#BitcoinStandard

Text

Bitcoin: The Ultimate Hedge Against Inflation, Tyranny, and Debasement

In an ever-changing financial landscape, finding a reliable hedge against economic uncertainties is more crucial than ever. Bitcoin, often hailed as "digital gold," has emerged as a powerful tool to safeguard against inflation, tyranny, and currency debasement. While not without its challenges, Bitcoin's unique properties make it an increasingly attractive option for those seeking financial security.

Bitcoin Fundamentals

Before delving into Bitcoin's potential as a hedge, it's essential to understand its basic mechanics. Bitcoin operates on a decentralized network called the blockchain, where transactions are verified and recorded by a global network of computers. New bitcoins are created through a process called mining, which also secures the network. Importantly, Bitcoin has a fixed supply cap of 21 million coins, a key feature in its potential as a store of value.

Inflation: The Silent Wealth Destroyer

Inflation erodes the purchasing power of traditional currencies, diminishing the value of savings over time. Central banks' monetary policies, especially the unprecedented levels of money printing in recent years, have fueled inflation rates worldwide. For instance, the U.S. inflation rate hit a 40-year high of 9.1% in June 2022, significantly impacting consumers' purchasing power.

Unlike fiat currencies, Bitcoin's capped supply of 21 million makes it inherently scarce. This fixed supply positions Bitcoin as a potential hedge against inflation, as its value isn't subject to debasement through excessive issuance.

Tyranny: Financial Freedom in the Digital Age

Throughout history, oppressive regimes have exploited financial systems to control and manipulate their populations. Recent examples include the freezing of bank accounts during the 2022 Canadian trucker protests and the severe capital controls imposed in countries like Venezuela and Zimbabwe.

Bitcoin's decentralized nature offers a solution. It operates on a peer-to-peer network, independent of any central authority. This decentralization ensures that no single entity can control or censor transactions, empowering individuals with greater financial autonomy.

Currency Debasement: Protecting Wealth from Devaluation

Currency debasement, the reduction of a currency's value through excessive issuance, has been a recurring theme in economic history. From the Roman Empire's devaluation of its silver coins to the hyperinflation in Weimar Germany and more recently in Venezuela, the consequences of debasement have been disastrous.

Bitcoin's transparent and immutable ledger prevents such practices. Every Bitcoin transaction is recorded and verified by the global network, ensuring trust and integrity in the system.

The Bitcoin Advantage: Beyond Traditional Assets

While traditional assets like gold and real estate have long been considered hedges, Bitcoin offers unique advantages:

Portability: Unlike gold or real estate, Bitcoin can be easily transferred across borders.

Divisibility: Bitcoin can be divided into tiny fractions, allowing for micro-transactions.

Verifiability: The blockchain provides a transparent record of all transactions.

Accessibility: Anyone with internet access can participate in the Bitcoin network.

Challenges and Considerations

Despite its potential, Bitcoin faces several challenges:

Volatility: Bitcoin's price can be highly volatile, which may deter some investors.

Regulatory uncertainty: The regulatory landscape for cryptocurrencies is still evolving.

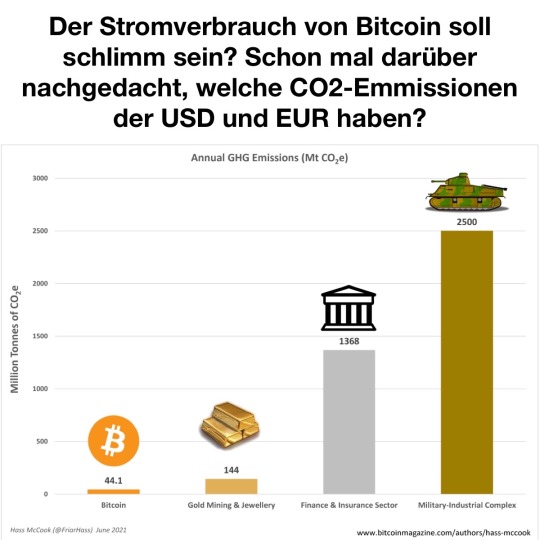

Environmental concerns: Bitcoin mining consumes significant energy, though efforts are being made to increase the use of renewable sources.

Adoption hurdles: While growing, Bitcoin's acceptance as a medium of exchange is still limited compared to traditional currencies.

Embrace the Future: Secure Your Financial Sovereignty

As we navigate uncertain economic times, Bitcoin provides a unique tool for those seeking financial security and independence. By potentially hedging against inflation, tyranny, and currency debasement, Bitcoin empowers individuals to take greater control of their financial destiny.

Investing in Bitcoin isn't just about potential gains; it's about exploring new avenues for financial sovereignty in an increasingly unstable world. Stay informed, do your research, and consider how Bitcoin might play a role in your long-term financial strategy. Bitcoin's transformative potential offers a beacon of hope for a more secure and autonomous financial future.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Crypto#Cryptocurrency#DigitalGold#FinancialFreedom#InflationHedge#BitcoinRevolution#Decentralization#Blockchain#EconomicSovereignty#Tyranny#CurrencyDebasement#Investing#FinancialSecurity#BitcoinAdvocate#SoundMoney#BitcoinStandard#FutureOfFinance#CryptoCommunity#DigitalCurrency#HardMoney#EconomicIndependence#InflationProtection#BitcoinEconomics#BitcoinEducation#BitcoinAwareness#financial experts#finance#financial empowerment#financial education

2 notes

·

View notes

Text

https://x.com/memesaufdeutsch/status/1745211190098243680?s=12

Was ist ein Bitcoin ETF?

0 notes

Text

Onboarding My Younger Sister To Bitcoin - Bitcoin Magazine

This is an opinion editorial by Santiago Varela, a bitcoin miner and writer from Mexico City.My sister turned 18 years old in the beginning of 2023 and I gave her a very unusual gift during this holiday season. Because I love her, I truly believe that the best gift I can give her is the orange pill.It all started with a letter that I wrote for her explaining the gift I was about to give her. Then, I handed her a copy of “The Bitcoin Standard” by Saifedean Ammous and a hardware wallet. However, that was just the beginning of a long process that we had to go through together if I really wanted to orange pill her.Of course, I was well aware that her first reaction to my surprise wasn't going to include the typical face of an 18-year-old girl opening her presents on a joyful Christmas morning. At first, she seemed more confused than excited. I have no doubt that she was expecting some nice pair of shoes or a cool gadget. I'm sorry sis, but that's how we maximalists roll. In the birthday/holiday letter, I pointed out three reasons why I was giving her this specific gift:- I want to set her on the path to financial freedom

- I want her to be a sovereign woman in a fiat world where dishonest relationships have been normalized

- As a high school senior who doesn't know what she wants to study in college, she could benefit from Bitcoin which might give her some ideas for what she wants to doThe long process of orange pilling my sister began with a quote from the prologue of “The Bitcoin Standard,” which I consider the perfect starting point. I asked her to read this quote over and over again before beginning the orange-pilling journey:“This book does not offer investment advice, but aims at helping elucidate the economic properties of the network and its operation, to provide readers an informed understanding of bitcoin before deciding whether they want to use it. Only with such an understanding, and only after extensive and thorough research into the practical operational aspects of owning and storing bitcoins, should anyone consider holding value in bitcoin. While bitcoin´s rise in market value may make it appear like a no-brainer as an investment, a closer look at the myriad hacks, attacks, scams, and security failures that have cost people their bitcoins provides a sobering warning to anyone who thinks that owning bitcoins provides a guaranteed profit. Should you come out of reading this book thinking that the bitcoin currency is something worth owning, your first investment should not be in buying bitcoins, but in time spent understanding how to buy, store, and own bitcoins securely. It is the inherent nature of bitcoin that such knowledge cannot be delegated or outsourced. There is no alternative to personal responsibility for anyone interested in using this network, and that is the real investment that needs to be made to get into bitcoin.”In the letter, I told her that I would help her set up the hardware wallet and I would send her a little bit of bitcoin. To begin, I sent her $10 worth of bitcoin. But then, to make sure that she invested time into acquiring the basic, necessary knowledge and to make her understand the proof-of-work philosophy, I promised that I would send her $100 worth of bitcoin for every chapter of the book that she read. Therefore, I prepared a quiz for each chapter to verify that she really read carefully. However, as someone who is deep down the Bitcoin rabbit hole, I knew that making her read the book to stack sats on her hardware wallet wasn't enough. That was nothing, we were just getting started. So, what was next in the orange-pilling journey? Every time that I crossed by any opportunity, I tried to convert that moment into a little Bitcoin lesson. For example, there was such an opportunity after my sister was assigned a project in her high school philosophy class. Knowing that I am a big fan of philosophy, she came to ask me for help. The project consisted of having a conversation with one of your family members but using the famous Socratic method for the conversation. If you don't know what that is, the Socratic method (named after Socrates) is “a form of cooperative argumentative dialogue between individuals, based on asking and answering questions to stimulate critical thinking and to draw out ideas and underlying presuppositions.” Obviously, we had a dialogue about Bitcoin and money using the Socratic method.Another thing I did in this orange-pilling journey was to show her a rabbit hole inside of the Bitcoin rabbit hole: bitcoin mining and energy. I love bitcoin mining and the energy aspects of Bitcoin. In fact, I love it so much that we have an ASIC in our garage. It wasn't really hard to make her grasp how passionate I am about home mining. Believe it or not, she had never even seen my ASIC (she had only heard the “brrrrrr”). Consequently, I took her to the garage and she got some hands-on experience. I also have my Bitcoin and Lightning nodes in the garage. That was a lot of fun because with tools like Mempool.Space and LnVisualizer I was able to help her see the tangible side of Bitcoin. This is when I really felt that it all began to come together.As you all likely know, knowledge about Bitcoin can’t be delegated or outsourced. When it comes to Bitcoin, there is no alternative to personal responsibility. Although I’ve told her that I’d love to help her with anything, I can’t guide her down the rabbit hole forever. You have to go down the Bitcoin rabbit hole by yourself. I guided her for a long time but the moment for her to embark on the journey for herself is here. Like Oscar Wilde once said: “Education is an admirable thing. But it is well to remember from time to time that nothing that is worth knowing can be taught.”So, I began treating her like any other Bitcoin pleb out there and let her go down the rabbit hole by herself. The only thing I did was to send her a bunch of resources (articles, podcasts, videos, books, etc.) and let her go her own way. At the same time, I realized that I could do this with other kids that are about the same age as my sister. Even better, I realized that my sister could help me with this and introduce her digital-native friends to Bitcoin because, if you care about Bitcoin, you should onboard people individually. Accordingly, I’ve decided to turn our garage into a little Bitcoin academy. Although my sister was the guinea pig for this experiment (and, as I am writing, she is the only student that has attended Bitcoin academy), I have to give a big shout out to other Bitcoiners around the world who have shared educational content for anyone to use. For example, Mi Primer Bitcoin (from El Salvador) has an amazing Bitcoin diploma workbook that anyone can download for free. I have no doubt that initiatives like theirs or like Escuelita Bitcoin in Uruguay are what we need if we want a future with sovereign individuals. We need to teach the young. Hopefully, this inspires other Bitcoiners around the world to introduce their younger siblings to Bitcoin. I was inspired by initiatives like the ones mentioned above and by stories like the Denver middle schoolers who became Bitcoin entrepreneurs. With a little bit of luck, the next time I write an article for Bitcoin Magazine, it’ll be about Mexico City middle schoolers who became Bitcoin entrepreneurs. For now, stay humble and stack sats my friends. This is a guest post by Santiago Varela. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Read More

Source by

Read the full article

0 notes

Photo

#bitcoinstandard #currency of the internet. #consensus #proofofwork #PoW #mining #trustcode #newage #storeofvalue #mediumofexchange #btc #bch #internetmoney #limitless #boarderless #decentralized (at Decentralized) https://www.instagram.com/p/BnF2IgwgQYi/?utm_source=ig_tumblr_share&igshid=114mzpz71y907

#bitcoinstandard#currency#consensus#proofofwork#pow#mining#trustcode#newage#storeofvalue#mediumofexchange#btc#bch#internetmoney#limitless#boarderless#decentralized

4 notes

·

View notes

Photo

The Fiat Standard - The debt slavery alternative to human civilization. The Bitcoin Standard - The decentralized alternative to central banking. GOOGLE @SANDHUVALUEINVESTING Website- www.Sandhuvalueinvesting.blogspot.com Instagram- https://www.instagram.com/sandhuvalueinvesting Telegram- https://t.me/SandhuValueInvesting WordPress- https://sandhuvalueinvesting.wordpress.com Sharechat- https://sharechat.com/profile/sandhuvalueinvesting?d=n Pinterest- https://pin.it/2PES7ya Twitter- https://twitter.com/SandhuInvesting?t=5DDavO8KP6snBPqIM7_chA&s=09 Facebook- https://m.facebook.com/SandhuValueInvesting/ LinkedIn- https://www.linkedin.com/in/sandhuvalueinvesting #fiat #fiatstandard #bitcoin #bitcoinstandard #stockmarkets #sandhuvalueinvesting #debt #slavery #debtslavery #debtslave #centralbank #centralbanks #decentralized #decentraland #decentralization #decentralizedfinance #decentralizedworld #Cryptocurrency #binance #Wazirx #matic #maticcoin #maticnetwork #fantom #fantomcoin #shibainucoin #ethereum #mana https://www.instagram.com/p/CXbcdtmvumg/?utm_medium=tumblr

#fiat#fiatstandard#bitcoin#bitcoinstandard#stockmarkets#sandhuvalueinvesting#debt#slavery#debtslavery#debtslave#centralbank#centralbanks#decentralized#decentraland#decentralization#decentralizedfinance#decentralizedworld#cryptocurrency#binance#wazirx#matic#maticcoin#maticnetwork#fantom#fantomcoin#shibainucoin#ethereum#mana

0 notes

Photo

Dr. @saifedean Ammous, author of “#thebitcoinstandard and “The Fiat Standard,” joined Dr. Jordan B. Peterson, clinical psychologist, best-selling author, and host of The #JBP Podcast, to discuss #money, #economics, incentives, #decentralization, #Bitcoin, and #fiatcurrency “Learned a lot,” @jordan.b.peterson tweeted, after the conversation with Ammous. “Bought some more #bitcoin. Inflation be damned.” Ammous walked through many of the nuances of Bitcoin, including its #technology and #economic dynamics, shedding light on plenty of reasons why the monetary system is unique. The author of The Fiat Standard, a follow-up to his famous work The #BitcoinStandard, delved into details in a beginner-friendly fashion, hashing out complex topics into more straightforward concepts. #Peterson asked thoughtful questions, which were explored in detail throughout the conversation. Many of his doubts resonate with beginners, who naturally try to puzzle through the distinctiveness of Bitcoin and why exactly it is the solution for many problems society currently faces. “There are no insiders on Bitcoin,” Ammous said while explaining how the #monetarynetwork manages to be a genuinely decentralized one, differently than other projects. “Bitcoin only has users…no admins. There is nobody with a master key.” https://www.instagram.com/p/CWalCbZsfkH/?utm_medium=tumblr

#thebitcoinstandard#jbp#money#economics#decentralization#bitcoin#fiatcurrency#technology#economic#bitcoinstandard#peterson#monetarynetwork

0 notes

Photo

I’m trying to show these biztards, how putting profit into BTC and ETH. Supercharged my trading profits. Crypto is a rising tide that lifts all ships. But don’t get caught going against the 4 year, BTC cycle. That’s how you get rekt! Thank you Plan B, Saifedean Ammous and Satoshi. 🤓 Turn on notifications and swipe right for a peak inside my strange mind. #bitcoinstandard #thebitcoinstandard #saifedeanammous #planb #planbitcoin #stocktoflow #stock2flow #btchalvingcycletrader #trendtrading #trendtrader #cryptotrends #btctrends #hodluntil2022 #illmakeyourich #youllmakeyourselfwealthy #wediditfrens (at Boulevard Pool at The Cosmopolitan of Las Vegas,) https://www.instagram.com/p/CEdNhhTgl59/?igshid=uqcuizzzdnhs

#bitcoinstandard#thebitcoinstandard#saifedeanammous#planb#planbitcoin#stocktoflow#stock2flow#btchalvingcycletrader#trendtrading#trendtrader#cryptotrends#btctrends#hodluntil2022#illmakeyourich#youllmakeyourselfwealthy#wediditfrens

0 notes

Photo

📣 #Tonga to Make #BTC as Legal Tender by Q2 & #BTCMining by Q3 of 2023

👉 #LordFusitu’a, a former member of the Tongan parliament, has shared a timeline for the country’s plan to adopt #Bitcoin (#BTC).

👉 A #Tongannobleman, Fusitu’a, had previously disclosed the four-step plan, a copy of the Salvadoran #Bitcoin playbook.

👉 Step one is remittance, two is legal tender, three is #Bitcoinmining, and four is moving national treasuries into #Bitcoin, effectively upgrading the nation onto a #Bitcoinstandard.

👉 During a #Twitter conversation, Lord Fusitu’a said that if the bill is passed in the beginning to mid-October. After this, the bill goes to the palace office for three to four weeks. HM [His Majesty] will give or not give royal assent by mid-November.

Learn more...👇

Web 🌐 http://bit.ly/358ywyu

Android 📲 http://bt.ly/2PhGUF5

iOS 📲 https://apple.co/2DJ7bqL

&

YouTube https://bit.ly/3oHXDBB

Telegram 🌐 http://bit.ly/2XgolES

Medium 🌐 https://bit.ly/3eGCaVE

Discord https://bit.ly/3yjEkUB

Airdrops 💰 https://bit.ly/3bDim5m

0 notes

Text

The Alternative to Central Banking – Robert Kiyosaki and Saifedean Ammous [Rich Dad Radio Show]

youtube

Gold became money as determined by the free market because of its properties—scarcity. But with the invention of Bitcoin, we are now seeing a historical event that will never be repeated. Bitcoin’s characteristics make it a direct competitor to the central banks because of its absolute scarcity, resistance to theft and confiscation, and the system that it’s built upon prevents it from being shut down.

Saifedean Ammous, economist and author of The Bitcoin Standard: The Decentralized Alternative to Central Banking says, “The higher the ratio of the stock to the flow, the more likely a good is to maintain its value over time and thus be more salable across time.” And he says it’s this reason Bitcoin is the only working alternative for central banking.

Host Robert Kiyosaki and Saifedean Ammous answer the questions surrounding Bitcoin and why it the “first demonstrably reliable operational example of digital cash and digital hard money.”

Website: www.saifedean.com

#robertkiyosaki #bitcoinstandard #financialeducation

https://www.richdad.com/

Facebook: @RobertKiyosaki

https://www.facebook.com/RobertKiyosaki/

Twitter: @TheRealKiyosaki

Tweets by theRealKiyosaki

Instagram: @TheRealKiyosaki

https://www.instagram.com/therealkiyosaki/

The post The Alternative to Central Banking – Robert Kiyosaki and Saifedean Ammous [Rich Dad Radio Show] appeared first on News Lookout.

source https://newslookout.com/inspire/the-alternative-to-central-banking-robert-kiyosaki-and-saifedean-ammous-rich-dad-radio-show/

0 notes

Video

( BITCOIN STANDARD ) in Deutsch ! CHINA Neues Kryptographie-Gesetz !

0 notes

Text

The Future of Bitcoin in the Global Economy

As the world grapples with economic instability, Bitcoin is emerging as a beacon of hope, promising to reshape the global financial landscape. Our current economic system, plagued by inflation, currency devaluation, and a growing distrust in central banks, desperately needs an alternative that offers stability and security. Bitcoin, with its decentralized nature and finite supply, stands out as a revolutionary force poised to transform the way we understand and use money.

Unlike traditional fiat currencies, which can be printed at will, Bitcoin's supply is capped at 21 million coins, making it inherently deflationary. This scarcity, combined with its decentralized structure, positions Bitcoin as a robust hedge against inflation and a reliable store of value. As more individuals and institutions recognize these unique attributes, the adoption of Bitcoin is set to surge, integrating it further into the global economy.

The transition to a Bitcoin standard will profoundly impact how we price assets and conduct transactions. In a true free market, prices are determined by supply and demand, free from government intervention. Bitcoin embodies this principle, as it is immune to manipulation by central banks or governments. As Bitcoin becomes more ingrained in our financial system, we will witness a significant repricing of assets. Real estate, commodities, and even stocks will be evaluated in terms of their value in Bitcoin, leading to more transparent and accurate pricing driven solely by market forces.

Moreover, Bitcoin's decentralized nature promises to enhance financial inclusion. In regions with unstable currencies or limited access to banking services, Bitcoin offers a way for people to participate in the global economy. This increased participation will drive economic growth and spur innovation, breaking down barriers that have long hindered progress.

Transaction costs are another area where Bitcoin stands to make a substantial impact. Traditional banking transactions can be slow and expensive, whereas Bitcoin transactions are typically faster and cheaper. This efficiency will lower costs for businesses and consumers alike, boosting economic activity and productivity.

However, the path to a Bitcoin-dominated economy is not without challenges. Regulatory uncertainty remains a significant hurdle, as governments worldwide grapple with how to regulate this new form of currency. Clear and consistent regulations are essential to ensure safe and widespread adoption. Security is another critical concern. As with any digital asset, safeguarding Bitcoin wallets and exchanges from theft and fraud is paramount. Additionally, Bitcoin's infrastructure must scale to handle increased transaction volumes, a challenge that technological advancements like the Lightning Network aim to address.

The future of Bitcoin in the global economy is undeniably promising. By harnessing the power of free market dynamics, Bitcoin can lead us to a more transparent, efficient, and inclusive financial system. The repricing of assets, enhanced financial inclusion, and reduced transaction costs are just a few of the myriad benefits Bitcoin offers. As we stand on the brink of this financial revolution, it is essential to address the challenges ahead and ensure that the transition to a Bitcoin standard benefits all.

The journey towards embracing Bitcoin is not without its hurdles, but the potential rewards make it a path worth pursuing. Staying informed and engaged will be crucial as we navigate this transformative period. Bitcoin is not just a digital currency; it is a symbol of economic freedom and a testament to the power of decentralization. As we move forward, let us embrace the possibilities it offers and work towards a future where financial stability and security are accessible to all.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#GlobalEconomy#FinancialRevolution#Cryptocurrency#FutureOfFinance#DecentralizedFinance#DigitalGold#BitcoinStandard#EconomicFreedom#FinancialInclusion#Blockchain#BitcoinAdoption#FreeMarket#CryptoInnovation#EconomicTransformation#financial education#unplugged financial#finance#financial experts#financial empowerment#digitalcurrency

3 notes

·

View notes

Text

https://x.com/memesaufdeutsch/status/1700805372460646802?s=12

0 notes

Quote

Mooi artikel over de rol van #Bitcoin versus #goud en de hypothetische introductie van een mogelijke Bitcoin standaard – #BitcoinStandard!https://t.co/T3CYYLLFQq

— Jan Mertens (@mertensposts) April 6, 2018

https://platform.twitter.com/widgets.js

via Twitter https://twitter.com/mertensposts

April 07, 2018 at 01:05AM

https://t.co/T3CYYLLFQq

0 notes