#BFSI Automation

Explore tagged Tumblr posts

Text

Elevating Communication with AI Voice Bot Technology

Imagine a world where businesses can have natural, intelligent conversations with their customers through technology. That’s exactly what an AI voice bot offers. Unlike traditional bots, these advanced systems understand context and respond with meaningful answers, making interactions smoother and more personal.

At VoiceOwl.ai, we’re dedicated to building AI voice bot solutions that fit seamlessly into your existing setup, helping automate customer service and make every interaction count.Our AI voice bots are designed to learn and improve over time, ensuring they keep up with your needs and provide the best possible responses.

Whether you need help with customer support, virtual assistants, or smart home devices, VoiceOwl.ai is here to bring the future of communication to your business.

#Lead verification automation#Lead Qualification automation#BFSI Automation#NBFC Automation#ABM Marketing Automation#Call Center Automation#Conversational AI#RCM Automation#E-commerce Automation#Logistics Automation#Recruitment Automation

0 notes

Text

United States marketing automation market size reached USD 19.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 53.8 Billion by 2033, exhibiting a growth rate (CAGR) of 12.2% during 2025-2033. The rising focus of marketers on strategic initiatives, creative campaigns, and more robust customer relationship management is primarily driving the market growth across the country.

#United States Marketing Automation Market Report by Component Type (Software#Services)#Deployment Type (On-premises#Cloud-based)#End User (SMEs#Large Enterprises)#Application (Campaign Management#Email Marketing#Lead Nurturing and Lead Scoring#Social Media Marketing#Inbound Marketing#and Others)#Vertical (BFSI#Retail#Healthcare#IT and Telecom#Government#Entertainment and Media#Education#and Region 2025-2033

0 notes

Text

Streamline Banking Operations with AI-driven bank Statement Analyzer: Unlocking Efficiency and Detecting Fraud

In today’s fast-paced financial landscape, where efficiency and accuracy are paramount, staying ahead of the competition is crucial for banks and financial institutions. To optimize and analyze credit underwriting processes and automate CAM (credit assessment and monitoring) operations, the adoption of advanced technologies has become imperative. This is where the AI-driven Bank Statement Analyzer comes in. It is a groundbreaking tool that leverages the power of artificial intelligence and machine learning to streamline operations, unlock efficiency, and enhance fraud detection like never before. By analyzing bank statements with speed and accuracy, the AI-Driven Bank Statement Analyzer can quickly identify any irregularities or suspicious activity, allowing financial institutions to take immediate action. This tool not only saves time and resources but also ensures a more secure and reliable credit assessment process for both the institution and its clients.

The role of AI in the Indian financial sector was examined in a study by Ficci and PWC titled “Uncovering the ground truth: AI in Indian financial services” which was released in February 2022. As stated in the report:

The primary drive for AI-enabled use cases, according to 83% of Indian financial services companies or organizations, is improving the client experience.

The majority of them — 57% — strongly concur that AI will provide them an advantage over their competitors.

(Source: Indian FS AI Adoption Survey 2021)

Leading Business Factors for AI-enabled Application Cases

Top Five AI use Cases that Firms have Adopted

Let’s Understand the Bank Statement Analyzer Powered by Artificial Intelligence

The AI-driven Bank Statement Analyzer is an intelligent software solution designed to transform the way financial institutions handle credit underwriting and CAM processes. By harnessing cutting-edge AI algorithms and data analytics, this technology-driven solution simplifies and accelerates the assessment of a borrower’s financial health and risk profile. It can also help identify potential fraud and improve the accuracy of credit decisions. With the AI-driven Bank Statement Analyzer, financial institutions can streamline their operations, reduce costs, and provide better customer service by offering faster loan approvals and more personalized lending options. Additionally, the tool can assist in monitoring a borrower’s repayment behavior and identifying any potential delinquencies or defaults, allowing for proactive measures to be taken to mitigate risk. Overall, the AI-Driven Bank Statement Analyzer is a valuable asset for financial institutions looking to improve their lending processes and make more informed credit decisions.

How Does It Work?

The AI-driven bank Statement Analyzer harnesses the power of artificial intelligence and machine learning to interpret and analyze bank statements with remarkable speed and accuracy. Here’s how it works:

Data Extraction: The system securely extracts relevant financial data from the borrower’s bank statements, eliminating the need for manual data entry and minimizing errors.

Categorization and Trend Analysis: The software automatically categorizes transactions, segregating them into income, expenses, and other relevant categories. It also performs trend analysis to identify spending patterns and financial behaviors.

Financial Health Assessment: Using sophisticated algorithms, the AI-driven Bank Statement Analyzer evaluates the borrower’s financial health by analyzing key indicators such as income stability, cash flow, debt-to-income ratio, and savings patterns.

Fraud Detection: The system incorporates advanced fraud detection techniques to identify suspicious transactions, including money laundering, fraudulent activities, and potential risks.

Account Aggregator Enablement: The AI-driven bank Statement Analyzer seamlessly integrates with account aggregator platforms, allowing financial institutions to securely access and analyze consolidated financial data from the borrower’s multiple bank accounts. This enables a comprehensive assessment of the borrower’s financial position.

Benefits of the AI-Driven Bank Statement Analyzer:

Enhanced Efficiency: The automated analysis of bank statements significantly reduces the time and effort involved in credit underwriting, enabling financial institutions to process loan applications faster and more accurately.

Improved Risk Assessment: The AI-Driven Bank Statement Analyzer provides a holistic view of the borrower’s financial situation, empowering lenders to make better-informed decisions and mitigate risk effectively.

Fraud Detection and Prevention: By leveraging advanced fraud detection techniques, the solution helps financial institutions identify suspicious transactions, enabling timely intervention and preventing fraudulent activities.

Cost Reduction: By automating manual processes and reducing the need for manual data entry, the AI-Driven Bank Statement Analyzer significantly reduces operational costs and increases overall efficiency.

Seamless Integration: The solution seamlessly integrates with existing CAM and credit underwriting platforms, ensuring a smooth implementation process and compatibility with existing systems.

With success comes certain challenges in the Indian financial sector’s use of artificial intelligence

The Indian banking, financial services, and insurance (BFSI) sector is witnessing a growing demand for artificial intelligence (AI) technologies such as chatbots, voice bots, and video bots. However, the sector faces significant challenges in fully embracing AI due to the need for greater clarity in several critical areas, including explainability, fairness, transparency, accountability, probability, and accessibility. Addressing these aspects from both a technological and legal standpoint is crucial for successful AI integration in the sector.

Regulation and Legal Considerations: To regulate AI in India, the Government appointed NITI Aayog in 2018 to develop laws covering ethical and system considerations. However, the current legal infrastructure is still in its early stages and fails to address various implications, including biased data outcomes, sharing of sensitive or personal data, accountability in accidents involving human or property losses, transparency of AI models and outcomes, rights of AI robots, intellectual property rights (IPRs), copyrights, competition laws, and patent credits. The undefined contours of AI applications have resulted in a lag in policymaking and regulation.

Need for Self-Governance and Framework: As the adoption of AI technologies continues at an unprecedented pace worldwide, implementers in the Indian financial sector need to establish a self-governed, self-regulated, and self-audited framework to ensure compliance with laws and regulations. This framework should encompass defining the scope of the problem, unbiased data collection, proper data labeling, data processing, training, deployment, and dynamic evaluation. By adhering to such a framework, organizations can avoid violations and navigate the complexities associated with AI integration.

Choose the Best AI-Driven Bank Statement Analyzer for Your Financial Institution

In the fast-paced world of finance, accurate and efficient analysis of bank statements is crucial for any financial institution. The AI-Driven Bank Statement Analyzer automates the process of extracting valuable insights from these documents, saving time and reducing the risk of errors. However, with a multitude of options available on the market, selecting the right AI-Driven Bank Statement Analyzer can be a daunting task. To help you make an informed decision, we have compiled a guide on how to choose the right AI-Driven Bank Statement Analyzer for your financial institution.

Define Your Requirements: Start by identifying your specific requirements and objectives. Consider the size of your institution, the volume of bank statements you process, and the level of complexity involved. Determine the key features you need, such as data extraction, categorization, trend analysis, or fraud detection. A clear understanding of your requirements will guide you in selecting the most suitable solution.

Evaluate Accuracy and Efficiency: Accuracy and efficiency are paramount when it comes to bank statement analysis. Look for AI-driven bank Statement Analyzers that employ advanced AI algorithms and machine learning techniques to ensure precise data extraction and reliable analysis. Efficiency is equally important, as the timely processing of statements can significantly impact your institution’s operations. Consider solutions that offer high processing speed and can handle large volumes of statements without compromising accuracy.

Integration Capabilities: Compatibility with your existing systems and workflows is crucial for seamless integration. The chosen AI-driven bank Statement Analyzer should be able to integrate with your financial institution’s core banking software, accounting systems, and other relevant platforms. It should allow for easy data transfer, enabling efficient collaboration among different departments and stakeholders.

Customization and Flexibility: Every financial institution has unique requirements and the AI-Driven Bank Statement Analyzer should be flexible enough to accommodate them. Look for a solution that offers customization options, allowing you to tailor the analysis process to your institution’s specific needs. The ability to define custom rules, filters, and reporting formats can significantly enhance the analyzer’s effectiveness.

Security and Compliance: When dealing with sensitive financial data, security and compliance are of utmost importance. Ensure that the AI-driven bank Statement Analyzer you choose adheres to strict security protocols, including encryption, access controls, and data protection measures. It should also comply with relevant industry regulations and standards, such as GDPR or PCI DSS, to safeguard customer information and maintain data integrity.

Scalability and Future-Proofing: Consider the scalability of the AI-Driven Bank Statement Analyzer as your institution grows. Ensure that the solution can handle increased volumes of statements and adapt to evolving business needs. Look for providers that offer regular updates and enhancements to keep pace with industry advancements. Future-proofing your investment will save you from the hassle of switching to a new analyzer soon.

User Experience and Support: Usability and user experience play a significant role in successfully implementing any technology. Choose an AI-Driven Bank Statement Analyzer that is intuitive, user-friendly, and requires minimal training. Look for a provider that offers comprehensive technical support, including documentation, training resources, and responsive customer service. A reliable support system will ensure smooth operations and quick resolution of any issues.

Cost and Return on Investment: Evaluate the total cost of ownership for the AI-Driven Bank Statement Analyzer, including initial setup costs, licensing fees, maintenance expenses, and any additional charges. Compare the costs against the expected return on investment (ROI). Consider factors such as time saved, reduction in errors, improved efficiency, and the ability to uncover valuable insights. A solution with a favorable ROI will prove to be a worthwhile investment for your financial institution.

By following these guidelines and conducting thorough research, you will be able to select an AI-driven bank Statement Analyzer that aligns with your institution’s goals and maximizes operational efficiency. Remember to evaluate multiple vendors and request demonstrations or trials to assess the usability and functionality of different solutions. Additionally, seek feedback from other financial institutions or industry professionals to gather insights and recommendations based on their experiences. Taking a collaborative approach will help you make a well-informed decision and choose the AI-Driven Bank Statement Analyzer that best suits your institution’s needs.

Once you have selected the right AI-Driven Bank Statement Analyzer, it’s essential to plan for a smooth implementation process. Collaborate with the solution provider to create an implementation strategy that aligns with your institution’s existing systems and workflows. Define clear timelines, allocate resources, and communicate the changes to relevant stakeholders within your organization.

During the implementation phase, provide comprehensive training to your staff to ensure they are proficient in using the AI-Driven Bank Statement Analyzer. The solution provider should offer training materials, user manuals, and ongoing support to address any questions or concerns that may arise.

Post-implementation, continuously monitor the performance of the AI-Driven Bank Statement Analyzer and gather feedback from users. Regularly assess its effectiveness, identify areas for improvement, and collaborate with the solution provider to implement necessary updates or enhancements.

The Novel Patterns– CART — AI-Driven Bank Statement Analyzer’s ability to assist financial institutions in identifying fraud and saving sizeable sums of money is one of its key advantages. With a track record to back it up, CART has already won over 100 major clients’ trust and processes more than 250 million transactions each month. CART has successfully detected fraudulent activity and owing to its efficient fraud detection technique, averting potential losses of over INR 100 million every month. These astounding figures demonstrate how the Novel Patterns — CART — AI-Driven Bank Statement Analyzer protects financial institutions and strengthens their dedication to offering their clients safe and dependable services. Financial institutions can benefit from the most recent technology by utilizing AI and sophisticated analytics.

Robust Fraud Detection: CART employs advanced algorithms and machine learning techniques to identify fraudulent activities within bank statements. Its sophisticated fraud detection capabilities enable financial institutions to detect suspicious transactions, money laundering attempts and potential risks effectively. By proactively identifying and preventing fraudulent activities, CART helps safeguard the financial integrity of institutions and protects them from significant financial losses.

Impressive Client Base: With its proven track record, CART has gained the trust of more than 75 major clients in the financial industry. This extensive client base reflects the reliability and effectiveness of the solution. Financial institutions can benefit from CART’s established reputation and industry-wide adoption, ensuring they are utilizing a trusted and reputable tool for their bank statement analysis needs.

High Transaction Volume: CART is equipped to handle high transaction volumes efficiently. It processes over 250 million transactions on a monthly basis, showcasing its scalability and ability to manage large-scale operations. Financial institutions dealing with substantial transaction volumes can rely on CART to effectively analyze and extract valuable insights from their bank statements, regardless of the volume.

Substantial Cost Savings: By leveraging CART’s robust fraud detection techniques, financial institutions have achieved significant cost savings. The solution has helped prevent potential losses of over INR 100 million by identifying fraudulent activities early on. Detecting and mitigating fraudulent transactions not only saves financial institutions from financial losses but also protects their reputation and customer trust. CART’s ability to detect fraud efficiently contributes to the overall cost reduction and financial stability of institutions.

Cutting-edge Technology: The Novel Patterns — CART — AI-Driven Bank Statement Analyzer incorporates advanced technologies such as artificial intelligence and machine learning. These technologies enable CART to continuously learn and adapt to evolving patterns and trends in bank statements. By leveraging cutting-edge technology, financial institutions can stay ahead of emerging fraud schemes, improve their risk management capabilities, and make more informed decisions.

Enhanced Operational Efficiency: CART streamlines bank statement analysis processes, resulting in improved operational efficiency for financial institutions. By automating manual tasks such as data extraction and categorization, CART reduces the time and effort required to analyze bank statements. This automation allows institutions to process loan applications faster, make quicker lending decisions, and provide better customer service. The increased efficiency and streamlined processes contribute to overall operational excellence and improved customer satisfaction.

In conclusion, the AI-driven Bank Statement Analyzer is a transformative solution for financial institutions, revolutionizing operations by offering improved efficiency, enhanced risk assessment, fraud detection capabilities, and significant cost reduction. By carefully selecting and implementing this technology, institutions can unlock their full potential, staying ahead in the competitive financial landscape. Embracing the power of AI, financial institutions can elevate their bank statement analysis to new heights. The Novel Patterns — CART — AI-Driven Bank Statement Analyzer serves as a powerful tool, enabling institutions to detect fraud effectively and achieve substantial cost savings. With its robust capabilities, impressive client base, ability to handle high transaction volumes, cutting-edge technology, and enhanced operational efficiency, CART empowers financial institutions to strengthen risk management practices, protect financial integrity, and deliver superior services to customers. By adopting CART, institutions can leverage advanced analytics and AI-driven solutions, gaining a competitive edge in today’s dynamic financial landscape

#cart#fintech#novel patterns#account aggregator#bfsi#wealth management#credit underwriting#finance#banking#automation#bank statements#bank statemen analyzer

0 notes

Text

Driving Innovation: A Case Study on DevOps Implementation in BFSI Domain

Banking, Financial Services, and Insurance (BFSI), technology plays a pivotal role in driving innovation, efficiency, and customer satisfaction. However, for one BFSI company, the journey toward digital excellence was fraught with challenges in its software development and maintenance processes. With a diverse portfolio of applications and a significant portion outsourced to external vendors, the company grappled with inefficiencies that threatened its operational agility and competitiveness. Identified within this portfolio were 15 core applications deemed critical to the company’s operations, highlighting the urgency for transformative action.

Aspirations for the Future:

Looking ahead, the company envisioned a future state characterized by the establishment of a matured DevSecOps environment. This encompassed several key objectives:

Near-zero Touch Pipeline: Automating product development processes for infrastructure provisioning, application builds, deployments, and configuration changes.

Matured Source-code Management: Implementing robust source-code management processes, complete with review gates, to uphold quality standards.

Defined and Repeatable Release Process: Instituting a standardized release process fortified with quality and security gates to minimize deployment failures and bug leakage.

Modernization: Embracing the latest technological advancements to drive innovation and efficiency.

Common Processes Among Vendors: Establishing standardized processes to enhance understanding and control over the software development lifecycle (SDLC) across different vendors.

Challenges Along the Way:

The path to realizing this vision was beset with challenges, including:

Lack of Source Code Management

Absence of Documentation

Lack of Common Processes

Missing CI/CD and Automated Testing

No Branching and Merging Strategy

Inconsistent Sprint Execution

These challenges collectively hindered the company’s ability to achieve optimal software development, maintenance, and deployment processes. They underscored the critical need for foundational practices such as source code management, documentation, and standardized processes to be addressed comprehensively.

Proposed Solutions:

To overcome these obstacles and pave the way for transformation, the company proposed a phased implementation approach:

Stage 1: Implement Basic DevOps: Commencing with the implementation of fundamental DevOps practices, including source code management and CI/CD processes, for a select group of applications.

Stage 2: Modernization: Progressing towards a more advanced stage involving microservices architecture, test automation, security enhancements, and comprehensive monitoring.

To Expand Your Awareness: https://devopsenabler.com/contact-us

Injecting Security into the SDLC:

Recognizing the paramount importance of security, dedicated measures were introduced to fortify the software development lifecycle. These encompassed:

Security by Design

Secure Coding Practices

Static and Dynamic Application Security Testing (SAST/DAST)

Software Component Analysis

Security Operations

Realizing the Outcomes:

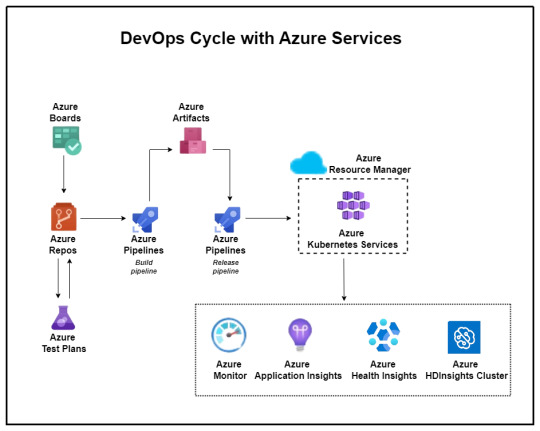

The proposed solution yielded promising outcomes aligned closely with the company’s future aspirations. Leveraging Microsoft Azure’s DevOps capabilities, the company witnessed:

Establishment of common processes and enhanced visibility across different vendors.

Implementation of Azure DevOps for organized version control, sprint planning, and streamlined workflows.

Automation of builds, deployments, and infrastructure provisioning through Azure Pipelines and Automation.

Improved code quality, security, and release management processes.

Transition to microservices architecture and comprehensive monitoring using Azure services.

The BFSI company embarked on a transformative journey towards establishing a matured DevSecOps environment. This journey, marked by challenges and triumphs, underscores the critical importance of innovation and adaptability in today’s rapidly evolving technological landscape. As the company continues to evolve and innovate, the adoption of DevSecOps principles will serve as a cornerstone in driving efficiency, security, and ultimately, the delivery of superior customer experiences in the dynamic realm of BFSI.

Contact Information:

Phone: 080-28473200 / +91 8880 38 18 58

Email: [email protected]

Address: DevOps Enabler & Co, 2nd Floor, F86 Building, ITI Limited, Doorvaninagar, Bangalore 560016.

#BFSI#DevSecOps#software development#maintenance#technology stack#source code management#CI/CD#automated testing#DevOps#microservices#security#Azure DevOps#infrastructure as code#ARM templates#code quality#release management#Kubernetes#testing automation#monitoring#security incident response#project management#agile methodology#software engineering

0 notes

Text

Why Documentation in BFSI sector is not a challenge anymore?

Apart from government agencies, employees working in banks & other financial institutions have to adhere to the enormous amount of rules & regulations when it comes to managing information.

Information also includes the confidential data that is maintained on the bank’s servers, as well as documents that are submitted by customers & businesses that have some kind of working relationship with the bank.

Document ‘Identification’ & ‘Maintenance’ – A growing challenge for Banks & other Financial Institutions

As per a report, Identity of Client (bank accounts opened with names similar to other established business entities, false identification documents, etc.) is one of the most important factors that can make or break the reputation of a bank. Employees have to deal with a significant amount of paperwork, though financial institutions are trying their best in order to keep the costs of maintaining these paper documents under control. Take the case of maintaining the documents submitted by a new customer at the time of opening a new bank account. There is a significant amount of data from the account opening form that needs to be fed to the back-end system and any error caused by the manual entry can result in loss of business, indirectly impacting the ‘client satisfaction index’. As banks have to adhere to a lot of regulatory and compliance standards, maintaining documentation for compliance is also a big task. Irrespective of the nature of the documents e.g. account opening forms, loan processing forms, KYC (Know Your Customer), mortgage forms, etc.; they need to be maintained in a manner where less effort is spent on ‘Document Identification’. If the bank falters in any of these tasks, it would hamper the productivity of the staff.

Document ‘Standards’ & ‘Retrieval’: Unstructured & non-uniform formats followed by different departments impacting ‘customer experience’

Irrespective of the size of the bank, the overall structure of any banking organization is considered to be highly complex as there are a number of departments providing different services to their esteemed customers. Hence, each department might be having its own format of document descriptions, document folder structure, metadata, etc. which makes the task of accessing/editing/searching ‘common’ documents across departments a tedious task. Inadequate content management can make retrieval of important documents highly complex, thereby impacting the pace at which the other follow-on activities are executed. These delays can result in a sub-optimal customer experience which can negatively impact the bank’s brand & business. The tasks like document processing, extracting customer information from the form, matching customer signature to prevent frauds, etc. are mundane in nature, yet very critical in nature; so they need to be performed with utmost precision. However, due to the mundane nature of these tasks, they are more prone to manual errors. Though the problems mentioned so far are different in nature, there is a common pattern in each of them – bank representatives have to review a number of documents and in most scenarios, he/she has to manually enter the details at the back-end. How can banks get out of this ‘document chaos’ and keep their employees motivated to provide excellent services to their customers?

Intelligent information Management (IIM) – Solving the ‘documentation crisis’ faced by the BFSI sector

Intelligent information Management (IIM) platform from AIQoD can be instrumental in automating critical activities mentioned below

Capture – Gather input from tools like scanners, ERP, spreadsheets, etc.

Processing – Match, structure, and figure out ‘any’ discrepancy in the data

Routing – Insertion of data in the ERP or any other backend/accounting system

Retrieval – Retrieve or query data from ERP or any other backend/accounting system

The platform leverages technologies like Machine Learning (ML), Artificial Intelligence (AI), Image Processing, etc. in order to bring intelligence to a routine, yet critical job like ‘Documentation’. Highly accurate Handwriting Recognition feature in the platform can be used for signature verification. Optical Character Recognition (OCR) feature in cognizance with mobile capture & recognition feature identifies and extracts text from documents and images, thereby eliminating chances of error in processing and management. Irrespective of the department, employees within the bank can use a common automated workflow for input, indexing, search, and processing of documents so that they can focus on activities that require creative intelligence, rather than spending their time in scouting for documents. Incorporation of IIM in a task like ‘documentation’ can have far-fetched benefits, some of which are listed below

Centralized Access to documents

Faster retrieval & processing of documents

Compliance with the required financial regulations

Enhanced accuracy of documents

Boost in employee’s morale and productivity

Conclusion

RPA for ‘documentation identification & maintenance’ for BFSI sector has multi-fold benefits and can help in providing enhanced customer experience, engaging employees with important tasks and saving overhead costs.

0 notes

Text

Harnessing Automation: RPA in Banking Industry

Robotic Process Automation (RPA) assists banks and accounting units in automating repetitive manual operations, allowing staff to concentrate on more important activities and giving the company a competitive edge. Let’s discuss more about prominent use cases and benefits of RPA in Banking and Finance.

Harness the power of automation in the banking industry. Explore the multifaceted benefits and applications of RPA for a competitive edge in finance.

#RPA in banking and finance#RPA in banking industry#RPA in banking#RPA in banking sector#RPA automation in banking#benefits of RPA in banking#RPA applications in banking#RPA use cases in banking#RPA in banking and financial sector#RPA in bfsi sector#use of RPA in banking#RPA in bfsi

0 notes

Text

Robotic Process Automation in BFSI Market Key Players, Industry Overview, Application and Analysis to 2024 to 2031

Robotic Process Automation in BFSI Market: Navigating the Future of Financial Operations

The Robotic Process Automation in BFSI Market was valued at 710.63 Billion in 2022 and expected to grow at CAGR of 40.1% over forecast period. In the dynamic landscape of the Banking, Financial Services, and Insurance (BFSI) sector, the integration of Robotic Process Automation (RPA) has emerged as a transformative force, reshaping traditional workflows and operational paradigms. RPA, a technology that utilizes robots or 'bots' to automate repetitive tasks, is gaining widespread adoption in the BFSI sector due to its potential to enhance efficiency, reduce operational costs, and mitigate risks.

Get the PDF Sample Copy (Including FULL TOC, Graphs, and Tables) of this report @ https://www.sanglobalresearch.com/request-sample/3039

Overview:

The BFSI sector, being data-intensive and compliance-driven, has recognized the significance of RPA in optimizing processes. RPA in BFSI involves the deployment of software robots to perform rule-based tasks, such as data extraction, validation, and reconciliation, across various functions like customer onboarding, account management, fraud detection, and regulatory compliance. This automation not only accelerates routine tasks but also ensures accuracy, enabling financial institutions to redirect human resources to more strategic and value-added activities.

Drivers:

Several factors fuel the rapid adoption of RPA in the BFSI sector. One of the primary drivers is the quest for operational efficiency. RPA streamlines mundane tasks, allowing financial institutions to handle vast volumes of data swiftly and accurately. Cost reduction is another compelling driver as RPA diminishes the need for manual intervention, leading to significant savings in labor costs. Additionally, regulatory compliance is a critical aspect of the BFSI sector, and RPA ensures adherence to stringent norms by minimizing errors and ensuring consistency in processes.

Restraints:

Despite the promising prospects, the integration of RPA in BFSI is not without challenges. One notable constraint is the initial investment required for implementation. While the long-term benefits are substantial, some financial institutions may hesitate due to the upfront costs associated with acquiring and implementing RPA solutions. Moreover, concerns regarding data security and privacy may act as a deterrent, especially in an industry where safeguarding sensitive customer information is paramount.

Growth Factors:

The growth of RPA in BFSI is propelled by its adaptability to diverse processes within the sector. As financial institutions increasingly recognize the potential of RPA to enhance customer experience, the technology is witnessing widespread adoption. Moreover, the scalability of RPA solutions ensures that they can be tailored to fit the unique requirements of different organizations, irrespective of their size or complexity. The continuous advancements in RPA technology, including the incorporation of artificial intelligence and machine learning capabilities, further contribute to its sustained growth in BFSI.

Future Outlook:

The future of RPA in BFSI appears promising, with ongoing technological advancements and a growing emphasis on digital transformation. The integration of cognitive capabilities, such as natural language processing and sentiment analysis, will elevate RPA from rule-based automation to a more intelligent and adaptive solution. This evolution is expected to drive innovation in areas like customer service, risk management, and decision-making processes, positioning RPA as a cornerstone of BFSI's digital evolution.

In conclusion, the integration of Robotic Process Automation in the BFSI sector represents a transformative shift in operational dynamics. As financial institutions navigate the challenges of a rapidly evolving landscape, RPA stands out as a key enabler of efficiency, cost-effectiveness, and compliance. While hurdles exist, the numerous drivers and growth factors underscore the inevitability of RPA becoming an integral part of the future of BFSI operations.

Get Customization on this Report: https://www.sanglobalresearch.com/customization/3039

Key Companies Profiled: NICE; Nintex UK Ltd. (Kryon Systems); Pegasystems Inc.; Protiviti Inc.; UiPath; WorkFusion, Inc., Antworks, Atos SE; Automation Anywhere, Inc.; Blue Prism Limited; EdgeVerve Systems Ltd.; FPT Software; IBM; Kofax Inc.; Microsoft (Softomotive)

Global Robotic Process Automation in BFSI Market, Report Segmentation

Robotic Process Automation in BFSI Market, By Type

Software

Services

Services

Robotic Process Automation in BFSI Market, By Organization

SMEs

Large Enterprises

Robotic Process Automation in BFSI Market, By Application

Banking

Financial Services & Insurance

Global Anti-aging Devices Market, Regional Outlook

North America (U.S., Canada, and Mexico)

Europe (Germany, France, Italy, Spain, U.K., Russia, and Rest of Europe)

Asia Pacific (China, India, Japan, Australia, and Rest of Asia Pacific)

South America (Brazil, Argentina, and Rest of South America)

Middle East & Africa (South Africa, UAE, and Rest of ME&A)

To know about the assumptions considered for the study download the pdf brochure: https://www.sanglobalresearch.com/report/robotic-process-automation-in-bfsi-market/3039

Thank you for reading the report. The report can be customized as per the requirements of the clients. For further information or query about customization, please reach out to us, and we will offer you the report best suited for your needs.

Related Reports:

Artificial Intelligence Market: https://sanglobalresearch.com/report/artificial-intelligence-market/3027

Artificial Intelligence in Construction Market: https://sanglobalresearch.com/report/artificial-intelligence-in-construction-market/3026

About Us:

At San Global Research Report, we pride ourselves on our commitment to quality and accuracy. Our team of experienced researchers utilizes a combination of quantitative and qualitative methods to ensure that our findings are both accurate and reliable. With a strong emphasis on responsiveness, transparency, and collaboration, we work closely with our clients to understand their objectives and deliver actionable insights. Learn more about our research approach and how it can benefit your business.

Contact Us:

Address: Gera Imperium Rise, Phase 2 Hinjewadi, Pune, India

San Global Research | Web: http://www.sanglobalresearch.com

Direct Line: +91 9209275355

E-mail: [email protected]

0 notes

Text

Making Middle East BFSI Future Ready Today!

Elevating CX with AI-Led Hyper-personalization - for a Modern age "Digital BFSI" of Middle East

0 notes

Text

#Ai-powered#Ai automation#chatbot#ai chatbot#fintech#BFSI#business#artificial intelligence#bots#customer service#werqlabs

0 notes

Text

Reimagining How We Talk to Technology: Voice Assistant Bots and Generative AI

Keeping up with all the communication tasks in a busy business can be tough. That’s where our Voice Assistant Bots at VoiceOwl.ai can help. We’ve designed these bots to take the load off your team by automating key processes, so they can focus on what really matters—growing your business and boosting sales.

Imagine your sales reps spending their time only on leads that are ready to convert, while our Voice Assistant Bots handle the rest. They can verify, qualify, and nurture leads, making sure your team is always talking to the right people at the right time. This doesn’t just save time—it helps you have 10 times more meaningful conversations, which can seriously boost your sales.

And it doesn’t stop there. Our Voice Assistant Bots can also scale up your sales, pre-sales, and even debt collection calls. By automating these tasks, you reduce the manual work, cut costs by up to 60%, and let your team focus on the bigger picture—like building strong customer relationships and closing more deals.

With VoiceOwl.ai, you’re not just getting a tool—you’re getting a smarter way to communicate. Let our Voice Assistant Bots handle the repetitive stuff, so your team can do what they do best: grow your business.

#Lead verification automation#Lead Qualification automation#BFSI Automation#NBFC Automation#ABM Marketing Automation#Call Center Automation#Conversational AI#RCM Automation#E-commerce Automation#Logistics Automation#Recruitment Automation

0 notes

Text

#United States Marketing Automation Market Report by Component Type (Software#Services)#Deployment Type (On-premises#Cloud-based)#End User (SMEs#Large Enterprises)#Application (Campaign Management#Email Marketing#Lead Nurturing and Lead Scoring#Social Media Marketing#Inbound Marketing#and Others)#Vertical (BFSI#Retail#Healthcare#IT and Telecom#Government#Entertainment and Media#Education#and Region 2024-2032

0 notes

Text

BFSI Software Testing: Ensuring Secure and Seamless Financial Experiences with ideyaLabs in 2025

Introduction to BFSI Software Testing

Banking, Financial Services, and Insurance (BFSI) shape the backbone of modern economies. Software financial services securely and efficiently. As digital adoption accelerates, robust BFSI software testing becomes crucial. Weak testing exposes institutions to fraud, data breaches, regulatory penalties, and service disruptions. Financial sector organizations recognize software testing as essential for trust, compliance, and user satisfaction.

Understanding the Current BFSI Digital Landscape

In 2025, digital banking surpasses traditional channels. Customers prefer mobile apps and online portals for transactions, investments, and insurance services. Automation powers loan approvals, claims processing, and risk assessments. Each touchpoint carries sensitive customer information. Application performance influences customer experience. A single glitch causes reputational and financial damage. BFSI software testing verifies reliability, security, and compliance for every application.

Why BFSI Software Testing Demands Specialization

BFSI systems manage complex workflows, heavy transaction loads, and strict regulatory requirements. Testing financial software presents unique challenges. Transaction validations, concurrency management, encryption, and disaster recovery protocols require expert handling. Even a minor error in test design can lead to far-reaching consequences.

Dedicated BFSI software testing methods ensure robustness. Testers simulate real-world financial operations. They validate rapid fund transfers, multi-factor authentication, anti-fraud workflows, and accurate account reconciliations. Security, speed, and compliance define quality in BFSI technology ecosystems.

ideyaLabs: The Catalyst for Trusted BFSI Software Testing

ideyaLabs leads the BFSI software testing landscape. The team delivers end-to-end testing solutions tailored for banking, financial services, and insurance domains. ideyaLabs understands sector-specific regulations and operational nuances. Focused industry expertise translates into higher test coverage, lower risk, and faster go-lives.

Core Areas of BFSI Software Testing by ideyaLabs

1. Functional Testing for Reliable Transactions

Functional accuracy forms the foundation of financial software quality. ideyaLabs tests each function in banking, financial services, and insurance platforms. Deposit processing, payment gateways, loan origination, policy issuance, and claims management receive thorough validation. Each user journey works as intended, under varied scenarios and loads.

2. Performance Testing to Handle Massive Transactions

BFSI solutions process millions of transactions per day. Slow response times frustrate customers and lead to loss of business. ideyaLabs performance tests BFSI applications for scalability, speed, and consistency. Simulations gauge system behavior under peak traffic. Testing experts identify bottlenecks and fine-tune systems for optimal throughput.

3. Security Testing for Data Integrity and Regulatory Compliance

Cybersecurity threats target BFSI institutions relentlessly. Regulations impose strict mandates for data protection, privacy, and auditability. ideyaLabs conducts security testing to uncover vulnerabilities before attackers do. Penetration tests, risk assessments, and vulnerability scans fortify applications. ideyaLabs ensures compliance with data handling, encryption, and access control standards.

4. Automation Testing for Accelerated Digital Transformation

Modern banks and insurers embrace DevOps and continuous delivery. Software releases need rapid validation without sacrificing quality. ideyaLabs develops robust test automation frameworks for BFSI workloads. Regression cycles become faster, more accurate, and repeatable. Automation speeds up innovation cycles in today's BFSI environment.

5. Regulatory Compliance Testing for Peace of Mind

Frequent policy updates and evolving standards present constant regulatory challenges. ideyaLabs stays updated with the latest mandates. The team verifies compliance across application layers. Testing incorporates legal, operational, and reporting checks. This approach prevents regulatory fines and ensures a smooth audit trail.

6. User Experience Testing for Customer Loyalty

Financial customers demand intuitive, frictionless digital journeys. Even minor usability issues result in lost engagement. ideyaLabs tests user interfaces on multiple devices, platforms, and accessibility configurations. Testing covers onboarding, transactions, self-service, and helpdesk modules. The result: satisfied users and higher customer retention.

How ideyaLabs’ Approach Revolutionizes BFSI Software Testing in 2025

Specialized Banking Domain Knowledge

ideyaLabs employs BFSI testing specialists with deep sectoral understanding. Domain-specific expertise results in meaningful test cases, credible defect identification, and actionable feedback. The team understands unique risks attached to lending, payments, investments, and insurance segments.

End-to-End Test Coverage

Technical specialists cover every layer— front end, middleware, backend, integrations, and data. ideyaLabs creates comprehensive test suites. Test cases cover APIs, databases, business processes, and third-party connections. Comprehensive coverage eliminates loopholes missed by generic testing providers.

Agile and Scalable Testing Models

BFSI sector software evolves continuously. ideyaLabs aligns with agile and DevOps practices. Testing integrates seamlessly with development pipelines. The approach enables rapid defect discovery and remediation across sprints. Testing models scale with project needs, timelines, and complexity.

Focus on Quality and Customer Centricity

Each ideyaLabs engagement embodies a quality-first mindset. The team aligns with client objectives and customer needs. Individual test plans maximize business value. Stakeholders receive actionable test reports, risk insights, and compliance dashboards.

Proven Track Record with BFSI Clients

ideyaLabs has successfully delivered projects for global banks, NBFCs, insurance leaders, and fintech disruptors. Case studies showcase reduced post-launch defects, accelerated rollout cycles, higher compliance, and reduced downtime. BFSI clients trust ideyaLabs as a strategic quality assurance partner.

Future Trends in BFSI Software Testing

Artificial intelligence and machine learning revolutionize financial software. Risk models, chatbots, and fraud detection run on smart algorithms. ideyaLabs refines BFSI software testing methodologies for these emerging technologies. Model-based testing, synthetic data generation, and AI validation tools enable reliable next-generation fintech.

Open banking expands financial connectivity. Secure API testing gains critical importance. ideyaLabs delivers advanced API testing for regulatory and ecosystem compliance. Internet of Things (IoT) and embedded finance require new security and integration testing paradigms. ideyaLabs stays ahead of the innovation curve in BFSI software testing.

The Business Impact of Effective BFSI Software Testing

Financial organizations concentrate on growth, innovation, and customer trust. Effective BFSI software testing by ideyaLabs directly supports these goals. Key business benefits include:

Reduced business risk from downtime and fraud

Consistent regulatory compliance and audit readiness

Enhanced customer satisfaction across digital touchpoints

Faster release cycles and time-to-market

Lower maintenance costs through early defect detection

Choose ideyaLabs for BFSI Software Testing Excellence

In 2025, BFSI technology innovation continues to accelerate. Banks, insurers, and financial services providers need strategic partners to guarantee software reliability and security. ideyaLabs stands as the premier partner in BFSI software testing. The company brings proven expertise, tailored solutions, and industry leadership.

Organizations trust ideyaLabs to safeguard their software investments, comply with regulations, and provide seamless digital experiences. The future of finance demands excellence in testing. ideyaLabs delivers this excellence, every day, to every client.

Connect with ideyaLabs for Next-Generation BFSI Software Testing Services

Future-ready BFSI organizations stay ahead by partnering with ideyaLabs. Explore specialized BFSI software testing solutions designed for evolving business needs. ideyaLabs drives performance, compliance, and user delight in the fast-paced financial sector. Reach out today for a consultation and step into a more reliable digital future.

0 notes

Text

Analytics as a Service Market Size, Share & Growth Analysis 2034: Turning Real-Time Data into Smart Business Decisions

Analytics as a Service (AaaS) Market is gaining rapid momentum as businesses increasingly prioritize data-driven decision-making. AaaS provides organizations with cloud-based access to powerful analytics tools — such as predictive analytics, data visualization, and machine learning — without the need for extensive in-house infrastructure. This model supports flexible deployment, scalability, and cost efficiency, making it particularly attractive to enterprises navigating digital transformation. By outsourcing analytics needs to expert providers, companies across sectors — from retail and healthcare to BFSI and manufacturing — can focus on core operations while tapping into valuable insights. In 2024, the market demonstrated impressive performance with a volume of 320 million metric tons, forecasted to rise significantly by 2028.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS25837

Market Dynamics

A number of critical dynamics are fueling the expansion of the AaaS market. Foremost is the demand for agile and scalable solutions that can adapt to fast-changing market conditions. The rise of big data and IoT devices has led to an exponential increase in data generation, further elevating the need for real-time and advanced analytics. Predictive analytics is currently the most sought-after segment, as businesses aim to forecast trends and customer behavior with precision. Descriptive and diagnostic analytics also remain vital, enabling organizations to derive meaning from historical data.

On the flip side, concerns around data privacy and security remain a significant challenge. As companies shift to cloud platforms, the threat of cyberattacks and data breaches grows, prompting the need for advanced cybersecurity and regulatory compliance. Additionally, the shortage of skilled professionals and the complexity of integrating analytics into legacy systems present notable barriers to broader adoption.

Key Players Analysis

The AaaS market features a mix of established tech giants and emerging innovators. Industry leaders such as IBM, Microsoft, Google, and Amazon Web Services dominate due to their advanced cloud infrastructure and comprehensive analytics portfolios. These companies continue to invest heavily in AI and machine learning to enhance the intelligence and automation of their platforms.

Emerging players like Alteryx, Fractal Analytics, Sisense, and Mu Sigma are gaining traction with specialized offerings tailored to sector-specific needs. Startups such as Data Minds, Predictive Pulse, and Insight Forge are also disrupting the landscape with niche solutions, intuitive dashboards, and real-time analytics services for smaller and mid-sized enterprises.

Regional Analysis

North America is the undisputed leader in the Analytics as a Service market, benefiting from its strong digital infrastructure, early technology adoption, and a high concentration of analytics providers. The United States continues to spearhead innovation and growth in this domain, especially in sectors like finance, healthcare, and IT.

Europe holds the second-largest share, driven by strict regulatory frameworks such as GDPR and rising demand for secure, compliant analytics services. The United Kingdom, Germany, and France are particularly active markets within the region.

The Asia-Pacific region is witnessing the fastest growth, underpinned by large-scale digital initiatives in India, China, and Japan. Rising internet penetration, government support, and the rapid digitization of businesses are contributing to a surge in AaaS demand.

Latin America and the Middle East & Africa are emerging markets showing strong potential. Countries like Brazil, UAE, and Saudi Arabia are investing in smart technologies and gradually embracing analytics to boost economic competitiveness and public services.

Recent News & Developments

In recent months, the AaaS landscape has been shaped by a series of technological advancements and strategic moves. Pricing has become more competitive, with services now accessible at monthly rates ranging from $100 to $500, appealing to a wider user base. A growing trend is the integration of AI and ML to enhance the depth and accuracy of analytics, especially in predictive and prescriptive applications.

Key players are forming strategic partnerships and acquisitions to expand their market reach. For instance, IBM and SAP have entered alliances to combine business intelligence with cloud analytics. There’s also a heightened focus on real-time analytics capabilities, allowing businesses to react to data insights instantaneously — an increasingly critical requirement in volatile markets.

Browse Full Report : https://www.globalinsightservices.com/reports/analytics-as-a-service-market/

Scope of the Report

This report provides a detailed overview of the Analytics as a Service Market, analyzing various dimensions such as type, deployment, application, and regional performance. It covers all essential services, including customer analytics, risk management, financial forecasting, and workforce optimization. The report also examines enabling technologies — like machine learning, blockchain, and cloud computing — that are shaping the market’s trajectory.

Additionally, it offers a robust competitive landscape analysis, identifying key players, emerging companies, and strategic developments. It highlights challenges such as data integration, talent shortages, and privacy regulations, while also outlining growth opportunities in sectors like healthcare, retail, and energy. Stakeholders will gain deep insights into market dynamics, investment opportunities, and future outlook, equipping them for strategic decision-making in this dynamic environment.

#analyticsasaservice #cloudanalytics #predictiveanalytics #datavisualization #machinelearning #bigdata #realtimeanalytics #aiintegration #businessintelligence #digitaltransformation

Discover Additional Market Insights from Global Insight Services:

Speech Analytics Market : https://www.globalinsightservices.com/reports/speech-analytics-market/

Commercial Drone Market : https://www.globalinsightservices.com/reports/commercial-drone-market/

Product Analytics Market : https://www.globalinsightservices.com/reports/product-analytics-market/

Streaming Analytics Market : https://www.globalinsightservices.com/reports/streaming-analytics-market/

Cloud Native Storage Market : https://www.globalinsightservices.com/reports/cloud-native-storage-market/

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

CloudHub BV: Unlocking Business Potential with Advanced Cloud Integration and AI

Introduction

At the helm of CloudHub BV is Susant Mallick, a visionary leader whose expertise spans over 23 years in IT and digital transformation diaglobal. Under his leadership, CloudHub excels in integrating cloud architecture and AI-driven solutions, helping enterprises gain agility, security, and actionable insights from their data.

Susant Mallick: Pioneering Digital Transformation

A Seasoned Leader

Susant Mallick earned his reputation as a seasoned IT executive, serving roles at Cognizant and Amazon before founding CloudHub . His leadership combines technical depth — ranging from mainframes to cloud and AI — with strategic vision.

Building CloudHub BV

In 2022, Susant Mallick launched CloudHub to democratize data insights and accelerate digital journeys timeiconic. The company’s core mission: unlock business potential through intelligent cloud integration, data modernization, and integrations powered by AI.

Core Services Under Susant Mallick’s Leadership

Cloud & Data Engineering

Susant Mallick positions CloudHub as a strategic partner across sectors like healthcare, BFSI, retail, and manufacturing ciobusinessworld. The company offers end-to-end cloud migration, enterprise data engineering, data governance, and compliance consulting to ensure scalability and reliability.

Generative AI & Automation

Under Susant Mallick, CloudHub spearheads AI-led transformation. With services ranging from generative AI and intelligent document processing to chatbot automation and predictive maintenance, clients realize faster insights and operational efficiency.

Security & Compliance

Recognizing cloud risks, Susant Mallick built CloudHub’s CompQ suite to automate compliance tasks — validating infrastructure, securing access, and integrating regulatory scans into workflows — enhancing reliability in heavily regulated industries .

Innovation in Data Solutions

DataCube Platform

The DataCube, created under Susant Mallick’s direction, accelerates enterprise data platform deployment — reducing timelines from months to days. It includes data mesh, analytics, MLOps, and AI integration, enabling fast access to actionable insights

Thinklee: AI-Powered BI

Susant Mallick guided the development of Thinklee, an AI-powered business intelligence engine. Using generative AI, natural language queries, and real-time analytics, Thinklee redefines BI — let users “think with” data rather than manually querying it .

CloudHub’s Impact Across Industries

Healthcare & Life Sciences

With Susant Mallick at the helm, CloudHub supports healthcare innovations — from AI-driven diagnostics to advanced clinical workflows and real-time patient engagement platforms — enhancing outcomes and operational resilience

Manufacturing & Sustainability

CloudHub’s data solutions help manufacturers reduce CO₂ emissions, optimize supply chains, and automate customer service. These initiatives, championed by Susant Mallick, showcase the company’s commitment to profitable and socially responsible innovation .

Financial Services & Retail

Susant Mallick oversees cloud analytics, customer segmentation, and compliance for BFSI and retail clients. Using predictive models and AI agents, CloudHub helps improve personalization, fraud detection, and process automation .

Thought Leadership & Industry Recognition

Publications & Conferences

Susant Mallick shares his insights through platforms like CIO Today, CIO Business World, LinkedIn, and Time Iconic . He has delivered keynotes at HLTH Europe and DIA Real‑World Evidence conferences, highlighting AI in healthcare linkedin.

Awards & Accolades

Under Susant Mallick’s leadership, CloudHub has earned multiple awards — Top 10 Salesforce Solutions Provider, Tech Entrepreneur of the Year 2024, and IndustryWorld recognitions, affirming the company’s leadership in digital transformation.

Strategic Framework: CH‑AIR

GenAI Readiness with CH‑AIR

Susant Mallick introduced the CH‑AIR (CloudHub GenAI Readiness) framework to guide organizations through Gen AI adoption. The model assesses AI awareness, talent readiness, governance, and use‑case alignment to balance innovation with measurable value .

Dynamic and Data-Driven Approach

Under Susant Mallick, CH‑AIR provides a data‑driven roadmap — ensuring that new AI and cloud projects align with business goals and deliver scalable impact.

Vision for the Future

Towards Ethical Innovation

Susant Mallick advocates for ethical AI, governance, and transparency — encouraging enterprises to implement scalable, responsible technology. CloudHub promotes frameworks for continuous data security and compliance across platforms.

Scaling Global Impact

Looking ahead, Susant Mallick plans to expand CloudHub’s global footprint. Through technology partnerships, enterprise platforms, and new healthcare innovations, the goal is to catalyze transformation worldwide.

Conclusion

Under Susant Mallick’s leadership, CloudHub BV redefines what cloud and AI integration can achieve in healthcare, manufacturing, finance, and retail. From DataCube to Thinklee and the CH‑AIR framework, the organization delivers efficient, ethical, and high-impact digital solutions. As business landscapes evolve, Susant Mallick and CloudHub are well-positioned to shape the future of strategic, data-driven innovation.

0 notes

Text

Best Construction Finance Management Monitoring Software Solutions

Experience a new era of construction finance management with our futuristic software solutions that empower you to stay ahead of the competition. Streamline Construction Projects with Servosys, Intelligent Finance Management Software Solutions to Enhance your customer experience while managing & monitoring these processes.

#constructionfinancemanagment#constructionfinancemonitoring#bpms#bpm#bfsi#banks#nbfc#digitaltransformation#digitalinnovation#automation

0 notes