to 10,000 mAh

▸ 10,000 to 60,000 mAh

▸ 60,000 mAh and Above

Based on Voltage, the Lithium-ion Battery Market has been Segmented as follows:

▸ Low (Below 12 V)

▸ Medium (12 V-36 V)

▸ High (Above 36 V)

Based on Industry, the Lithium-ion Battery Market has been Segmented as follows:

▸ Consumer Electronics

▸ Smartphones

▸ UPS

▸ Laptops

▸ Others

▸ Automotive

▸ Plug-in Hybrid Vehicles

▸ Aerospace

▸ Commercial Aircraft

▸ Marine

▸ Commercial

▸ Tourism

▸ Medical

▸ Industrial

▸ Mining Equipment

▸Construction Equipment

▸ Forklifts, automated guided vehicles (AGV), and automated mobile robots (AMR)

▸ Power

▸ Telecommunications

Based on Region, the Lithium-ion Battery Market has been Segmented as follows:

▸ North America

▸ Europe

▸ Asia Pacific (APAC)

▸ Rest of the World (RoW)

Click to Request Free 10% Customization on this Report @ https://www.marketdigits.com/request/customization/633

Why Should Access to This Report? Access to this report provides valuable insights and data that can help businesses, investors, and stakeholders make informed decisions. Understanding market dynamics, trends, and competitive landscapes is crucial for developing strategies, identifying opportunities, and staying ahead in the rapidly evolving lithium-ion battery market. Whether you are a manufacturer, supplier, investor, or policymaker, this report offers the comprehensive analysis and actionable insights needed to navigate this dynamic market.

Conclusion: The lithium-ion battery market is poised for significant growth, driven by the rising demand for efficient energy storage solutions in various sectors. As technological advancements continue to enhance battery performance and reduce costs, the market offers vast opportunities for innovation and expansion.

This report provides a thorough analysis of the market landscape, helping stakeholders understand key trends, challenges, and growth prospects. By leveraging the insights provided in this report, businesses can strategically position themselves to capitalize on the emerging opportunities in the lithium-ion battery market.

0 notes

Text

New Materials in China Overview and Insights-ACF Lab Report

China's new material insight can be summarized and summarized from the following aspects:

I. Basic Overview

New materials refer to newly developed or developing structural materials with excellent performance and functional materials with special properties, which are the basis of modern science and technology development. New materials technology is known as the "mother of invention" and "industrial food". In China, the new materials industry, as an important part of the country's strategic emerging industries, plays an important supporting role in economic and social development and national security.

II. Industry Classification

China focuses on the development of three major categories of new materials, including advanced basic materials, key strategic materials and cutting-edge new materials. Each major category contains specific new materials in a wide range of subfields.

Industrial Structure

In the industrial structure, special metal functional materials, modern polymer materials and high-end metal structural materials account for a relatively high proportion of 32%, 24% and 19% respectively, while cutting-edge new materials account for only 3% of the total.

Industry Scale

In recent years, the market scale of China's new materials industry has continued to expand, showing strong growth momentum. Data show that the market scale of China's new materials industry reached about 6.8 trillion yuan in 2022, with a compound annual growth rate of 15.66% in the past five years. By 2023, the market size of China's new materials industry has reached 7.9 trillion yuan, while it is expected to further grow to 9.1 trillion yuan in 2024.

V. Industry Chain Mapping

China's new materials industry chain upstream for metal raw materials, alloys, chemical fibers, ceramics, plastics, bio-based, resins, graphite and other raw materials; midstream for the manufacture of new materials, mainly including graphene materials, superconducting materials, 3D printing materials, intelligent bionic materials and metamaterials, nanomaterials, biomedical materials, and liquid metals, etc.; downstream for the application field, cutting-edge new materials are widely used in electrical and electronic, automotive, new energy, medical, aerospace and other fields. new energy, medical treatment, aerospace and aviation, and other fields.

VI. Key Enterprises

China's new materials industry has a number of key enterprises, which have strong R&D strength and market competitiveness in their respective fields, and have made important contributions to promoting the development of China's new materials industry.

VII. Development trend

The development trend of China's new materials industry is characterized by the following aspects:

Environmental protection and sustainable development: with the increasing awareness of environmental protection, the future research and development of new materials will pay more attention to the renewability, degradability and recyclability of materials in order to reduce the negative impact on the environment.

Functional diversification and intelligence: future new materials will pay more attention to the comprehensive optimization of mechanical properties, optical properties, electromagnetic properties and other aspects to meet the needs of different fields. At the same time, with the development of Internet of Things, artificial intelligence and other technologies, new materials will also pay more attention to intelligence, to realize the self-perception, self-diagnosis and self-repair ability of materials.

Interdisciplinary integration and collaborative innovation: future research on new materials will pay more attention to the cross-fertilization of different disciplines to realize the optimization and innovation of material performance in various aspects.

Industry-academia-research cooperation and international exchanges: The research and application of new materials require the joint efforts and cooperation of all parties, and industry, academia and government departments need to strengthen cooperation to jointly promote the development and application of new materials technology. At the same time, the research of new materials also needs to be in line with international standards, strengthen international exchanges and cooperation, absorb the international advanced technology and concepts, and promote the development of China's new materials industry.

Science and technology are the first productive forces, and China's new materials industry has shown rapid development under the guidance of national policies and driven by market demand. In the future, with the continuous progress of science and technology and the increasing demand for high-performance materials in various industries, China's new materials industry will continue to maintain a strong growth momentum, and is expected to occupy a more important position in the international market.

400-6543-699

www.acf.com

0 notes

Text

Future of Batteries Market Size, Share, Industry Trends by 2035

The global future of batteries market size was valued at 16 million units in 2024 and is expected to reach 62 million units by 2035, at a CAGR of 12.7% during the forecast period 2024-2035.The growing consciousness among consumers regarding environmental issues and their preference for eco-friendly modes of transportation is propelling the demand for electric vehicles. Increased driving range, quicker charging times, and longer battery life impact consumer choices. Furthermore, improvements in lithium-ion, solid-state, and other developing battery technologies have increased EVs' efficiency, range, and affordability. Well-known automakers have committed to converting their fleets to electric vehicles and are making significant investments in electric car technologies. This dedication to EVs drives market expansion and battery development.

Market Dynamics:

Driver: Advancements in battery technology

A number of companies have achieved significant advancements in EV battery technology, enabling EVs to become a competitive alternative to traditional automobiles. Continuous advancements in electric vehicle (EV) battery technology aim to increase the range of EVs. Most large EV battery manufacturers innovate in battery chemistry and design to increase EV range and reduce the need for frequent charging. The battery's cathode chemistry is a major factor in its performance. Three major groups of cathode chemistries are currently in widespread use in the automobile industry: lithium nickel manganese cobalt oxide (NMC), lithium nickel cobalt aluminum oxide (NCA), and lithium iron phosphate (LFP). Because of their higher nickel content, NMC and NCA cathodes are in the most demand out of all of them. They provide high energy density. In addition, since 2020, LFP has gained popularity because of its nickel- and cobalt-free composition and the high cost of battery metals. Unlike hydroxide, which is used for nickel-rich chemistries, LFP uses lithium carbonate.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=243513539

Opportunity: Increase in R&D efforts toward creating more advanced battery chemistries

As the world moves toward adopting clean energy, battery manufacturers are increasing their R&D efforts to develop different battery chemistries. For instance, major players like Amprius Inc. (US) and Nexeon Corporation (UK) are developing silicon anode batteries with enhanced features. These advanced silicon anode batteries are expected to be widely adopted in the coming years. Tesla, Inc. (US) and Panasonic Holdings Corporation (Japan) are also researching and developing silicon anode and lithium-air batteries to power EVs. In June 2023, LG Energy Solution (South Korea) and NOVONIX (Australia) entered into a Joint Research and Development Agreement (JDA) to collaborate on the development of artificial graphite anode material for lithium-ion batteries. VARTA AG (Germany) is also involved in international research projects. Its R&D project, SintBat, aims to develop energy-efficient, cheap, and maintenance-free lithium-ion-based energy storage systems using silicon-based materials and new processing technologies.

“Cylindrical segment is expected to grow at the fastest rate during the forecast period.”

The cylindrical segment is projected to register the highest CAGR during the forecast period. Durable and long-lasting are two characteristics of cylindrical batteries. Due to their excellent confinement and effective mechanical resistance against internal and external pressures, cylindrical cells are the least expensive to manufacture compared to alternative EV battery types. Manufacturers are starting to use cylindrical batteries as well. Tesla, for instance, uses cylindrical batteries due to their dependability and robustness. The new generation of cylindrical batteries, like the 4680 format pioneered by Tesla, boasts significant improvements in range and efficiency compared to older models.

“Solid state battery expected to be the next big shift during forecast period.”

Emerging solid-state battery technology has various potential benefits for electric vehicles. Unlike traditional lithium-ion batteries, which utilize liquid electrolytes, they use solid electrolytes. Because solid electrolytes are less likely to experience problems like leaking, overheating, and fire hazards, they are considered safer overall for electric vehicles. Faster charging times could be possible using solid-state batteries as opposed to lithium-ion batteries. Because of their enhanced conductivity and capacity to tolerate higher charging rates, EVs may require fewer charging cycles, saving users time and increasing convenience. For instance, In October 2023, Toyota secured a deal to mass-produce solid-state EV batteries with a 932-mile range. Using materials developed by Idemitsu Kosan will allow Toyota to commercialize these energy-dense batteries by 2028. Solid-state batteries can significantly extend a vehicle's driving range as well. It is projected that a solid-state battery replacement may quadruple the driving range of the Tesla Roadster. Such benefits will help the solid state battery market grow over the projected period.

“North America to be the prominent growing market for EV batteries during the forecast period.”

The automotive sector in North America is one of the most developed worldwide. Major commercial automakers like Tesla, Proterra, MAN, and NFI Group are based in the region, which makes it well-known for its cutting-edge EV R&D, inventions, and technological advancements. These businesses are investing in constructing and expanding battery production plants in North America. To meet the growing demand for electric vehicles, these facilities produce sophisticated battery technology, including lithium-ion batteries. The US has historically led the way in technology in North America. Leading EV battery suppliers and startups have partnered with OEMs in the North American EV market. For example, GM and LG Chem have partnered.

Key Players

The major players in Future of Batteries market include CATL (China), BYD Company Ltd. (China), LG Energy Solution Ltd. (South Korea), Panasonic Holdings Corporation (Japan), and SK Innovation Co., Ltd. (South Korea). These companies adopted various strategies, such as new product developments and deals, to gain traction in the market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=243513539

0 notes

Text

Silicon Anode Market: Powering the Future of Energy Storage

Introduction

Silicon anode is emerging as one of the most promising anode materials for the next generation of lithium-ion batteries due to its high theoretical capacity which is nearly 10 times greater than that of conventional graphite anodes. While silicon offers incredible storage potential, its use also presents significant engineering challenges as silicon undergoes a huge volume change of up to 300% during the charge-discharge cycles which can cause the anode to crack and crumble leading to rapid capacity fade. Researchers across the world are working on developing techniques to overcome this issue and make silicon anodes a commercial reality.

Nanostructured Silicon to Reduce Volume Change

A popular approach to deal with the volumetric expansions of silicon is to employ nanostructured forms of silicon such as silicon nanowires, nanoparticles or thin films which can better accommodate the large volume changes. Nanostructuring helps reduce mechanical stresses and improves cycle life by preventing cracking and pulverization. Many battery makers are experimenting with silicon nanostructures either alone or in composites with graphite and binders. For example, Enevate has developed silicon nanocoating technology where a thin layer of silicon is deposited onto metal current collectors using chemical vapor deposition process. This allows more than 80% capacity retention after 200 cycles with a 1000mAh/g silicon loading. Design of Elastic Polymer Matrix Another effective strategy is to suspend silicon nanoparticles within a porous, elastic polymer matrix such as polyacrylic acid, polyimide or carboxymethyl cellulose which acts as a ‘structural buffer’ and endures volume changes without breaking apart. The polymer matrix prevents cracking and offers flexibility for volume changes while maintaining good electronic contact between particles. Many startups like Amprius, OneD Materials and Sila Nanotechnologies are developing such silicon-polymer composite anodes for production. These anodes based on 25-50% silicon loading have shown high coulombic efficiencies above 99% for over 1500 cycles with capacities above 1000mAh/g. Use of Silicon-Carbon Composite Blending silicon with carbon is yet another approach gaining prominence. Companies like Lishen and Enovix are developing silicon-graphite-carbon composite anodes that leverage the advantages of both materials. Here, graphite provides the structural integrity while nano-silicon improves capacities. The carbon phase acts as a buffer against volume changes. Though capacities are lower than pure silicon, silicon-carbon composites offer higher cycle stability and are easier to commercialize. With 10-30% silicon content, capacities of 500-800mAh/g have been demonstrated along with over 2000 cycles of lifetime. They also reduce manufacturing complexities and costs. Solid Electrolyte Interface for Stability Stable formation of solid electrolyte interface (SEI) layer on the anode surface plays a crucial role in long cycle life. During charging, any fresh silicon surfaces exposed must quickly form a protective SEI layer to prevent further electrolyte decomposition. Researchers at Stanford University developed a method where a thin film of lithium phosphorus oxynitride is deposited on nanostructured silicon to stabilize SEI formation and achieve high coulombic efficiencies of over 99.8% for 500 cycles. Other approaches involve using electrolyte additives or surface coatings to engineer an optimized artificial SEI for improved kinetics and stability. Progress towards Commercialization Despite significant technical challenges, the huge promises of silicon anodes have ignited a wave of commercialization efforts. Enovix has demonstrated 3000+ cycles silicon anodes at large 1Ah size and is working with mobile phone manufacturers for product integration. Dash is aiming for electric vehicles and energy storage with an advanced nanocomposite anode claiming 3000 cycles at 80% capacity retention. Several silicon startups are now scaling production and bringing tons per month of cells to the market. Chinese battery giants like Lishen and EVE have also committed multi-million dollar silicon R&D programs. With continuous improvements, silicon dominated batteries could potentially power electric vehicles with 500-1000 km range on a single charge in the next 5-10 years, accelerating the transition to clean energy.

0 notes

Text

Battery Material Market Analysis 2023 Dynamics, Players, Type, Applications, Trends, Regional Segmented, Outlook & Forecast till 2033

The global battery materials market size reached USD 54.1 billion in 2022 and is set to total USD 57.9 billion by 2023. Global battery material sales are projected to increase at 5.9% CAGR during the assessment period, taking the overall market valuation to around USD 102.8 billion by 2033.

Introduction to the Battery Material Market

The battery material market encompasses the production, distribution, and utilization of materials used in the manufacturing of batteries for various applications, including consumer electronics, electric vehicles (EVs), energy storage systems, and renewable energy integration. Battery materials play a crucial role in determining the performance, energy density, lifespan, and safety of batteries, influencing their adoption and effectiveness in different sectors.

Key Materials and Functionality

The battery material market includes several key materials:

Cathode Materials: Cathode materials, such as lithium cobalt oxide (LCO), lithium iron phosphate (LFP), and nickel manganese cobalt (NMC), play a critical role in determining the energy density, voltage, and cycling stability of lithium-ion batteries (LIBs) used in EVs, portable electronics, and grid-scale energy storage systems.

Anode Materials: Anode materials, including graphite, silicon, and lithium titanate (LTO), store and release lithium ions during charge and discharge cycles, influencing the capacity, charging rate, and lifespan of LIBs. Advanced anode materials, such as silicon-graphite composites and silicon-based nanostructures, offer higher energy storage capacity but face challenges related to volume expansion and cycling stability.

Electrolyte Materials: Electrolyte materials, such as lithium salts (e.g., lithium hexafluorophosphate), solvents, and additives, facilitate the transport of lithium ions between the cathode and anode in LIBs, enabling electrochemical reactions and ion conduction. Solid-state electrolytes, polymer electrolytes, and ceramic electrolytes offer advantages in terms of safety, stability, and energy density compared to liquid electrolytes.

Separator Materials: Separator materials, typically made of porous polymeric membranes or ceramic-coated films, prevent direct contact between the cathode and anode in LIBs, preventing short circuits while allowing the passage of lithium ions. Advanced separator materials with enhanced thermal stability, mechanical strength, and ion conductivity contribute to improved battery safety and performance.

Trends: Identify and analyze trends relevant to the market you're researching. This could include shifts in consumer behavior, industry regulations, technological advancements, or changes in market demand. Look at both short-term and long-term trends to provide a comprehensive view.

Technological Developments: Highlight the latest technological innovations impacting the market. This might involve advancements in automation, artificial intelligence, IoT (Internet of Things), blockchain, or any other relevant technologies. Discuss how these developments are shaping the industry landscape and driving change.

Analysis: Conduct a thorough analysis of the market, including SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis, Porter's Five Forces analysis, and any other relevant analytical frameworks. Assess market dynamics, competitive landscape, and barriers to entry. Provide insights into market segmentation, customer demographics, and buying behavior.

Growth Drivers: Identify the primary drivers fueling market growth. This could include factors such as increasing demand for certain products or services, expansion into new geographic regions, rising disposable income levels, technological advancements driving innovation, or favorable regulatory policies. Quantify the impact of these drivers on market growth wherever possible.

Receive the FREE Sample Report of Battery Material Market Research Insights @ https://stringentdatalytics.com/sample-request/battery-material-market/14599/

Market Segmentations:

Global Battery Material Market: By Company Celgard Umicore GS Yuasa Corp Panasonic Corporation Envia System Duracell International GP Batteries international Toda Kogyo

Global Battery Material Market: By Type Lead-Acid Lithium-Ion

Global Battery Material Market: By Application Automotive EVs Portable Devices Industrial

Regional Analysis of Global Battery Material Market

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Battery Material market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Click to Purchase Battery Material Market Research Report @ https://stringentdatalytics.com/purchase/battery-material-market/14599/?license=single

Challenges: Identify and discuss the challenges that the market is currently facing. These challenges could include regulatory hurdles, economic instability, supply chain disruptions, intense competition, changing consumer preferences, or technological limitations. Provide insights into how these challenges are impacting the industry and potentially hindering growth or innovation.

Future Outlook: Offer a forward-looking perspective on the market's trajectory. Based on the analysis conducted earlier, forecast the future direction of the market. Consider factors such as emerging technologies, shifting consumer behaviors, regulatory changes, and global economic trends. Discuss potential opportunities that may arise in the future and how stakeholders can capitalize on them. Additionally, highlight potential threats or disruptions that could impact the market landscape.

Mitigation Strategies: Suggest mitigation strategies to address the challenges identified and capitalize on future opportunities. This could involve recommendations for businesses to adapt their strategies, invest in R&D, forge strategic partnerships, or diversify their product/service offerings. Provide actionable insights that stakeholders can use to navigate uncertainties and position themselves for success in the evolving market environment.

Key Report Highlights:

Key Market Participants: The report delves into the major stakeholders in the market, encompassing market players, suppliers of raw materials and equipment, end-users, traders, distributors, and more.

Comprehensive Company Profiles: Detailed company profiles are provided, offering insights into various aspects including production capacity, pricing, revenue, costs, gross margin, sales volume, sales revenue, consumption patterns, growth rates, import-export dynamics, supply chains, future strategic plans, and technological advancements. This comprehensive analysis draws from a dataset spanning 12 years and includes forecasts.

Market Growth Drivers: The report extensively examines the factors contributing to market growth, with a specific focus on elucidating the diverse categories of end-users within the market.

Data Segmentation: The data and information are presented in a structured manner, allowing for easy access by market player, geographical region, product type, application, and more. Furthermore, the report can be tailored to accommodate specific research requirements.

SWOT Analysis: A SWOT analysis of the market is included, offering an insightful evaluation of its Strengths, Weaknesses, Opportunities, and Threats.

Expert Insights: Concluding the report, it features insights and opinions from industry experts, providing valuable perspectives on the market landscape.

Customization of the Report:

This report can be customized to meet the client’s requirements. Please connect with our sales team ([email protected]), who will ensure that you get a report that suits your needs. You can also get in touch with our executives on +1 346 666 6655 to share your research requirements.

About Stringent Datalytics

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs.

Reach US

Stringent Datalytics

+1 346 666 6655

Social Channels:

Linkedin | Facebook | Twitter | YouTube

0 notes

Text

0 notes

Text

Anode Material for Automotive Lithium-Ion Battery Market To Reach USD 1,348.6 Million by 2030

The anode material for automotive lithium-ion battery market will grow at a rate of 5.7% in the years to come, to reach USD 1,348.6 million by 2030, as mentioned in one of its reports by P&S Intelligence.

The growing sales of EVs, accompanied by the incessant decrease in the prices of anode materials, are the main factors powering the growth of the industry.

The artificial graphite category led the industry, and the situation will be like this in the years to come. This is credited to the benefits of this material over other anode materials. For example, improved power output and/or energy density, decreased cost, and advanced recycling performance.

The commercial vehicle category will power at the fastest rate in the anode material for automotive lithium-ion battery market in the years to come, with regards to revenue.

Furthermore, the category will be the second-largest, following passenger cars, in the future. This is because the battery being used in E-commercial vehicles, as well as buses and trucks, requirement to have a high battery capacity, and energy density.

BEV had the highest revenue in the industry in the recent past. The ascendency of the category is chiefly credited to the fact that different from HEV and PHEV, BEVs have only one power source, which contributes to the higher acceptance of lithium-ion batteries in BEVs, therefore generating the highest requirement for anode material.

APAC led the anode material for automotive lithium-ion battery market in the recent past, and it will remain the largest in the years to come. Its dominance is powered by the enormous requirement for EVs in China.

This large size of the Chinese market is because government authorities have been providing infra support for example charging station spaces, providing subsidies and incentives, and pouring enormous sums in the EV industry.

Europe will advance at the highest rate in the market by the end of this decade.

This has a lot to do with the fact that the EU has planned joint efforts with battery producers and commercial lenders for building an ecosystem, with an enormous investment, for becoming self-reliant in battery production for powering EVs.

The inflow of investments is a key trend in the industry. Throughout the charging process, the anode engrosses a large count of lithium-ions. Graphite can grip them well, but a silicon anode waves over 300%, producing its surface for cracking and the energy storage performance for dropping rapidly.

The increasing sales of electric vehicles, happening all over the world has a positive impact on the demand for anode material for automotive lithium-ion battery.

#Anode Material for Automotive Lithium-Ion Battery Market Share#Anode Material for Automotive Lithium-Ion Battery Market Size#Anode Material for Automotive Lithium-Ion Battery Market Growth#Anode Material for Automotive Lithium-Ion Battery Market Applications#Anode Material for Automotive Lithium-Ion Battery Market Trends

1 note

·

View note

Text

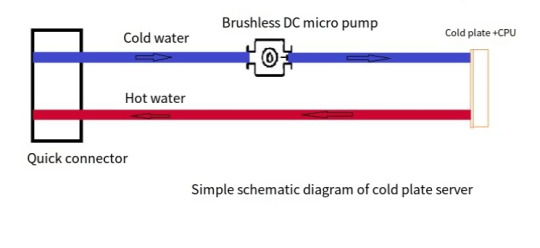

1U 2U Rack Server Water Cooling Pump Solution

Basic Market Situation

With the advent of the digital age, data center servers have experienced rapid and continuous development and are playing an increasingly important role, providing powerful computing capabilities for applications such as cloud computing, artificial intelligence, and big data. As servers continue to evolve and expand in scale, their processing power and storage capacity continue to increase, and their heat dissipation requirements are getting higher and higher. The traditional air cooling method can no longer meet the growing demand for heat dissipation. To solve this problem, server liquid cooling solutions emerged.

Market Pain Points

There are some difficulties in implementing liquid cooling solutions in 1U 2U Rack Servers:

Limited Design Space: The original air-cooling design solution is relatively mature. If you want to add a liquid cooling solution while maintaining the original design solution, the layout space for the liquid cooling solution will be very limited. 1U server Height = 4.445 cm, 2U server height = 4.445*2 = 8.89 cm.

Sealing and Anti-leakage: Liquid cooling systems involve the use of a large amount of liquid media, and the core component in the server is the chip (CPU and GPU, etc.). Once the chip comes into contact with liquid, there is a risk of burning, resulting in The entire server is damaged, so it's crucial to ensure the fluid circulation system is air-tightness and leak-proof.

Heat Dissipation Efficiency and Performance: More than 55% of chip failures are caused by heat transfer failure or temperature rise. If the chip is above 70 degrees, its reliability will be reduced by 50% for every 10 degrees of temperature increase. Once the quality of the components in the cooling assembly is not good or the circulation design is not effective, there is a possibility of unstable product performance, which will lead to local overheating or insufficient cooling, thus affecting the normal operation of the server.

TOPSFLO Water Cooling Pump Solution

liquid-cooled servers, TOPSFLO Water Cooling Pump has specially designed a water pump with a unique flat design for them, which can better solve the problems currently encountered by rack server manufacturers:

The thickness of TOPSFLO mini water pump is as low as 36mm and the overall size is small. The solution of combining water pump with cold plate can be customized to help save space in data center. Compared with bulky traditional cooling equipment, the compact design of mini water pumps makes server liquid cooling systems easier to deploy in limited spaces.

TOPSFLO water cooling pumps adopt static seal design, imported PPS high-quality materials, high-precision molds, 100% strict air tightness testing of the water pump through high-standard air tightness testing equipment imported from France, effectively reducing the risk of leakage to ensure the safety of the server system performance and reliability.

TOPSFLO server liquid cooling pumps adopt unique rotor suspension technology and select high-wear-resistant imported graphite bushings and high-precision ceramic shafts to resist long-term operation and inevitable wear, ensure stable performance and operating status of the water pump, and reduce server system failures and downtime.

According to the heat dissipation requirements of the server, TOPSFLO mini water cooling pump TDC is customized with a maximum flow rate of 8L/min and a maximum water head of 5M. The flow rate and water head are optimized in a compact size to meet the heat dissipation needs of the system. At the same time, the built-in smart chip can customize intelligent speed regulation and signal feedback functions to meet the needs of real-time intelligent monitoring of servers and help achieve more precise temperature control and stability of the server system.

Email: [email protected]

Whatsapp/Wechat:+86-19376691419

🔗Find More Detials: http://www.topsflo.com/special-pumps/servers-liquid-cooling-pump.html

youtube

youtube

Key Words: Rackmount server, high density server, GPU Server, Liquid Cooled Rackmount Server, Rack Servers, server liquid cooling pump, 2U Rackmount Server, 1U Rackmount Server, Data center rack server, Performance rack server, Microserver, High-density rack server, Rack mounted server, Rack server cooling pump, Server coolant pump, Rack server liquid cooling solution, Liquid coolant circulation pump, Rack server heat dissipation pump, Rack server coolant circulation pump, Reliable pump for rack server cooling, Quiet pump for rack server cooling

#dcwaterpump#waterpump#brushlessdcpump#12vdcwaterpump#12vwaterpump#24vdcwaterpump#dc water pump#bldcpump#liquidcoolingsystem#liquid cooling#servercoolingpump

0 notes

Text

0 notes

Text

Rating Bucky's (prosthesis) arms:

SILVERY STEEL + RED STAR

This is a good, simple color scheme. With a nice contrast. A single red star on a highly polished steel is an distinctive and unforgettable look.

Now take a closer look at the steely part:

The segments of this arm are not too big and not too small. They look like something that might really exist and function. The sizes of these segments are perfectly in the middle between something that looks like it can bend like a real arm and the need for big sturdy pieces serving as a armor.

These big pieces are giving us a beautiful shining surfaces.

And the gaps between segments where we can see tiny pieces of the internal mechanism? Breathtaking.

Now to the color of this steel:

It gives a feel of surgical steel. Clean, inhuman and indestructible. This arm will crush the concrete. This arm will rip your throat like it's made of paper. This arm will squeeze your bones like they were a warm plasticine.

And finally - the red star.

It's not just an ordinary red. It is a vibrant transparent red.

With your last dying breath you realize: the blood of Winter Soldier's victims dripping down his mechanical arm is exactly the same shade as the red star.

This arm was not designed for stealth.

This arm is an element of psychological warfare.

If you see the Winter Soldier coming at you with his arm uncovered, then that means that he wanted to be seen.

This arm was designed to send a message and that message is: Running is pointless, hiding won't save you. You are already dead.

This is the arm that comes with its own soundtrack.

11/10

GRAPHITE BLACK + GOLD

This design doesn't cares about fashion trends. This design sets a new ones.

It's a Lamborghini among arms.

This graphite black? It's a nice warm color. More human one. And the gold trim? An eye-pleasing contrast.

This color scheme is classic and extravagant at once.

A highly polished black vibranium gives a good clean look. The dark color also makes it easier for this arm to pass as a long sleeve than an artificial body part. Delicate gold details between segments are here to make sure the whole arm doesn't look like a black earthworm.

The general layout and shape of segments looks very similar to the previous one. No need to change something, that is already perfect.

This arm is better than your new iphone. This arm is more advanced than everything that NASA owns. This arm is more expensive than your rare Bugatti and Maybach combined. This is the arm that lays on velvet cushions. And it doesn't cares.

This arm is like a sleepy black panther looking at you with golden eyes. It's pure strength, that you underestimate until it's too late.

11/10

GRAPHITE BLACK + WHITE STAR Generally a design very similar to the last one, but toned down for stealth. A highly polished black vibranium this time is paired with a silvery vibranium. Black with silvery metal? This color scheme isn't a groundbreaking, you may complain. But it's exactly what it was aiming for. The description of this design sounds like a description of many other prosthesis on the market. A very useful thing for doing secret missions and wandering unnoticed among crowds.

And the white star. A pure one. Keeping the whole design simply. Positioned exactly where the red one was before. Definitely it's not a coincidence. Also notice how it can be easily covered even by a short sleeve.

An elegant and stealthy design. 10/10

#Bucky Barnes#captain america 2#infinity war#Falcon & Winter Soldier#I have some strong opinions about these arms#and I decided to share#my stuff#my edit#The Falcon and the Winter Soldier

91 notes

·

View notes