#Best Ny Merchant Cash Advance

Text

Optimizing Financial Health: Choosing Between Business Financing Solutions and Debt Consolidation

In the world of business, managing finances efficiently is as critical as any strategic business operation. Companies frequently encounter the challenge of balancing growth with financial stability. This is where understanding the intricacies of Business Financing Solutions and the role of Business Debt Consolidation Companies becomes crucial. Both options offer pathways to financial health but cater to different needs and situations.

Exploring Business Financing Solutions

merchant cash advance ny encompass a broad range of options designed to infuse capital into a company. These solutions include traditional loans, lines of credit, equity investments, and more innovative approaches like crowdfunding or peer-to-peer lending. Each option comes with its own set of advantages and suitability, depending on the company’s stage of growth, industry, and financial health.

For startups and expanding businesses, these financing solutions provide the necessary capital to scale operations, enter new markets, or enhance product offerings. For established businesses, they offer an opportunity to innovate or improve existing processes and technologies.

The Role of Business Debt Consolidation Companies

On the other side of the spectrum, Business Debt Consolidation Companies specialize in helping businesses manage and mitigate their existing debt. These companies offer services to consolidate multiple debt obligations into a single loan with a potentially lower interest rate and more favorable repayment terms.

The primary benefit of engaging with merchant cash debt is the simplification of financial management. By consolidating debts, businesses can enjoy a single, predictable payment schedule, which can help in better cash flow management and reduce financial stress. This strategy is particularly beneficial for businesses that have accumulated high-interest debts across various sources.

Making the Right Financial Choice

The choice between leveraging Business Financing Solutions and working with Business Debt Consolidation Companies depends on the specific financial circumstances and strategic goals of a business. For businesses aiming for expansion but held back by multiple debt payments, consolidation may free up necessary resources. Conversely, those looking for an infusion of capital to propel growth might find direct financing solutions more appropriate.

Businesses need to conduct a thorough assessment of their financial statements and projections to understand which option aligns best with their long-term objectives. Consulting with financial advisors or experts in corporate finance can provide deeper insights and guidance, ensuring that businesses make informed decisions that enhance their financial and operational health.

Conclusion

Whether navigating through options provided by Business Financing Solutions or seeking the aid of Business Debt Consolidation Companies, businesses have several paths to improving their financial posture. Understanding the nuances of each option and how they align with your business goals is crucial. For specialized assistance in navigating these complex financial landscapes, Grantphillipslaw.com offers expert legal and financial guidance. Their team can help decipher the best strategies for debt management and financing solutions, setting your business on the path to sustained growth and stability.

0 notes

Text

Merchant Cash Advance NY Apr Law | Grantphillipslaw.com

Get the best legal advice for your Merchant Cash Advance in NY with Grantphillipslaw.com. Our team specializes in Apr law to protect your business.

Merchant Cash Advance NY Apr Law

0 notes

Text

Looking for reliable and cost-effective payment processing solutions in Manhattan, NY? Look no further than Zero Fees Processing! We are your premier partner for all your payment processing needs, specializing in credit card processing services, card payment processing, and merchant services.

At Zero Fees Processing, we understand the importance of affordability for small businesses. That's why we offer no fee credit card processing, helping you save on transaction costs and increasing your profit margins. Say goodbye to hefty processing fees and hello to transparent and fair payment processing.

Our team is equipped with the best credit card terminals and cutting-edge technology to ensure seamless and secure transactions. We provide credit card processing machines specifically designed for small businesses, offering user-friendly interfaces and advanced security features to protect your customers' sensitive data.

As a trusted financial institution, Zero Fees Processing is committed to delivering exceptional customer service and tailored solutions. We work closely with you to understand your unique business needs and provide personalized merchant services that meet your requirements. Our dedicated team is always available to assist you with any inquiries or concerns you may have.

With Zero Fees Processing, you can streamline your payment processes, enhance your cash flow, and provide a convenient and secure payment experience for your customers. We take pride in our commitment to transparency, reliability, and affordability. Don't let high processing fees eat into your profits. Choose Zero Fees Processing as your payment processing partner in Manhattan, NY. Visit our website at zerofeesprocessingny.com to learn more about our services and take the first step towards efficient and cost-effective payment solutions for your business.

1 note

·

View note

Text

Business Loan Debt Settlement

Do you want some kind of Business Debt help? Then here is the solution for you. You can take help from Attorneys who rely on a combined experience of 35 yrs in Business Debt settlement and apart from this, they have been dealing with Best Ny Merchant Cash Advance Debt for the last 10 yrs.

0 notes

Text

Merchant Cash Advance New York, NY

Founded by entrepreneurs and financial experts alike, it took only a short time for BlueSky to become one of the most competitive cash advance companies in the industry. Our in-house approval and funding system lowers brokerage fees and allows us to offer a best rate guarantee to our clients. Call us today and experience the BlueSky difference for yourself.

Contact address: Sky Small Business Loans, 99 Wall Street #1003, New York, NY 10005, Phone: (212) 500-0110

1 note

·

View note

Text

Resolve Your Debts with Trustworthy Merchant Cash Advance Attorneys

Would you like to get a professional help from the skilled Merchant Cash Advance Attorney Missouri? You can always contact Grant Phillips Law. The expert specialists are always ready to provide you with a unique approach so that you can have your debt issues resolved fast and effectively. A merchant cash advance is a popular but sometimes it’s also a dangerous form of business funding. Many business cash-advances require a daily repayment which can be very stressful and challenging for a business. If you are also one of those people that has faced the same issue, hurry up to speak to the Merchant Cash Advance Attorney Missouri as early as possible. He can protect you from unsavory collection practices and help you resolve your debts.

Merchant Cash Advance is one of the most common types of financing. It is especially popular for small businesses. If you explore this cash advance, it will seem to be a good way to resolve your business’s cash flow problems. However, it is not considered to be the best solution. That is why you should never hesitate to contact the Merchant Cash Advance Attorney Maryland. Grant Phillips Law PLLC with the main office located in the Long Beach, NY area is committed to helping small businesses across the country. So if you seek business debt relief, simply get in touch with the Merchant Cash Advance Attorney Maryland. Do not let merchant cash advance bring so many problems and then eat up all of your business profits. Not all people can meet their daily payments, so if you are one of those people and you have no way out, get help from Grant Phillips Law, PLLC.

The office of Grant Phillips Law, PLLC has settled millions of dollars in debt with the lenders most often involved. Once you work with this team, you can renegotiate your loan. With the Merchant Cash Advance Attorney Minnesota, you will have a free consultation and discuss all the options with this expert. You will learn about how they can settle this debt for you. Gone are the days when you had to stick it out with your high-interest merchant cash advance. Contact the Merchant Cash Advance Attorney Minnesota if you are drowning in debt from a high-interest loan and see how perfect solutions you will get in the shortest possible time. The reasons why their merchant cash advance settlement services stand out are a lot. The best part is that this team offers fast response time and these specialists get back to their clients within 5 hours. You can also speak to an attorney at any time you need. The professionals will offer professional advice based on proven results. As they are in the business for 15 years, you can feel at ease that they will never leave you alone. No matter where you are in the country you can contact this firm in Long Beach, NY to set up a free business debt relief consultation. Grant Phillips Law is just once call away from you!

0 notes

Text

8 Online Guaranteed Installment Loans for Bad Credit

Getting approved for a bad credit loan is, in many ways, much like searching for a new job after graduation. Finding a job right out of school can feel like an impossible task: the professional jobs want you to have experience, and whatever job experience you may have had while going to school is typically not the right kind.

Having poor or limited credit is a very similar experience. Either you don’t have a well-established credit history — or you established it in the wrong way. After one, two, or even a series of rejections, it can leave you wondering, “Are any lenders guaranteed to accept me?”

While it’s not easy to find any hard-and-fast guarantees in the consumer credit world, what you can often find with relative abundance are lenders with flexible credit requirements that will take a chance on your poor or limited credit history. Below are the top options for finding a loan with bad credit:

Installment Loans | Short-Term Loans | Credit Cards

The Best Guaranteed “Installment” Loans for Bad Credit

Named for the method of repayment, installment loans are repaid through a series of regular, set installments — typically monthly payments. Personal installment loans are often a good way to finance purchases you need to repay over a period of months or years, as they can usually be obtained with lengths extending up to seven years.

Installment loans are often the best financing method for larger purchases, as well. In fact, our top-rated personal installment loan networks include lenders offering amounts up to $35,000 for qualified applicants.

1.MoneyMutual

START NOW »

Short-term loans up to $2,500Online marketplace of lendersFunds available in as few as 24 hoursSimple online form takes less than 5 minutesTrusted by more than 2,000,000 customersNot available in NYClick here for official site, terms, and details.

★★★★★

4.8

Overall RatingOur Review »

Loan AmountInterest RateLoan TermLoan ExampleUp to $2,500VariesVariesSee representative example

2.CashUSA.com

START NOW »

Loans from $500 to $10,000All credit types acceptedReceive a loan decision in minutesGet funds directly to your bank accountUse the loan for any purposeClick here for official site, terms, and details.

★★★★★

4.7

Overall Rating

Loan AmountInterest RateLoan TermLoan Example$500 to $10,0005.99% - 35.99%3 to 72 MonthsSee representative example

3.CreditLoan.com

START NOW »

Loans from $250 to $5,000Cash deposited directly into your accountGet money as soon as tomorrowBad credit OKMore than 750,000 customers since 1998Click here for official site, terms, and details.

★★★★★

4.6

Overall Rating

Loan AmountInterest RateLoan TermLoan Example$250 to $5,000VariesVariesSee representative example

+See More Installment Loans for Bad Credit

While individual requirements vary by lender, most lenders will have a few basic requirements to qualify for an installment loan, including the necessity of an active checking account. You’ll also typically need to meet minimum income requirements, which will vary based on your credit score and the size of your loan.

Additionally, when comparing personal installment loans, be sure to examine each factor of the loan, rather than solely focusing on the size of your monthly payment. That’s because the total cost of your loan will be determined by all the factors, including the APR, monthly payment, and the length of your loan.

For instance, it can be tempting to choose the longest loan possible so that your monthly payment is at its lowest. However, the longer you take to repay your loan, the more interest payments you’ll need to make, and the more your loan will end up costing you overall.

The Best Guaranteed “Short-Term” Loans for Bad Credit

Where personal installment loans are designed to finance larger and longer-term purchases, short-term loans are just that: short-term financing. Typically extending between a week and six months, short-term loans, sometimes called cash advance loans, are repaid in a single lump sum that includes both the principal loan amount and any applicable interest or finance charges.

Short-term loans are generally offered in smaller amounts than other loan products, with our expert-reviewed options providing short-term loans up to $2,500. Our providers include online lending networks that connect hundreds of lenders from around the country, meaning you can obtain multiple quotes with a single application.

4.MoneyMutual

START NOW »

Short-term loans up to $2,500Online marketplace of lendersFunds available in as few as 24 hoursSimple online form takes less than 5 minutesTrusted by more than 2,000,000 customersNot available in NYClick here for official site, terms, and details.

★★★★★

4.8

Overall RatingOur Review »

Loan AmountInterest RateLoan TermLoan ExampleUp to $2,500VariesVariesSee representative example

5.BadCreditLoans.com

START NOW »

Loans from $500 to $5,000Helping those with bad credit since 1998Get connected with a lenderSimple form & quick fundingGet your money as soon as next business dayClick here for official site, terms, and details.

★★★★★

4.6

Overall RatingOur Review »

Loan AmountInterest RateLoan TermLoan Example$500 to $5,0005.99% - 35.99%3 to 60 MonthsSee representative example

+See More Short-Term Loans for Bad Credit

While many short-term loan lenders offer flexible credit requirements — so flexible it’s practically guaranteed — that flexibility comes with a price. Namely, most short-term loans have particularly high interest rates. In fact, some short-term cash advance loans can have APRs in the hundreds of percentage points, with a 400% APR not unheard of (or even uncommon).

Another concern when it comes to short-term loans is ensuring you can repay the entire amount at the end of your loan, since you’ll be required to hand over the full loan amount plus all fees. If you can’t repay the full amount, you may be stuck paying substantial late fees on top of what you already owe.

In some cases, you may choose to extend your loan for another few weeks or months to avoid paying late fees, but it’ll cost you another round of finance charges to do so. If you know you will need a longer period of time to repay what you borrow, you may want to consider a personal installment loan instead of a short-term loan, as installment loans can be repaid in smaller monthly payments over six months or more.

The Best Guaranteed “Credit Cards” for Bad Credit

Although not often considered as a loan alternative, credit cards can be a handy form of financing for certain types of purchases. In particular, most occasions where you would consider a short-term loan, you can likely use a credit card instead. And, given that the average credit card charges an interest rate around 16%, using a credit card instead of a higher-APR short-term loan may actually be the more frugal choice.

The options for credit cards will include unsecured cards and secured cards. Due to the initial deposit requirement, secured credit cards are one of the few “guaranteed” forms of financing in the consumer credit world, as some may not even require a credit check at all. Start exploring your options with our list of top cards for bad credit.

6.Fingerhut Credit Account

APPLY HERE »

Easy application! Get a credit decision in seconds.Build your credit history – Fingerhut reports to all 3 major credit bureausUse your line of credit to shop thousands of items from great brands like Samsung, KitchenAid, and DeWaltNot an access cardClick here for official site, terms, and details.

★★★★★

4.8

Overall Rating

Application LengthInterest RateReports MonthlyReputation Score5 MinutesSee issuer websiteYes9.0/10

7.Total Visa® Card

APPLY HERE »

Checking account requiredFast and easy application process; response provided in secondsA genuine Visa card accepted by merchants nationwide across the USA and onlineManageable monthly paymentsIf approved, simply pay a program fee to open your account and access your available creditReports monthly to all three major credit bureausClick here for official site, terms, and details.

★★★★★

4.7

Overall Rating

Application LengthInterest RateReports MonthlyReputation Score9 MinutesSee termsYes8.5/10

8.First Access Solid Black VISA Credit Card

APPLY HERE »

Get the security and convenience of a full-feature, unsecured Visa® Credit Card – accepted at millions of merchant and ATM locations nationwide and onlineReporting monthly to all three major credit reporting agenciesPerfect credit not required for approval; we may approve you when others won’tEasy and secure online applicationIf approved, pay a Program Fee and you can access the $300 credit limit (subject to available credit)Click here for official site, terms, and details.

★★★★★

4.7

Overall Rating

Application LengthInterest RateReports MonthlyReputation Score10 MinutesSee TermsYes8.0/10

+See More Credit Cards for Bad Credit

One of the best things about using a credit card instead of a short-term loan is that you can potentially avoid paying interest entirely if you pay off your credit card before the end of your grace period. For most cards, the grace period is the time between when the charge is made, and when the bill for that charge is due. So long as you pay off your full balance before your billing date, you won’t be charged interest for that balance.

The thing to remember about credit cards is that they may come with a variety of fees that loans won’t include. For instance, most credit cards, particularly those for poor credit, will charge an annual fee, typically right when you open your account and then each year on your account anniversary.

Other common credit card fees include processing or program fees, which are generally one-time fees charged when you open your account. You may also be charged fees for using any extra card services, such as making a balance transfer or cash advance, but these can be avoided simply by not using these services.

Use Your Loan Wisely to Build Credit

While it can be difficult to find financing with poor or limited credit, options are out there, if you know where to look. And though few of those options are truly guaranteed, many lenders offer flexible requirements that are the next best thing.

Of course, the best way to guarantee your choice of financing in the future is to work hard to build your credit now. No matter which type of financing you choose, be it an installment loan, short-term loan, or credit card, you can use that financing to improve your credit — and, thus, improve your credit options.

In some ways, think of your new bad credit loan as that entry-level job right out of college. If you work hard and build the right kind of experience, you can expect to advance in your career. And if you use your new loan responsibly, making payments on-time and building your credit history in a positive way, you can expect your credit score to advance, too.

Read the full article

0 notes

Text

8 Online Guaranteed Installment Loans for Bad Credit

Getting approved for a bad credit loan is, in many ways, much like searching for a new job after graduation. Finding a job right out of school can feel like an impossible task: the professional jobs want you to have experience, and whatever job experience you may have had while going to school is typically not the right kind.

Having poor or limited credit is a very similar experience. Either you don’t have a well-established credit history — or you established it in the wrong way. After one, two, or even a series of rejections, it can leave you wondering, “Are any lenders guaranteed to accept me?”

While it’s not easy to find any hard-and-fast guarantees in the consumer credit world, what you can often find with relative abundance are lenders with flexible credit requirements that will take a chance on your poor or limited credit history. Below are the top options for finding a loan with bad credit:

Installment Loans | Short-Term Loans | Credit Cards

The Best Guaranteed “Installment” Loans for Bad Credit

Named for the method of repayment, installment loans are repaid through a series of regular, set installments — typically monthly payments. Personal installment loans are often a good way to finance purchases you need to repay over a period of months or years, as they can usually be obtained with lengths extending up to seven years.

Installment loans are often the best financing method for larger purchases, as well. In fact, our top-rated personal installment loan networks include lenders offering amounts up to $35,000 for qualified applicants.

1.MoneyMutual

START NOW »

Short-term loans up to $2,500Online marketplace of lendersFunds available in as few as 24 hoursSimple online form takes less than 5 minutesTrusted by more than 2,000,000 customersNot available in NYClick here for official site, terms, and details.

★★★★★

4.8

Overall RatingOur Review »

Loan AmountInterest RateLoan TermLoan ExampleUp to $2,500VariesVariesSee representative example

2.CashUSA.com

START NOW »

Loans from $500 to $10,000All credit types acceptedReceive a loan decision in minutesGet funds directly to your bank accountUse the loan for any purposeClick here for official site, terms, and details.

★★★★★

4.7

Overall Rating

Loan AmountInterest RateLoan TermLoan Example$500 to $10,0005.99% - 35.99%3 to 72 MonthsSee representative example

3.CreditLoan.com

START NOW »

Loans from $250 to $5,000Cash deposited directly into your accountGet money as soon as tomorrowBad credit OKMore than 750,000 customers since 1998Click here for official site, terms, and details.

★★★★★

4.6

Overall Rating

Loan AmountInterest RateLoan TermLoan Example$250 to $5,000VariesVariesSee representative example

+See More Installment Loans for Bad Credit

While individual requirements vary by lender, most lenders will have a few basic requirements to qualify for an installment loan, including the necessity of an active checking account. You’ll also typically need to meet minimum income requirements, which will vary based on your credit score and the size of your loan.

Additionally, when comparing personal installment loans, be sure to examine each factor of the loan, rather than solely focusing on the size of your monthly payment. That’s because the total cost of your loan will be determined by all the factors, including the APR, monthly payment, and the length of your loan.

For instance, it can be tempting to choose the longest loan possible so that your monthly payment is at its lowest. However, the longer you take to repay your loan, the more interest payments you’ll need to make, and the more your loan will end up costing you overall.

The Best Guaranteed “Short-Term” Loans for Bad Credit

Where personal installment loans are designed to finance larger and longer-term purchases, short-term loans are just that: short-term financing. Typically extending between a week and six months, short-term loans, sometimes called cash advance loans, are repaid in a single lump sum that includes both the principal loan amount and any applicable interest or finance charges.

Short-term loans are generally offered in smaller amounts than other loan products, with our expert-reviewed options providing short-term loans up to $2,500. Our providers include online lending networks that connect hundreds of lenders from around the country, meaning you can obtain multiple quotes with a single application.

4.MoneyMutual

START NOW »

Short-term loans up to $2,500Online marketplace of lendersFunds available in as few as 24 hoursSimple online form takes less than 5 minutesTrusted by more than 2,000,000 customersNot available in NYClick here for official site, terms, and details.

★★★★★

4.8

Overall RatingOur Review »

Loan AmountInterest RateLoan TermLoan ExampleUp to $2,500VariesVariesSee representative example

5.BadCreditLoans.com

START NOW »

Loans from $500 to $5,000Helping those with bad credit since 1998Get connected with a lenderSimple form & quick fundingGet your money as soon as next business dayClick here for official site, terms, and details.

★★★★★

4.6

Overall RatingOur Review »

Loan AmountInterest RateLoan TermLoan Example$500 to $5,0005.99% - 35.99%3 to 60 MonthsSee representative example

+See More Short-Term Loans for Bad Credit

While many short-term loan lenders offer flexible credit requirements — so flexible it’s practically guaranteed — that flexibility comes with a price. Namely, most short-term loans have particularly high interest rates. In fact, some short-term cash advance loans can have APRs in the hundreds of percentage points, with a 400% APR not unheard of (or even uncommon).

Another concern when it comes to short-term loans is ensuring you can repay the entire amount at the end of your loan, since you’ll be required to hand over the full loan amount plus all fees. If you can’t repay the full amount, you may be stuck paying substantial late fees on top of what you already owe.

In some cases, you may choose to extend your loan for another few weeks or months to avoid paying late fees, but it’ll cost you another round of finance charges to do so. If you know you will need a longer period of time to repay what you borrow, you may want to consider a personal installment loan instead of a short-term loan, as installment loans can be repaid in smaller monthly payments over six months or more.

The Best Guaranteed “Credit Cards” for Bad Credit

Although not often considered as a loan alternative, credit cards can be a handy form of financing for certain types of purchases. In particular, most occasions where you would consider a short-term loan, you can likely use a credit card instead. And, given that the average credit card charges an interest rate around 16%, using a credit card instead of a higher-APR short-term loan may actually be the more frugal choice.

The options for credit cards will include unsecured cards and secured cards. Due to the initial deposit requirement, secured credit cards are one of the few “guaranteed” forms of financing in the consumer credit world, as some may not even require a credit check at all. Start exploring your options with our list of top cards for bad credit.

6.Fingerhut Credit Account

APPLY HERE »

Easy application! Get a credit decision in seconds.Build your credit history – Fingerhut reports to all 3 major credit bureausUse your line of credit to shop thousands of items from great brands like Samsung, KitchenAid, and DeWaltNot an access cardClick here for official site, terms, and details.

★★★★★

4.8

Overall Rating

Application LengthInterest RateReports MonthlyReputation Score5 MinutesSee issuer websiteYes9.0/10

7.Total Visa® Card

APPLY HERE »

Checking account requiredFast and easy application process; response provided in secondsA genuine Visa card accepted by merchants nationwide across the USA and onlineManageable monthly paymentsIf approved, simply pay a program fee to open your account and access your available creditReports monthly to all three major credit bureausClick here for official site, terms, and details.

★★★★★

4.7

Overall Rating

Application LengthInterest RateReports MonthlyReputation Score9 MinutesSee termsYes8.5/10

8.First Access Solid Black VISA Credit Card

APPLY HERE »

Get the security and convenience of a full-feature, unsecured Visa® Credit Card – accepted at millions of merchant and ATM locations nationwide and onlineReporting monthly to all three major credit reporting agenciesPerfect credit not required for approval; we may approve you when others won’tEasy and secure online applicationIf approved, pay a Program Fee and you can access the $300 credit limit (subject to available credit)Click here for official site, terms, and details.

★★★★★

4.7

Overall Rating

Application LengthInterest RateReports MonthlyReputation Score10 MinutesSee TermsYes8.0/10

+See More Credit Cards for Bad Credit

One of the best things about using a credit card instead of a short-term loan is that you can potentially avoid paying interest entirely if you pay off your credit card before the end of your grace period. For most cards, the grace period is the time between when the charge is made, and when the bill for that charge is due. So long as you pay off your full balance before your billing date, you won’t be charged interest for that balance.

The thing to remember about credit cards is that they may come with a variety of fees that loans won’t include. For instance, most credit cards, particularly those for poor credit, will charge an annual fee, typically right when you open your account and then each year on your account anniversary.

Other common credit card fees include processing or program fees, which are generally one-time fees charged when you open your account. You may also be charged fees for using any extra card services, such as making a balance transfer or cash advance, but these can be avoided simply by not using these services.

Use Your Loan Wisely to Build Credit

While it can be difficult to find financing with poor or limited credit, options are out there, if you know where to look. And though few of those options are truly guaranteed, many lenders offer flexible requirements that are the next best thing.

Of course, the best way to guarantee your choice of financing in the future is to work hard to build your credit now. No matter which type of financing you choose, be it an installment loan, short-term loan, or credit card, you can use that financing to improve your credit — and, thus, improve your credit options.

In some ways, think of your new bad credit loan as that entry-level job right out of college. If you work hard and build the right kind of experience, you can expect to advance in your career. And if you use your new loan responsibly, making payments on-time and building your credit history in a positive way, you can expect your credit score to advance, too.

Read the full article

0 notes

Text

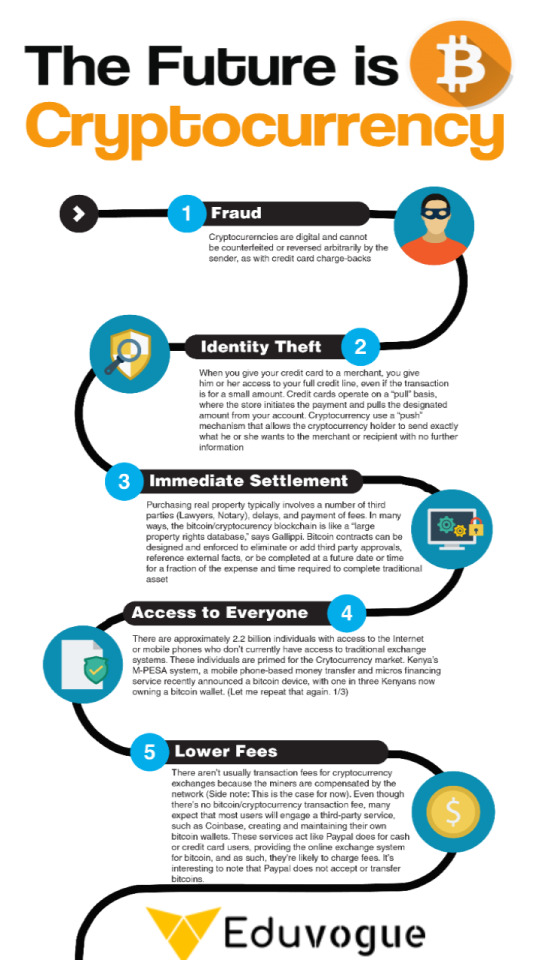

4 ADVANTAGES OF ACCEPTING CRYPTOCURRENCY IN YOUR BUSINESS

A cryptocurrency may be a digital currency that's created and managed through the utilization of advanced secret writing techniques referred to as cryptography. Cryptocurrency created the leap from being a tutorial idea to (virtual) reality with the creation of Bitcoin in 2009. While Bitcoin attracted a growing following in resulting years, it is now best of rest as a future of transaction captured important capitalist and media attention in Gregorian calendar month 2013 once it peaked at a record $266 per bitcoin onc surging 10-fold in the preceding two months. Bitcoin sported a value of over $2 billion at its peak, however a five hundredth plunge shortly thenceforth sparked a raging dialogue concerning the long run of cryptocurrencies generally and Bitcoin in particular.So, can these different currencies eventually supervene upon typical currencies and become as present as greenbacks and euros someday? Or ar cryptocurrencies a passing furor which will flame out before long?The answer lies with Bitcoin.

As a business owner, a part of your responsibility is to make sure that you just supply completely different sorts ofpayment for purchasers and customers. This includes newer sorts of payment furthermore, like acceptive cryptocurrency.Cryptocurrency has been creating a splash in recent years because the way forward for payments. Major firms like Microsoft currently settle for it as a kind of payment, 2 NY town colleges currently settle for it as tuition payment and Bitcoin alone has up nearly 900% in two years.

Many small businesses – like coffee shops and restaurants – have also begun accepting cryprocurrency as a form of valid payment. This points to the fact that cryptocurrency may be here to stay. Here are x advantages to accepting cryptocurrency in your business.

LOWER TRANSACTION FEES.

It’s no secret that small businesses are getting creamed by processing fees, so accepting cryptocurrency can help mititgate the sting. By general rule, cryptocurrency has lower per transaction fees than accepting credit cards and debit cards. This is the most important advantage of cryptocurrency

With credit and debit, you’re looking at at least 3 percent transaction fees plus multiple hidden feees. Meanwhile, with cryptocurrency like Bitcoin, it is said that merchants can reduce their fees to less than one percent.

FRAUD PROTECTION.

Part of the appeal of accepting cryptocurrency in your business is fraud protection. With cryptocurrency, clients and customers don’t need to give you personal financial information.

This is in the same way PayPal acts as the third party between consumer and merchant. The only difference is the third party would be sending and receiving cryptocurrency like Bitcoin.

In a time when criminals are getting better at hacking small businesses to get customer financials, this added layer of security can give everyone peace of mind.

YOU GET THE MONEY FASTER.

When accepting credit and debit card payments, business owners may not see that money for a while. Because of all the parties involved, and because they all have different rules, it could be anywhere from a couple of days to an entire week before they see the money hit their bank account. This can be incredibly frustrating when you need cash flow, have bills to pay and need to make payroll.

The good news is this usually isn’t the case with cryptocurrency. This means business owners can have faster access to cash so they can keep their business running.

CRYPTOCURRENCY EASES FOREIGN PAYMENTS.

Many businesses are weary of going global because currency exchange and foreign transaction fees are an accounting nightmare. They can also be very expensive. While some intermediaries like PayPal have tried to alleviate this, you’re still looking at a 3.9% fee to accept foreign payments.

Again, cryptocurrency comes to the rescue. Because cryptocurrency like Bitcoin is global, it removes this headache from the equation. This makes it easier for merchants to expand beyond their own borders without having to worry about the costly consequences. There’s no comparison between $0 and a 3.9% fee.

FINAL THOUGHTS

Because cryptocurrencies are becoming more commonplace, small businesses may want to consider accepting cryptocurrency as a form of payment. Not only will your customers likely be more inclined to use it now, but there are also some advantages for you as a business owner. Thank you for reading and stay tune for my next blog on “how to earn faster with less investment in bitcoins”

0 notes

Link

Are you a small business owner who needs to raise capital quickly? A merchant cash advance (MCA) can be a good deal. MCA is not typically a loan. It’s a form of financing that allows your firm to sell a portion of your future sales in exchange for getting an immediate payment. Want to cover your payroll or sudden business expense? Get the merchant cash advance service in Brooklyn today!

#Merchant Cash Advance Service Brooklyn#Best Small Business Lines Of Credit Brooklyn NY#Business Funding Loans NYC#Small Business Loans In New York#Business Property Loans In NY

0 notes

Text

7 Reward Of Online Cash Advance Loans And How You Can Build Full Use Of It

It's a good idea to take the time it's essential to get emergency cash the perfect and most manageable way in your specific monetary scenario. Worse, though, is that interest on cash advances begins build up on the day you are taking out the Online Cash Advance Loans - there's normally no grace interval. Ny (ap) — the lenders who advance poor individuals cash on their paychecks cost exorbitant rates of interest that usually snare probably the most vulnerable prospects in a cycle of debt, the business's critics have long said.From paying off your stability in full to avoiding money advances, read suggestions for preventing financial disasters utilizing bank cards. In addition to 1 % cash back on each day spending, the uncover it card comes with quarterly 5 percent cash again bonus classes.

We pull out our bank card, and pay for something online, simply to comprehend we simply signed up for one thing that won't work. It was noted that this was a violation of the rules governing the discharge, use and liquidation of cash advances. Overall a Online Cash Advances is something it's best to think about if you're in a dire financial scenario. It units up unrealistic expectation that this show, nor another show, can stay as much as. The same tv lists for $1939 no tax and free shipping from after all the reward card cannot be used there. Understanding all of the interest rates on your bank card will be confusing to learn and understand. You never know once you may fall in to any type of money hassle, in that case it is you the way needs to stay up for fill in the abrupt money trauma.

This data holds effectively for the service provider money advance industry because the sum of money a restaurant and/or bar can qualify for is predicated on their month-to-month historic credit / debit card processing totals. Many qualified retirees have no idea that they will sell a particular portion of their pension income stream in change for lump sum pension money advance to cowl an sudden life event and even finance a life alternative. Earlier than making use of for cash, spend some time to depend all the costs to be able to know for certain whether or Cash Advance Direct Lenders Only possibility is beyond your purse as a result of it contains cash advance charge, have no grace period, and better rate of interest compared with purchases. There are debtors who proceed to go for multiple loans with a view to settle a cash advance they could have rolled over a number of instances. Loans requested after 7:forty five pm eastern time on sunday will typically fund the next tuesday. Mid illini credit score union provides two different playing cards that come with no cash advance charges. How it works: the blue money most well-liked is our high choose for cardholders that need to maximize cash back on groceries.

When your enterprise accepts about $5,000 minimum in bank card sales and you do not have records of open bankruptcies, then you'll be able to easily and quickly get certified. Don't miss ration of the memento funds over not lone will veritable ruin your possibilities of getting other money advances from that company prerogative the unfolding, but additionally, you will retain to pay suspicion. To be eligible for this non-obligatory fee plan, have $500 deposited during one calendar month. There are lots of service provider money cloud lenders that present companies online via their tracking programs. Like the best purchase card, this card presents 5 p.c off of all purchases or special financing options. The important thing to maximizing these great cash back card presents is to seek out the cards that supply cash back in categories you utilize essentially the most. You could possibly positively not want to purchase a brand new automobile with the assistance of fast money portland oregon. Shifting forward, the business agrees to have 15% of its credit card transactions withheld by the Cash Advance Companies company (the holdback) till the $13,000 is collected. Together with your financial loans you receive an fringe of not putting any helpful property of the one you have got threatened since these are unsecured bank card anyway. Therefore, by giving out a money advance, a bank stands more to lose and increases the danger it takes on. The result of this increased threat is the elevated fees and interest which we discussed above. Advance america applications processed earlier than eight p.m.

Et are typically funded the next banking day, but exceptions could apply. Caveat: penfed is a credit score union, so you could first become a member of the credit score union as a way to be eligible. Necessary data for opening a brand new card account: to assist the federal authorities combat the funding of terrorism and cash laundering actions, the usa patriot act requires all financial institutions and their third events to acquire, verify, and document info that identifies every one who opens a card account. You're really not going to have the earnings and you've got already run up all this debt on a bank card to try to hold your life-style the identical. Merchant Cash Advance Companies of many greatest issues many people with unhealthy or poor credit score have is finding lenders that can work with them. You are beneath no obligation to use our free service to provoke contact, or request credit score with any lenders. For taking place if there's any incidence it power get for us to spend whatsoever we characteristic and we may still say extra money to encounter our bills to pay our monthly payments or the monthly installments of our loans. Cash converters united kingdom price ticket any selected cost regarding 33. It has 5% for the buybacks via a option to commit the off of take price subsequent thirty days.

0 notes

Text

Headline News from PaymentsNews.com - January 25, 2017 http://ift.tt/2ksFrig

Headline News is brought to you by Glenbrook Partners. Glenbrook provides payments strategy consulting and education services to payments professionals worldwide!

ON THE WEB

Banks and Credit Unions Expect Bigger Tech Budgets in 2017 - Wall Street Journal CIO Journal blog - "A majority of community-based financial institutions expect technology spending to grow 1% to 10% in 2017 from last year as they look to improve the utilization of technology across digital banking, customer relationship management and IT systems, a new survey says."

Thai Digital-Payment System May Save Banks $2 Billion - Bloomberg - "Thailand is due to roll out a national digital-payment system that levies much smaller transaction fees than the nation’s banks. Yet lenders expect the network to help rather than hinder them financially. Commercial banks could save some 77 billion baht ($2.18 billion) in the next 10 years as the so-called PromptPay service curbs the use of cash, according to Thai Bankers’ Association Chairman Predee Daochai. That will exceed the revenue loss from money transfers and payments by 20 billion baht, he said."

J.P. Morgan, Intuit Give Mint, TurboTax Customers Wider Access to Bank Data - Wall Street Journal - "J.P. Morgan Chase & Co. and Intuit Inc. have ended a long standoff with a new agreement to let the bank’s customers check account information on the technology firm’s sites without sharing their Chase passwords. The nation’s largest bank struck the deal with the owner of Mint.com, TurboTax Online and QuickBooks Online in an effort to ease tension with operators of increasingly popular personal-finance websites and applications, the companies said. "

UNITED AIRLINES TO ACCEPT UNIONPAY CREDIT CARDS FOR ONLINE TICKET BOOKING - Cards International - "United Airlines, UnionPay International and Planet Payment have teamed up to facilitate UnionPay credit card acceptance with the airlines for reservations and other ticketing purchases online and through call centres. The first phase of this launch will support the acceptance of UnionPay credit cards while acceptance of UnionPay Debit cards expected will be introduced at a later date."

Fintech sector needs more regulatory oversight: Bundesbank - Reuters - "Financial technology companies require greater oversight because they have the potential to disrupt the banking industry and could threaten financial stability, Bundesbank President Jens Weidmann said on Wednesday. So-called Fintechs typically use advances in technology to provide cheap and easy-to-access services, from transfers and trading to crowdfunding, operating largely outside of banking regulations. "Getting a clearer picture of fintechs' business activities is essential if we are to better understand whether and in what way they might pose a threat to financial stability," said Weidmann, who sits on the European Central Bank's Governing Council."

Biller Bill-Pay Sites Crush Bank Sites While Both Camps Look to Faster-Payment Offerings - Digital Transactions News - "In the battle over online bill payments, biller sites have been beating bank and third-party sites handily, but now the battle has turned into a rout. Biller sites accounted for fully 73% of online bills paid by consumers last year, up from 62% in 2010, according to a report released Tuesday by Boston-based research firm Aite Group and sponsored by Naples, Fla.-based payments-technology vendor ACI Worldwide Inc."

Google brings HCE payments to Android Wear 2.0 - NFC World - "Google is adding support for host card emulation (HCE) based NFC payments to smartwatches in Android Wear 2.0, the new version of its operating system for smartwatches which is scheduled to be released in early February 2017."

PayPal users can now deposit cash at any 7-Eleven - Mobile Commerce Daily - "“By allowing consumers to buy a card with cash and then use it to pre-load a PayPal account, they give consumers a safe, secure ‘bank’ with instant access via any of the 15 Million stores that that accept PayPal, whether that’s online or in-store. The 7-Eleven shopper demographic is one that is perhaps less likely to have a PayPal account already, so this move also drives more sign-ups to PayPal, who see a transaction fee from merchants when PayPal is used to pay for things.”"

Smartphone screen size linked to e-commerce sales uplift - ComputerWeekly - "Sean McGee, director of e-commerce at Schuh, said screen size is what matters, with uplifts in e-commerce sales correlating with the introduction of larger screen smartphones. “The bigger the screen, the better the conversion rate,” he added. According to IMRG’s index, sales from mobile devices lifted with the introduction of the iPhone 6 in 2014. Samsung similarly lifted mobile e-commerce sales in 2016."

ON THE WIRES

Zoho Launches Checkout; Empowers Businesses to Collect Online Payments with Ease - "Zoho, the leading cloud-based business operating system, today unveiled Zoho Checkout, a payments solution that allows businesses to create customized, secure checkout pages without requiring the technical expertise traditionally needed to set up checkout pages. Ideal for businesses of all sizes and across industries, Zoho Checkout delivers flexible payment options, real-time analytics, and customizable design. Zoho Checkout is the latest addition to the Zoho Finance Suite, one of the most comprehensive cloud-based financial applications in the market today."

Piggy, a New Automatic Coupon and Cashback Rewards Service, Makes Saving Money and Earning Rewards Dead Simple - "Everyone loves to save money, but it takes a lot of time and effort to search for available discounts and coupons before making online purchases. Piggy, a new coupon and cashback rewards service, changes that with patent-pending browser extensions that make savings automatic and simple. A free, 5-star rated browser add-on that works on Google Chrome, Safari and Firefox, Piggy scours the internet for the best deals and coupons for more than 2,000 major retailers, automatically adds discounts to the user's cart at checkout and gives customers cashback rewards on their purchases."

GLENBROOK PAYMENTS EDUCATION EVENTS

Our next Glenbrook payments education events are in San Jose, CA, New York, NY, and Atlanta, GA. See our spring schedule here. We hope to see you there!

Bring your colleagues along! Group discounts are available. For more information or to learn about our private workshops conducted at your location, contact Glenbrook's Russ Jones.

UPDATES FROM GLENBROOK

Join us at the 2017 FinTech Georgia Symposium February 9! Glenbrook is a proud sponsor of the 2017 FinTech Georgia symposium. Join us for this great event on February 9 in Atlanta. Reach out to Glenbrook's Elizabeth McQuerry, a board member of the Technology Association of Georgia, to schedule a meeting with the Glenbrook partners in town for the symposium.

We're hiring! Passionate about payments? Love solving tough client problems? If that describes you, come join us! Click here to learn more!

Join our mailing list for updates about Glenbrook events. Follow us on Twitter: @paymentsnews and @paymentsviews

Click here to share PaymentsNews with a friend

Note: Headline News is compiled by Glenbrook Partners. Throughout the day, as we spot interesting developments, this post is updated. Do you have news to share? Tell us here: [email protected]!

from Payments News - from Glenbrook Partners http://ift.tt/2ksFrig

via IFTTT

0 notes