#Blockchain Identity Management Market Scope

Explore tagged Tumblr posts

Text

#Blockchain Identity Management Market Scope#Blockchain Identity Management Market Trends#Blockchain Identity Management Market Growth

0 notes

Text

Blockchain in Manufacturing Market Creating Safer, Transparent Production Networks

The Blockchain in the Manufacturing Market was valued at USD 3.9 billion in 2023 and is expected to reach USD 116.9 billion by 2032, growing at a CAGR of 45.93% from 2024-2032.

Blockchain in Manufacturing Market is experiencing transformative growth as industries adopt decentralized technologies to improve transparency, traceability, and operational efficiency. From raw material sourcing to supply chain logistics, blockchain is reshaping how manufacturers manage data integrity and security across global networks.

U.S. manufacturers are rapidly deploying blockchain to enhance product traceability and drive smart factory initiatives

Blockchain in Manufacturing Market continues to expand as companies recognize its potential to eliminate fraud, reduce costs, and ensure compliance in real-time. With its capability to create immutable records, blockchain is gaining traction in critical manufacturing domains such as aerospace, automotive, and electronics.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6681

Market Keyplayers:

IBM Corporation – IBM Blockchain

Microsoft Corporation – Azure Blockchain Service

Amazon Web Services (AWS) – Amazon Managed Blockchain

Oracle Corporation – Oracle Blockchain Platform

SAP SE – SAP Blockchain

Huawei Technologies Co., Ltd. – Huawei Blockchain Service

Infosys Limited – Infosys Blockchain Suite

Intel Corporation – Intel Sawtooth

Siemens AG – Siemens Blockchain Lab

Wipro Limited – Blockchain as a Service (BaaS)

Deloitte Touche Tohmatsu Limited – Deloitte Blockchain Solutions

Accenture Plc – Accenture Blockchain Services

Capgemini SE – Capgemini Blockchain Applications

TIBCO Software Inc. – TIBCO Blockchain Solution

Chainstack – Chainstack Blockchain Platform

Market Analysis

The integration of blockchain in manufacturing is no longer a concept—it's becoming a core operational strategy. Manufacturers are leveraging blockchain for end-to-end supply chain visibility, smart contract automation, and counterfeit mitigation. These benefits are especially valuable in high-risk and highly regulated sectors. In the U.S., early adoption is driven by Industry 4.0 initiatives, while Europe is seeing strong traction through sustainability compliance and digital transformation mandates.

Market Trends

Growing use of blockchain for real-time supply chain transparency

Increased deployment of smart contracts to automate procurement and payments

Adoption of decentralized identity systems for equipment and personnel verification

Integration with IoT and AI for advanced process validation and data logging

Rising focus on carbon tracking and ESG reporting through blockchain ledgers

Use in quality control to ensure product authenticity and batch traceability

Formation of blockchain consortia among leading manufacturers and suppliers

Market Scope

The Blockchain in Manufacturing Market offers vast potential as manufacturers seek greater control, security, and interoperability in increasingly complex production ecosystems.

Immutable data for compliance audits and quality assurance

Enhanced supplier coordination through shared digital ledgers

Fraud and counterfeit reduction via product serialization

Real-time visibility into multi-tier supply chains

Integration with legacy ERP and MES systems

Streamlined documentation and record-keeping

Greater trust among global stakeholders and partners

Forecast Outlook

The outlook for blockchain in manufacturing is highly promising. With increasing regulatory pressure, demand for transparency, and the push toward smarter factories, blockchain adoption is set to accelerate. The U.S. remains a leader in pilot projects and implementation, while European countries are integrating blockchain into sustainability and circular economy frameworks. As manufacturing networks become more digital and global, blockchain’s role in enabling trust, efficiency, and innovation will be central to future growth.

Access Complete Report: https://www.snsinsider.com/reports/blockchain-in-manufacturing-market-6681

Conclusion

Blockchain in manufacturing is no longer an emerging trend—it's a competitive advantage. As industries pivot to digital-first strategies, blockchain offers the trust infrastructure needed for secure, transparent, and agile manufacturing. Businesses in the U.S. and Europe that invest in blockchain today are not just optimizing workflows—they are shaping the foundation of next-generation manufacturing.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

U.S.A witnesses rapid transformation in the Next-Generation ICT Market driven by digital innovation

U.S.A drives innovation as Smart Port Market reshapes maritime infrastructure

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

0 notes

Text

Exploring the Expanding Horizons of Hardware Security Modules Market Size

The surge in cybersecurity threats and increasing reliance on secure digital infrastructure are fueling substantial growth in the Hardware Security Modules Market Size. As more industries transition to digital operations, the need to protect cryptographic keys, secure financial transactions, and enforce regulatory compliance has never been greater. The global Hardware Security Modules (HSM) market is expected to reach USD 3.9 billion by 2030, growing at a compound annual growth rate (CAGR) of 11.4% from 2023 to 2030.

What is Driving the Market Expansion?

1. Proliferation of Cloud-Based Services

With the rise of SaaS platforms and cloud-native applications, enterprises are increasingly deploying cloud-based HSM solutions. These tools allow for high-assurance cryptographic key management with on-demand scalability, which has significantly expanded the Hardware Security Modules Market Size.

2. Stringent Data Security Regulations

Global regulations like GDPR, HIPAA, and FIPS 140-2 require organizations to maintain high levels of data integrity and privacy. HSMs, which offer tamper-proof key storage and cryptographic functions, are being adopted to ensure compliance, particularly in industries like BFSI, healthcare, and government.

3. Adoption in Emerging Economies

Countries in Asia-Pacific, the Middle East, and Latin America are ramping up their cybersecurity investments. Initiatives such as India’s Digital India and ASEAN’s cybersecurity programs are accelerating the adoption of HSMs, adding momentum to the market size globally.

Regional Analysis of Hardware Security Modules Market Size

North America leads the market, thanks to early tech adoption, regulatory frameworks, and the presence of leading HSM providers like Thales, IBM, and Futurex.

Europe is showing strong growth fueled by GDPR mandates and increased investment in IT infrastructure.

Asia-Pacific is expected to be the fastest-growing region, driven by government-led digital initiatives and the booming fintech sector in countries such as China, India, and Singapore.

Segment Insights

By Type:

LAN-based/Network-attached HSMs dominate due to their strong presence in large enterprises.

USB-based and PCIe-based HSMs are gaining traction among small and mid-size businesses due to their affordability and plug-and-play use.

By Deployment:

On-Premise HSMs offer complete control, preferred by highly regulated industries.

Cloud-based HSMs are growing rapidly, supporting hybrid and multi-cloud environments.

By Application:

Banking and Finance: Core use in digital payment encryption, ATM/POS protection, and securing SWIFT transactions.

Healthcare: Protecting patient health records and ensuring HIPAA compliance.

Telecom and Defense: Securing communication channels and operational data.

Hardware Security Modules Market Growth: A Future Outlook

Innovations such as Post-Quantum Cryptography (PQC) and Zero Trust Architecture (ZTA) are expected to further boost market size. Enterprises are now looking at HSMs as foundational components for digital trust, integrating them with blockchain, IoT, and AI systems for next-gen security.

Moreover, industries like automotive (for V2X communication), industrial IoT, and public infrastructure are beginning to rely on HSMs to secure critical infrastructure and digital identities, widening the scope of market applications.

Key Players in the Market

Thales Group

IBM Corporation

Utimaco GmbH

Futurex

Atos SE

Hewlett Packard Enterprise

These companies are focusing on R&D and strategic alliances to innovate scalable and compliant HSM solutions for global enterprises.

Conclusion

The Hardware Security Modules Market Size reflects a strong upward trajectory, propelled by the rapid digitalization of business processes, stringent compliance requirements, and growing security concerns. As organizations continue to invest in robust data protection systems, HSMs will become even more vital to securing digital trust in the years ahead.

0 notes

Text

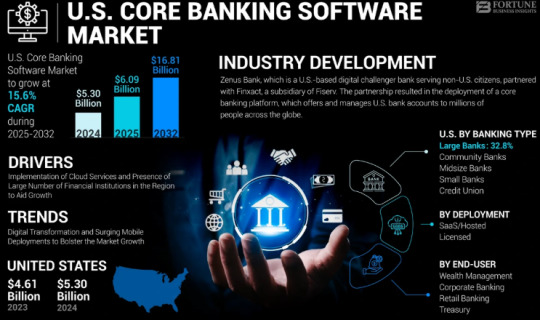

The U.S. Core Banking Software Market Size, Share | CAGR 15.6% during 2024-2030

The U.S. core banking software market Size was valued at USD 5.30 billion in 2024 and is projected to grow from USD 6.09 billion in 2025 to USD 16.81 billion by 2032, exhibiting a CAGR of 15.6% during the forecast period. Driven by the modernization of legacy banking systems, increasing customer demand for digital-first banking experiences, and adoption of cloud-native platforms, the U.S. banking industry is rapidly shifting toward agile, API-driven core banking systems.

Key Market Highlights:

2024 U.S. Market Size: USD 5.30 billion

2025 U.S. Market Size: USD 6.09 billion

2032 U.S. Market Size: USD 16.81 billion

CAGR (2025–2032): 15.6%

Market Outlook: Cloud-first transformation of retail and commercial banking infrastructure

Leading Players in the U.S. Market:

FIS (Fidelity National Information Services)

Finastra

Temenos USA

Oracle Financial Services Software

Jack Henry & Associates

SAP America

nCino

Infosys (EdgeVerve)

Thought Machine

Backbase

Mambu

Q2 Holdings

TCS BaNCS (U.S. operations)

Request Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/u-s-core-banking-software-market-107481

Market dynamics:

Growth Drivers:

Legacy System Modernization: Traditional banks are replacing decades-old core systems to enable agility, scalability, and faster innovation.

Rise of Digital-Only Banks & Neobanks: Challenger banks are opting for coreless and cloud-native platforms to deliver real-time banking experiences.

Regulatory Mandates: U.S. regulations increasingly demand transparency, real-time compliance, and modular tech stacks.

Omnichannel and Mobile Banking Boom: Surge in mobile-first customers is accelerating demand for flexible and API-driven core systems.

Adoption of BaaS & Embedded Finance: Banks are embedding financial services into non-banking platforms, requiring agile backend core systems.

Key Opportunities:

AI-Powered Core Modernization: Integration of AI for risk scoring, predictive analytics, and process automation

Cloud Migration Projects: Large-scale re-platforming from on-premise to cloud-native or hybrid models

Banking-as-a-Service (BaaS): U.S. institutions offering core services to fintechs and enterprises

Open Banking APIs: Ecosystem expansion through developer-friendly, regulatory-compliant APIs

Personalized Customer Experience Engines: Data-driven personalization built directly into core systems

Technology & Application Scope:

Deployment Models:

Cloud-native

On-premises

Hybrid (transitional)

Core Features:

Customer and account management

Payments and transaction processing

Lending and credit modules

Risk and compliance automation

Real-time reporting and dashboards

Target Users:

Retail banks

Credit unions

Community banks

Commercial and corporate banks

Neobanks and fintechs

Speak to Analysts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/u-s-core-banking-software-market-107481

Recent Developments:

January 2024 – A top-10 U.S. bank announced a $700M multiyear plan to migrate its entire core system to a cloud-native microservices architecture with Temenos and AWS.

October 2023 – Jack Henry & Associates launched a new AI-powered fraud prevention module integrated into its core platform, reducing false positives by 45%.

July 2023 – A mid-sized credit union in the Midwest completed a legacy core banking system overhaul, leading to a 22% increase in customer satisfaction due to improved digital banking capabilities.

Trends Shaping the U.S. Core Banking Market:

Composable Banking Architecture: Shift toward modular, plug-and-play architecture

AI & Machine Learning in Core: Real-time fraud detection, dynamic credit risk models, and intelligent automation

Blockchain Integration: Experiments in real-time settlement, decentralized identity, and smart contracts

Low-Code/No-Code Customization: Democratization of development within banking teams

Cybersecurity Embedded in Core: Zero-trust frameworks and secure-by-design approaches

Conclusion:

The U.S. core banking software market is undergoing a significant transformation, driven by rising customer expectations, digital competition, and the imperative to stay compliant and resilient. The future belongs to banks that embrace modular, cloud-native, and API-driven core platforms—designed to scale, personalize, and evolve. As the market accelerates toward modernization, technology vendors and banks alike are finding immense value in flexible ecosystems, open banking capabilities, and real-time innovation.

Frequently Asked Questions: 1. What is the projected value of the global market by 2032?

2. What was the total market value in 2024?

3. What is the expected compound annual growth rate (CAGR) for the market during the forecast period of 2025 to 2032?

4. Which industry segment dominated market in 2023?

5. Who are the major companies?

6. Which region held the largest market share in 2023?

#U.S. Core Banking Software Market Share#U.S. Core Banking Software Market Size#U.S. Core Banking Software Market Industry#U.S. Core Banking Software Market Driver#U.S. Core Banking Software Market Growth#U.S. Core Banking Software Market Analysis#U.S. Core Banking Software Market Trends

0 notes

Text

Securing Investments with Blockchain: How Real Estate Tokenization Is Reshaping Property Ownership

Introduction

Real estate has been considered one of the most reliable routes to wealth structure. From rental income to long- term appreciation, property power offers a palpable, stable investment with a far better chance of abnormal returns than utmost other requests. Nevertheless, the traditional real estate request has crunches, especially for an individual or first- time investor.

Buying a property requires high original investment, a great deal of paperwork, legal freights, and trusted peacemakers. In addition, liquidity is still another big issue dealing a property could mean taking months. It's nearly noway easy or fast to get the capital tied up in real estate. These challenges constitute a nearly impermeable barricade to investing in real estate, keeping participation exclusive for high- net- worth individualities or institutional players.

Understanding Real Estate Tokenization

Tokenizing real estate is the act of digitizing a real estate power and predicated on the identification of the commemoratives under the blockchain which record and manage the asset's power from the physical property. The tokenized unit may pertain to a fractional share in a single- family house for a time- share, for illustration, a marketable structure or a portfolio of numerous properties.Instead of buying an entire structure, they can buy different commemoratives representing fractions of power in that property. For illustration, if a structure is valued at$ 1 million and divided into 100,000 commemoratives, each memorial would represent a$ 10 stake in the asset.

Why Blockchain Equals Security in Real Estate Investments

Real estate tokenization links blockchain technology to decentralized, tamper proof digital census that offers important security features unmatched by traditional systems. In the terrain of real estate, blockchain does just streamline processes; it redefines trust, translucence, and responsibility.

1. Immutable Records

Once trade data is entered into the blockchain, it no way gets changed or deleted, but remains permanently in the records of property power, trade history, and legal agreements. Fraud becomes nearly impossible because it's designed to help a fake deed, a forged hand, and double selling.

2. Smart Contracts

Smart contracts are agreements that automatically tone- execute whenever a quested condition has been fulfilled- for illustration, payment entered, identity revealed, etc. This means that whenever an agreement has been reached by the debating parties, the trade automatically completes without grueling time consumption or mortal error due to legal ambiguity.

3. Transparent Deals

All the deals in the blockchain are recorded in a distributed census that can be seen by all the parties in the network and makes it truly clear for the investor to know who has what, track a property history, and who is tractable or not. therefore, a certain degree of trust is erected into the system with its participation, which generally fails in other traditional real estate systems.

Traditional Investment Pitfalls vs. Tokenized Real Estate

Traditional real estate

Traditional real estate investing is slow, costly, and exclusive. But, the tokenization of real estate is helping to address many long-standing issues. The following is how tokenized real estate compares with traditional real estate Traditional real estate problems; historical real estate, through ages, has been a proven way to make wealth for millions but comes with a few challenges tied to it. Minimum investment does not avail properties at most from the typical average investor, as it takes hundreds of thousands and often even millions for property ownership. It has limited scope for liquidity, as selling any property takes months or even years; thus, the capital will remain parked until the asset is sold. The transaction process would be complex and slow and involves quite many intermediaries, extensive paperwork, and lengthy legal checks that may take weeks or months to complete. Moreover, typical property agreements are often sealed under very complicated and difficult legal frameworks, hence making it even more challenging for investors to understand the entire procedure,

Tokenized Real Estate

With tokenized real estate, many of these issues seem to be solved within their functional status here. Many of these issues are addressed by tokenized real estate, which makes use of blockchain technology. Fractional ownership in real estate means that people can now own a fraction of the properties, greatly reducing the entry barrier to owning real estate. Tokenized assets can be traded on digital platforms as tokens, which adds liquidity as opposed to property, which typically has no liquidity. Therefore, automating and simplifying the so-called ownership transfer process can even make this transaction instant without much involvement of finance. More importantly, this creates transparency and trust and an impenetrable, easily verifiable record of each transaction and ownership change on the blockchain. Thus, it offers a more secure, efficient, and inclusive way of investing in real estate.

Global Access Fractional Ownership Safer & Smarter Investing

Global Reach Without Geographic Barriers

Investing in a foreign country usually involves regulations, partnership with locals, currency exchange, and legal barriers-the most overwhelming barriers to investing abroad. Tokenized real estate does away with most of that and provides blockchain seamless access to verified global assets. Today's property investment from Nairobi, Berlin, or São Paulo has become a reality within a few clicks-most likely without all travel, brokers, or red tape.

Fractional Ownership = Diversified Portfolios

Tokenizing a property means it can break down to thousands (if not millions) of tokens, thus allowing fractional ownership. Instead of concentrating all the cash in one property, the investor can invest in several properties and their locations: residential, commercial, hospitality, and industrial. This diversification reduces risks significantly. This is similar to what mutual funds or ETFs do, but it is now being applied to real estate.

Investing Smartly, Your Way

Investors through blockchain platforms can be able to manage their portfolios in real-time. All one needs to do is access the phone or laptop and track performance, receive rent income distributions, reinvest, or sell your tokens. There is total transparency, safety, and record in an unchangeable ledger, which eliminates uncertainty and friction usually associated with traditional investing.

How to Start Investing in Tokenized Real Estate

1. Choose a Trusted Platform

Importantly, the choice of the tokenization platform must be wise. It should be a regulated, secure, and trustworthy one. The company should be duly licensed in your area. This means it has to be transparent about the properties it lists for sale, how it is set up legally, and the custody of funds. In addition, most platforms are user-friendly to a large extent, offering simple dashboards along with legal documents and investor protection.

2. Research Properties

Just like in any traditional real estate transaction, due diligence must be exercised. Different properties come with different considerations: location, type (be it residential, commercial, etc.), anticipated returns, tenant history, and risks involved. Most platforms have done well to provide you with virtual site visits, research performance metrics, and market trends to inform your decision-making.

3. Purchase Tokens

After selecting a particular investment, you can purchase fractional shares (tokens) in the property with fiat currency such as USD or EUR or cryptocurrency such as Bitcoin or Ethereum, depending on the platform. Transactions occur and are verified using blockchain technology, and are fast, secure, and usually finalized by smart contracts.

4. Track and Trade Your Investments

After the purchase of tokens, you can follow their performance from your dashboard. Some platforms allow you to earn rental distributions, while some, after a designated lock-in period, will allow the resale of your tokens in the secondary market. You can manage your investments just as you would with stocks or any cryptocurrency.

Conclusion

Real estate tokenization signifies a paradigm shift for the buying, selling, and ownership of properties, rather than being a passing trend. Utilizing the power of blockchain technology renders a certain level of security, transparency, and access to an otherwise slow, expensive, and exclusive industry. Easier wealth building for investors, flexible investments are now better days. Aged doors opening for the wealthy and well-connected are being chipped away with tokenized real estate on account of lowered barriers to entry, global reach, and real-time control over their investments.

0 notes

Text

Blockchain in ICT Industry Outlook to 2032: Market Size, Share, Growth & Analysis

The Blockchain in the ICT Market is changing how the data is stored, tracked, and shared among information and communication technology ecosystems; hence, it is emerging as a transformational force within ICT.

blockchain technology has emerged as a transformative force across the Information and Communication Technology (ICT) sector. Known primarily for its application in cryptocurrencies, blockchain is now being adopted in a wide range of ICT functions including secure data transmission, decentralized cloud storage, identity verification, digital payments, and smart contracts. As data becomes the backbone of digital economies, the need for transparency, security, and efficiency is propelling blockchain into the mainstream of ICT infrastructure.

Blockchain in ICT Market: Size, Share, Scope, Analysis, Forecast, Growth, and Industry Report 2032 indicates that the global market is poised for strong expansion, with rapid digital transformation and the increased need for secure communication networks acting as key drivers. Governments, telecom providers, cloud service platforms, and enterprise IT departments are exploring blockchain to decentralize control, reduce fraud, and enable trustless transactions. As the technology matures, it is expected to revolutionize the architecture of ICT systems globally.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/5509

Market Keyplayers:

IBM – IBM Blockchain

Microsoft – Azure Blockchain Service

Oracle – Oracle Blockchain Platform

Accenture – Accenture Blockchain Solutions

Amazon Web Services (AWS) – Amazon Managed Blockchain

Intel – Intel Hyperledger Sawtooth

SAP – SAP Cloud Platform Blockchain

Ripple – RippleNet

Chainalysis – Chainalysis Reactor

Coinbase – Coinbase Blockchain Solutions

VeChain – VeChainThor Blockchain

Blockchain.com – Blockchain Wallet

Hyperledger – Hyperledger Fabric

Market Trends

Decentralized Identity Management: Enterprises are increasingly using blockchain to offer users control over their digital identities without relying on centralized authorities, reducing the risk of identity theft and enhancing privacy.

Blockchain-as-a-Service (BaaS): Tech giants like Microsoft, IBM, and Amazon Web Services are offering blockchain platforms that allow companies to develop and deploy blockchain applications without building the technology from scratch.

Telecom Transformation: Telecommunications companies are leveraging blockchain to automate processes like billing, number portability, and roaming services, significantly cutting operational costs and fraud.

Integration with Emerging Technologies: Blockchain is being integrated with AI, IoT, and 5G networks to improve data integrity, enable secure machine-to-machine communication, and enhance decision-making.

Enquiry of This Report: https://www.snsinsider.com/enquiry/5509

Market Segmentation:

By Component

Platforms:

Services

By Organization Size

Small and Medium Enterprises (SMEs)

Large Enterprises

By Deployment Type

On-premises

Cloud-based

By End-user

Telecommunication Providers

IT Service Providers

Cloud Service Providers

Networking Companies

Data Center Operators

Market Analysis

North America currently leads the market, thanks to high levels of digital adoption, regulatory support, and a strong ecosystem of blockchain startups. However, Asia-Pacific is rapidly catching up due to smart city initiatives, e-governance programs, and growing investments in blockchain R&D.

Several factors are contributing to this growth:

Increased Demand for Data Security: With rising cyber threats, blockchain’s immutable ledger offers a robust solution for safeguarding sensitive ICT data.

Regulatory Evolution: Many governments are moving towards clear blockchain regulations, enhancing adoption across sectors such as healthcare, finance, and telecom.

Cost Efficiency and Automation: Smart contracts and decentralized applications are reducing manual workloads, lowering costs, and minimizing errors in ICT operations.

Despite the promising outlook, challenges remain. Scalability, energy consumption, interoperability, and lack of standardization are critical hurdles that need to be addressed. Nonetheless, continuous innovation and collaborative efforts among governments, academia, and industry players are helping overcome these barriers.

Future Prospects

The future of blockchain in ICT is marked by integration, scalability, and mass adoption.

Scalable Blockchain Networks: Solutions like Layer 2 protocols, sharding, and consensus algorithm optimization are being developed to handle large-scale ICT operations.

Blockchain-Enabled Cloud Infrastructure: As cloud computing grows, blockchain is expected to offer decentralized storage and improved data access control mechanisms, particularly useful for multinational ICT firms.

Cross-Industry Collaborations: Tech and telecom industries are forming consortia and alliances to standardize blockchain practices, fostering ecosystem-wide interoperability.

Smart Infrastructure & Governance: In future smart cities, blockchain may serve as the backbone for managing utilities, data sharing, public records, and secure communications between government departments.

Green Blockchain Technologies: With environmental sustainability gaining importance, developers are focusing on energy-efficient consensus mechanisms like Proof of Stake and hybrid models.

Access Complete Report: https://www.snsinsider.com/reports/blockchain-in-ict-market-5509

Conclusion

Blockchain is no longer a niche innovation—it is a pivotal component of the ICT industry's digital evolution. From enhancing transparency in telecommunications to securing cloud storage and automating enterprise operations, the technology is proving its utility across the spectrum. The global momentum behind blockchain adoption is creating vast opportunities for both established companies and startups within the ICT ecosystem.

As infrastructure becomes smarter and more connected, blockchain’s role will grow even more significant. Its ability to establish trust, decentralize control, and enhance operational efficiency will make it an indispensable part of next-generation ICT frameworks. The coming decade promises to be a defining period for blockchain in ICT, with innovations, regulations, and collaborations driving a more secure and transparent digital world.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

0 notes

Text

Blockchain Supply Chain Market 2024 : Size, Growth Rate, Business Module, Product Scope, Regional Analysis And Expansions 2033

The blockchain supply chain global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Blockchain Supply Chain Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The blockchain supply chain market size has grown exponentially in recent years. It will grow from $1.28 billion in 2023 to $2.04 billion in 2024 at a compound annual growth rate (CAGR) of 59.7%. The growth in the historic period can be attributed to rise in counterfeit products, rising adoption in the automotive industry, increasing use of blockchain for inventory management, rise of blockchain in logistics, and rising demand for resilient supply chains. The blockchain supply chain market size is expected to see exponential growth in the next few years. It will grow to $13.33 billion in 2028 at a compound annual growth rate (CAGR) of 59.9%. The growth in the forecast period can be attributed to focus on sustainable and ethical sourcing, focus on risk management, need to reduce operational costs, need for real-time monitoring of supply chain activities, and improve supplier relationship management. Major trends in the forecast period include shift towards decentralized supply chain models, anti-counterfeiting solutions, integration of AI with blockchain technology, use of digital twins, and innovations in blockchain security.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/blockchain-supply-chain-global-market-report

The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Market Drivers - The increasing number of cyber-attack instances is expected to propel the growth of the blockchain supply chain market going forward. Cyber-attacks involve intentionally compromising digital systems to steal, alter, or damage data. Cyber-attacks are attributed to vulnerabilities in digital systems, insufficient security measures, and human error, often exploited by malicious actors seeking unauthorized access or disruption. Blockchain technology provides a decentralized and immutable ledger to enhance supply chain security against cyber-attacks, which ensures that all transactions are securely recorded and resistant to tampering. For instance, according to the 2023 Data Breach Report published by the Identity Theft Resource Center, a US-based non-profit organization, in the first three quarters of 2023, newly discovered cyber vulnerabilities surged by 1,620 percent, reaching 86 compared to just 5 for the entire year of 2022. Therefore, the increasing instances of cyber-attacks drive the growth of the blockchain supply chain market.

Market Trends - Major companies operating in the blockchain supply chain market are developing innovative technologies, such as hyperledger, to enhance supply chain management transparency, security, and efficiency. Hyperledger is an open-source blockchain framework designed to support the development of enterprise-grade blockchain applications, providing a modular and customizable infrastructure for secure and transparent transactions. For instance, in October 2022, BASF SE, a Germany-based chemical company, launched Seed 2 Sew, a blockchain platform. The platform utilizes hyperledger technology, allowing all partners within the cotton value chain to digitally record and approve each step, thus closing the information gap that has historically existed between farmers and the textile industry. This effort enhances sustainability and reduces the carbon footprint associated with cotton garment production.

The blockchain supply chain market covered in this report is segmented –

1) By Component: Services, Platform 2) By Application: Payment And Settlement, Product Traceability, Counterfeit Detection, Smart Contracts, Risk And Compliance Management, Other Applications 3) By Industry Vertical: Retail And Consumer Goods, Healthcare And Life Sciences, Manufacturing, Logistics, Oil And Gas, Other Industry Verticals

Get an inside scoop of the blockchain supply chain market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=19339&type=smp

Regional Insights - North America was the largest region in the blockchain supply chain market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the blockchain supply chain market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the blockchain supply chain market are Walmart Inc., Amazon.com Inc., Microsoft Corporation, Alibaba Group Holding Limited, Huawei Technologies Co. Ltd., Siemens AG, Deloitte Touche Tohmatsu Limited, Accenture plc, International Business Machines Corporation, Oracle Corporation, Honeywell International Inc., SAP SE, Salesforce Inc., Tata Consultancy Services Limited, Hewlett Packard Enterprise Company, Infosys Limited, Nippon Express Co. Ltd., Wipro Limited, TIBCO Software Inc., VeChain, Chronicled Inc., Guardtime, Omnichain Inc., Auxesis Group, SyncFab Co., Provenance

Table of Contents 1. Executive Summary 2. Blockchain Supply Chain Market Report Structure 3. Blockchain Supply Chain Market Trends And Strategies 4. Blockchain Supply Chain Market – Macro Economic Scenario 5. Blockchain Supply Chain Market Size And Growth ….. 27. Blockchain Supply Chain Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

IDO Marketing Price and Package: What You Need to Know

In the realm of decentralized finance (DeFi) and blockchain technology, Initial Dex Offerings (IDOs) have become a popular method for startups to raise funds and engage with the crypto community. However, launching a successful IDO involves more than just technical preparations—it requires a well-defined marketing strategy, accompanied by careful consideration of costs, packages, and overall budgeting. This blog explores the intricacies of IDO marketing costs, the elements of an effective marketing package, and essential considerations for startups looking to navigate this dynamic fundraising landscape.

Understanding IDO Marketing Essentials

An IDO is not just a fundraising event; it's an opportunity to establish credibility, build a community, and generate long-term interest in a project. Effective marketing is critical to achieving these goals, and it typically involves several key components:

Brand Positioning and Messaging: Crafting a compelling narrative that communicates the project's value proposition clearly and resonates with the target audience.

Community Engagement: Building and nurturing a supportive community of early adopters, investors, and enthusiasts through various channels like social media, forums, and community platforms.

PR and Media Outreach: Securing media coverage, participating in interviews, and leveraging influencers to amplify visibility and credibility.

Digital Marketing: Utilizing online advertising, content marketing, and email campaigns to reach and engage with a broader audience.

Tokenomics and Incentives: Designing a tokenomics model that incentivizes participation and aligns with long-term project goals.

Factors Influencing IDO Marketing Costs

The cost of IDO marketing can vary widely based on several factors:

Project Complexity and Scope: The complexity of the project, its technological requirements, and the novelty of the idea can impact marketing costs.

Target Audience and Market Size: The size and demographics of the target audience influence the scale and scope of marketing efforts.

Geographical Reach: Whether the marketing campaign targets a local, regional, or global audience affects costs, particularly in terms of media buying and influencer outreach.

Type of Marketing Channels: The choice of marketing channels—such as social media, paid advertising, PR campaigns, or influencer partnerships—significantly impacts costs.

Duration of Marketing Campaign: The length of the marketing campaign, including pre-launch, launch, and post-launch phases, affects budgeting and resource allocation.

Components of an Effective IDO Marketing Package

An effective IDO marketing package encompasses various strategies and activities tailored to the specific needs and goals of the project. Here are essential components typically included in an IDO marketing package:

1. Strategic Planning and Consulting

Market Research: Conducting thorough market research to understand the competitive landscape, target audience, and market trends.

Marketing Strategy Development: Developing a comprehensive marketing strategy aligned with project goals, including brand positioning, messaging, and campaign timeline.

2. Brand Identity and Content Creation

Logo and Visual Identity: Designing a distinctive logo and visual assets that reflect the project's identity and resonate with the target audience.

Content Creation: Developing high-quality content such as whitepapers, blogs, videos, and infographics to educate and engage potential investors and users.

3. Community Building and Management

Community Engagement: Building and managing online communities through platforms like Telegram, Discord, and social media channels to foster interaction, answer queries, and generate buzz.

Community Management: Implementing strategies to nurture and grow the community, including organizing AMAs (Ask Me Anything sessions), contests, and community-driven initiatives.

4. PR and Media Outreach

Press Releases and Media Kits: Crafting compelling press releases and media kits to announce milestones, partnerships, and project updates to the media and crypto influencers.

Media Relations: Establishing relationships with journalists, bloggers, and influencers in the blockchain and crypto space to secure media coverage and interviews.

5. Digital Marketing and Advertising

Social Media Marketing: Running targeted advertising campaigns on platforms like Twitter, Facebook, and LinkedIn to increase visibility and attract potential investors.

Content Marketing: Publishing SEO-optimized content on the project's blog and other platforms to enhance organic reach and establish thought leadership.

6. Influencer Partnerships

Influencer Outreach: Collaborating with influencers and thought leaders in the blockchain and DeFi community to endorse the project, reach their followers, and build credibility.

7. Tokenomics Design and Distribution Strategy

Tokenomics Consultation: Designing a tokenomics model that incentivizes early adopters and aligns with the project's long-term goals and sustainability.

Token Distribution Strategy: Planning and executing a fair and transparent token distribution strategy to ensure broad participation and equitable distribution.

Budgeting and Allocating Resources

Effective budgeting is crucial to maximizing ROI and ensuring the success of an IDO marketing campaign. Startups should consider the following when budgeting for IDO marketing:

Allocating Resources: Determining how much budget to allocate to each component of the marketing package based on priorities and projected outcomes.

Monitoring and Adjusting: Continuously monitoring the performance of marketing campaigns and adjusting strategies based on real-time data and feedback.

Contingency Planning: Setting aside a contingency budget for unforeseen expenses or adjustments needed during the campaign.

Conclusion

Launching a successful IDO requires a strategic approach to marketing that goes beyond fundraising—it's about building credibility, engaging the community, and establishing a solid foundation for long-term growth. By understanding the costs involved, crafting a comprehensive marketing package, and allocating resources effectively, startups can enhance their chances of standing out in the competitive landscape of decentralized finance and blockchain technology. As the crypto market continues to evolve, IDOs represent a powerful tool for startups to innovate, raise capital, and realize their visions in a global, decentralized economy.

0 notes

Text

Blockchain in Manufacturing Market Size, Share, Analysis, Forecast, and Growth 2032: Insights into Market Dynamics and Competitive Landscape

The Blockchain in the Manufacturing Market was valued at USD 3.9 billion in 2023 and is expected to reach USD 116.9 billion by 2032, growing at a CAGR of 45.93% from 2024-2032.

Blockchain in Manufacturing Market is rapidly emerging as a transformative force, offering traceability, transparency, and efficiency across industrial operations. From supply chain optimization to digital identity verification for parts, manufacturers in the USA and Europe are embracing blockchain to modernize legacy systems and meet evolving compliance demands.

U.S. Manufacturing Embraces Blockchain for Traceability and Efficiency Gains

Blockchain in Manufacturing Market is seeing accelerated adoption fueled by Industry 4.0 initiatives and the growing need for secure, tamper-proof data exchange. As manufacturing ecosystems grow more complex and globally connected, blockchain provides a decentralized solution to eliminate bottlenecks and improve end-to-end visibility.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6681

Market Keyplayers:

IBM Corporation – IBM Blockchain

Microsoft Corporation – Azure Blockchain Service

Amazon Web Services (AWS) – Amazon Managed Blockchain

Oracle Corporation – Oracle Blockchain Platform

SAP SE – SAP Blockchain

Huawei Technologies Co., Ltd. – Huawei Blockchain Service

Infosys Limited – Infosys Blockchain Suite

Intel Corporation – Intel Sawtooth

Siemens AG – Siemens Blockchain Lab

Wipro Limited – Blockchain as a Service (BaaS)

Deloitte Touche Tohmatsu Limited – Deloitte Blockchain Solutions

Accenture Plc – Accenture Blockchain Services

Capgemini SE – Capgemini Blockchain Applications

TIBCO Software Inc. – TIBCO Blockchain Solution

Chainstack – Chainstack Blockchain Platform

Market Analysis

The adoption of blockchain in manufacturing is being driven by the rising need for transparent supply chains, reduction in counterfeit risks, and secure data exchange between suppliers, factories, and distributors. As regulatory scrutiny and consumer expectations increase, manufacturers are leveraging blockchain to build trust and streamline quality assurance.

In the USA, automotive and aerospace sectors are leading use cases, while Europe’s regulatory emphasis on sustainability and data integrity is catalyzing blockchain-powered solutions in smart factories and sustainable production models.

Market Trends

Integration of blockchain with IoT for real-time asset tracking

Adoption of smart contracts for automated procurement and payments

Blockchain-enabled supply chain provenance to combat counterfeiting

Growing use in predictive maintenance via decentralized data records

Deployment in digital twins to secure and authenticate virtual replicas

Increased collaboration among manufacturers and tech providers for blockchain consortiums

Use of blockchain for compliance and audit trails in regulated industries

Market Scope

The scope of blockchain in the manufacturing market is expanding beyond traditional traceability. Manufacturers are embedding blockchain into core operational workflows, enabling next-gen transparency, accountability, and automation.

Secure supplier collaboration across global networks

End-to-end product lifecycle tracking

Streamlined recall management with verifiable audit trails

Decentralized inventory and logistics systems

Sustainable sourcing and carbon tracking solutions

Risk mitigation via tamper-proof production data

IP protection for patented designs and manufacturing processes

Forecast Outlook

The Blockchain in Manufacturing Market is on a promising growth trajectory as organizations realize its value in enabling real-time, secure, and automated data sharing. Looking ahead, the focus will shift toward large-scale deployments, platform standardization, and integration with advanced technologies such as AI and robotics. The USA and Europe are set to lead this innovation wave, fueled by strong industrial bases, tech investments, and rising demand for responsible manufacturing.

Access Complete Report: https://www.snsinsider.com/reports/blockchain-in-manufacturing-market-6681

Conclusion

Blockchain is no longer a buzzword—it's becoming a backbone for the next generation of intelligent manufacturing. From Stuttgart to Detroit, factories are transforming into transparent, secure, and data-driven environments. As complexity grows, blockchain offers the clarity and control manufacturers need to compete and lead in a digital-first world.

Related Reports:

USA is embracing the Blockchain IoT market with cutting-edge innovations and smart integrations

U.S.A leads the way in revolutionizing the Data Integration Market with cutting-edge innovations

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Blockchain in Manufacturing Market#Blockchain in Manufacturing Market Scope#Blockchain in Manufacturing Market Share#Blockchain in Manufacturing Market Growth

0 notes

Text

Blockchain as a Service Market: Forthcoming Trends and Share Analysis by 2030

Global Blockchain as a Service (BaaS) Market size is expected to grow from USD 4.23 Billion in 2023 to USD 30.4 Billion by 2032, at a CAGR of 24.5% during the forecast period (2024-2032).

Blockchain-as-a-Service, or BaaS, refers to a business model wherein organizations that design, develop, and construct blockchain applications can use cloud-based networks for creation, management, and upkeep. An crucial turning point in the development of blockchain technology has been reached with the introduction of the BaaS model, which signals a departure from the original use case of blockchain technology—cryptocurrencies—and points to new applications for the technology. Fundamentally, Blockchain as a Service (BaaS) allows users to take advantage of cloud services to develop, host, and manage blockchain-based applications without having to worry about the expenses, overhead, and operational difficulties associated with setting up, configuring, and running a blockchain.

Distributed ledgers, supply chain management systems, and digital identity management systems are just a few of the blockchain-based applications that may be created with the help of BaaS's pre-built services and apps. The BaaS market is divided into two segments based on component types: services and tools. Among the market's application segments are payments, supply chain management, identity management, smart contracts, and governance.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://introspectivemarketresearch.com/request/3974

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Leading players involved in the Blockchain as a Service Market include:

Cognizant (U.S.), Consensys (U.S.), IBM (U.S.), Microsoft (U.S.), Altoros (U.S.), HPE (U.S.), Amazon Web Services (AWS) (U.S.), R3 (U.S.), Oracle (U.S.), Dragonchain (U.S.), Cryptowerk (U.S.), Altoros (U.S.)

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

If You Have Any Query Blockchain as a Service Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/3974

Segmentation of Blockchain as a Service Market:

By Component

Tools

Services

By Application

Supply Chain Management

Payments

Risk & Compliance Management

Others

By End Users

BFSI

Healthcare & Life Sciences

Government

Retail & Consumer Goods

Others

An in-depth study of the Blockchain as a Service industry for the years 2023–2030 is provided in the latest research. North America, Europe, Asia-Pacific, South America, the Middle East, and Africa are only some of the regions included in the report's segmented and regional analyses. The research also includes key insights including market trends and potential opportunities based on these major insights. All these quantitative data, such as market size and revenue forecasts, and qualitative data, such as customers' values, needs, and buying inclinations, are integral parts of any thorough market analysis.

Market Segment by Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Key Benefits of Blockchain as a Service Market Research:

Research Report covers the Industry drivers, restraints, opportunities and challenges

Competitive landscape & strategies of leading key players

Potential & niche segments and regional analysis exhibiting promising growth covered in the study

Recent industry trends and market developments

Research provides historical, current, and projected market size & share, in terms of value

Market intelligence to enable effective decision making

Growth opportunities and trend analysis

Covid-19 Impact analysis and analysis to Blockchain as a Service market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=3974

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1 773 382 1049

Email: [email protected]

#Blockchain as a Service#Blockchain as a Service Market#Blockchain as a Service Market Size#Blockchain as a Service Market Share#Blockchain as a Service Market Growth#Blockchain as a Service Market Trend#Blockchain as a Service Market segment#Blockchain as a Service Market Opportunity#Blockchain as a Service Market Analysis 2024

0 notes

Text

Flipkart aims to expand the utility of its Blockchain-based FireDrops platform by exploring…

Flipkart’s Expansion Journey with FireDrops Blockchain Platform

Flipkart, a pioneer in e-commerce, is embarking on an ambitious journey to amplify the utility of its groundbreaking Blockchain-based FireDrops platform. This initiative marks a significant step forward in the company’s commitment to leveraging emerging technologies for greater efficiency and customer satisfaction.

Exploring New Horizons: Additional Use Cases

As Flipkart continues to innovate, it recognizes the immense potential of blockchain technology beyond its current applications. Hence, the company is proactively exploring additional use cases to expand the scope of its FireDrops platform. This strategic move aligns with Flipkart’s vision to stay at the forefront of technological advancements in the e-commerce landscape.

Enhancing Security and Transparency

One of the primary motivations behind Flipkart’s initiative is to enhance the security and transparency of its operations. By integrating blockchain technology into its FireDrops platform, Flipkart aims to fortify its infrastructure against potential threats while ensuring utmost transparency in transactions. This proactive approach underscores Flipkart’s unwavering commitment to safeguarding customer data and fostering trust among stakeholders.

Streamlining Supply Chain Operations

Furthermore, Flipkart recognizes the potential of blockchain technology in streamlining its supply chain operations. By leveraging the immutable and decentralized nature of blockchain, Flipkart can optimize inventory management, traceability, and authentication processes. This streamlined approach not only enhances operational efficiency but also minimizes instances of fraud and counterfeit products, thereby elevating the overall customer experience.

Strengthening Partnerships and Collaborations

Moreover, Flipkart’s endeavor to expand the utility of its FireDrops platform presents an opportunity to strengthen partnerships and collaborations within the industry. By engaging with stakeholders across various sectors, Flipkart can co-create innovative solutions and unlock new possibilities for blockchain adoption. This collaborative approach underscores Flipkart’s commitment to fostering an ecosystem of innovation and growth.

Driving Technological Advancements

As Flipkart delves deeper into exploring additional use cases for its FireDrops platform, it is poised to drive technological advancements in the e-commerce domain. By pushing the boundaries of blockchain innovation, Flipkart sets a precedent for other industry players to follow suit. This relentless pursuit of excellence reaffirms Flipkart’s position as a trailblazer in the ever-evolving landscape of digital commerce.

Empowering Customers with Data Ownership

Furthermore, Flipkart’s expansion of the FireDrops platform empowers customers by granting them greater control over their data. Through blockchain-enabled features such as decentralized identity management and data privacy protocols, Flipkart ensures that customers retain ownership of their personal information. This customer-centric approach not only enhances trust but also fosters a more personalized and secure shopping experience.

Leveraging Scalability for Growth

Additionally, Flipkart’s strategic initiative to explore additional use cases for its FireDrops platform is underpinned by scalability. By harnessing the scalability of blockchain technology, Flipkart can accommodate growing volumes of transactions and users without compromising performance. This scalability aspect is pivotal in supporting Flipkart’s ambitious growth trajectory and maintaining its competitive edge in the market.

Embracing Innovation for the Future

In conclusion, Flipkart’s commitment to expanding the utility of its FireDrops platform exemplifies its unwavering dedication to innovation and progress. By embracing blockchain technology and exploring new use cases, Flipkart positions itself as a frontrunner in driving transformative change within the e-commerce landscape. As Flipkart continues to push the boundaries of technological innovation, it paves the way for a future where efficiency, transparency, and customer-centricity reign supreme.

CONCLUSION

Flipkart’s initiative to broaden the scope of its Blockchain-based FireDrops platform reflects its commitment to innovation and adaptation. By venturing into new use cases, Flipkart aims to enhance the utility and versatility of the platform, potentially unlocking further benefits for its users and stakeholders. This strategic move aligns with Flipkart’s ongoing efforts to leverage cutting-edge technology to drive growth and deliver value in the dynamic e-commerce landscape.

0 notes

Text

Aviation Blockchain Market Unidentified Segments – The Biggest Opportunity Of 2023

Latest released the research study on Global Aviation Blockchain Market, offers a detailed overview of the factors influencing the global business scope. Aviation Blockchain Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the Aviation Blockchain The study covers emerging player’s data, including: competitive landscape, sales, revenue and global market share of top manufacturers are Microsoft Corporation (United States), IBM Corporation (United States), Zamna Technologies (United Kingdom), Aeron Labs (Belize), Winding Tree (Switzerland), Volantio Inc (United States), Filament (United States), Infosys (India), Insolar Technologies (Switzerland), Leewayhertz Technologies (United States), Moog Inc. (United States), Deloitte (United States), Avinoc LTD (Hong Kong), Leewayhertz Technologies (United States)

Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/124057-global-aviation-blockchain-market?utm_source=Organic&utm_medium=Vinay

Aviation Blockchain Market Definition:

Blockchain is a special type of distributed ledger in which the data is collated into “blocks†before being added to the shared database, and the blocks combine to form a single sequential chain. In the aviation sector, Blockchain is used to provide reliability, convenience, transparency, and validation benefits. Blockchain in aviation helps to maintain and records data so that multiple stakeholders can confidently share mutual access. It operates by recording and storing every transaction across the peer-to-peer network in a cryptographically-linked block structure that is replicated across network participants. Blockchain enables multiple stakeholders to operate from a single, shared, mutualized data ledger, eliminating the need for separate record-keeping and reconciliation. The Blockchain contains a record of all transactions and data recorded in the chain from its inception. According to Air Transport IT Insights published by SITA Groups in 2018, 34% of airports are planning Blockchain research and development programs by 2021. One area in which airports see Blockchain potential is the ability to help improve passenger identification processes, in part by reducing the need for multiple ID checks. This growing adoption of Blockchain in aviation will rapidly drive the market growth in upcoming years.

Market Trend:

Companies Integrating Blockchain Technology in Aerospace Industry

Market Drivers:

Robust Cryptographic Techniques enables Greater Certainty of Data Quality

Reduced Costs and Transactional Complexities

Distributed and Stability Benefit

Market Opportunities:

Streamline The Earning, Spending, Accounting and Reconciliation Of Frequent Flyer Points

Tracking of the Status and Location of Valuable Assets such as Passenger Bags, Cargo, and Aircraft Spare Parts

Passenger and Crew Identity Management

The Global Aviation Blockchain Market segments and Market Data Break Down are illuminated below:

by Application (Passenger-Focused and Ticket Sales (Passenger Identity Information,, Passenger Loyalty Programs, Blockchain Registers of Flights & Ticket), Aircraft Ownership and Financing, Cabin Crew, Aircraft Parts and Subsystems (Parts Tracking, Registers of Aircraft Parts and Subsystems, and Aircraft Parts and Subsystems Service Histories)), Function (Record-Keeping, Transactions), Platform (Manufacturers, MRO Service Providers, Airline Company, Customer, Flight Auditor, Buyer), Aviation Blockchain Type (Public, Private, Hybrid), Components (Database, Permissioned Blockchain, Smart Contract, Public Blockchain, Supply Chain Management)

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Enquire for customization in Report @: https://www.advancemarketanalytics.com/enquiry-before-buy/124057-global-aviation-blockchain-market?utm_source=Organic&utm_medium=Vinay

What benefits does AMA research study is going to provide?

Latest industry influencing trends and development scenario

Open up New Markets

To Seize powerful market opportunities

Key decision in planning and to further expand market share

Identify Key Business Segments, Market proposition & Gap Analysis

Assisting in allocating marketing investments

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Southeast Asia.

0 notes

Text

Future Trends in IoT Security Market: Scope, Size, Share, Forecast & Industry Growth Report 2032

The IoT Security Market was valued at USD 25 billion in 2023 and is expected to reach USD 153.44 billion by 2032, growing at a CAGR of 22.40% from 2024-2032.

Internet of Things (IoT) continues to revolutionize industries by enabling real-time data exchange and automation. From smart homes and wearables to industrial machines and connected vehicles, IoT devices are now central to modern digital ecosystems. However, this massive expansion has also introduced new vulnerabilities, making IoT security a critical priority for governments, enterprises, and consumers. The rise in cyber threats, data breaches, and privacy concerns has prompted organizations to invest in comprehensive IoT security solutions to protect devices, data, and networks from malicious attacks.

The IoT Security Market Size, Share, Scope, Analysis, Forecast, Growth, and Industry Report 2032 highlights the growing urgency for robust cybersecurity frameworks tailored to IoT ecosystems. As connected devices proliferate across sectors like healthcare, automotive, manufacturing, and smart cities, the market for IoT security solutions is projected to grow significantly. Businesses are shifting from reactive defense mechanisms to proactive threat prevention and real-time monitoring, spurring demand for advanced technologies such as AI-powered threat detection, encryption, authentication, and endpoint security solutions.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/5492

Market Keyplayers:

Microsoft (Azure IoT, Microsoft Defender for IoT)

Fortinet (FortiGate, FortiSIEM)

AWS (AWS IoT Device Defender, AWS IoT Core)

IBM (IBM Security QRadar, IBM Watson IoT)

Intel (Intel vPro, Intel Secure Device Onboard)

Cisco (Cisco IoT Threat Defense, Cisco Edge Intelligence)

Thales Group (Thales CipherTrust, Thales Cloud Security)

Infineon (OPTIGA Trust X, OPTIGA TPM)

Allot (Allot SmartConnect, Allot Service Gateway)

Atos (Atos Codex IoT, Atos Security Management)

Checkpoint (Check Point IoT Security, Check Point SandBlast)

Palo Alto Networks (IoT Security, Cortex XSOAR)

Mobileum (Mobileum IoT Security, Mobileum Fraud Management)

Entrust (Entrust Identity, Entrust PKI)

NXP Semiconductors (NXP EdgeLock, NXP Secure IoT)

Kaspersky (Kaspersky IoT Security, Kaspersky Embedded Systems Security)

MagicCube (MagicCube IoT Security Platform, MagicCube IoT Authentication)

Claroty (Claroty Platform, Claroty Remote Access)

Ordr (Ordr IoT Security, Ordr Asset Discovery)

Armis (Armis IoT Security, Armis Device Management)

Nozomi Networks (Nozomi Networks SCADAguardian, Nozomi Networks Vantage)

Keyfactor (Keyfactor Command, Keyfactor IoT Security)

Particle Industries (Particle IoT Platform, Particle Device Management)

Karamba Security (Karamba Carwall, Karamba IoT Security)

Forescout (Forescout Platform, Forescout IoT Security)

Market Trends

AI and Machine Learning Integration: Security solutions are increasingly using artificial intelligence (AI) and machine learning (ML) to predict, detect, and respond to threats in real-time. These technologies enable automated security analytics, anomaly detection, and predictive threat intelligence for faster incident response.

Zero Trust Architecture: The zero trust security model, which assumes no device or user is inherently trustworthy, is gaining traction in IoT environments. It enforces strict identity verification and access control policies, improving overall security posture.

Blockchain for Secure IoT: Blockchain is emerging as a promising solution for decentralized, tamper-proof data transmission between IoT devices. It enhances transparency, traceability, and trust among devices and users.

Edge Security Solutions: As more processing is done at the edge (close to the data source), edge-specific security solutions are being developed to ensure low-latency protection without compromising performance.

Regulatory Frameworks and Compliance: Governments and regulatory bodies worldwide are introducing stricter compliance standards and cybersecurity regulations for IoT, such as GDPR, NIST IoT guidelines, and cybersecurity labeling for consumer devices.

Enquiry of This Report: https://www.snsinsider.com/enquiry/5492

Market Segmentation:

By Component

Solutions

Services

By Security Type

Network Security

Endpoint Security

Application Security

Cloud Security

Others

By Deployment

Cloud

On-premise

By Enterprise Size

Small and Medium Enterprises

Large Enterprises

By End Use

Energy and Utilities

Manufacturing

Automotive

Transport

Consumer Electronics

Healthcare

Market Analysis

The IoT security market is poised for robust growth over the next decade. In 2022, the market was valued in the multi-billion-dollar range and is expected to grow at a double-digit compound annual growth rate (CAGR) through 2032. This expansion is fueled by the exponential rise in connected devices, expected to surpass 30 billion by the end of the forecast period.

Sectors such as healthcare, transportation, and manufacturing are increasingly deploying IoT technologies to drive efficiency and innovation. However, these sectors also face elevated security risks due to the sensitivity of data and the critical nature of operations. Consequently, demand for tailored security solutions like device authentication, intrusion detection systems, and secure communication protocols is surging.

Key players in the market are investing heavily in R&D to create scalable, interoperable security platforms. Strategic partnerships between technology providers and enterprises are also on the rise, aimed at delivering end-to-end IoT protection. Furthermore, the rise of 5G is expected to enhance connectivity while also introducing new security challenges, further fueling the need for advanced security frameworks.

Future Prospects

The IoT security landscape will continue to evolve rapidly in response to the increasing sophistication of cyberattacks and the dynamic nature of IoT ecosystems. The future will likely witness broader adoption of security-as-a-service models, allowing organizations to deploy cloud-based protection with minimal infrastructure investment. Integration of threat intelligence platforms with IoT security systems will provide real-time insights and predictive capabilities to mitigate risks effectively.

The growth of smart cities and connected public infrastructure will demand robust and scalable security solutions to manage large-scale, heterogeneous device networks. The automotive sector, with its push toward connected and autonomous vehicles, will also play a pivotal role in shaping the future of IoT security.

Additionally, consumer awareness of data privacy and digital safety is rising, prompting manufacturers to embed security features at the hardware level. Government incentives and stricter compliance norms will continue to act as catalysts for widespread adoption across both developed and emerging markets.

Access Complete Report: https://www.snsinsider.com/reports/iot-security-market-5492

Conclusion

The IoT security market is entering a pivotal era marked by heightened demand, innovation, and regulatory oversight. As the number of connected devices grows exponentially, so too does the need for comprehensive, adaptive, and proactive security measures. The integration of AI, blockchain, and edge computing, along with the evolution of regulatory frameworks, will shape a more secure IoT environment in the years ahead. By 2032, the industry is expected to not only expand in size and scope but also redefine the standards for digital trust and data protection in an interconnected world.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

0 notes

Text

Navigating the New Frontier: Token Sales Platform Development Services

In the era of blockchain and cryptocurrencies, token sales have emerged as a vital mechanism for fundraising and engaging with a global audience of investors and enthusiasts. Token sales, commonly known as Initial Coin Offerings (ICOs), Security Token Offerings (STOs), or Initial Exchange Offerings (IEOs), represent a paradigm shift in how companies and projects can access capital. As a result, token sales platform development services have become increasingly sought after by startups and enterprises alike, aiming to leverage this innovative approach to growth.

The Emergence of Token Sales Platforms

Token sales platforms are specialized ecosystems that facilitate the sale of blockchain-based tokens to a wide audience. These platforms are not merely websites but are complex pieces of software that incorporate blockchain technology, smart contracts, digital wallets, and security measures to ensure a smooth and secure transaction process for both the token issuers and buyers.

The rise of these platforms has been fueled by the need for a structured, reliable, and efficient way to conduct token sales that comply with various jurisdictions' regulatory frameworks. Token sales platform development services offer a full suite of solutions, from the creation of the token itself to the final distribution and beyond.

Core Features of Token Sales Platforms

A comprehensive token sales platform typically includes the following features:

Smart Contract Development: At the heart of a token sale is the smart contract, the self-executing contract with the terms of the sale directly written into code. Development services ensure that these contracts are audited, secure, and perform as intended.

User Dashboard: Participants need a user-friendly interface to purchase and manage their tokens. The dashboard provides real-time information on the sale progress, personal investment tracking, and token distribution.

Wallet Integration: Secure wallet integration is essential for participants to store and manage their purchased tokens.