#Binance Exchange Number

Text

First Time Investing in Crypto: Tips for New Traders on the Digital Coin Market

This has changed the financial landscape for good; it is the first time in history that investors have a share of this type since cryptocurrency entered the market. But then again, getting into the crypto market to begin with can be incredibly intimidating for a novice. This includes some key tips that you must know for making trade-offs more intelligent and how to invest in cryptocurrencies.

1. Understand the Basics

Understand the basic principles of what Cryptocurrency is, how it works before you invest. If you're unfamiliar, cryptocurrencies are basically decentralized systems, operating with a peer-to-peer framework, that let users do all sorts of things like get rewards for paying on time or using an app. Because they are not organically produced like typical tender, these financial tools are meant to be circulated in a decentralized way via blockchain networks. Educate yourself onwards like blockchain, altcoins, wallets and exchanges.

2. Do Your Research

The value of cryptocurrencies is influenced by a number of factors, and this makes it an extremely volatile market. Learn about various cryptocurrencies and how they are used. Tools like CoinMarketCap and CoinGecko show trends, rankings other handy information regarding ranging and past data. Follow us on Twitter for more news and updates on the Bitcoin space.

3. Diversify Your Portfolio

Investors apply diversification in their investment strategies. Diversify by investing in multiple cryptocurrencies I mean, everyone knows Bitcoin and Ethereum — why not looking a little bit further down the line at some promising altcoins with real fundamentals. A healthy mix of investments can ensure you have a little exposure to any type of gain or loss that may arise.

4. Only Invest What You Can Afford to Lose

The world of crypto is such that even the prices can and do tend to rise or crash in a jiffy, thanks to high volatility. Gamble only with money you can afford to lose without impacting your finances. Never borrow to invest in crypto or use your emergency savings for crypto investing. This approach ensures that you still are able to stay financially safe in case there's a downtrend.

5. Choose a Reliable Exchange

It is important to be sure that you deal with reliable cryptocurrency exchanges for safe trading. Search for exchanges with strong security protocols, a simple UI, and broad coin support. Some of the most trusted exchanges that people have been using include Binance, Coinbase and Kraken. Are they regulated and insured for digital assets.

6. Secure Your Investments

In the world of crypto, security is vital. Keep your cryptocurrencies on hardware wallets or in cold storage solutions; simply turn on 2FA in your exchange accounts and do not publish or disclose the private keys. Keep your software up to date and watch out for phishing attacks and malware.

7. Stay Informed and Adapt

As we know the crypto market is alive and never takes a nap. Learn from the market, regulatory and tech changes. Engage in some of the crypto community forums on platforms like Reddit, Twitter and Telegram to get the benefits of inside knowledge from other investors. Change your investment plan based on new informational and market circumstances

8. Have a Long-Term Perspective

Although there is money in short-term trading, it often requires quite a bit of time and skill to excel what you do. Long term investment strategy If you are beginner, Long term is the best way for you to invest your money from beginning. Look at the long term growth potential of cryptocurrencies instead of trying to make a quick buck. I read many books and listend to a lot of podcasts about the stock market, nearly all these sources agreed that patience and discipline was key to becoming a successful long-term investor.

9. Seek Professional Advice

If you are uncertain about the investments, you can get help from financial advisors or even some crypto experts. They can offer some personalized advice, depending on your financial goals and comfort with risk. Expert help will make it easier for you to manage the particularly volatile world of crypto.

Conclusion

Investing in cryptocurrency can also be a lucrative endeavor as long the trader is well-versed when it comes to his or her craft. These basic principles, combined with extensive research, establishing a diversified portfolio, and security first will put you in good stead on your crypto investment journey. The key is to stay informed, adapt and think long-term in order for you to succeed.

#crypto#cryptocurrency#cryptocurreny trading#cryptocommunity#investing#economy#investment#bitcoin#ethereum#blockchain#personal finance#finance

2 notes

·

View notes

Text

Binance: World’s largest exchange

To gain further insight into Binance, it is necessary to first comprehend the notion of cryptocurrencies. Despite its boom, a lot of people these days are unaware of what cryptocurrencies actually are. A cryptocurrency is a kind of digital or virtual money that is protected by cryptography and is very difficult to fake or spend twice. Blockchain-based decentralized networks underpin a large number of coins.

In terms of the amount of cryptocurrency traded every day, Binance is the biggest cryptocurrency exchange in the world.[2] It is registered in the Cayman Islands and was established in 2017.

Changpeng Zhao, a developer who had previously worked on high-frequency trading software, launched Binance. China was the original home of Binance, but as cryptocurrency regulation in China grew, the company relocated its offices outside of the country.

Following the Chinese government's prohibition on cryptocurrency trading in September 2017, the company was compelled to exit the country. Since then, it has offices in Taiwan and Japan. Currently, Malta serves as its base.

The goal of Binance is to attract as many users as possible. The exchange offers enough currencies and functionality to satisfy experienced traders while remaining user-friendly enough for beginners. For cryptocurrency traders of practically any experience level, I would suggest Binance.

The biggest cryptocurrency trading platform worldwide is called Binance.1. It is not very user-friendly, despite having a wide range of trading options and features. Depending on their level of experience and education, investors may encounter a challenging learning curve when using Binance.

Binance provides a vast range of trading options, such as an amazing assortment of market charts and hundreds of cryptocurrencies, through its desktop or mobile dashboards. In addition, a range of order types and trading alternatives, such as options and futures, are available to users. Only more than 65 cryptocurrencies are accessible to American consumers, and many services and possibilities are unavailable in the country.

Binance offers a thorough learning platform, an NFT platform, and more in addition to its tools and services. US clients don't seem to have access to the NFT marketplace just now.

Only more than 65 of the more than 365 cryptocurrencies that Binance offers for trading are accessible in the United States. It also supports a range of fiat currencies, such as USD, EUR, AUD, GBP, HKD, and INR, for users who are located abroad. Binance offers an extensive selection of cryptocurrency pairs based on your region.

Binance Coin (BNB), VeChain (VET), Harmony (ONE), VeThor Token (VTHO), Dogecoin (DOGE), and Matic Network (MATIC) are a few of the cryptocurrencies that are available on Binance U.S. Furthermore, Binance accepts well-known cryptocurrencies like:

Dash (DASH)

Cosmos (ATOM)

Compound (COMP)

Bitcoin (BTC)

Ethereum (ETH)

Litecoin (LTC)

Cardano (ADA)

For more information>>

#CryptoExchange#Binance#Cryptocurrency#Blockchain#CryptoTrading#CryptocurrencyExchange#Bitcoin#Finance#CryptoNews

2 notes

·

View notes

Text

How to Be a Great Cryptocurrency Trader

Because the cryptocurrency market is so volatile, trading cryptocurrencies can be both extremely rewarding and extremely difficult. You need to have a disciplined mindset, create winning tactics, and comprehend the market in order to become a profitable cryptocurrency trader. In plain words, this post will walk you through the fundamentals of becoming a successful bitcoin trader.

Understanding the Cryptocurrency Market

What is Cryptocurrency?

Cryptocurrency is a type of virtual or digital money that is secured by encryption. On decentralized networks powered by blockchain technology, cryptocurrencies function differently from conventional currencies that are issued by governments. Since the creation of the first cryptocurrency, Bitcoin, in 2009, many more have been produced.

How Does Cryptocurrency Trading Work?

Buying and selling virtual currencies with the intention of turning a profit is known as cryptocurrency trading. Cryptocurrency trading is available on a number of exchanges, including Binance, Coinbase, and Kraken. The value of cryptocurrencies varies according on news about regulations, technological developments, market demand, and general economic conditions.

Steps to Becoming a Great Cryptocurrency Trader

1. Educate Yourself

Learning about the market is the first step to becoming a great bitcoin trader. Here are some crucial aspects to pay attention to:

Blockchain Technology: Recognize the foundations of blockchain technology, which underpins cryptocurrencies.

Different Cryptocurrencies: Discover the several cryptocurrencies, the applications for them, and the underlying technology.

Market Analysis: Examine both fundamental analysis—which assesses a cryptocurrency's worth and potential—and technical analysis, which makes use of charts and indicators.

Trading Platforms: Learn about the features of the various cryptocurrency exchanges.

2. Create a Trading Plan

A detailed strategy including your trading objectives, risk tolerance, and techniques is called a trading plan. Here's how to draft a successful trading strategy:

Set Clear Goals: Establish both your short- and long-term trading objectives. Do you want to invest for the long term or are you just looking for immediate returns?

Risk Management: Determine the amount of money you are ready to lose on each deal. It's customary to never risk more than 1% to 2% of your entire capital in a single transaction.

Entry and Exit Strategies: Establish the parameters by which you will enter and exit deals. This could be determined by other variables, news stories, or technical indicators.

Record Keeping: To keep track of your deals, including the reasons you entered and left each deal as well as the results, keep a trading journal.

3. Choose the Right Trading Platform

The trading platform you choose will determine how successful you are as a bitcoin trader. Here are some things to think about:

Security: Select a platform that offers strong security features to safeguard your money..

Fees:Examine and contrast the trading costs offered by various platforms.

User Interface:Seek for a platform with an interface that is easy to use and intuitive.

Liquidity: Make sure there is a lot of liquidity on the platform so you can buy and sell cryptocurrencies fast.

4. Practice with Paper Trading

It's a good idea to practice with paper trading before risking real money. Paper trading is the practice of mimicking deals with virtual currency. As a result, you may practice using the trading platform and test your trading techniques without having to worry about losing real money.

5. Start Small

When the time comes for you to start trading with real money, start modest with your funds. In this manner, you may control your risk and earn experience without having to risk a sizable amount of your money. You can progressively increase your trading capital as you gain success and confidence.

Developing Effective Trading Strategies

1. Technical Analysis

In technical analysis, price charts are examined, and indicators are used to forecast future price movements. Here are some essential instruments and ideas:

Candlestick Charts: The opening, closing, high, and low prices for a certain time period are shown in these charts. Future price fluctuations may be indicated by candlestick patterns.

Moving Averages: These average prices over a given time span might be used to spot trends. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) are the two most used varieties.

Relative Strength Index (RSI): The pace and variation of price fluctuations are measured by this momentum indicator. Overbought situations are indicated by an RSI above 70, while oversold conditions are indicated by an RSI below 30.

MACD (Moving Average Convergence Divergence): This indicator can be used to detect changes in momentum and trends by displaying the connection between two moving averages.

2. Fundamental Analysis

Evaluating a cryptocurrency's inherent worth is a component of fundamental analysis. Here are some things to think about:

Technology: Examine the underlying technologies behind cryptocurrencies. Does it tackle problems in the actual world and is it innovative?

Team: Examine the underlying technologies behind cryptocurrencies. Does it tackle problems in the actual world and is it innovative?

Adoption: Take a look at how widely used and adopted cryptocurrencies are. Are practical uses for it being made?

Partnerships: Think about the alliances and groups the initiative has brought together. Robust alliances may portend a bright future.

3. Sentiment Analysis

Evaluating investor sentiment and market sentiment are key components of sentiment analysis. Here are a few methods for performing sentiment analysis:

News and Social Media: Keep an eye on forums, social media, and news articles for conversations and viewpoints regarding cryptocurrency.

Market Sentiment Indicators: Use resources such as the Crypto Fear and Greed Index, which gauges sentiment in the market by looking at a number of different variables.

Managing Risk

1. Diversify Your Portfolio

To lower risk, diversification entails distributing your money among several cryptocurrencies. You can reduce the negative effects of a performing asset on your portfolio as a whole by diversifying.

2. Use Stop-Loss Orders

An order to sell cryptocurrency when it hits a certain price is known as a stop-loss order. If the market swings against your position, this helps to reduce your losses.

3. Don’t Invest More Than You Can Afford to Lose

Invest only funds that you are willing to lose. There is always a chance of losing money when investing in cryptocurrency markets because they may be very volatile.

4. Stay Informed

Keep yourself informed about the most recent events and advancements in the bitcoin space. This assists you in deciding wisely and adjusting to changes in the market.

Trading Psychology

1. Control Your Emotions

Fear and greed are two strong emotions that can impair judgment and cause you to make bad trading judgments. Acquire emotional self-control and follow your trading plan.

2. Be Patient

It takes patience to trade successfully. Avoid making transactions without doing the necessary research and preparation. Hold off till the appropriate moments.

3. Learn from Your Mistakes

Examine your previous trades and take note of your errors. Determine what went wrong and how your tactics might be strengthened.

4. Stay Disciplined

Trading successfully requires discipline. Adhere to your trading strategy and refrain from making snap judgments. Results are consistent when discipline is maintained.

Continuous Learning and Improvement

1. Follow Experts

Pay attention to knowledgeable traders and authorities in the bitcoin field. Take note of their tactics and insights.

2. Join Trading Communities

Participate in online trading forums and communities to exchange concepts, talk about tactics, and pick up tips from other traders.

3. Read Books and Take Courses

Invest in your education by learning about bitcoin trading through books and courses. Maintaining a competitive edge in the market requires constant learning.

4. Practice Regularly

Regular practice will help you stay sharp and refine your trading skills. Your confidence and experience will grow as you trade more.

Conclusion

It takes a combination of education, strategy, discipline, and ongoing learning to become a great bitcoin trader. You may improve your chances of success in the thrilling realm of cryptocurrency trading by comprehending the market, creating winning trading techniques, controlling risk, and keeping a disciplined mentality. Recall that trading is a journey, and the secret to long-term success is constant progress.

2 notes

·

View notes

Text

Best Bitcoin Alternatives: Exploring Top Cryptocurrencies for 2024 by Simplyfy

Bitcoin, the pioneering cryptocurrency, has long been the standard-bearer in the world of digital currencies.

However, the crypto market has grown exponentially, and several preferences to Bitcoin now provide special points and benefits. This article, promoted via Simplyfy, targets to information you via the fantastic Bitcoin choices for 2024, supporting you make knowledgeable choices in the evolving panorama of digital assets.

Introduction to Bitcoin and Its Alternatives

Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, revolutionized the financial world by introducing a decentralized form of currency.

Its meteoric upward shove in fees and massive adoption have paved the way for lots of different cryptocurrencies. These alternatives, frequently referred to as altcoins, serve a number of purposes, from improving privateness and enhancing transaction speeds to imparting revolutionary structures for decentralized purposes (DApps).

Why Look Beyond Bitcoin?

While Bitcoin remains a cornerstone of the crypto market, there are several reasons why investors and enthusiasts might seek alternatives:

1. Scalability: Bitcoin's transaction speed and scalability have been points of contention.

Some selections provide quicker and extra scalable solutions.

2. Transaction Fees: As Bitcoin's network becomes busier, transaction fees can rise.

Some altcoins supply less expensive transaction costs.

3. Utility: Many altcoins are designed with specific use cases in mind, from smart contracts to privacy features.

4. Investment Diversification: Diversifying one's portfolio with multiple cryptocurrencies can mitigate risk and potentially increase returns.

Top Bitcoin Alternatives in 2024

1. Ethereum (ETH)

Overview: Launched in 2015 by Vitalik Buterin, Ethereum is more than just a cryptocurrency.

It’s a decentralized platform that allows builders to construct and set up clever contracts and decentralized purposes (DApps).

Key Features:

Smart Contracts: Self-executing contracts with the terms of the agreement directly written into code.

Decentralized Applications (DApps): Applications that run on a decentralized network.

Ethereum 2.0: The ongoing improvement to Ethereum goals to enhance scalability, security, and sustainability via a shift from Proof of Work (PoW) to Proof of Stake (PoS).

Pros:

- Highly versatile platform with numerous use cases.

- Strong developer community.

- Continuous improvement and scalability through Ethereum 2.0.

Cons:

- High transaction fees (gas fees) during network congestion.

- Complex for new users compared to simpler cryptocurrencies.

2. Binance Coin (BNB)

Overview: Binance Coin is the native cryptocurrency of the Binance Exchange, one of the largest cryptocurrency exchanges in the world. Initially launched as an ERC-20 token on the Ethereum blockchain, BNB has since transitioned to the Binance Chain.

Key Features:

Exchange Utility: Primarily used to pay for trading fees on Binance, offering discounts to users.

Binance Smart Chain (BSC): Supports smart contracts and is known for its low transaction fees and high throughput.

Pros:

- Strong backing and integration with the Binance Exchange.

- Low transaction fees on BSC.

- Continuous development and use cases expanding beyond the Binance platform.

Cons:

The centralized nature of Binance raises concerns among decentralization purists.

- Regulatory scrutiny due to its association with Binance.

3. Cardano (ADA)

Overview: Cardano is a third-generation blockchain platform founded by Charles Hoskinson, a co-founder of Ethereum. It aims to provide a more balanced and sustainable ecosystem for cryptocurrencies.

Key Features:

Proof of Stake (PoS): Uses the Ouroboros PoS protocol, which is energy efficient.

Research-Driven: Development is backed by peer-reviewed academic research.

Scalability and Interoperability: Designed to improve scalability and interoperability compared to previous generations of blockchain.

Pros:

- Strong focus on security and sustainability.

- Continuous updates and improvements.

- Active community and developer involvement.

Cons:

- Slow development process due to its research-driven approach.

- Still in the early stages compared to some competitors.

4. Solana (SOL)

Overview: Solana is a high-performance blockchain supporting builders around the world creating crypto apps that scale today. It aims to provide decentralized finance solutions on a scalable and user-friendly blockchain.

Key Features:

Proof of History (PoH): A unique consensus algorithm that provides high throughput.

Low Transaction Fees: Designed to offer low-cost transactions.

Scalability: Capable of handling thousands of transactions per second.

Pros:

- Extremely fast and scalable.

- Low transaction costs.

- A growing ecosystem of DApps and DeFi projects.

Cons:

- Relatively new and still proving its stability.

- Centralization concerns due to the small number of validators.

5. Polkadot (DOT)

Overview: Founded by Dr. Gavin Wood, another co-founder of Ethereum, Polkadot is a heterogeneous multi-chain framework.

It approves a number of blockchains to switch messages and fees in a trust-free fashion.

Key Features:

Interoperability: Connects multiple blockchains into a single network.

Scalability: Enables parallel processing of transactions across different chains.

Governance: Decentralized governance model allowing stakeholders to have a say in the protocol's future.

Pros:

- Focus on interoperability and connecting different blockchains.

- High scalability potential.

- Strong developer and community support.

Cons:

The complexity of the technology might pose a barrier to new users.

- Competition with other interoperability-focused projects.

6. Chainlink (LINK)

Overview: Chainlink is a decentralized oracle network providing reliable, tamper-proof data for complex smart contracts on any blockchain.

Key Features:

Oracles: Bridges the gap between blockchain and real-world data.

Cross-Chain Compatibility: Works with multiple blockchain platforms.

Decentralized Data Sources: Ensures data reliability and security.

Pros:

- Unique and crucial role in enabling smart contracts to interact with external data.

- Strong partnerships with major companies and blockchains.

- Growing use cases and applications.

Cons:

- Highly specialized use cases might limit broader adoption.

- Dependence on the success of the smart contract ecosystem.

7. Ripple (XRP)

Overview: Ripple aims to enable instant, secure, and low-cost international payments.

Unlike many different cryptocurrencies, Ripple focuses on serving the desires of the monetary offerings sector.

Key Features:

RippleNet: A global network for cross-border payments.

XRP Ledger: A decentralized open-source product.

Speed and Cost: Provides fast transactions with minimal fees.

Pros:

- Strong focus on financial institutions and cross-border payments.

- Low transaction fees and fast settlement times.

- Significant partnerships with banks and financial institutions.

Cons:

- Centralization concerns due to Ripple Labs’ control.

- Ongoing legal issues with regulatory authorities.

8. Litecoin (LTC)

Overview: Created by Charlie Lee in 2011, Litecoin is often considered the silver to Bitcoin’s gold.

It targets to supply fast, low-cost repayments by way of the usage of a one-of-a-kind hashing algorithm.

Key Features:

Scrypt Algorithm: Allows for faster transaction confirmation.

SegWit and Lightning Network: Implements advanced technologies for scalability.

Litecoin Foundation: Active development and community support.

Pros:

- Faster transaction times compared to Bitcoin.

- Lower transaction fees.

- Active development and widespread adoption.

Cons:

- Limited additional functionality beyond being a currency.

- Competition from newer and more versatile cryptocurrencies.

9. Stellar (XLM)

Overview: Stellar is an open network for storing and moving money.

Its aim is to allow monetary structures to work collectively on a single platform.

Key Features:

Stellar Consensus Protocol (SCP): Allows for faster and cheaper transactions.

Anchor Network: Connects various financial institutions to the Stellar network.

Focus on Remittances: Facilitates cross-border payments and remittances.

Pros:

- Low transaction fees and high speed.

- Focus on financial inclusion and connecting global financial systems.

- Strong partnerships and adoption in the financial sector.

Cons:

- Competition from other payment-focused cryptocurrencies.

- Centralization concerns regarding development control.

10. Monero (XMR)

Overview: Monero is a privacy-focused cryptocurrency that aims to provide secure, private, and untraceable transactions.

Key Features:

Privacy: Uses advanced cryptographic techniques to ensure transaction privacy.

Decentralization: Emphasizes decentralization and security.

Fungibility: Every unit of Monero is indistinguishable from another.

Pros:

- Strong privacy and security features.

- Active community focused on maintaining privacy.

- Continuous development and improvements.

Cons:

- Privacy focus attracts regulatory scrutiny.

- Not as widely accepted as other cryptocurrencies.

Conclusion

The cryptocurrency market affords a plethora of options to Bitcoin, every with its special features, advantages, and viable downsides.

Whether you're looking for faster transaction speeds, lower fees, advanced functionalities like smart contracts, or enhanced privacy, there is likely a cryptocurrency that meets your needs. Ethereum, Binance Coin, Cardano, Solana, Polkadot, Chainlink, Ripple, Litecoin, Stellar, and Monero are among the top contenders worth considering in 2024.

As with any investment, it is quintessential to behavior thoroughly lookup and reflect on consideration on your monetary dreams and hazard tolerance. The crypto market is quite risky and can be unpredictable. Diversifying your investments and staying knowledgeable about market tendencies and technological developments can assist you navigate this.

#simplyfy#news#bitcoin#cryptocurrency#crypto#blockchain#digitalcurrency#cryptonews#cryptotrading#simplyfycrypto#simplyfynews

3 notes

·

View notes

Text

The Securities and Exchange Commission sued crypto exchange Coinbase

in New York federal court on Tuesday morning, alleging that the company was acting as an unregistered broker and exchange and demanding that the company be “permanently restrained and enjoined” from continuing to do so.

Shares closed down 12% Tuesday. Coinbase stock had already fallen 9% on Monday, after the SEC unveiled charges against rival crypto exchange Binance and its founder Changpeng Zhao.

“These trading platforms, they call themselves exchanges, are commingling a number of functions,” SEC chair Gary Gensler said on CNBC Tuesday. “We don’t see the New York Stock Exchange operating a hedge fund,” Gensler continued.

Coinbase’s flagship prime brokerage, exchange and staking programs violate securities laws, the regulator alleged in its complaint. The company “has for years defied the regulatory structures and evaded the disclosure requirements” of U.S. securities law.

8 notes

·

View notes

Text

Half of Tesla's deliveries in 2021 came from its plant in Shanghai (which has the highest production of any Tesla facility, btw), with China accounting for 40% of Tesla's annual production capacity, and currently the Chinese sales of Tesla products account for 25% of the total revenue (but the second most by specific country, after the US) and increasing more and more each year). Tesla's also owes almost billions in loans to just one Chinese lender, and has regularly borrowed and repaid millions of dollars from and to other Chinese lenders over the last few years.

Tesla was the first foreign care manufacturer in China *not* required to partner with a Chinese company (and considering Xi Jinping's wolf warrior diplomacy and economic policies over the last few years, is remarkable in and of itself!) and was given a ton of favorable exemptions to otherwise pretty stringent Chinese regulations and corporate requirements.

I just think it's important to keep all that in mind, when also considering that Binance, a Chinese-linked cryptocurrency exchange, accounts for 7% of the outside equity financing for Musk's Twitter takeover deal (with Saudi Prince Alwaleed Bin Talal Bin Abdulaziz Al Saud's investment company contributing 27%, VyCapital out of Dubai making up 10%, and the Qatar sovereign wealth fund making up 5%).

Musk contributed 43% of the financing for the Twitter takeover, with an additional 13% provided by a margin loan secured by Tesla (meaning borrowing against the value of Tesla securities/stocks) and 28% coming from debt financing (aka taking out/selling loans and bonds).

That works out to, what, 84? percent of the financing for Twitter, which means that the actual other outside investors/financers, while only making up 15-ish percent of the financing, have a outsized power and influence (especially if they also are both Tesla investors/stockholders, for example, and/or also separately/additionally had a hand in the debt financing as well). And so if there's pressure on Tesla, or on Musk's finances otherwise, and keeping in mind that the creditors who will have to be paid back for the loans has both increased in number and in amount owed...

12 notes

·

View notes

Text

𝙍𝙚𝙖𝙨𝙤𝙣𝙨 𝙩𝙤 𝙏𝙧𝙖𝙙𝙚 𝙉𝙁𝙏𝙨 𝙤𝙣 𝘽𝙞𝙣𝙖𝙣𝙘𝙚 𝙉𝙁𝙏 𝙈𝙖𝙧𝙠𝙚𝙩𝙥𝙡𝙖𝙘𝙚.

Binance, one of the largest cryptocurrency exchanges in the world, has recently launched its own NFT (non-fungible token) marketplace, called"Binance NFT" or simply "BNFT". The marketplace allows creators to tokenize and sell their digital artworks, collectibles, and other forms of digital assets on the blockchain.

𝘽𝙞𝙣𝙖𝙣𝙘𝙚 𝙉𝙁𝙏𝙨 𝙈𝙖𝙧𝙠𝙚𝙩𝙥𝙡𝙖𝙘𝙚

Binance NFT offers a user-friendly interface with a smooth browsing experience"Binance NFT". It aims to be a one-stop-shop for buying and selling NFTs, featuring everything from digital artwork and collectibles to music and gaming assets.

Binance NFT offers both fixed-price and auction-style sales, with the option for creators to set a reserve price or minimum bid for their items. It also supports both Binance's own Binance Coin (BNB) cryptocurrency and major credit cards as payment methods.

Binance NFT also aims to be a platform for creators, offering various tools and services for artists and other content creators to mint and sell their own NFTs. This includes easy-to-use NFT creation tools, customizable storefronts, and access to Binance's large user base and marketing resources.

Overall, Binance's entry into the NFT market is a major development in the world of blockchain-based digital assets and could have significant implications for the growth and mainstream adoption of NFTs.

Why i prefer to buy NFTs on Binance NFT

# Wide Selection of NFTs :- Binance NFT offers a vast collection of NFTs from various popular artists, celebrities, and brands. Buyers can choose from a wide range of NFTs on Binance NFT.

Wide Range of NFTs : Binance NFT offers a wide range of NFTs to choose from, including artwork, sports collectibles, gaming items, and more. This ensures that buyers have a diverse range of options to choose from based on their interests.

# Secure Platform :- Binance NFT is a secure platform, offering users the peace of mind that their transactions and artwork are protected. This is particularly important for those looking to invest significant amounts in NFTs.

# User-Friendly :- Binance NFT is user-friendly, making it easy for users to browse and buy NFTs. The platform also offers features such as auctions and exclusive drops, making it an exciting place to discover new NFTs.

# Low Fees :- Binance NFT charges low fees for buying and selling NFTs, making it an affordable option for both buyers and sellers. This ensures that users get the best value for their money.

# Integration with Binance :- Binance NFT is integrated with the Binance ecosystem, which means that users can easily buy and sell NFTs using their existing Binance account. This makes it a convenient option for those who already use Binance for cryptocurrency trading.

Overall, Binance NFT offers a secure, user-friendly, and affordable platform for buying and selling NFTs. Its wide range of NFT options, low fees, and integration with Binance make it a popular choice for NFT enthusiasts.

Here are the steps that you can follow to buy NFTs on Binance NFT Marketplace:

1. Go to the Binance NFT marketplace 👇👇👉👉👉

2. Create an account or log in if you already have one.

3. Browse through the available NFT collections or use the search function to find specific NFTs.

4. Once you find an NFT that you like, click on it2. Click on the NFT that you want to buy. This should take you to the item page.

3. On the item page, you can view the item details, such as the name, description, price, and the number of items available.

4. If you intend to buy the NFT immediately, click the “Buy Now” button. If you want to bid on the NFT, click the “Place a Bid” button instead.

5. If you clicked the “Buy Now” button, confirm the purchase by clicking the “Confirm” button.

6. If you clicked the “Place a Bid” button, enter your bid amount and click the “Place Bid” button.

7. Once you’ve completed either of the above steps, the NFT should automatically be added to your Binance NFT wallet.

8. To view your NFT collection, go to your Binance NFT wallet and check your NFT holdings.

9. You can also sell your NFTs on the Binance NFT Marketplace by listing them for sale. To do this, go to your wallet, click on the NFT you want to sell, click on the “Sell” button, and set your price.

10. Lastly, keep in mind that some NFTs are only available to certain users or are part of exclusive drops. Check the eligibility requirements before attempting to purchase an NFT.

In summary, Binance NFT offers a user-friendly platform that provides a diverse range of NFTs, low transaction fees, and high security measures, making it an excellent choice for anyone looking to invest in NFTs.

4 notes

·

View notes

Text

Coinbase Clone Script - The Best way to start a Crypto Exchange like Coinbase

The crypto market is growing at a rapid pace with the huge rise in the number of people across the globe making use of crypto exchange platforms for trading cryptos, investing cryptos, etc. So, there is a great demand for crypto exchange platforms these days, and seeing this massive growth of the crypto sector many proprietors show interest in plunging into this flourishing sector.

So it's the right time for you as a founder/aspiring entrepreneur to take advantage of the opportunities waiting. Take your crypto exchange business like Coinbase to the market with ready-made solutions and cater to crypto traders and investors.

But, How to build such a feature-rich crypto exchange like Coinbase? will be the question that will strike your mind now. A readymade and quickly customizable Coinbase clone script is the best choice to build a full-fledged crypto exchange within a short span of time and within the budget. This is because a ready-to-use Coinbase clone will include key functions to arrive at an outstanding crypto trading platform meeting your crypto exchange business concepts.

What is Coinbase Clone Script?

Coinbase clone script is the ready-made user-to-admin cryptocurrency exchange clone script of the Coinbase exchange. Coinbase clone script covers a similar user interface, plug-ins, and existing features of Coinbase. It is a multi-tested script, so it helps you to create and launch a high-grade crypto exchange like Coinbase within 10 days. Plurance's Coinbase clone script is a 100% customizable solution. By using our reliable Coinbase clone script, you can do certain modifications to themes, designs, features, and more based on business requirements. In addition to this, our Coinbase clone script uses high-level security features. So your crypto exchange will be more secure and reliable.

Features of Coinbase Clone Script

Responsive User Interface

Transaction history

Communication channels for traders

Two-factor authentication

Two-factor authentication

Robust escrow wallet

Multiple crypto support

Multiple payment methods

Device management

Regular notifications

Admin Portal

KYC verification

Secured content management system

Two-factor authentication

Anti-DDoS security

SSL injection

CSRF protection

HTTP authentication

Lock registry

And More

Why Choose Plurance For Your Crypto Exchange Business?

In the cryptocurrency industry, Plurance is a premier Coinbase clone script software provider. We excel at providing an unparalleled range of crypto exchange clone script software solutions for all popular exchanges. So far, we've supported several crypto startups as well as entrepreneurs in launching a feature-rich cryptocurrency exchange like Coinbase.

We have a team of well-experienced front-end & back-end developers, Quality analysts, Android & iOS developers for the Coinbase clone app development, and project engineers to structure your crypto exchange project as per your business concepts.

Our team of experts has rich expertise in delivering White label crypto exchange clone scripts for various crypto exchange business models over the years. Our reliable Coinbase clone script includes many interesting functionalities and state-of-the-art technologies to arrive at a complete crypto exchange like Coinbase.

Want to create clones of popular crypto exchange like Coinbase for your crypto exchange business? You must put an end to your search here. You can have fully prepared clones/ clone scripts to reach the correct users by engaging with us. With a few clicks, you may create a clone of popular crypto exchanges such as Coinbase, Binance, Paxful, Remitano, and so on.

So, if you want to establish a crypto exchange similar to existing ones like Coinbase, contact us to get a best-in-class Coinbase clone development service for developing a crypto exchange like Coinbase according to your requirements.

Book A Free Demo @ Coinbase Clone Script

2 notes

·

View notes

Text

The 5 Best Marketplaces to Mint an NFT for Free in 2023

Readers like you help support MUO. When you make a purchase using links on our site, we may earn an affiliate commission. Read More.

NFTs are all the rage, with many crypto enthusiasts looking for the next big project to invest in. Non-fungible tokens are simply unique tokens that you can use to verify an individual’s ownership of a digital asset, such as artwork.

Minting an NFT means turning a digital file into a digital asset and launching it on the Ethereum blockchain. The digital asset is then stored on the blockchain and nobody can then remove or modify it. Before you mint an NFT, it’s important to choose a viable marketplace. There are several NFT marketplaces that you can choose from, including those that offer free minting options.

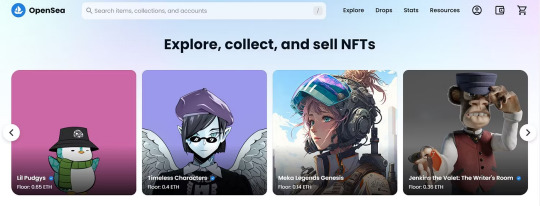

1. OpenSea

OpenSea is a popular NFT marketplace that is home to projects like BAYC and Azuki. Minting an NFT on OpenSea is very easy. It supports all kinds of digital assets, from virtual worlds and collectibles to art, photography, and sound recordings.

OpenSea offers Klatyn, Polygon, and Ethereum blockchains. It supports more than 150 cryptocurrencies, though since you buy using Ethereum, expect to pay a higher gas fee. OpenSea recently launched its own gas-free minting option, though they charge 2.5% of every transaction on the platform.

OpenSea is arguably the biggest NFT marketplace right now, and it also allows authors and creators to charge up to 10% in royalty fees.

RELATED:The Best Apps For NFT Enthusiasts

2. Rarible

Another excellent marketplace to mint an NFT on is Rarible. Rarible is ideal if you want to sell NFTs focusing on art and photography. It offers support for Ethereum, Flow, and Tezos blockchains.

You can sell both single NFTs or full collections on Rarible. Since it supports Tezos, you can save quite a bit on gas fees (it costs only $0.5 to mint NFTs on Tezos). With their “lazy minting” feature, you can create an NFT for free and have the buyer pay gas fees when they purchase it.

Rarible also has its own token known as RARI, and as a user, you get to vote on any upgrades that the developers want to introduce.

3. Binance NFT

Binance is one of the largest cryptocurrency exchanges in the world. Its NFT marketplace is an excellent option for anyone looking to mint on a future-proof platform.

Unlike OpenSea, Binance charges just 1% per transaction, and it also gives you the option of cashing out your money in fiat currency. If you already own Binance tokens (BNB), buying and selling on the marketplace gets easier due to native support.

Binance NFT requires users to make bids using BNB, BUSD, or ETH. Owing to the sheer size of the marketplace, Binance has been able to enter into several excellent partnerships with NFT creators. So, it’s as good a place as any to mint your first NFT!

Binance charges 0.005 BNB to mint an NFT on its platform, but the first 10 are free.

RELATED:Top Things To Check Before Buying An NFT

4. Nifty Gateway

Nifty Gateway was responsible for some of the most expensive early NFT sales. Beeple’s CROSSROAD sold on Nifty Gateway for millions. The world’s most expensive NFT also sold here for a cool $91.8 million!

Many celebrity artists purchase their NFTs from here, so if you are working on a premium collection, Nifty might be a great place to launch it. Unlike other platforms, Nifty uses “open editions”. Essentially, it creates an unlimited number of variants for a brief period, retailing for a fixed price.

RELATED:Risks Of NFTs You Simply Cannot Ignore

Once the timer runs out, the creator cannot issue any more NFTs from that collection. This creates a sense of exclusivity amongst holders, which leads to higher sales. Creators can also receive payments in fiat currency.

Nifty Gateway doesn’t charge a minting fee for on-platform transactions. It also lists NFTs that are on sale on other platforms, like OpenSea.

5. Async Art

Async Art only supports NFT creation on the Ethereum blockchain, and it focuses primarily on programmable art. Unlike conventional NFTs, NFTs on Async Art include Layers. There’s a separate Master, which is the full NFT, while the Layers are discrete elements that you can use to customize your NFT.

Since this process tokenizes each layer, several artists can contribute to modify the Master NFT. This is great for innovation and collaboration, but it does mean you can’t share such NFTs on conventional marketplaces.

Async now offers Blueprints which are like Collections on OpenSea. Anyone can mint an NFT for a base price until it reaches a maximum limit, after which price varies based on market conditions.

Async Art also supports gasless minting, allowing artists to create “Gasless Autonomous Art.” It allows artists to specify rules for each Layer so other collaborators better understand the artist’s vision at the time of minting.

Creating NFTs Is Easier Than Ever Before

If you want to create an NFT and launch it, there are many platforms allowing you to do so. This list is by no means exhaustive, and other platforms like SuperRare and MakersPlace also exist.

However, if you are getting started, these are the best options out there. You can even create an NFT on your mobile and upload it directly to any of these marketplaces!

2 notes

·

View notes

Text

What is the best exchange, OKX or Binance?

Binance and OKX are among the most talked-about crypto exchanges in the world. After reading this post, you will be able to choose the exchange that is most suitable for you.

youtube

Binance Review

Binance is a name you may have heard of even if you're new to crypto. Binance was established in the year 2017 and is the most popular crypto exchange by trading volume. There are currently over 28 million users.

Binance allows traders to experience huge trading volumes and liquidity, as well as low costs. It also offers an advanced trading platform.

Security, Fees, and other features of Binance

Binance has accounts that are tier-based, meaning traders can boost their VIP level by achieving the highest volume of transactions or having the native BNB tokens. In addition to the very lower cost of trading, Binance also offers a few trading pairs for absolutely no cost.

Concerning security, Binance follows industry standards and is attentive to its fund security. The exchange was hacked by a hacker in January 2019, resulting in a loss of $40,000. These funds were later returned.

Products from Binance Available

Binance is the home of the most number of products across the entire crypto industry. It will require a different article to list all the offerings. So, here are some of the most intriguing products of Binance.

A top-of-the-line trading platform.

Futures market that includes over 130 cryptocurrency assets.

You can leverage your tokens as high as 4x.

A launchpad with great IDO/ICO events.

Solid NFT market.

Binance Card for crypto spending

Earn an income that is passive with Binance.

OKX Review

OKX was launched in 2016 as one of the first cryptocurrency exchanges. It has made significant strides. The exchange was previously known as OKEX. The year 2022 was when OKX changed its name to OKX and revamped its platform.

Instead of being merely a trading exchange, OKX functions as a one-stop shop for everything crypto-related like the DeFi metaverse, DeFi, and Web3 projects. OKX is a fantastic choice for traders because it offers a range of crypto-related products as well as a high-performance trading platform. It also permits you to trade with no KYC.

Features, Fees, And Security Of OKX

Traders can select from several types of accounts on their KYC level and requirements. OKX provides high security and keeps 95% of client funds in cold storage.

OKX Products Offered

OKX offers a wide range of products that will satisfy all types of traders. Below are some of the most frequently used products offered by OKX.

Crypto trading is powered by an advanced platform.

Wide variety of kinds of trading orders.

OKX Earn provides passive income for cryptocurrency.

Dive into the world of DeFi metaverse, DeFi, and Web3 projects.

Take part in Polkadot & Kusama Slot Auctions.

Take advantage of integrated walled and trading bots.

OKX Vs. Binance

After you've gone through the report It's time to find out which one is the best about various criteria including security, user experience, and costs. Let's look at the offered products.

OKX Vs. Binary: Products Available

Both exchanges provide products with more in common than differences. Binance has greater financial support for crypto assets and offers a wider range of products. OKX however, has a better trading experience and a stronger self-custodial web3 account. While we like to place Binance as the best in this category, OKX is not that far from the top.

OKX vs. Binary: User-Friendliness

Newer traders will find it difficult to use the interfaces of both platforms due to the large range of products and features that are available. However, if you're an experienced trader who knows the ropes The user experience is likely to be better on both of the platforms. It's difficult to decide which platform is better in this case, therefore we referred to it as an "equal".

OKX vs. Binance: Fees

Both exchanges are renowned for their low-cost structures. In the beginning, the fees for the taker and maker are 0.1%. OKX charges 0.08% for both takers and makers, and 0.1 percent, respectively. Binance is the clear winner, despite significantly lower trading charges. It offers zero fees for trading with stablecoin BTC pairs, BUSD spot trading charges, and complete fiat banking services.

OKX vs. Security

A similar approach to security measures can be seen in both of these top-tier cryptocurrency exchanges. It's impossible to go wrong if security is your primary security concern.

Conclusion

Both Binance and OKX are among the largest crypto exchanges in the world. With both exchanges, you won't be disappointed. Binance is a good choice for traders who want better access to money. OKX is the best option for traders looking for KYC trading and more efficient bot implementation.

FAQs

Which is the better option, OKX or. Binance?

The demands of the trader will determine which exchange is the best. Binance is the largest cryptocurrency exchange. OKX has many impressive features. Doing research is the best method to find out what functions best.

Is Binance secure?

Binance, an exchange that is highly regulated has a global service, and has earned the trust of millions of customers. It also has great security features and even an insurance fund to safeguard clients' funds.

2 notes

·

View notes

Text

Anticipated Bitcoin Surge in October Following September’s Decline: Why It Will Happen

Key Points

Bitcoin’s open contracts are higher than in 2021, indicating potential for price growth.

The estimated leverage ratio across exchanges has reached a new yearly high, suggesting an increase in risk-taking by Bitcoin traders.

Bitcoin Market Recovers from Dip

The Bitcoin (BTC) and wider crypto market are showing signs of recovery after a five-month dip that followed the March cycle end.

Despite the perceived lower interest in the overall crypto market compared to previous cycles, current prices are similar to those seen in 2021, a year that saw a significant dip before a surge.

The number of open contracts for BTC is notably higher than in 2021, suggesting a potential for price growth if market conditions improve.

Bitcoin CME Price Action and Leverage Ratio

Bitcoin’s price action on the Chicago Mercantile Exchange (CME) is crucial to monitor, especially in the current Bitcoin ETF era. These ETFs track the price of BTC on the CME, rather than spot Bitcoin.

The CME chart currently shows BTC in a descending broadening wedge pattern, a bullish indicator, and Bitcoin has reclaimed its 200-day simple moving average, a key signal of market strength.

Furthermore, the estimated leverage ratio across crypto exchanges has reached a new yearly high, according to data from CryptoQuant. This suggests that Bitcoin traders are increasingly willing to take on more risk, which could be a bullish signal.

Bitcoin Average Returns and Whale Activity

Historical data indicates that August and September are typically the weakest months for Bitcoin in terms of returns. However, traders who can endure these months may look forward to better returns in the following months, based on past performance.

On the other hand, BTC whales are beginning to take profits. This was evidenced when a whale deposited 119 BTC, worth $7.14 million, to Binance for profit-taking.

Despite this, the long-term outlook for Bitcoin remains positive as major industry players continue to support the cryptocurrency.

0 notes

Text

Top Bitcoin Trading Platforms in Singapore 2024: Review of the Best Exchanges

Since the cryptocurrency sector continues to grow, Singapore remains at the top of a Bitcoin trading hub. In 2024, therefore, this is going to be a year where Singaporean investors can enjoy a number of premium Bitcoin trading platforms that will more satisfactorily meet the needs and expectations of both new and seasoned investors. Selecting the correct exchange is what really makes a difference in efficiency, security, and experience in trade.

There are a good number of Bitcoin trading platforms in Singapore, but some standout as easy to use and having robust security measures as well as comprehensive features. Some of the leading platforms include Binance, Coinbase, and Crypto.com. A very popular trading platform offered by Binance is great trading pairs, easy fees, and advanced tools for trading. With several more features, this is high liquidity, hence performing smooth trades.

Another popular choice is Coinbase, which is said to have a very well-structured interface and reliable security measures. It offers a very secure environment through insured coverage and regular audits. This is very useful for new users of Bitcoin trading because of its simple interface and the existence of many educational resources.

Crypto.com differs from other exchanges, as its trading platform allows for flexibility in trading and even staking, with earnings options attached. This cryptocurrency exchange therefore offers much more than just Bitcoin, allowing users to venture into a large array of cryptocurrencies to diversify their investments. Additionally, it has some of the most competitive fees and rewards, which adds value to the end-users.

Cryptocurrency trading should be highly secure, and the best trading platforms implement advanced measures such as two-factor authentication, cold storage, and encryption to protect the assets of the users. Good customer support and transparent fee structures are important factors to ensure a perfect trading experience.

In summary, the Bitcoin trading landscape in Singapore for 2024 is represented by a set of top-tier platforms in terms of security, functionality, and user support. The detailed evaluation according to their needs and preferences becomes the guiding factor in navigating the Bitcoin market for investors.

For More Info:-

cryptocurrency trading platform Singapore

best cryptocurrency wallet singapore

bitcoin trading platform singapore

0 notes

Text

Why is Now the Perfect Time to Invest in Cryptocurrency Exchange Development?

As digital currencies become more widely accepted, the demand for cryptocurrency exchanges grows exponentially. There has never been a better opportunity to engage in cryptocurrency exchange development for business owners looking to capitalize on this expanding market. The current landscape is ripe for opportunity, and those who act now stand to gain significant benefits. In this blog, we will explore why now is the perfect time to invest in cryptocurrency exchange development. From the booming market to the accelerating mainstream adoption, we'll explore the key factors that make this a suitable moment to enter this profitable industry.

Explosive Market Growth

The cryptocurrency sector has grown at an exclusive rate over the last decade, and there are no signs of it slowing down. As of 2024, the global cryptocurrency market capitalization had reached trillions of dollars, with millions of people trading digital assets every day. This incredible growth has resulted in a massive need for reputable and user-friendly cryptocurrency exchanges. Businesses that engage in exchange development now can gain access to this growing sector and establish an important presence in the digital economy.

Mainstream Adoption and Regulation

One of the most important indicators that now is the time to invest in cryptocurrency exchange development is the growing public usage of digital currencies. Major organizations, financial institutions, and even governments are recognizing the usefulness of cryptocurrency and incorporating it into their operations. Furthermore, regulatory frameworks are becoming clearer, creating a more secure environment for enterprises operating in the cryptocurrency industry. This trend toward popular acceptance and regulation provides an excellent opportunity for entrepreneurs to build a trustworthy and compliant trading platform.

Technological Advancements

Exciting advances in blockchain technology provide yet another compelling incentive to invest in cryptocurrency exchange development today. Blockchain technology has progressed completely, providing more scalable, secure, and efficient solutions than ever before. These technological advancements make it easier for corporations to build strong exchanges capable of handling large amounts of transactions while maintaining user security. By exploiting these improvements, businesses can create advanced exchanges that meet the market's rising demands.

Clone Scripts: A Fast-Track to Success

For firms looking to build a cryptocurrency exchange rapidly, using clone scripts such as Binance Clone Script, Coinbase Clone Script, or Paxful Clone Script provides a speedy path to success. These clone scripts offer a ready-made solution that mimics the essential features and operations of renowned exchanges, allowing entrepreneurs to develop a fully operating platform in a fraction of the time required to construct from scratch.

Binance Clone Script: Binance is the world's largest cryptocurrency exchange by trading volume, making it an ideal role model for forward-looking exchange entrepreneurs. A Binance Clone Script has all of Binance's major features, such as multi-currency support, high liquidity, and advanced trading choices. It's an excellent solution for organizations wishing to reach a large number of customers while also providing a reliable trade platform.

Coinbase Clone Script: Coinbase is well-known for its user-friendly interface and good regulatory compliance. A Coinbase Clone Script enables businesses to build a platform that appeals to both rookie and expert traders, including safe wallets, simple fiat-to-crypto conversion, and compliance with local regulations.

Paxful Clone Script: Paxful is a popular peer-to-peer (P2P) cryptocurrency exchange that lets users buy and sell Bitcoin with a variety of payment options. A Paxful Clone Script is ideal for organizations wishing to enter the P2P exchange industry, as it includes features like escrow services, secure transactions, and multi-payment possibilities. This script allows businesses to build a platform that directly connects buyers and sellers, adapting to a wide and global audience.

Profitability and Revenue Streams

Investing in cryptocurrency exchange development has significant profit potential. Exchange platforms make money from a variety of sources, including transaction fees, listing fees, withdrawal fees, and staking rewards. As trading volumes increase, so does the opportunity for big profits on investment. Businesses can also experiment with new revenue models such as margin trading, futures contracts, and token sales to increase their profits.

Conclusion:

The current position provides a unique opportunity for business persons interested in cryptocurrency exchange development. With accelerating market expansion, rising mainstream usage, technology improvements, and multiple revenue streams, the potential benefits are enormous. Businesses that invest in exchange development now may place themselves at the forefront of the digital economy and benefit from the next wave of financial innovation.

Whether you’re interested in a custom-built exchange or a Clone Script, the time to act is now. Embrace the future of finance, and start building your exchange platform today. Partner with a trusted cryptocurrency exchange development company like Kryptobees to bring your vision to life. Let’s revolutionize the way the world trades digital assets together.

#crypto exchange development company#crypto exchange software development company#crypto exchange app development#white label cryptocurrency exchange script

0 notes

Text

Guide To Web3 Development: Costs And Benefits

The rapid rise of Web3 technologies is reshaping the digital world, introducing new ways of interacting with the internet through decentralized systems. Web3, built on blockchain technology, brings concepts like decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized applications (dApps) to the forefront. For businesses looking to build on Web3, understanding the associated development costs and potential benefits is essential to making informed decisions.

This guide will delve into the costs of Web3 development, breaking down key factors that impact pricing, as well as the benefits that make it a worthy investment for organizations.

Understanding Web3 Development Costs

Building a Web3 application is complex and differs from traditional web development in several ways, primarily due to the decentralized nature of blockchain and smart contract integration. The costs associated with Web3 development vary based on factors like the type of platform being built, the blockchain being used, and the overall complexity of the project. Below are the major factors influencing Web3 development costs:

1. Project Scope and Complexity

The scope and complexity of your Web3 project are perhaps the most significant cost drivers. A simple decentralized application (dApp) with basic functionality will cost significantly less than a multi-chain decentralized exchange (DEX) or a complex decentralized finance (DeFi) platform.

Types of Web3 Projects:

DApps: Simple decentralized apps with a limited number of features, such as a token wallet or an NFT marketplace, can be relatively affordable.

Smart Contracts: Writing and deploying smart contracts requires a high level of security and precision since errors can lead to costly vulnerabilities. The complexity of the contract will directly affect development costs.

NFT Platforms: NFT marketplaces or platforms are more complex due to the integration of minting, trading, and royalties systems, often pushing costs higher.

DeFi Platforms: Decentralized finance platforms require intricate financial logic, real-time data feeds, and robust security, making them among the most expensive Web3 projects to develop.

2. Blockchain Platform

The blockchain platform you choose for your Web3 development also plays a significant role in determining costs. Ethereum, being the most popular and established platform for smart contracts, often leads to higher development and transaction fees due to its congestion and gas fees.

Other blockchains, such as Solana, Binance Smart Chain (BSC), and Polygon, offer cheaper alternatives but may have different levels of developer community support or toolsets. The blockchain platform chosen influences not just the development costs but also the ongoing operational expenses.

Ethereum: High gas fees and slow transaction times, but it is the most established and secure for Web3 development.

Solana: Offers faster transactions and lower costs but may come with less robust development resources.

Binance Smart Chain (BSC): Cheaper transaction fees compared to Ethereum and has gained popularity for DeFi and NFT projects.

Polygon: A Layer-2 scaling solution for Ethereum that offers reduced costs and increased transaction speeds.

3. Development Team

The size and expertise of the development team have a direct impact on costs. Web3 development requires specialized skills in blockchain development, smart contracts, and cryptographic algorithms, which means you’ll need a team of experts. Hiring a Web3 development team can include various costs depending on whether you use freelancers, an agency, or an in-house team.

Freelancers: Often more affordable, but they may lack the broad experience needed for larger or more complex projects.

Development Agencies: A specialized Web3 development agency will provide a more comprehensive solution, with designers, developers, and project managers working together. However, this is usually the most expensive option.

In-House Team: Building an in-house Web3 development team requires long-term investment, as you’ll need to hire experts in blockchain, cryptography, and smart contracts. This option is best for businesses that plan to continually develop and maintain decentralized projects.

4. Smart Contract Audits and Security

Security is paramount in Web3 development services, especially when financial transactions are involved, as seen in DeFi projects or NFT marketplaces. Smart contracts are immutable, meaning they can’t be altered once deployed, making it crucial to ensure their security from the start.

Smart contract audits, conducted by third-party security firms, are essential to ensure that the code is free of vulnerabilities. Depending on the complexity of your contract, audit costs can range from several thousand dollars to tens of thousands. The cost of not performing audits can be even higher, with high-profile hacks in the DeFi space leading to multi-million-dollar losses.

5. Ongoing Maintenance and Updates

Web3 projects require ongoing maintenance, including server upkeep, smart contract upgrades, and responding to user feedback. While decentralized systems may reduce the need for continuous updates compared to traditional software, factors like security patches, performance optimization, and user experience improvements still necessitate ongoing investment.

6. Marketing and Community Building

One often-overlooked cost in Web3 development is marketing and community building. A major component of Web3 success hinges on building a strong, engaged community that supports the platform, particularly for projects involving tokens or NFTs. Marketing efforts can include creating content, running social media campaigns, building partnerships, and participating in decentralized communities. This adds to the overall cost, but it’s essential for user adoption and network growth.

Benefits of Web3 Development

Despite the associated costs, Web3 development offers significant benefits that make it a worthwhile investment. These benefits, driven by decentralization, transparency, and user empowerment, can transform businesses and industries. Here’s a breakdown of the key benefits:

1. Decentralization and Ownership

Web3 development is built on decentralized infrastructure, meaning that control over data, assets, and applications is no longer held by a single entity. This allows users to take ownership of their data, interactions, and assets on the platform. For businesses, this decentralization increases transparency and reduces reliance on intermediaries, offering a more equitable model.

For instance, NFT marketplaces allow creators to retain ownership of their work and receive royalties for future sales, while DeFi platforms enable users to manage their finances without traditional banks. Decentralization also enhances security by reducing the risk of single points of failure, which are common in centralized systems.

2. Trust and Transparency

Blockchain, the backbone of Web3, provides inherent transparency because all transactions and data are recorded on a public, immutable ledger. This builds trust among users, especially in sectors like finance, real estate, and supply chain management, where transparency is critical.

Smart contracts further enhance this trust by executing agreements without intermediaries, ensuring that transactions occur exactly as programmed. This eliminates the need for middlemen, reduces operational costs, and increases the speed of transactions.

3. Monetization Opportunities

Web3 development opens up numerous new avenues for monetization. Whether through NFTs, token economies, or decentralized finance, businesses can create models that allow users to participate directly in value generation. Tokenization, in particular, provides a powerful way to reward users for their participation or contributions to a platform.

For instance, platforms like Axie Infinity and Decentraland have created entire economies where users can earn by playing games or contributing to virtual worlds. DeFi platforms also enable users to earn yields on their crypto assets without relying on traditional financial institutions.

4. Interoperability

Web3 promotes interoperability between platforms, blockchains, and applications, allowing for seamless integration and collaboration. With cross-chain functionality, users can transfer assets, data, and services across different ecosystems, providing more flexibility and expanding the potential user base.

For businesses, this means the ability to tap into multiple blockchain networks, attracting a wider range of users and reducing the barriers to entry across different markets.

5. Enhanced Security and Privacy

Web3 applications often rely on cryptography to secure transactions and protect user privacy. Decentralized networks are generally more secure than traditional centralized systems since there is no single point of failure. Additionally, blockchain’s transparent nature allows users to verify the authenticity and integrity of transactions or data without exposing personal information.

In a world where data breaches and privacy concerns are increasingly prevalent, Web3 offers a more secure and private way for users to interact with applications and manage their digital identities.

Conclusion

While the costs of Web3 development can vary widely depending on the complexity of the project, blockchain platform, and security measures required, the benefits make it a promising investment for businesses looking to capitalize on the future of the internet. Decentralization, enhanced security, new monetization models, and increased transparency offer significant advantages that set Web3 apart from traditional web development.

By carefully weighing the costs against these benefits, businesses can make informed decisions about when and how to invest in Web3 development, positioning themselves for success in this rapidly evolving digital landscape.

Source Url :www.repurtech.com/guide-to-web3-development-costs-and-benefits/

0 notes

Text

Cryptocurrency has a serious problem: The party’s over. Fresh dollars from naive retail buyers aren’t coming in anymore after the crashes in May and June, despite a round of advertising during the Super Bowl in February reaching every consumer in the United States. Without those fresh dollars, the holders can’t cash out.

Crypto trading firms hold large piles of assets whose “market cap”—their alleged mark-to-market value—supposedly adds up to a trillion dollars. But this number is unrealizable nonsense because the actual dollars just aren’t there. Everyone in the system knows it. What to do?

The regulated U.S.-based exchanges are just the cashier’s desk for the wider crypto casino. The real trading action, as well as price discovery, is on the unregulated offshore exchanges. These include Binance, OKX, and Huobi. Until Tuesday, Nov. 8, they also included Sam Bankman-Fried’s FTX, which cut off customer withdrawals around 11:37 a.m. UTC on Nov. 8 and then revealed around 4 p.m. UTC that it was suffering a “liquidity crisis.” FTX is just the latest casualty in a series of collapses that began with Terraform Labs’s UST stablecoin; that took out Celsius Network, Voyager Digital, and many other crypto trading firms; and that is now gradually driving the price and trading volume of cryptocurrencies to what they should be: zero.

FTX desperately sought more funding, but to no avail; at press time, FTX had been shut down by its Bahamian regulator and put into liquidation, as well as was filing for bankruptcy in the United States and Bankman-Fried has resigned as CEO. But the fall of FTX has been particularly remarkable in part because its founder was unusually feted.

Sam Bankman-Fried, often referred to as SBF, was born in 1992 to parents who were both academics at Stanford University. After gaining a physics degree at the Massachusetts Institute of Technology, he was introduced to the “effective altruism” quantified charity movement by “longtermist” William MacAskill, and he took a job at quantitative trading firm Jane Street in 2014 with the aim of “earning to give,” a buzzword among effective altruists who believe that the most effective way to do good is to make a lot of money first—even in ethically dubious ways—in order to give it away.

After three years at Jane Street, Bankman-Fried started his own cryptocurrency hedge fund, Alameda Research, during the 2017 bitcoin bubble. He has said that he made the money to start FTX from an arbitrage opportunity. In 2018, bitcoin cost more in Japan than it did in the United States; everyone could see this, but for unclear reasons, only Alameda was in a position to exploit it.

FTX was founded in May 2019. Alameda could trade there and served as the exchange’s market maker. In most regulated markets, this would not be allowed because of the obvious conflicts of interest and the incentives to trade against your own customers—but offshore crypto is unregulated. FTX rapidly became very popular, offering complex products such as options trading, perpetual futures, and tokenized stock market shares, and it was perfectly placed for the 2021 crypto bubble, when bitcoin rocketed to $69,000, the volume of trade soared, and ordinary people the world over were sold hard on getting into just a bit of crypto. FTX did not allow U.S. customers but started a separate exchange, FTX US, in May 2020.

During the 2021 crypto bubble, Bankman-Fried started promoting himself as a billionaire public thinker with big ideas and a deliberate mystique. He posed for the front covers of Fortune and Forbes. He was invariably photographed in shorts, a T-shirt, and untied shoes. He reportedly said, “I think it’s important for people to think I look crazy.” This worked on the venture capitalists, such as Sequoia Capital, which bought his pitch—hook, line, and sinker—with a writer on its website saying: “And, since SBF is obviously a genius, I should simply assume that, compared with me, SBF will always be playing at level N+1.”

High-profile visitors would be scheduled to arrive when Bankman-Fried was asleep in the office beanbag. He spoke to the media about his charitable mission—even if the charities’ goals sometimes seemed odd, such as fighting risks from hypothetical future artificial intelligences.

FTX marketed itself heavily. It got Larry David to do a Super Bowl ad this year in which his character’s skepticism turned out to be completely correct. Bankman-Fried bought a 7.6 percent share in popular day-trading brokerage Robinhood. FTX sports sponsorships included the Miami Heat’s FTX Arena, MLB umpire patches, the Mercedes-AMG Petronas Formula 1 racing team, and athletes such as quarterback Tom Brady. FTX even advertised in fortune cookies. FTX worked hard to paint itself as a trustworthy, fully capitalized institution run by smart and sensible people—even as it was operating almost entirely outside any regulation and was a hollow shell.

But Bankman-Fried was also keen to sell himself as a philanthropist. Bankman-Fried formed a super PAC, Protect Our Future, to lobby for political candidates in the 2022 U.S. midterm elections, spending over $39 million. Several million dollars went to sponsoring his fellow effective altruist Carrick Flynn in a Democratic primary for the House of Representatives, but Flynn lost his primary to Andrea Salinas.

Bankman-Fried aggressively lobbied in Washington, D.C., for the Commodity Futures Trading Commission to control crypto in the United States. He was photographed with its commissioner, Caroline Pham. Bankman-Fried’s policy proposals upset many of his fellow crypto institutions, most notably offshore crypto exchange Binance and its CEO, Changpeng Zhao, who felt that Bankman-Fried was setting the rest of the industry up for failure.

Bankman-Fried’s media promotion served to distract attention from what was going on inside FTX. Occasionally, warning signs would leak: His Forbes billionaire list entry included a cautionary note that most of his claimed wealth “was tied up in ownership of about half of FTX and a share of its FTT tokens.”

FTT was the internal trading token of FTX—like supermarket loyalty points for frequent traders, who could get discounted trading fees and free withdrawals. The token was also traded in the wider crypto market. On Nov. 2, a balance sheet was leaked showing that a third of Alameda’s claimed assets were a large volume of FTT. It was as if the Tesco supermarket chain was solvent only if you counted its own made-up Clubcard points as assets. Alameda had also used this pile of FTT as collateral for loans from outside companies.