#Bitso

Explore tagged Tumblr posts

Text

Bitso Launches Web3 Wallet, Aims to Bridge Traditional and Decentralized Finance

Bitso, a leading cryptocurrency exchange based in Mexico and catering to the Latin American market, has unveiled a new Web3 wallet designed to integrate users into the decentralized finance (DeFi) ecosystem. This initiative is part of Bitso’s strategy to streamline customer access to services like non-fungible tokens (NFTs) and decentralized exchanges from a trusted platform. The newly launched…

View On WordPress

0 notes

Text

#Cripto - Nueva Integración de Payoneer y Bitso para simplificar los pagos digitales

Payoneer – la compañía de tecnología financiera que empodera a las pequeñas y medianas empresas (PYMES) del mundo para realizar transacciones, hacer negocios y crecer a nivel global – y Bitso – la empresa de servicios financieros impulsados por criptomonedas líder en Latinoamérica-, anuncian su nueva integración que facilitará la vinculación de los usuarios con los servicios de ambas compañías…

View On WordPress

0 notes

Text

wearing a tshirt that says "ASK ME ABOUT 100KANOJO"

#➳ the fool speaks#class starts in a bitso i might not answer til school ends if anyone actually does but. yk

2 notes

·

View notes

Note

WHAT AN AMAZING COLLECTION !!!!!!!!!!!!!!!!!!!! i love the dragons protecting the display OOOOOOOUGH SHARKS TEETH YEAAAAAAAAA Do you have any specific favorites? (& What about them said Pick Me to you? (i love rocks sm but have none space so i only have a lil bag of my own) )

YESS!!! THANK YUOU!!! and ofc i gotta have dragons B)

and HMMM OKAY lemme THInks

so *now* pick and buy gems at trinket stores whenver i go travelling and see any tha i just dont own yet (or if theres a piece that's really pretty to me that i DO have, but it's just unique and cool and i want it)

but back then id just..! buy whatever was Cool to me . id always buy so many at once my god

my favorites are defo my extra silly fancy lookin gems!! lemme show em here (older pics) (some are fancier bc i took them for my personal collection list google doc)

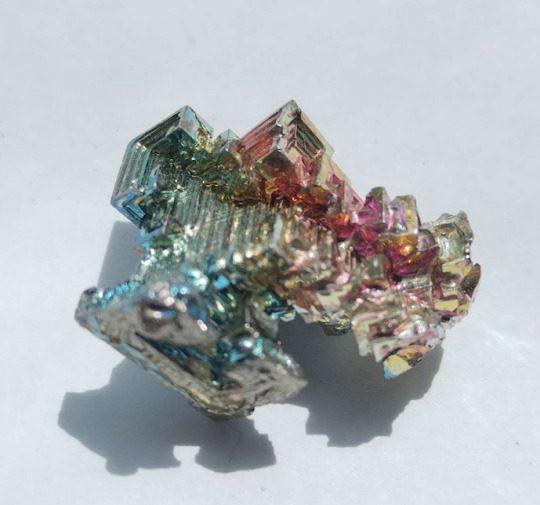

bismuth!!

these quartz! i was told they are some type of quartz! these are special to me because i got them a year ago during a school trip to germany - i only had a few euros on me and i ended up spending it all on gems. we checked out the christmas markets and there was an friendly old fellow who was selling gemstones and other things! he even had a cutter and could speak english. we chatted a bit and i listened to him talk about things (like how these lil fellas are formed. i know nothing about chemicals but i just think these things are interesting!!!! i actually get most my gems from giftshops near cave tours because i love visiting them and think it's interesting ^^

anyways he had a little box of various "rocks" that could possibly be geodes that he'd cut and see if they are! the price depended on their size. he said that i could guess with the weight and feel of the "rock" and let me pick from a few that could possible be ones. i said it didn't matter to me if it's gonna be hollow or not, since it's cool to me anyways!

so while my classmates waited and stared at me i just watched this guy cut it nicely in half like this - and he then even cut the smaller flatter piece of it, too. it was very nice! it's also where i bought the tooth, the bismuth, and some other things that i forgot as well... oops. i got a lot of gems

this shimmery pretty goldstone / aventurine glass ! wacky picture quality but i don't feel like getting new pics (+ im on pc now) (lie: i ended up getting new pics later)

. it's a man-made lil' mineral, but it's very lovely regardless! i honestly only care about the "realness" only i it's a scam of some sort. any rock, trinket, gem or mineral, man-made or not is very niceys to me. (i still want an opal tho i only got an opalite which was mislabeled. i dont think on purpose since these stores sometimes accidentally mislabel or misspell things. or use czech names which gets confusing. yeah i may have inaccurate names for some of my gems but i try my best to be accurate. im no pro im just a collector little beast)

some type of peacock ore! (either treated chalcopyrite or bornite, as i've previously written down. i'll trust my past self)

aura quartz! one of my first 3 pieces ive ever gotten that sparked my collection

all of these little fellas i bought at the same place for really cheap! filled my lil collection quite a bitso. i loves tghem. theyre like cereal To Me

in order: garnet, carnelian, emerald, tusquoise (why isnt this one in my list. oh my god how many gems did i miss. i still have a few to add that ill list on the list later that i need to re-check what gems they are. lord.) opalite, chalcedony, snowflake obsidian, obsidian (?), onyx. + not pictured an aquamarine which...? i cant find? im not checking if i put it behind a bigger gem and i cant FIND IT.

i really need to do a new and better gem list . oops. i cant always rely on my memory for these names

my EYES! in order: tiger's eye 2x, hawk's eye, bull's eye

my funny silly mosly multicolor fellas idk they fit the Vibes. i likes thgem (appreciae this secion i had to make sure and like re-identify half of these but i still could be incorrect)

in ORDER... lapis lazuli, sodalite 2x, elbaite (most likely), chrysocolla, rhodonite, blue apatite, amazonite, kyanite

dalmatian jasper and unakite

...some kinda jasper?

so ya!! thats some of my Rocks. this took a while bc i had to look what some of these are again @_@ i loaves them . todays guzma enrichment: this

5 notes

·

View notes

Text

跨境结算基础设施 XFX 完成 910 万美元种子轮融资,Haun Ventures 和 Castle Island Ventures 领投

深潮 TechFlow 消息,6 月 17 日,据官方消息,跨境结算基础设施项目 XFX 正式上线并完成 910 万美元种子轮融资。此轮融资由 Haun Ventures 和 Castle Island Ventures 领投,Oak HC/FT、MAYA Capital、Coinbase Ventures、Paxos、Bitso 等机构参投。 XFX 专注于构建机构级跨境结算基础设施,旨在推动全球资金流动的未来发展。该项目的具体技术细节和应用场景尚未公布,但其获得多家知名区块链投资机构支持表明市场对跨境支付解决方案的持续关注。

0 notes

Text

RLUSD Launch Price Prediction: Here’s What Industry Leaders Are Saying

Ripple is set to launch its USD-backed stablecoin, RLUSD, on December 17, 2024. The stablecoin will initially be available on platforms like Uphold, MoonPay, CoinMENA, Bitso, and Archax, with plans to expand to more exchanges in the future. RLUSD is backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents, offering transparency through monthly third-party audits of its reserves.

www.cifdaq.com

0 notes

Text

Ripple is set to launch its USD-backed stablecoin, RLUSD, on December 17, 2024. The stablecoin will initially be available on platforms like Uphold, MoonPay, CoinMENA, Bitso, and Archax, with plans to expand to more exchanges in the future. RLUSD is backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents, offering transparency through monthly third-party audits of its reserves.

While RLUSD is designed to always maintain a $1 value, some collectors are already bidding on it in on-chain marketplaces, with bids reaching up to 836 XRP ($2068) (As reported by Coindesk) before its release. This early demand could lead to temporary price fluctuations, as RLUSD may not have enough liquidity to immediately maintain its $1 peg.

Himanshu Maradiya, Chairman and Founder, CIFDAQ, told Coinpedia,

www.cifdaq.com

0 notes

Text

A Bitso Business - segmento B2B da Bitso, que fornece a infraestrutura para pagamentos transfronteiriços eficientes e transparentes - anunciou hoje a criação da Juno, sua subsidiária dedicada à emissão e gestão de ativos virtuais. Como primeiro lançamento, a Juno anuncia o token MXNB na rede Arbitrum, uma stablecoin atrelada ao valor do peso mexicano, com paridade de 1:1 garantida por reservas fiduciárias. Devido à sua alta segurança, escalabilidade, velocidade e crescente ecossistema na América Latina, a Arbitrum é a blockchain de base e a rede inicial onde o crescimento do MXNB será impulsionado.O setor de stablecoins vem crescendo rapidamente, atingindo uma capitalização superior a 230 bilhões de dólares em março de 2025, e movimentando trilhões em volume de transação anualmente. A expectativa do mercado é de que as stablecoins aprimorem ainda mais a infraestrutura financeira, cujo processo de inovação em relação às moedas fiduciárias tem sido lento, em áreas como pagamentos e transferências internacionais. Um estudo recente da Bitso Business, conduzido pela PCMI, revelou que a tecnologia blockchain e as stablecoins estão se tornando o método preferido para transferências globais, pela sua capacidade de eliminar intermediários, cortar custos e aumentar a velocidade nas transações. Diante desse cenário promissor e o crescente número de projetos relacionados a stablecoins em desenvolvimento, a Bitso Business nomeou recentemente Ben Reid como o novo Head de Stablecoins. Ele liderará a estratégia da empresa para acelerar a adoção global desses ativos em mercados emergentes, oferecendo às empresas e consumidores maior eficiência nos pagamentos, inclusão financeira e acesso ampliado aos mercados financeiros. “As empresas globais enfrentam desafios monetários significativos para atender clientes em novos mercados e realizar pagamentos transfronteiriços, como altos custos e tempos de transação ineficientes. As stablecoins oferecem uma alternativa rápida, econômica e transparente atrelada a uma moeda fiduciária, e têm sido fundamentais para expandir o acesso a mercados estrangeiros e transformar os pagamentos em todo o mundo. A MXNB permite que empresas globais façam negócios na América Latina de uma maneira mais eficiente, e a Juno será um player essencial na emissão e troca de tokens digitais, ajudando a impulsionar as oportunidades na região”, disse Ben Reid, Head de Stablecoins da Bitso Business. Para impulsionar a distribuição e crescimento da MXNB em um ecossistema vibrante e influente, com projetos ativos em pagamentos, remessas, gestão de patrimônio, DeFi e gaming, entre outros, a Juno firmou uma parceria com a Arbitrum, uma das soluções de escalabilidade Layer 2 (L2) mais adotadas no Ethereum. Essa tecnologia foi projetada para aumentar a velocidade das transações e reduzir os custos, mantendo a segurança e descentralização do Ethereum. "Atuar em conjunto com a Bitso Business e a Juno com o MXNB permite que a Arbitrum participe de um projeto altamente significativo para a indústria de pagamentos digitais transfronteiriços", disse Austin Ballard, Gerente de Parcerias da Offchain Labs. "A escolha da Arbitrum como blockchain nativa para a implementação da MXNB aproveita a expertise e as capacidades do ecossistema Arbitrum no México e demais mercados, além de conectar-se à comunidades de desenvolvedores consolidadas na América Latina e a uma rede de parceiros em serviços financeiros e fintechs. Isso impulsionará o desenvolvimento de produtos para esse token em uma região onde empresas locais e globais estão ávidas por soluções como essa". Como parte do grupo Bitso, a Juno operará de forma independente para gerenciar operações de stablecoins, incluindo a MXNB, garantindo aderência aos mais altos padrões de custódia segregada, gestão e transparência para fundos tanto em moedas fiduciárias quanto em cripto. A MXNB combina as vantagens da tecnologia blockchain — como transparência, velocidade de transação e acessibilidade global — com estabilidade assegurada por rigorosos mecanismos de controle operacional. Ela é totalmente lastreada pelo valor equivalente em pesos mexicanos, e as reservas são auditadas regularmente por terceiros para garantir transparência e confiança. A stablecoin MXNB atenderá a diversos casos de uso institucionais, incluindo: - Pagamentos transfronteiriços: Com o MXNB, as empresas poderão converter fundos entre outras stablecoins atreladas à sua moeda local. A Juno permite que as empresas convertam stablecoins lastreadas em dólares a MXNB, para que possam realizar transferência rápida de valores para outras instituições, seja por meio de transferências de criptomoedas ou de pesos mexicanos, facilitadas pelo sistema SPEI. - Fintechs e carteiras digitais: Infraestrutura que expande o acesso ao mercado para entidades estrangeiras e locais por meio de ativos digitais, abrindo oportunidades de expansão regional com custos reduzidos. - Pagamentos digitais: Provedores de serviços de pagamento podem expandir suas ofertas integrando a MXNB em suas soluções, permitindo liquidações mais rápidas e taxas de transação menores para indivíduos e comerciantes. - Remessadoras de dinheiro: Empresas de remessas podem utilizar a MXNB para realizar pagamentos mais rápidos e com menores custos aos destinatários. Para facilitar o acesso corporativo à MXNB, a Juno desenvolveu a Juno Mint Platform, que oferece operação via navegador, além de um conjunto completo de APIs. Essas ferramentas possibilitam aos clientes o acesso a serviços como de emissão e resgate de tokens, envio e recebimento de pagamentos de moeda fiduciária a MXNB por meio de infraestruturas de pagamento locais e conversões entre stablecoins. Read the full article

0 notes

Text

RLUSD Launch Price Prediction: Here’s What Industry Leaders Are Saying

Ripple is set to launch its USD-backed stablecoin, RLUSD, on December 17, 2024. The stablecoin will initially be available on platforms like Uphold, MoonPay, CoinMENA, Bitso, and Archax, with plans to expand to more exchanges in the future. RLUSD is backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents, offering transparency through monthly third-party audits of its reserves. While RLUSD is designed to always maintain a $1 value, some collectors are already bidding on it in on-chain marketplaces, with bids reaching up to 836 XRP ($2068) (As reported by Coindesk) before its release. This early demand could lead to temporary price fluctuations, as RLUSD may not have enough liquidity to immediately maintain its $1 peg.

Himanshu Maradiya, Chairman and Founder, CIFDAQ, told Coinpedia,“Ripple’s RLUSD stablecoin, pegged to $1, has already generated significant excitement ahead of its launch, with onchain bids soaring up to $2,000. This pre-launch frenzy reflects limited supply and heightened demand, as speculators rush to secure the first RLUSD tokens.” He added,“While such inflated prices may turn heads, volatility is expected to settle, bringing the price closer to $1 as liquidity normalizes post-launch. With RLUSD set to go live on the XRP Ledger, Ripple’s entry into the stablecoin market marks a pivotal moment, enhancing utility, driving liquidity, and strengthening stablecoins’ role in cross-border payment solutions.”

www.cifdaq.com

0 notes

Text

La evolución de los exchanges en Latinoamérica: integración financiera y nuevas tendencias en adopción

Los exchanges de criptomonedas en Latinoamérica han pasado de ser plataformas de nicho a convertirse en actores clave dentro del ecosistema financiero. Su crecimiento ha sido impulsado por la creciente demanda de stablecoins, pagos digitales, inversión en Bitcoin y trading avanzado, así como por la integración con bancos y fintechs.

Stablecoins, pagos y trading: los productos más demandados

La demanda de criptomonedas en la región varía según el perfil del usuario. Según Julián Colombo, CEO de Bitso, las stablecoins son las más utilizadas en países con alta inflación como Argentina y Venezuela:

"Las stablecoins son el producto estrella en países con alta inflación o restricciones cambiarias. Muchos usuarios las utilizan como reserva de valor o para dolarizar ingresos."

Por su parte, José Luis del Palacio, cofundador de Decrypto, destaca que en el ámbito empresarial las monedas estables son clave para pagos de comercio exterior y contratación de colaboradores remotos:

"Los bancos no atienden ese tipo de transferencias, por lo que las criptomonedas ofrecen una solución eficiente y rápida."

En el sector financiero, Patrick Silveira, Expansion Manager de Coincall, señala el crecimiento del trading de opciones sobre criptomonedas:

"Observamos un aumento en la demanda de trading de opciones de cripto. Los inversores utilizan estas herramientas para estrategias avanzadas y gestión de riesgos."

Finalmente, Pablo Casadio, Co-founder & CFO Bit2Me, resalta el crecimiento del staking como alternativa de inversión:

"Cada vez más usuarios buscan generar rendimientos pasivos con sus activos digitales."

El acercamiento de los exchanges con el sistema financiero

En los últimos años, los exchanges han comenzado a integrarse con bancos y fintechs, facilitando la adopción de criptomonedas en el sector financiero tradicional.

Desde Bitso, Colombo señala:

"Las fintechs y los bancos están analizando cómo integrar servicios como custodia de activos digitales, préstamos respaldados en cripto y pagos internacionales con stablecoins."

Desde Bit2Me, Casadio destaca el impacto de la regulación en el crecimiento del sector:

"El año 2025 será clave para la adopción institucional. Grandes bancos y fintechs están integrando servicios cripto."

Por su parte, Decrypto ha experimentado un mayor acercamiento empresarial tras obtener licencia de la CNV:

"Muchas empresas que tenían dudas sobre trabajar con criptomonedas ahora están confiando más y abriendo cuentas con nosotros." – José Luis del Palacio.

Un mercado en expansión

El ecosistema cripto en Latinoamérica sigue evolucionando con una mayor adopción tanto por usuarios particulares como por empresas e instituciones financieras. La transparencia, la regulación y la educación financiera serán factores determinantes para consolidar la adopción masiva en la región.

#Mercado#Expanción#Finanzas#Token DEFI#Opinion#Exchange#Crypto#Cryptopcurrency#BTC#AVAX#ADA#HBAR#MITHR#ACCIO#CONGO#KEnya

1 note

·

View note

Text

RLUSD Launch Price Prediction: Here’s What Industry Leaders Are Saying Ripple is set to launch its USD-backed stablecoin, RLUSD, on December 17, 2024. The stablecoin will initially be available on platforms like Uphold, MoonPay, CoinMENA, Bitso, and Archax, with plans to expand to more exchanges in the future. RLUSD is backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents, offering transparency through monthly third-party audits of its reserves. While RLUSD is designed to always maintain a $1 value, some collectors are already bidding on it in on-chain marketplaces, with bids reaching up to 836 XRP ($2068) (As reported by Coindesk) before its release. This early demand could lead to temporary price fluctuations, as RLUSD may not have enough liquidity to immediately maintain its $1 peg. Himanshu Maradiya, Chairman and Founder, CIFDAQ, told Coinpedia, www.cifdaq.com

0 notes

Text

RLUSD Launch Price Prediction: Here’s What Industry Leaders Are Saying

Ripple is set to launch its USD-backed stablecoin, RLUSD, on December 17, 2024. The stablecoin will initially be available on platforms like Uphold, MoonPay, CoinMENA, Bitso, and Archax, with plans to expand to more exchanges in the future. RLUSD is backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents, offering transparency through monthly third-party audits of its reserves.

While RLUSD is designed to always maintain a $1 value, some collectors are already bidding on it in on-chain marketplaces, with bids reaching up to 836 XRP ($2068) (As reported by Coindesk) before its release. This early demand could lead to temporary price fluctuations, as RLUSD may not have enough liquidity to immediately maintain its $1 peg.

Himanshu Maradiya, Chairman and Founder, CIFDAQ, told Coinpedia,

“Ripple’s RLUSD stablecoin, pegged to $1, has already generated significant excitement ahead of its launch, with onchain bids soaring up to $2,000. This pre-launch frenzy reflects limited supply and heightened demand, as speculators rush to secure the first RLUSD tokens.”

He added,

“While such inflated prices may turn heads, volatility is expected to settle, bringing the price closer to $1 as liquidity normalizes post-launch. With RLUSD set to go live on the XRP Ledger, Ripple’s entry into the stablecoin market marks a pivotal moment, enhancing utility, driving liquidity, and strengthening stablecoins’ role in cross-border payment solutions.”

XRP Price Expected To Reach New Highs

Ever since the news about RLUSD launch was announced, XRP has been rising and is currently trading close to the $2.60 levels. Experts are suggesting that XRP bulls may break the previous ATHs once RLUSD goes live. However, XRP has been facing major resistance at $3 and it remains to be seen if the altcoin can cross the crucial mark today.

0 notes

Text

RLUSD Launch Price Prediction: Here’s What Industry Leaders Are Saying

Ripple is set to launch its USD-backed stablecoin, RLUSD, on December 17, 2024. The stablecoin will initially be available on platforms like Uphold, MoonPay, CoinMENA, Bitso, and Archax, with plans to expand to more exchanges in the future. RLUSD is backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents, offering transparency through monthly third-party audits of its reserves.

While RLUSD is designed to always maintain a $1 value, some collectors are already bidding on it in on-chain marketplaces, with bids reaching up to 836 XRP ($2068) (As reported by Coindesk) before its release. This early demand could lead to temporary price fluctuations, as RLUSD may not have enough liquidity to immediately maintain its $1 peg.

Himanshu Maradiya, Chairman and Founder, CIFDAQ, told Coinpedia,

“Ripple’s RLUSD stablecoin, pegged to $1, has already generated significant excitement ahead of its launch, with onchain bids soaring up to $2,000. This pre-launch frenzy reflects limited supply and heightened demand, as speculators rush to secure the first RLUSD tokens.”

He added,

“While such inflated prices may turn heads, volatility is expected to settle, bringing the price closer to $1 as liquidity normalizes post-launch. With RLUSD set to go live on the XRP Ledger, Ripple’s entry into the stablecoin market marks a pivotal moment, enhancing utility, driving liquidity, and strengthening stablecoins’ role in cross-border payment solutions.”

XRP Price Expected To Reach New Highs

Ever since the news about RLUSD launch was announced, XRP has been rising and is currently trading close to the $2.60 levels. Experts are suggesting that XRP bulls may break the previous ATHs once RLUSD goes live. However, XRP has been facing major resistance at $3 and it remains to be seen if the altcoin can cross the crucial mark today.

0 notes

Text

RLUSD Launch Price Prediction: Here’s What Industry Leaders Are Saying

Story Highlights

Ripple’s RLUSD stablecoin launch sparks excitement with on-chain bids hitting $2,068, driving XRP price close to $2.60.

RLUSD stablecoin debuts Dec 17, 2024, with strong demand and plans to boost liquidity, utility, and cross-border payments.

Ripple is set to launch its USD-backed stablecoin, RLUSD, on December 17, 2024. The stablecoin will initially be available on platforms like Uphold, MoonPay, CoinMENA, Bitso, and Archax, with plans to expand to more exchanges in the future. RLUSD is backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents, offering transparency through monthly third-party audits of its reserves.

While RLUSD is designed to always maintain a $1 value, some collectors are already bidding on it in on-chain marketplaces, with bids reaching up to 836 XRP ($2068) (As reported by Coindesk) before its release. This early demand could lead to temporary price fluctuations, as RLUSD may not have enough liquidity to immediately maintain its $1 peg.

Himanshu Maradiya, Chairman and Founder, CIFDAQ, told Coinpedia,

“Ripple’s RLUSD stablecoin, pegged to $1, has already generated significant excitement ahead of its launch, with onchain bids soaring up to $2,000. This pre-launch frenzy reflects limited supply and heightened demand, as speculators rush to secure the first RLUSD tokens.”

He added,

“While such inflated prices may turn heads, volatility is expected to settle, bringing the price closer to $1 as liquidity normalizes post-launch. With RLUSD set to go live on the XRP Ledger, Ripple’s entry into the stablecoin market marks a pivotal moment, enhancing utility, driving liquidity, and strengthening stablecoins’ role in cross-border payment solutions.”

XRP Price Expected To Reach New Highs

Ever since the news about RLUSD launch was announced, XRP has been rising and is currently trading close to the $2.60 levels. Experts are suggesting that XRP bulls may break the previous ATHs once RLUSD goes live. However, XRP has been facing major resistance at $3 and it remains to be seen if the altcoin can cross the crucial mark today.

Source: https://shorturl.at/JRMd1 www.cifdaq.com

0 notes

Text

RLUSD Launch Price Prediction: Here’s What Industry Leaders Are Saying

Ripple is set to launch its USD-backed stablecoin, RLUSD, on December 17, 2024. The stablecoin will initially be available on platforms like Uphold, MoonPay, CoinMENA, Bitso, and Archax, with plans to expand to more exchanges in the future. RLUSD is backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents, offering transparency through monthly third-party audits of its reserves.

RLUSD stablecoin debuts Dec 17, 2024, with strong demand and plans to boost liquidity, utility, and cross-border payments.

While RLUSD is designed to always maintain a $1 value, some collectors are already bidding on it in on-chain marketplaces, with bids reaching up to 836 XRP ($2068) (As reported by Coindesk) before its release. This early demand could lead to temporary price fluctuations, as RLUSD may not have enough liquidity to immediately maintain its $1 peg.

“Ripple’s RLUSD stablecoin, pegged to $1, has already generated significant excitement ahead of its launch, with onchain bids soaring up to $2,000. This pre-launch frenzy reflects limited supply and heightened demand, as speculators rush to secure the first RLUSD tokens.”

“While such inflated prices may turn heads, volatility is expected to settle, bringing the price closer to $1 as liquidity normalizes post-launch. With RLUSD set to go live on the XRP Ledger, Ripple’s entry into the stablecoin market marks a pivotal moment, enhancing utility, driving liquidity, and strengthening stablecoins’ role in cross-border payment solutions.”

XRP Price Expected To Reach New Highs

Ever since the news about RLUSD launch was announced, XRP has been rising and is currently trading close to the $2.60 levels. Experts are suggesting that XRP bulls may break the previous ATHs once RLUSD goes live. However, XRP has been facing major resistance at $3 and it remains to be seen if the altcoin can cross the crucial mark today.

Metaplanet Raises $30 Million in Zero-Interest Bonds to Buy Bitcoin

Metaplanet issues zero-interest bonds to expand its Bitcoin holdings and fuel growth.

Zero-interest bonds reduce short-term financial strain while boosting long-term Bitcoin investments.

Metaplanet, a Tokyo-listed company, is taking a major step to increase its Bitcoin reserves by issuing 4.5 billion yen (about $30 million) in ordinary bonds. This move reflects the company’s strategy, similar to MicroStrategy, of holding Bitcoin as a key asset.

Metaplanet, a Tokyo-listed company, is taking a major step to increase its Bitcoin reserves by issuing 4.5 billion yen (about $30 million) in ordinary bonds. This move reflects the company’s strategy, similar to MicroStrategy, of holding Bitcoin as a key asset.

Zero-Interest Bonds with a Clear Purpose

The new fourth series of bonds come with a zero-interest rate, making them a smart financial choice for Metaplanet. These bonds will mature on June 16, 2025, giving the company ample time to carry out its Bitcoin purchasing plan.

What makes Metaplanet’s approach unique is its plan to repay the bonds using funds raised from previously issued warrants. This ensures that the company can manage its financial obligations effectively without taking on extra debt.

By issuing zero-interest bonds, Metaplanet reduces its short-term financial pressures while investing in Bitcoin for long-term growth. This strategy shows the company’s belief in Bitcoin’s potential, with the cryptocurrency currently valued at a market cap of $2.12 trillion.

Financial Stability Remains Key

To ensure confidence among investors, Metaplanet has adopted a structured repayment approach. The company plans to use proceeds from warrant exercises to repay these bonds. By recycling its capital this way, Metaplanet showcases its ability to balance financial innovation with responsibility.

This method not only secures bondholders but also highlights the company’s focus on sustainable capital management.

Institutional adoption is fueling Bitcoin’s rise read Bitcoin price prediction to see how mainstream investments shape its future highs!

Ongoing Metaplanet Bond Issuance for Bitcoin

However, this isn’t the first time Metaplanet has issued such a bond. In its earlier move, Metaplanet announced the issuance of one-year ordinary bonds worth 1.75 billion yen ($11.3 million) at an annual interest rate of 0.36%.

The entire amount raised was dedicated to acquiring Bitcoin, highlighting the company’s clear strategy to strengthen its BTC reserves.

However, Metaplanet began its Bitcoin buying journey in April this year, positioning it as a hedge against Japan’s growing debt issues and the yen’s volatility. So far, the company has bought 1,142 BTC, which is currently valued at around $122.67 million.

With each bond issuance and Bitcoin acquisition, Metaplanet is building a financial strategy that not only hedges against economic uncertainty but also positions it for growth.

www.cifdaq.com

0 notes